- 1FAST School of Management, Islamabad, Pakistan

- 2National University of Computer and Emerging Sciences, Islamabad, Pakistan

- 3Department of Software Engineering, International Islamic University, Islamabad, Pakistan

- 4Electrical Engineering Department, Sukkur IBA University, Sukkur, Pakistan

- 5School of Information Engineering, Changchun Sci-Tech University, Changchun, China

- 6Department of Computer Science and Information Engineering, Chaoyang University of Technology, Taichung, Taiwan

- 7School of Civil Engineering and Architecture, Xiamen University of Technology, Xiamen, China

Mental and emotional issues are the top-level concerns of public health worldwide. These issues surged during Coronavirus (COVID-19) pandemic due to varied medical, social, and personal reasons. The social determinants highlighted in the literature mainly focus on household solutions rather than on increasing the financial wellbeing of individuals, especially for the most vulnerable groups where the psychological distress coming from the social inequalities cannot be entirely treated. Hence, this study attempts to familiarize the financial capability (the financial literacy, attitude, skills and behavior required for effective financial management) construct into public health domain in the times of COVID-19 as a determinant of psychological distress, and also explores the role of gender in it. The study uses Ordinary Least Square (OLS) regression analysis and employs mental distress questions and Organization for Economic Cooperation and Development (OECD) 2018 financial capability toolkit to collect data from a large sample of households from all over Pakistan. It is inferred that the higher the financial capability, the lower the financial and mental distress during COVID-19. Additionally, females are less financially knowledgeable, depict poor financial behaviors, and face more psychological issues than their counterparts. Age and education are also linked to mental stress during COVID-19. Finally, gender plays a moderating role in financial behavior, and financial and mental stress of households. As evident, COVID-19 is not going away soon hence the findings are relevant for policymakers to proactively plan for the pandemic's upcoming waves and help people be better financially equipped to fight against this or any upcoming crisis, and achieve better mental and physical health.

1. Introduction

The World Health Organization (WHO) emphasizes on six different components of mental health that include self-complacency, self-rule, self-growth, good relations, purpose in life, and social wellbeing of an individual (1). These emotional and mental issues, being top-level concerns of public health all over the world, have risen significantly during the Coronavirus (COVID-19) outbreak that has brought uncertainties to all walks of life, including the fear of contracting the virus and death from it (2–7). Consequently, people are suffering from anxiety, sadness, nervousness, frustration, and other severe mental disorders (8–10). Studies have also reported suicidal attempts as a result of social distancing, limited physical mobility, lockdowns, quarantines, self-isolation, and financial stress during the current pandemic (11).

Individuals not only had to face health emergencies, but the financial requirements to pay for healthcare, increased utility bills due to work from home, unemployment, and stockpile also surged (12–14). These ambiguous circumstances, the uncertainty of the pandemic situation, and the inability to cope with it, resulted in further financial stress, which is the state of anxiety, worry, and tension related to debt, money management and current expenses (15). Since financial stress is linked to mental health (16), when individuals were not able to fund their obligations, their stress increased, and as a result, their health was affected (17).

It is noted that people with a better understanding of savings and finance are better at financial management, and they are more likely to be prepared for any financial shock, or emergency (18) hence possess better mental health than the ones who do not understand the concept and are more likely to have mental health issues as compared to their counterparts (19, 20). However, whether people have learned from the previous crises, like the “Great Recession”, and have prepared themselves against financial and mental shocks by increasing their financial resilience through positive financial behaviors or not, remains unanswered.

Prolonged financial hardships can have detrimental effects on individuals' wellbeing and health (21–24). Despite the ubiquitous acknowledgement of economic hardship as a determining factor of health, it has mainly been assessed through income disparities, food and housing insecurities and other basic needs (16, 22). Wide-ranging solutions, such as efforts to improve financial knowledge, financial attitude and financial behavior to prepare individuals for financial shocks through savings and decreasing income uncertainty among poor in developing countries, are missing from the field of public health (25, 26). This becomes increasingly important and more relevant in the times of a pandemic like COVID-19, where rise in mental stress levels is repeatedly highlighted in the literature (27–31). Building on the evident link between income and mental health, this study demonstrates that financial capability is a significant, independent social determining factor of mental health which has helped individuals to fight against the worlds' most unprecedented global crisis in the shape of the COVID-19 pandemic, and can be influenced to develop overall health and wellbeing.

This study is organized into 5 sections with literature review and background in Section 2; Section 3 entails the detailed methodology adopted to collect and analyze data. Results are reported in Section 4, whereas Section 5 concludes the study with implications and future recommendations.

2. Literature review

Stress in any form has its effects on health, and financial stress is the most common cause of anxiety and depression (1), which is the emotional and mental tension resulting from the inability to meet financial needs like paying for bills, rent, groceries, education for children and healthcare (2). Financial stress can even lead to further varied and complex issues such as delays in health care, as observed in 29% of Americans who neglected their medical issues and postponed medical checkups because of financial constraints, which had a deteriorating effect on their health (32). Financial stress can also result in poor mental and physical health, resulting in headaches, migraines, heart diseases, sleep disorders, diabetes, and much more. Moreover, prolonged financial distress can lead to flaring-up of symptoms of other diseases (33). Anxiety induced by this can also lead to unhealthy coping behaviors, which include increased drug abuse and emotional eating, as 33% Americans were reported to have unhealthy eating behaviors as a consequence of stress (34).

Psychological stress can be a result of many internal as well as external factors that include socioeconomic demographic factors like gender, income, race, region, education, and others (35). It is also postulated that low-income groups may experience high financial stress as their work environments are unsafe and their jobs are less flexible. They cannot even think about switching jobs due to lack of financial support (36). Additionally, these groups have no access to health insurance or health care facility, which adds to their mental and physical health issues (37). Similarly, less educated women are more prone to mental health issues caused by food insecurity and financial distress as compared to their counterparts (38). These issues are faced more by developing countries than developed countries as the unemployment rate is high (39).

Further, lack of comprehensive education is also highlighted as a significant contributor to financial stress. The importance of financial literacy, which refers to money management knowledge and skills to make informed decisions for better financial wellbeing, is even enhanced in the case of a crisis, where due to lack of financial literacy, poor money management, and ill planning, people faced financial distress. (40). It is also noted that individuals with better financial education, financial attitudes, and financial behaviors are better at financial management, and they are more likely to be prepared for any financial shock or emergency and hence, possess better mental health (41).

With the significance of financial knowledge and behavior clearly established for better mental health, its relevance surges during an emergency situation like that of COVID-19, the world's most unprecedented global crisis (42). During COVID-19, many individuals lost their jobs globally, making them unable to fulfill basic needs such as paying rent, buying groceries, and other educational and medical expenditures, consequently affecting the mental and physical health of the masses (17, 30, 42). As a result, in this health and employment crisis case, regaining financial footing became a challenge, and many were found scrambling (43).

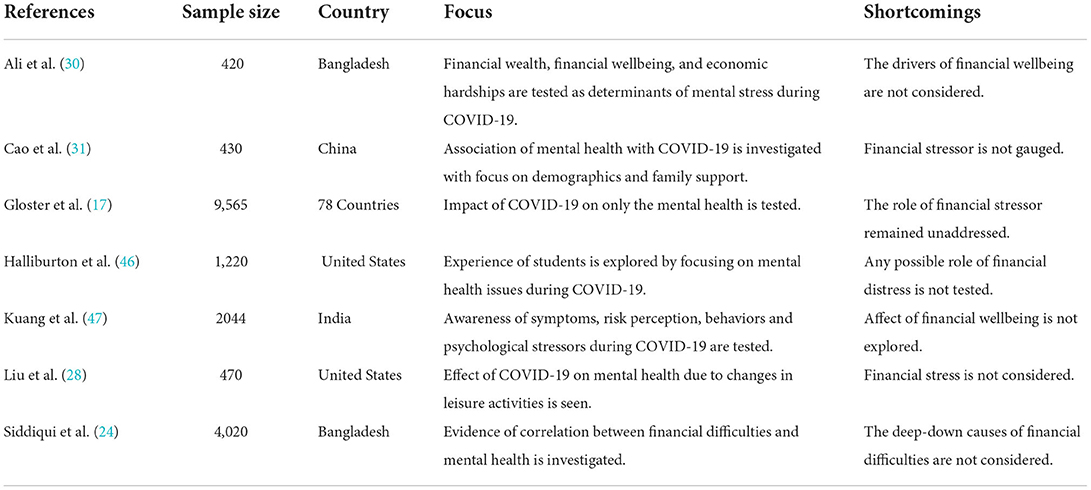

Medical research mainly focused on the medical issues and illnesses arising from the COVID-19 pandemic in developed countries (44, 45). However, little is known about the public mental health issues arising from financial distress, and whether people have learned from the previous setbacks such as the “Great Recession”, and have prepared themselves for financial as well as mental shocks in terms of increasing their financial resilience through positive financial behaviors or not during COVID-19 (Table 1 reports the focus and shortcomings of cited work during COVID-19 in a greater detail). Hence, the current study fills this gap by exploring the much ignored role of financial attitude, financial behavior, and financial knowledge on mental stress due to the financial situation of individuals during the current pandemic, and it also studies the role of socioeconomic and demographic factors. Since, the dynamics of financial literacy levels vary along regions and cultures (19), the evidence in this study is presented by taking into account data collected from a developing country, Pakistan.

3. Methods

The study is conducted by adaption of harmonized Financial Capability Survey (48) available globally by the Organization for Economic Cooperation and Development (OECD). The survey was divided into questions based on three parts: financial knowledge, financial attitude, and financial behavior, that are clubbed together to form the overall financial literacy of households (49). This section discusses the methods of construction of variables and data collection.

Financial knowledge helps households make well-informed financial decisions by comparing different products; it also facilitates them to employ numeracy skills (which can be helpful to understand financial news and events, thus facilitating people to respond in an appropriate manner). Its score is computed based on seven questions about the concept of inflation, interest compounding, and risk and return. The aggregate score ranges from 0 to 7.

Financial behavior concerns taking such financial actions that result in financially savvy individuals paying bills on time, shopping around to make informed purchases; hence its aggregate score is based on questions relating to savings, budgeting, borrowing, payments, and purchases and can go from 0 to 9.

Financial attitude measures individuals' attitude toward saving and spending and time preference for example, “I tend to live for today and let tomorrow take care of itself” which also leads to financial resilience. This score ranges from 1 to 5.

The overall financial capability score is the summation of the three sub-scores: financial knowledge, financial attitude, and financial behavior, and can range from 1 to 21. Other than the demographic and socioeconomic factors (gender, marital status, region, education, income, age, and experience), the survey additionally asks whether the respondents are stressed due to their financial situation during COVID-19. The econometric model is as follows:

where MeCOVIDi is the mental stress during COVID-19, FCiis the financial capability score calculated based on OECD toolkit 2018 (48), and Xi is the demographic and socioeconomic variable such as gender, marital status, region, education, income, age, and experience and epsiloni is the error term.

To check the moderation effect, Process Macro (50) is used by applying the following econometric model.

Here FBi refers to the financial behavior and Genderi is the dummy variable, where “1” represents female gender.

4. Data collection

A sample of 730 (seven hundred thirty) individuals from several households across Pakistan constitutes this study. Convenience sampling technique is used to collect the data as due to the lockdown and government restrictions during the pandemic, physical data collection was very difficult, hence reaching out people was a limitation. The data is collected from all five provinces of Pakistan: Khyber Pakhtunkhwa (KPK), Sindh, Punjab, Gilgit-Baltistan, and Baluchistan. In addition to this, data is also collected from Azad Jammu and Kashmir. The response rate was 80.8%, as 730 questionnaires were received from 904 sent out surveys.

5. Results

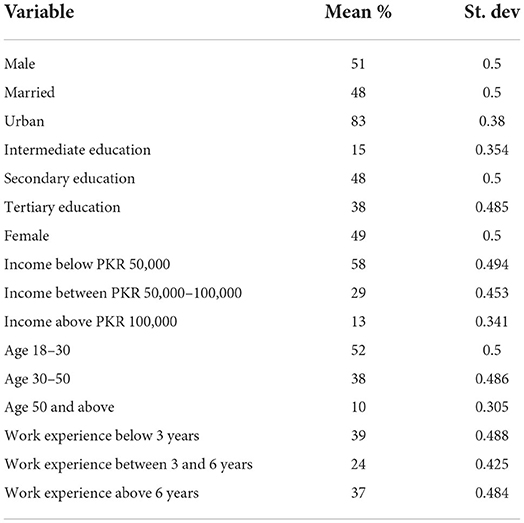

Table 2 shows the descriptive analysis (means and standard deviation) of the data collected from all over Pakistan. Of all the respondents 51% are male, 48% are married, 38% have received tertiary education, and 48% have received secondary education. The data is distributed among different income groups, with medium-income groups constituting 29% of the data, 38% belonging to middle age groups, and 24% having a work experience of 3–6 years.

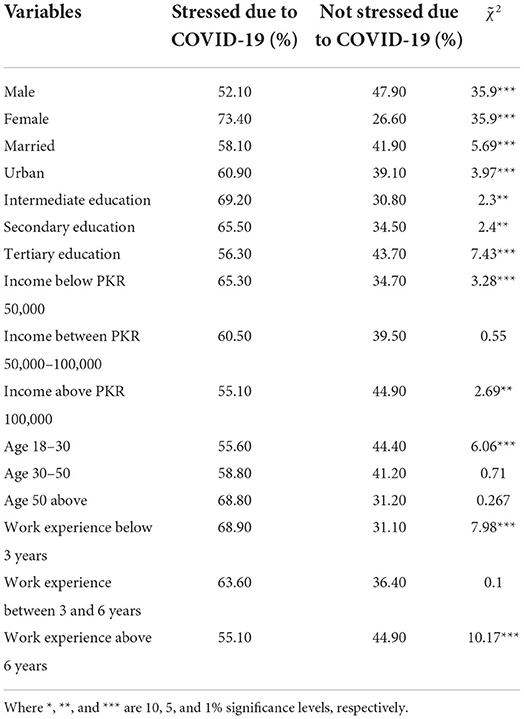

Table 3 reports the the number of people stressed due to COVID-19 with their chi-squared coefficients and their level of significance. It can be observed that females are more stressed than men. In a similar manner, married people are more stressed because of their increased responsibilities. 61% respondents belonging to urban areas are observed to be more worried about their financial situation since these areas are more prone to COVID-19 as compared to rural areas. It is also noted that the education level of people matters, as the ones who were more educated stressed less about their financial situation. High-income respondents are less worried about COVID-19 regarding their financial situation as their income can cover their health costs. Old age groups are more prone to contracting COVID-19; hence they are more worried about COVID-19 and their financial situation respectively. As work experience increases, individuals are more likely to have better income and are less financially stressed.

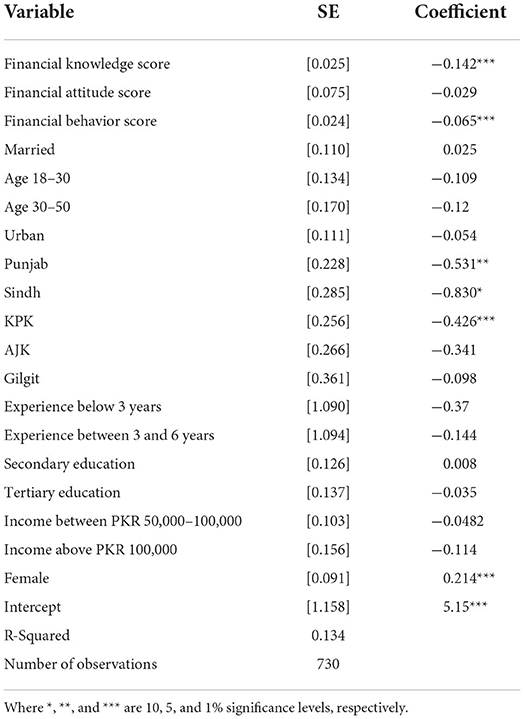

Table 4 reports the effect of financial capability components on financial distress during COVID-19. It can be inferred that financial knowledge and financial behavior are significantly negatively related to financial distress (significant at 1%), whereas a statistical link with financial attitude could not be established. Additionally, respondents belonging from Punjab, Sindh, and KPK are significantly less worried about their financial situation as compared to those belonging from Balochistan; in a similar manner, females are significantly more worried about their financial situation during COVID-19 (significant at 1%) and hence have faced more mental health issues.

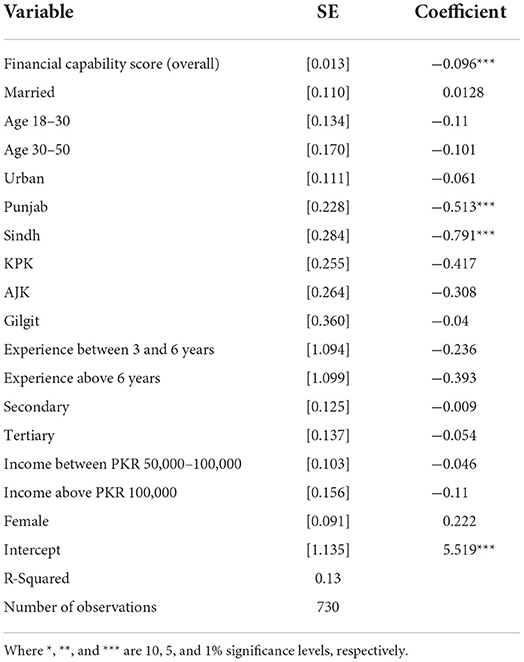

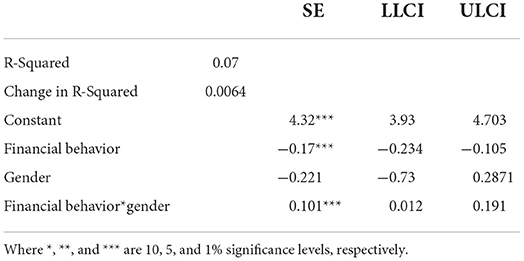

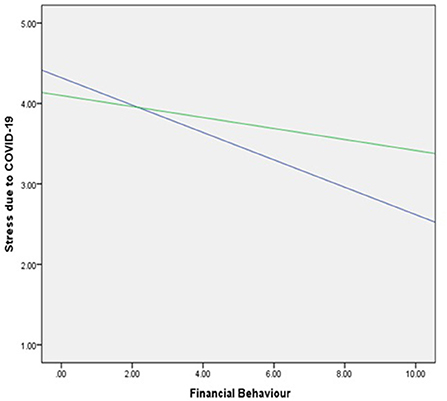

Table 5 reports regression results for the effect of financial capability on financial distress related to COVID-19. The score comprises of three components: financial attitude, financial knowledge, and financial behavior, so individuals with better overall financial capability have well-managed their financial situation and are less stressed. The overall financial capability scores are significantly negatively related to financial distress (significant at 1%). It can be observed from the results reported in Table 6 that gender moderates the relation between financial behavior and stress due to COVID-19. A change in R-square suggests that gender as a moderator affects stress more than an independent variable. On average, the stress levels of females are higher than males, where males have scored 4.1 in the stress levels and females have scored 4.32. This can also be observed from the moderation graph shown in Figure 1.

6. Discussion

Psychological stress severely impacts individuals' emotional and mental health, and several factors increase it. For instance, stress and anxiety in any individual are augmented as a result of the inability to fulfill basic needs such as paying the rent, buying groceries, and other educational and medical expenditures, especially during a crisis (51). Those who have a better education tend to be less stressed about their financial situation. High-income respondents are less worried about their financial situation during the pandemic as their income can cover their health costs. Old age groups are more prone to contracting COVID-19. Hence, they are more worried about COVID-19 and their financial situation. Individuals with better or more work experience are more likely to have better income and are therefore less stressed.

The study also incorporated demographics and socioeconomic factors to observe their dynamic role in psychological distress due to COVID-19. It is observed that in line with many studies, women tend to be less financially literate, hence depict poor financial behaviors and are more likely to be stressed due to COVID-19 because of the limited financial access and exposure given to females in developing countries (52–54). Thus, lack of financial literacy also contributes to increased stress levels of women due to the current pandemic. In addition, it is observed that financial attitude does not impact psychological distress during COVID-19 (55).

Similarly, it can be observed that more educated and high-income people show better financial behaviors and are less worried about their financial situations, hence facing a low level of psychological distress (56). The people who possess low education levels or fall under low-income groups are not knowledgeable enough about saving during the crisis, and are more worried about their necessities during an emergency (51). The study also investigated whether people with high debt levels are more worried about their financial distress during the pandemic or not, and it is conceived that households with high debt levels are financially distressed during the pandemic (43).

7. Practical implications and future directions

Financial stress is considered as one of the main mental stressors, and in severe cases may lead to increased risk of heart disease and physical pain. This risk may further increase during global crises, disasters, or pandemics like that of COVID-19. Despite evident contribution of efforts made to increase financial capability of individuals in protecting them from financial shocks and building their financial resilience to minimize the income disparities and achieve financial and healthier wellbeing, this remains unaddressed in the public health backdrop. To better understand the implication of financial health on public health, integration of financial capability into other health determinants will help drive far-reaching and effective interventions by offering solutions through a framework which is not based on siloed methods of housing, food, utilities or other economic hardships only. It can help focus on these matters by pursuing to improve financial knowledge and financial behavior of masses especially females, which will lead them to make well-informed financial decisions regarding how to spend, borrow, and save. Additionally, the public health community with the help of policymakers should devise financial literacy programs and create opportunities for the ones who are socially as well as financially marginalized to construct their wealth, bring sustainability and prepare them for any future crisis.

Though the current study is the first of its kind to conduct a financial capability survey in Pakistan, to gauge the effect of stress during the COVID-19 pandemic, it has a few shortcomings. To begin with, though the survey covers all provinces of Pakistan yet, due to limited physical mobility during the current pandemic, data is mainly collected online. Moreover, other reasons for financial distress are not explored in the study. The current study creates a base for future scholars in the area to investigate the impact of financial literacy-based interventions that will build financial capabilities of people to increase their financial wellbeing, that can consequently improve their mental health.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethics approval and written informed consent were not required for this study in accordance with national guidelines and local legislation.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Mukhtar S. Pakistanis' mental health during the COVID-19. Asian J Psychiatry. (2020) 51:102127. doi: 10.1016/j.ajp.2020.102127

2. Amanat A, Rizwan M, Javed AR, Abdelhaq M, Alsaqour R, Pandya S, et al. Deep learning for depression detection from textual data. Electronics. (2022) 11:676. doi: 10.3390/electronics11050676

3. Bhattacharya S, Maddikunta PKR, Pham QV, Gadekallu TR, Chowdhary CL, Alazab M, et al. Deep learning and medical image processing for coronavirus (COVID-19) pandemic: a survey. Sustain Cities Soc. (2021) 65:102589. doi: 10.1016/j.scs.2020.102589

4. Ayoub A, Mahboob K, Javed AR, Rizwan M, Gadekallu TR, Abidi MH, et al. Classification and categorization of COVID-19 outbreak in Pakistan. Comput Mater Continua. (2021) 1253–69. doi: 10.32604/cmc.2021.015655

5. Aslam B, Javed AR, Chakraborty C, Nebhen J, Raqib S, Rizwan M. Blockchain and ANFIS empowered IoMT application for privacy preserved contact tracing in COVID-19 pandemic. Pers Ubiquit Comput. (2021) 1–17. doi: 10.1007/s00779-021-01596-3

6. Shabbir A, Shabbir M, Javed AR, Rizwan M, Iwendi C, Chakraborty C. Exploratory data analysis, classification, comparative analysis, case severity detection, and internet of things in COVID-19 telemonitoring for smart hospitals. J Exp Theoret Artif Intell. (2022) 1–28. doi: 10.1080/0952813X.2021.1960634

7. Pakpour AH, Griffiths MD. The fear of COVID-19 and its role in preventive behaviors. J Concurrent Disord. (2020) 2:58–63. doi: 10.54127/WCIC8036

8. Bendau A, Kunas SL, Wyka S, Petzold MB, Plag J, Asselmann E, et al. Longitudinal changes of anxiety and depressive symptoms during the COVID-19 pandemic in Germany: the role of pre-existing anxiety, depressive, and other mental disorders. J Anxiety Disord. (2021) 79:102377. doi: 10.1016/j.janxdis.2021.102377

9. Javed AR, Shahzad F, ur Rehman S, Zikria YB, Razzak I, Jalil Z, et al. Future smart cities requirements, emerging technologies, applications, challenges, and future aspects. Cities. (2022) 129:103794. doi: 10.1016/j.cities.2022.103794

10. Imran A, Alnumay WS, Rashid A, Hur S, Ali Kashif B, Yousaf Bin Z. Prediction models for COVID-19 integrating age groups, gender, and underlying conditions. Comput Mater Continua. (2021) 3009–44. doi: 10.32604/cmc.2021.015140

11. Mamun MA, Griffiths MD. First COVID-19 suicide case in Bangladesh due to fear of COVID-19 and xenophobia: possible suicide prevention strategies. Asian J Psychiatry. (2020) 51:102073. doi: 10.1016/j.ajp.2020.102073

12. Abbas S, Jalil Z, Javed AR, Batool I, Khan MZ, Noorwali A, et al. BCD-WERT: a novel approach for breast cancer detection using whale optimization based efficient features and extremely randomized tree algorithm. PeerJ Comput Sci. (2021) 7:e390. doi: 10.7717/peerj-cs.390

13. Leddy AM, Weiser SD, Palar K, Seligman H. A conceptual model for understanding the rapid COVID-19-related increase in food insecurity and its impact on health and healthcare. Am J Clin Nutr. (2020) 112:1162–9. doi: 10.1093/ajcn/nqaa226

14. Mubashar A, Asghar K, Javed AR, Rizwan M, Srivastava G, Gadekallu TR, et al. Storage and proximity management for centralized personal health records using an IPFS-based optimization algorithm. J Circ Syst Comput. (2021) 2250010. doi: 10.1142/S0218126622500104

15. Thayer ZM, Gildner TE. COVID-19-related financial stress associated with higher likelihood of depression among pregnant women living in the United States. Am J Hum Biol. (2021) 33:e23508. doi: 10.1002/ajhb.23508

16. Weida EB, Phojanakong P, Patel F, Chilton M. Financial health as a measurable social determinant of health. PLoS ONE. (2020) 15:e0233359. doi: 10.1371/journal.pone.0233359

17. Gloster AT, Lamnisos D, Lubenko J, Presti G, Squatrito V, Constantinou M, et al. Impact of COVID-19 pandemic on mental health: an international study. PLoS ONE. (2020) 15:e0244809. doi: 10.1371/journal.pone.0244809

18. Khan F, Siddiqui MA, Imtiaz S. Role of financial literacy in achieving financial inclusion: a review, synthesis and research agenda. Cogent Bus Manage. (2022) 9:2034236. doi: 10.1080/23311975.2022.2034236

19. Demirgüç-Kunt A, Klapper LF. Measuring financial inclusion: the global findex database. World Bank Policy Research Working Paper. (2012).

20. Javed AR, Sarwar MU, Beg MO, Asim M, Baker T, Tawfik H. A collaborative healthcare framework for shared healthcare plan with ambient intelligence. Hum Centric Comput Inform Sci. (2020) 10:1–21. doi: 10.1186/s13673-020-00245-7

21. Chilton M, Knowles M, Bloom SL. The intergenerational circumstances of household food insecurity and adversity. J Hunger Environ Nutr. (2017) 12:269–97. doi: 10.1080/19320248.2016.1146195

22. Frank DA, Casey PH, Black MM, Rose-Jacobs R, Chilton M, Cutts D, et al. Cumulative hardship and wellness of low-income, young children: multisite surveillance study. Pediatrics. (2010) 125:e1115–23. doi: 10.1542/peds.2009-1078

23. Sandel M, Sheward R, Ettinger de Cuba S, Coleman S, Heeren T, Black MM, et al. Timing and duration of pre-and postnatal homelessness and the health of young children. Pediatrics. (2018) 142. doi: 10.1542/peds.2017-4254

24. Siddique AB, Nath SD, Islam MS, Khan TH, Pardhan S, Amin MZ, et al. Financial difficulties correlate with mental health among Bangladeshi residents amid COVID-19 pandemic: findings from a cross-sectional survey. Front Psychiatry. (2021) 12:755357. doi: 10.3389/fpsyt.2021.755357

25. Sherraden MS, Huang J, Frey JJ, Birkenmaier J, Callahan C, Clancy MM, et al. Financial Capability and Asset Building for All. American Academy of Social Work and Social Welfare (2015). p. 1–29.

26. Heckman SJ, Hanna SD. Individual and institutional factors related to low-income household saving behavior. J Fin Counsel Plan. (2015) 26:187–99. doi: 10.1891/1052-3073.26.2.187

27. Salerno JP, Devadas J, Pease M, Nketia B, Fish JN. Sexual and gender minority stress amid the COVID-19 pandemic: implications for LGBTQ young persons' mental health and well-being. Public Health Rep. (2020) 135:721–7. doi: 10.1177/0033354920954511

28. Liu HL, Lavender-Stott ES, Carotta CL, Garcia AS. Leisure experience and participation and its contribution to stress-related growth amid COVID-19 pandemic. Leisure Stud. (2022) 41:70–84. doi: 10.1080/02614367.2021.1942526

29. Zhai Y, Du X. Addressing collegiate mental health amid COVID-19 pandemic. Psychiatry Res. (2020) 288:113003. doi: 10.1016/j.psychres.2020.113003

30. Ali M, Uddin Z, Hossain A. Economic stressors and mental health symptoms among Bangladeshi rehabilitation professionals: a cross-sectional study amid COVID-19 pandemic. Heliyon. (2021) 7:e06715. doi: 10.1016/j.heliyon.2021.e06715

31. Cao Y, Ma ZF, Zhang Y, Zhang Y. Evaluation of lifestyle, attitude and stressful impact amid COVID-19 among adults in Shanghai, China. Int J Environ Health Res. (2022) 32:1137–46. doi: 10.1080/09603123.2020.1841887

32. Gallup A, Gallup AM, Newport F. The Gallup Poll: Public Opinion 2005. Rowman & Littlefield (2006).

33. Stuckler D, Meissner CM, King LP. Can a bank crisis break your heart? Global Health. (2008) 4:1–4. doi: 10.1186/1744-8603-4-1

34. Thalmayer AG, Toscanelli C, Arnett JJ. The neglected 95% revisited: is American psychology becoming less American? Am Psychol. (2021) 76:116. doi: 10.1037/amp0000622

35. Xu Y, Beller AH, Roberts BW, Brown JR. Personality and young adult financial distress. J Econ Psychol. (2015) 51:90–100. doi: 10.1016/j.joep.2015.08.010

36. Benach J, Muntaner C. Precarious employment and health: developing a research agenda. J Epidemiol Commun Health. (2007) 61:276–7. doi: 10.1136/jech.2005.045237

37. Fiscella K, Franks P, Doescher MP, Saver BG. Disparities in health care by race, ethnicity, and language among the insured: findings from a national sample. Med Care. (2002) 52–9. doi: 10.1097/00005650-200201000-00007

38. Maclean H, Glynn K, Ansara D. Multiple roles and women's mental health in Canada. BMC Womens Health. (2004) 4:1–9. doi: 10.1186/1472-6874-4-S1-S3

39. Bartolucci F, Choudhry MT, Marelli E, Signorelli M. GDP dynamics and unemployment changes in developed and developing countries. Appl Econ. (2018) 50:3338–56. doi: 10.1080/00036846.2017.1420894

40. Engelhardt GV, Eriksen MD. Housing-Related Financial Distress During the Pandemic. Research Institute for Housing America Special Report (2020).

41. Klapper L, Lusardi A, Panos GA. Financial literacy and its consequences: evidence from Russia during the financial crisis. J Bank Fin. (2013) 37:3904–23. doi: 10.1016/j.jbankfin.2013.07.014

42. Khan F, Ateeq S, Ali M, Butt N. Impact of COVID-19 on the drivers of cash-based online transactions and consumer behaviour: evidence from a Muslim market. J Islamic Market. (2021). doi: 10.1108/JIMA-09-2020-0265

43. Kurowski Ł. Household's overindebtedness during the COVID-19 crisis: the role of debt and financial literacy. Risks. (2021) 9:62. doi: 10.3390/risks9040062

44. Kelly B. Quarantine, restrictions and mental health in the COVID-19 pandemic. QJM Int J Med. (2020). doi: 10.1093/qjmed/hcaa322

45. Pairo-Castineira E, Clohisey S, Klaric L, Bretherick AD, Rawlik K, Pasko D, et al. Genetic mechanisms of critical illness in COVID-19. Nature. (2021) 591:92–98. doi: 10.1038/s41586-020-03065-y

46. Halliburton AE, Hill MB, Dawson BL, Hightower JM, Rueden H. Increased stress, declining mental health: emerging adults' experiences in college during COVID-19. Emerg Adulthood. (2021) 9:433–48. doi: 10.1177/21676968211025348

47. Kuang J, Ashraf S, Das U, Bicchieri C. Awareness, risk perception, and stress during the COVID-19 pandemic in communities of Tamil Nadu, India. Int J Environ Res Public Health. (2020) 17:7177. doi: 10.3390/ijerph17197177

48. OECD. OECD/INFE Toolkit for Measuring Financial Literacy and Financial Inclusion. OECD Publishing, Paris (2018).

49. Morgan PJ, Long TQ. Financial literacy, financial inclusion, and savings behavior in Laos. J Asian Econ. (2020) 68:101197. doi: 10.1016/j.asieco.2020.101197

50. Hayes AF. Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach. Guilford Publications (2017).

51. Shammi M, Bodrud-Doza M, Islam ARMT, Rahman MM. COVID-19 pandemic, socioeconomic crisis and human stress in resource-limited settings: a case from Bangladesh. Heliyon. (2020) 6:e04063. doi: 10.1016/j.heliyon.2020.e04063

52. Bucher-Koenen T, Lusardi A, Alessie R, Van Rooij M. How financially literate are women? An overview and new insights. J Cons Affairs. (2017) 51:255–283. doi: 10.1111/joca.12121

53. Taft MK, Hosein ZZ, Mehrizi SMT, Roshan A. The relation between financial literacy, financial wellbeing and financial concerns. Int J Bus Manage. (2013) 8:63. doi: 10.5539/ijbm.v8n11p63

54. Lusardi A, Mitchell OS. Planning and financial literacy: how do women fare? Am Econ Rev. (2008) 98:413–17. doi: 10.1257/aer.98.2.413

55. Chawla D, Joshi H. The moderating role of gender and age in the adoption of mobile wallet. Foresight. (2020). doi: 10.1108/FS-11-2019-0094

56. Rentková K, Mitková L, Mariak V. Financial literacy: does the financial advisor help? Leadership & Management: Integrated Politics of Research and Innovations. (2018) p. 166. Rentková K, Mitkova L, Mitková L. “Leadership & Management: Integrated Politics of Research and Innovations Financial (I) literacy: Does the Financial Advisor Help? Integrated Politics of Research and Innovations. (2018) 166–172.

Keywords: mental health, COVID 19, financial health, financial capability, financial literacy, socioeconomic and demographic factors, developing countries

Citation: Khan F, Siddiqui MA, Imtiaz S, Shaikh SA, Chen C-L and Wu C-M (2022) Determinants of mental and financial health during COVID-19: Evidence from data of a developing country. Front. Public Health 10:888741. doi: 10.3389/fpubh.2022.888741

Received: 07 March 2022; Accepted: 18 July 2022;

Published: 31 August 2022.

Edited by:

Enamul Kabir, University of Southern Queensland, AustraliaReviewed by:

Habib Ullah Khan, Qatar University, QatarImran Razzak, University of New South Wales, Australia

Copyright © 2022 Khan, Siddiqui, Imtiaz, Shaikh, Chen and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Falak Khan, ZmFsYWsua2hhbkBudS5lZHUucGs=; Chin-Ling Chen, Y2xjQG1haWwuY3l1dC5lZHUudHc=

Falak Khan

Falak Khan Muhammad A. Siddiqui1,2

Muhammad A. Siddiqui1,2 Salma Imtiaz

Salma Imtiaz