- 1School of Economics, Shandong Technology and Business University, Yantai, China

- 2School of Economics and Trade, Hunan University, Changsha, China

- 3Department of Business Administration, Sukkur IBA University, Sukkur, Pakistan

Our study explores the impact of financialization on carbon emissions by utilizing diverse financialization proxies, particularly for China. We examine the impact of financialization, institutional quality, globalization, natural resources, trade openness, and renewable and nonrenewable energy consumption on environmental pollution over the period 1996–2017 by utilizing dynamic autoregressive distributed lag (ARDL) simulations. The empirical findings of the study indicate that institutional quality, trade, globalization, natural resources, and renewable energy consumption significantly decrease environmental pollution in the long run, while foreign direct investment and financialization have neutral effects on carbon emissions. Our findings demonstrate that a 1% increase in institutional quality, trade, IFDI, renewable energy, and globalization leads to a decrease in CO2 emissions by 0.198, 0.016, 0.075, 0.010, and 0.072%, respectively. Even though financialization indexes contributed insignificantly to environmental degradation, other explanatory variables significantly affected carbon emissions through indirect effects of financialization. Financialization indexes behave in a similar context, and these proxy indicators are good parameters to understand the complex nature of financialization. Moreover, in order to achieve low carbon emissions and sustainable development, countries need viable financial institutions that focus on green growth by promoting clean production process strategies to ensure the reduction of CO2 emissions.

Introduction

Global warming has emerged as a challenging environmental issue in recent decades (1–4) and it may terribly affect the health of human beings (5–8). Over the last two decades, environmental degradation has become a serious challenge worldwide that has forced researchers, scholars, and policy makers to think properly about environmental issues and provide environmentally friendly policies (6–8). Such a rise in the worldwide temperature due to global warming and its harmful effects on the environment caused the arrangement of a United Nations convention on climate change in 1992. Later, the Kyoto Protocol convention was arranged in 1997 and subsequently, the Paris Contract session was convened in 2015 to reduce global warming by imposing environmental restrictions on gas emissions. Environmental degradation arises due to emissions of greenhouse gases and thus, it has become a serious issue worldwide in environmental disputes (9). Carbon dioxide (CO2) emits approximately 75% of greenhouse gases (10). The world's top 10 carbon-emitting countries represent almost 67% of the total emissions of the world, and China is included among the top 10 carbon-emitting countries of the world (2). Accordingly, strict disciplinary measures are needed to reduce CO2 emissions from top pollution-emitting countries.

China has undergone marvelous economic development since it opened its borders for international capital flows in recent decades. Hence, this rapid economic development of the Chinese economy severely affected the environment and gave rise to environmental pollution. A lot of empirical studies have investigated the various determinants of environmental pollution particularly in the case of China (11, 12). Industrial development is highly associated with environmental issues and empirical evidence confirms that a large number of industries emit huge amounts of greenhouse gases in China (13). At the present time, there is roughly 50% of annual greenhouse gas emission growth in China and it must be urgently evaluated by environmental protection regulations or must be regulated by the Chinese laws of environmental sustainable development. China started the policy to develop environmental institutions in 1972 and the Chinese government sent an official delegation to attend the United Nation conference on environmental development and sustainability in 1972 which was held in Stockholm1. Local environmental regulations were enforced in China in 1989 when the environmental protection law was approved by the National People's Congress of People's Republic of China. Up until now, 29 laws have been formulated by the National People's Congress and its standing committee of P.R. China regarding environmental protection and sustainable development. China's first political priority is to develop a pollution-free environment. Recently in China, large scale environmental policies have been implemented at the national level, such as the 2015 Environmental Protection Law, 2017 Environmental Protection Tax Law, and 2018 Environmental Protection Tax Law (14).

The Chinese government is persistently working hard to minimize the harmful effects of industrial development on environmental sustainability as per reports of different 5-year plans (FYPs). Economic development and sustainable environment is the core agenda of China (15). The Chinese supreme legislature body approved an environmental resolution on climate change within the context of environmental challenges in 2009 (16). The International Energy Agency (IEA) presented a critical analysis report and confirmed that the Chinese government has significantly launched environmental protection policy measures at national, provincial, and lower district levels in order to attain the targets of green energy and sustainable environment (17). The Chinese government has the realized harmful effects of gas emissions from inefficient power plants in its 5-year plans and strictly enforced environmentally friendly policies to reduce carbon emissions and environmental pollution. The FYPs are developed by the Chinese government, and environment protection strategies were the top priority of government officials, scholars, and environmental experts in the different 5-year plans of China (18). The environmental protection laws (EPLs) of China highlighted environmental challenges and provided effective environmental planning and effective legislative and institutional settings in the context of the environmental governance system of China. The EPLs are designed to deal with environmental challenges, highlighting the shortcomings in the environmental system, and propose better solutions for a sustainable environment (19).

China has achieved a lot of economic development in the recent decades but, alternatively, this rapid economic development adversely affected the environment and raised a lot of environmental challenges and issues for China (20). As per the latest statistical reports, China has become the world's largest CO2 emitter and energy consumer (21). Its energy consumption per unit of GDP is twice the world's average and per capita CO2 emissions have increased by 40% of world's average. The growth rate of CO2 emissions in China has risen more than 11 percent per annum (22). Accordingly, this rapid increase of CO2 emissions in the last couple of years might result in environmental degradation of the Chinese economy (23, 24). Empirical literature has keenly emphasized the significance of the relationship between environmental pollution and economic growth (25–28). The economic rationality and validity of the environmental Kuznets curve (EKC) hypothesis is widely debated while exploring the environment-growth nexus (29–35) and energy-environment-growth nexus in the long run and short run (7, 36, 37).

Some empirical studies, such as Boutabba (38), Bekhet et al. (39), Gokmenoglu and Sadeghieh, (40), Wang et al. (41), and Shahbaz et al. (42), considered financial development as a key explanatory variable, and empirical findings of these studies strongly supported the fact that financial development determines changes in carbon emissions. The recent literature has focused on investigating the impact of financialization on environmental development (38). Different scholars have diverse opinions on the nexus between financial development and environmental degradation. A lot of empirical studies conclude that financial development aggravates environmental degradation (41, 43–48). A stable financial system not only increases the efficiency of the financial sector but also contributes toward rapid economic development of a country (44, 49–51). The development of the stock markets and financial institutions reduces financing expenses and eases the liquidity requirements of firms, thus it help firms to invest in new projects to expand production, stimulate energy demand and thus, in turn, can give rise to environmental pollution (52–54). Financial markets encourage the public to borrow loans from financial institutions and buy heavy weight vehicles that can be the principal cause of the increase in carbon emissions (44).

Conversely, other schools of thought argue that financial development reduces environmental pollution by employing energy-efficient technology (20, 50, 55–63). With advancement of technology, financial markets developed globally and turned in to multinational corporations. Financial markets promote investment activities and monitor performance of the companies. The principal role of the financial sector is to bring lenders and borrowers close to each other with the purpose of efficient utilization of capital in a profitable way. Financial markets play a key role in the economy development of a country (64). Financial institutions especially banks and stock exchanges utilize public deposit funds and savings for investment purposes in a productive way and thus, in turn, contribute toward economic development of a country (65).

The prime contribution of this empirical study is to familiarize readers with the diverse financialization proxies which are introduced by IMF in order to understand and explore more comprehensively the impact of financialization indexes on carbon emissions particularly in the case of China. A large number of previous empirical studies have used a single proxy to denote financial development. For example, a study of Al-Mulali et al. (30) focused on the European region and investigated the impact of financial development on carbon emissions. They employed domestic credit to the private sector (% GDP) proxy variable to denote financial development. There are many empirical studies, such as Ahmed (66) and Haseeb et al. (67) for BRIC countries; Ali et al. (68) for Nigeria; and Kayani et al. (69) for emitter countries, which have employed a simple and single proxy variable to denote financial development. These empirical studies found a positive impact of financial development on environmental degradation. On the other hand, using the same proxy variable to denote financialization, some empirical studies, such as Jalil and Feridun (20) for China; Shahbaz et al. (70) for South Africa; Shahbaz et al. (71) for Malaysia; Nasreen and Anwar (72) for low-, middle-, and high-income countries; Lee et al. (73) for OECD; Abbasi and Riaz (10) for Pakistan; Dogan and Seker (74) for top renewable energy countries; and Gill et al. (75) for Malaysia, concluded that financial development unfavorably and negatively affects environmental issues. Henceforth by employing the same proxy variable to denote financialization, some empirical studies, such as Ozturk and Acaravci (76) for Turkey; and Seetanah et al. (9) for Small Island Developing States, found an insignificant impact of financial liberalization on environmental degradation in the long run.

Many empirical studies, such as Ziaei (77) for European, East Asian, and Oceania countries; Ali et al. (68) for Nigeria; and Jiang and Ma (78) for developed, emerging, and developing countries, have used an alternative simple proxy variable (domestic credit provided by financial sector) to investigate its impact on environmental issues. Additionally, some of the recent empirical studies applied several other proxy variables to denote financial development for robustness checks. For example, Tsaurai (79) employed three different proxies of financial development in his analysis for Africa. These three different financialization proxy measures employed are broad money, domestic credit to financial sector, and domestic credit to private sector by banks. Katircioglu and Taşpinar (80) used four different proxies, such as liquid liabilities; broad money supply; domestic credits to the banking and private sector; and ratio of commercial bank assets to central bank assets plus commercial bank assets, and they found an adverse impact of financial liberalization on carbon emissions for Turkey. Shoaib et al. (51) employed five different proxies, such as stock market capitalization; domestic credit to private sector; stock market turnover ratio; bank z-score; and bank net interest margin, to investigate the impact of financial development on environmental pollution for developed and developing countries and found a favorable impact of financial development on carbon emissions.

The fact that the above mentioned empirical studies utilized more than one proxy for financial liberalization index is quite motivational because these indicators of financialization may not comprehensively cover the complex nature of financialization (65). In order to overcome the limitation of single proxies of financial liberalization, our study fills this gap by employing multiple or diverse indices of financial development (65), thus to the best to our knowledge, this is the first study that extends the literature by utilizing multiple or different indices of financialization particularly in the case of China. These indices summarize the state of financial markets and institution in terms of depth2, access3, and efficiency4 (81, 82). The diversity of the financial structure proposes multiple indicators to measure the effects of financial development across countries (2). Amin et al. (2) tried to explore the impact of financialization on carbon emissions by utilizing a comprehensive index of nine different financial index proxies for the top 10 carbon-emitting5 countries based on panel data studies. However, it is widely recognized that any potential inference drawn from these cross-country studies provides only a general understanding of the linkage between the variables, and thus are unable to offer much guidance on policy implications for each country (23). Hence, the focus of this research is to investigate the impact of financialization on carbon emissions by employing multiple or different financialization proxies6, particularly in the case of China.

A few empirical research studies, such as Xiong and Qi (84), Jalil and Feridun (20), and Zhang (50), explored the impact of financial development on carbon emissions by employing simple proxy variables for financialization, particularly in the case of China, but we extend the contribution of these empirical studies by introducing multiple indexes of financialization proxies in order to explore more comprehensively the impact of financialization on carbon emissions, particularly in the case of China. Xiong and Qi (84) provided valuable insight between financial development and carbon emissions by incorporating interesting variables in the model but this study was narrowly focused at the Chinese provincial level and also employed a single proxy for the financialization index. Accordingly, we are conceptualizing key variables such as institutional quality, globalization, FDI inflows, and natural resources in order to reduce the problems of omitted variable bias in our proposed study. These variables are significantly ignored in the prior works of Zhang (50), and Jalil and Feridun (20) because empirical study of Tamazian and Rao (57) confirm the role of improved governance in reducing environmental problems. Equally, empirical literature, such as Frankel and Romer (85), Bhattacharya et al. (86), Sharif et al. (87), also confirm the significant role of FDI inflows, natural resources, and renewable energy in reducing environmental problems. Moreover, our analysis is robust as we are utilizing an updated dataset for the rapidly growing economy of China from 1996 to 2017 annually, and also we are applying the most robust dynamic autoregressive distributed lag (ARDL)7 methods to control the endogeneity, multicollinearity, and autocorrelations issues for the time series dataset of our empirical research study and thus this advanced methodology is not applied in the prior works of Xiong and Qi (84), Jalil and Feridun (20), and Zhang (50).

Our study contributes to the existing literature in several ways. Firstly, it introduces financialization by utilizing various proxies that have never been utilized before for China. Secondly, the impact of institutional quality has been ignored in earlier literature, our study identified the impact of institutions on environmental degradation. Thirdly, we have employed an up-to-date econometric methodology.

The remainder of the study is as follows. Section Model, Data, and Econometric Methodology defines the model, data, and methods; Section Results and Discussion explores the empirical results and discussion; and Section Conclusion and Policy Recommendations presents the conclusion of the study and policy implications.

Model, Data, and Econometric Methodology

This study investigates the role of institutional quality, financialization indexes, FDI, natural resources, trade openness, globalization, and renewable and non-renewable energy consumption on carbon emissions for China from 1996 to 2017 annually. Inspired by the work of Al-Mulali et al. (30), we have extended our model by adding some important variables.

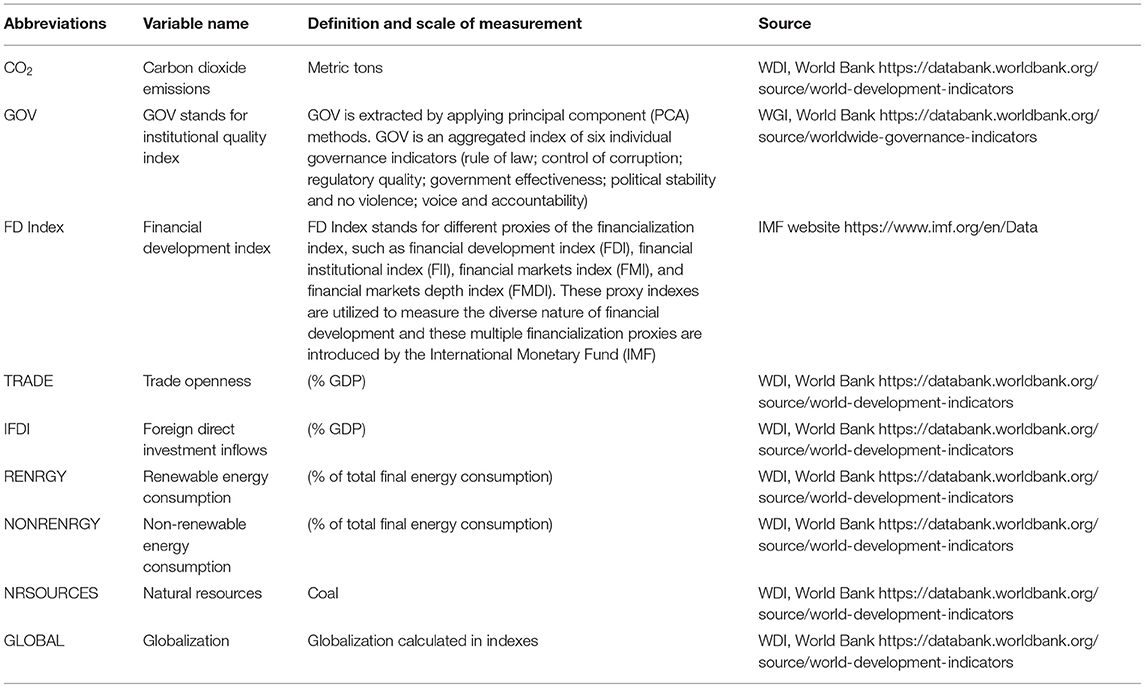

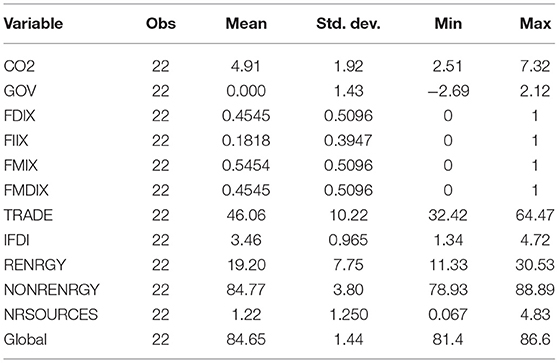

where CO2 emission is an environmental indicator; GOV is the governance index, FD Index is the financial development index, TRADE is trade openness, IFDI is a foreign direct investment inflow, RENRGY is renewable energy consumption, NONRENRGY is non-renewable energy consumption, NRSOURCES is natural resources, and GLOBAL is the globalization index. The description of all indicators is reported in Table 1. The summary statistics of all the variables are reported in Table 2 which demonstrates the mean, maximum, minimum, and standard deviation values of the variables. The results of descriptive statistics depict positive trends for all the variables. These variations seem sufficient for further empirical estimation.

As per the results in Table 2, the mean value of carbon emissions is 4.91 and its range starts from the minimum value of 2.51 and ends with the maximum value of 7.32. Financialization index proxies (FDIX, FIIX, FMIX, and FMDIX) assume an average value of 0.4545 (FDIX), 0.1818 (FIIX), 0.5454 (FMIX), and 0.4545 (FMDIX) with the minimum value of these proxy indexes starting from a value of 0 and up to a maximum value of 1. The average value of the governance index (GOV) is zero, the GOV index range starts from a minimum value of 0 and ends with a maximum value of 1. The mean values of FDI inflows (IFDI) and TRADE are 3.46 and 46.06, respectively. The average values of renewable energy (RENRGY) and nonrenewable energy (NONRENRGY) are 19.20 and 84.77, respectively. The average values of globalization index and natural resources are 84.65 and 1.22, respectively.

Econometric Methodology

Jordan and Philips (88) developed a new dynamic stimulated ARDL method namely the dynamic ARDL simulations approach to overcome the complications in short- and long-run examinations of the original ARDL approach. The dynamic simulations ARDL approach estimates and predicts the probability change of the regression and on one regressor, while keeping other regressors unchanged. On the other hand, the Pesaran ARDL approach only examines the long-run and short-run linkage between variables. Although the implementation of the ARDL approach is very convenient, its dynamic form accepts the first difference and multiple lags of both regressor and regression (88). To estimate the dynamic ARDL simulations, all the variables in the econometric model must be stationary at the first difference I(I), and there should be cointegration among all indicators (37, 88). This method uses multivariate normal distribution to simulate the vector of parameters 5,000 times. The equational form of the dynamic ARDL simulations approach is presented in equation (1).

In equation (1), y demonstrates the variation in the dependent variable; ∅0 is the intercept; t-1 is the maximum p-value of the regressor; nkshows the number of lags; Δ is the first difference; t is the time period, while μ is the error term. The null hypothesis of no cointegration H0 = ∅0 + ∅1 + … + ∅k = 0 is checked against the alternate hypothesis HA = ∅0 + ∅1 + … + ∅k ≠ 0. The null hypothesis of no co-integration is rejected if the calculated value of F-statistics is greater than its critical value.

The novelty of our study is that it employs the dynamic ARDL approach based on dynamic simulations which has recently been added to the existing literature by Sarkodie et al. (37).

Results and Discussion

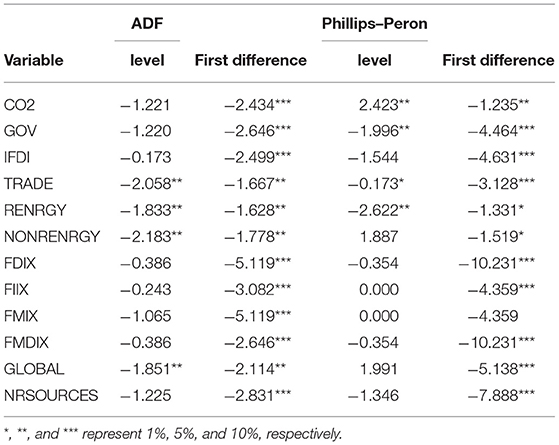

Before applying the dynamic ARDL simulations approach, the first step is to check the stationarity of all variables, that is, the dependent variable should be stationary at first difference I(1), while all independent variables must be stationary at level or at the first difference, i.e., I(0) or I(1).

This study applies augmented Dickey-Fuller (ADF) and Phillip-Perron (PP) unit root tests to check the stationarity of all variables. The results of unit root tests in Table 3 demonstrate that all variables are stationary at first difference I(1).

Dynamic ARDL Simulations

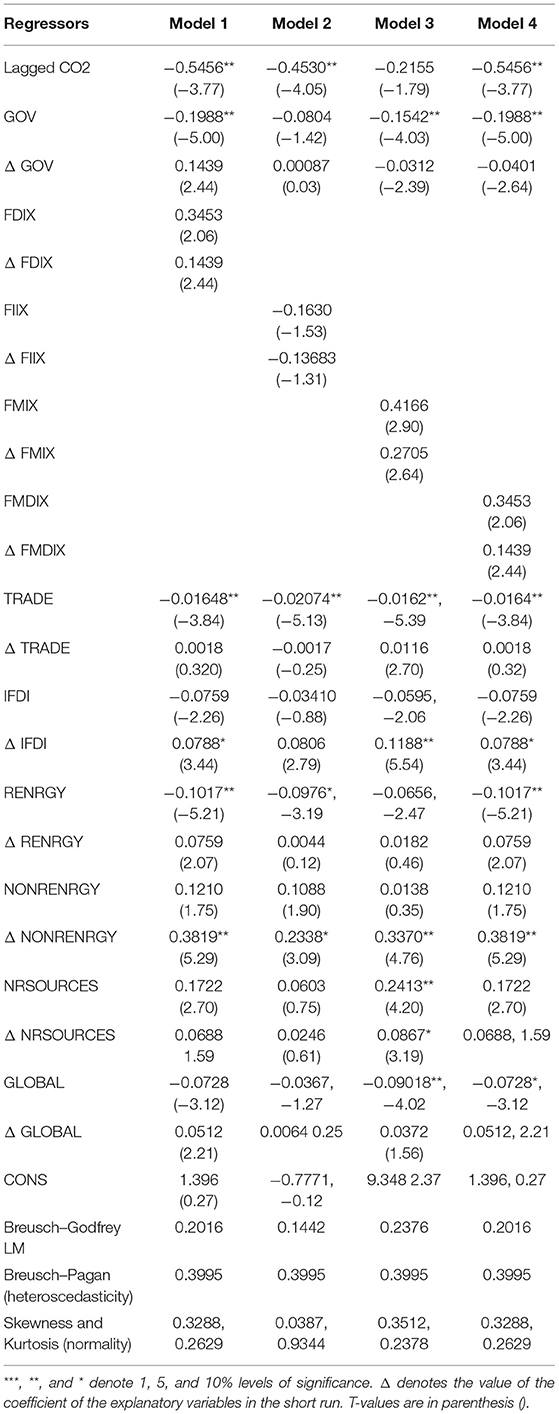

The results of the dynamic ARDL simulations are reported in Table 4. The governance has a negative relationship with CO2 emissions which implies that an increase in the quality of institutional quality leads to a decrease in CO2 emissions in China. Our empirical estimations are consistent with the findings of Tamazian and Rao (57) which supported the role of improved governance in reducing environmental problems. Establishment of stable financial, economic, and environmental institutions contributes to green energy, thus helping to mitigate environmental degradation. It can be said that the expansion of government spending and development of institutional quality stimulate economic activities in an economy, attract foreign direct investment and trade, which ultimately strengthens the scale effects on carbon emissions.

The negative and significant relationship between trade and CO2 emissions implies that international trade helps to mitigate environmental degradation. A potential reason is that China's higher economic growth rate and increased income have reduced trade barriers, which ultimately leads to improve environmental quality. Furthermore, China has improved its manufacturing structure. Due to the increased demand for traded goods, low-polluting goods produced in China have greatly contributed to the reduction of CO2 emissions. Our findings are consistent with Chen et al. (89), Yazdi and Beygi (90), Hao and Liu (91), and Shahbaz et al. (70).

The coefficient of foreign direct investment (IFDI) shows insignificant results in the long run while it depicts a positive and significant relationship in the short run. The negative coefficient of renewable energy consumption (RENRGY) demonstrates that a rise in the share of renewable energy consumption adversely affects CO2 emissions in China. In China, with increasing concerns regarding health environmental costs of CO2 emissions, RENRGY must become an effective substitute for fossil fuels (such as oil, coal, and natural gas). Our results are similar to those of Anwar et al. (92), Wang et al. (41), and Bekun et al. (93), who found that an increase in the demand of energy and enormous consumption of non-renewable energy sources exerts an adverse impact on the environment.

The impact of natural resources on CO2 emissions is positive and significant for China. Abundant natural resources minimize the need for fossil fuel energy; in addition, these results are related to the use of China's own energy sources (such as natural gas and renewable energy), which emit fewer emissions than fossil energy sources. The coefficient of globalization shows a negative and significant relationship with CO2 emissions in China. Shahbaz et al. (94) argued that globalization adversely affects CO2 emissions through income effect, scale effect, and technique effect. In addition, this also confirms the Chinese government's willingness and concern to reduce carbon dioxide emissions by adopting environmental policies with rapid economic growth.

Empirical results show that financialization indexes8 (FDIX, FMIX, and FMDI) positively but insignificantly contribute toward environmental pollution except FIIX9. Conversely, FIIX reduces environmental pollution but the effects are insignificant. Even though financialization indexes contributed insignificantly to environmental degradation when we analyze the separate impact of each financialization index on carbon emissions in model 1, model 2, model 3, and model 4, other explanatory variables10 significantly affected carbon emissions in all models through indirect effects of these financial indicators. We notice that financial indexes affected carbon emissions indirectly through other explanatory variables in model 1, model 2, model 3, and model 4 as all of the explanatory variables significantly affected carbon emissions in the models of our proposed study. As per estimations, we notice that financialization development indexes are quite similar in nature and behave in a similar context, and these proxy indexes can be utilized to measure the diverse nature of financial development. Our empirical estimations are parallel to those by Seetanah et al. (9) and Ozturk and Acaravci (76) who found neutral effects of financialization on environmental degradation in the long run.

The results of the diagnostic tests are presented in Table 4. The diagnostic tests are applied to check the consistency of econometric models. The results of the Breusch-Godfrey LM test demonstrate that no serial correlation was found in the model. The results of Breusch-Pagan show the absence of heteroscedasticity in the model. To check the normality of the dataset, we have applied skewness and kurtosis tests. The results demonstrate that normal distribution existed under the null hypothesis.

Conclusion and Policy Recommendations

In recent decades, global warming has emerged as a challenging issue that may cause deterioration of sustainable development across the globe. Over the last couple of decades, CO2 emissions have widely and significantly contributed to global warming which ultimately heinously affects climate change and increases environmental pollution across the globe. Accordingly, it is quite interesting to explore those factors which widely contributed to carbon emissions and environmental pollution. This empirical study explores the impact of diverse financial development indexes, institutional quality, trade, globalization, natural resources, and renewable and nonrenewable energy consumption on carbon emissions for China over the period 1996–2017 annually.

This empirical study has applied advanced methodology; namely, dynamic time series ARDL simulations proposed by (88). The dynamic ARDL simulations overcome limitations in the already existing ARDL approach model. This approach used 5000 simulations of the vector of parameters by utilizing multivariate normal distribution. The study examined the impact of financialization indexes, institutional quality, globalization, natural resources, and various other environmental factors, for instance, renewable and nonrenewable energy consumption, foreign direct investment, and trade on environmental degradation. Empirical results conclude that institutional quality, globalization, natural resources, trade, and renewable energy consumption significantly and negatively contributed toward carbon emissions, while foreign direct investment and nonrenewable energy consumption had neutral effects on CO2 emissions. Even though financialization indexes contributed insignificantly to environmental degradation, other explanatory variables significantly affected carbon emission in all models through indirect effects of these financial indicators.

Financialization indexes affected carbon emissions indirectly through other explanatory variables in model 1, model 2, model 3, and model 4. We infer from our empirical results that financialization indexes are quite similar in nature and behave in a similar context, and these proxy indicators are good parameters to analyze the diverse nature of financialization. Based on our empirical results, this study provides some important policy implications. Firstly, institutional quality significantly decreases carbon emissions, thus, researchers must formulate strong policies to strengthen financial and local institutions in order to significantly reduce environmental pollution. The lack of environmental protection policies in financial institutions has led to increased CO2 emissions. Therefore, it is recommended to strengthen financial institutions and adopt environmentally friendly policies to decrease CO2 emissions. The establishment of stable financial, economic, and environmental institutions contributes to green energy, thus helping to mitigate environmental degradation. The findings of the study demonstrate that globalization, natural resources, trade, and renewable energy consumption contribute toward the reduction of environmental pollution in China which promotes sustainable development. In order to promote an eco-friendly environment, policy makers and public institutions should follow global environmentally friendly laws and promote a globalized business environment in order to significantly attract foreign companies and global investors; thus, subsequently, more globalized environmental laws and environmentally friendly policies can significantly reduce environmental issues. In order to maintain a high-quality environment, policy makers must establish consistency between environment and economic policies through utilization of natural resources and globalization. Our findings demonstrate that a 1% increase in institutional quality, trade, IFDI, renewable energy, and globalization leads to a decrease in CO2 emissions by 0.198, 0.016, 0.075, 0.010, and 0.072%, respectively.

As far as the limitations of the current study are concerned, we had to remove some financialization proxies due to omitted variable bias or model misspecification error. Henceforth, we can further extend this study by adding all of the nine diverse indexes of financialization proxies11 in order to comprehensively understand the role of financialization in terms of environmental degradation, particularly for China. Additionally, the dataset of our empirical study comprises information from 1996 to 2017 annually, which is another limitation of our study. Thus, we can further extend our study by overcoming these limitations by utilizing all nine indexes of financialization proxies and using updated datasets (conditionally depends upon the availability of datasets) in order to derive more interesting policy implications particularly in the case of China. Additionally, this is a single country analysis, we suggest that future studies can be extended to a larger sample of countries in order to obtain broader conclusions.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary materials, further inquiries can be directed to the corresponding authors.

Author Contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This project was supported by National Social Science Fund of China (Grant No. 21BJY113).

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^https://www.cfr.org/backgrounder/chinas-environmental-crisis (accessed on 10 July 2018).

2. ^Size and liquidity.

3. ^Ability of enterprises to obtain financial services.

4. ^Ability of institutions to provide their financial services at the lowest possible cost with optimum returns.

5. ^China is also included among the top 10 carbon-emitting countries.

6. ^We had to remove some proxies from the financialization index due to omitted variable bias in the model; these novel financialization proxies were introduced by (83).

7. ^Dynamic autoregressive distribution lag simulations methodology.

8. ^Financial development index (FDIX); financial market index (FMIX); financial markets depth index (FMDIX).

9. ^Financial institutional index (FIIX).

10. ^Institutional quality; natural resources; trade liberalization; globalization; renewable energy.

11. ^These diverse indexes of nine financialization proxies are introduced by International Monetary Fund (IMF).

References

1. Amin A, Dogan E. The role of economic policy uncertainty in the energy-environment nexus for China: evidence from the novel dynamic simulations method. J Environ Manage. (2021) 292:112865. doi: 10.1016/j.jenvman.2021.112865

2. Amin A, Dogan E, Khan Z. The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci Total Environm. (2020) 740:140127. doi: 10.1016/j.scitotenv.2020.140127

3. Yousaf H, Amin A, Baloch A, Akbar M. Investigating household sector's non-renewables, biomass energy consumption and carbon emissions for Pakistan. Environ Sci Pollut Res. (2021) 1–11. doi: 10.1007/s11356-021-12990-y

4. Intergovernmental Panel on Climate Change (IPCC). Climate Change Synthesis Report 2007. (2007). Available online at: http://www.ipcc.ch/S.

5. Murshed M, Nurmakhanova M, Elheddad M, Ahmed R. Value addition in the services sector and its heterogeneous impacts on CO2 emissions: revisiting the EKC hypothesis for the OPEC using panel spatial estimation techniques. Environ Sci Pollut Res. (2020) 27:38951–73. doi: 10.1007/s11356-020-09593-4

6. Adedoyin FF, Gumede ML, Bekun FV, Etokakpan MU, Balsalobre–Lorente D. (2020). Modelling coal rent, economic growth and CO2 emissions: Does regulatory quality matter in BRICS economies? Sci Total Environ. doi: 10.1016/j.scitotenv.2019.136284

7. Mardani A, Streimikiene D, Cavallaro F, Loganathan N, Khoshnoudi M. Carbon dioxide (CO2) emissions and economic growth: a systematic review of two decades of research from 1995 to 2017. Sci Total Environ. (2019) 649:31–49. doi: 10.1016/j.scitotenv.2018.08.229

8. Zhang B, Wang Z, Wang B. Energy production, economic growth and CO 2 emission: evidence from Pakistan. Natural Hazards. (2018) 90:27–50. doi: 10.1007/978-981-10-2935-6

9. Seetanah B, Sannassee RV, Fauzel S, Soobaruth Y, Giudici G, Nguyen APH. Impact of economic and financial development on environmental degradation: evidence from small island developing states (SIDS), emerging markets finance and trade. Emerg Mark Finance Trade. (2018) 55:308–22. doi: 10.1080/1540496X.2018.1519696

10. Abbasi F, Riaz K. CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy. (2016) 90:102–114. doi: 10.1016/j.enpol.2015.12.017

11. Song T, Zheng T, Tong L. An empirical test of the environmental Kuznets curve in China: a panel cointegration approach. China Economic Review. (2008) 19:381–92. doi: 10.1016/j.chieco.2007.10.001

12. Dean J, Lovely M, Wang H. Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ. (2009) 90:1–13. doi: 10.1016/j.jdeveco.2008.11.007

13. Fang K, Wei Q, Logan KK. Protecting the public's environmental right-to-know: developments and challenges, China's legislative system for EEID, 2007–2015. J Environ Law. (2017) 29:285–315. doi: 10.1093/jel/eqx014

14. Jin Y, Andersson H, Zhang S. Air pollution control policies in China: a retrospective and prospects. Int J Environ Res Public Health. (2016) 12:1219. doi: 10.3390/ijerph13121219

15. Jiang X. Legal Issues for Implementing the Cleand Development Mechanism in China, Ph, D. Thesis. Sydney Australia: University of Western Sydney. (2010).

16. Hangsheng X. Climate Change China's View. (2018). Available online at: https://www.chinadaily.com.cn/business/2009-11/18/content_8995240.htm (accessed June 5, 2018).

17. Wang L, Zhang F, Pilot E, Yu J, Nie C, Holdaway J, et al. Taking action on air pollution control in the Beijing-Tianjin-Hebei (BTH) region: Progress, challenges and opportunities. Int J Environ Res Public Health. (2018) 15:306. doi: 10.3390/ijerph15020306

18. Chang YC, Wang N. Environmental regulations and emissions trading in China. Energy Policy. (2010) 38:3356–3364. doi: 10.1016/j.enpol.2010.02.006

19. Khan MI, Chang YC. Environmental challenges and current practices in China—a thorough analysis. Sustainability. (2018) 10:2547. doi: 10.3390/su10072547

20. Jalil A, Feridun M. The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energy Economics. (2011) 33:284–91. doi: 10.1016/j.eneco.2010.10.003

21. Al-Arkawaz SAZ. Measuring the influences and impacts of signalized intersection delay reduction on the fuel consumption, operation cost and exhaust emissions. Civil Engineering Journal. (2018) 3:552–71. doi: 10.28991/cej-0309115

22. Auffhammer M, Carson RT. Forecasting the path of China's CO2 emissions using province-level information. J Environ Econ Manage. (2008) 55:229–47. doi: 10.1016/j.jeem.2007.10.002

23. Ang J. CO2 emissions, research and technology transfer in China. Ecological Economics. (2009) 68:2658–65. doi: 10.1016/j.ecolecon.2009.05.002

24. Jalil A, Mahmud SF. Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy. (2009) 37:5167–72. doi: 10.1016/j.enpol.2009.07.044

25. Stern DI. The rise and fall of the environmental Kuznets curve. World Dev. (2004) 32:1419–39. doi: 10.1016/j.worlddev.2004.03.004

26. Fodha M, Zaghdoud O. Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy. (2010) 38:1150–6. doi: 10.1016/j.enpol.2009.11.002

27. Omri A. An international literature survey on energy -economic growth nexus: Evidence from country -specific studies. Renew Sust Energ Rev. (2014) 38:951–9. doi: 10.1016/j.rser.2014.07.084

28. Churchill SA, Ivanovski K. Electricity consumption and economic growth across Australian states and territories. Appl Econ. (2020) 52:866–78. doi: 10.1080/00036846.2019.1659932

29. Shahbaz M, Lean HH, Shabbir MS. Environmental Kuznets curve hypothesis in Pakistan: Cointegration and Granger causality. Renew Sust Energ Rev, forthcoming issues. (2012). doi: 10.1016/j.rser.2012.02.015

30. Al-Mulali U, Tang CF, Ozturk I. Does financial development reduce environmental degradation? Evidence from a panel study of 129 countries. Environ Sci Pollut Res. (2015) 22:14891–900. doi: 10.1007/s11356-015-4726-x

31. Alam MM, Murad MW, Noman AHM, Ozturk I. Relationships among carbon emissions, economic growth, energy consumption and population growth: testing Environmental Kuznets Curve hypothesis for Brazil, China, India and Indonesia. Ecol Indic. (2016) 70:466–79. doi: 10.1016/j.ecolind.2016.06.043

32. Kwakwa PA, Adu G. Effects of income, energy consumption and trade openness on carbon emissions in Sub -Saharan Africa. J Energy Dev. (2016) 41:86–117.

33. Aboagye S. Economic Expansion and Environmental Sustainability Nexus in Ghana. African Dev Rev. (2017) 29:155–68. doi: 10.1111/1467-8268.12247

34. Dong K, Sun R, Jiang H, Zeng X. CO2 emissions, economic growth, and the environmental Kuznets curve in China: What roles can nuclear energy and renewable energy play? J Cleaner Product. (2018) 196:51–63. doi: 10.1016/j.jclepro.2018.05.271

35. Sinha A, Shahbaz M. Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renewable Energy. (2018) 119:703–11. doi: 10.1016/j.renene.2017.12.058

36. Dogan E, Ulucak R, Kocak E, Isik C. The use of ecological footprint in estimating the Environmental Kuznets Curve hypothesis for BRICST by considering cross -section dependence and heterogeneity. Sci Total Environ. (2020) 138063. doi: 10.1016/j.scitotenv.2020.138063

37. Sarkodie SA, Strezov V, Weldekidan H, Asamoah EF, Owusu PA, Doyi INY. Environmental sustainability assessment using dynamic autoregressive distributed lag simulations—nexus between greenhouse gas emissions, biomass energy, food and economic growth. Sci Total Environ. (2019) 668:318–332. doi: 10.1016/j.scitotenv.2019.02.432

38. Boutabba MA. The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model. (2014) 40:33–41. doi: 10.1016/j.econmod.2014.03.005

39. Bekhet HA, Matar A, Yasmin T. CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev. (2017) 70:117–32. doi: 10.1016/j.rser.2016.11.089

40. Gokmenoglu K, Sadeghieh M. Financial development, CO2 emissions, fossil fuel consumption and economic growth: the case of Turkey. Strateg Plan Energy Environ, 38:7–28. doi: 10.1080/10485236.2019.12054409

41. Wang C, Zhang X, Ghadimi P, Liu Q, Lim M, Stanley E. The impact of regional financial development on economic growth in Beijing –Tianjin–Hebei region: a spatial econometric analysis. Physica A. (2019) 521:635–48. doi: 10.1016/j.physa.2019.01.103

42. Shahbaz M, Haouas I, Sohag K, Ozturk I. The financial development - environmental degradation nexus in the United Arab Emirates: the importance of growth, globalization and structural breaks. Environ Sci Pollut Res. (2020) 1–15. doi: 10.1007/s11356-019-07085-8

43. Brännlund R, Ghalwash T, Nordström J. Increased energy efficiency and the rebound effect: effects on consumption and emissions. Energy Econ. (2007) 29:1–17. doi: 10.1016/j.eneco.2005.09.003

44. Sadorsky P. The impact of financial development on energy consumption in emerging economies. Energy Policy. (2010) 38: 2528–35. doi: 10.1016/j.enpol.2009.12.048

45. Sadorsky P. Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy. (2011) 39:999–1006. doi: 10.1016/j.enpol.2010.11.034

46. Coban S, Topcu M. The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Econ. (2013) 39:81–8. 001 doi: 10.1016/j.eneco.2013.04.001

47. Islam F, Shahbaz M, Ahmed AU, Alam MM. Financial development and energy consumption nexus in Malaysia: A multivariate time series analysis. Econ Model. (2013) 30:435–41. doi: 10.1016/j.econmod.2012.09.033

48. Tang CF, Tan BW. (2014). The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Qual Quant 48: 781–797. doi: 10.1007/s11135-012-9802-4

49. Tamazian A, Chousa JP, Vadlamannati KC. Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy. (2009) 37:246–53. doi: 10.1016/j.enpol.2008.08.025

50. Zhang Y-J. The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy. (2011) 39:2197–203. doi: 10.1016/j.enpol.2011.02.026

51. Shoaib HM, Rafique MZ, Nadeem AM, Huang S. Impact of financial development on CO2 emissions: A comparative analysis of developing countries (D8) and developed countries (G8). Environ Sci Pollut Res. (2020). doi: 10.1007/s11356-019-06680-z

52. Anser MK, Syed QR, Lean HH, Alola AA, Ahmad M. Do economic policy uncertainty and geopolitical risk lead to environmental degradation? Evidence from Emerging Economies. Sustainability. (2021) 13:5866. doi: 10.3390/su13115866

53. Dasgupta S, Laplante B, Mamingi N. Pollution capital markets in developing countries. J Environ Econ Manage. (2001) 42:310–35. doi: 10.1006/jeem.2000.1161

54. Ma X, Fu Q. The influence of financial development on energy consumption: worldwide evidence. Int J Environ Res Public Health. (2020) 17:1428. doi: 10.3390/ijerph17041428

55. King RG, Levine R. Finance and growth: Schumpeter might be right. Q J Econ. (1993) 108:717–37. doi: 10.2307/2118406

56. Tadesse S. Financial Development and Technology. William Davidson Institute. (2005) 749. doi: 10.2139/ssrn.681562

57. Tamazian A, Rao BB. Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy economics. (2010) 32:137–45. doi: 10.1016/j.eneco.2009.04.004

58. Shahbaz M, Hye QMA, Tiwari AK, Leitão NC. Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev. (2013) 25:109–21. doi: 10.1016/j.rser.2013.04.009

59. Shahbaz M, Jam FA, Bibi S, Loganathan N. Multivariate Granger causality between CO2 emissions, energy intensity and economic growth in Portugal: evidence from cointegration and causality analysis. Technol Econ Dev Econ. (2016) 22:47–74. doi: 10.3846/20294913.2014.989932

60. Shahzad SJH, Rehman M, Hurr M, Zakaria M. Do Economic and Financial Development Increase Carbon Emission in Pakistan: Empirical Analysis through ARDL Cointegration and VECM Causality. MPRA Paper 60310. Germany: University Library of Munich. (2014)

61. Chang SC. Effects of financial developments and income on energy consumption. Int Rev Econ Finance. (2015) 35:28–44. doi: 10.1016/j.iref.2014.08.011

62. Pata UK. Renewable energy consumption, urbanization, financial development, income and CO2emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod. (2018) 187:770–9. doi: 10.1016/j.jclepro.2018.03.236

63. Tadesse SA. Financial Development and Technology (SSRN Scholarly Paper No. ID 681562). Rochester, NY: Social Science Research Network. (2005).

64. Levine R. Finance and Growth: Theory and Evidence. Handbook of Economic Growth. In: Aghion P, Durlauf S, editors. Handbook of Economic Growth, edition 1. Elsevier. p. 865–934. (2005). doi: 10.1016/S1574-0684(05)01012-9

65. IMF. (2020). Available online at: https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B

66. Ahmed K. Revisiting the role of financial development for energy -growth -trade nexus in BRICS economies. Energy. (2017) 128:487–95. doi: 10.1016/j.energy.2017.04.055

67. Haseeb A, Xia E, Danish, Baloch MA, Abbas K. Financial development, globalization, and CO2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res Int. (2018) 25:31283–31296. doi: 10.1007/s11356-018-3034-7

68. Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bar UAA. Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. Geo Journal. (2018) 84:641–55. doi: 10.1007/s10708-018-9880-5

69. Kayani GM, Ashfaq S, Siddique A. Assessment of financial development on environmental effect: implications for sustainable development. J Clean Prod. (2020). doi: 10.1016/j.jclepro.2020.120984

70. Shahbaz M, Tiwari AK, Nasir M. The Effects of Financial Development, Economic Growth, Coal Consumption and Trade Openness on CO2 emissions in South Africa. Energy Policy. (2013) 61:1452–9. doi: 10.1016/j.enpol.2013.07.006

71. Shahbaz M, Solarin SA, Mahmood H, Arouri M. Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Economic Modelling. (2013) 35:145–52. doi: 10.1016/j.econmod.2013.06.037

72. Nasreen S, Anwar S. The impact of economic and financial development on environmental degradation: An empirical assessment of EKC hypothesis. Studies in Economics and Finance. (2015) 32:2015. doi: 10.1108/SEF-07-2013-0105

73. Lee JM, Chen KH, Cho CH. The relationship between CO2 emissions and financial development: evidence from OECD countries. The Singapore Economic Review. (2015) 60:1550117. doi: 10.1142/S0217590815501179

74. Dogan E, Seker F. An investigation on the determinants of carbon emissions for OECD countries: empirical evidence from panel models robust to heterogeneity and cross - sectional dependence. Environ Sci Pollut Res. (2016) 23:14646–55. doi: 10.1007/s11356-016-6632-2

75. Gill AR, Hassan S, Haseeb M. Moderating role of financial development in environmental Kuznets: a case study of Malaysia. Environ Sci Pollut Res. (2019) 26:34468–78. doi: 10.1007/s11356-019-06565-1

76. Ozturk I, Acaravci A. The long -run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Economics. (2013) 36:262–7. doi: 10.1016/j.eneco.2012.08.025

77. Ziaei SM. Effects of financial development indicators on energy consumption and CO2 emission of European, East Asian and Oceania countries. Renew Sustain Energy Rev. (2015) 42:752–9. doi: 10.1016/j.rser.2014.10.085

78. Jiang C, Ma X. The impact of financial development on carbon emissions: a global perspective. Sustainability. (2019) 11:5241. doi: 10.3390/su11195241

79. Tsaurai K. The impact of financial development on carbon emissions in Africa. Int J Energy Econ. (2019) 9:144. doi: 10.32479/ijeep.7073

80. Katircioglu ST, Taşpinar N. Testing the moderating role of financial development in an environmental Kuznets curve: empirical evidence from Turkey. Renew Sust Energ Rev. (2017) 68:572–86. doi: 10.1016/j.rser.2016.09.127

81. Aizenman J, Jinjarak Y, Park D. Financial Development and Output Growth in Developing Asia and Latin America: A Comparative Sectoral Analysis. NBER Working Paper 20917. Cambridge, Massachusetts: National Bureau of Economic Research. (2015). doi: 10.3386/w20917

82. Cihák M, Demirgüç -Kunt A, Feyen E, Levine R. Benchmarking Financial Development Around the World. World Bank Policy Research Working Paper 6175. Washington, DC: World Bank. (2012). doi: 10.1596/1813-9450-6175

83. IMF. (2020). Available online at: https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B

84. Xiong L, Qi S. Financial development and carbon emissions in Chinese provinces: a spatial panel data analysis. The Singapore Economic Review. (2018) 63:447–64. doi: 10.1142/S0217590817400203

85. Frankel J, Romer D. Does trade cause growth? Am Econ Rev. (1999) 89:379–99. doi: 10.1257/aer.89.3.379

86. Bhattacharya M, Paramati SR, Ozturk I, Bhattacharya S. The effect of renewable energy consumption on economic growth: evidence from top 38 countries. Appl Energy. (2016) 162:733–41. doi: 10.1016/j.apenergy.2015.10.104

87. Sharif A, Mishra S, Sinha A, Jiao Z, Shahbaz M, Afshan S. The renewable energy consumption -environmental degradation nexus in Top−10 polluted countries: fresh insights from quantile -on -quantile regression approach. Renewable Energy. (2020) 150:670–90. doi: 10.1016/j.renene.2019.12.149

88. Jordan S, Philips AQ. Cointegration testing and dynamic simulations of autoregressive distributed lag models. Stata J. (2018) 18:902–23. Available online at: https://journals.sagepub.com/doi/pdf/10.1177/1536867X1801800409

89. Chen Y, Wang Z, Zhong Z. CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renewable energy. (2019) 131:208–16. doi: 10.1016/j.renene.2019.03.058

90. Yazdi SK, Beygi EG. The dynamic impact of renewable energy consumption and financial development on CO2 emissions: for selected African countries. Energy Sources B: Econ Plan Policy. (2018) 13:13–20. doi: 10.1080/15567249.2017.1377319

91. Hao Y, Liu Y. Effects of foreign business on carbon emission in China: a provincial 608 panel data-based analysis. China Environm Managem. (2015) 4:85–93.

92. Anwar A, Siddique M, Dogan E, Sharif A. The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: evidence from Method of Moments Quantile Regression. Renew Energy. (2021) 164:956–67. doi: 10.1016/j.renene.2020.09.128

93. Bekun FV, Alola AA, Sarkodie SA. Toward a sustainable environment: nexus between CO2 emissions, resource rent, renewable and non-renewable energy in 16- EU countries. Sci Total Environ. (2019) 657:1023–9. doi: 10.1016/j.scitotenv.2018.12.104

Keywords: financial development, CO2 emissions, institutional quality, renewable energy, sustainability development

Citation: Ameer W, Amin A and Xu H (2022) “Does Institutional Quality, Natural Resources, Globalization, and Renewable Energy Contribute to Environmental Pollution in China? Role of Financialization”. Front. Public Health 10:849946. doi: 10.3389/fpubh.2022.849946

Received: 06 January 2022; Accepted: 11 February 2022;

Published: 31 March 2022.

Edited by:

Rida Waheed, Jeddah University, Saudi ArabiaReviewed by:

Munir Ahmad, Zhejiang University, ChinaUmer Shahzad, Anhui University of Finance and Economics, China

Copyright © 2022 Ameer, Amin and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Waqar Ameer, d2FxYXIuYW1lZXJAeWFob28uY29t; Helian Xu, eHVoZWxpYW5AMTYzLmNvbQ==

Waqar Ameer

Waqar Ameer Azka Amin

Azka Amin Helian Xu2*

Helian Xu2*