94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Public Health , 18 April 2022

Sec. Health Economics

Volume 10 - 2022 | https://doi.org/10.3389/fpubh.2022.792946

This article is part of the Research Topic Economic and Financial Issues in the Post-COVID-19 World: Implications and Role of Public Health View all 46 articles

This study investigates the nexus of coronavirus disease 2019 (COVID-19) shock, financial flexibility (FF), and firm performance (FP) in Taiwan listed hotel firms. Quantile regression (QR) methods were used to analyze the data from Taiwan Stock Exchange listed hotel firms between 2020 Q1 and 2021 Q2. The results evidence that there is an inversed U-shaped linkage between FF and FP for the hotel industry. Additionally, FF has an inverted U-shaped effect on FP for the asset-light hotel firms for all quantiles except the 50th quantile. In addition, FF also has an inverted U-shaped impact on FP for the asset-heavy hotel firms in the 10th and 90th quantiles. A significant finding in this study is that there is a concave non-linear relationship between FF and FP, consistent with the law of diminishing marginal return. That is, with an increase in FF, the FP is on the rise; when FF exceeds the inflection point level, the FP begins to decline. Thus, a firm must ensure that the FF strategy it adopts must be the most efficient and effective, i.e., it must bring the trade-off between costs and benefits. The empirical results highlight the need for the hotel industry of Taiwan to take the rolling adjustment and optimization of FF after the COVID-19 pandemic for long-term sustainability.

The coronavirus disease 2019 (COVID-19) had spread across the world at an unprecedented rate, which has caught governments off guard and unprepared for such an impactful pandemic. Strict regulations, such as state of emergencies, stay-at-home orders, and border closings, have contributed to serious economic consequences (1). The impact on enterprises within the hospitality and travel industries, in particular the hotel industry, has been dramatic (2, 3). The decline in family and business travel has caused a direct impact on the performance of the entire hotel industry during the COVID-19 shock (4). According to the latest IBISWorld Industry Report for Hotels and Motels in the United States, the hotel and motel industry has been one of the industries severely hit by the COVID-19 pandemic, and industry revenues are expected to fall 45.7% alone in 2020 to the record lows of $107.7 billion (5). The hotel industry of Taiwan has been severely affected, during the first half of 2020, the industry revenue of hotels decreased by more than NT $12.863 billion from the same period last year, a significant drop of 43.39% from the same period last year (6).

Financial flexibility (FF) is the capability of a financial enterprise to obtain and restructure the required finance for minimum cost (7) and can help firms respond to the market changes affecting investment, performance, and business growth. Even in a crisis, companies with adequate FF have greater cash reserves to economically raise capital to fund new growth opportunities and further improve performance (8). Recently, enterprises worldwide have looked to increase their FF to avoid uncertainty and seize growth opportunities (9, 10).

Several researchers have explored the challenges faced by the hotel industry and its corporate response to the COVID-19 shock (11–14); nevertheless, there is no empirical research that evaluates the effect of the COVID-19 epidemic on the firm performance (FP) of the hotel industry. This study not only offers additional empirical evidence on the effect of the COVID-19 epidemic but also provides a deeper understanding of how FF affects FP amid a COVID-19 crisis. The literature concerning the relationship between FF and FP is inconclusive. There are numerous studies that indicate a positive FF-FP relationship (15–18), conversely, some articles argue that high FF leads to overinvestment (19).

Recently, in the research of Fahlenbrach et al. (20), firms with high FF experienced a stock price drop lower by 26% than those with low FF accounting for a firm's industry. This effect was greater in industries that were more severely affected by the COVID-19 shock. Ramelli and Wagner (21) have shown that firms with FF experienced greater stock performance in the initial stages of the COVID-19 epidemic. In addition, the scholar (22) confirmed that FF has a positive impact on FP for the Taiwanese manufacturing industry during the COVID-19 shock. Some studies have focused on the nonlinear concave (inverted U-shaped) relationship between FF and FP (23, 24). The inverted U-shaped curve demonstrates that initially FP rises as FF increases; however, on reaching the FF threshold, FP declines as FF increases. Until now, there is no consensus as to whether FF increases or decreases FP during the COVID-19 shock. Prompted by the ongoing debate, a primary enquiry of this research is whether FF impacts FP and more specifically, how it effects FP. In addition, we compare the FF-FP nexus during the pre- and post-COVID periods.

This research contributes to the extant literature and helps in bridging this gap in previous studies by exploring the impact of FF on FP for Taiwan listed hotel firms, considering a non-linear association. By utilizing the quantile regression (QR) method, this study addresses the tail information of FP (proxies by return on equity [ROE]) and identifies how FF affects different FF quantiles. Moreover, this article investigates whether the FF-FP nexus varies with different hotel industries' operational characteristics (asset-heavy and asset-light business models). These contributions highlight the importance of this study.

This study has several significant findings. The first analysis shows a convex (inverted U-shaped) FF-FP nexus in Taiwan hotel firms during 2020 Q1–2021 Q2. QR approach displays a concave FF-FP nexus in all ROE quantiles except the 25th quantile. That is, with an increase in FF, the FP is on the rise, however, FP is beneficial only up to a threshold point, after which there are diminishing marginal returns to FP. In other words, the hotel firm must ensure that the FF strategy it adopts must be the most efficient and effective, i.e., it must bring the trade-off between costs and benefits. The second analysis shows the linkage between FF and FP following different patterns for the asset-heavy business model (AHBM) and asset-light business model (ALBM) hotel firms. For the AHBM firms, the QR approach evidence a concave (inverted U-shaped) FF-FP nexus in the 10th and 90th quantiles. Similarly, the QR approach shows a concave FF-EP nexus in all ROE quantiles except the 50th quantile, in the ALBM hotel firms. The third analysis supports the inverted U-shaped nexus between FF and FP during the COVID-19 while no relationship exists before the COVID-19. This finding may indicate some structural changes in the FF of the hotel industry between the two periods due to the COVID-19 pandemic.

The rest of the analysis is divided into five parts after the introduction. The research history and current results on the effects of FF on FP are clarified in the literature review section. The research methodology segment describes the sample and data collection process, research model, and methods. We present the details of the empirical results in the fourth segment. The discussion of findings and their implication is described in the fifth segment, and finally, Section 6 concludes the study.

The tourism and hospitality industry is especially affected by health emergencies (25–27). For example, the hotel industry is one of the most affected as domestic and foreign travel has been restricted to prevent the spread of COVID-19. The sensitivity of the hotel industry to external shocks compared to other service industries, combined with its higher fixed assets, higher fixed costs, and higher leverage structures, makes the hotel industry more vulnerable to the COVID-19 pandemic (28, 29).

Recent research has found that the financial strength of a company is becoming particularly important: stock market prices are less affected by the crisis in firms with more cash holdings, lower leverage, and more profits (21, 30, 31). Recent papers have focused on the impact of the pandemic on the stock prices and value creation of hotel companies. Wu et al. (32) adopted the event research method to explore the impact of COVID-19 on the stock price fluctuations of China's tourism industry. The results show that the COVID-19 crisis has had a negative impact on the hospitality and tourism sector stocks of China.

The resource-based view argues that enterprises with idle or surplus resources can use these resources to obtain external opportunities and promote enterprise growth (33). In addition, the tradeoff theory (34) states that when firms experience financial difficulties, sufficient cash reserves help reduce risks (24). The agency theory (35, 36), however, predicts that when a firm has extra cash, managers may waste it or invest in detrimental projects. Additionally, an excessive FF will lead to excessive idle cash, making the profitability of corporate cash relatively weak. Conversely, however, the low debt and low leverage have no incentive effect and will reduce FP (24).

Despite the extensive previous literature on the FF-FP nexus, there are still competing views. Chun and Yanbo (15) examined whether investment scale or efficiency guides the FF-FP relationship for companies listed on the Shanghai and Shenzhen stock exchanges (SSSE) and showed that FF significantly positively impacts FP. Arslan-Ayaydin et al. (8), from 1994 to 2009, assessed the impact of FF on FP of East Asian firms and indicated that corporations with optimum FF perform better in a financial crisis. Al-Slehat (16), from 2010 to 2017, explored the impact of FF on the FP of service industries in Jordan and found it had a positive influence.

Mehmood et al. (37) reported that FF had a positive influence on FP for the Pakistan Stock Exchange listed enterprises, from 1992 to 2014. The same positive relationship for Pakistani enterprises was also reported by Ali and Siddiqui (17), from 2009 to 2018. Recent research had shown that firms with FF experienced greater stock performance in the initial stages of the COVID-19 epidemic (20, 21). In addition, the scholar verified that FF has a positive impact on FP for the Taiwanese manufacturing industry during the COVID-19 shock (22). Contrastingly, some studies suggest that high FF leads to overinvestment from an agency costs perspective (19).

Recently, mixed results on the impact of FF on FP have led to doubt surrounding the linear relationship between the two variables, thus instigating the adoption of nonlinear models. Some studies concentrating on the nonlinear FF-FP relationship evidence that it has a concave (inverted U-shaped) pattern. For example, Yi (23) explored the impact of FF on the FP of SSSE listed manufacturing firms, from 2011 to 2017, and found the relationship to be concave. Gu and Yuan (24), from 2015 to 2018, investigated the associations among internal control, FF, and FP of SSSE listed Chinese information technology companies and confirmed that FF has a concave effect on FP. Chang and Wu (38) applied QR to analyze the effect of FF on FP for the Taiwan Stock Exchange (TSE) listed semiconductor firms, from Q1 2020 to Q1 2021, and evidenced a concave FF-FP nexus.

The aforementioned studies argue that improvement to the level of FF assists enterprises to achieve optimal performance. When FF exceeds the threshold (inflection point) level, the level of FF has a negative impact on FP. Consequently, the present study allows for the presence of both the positive and negative effects of FF levels on the performance of hotel firms by applying a concave function, as in Yi (23), Gu and Yuan (24), and Cang and Wu (38). Therefore, the first hypothesis is proposed:

H1. The effect of FF on FP is non-linear and assumes an inverted U-shaped form.

Recently, major hotel companies have increasingly reduced their ownership of hotel assets in the favor of ALBM (39). Some studies, from the dynamic capability's perspective, consider that ALBM is one of the unique dynamic capabilities of hotel enterprises, which can modify and update existing resources as per the environmental changes, so as to gain advantages over competitors and achieve excellent FP (40–42). In addition, some studies identified both positive and negative effects on ALBM (AHBM) on FP, nevertheless, the results of these articles were contradictory and inconclusive. Sohn et al. (43) verified a positive correlation between the ALBM, operating profitability, and enterprise value, indicating that ALBM improved FP. Seo et al. (44) also indicated a positive relationship between ALBM and FP for the United States loading firms. Conversely, Blal and Bianchi (45) found that the ALBM model had no impact on FP, e.g., share returns, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBIDTA), and ROE, of the six leading U.S. corporations over a 16-year period. On the other hand, Low et al. (46) found that AHBM hotel companies were preferred over ALBM hotel companies. Consequently, based on the above discussion, the second and third hypotheses are as follows:

H2. There is a significant positive relationship between FF and FP in AHBM hotel firms.

H3. There is a significant positive relationship between FF and FP in ALBM hotel firms.

The sample included all 20 publicly traded hotel firms listed on the TSE. The sample hotel companies provided financial data from Q1 2020 to Q2 2021. Taiwan Economic Journal (TEJ) database provides the financial and accounting data of firms to measure FP. The quarter values of one firm were missing from Q4 2020 due to the recompilation of their financial reports, as a result, 119 quarterly sample observations were available.

ROE commonly appears in the empirical board literature as holistic measures of FP (47, 48). To measure the performance and the ability to generate profits, the ROE of different hotel firms was compared. ROE is operationalized as the net income divided by shareholder equity.

FF is the independent variable. Since there is no unified standard method for FF measurement, this article refers to the finding of other authors (17, 22), where FF is computed as FF = Cash flexibility + Debt flexibility.

The following control variables were selected as previous studies found they have an effect on FP: growth rate of revenue (REVG) is referred to as the quarter-over-quarter percentage increase in revenue; current ratio (RDG) is calculated as current assets/current liability; net profit growth rate before taxes (BNIG) is measured by “net profit before taxes for the current period minus net profit before tax of the previous period divided by net profit before tax of the previous period”; the growth rate of owner's equity (OEG) is captured as the percentage change in owner's equity over the prior period (49, 50); average collection days (ARD) (51, 52); and SIZE (firm size (SIZE) is measured by the natural logarithm of total assets (48, 53).

In hospitality and tourism research, it is customary to use the ordinary least square (OLS) regression to test the hypotheses (54), as it captures the relationships at the mean. Nonetheless, focusing on central influences may lead to the underestimation or overestimation of correlation coefficients or failure to identify important associations, which may result in false positives and ignoring information at the tail of the distribution (55). As quantile regression (QR) allows for a full range of conditional quantile functions (55) and is more robust, providing more efficient estimations, besides, QR can bring an additional research advantage in tourism studies (54, 56). Hence, this research utilizes Koenker and Bassett's (57) QR model as follows.

where Qθ(ROEit|Xit) is the θ-th QR function. ROEit is the FP of i firm in t quarter; FFit is the FF of i firm in t quarter; FF2it

is the square of FF for i firm in t quarter; CONit is referred to as the control variables in the model including quarter and industry level controls; εθit represents error terms for firm i at quarter t at the θ-th quantile. The aforementioned QR model explores the nonlinear FF-EP nexus within financial quarters, after heteroscedasticity adjustment with a cluster at the firm level.

Furthermore, as described by the authors (58–60), it is best to use bootstrapping as an effective robust resampling technique to obtain healthy estimated results when the sample in the empirical model using quantile regression is small. In a recent study, academics have used QR as an available bootstrap method in statistical analysis software, such as STATA (61). These are standard methods for estimating the asymptotic covariance matrix of coefficients (62). In this study, we employed the QR approach to examine whether the determinants' effects are distinguishable across the quantiles in the conditional distribution of the dependent variable. In our estimations, 200 bootstrap replications are set to guarantee a small sample variability of the covariance matrix.1

Table 1 shows the descriptive statistics of the variables used in this study. Before the COVID-19, the mean of FF for the TSE listed hotel firms is 54.804%. The mean (median) of ROE is 0.966% (0.57%), the minimum is −63.83%, and the maximum is 173.46%. During the COVID-19, the average level of FF for the hotel firms is 53.203%. For ROE, the mean value is −17.662%, the median is −0.63%, the minimum is −714.92%, and the maximum is 24.69%. The mean value of ROE is lower than the median, and there is a wide range between the minimum and maximum values. The skewness value is −6.198 and the kurtosis value is 42.315, which illustrates that the distribution of ROE is skewed and heavily left-tailed. The normality test on ROE verifies that its Jacque-Bera statistic (=83,000, p < 0.001) rejects the hypothesis of ROE normally distributed.

Further analyses of before-COVID-19 and during-COVID-19, however, reveal some interesting findings: OLS regression reveals the inverted U-shaped nexus between FF and FP during the COVID-19 while no relationship exists before the COVID-19, as shown in Table 2. In addition, this study uses the seemingly unrelated estimation (SUE) (64) to adjust standard errors (SEs) simultaneously to compare the coefficients from the OLS estimated results before COVID-19 and during COVID-19. To be specific, the gaps between any two coefficients were tested to determine if gaps were equal to zero or not by using the Hausman test (65). From Table 2, it is possible that the effect of independent and control variables differed across periods.

Furthermore, the findings may indicate some structural changes in the FF of the hotel industry between the two periods due to the COVID-19 pandemic. Perhaps the ALBM employed by many hospitality firms (e.g., franchising strategy), further maturing in 2020, may have contributed to some of the discrepancies seen in this study. Thereafter, this study only concerns the effect of FF on EP amid the COVID-19 epidemic period.

First, whether multi-collinearity exists among the independent variables was investigated. Table 3 contains the results of the variance inflation factor (VIF) on the independent variable with a mean VIF of 1.20. The highest value is 1.56, which is far below the cut-off value of 10, suggested by Hair et al. (66). Therefore, no multicollinearity problem is suspected.

Next, Table 4 exhibits the results of the OLS and QR analysis for the full hotel industry. OLS regression estimation results reveal that the coefficients of FF and FF2 are positive and negative (p < 0.01), respectively, and both are statistically significant, indicating the nonlinear (inverted U-shaped) FF-FP nexus. Additionally, the QR approach reveals that the coefficients of FF and FF2 are positive and negative (p < 0.01), respectively, and both are statistically significant in all quantiles except the 25th quantile. This shows that the nexus between FF and FP is a nonlinear inverted U-shaped form in all quantiles, except the 25th quantile (Table 4). Thus, H1 is supported.

Regarding the control variables, OLS estimation results show that REVG significantly positively impacts FP, whereas QR results evidence that the positive effect of REVG is predominantly in the 50th, 75th, and 90th quantiles. The OLS estimation results of RDG verify that there is a significant negative effect; nevertheless, this is not apparent in the QR estimation results. BNIG and ARD are neither significant in the OLS nor QR estimation results. OLS estimation results expose that OEG has a positive effect; however, this is not apparent in the QR results. OLS analysis reveals that the SIZE has a positive effect; however, this is not apparent in the QR results (Table 4).

Results confirmed that the impact of FF (including its components) on FP is heterogeneous across the ROE distributions. Inter-quantile regression was employed to test whether the slope of the entire quantile is equal to verify that the difference is statistically significant (57). The F statistic formula was also used to test the equality of the coefficient across various quantile pairings. Table 5 shows the results of the F-test and the corresponding values of p after examining the uniformity of the coefficient only between the upper (90th) and lower quantiles (10th), using the bootstrap process with 200 replications. Table 5 presents the inter-quantile results for ROE. For the whole hotel, there are statistically significant differences in the parameter estimates of FF and FF2 for the symmetrical quantiles [quantile (90/10)].

In addition, the business model of the hotel generally distinguishes between the AHBM and ALBM. Thus, this paper divides the full hotel industry into the AHBM and ALBM hotel firms. The asset-light business model of hotel firms was measured through the ratio of the fixed assets (property, plant and equipment, PPE) to total assets ratio (67) quarter-by-quarter. Consequently, the subsample of 65 AHBM firms was above the average fixed assets to total assets ratio, and the subsample of 54 ALBM firms was below the average fixed assets to total assets ratio. Tables 6, 7 show the estimation results for these subsamples.

For the AHBM hotel companies, the OLS estimation results show that FF has not significantly positively influenced FP, which does not support H2 (Table 6). However, the QR approach reveals an inverted U-shaped FF-FP nexus in the lowest (10th) and the highest (90th) quantiles. For ALBM hotel firms, OLS regression reveals a significantly positive impact on FP, which does support H3 (Table 7). Furthermore, OLS verified that there is an inverted U-shaped (concave) FF-FP nexus and that QR had a concave impact on FP in all quantiles except the median quantile, again demonstrating that FF had a nonlinear concave effect on FP.

To perform a robustness test to check the consistency of the results, the model was estimated using different subsamples. This study utilizes firm size as a proxy for information asymmetry according to the current literature conventions. It is assumed that large enterprises have a low degree of information asymmetry and small enterprises have a high degree of information asymmetry and are treated as a separate sample (68). Thus, the subsample of 60 large firms was above the average value of nature logarithm of total assets, and the subsample of 59 small firms was below. Tables 8, 9 reveal the estimation results for these subsamples. The empirical results reveal that the FF and FF2 are positively and negatively significant, respectively, indicating a concave (inverted U-shaped) linkage between FF and FP, similar to the main consequences.

This empirical investigation of the nonlinear FF-FP relationship uses OLS and QR analysis on data from the TSE listed hotel firms. The results elicit several findings regarding the relationship between FF and FP as follows.

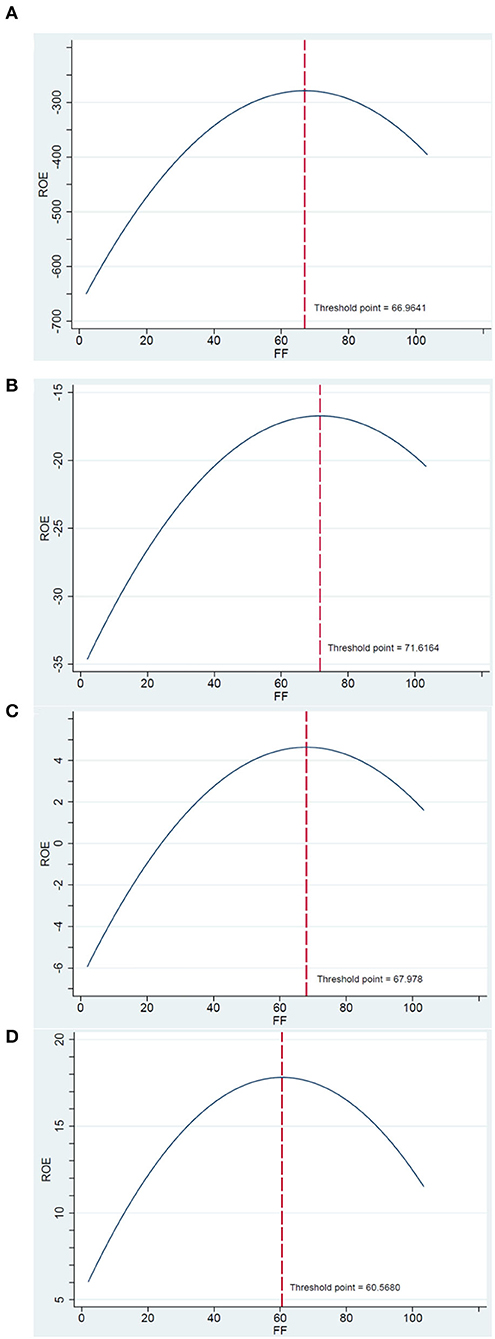

This research verifies that the FF-FP nexus is a concave or an inverted U-shaped in all quantiles, except the 25th quantile. It indicates that the influence of FF on FP first increases and then decreases after reaching the optimal FF threshold. By solving the first derivative, the optimal FF values are 66.98, 71.66, 68.88, and 61.26% in the 10th, 50th, 75th, and 90th quantiles, respectively, as reported in Table 4 and shown in Figures 1A–D. Figures 1A–D indicates that FF can start enhancing the firm performance before the threshold point and reach the optimal firm performance at the threshold. Thus, the hotel firms should focus on the dynamic control and optimization of FF to obtain the maximum FP.

Figure 1. The inverted U–shaped financial flexibility (FF)-firm performance (FP) nexus for hotel companies in (A) 10th, (B) 50th, (C) 75th, and (D) 90th quantile.

With regarding to AHBM hotel firms, the study evidenced a concave FF-FP nexus in the 10th and 90th quantiles. In addition, the optimal numbers of FF are 84.53 and 44.79% in the 10th and 90th quantile, respectively, as reported in Table 6. Similarly, for the ALBM hotel firms, the study also shows a concave FF-EP nexus in all ROE quantiles except the 50th quantile. In addition, the optimal numbers of FF are 67.1, 65.81, 57.07, and 62.67% in the 10th, 25th, 75th, and 90th quantiles, respectively, as reported in Table 7. Thus, either AHBM or ALBM hotel firms should focus on the dynamic control and optimization of FF to obtain the maximum FP.

To sum up, we find an inverted U-shaped relationship between FF and FP. Increases in FF improve FP. However, FP is beneficial only up to a point, after which there are diminishing marginal returns to FF. The inverted U-shaped FF-FP nexus is guided by a trade-off. Thus, a firm must have an efficient FF in place that balances the cost and benefits. More specifically, the hotel industry of Taiwan (includes AHBM and ALBM firms) set target FF based on the balance between the marginal benefits and costs of FF. These results confirm that the FF plays a significant role in the decision-making of Taiwanese hotel firms.

This study adds to the literature by showing that the FF-FP nexus follows an inverted U-shaped form in the Taiwanese hotel industry amid the COVID-19 epidemic. Different results are found as the hotel industry is divided between AHBM and ALBM hotel firms. We found that the impact of FF on FP is an inverted U-shaped for the AHBM hotel firms in the lowest and the highest ROE quantiles. This means that FF influences AHBM hotel firms with the worst and best performance and does not influence firms with performance in the 25th, 50th, and 75th quantiles. In addition, the impact of FF on FP follows an inverted U-shaped for the ALBM hotel firms in all ROE quantiles, except the 50th quantile. It implies that FF influences ALBM hotel firms with lower and upper performance and does not influence companies with performance in the median. Overall, the findings lend support that the FF has value in difficult market conditions, especially the COVID-19 epidemic period.

The empirical results of this study elicit several practical implications. First, policymakers should develop FF policies that enable companies to respond positively amid a crisis, such as financial difficulty during an epidemic, and maintain effective investment policies. Second, in the terms of hotel managers, whose operating are either AHBM or ALBM, should put more emphasis on their companies' maintenance of FF. Third, from the perspective of investors, the results can be used as a reference for hotel portfolio evaluation. Analysts or investors can compare the FF of a hotel firm against the proposed thresholds to predict their possible future performance.

This study is not free from limitations. First, despite the ongoing COVID-19 epidemic, data were only examined from 2020 Q1 to 2021 Q2, from the TSE listed hotel firms. Given that there are not many hotel firms traded on the TSE, this paper can only use a small sample size of 20 hotel firms (119 quarterly sample observations). Ongoing research should include longer periods of study. Second, given that the hotel industry could vary in different countries, it would be interesting to see if studies based on data from other countries would find a significant nonlinear FF-FP relationship and how different FF influences FF across countries (or sectors/industries). Lastly, Gozgor et al. (69) show that the geopolitical risks negatively affect the capital investment in tourism, and Gozgor et al. (70) reveal that the higher level of legal system quality and the better protection of property rights promote inbound tourism. Future studies should discuss the role of geopolitical risks and institutional quality to improve our understanding of the COVID-19 effect in the hotel sector.

The original contributions presented in the study are included in the article/supplementary files, further inquiries can be directed to the corresponding author.

XZ, B-GC, and K-SW: conceptualization. B-GC and K-SW: methodology, formal analysis, writing—original draft, and writing—review and editing. B-GC: software and data curation. XZ: visualization. All authors have read and agreed to the published version of the manuscript.

This work was funded by Natural Science Foundation of China (Grant No: 72162028).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. ^Sakov and Bicke (63) suggest a data-dependent rule for choosing the number of bootstrap replications (i.e., the size of bootstrap sample): m = kn2/5, in which m and n are the size of the bootstrap sample and original sample, respectively, and k is a constant smaller than or equal to the number of variables (Li, Sun, & Zou, 2009). This rule in our case leads to m = 55.

1. Polemis ML. The Impact of COVID-19 on Hotel Performance: Evidence From a Difference-in-Differences Approach. MPRA Paper 102053, University Library of Munich, Germany. Available online at: https://mpra.ub.uni-muenchen.de/102053/ (accessed April 18, 2021).

2. Sharma A, Nicolau JL. An open market valuation of the effects of COVID-19 on the travel and tourism industry. Ann Tour Res. (2020) 83:102990. doi: 10.1016/j.annals.2020.102990

3. Zenker S, Kock F. The coronavirus pandemic – a critical discussion of a tourism research agenda. Tour Manag. (2020) 81:104164. doi: 10.1016/j.tourman.2020.104164

4. Sharma A, Shin H, Santa-María MJ, Nicolau JL. Hotels' COVID-19 innovation and performance. Ann Tour Res. (2021) 88:13180. doi: 10.1016/j.annals.2021.103180

5. Sheel A. Hotel industry performance in 2019-2020, COVID-19 impact, and the JHFM index. J Hosp Financial Manag. (2020) 28:81–3. doi: 10.7275/7m54-0b48

6. Kuo CW. Can we return to our normal life when the pandemic is under control? A preliminary study on the influence of COVID-19 on the tourism characteristics of Taiwan. Sustainability. (2021) 13:9589. doi: 10.3390/su13179589

7. Gamba A, Triantis A. The value of financial flexibility. J Finance. (2008) 63:2263–96. doi: 10.1111/j.1540-6261.2008.01397.x

8. Arslan-Ayaydin Ö, Florackis C, Ozkan A. Financial flexibility, corporate investment and performance: evidence from financial crises. Rev Quant Finance Account. (2014) 42:211–50. doi: 10.1007/s11156-012-0340-x

9. Yun J, Ahmad H, Jebran K, Muhammad S. Cash holdings and firm performance relationship: do firm-specific factors matter? Econ Res -Ekon. (2021) 34:1238–305. doi: 10.1080/1331677X.2020.1823241

10. La Rocca M, Cambrea DR. The effect of cash holdings on firm performance in large Italian companies. J Int Financial Manag Account. (2019) 30:30–59. doi: 10.1111/jifm.12090

11. Jiang Y, Wen J. Effects of COVID-19 on hotel marketing and management: a perspective article. Int J Contemp Hosp Manag. (2020) 32:2563–73. doi: 10.1108/IJCHM-03-2020-0237

12. Denizci Guillet B, Chu AMC. Managing hotel revenue amid the COVID-19 crisis. Int J Contemp Hosp Manag. (2021) 33:604–27. doi: 10.1108/IJCHM-06-2020-0623

13. Yacoub L, ElHajjar S. How do hotels in developing countries manage the impact of COVID-19? The case of Lebanese hotels. Int J Contemp Hosp Manag. (2021) 33:929–48. doi: 10.1108/IJCHM-08-2020-0814

14. Yang M, Han C. Revealing industry challenge and business response to Covid-19: a text mining approach. Int J Contemp Hosp Manag. (2021) 33:1230–48. doi: 10.1108/IJCHM-08-2020-0920

15. Chun MA, Yanbo J. What drives the relationship between financial flexibility and firm performance: Investment scale or investment efficiency? Evidence from China. Emerg Mark Finance Trade. (2016) 52:2043–55. doi: 10.1080/1540496X.2015.1098036

16. Al-Slehat ZAF. The impact of the financial flexibility on the performance: An empirical study on a sample of Jordanian services sector firms in period (2010-2017). Int J Bus Manag. (2019) 14:1–11. doi: 10.5539/ijbm.v14n6p1

17. Ali A, Siddiqui DA. Exploring the Nexus Between Financial Flexibility, Managerial Efficiency, Ownership, Performance: An Interactive Model for Growth, Mature, Stagnant Companies in Pakistan. (2020). Available online at: http://dx.doi.org/10.2139/ssrn.3681306 (accessed November 25, 2020).

18. Bilyay-Erdogan S. Does financial flexibility enhance firm value? A comparative study between developed and emerging countries. Bus Theory Pract. (2020) 22:723–36. doi: 10.3846/btp.2020.12680

19. Agha M, Faff R. An investigation of the asymmetric link between credit re-ratings and corporate financial decisions: “Flicking the switch” with financial flexibility. J Corp Finance. (2014) 29:37–57. doi: 10.1016/j.jcorpfin.2014.08.003

20. Fahlenbrach R, Rageth K, Stulz RM. How Valuable is Financial Flexibility When Revenue Stops? Evidence From the COVID-19 Crisis. NBER Working Paper no. 27106 (2020). Available online at: http://dx.doi.org/10.2139/ssrn.3586540 (accessed September 6, 2020).

21. Ramelli S, Wagner AF. Feverish stock price reactions to COVID-19. Rev Corp Finance Stud. (2020) 9:622–55. doi: 10.1093/rcfs/cfaa012

22. Teng X, Chang BG, Wu KS. The role of financial flexibility on enterprise sustainable development during the COVID-19 crisis– a consideration of tangible assets. Sustainability. (2021) 13:1245–61. doi: 10.3390/su13031245

23. Yi J. Financial flexibility, dynamic capabilities, and the performance of manufacturing enterprises. J Res Emerg Mark. (2020) 2:19–32. doi: 10.30585/jrems.v2i2.465

24. Gu Y, Yuan F. Internal control, financial flexibility and corporate performance-Based on empirical analysis of listed companies in information technology industry. J Phys Conf Ser. (2020) 1607:012118. doi: 10.1088/1742-6596/1607/1/012118

25. Dahles H, Susilowati TP. Business resilience in times of growth and crisis. Ann Tour Res. (2015) 51:34–50. doi: 10.1016/j.annals.2015.01.002

26. Novelli M, Gussing Burgess L, Jones A, Ritchie BW. ‘No Ebola…still doomed' – the Ebola-induced tourism crisis. Ann Tour Res. (2018) 70:76–87. doi: 10.1016/j.annals.2018.03.006

27. Crespí-Cladera R, Martín-Oliver A, Pascual-Fuster B. Financial distress in the hospitality industry during the Covid-19 disaster. Tour Manag. (2021) 85:104301. doi: 10.1016/j.tourman.2021.104301

28. Kizildag M. Financial leverage phenomenon in hospitality industry sub-sector portfolios. Int J Contemp Hosp Manage. (2015) 27:1949–78. doi: 10.1108/IJCHM-07-2014-0347

29. Kizildag M, Ozdemir O. Underlying factors of ups and downs in financial leverage overtime. Tour Econ. (2017) 23:1321–42. doi: 10.1177/1354816616683579

30. Ding W, Levine RE, Lin C, Xie W. Corporate immunity to the COVID-19 pandemic. J Financ Econ. (2021) 141:802–30. doi: 10.1016/j.jfineco.2021.03.005

31. Pagano M, Wagner C, Zechner J. Disaster Resilience Asset Prices. In: SSRN working paper (2021). Available on at: https://doi.org/10.2139/ssrn.3603666 (11 March, 2022).

32. Wu W, Lee CC, Xing W, Ho SJ. The impact of the COVID-19 outbreak on Chinese listed tourism stocks. Financ Innovat. (2021) 7:22. doi: 10.1186/s40854-021-00240-6

33. Nohria N, Gulati R. What is the optimum amount of organizational slack? A study of the relationship between slack and innovation in multinational firms. Eur Manag J. (1997) 15:603–11. doi: 10.1016/S0263-2373(97)00044-3

34. Modigliani F, Miller MH. Corporate income taxes and the cost of capital. Am Econ Rev. (1963) 53:433–43.

35. Jensen MC, Meckling WH. Theory of the firm: managerial behavior, agency costs and ownership structure. J Financ Econ. (1976) 3:305–60. doi: 10.1016/0304-405X(76)90026-X

36. Jensen MC. Agency costs of free cash flow, corporate finance, and takeovers. Am Econ Rev. (1986) 76:323–9. doi: 10.2139/ssrn.99580

37. Mehmood Y, Rizwan MF, Rashid A. Exploring the relationship between financial distress, financial flexibility, and firm performance empirical evidence from Pakistan stock exchange. NICE Res J Soc Sci. (2018) 11:2210–29. doi: 10.51239/nrjss.v0i0.68

38. Chang BG, Wu KS. Concave effect of financial flexibility on semiconductor industry performance: Quantile regression approach. Technol Econ Dev Econ. (2022) (In Press). doi: 10.3846/tede.2022.16622.

39. Seo K, Soh J. Asset-light business model: an examination of investment-cash flow sensitivities and return on invested capital. Int J Hosp Manag. (2019) 78:169–78. doi: 10.1016/j.ijhm.2018.12.003

40. Teece DJ, Pisano G, Shuen A. Dynamic capabilities and strategic management. Strateg Manag J. (1997) 18:509–533.

41. Eisenhardt KM, Martin JA. Dynamic capabilities: what are they? Strateg Manag J. (2000) 21:1105–21. doi: 10.1002/1097-0266(200010/11)21:10/11<1105::AID-SMJ133>3.0.CO;2-E

42. Zahra SA, Sapienza HJ, Davidsson P. Entrepreneurship and dynamic capabilities: a review, model and research agenda. J Manag Stud. (2006) 43:917–55. doi: 10.1111/j.1467-6486.2006.00616.x

43. Sohn J, Tang CH, Jang S. Does the asset-light and fee-oriented strategy create value? Int J Hosp Manag. (2013) 32:270–7. doi: 10.1016/j.ijhm.2012.07.004

44. Seo K, Woo L, Mun SG, Soh J. The asset-light business model and firm performance in complex and dynamic environments: The dynamic capabilities view. Tour Manag. (2021) 85:104311. doi: 10.1016/j.tourman.2021.104311

45. Blal I, Bianchi G. The asset light model: a blind spot in hospitality research. Int J Hosp Manag. (2019) 76:39–42. doi: 10.1016/j.ijhm.2018.02.021

46. Low W, Das P, Piffaretti C. The role of hotels in mixed asset portfolios: revisiting the asset-heavy versus asset-light debat. I J Built Environ Proj Asset Manag. (2015) 1:273–92. doi: 10.1504/IJBEAM.2015.075061

47. Lan T, Chen Y, Li H, Guo L, Huang J. From driver to enabler: the moderating effect of corporate social responsibility on firm performance. Econ Res Ekon Istraz. (2021) 34:2240–62. doi: 10.1080/1331677X.2020.1862686

48. Sun Y, Li Y. COVID-19 Outbreak and financial performance of Chinese listed firms: Evidence from corporate culture and corporate social responsibility. Front Public Health. (2021) 9:710743. doi: 10.3389/fpubh.2021.710743

49. Rahayu SM. Mediation effects financial performance toward influences of corporate growth and assets utilization. Int J Product Perform Manag. (2019) 68:981–96. doi: 10.1108/IJPPM-05-2018-0199

50. Sardo F, Serrasqueiro Z. Intellectual capital, growth opportunities, and financial performance in European firms: dynamic panel data analysis. J Intellect Cap. (2018) 19:747–67. doi: 10.1108/JIC-07-2017-0099

51. Zeidan R, Shapir OM. Cash conversion cycle and value-enhancing operations: theory and evidence for a free lunch. J Corp Finance. (2017) 45:203–19. doi: 10.1016/j.jcorpfin.2017.04.014

52. Boisjoly RP, Conine TE Jr, McDonald MB. Working capital management: Financial and valuation impacts. J Bus Res. (2020) 108:1–8. doi: 10.1016/j.jbusres.2019.09.025

53. Song HJ, Yeon J. Lee S. Impact of the COVID-19 pandemic: evidence from the US restaurant industry. Int J Hosp Manag. (2021) 92:102702. doi: 10.1016/j.ijhm.2020.102702

54. Assaf AG, Tsionas M. Changing the basics: towards more use of quantile regressions in hospitality and tourism research. Int J Hosp Manag. (2018) 72:140–4. doi: 10.1016/j.ijhm.2018.01.009

55. Chiang TC Li J, Tan L. Empirical investigation of herding behavior in Chinese stock markets: evidence from quantile regression analysis. Glob Finance J. (2010) 21:111–24. doi: 10.1016/j.gfj.2010.03.005

56. Assaf AG, Tsionas M. Quantitative research in tourism and hospitality: an agenda for best-practice recommendations. Int J Contemp Hosp Manag. (2019) 31:2776–87. doi: 10.1108/IJCHM-02-2019-0148

58. Hahn J. Bootstrapping quantile regression estimators. Econom Theory. (1995) 11:105–21. doi: 10.1017/S0266466600009051

59. Feng X, He X, Hu J. (2011). Wild bootstrap for quantile regression. Biometrika. (2011) 98:995–9. doi: 10.1093/biomet/asr052

60. Nikitina L, Paidi R, Furuoka F. Using bootstrapped quantile regression analysis for small sample research in applied linguistics: some methodological considerations. PLoS ONE. (2019) 14:1–19. doi: 10.1371/journal.pone.0210668

61. Zhao L, Liu Z, Vuong THG, Nguyen HM, Radu F, Tabîrca AI, et al. Determinants of financial sustainability in Chinese firms: a quantile regression approach. Sustainability. (2022) 14:1555. doi: 10.3390/su14031555

62. Buchinsky M. Estimating the asymptotic covariance matrix for quantile regression models a Monte Carlo study. J Econ. (1995) 68:303–38. doi: 10.1016/0304-4076(94)01652-G

63. Sakov A, Bicke P. Choosing m in the m out of n Bootstrap. In: Proceedings of the American Statistical Association, Section on Bayesian Statistical Science. Baltimore, MD (1999). p. 125–8.

64. Weesie J. Seemlingly unrelated estimation and the cluster-adjusted sandwich estimator. Stata Tech Bull. (2000) 52:34–7. Available online at: http://stata-press.com/journals/stbcontents/stb52.pdf

65. Hausman JA. Specification tests in econometrics. Econometrica. (1978) 46:1251–71. doi: 10.2307/1913827

66. Hair JF, Hult GTM, Ringle CM, Sarstedt M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). 2nd ed. Thousand Oaks: Sage (2017).

67. Märklin P, Bianchi G. A differentiated approach to the asset-light model in the hotel industry. Cornell Hosp Q. (2021) (In press). doi: 10.1177/19389655211006076

68. Saygili E, Arslan S, Birkan AO. ESG practices and corporate financial performance: evidence from BORSA ISTANBUL. Borsa Istanbul Rev. (2021). doi: 10.1016/j.bir.2021.07.001. [In Press].

69. Gozgor G, Lau MCK, Zeng Y, Yan C, Lin Z. The impact of geopolitical risks on tourism supply in developing economies: the moderating role of social globalization. J Travel Res. (2022) 61:872–86. doi: 10.1177/00472875211004760

Keywords: COVID-19, financial flexibility, firm performance, hotel industry, quantile regression

Citation: Zhang X, Chang B-G and Wu K-S (2022) COVID-19 Shock, Financial Flexibility, and Hotels' Performance Nexus. Front. Public Health 10:792946. doi: 10.3389/fpubh.2022.792946

Received: 11 October 2021; Accepted: 17 March 2022;

Published: 18 April 2022.

Edited by:

Giray Gozgor, Istanbul Medeniyet University, TurkeyReviewed by:

Ching Hsun Chang, National Taiwan Normal University, TaiwanCopyright © 2022 Zhang, Chang and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kun-Shan Wu, a3Vuc2hhbkBtYWlsLnRrdS5lZHUudHc=

†ORCID: XueHui Zhang orcid.org/0000-0002-6705-691X

Bao-Guang Chang orcid.org/0000-0001-9352-8012

Kun-Shan Wu orcid.org/0000-0001-9550-8840

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.