94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Public Health, 10 November 2022

Sec. Public Health Policy

Volume 10 - 2022 | https://doi.org/10.3389/fpubh.2022.1037763

Guomei Tian1†

Guomei Tian1† Jinpeng Xu2†

Jinpeng Xu2† Ting Zhang2†

Ting Zhang2† Hongyu Zhang2

Hongyu Zhang2 Jian Liu2

Jian Liu2 Qi Shi2

Qi Shi2 Fangmin Deng2

Fangmin Deng2 Fangting Chen2

Fangting Chen2 Jingran He2

Jingran He2 Qunhong Wu2

Qunhong Wu2 Zheng Kang2*

Zheng Kang2* Hui Wang3*

Hui Wang3*Background: Rural residents' participation in medical insurance has a significant relationship to the affordability of their medical care. This study aims to investigate the willingness of rural residents to participate in basic medical insurance for urban and rural residents and its determinants so as to enhance their willingness to participate in medical insurance.

Methods: Data were obtained from 1,077 validated questionnaires from rural residents. Chi-square test and multiple logistic regression analysis were adopted to analyze determinants of rural residents' willingness to participate in basic medical insurance for urban and rural residents.

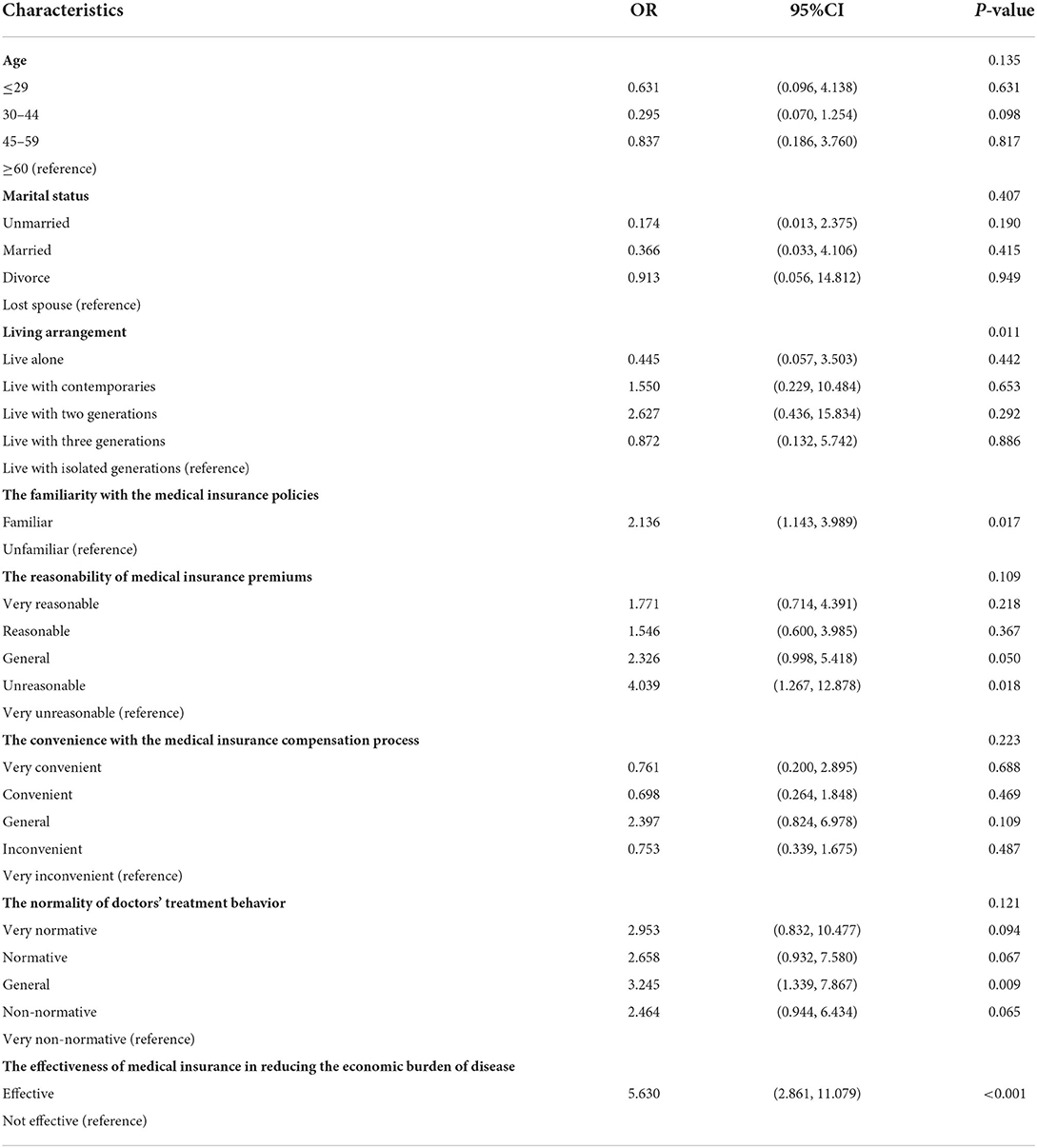

Results: 94.3% of respondents were willing to participate in basic medical insurance for urban and rural residents and this was associated with the familiarity with the medical insurance policies [OR = 2.136, 95% CI (1.143, 3.989)], the reasonability of medical insurance premiums [OR = 2.326, 95% CI (0.998, 5.418)], the normality of doctors' treatment behavior [OR = 3.245, 95% CI (1.339, 7.867)] and the medical insurance's effectiveness in reducing the economic burden of disease [OR = 5.630, 95% CI (2.861, 11.079)].

Conclusion: Even though most respondents were willing to participate in basic medical insurance for urban and rural residents, some aspects need to be improved. The focus should be on promoting and regulating the behavior of medical staff. Financing policies and reimbursement of treatment costs need to be more scientifically developed. A comprehensive basic healthcare system needs to be optimized around the core function of “hedging financial risks”.

Since 1998, basic medical insurance had been proposed and established in China. The basic medical insurance divided the insured population into employees and residents. Residents are classified as rural or urban according to their status, with the new rural cooperative medical insurance and the basic medical insurance for urban residents catering to the needs of these two groups, respectively. As the economy develops, basic medical insurance continues to make progress in addressing medical needs and improving the health of the population. In particular, the health status of rural insured residents has been greatly improved as a result (1).

However, the problems of scattered medical insurance institutions, large disparities between urban and rural medical coverage, and inequitable allocation of health resources still exist (2–4). Faced with this situation, in 2016, the Chinese government called for the integration of the basic medical insurance for urban residents and the new rural cooperative medical insurance system into a new system called Basic Medical Insurance for Urban and Rural Residents (BMIURR). This new BMIURR covers all urban and rural residents, except those insured under the urban employee basic medical insurance. This means that urban and rural residents are no longer restricted by geography and status and can enjoy uniform medical insurance payments and participation. After the integration of basic medical insurance, rural residents have equitable access to better medical services and greater protection (5, 6).

The occurrence of any behavior may be driven by willingness (7). Willingness has a certain degree of spontaneity, and it can accurately predict actual behavior when not disturbed by situational factors (8). As a public policy in which residents voluntarily participate, their willingness to participate and support the policy is directly related to the coverage and sustainability of the medical insurance system. Even with the large number of rural residents moving to the cities and towns, the population of rural residents still accounts for about 35% of China's total population (9). To promote the development of urban-rural integration and reduce rural poverty due to illness, promoting active participation in BMIURR by rural residents is the primary prerequisite to ensure the sustainability of this basic medical insurance.

In examining Malaysian residents' willingness to enroll in the newly introduced community health insurance, Shafie and Hassali (10) found that culture, monthly household income, and the presence of chronic diseases had a significant effect on their willingness to enroll. Duku et al. (11) found that because of adverse selection, people who have used health services or are expected to use them are more likely to participate in health insurance, while most people who have not used health insurance will be reluctant to participate. From the perspective of rural residents' participation behavior, Haile et al. (12) found that 78% of the respondents were willing to join the newly introduced community health insurance scheme in 2010, where socioeconomic and social capital factors had a significant effect on the willingness to participate. Indians who are not well-educated are not very conscious of health precautions, so they are not very willing to take insurance (13).

To the best of our knowledge, few studies have examined the willingness to participate in health insurance among rural groups in China. Therefore, the purpose of this study was to examine the willingness of rural residents to participate in medical insurance. Three representative cities in eastern, western, and northeastern China, namely Shandong, Shanxi, and Liaoning, were selected as study sites to investigate rural residents in these areas and their willingness to participate in BMIURR and to determine the most influential factors regarding their participation. The results can provide information and suggestions for health policy-makers and administrators of medical and health institutions, refine the medical insurance policy, further promote the development of BMIURR, and effectively protect the lives and economies of rural residents.

A cross-sectional questionnaire survey was used to analyze the determinants of rural residents' willingness to participate in the basic medical insurance for urban and rural residents. A face-to-face questionnaire survey was conducted in Shandong, Shanxi, and Liaoning provinces from January to December 2019 using a random sampling method. The questionnaire was designed to survey respondents on a range of information, including demographic status, perceptions of medical insurance, and willingness to participate. The results of questionnaires from people living in rural areas were selected as the sample data for this study. We followed the formula below in calculating the sample size for this sampling.

where z determines the confidence level, and the z value is generally 1.96 corresponding to the 95% confidence level we chose. P is the percentage of a feature in the target population, which is generally set to 0.5 if no prior data are available. d is the acceptable precision/accuracy level, generally, we took 0.03. Therefore, according to the formula, 1,067 samples should be investigated in this study. Because of the possible variation in questionnaire return rates, we ended up surveying a sample of 1,096. After quality screening to exclude the 19 unqualified samples, 1,077 valid questionnaires were finally retained, with a valid return rate of 98.27%.

The dependent variable of the study was the willingness of rural residents to participate in health insurance. Respondents were asked to indicate whether they would like to participate in the BMIURR (1 = No, 2 = Yes).

Independent variables included in the modeling were demographic characteristics (age, gender, marital status, and education), socio-economic status (annual household income level, living arrangement, and low-income family), and physical condition (chronic disease). In addition, based on Donabedian's “Structure-Process-Outcome” quality model (14), their perception of medical insurance was captured on the evaluation index constructed in the framework of the “system design-operation process-operation effect” (the familiarity with the medical insurance policies, the reasonability of medical insurance premiums, the satisfaction with medical insurance compensation coverage, the convenience with the medical insurance compensation process, the normality of doctors' treatment behavior, and the effectiveness of medical insurance in reducing the economic burden of disease). 5-point Likert scale were used to measure respondents' perceptions of the reasonability of medical insurance premiums, the convenience with the medical insurance compensation process, and the normality of doctors' treatment behavior. The normality of doctors' treatment behavior was based on residents' responses to the question, “Do you think physicians' practice is normality?” (ranging from 1, very normative, to 5, very non-normative).

Data were analyzed using SPSS 22.0 (IBM Corp. Released 2013. IBM SPSS Statistics for Windows, Version 22.0. Armonk, NY: IBM Corp.). Descriptive statistical analysis was used to describe the characteristics of the respondents and their willingness to participate in BMIURR in general. The chi-square test was used to determine the significance of the association between willingness to participate and independent variables of different categories and levels. Multiple logistic regression was constructed to identify factors influencing willingness to participate in BMIURR after adjusting for the effects of other independent variables. OR, P-values and 95% CI were calculated, and two-sided statistical significance was set at P < 0.05.

A total of 1,077 respondents were included in the cross-sectional analysis, of which 47.1% were male and 52.9% were female. The age was mainly concentrated between 30 and 44 years old. The percentage of respondents whose education level is “junior high school” was 47.6%. The majority of respondents were married (79.5%) and the type of residence was mainly two-generation living (64.4%). The majority of household incomes were above 50,000 RMB, accounting for 36.5% of the total. In terms of health status, 90.0% of the respondents suffered from chronic diseases in the past 6 months (Table 1).

This study shows that 94.3% of the respondents were willing to participate in the basic medical insurance for urban and rural residents. Age, marital status, living arrangement, the familiarity with the medical insurance policy, the reasonability of medical insurance premiums, the convenience with the medical insurance compensation process, the normality of doctors' treatment behavior, the effectiveness of medical insurance in reducing the economic burden of disease factors were significantly associated with the respondents' willingness to participate in BMIURR (Table 1).

To further explore the factors influencing the public's willingness to participate in BMIURR, we included the statistically significant variables in the univariate analysis in a multiple logistic regression analysis. Multiple logistic regression results showed that the deeper the knowledge of health insurance [OR = 2.136, 95% CI (1.143, 3.989)], the stronger the willingness to participate in basic health insurance for urban and rural residents. The public's willingness to participate in health insurance is higher among those who believe health insurance costs are generally reasonable compared to those who believe health insurance costs are unreasonable [OR = 2.326, 95% CI (0.998, 5.418)] (P = 0.05, hint of significance). The public's willingness to participate in insurance is stronger for those who perceive doctors' treatment behavior as generally regulated than for those who perceive them as very irregular [OR = 3.245, 95% CI (1.339, 7.867)]. The public that believes health insurance reduces the financial burden of illness is more likely to participate than those who believe that it does not [OR = 5.630, 95% CI (2.861, 11.079)] (Table 2).

Table 2. Logistic regression results of willingness to participate in urban and rural residents' basic medical insurance (n = 1,077).

BMIURR can provide the basic medical security that rural residents need, promote satisfaction with the need for medical services, and effectively reduce the occurrence of poverty among rural residents due to illness. Therefore, it is crucial to improve the motivation of rural residents to ensure their willingness to participate in medical insurance. The results of the study indicate that there are four main factors affecting the willingness to participate: the familiarity with the medical insurance policies, the reasonability of medical insurance premiums, the normality of doctors' treatment behavior, and the effectiveness of medical insurance in reducing the economic burden of disease.

Rural residents with better recognition of the medical insurance policy were more likely to participate than those with poor recognition, which is consistent with the results of another study (15). The survey found that the number of rural residents who did have a certain understanding of the medical insurance system was larger than the number of those who did not. This may be due to the positive publicity achieved by rural officers and medical insurance agencies in raising medical insurance awareness. Furthermore, the KAP model predicts that people will adopt certain behaviors based on three stages: knowledge acquisition, attitude generation, and practice formation (16). Once rural residents can recognize the benefits that health insurance policies can bring to individuals, this may increase their willingness to participate in BMIURR.

The study found that the willingness to participate in BMIURR was higher among rural residents who considered the premiums for health insurance to be largely reasonable. Since the BMIURR was established, premiums have been gradually increasing to improve health insurance benefits. Although the annual income of rural residents has been increasing in recent years (17), their health service utilization equity has not improved as much as in urban areas (18, 19). As a result, they are not very willing to participate in health insurance. Some research has also found that the high fee for medical insurance is one reason why American farmers do not participate (20). For those with high incomes, health insurance premiums have no impact on their quality of life and are more motivated to purchase health insurance. On the other hand, low-income rural residents are dissuaded from the positive benefits of participating in medical insurance due to increasing premiums (21). Rural households have lower annual incomes, and as premiums increase, the proportion of medical expenses gradually increases, which may have an impact on normal household expenses, thus reducing the willingness to participate in insurance. I Especially if the individual is in good health, they are more reluctant to be insured.

In addition, the normality of doctors' treatment behavior was a significant variable in rural residents' willingness. The professional ethics of doctors in the appointed medical institution, the rational use of drugs, and the understanding of the medical insurance policy affected the satisfaction with the medical insurance. At present, the growth of medical expenses is mainly caused by non-normality medical service behavior, which is the increase in non-normality expenses caused by excessive medical treatments (22). Dranove suggested through a model that doctors tend to over-medicate, as evidenced by excessive test recommendations, leading to increased costs for tests (23). Although the current medical insurance payment method plays a role in controlling medical insurance fees, it has little effect on regulating the medical behavior of hospitals and doctors (24, 25). Nowadays, the drug proportion continues to decrease, but total medical expenses are growing rapidly. In the implementation of the “drug proportion” policy, the partial control of the drug proportion was found to induce excessive physical examinations, which meant that the policy did not fundamentally regulate medical behavior or medical expenses (26). The total payment control of basic medical insurance, which is currently widely practiced in China, is mainly aimed at controlling medical insurance expenses at medical institutions and indirectly regulating the medical behavior of doctors. However, in the implementation, it was found that the ability to guarantee the quality of medical services was weak, and when the quality of supervision was insufficient, the patient's timely use of essential medical resources was affected, especially patients with serious diseases. Patients may be reluctant to make enrolment because they do not receive access to basic healthcare resources during healthcare utilization (27). The Medicare physician system extends the supervision of the medical institution to the doctor by directly linking to the doctor's examination. The aim of the system is to regulate the medical service behavior of doctors (including diagnosis and prescription) to insure the reasonable use of Medicare funds. However, upon being implemented, the system was found to lack constraints in terms of policies and regulations, meaning that the cost of violations and warnings was minimal. Although it also includes many punitive measures, these can lead to a decrease in physician motivation. Meanwhile, Keenan et al. found that medical students similarly believed that physicians who violated program rules were less likely to be punished by official agencies and that the cost of punishment was lower (28), which could lead to a decreased likelihood that physicians will regulate their behavior.

With the new medical reform, the trend of the excessively rapid growth of medical expenses has been curbed and the proportion of individual health expenditures to total health expenditures has fallen to 28.8% in 2018 (29). The policy and associated measures play a role in regulating medical behavior, controlling medical expenses, and encouraging the sustainable development of medical insurance, but the normality of medical behavior still needs to be improved. However, most respondents who labeled the behavior of doctors as “non-normality” were found to be willing to participate in medical insurance, this may be related to the low payment ability of low-income rural residents and their greater dependency on medical insurance reimbursements. Additionally, the uncertainty of medical practice determines the uncertainty of the cost of care, as doctors have to choose different treatment options depending on the patient's condition. As a result, the cost of treatment for the same disease varies from patient to patient. The variability of diseases and the uncertainty of medical costs means that there will always be some benefits and some losses for the insurance provider, leading to the possibility of adverse selection by patients (30).

The results demonstrate that the effectiveness of medical insurance in reducing the economic burden of disease was highly related to willingness to participate. From a cost-benefit perspective, the public is likely to participate in insurance only when the benefits are greater than the costs. The economic burden of disease refers to economic loss due to illness, disability, or premature death of patients, and the economic loss of resources for the family and society tasked by caring for those affected by illnesses. Medical insurance plays an important role in reducing the financial burden of illness on the public, especially in terms of reduced personal health expenditures. Dou et al. (31) noted that the economic burden of disease of insured residents is lower than that of uninsured residents and that participation in medical insurance has a positive effect on reducing the economic burden of disease. Zhou et al. (32) also found that participation in health insurance had a positive effect on reducing the financial burden of illness. Having health insurance is a determinant of household catastrophic health expenditures for cancer patients in Korea (33), and having health insurance can effectively reduce household health expenditures. The incidence of catastrophic health expenditure for an insured family is significantly lower than that of an uninsured family (34).

However, the basic medical insurance level of coverage is still limited. When catastrophic health expenditure occurs, basic medical insurance will not be enough to relieve the heavy economic burden of disease. The World Health Organization argued that catastrophic health expenditures could create poverty if household health expenditures reach or exceed 50% of the household's non-food expenditure (35). There is a higher incidence of catastrophic health expenditures among households living in rural areas or poverty areas (36). The occurrence of severe diseases and their associated medical expenses can generate catastrophic health expenditures for uninsured households and there is therefore a positive relationship between serious diseases and poverty (37–39). The integration of urban and rural social health insurance has increased residents' utilization of health services but failed to reduce their financial burden of health care, especially for the poor (40). Therefore, although China initially established a relatively faultless basic medical system, it also needs to optimize the system design around the core function of “hedging financial risks” in medical security systems.

This study has several limitations. First, data were collected through a self-assessment questionnaire, and therefore, subjective bias may exist between the actual effect and the measured result. Second, due to the limitation of time and resources, only three provincial participants were selected as the subjects of this study, and the results may not be extended to other regions in China. Finally, the results cannot be interpreted as causality due to the cross-sectional design. To get more accurately assess the willingness of residents to participate in medical insurance, further studies are recommended to develop a more comprehensive and effective evaluation tool and a thorough analysis of the influencing factors on the willingness to participate.

The study of rural residents' willingness to participate in BMIURR is of great significance for the sustainable development of the health insurance system. According to the results, most rural residents were willing to participate in basic medical insurance. The familiarity with the medical insurance policies, the reasonability of medical insurance premiums, the normality of doctors' treatment behavior, and the effectiveness of medical insurance in reducing the economic burden of disease were the factors that had a significant relationship with rural residents' willingness to participate. Enabling the dissemination of Medicare information requires regular professional training of the staff in the Medicare department and the appointed medical institution so they understand the content and changes in Medicare policy on a timely basis. To solve the problem of doctors' non-normality medical behavior, relevant departments should continuously improve related medical insurance management and take measures according to the present situation. Last but not least, the Chinese government should accelerate the establishment of the medical bottom-line guarantee mechanism for the poor.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

The study protocol was reviewed and approved by the Research Ethics Committee of Harbin Medical University. Within the ethics and consent to participate declaration, this study adopted the form of verbal consent. Before conducting the investigation, the participants were explained the purpose of the questionnaire, and then the participants were asked for verbal consent. After the participants agreed, the questionnaire would be conducted. Because the survey participants are rural residents, most of them have limited educational levels. A questionnaire investigation was conducted with the participants' verbal consent.

GT conceived the idea and wrote the manuscript. JX and TZ designed this study and conducted statistical analyses. ZK contributed to the writing-review and editing and funding acquisition. HZ, JL, QS, and FD acquired the data and contributed additional advice regarding the analysis. FC and JH provided constructive suggestions for the discussion of the manuscript. QW and HW critically revised the paper. All authors read and approved the final manuscript.

The research was supported by National Natural Science Fund of China (72074064 and 71573068) and National Social Science Fund of China (19AZD013).

The authors thank all participants in this study, as well as all the interviewers for data collection. We are also grateful to all the reviewers for their insightful comments and suggestions.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

BMIURR, Basic medical insurance for urban and rural residents.

1. Meng Q, Fang H, Liu X, Yuan B, Xu J. Consolidating the social health insurance schemes in China: towards an equitable and efficient health system. Lancet. (2015) 386:1484–92. doi: 10.1016/S0140-6736(15)00342-6

2. Lei X, Lin W. The new cooperative medical scheme in rural China: does more coverage mean more service and better health? Health Econ. (2009) 18 (Suppl. 2):S25–46. doi: 10.1002/hec.1501

3. Holly Wang H, Huang S, Zhang L, Rozelle S, Yan Y. A comparison of rural and urban healthcare consumption and health insurance. China Agricultural Econ Rev. (2010) 2:212–27. doi: 10.1108/17561371011044315

4. Wu Z, Lei P, Hemminki E, Xu L, Tang S, Li X, et al. Changes and equity in use of maternal health care in China: from 1991 to 2003. Maternal Child Health J. (2012) 16:501–9. doi: 10.1007/s10995-011-0773-1

5. Ma C, Huo S, Chen H. Does integrated medical insurance system alleviate the difficulty of using cross-region health care for the migrant parents in China– evidence from the China migrants dynamic survey. BMC Health Serv Res. (2021) 21:1053. doi: 10.1186/s12913-021-07069-w

6. Fan X, Su M, Si Y, Zhao Y, Zhou Z. The benefits of an integrated social medical insurance for health services utilization in rural China: evidence from the China health and retirement longitudinal study. Int J Equity Health. (2021) 20:126. doi: 10.1186/s12939-021-01457-8

7. Kotler P. Marketing Management: Analysis, Planning, Implementation and Control. Upper Saddle River, NJ: Prentice–Hall (1967).

8. Fishbein M, Ajzen I. Belief, Attitude, Intention and Behaviour: An Introduction to Theory and Research. Addison-Wesley (1975).

9. National Bureau of Statistics of China. Main Data of the Seventh National Population Census. (2021). Available online at: http://www.stats.gov.cn/english/PressRelease/202105/t20210510_1817185.html (accessed May 11, 2021)

10. Shafie AA, Hassali MA. Willingness to pay for voluntary community-based health insurance: findings from an exploratory study in the state of Penang, Malaysia. Soc Sci Med. (2013) 96:272–6. doi: 10.1016/j.socscimed.2013.02.045

11. Duku SK, Asenso-Boadi F, Nketiah-Amponsah E, Arhinful DK. Utilization of healthcare services and renewal of health insurance membership: evidence of adverse selection in Ghana. Health Econ Rev. (2016) 6:43. doi: 10.1186/s13561-016-0122-6

12. Haile M, Ololo S, Megersa B. Willingness to join community-based health insurance among rural households of Debub Bench District, Bench Maji Zone, Southwest Ethiopia. BMC Public Health. (2014) 14:591. doi: 10.1186/1471-2458-14-591

13. Jain A, Swetha S, Johar Z, Raghavan R. Acceptability of, and willingness to pay for, community health insurance in rural India. J Epidemiol Global Health. (2014) 4:159–67. doi: 10.1016/j.jegh.2013.12.004

14. Ayanian JZ, Markel H. Donabedian's lasting framework for health care quality. New Engl J Med. (2016) 375:205–7. doi: 10.1056/NEJMp1605101

15. Madhukumar S, D S, Gaikwad V. Awareness and perception regarding health insurance in Bangalore rural population. Int J Med Public Health. (2012) 2:18–22. doi: 10.5530/ijmedph.2.2.5

16. Launiala A. How much can a kap survey tell us about people's knowledge, attitudes and practices? Some observations from medical anthropology research on malaria in pregnancy in Malawi. Anthropol Matters. (2009) 11:1–13. doi: 10.22582/am.v11i1.31

17. National Bureau of Statistics of China. Statistical Communiqué of the People's Republic of China on the 2019 National Economic and Social Development. (2020). Available from: http://images.mofcom.gov.cn/us2/202011/20201111065439266.pdf (accessed February 28, 2020).

18. Yang W. China's new cooperative medical scheme and equity in access to health care: evidence from a longitudinal household survey. Int J Equity Health. (2013) 12:20. doi: 10.1186/1475-9276-12-20

19. Zhou Z, Gao J, Fox A, Rao K, Xu K, Xu L, et al. Measuring the equity of inpatient utilization in chinese rural areas. BMC Health Serv Res. (2011) 11:201. doi: 10.1186/1472-6963-11-201

20. Hueth DL, Furtan WH. Economics of Agricultural Crop Insurance: Theory and Evidence. Dordrecht: Springer (1994). doi: 10.1007/978-94-011-1386-1

21. Boateng D, Awunyor-Vitor D. Health insurance in Ghana: evaluation of policy holders' perceptions and factors influencing policy renewal in the Volta Region. Int J Equity Health. (2013) 12:50. doi: 10.1186/1475-9276-12-50

22. Arrow KJ. Uncertainty and the welfare economics of medical care. 1963. J Health Politics Policy Law. (2001) 26:851–83. doi: 10.1215/03616878-26-5-851

23. Dranove D. Demand inducement and the physician/patient relationship. Econ Inquiry. (1988) 26:281–98. doi: 10.1111/j.1465-7295.1988.tb01494.x

24. Rice T. Physician payment policies: impacts and implications. Annu Rev Public Health. (1997) 18:549–65. doi: 10.1146/annurev.publhealth.18.1.549

25. Freebairn J. Evaluation of the supplier-induced demand for medical care model. Aust Econ Rev. (2001) 34:353–5. doi: 10.1111/1467-8462.00204

26. Gan C. Can Regulation of Drug Proportion Control Medical Expenses?–Based on Theoretical and Empirical Analysis on County Hospitals. Collected Essays Financ Econ. (2014) 184:87–96.

27. Sakyi EK, Atinga RA, Adzei FA. Managerial problems of hospitals under Ghana's national health insurance scheme. Clin Governance Int J. (2012) 17:178–90. doi: 10.1108/14777271211251291

28. Keenan CE, Brown GC, Pontell HN, Geis G. Medical students' attitudes in physician fraud and abuse in the medicare and medicaid programs. J Med Educ. (1985) 60:167–73. doi: 10.1097/00001888-198503000-00002

29. Wu J,. The Proportion of Individual Health Expenditure to Total Health Expenditure Had Dropped. (2018). Available online at: http://www.gov.cn/zhengce/2018-02/13/content_5266375.htm (accessed February 13, 2018).

30. Zhang L, Cui Y, Zheng M-B, Xiao Y. Countermeasures and research on adverse selection of venture capital under asymmetric information. Indian J Biotechnol. (2014) 10:10677–82.

31. Dou G, Wang Q, Ying X. Reducing the medical economic burden of health insurance in China: achievements and challenges. Biosci Trends. (2018) 12:215–9. doi: 10.5582/bst.2018.01054

32. Zhou S, Zhou C, Yuan Q, Wang Z. Universal health insurance coverage and the economic burden of disease in Eastern China: a pooled cross-sectional analysis from the national health service survey in Jiangsu Province. Front Public Health. (2022) 10:738146. doi: 10.3389/fpubh.2022.738146

33. Lee M, Yoon K. Catastrophic health expenditures and its inequality in households with cancer patients: a panel study. Processes. (2019) 7:39. doi: 10.3390/pr7010039

34. Gyedu A, Goodman SK, Katz M, Quansah R, Stewart BT, Donkor P, et al. National health insurance and surgical care for injured people, Ghana. Bull World Health Organ. (2020) 98:869–77. doi: 10.2471/BLT.20.255315

35. Reinhardt U, Cheng T. The world health report 2000 – health systems: improving performance. Bull World Health Org. (2000) 78:1064.

36. Li Y, Wu Q, Xu L, Legge D, Hao Y, Gao L, et al. Factors affecting catastrophic health expenditure and impoverishment from medical expenses in China: policy implications of universal health insurance. Bull World Health Org. (2012) 90:664–71. doi: 10.2471/BLT.12.102178

37. Schneider P. Why should the poor insure? Theories of decision-making in the context of health insurance. Health Policy Plan. (2004) 19:349–55. doi: 10.1093/heapol/czh050

38. Yardim MS, Cilingiroglu N, Yardim N. Catastrophic health expenditure and impoverishment in Turkey. Health Policy. (2010) 94:26–33. doi: 10.1016/j.healthpol.2009.08.006

39. Kusuma YS, Babu BV. The costs of seeking healthcare: illness, treatment seeking and out of pocket expenditures among the urban poor in Delhi, India. Health Soc Care Community. (2019) 27:1401–20. doi: 10.1111/hsc.12792

Keywords: basic medical insurance, willingness, influential factors, rural residents, China

Citation: Tian G, Xu J, Zhang T, Zhang H, Liu J, Shi Q, Deng F, Chen F, He J, Wu Q, Kang Z and Wang H (2022) Rural residents' willingness to participate in basic medical insurance and influential factors: A survey of three provinces in China. Front. Public Health 10:1037763. doi: 10.3389/fpubh.2022.1037763

Received: 06 September 2022; Accepted: 17 October 2022;

Published: 10 November 2022.

Edited by:

Ding Li, Southwestern University of Finance and Economics, ChinaReviewed by:

Lei Shi, Southern Medical University, ChinaCopyright © 2022 Tian, Xu, Zhang, Zhang, Liu, Shi, Deng, Chen, He, Wu, Kang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zheng Kang, a2FuZ3poZW5nQGhyYm11LmVkdS5jbg==; Hui Wang, bTE4MjQ1OTQ5MzQyQDE2My5jb20=

†These authors have contributed equally to this work and share first authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.