- Chinese Academy of Science and Technology for Development, Beijing, China

The development of science and technology (sci-tech) finance is conducive to improving the transformation quality of sci-tech achievements and optimizing the allocation of resources. However, the current sci-tech finance field in China is mainly promoted by the way of government work, and the theoretical research on the operation mechanism and system structure of sci-tech finance is relatively lagging. This article constructs the research framework of the sci-tech financial ecosystem from the perspective of ecology, uses the quantitative method of index design to deconstruct the gap between China and other major countries in the world, and analyzes the reasons and enlightenment. It is expected to provide decision-making support for relevant policies from the perspective of top-level design while promoting theoretical research.

Introduction

Finance of science and technology (“sci-tech finance”) has become an important driving force for technology enterprises to achieve high-quality development. Relevant foreign research is mainly focused on the impact of financial innovation on technological innovation. Schumpeter (1912) for the first time proposed the concept of “innovation” in “the theory of economic development,” and put credit creation theory in “innovation theory,” believing that innovation can push the economy to break out of the usual track, and the financial intermediation and financial services that it provides will play an important role in this process, that is, creating capital through credit expansion to achieve innovation, which is usually regarded as the starting point for systematic academic research in technology finance. Modigliani and Miller (1958) proposed the famous Modigliani–Miller (MM) theorem, believing that there exists a debt ratio that maximizes the value of a company, and based on this, he studied the source and structure of financing. Mckinnon and Shaw have questioned the neoclassical model of supply and demand from different perspectives. Mckinnon (1973) believed that in the long run, enterprises lacking external financing will not only affect capital accumulation but also hinder technological progress due to the limited capital scale, which is the “financial repression theory.” In his “Financial Deepening Theory,” Shaw (1973) pointed out that when the government's interest rate control is relatively loose, the demand of various departments for financial development will further expand, thus forming a virtuous cycle between monetary finance and the real economy. An important conclusion of these two classical financial development theories is that financial development promotes technological innovation. In 1983, Perez systematically revealed the basic economic paradigm of the symbiosis between technological innovation and financial capital for the first time in Technological Revolution and Financial Capital (Perez, 2007). King and Levine (1993) conducted an empirical study on the financial system and financial order of Western developed countries through the endogenous growth model, proving that financial development does promote sci-tech innovation, holding that banks and capital markets have different mechanisms, and promoting effects on sci-tech innovation. Perez (2002) summarized the laws of technological revolution and found that the reform of the financial and credit system has played an important role in promoting it. Nanda and Nicholas (2014) pointed out that although commercial banks play a positive role in technological innovation, they have a limited effect on the breakthrough of high-end frontier technology. Considering that the price of the capital market can reflect market information more accurately and timely, it is more suitable for technological innovation with high uncertainty (Fang et al., 2014).

In China, the theoretical discussion on sci-tech finance mainly focuses on the connotation of sci-tech finance and the coupling relationship between sci-tech and finance. Wang (2007) believed that there is a strong coupling relationship between technological innovation and financial development. Zhao et al. (2010) believed that sci-tech finance is an important part of the national sci-tech innovation system. Fang (2010) believed that sci-tech finance work is an important part of sci-tech work, and its foothold is a series of financial innovation behaviors triggered by sci-tech innovation activities. Hu and Zheng (2010) applied the loose coupling theory to classify the interaction mechanism of technological innovation and financial innovation into the interaction mechanism of system elements at the micro level, the matching mechanism of supply and demand of technology and finance at the medium level, and the coordination mechanism of system development at the macro level. Wang and Huang (2016) believed that the coupling relationship between sci-tech and finance presents a spiral shape with close relationship and complex effects.

This article believes that the connotation and extension of sci-tech finance need to be further extended with the systematic advancement of sci-tech reforms and financial reforms in China. Here, the “finance” in “sci-tech finance” broadly refers to all kinds of financing channels supporting sci-tech innovation, including government financial input, and various types of investment such as financial institutions, quasi-financial institutions, non-financial institutions, and individuals. Sci-tech finance is not only a set of institutionalized arrangements but also has evolved into an ecosystem in which various innovation subjects coexist.

Model Construction of Sci-Tech Financial Ecosystem

Theoretical and Model Construction

At present, there are a few studies on connotation interpretation and index system construction of the sci-tech financial ecosystem. In terms of concept and mechanism, Jia et al. (2014) believed that sci-tech financial institutions should interact and cooperate with the government, innovate ways to generate power on the supply, use the “pearl necklace” mode to break through cross-border cooperation, and promote the development of the sci-tech financial ecosystem. Zhang (2016) believed that the process of innovative resource allocation is very similar to that of a natural ecosystem, with characteristics of self-organization and dynamic adaptability, and constructed the planning framework of the sci-tech financial ecosystem from the perspective of an ecosystem. Zhang and Gao (2019) believed that one of the important factors for the tech-finance ecosystem to maintain innovation motivation is the reasonable distribution of interests among various subjects.

In terms of the evaluation of the sci-tech financial ecosystem, some scholars mainly constructed a competitiveness index system from the perspective of the global competitiveness index and the global innovation index. Some Chinese scholars mainly probed into the differences between the different areas, such as Zhang (2017) who conducted an empirical study on provincial panel data from two dimensions: the development level of sci-tech finance and the concentration degree of sci-tech finance, and concluded that sci-tech finance ecology plays a supporting and guiding role in sci-tech innovation, and believed that the perfection of sci-tech finance ecology strengthens the innovation spillover effect to a certain extent. Zhang and Zhang (2018) constructed regional sci-tech innovation system indicators from five dimensions: government agencies, sci-tech innovation enterprises, sci-tech financial market, basic support environment, and sci-tech resource environment. Bai and Yu (2019) divided the elements of the techno-financial ecosystem into producers, disintegrators, consumers, and inorganic environment, and evaluated and analyzed the development of the techno-financial ecosystem. Liu and Zhang (2021) measured the symbiotic level and symbiotic evolutionary momentum of China's regional sci-tech finance ecosystem and believed that provinces with higher development levels of sci-tech finance in China are mainly concentrated in the eastern region, and the gap between the eastern region and the central and western regions is gradually increasing. Overall, the research of scholars mainly focussed on connotation discussion and regional evaluation, and there is a lack of discussion on the relationship between the sci-tech financial ecosystem and the national innovation ecosystem, not to mention research on greater historical depth and wider scope from the theoretical system.

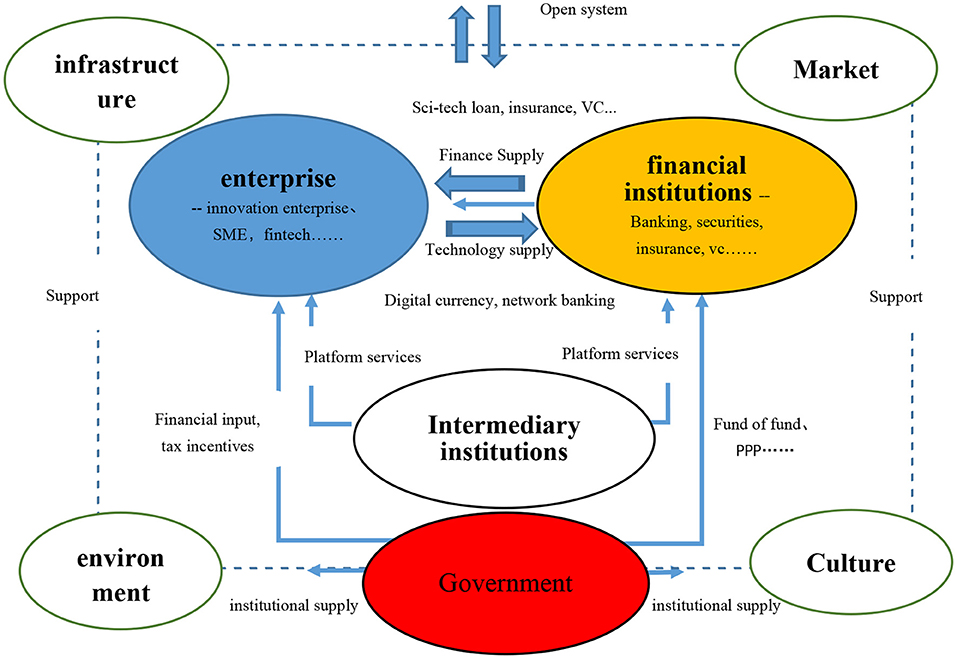

This article believes that the sci-tech financial ecosystem is a subsystem of the national innovation ecosystem, which takes enterprise innovation as the main body, emphasizes the supporting role of the financial system to the main body of innovation, and serves the overall strategic goal of national innovation. The components of the ecosystem of sci-tech finance include the main subjects of sci-tech finance and the supporting environment. The basic subjects include government, innovative enterprises, financial (non-financial) institutions, intermediary organizations, financial market, financial infrastructure, and policy environment. In addition, it also includes a chain of various main activities: innovation chain, capital chain, policy chain, talent chain, information chain, etc. (see Figure 1).

Among them, innovation-oriented enterprises are the practitioners and finishers of innovation. On the one hand, enterprises are the main object of sci-tech finance services, which need to obtain the investment in the innovation process through a capital network. On the other hand, enterprises can feedback financial innovation through innovation activities and form positive interactions with financial institutions. Financial (non-financial) institutions are the main capital providers of technological innovation activities, which provide effective financial support for the start-up and development of innovation activities. In addition, financial institutions continue to upgrade financial services and optimize resource allocation through technological innovation activities. Intermediary service institutions play the role of service link among subjects, including institutions providing services for effective flow and rational allocation of sci-tech resources, platforms for sci-tech financing services, and institutions providing consultation for innovation subjects. The government mainly plays two roles in the ecosystem of sci-tech finance. On the one hand, the government is the fund provider of sci-tech enterprises, focusing on solving the problem of market supply insufficiency. On the other hand, the government strives to solve the input and efficiency problems of the innovation system by formulating relevant policies and standards for innovation activities, creating a stable macroeconomic environment, effective financial market environment, and legal environment, and establishing links among different innovation subjects. In addition, the ecosystem of sci-tech finance also includes various supporting environments, such as financial infrastructure, market organization, and innovative cultural environment.

Operation Mechanism and Characteristics of Sci-Tech Financial Ecosystem

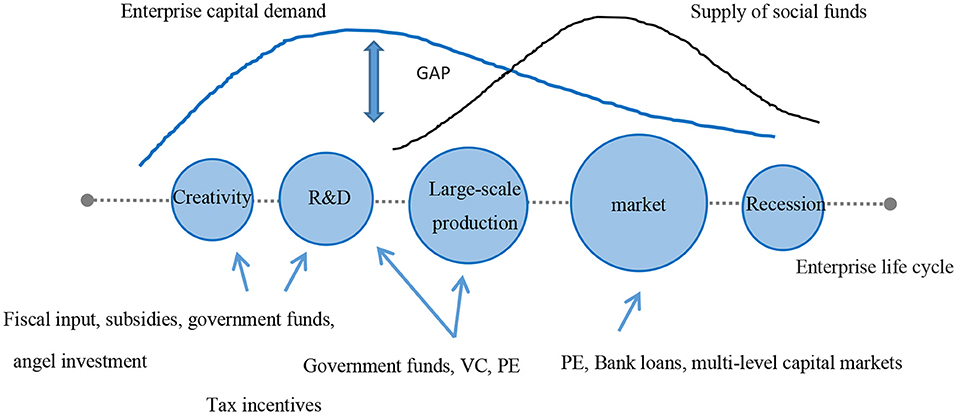

In essence, the sci-tech financial ecosystem is an open innovation system composed of multiple subjects, which is characterized by diversity, self-organization adaptability, stable balance and dynamic evolution, and development. The process of system evolution and resource allocation is highly similar to the natural ecosystem. Among them, the allocation of innovation resources, such as technology, capital, policy, and information, is gradually formed by the self-organization of innovation subjects based on market rules and shows dynamic adaptability in the industrial life cycle. For example, when enterprises are in the early stage of development, they mainly rely on fiscal input, angel investment, venture capital, and other capital support. When innovative enterprises enter the period of rapid growth to maturity, the industrial competition pattern and corporate profits are relatively stable, the main innovation activities are focused on the development of new products and technological upgrading, and the capital sources mainly come from bank credit and capital market. When enterprises enter the recession period, the purpose of financing focuses on technological transformation, and the main sources of funds are self-financing and mergers and acquisitions (see Figure 2).

The characteristics of the internal mechanism of the sci-tech financial ecosystem are as follows: first, the innovation subject of the sci-tech financial ecosystem needs to constantly optimize the allocation of innovation resources to maintain the dynamic balance with the environment; second, the ecosystem of technology and finance needs to constantly absorb external resources and carry out open innovation; and third, the sci-tech financial ecosystem is a dynamic evolution process, and the main elements of innovation will continue to evolve and feedback.

The Historical Evolution of China'S Sci-Tech Financial Ecosystem

From a historical perspective, sci-tech finance has a long history of ecological development. Since the advent of financial instruments, it has continuously provided various forms of financing for sci-tech progress. Especially since the reformation and opening up, the role of the government has been strengthened, and the ecological development in sci-tech finance has evolved from spontaneous development to initiative design by the government. Since 2006, the important role of science and technology has become increasingly prominent, followed by the continuous enrichment of financial instruments, the continuous improvement of financial markets, and the increasingly perfect ecosystem of sci-tech finance.

The Initial Stage (1978–1991)

Since the reformation and opening up, in order to meet the requirements of national sci-tech reformation and development, with the joint efforts of relevant parties, the state has begun to promote the development of science and technology by financial means. In 1985, the Decision of the Central Committee of the Communist Party of China on the Reform of Science and Technology System proposed the establishment of venture capital and the development of sci-tech credit business. The technology market was born, which started the process of market-oriented transfer and transformation of sci-tech achievements. During this period, the role of financial institutions in promoting the development of science and technology was gradually recognized, and some main elements of financial services for science and technology were emerged. However, during this period, China was mainly based on the planned economy, and the reform of the sci-tech system has just been put on the agenda. Technology and finance's innovative tools, infrastructure, financial markets, and other aspects were still in the initial stage, and most of its innovative activities were in a closed system, and all kinds of information dissemination were not active, making it difficult for the innovation chain to realize interactive feedback.

Diversified Exploration Stage (1992–2005)

Since 1992, China's sci-tech financial ecosystem has entered the stage of diversified exploration based on the market economy. In 1994, the State Economic and Trade Commission and the Ministry of Finance founded China's first national economic and technological investment guarantee company. In 1996, the Law of the People's Republic of China on Promoting the Transformation of sci-tech Achievements stated that “the state encourages the establishment of sci-tech achievements transformation funds and venture capital to accelerate the industrialization of major sci-tech achievements.” In 1999, the Ministry of Science and Technology officially launched the “Technology Innovation Fund for Small and Medium-sized Science and Technology Enterprises”; The General Office of the State Council issued Several Opinions on Establishing Venture Capital Mechanism, which promoted the development of venture capital in China. China Development Bank successively issued two bundled enterprise bonds of national high-tech zones to support the construction of national high-tech zones in 1997 and 2003. The capital market is moving toward multiple levels. In 2004, the Shenzhen Stock Exchange launched the SME Board. During this period, with the deepening of market-oriented reform, especially the reform and improvement of the financial market, the equity financing channels of the capital market, and sci-tech and financial ecology were continuously enriched. The main body of sci-tech and financial ecology was further improved, and the financial instruments to support the development of science and technology gradually increased. There are various financing methods such as government's fund of funds, venture capital, sci-tech loans, sci-tech guarantee, small- and medium-sized board financing, and debt financing. The basic economic system with marketization as the main body has also promoted the links of various innovation chains, and the sci-tech and financial ecosystem have begun to take shape.

Rapid Development Stage (2006–Present)

In 2006, the promulgation of the National Medium- and Long-Term Science and Technology Development Plan (2006–2020) marked a new stage of China's sci-tech system innovation. In the plan and its supporting policies, there were as many as nine policies related to technology and finance, covering bank credit, capital market, insurance, guarantee, venture capital, and so on. During this period, the role of the market in resource allocation gradually rose from a basic role to a decisive role. Overall, this stage presents four characteristics:

First, it constructed the top-level design and working mechanism of the sci-tech and financial policy. In 2011, the Ministry of Science and Technology together with the People's Bank of China, the Ministry of Finance, and other departments set up a coordination and guidance group to promote the pilot work for the sci-tech financial policy. In 2016, the Outline of National Innovation-Driven Development made arrangements for the sci-tech and financial work, and the State Council issued the 13th Five-Year National Science and Technology Innovation Plan, which took “the formation of sci-tech and financial ecosystem with coordinated integration of various financial instruments” as an important measure for the sci-tech development. Local sci-tech departments and national high-tech zones all over the country attached great importance to it and continuously deepened the work in the sci-tech financial ecosystem.

Second, diversified investment entities became increasingly rich and active. The mode of financial input was continuously optimized. The central authorities successively set up venture capital funds for small- and medium-sized sci-tech enterprises, fund of funds for the transformation of sci-tech achievements, fund of funds for emerging industries, and development funds for small- and medium-sized enterprises. Local governments also set up a fund of funds with sci-tech innovation as the main support object. The scale of the venture capital industry gradually expanded. At the end of 2020, there were 3,290 venture capital firms in China, with a total management capital of 1.12 trillion yuan, ranking second in the world after the United States in market size; the cumulative number of investment projects was 28,145, and 11,235 were invested in high-tech enterprises. Bank credit continued to innovate its products. Banks provide technology enterprises with various financial products including intellectual property pledge, equity pledge, accounts receivable pledge, order pledge, export tax rebate pledge, etc. At the end of 2021, the loan balance of sci-tech enterprises had reached 5.78 trillion yuan, and there were 959 sci-tech characteristic sub-branches and technology and finance franchise institutions set up by various financial institutions. Science and technology insurance was constantly innovating. At the end of 2020, the insurance industry provided more than 2.2 trillion yuan in risk protection for sci-tech innovation through the first major technical equipment insurance, and 14.1 trillion yuan in financial support for the development of the real economy through stocks, funds, bonds, and other forms. The multi-level capital market was continuously improved, and the technological securities markets in Shenzhen, Shanghai, and Beijing developed differently. At the end of 2021, there were 337 listed companies on the sci-tech innovation board, with a total market value of 5.6 trillion yuan, and the Initial Public Offering (IPO) raised 200.711 billion yuan. There were 1,090 listed companies on the Growth Enterprise Market (GEM), with a total market value of 14.05 trillion yuan.

Third, the two-way integration of sci-tech and finance accelerated, and new products and tools constantly emerged. The year 2017 was called “the first year of FinTech.” The People's Bank of China set up the FinTech Committee to strengthen the research planning and overall coordination of financial technology work. And the role of finance and sci-tech began to merge in both directions, and technology enterprises began to feedback financial institutions. FinTech boomed in China, and new products and tools constantly emerged. According to the data from China's ICT Institute, it was estimated that the FinTech application market of banks, insurance, securities, trusts, and other financial institutions would reach 250 billion yuan in 2021.

Fourth, the openness of the sci-tech and finance system was improved, and its integration into globalization was accelerated. China's policy environment initially set up obstacles for foreign investors to participate in China's sci-tech and finance ecosystem, but structural reforms paved the way for foreign investors' prosperity in China over the past decade. Especially in recent years, the Chinese government has continued to establish an effective legal structure, allowing foreign venture capital to set up foreign banks and insurance institutions in China, participate in Chinese venture capital, and gradually liberalize and abolish restrictive measures such as capital controls.

Construction of the Index System of Sci-Tech Financial Ecosystem

Design of the Index System

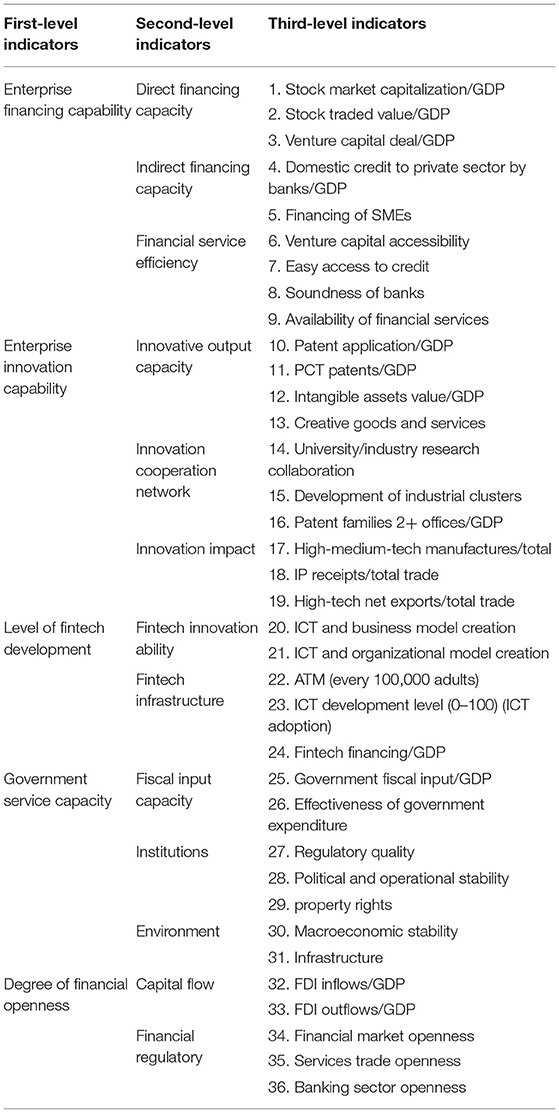

Starting from the map of the sci-tech financial ecosystem, this article considers that the factors affecting the sci-tech financial ecosystem mainly including the financing capability of enterprises, the innovation capability of enterprises, the development level of fintech, the serviceability of government, and the openness of financial market. Among them, enterprise financing capability mainly includes direct financing capacity, indirect financing capacity, and financial service efficiency. Enterprises' innovation capability is represented by innovation output capability, innovation cooperation network, and innovation influence. The level of fintech development is the product of the advanced stage of ecosystem development. On the one hand, innovation enterprises feedback financial enterprises and promote innovation of financial institutions. On the other hand, financial institutions can better serve innovation enterprises through financial innovation. Since there is no standardized statistical evaluation index for the fintech research, this study adopts the fintech innovation capability, supporting infrastructure and financing capability for evaluation. Government service capability is an important part of the financial ecosystem. On the one hand, the government, as the main input subject, provides financial support for innovative enterprises; on the other hand, as the environmental builder, the government provides institutional and environmental guarantees for the ecosystem. In this article, the fiscal input capacity, system construction, and environmental construction indicators are used for capacity evaluation. The degree of financial openness is an important index to measure the degree of openness of the sci-tech financial ecosystem. International openness is conducive to the free flow and innovative development of elements within the ecosystem. In combination with theoretical research and data availability and comparability, the index system design of the sci-tech financial ecosystem is shown in Table 1.

Data Processing Method

In consideration of the different basis between countries and the heterogeneity among indicators, this study adopts the benchmarking method to carry out the dimensionless normalization of the original values of the three-level indicators.

Carry on the index weighted score to the first-level and second-level indicators, respectively.

Here, the weight processing of β is confirmed according to the expert scoring method (Delphi method). The data mainly came from the World Bank, the Organization for Economic Cooperation and Development (OECD), the Global Competitiveness Report, the Global Innovation Index report, and the National Bureau of Statistics database. The data time dimension is from 2010 to 2019.

International Comparison and Evaluation

This article intends to select the United States, the United Kingdom, Japan, Germany, South Korea, India, and China for international comparison. It is mainly based on two considerations: first, the selected countries include countries represented by direct financing channels (the United States, the United Kingdom, and India) and indirect financing channels (Germany, Japan, and South Korea) in order to explore the influence of different financing channels. Second, the selected countries include both benchmarking developed countries (the United States and Japan) and countries with similar development stages as China (such as India), so as to explore the gap in China's stage characteristics. In addition, based on the integrity and availability of data, only some representative countries are selected.

The Overall Evaluation

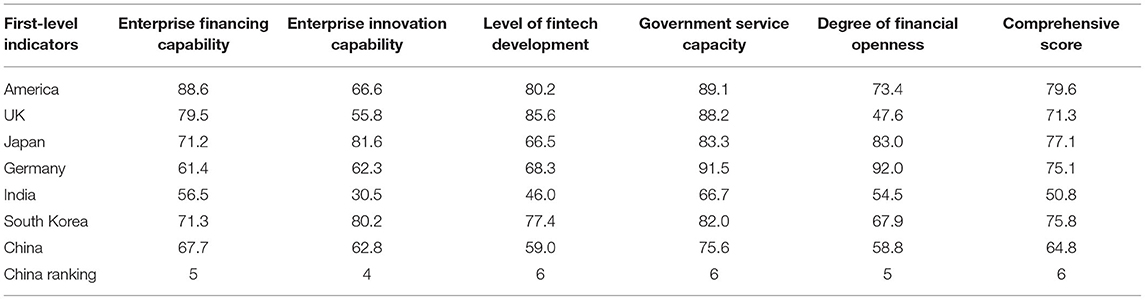

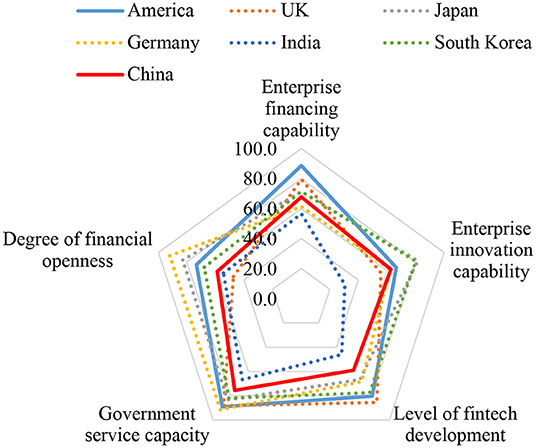

From the perspective of the overall score of the sci-tech financial ecosystem (Table 2; Figure 3), China's financial resource supportability, enterprise innovation ability, and government support serviceability are relatively good, and there is a certain gap between China and developed countries in each index score, far better than India. The comprehensive evaluation score is about 80% of the highest score (the United States).

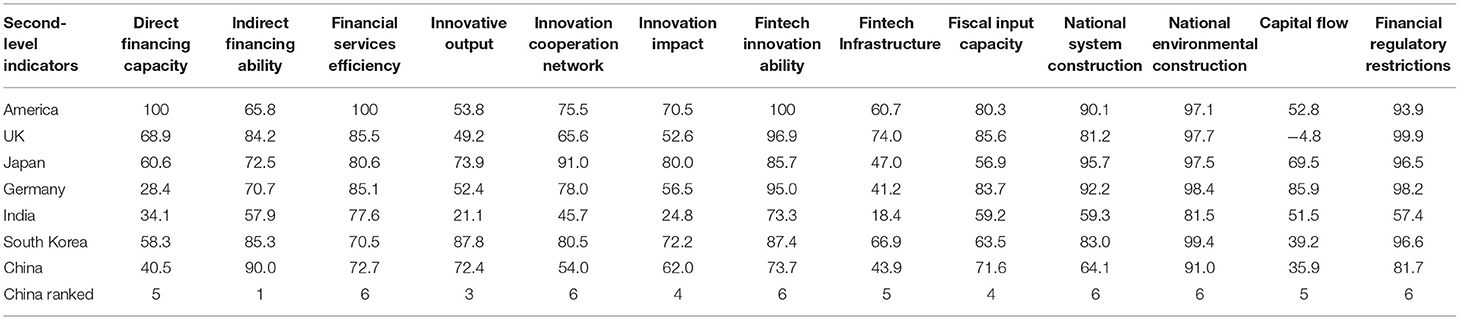

From the second-level index score of the sci-tech financial ecosystem (Table 3; Figure 4), China has a huge banking system, which belongs to a country with indirect financing channels as the main channel. The fiscal input capacity, enterprises' innovative output capacity and influence, and national environmental construction are better. However, its performance in national institution building, direct financing capacity, capital flow, and fintech Infrastructure needs to be improved.

Sub-Index Evaluation

This section analyzes the three-level index of the sci-tech financial ecosystem.

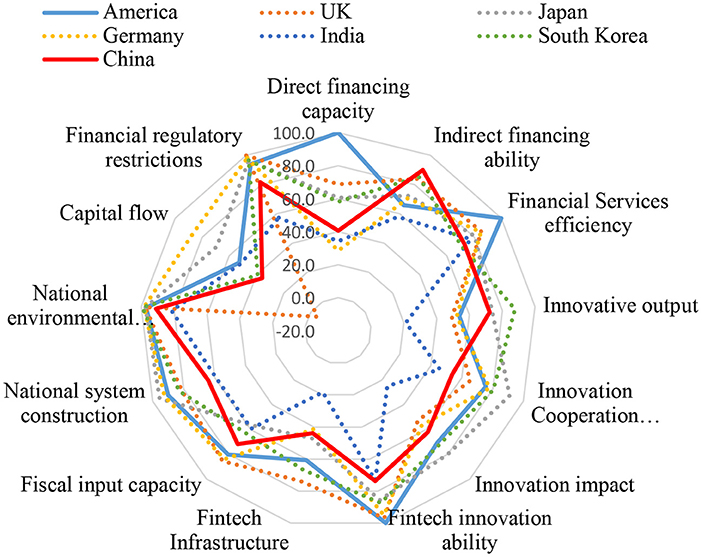

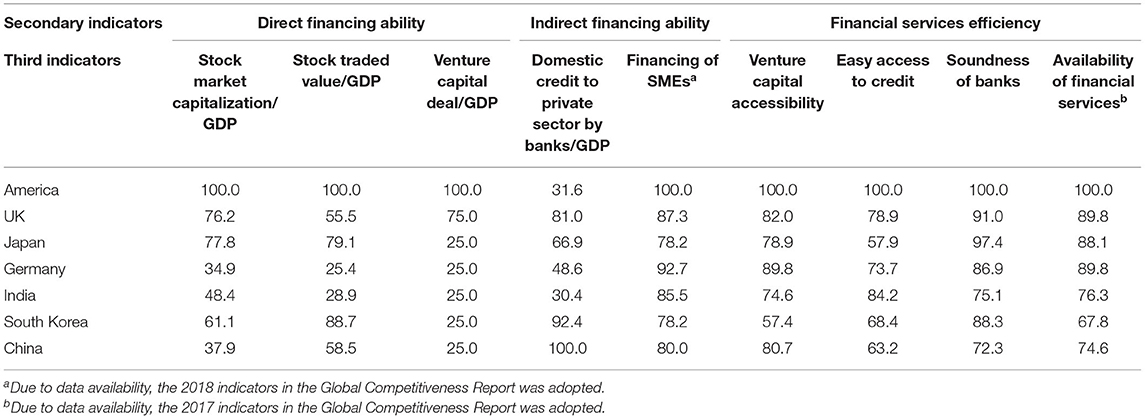

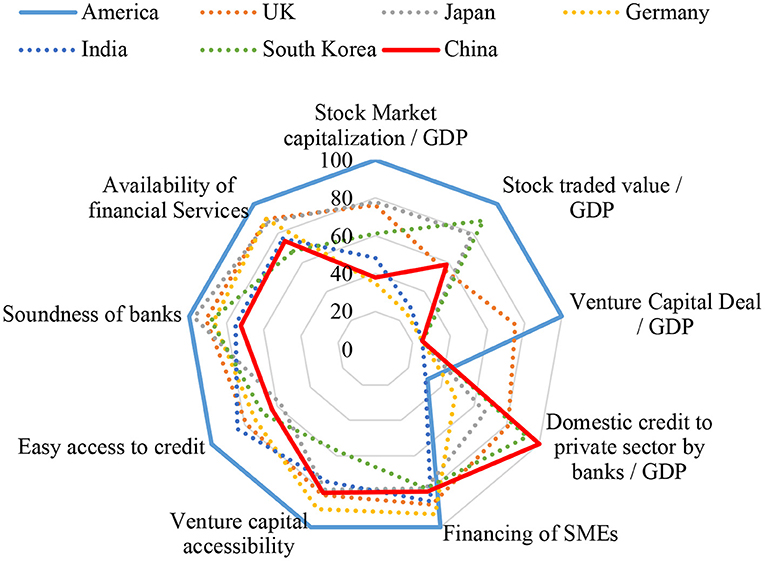

Enterprise Financing Capability

As can be seen from the index evaluation scores (Table 4; Figure 5), the United States is an absolute financial power, with outstanding performance in all aspects of the ability of financial support for technology enterprises. Although equity financing is the main channel in the United States, the robustness of the banking system, the availability of loans, and the ability of financial services are first. Germany is a typical country with indirect financing channels, and SMEs have a strong financing capacity, so it is easier to obtain bank loans. In comparison, there is a certain gap in China's overall financial resource support capacity. Among them, the private loan capacity of banks is outstanding, but the financing capacity of SMEs still needs to be further improved. It is difficult for innovation enterprises to obtain loans through banks, and the performance of financial services is mediocre. In terms of direct financing, the financing capacity of the capital market and venture capital investment capacity should be enhanced. It is worth affirming that with the development of venture capital, it is easier for enterprises to obtain venture capital than before.

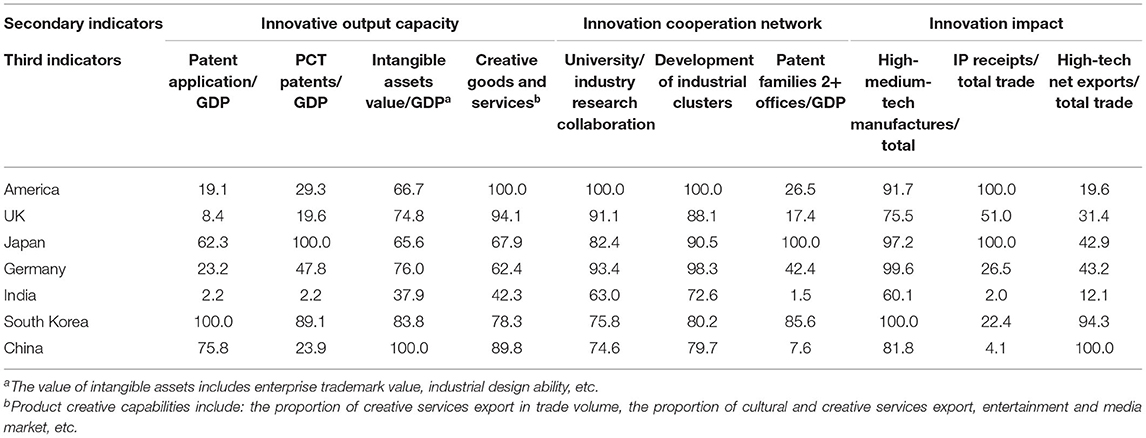

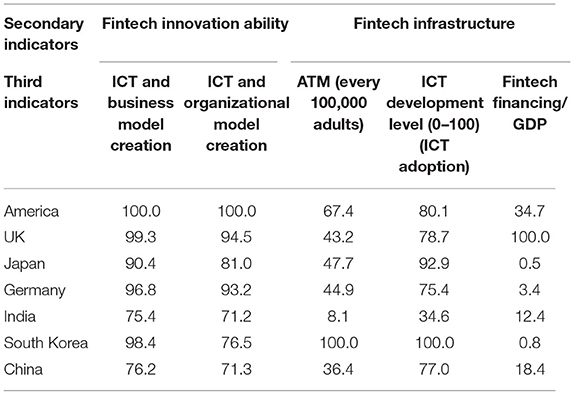

Enterprise Innovation Capability

In terms of enterprises' innovation output capacity (Table 5; Figure 6), South Korea has the highest number of unit patent applications, and the number of unit patent applications in China is also at a relatively high level, but there are fewer high-level patents, and the patent quality needs to be improved. It is worth affirming that the intangible asset value and product creative ability of Chinese enterprises rank first, which indicates to some extent that the innovation output of Chinese enterprises is well adaptable to the market. From the perspective of a technological innovation cooperation network, the United States has the best industrial cluster development, whereas China's industry–university cooperation ability is average with a low score, especially in patent cooperation. From the perspective of the influence of sci-tech innovation, the production of high-end technology in proportion and the export of high-tech products accounted for a high score, this indicates that to some extent, China's main export technology has given priority to advanced technology. The low score of intellectual property income in trade also indicates that China's intellectual property technology content is low, and it is generally at the low-end of the industrial chain.

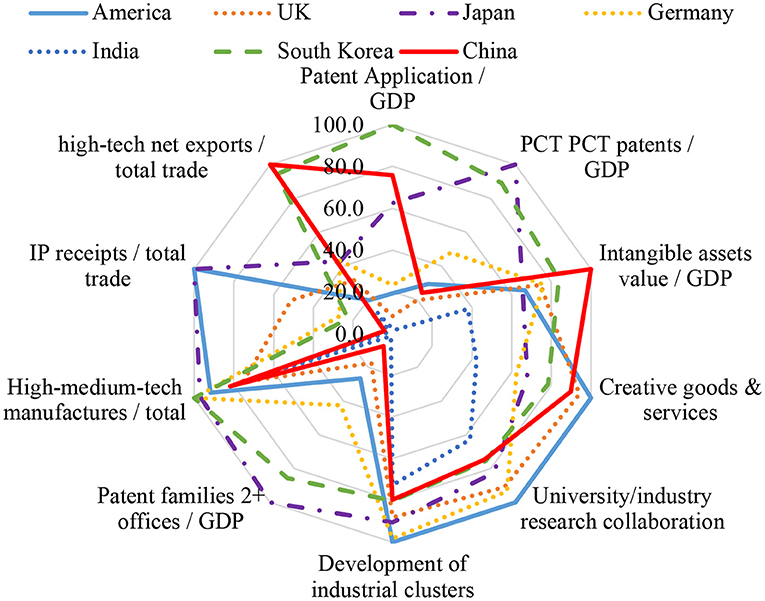

Fintech Development

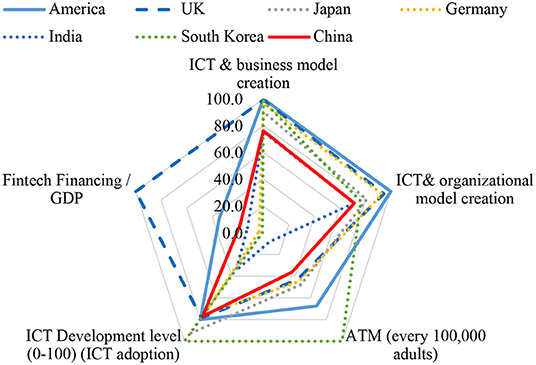

From the index evaluation of fintech development (Table 6; Figure 7), in terms of business model and organizational model innovation, the United Kingdom, the United States, and Germany are in the forefront. China's index evaluation score is close to India. In terms of fintech infrastructure, South Korea scored the highest, with China in the middle. The United Kingdom has the highest proportion of fintech funding as a percentage of Gross Domestic Product (GDP), followed by the United States and China. Overall, China has a good development situation for fintech and a relatively complete fintech infrastructure.

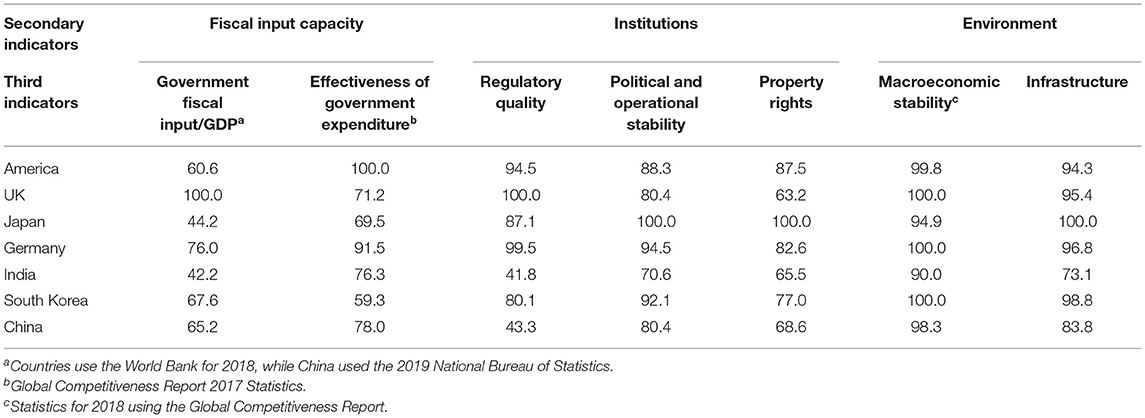

Government Service Capacity

From the evaluation indicators of government service capacity (Table 7; Figure 8), the fiscal input capacity and efficiency of the Chinese government are in the middle level, better than those of South Korea and India. In terms of institutional construction, the stability of policy operation is good, but the quality of regulatory and the construction of property rights are at a low level. In terms of environmental construction, the macroeconomic stability is good, and the gap between the level of infrastructure and foreign developed countries is small.

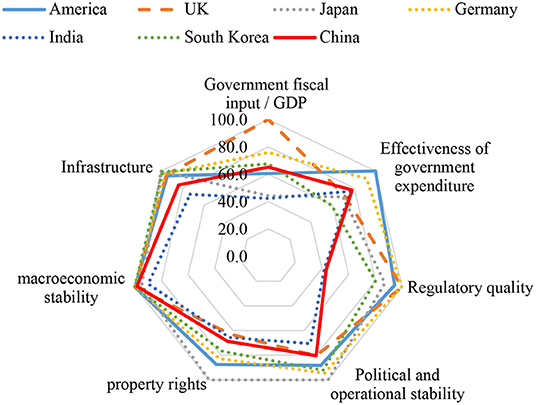

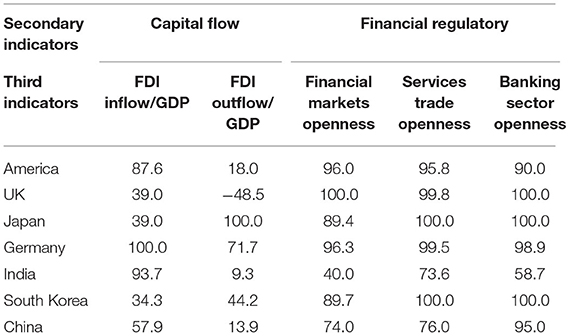

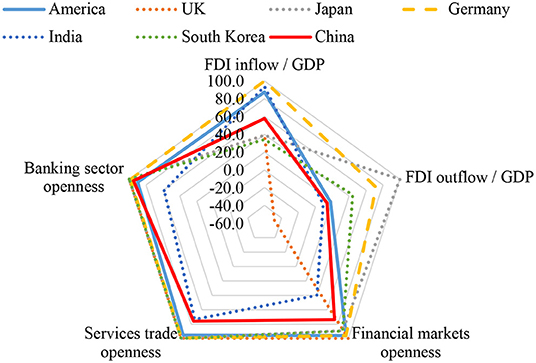

Degree of Financial Openness

From the perspective of financial capital flows (Table 8; Figure 9), the Chinese market is attractive to some extent. Foreign Direct Investment (FDI) inflow takes a relatively high proportion of GDP, whereas outflow is relatively low. From the perspective of market regulation, China's banking industry is relatively open to the outside world, whereas the financial services and market are relatively conservative. Due to strict regulation, the openness degree is low.

Conclusions and Policy Implications

From the perspective of the development trend of the Chinese sci-tech financial ecosystem, various indicators have improved significantly in the past decade, especially the openness of the financial market, government service capacity, and innovation enterprises' financing capacity. Most indicators score closely with developed countries.

From the perspective of the development path of the sci-tech financial ecosystem, the overall shape of China's five indicators is most like that of the United States, and the development path mainly takes the United States as a reference. The difference is that the United States is a country dominated by equity financing in the capital market, whereas China has a strong indirect financing capacity. Judging from the indicators, the country's financial development path cannot completely determine the financing efficiency of enterprises. Whether it is the financial market dominated by direct financing (such as the United States, Britain, and India) or the financial market dominated by indirect financing (Germany, Japan, and South Korea), what really determines the financing efficiency of innovative enterprises is not only the development degree of the whole financial market but also the difficulty for enterprises of obtaining financing, namely the serviceability of the financial market. In addition, the openness of the financial market and the government support can also affect the allocation efficiency of financial resources.

Judging from the evolution path of China's sci-tech financial ecosystem and international experience, China should give full play to the decisive role of the market in resource allocation and make new breakthroughs in strengthening coordination, creating an environment, and strengthening capacity building.

Give Full Play to the Complementary Role of the Government and the Market

From the international comparison, the efficiency of the Chinese government's financial input is relatively good, but the institutional construction is relatively backward. The degree of market openness needs to be further improved. In practice, local governments in China have combined government guidance with market operation, actively exploring new ways of fiscal input and guiding various types of capital to support sci-tech innovation activities. Furthermore, China should further strengthen institutional construction, including innovation mechanisms, perfect property rights, and flexible governance, to expand the opening of the financial market at the national level. At the local level, according to the sci-tech financial foundation and the characteristics of industrial development, China should grasp the key links that inhibit the financing of innovation enterprises and hinder the transformation of sci-tech achievements, give full play to the complementary role of the government and the market, optimize the allocation of various resources, and achieve key breakthroughs.

Further Improve the Coordination and Interaction Mechanism Between Sci-Tech and Finance

The sci-tech finance involves two systems of sci-tech innovation and financial service, with diversified and multi-level participation. Only through good mechanism design, strengthened coordination, and cooperation between different departments can a deeply integrated ecological pattern be formed. In the next step, China should further promote the feedback role of technology in financial innovation, promote the development of fintech, and enhance the ability of finance to serve science and technology through fintech innovation. China should strengthen the link feedback mechanism among the government, enterprises, financial institutions, and intermediary institutions and establish a systematic and efficient sci-tech financial ecosystem.

Establish and Improve the New Path for Integrated Development of Stocks and Bonds

From the perspective of international comparison, the development of China's equity financing channels is relatively backward, and the overall service capacity of the financial industry needs to be improved. Furthermore, China should perfect the construction of China's multi-level capital market as soon as possible and improve the policies' continuity and stability, and also establish a new mechanism for the mutual development of equity financing and debt financing to form complementary effects. To enhance the financing and service capacity of the entire financial market, especially for innovative SMEs, China should make full use of new tools and means such as regulatory technology to enhance risk warning and prevention and control capabilities, reduce loan costs, and enhance the availability of loans.

Steadily Promote the Support and Capacity Building of Sci-Tech Finance

The development of sci-tech finance depends on the construction of a basic environment. The next step is to give full play to the characteristics of the digital economy and build a batch of platform service systems based on big data. First, China should promote the construction of digital technology financial service platform and connect the database of innovation SMEs with various financing channels. Second, China should accelerate the construction of the credit system for sci-tech enterprises, integrate science and technology, finance, taxation, and industry information, establish the credit evaluation model of innovation enterprises, and combine the credit evaluation results with the government project approval, policy subsidies, financing guarantee, credit loans, and other aspects. Third, China should establish a sound sci-tech finance statistical survey system and design statistical indicators in a reasonable way to provide support for optimizing resource allocation.

Author Contributions

The main core ideas and writing were completed by ZJ. The data collection was completed by SM. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Strategic Research Project of the Ministry of Science and Technology of the People's Republic of China.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bai, Y., and Yu, L. (2019). Evaluation and spatial evolution trend analysis of science and technology financial ecosystem in China. Sci. Technol. Manag. Res. 39, 67–74.

Fang, H. (2010). Thinking on theory, practice and policy of science and technology finance. China Sci. Technol. Forum 2010, 5–10. doi: 10.13580/j.cnki.fstc.2010.11.017

Fang, V. W., Tian, X., and Tice, S. (2014). Does stock liquidity enhance or impede firm innovation?. J Finance 69, 2085–2125. doi: 10.1111/jofi.12187

Hu, G., and Zheng, M. (2010). Research on the mechanism and mode of coupling technological innovation and financial innovation. Wuhan Finance 10, 20–23.

Jia, K., Meng, Y., and Zhao, Y. (2014). “Pearl necklace” mode, scientific and financial ecological innovation and new supply management—based on zhe jiang Zhong xin Li he Company survey. Econ. Res. 25, 3–14. doi: 10.16110/j.cnki.issn2095-3151.2014.25.011

King, R. G., and Levine, R. (1993). Finance, entrepreneurship, and growth. J. Monetary Econ. 32, 513–542. doi: 10.1016/0304-3932(93)90028-E

Liu, L. Y., and Zhang, Y. (2021). Symbiosis and Evolution of Science and Technology Financial Ecosystem Empirical Research. Science and technology progress and countermeasures, p. 1–11. Available online at: http://kns.cnki.net/kcms/detail/42.1224.G3.20210111.0910.002.html (accessed January 24, 2021)

Mckinnon, R. I. (1973). Money, and capital in economic development. Am. Polit. Sci. Rev. 68, 1822–1824.

Modigliani, F., and Miller, M. (1958). The cost of capital, corporate finance, and the theory of investment: comment. Am. Econ. Rev. 48, 261–297.

Nanda, R., and Nicholas, T. (2014). Did bank distress stifle innovation during the Great Depression?. J Financ. Econ. 114, 273–292. doi: 10.3386/w20392

Perez, C. (2002). Technological Revolutions and Financial Capital: The Dynamics of Bubbles and Golden Ages. Northampton, MA: Edward Elgar.

Perez, C. (2007). Technological revolution and Financial Capital: Bubbles and the dynamics of the Golden Age. Beijing: China Renmin University Press.

Wang, R., and Huang, J. (2016). Research on the connotation, characteristics and mode of the coupling of scientific and technological innovation and financial innovation. Wuhan. Univ. Technol. (Soc. Sci. Edn.). 29, 875–882.

Zhang, H. (2016). Planning framework and collaborative innovation mechanism of sci-tech and financial innovation ecosystem. Sci. Manag. Res. 34, 89–93. doi: 10.19445/j.cnki.15-1103/g3.2016.05.023

Zhang, M. (2017). An empirical study on science and technology finance ecology and its performance in China. Sci. Technol. Prog. Count. Meas. 34, 14–19.

Zhang, Y., and Zhang, Q. (2018). Dynamic comprehensive evaluation of regional sci-tech and financial ecosystem. Stud. Sci. Sci. 36, 1963–1974. doi: 10.16192/j.cnki.1003-2053.2018.11.006

Zhang, Z., and Gao, P. (2019). Research on collaborative innovation and profit distribution mechanism of science and technology and finance ecosystem. Macroecon. Res. 09, 47–57.+66. doi: 10.16304/j.cnki.11-3952/f.2019.09.005

Keywords: finance innovation, sci-tech financial, sci-tech financial ecosystem, index construction, international comparison

Citation: Junfang Z and Mu S (2022) Construction of Sci-Tech Financial Ecosystem Indicators and International Comparative Research. Front. Polit. Sci. 4:865884. doi: 10.3389/fpos.2022.865884

Received: 30 January 2022; Accepted: 19 April 2022;

Published: 23 May 2022.

Edited by:

Ai Sugiura, United Nations Educational, Scientific and Cultural Organization, FranceReviewed by:

Zafar Nazarov, Purdue University Fort Wayne, United StatesMohit Nayal, National Maritime Foundation, India

Copyright © 2022 Junfang and Mu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhang Junfang, empma2piQDE2My5jb20=

Zhang Junfang

Zhang Junfang Su Mu

Su Mu