- School of Management, Jiangsu University, Zhenjiang, China

“Government, bank, and guarantee institution” cooperative financing guarantee (hereinafter referred to as the cooperation mechanism) is an important way to alleviate the financing difficulties of China’s new agricultural entities and raise the credit line of bank financing. In order to find an effective way for the improvement of low-level equilibrium in the actual operation of the cooperation mechanism, this study builds a three-party evolutionary game model using the local government, banks, and agricultural guarantee institutions, with incomplete information on all partners of the cooperation mechanism as the study object. This model focuses on the weak activeness, strong dependence, poor cooperation effect, lower credit line of guarantee, and other specific problems. Moreover, this study analyzes the equilibrium solution of this model and extracts the significant factors affecting the positive cooperation behaviors of the three parties (government, banks, and guarantee institutions) in the view of interest realization. Analog simulation is performed to explore the key conditions for truly alleviating the financing risks of new agricultural entities, thus helping improve the operation quality of the cooperation mechanism. According to the study results, the focus of “government, bank, and guarantee institution” cooperation should be shifted from post risk sharing to prior risk identification. Specifically, the government should further share high-quality information affiliated with farmland management rights and reflecting the status of risks; guide banks and agricultural guarantee institutions should share the cost of risk identification, accelerate the acquisition of higher information transformation value, and prevent the “free rider problem.” In the last part, policies are recommended in four aspects, including risk information sharing, risk identification quality improvement, risk identification cost sharing, and risk information value transformation, which have practical guiding significance for the sustainable development of “government, bank, and guarantee institution” financing guarantee for China’s new agricultural entities.

1 Introduction

China’s new agricultural business entities (hereinafter referred to as new agricultural entities) mainly refer to large-scale business entities, such as family farms, large farmer households, farmer cooperatives, and leading agricultural industrialization enterprises, which serve as the backbone of China’s rural revitalization strategy. Large farmers in Europe and the United States are privileged in terms of long-term assets and financing credits. Unlike them, most of China’s new agricultural entities are experiencing an early start-up. There is a lack of guarantees and historical credit information, resulting in great financing difficulty [1]. In order to eliminate the financing difficulties, the Chinese government has arranged special funds to help upgrade the industry, hoping that new agricultural entities will achieve a stronger profitability and driving effect. Therefore, it has launched a package of construction plans for the cooperation mechanism for farmers, mainly focusing on two aspects. In the first aspect, efforts are made to improve the financing risk sharing and compensation mechanism for the cooperation mechanism. In detail, a financing guarantee cooperation system is built involving the government, banks, policy-related agricultural guarantee institutions (hereinafter referred to as agricultural guarantee institutions), and other entities, thus constituting a complete and orderly credit system characterized by revenue sharing, risk sharing, complementary advantages, mutual benefit, a win–win situation, and sustainable development among multiple entities [2]. In the second aspect, there is comprehensive exploration of the advantages of large-scale farmland management rights through “government, bank, and guarantee institution” cooperation [3]. With the support of the Rural Land Contract Law of the People’s Republic of China (Draft Amendment), the government took tentative action in 2019, using farmland management rights to link financing entities, land resources, and funds, and finding a new financing method for large-scale farmland management rights based on counter-guarantee. These policy constructions are regarded as important ways to solve the financing dilemma of new agricultural entities. The former focuses on the cooperation of the government, banks, and guarantee institutions to share financing risks, while the latter focuses on the cooperation of the government, banks, and guarantee institutions to tap the value of farmland. They are all concrete manifestations of the cooperation between the government, banks, and guarantee institutions. At present, “government, bank, and guarantee institution” agricultural financing guarantee cooperation, which focuses on risk sharing, has been recommended as one of the top 10 innovative agricultural support modes by China’s Ministry of Agriculture and extended to different provinces and municipalities nationwide. By the end of 2021, the financing mode based on the counter-guarantee of farmland management rights had been disseminated to 232 regions of China as a pilot program, achieving a cumulative loan of RMB 96.4 billion (most of the loan receivers are new agricultural entities) [4].

However, the actual operation effect of the financing based on the cooperation mechanism deviates from expectations while experiencing large-scale promotions and is in a low-level equilibrium state [5]. Contradictions are also discovered. No matter what kind of policy, the regional implementation rate is rising all the time. Nevertheless, banks and agricultural guarantee institutions are rarely passionate about actual cooperation. Specifically, some banks are reluctant to participate in the cooperation mechanism and implement the corresponding preferential interest rates. Even though banks are involved in the cooperation mechanism, they are not willing to offer funds, usually providing a conservative credit line for new agricultural entities. Agricultural guarantee institutions should spare no effort to let banks raise the credit line. However, they are not fully capable or motivated to identify the true state of customers, failing to encourage banks to reduce the credit risk of new agricultural entities and address the concern of risk control [6]. What is the cause of such contradiction? A conflict between the endowment effect of financial policies in helping those in distress and the financial attribute of seeking advantages and avoiding disadvantages is proven by the result of theoretical analysis. The main component of risk sharing lies in the cooperation among the government, banks, and agricultural guarantee institutions to share the financing risks of new agricultural entities [7]. The counter-guarantee of farmland management rights is intended for discovering the value of large-scale land management rights in guarantee and risk reduction based on the cooperation among the government, banks, and agricultural guarantee institutions. Both of them have logically given priority to post compensation and risk sharing, using beneficial financial policies to offset the financial attribute of seeking advantages and avoiding disadvantages [8]. In actual operations, we steadily find a complete dependence on the favorable policies of local governments. In the process of proportional risk sharing, for example, the active risk control behaviors of banks and agricultural guarantee institutions are seldom seen. Instead, they rely entirely on the favorable subsidies of local governments (such as tax relief) and compensations for default to transfer the financing risk of new agricultural entities [9]. Some banks even raise the credit line only after all the risks are transferred. However, the difficulty of circulating, managing, and disposing of farmland management rights and affiliated economic goods in the operation of farmland management rights based on counter-guarantee is very noticeable, resulting in a high cost. For this reason, it is necessary to rely entirely on government-supported measures and corresponding favorable compensation measures. Otherwise, banks and guarantee institutions are reluctant to accept such a counter-guarantee, thereby making it hard to implement the relevant policies [10].

Governments can increase the coverage rate of the cooperation mechanism through a series of favorable policies. However, such an increase is only a cover-up. Post-risk compensation can reduce the concern of banks, but it does not truly mitigate systemic risks [11]. If any new agricultural customer has not been identified and screened in advance, blindly raising the credit line will only lead to systemic risk and eventually tilt toward the government, which not only goes against the objective of the policy on helping those in distress but also increases the financial pressure [12]. The credit theory suggests that financial institutions should have full incentive to screen the loan risk of customers. However, both system participation and the drive of banks and agricultural guarantee institutions come from policy incentives rather than profit-seeking nature for the loans based on risk sharing and counter-guarantee of farmland management rights [13]. In addition, the seasonal fluctuations in the capital demand of agricultural business projects, the dispersion and distance of customers, and the lack of historical credit information lead to the low profit margins and high cost of guarantees and loans in an environment with a favorable interest rate, further increasing the cost and difficulty for banks and agricultural guarantee institutions to collect and obtain risk information [14]. Therefore, even if banks and agricultural guarantee institutions are involved in cooperation, they lack the subjective motivation and ability to control the risks of new agricultural customers. In order to break through the low-level equilibrium of the “government, bank, and guarantee institution” cooperation for the financing guarantee of new agricultural entities, the mechanism should be extended on the basis of the institutional logic of “controlling the risk of financing guarantee.” Risk sharing, counter-guarantee, and mortgage of farmland management rights are classified as passive compensation of post risks, and the key to controlling the risk of financing guarantee lies in the prior identification and screening of risks.

Most current research studies focus on the financing guarantee cooperation involving government, banks, and agricultural guarantee institutions in the following aspects: (1) exploring the feasibility and plausibility of such a financing guarantee. Scholars believe that most of China’s new agricultural entities have low management standards, poor availability of historical credit information, high natural and market risks, large capital investments, long payback period, and many other high-risk factors [15]. Moreover, borrowers have more information than lenders. The information asymmetry between the two sides is more likely to cause financing risks [16]. In this sense, the original intention of the financing guarantee was for the three parties to cooperate to share the high financing risks of new agricultural entities and alleviate the credit concerns of banks [17]. In this cooperation mechanism, guarantee institutions serve as a bridge. They can bear some of the risks for banks. In the face of asymmetric information, they can work as an indirect information source to enhance banks’ ability to assess the expected return and accelerate the conclusion of loan agreements between borrowers and lenders. This serves as the basis for cooperation between banks and guarantee institutions [18]. Guarantee institutions can help reduce part of the banks’ financing risk, but their tolerance for risks is limited. If no reliable rules and regulations are available, the financing risk sharing will be unreasonable, thereby leading to a moral hazard and causing losses to banks and guarantee institutions [19]. The related scholars have further demonstrated the importance of the government accordingly. According to relevant studies, government participation is the outcome of combining government intervention theory and financing guarantee theory. It is a way for governments to assume responsibility for public financial services and also a mode for governments to fulfill the duties of public financial services [20, 21]. The cooperation mechanism reflects the complementarity and inclusiveness of China’s policy-oriented finance as inherent attributes. When the formal financial system cannot meet the financing demand of agricultural business entities, small- and medium-sized enterprises, and other financially vulnerable groups, the more authoritative credit endorsement of governments will not only increase the credit of lenders but also make up for the lack of credit for guarantee institutions, thus helping further transfer risks [22]. Meanwhile, grassroots governmental organizations can obtain relevant information about lenders more efficiently, truthfully, and authoritatively, which is more conducive to the reasonable deployment of credit resources, and they also help guarantee institutions establish more authoritative communication channels between borrowers and banks. In addition, these efforts will facilitate the reduction of financing costs; improve economic efficiency such as the financing rate, resource allocation rate, and capital utilization rate; and further alleviate the concerns of banks [23]. (2) Exploring the behavioral dilemma of the government, banks, and guarantee institutions. First of all, in the cooperation based on proportional risk sharing, banks, as the suppliers of funds, are in an advantageous position. Faced with the higher financing risk of agricultural entities, they will choose to involve guarantee institutions when providing financing services and use their advantageous position to transfer the risks to the guarantee institution, which will further adversely influence the interests of guarantee institutions [24]. Since each party involved in financing has different credit levels, these credit levels should be balanced by guarantee institutions providing an equilibrium value [25]. However, in actual operations, the behavior of guarantee institutions has been “alienated.” For example, a large number of private capitals not accepted by the banking industry enter the guarantee industry and play the role of “shadow banking” [26]. Guarantee institutions have no advantages in information. However, a large number of risks have been transferred to them by banks. In this process, banks are arbitrary. In fact, guarantee institutions face dual moral hazards from banks and enterprises and a lack of ability to acquire risk information [27]. Moreover, profitability is lower, and guarantee institutions are not fully motivated and enabled for risk control. Extreme business behaviors in violation of relevant rules and regulations occur now and then [28]. Some studies have pointed out that whether the credit guarantee increases the amount of loans is actually difficult to measure and that the amount of guaranteed loans is not directly related to the subsequent development of credit subjects. Financing guarantee only shares the risk and does not solve the financing problem of vulnerable groups. However, if guarantees are provided to all enterprises that request financing, it will pose a systemic risk [29]. Similarly, the government behavior is also in a dilemma. On the one hand, the construction of a policy-oriented financing guarantee system by the government can indeed further facilitate guarantee institutions to increase credit and risk distribution, ease the pressure on guarantee institutions and banks, and reduce financing costs in actual operations. These benefits will help agricultural entities obtain loans [30]. On the other hand, if policy behaviors only focus on risk sharing, they will increase financial pressure and have limited effect on lowering the financing threshold [31]. In the long run, policy behaviors cannot fundamentally overcome the financing difficulties of vulnerable groups. If the policy is too inclusive, it is not helpful for systemic risk control [23]. With reference to the previous analysis, the government should guide banks and guarantee institutions to establish a grading mechanism based on the actual development level and credit level of agricultural entities, integrate the development of agricultural entities, and judge the risk of repayment. This is the fundamental way to help banks and guarantee institutions reduce losses [32]. Second, in the cooperation of farmland management rights based on counter-guarantee, banks are not active in responding to the request of customers for loans based on the counter-guarantee of large-scale farmland management rights [33]. In this view, banks only have a slight effect on increasing the amount of financing guarantee. This situation originally arose because it is difficult to transform the mortgage value of farmland management rights; most new agricultural entities only pay one-year land rents, and banks cannot get compensated by defaults through rents [34]. Although banks possess the land management rights and the rights to dispose of economic derivatives on the land (such as fixed assets and economic crops), disposal is accompanied by great difficulty and requires additional disposal costs [35]. Therefore, when banks get farmers with a loan request based on the counter-guarantee of farmland management rights, they often require the participation of guarantee institutions. In fact, banks shift the risk of land transfer to guarantee institutions [36]. The participation of guarantee institutions can improve the financing enthusiasm of banks. However, this will increase the burden on guarantee institutions. In comparison with banks, guarantee institutions lack a grassroots network and risk control ability. It is more difficult for them to solve the problem of land management right circulation. Therefore, it is a general consensus for the government to build a land transfer platform to accelerate the land transfer rate and improve the efficiency of transforming the guarantee value of land management rights [37].

On the one hand, these studies emphasize the necessity and plausibility of the three-party cooperation model involving the government, banks, and guarantee institutions in sharing risks and discovering the mortgage value of large-scale land management rights guarantees. On the other hand, these studies reaffirm the positive effect of the cooperation model in helping new agricultural entities out of the financing dilemma. However, they fail to explain why there are still practical problems, such as low enthusiasm for cooperation and a low level of financing among the three parties in actual operation. As implied by the existing literature, the financing weakness of new agricultural entities and asymmetric information between borrowers and leaders are the significant factors leading to high financing risks and lower financing levels [38]. For those new agricultural entities with large-scale farmland management rights, the risk of bad debts will be significantly reduced if there is a large fixed asset investment in the associated agricultural land management rights or if the comprehensive asset capacity is high [39, 40]. In this view, risk reduction and financing level improvement will not only facilitate post-risk transfer but also boost prior risk screening and risk identification, thus eliminating information asymmetry. In addition to the guarantee value, farmland management rights also have the information function value of transmitting risk signals, which is of positive significance for identifying risks, screening credit customers with development potential, and improving the operation level of the financing system [41]. However, we should not solely rely on the efforts of one party. Therefore, we should work harder to explore how to bring the respective advantages of the three parties into play and start further sustainable and positive cooperation based on the original cooperation. Based on the previous analysis, the study in this paper explores how to further mobilize the government, banks, and guarantee institutions as the principals in this model based on the current policy operation, thus identifying and reducing information asymmetry as the breakthrough point, helping the cooperation break the low-level equilibrium, and finally achieving sustainable development. This study intends to build the evolutionary game model of three-party cooperation involving the government, banks, and guarantee institutions, hoping to find the significant factors affecting the positive cooperation behaviors of these three parties. In addition, this study recommends a new approach for the sustainable cooperation to improve the operation quality of the “government, bank, and guarantee institution” cooperation mechanism. In this way, government and banks can work together to prevent the moral hazard caused by financing new agricultural entities, select new agricultural customers with development potential to offer accurate financial support, and reduce the overall risk of the financing system. With the cooperation mechanism of really sharing both risks and benefits, new agricultural entities will receive help for development, optimizing policy efficiency.

2 Conceptual model of subject behavior relationships under the “government, bank, and guarantee institution” mode

The cooperation mechanism mainly involves four types of subjects, including the government, banks, policy-oriented agricultural guarantee institutions, and new agricultural business entities. New agricultural business entities are the object of service because they are in a weak financial position. In consideration of the aforementioned fact, whether the amount of financing guarantee can be successfully obtained is subject to the behavior decisions of the government, banks, and agricultural guarantee institutions. For this reason, this study focuses on the analysis of these three subjects.

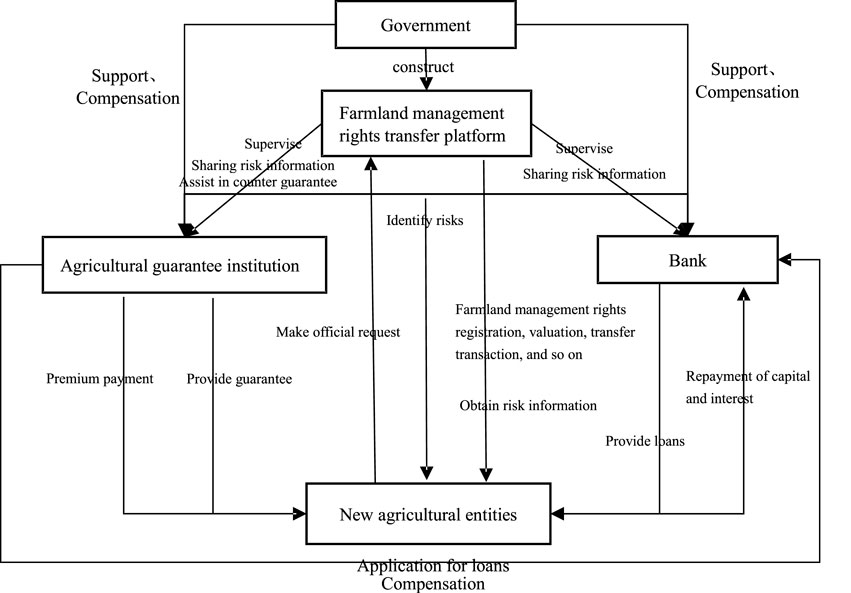

With reference to the subject interactive process of the “government, bank, and guarantee institution” cooperative financing guarantee in a pilot area in China in 2016, we can render the interactive process of the three subjects. First, the grassroots government builds a farmland management rights transfer platform for farmland management rights registration, valuation, large-scale farmland transfer transactions, management of guaranteed farmland management rights, and transfer of bad management rights. The government has established a special venture fund, with which discount is provided to pilot financing guarantee programs and non-performing loans are paid proportionally. Second, as a loan applicant, new agricultural entities can assess the guarantee value of farmland management rights using the platform, apply for participation in pilot financing guarantee programs, and accept the qualification examination. Third, agricultural guarantee institutions will, in accordance with relevant policies, refer to the value of farmland management rights and financial subsidies, evaluate profits and costs, make a decision on whether to provide guarantee, and apply to banks for a loan. If the application is approved, the platform will help new agricultural entities obtain the loan, thereby collecting a guarantee fee. In case of any non-performing loan, the platform will proportionally pay an amount to the bank. Then, recovery is performed by the agricultural guarantee institution for the defaulter. If the recovery fails, the platform will assist the agricultural guarantee institution in disposing of the farmland management rights as a counter-guarantee to make up for the losses. Fourth, based on the application, the bank will thoroughly evaluate the farmland management rights and financial subsidies of new agricultural entities, assess the profits and costs, and make a decision on whether to approve the loan application. This constitutes the cooperation and interaction among the government, banks, and guarantee institutions in exploring the guarantee value of large-scale farmland management rights and in sharing risks. If the risk signal value of farmland management rights is increased, improvements should be made in the following aspects: (1) the grassroots government builds a land management rights transfer platform. Based on the original responsibilities and affairs, the platform can obtain the risk information of large-scale farmland management rights involved in counter-guarantee (such as information on the transfer value of farmland management rights, the status of investment in the assets attached to the farmland, the status of crops attached to the farmland, information on the technological innovation application value, and the management model). Meanwhile, the risk information will be shared with the cooperative bank and agricultural guarantee institution to provide an objective basis for risk identification. (2) The agricultural guarantee institution and the bank individually or jointly pay the cost of risk identification and the value of the shared risk information transformation and hereby decide whether to provide guarantee services or approve the loan application. In other words, differential guarantee loan strategies should be selected through risk identification. For those new agricultural entities with risks lower than the general credit requirements, the bank can lend directly. For those new agricultural entities with risks higher than the general credit requirements but showing a certain development potential, the bank and the agricultural guarantee institution can jointly start lending. For those entities with very high risks but no development potential, the agricultural guarantee institution should reject the guarantee, and the bank should reject the loan application. In this way, a conceptual map of the cooperation behavior interaction process among the government, banks, and guarantee institutions for financing guarantee of new agricultural entities is developed (Figure 1).

In this process, the three parties not only cooperate with each other in risk sharing and exploring the mortgage value in guarantee but also identify and use the risk information value of the farmland management rights.

During the cooperation, the government aims to maximize social and economic benefits, hoping to expand the scale of new agricultural entities and reduce overall systemic risks. The government tries to raise the credit line and reduce risk for guarantee institutions through measures such as risk sharing based on proportional compensation and counter-guarantee of farmland management rights so as to relieve the pressure of risk control on banks. Moreover, various incentive policies are formulated to strengthen the role of agricultural guarantee institutions as a bridge. Banks are encouraged to cooperate with agricultural guarantee institutions to actively perform their duties and identify and reduce systemic risks. All the aforementioned efforts are made to achieve the policy goal of extending both guarantee and loan businesses to include new agricultural entities. If the policies place particular stress on the compensation of post risks, the policy effect will be weakened accordingly. For example, banks rely too much on risk transfer. Guarantee institutions are incapable of eliminating banks’ concerns of risk control. Banks and guarantee institutions are not fully motivated to identify customer risks and expand the financing guarantee business for potential new agricultural entities. If we fail to mobilize banks and guarantee institutions’ cooperation, the policy will get entangled in a negative state.

As the fund provider, banks are in a more competitive position, hoping to increase financing returns based on reduced risks. As independent economic units, they always try to maximize their own interests. The new agricultural financing is essentially inclusive finance with a lower loan interest rate and return. Most new agricultural entities lack historical credit information and collaterals, resulting not only in a high financing risk but also in high risk identification difficulty and cost. Affected by low return but high risk and cost, risk control mainly depends on government incentive policies, default compensation, counter-guarantee of farmland management rights, and the guarantee of an agricultural guarantee institution for risk transfer. In respect of the aforementioned fact, banks are far less motivated to identify the real risks of new agricultural entities by spending additional human resources, materials, and financial costs. Therefore, in the whole process of financing, banks adopt a passive attitude. When the government offers weak incentives and little compensation that cannot cover the risk suffered by banks, banks will be reluctant to lend to new agricultural entities, or the loan scale is small. When government incentives and risk-sharing measures can greatly transfer risks, banks will increase the loan amount. Due to the asymmetry between cost and benefit, banks are passive in risk control, causing a high level of risk in the financing system. Then, banks cannot wait for sustainable development.

Agricultural guarantee institutions are in a weaker position in the whole “government, bank, and guarantee institution” financing system. They are policy- and market-oriented. With these dual attributes, they hope to maximize their own interests and should take into account the policy implementation of inclusive finance. Agricultural guarantee institutions often have a large amount of government investment, laying a more sufficient financial foundation than market-oriented guarantee institutions and a stronger immunity against risks. However, due to the policy constraints on behavioral decisions and the necessity of considering the risk of state-owned asset loss, their behavior is more conservative. Along with insufficient market competition, there are fewer policy-oriented agricultural guarantee institutions. They are small scale and lack high risk-control abilities. Therefore, policy-oriented agricultural guarantee institutions hope to expand the scope of financing credit for new agricultural entities, raise the overall credit line of banks, and become a bridge between banks and new agricultural entities based on the requirements of inclusive finance. While helping more new agricultural entities apply for more bank loans, they can obtain the expected guarantee income. Moreover, they are incapable of bearing the default risk of new agricultural entities alone and identifying these default risks. They are also afraid to bear the responsibility for the loss of state-owned assets caused by the high default rate of new agricultural entities. In the face of the guarantee claims from new agricultural entities, their behavior is conservative, and they neither dare to significantly vouch for new agricultural entities nor alleviate the banks’ concern over risks. Therefore, they are in a dilemma.

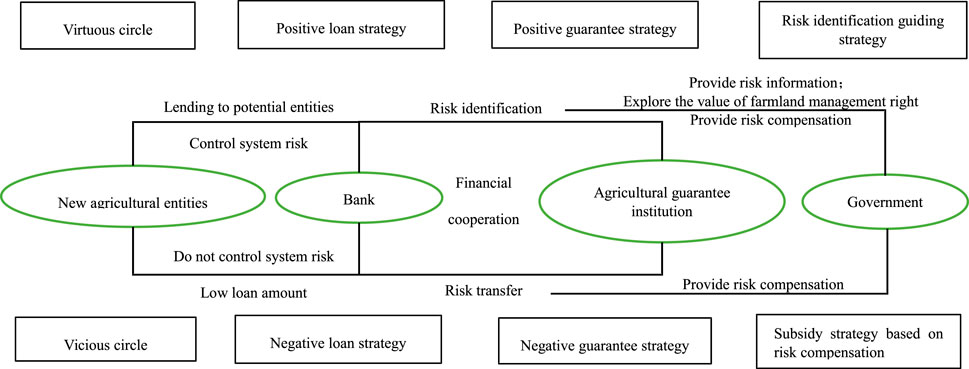

In summary, the government, banks, and agricultural guarantee institutions are closely linked in the process of financing guarantees for new agricultural entities. The government needs the active cooperation of banks and agricultural guarantee institutions to screen new agricultural entities with development potential for financial support, reduce the risk of the financing system, increase the amount of financing, and create more social and economic benefits. In this cooperation mechanism, banks will issue loans to new agricultural entities based on risk sharing, guarantee, counter-guarantee, and policy incentives. Agricultural guarantee institutions need government support to obtain financial support and risk resistance. Moreover, they require bank loans so as to achieve their goals of inclusive finance and profitability. These subjects have different value attributes and objectives. Therefore, the effectiveness of various government measures is limited; banks are in a negative state and rely on risk transfer. Agricultural guarantee institutions are not motivated and empowered to increase the amount of financing guaranteed and alleviate the concern of banks over risk control. In this sense, they are also in a negative state. The entire financing guarantee system enters a vicious circle. By clarifying the interaction and game relationship among the government, banks, and agricultural guarantee institutions, it is of great significance to properly avoid the negative behavior of all the subjects in the process of financing new agricultural entities, thus promoting the sustainable development of the financing market. Each party has its own goals, making it difficult to meet the requirements of all parties. Under such circumstances, they will choose different strategies according to their own interests, adapting them to specific situations. The conceptual model of strategy selection by the government, banks, and agricultural guarantee institutions is shown in Figure 2.

3 Building a game model related to the cooperation behavior in the cooperation mechanism of financing guarantee for new agricultural entities

In order to more specifically analyze how the three parties carry out sustainable and active cooperation and open the black box of tripartite interests, the authors build a cooperative game model of “government, bank, and guarantee institution” financing guarantee, observe the evolution trend of the system, and verify the feasibility of the cooperation path through simulation based on practical source data.

3.1 Basic hypothesis of the model

Hypothesis 1. government, banks, and agricultural guarantee institutions are limited rational decision-makers. It is difficult for each game subject to make the best strategic choice in an event. Therefore, they should keep simulating and learning from each other in the process of the game, thus steadily optimizing their own behaviors.

Hypothesis 2. government, banks, and agricultural guarantee institutions can choose two strategies. There are two types of government strategies [29]. The first one is the subsidy strategy based on risk compensation, in which the government only offers a certain amount of discount subsidy to guarantee loans for new agricultural entities and proportional risk compensation. The second one refers to the risk identification-guiding strategy, in which the government further shares the affiliated risk information of farmland management rights based on the previous strategy and motivates banks and guarantee institutions to cooperate for risk identification.There are two bank strategies [30]. In the first strategy, banks issue loans in a negative way and approve loan applications when both guarantee and subsidy can offset specific risks. In the second strategy, banks issue loans in a positive way, play an active role in identifying the risk level of customers, and make differential loan decisions based on guarantees. Banks develop risk identification products that comply with the characteristics of new agricultural entities based on the shared risk information and expenditures. Using the product, they can find three types of new agricultural customers, including the customers that meet the existing credit criteria, the customers having development potential but failing to meet the existing credit criteria of banks, and the customers failing to meet the development potential standard. Banks selectively issue loans based on the status of guarantee.There are two strategies for agricultural guarantee institutions [31]. In the first strategy, agricultural guarantee institutions provide guarantee services in a negative way and decide to guarantee only when the incentives and subsidies can offset the specific risks. In the second strategy, they provide guarantee services in a positive way, play an active role in developing and using the shared risk information, and then identify the risk level of new agricultural entities. Agricultural guarantee institutions develop risk identification products based on the shared risk information and expenditures. Using the product, they can find new agricultural customers with development potential failing to meet the existing credit criteria of banks and selectively provide guarantee services. If the second strategy is chosen, it means that the agricultural guarantee institution will cooperate with the bank to jointly bear the risk identification cost. Then, both parties will cover a lower cost.Based on the aforementioned analysis, the following strategies are recommended: the government (the subsidy strategy based on risk compensation and the risk identification-guiding strategy), banks (the strategy of issuing loans in a negative way and the strategy of issuing loans in a positive way), and agricultural guarantee institutions (the strategy of providing guarantee service in a negative way and the strategy of providing guarantee service in a positive way). Each party has two strategies. The possibilities for each of them to choose the positive strategy are

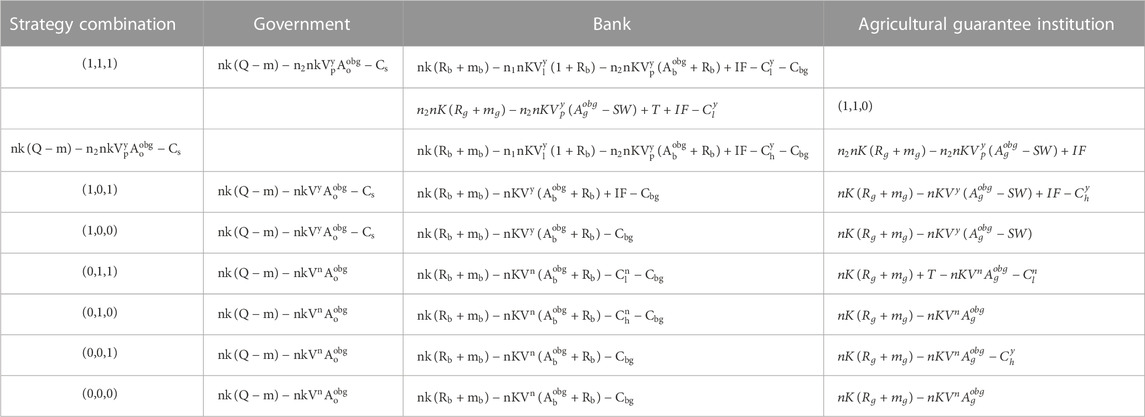

Hypothesis 3. Both government benefits and costs can be quantified [23]. The government builds a land transfer platform, which helps reduce the transfer cost of large-scale farmland management rights and improves the transfer efficiency and guarantee value of the rights. In addition, the platform can acquire risk information from the rights and share the information with banks and agricultural guarantee institutions. The benefits obtained by the government include the local agricultural development tax revenue, the increase of jobs, the improvement of social equity, and the improvement of the government’s reputation due to the government’s active solution to the financing problems of new agricultural entities. In theory, the governmental benefits should increase in proportion to the scale of financing and lending. In the cooperation mechanism, it is supposed that the loan amount is determined by the risk reserve and credit guarantee leverage jointly established by the government and agricultural guarantee institution. The yield was set as

Hypothesis 4. The bank’s benefits and costs can be quantified [32]. Assuming that Rb is the benchmark interest rate for bank loans and

Hypothesis 5. : The benefits and costs of an agricultural guarantee institution can be quantified [33]. Agricultural guarantee institutions can obtain guarantee fees by providing guarantee services for new agricultural business entities. Affected by the different strategies of the government and banks, there will also be different benefits and costs if the strategies chosen by agricultural guarantee institutions are different. Here, it is assumed that the government shares information about risks associated with the farmland management rights and that agricultural guarantee institutions provide guarantee services in a positive way. First, agricultural guarantee institutions should bear the risk identification cost. If they perform risk identification with banks, both of them should bear the cost. If banks carry out risk identification solely, they should bear the cost themselves. Second, the transformation value (IF) of risk information can be obtained. Third, if both agricultural guarantee institutions and banks choose positive strategies, the former ones will be recognized by banks, and banks will achieve long-term cooperation with them, resulting in long-term benefit T. Fourth, the agricultural guarantee institutions that have adopted a positive strategy will guarantee those loan projects of new agricultural entities that have risks higher than the requirements of general banks for separate loans but show development potential. In other words, the institution will apply to banks for the loan based on the “government, bank, and guarantee institution” cooperative guarantee. If the bank agrees, the agricultural guarantee institution will obtain the subsidy to the rate of guarantee fee and receive the government guarantee rate subsidy (assuming that

3.2 Construction of the replicated dynamic equation

When one party’s expected value of a particular strategy is higher than the average expectation of a mixed strategy in a three-party game, the strategy is more likely to be adopted. According to the Malthusian dynamic equation, as long as the individual who adopts this strategy has a higher degree of adaptation than the average group, the strategy will grow over time, and the expected value of each subject can be calculated accordingly.

Therefore, the replicated dynamic equation of the government, banks, and agricultural guarantee institutions is, respectively,

3.3 Solving the equilibrium point of the evolutionary game

In the process of a dynamic game, the probability x, y, and z of the selection strategy for the government, banks, and agricultural guarantee institutions, respectively, participating in the game are related to time t, thus knowing that the solution domain of the replicated dynamic equation set is

4 Stability analysis of the evolution of subject behaviors

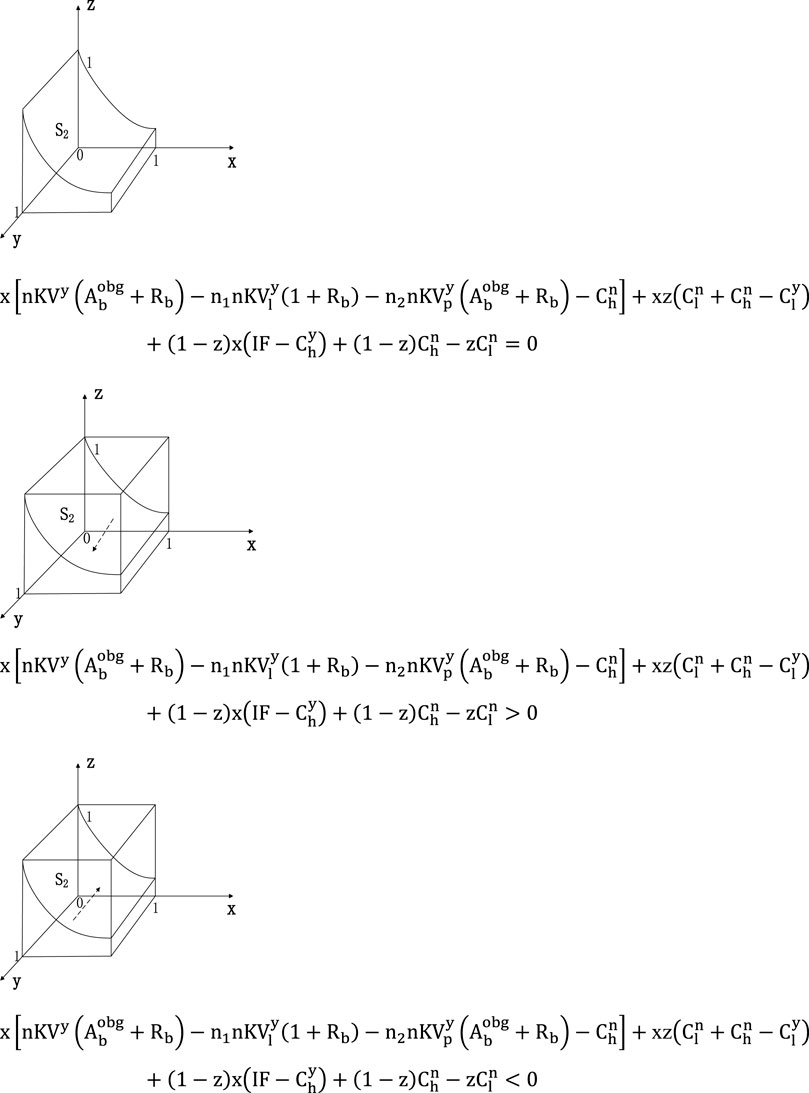

According to the basic nature of the replicated dynamic equation in the game model, F’(x) represents the ratio of group strategy selection over time. When F’(x) is 0, group strategy selection does not change over time. When F’(x) is greater than 0, the rate of change in group strategy selection increases over time, and x is an unstable point. When F’(x) is less than 0, the rate of change in group strategy selection decreases over time, and x is a stable point.

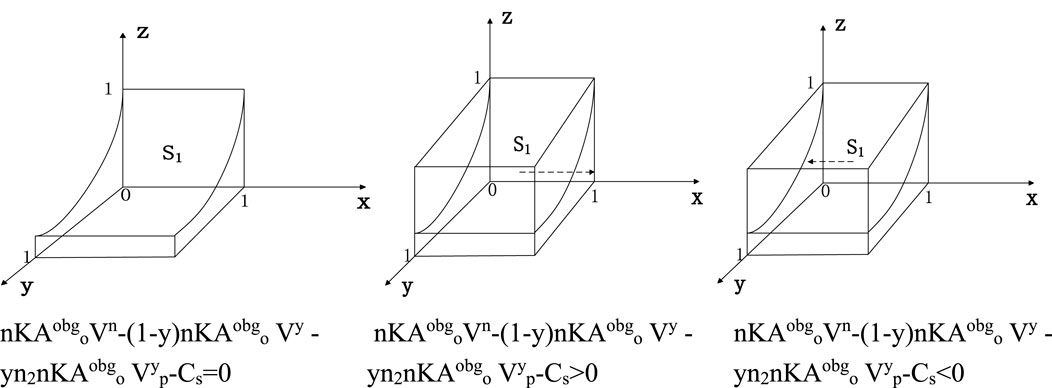

(1) Analysis of government’s asymptotic stability

①When

②When

③When

The dynamic trend and stability analysis of government strategy selection are shown in Figure 3.

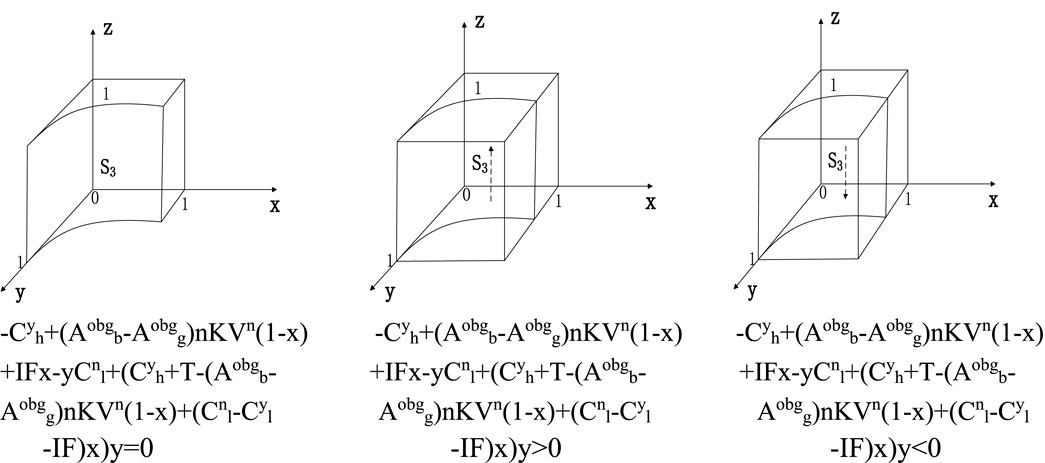

(2) Analysis of bank’s asymptotic stability

①When

②When

③When

The dynamic trend and stability analysis of bank strategy selection are shown in Figure 4.

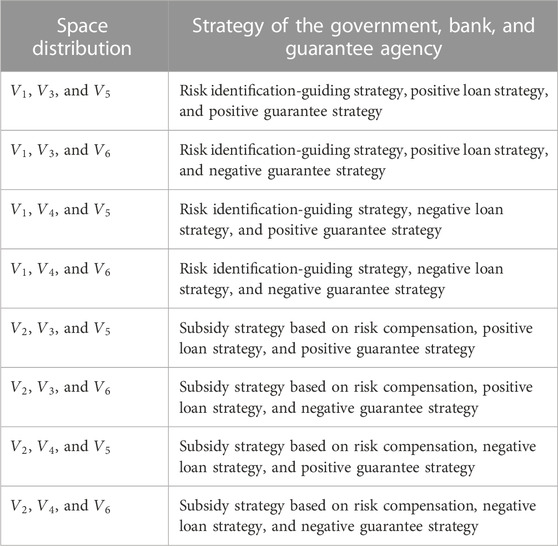

(3) Analysis of agricultural guarantee institution’s asymptotic stability

①When

②When

③When

The dynamic trend and stability analysis of agricultural guarantee institution strategy selection are shown in Figure 5.

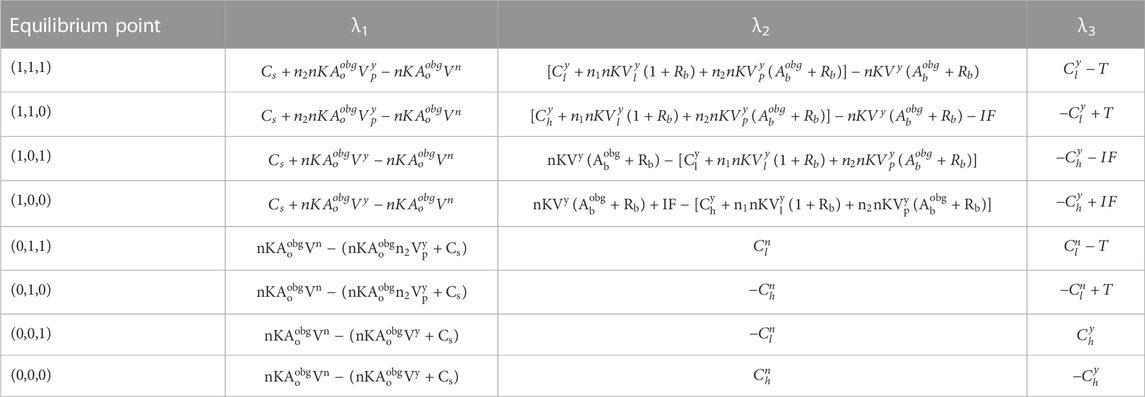

(4) System stability analysis of a three-party game

Different equilibrium states can be obtained by analyzing the evolutionary game of three-party subjects. It is assumed that the curved surface

The stable strategy combination obtained through asymptotic stability analysis is not necessarily the stable evolutionary strategy of the game system, and the stability of the equilibrium point of eight strategy combinations requires further analysis about points (0,0,0), (1,0,0), (0,0,1), (1,0,1), (0,1,0), (1,1,0), (0,1,1), and (1,1,1). According to the replicated dynamic equation of subjects, the corresponding Jacobian matrix is obtained as follows:

According to the Lyapunov stability theorem, the equilibrium point is stable if all characteristic values of the Jacobian matrix are negative. The results of the local stability analysis of the game system are shown in Table 3.

According to the results of the local stability analysis in the table, the characteristic value corresponding to (0,1,1), (0,0,1), and (0,0,0) already has a value determined to be a positive number, which is definitely not outside the range of a stable point. Several other equilibrium points require further discussion. According to the strategy space of the three subjects and the actual situation, the following criteria should be met if intending to make the business cooperation of subject space evolve toward the ideal direction (1,1,1):

For the government, the sum of the cost of risk information sharing and the default loss borne by the government after the transformation of risk information value is less than that of the loan loss borne by the government when value transformation is not performed for the information. The government tends to choose the risk identification-guiding strategy. When the sum of the costs paid in the positive loan strategy and the loan default losses is less than that of the default losses borne in the negative loan strategy, banks tend to choose the former situation. For agricultural guarantee institutions, when the cost of adopting the positive guarantee strategy is less than the long-term benefits brought by the bank’s recognition, they tend to choose this strategy.

Through the analysis, the following conclusions are drawn: (1) whether the government shares high-quality information related to large-scale farmland management rights that can reflect the risks of new agricultural entities is closely related to whether banks and agricultural guarantee institutions adopt the corresponding positive strategies. (2) The following criteria will decide whether banks select the positive loan strategy. First, they make sure that default losses can be tangibly reduced. Second, agricultural guarantee institutions should choose the same strategy as banks to jointly reduce costs. If the strategy cost of banks is too high or unprofitable, banks will evolve toward the negative loan strategy. (3) If the agricultural guarantee institution adopts a positive strategy, it can indeed get the bank’s affirmation and long-term benefits. When the benefits are higher than the cost paid, the agricultural guarantee institution will tend to use this strategy for a long time. Otherwise, the behavior of agricultural guarantee institutions will evolve toward the negative strategy. In summary, the stability analysis, the cost of risk information sharing, the default control rate of new agricultural entities, and the amount of the government’s compensation for losses are significant factors deciding whether the government builds a platform to share risk information. The transformation value of risk information, the cost of risk identification, the default rate of new agricultural entities, and the amount of compensation for the losses of banks are significant factors deciding whether banks adopt the positive loan strategy. The transformation value of risk information, the cost of risk identification, the default rate of new agricultural entities, the amount of compensation for the losses of agricultural guarantee institutions, and the long-term cooperative benefits brought by bank recognition are significant factors deciding whether agricultural guarantee institutions adopt the positive loan strategy. Among these factors, the transformation value of risk information, the cost of risk identification, and the default control rate of new agricultural entities are related to the yield of multiple subjects. Therefore, it is necessary to explore the impact of these key factors on the strategy selection of three parties and system evolution based on the stability of a single subject to verify the theoretical hypothesis.

5 Simulation and theoretical hypothesis verification

5.1 Initial situation parameter setting

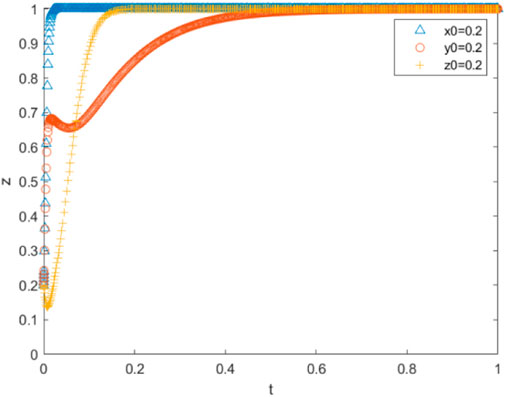

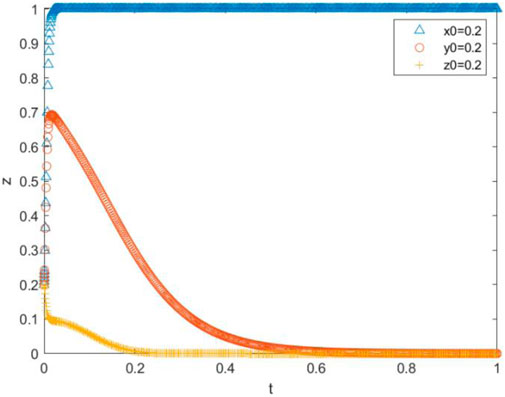

According to the constraints of the replicated dynamic equation and optimal equilibrium (1,1,1), the interactive behavior evolution of the government, banks, and agricultural guarantee institutions is numerically simulated and analyzed using MATLAB software based on theoretical analysis. x0, y0, and z0, respectively, indicate the initial proportion for the government to choose the positive guiding strategy, the initial proportion for the bank to choose the positive loan strategy, and the initial proportion for the agricultural guarantee institution to choose the positive guarantee strategy. It is assumed that the initial state is (0.2,0.2,0.2), the initial time is 0, and the evolution end time is 1.

It is also assumed that in the initial ideal situation, the return will be higher than the paid cost if the government chooses the risk identification-guiding strategy. If both banks and guarantee institutions choose a positive strategy, they will share the cost of risk identification, reduce the default rate, and jointly promote an increase in the guarantee leverage. The guarantee institution will be recognized by the bank and then receive long-term benefits. The initial value of the ideal state of the model parameters is parameterized with reference to actual situations.

According to the estimation and calculation data of a regional bank in China, the average financing default rate of new agricultural entities is about 0.3% in the natural situation without risk information sharing, mortgage guarantee, and positive customer screening of banks and guarantee institutions. Assuming that under the ideal system operation state, the risk information sharing by governments can better restrain the default behavior of new agricultural entities and reduce the system default rate to 0.28. If banks issue loans in a positive way, they can effectively identify the risk of new agricultural entities, screen loan customers, and finally control the default rate at 0.015. If banks cooperate with guarantee institutions, both parties will choose the positive loan and guarantee strategy, and guarantee institutions will share the risk; therefore, banks will appropriately lower the loan threshold, increase the tolerance for default rates, and finally control the default rate at 0.03.

According to the data from a local statistical yearbook in China, the loan interest rate of China’s banks for new agricultural entities is 0.04, and the guarantee leverage is about 3. The proportion of issuing loans by banks alone is 0.1, and the proportion of issuing loans through the cooperation of banks and guarantee institutions is 0.9, meeting the criterion of

According to the statistical yearbook and the author’s study data in the “government, bank, and guarantee institution” financing guarantee pilot area, it is assumed that the loan principal basis point is 10,000, and the cost required by the government to collect and share risk information is 1,000 based on proportional calculations. With available risk information, the cost paid by banks and agricultural guarantee institutions on risk identification with cooperation is 100, and the cost paid by banks and agricultural guarantee institutions is 200 when they have not cooperated with each other. In a situation without risk information, banks and agricultural guarantee institutions should separately collect risk information, resulting in a high risk identification cost. The cost, respectively, paid by either party is 600 when they cooperate with each other and 1,200 when they do not cooperate with each other.

According to the current system of the “government, bank, and guarantee institution” financing guarantee pilot area, the ratio of risks undertaken by them is 0.1, 0.3, and 0.6, respectively.

Then, the parameter initial values are set as follows:

The result of system simulation in an ideal situation is shown in Figure 6, indicating that the system is in the ideal state (1,1,1) and using this state as the benchmark to compare the change of all parameters.

5.2 Numerical simulation and result analysis

(1) Numerical simulation of changes in risk identification quality

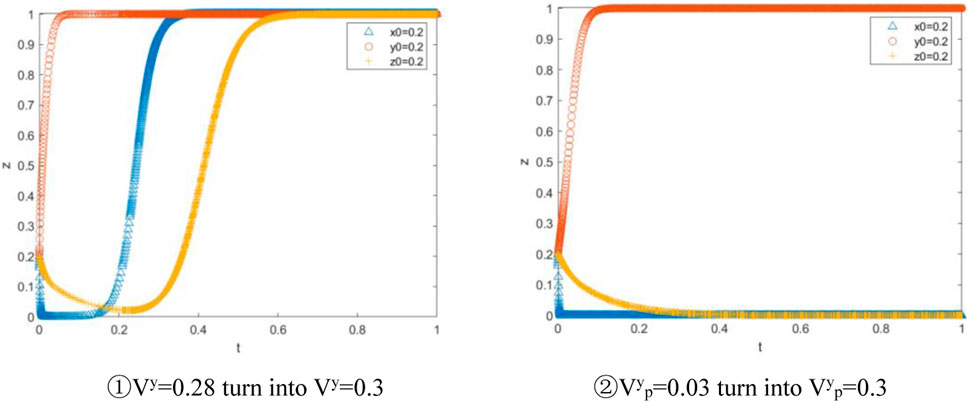

In the initial ideal state, the farmland management rights transfer platform established by the government and the shared risk information are of high quality. In addition, the counter-guarantee of farmland management rights and the sharing of risk information serve as restraints on new agricultural entities, which can reduce the default rate

Other condition values are set, and it is ensured that they are not changed. If the risk information shared by governments is not significantly effective in restraining new agricultural entities and no notable decrease is seen in the initial default rate;

This result shows that the natural constraint of risk information sharing on the default of new agricultural entities is not a sufficient condition for system stability. Based on risk information sharing, the three parties should cooperate with each other for risk identification, thereby screening customers effectively and reducing the default rate. Only when the quality of risk identification is high can the government, banks, and agricultural guarantee institutions achieve profitability through the related positive strategies and ultimately realize sustainable cooperation among the three parties.

If it is intended to improve the quality of risk identification and substantially reduce the default rate, the high-quality risk information shared by the government is not a condition value but an essential condition, according to the findings of statistical analysis using the game model. Moreover, human resources, materials, technologies, and other costs of banks and agricultural guarantee institutions for risk identification are essential conditions. Both of the aforementioned conditions are indispensable.

(2) Numerical simulation of changes in the transformation value of risk information

One or two parties of banks and agricultural guarantee institutions will develop the risk information shared by the government (for example, develop the guaranteed loan business based on risk levels). The outcomes will help banks and agricultural guarantee institutions reduce risks, expand business, and gain reputation. This series of economic and social values is defined by the transformation value of information. In the initial ideal state, the transformation value (IF) of risk information accessible to banks and agricultural guarantee institutions is quantified to 50.

Other condition values are set, and it is ensured that they are not changed. The transformation value (IF) of risk information is reduced from 50 to 30. According to the simulation results, banks and guarantee institutions have withdrawn from the risk identification of new agricultural entities, and the cooperation is therefore terminated (Figure 8). This result reaffirms that the high-quality risk information shared by the government is only the first step. It is very important to make good use of risk information and strive to transform risk information into more and more favorable economic and social values. It is also of great significance for banks and guarantee institutions to achieve continuous financing and guarantee. However, it is to be noted that both parties will obtain the benefit of transformation value as long as either a bank or an agricultural guarantee institution adopts the positive strategy. A “free rider” problem may occur. Each party hopes that the other party will pay more for cooperation, allowing them to gain more benefits. In order to explore whether the transformation value of information can continuously promote three-party cooperation, it is necessary to further study the strategy selection of both parties under the change in risk identification cost.

(3) Numerical simulation of changes in risk identification cost

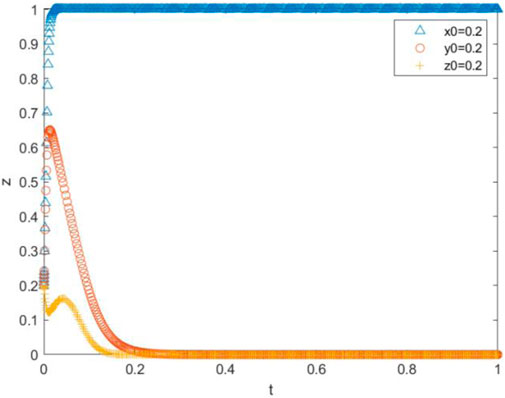

If the government does not share risk information in the initial ideal state, cooperation will require a higher cost for banks and agricultural guarantee institutions to collect risk information and then identify risks. In the case of cooperation without shared information, the risk identification cost

While other conditions remain unchanged, the risk identification cost is set after the government has set up a platform and shared risk information equal to the cost when the risk information is not shared (

It also needs to be further studied whether the risk identification jointly implemented by banks and agricultural guarantee institutions will affect system stability when the government has shared true and effective information. All parameter values are restored to the initial ideal state, and the risk identification cost based on the cooperation of banks and agricultural guarantee institutions is set equal to the cost of separate risk identification (by changing

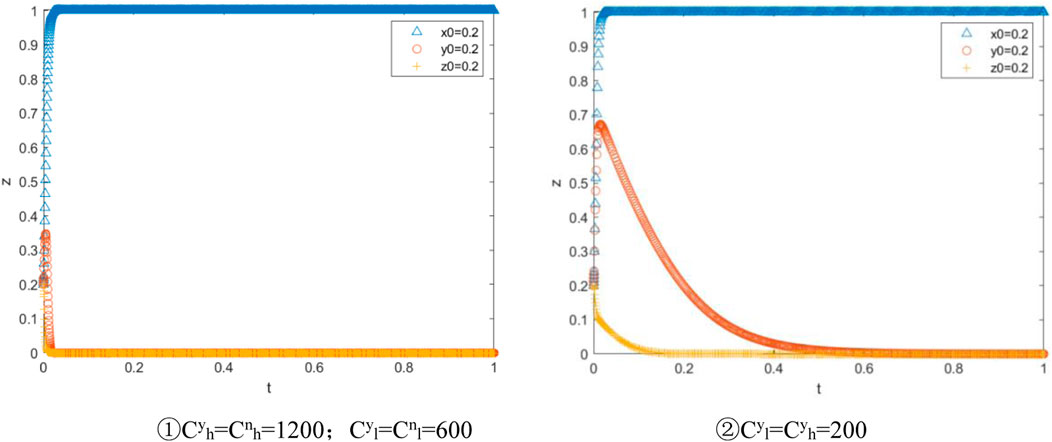

(4) Numerical simulation of changes in long-term benefits brought by the participation of agricultural guarantee institutions in risk identification.

Agricultural guarantee institutions will be recognized and encouraged by banks when they work hard to identify risks and provide guarantee services selectively in the initial ideal state. Banks will reach a long-term cooperation intention with agricultural guarantee institutions so as to facilitate them in further identifying risks, helping banks control those risks, saving costs, and bringing in more high-quality financing guarantee customers. Meanwhile, agricultural guarantee institutions can obtain benefits from the long-term cooperation. It is assumed that the initial value

The strategy selection of three parties with the change in long-term benefit values is reviewed. It is ensured that other conditions remain unchanged. The condition is set as follows: agricultural guarantee institutions work hard to identify risks and are recognized by banks and the long-term benefit T is reduced from 120 to 50. The simulation results are shown in Figure 10, indicating that banks and agricultural guarantee institutions tend to be non-cooperative. For agricultural guarantee institutions, the recognition of banks and long-term cooperation with banks are of great importance. If the benefit exceeds the cost, agricultural guarantee institutions are willing to cooperate with banks, helping them share risk control pressures and costs. If not recognized by banks, agricultural guarantee institutions will withdraw from the cooperation. Then, banks must separately bear the risk identification cost and pressure. Therefore, banks will also gradually withdraw from the three-party cooperation, and the cooperation will come to an end.

6 Study conclusion

This study builds an evolutionary game model of “government, bank, and guarantee institution” cooperative financing guarantee for new agricultural entities. Based on the post-risk transfer for three parties, this study discusses the cooperation of positive financing guarantee in relation to prior risk identification. According to the study findings, the cooperation mechanism should not only focus on the post-risk transfer but also take the prior risk identification as a breakthrough point to tangibly reduce the systemic risk of financing guarantee, which is feasible in eliminating the financing dilemma. According to the result of the simulation, efforts should be made in four aspects, including risk information sharing, risk identification quality, risk identification cost sharing, and risk information value transformation, to mobilize the three parties for positive cooperation, really reduce risks, and improve operation quality. First, the government is recommended to build a high-quality farmland management rights transfer platform and share the high-quality information data that are related to the farmland management rights and can reflect the risks of new agricultural entities. Second, banks and guarantee institutions should be guided to make good use of the information, improve the quality of risk identification, find out about new agricultural entities with development potentials, tangibly reduce the system default rate, and convert risk information into favorable economic and social values. Furthermore, banks and guarantee institutions should be encouraged to achieve long-term cooperation for risk identification and jointly bear the cost of risk identification. Banks should be encouraged to recognize the participation of agricultural guarantee institutions in risk identification and facilitate the transformation value to increase risk information. In this way, a new model of sustainable cooperation among the government, banks, and guarantee institutions for the financing guarantee of new agricultural entities is formed. The conclusions are specified as follows:

With reference to the strategies adopted by each party in the cooperation mechanism, whether the government builds a platform and shares high-quality information is closely related to whether banks and agricultural guarantee institutions adopt positive loan and guarantee strategies. Second, the tangible reduction of loss caused by default behaviors and the sharing of risk identification costs by agricultural guarantee institutions play a decisive role in driving banks to adopt positive loan strategies. Third, agricultural guarantee institutions will tend to choose the positive guarantee strategy if they are recognized by banks, and the long-term benefits are higher than the paid risk identification costs.

In respect of the “government, bank, and guarantee institution” financing guarantee system stability, the quality of risk identification is one of the significant factors affecting the sustainable cooperation among the three parties. High-quality risk information is one of the essential conditions to improve the quality of risk identification, accurately screen customers, and tangibly reduce the default rate. For this reason, it is necessary for the government to build a platform to protect the economic value of counter-guarantee with farmland management rights, further explore the associated risk information that can reflect the actual risk status of new agricultural entities, and finally realize the sharing of risk information.

Accurate processing of risk information by banks and agricultural guarantee institutions is another essential condition to improve the risk identification quality, accurately screen customers, and tangibly reduce the default rate. Therefore, it is necessary to mobilize banks and agricultural guarantee institutions for risk identification and drive both parties to choose differential financing guarantee strategies for different new agricultural entities to control systemic risks on the basis of high-quality information sharing. In addition, banks and agricultural guarantee institutions need to be made aware of the benefits of adopting positive strategies in different aspects, such as risk identification cost sharing and risk information transformation value, thereby truly motivating both parties.

In order to mobilize banks and agricultural guarantee institutions for cooperation, the sharing of risk identification costs is one of the significant driving factors. If the risk identification cost is too high, the behavior of the three parties will evolve in an unfavorable trend. In order to reduce and save costs, the high-quality risk information of governments still plays a vital role, which exempts banks and agricultural guarantee institutions from additional human resources, materials, and financial resources. Second, banks and agricultural guarantee institutions can share technologies, personnel, and data through risk identification and reduce the identification cost based on cooperation, thus achieving a win–win situation. The idea that either party wants to be a “free rider” and hopes that the other party can pay more to obtain benefits is not sustainable. Since the “free rider” is not feasible, the three parties should be guided to create a favorable long-term mechanism for cost sharing.

More value transformations of risk information after banks and agricultural guarantee institutions choose positive financing guarantee strategies are identified as another significant driving factor to motivate all parties for cooperation. According to the simulation result, the series of economic and social values obtained by either or both banks and agricultural guarantee institutions through the processing of risk information, such as risk reduction, business expansion, and reputation promotion, will facilitate sustainable cooperation among the three parties. For this reason, the government is recommended to increase the transformation value of such risk information in some ways, such as social desirability and media publicity, thus promoting the sustainable development of “government, bank, and guarantee institution” positive cooperation.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

JZ was responsible for building models and writing the paper; ZM was responsible for research and collecting data; FZ was responsible for analyzing the data and improving the model; and QZ was responsible for literature search and writing the review. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Jiangsu Social Science Foundation [grant number 19JD012] and the Key Project of Philosophy and Social Science Research in Colleges and Universities in Jiangsu Province [grant number 2022SJZD017].

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Saito K, Tsuruta D. Information asymmetry in small and medium enterprise credit guarantee schemes: evidence from Japan. Appl Econ (2018) 50(22) 1–17. doi:10.1080/00036846.2017.1400651

2. Mei Q, Hong-Zhen XU The study of bank-guarantee risk sharing in Re-guarantee system—based on system dynamics. Technoecon Manag Res (2014) (2):78–82.

3. Choe C. The political economy of SME financing and Japan's regional bank problems. Pacific-Basin Finance J (2007) 15:353–67. doi:10.1016/j.pacfin.2006.10.001

4. Corrado G, Corrado L. Inclusive finance for inclusive growth and development. Curr Opin Environ Sustain (2017) 24:19–23. doi:10.1016/j.cosust.2017.01.013

5. Jiang F, Jiang Z, Kim KA. Capital markets, financial institutions, and corporate finance in China. J. Corp Finance (2020) 63:101309. doi:10.1016/j.jcorpfin.2017.12.001

6. Arun T, Kamath R. Financial inclusion: Policies and practices. IIMB Manag Rev (2015) 27(4):267–87. doi:10.1016/j.iimb.2015.09.004

7. Nguyen VS, Mai TTH, Thuan TD, Tien DV, Phuong NTM, Thai VH, et al. SME financing role in developing business environment and economic growth: Empirical evidences from technical SMEs in vietnam. Environ Sci Pollut Res Int (2022) 29(35):53540–52. doi:10.1007/s11356-022-19528-w

8. Ghalke A, Kumar S, Nageswara Rao SVD. SME financing through public equity: Review of the Indian SME exchanges. Indian Growth Dev Rev (2022) 15(1):85–97. doi:10.1108/IGDR-10-2021-0138

9. Rostam AM, Ahmed RA, Tisha RT, Ashikul IM. Does SME financing perform well from both demand and supply sides? The case of a developing country. Int J Financial Eng (2021) 08(04). doi:10.1142/S2424786321420020

10. Van Klyton A, Rutabayiro-Ngoga S. SME finance and the construction of value in Rwanda. J Small Bus Enterp Dev (2018) 25(4):628–43. doi:10.1108/JSBED-02-2017-0046

11. Li S, Yang Y, Zongfang Z. Research on impact of moral hazard on individual credit risk. Proced Comp Sci (2014) 31:577–86. doi:10.1016/j.procs.2014.05.304

12. Lv Y, Ma G, Ding J. Breakthrough path of low-level equilibrium of China's policy-oriented financing guarantee market. Front Psychol (2022) 13:918481. doi:10.3389/fpsyg.2022.918481

13. Xu R, Guo T, Zhao H. Research on the path of policy financing guarantee to promote SMEs’ green technology innovation. Mathematics (2022) 10(4):642. doi:10.3390/math10040642

14. Lv Y, Ma G, Lv L, Ding J. The design of incentive mechanism for policy-oriented guarantee institutions’ digital transformation in China. Discrete Dyn Nat Soc (2022) 2022:1–10. doi:10.1155/2022/6334476

15. Liu R, Sui JH, Jiang LT. Current status and possible solutions to the financing difficulties of small-and medium-sized enterprises in China. In: Proceeding of the 2015 International Conference on Industrial Technology and Management Science; Tianjin, China. Atlantis Press (2015). p. 1612–5. doi:10.2991/itms-15.2015.392

16. Jianzhong Y, Jundan P. A research on the financing efficiency of small and medium-sized enterprises by fuzzy evaluation method. Proceeding of the 2015 8th International Conference on Intelligent Computation Technology and Automation (ICICTA). IEEE, June 2015, Nanchang, China, 2015: 89–93.

17. Adusei M, Adeleye N. Corporate disclosure and credit market development. J Appl Econ (2021) 24(1):205–30. doi:10.1080/15140326.2021.1901644

18. Umehara E, Ohta T. Using game theory to investigate risk information disclosure by government agencies and satisfying the public—the role of the guardian agent. IEEE Trans Syst Man, Cybernetics-A: Syst Humans (2009) 39(2):321–30. doi:10.1109/tsmca.2008.2010796

19. Yoon KS. Enhancing information sharing in the public sector: An empirical study. Informatization Policy (2012) 19(4):83–104.

20. Fan J, Zhang P, Yen DC. G2G information sharing among government agencies. Inf Manag (2014) 51(1):120–8. doi:10.1016/j.im.2013.11.001

21. Adhikary BK, Kutsuna K, Stephannie S. Does the government credit guarantee promote micro, small, and medium enterprises? Evidence from Indonesia. J Small Business Entrepreneurship (2021) 33(3):323–48. doi:10.1080/08276331.2019.1666338

22. Chowdhury MSA, Azam MKG, Islam S. Problems and prospects of SME financing in Bangladesh. Asian Business Rev (2013) 2(2):51–116. doi:10.18034/abr.v2i2.304

23. Beck T, Klapper LF, Mendoza JC. The typology of partial credit guarantee funds around the world. J Financial Stab (2010) 6(1):10–25. doi:10.1016/j.jfs.2008.12.003

24. D’Orazio P, Valente M. The role of finance in environmental innovation diffusion: An evolutionary modeling approach. J Econ Behav Organ (2019) 162:417–39. doi:10.1016/j.jebo.2018.12.015

25. Rehman K, Khan HH, Sarwar B, Muhammad N, Ahmed W, Rehman ZU. A multi-group analysis of risk management practices of public and private commercial banks. The J Asian Finance Econ Business (2020) 7(11):893–904. doi:10.13106/jafeb.2020.vol7.no11.893

26. Altman EI, Esentato M, Sabato G. Assessing the credit worthiness of Italian SMEs and mini-bond issuers. Glob Finance J (2020) 43:100450. doi:10.1016/j.gfj.2018.09.003

27. Bachas N, Kim OS, Yannelis C. Loan guarantees and credit supply. J Financial Econ (2021) 139(3):872–94. doi:10.1016/j.jfineco.2020.08.008

28. Berkman H, Cole RA, Fu LJ. Expropriation through loan guarantees to related parties: Evidence from China. J Banking Finance (2009) 33(1):141–56. doi:10.1016/j.jbankfin.2007.11.001

29. Scholtens B. Finance as a driver of corporate social responsibility. J Business Ethics (2006) 68(1):19–33. doi:10.1007/s10551-006-9037-1

30. Eshet A. Sustainable finance? The environmental impact of the‘Equator principles’and the credit industry. Int J Innovation Sust Dev (2017) 11(2-3):106–29. doi:10.1504/ijisd.2017.083305

31. Gendron M, Son-lai V, Soumare I. Effects of maturity choices on loan-guarantee portfolios. J Risk Finance (2006) 7(3):237–54. doi:10.1108/15265940610664933

32. Gai L, Ielasi F, Rossolini M. Smes, public credit guarantees and mutual guarantee institutions. J Small Business Enterprise Dev (2016) 23(4):1208–28. doi:10.1108/jsbed-03-2016-0046

33. Soundarrajan P, Vivek N. Green finance for sustainable green economic growth in India. Agric Econ (Zemed Ekon.) (2016) 62(62):35–44. doi:10.17221/174/2014-agricecon

34. Zheng P, Zhang Z. Analyzing characteristics and implications of the mortgage default of agricultural land management rights in recent China based on 724 court decisions. Land (2021) 10(7):729. doi:10.3390/land10070729

35. Peng Y, Liu W, Tan C. Study on risks in mortgage financing of rural land management right. In: 6th International Conference on Social Science, Education and Humanities Research (SSEHR 2017). Atlantis Press (2018). p.692–701. doi:10.2991/ssehr-17.2018.151

36. Gai L, Ielasi F, Rossolini M. SMEs, public credit guarantees and mutual guarantee institutions. J Small Bus Enterp Dev (2016) 23:1208–88. doi:10.1108/JSBED-03-2016-0046

37. de la Fuente-Cabrero C, de Castro-Pardo M, Santero-Sánchez , Laguna-Sánchez P. The Role of mutual guarantee institutions in the financial sustainability of new family-owned small businesses. Sustainability (2019) 11(22):6409. doi:10.3390/su11226409

38. Qin M, Wachenheim CJ, Wang Z, Zheng S. Factors affecting Chinese farmers’ microcredit participation. Agric Finance Rev (2019) 79(1):48–59. doi:10.1108/AFR-12-2017-0111

39. Yang W, Yan W. Analysis on function orientation and development countermeasures of new agricultural business entities. J Northeast Agric Univ (2016) 23(2):82–8. doi:10.1016/S1006-8104(16)30051-4

40. Valaskova K, Kliestik T, Svabova L, Adamko P. Financial risk measurement and prediction modelling for sustainable development of business entities using regression analysis. Sustainability (2018) 10(7):2144. doi:10.3390/su10072144

Keywords: cooperation behavior, financing guarantee, China’s new agricultural entities, low-level equilibrium, evolutionary game

Citation: Zhang J, Mei Z, Zhang F and Zhou Q (2023) An evolutionary game study on the cooperation behavior of the “government, banks, and guarantee institutions” in financing guarantee for China’s new agricultural entities. Front. Phys. 11:1121374. doi: 10.3389/fphy.2023.1121374

Received: 11 December 2022; Accepted: 09 January 2023;

Published: 08 March 2023.

Edited by:

Jianrong Wang, Shanxi University, ChinaReviewed by:

Fuli Zhou, Zhengzhou University of Light Industry, ChinaJinnan Wu, Anhui University of Technology, China

Copyright © 2023 Zhang, Mei, Zhang and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jingjing Zhang, emhqaW5nLXVqc0Bmb3htYWlsLmNvbQ==

Jingjing Zhang

Jingjing Zhang Zhu Mei

Zhu Mei Fan Zhang

Fan Zhang