- Department of Physics, Inha University, Incheon, South Korea

A stock market is a complex system consisting of many interacting agents. We consider recent progress with complex networks constructed from cross-correlation of financial time series in the stock market. We review some methods and discuss the challenges in generating such complex networks that have a reasonable threshold.

1 Introduction

We consider complex networks in the stock market, which are generated by calculating cross-correlation coefficients of the logarithmic return between securities or stock indices. We connect two securities or indices with cross-correlation coefficients in descending order up to the number of links,

In this note, we discuss recent methods and applications of complex networks in the stock market and the pros and cons of threshold networks in the stock market.

2 Review

In a stock market, the indices or stock prices of individual companies become correlated with each other over time. The idea of complex networks applies to both stock markets and financial markets. We can construct a network based on world trade because the weights of the links are defined by trade flows, such as imports or exports among countries. In a stock market, one uses the cross-correlation coefficients of the stock indices or the prices of individual securities to generate a complex network. Consider a time series of a stock index on day

where

The MST is like a skeleton tree in the stock market, which is connected by tightly correlated indices or stock prices, with the number of links denoted as

In the complex network of a stock market, the nodes are the stock indices or securities belonging to the stock market. When we consider cross-correlations among the indices of world markets, a node is a country’s stock index, such as the NYSE, the KOSPI, and the Nikkei. When we consider cross-correlation in intra-stock markets, nodes are securities such as Apple and Google in the U.S. stock market. We assign a link to the threshold networks when the cross-correlation coefficient between two companies is greater than a threshold value, such as

When one generates the threshold network, there is no concrete criterion for assigning threshold

Strongly connected links between two securities mean that they should behave synchronously. Therefore, when we build a portfolio, we can avoid choosing highly correlated or heavily connected securities from a threshold network. However, heuristic determination of the threshold value is an open issue in threshold networks. Nobi et al. chose a threshold value

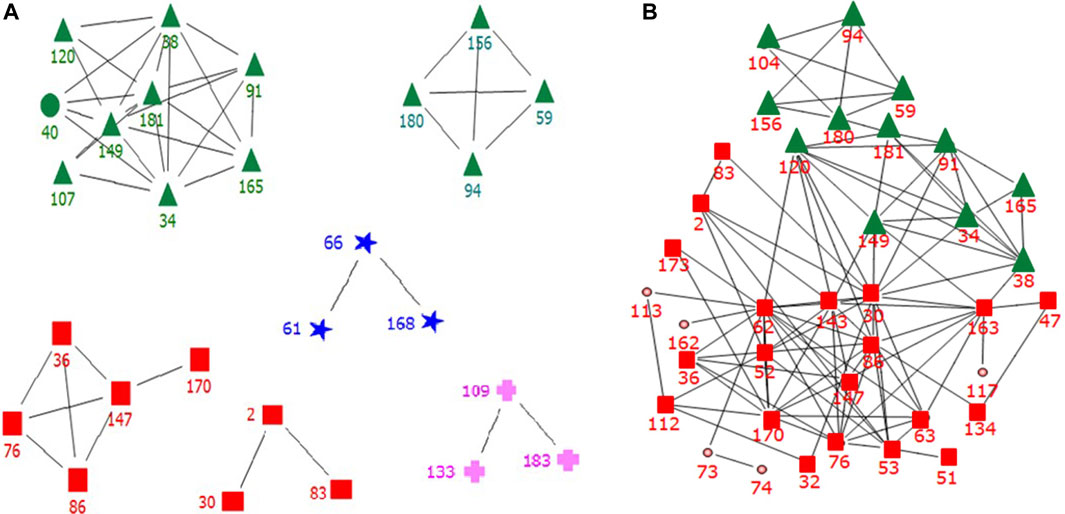

FIGURE 1. Threshold network with threshold

When we choose a threshold value, we can compare the distribution of the cross-correlation coefficients between the original time series and a shuffled time series. The shuffled time series destroys cross-correlation but maintains the distribution function of the returns. When we estimate the cross-correlation, a few high logarithmic returns heavily contribute to the value of the cross-correlation coefficients. This is an intrinsic problem in a time series if there are events with extreme values. In a threshold network, we obtain a unidirectional network. In the real world, the information flow between two securities is asymmetric and directional. Some researchers apply Granger causality, transfer entropy, causation entropy, and network entropy to generate a directional network in the stock market [18–22].

The strong points of a threshold network based on cross-correlation are that it is easy to construct the network and obtain intuitive relationships among the companies via the network. When we scan the changes in a threshold network over time, we can observe dynamic changes in the network, as shown in Figure 1. The properties of the threshold network help us understand the characteristics of the stock market. A weak point in the threshold network is that there is no concrete criterion for assigning the threshold. Therefore, if we change the threshold value, the connecting pattern changes heavily. When we obtain the threshold network, it does not give any causal relationships among companies because threshold networks are based on cross-correlation among time series.

The structural change of a complex network in the stock market can be applied to measure the impact of a crisis and the instability of the market [10, 15, 23–31]. A big shock on the market should change the structure of the stock network. The length of the minimum spanning tree experiences a drastic reduction when facing systemic risk [24]. The hierarchy of global trade networks increases during a period of recession [25]. Characteristics of complex networks, such as clustering coefficients, centrality, network size, and occupation ratio, are associated with systemic risk and instability in the stock market [23, 27].

In summary, we introduced a threshold method to generate a complex network via the cross-correlation of logarithmic returns in the stock market. We want to get some useful information from a complex network. We estimate properties like average degree, clustering coefficients, centrality, and community detection in the generated threshold networks. We need to relate these qualities to market stability, systemic risk in the market, investing strategies, etc. To accomplish these goals, we need to generate suitable complex networks for the stock market by using reasonable criteria.

3 Conclusion

We discussed methods of creating a threshold network using cross-correlation coefficients between securities or indices in stock markets. In the threshold method, we assigned a heuristic threshold value to generate the stock network. We need a more concrete criterion for choosing the threshold value for a threshold network. The dynamic changes of a threshold network in the stock market can be applied to understand the systemic risk and stability in the market.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author contributions

JP, CC, and JL performed conception and design of the research, the acquisition and analysis of data, interpretation, writing, and revising.

Funding

This work was supported by Inha University Research Grant.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Mantegna R. Hierarchical structure in financial markets. Eur Phys J B (1999) 11:193–7. doi:10.1007/s100510050929

2. Mantegna R, Stanley H. An introduction to Econophysics: Correlations and complexity in finance. Cambridge: Cambridge University Press (2000). p. 105.

3. Tumminello M, Aste T, Di Matteo T, Mantegna R. A tool for filtering information in complex systems. Proc Natl Acad Sci U S A (2005) 102:10421–6. doi:10.1073/pnas.0500298102

4. Boginski V, Butenko S, Pardalos P, Pardalos PM. Statistical analysis of financial networks. Comput Stat Data Anal (2005) 48:431–43. doi:10.1016/j.csda.2004.02.004

5. Lee E, Lee J, Hong B, Hong BH. Complex networks in a stock market. Comp Phys Commun (2007) 177:186. doi:10.1016/j.cpc.2007.02.047

6. Onnela J, Kaski K, Kertesz J. Clustering and information in correlation based financial networks. The Eur Phys J B - Condensed Matter (2004) 38:353–62. doi:10.1140/epjb/e2004-00128-7

7. Huang W, Zhuang X, Yao S, Yao S. A network analysis of the Chinese stock market. Physica A: Stat Mech its Appl (2009) 388:2956–64. doi:10.1016/j.physa.2009.03.028

8. Tse C, Liu J, Lau F, Lau FC. A network perspective of the stock market. J Empirical Finance (2010) 17:659–67. doi:10.1016/j.jempfin.2010.04.008

9. Namaki A, Shirazi AH, Raei R, Jafari G. Network analysis of a financial market based on genuine correlation and threshold method. Physica A: Stat Mech its Appl (2011) 390:3835–41. doi:10.1016/j.physa.2011.06.033

10. Nobi A, Maeng S, Ha G, Lee J. Effects of global financial crisis on network structure in a local stock market. Physica A: Stat Mech its Appl (2014) 407:135–43. doi:10.1016/j.physa.2014.03.083

11. Nobi A, Lee S, Kim D, Lee J, Kim DH. Correlation and network topologies in global and local stock indices. Phys Lett A (2014) 378:2482–9. doi:10.1016/j.physleta.2014.07.009

12. Kumar S, Deo N. Correlation and network analysis of global financial indices. Phys Rev E (2012) 86:026101. doi:10.1103/PhysRevE.86.026101

13. Ha G, Lee J, Nobi A. Threshold network of a financial market using the P-value of correlation coefficients. J Korean Phys Soc (2015) 66:1802–8. doi:10.3938/jkps.66.1802

14. Xu X, Wang K, Zhu L, Zhang L, Zhu L. Efficient construction of threshold networks of stock markets. Physica A: Stat Mech its Appl (2018) 509:1080–6. doi:10.1016/j.physa.2018.06.083

15. Rakib M, Nobi A, Lee J, Lee JW. Structure and dynamics of financial networks by feature ranking method. Sci Rep (2021) 11:17618. doi:10.1038/s41598-021-97100-1

16. Mafwele B, Lee J. Relationships between transmission of malaria in Africa and climate factors. Sci Rep (2022) 12:14392. doi:10.1038/s41598-022-18782-9

17. Bardoscia M, Barucca P, Battiston S, Caccioli F, Cimini G, Garlaschelli D, et al. The physics of financial networks. Nat Rev Phys (2021) 3:490–507. doi:10.1038/s42254-021-00322-5

18. Vyrost T, Lyocsa S, Baumohl E, Baumohl E. Granger causality stock market networks: Temporal proximity and preferential attachment. Physica A: Stat Mech its Appl (2015) 427:262–76. doi:10.1016/j.physa.2015.02.017

19. Yao C, Li H. Effective transfer entropy approach to information flow among EPU, investor sentiment and stock market. Front Phys (2020) 8:206. doi:10.3389/fphy.2020.00206

20. Niu H, Hu Z. Information transmission and entropy-based network between Chinese stock market and commodity futures market. Resour Pol (2021) 74:102294. doi:10.1016/j.resourpol.2021.102294

21. Wang X, Sun M. A novel prediction model of multi-layer symbolic pattern network: Based on causation entropy. Physica A: Stat Mech its Appl (2021) 575:126045. doi:10.1016/j.physa.2021.126045

22. Qiuna L, Han L, Wan Y, Yin L, Wan Y. Stock net entropy: Evidence from the Chinese growth enterprise market. Entropy (2018) 20:805. doi:10.3390/e20100805

23. Shi Y, Zheng Y, Guo K, Jin Z, Huang Z, Guo K. The evolution characteristics of systemic risk in China’s stock market based on a dynamic complex network. Entropy (2020) 22:614. doi:10.3390/e22060614

24. Onnela J, Chakraborti A, Kasksi K, Kertesz J, Kanto A, Kaski K, et al. Dynamics of market correlations: Taxonomy and portfolio analysis. Phys Rev E (2003) 68:056110. doi:10.1103/PhysRevE.68.056110

25. He J, Deem M. Structure and response in the world trade network. Phys Rev Lett (2010) 105:198701. doi:10.1103/PhysRevLett.105.198701

26. Yalamova R, McKelvey B. Explaining what leads up to stock market crashes: A phase transition model and scalability dynamics. J Behav Finance (2011) 12:169–82. doi:10.1080/15427560.2011.602484

27. Long H, Zhang J, Tang N. Does network topology influence systemic risk contribution? A perspective from the industry indices in Chinese stock market. Plos One (2017) 12:e0180382. doi:10.1371/journal.pone.0180382

28. Lee J, Nobi A. State and network structures of stock markets around the global financial crisis. Comput Econ (2018) 51:195–210. doi:10.1007/s10614-017-9672-x

29. Nobi A, Tuhin K, Lee J, Lee JW. Application of principal component analysis on temporal evolution of COVID-19. Plos One (2021) 16:e0260899. doi:10.1371/journal.pone.0260899

30. Nobi A, Lee T, Lee J, Lee JW. Structure of trade flow networks for world commodities. Physica A: Stat Mech its Appl (2020) 556:124761. doi:10.1016/j.physa.2020.124761

Keywords: complex systems (CS), econophysics, complex network, stock market, time series analysis

Citation: Park J, Cho CH and Lee JW (2022) A perspective on complex networks in the stock market. Front. Phys. 10:1097489. doi: 10.3389/fphy.2022.1097489

Received: 14 November 2022; Accepted: 06 December 2022;

Published: 23 December 2022.

Edited by:

Raul Matsushita, University of Brasilia, BrazilReviewed by:

Joao Plinio Juchem Neto, Federal University of Rio Grande do Sul, BrazilIram Gleria, Federal University of Alagoas, Brazil

Copyright © 2022 Park, Cho and Lee. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jae Woo Lee, amFld2xlZUBpbmhhLmFjLmty

Jihun Park

Jihun Park Jae Woo Lee

Jae Woo Lee