- 1Department of Economics, Seijo University, Tokyo, Japan

- 2Graduate School of Integrated Basic Sciences, Nihon University, Tokyo, Japan

This article presents a continuous cascade model of volatility formulated as a stochastic differential equation. Two independent Brownian motions are introduced as random sources triggering the volatility cascade: one multiplicatively combines with volatility; the other does so additively. Assuming that the latter acts perturbatively on the system, the model parameters are estimated by the application to an actual stock price time series. Numerical calculation of the Fokker–Planck equation derived from the stochastic differential equation is conducted using the estimated values of parameters. The results reproduce the probability density function of the empirical volatility, the multifractality of the time series, and other empirical facts.

Introduction

In financial time series, past coarse-grained measures of volatility correlate better to future fine-scale volatility than the reverse process. Such a causal structure of financial time series was first reported by Müller et al. [1]. Since then, the causal structure between time scales, the flow of information from a long-term to a short-term scale, was investigated empirically in financial markets; it has been supported by multiple studies [2, 3] as a stylized fact of financial time series [4]. The asymmetric flow of information resembles an energy cascade found in conditions of turbulence. In a developed turbulent flow, the energy injected from the outside at macroscopic spatial scales is transferred to smaller scales and finally dissipated as heat at microscopic spatial scales [5–9]. Gashghaie et al. investigated details of the self-similar transformation rule of the probability density function of price fluctuations and the nonlinear scaling law of the structure function (nth moment of fluctuations), signifying the multifractality of the time series, in their study of the time series of foreign exchange. They pointed out the similarity of price changes in the financial time series to the velocity difference between two spatial points in turbulence [10, 11]. The intermittency in turbulence is a phenomenon characterized by the sudden temporal change of the statistical feature of fluctuations and the spatial coexistence of large and small fluctuations. Such intermittency, which is frequently encountered in heterogeneous complex systems, is well known in financial markets as volatility clustering [4, 12]. Intermittency at each time scale produces a characteristic hierarchical structure designated as multifractality [8, 9].

In the developed turbulence, the process by which mechanically generated vortices on a macroscale deform and destabilize according to the Navier–Stokes equation and then split into smaller vortices is regarded as an energy cascade. A similar idea of modeling multifractal time series by a recursive random multiplication process from a coarse-grained scale to a microscopic scale has offered an attractive means of describing financial time series [13, 14]. Chen et al. verified the statistics of multiplier factors in the random multiplication process of turbulent flow by empirical studies using measured data and numerical experiments of Navier–Stokes equations [15]. Results show that the multiplier factors connecting two adjacent layers follow a Cauchy distribution in which all moments diverge and show that they are not independent. They show strongly negative correlation between the multiplier factors of adjacent layers. The authors verified the statistics of multipliers calculated backward from actual stock price fluctuations, finding a Cauchy distribution of multiplier factors and also the strongly negative correlation between the multiplier factors in financial markets. Results show that the discrete cascade model using the random multiplication process did not reproduce the statistical property of the multiplier factors. Therefore, as an alternative model, a discrete random multiplicative cascade process with additional additive stochastic processes [16–18], or a model formulated as the Fokker–Planck equation considering the cascade process as a continuous Markov process [19–23] was proposed. Those models have been applied to stock market or foreign exchange market data, yielding empirical results including the statistics of multipliers.

This study examines a continuous cascade model of volatility formulated as a stochastic differential equation including two independent modes of Brownian motion: one has multiplicative coupling with volatility; the other has additive coupling as in the discrete random multiplicative cascade process with additional additive stochastic processes described above. The model parameters are estimated by its application to the stock price time series. Numerical calculation of the Fokker–Planck equation derived from the stochastic differential equation is conducted using the estimated values of parameters resulting in successful reproduction of the pdf of the empirical volatility and the multifractality of the time series.

Materials and Methods

Continuous Random Cascade Model

Stochastic Differential Equation

These analyses examine the following wavelet transform of the variation of the logarithmic stock price denoted by

where the function ψ is designated as the analyzing wavelet. When using the delta function

In general, by using the nth derivative of the function having asymptotic fast decay as the analyzing wavelet, one can remove the local trend of mth order

In actual financial market, the price fluctuation is nonstationary and the volatility is not observable. The quantity used herein is the absolute value of the wavelet transform

The following stochastic equation is used to start.

In that equation,

The solution is obtained easily using Ito’s formula as [24].

The power law behavior of the qth moment

The multifractality of signal

We introduce an additional additive stochastic process as we have done in the discrete cascade model. We first consider the following stochastic differential equation.

The equation is produced on the assumption that Brownian motions

To solve the stochastic differential Eq. 7, we consider the following stochastic differential equation:

which is the same as Eq. 4. Using the solution of Eq. 8

the solution of Eq. 7 is expressed as shown below:

Statistics of Multipliers

We have mentioned the statistics of multipliers in Introduction:

(1) The stochastic multiplier

(2) When considering the three scales

Here, we show property (1) and infer the existence of correlation between adjacent multipliers under some reasonable approximations. The parameter

Therefore, the difference

By defining the differences

Relation to Discrete Random Cascade Model

Assuming that

we obtain the discrete random cascade equation as

where

shows that deviation of the quadratic curve from the origin results from the parameter

Constraint Condition From the pdf of

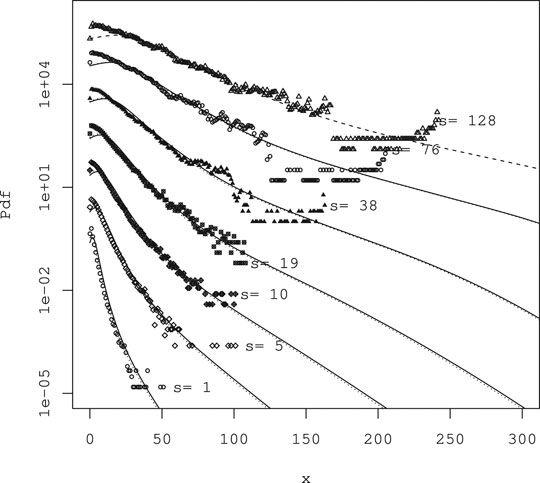

A remarkable feature of the probability density function (pdf) of the quantity

Derivation of the constraint condition Eq. 15 is given in Appendix 1.

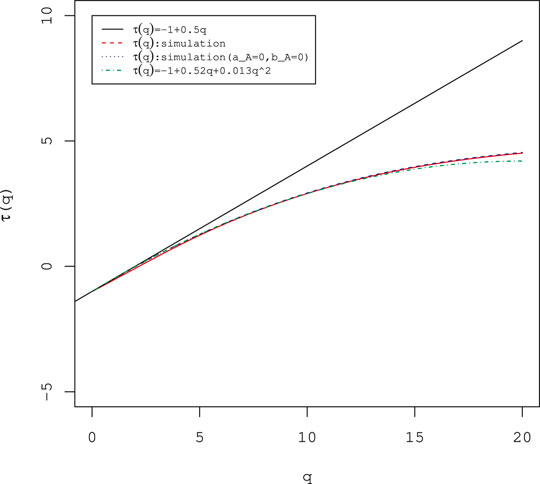

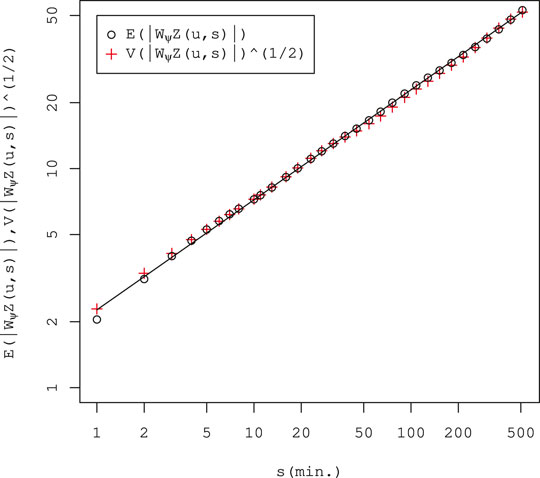

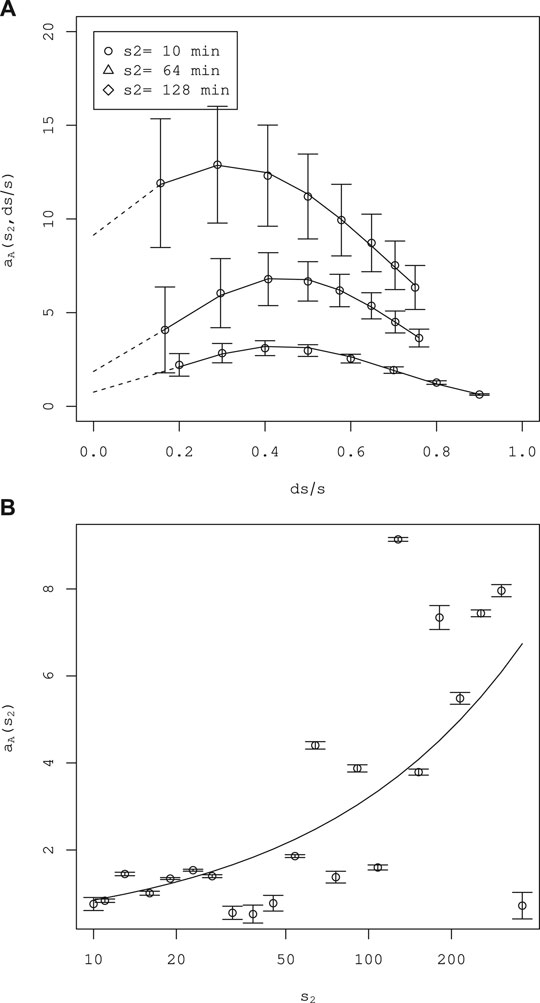

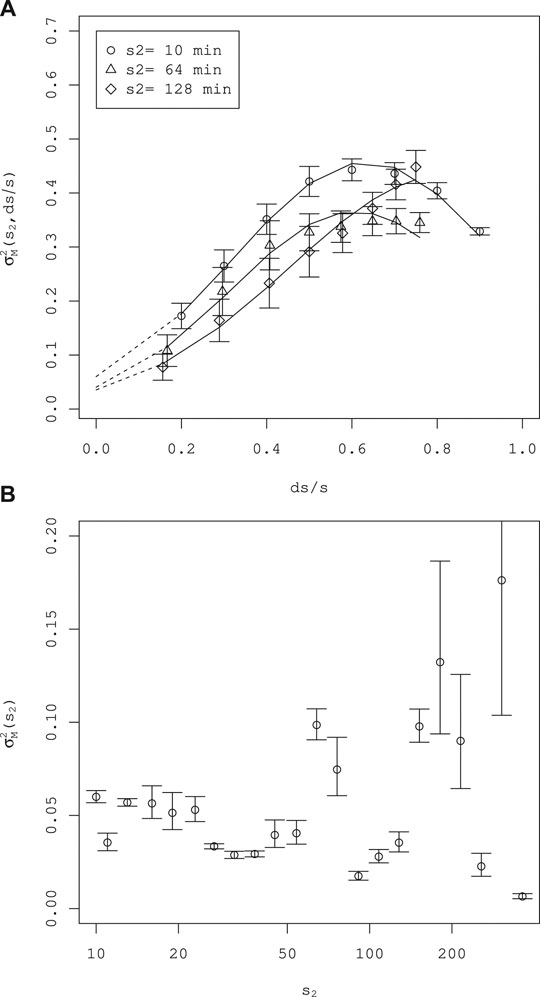

FIGURE 1. Scaling properties of

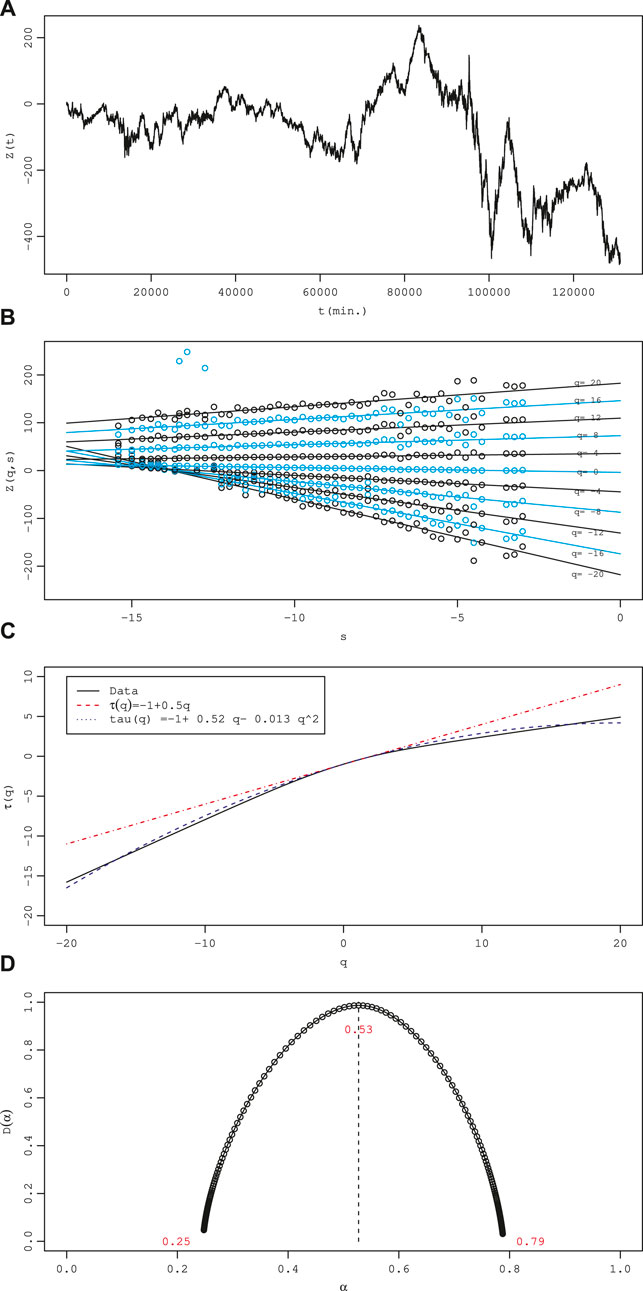

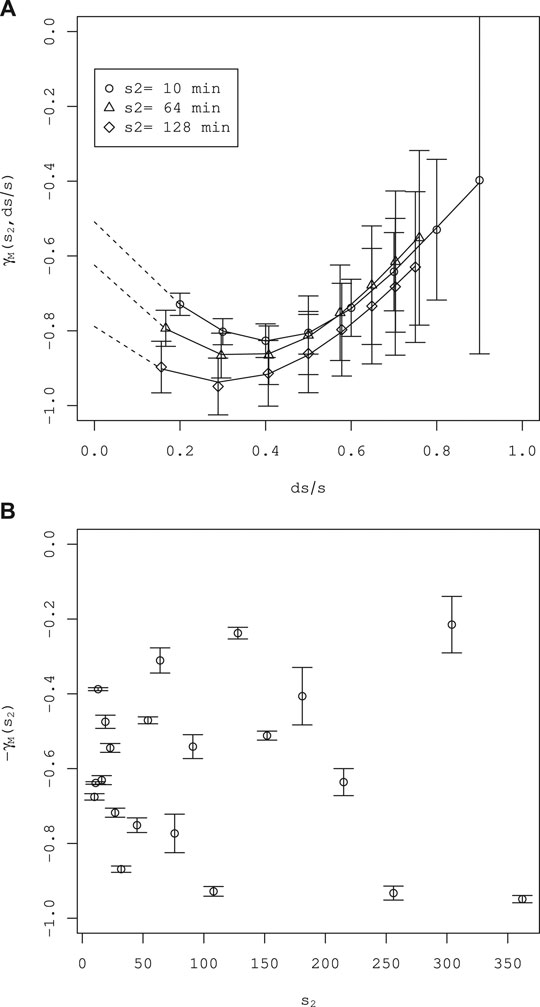

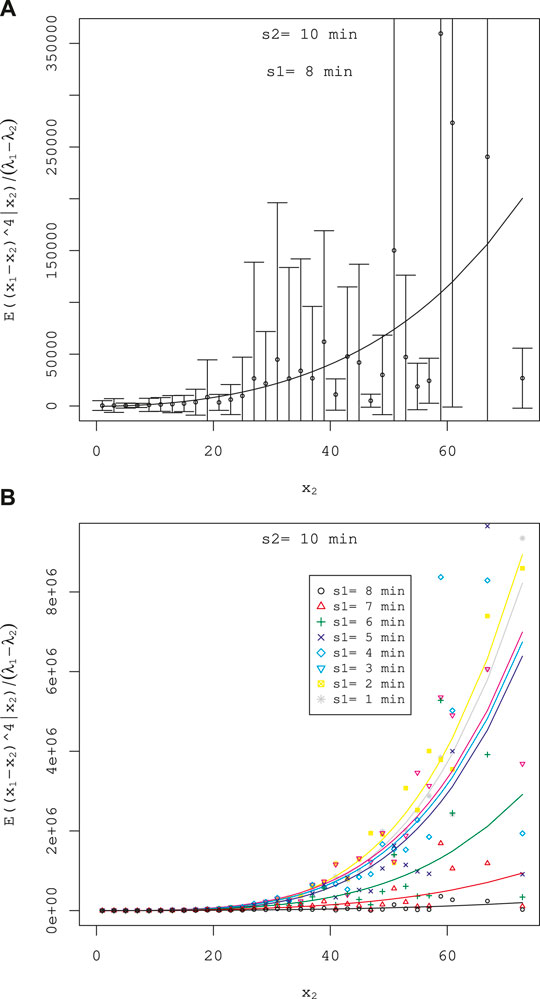

FIGURE 2. Results of multifractal analysis. (A)

The additional additive stochastic process in model Eq. 7 is expected to be a small perturbation to basic model Eq. 4 to avoid violating multifractality. We also impose the following condition for all scales s:

The power law scaling shown in Figure 1,

and condition Eq. 16 show the following constraint condition:

Inserting Eq. 18 into Eq. 15, we also have the equation:

Fokker–Planck Equation

We can derive the Fokker–Planck equation for the stochastic process

Therein, the functions

The kth moment of the change

Therein, we used the identity

Coefficients

Empirical Study

Data

We analyze the normalized average of the logarithmic stock prices of the constituent issues of the FTSE 100 Index listed on the London Stock Exchange for November 2007 through January 2009, which includes the Lehman shock of September 15, 2008 and the market crash of October 8, 2008.

Data Processing

First, we calculate the average deseasonalized return of each issue

where

The data size L is

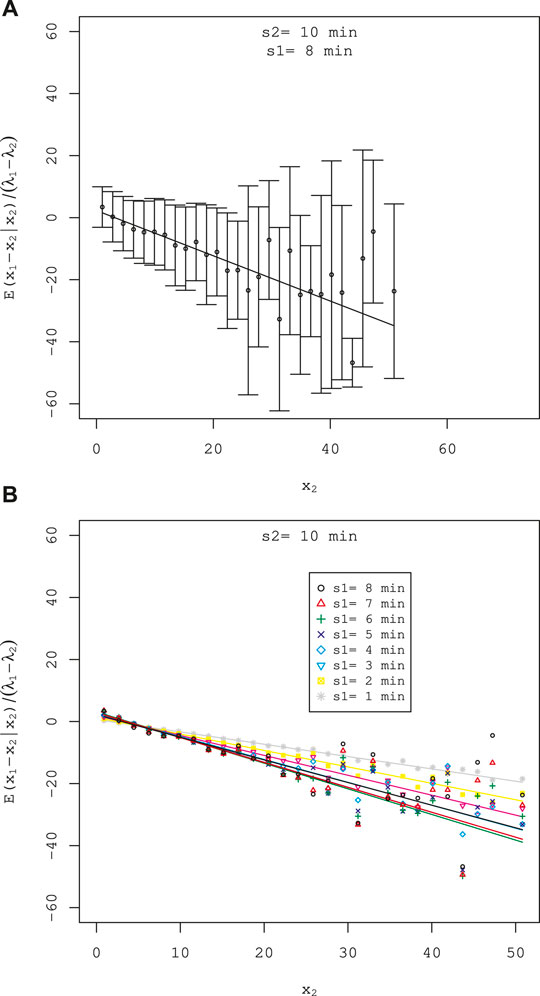

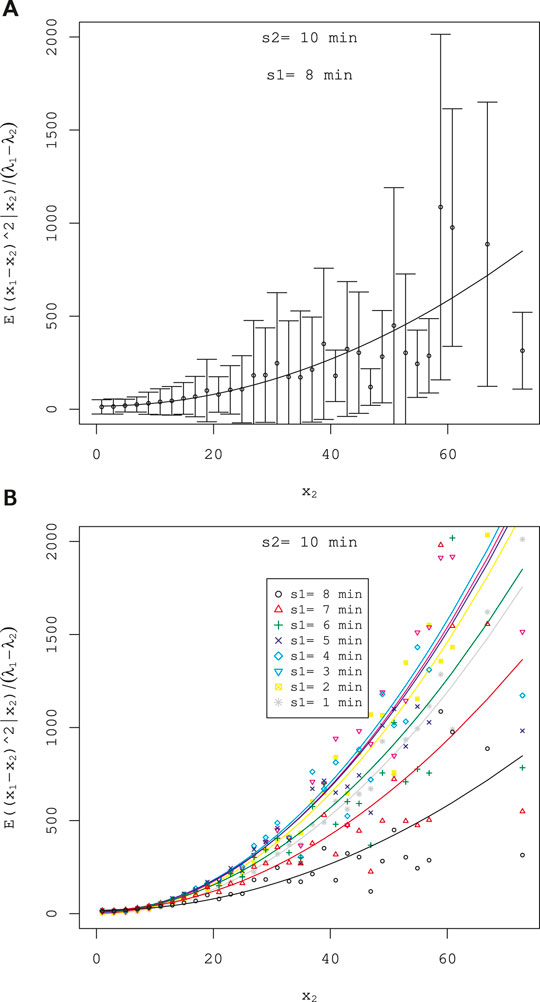

FIGURE 3. Regression of

Results

Multifractal Analysis

First, we analyze the multifractal properties of the path

where x in a neighborhood of

For multifractal paths, the Hölder exponent α is distributed in a range; for paths of the Brownian motion, which are fractal,

Muzy, Bacry, and Arneodo proposed the wavelet transform modulus maxima (WTMM) method based on continuous wavelet transform of function to calculate the singular spectrum

Parameter Estimations

aA and γM

Parameters

where

where the standard errors are in parentheses. The estimated exponent

where the standard error is the value in the parenthesis.

FIGURE 4. Estimation of the parameter

FIGURE 5. Estimation of the parameter

FIGURE 6. Regression of

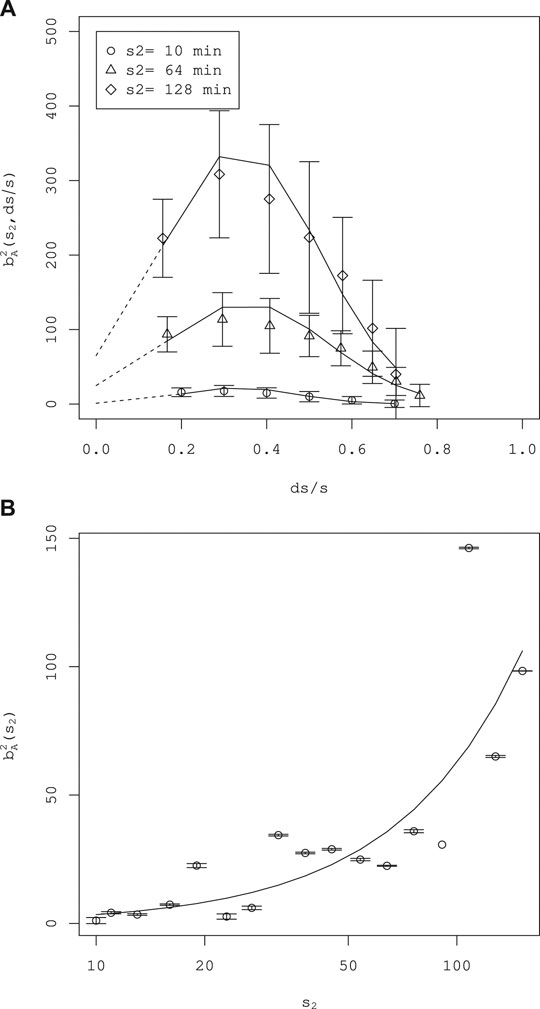

bA and σM

Similarly, we estimate parameters

As shown in Figure 6A, the second moment is well fitted by a quadratic function. Fitting of this kind is applied to various

where the standard errors are in parentheses. The estimated exponent

Therein, the standard error is in the parenthesis.

FIGURE 7. Estimation of the parameter

FIGURE 8. Estimation of the parameter

FIGURE 9. Fitting of

Higher Moments

Similarly, it is possible to show the kth (

FIGURE 10. Pdf of measured

Numerical Calculation of the Fokker–Planck Equation

We confirmed that estimation of the parameter

where ϵ is a small parameter. The consistent range of ϵ found by estimation of Eq 29 and Eq 32 is

Using results of the numerical calculation of the pdf obtained at each scale, we calculate the scaling exponent

The result is presented in Figure 11. No difference exists between the two numerical calculation results. Both curves are convex upward, indicating multifractal properties. Comparison with measured values is also good. These results, when combined with consideration of the statistics of multipliers given in 2.1.2, underscore the effectiveness of the continuous cascade model Eq. 7 with additive stochastic processes proposed.

Discussion

The random cascade model has evolved as a model of developed turbulence. The original model, in which the stochastic process that connects each layer of the spatial scale is an independent random multiplication process, contradicts results obtained through empirical research. Therefore, an improved discrete random multiplicative cascade model with additional additive stochastic processes was proposed along with a model formulated as a Fokker–Planck equation by considering cascade processes as a continuous Markov process. Moreover, those models have been applied to data analysis of the stock market and the foreign exchange market, where they have been successful. Herein, we propose a continuous cascade model formulated as a stochastic differential equation of volatility including two independent modes of Brownian motion: one has multiplicative coupling with volatility; the other has additive coupling, as in an improved discrete cascade model for the stock market, with effectiveness clarified by results of earlier research [18]. The model parameters were estimated by application to a stock price time series. The Fokker–Planck equation was derived from the stochastic differential equation as a master equation with the transition probability density function of volatility. Furthermore, the model parameters were estimated by its application to the average stock price time series made from FTSE 100 constituents listed on the London Stock Exchange. At that time, as an alternative variable of volatility, the wavelet transform coefficient with the second derivative of the Gaussian function as an analyzing wavelet was used. Numerical calculation of the Fokker–Planck equation was conducted using the estimated parameter values. The results reported herein faithfully reproduce the results of an earlier empirical study. This model includes information about neither the time axis nor the sign of the price fluctuation, which is necessary for a model of price fluctuations. The actual stock market exhibits well-known properties that break symmetry with respect to the time axis, such as the causal structure from long-term to short-term scale volatility described first in Introduction and price–volatility correlation (leverage effect) [412]. Therefore, the extension of the random cascade model to encompass these phenomena remains as a subject for future work.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: Historic Price Service (HPS) provided by the London Stock Exchange (https://www.londonstockexchange.com/products-and-services/reference-data/hps/hps.htm).

Author Contributions

JM conducted the empirical and numerical study of the model based on the dataset. KK theoretically analyzed the model. All authors agree to be accountable for the contents of the work.

Funding

This research was partially supported by a Grant-in-Aid for Scientific Research (C) No. 16K01259.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relation that could be construed as a potential conflict of interest.

Acknowledgments

One author, JM, expresses special appreciation for support by a Seijo University Special Research Grant.

Appendix 1

Derivation of Eq 15

We introduce some notation for simplification of the description:

From Eq. 13, we have

We also have

Because of the coincidence of the expected value and the standard deviation, we have

Appendix 2

WTMM Method

The WTMM method builds a partition function from the modulus maxima of the wavelet transform defined at each scale s as the local maxima of

The partition function is defined by the maxima lines as

Assuming power law behavior of the partition function

one can define the exponents

References

1. Müller UA, Dacorogna MM, Davé RD, Olsen RB, Pictet OV, von Weizsäcker JE. Volatilities of different time resolutions–analyzing the dynamics of market components. J Empir Finance. (1997). 4:213–39. doi:10.1016/s0927-5398(97)00007-8.

2. Arnéodo A, Muzy J-F, Sornette D. “Direct” causal cascade in the stock market. Eur Phys J B. (1998). 2:277–82. doi:10.1007/s100510050250.

3. Lynch PE, Zumbach GO. Market heterogeneities and the causal structure of volatility. Quant Finance. (2003). 3:320–31. doi:10.1088/1469-7688/3/4/308.

4. Cont R. Empirical properties of asset returns: stylized facts and statistical issues. Quant Finance. (2001). 1:223–36. doi:10.1080/713665670.

5. Richardson LF. Weather prediction by numerical process. Cambridge UK: Cambridge University Press (1922). p. 236.

6. Kolmogorov AN. The local structure of turbulence in incompressible viscous fluids for very large Reynolds numbers. Dokl Akad Nauk SSSR. (1941). 30:301–5.

7. Kolmogorov AN. A refinement of previous hypotheses related to the local structure of turbulence in a viscous incompressible fluid at high Reynolds number. J Fluid Mech. (1962). 13:301–5. doi:10.1017/s0022112062000518.

8. Mandelbrot BB. Intermittent turbulence in self-similar cascades: divergence of high moments and dimension of the carrier. J Fluid Mech. (1974). 62:331–58. doi:10.1017/s0022112074000711.

9. Frisch U. Turbulence: the legacy of A. Kolmogorov. Cambridge, UK: Cambridge University Press (1997). p. 312.

10. Ghashghaie S, Breymann W, Peinke J, Talkner P, Dodge Y. Turbulent cascades in foreign exchange markets. Nature. (1996). 381:767–70. doi:10.1038/381767a0.

11. Schmitt F, Schertzer D, Lovejoy S. Multifractal analysis of foreign exchange data. Appl Stoch Model Data Anal. (1999). 15:29–53. | doi:10.1002/(sici)1099-0747(199903)15:1<29::aid-asm357>3.0.co;2-z.

12. Bouchaud J-P, Potter M. Theory of financial risk and derivative pricing: from statistical physics to risk management. 2nd ed. Cambridge, UK: Cambridge University Press (2003). p. 400.

13. Arneodo A, Bacry E, Muzy JF. Random cascades on wavelet dyadic trees. J Math Phys. (1998). 39:4142–64. doi:10.1063/1.532489.

14. Breymann W, Ghashghaie S, Talkner P. A stochastic cascade model for Fx dynamics. Int J Theor Appl Finance. (2000). 03:357–60. doi:10.1142/s021902490000019x.

15. Chen Q, Chen S, Eyink GL. Kolmogorov’s third hypothesis and turbulent sign statistics. Phys Rev Lett. (2003). 90:254501. doi:10.1103/physrevlett.90.254501. |

16. Jiménez J. Intermittency and cascades. J Fluid Mech. (2000). 409:99–120. doi:10.1017/s0022112099007739.

17. Jiménez J. Intermittency in turbulence. Proceedings of the 15th “Aha Huliko” a Winter Workshop, 2007 January 23–26; Honolulu,Publication Services, SOEST, University of Hawaii; (2007). p. 99–120.

18. Maskawa J-i., Kuroda K, Murai J. Multiplicative random cascades with additional stochastic process in financial markets. Evol Inst Econ Rev. (2018). 15:515–29. doi:10.1007/s40844-018-0112-y.

19. Friedrich R, Peinke J. Description of a turbulent cascade by a Fokker-Planck equation. Phys Rev Lett. (1997). 78:863–6. doi:10.1103/physrevlett.78.863.

20. Renner C, Peinke J, Friedrich R. Evidence of Markov properties of high frequency exchange rate data. Phys Stat Mech Appl. (2001). 298:499–520. doi:10.1016/s0378-4371(01)00269-2.

21. Renner C, Peinke J, Friedrich R. Experimental indications for Markov properties of small-scale turbulence. J Fluid Mech. (2001). 433:383–409. doi:10.1017/s0022112001003597.

22. Siefert M, Peinke J. Complete multiplier statistics explained by stochastic cascade processes. Phys Lett. (2007). 371:34–8. doi:10.1016/j.physleta.2007.05.111.

23. Reinke N, Fuchs A, Nickelsen D, Peinke J. On universal features of the turbulent cascade in terms of non-equilibrium thermodynamics. J Fluid Mech. (2018). 848:117–53. doi:10.1017/jfm.2018.360.

24. Peinke C. Stochastic methods. 4th ed. Berlin Heidelberg, Germany: Springer-Verlag (2009). p. 447.

25. Risken H. The fokker–planck equation. 2nd ed. Berlin Heidelberg, Germany: Springer-Verlag (1889). p. 472.

26. Muzy JF, Bacry E, Arneodo A. Multifractal formalism for fractal signals: the structure-function approach versus the wavelet-transform modulus-maxima method. Phys Rev E. (1993). 47:875–84. doi:10.1103/physreve.47.875.

Keywords: Fokker–Planck equation, intermittency, Langevin equation, Markovian process, multifractal

Citation: Maskawa J-i and Kuroda K (2020) Model of Continuous Random Cascade Processes in Financial Markets. Front. Phys. 8:565372. doi: 10.3389/fphy.2020.565372

Received: 25 May 2020; Accepted: 29 October 2020;

Published: 27 November 2020.

Edited by:

Wei-Xing Zhou, East China University of Science and Technology, ChinaReviewed by:

Haroldo V. Ribeiro, State University of Maringá, BrazilJoachim Peinke, University of Oldenburg, Germany

Copyright © 2020 Maskawa and Kuroda. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jun-ichi Maskawa, bWFza2F3YUBzZWlqby5hYy5qcA==

Jun-ichi Maskawa

Jun-ichi Maskawa Koji Kuroda2

Koji Kuroda2