- Division of Environmental Technology and Management, Department of Management and Engineering, Linköping University, Linköping, Sweden

Introduction: With the much-needed transformation from linear to more circular resource flows, it is imperative for enterprises to understand their financial prospects. Transforming towards Product-as-a-Service (PaaS) with circular elements introduces new considerations that must be addressed to ensure profitability and sustainability. However, there is a lack of comprehensive financial assessments based on empirical cases to guide companies in assessing the lucrativeness of their transformations. This paper addresses this gap by proposing a simple-to-use and flexible financial assessment model for PaaS, helping practitioners identify the conditions necessary for financial viability from both provider and user perspectives.

Methods: Grounded in transdisciplinary research, this study focuses on a construction machine manufacturer's transformation from a traditional one-off sales business model to PaaS. The transformation is analysed through the development of a life cycle costing financial assessment model that addresses relevant cost drivers.

Results: Using discounting methods, the model can help practitioners generate scenarios to identify feasible solutions for profitable PaaS setups. Additionally, the paper presents an analytical procedure to identify conditions for a financially viable PaaS. The procedure includes scenario-based analysis that accounts for systemic changes often necessary for successfully realising PaaS.

Discussion: By following the proposed procedure, along with the financial assessment model, manufacturers can streamline their financial assessments to identify necessary changes. For the analysed case company, the modelling results indicate that it must redesign its products for PaaS to outperform its previous business model.

1 Introduction

Product-as-a-Service (PaaS) is a style of offerings where a manufacturer gets paid by providing the product functions over time while maintaining the ownership of the product (Geissdoerfer et al., 2018; Sakao, 2022). Thus, PaaS economically incentivises the manufacturer to use the product with its fuller technical lifespan, typically via multiple contracts with end users. PaaS is a special type of product-service system (PSS) (Belkadi et al., 2020; Brissaud et al., 2022), which is an augmented system for manufacturers and was heralded as among the most promising measures towards a resource-efficient and circular society (Tukker, 2015). PaaS, through its potential to enhance financial performances (Kaddoura et al., 2019), attracts manufacturing businesses in various product sectors (Matschewsky et al., 2020; Yang and Evans, 2019). Moreover, an increasing number of companies have indeed offered PaaS in various product sectors.

Like any other business offering, PaaS needs to be assessed for financial viability during design before being introduced to a specific market (Averina et al., 2022). Its financial performance depends on various engineering factors, on top of the revenue, such as the production cost, the product lifespan, and the time required for maintenance, which often have interplays and interdependencies (Brissaud et al., 2022). It is highly complex just to calculate the financial performance of PaaS, especially when the complexity of the product is high. Furthermore, finding a win-win condition in the vast solution space for the provider and the user is an engineering challenge. Industry needs support for the assessment and analysis that goes beyond calculating the cost for manufacturing a product, as typically done in a one-off sales-based business model. However, after reviews of the literature (Golinska-Dawson et al., 2023; Vogt Duberg et al., 2024), it was concluded that a gap exists in practical yet theory-based support for manufacturers’ identification of the financial viability of PaaS. Therefore, this paper fills the gap with the aim of proposing a simple-to-use and flexible financial assessment model for PaaS and helping practitioners identify the conditions of financial viability, addressing relevant cost drivers and their interlinkages from a life cycle perspective. To do so, transdisciplinary research is used to develop and validate the proposal: a case is taken from a company based in Europe that manufactures and sells construction machines used by businesses.

The contributions of this paper to the literature are three-fold: (1) an industry-usable yet science-based model for PaaS financial assessment that is developed on a spreadsheet software (provided as Supplementary Material); (2) a procedure, using the proposed assessment model, to identify the conditions for the financial viability of PaaS both from the provider and user perspectives; and (3) an account of a complex product manufacturer’s successful application of the model and approach with a real-life case in industry.

2 Research motivations

Financial assessment and evaluation are essential in designing any new business offering before its introduction to a market (Averina et al., 2022), and PaaS offerings are no exception (Mahut et al., 2017; van Loon and Van Wassenhove, 2020). Models are needed for the transparency of the assessment and effectiveness in archiving the decision-making rationale. The widely used models are labelled as life cycle costing, and these create a systems perspective of an offering’s cash flows through the product life cycle stages (Westkämper et al., 2000). Although these models are neither standardised (Kambanou, 2020) nor well-established in the scientific literature (Kanzari et al., 2022), they have been effectively used in manufacturing for decades (Haanstra et al., 2021; Janz et al., 2005; Sakao and Lindahl, 2015).

A small but increasing body of PaaS research based on industry cases has shown a variety of relevant aspects of financial assessments of PaaS for manufacturers. They can be summarised into two categories. The first one refers to the needed perspectives of both the provider and user. PaaS business models are relatively new to potential users and must be attractive from their perspective (Rexfelt and Hiort af Ornäs, 2009), meaning that finding win-win situations between stakeholders in the value network is recognised an important task (Peillon et al., 2023). The second category originates from the complexity of the calculations. Product design is highly influential on the firm’s profits (Hidalgo-Crespo et al., 2024; Kuo et al., 2019); it is, therefore, sensible to propose the use of computer-aided engineering (CAE) environment for such assessments (Bertoni and Bertoni, 2020). Moreover, the costs for services are uncertain (Erkoyuncu et al., 2011), because they are influenced by stochastic events such as product malfunctions and the wide geographical distribution of end users. These cost variations significantly influence the profitability (van Loon and Van Wassenhove, 2020). Additional complexity also exists because these service costs depend on product design. To adequately address the situations, a framework for cost estimation with systems thinking was shown useful (Rodríguez et al., 2022).

For manufacturers to grasp the difference between a one-off sales-based business model and a PaaS model during the design stage, it is necessary to provide manufacturers with transparent and user-friendly assessment methods. The existing methods to estimate costs for PaaS or related offerings in literature can be categorised into two. One tends to provide comprehensive assessment methods that sometimes cover all three sustainability pillars but are often too generic or abstract for reliable decision-making on the financial aspect (Luthin et al., 2024). The other adopts parameters too detailed against accessible data in practice (Bressanelli et al., 2019a; van Loon and Van Wassenhove, 2020). Thus, literature reviews (Golinska-Dawson et al., 2023; Vogt Duberg et al., 2024) concluded that a gap exists in practical yet theory-based support for manufacturers’ identification of the financial viability of PaaS. This observation is in line with a conclusion by another review (Kanzari et al., 2022); only a few assessment methods applicable during the design phase were reported. Moreover, several case-based research studies advocate for further research on real cases (Bressanelli et al., 2019a; van Loon et al., 2022; Vogt Duberg and Sakao, 2024). This is the gap that this paper aims to fill.

3 Proposal – financial assessment model for PaaS

3.1 Defining the sales and PaaS business models

In the financial assessment model, a PaaS business model is compared to a one-off sales business model. The one-off sales represents the business as usual, serving as the base case that PaaS must outperform. Henceforth, these business models are labelled Sales and PaaS, respectively. In Sales a product user purchases a product and obtains ownership of it. A warranty is provided for a certain period, during which the provider must provide free-of-charge repair or product substitution in case of failures. In this paper, several use cycles are compared. When assuming a product life of a solely one-use cycle, the product is manufactured and then maintained and repaired when needed, and at the end of life, it is recycled or disposed of. Outside of the warranty period, the user must either perform all maintenance activities without the involvement of the provider or pay the provider a fee for the service. When assuming more than one use cycle, remanufacturing is performed at the end of use of each cycle. In cases where all cores (def. used, disposed or broken product intended for remanufacturing) cannot be acquired or cannot be remanufactured, the corresponding number of products are manufactured instead.

In the PaaS model, the setup is similar, but with the exception that the user does not obtain ownership of the product, and all running costs are covered by the PaaS fee. The provider schedules maintenances, performs repairs, and is responsible for all other activities to provide PaaS to the user. At the end of use, the cores are acquired for remanufacturing and reinstated into another use cycle without any major effort by the provider. The acquisition cost solely depends on the effort to transport the cores to the remanufacturing facility, where the core is restored to its original specification, condition, and performance. In this process, the cores can also undergo upgrading to sustain their attractiveness on the market. At the end of life, recycling is performed. From the user perspective, there is no difference between having new or remanufactured products as their performance is the same, and as such, the PaaS fee is equal for the two product types.

3.2 The basics of the financial assessment model

The financial assessment model used in assessing the prosperity of the PaaS model in relation to Sales is based on net present value (NPV) and total cost of ownership (TCO). Both approaches utilise discount rates to capture the fluctuation of the monetary value over time; that is, future monetary flows are not valued the same as current flows. This assessment provides two perspectives: the provider perspective (the OEM; original equipment manufacturer) and the user perspective (the customer). The dual perspective is reasonable since it is easy to create a PaaS that delivers high value for the provider by increasing the PaaS fee. However, since the PaaS fee also affects how the customer perceives the offering (cf. Akbar and Hoffmann, 2018; Hanemann, 1991) in relation to Sales and competitors, an increased PaaS fee lowers the attractiveness of the offering from the customer perspective, thus lowering their willingness to pay. For the assessment in this paper, the complexity of the perception of products and willingness to pay is relaxed by assuming that the customer selects an offering based on the lowest TCO. In practice, this assumption ignores additional benefits of PaaS, such as hassle-free operation (cf. Akbar and Hoffmann, 2020; Sánchez-Fernández et al., 2009; Zauner et al., 2015), the precise prediction of the cost, a lower amount of payment recurring over time, and asset-freeness in the financial bookkeeping, meaning that the benefits of PaaS will be underestimated.

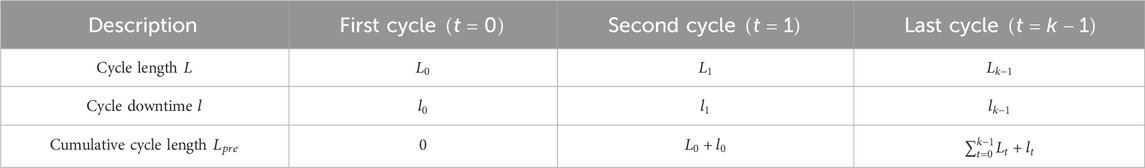

In order to create a flexible spreadsheet-based NPV and TCO model, the rows and columns of the sheet were utilised to facilitate the variability of every parameter. In this model, the input columns in the spreadsheet have two different bases depending on how frequently the input parameters vary over time. If the parameters are (1) constant within each use cycle, the columns represent cycles, while if (2) the parameters vary within a shorter time, the columns represent this period instead. Given the first example, the principle is illustrated in Table 1. Each use cycle

Table 1. Examples of how the parameters of different cycles are inserted into the spreadsheet application.

The NPV for the provider is based on subtracting discounted costs from revenues; see Equations 1, 2, while for the user, it is primarily based on costs; Equations 3, 4. The description of the parameters is provided in the nomenclature. The sole exception is in the Sales model, where the sales of cores from the user to the provider are present, and thus, the total value of costs is reduced by the buy-back or sell-back value of core acquisition.

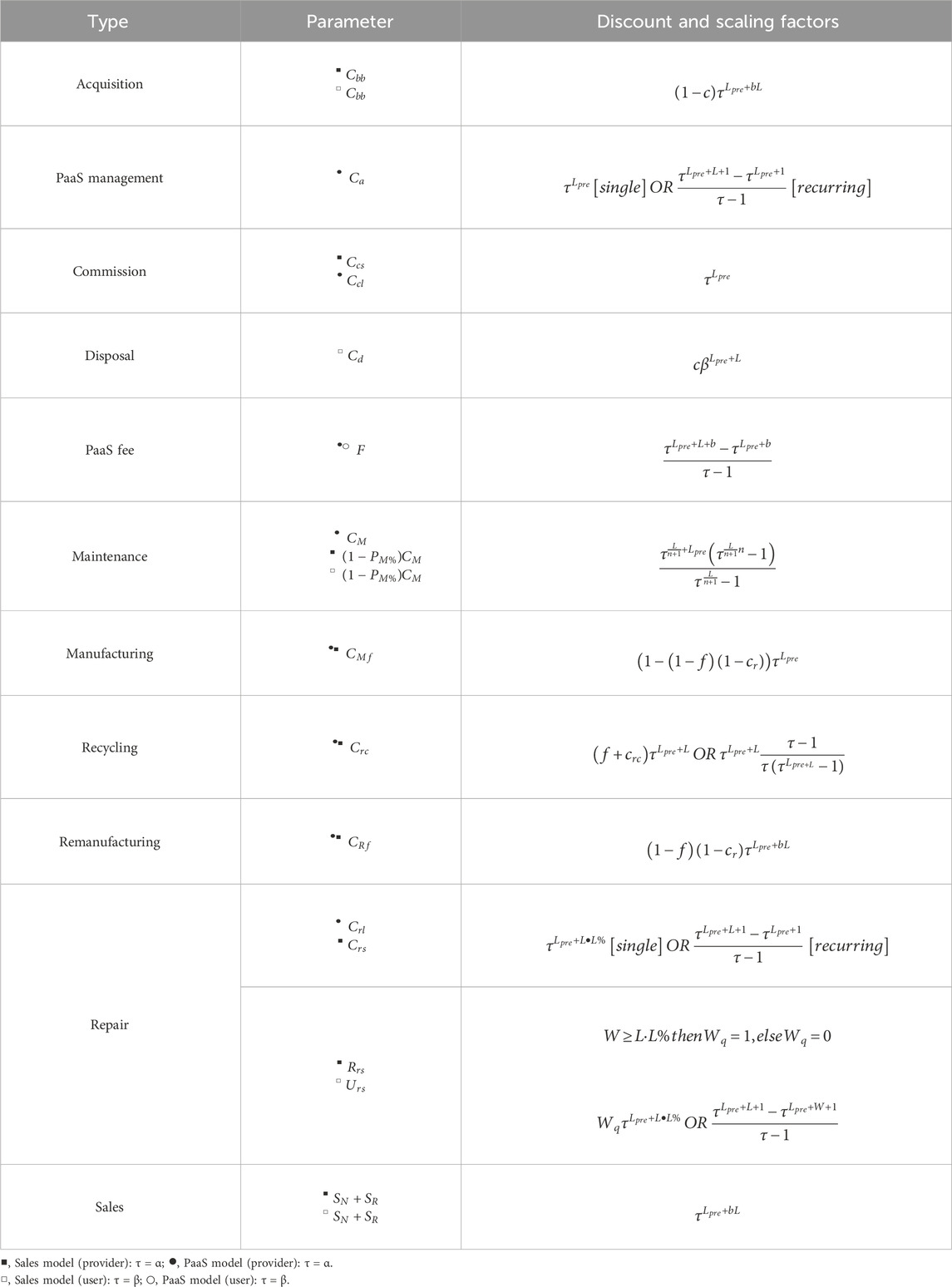

The parameters in Equations 1–4 are scaled based on the discount and scaling factors provided in Table 2. As such, each parameter is multiplied by its corresponding factor. In the equations, two different discount factors are used, one for the provider

Table 2. The parameters used in the financial assessment model and their corresponding discount and scaling factor to discount the values over time. Four scenarios are indicated by the signs ■, □, ●, and ○ as defined at the bottom.

Discounting methods, such as NPV, are based on discounting individual transactions to capture their value in today’s terms. Hereafter, the term transaction value is used to label all cash flows, both revenues and costs. Such transactions

This principle is used for all the aggregated discount factors, as presented in Table 2. The difference lies at which point in time each transaction occurs. This is further elaborated upon in the subsections dedicated to the parameters. By using this discounting method, comparing alternatives of different lengths is not possible without tweaking the values to use the same point of reference. In this paper, the method equivalent annual annuity (EAA) is applied to overcome this. By using EAA, one transaction value is equally distributed over a determined timespan

The EAA is derived by inverting the geometric sum, given that

3.2.1 Repair transaction

The repair parameter corresponds to the process that occurs after a product failure. Repair returns the product to the intended condition. In PaaS, the user is provided free-of-charge repairs throughout the use period unless the product is used beyond its intended purpose or mismanaged. As such, the provider is responsible for all repair-related costs. In Sales, there are multiple options for how a repair is conducted, for example, by the provider or the user. A user can order and pay for a repair from the provider, meaning that the provider has both costs and revenues related to the repair activity. Furthermore, if there is an active warranty period (i.e.,

The point of failure is based on a mean time to failure (MTTF) estimation labelled as

3.2.2 Maintenance transaction

The maintenance transaction covers planned activities to keep the product operating at its expected capacity. Such activities could be service checks, minor repairs, and the replacement of wearing parts. To discount the maintenance transactions, a time between maintenances (TBM) is calculated using the cycle length

The TBM determines the point in time when the maintenance activity occurs, and the transaction is registered for the provider and user. In PaaS, the base case is that the maintenance is included in the PaaS fee, meaning that the transaction is limited to the provider. Meanwhile, in Sales, the user maintains the product without provider involvement. These setups are not fixed in the model and can easily be tweaked to explore different scenarios where the provider, for example, sells different maintenance packages. Using the geometric sum, similar to Equation 6, the discounted maintenance is described by Equation 9. Given a scenario where the provider profits from maintenance, the markup parameter in the equation is positive (

3.2.3 Remanufacturing transaction

In the two business models, the remanufacturing process provides additional lives for the end-of-use products. In addition to the remanufacturing process cost, the total remanufacturing cost is impacted by the core acquisition activities and success rates. Typically, all cores cannot be acquired from the use phase for remanufacturing (Östlin et al., 2008a; Zhou and Gupta, 2019). There are several reasons for this, for example, the user preventing the provider from acquiring the core or the core not fulfilling the expected quality requirements for achieving a successful remanufacturing process (Gaur et al., 2017). To create a lucrative remanufacturing process, remanufacturers tend to set requirements on the condition of cores to keep the remanufacturing efforts to reasonable levels through inspection, sorting, or screening activities (Ridley et al., 2019; Wei et al., 2015). Another perspective is the remanufacturing yield (cf. van Loon and Van Wassenhove, 2018), which is interpreted as the ratio of cores that can be reprocessed into remanufactured products. Even though inspection activities are performed, some cores are filtered out during the remanufacturing process due to unexpected issues. In some cases, these cores can be cannibalised (cf. Atasu et al., 2010; Guide and Li, 2010), meaning that components are extracted and used to remanufacture another core. As such, the remanufacturing yield is the rate or probability that a core can be remanufactured and implies that the core acquisition cost is present, but either another core must be acquired or a new product must be brought in. In this model, product cannibalism on the component level is not considered.

In the financial assessment model, the remanufacturing core collection rate

3.2.4 End-of-life transactions

At the end of life, it is assumed that the products undergo either recycling or disposal activities. As long as the provider keeps the ownership of the product, that is, through PaaS, the proposed model assumes recycling over disposal. The model has a simplified view of these two activities as they only induce a single transaction influencing the NPV or TCO value. In a more complex model, the material resources from recycling could be integrated into the manufacturing or remanufacturing process. As such, recycling and disposal are assumed to be outsourcing activities for the user and provider.

Since product cannibalism and core acquisition were not modelled extensively within the remanufacturing system, cores that do not reach the remanufacturing process or are of insufficient condition are redirected into the recycling or disposal flows. Hence, the recycling cost

3.2.5 Other transactions

The remaining transactions in the proposed model are built on the same principles described for the maintenance, repair, remanufacturing, and end-of-life activities, where the point in time determines the discount factor. For example, administrative transactions for managing PaaS occur both at the start of a use cycle and periodically; see Table 2. The use of this activity is to manage activities related to setting up PaaS between the user and the provider, as well as manage planning, support, and other types of administration throughout the use cycle. The commission is a transaction between the provider and a potential third-party actor who manages the sales activities of Sales and PaaS to the user. In this model, it is assumed that this transaction occurs at the start of a use cycle, but by using a discount factor similar to the one for PaaS management administration, this can easily be adapted according to needs.

Similarly, the PaaS fee

These transactions depend on the manufacturing-to-remanufacturing ratio. For example, if there is a remanufacturing process activity, there is also a sold remanufactured product, and vice versa. In cases where the collection rate and remanufacturing yield induce non-binary values, the model provides an average scenario, as shown in Equation 15.

As such, the sum of the remanufacturing and manufacturing, as well as the sales activities, always equals one unless exceptional cases are introduced. This case also implies that the remanufacturing and manufacturing values are discounted based on the same point in time.

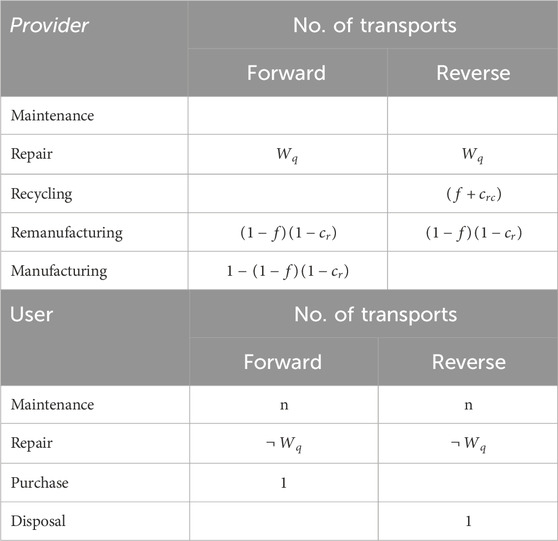

3.2.6 Transport transactions

The transactions for transports occur at the same time as their corresponding activity, and, therefore, they are discounted using the same factor. It is assumed that the lead time between forward and reverse transports for maintenance and repairs has a negligible impact on the results or that the transaction occurs decoupled from its activity in practice; therefore, the lead time aspect has not been integrated for all activities. For other instances, a lead time parameter should be implemented to postpone the transaction for reverse transports, similar to how products are transported to and from the user at the start (

Which of the provider and user covers the transport cost is determined by modifying a decision parameter. See Table 3 for a description of the Sales setup. For PaaS, the same principle was adopted. However, repairs are utilising the same transport option as for maintenance given the assumption that the point of the transaction is fixed, but the transport activity in practice is flexible. For instances where this is not an accurate representation, the discount factor and number of transports should be modified in the Supplementary Material. As such, if a product fails, the maintenance activity could be performed prematurely or be postponed, preventing repairing a product, and then shortly after, taking it back for maintenance. The repair transport transactions are dependent on whether there is an active warranty. For the base case, it is assumed that the provider covers warranty-related transport costs.

3.3 An approach to identify the conditions for the financial viability of PaaS

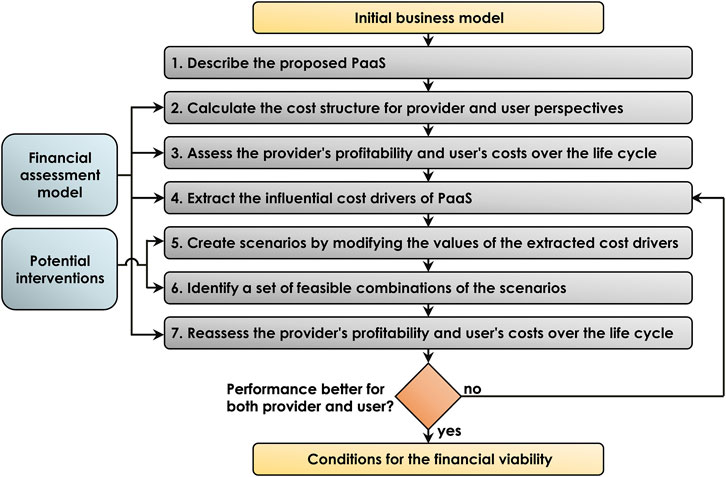

For an OEM to identify the financially viable conditions under which the PaaS outperforms its business-as-usual business model, while also reducing costs for the user, an iterative seven-step procedure is proposed; see Figure 1. The seven-step procedure is designed to systematically lead an OEM towards the conditions where PaaS can be offered more lucratively for the provider and at a lower cost for the user. The intention of the procedure is also to support in replicating the methodological approach to reach the analytical results.

Step 1: The procedure begins with describing the proposed PaaS. This step is necessary as the business model’s elements must be defined to be interpreted in a financial assessment. The more detailed description, the more accurate outputs the financial assessment, provided sufficient input data are accessible or estimated.

Step 2: Using the description and data inputs, the cost structure of both the business-as-usual and PaaS is calculated, with and without using NPV. The cost structure corresponds to all the cost elements or drivers within each business model. Note that the cost structure should separate cost drivers from different stages of the business model. For example, in PaaS, several use-phases exist, with certain costs being more prominent in specific phases. The cost structure provides information about each cost driver’s impact level on the total cost.

Step 3: For the provider’s perspective, revenue streams are critical to ensure a profitable and competitive business model. Therefore, all revenues must be calculated considering the entire product life cycle. For the user perspective, this step is similar to Step 2 as there are not many revenue streams. However, revenues can occur from, for example, sales of cores. Here, the cash flows over different life cycle lengths are made comparable using costing techniques, such as the EAA as covered in Section 3.2.

Step 4: The financial overview is then used to extract most influential cost drivers on financial performance. These are selected for the scenario analysis. Due to the high influence, modifying them significantly impacts the business model’s performance.

Step 5: The scenario analysis is based on the influential cost drivers and knowledge of the business practice, which means that it is not mere mathematical exercise but involves engineering activities. Each driver is modified within a predetermined range, either by reasonable estimations or all possible values. This provides insights into the cost driver’s impact on financial performance and indicators of its sensitivity and robustness.

Step 6: If the scenario analysis indicates that values benefit both the provider and user, these cost drivers are selected for the further analysis. The same applies for drivers that moves the values in the right direction or if combinations of the scenarios likely achieve synergetic effects.

Step 7: The last step is to reassess the provider’s profitability and user’s total cost of ownership regarding the scenario combination in relation to business-as-usual business model. If a win-win solution space is identified for both the provider and user, it must be investigated whether reaching this state in practice is feasible and what the requirements are. If a win-win solution space is not found or if it is not robust, realisable, or unsatisfactory, there is a feedback loop back to Step 4 to select other cost drivers to analyse.

Figure 1. The seven-step procedure for identifying conditions for financial viability. Note: Potential interventions refer to relevant changes possible to be implemented in PaaS and require knowledge of the business practice, such as modifying product component durability and introducing regular inspection services.

4 Application to the Falador case – European manufacturer of construction machines

4.1 Case company and PaaS

The case company–hereafter called Falador–is a well-established OEM and provider of high-quality machines in the construction business-to-business industry. Like many other enterprises (Calzolari et al., 2021; Skärin et al., 2022), Falador is applying an increasingly advanced sustainability strategy. This company is interesting from a research perspective as it is currently developing a circular business model while continuing to focus on the manufacturing of high-quality products. The new business model shifts from one-off sales to providing products through a subscription, utilising an access-based circular business model (cf. Bocken et al., 2016), specifically a PaaS business model. In the PaaS business model, the customer gets access to the products, while Falador keeps the ownership and performs maintenance throughout the product life cycle. Due to the professional, heavy-duty work environment of Falador’s products, the products are prone to wear and deterioration. Moreover, despite regular maintenances, the lifespan of the products is relatively short. However, many of the expensive components outlast the life of the whole product, but due to the current business model, the embedded value of these components has not been fully utilised. This situation is caused by a typical product design where components’ technical lifespans significantly differ from each other in a product.

Falador has a plan for how PaaS should be realised. However, due to being profit-driven, the profitability of the new offering must be assessed before a realisation. Naturally, when introducing a service in addition to a product offering, new types of costs are induced (Kambanou and Sakao, 2020). These costs are added to existing costs, such as manufacturing and forward logistics, thus making the initial costs higher. To realise higher or comparable profitability to Sales, there are benefits in retaining the value of the returning products at the end of the use period (cf. Jensen et al., 2019; Nasr et al., 2018). Two major approaches for end-of-use management are remanufacturing and refurbishment (EMF, 2015), and these can retain the value embedded in products regarding material and energy, hence making them preferable over, for example, recycling (Gharfalkar et al., 2015; Kurilova-Palisaitiene et al., 2023). Nevertheless, from a sustainability perspective, considering not only environmental factors but also economic ones, the returning products must be reprocessed in a way that secures a sufficient return on investment (Östlin et al., 2008b). This was the aspect that interested Falador most. To promote the new business model internally, sufficient insights were needed on whether PaaS could provide any value. Even though a lower environmental footprint was expected to be achieved with PaaS due to a higher level of circular flows and through remanufacturing and refurbishment (cf. Sundin and Lee, 2011), Falador has to stay competitive and profitable on the market to secure its competitiveness long-term. As such, the financial insights in this paper have high practical applicability as they influence Falador–a major OEM in the construction machine industry–to adopt circularity practices. The successful implementation of the PaaS model would not only change Falador’s operations but influence the whole value network from suppliers to competitors by adopting higher levels of circularity.

When the collaboration with the case company Falador started, the ideas for the PaaS were conceptual, without any pilot activity prepared. The financial assessment model was, therefore, developed to consider the ideas and utilised, to a high degree, experts within Falador to provide parameter values for the inputs that could not directly be received from the Sales model. Certain values were based on the service, maintenance, and repair activities of the products to gain parameter values for failure rates, maintenance intervals, and remanufacturing, to name a few. Moreover, for example, the discount rate was derived from the expected return of investment rate from alternative investments. The parameter values used, and the results from the financial assessment, are direct consequences of the Falador case study and the information the company provided. Moreover, the most uncertain parameter values in the model for Falador are related to the cost of remanufacturing, PaaS management, repair, and maintenance, as these represent estimated values of a future business model implementation. Given the analytical procedure outlined in Section 3.3, the modelling results are intended to calibrate expectations with reality by providing insights into business model performance based on specific inputs. Thanks to the model’s flexibility, once more accurate data, such as PaaS management and maintenance costs, are collected, these new input values can be incorporated into the model for more precise insights. This scenario approach on Falador highlights potential solution-spaces (or potential outcomes) for the business model development, guiding the company (or others) towards achieving a win-win state. In this paper, a single product model and its PaaS setup are addressed. This example has been selected as it covers most of the features of the PaaS ideas of Falador.

The financial assessment is based on the commercial spreadsheet software Microsoft Excel to provide a flexible assessment model that companies can use internally without dedicated software support or advanced modelling expertise, thus providing a high level of usability and applicability. The software application was also selected to provide a high level of transparency of the internal model logic as it was perceived to provide a high level of confidence at Falador that the model delivers reliable results. As such, Falador or other companies using this model can easily view the linkages between inputs, assumptions, and outputs to create an understanding of the performance of PaaS and Sales, respectively. In the financial assessment, as presented below, the two business models are kept as similar as possible to create a basis for informed decision-making to provide a more profitable PaaS than its forerunner. View the financial assessment model in the Supplementary Material.

4.2 Transdisciplinary research methodology

The research approach applied in this study follows the framework of transdisciplinary research, as outlined by Lang et al. (2012) and further developed, e.g., by Renn (2021), Schaltegger et al (2013). The investigation of Falador also followed the case study guidelines by Yin (2018). The research team and OEM representatives worked in iterative interactions with their own purposes to the common goal of developing circular, resource-efficient, and effective solutions. To establish a collaborative partnership, both parties identified a shared interest in addressing the OEM’s challenge through research-based solutions. The OEM presented a specific problem, and the researchers offered their expertise to develop a solution. The research aimed to realise a PaaS business model, as described in the above introduction, which required the development of a calculation model for financial assessments.

The research team engaged in a series of 26 interactions with the OEM, each lasting 30–60 minutes. These interactions served as a platform for semi-structured discussions, where both parties reviewed progress and exchanged ideas. The research team posed semi-structured questions focusing on the envisioned PaaS business model, OEM characteristics, and model design. During the research, data was collected from these interactions, which provided insights into the development at the OEM and the thought process that led to different business model-related solutions. Additionally, these interactions shed light on the internal struggles within the OEM to find ways to motivate the positive effects of new ideas related to a CE and demonstrate how these ideas could lead to positive balance sheet outcomes.

Based on the data collected, an analytical net present value-based financial assessment model was developed using the commercial spreadsheet software Microsoft Excel. The research team presented this model to the OEM for review and validation. On the OEM side, the model was assessed using product expertise and other product- and operation-related datasets. Furthermore, the model was applied in a remanufacturing pilot case to validate its results. The OEM provided feedback and inputs, enabling the research team to refine and improve the model’s accuracy. Developing the financial assessment model and its subsequent validation through expert input and real-world application formed a crucial part of the research process. The contributions of this paper, thanks to this research process, are insights into how to perform scenario-based financial assessments to pinpoint lucrative business opportunities. They also shed light on the potential positive outcomes associated with adopting CE-related ideas.

5 Results of application to Falador’s case

The perspective used in this paper is at the decision point for providing (or engaging in) a PaaS instead of a product purchase. Therefore, this paper focuses on comparing Sales and PaaS in terms of the direct profitability (NPV) of the provider and the usage cost (TCO) of the user. The product reliability and user behaviour are considered identical between the two business models, which is a limitation. The intention of this comparison is to identify possible feasible settings where PaaS outperforms Sales in terms of profit for the provider and TCO for the user. Other possible benefits from either of the business models are beyond this comparison. This perspective and the scope are expected to inform OEMs of key information, despite the limitation, especially for OEMs considering implementing PaaS. The procedure follows the seven-steps in Figure 1, whereas the first step corresponds to the case description in Section 4.1.

5.1 Provide a financial overview for each business model

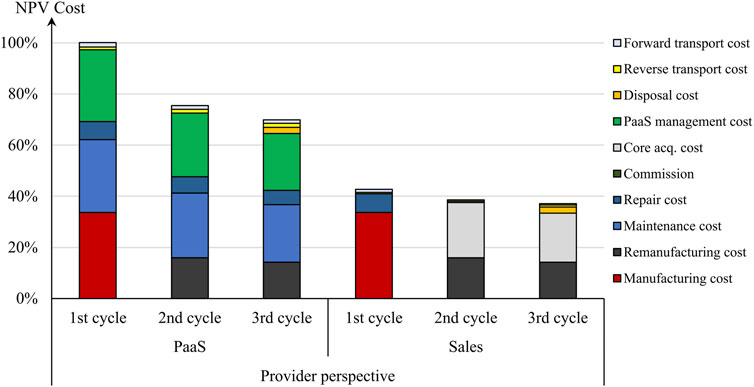

For Falador, both non-discounted and discounted values were used when disseminating the results. While non-discounted values might not accurately represent today’s value of the transactions, they were useful for discussing the assumptions of the assessments as constant values across cycles are easier to grasp. In this paper, only the discounted transaction values were considered. As the second step of the procedure, Figure 2 depicts the base case discounted costs of PaaS and Sales for three equally long use cycles.

Figure 2. NPV-based discounted PaaS and Sales costs for the provider over three use cycles. The bars show the discounted costs from cradle to grave.

From the PaaS perspective illustrated in Figure 2, the provider has the new PaaS management and maintenance cost that do not appear in Sales. The new PaaS management cost is necessitated because the PaaS model is emerging at the case company. The maintenance is a cost borne by the user in the Sales case without the provider’s involvement and is shifted to the provider. In PaaS, the provider ensures that the product is running according to its specifications, meaning that it also bears the cost of maintenance. Ultimately, the PaaS fee covers these maintenance costs, resulting in indirect costs for the user. Figure 3 shows the EAA of PaaS and Sales for the three different use cycles by distributing the costs equally over the offering’s length. This approach allows us to compare offerings of different time lengths, as covered in Section 3.2. In Figure 3, the EAA cost values of Figure 2 correspond to the bar with three cycles of the provider PaaS and Sales, respectively. Moreover, since the PaaS provider is responsible for ensuring a high service level (low risk for downtime due to failure) as part of the offering, the maintenance frequency is set higher than in Sales, leading to higher maintenance costs. The higher cost is also related to the user in Sales being, to a larger extent, able to perform minor maintenance operations onsite without requiring large inputs or transports of the products.

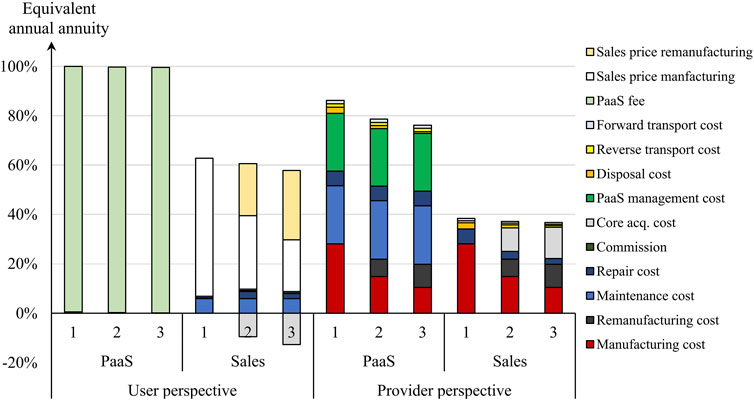

Figure 3. Equivalent annual cost for the PaaS and Sales model scenarios with one, two, and three use cycles. Note: Each bar corresponds to one product life cycle from cradle to grave. 1, 2, and 3 for the average of one, two, and three cycles, respectively.

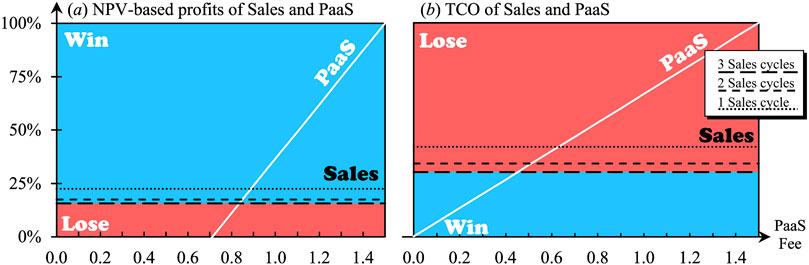

For the provider and user, given the base case parameter values for the scenarios in Figure 3, the total cost of PaaS is for all instances higher than Sales; note that the maintenance cost in Sales is disregarded here. Therefore, if the TCO, except its own maintenance cost, is the criterion for choice, then Sales is always preferable over PaaS. The PaaS option becomes more economical for the user when the PaaS fee is reduced; however, as indicated in Figure 4, when reducing the PaaS fee by 15% or more of the base value (i.e., 0.85 or lower on the PaaS fee), Sales is financially more advantageous for the provider. This assessment corresponds to the third step of Figure 1.

Figure 4. (A) The NPV-based profits of the Sales and PaaS models for the provider and (B) the TCO for the user. The solid white line shows the profit from the PaaS contract over three use cycles, while the striped lines show the Sales profit over one, two, and three Sales cycles, respectively. When the PaaS line falls within the blue (win) area, PaaS outperforms Sales for all Sales cycles. The solid line does not reach the blue area for both (A) and (B) simultaneously, indicating a win-win state for the provider and user is infeasible.

5.2 Create scenarios by modifying the influential cost drivers

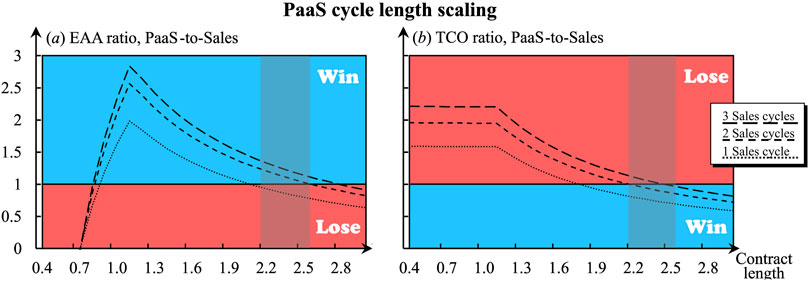

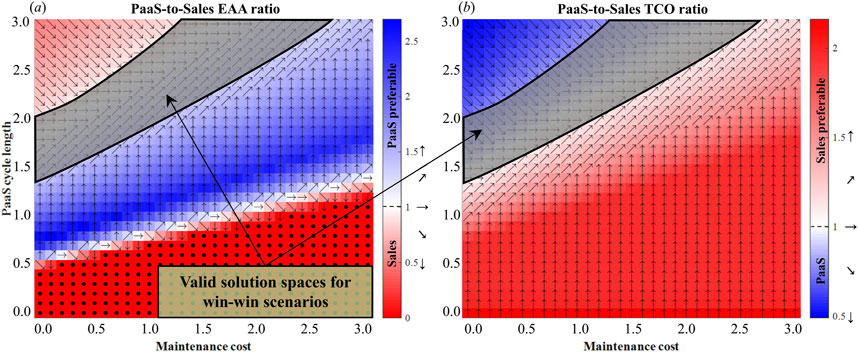

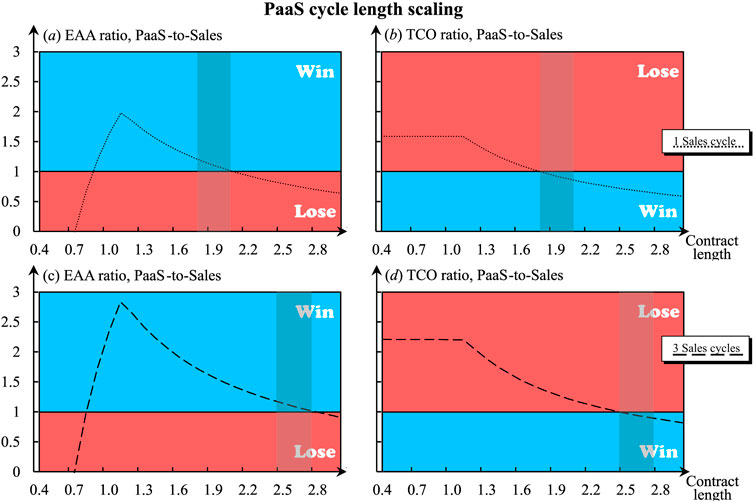

To achieve Falador’s pursued benefits of providing the new PaaS business model, other means are necessary to reduce the product life cycle cost in the PaaS model. These reductions are primarily related to the use phase, as the other phases of the business models are assumed to be identical. Therefore, the influential cost drivers should be analysed (Step 4) and then using these to create scenarios (Step 5). For this case, one alternative was to modify the cycle length of the PaaS contract to identify whether the results could be altered to achieve a win-win scenario from both the provider and user perspectives. Figure 5 shows the PaaS-to-Sales ratio for the EAA and TCO when scaling the base-case PaaS cycle length. Here, as described by Equation 14, the PaaS fee is dynamic based on the total cost and caps at an upper limit, which corresponds to the point of each curve where the scale is 1.1.

Figure 5. Relative PaaS-to-Sales performance by modifying the PaaS cycle length. Note: A ratio of one indicates the break-even point, where PaaS and Sales are equally profitable for the provider (EAA) or costly for the user (TCO). The three lines show the influence of having one, two, or three Sales cycles. The line for two Sales cycle reaches the blue (win) area, where PaaS outperforms Sales for both (A) and (B) at contract length between 2.2 and 2.6. This area is highlighted in grey.

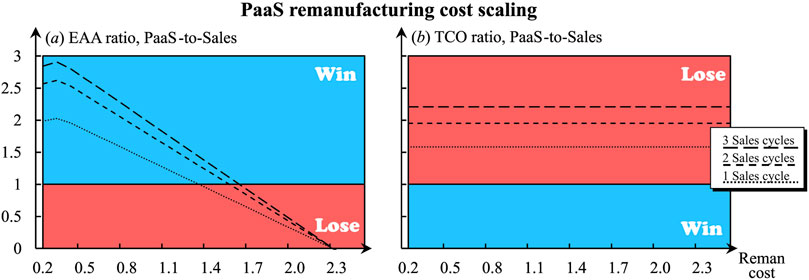

The longer the cycles, the lower the PaaS costs per time for the provider since, for example, start-up, manufacturing, remanufacturing, and maintenance costs are distributed over a longer period (longer cycles are assumed here to result in a longer time between maintenance sessions, as the number of maintenance sessions is assumed to be unchanged). As such, this analysis showed the impact of providing products of longer lifespans. In this case, there is a win-win scenario achievable (TCO ratio <1; EAA ratio >1) at two sales cycles within the PaaS contract length interval 2.2 to 2.6; see the highlighted (by shading) area in Figure 5. See also Figure A1 for the other two cycles. As such, Falador can introduce measures to motivate a longer lifespan, for example, through redesigns to make the products more durable. However, since the narrow interval width in Figure 5 causes a low advantage for PaaS (less than 1.2 times better than break-even on the vertical axis for the EAA ratio and more than 0.8 for the TCO ratio for either perspective), the robustness is modest: slight deviations from the base case can cause PaaS to lose its advantage, and, therefore, it is unreasonable to solely rely on the cycle length in this case. As Figure 6 depicts, neither can Falador rely on the remanufacturing cost as a beneficial TCO ratio does not coexist with a beneficial EAA ratio, meaning a lower remanufacturing cost does not have a significant impact.

Figure 6. Relative PaaS-to-Sales performance by modifying the PaaS remanufacturing cost. Note: A ratio of one indicates the break-even point, where PaaS and Sales are equally profitable for the provider (EAA) or costly for the user (TCO). The three lines do not reach the blue area for both (A) and (B) simultaneously, indicating a win-win state for the provider and user is infeasible.

In Figure 7, the influence on the provider EAA and user TCO by modifying the maintenance cost is shown. While Falador’s priority of the two business models could be altered through different maintenance costs, the TCO of PaaS is always higher for the user. Consequently, through the maintenance cost alone, the user would, from a cost perspective, always prefer the Sales model. Therefore, as with the remanufacturing cost, to make PaaS lucrative from both the provider and user perspectives, other measures need to be implemented simultaneously to reduce the product life cycle cost of PaaS sufficiently.

Figure 7. Relative PaaS-to-Sales performance by modifying the PaaS maintenance cost. Note: A ratio of one indicates the break-even point, where PaaS and Sales are equally profitable for the provider (EAA) or costly for the user (TCO). The three lines do not reach the blue area for both (A) and (B) simultaneously, indicating a win-win state for the provider and user is infeasible.

5.3 Enable financially viable PaaS by combining scenarios to reach synergetic effects

As shown in Figures 2, 3, the PaaS management and maintenance are the recurring transactions that influence the total product life cycle cost the most. On one hand, the PaaS management cost could be reduced independently of the product by, for example, creating more automated and streamlined management of PaaS. However, this is difficult to achieve on a short-term basis since the optimisation can only be performed once sufficient experience has been obtained. The PaaS management cost per product is also high due to the PaaS offering initially targeting a small share of the total turnover, and it is yet to be synchronised with the current Sales management system, meaning that PaaS bears additional management costs compared to Sales. However, since this is an internal and specific constraint of Falador, and since PaaS should be lucrative even during the initiation phase, this aspect is not further discussed in this paper. On the other hand, the maintenance cost is influenced by the durability and quality attributes of the product. In a traditional Sales model, these product attributes should satisfy the expectations of the customer to ensure recurrent purchases at the end of life, at least from the perspective of maximising long-term profit (Rivera and Lallmahomed, 2016). The incentive for the provider to reduce the usage cost is more apparent in the PaaS model (Kjaer et al., 2019; Tukker, 2015), since it must ensure that the product is in working condition at all times to guarantee high customer satisfaction and low use-phase costs for the provider. In the case of Falador, many of the components in its products are prone to wearing, meaning that regular maintenances are required. However, this requirement could be relaxed by introducing certain measures, such as redesign for higher durability or ease of maintenance (Bocken et al., 2016). Currently, there is a low amount of data accessible for Falador to analyse for design and durability improvements. This is a consequence of the current low interest for the use phase due to not having an incentive to provide even higher durability and due to an inability to track products without retaining ownership.

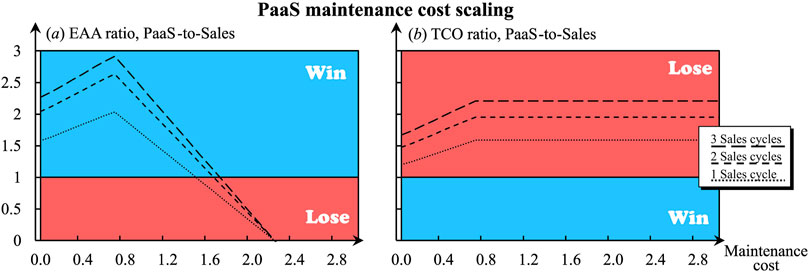

When introducing PaaS with retained ownership, easier access to cores (Guidat et al., 2014; Sundin and Bras, 2005), and higher incentives to care for products after the point of sales (Kjaer et al., 2019), there are high possibilities for introducing product redesigns based on real-use scenarios that improve the quality of products and their durability. While the individual modifications of the cycle length, remanufacturing cost, and maintenance cost are unable to provide robust scenarios where PaaS is preferable (as part of Step 5), viewing them simultaneously can provide directions for how PaaS and the product could be redesigned (Step 6 and 7). Since both the cycle length and maintenance cost affect the TCO and EAA ratios synchronously (compare Figures 5, 7, i.e., a maintenance cost lower than 0.8 improves the TCO for all contract lengths while contract lengths longer than 1.2 provide all maintenance costs), a combination of longer PaaS cycle lengths and varied maintenance costs, as in Figure 8, could provide a scenario where PaaS leads to a win-win state for both the user and provider. These combinations are reasonable to achieve as high product durability correlates with longer product lives, lower maintenance requirements, and potentially lower maintenance costs. Hence, the highlighted area in Figure 8 is the PaaS win-win solution space that Falador should aim for. As discussed earlier, a similar analysis and conclusion could also be achieved by modifying the PaaS management cost.

Figure 8. PaaS-to-Sales (A) EAA and (B) TCO ratios with modified cycle length and maintenance cost. Values lower or equal to one imply that the Sales is preferable from a provider (EAA) perspective and the PaaS model is preferable from a user (TCO) perspective. This break-even point is labelled by the right arrow sign →, while infeasible solutions are labelled by bullet points ●.

Furthermore, to reduce maintenance costs (cf. Kumar and Krishnan, 2017), existing repair and maintenance data from Falador was collected and analysed. This analysis complemented product development durability insights of the products with the performance in the use phase. Moreover, the maintenance procedure could more accurately be determined by linking the probability of failure on an individual component basis; compare the work by Diallo et al. (2017). Previously at Falador, such procedures were primarily based on expertise judgements and recommendations from the product development phase. Work is also being conducted to utilise this data to adapt the maintenance, repair, and remanufacturing procedures based on different usage behaviours (cf. Gavidel and Rickli, 2017). For example, Falador has experienced, like other providers [e.g., Moeller and Wittkowski (2010), Tunn and Ackermann (2020)], that rented products tend to be used with lower cautiousness relative to user ownerships unless there is a punishment mechanism implemented in the offering. This is believed to be important to acknowledge in the PaaS model since with a known product end of use, it could be the case that the user is less likely to attempt to apply measures to prolong the product’s lifespan, given that there is no incentive for them to be careful. Naturally, the cautiousness could be incentivised by introducing deductions or similar if the product is returned in a state lower than the providers’ expectations. However, this could increase the risk awareness of the users and redirect their purchase intentions towards other safer offerings.

6 Discussion

6.1 Financial assessment model

The proposed financial assessment model was shown effective to support the OEM, Falador, in developing an access-based business model, namely, PaaS (Section 5). This model is transparently provided in the Supplementary Material in an open science spirit so that it can be revisited by other researchers and practitioners for further advancement and dissemination of the knowledge. The model (Section 3) was shown to be able to address the needed level of PaaS complexity (including both provider and user perspectives) in a practitioner-friendly manner as well as run on the data available in practice. The transdisciplinary research approach was an enabler to the quality of the model: the researchers and the OEM exchanged data and expertise beyond their internal boundaries to successfully show how life cycle costing could answer the questions posed by industry. Falador indeed stated significant benefits: “The researchers helped us to develop a calculation model, much faster and much more realistic than we could do on our own.” The calculation results showed that it is not lucrative for Falador to substitute the current one-off sales business model without introducing additional measures that reduce the total product life cycle costs of its products. This is the case due to, among other things, the professional heavy-duty working environments of the products and the high PaaS management and maintenance costs partly caused by the inexperience of managing PaaS offerings. These cost types tend to be pronounced in PaaS, as indicated in other adoption cases of baby prams (Mont et al., 2006), water heaters (Kuo et al., 2019), and washing machines (van Loon et al., 2022; van Loon et al., 2020).

6.2 Procedure including scenario analysis

Another major contribution is the structured scenario analysis represented by the seven-step procedure (Figure 1) building upon the financial assessment model. The procedure was demonstrated useful on Falador’s circumstances in Section 5. It is innovative with identifying the conditions for the financial viability of PaaS within the vast possible solution space described by a high number of parameters, compared to the extant literature (Alamerew and Brissaud, 2020; Sauve et al., 2023; van Loon et al., 2020; van Loon et al., 2018). The power of scenario analysis is highly relevant, because a mere introduction of PaaS to manufacturing that has been optimised for the one-off sales-based business model is often economically unfeasible (as explained in the previous paragraph); see also e.g., Kambanou et al. (2024), van Loon et al. (2022). Moreover, combining multiple scenarios (the sixth step of the procedure) is important to take advantage of the interdependencies of elements in the system and introduce systemic changes on the system. The systemic changes are often perceived too risky and as a major barrier for PaaS or the like; hence, the proposed support could be significant to help industry make such changes. Furthermore, the procedure has potential to contribute to the standardisation of structuring and developing assessments for practitioners, given the call for research towards standardisation by other authors, for example, Bressanelli et al., 2019a; Kanzari et al. (2022); van Loon and Van Wassenhove (2020).

6.3 Account from industry

The documented application to Falador provides a rich account for PaaS development with quantitative financial terms for the systemic changes that were argued essential for a circular economy (Bressanelli et al., 2019b; Kurilova-Palisaitiene et al., 2024; Schultz and Reinhardt, 2022; Wiesmeth, 2020). The scenario analysis showed that by using the base scenario of Falador, the Sales model outperforms PaaS from the TCO user perspective, indicating that there are few incentives for a cost-minded user to prefer the PaaS option. This is related to the emergence of new types of costs related to the management of PaaS. To reach a stage where both perspectives–provider profitability and user cost–provide a win-win scenario for PaaS, systemic changes were required. Here, it was shown how a feasible scenario where PaaS outperforms Sales can be achieved by, firstly, prolonging the PaaS contract cycle length and, secondly, keeping the maintenance cost within certain intervals; see Figure 8. These modifications relate to both product redesigns and adaptations of the PaaS business model in realising feasible win-win solutions. As shown in the Falador case, as in other studies (Mont et al., 2006; Rodríguez et al., 2022; Tunn and Ackermann, 2020; van Loon et al., 2022), the PaaS management and maintenance costs are more pronounced in PaaS relative to Sales. This is caused by requiring additional management of the products throughout the use period related to tracking, takeback, different customer behaviour, and ensuring high user satisfaction. Consequently, with the higher level of OEM responsibility to ensure short downtimes and high accessibility, the maintenance cost is higher as well. In the Falador case, the PaaS management costs are based on the existing organisational structure and software solutions and are decoupled from product-specific costs; therefore, further investigation of them has not been within the scope of this paper. This perspective related to the long-term impact and decision-making is recommended for future research. The remaining primary cost drivers are considered in the scenario analysis to identify the feasible solutions.

6.4 Further possible improvement

To realise the above-stated scenarios in a real-life industry case, refining the maintenance policies and redesigning the products are necessary to improve their durability, which results in a longer time between maintenance instances and a reduction of the maintenance cost. Naturally, such redesign measures also influence the remanufacturing and manufacturing costs of the products. Typically, remanufacturing processes benefit from high quality as more cores can be restored to the required specifications and with less effort (Steinhilper and Weiland, 2015). Furthermore, guidelines for design for remanufacturing also tend to lower the effort for maintenance and repair (Hatcher et al., 2011; Ijomah et al., 2007). For manufacturing processes, higher quality tends to imply higher manufacturing costs (Farooq et al., 2017; Verma and Boyer, 2010), that is, cost increases that should be considered in the analysis as well. This paper has not considered this in the financial assessment, as it is prioritised to identify whether the new business model is lucrative compared to the business as usual, or which measures should be focused on to ensure that it is.

6.5 Limitations of this research

The scenario-based analysis under the case study has a set of limitations, due to its modelling assumptions. The identical failure distributions of products in the PaaS and Sales business models is one; others are company-based demands, for example, a maximum cap level of the PaaS fee that otherwise is set completely by a bottom-up approach; see Equation 14. While the identical failure distribution might not be the case due to different use patterns within the business models (Moeller and Wittkowski, 2010), estimating more representative distributions is difficult due to the lack of data. Typically, products under PaaS contracts experience higher failure rates, partly due to lower perceived responsibility for the product (Tunn and Ackermann, 2020). Consequently, this assumption likely favours Sales, implying a slight underestimation of PaaS performance. However, the developed model, supports differentiated failure rates, provided such data is available. While the modifications of the parameters in the scenarios highlight the potential outcome and reduce the uncertainties, there might be an effect on the cost of repairs, maintenance, remanufacturing, and, thus, end results. The current literature on the topic does not provide sufficient support for more accurate estimations. Moreover, the choice or estimation of the maximum cap of the PaaS fee for Falador significantly impacts the ratio between provider and user benefit. It should, therefore, be set by high cautiousness as finding the sweet spot is challenging. In Falador’s case, the cap was set high enough to reliably cover the cost structure of the base case while also being reasonable according to Falador’s perception of market acceptance. For example, in Figure 5, a lower PaaS fee cap would reduce or eliminate the win-win area, as the right-hand side of the figure in (a) would shift into the area of lose, making a win-win state infeasible. Meanwhile, the user in (b) would gain increased benefits. Consequently, despite the model and case having a cost-centric focus, the outcome also depends on the perceived value of the offering (cf. Kambanou et al., 2024; Petänen et al., 2024). Thus, it is also important to consider the results in relation to the additional value PaaS typically provides such as ease of use, accessibility, or convenience (cf. Akbar and Hoffmann, 2020; Sánchez-Fernández et al., 2009; Zauner et al., 2015). In this paper, these additional benefits are likely to underestimate the value of PaaS relative to Sales. However, this is not a limitation of the model itself but rather a reflection of the selected inputs. Therefore, when applying similar assessments to other companies and disseminating the results and potential effects, the inputs and assumptions must be clear and transparent to provide reliable insights. Lastly, the validation in this paper was based on a single case, which means that application to more cases is needed to increase the generalisability of the proposed solution.

7 Conclusion

This paper presents a financial assessment scenario analysis directed towards supporting OEMs in changing their business to access-based business models, that is, PaaS. This transformation does not come without engineering challenges due to the inherent uncertainties of PaaS, for example, estimations of service requirements and product usage, and additional costs linked to the management of the offering. Firstly, the paper presents a financial assessment model for PaaS alongside its Supplementary Material. This model is generic and can be adapted to specific PaaS setups. Secondly, the paper proposes a systematic procedure that stepwise guides OEMs to build an analysis for identifying the financial viability of PaaS relative to their businesses as usual. The model and procedure were applied to a European manufacturer of construction machines, and for this case it was concluded that, among others, financially viable solutions are possible, but design modifications of its products were necessary for achieving a PaaS more lucrative than its business as usual and less costly for its customers (the users). Further generalisability of the case results is beyond this study. Thereby, they were shown useful for decision making in manufacturing practice for PaaS. A significant part of the contribution lies in the industry-usability and its usefulness for practical applications in identifying the financially viable conditions for PaaS.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

JVD: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Software, Validation, Visualization, Writing–original draft, Writing–review and editing. TS: Conceptualization, Funding acquisition, Investigation, Methodology, Project administration, Validation, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was supported by the Mistra REES (Resource-Efficient and Effective Solutions) programme (Grant No. 2014/16), funded by Mistra (The Swedish Foundation for Strategic Environmental Research). This research is also supported by the SCANDERE (Scaling up a circular economy business model by new design, leaner remanufacturing, and automated material recycling technologies) project granted from the ERA-MIN3 programme under grant number 101003575 and funded by VINNOVA, Sweden’s Innovation Agency (No. 2022-00070).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fmtec.2024.1498189/full#supplementary-material

References

Akbar, P., and Hoffmann, S. (2018). Under which circumstances do consumers choose a product service system (PSS)? Consumer benefits and costs of sharing in PSS. J. Clean. Prod. 201, 416–427. doi:10.1016/j.jclepro.2018.08.010

Akbar, P., and Hoffmann, S. (2020). Creating value in product service systems through sharing. J. Bus. Res. 121, 495–505. doi:10.1016/j.jbusres.2019.12.008

Alamerew, Y. A., and Brissaud, D. (2020). Modelling reverse supply chain through system dynamics for realizing the transition towards the circular economy: a case study on electric vehicle batteries. J. Clean. Prod. 254, 120025. doi:10.1016/j.jclepro.2020.120025

Atasu, A., Guide, V. D. R., and Van Wassenhove, L. N. (2010). So what if remanufacturing cannibalizes my new product sales? Calif. Manage. Rev. 52, 56–76. doi:10.1525/cmr.2010.52.2.56

Averina, E., Frishammar, J., and Parida, V. (2022). Assessing sustainability opportunities for circular business models. Bus. Strateg. Environ. 31, 1464–1487. doi:10.1002/bse.2964

Belkadi, F., Boli, N., Usatorre, L., Maleki, E., Alexopoulos, K., Bernard, A., et al. (2020). A knowledge-based collaborative platform for PSS design and production. CIRP J. Manuf. Sci. Technol. 29, 220–231. doi:10.1016/j.cirpj.2018.08.004

Bertoni, A., and Bertoni, M. (2020). PSS cost engineering: a model-based approach for concept design. CIRP J. Manuf. Sci. Technol. 29, 176–190. doi:10.1016/j.cirpj.2018.08.001

Bocken, N. M. P., de Pauw, I., Bakker, C., and van der Grinten, B. (2016). Product design and business model strategies for a circular economy. J. Ind. Prod. Eng. 33, 308–320. doi:10.1080/21681015.2016.1172124

Bressanelli, G., Perona, M., and Saccani, N. (2019a). Assessing the impacts of circular economy: a framework and an application to the washing machine industry. Int. J. Manag. Decis. Mak. 18, 282–308. doi:10.1504/IJMDM.2019.100511

Bressanelli, G., Perona, M., and Saccani, N. (2019b). Challenges in supply chain redesign for the Circular Economy: a literature review and a multiple case study. Int. J. Prod. Res. 57, 7395–7422. doi:10.1080/00207543.2018.1542176

Brissaud, D., Sakao, T., Riel, A., and Erkoyuncu, J. A. (2022). Designing value-driven solutions: the evolution of industrial product-service systems. CIRP Ann. 71, 553–575. doi:10.1016/j.cirp.2022.05.006

Calzolari, T., Genovese, A., and Brint, A. (2021). The adoption of circular economy practices in supply chains – an assessment of European Multi-National Enterprises. J. Clean. Prod. 312, 127616. doi:10.1016/j.jclepro.2021.127616

Diallo, C., Venkatadri, U., Khatab, A., and Bhakthavatchalam, S. (2017). State of the art review of quality, reliability and maintenance issues in closed-loop supply chains with remanufacturing. Int. J. Prod. Res. 55, 1277–1296. doi:10.1080/00207543.2016.1200152

EMF (2015). Towards a circular economy: business rationale for an accelerated transition. Ellen MacArthur Foundation.

Erkoyuncu, J. A., Roy, R., Shehab, E., and Cheruvu, K. (2011). Understanding service uncertainties in industrial product–service system cost estimation. Int. J. Adv. Manuf. Technol. 52, 1223–1238. doi:10.1007/s00170-010-2767-3

Farooq, M. A., Kirchain, R., Novoa, H., and Araujo, A. (2017). Cost of quality: evaluating cost-quality trade-offs for inspection strategies of manufacturing processes. Int. J. Prod. Econ. 188, 156–166. doi:10.1016/j.ijpe.2017.03.019

Gaur, J., Subramoniam, R., Govindan, K., and Huisingh, D. (2017). Closed-loop supply chain management: from conceptual to an action oriented framework on core acquisition. J. Clean. Prod. 167, 1415–1424. doi:10.1016/j.jclepro.2016.12.098

Gavidel, S. Z., and Rickli, J. L. (2017). Quality assessment of used-products under uncertain age and usage conditions. Int. J. Prod. Res. 55, 7153–7167. doi:10.1080/00207543.2017.1349954

Geissdoerfer, M., Morioka, S. N., de Carvalho, M. M., and Evans, S. (2018). Business models and supply chains for the circular economy. J. Clean. Prod. 190, 712–721. doi:10.1016/j.jclepro.2018.04.159

Gharfalkar, M., Court, R., Campbell, C., Ali, Z., and Hillier, G. (2015). Analysis of waste hierarchy in the European waste directive 2008/98/EC. Waste Manage 39, 305–313. doi:10.1016/j.wasman.2015.02.007

Golinska-Dawson, P., Sakao, T., Sundin, E., and Werner-Lewandowska, K. (2023). “Challenges and research issues for remanufacturing in paas from theory to industry perspective,” in Proceedings of the 27th international conference on production research. Cluj-Napoca, Romania.

Guidat, T., Barquet, A. P. B., Widera, H., Rozenfeld, H., and Seliger, G. (2014). “Guidelines for the definition of innovative industrial product-service systems (PSS) business models for remanufacturing,” in Procedia CIRP, 6th CIRP conference on industrial product-service systems, 193–198. doi:10.1016/j.procir.2014.01.023

Guide, V. D. R., and Li, J. (2010). The potential for cannibalization of new products sales by remanufactured products. Decis. Sci. 41, 547–572. doi:10.1111/j.1540-5915.2010.00280.x

Haanstra, W., Braaksma, A. J. J., and van Dongen, L. A. M. (2021). Designing a hybrid methodology for the Life Cycle Valuation of capital goods. CIRP J. Manuf. Sci. Technol. 32, 382–395. doi:10.1016/j.cirpj.2021.01.017

Hanemann, W. M. (1991). Willingness to pay and willingness to accept: how much can they differ? Am. Econ. Rev. 81, 635–647.

Hatcher, G. D., Ijomah, W. L., and Windmill, J. F. C. (2011). Design for remanufacture: a literature review and future research needs. J. Clean. Prod. 19, 2004–2014. doi:10.1016/j.jclepro.2011.06.019

Hidalgo-Crespo, J., Riel, A., Vogt Duberg, J., Bunodiere, A., and Golinska-Dawson, P. (2024). “An exploratory study for product-as-a-service (PaaS) offers development for electrical and electronic equipment,” in Procedia CIRP 31st CIRP conference on life cycle engineering, 521–526. doi:10.1016/j.procir.2024.01.076

Ijomah, W. L., McMahon, C. A., Hammond, G. P., and Newman, S. T. (2007). Development of design for remanufacturing guidelines to support sustainable manufacturing. Robot. Comput.-Integr. Manuf. 23, 712–719. doi:10.1016/j.rcim.2007.02.017

Janz, D., Sihn, W., and Warnecke, H.-J. (2005). Product redesign using value-oriented life cycle costing. CIRP Ann. 54, 9–12. doi:10.1016/S0007-8506(07)60038-9

Jensen, J. P., Prendeville, S. M., Bocken, N. M. P., and Peck, D. (2019). Creating sustainable value through remanufacturing: three industry cases. J. Clean. Prod. 218, 304–314. doi:10.1016/j.jclepro.2019.01.301

Kaddoura, M., Kambanou, M. L., Tillman, A.-M., and Sakao, T. (2019). Is prolonging the lifetime of passive durable products a low-hanging fruit of a circular economy? A multiple case study. Sustainability 11, 4819. doi:10.3390/su11184819

Kambanou, M. L. (2020). Life cycle costing: understanding how it is practised and its relationship to life cycle management—a case study. Sustainability 12, 3252. doi:10.3390/su12083252

Kambanou, M. L., Matschewsky, J., and Carlson, A. (2024). Business models and product designs that prolong the lifetime of construction workwear: success, failure and environmental impacts. Resour. Conserv. Recycl. 206, 107602. doi:10.1016/j.resconrec.2024.107602

Kambanou, M. L., and Sakao, T. (2020). Using life cycle costing (LCC) to select circular measures: a discussion and practical approach. Resour. Conserv. Recycl. 155, 104650. doi:10.1016/j.resconrec.2019.104650

Kanzari, A., Rasmussen, J., Nehler, H., and Ingelsson, F. (2022). How financial performance is addressed in light of the transition to circular business models - a systematic literature review. J. Clean. Prod. 376, 134134. doi:10.1016/j.jclepro.2022.134134

Kjaer, L. L., Pigosso, D. C. A., Niero, M., Bech, N. M., and McAloone, T. C. (2019). Product/service-systems for a circular economy: the route to decoupling economic growth from resource consumption? J. Ind. Ecol. 23, 22–35. doi:10.1111/jiec.12747

Kumar, A. R., and Krishnan, V. (2017). A study on system reliability in weibull distribution. Int. J. Inov. Res. Electr. Electron. Instrum. Control Eng. 5, 38–41. doi:10.17148/IJIREEICE.2017.5308

Kuo, T.-C., Chiu, M.-C., Hsu, C.-W., and Tseng, M.-L. (2019). Supporting sustainable product service systems: a product selling and leasing design model. Resour. Conserv. Recycl. 146, 384–394. doi:10.1016/j.resconrec.2019.04.007

Kurilova-Palisaitiene, J., Matschewsky, J., and Sundin, E. (2024). Four levels of remanufacturing maturity as a circular manufacturing indicator: a theoretical framework and practical assessment tool. Resour. Conserv. Recycl. 211, 107899. doi:10.1016/j.resconrec.2024.107899

Kurilova-Palisaitiene, J., Sundin, E., and Sakao, T. (2023). Orienting around circular strategies (Rs): how to reach the longest and highest ride on the retained value Hill? J. Clean. Prod. 424, 138724. doi:10.1016/j.jclepro.2023.138724

Lang, D. J., Wiek, A., Bergmann, M., Stauffacher, M., Martens, P., Moll, P., et al. (2012). Transdisciplinary research in sustainability science: practice, principles, and challenges. Sustain. Sci. 7, 25–43. doi:10.1007/s11625-011-0149-x

Luthin, A., Traverso, M., and Crawford, R. H. (2024). Circular life cycle sustainability assessment: an integrated framework. J. Ind. Ecol. 28, 41–58. doi:10.1111/jiec.13446

Mahut, F., Daaboul, J., Bricogne, M., and Eynard, B. (2017). Product-Service Systems for servitization of the automotive industry: a literature review. Int. J. Prod. Res. 55, 2102–2120. doi:10.1080/00207543.2016.1252864

Matschewsky, J., Lindahl, M., and Sakao, T. (2020). Capturing and enhancing provider value in product-service systems throughout the lifecycle: a systematic approach. CIRP J. Manuf. Sci. Technol. 29, 191–204. doi:10.1016/j.cirpj.2018.08.006

Moeller, S., and Wittkowski, K. (2010). The burdens of ownership: reasons for preferring renting. Manag. Serv. Qual. 20, 176–191. doi:10.1108/09604521011027598

Mont, O., Dalhammar, C., and Jacobsson, N. (2006). A new business model for baby prams based on leasing and product remanufacturing. J. Clean. Prod. 14, 1509–1518. doi:10.1016/j.jclepro.2006.01.024

Nasr, N. Z., Russell, J. D., Bringezu, S., Hellweg, S., Hilton, B., Kreiss, C., et al. (2018) “Re-Defining value - the manufacturing revolution. Remanufacturing, refurbishment, repair and direct reuse in the circular economy,” in A report of the international resource panel. Nairobi, Kenya: United Nations Environment Programme.

Östlin, J., Sundin, E., and Björkman, M. (2008a). Importance of closed-loop supply chain relationships for product remanufacturing. Int. J. Prod. Econ. 115, 336–348. doi:10.1016/j.ijpe.2008.02.020

Östlin, J., Sundin, E., and Björkman, M. (2008b). “Business drivers for remanufacturing,” in Proceedings of the 15th CIRP international conference on life cycle engineering (Sydney, Australia: The University of New South Wales), 581–586.

Peillon, S., Medini, K., and Wuest, T. (2023). Building win-win value networks for product-service systems’ delivery. Int. J. Manuf. Technol. Manag. 37, 619–637. doi:10.1504/IJMTM.2023.133693

Petänen, P., Sundqvist, H., and Antikainen, M. (2024). Deconstructing customer value propositions for the circular product-as-a-service business model: a case study from the textile industry. Circ. Econ. Sustain. 4, 1631–1653. doi:10.1007/s43615-024-00351-z

Renn, O. (2021). Transdisciplinarity: synthesis towards a modular approach. Futures 130, 102744. doi:10.1016/j.futures.2021.102744

Rexfelt, O., and Hiort af Ornäs, V. (2009). Consumer acceptance of product-service systems: designing for relative advantages and uncertainty reductions. J. Manuf. Technol. Manag. 20, 674–699. doi:10.1108/17410380910961055

Ridley, S. J., Ijomah, W. L., and Corney, J. R. (2019). Improving the efficiency of remanufacture through enhanced pre-processing inspection – a comprehensive study of over 2000 engines at Caterpillar remanufacturing, U.K. Plan. Control 30, 259–270. doi:10.1080/09537287.2018.1471750

Rivera, J. L., and Lallmahomed, A. (2016). Environmental implications of planned obsolescence and product lifetime: a literature review. Int. J. Sustain. Eng. 9, 119–129. doi:10.1080/19397038.2015.1099757

Rodríguez, A. E., Pezzotta, G., Pinto, R., and Romero, D. (2022). A framework for cost estimation in product-service systems: a systems thinking approach. CIRP J. Manuf. Sci. Technol. 38, 748–759. doi:10.1016/j.cirpj.2022.06.013

Sakao, T. (2022). Increasing value capture by enhancing manufacturer commitment—designing a value cocreation system. IEEE Eng. Manag. Rev. 50, 79–87. doi:10.1109/EMR.2022.3150851

Sakao, T., and Lindahl, M. (2015). A method to improve integrated product service offerings based on life cycle costing. CIRP Ann. 64, 33–36. doi:10.1016/j.cirp.2015.04.052

Sánchez-Fernández, R., Iniesta-Bonillo, M. Á., and Holbrook, M. B. (2009). The conceptualisation and measurement of consumer value in services. Int. J. Mark. Res. 51, 1–17. doi:10.1177/147078530905100108

Sauve, G., Esguerra, J. L., Laner, D., Johansson, J., Svensson, N., Van Passel, S., et al. (2023). Integrated early-stage environmental and economic assessment of emerging technologies and its applicability to the case of plasma gasification. J. Clean. Prod. 382, 134684. doi:10.1016/j.jclepro.2022.134684

Schaltegger, S., Beckmann, M., and Hansen, E. G. (2013). Transdisciplinarity in corporate sustainability: mapping the field. Bus. Strateg. Environ. 22, 219–229. doi:10.1002/bse.1772

Schultz, F. C., and Reinhardt, R. J. (2022). Facilitating systemic eco-innovation to pave the way for a circular economy: a qualitative-empirical study on barriers and drivers in the European polyurethane industry. J. Ind. Ecol. 26, 1646–1675. doi:10.1111/jiec.13299

Skärin, F., Rösiö, C., and Andersen, A.-L. (2022). An explorative study of circularity practices in Swedish manufacturing companies. Sustainability 14, 7246. doi:10.3390/su14127246

Steinhilper, R., and Weiland, F. (2015). “Exploring new horizons for remanufacturing an up-to-date overview of industries, products and technologies,” in Procedia CIRP, 22nd CIRP conference on life cycle engineering, 769–773. doi:10.1016/j.procir.2015.02.041

Sundin, E., and Bras, B. (2005). Making functional sales environmentally and economically beneficial through product remanufacturing. J. Clean. Prod. 13, 913–925. doi:10.1016/j.jclepro.2004.04.006

Sundin, E., and Lee, H. M. (2011). “In what way is remanufacturing good for the environment?,” in Design for innovative value towards a sustainable society (Dordrecht: Springer), 551–556. doi:10.1007/978-94-007-3010-6_106

Tukker, A. (2015). Product services for a resource-efficient and circular economy – a review. J. Clean. Prod. 97, 76–91. doi:10.1016/j.jclepro.2013.11.049

Tunn, V. S. C., and Ackermann, L. (2020). Comparing consumers’ product care in access and ownership models. Proc. Des. Soc. Des. Conf. 1, 2167–2176. doi:10.1017/dsd.2020.80

van Loon, P., Delagarde, C., and Van Wassenhove, L. N. (2018). The role of second-hand markets in circular business: a simple model for leasing versus selling consumer products. Int. J. Prod. Res. 56, 960–973. doi:10.1080/00207543.2017.1398429

van Loon, P., Delagarde, C., Van Wassenhove, L. N., and Mihelič, A. (2020). Leasing or buying white goods: comparing manufacturer profitability versus cost to consumer. Int. J. Prod. Res. 58, 1092–1106. doi:10.1080/00207543.2019.1612962