95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Mar. Sci. , 12 September 2024

Sec. Marine Affairs and Policy

Volume 11 - 2024 | https://doi.org/10.3389/fmars.2024.1463843

This article is part of the Research Topic Challenges and Solutions in Forecasting and Decision-Making in Marine Economy and Management View all 22 articles

Introduction: As global resource demands and environmental challenges intensify, China's vast marine resources present a significant opportunity for sustainable economic development. This study investigates the impact of financial development on high-quality growth in China's marine economy across 11 coastal regions from 2011 to 2020.

Methods: We examine a mediation and moderation model linking financial development and marine economic quality in China, where the marine economy increasingly relies on financial support. This study proposes marine innovation output and industrial structure upgradation as mediators, with marine capital investment as a moderator.

Results: Our findings reveal that financial development significantly promotes high-quality marine economic growth, albeit with regional heterogeneity. The strongest effect is observed in the Eastern Marine Economic Zone, while the Southern Marine Economic Zone shows the weakest impact. Marine scientific research and industrial structure upgrading serve as key mediating factors, with the former demonstrating a stronger intermediary effect. Notable, marine capital investment positively moderates the relationship between financial development and marine economic growth.

Discussion: This study innovatively combines macro-finance and micro-finance indicators to construct a comprehensive financial development index system. It incorporates a multi-dimensional approach to measuring high-quality development in coastal regions, challenging one-size-fits-all models by highlighting regional variations. By providing insights into specific differences and underlying mechanisms, our study offers valuable guidance for policymakers in crafting region-specific strategies to leverage financial development for sustainable marine economic growth.

As the world's population and economy grow, the resource constraints and environmental challenges posed by increasing industrialization, urbanization, and globalization are becoming increasingly evident. Under this background, the enormous potential of the world's oceans and marine environments has become sharper under the concerns over resource scarcity, environmental degradation, and the need for sustainable development pathways (OECD, 2016; European Commission, 2019; Lubchenco and Gaines, 2019). The sustainable development and utilization of marine resources represent a promising avenue for driving economic progress while promoting environmental sustainability (Teh and Sumaila, 2013; Visbeck, 2018; FAO, 2020; Hoegh-Guldberg et al., 2023).

For nations with extensive coastlines like China, the marine economy has emerged as a significant driver of growth (European Commission, 2019; Li et al., 2021). With over 18,000 kilometers of coastline, China's marine economy has witnessed remarkable expansion in recent years, with its gross marine product surpassing 9 trillion yuan in 2021, accounting for 7.9% of China's total GDP (2021 Statistical Bulletin of China Marine Economy). This growth has been particularly pronounced in China's eastern coastal regions, where the marine economy's contribution to regional GDP has reached 15% (Wang et al., 2018).

While the relationship between financial development and economic growth is well-studied (Beck et al., 2000; Levine, 2005), research specifically examining the link between financial development and marine economic growth is relatively scarce. Some studies have explored the role of financial institutions in supporting specific marine industries, such as fisheries (Sumaila and Huang, 2012) and offshore renewable energy (Esteban et al., 2011) Recent studies have begun exploring the overall impact of financial development on marine economic growth (Zheng et al., 2021; Tirumala and Tiwari, 2022), but a comprehensive understanding of the mechanisms and pathways linking finance to high-quality marine economic development remains elusive.

Despite the immense potential of the marine economy, marine industries face significant financing challenges, particularly in their transition towards high-quality development and in emerging sectors like marine biomedicine and renewable energy. These industries often require substantial capital, long financing periods, and involve high risks and returns (Tian et al., 2019).

The role of financial development in supporting the marine economy has garnered increasing attention from policymakers and researchers alike (Zheng et al., 2021; Tirumala and Tiwari, 2022). However, traditional financial services frequently fail to adequately address the varied requirements of maritime enterprises (Sumaila et al., 2021). This mismatch between financial products and industry needs is particularly pronounced in emerging marine sectors, where innovative financing mechanisms are crucial for fostering innovation and sustainable growth (Sumaila et al., 2021).

This study is motivated by the pressing need to understand how financial development can be effectively leveraged to support the sustainable growth and transformation of China's marine economy. As China continues to emphasize the importance of high-quality development in its economic planning, including in the marine sector, it is crucial to identify the most effective financial mechanisms and policies to support this goal. By focusing on the period from 2011 to 2020, which coincides with China's 12th and 13th Five-Year Plans and a period of significant growth and transformation in the marine economy, we aim to provide timely and policy-relevant insights.

This study aims to address this critical gap by examining the complex relationship between financial development and the high-quality growth of the marine economy in China's coastal regions. Specifically, we seek to answer two key questions:

1. How does financial development in coastal regions influence the high-quality development of the marine economy?

2. What are the underlying mechanisms and impact pathways through which financial development affects the marine economy's sustainable growth, innovation, and structural transformation?

Our objectives include quantifying the overall impact of financial development on various aspects of marine economic growth and uncovering the specific channels through which financial development contributes to marine economic growth, including support for marine scientific research, industrial structure upgrading, and interaction with marine capital investment.

To achieve these objectives, we employ a comprehensive methodology encompassing mechanism analysis, integrated measurement, empirical analysis, and pathway testing. We develop novel index systems to evaluate both financial development and the quality of marine economic growth, exploring underlying mechanisms through mediation effect analyses of marine scientific research and industrial structure upgrading, as well as a moderation effect analysis of marine capital investment.

This study contributes to the existing literature by:

a) Combining macro-finance and micro-finance indicators to construct a comprehensive financial development index system;

b) Employing multi-dimensional analysis to examine the impact pathways, exploring the mediating effects of marine innovation output and industrial structure upgradation, as well as the moderating role of marine capital investment;

c) Offering insights into spatial differences and regional variations in the relationship between financial development and high-quality marine economic development. This study bridges the gap between financial development theory and the practical needs of the marine economy, providing actionable insights for policymakers, financial institutions, and marine industry stakeholders.

The rest of the study is arranged as follows: The literature review is in Section 2. The effects of financial development on the marine economy are explained theoretically in Section 3. In Section 4, we construct two index systems using the entropy method: one for financial development and another for high-quality marine economic development in China's coastal regions. The empirical analyses to examine how financial development influences marine economic growth is in Section 5, and the mechanism test is in Section 6. Through the output of marine innovation and the optimization of industrial structure, the intermediate effect model is used to examine the potential influence of financial development on the high-quality growth of the marine economy. And moderating effect model is used to test if marine capital input influences the effect of financial development on the high-quality growth of the marine economy. And Section 7 is conclusion and offers suggestions and prospects.

This section draws upon a wide range of international literature, reflecting the global significance of financial development and marine economy research. The following sections explore key concepts, measurements, and intersections of these fields.

Financial development, crucial for economic growth, involves enhancing financial institutions, markets, and instruments to facilitate efficient resource allocation. The concept's evolution reflects the changing dynamics and complexities of the global financial landscape. Early literature employed indicators such as the ratio of broad money to GDP or private credit to GDP to measure financial intermediation depth and bank functionality. Seminal publications by Goldsmith (1969) and Engerman and McKinnon (1974) demonstrated the links between financial development and economic growth. As financial markets matured, researchers expanded the scope of financial development to encompass stock and bond markets, as well as non-bank financial institutions. Levine (1997) introduced a comprehensive measure of financial development, incorporating aspects such as financial system size, efficiency, and stability. Contemporary research explores the multifaceted nature of financial development, including financial accessibility, regulatory quality, and legal and institutional frameworks. Levine and Beck (1999) developed a comprehensive database facilitating cross-country comparisons and empirical analyses. Recent international studies have enhanced our understanding of financial development's role in promoting economic growth. Svirydzenka (2016) developed a comprehensive Financial Development Index for the IMF, encompassing multiple dimensions of both financial institutions and markets. Sugandi (2022) further explored fintech's impact on financial development, highlighting its potential to accelerate financial inclusion while introducing new risks.

Quantifying financial development has led to various indicators and composite indices. Scholars have developed indicators based on monetary and credit factors (Acheampong, 2019; Hung, 2023) or built systems assessing financial depth, accessibility, and efficiency. Wang et al. (2021a) proposed a four-dimensional indicator system encompassing financial depth, breadth, efficiency, and ecological environment. Nguyen et al. (2023) included evaluations of financial institutions, market effectiveness and domestic credit to the private sector. Comprehensive indicator sets for measuring financial systems development across countries are provided by the IMF's Financial Development Index (Svirydzenka, 2016) and the World Bank's Global Financial Development Database.

The marine economy, or blue economy, has garnered recognition as a potential driver of sustainable economic growth. It encompasses diverse ocean-related activities, including marine fisheries, aquaculture, maritime transport, coastal tourism, and emerging industries like offshore renewable energy and marine biotechnology (Pontecorvo et al., 1980; Colgan, 2013; Park and Kildow, 2015). Quantifying the economic impact of the marine economy is challenging due to its diverse nature. Researchers have employed various methodologies, such as input-output analysis and computable general equilibrium models (Park and Kildow, 2015). Wenhai et al. (2019) reviewed blue economy practices, emphasizing the need for integrated approaches. Cisneros-Montemayor et al. (2021) highlighted the importance of equity and inclusion in blue economy strategies, particularly for coastal communities and developing nations.

High-quality economic development has become a focal point, emphasizing sustainable growth, improved quality of life, and environmental sustainability (Simms and Boyle, 2009; Stefan, 2012; Lau et al., 2014). In the marine economy context, researchers have proposed various indicators and evaluation methods to assess high-quality development, including per capita gross ocean product (GOP) (Liu et al., 2017), marine economic efficiency, and total factor productivity (Liu et al., 2021; Ren and Ji, 2021). Gao et al. (2022) used a support vector machine (SVM) model and particle swarm optimization (PSO) to evaluate the high-quality development of China's marine sector. Sun et al. (2023) created a bidirectional multi-index comprehensive evaluation framework, applying the PSO and SVM model to assess China's marine economy's high-quality development. Feng et al. (2024) established an indicator system for marine economic development based on economic, ecological, and social dimensions. While research on high-quality marine economic development evaluation has increased (Li et al., 2020a; Chen et al., 2024; Han and Cao, 2024; Zhang and Wang, 2024), some indicators show weak relevance to marine economic development. Refining these indicator systems could enhance measurement accuracy.

The intersection of financial development and the marine economy has attracted increasing attention in recent literature. As a crucial component of the national economy, the marine sector requires a well-developed financial system to support its growth and sustainability (Xu and Cui, 2020; Wang et al., 2021a). However, research findings on the relationship between financial development and marine economic growth are diverse.

A significant body of research suggests that financial development positively promotes marine economic development. An and Li (2020) argue that finance can facilitate marine industry structure optimization, fostering growth. Tian et al. (2019) propose that the financial industry can enhance equity financing support through a green approval mechanism for marine planning. Gao (2020) highlights how finance development promotes marine economic growth through various investment and financing mechanisms. Recent studies have also explored innovative financial instruments, such as blue bonds, to encourage private investment in the blue economy (Wang et al., 2021b; Shiiba et al., 2022).

International research has emphasized the critical role of innovative financing mechanisms in supporting sustainable marine economic development. Sumaila et al. (2021) analyzed ocean finance strategies, emphasizing the need for both public and private sector involvement. They identified key ocean-based industries requiring sustainable financing and proposed a combination of financing mechanisms. Virdin et al. (2021) examined transnational corporations’ role in the ocean economy, suggesting potential avenues for leveraging corporate finance for sustainable marine development.

Conversely, some scholars have identified potential limitations or negative effects of financial development on the marine economy, termed ‘financial inhibition’. Song et al. (2020) revealed a threshold effect in the relationship between financial development and Chinese marine economic growth, suggesting that financial development enhances marine economic growth only beyond a certain level of initial financial sector development. Ma (2017) found that while total deposits have a positive impact on the marine economy, the insurance market has a negative impact, although neither effect was statistically significant. Zhao and Peng (2017) observed that credit and insurance markets could promote marine economic growth, while the stock market has a negative impact.

These conflicting findings underscore the complex nature of the relationship between financial development and marine economic growth. The impact varies depending on specific aspects of financial development, financial sector maturity, and the unique characteristics of marine economic activities. The concept of ‘high-quality development’ in the marine economy introduces additional dimensions that traditional economic growth metrics may not fully capture. While our study focuses on China's marine economy, these findings contribute to the broader international discourse on the relationship between financial development and sustainable marine economic growth. The insights gained from China's experience can inform global strategies for leveraging financial development to support high-quality growth in marine economies worldwide.

In conclusion, financial development assessment mainly focuses on macro indicators and overall financial institutions and markets, rarely examining them within a unified index framework. The growth of digital inclusive finance has become a key metric for evaluating financial development. Therefore, we incorporate the digital inclusive financial development index to improve comprehensiveness. Despite contributions to financial development and the marine economy concepts, research exploring the linkages between the two domains is lacking. We address this gap by conducting a sub-regional regression analysis of three main marine economic regions and categorically classifying 11 coastal provinces’ marine economies into research-driven and industry-driven sectors. This study provides a more comprehensive depiction of marine economic development in various locations with distinct characteristics, contributing to a holistic understanding of the interplay between finance and sustainable marine economic development.

Economic development, rooted in industrial economics, encompasses not only the growth of economic aggregates and social wealth but also the optimization of internal economic structures and enhancement of efficiency (Jiang et al., 2014). It impacts aspects of societal quality, including overall well-being, living standards, personal development, and the ecological environment (Plummer et al., 2018; Pan et al., 2021). High-quality economic development can be defined through the vision of innovation, coordination, greenness, openness, and sharing (Gao et al., 2022). In the context of the marine economy, these take on specific characteristics:

● Innovation focuses on advancing marine research and technology, evident in emerging industries like marine biomedicine and seawater utilization, as well as increased investment in marine scientific research (Kaye Nijaki and Worrel, 2012; Guo et al., 2022).

● Coordination aims to address the uneven development between China's eastern coastal regions and western areas, as well as disparities among coastal provinces (Liu et al., 2023; Yue et al., 2023).

● Green development emphasizes preserving the marine ecosystem while pursuing economic growth, addressing issues such as eutrophication, oil spills, and heavy metal pollution (Ren and Ji, 2021).

● Openness manifests in the harmonized growth of marine transportation, foreign trade, and port infrastructure (Yin et al., 2022), enhancing interconnectedness between China's overall economy and the marine industry (Zhang et al., 2022).

● Sharing focuses on generating employment opportunities, enhancing the well-being of coastal residents, and stimulating economic expansion in non-coastal areas (Plummer et al., 2018).

Based on these considerations, we define marine economic high-quality development as a mode of development characterized by innovation-driven growth in marine science and technology, coordinated regional development, sustainable environmental practices, enhanced land-sea connectivity, and shared benefits across coastal and inland regions.

Next, we disentangle the complex relationship between financial development and high-quality marine economic development by examining four distinct mechanisms: risk resilience, innovation capacity, industrial structure transformation, and capital accumulation. While these mechanisms may all contribute positively to marine economic development, understanding their individual roles and relative importance is crucial for targeted policy-making and financial strategies in the marine sector.

The marine economy is characterized by high capital requirements, extended investment cycles, substantial initial outlays, and vulnerability to natural disasters. Financial development is significant in enhancing the sector’s resilience to various risks by fostering the growth of insurance businesses and other financial products.

In China, marine insurance primarily covers ship and cargo insurance within the maritime transportation sector, offering timely compensation for damages and mitigating operational risks. The fishery sector can benefit from specialized insurance providing compensation for productivity losses due to severe weather events. As financial development progresses, it is expected to stimulate growth in the insurance industry, leading to more marine insurance providers and product diversification. This expansion of financial services contributes to increased production capacity in marine-related businesses and offers additional hedging options, enhancing overall risk management capabilities.

According to this analysis, we advance H1. Testing this hypothesis will help understand how financial tools can mitigate the unique risks in the marine sector, potentially leading to more stable growth.

H1: Financial development positively influences the high-quality growth of the marine economy by enhancing its resilience through the expansion and diversification of insurance and other financial products.

The marine economy, particularly its emerging sectors such as seawater utilization, marine biomedicine, and marine equipment manufacturing, are technology-intensive industries requiring substantial human capital and advanced technologies. These sectors focus on leading-edge innovation but face significant financial challenges due to high initial investments and associated risks. Financial development can address these challenges and promote innovation in the marine economy by:

a) Providing financial support for R&D through venture capital and private equity;

b) Attracting talent and technology to regions with advanced financial sectors;

c) Attracting skilled professionals with specialized knowledge in relevant fields like computer science and materials engineering.

In light of the above analysis, we advance the second hypothesis, which explores how financial development can overcome the high barriers to innovation in marine industries, which is crucial for long-term competitiveness.

H2: Enhanced financial development stimulates high-quality innovation in marine science and technology, thereby elevating the marine economic development level.

To achieve high-quality development in the marine economy, China must increasingly rely on investments in technology and scientific research. Currently, traditional marine sectors, such as coastal tourism, transportation, and marine fisheries, generally have a low level of scientific and technological integration and are heavily dependent on natural marine resources. Emerging marine industries, including marine biomedicine and marine equipment manufacturing, offer higher value-added opportunities, but they need to be developed.

Enhancing financial development in coastal regions contributes significantly to the structural improvement of the marine industry (An and Li, 2020; Sheng et al., 2021). Financial institutions can play a pivotal role in this transition by:

a) Strategically allocating funds across various industries;

b) Evaluating the potential of marine businesses for informed capital allocation;

c) Supporting core research and acquiring expertise in science and technology;

d) optimizing market mechanisms to increase product value;

e) Offering preferential financing to high-tech enterprises in the maritime sector.

Based on these considerations, we propose the third hypothesis. Examining this hypothesis will shed light on the role of finance in facilitating the necessary structural changes for high-quality marine economic development.

H3: Financial development positively influences the upgrading of the marine industrial structure, thereby enhancing the quality of the marine economic high-level development.

Capital accumulation is fundamental to economic growth, with external capital infusion accelerating this process. Financial development expedites capital accumulation by offering diverse investment opportunities for enterprises. In the marine economy context, this process plays a crucial role in driving economic growth and creates a positive feedback loop where financial development and capital accumulation mutually reinforce each other.

Within the framework of the marine economy, this process of capital accumulation through financial development plays a crucial role in:

a) Efficient allocation of surplus value for marine enterprises;

b) Creating a positive feedback loop between capital accumulation and financial industry growth;

c) Accelerating marine capital accumulation through external capital injection.

Based on these considerations, we propose the fourth hypothesis, which investigates how financial development addresses the capital-intensive nature of marine industries, which is essential for their expansion and modernization.

H4: Financial development accelerates capital accumulation in marine industries, leading to higher fixed asset investment growth in the marine sector compared to other sectors.

These distinct yet interrelated hypotheses aim to provide a nuanced understanding of how financial development contributes to high-quality marine economic growth, enabling policymakers to design targeted financial strategies for sustainable marine economic development.

The growth of the marine industry and the expansion of the marine economy have led to noticeable disparities among coastal locations (Sun et al., 2018). These regional differences are significantly influenced by the uneven distribution of marine resources in China, which impacts both marine economic growth and industrial structure (Meng et al., 2024). To analyze these disparities, this paper categorizes the 11 coastal provinces into three regions based on the "Thirteenth Five-Year Plan for National Marine Economic Development" in Figure 1, in which the Northern Marine Economic Zone includes Liaoning, Hebei, Tianjin and Shandong, the Eastern Marine Economic Zone includes Jiangsu, Shanghai and Zhejiang, and the Southern Marine Economic Zone includes Fujian, Guangdong, Guangxi and Hainan. These regions, arranged from north to south, exhibit variations in marine economic growth due to diverse factors, including marine resources, environmental conditions, and economic foundations.

Financial development is an ongoing process of advancement and enhancement. We define financial development by three key dimensions:

Quantitative changes across various financial institutions primarily reflect FS. Due to the diverse nature of these institutions, we use multiple indicators to measure the scale of the regional financial industry: stock market capitalization (SMC), regional deposit and loan balances (DLB), insurance premium income (IPI), number of regional financial practitioners (RFP), and financial industry added value (FAV). A higher index value indicates a higher level of financial development.

FST represents both the impact of finance on macroeconomic functioning and the alterations within the finance sector. We evaluate FST using the following indicators: financial interrelations Ratio (FIR), Loan-deposit Ratio (LDR), insurance density (ID), and insurance penetration (IP). These metrics provide insights into the optimization of the financial structure and its impact on resource allocation.

FA measures the ease with which individuals and businesses can access financial services. Traditional measures often rely on the developmental stage of inclusive finance, but this approach has limitations in capturing the rapidly evolving landscape of financial services. Our innovative approach focuses on the digital transformation of financial services, which has dramatically increased accessibility.

We construct the FA indicator based on five key aspects of digital financial inclusion: breadth of digital finance coverage (DFC), digital payments (DP), digital investment (DI), digital insurance (DIN), and digital lending (DL) (Guo et al., 2020). These indicators collectively provide a comprehensive picture of how technological advancements are reshaping financial accessibility. By focusing on digital financial services, we capture the transformative impact of fin-tech innovations.

We collect data from China Economic Statistical Yearbook (2011-2020), China Insurance Statistical Yearbook (2011-2020), Statistical Bulletins of National Economy and Social Development issued by various provinces and cities, Institute of Digital Finance, Peking University, and the Wind database. Linear interpolation is used to impute missing data.

For determining the weights of different indicators, we employ the entropy weight approach (Moeinaddini et al., 2010). The entropy technique is widely utilized as the primary objective method for determining the weights of criteria/constructs (Kumar et al., 2017; Teixeira et al., 2021). This objective method enhances the interpretability of results by providing a more objective assessment of data integrity, mitigating the impact of subjective factors that can influence other weighting methods, such as the Delphi method or analytic hierarchy process.

We determine weights for each secondary indicator by applying a standardized treatment using the following formula:

Since the indicators are all positive, , is the original indicator value. Table 1 represents the calculation results.

The final weights assigned to each indicator in our financial development evaluation system are presented in Table 1. Using these weights, we calculated the financial development scores for the 11 coastal provinces and cities of China from 2011 to 2020. The scores were multiplied by 100 to improve readability (Table 2).

This section presents the comprehensive evaluation results of financial development, calculated using the index system introduced in Section 4.2.1 and the entropy weighting method described in Section 4.2.2. The quantified financial development index for the 11 coastal provinces and cities from 2011 to 2020 will serve as our key explanatory variable (FD) in the subsequent empirical analysis.

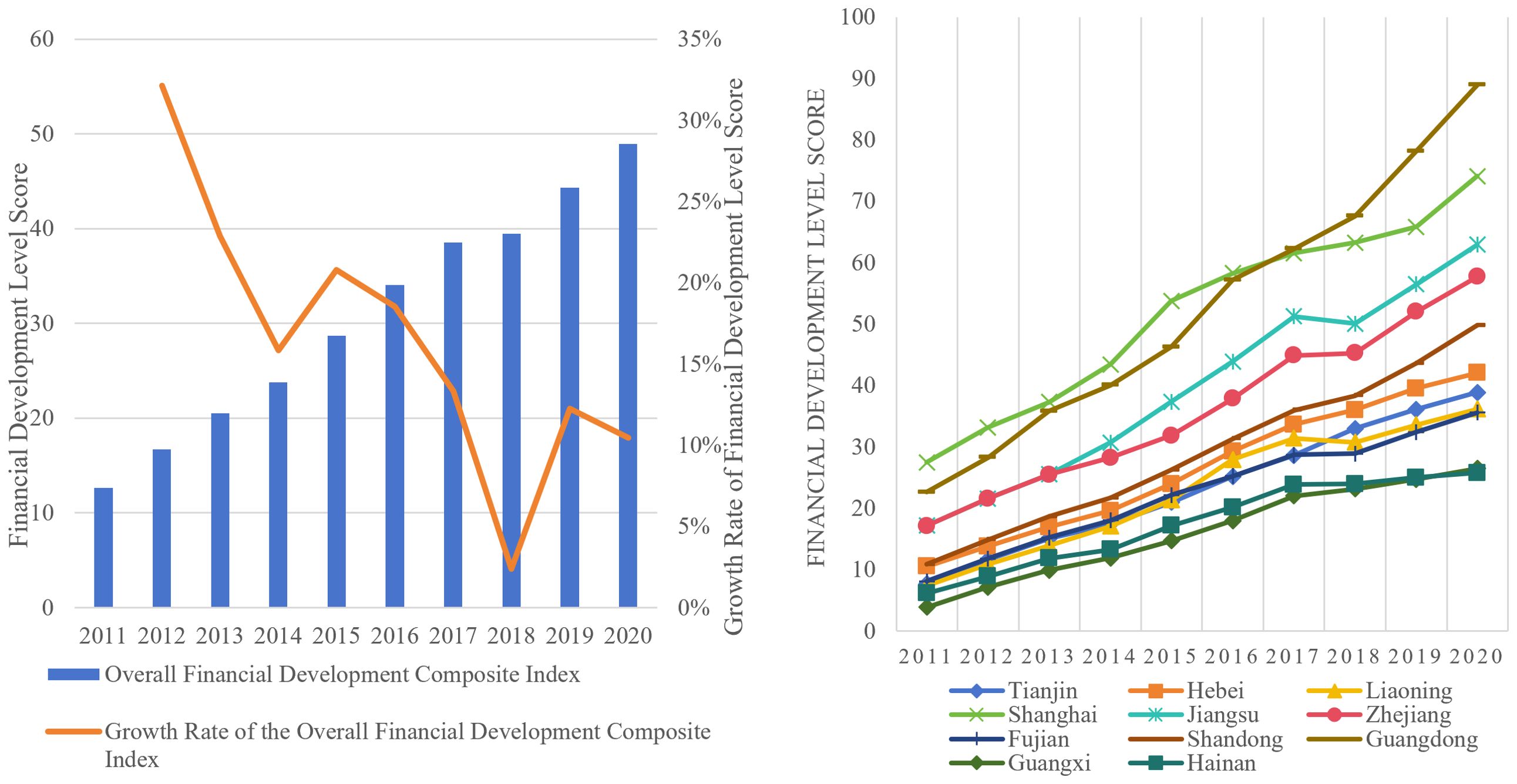

Our analysis reveals several key trends and features in China's coastal financial development (Figure 2A). There is a consistent upward trajectory from 2011 to 2020, reflecting successful financial reforms and increasing sophistication of China's financial markets. The steady growth can be generated by several factors, including the expansion of capital markets, the proliferation of financial products, and the increasing integration of China's financial system with global markets. However, a gradual deceleration in growth rate is observed, suggesting the maturation of the financial sector. A temporary slowdown occurred in 2018, likely due to global economic headwinds, primarily escalating international trade tensions. Despite this challenge, the overall financial development score did not decline, demonstrating the resilience of these financial systems. The rapid recovery and resumed growth post-2018 further demonstrate the adaptive capacity of these financial systems. This bounce-back can be attributed to proactive policy measures, including targeted monetary easing and regulatory support for key financial institutions.

Figure 2. The financial development in coastal regions from 2011 to 2020. Data Source: China Statistical Yearbook. (A) Financial Development: Overall Trend. (B) Financial Development: 11 Coastal Provinces and Cities.

Figure 2B illustrates the evolution of financial development scores for 11 coastal provinces and cities in China from 2011 to 2020. Significant disparities are evident across regions, largely influenced by regional economic development levels. Guangdong Province emerges as a leader in financial development, surpassing even Shanghai and widening the gap between them. Guangdong's financial sector, valued at over one trillion yuan, boasts the highest number of financial institutions in the country. Key financial infrastructures, such as the Shenzhen Stock Exchange and Guangzhou Futures Exchange, have laid a solid foundation for the province's financial advancement. The Greater Bay Area, encompassing Guangdong and Shenzhen, has gained global financial prominence, with these megacities ranking 9th and 25th worldwide as financial centers, respectively.

Jiangsu Province has maintained a steady level of financial development, benefiting from coordinated regional economic growth. As of 2021, Jiangsu and neighboring Zhejiang ranked second and fourth, respectively, in terms of GDP in China. However, their financial development is moderated by Shanghai's emergence as a prominent global financial hub. During the 13th Five-Year Plan period, Jiangsu led in bond issuance by non-financial non-central firms, while Zhejiang saw the second-highest number of newly listed companies.

Shandong Province follows closely, with its financial progress primarily driven by its substantial economic scale. Unlike Shanghai and Guangdong, Shandong's financial development is more directly tied to regional economic growth. In 2021, Shandong's Gross Regional Product ranked third in China, and its growing economy increased financing demand, which in turn drove the development of regional finance.

The remaining six coastal provinces and cities demonstrate weaker financial development compared to the leading regions. Hainan and Guangxi Zhuang Autonomous Region are particularly behind, largely due to their poor economic development and primary industry-dominated industrial structure. Their aggregate gross regional product was less than 25% of Guangdong's in 2021, and primary industries made up over 15% of their economies, second only to Heilongjiang, an agricultural province. This dependency on primary sectors has lowered the demand for sophisticated financial services. Despite being close to Guangdong, these provinces have not profited from financial concentration effects, demonstrating China's coastal areas' complex interaction between geography, economic structure, and financial development.

Assessing high-quality development in the marine economy requires a comprehensive and nuanced approach. While some researchers have employed singular metrics such as marine total factor productivity or the proportion of secondary and tertiary industries, most have opted for a multi-index comprehensive evaluation method. We introduce a comprehensive index system for evaluating the high-quality development of the marine economy that incorporates 20 indicators, combining China's new development concept and synthesizing insights from relative studies (Ding et al., 2021; Wang et al., 2021b; Sun et al., 2023). The index system comprises five key aspects: innovation, coordination, green, openness, and sharing.

The index system consists of three tiers. Target Tier represents the overarching goal - the high-quality development level of the marine economy. Criterion Tier encompasses the five key aspects of development: innovation, coordination, green, openness and sharing. And index tier comprises 15 specific indicators that collectively measure the various facets of high-quality marine economic development.

Innovation is fundamental in addressing the challenge of sustainable development momentum. The traditional resource-driven model of economic growth, relying on unrestricted and massive resource inputs, is unsustainable in the long term (Li et al., 2020b). Thus, innovation should become the primary driver for economic transition and transformation (Guo et al., 2022). In the context of the marine economy, more robust innovation capacity translates to more tremendous development potential, self-sufficiency, and a more favorable position in foreign trade. Recent years have seen increased investment in marine innovation research and development across coastal provinces and cities. To measure the Innovation Level, we employ four tertiary indices: the number of marine science and technology projects (NMSTP), the number of marine research institutes (NMRI), the number of marine researchers (NMR) and the number of marine patents grants (NMPG).

The Coordination Level focuses on addressing imbalanced development within the marine economy. It recognizes that marine economies evolve differently due to varying economic structures and marine resource endowments across provinces and cities. As Yue et al. (2023) note, economic conditions, social development, and environmental preservation all impact high-quality development in diverse ways. We assess the Coordination Level using four indicators: the contribution of the marine economy (CME), the proportion of secondary and tertiary marine industries (PSTMI), the growth rate of gross oceanic product (GRGOP) and the proportion of marine added value (PMAV), CME is the ratio of regional Gross Ocean Product (GOP) to Gross Regional Product (GRP) and PMAV is the Ratio of regional GOP to national GOP.

Green development is crucial for overcoming environmental resource limitations and shifting away from conventional economic growth paradigms. This dimension is particularly relevant for coastal communities facing significant challenges from ocean pollution, which can have substantial consequences for marine-related industries, especially mariculture. Following Ye et al. (2021), we focus on low energy consumption and reduced emissions, using four indicators: the volume of wastewater discharged per ten thousand yuan of GOP (VWG), the coverage rate of marine protected areas (MPA), the volume of wastewater discharged per ten thousand yuan of GDP (VWD) and the proportion of class I-III water quality in rivers discharging into the sea (CQW). MPA is the area of marine protected areas per kilometer of coastline.

Openness is a prerequisite for achieving both external and internal connectivity in the marine economy. It reflects a region's engagement in international trade and the global division of labor. China's eastern coastal region serves as the frontier of the country's opening up, with maritime tourism and marine transportation being particularly influenced by the degree of openness.

We evaluate the Openness Level using four indicators: the number of port berths (NPB), marine cargo transshipment volume (MCT), marine passenger turnover (MPT) and foreign trade contribution rate (FTC). FTC is the Ratio of the total volume of trade in goods to GRP.

The level of Sharing ensures that the benefits of marine economic development are distributed to citizens. As China's marine economy emerges as a potential economic growth pole, it should contribute to improving coastal residents' incomes, employment opportunities, and regional economic development. We measure the Sharing Level using four indicators: GOP per capita in coastal areas (GPC), the number of travel agencies per ten thousand people in coastal areas (TAP), the number of marine employment (NME) and rural-urban income ratio (RUIR).

The final comprehensive indicator system is illustrated in Table 3. To calculate the weighting of these indicators, we employ the entropy method. The final results for the marine economic high-quality development from 2011-2020 are calculated, scaled up by a factor of 100, and presented in Table 4.

Table 4. Scores of high-quality marine economic development for 11 coastal provinces and cites from 2011 to 2020.

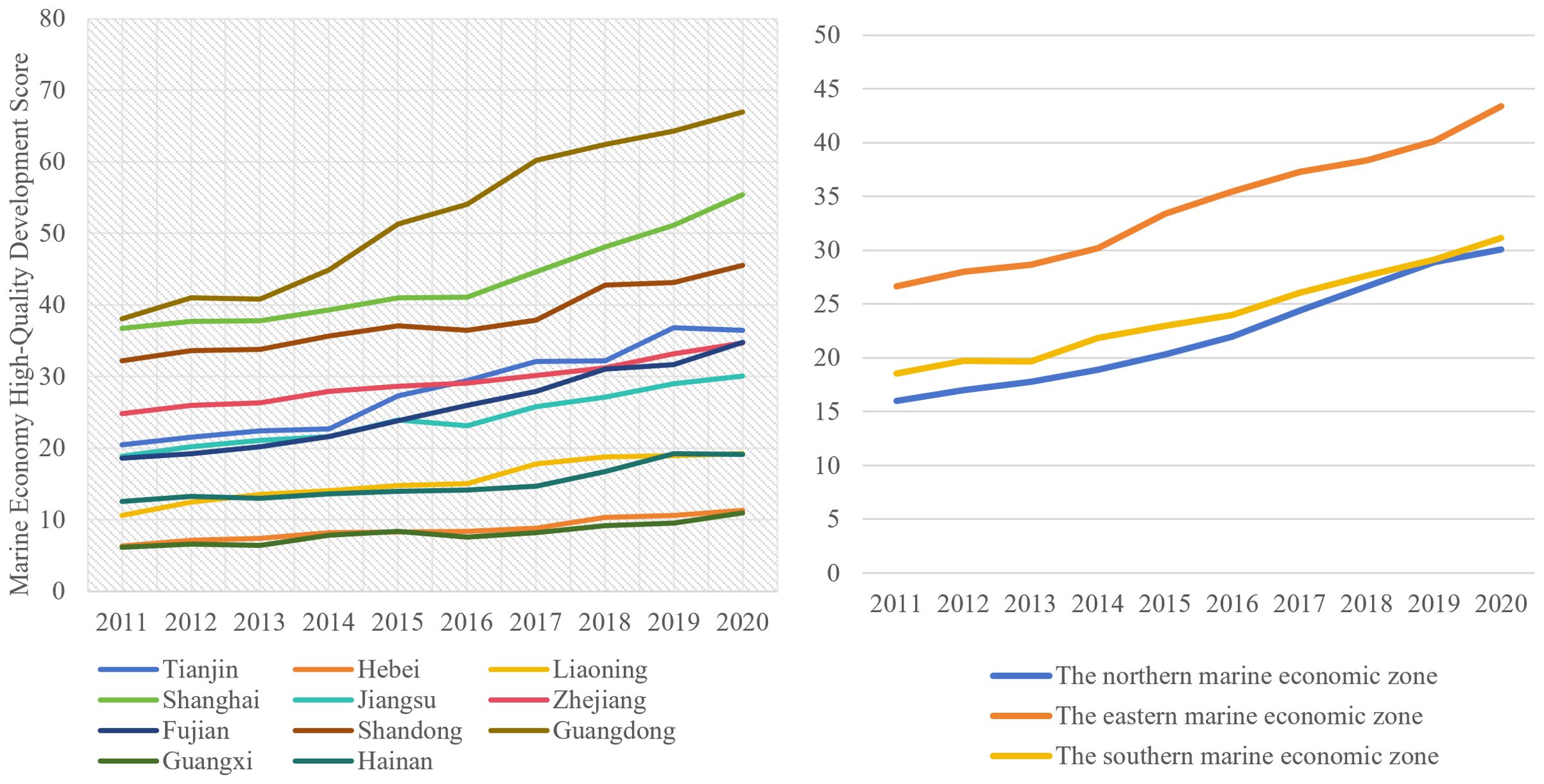

The analysis of high-quality development in China's marine economy from 2011 to 2020 reveals a complex landscape of regional progress and disparities. As illustrated in Figure 3A, across all coastal provinces, there is a consistent trend of improvement, though the pace and extent of development vary significantly.

Figure 3. The marine economy high-quality development in coastal regions from 2011 to 2020. Data Source: China Statistical Yearbook. (A) High-Quality Development: 11 Coastal Provinces and Cites. (B) High-Quality Development: Three Major Marine Regions.

Guangdong Province and Shanghai have emerged as clear frontrunners, demonstrating remarkable progress in their marine economic development scores. Their success can be attributed to the early adoption of pilot initiatives, well-established coastal tourism, and emphasis on scientific and technical components.

Another group of regions making strides in marine economic growth includes Shandong, Tianjin, Jiangsu, Zhejiang, and Fujian provinces. While these regions have shown significant growth, they face unique challenges. Shandong Province, for instance, has experienced a slowdown in recent years, resulting in a widening gap with Shanghai. Tianjin, on the other hand, has consistently shown growth, with its marine sector's gross domestic product (GDP) rising by more than 80%, driven by investments in offshore oil and gas, seawater desalination, and marine ship manufacturing.

In contrast, provinces such as Hainan, Liaoning, Hebei, and Guangxi lag in terms of high-quality marine economic development. Hainan Province, despite its significant reliance on the marine economy, faces challenges due to the limited size of its marine economic sector. These regions require increased attention and resources to stimulate and develop their marine economic sectors, highlighting the need for targeted policies and investments.

Figure 3B examines the high-quality development scores of China's three major marine economic zones. The eastern zone, with Shanghai as the core, consistently outperforms the northern and southern zones, exerting influence on Jiangsu and Zhejiang provinces. This configuration represents the most balanced development model among the three marine economic zones.

Figure 4 provides a more detailed view of the development levels of the marine economy across the 11 coastal provinces in 2020. The northern marine economic zone and the southern marine economic zone present a more complex picture. Since 2011, the northern economic zone has been steadily closing the gap with the southern economic zone. However, significant intra-regional disparities persist, particularly in the south zone, where Guangdong and Fujian propel development, while Guangxi and Hainan lag.

These findings underscore the need for tailored strategies to address regional imbalance and promote balanced, high-quality growth in China's marine economy sector. Future policies and initiatives should leverage the strengths of leading regions while providing targeted support to those lagging, ensuring a more equitable and sustainable development of China's marine economy as a whole.

To examine the impact of financial development on the high-quality growth of the marine economy, we propose the following model.

In this model, ME denotes the score of the marine economic high-quality development, which we calculated in Section 4.3.3; FD is the financial development score calculated in Section 4.2.3, which is based on the index system and weighting method described in Sections 4.2.1 and 4.2.2; RD, DPI, Lnop, and Fis serve as control variables. The index i corresponds to the province, t denotes the year, and is the error term, assumed to follow a normal distribution .

The financial development index (FD) serves as our key explanatory variable, hypothesized to influence the high-quality development of the marine economy (ME). Drawing from recent literature on coastal management and marine economics (Jiang et al., 2014; Sun et al., 2018; Gai et al., 2022) and potential impact on marine economic development, we identify four control variables: marine research investment (RD), per capita disposable income (DPI), level of international openness (Lnop), and financial support (Fis). Table 5 represents the explanation of the variables in the model (2) and their literature supports.

Table 6 shows the descriptive statistics of the variables. Most indicators exhibit positive skewness, suggesting a predominantly right-skewed distribution. The Jarque-Bera (JB) statistics indicate non-normal distributions for all variables. To ensure data reliability, we conduct unit root tests using LLC and ADF-Fisher methods. All variables pass both tests at the 1% significance level, confirming stationarity and mitigating spurious regression concerns (Table A1).

Pearson correlation coefficients in Table 7 demonstrate positive correlations between the high-quality development score of the marine economy (ME) and all other variables, significant at the 1% level. These findings suggest that all variables are positively associated with marine economy development. A Hausman test results in Table A2 fail to accept the null hypothesis at the 1% significance level, supporting the fixed effects model's suitability for our analysis.

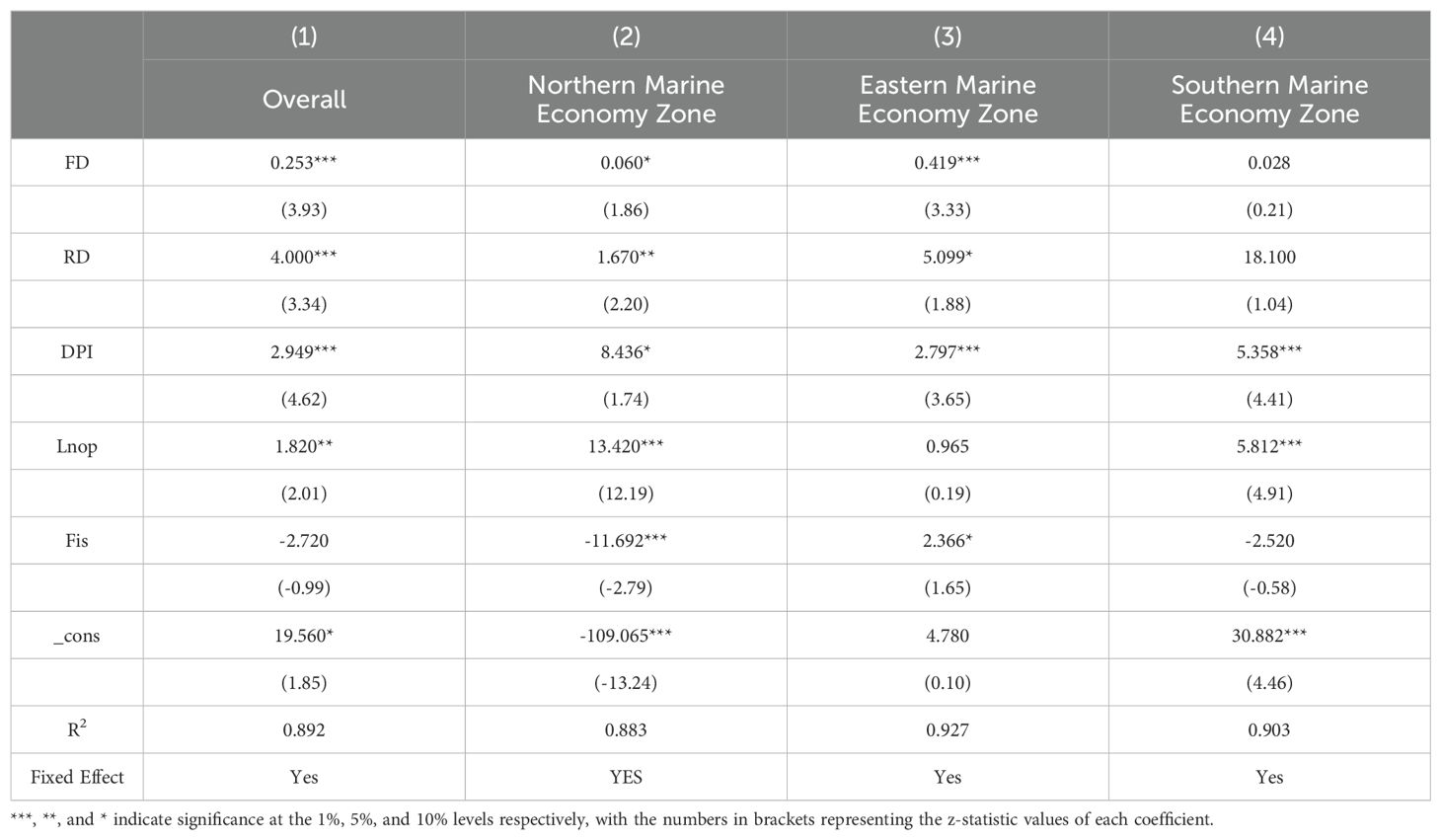

The regression outcomes in Table 8 reveal that financial development has a significant positive impact on the high-quality development of the marine economy. A 1% increase in financial development corresponds to a 0.253% growth in marine economy development quality (significant at a 1% level). The financial industry primarily supports marine economic growth by providing insurance and other financial instruments. The expansion of the insurance industry reduces business risks and contributes to the productive capacity of ocean-related firms. Additionally, advancements in financial development have facilitated the introduction of a wide range of financial derivatives for hedging risks, providing ocean-related enterprises with more hedging options and further enhancing their risk management capabilities, thereby supporting the steady growth of the marine economy. These findings provide initial support for H1, suggesting that financial development contributes to the high-quality growth of the marine economy by enhancing its resilience to various risks through the expansion and diversification of insurance and other financial products. The varying coefficients across different marine subsectors also lend support to H3, indicating that financial development influences the upgrading of the marine industrial structure. Among the control variables, scientific research investment, per capita disposable income, and openness positively contribute to the high-quality development of the marine economy. Notably, scientific research investment shows the most significant impact. The impact of local financial expenditure is less apparent, possibly due to insufficient allocation or resource diversion.

Table 8. Baseline model regression results for influence of financial development on marine economy high-quality development.

Regional variations are evident. The Eastern Marine Economic Zone demonstrates the most pronounced effect. These provinces offer a wide range of financial services for ocean-related firms, making it easier and more diverse for them to acquire financial support. In contrast, the Northern and Southern Marine Economic Zone, which include provinces with comparatively low financial development levels, show a limited influence on the high-quality development of the marine economy.

In the Northern Marine Economic Zone, openness significantly contributes to the advancement of high-quality development in the marine economy. Several large coastal ports make this zone a hub for international marine interaction. However, fiscal expenditure in this region may hinder high-quality marine sector growth by focusing on non-marine industries.

In the Eastern Marine Economic Zone, per capita disposable income plays a significant role in promoting high-quality development. The most economically advanced provinces and cities in China have the largest per capita disposable income, which corresponds to regional financial development levels. Thus, these regions' financial industries contribute more to the marine economy.

The Southern Marine Economic Zone shows substantial impacts from both per capita disposable income and the level of external development. This zone has remarkable ports, including Xiamen, Shenzhen, Guangzhou, and Beibu Gulf and has advanced worldwide trade. Residents' disposable money in this region supports high-quality marine economy growth by buying ocean-related services.

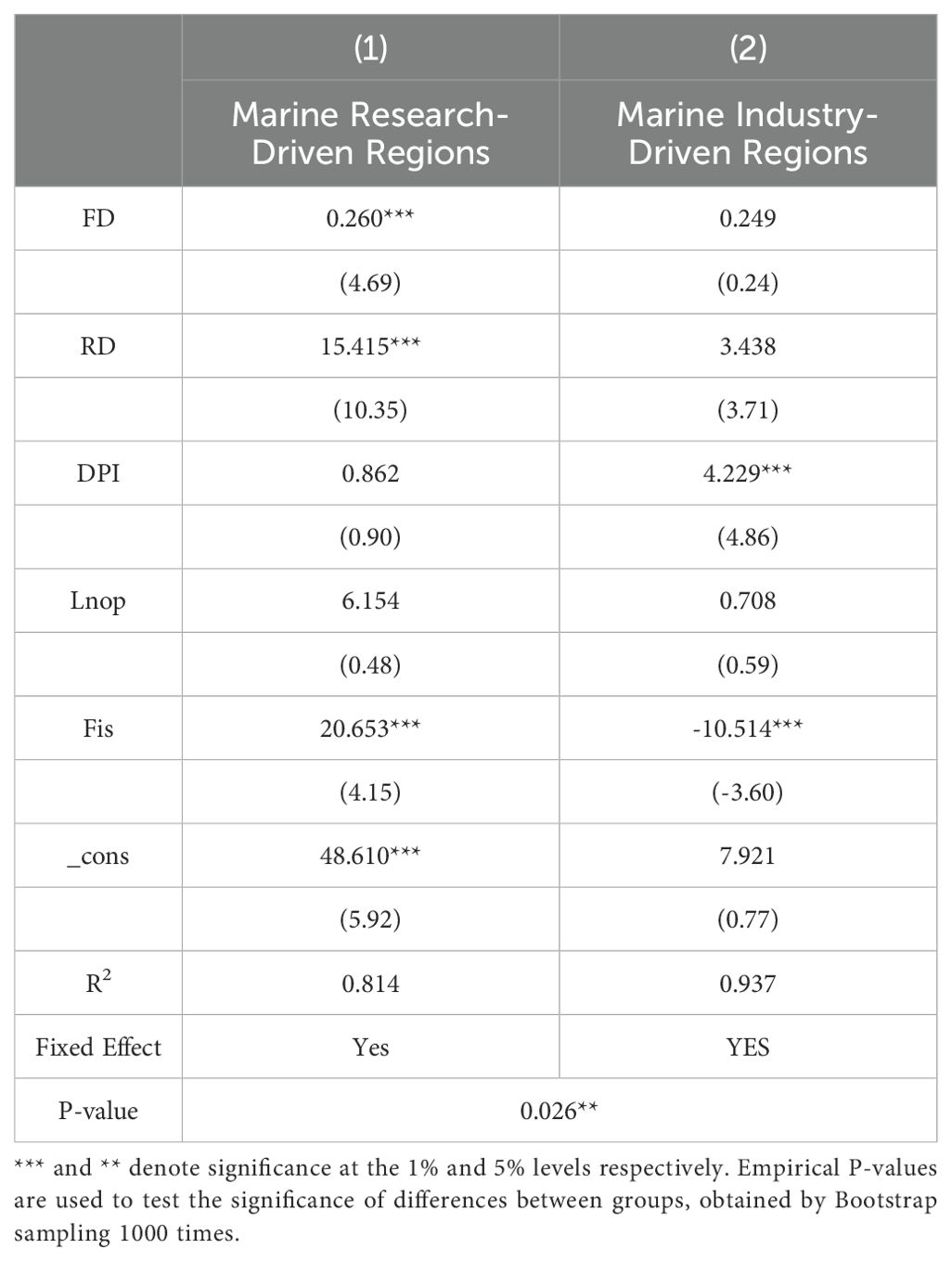

To explore potential heterogeneity in the effect of financial development on marine economic growth, we conducted a group analysis based on the proportion of marine scientific research and education management services in each province as of 2019. Provinces with a proportion exceeding 25.8% were classified as marine research and education promotion regions (Shanghai, Zhejiang, Guangdong, and Hainan). At the same time, those below this threshold were sorted as marine industry promotion regions (Liaoning, Tianjin, Hebei, Shandong, Jiangsu, Fujian, and Guangxi). This classification allowed us to investigate whether the nature of marine economic activities influences the relationship between financial development and economic growth.

The regression results in Table 9 reveal a striking contrast between the two groups. In marine research-driven regions, financial development exhibits a significant positive impact on the high-quality growth of the marine economy. This effect may be attributed to the higher investment in scientific research and innovation in these provinces, leading to a higher demand for specialized financial products such as venture capital funds and blue bonds. Moreover, the advanced financial industry in these regions facilitates more straightforward access to financing, further stimulating demand for such services.

Table 9. Regional hierarchical regression results for influence of financial development on marine economy high-quality development.

In contrast, in marine industry-driven regions, the effect of financial development on marine economic growth is statistically insignificant. This disparity suggests that areas with a dominant marine industry tend to allocate a more significant portion of funds towards production expansion rather than scientific research. The enterprises in these areas rely more heavily on their capital and traditional external financing, reducing their dependence on innovative financial services.

The impact of research and development (R&D) investment also differs between the two groups. In marine research-driven regions, R&D investment has a clear positive effect on the high-quality growth of the marine economy. However, this effect is not apparent in marine industry-driven regions. This finding underscores the importance of R&D in driving innovation and growth in research-intensive marine economies.

Interestingly, per capita disposable income shows a more significant impact on fostering high-quality growth in marine industry-driven regions. This aligns with the higher demand for social capital in these areas compared to research-driven regions, suggesting that consumer spending plays a crucial role in supporting marine industry growth.

The degree of external openness has a negligible impact on fostering high-quality growth in both regions. Financial expenditure, however, demonstrates divergent effects: it positively influences high-quality growth in research-driven regions but negatively impacts industry-driven regions. This discrepancy may be due to the allocation of financial resources primarily towards scientific research and innovation, potentially leaving industries with lower research investment underserved in industry-driven regions.

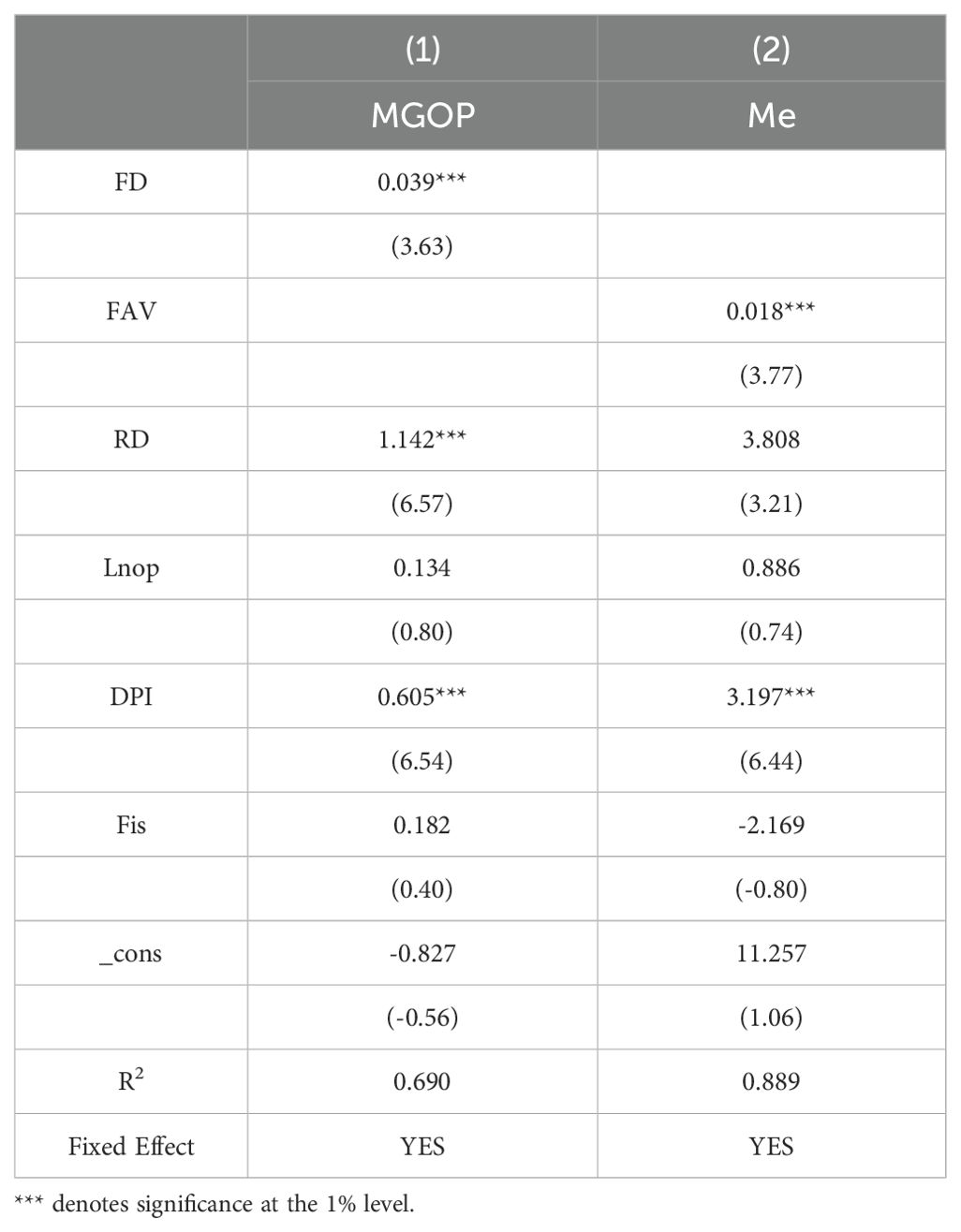

To validate our findings, we conducted a robustness test using an alternative variable method which ensures the stability of results across different key variables. This method is suitable for testing findings using traditional measures of economic output and financial development. It addresses concerns about the specificity of the constructed indices by using widely recognized economic indicators, demonstrating that the findings are not artifacts of the index construction methodology. We replaced the high-quality development level of the marine economy with per capita Marine GDP (MGDP) as the dependent variable. Additionally, we substituted the score of financial development level with the added value of the financial industry (FI) as an alternative measure of financial development. The model selection process and regression method remained consistent with the benchmark regression.

The robustness tests presented in Table A3 corroborate our initial conclusions. We observe a significant positive relationship between the level of financial development and marine economic growth, as measured by Marine GDP. This result aligns with our previous findings and underscores the direct impact of financial development on financing opportunities for marine-related industries.

As financial development improves, marine enterprises benefit from increased financial backing and access to diverse financing options, facilitating their growth and expansion. The test also revealed that a 1% increase in the added value of the financial industry leads to a 0.018% increase in the high-quality development level of the marine economy. While positive, this impact appears less pronounced compared to the effect of the overall financial development level.

These results suggest that while the growth of the pure financial industry positively influences the high-quality development of the marine economy, the broader measure of financial development, which encompasses various aspects of the financial system, has a more substantial impact. This finding highlights the importance of comprehensive financial development strategies that go beyond just expanding the financial sector.

The consistency of these findings across different variable specifications lends credibility to our initial results and strengthens our overall conclusions. These robust findings have important implications for policymakers and stakeholders in the marine economy. They suggest that efforts to enhance financial development, particularly those tailored to marine-related industries, can yield substantial benefits for marine economic growth. Furthermore, the results underscore the importance of adopting a holistic approach to financial development that considers not only the size of the financial sector but also its efficiency, accessibility, and alignment with the specific needs of the marine economy.

To deepen our understanding of the mechanisms through which financial development influences the high-quality growth of the marine economy, we conducted a mediation effects analysis. This analysis focuses on two potential mediating variables: marine innovation output and the upgrading of marine industrial structure. We use the proportion of marine scientific research output in the added value of marine and related industries (Pso) and the marine industrial structure upgrading index (Str) as our mediating variables. The specific form of the intermediary models is described as follows:

where and represent high-quality marine economic development, financial development, and control variables, respectively, for province i in year t. The results of the mediation effect are shown in Table 10.

The baseline model in column (1) confirms a significant positive effect of financial development on marine economic development (β = 0.253, p < 0.01). Also, financial development significantly promotes innovation (δ = 0.201, p < 0.01) and industrial upgrading (δ' = 0.341, p < 0.05). Both mediators contribute positively to marine economic development, with innovation showing a stronger effect (θ = 0.133, p < 0.05) compared to industrial upgrading (θ' = 0.045, p < 0.1).

The observed positive relationship between financial development and marine-related R&D expenditure or patents supports H2, confirming that financial development stimulates innovation in marine science and technology. We can draw this conclusion by examining the coefficients and significance levels in Model (5). The positive and significant coefficient of FD on Pso (δ = 0.201, p < 0.01) shows that financial development promotes marine innovation. The positive and significant coefficient of Pso on ME (θ = 0.133, p < 0.05) demonstrates that this innovation contributes to marine economic development. The indirect effect of financial development through innovation can be calculated as the product of these two coefficients (0.201 * 0.133 = 0.0267), which represents 10.57% of the total effect. This substantial mediation effect provides strong support for H2.

The second mediator, marine industrial structure upgrading (STR), demonstrates a notable positive correlation between financial development and industrial upgrading (δ' = 0.341, p < 0.05) in column (4). This suggests that financial development is essential in facilitating the transition of marine sectors. H3 indicates that financial development has a favorable impact on the upgrading of the marine industrial structure, leading to an enhancement in the quality of high-level development in the marine economy. The results of column (5) indicate that industrial structure upgrading has a positive impact on marine economic development (θ' = 0.045, p < 0.1), thus providing support for H3, albeit with a smaller coefficient compared to innovation output.

Calculating indirect effects, we find that marine innovation output mediates 10.57% of the total effect of financial development on marine economic growth, while industrial structure upgrading mediates 6.13%. These findings suggest that financial development's impact on marine economic growth is more strongly channeled through innovation rather than structural changes.

Financial development has a sustained direct effect after accounting for these mediators, suggesting further avenues of influence, such as risk management or market efficiency. These results emphasize the need for comprehensive financial policies that boost financial development, maritime innovation, and coastal industrial transformation.

To further validate our findings, we employed the Bootstrap method (Tables A4-A5). The results confirm the mediating roles of both marine innovation output (indirect effect: 0.349 [0.119, 0.632]) and industrial structure upgrading (0.272 [0.044, 0.517]). The significant indirect effects coupled with non-significant direct effects suggest that these two mediating variables do play a mediating utility between financial development and the level of high-quality development of the marine economy.

These results suggest that financial development significantly promotes marine economic growth, with innovation acting as a stronger mediator and industrial structure upgrading facilitating resource reallocation across marine industries. It emphasizes the need for comprehensive financial policies targeting marine innovation and industrial transformation in coastal regions, primarily through enhanced innovation capabilities and improved industrial structures.

Marine capital investment plays a crucial role in expanding maritime enterprises, potentially amplifying the impact of financial development on marine economic growth. Due to limitations in provincial and municipal data on marine capital investment, we use marine fixed asset investments from 11 provinces and cities (2011-2020) as a proxy, calculated by multiplying social fixed asset investment with the proportion of Gross Ocean Product (GOP) to national GDP. To construct the moderation effect model, we log-transform the data, where represents the logarithm of marine fixed asset investment for province in year. Other variables retain their previously defined meanings. The moderation effect model is constructed as follows:

where denotes the logarithm of marine fixed asset investment for province i in year t.

Table 11 presents the results of our moderation analysis. Notably, the interaction term between financial development and marine capital investment shows a positive correlation at the 5% significance level. The observed positive relationship between financial development and fixed asset investment in the marine sector provides strong support for H4, confirming that financial development promotes capital accumulation in the marine economy. Financial development (FD), marine capital investment (Lninv), and their interaction (Lninv * FD) all exhibit positive and significant effects. Control variables such as R&D investment (RD), economic openness (Lnop), and income level (DPI) show positive impacts, while fiscal decentralization (Fis) demonstrates a negative effect.

This synergistic effect can be attributed to several mechanisms. Firstly, increased marine capital investment expands the pool of available funds for sea-related financial products, facilitating the growth of marine finance and enhancing the financial sector’s capacity to support marine enterprises. Secondly, growth in marine capital investment leads to an expansion in the operational scale of ocean-related enterprises, increasing the overall size of the marine economy and boosting demand for financial services. Furthermore, marine capital investment helps ocean-related enterprises by broadening their financing channels and reducing both financing thresholds and costs when accessing financial services.

The positive interaction between financial development and marine capital investment creates a conducive environment for high-quality growth in the marine economy. It strengthens the financial sector's capacity to support marine industries and enhances the ability of marine enterprises to utilize financial services effectively. This symbiotic relationship between financial development and marine capital investment ultimately drives sustainable economic growth in China's marine sector.

Our empirical analysis provides strong evidence for the significant role of financial development in promoting high-quality growth in China's marine economy. This section compares and contrasts our key findings with recent literature.

Firstly, our results demonstrate that financial development positively influences the high-quality growth of the marine economy by enhancing its resilience to risks through expanded financial products. This finding aligns with Su et al. (2021), who found that financial development significantly promotes marine economic growth in China's coastal areas. However, while Su et al. (2021) focused on the overall impact, our study extends this understanding by identifying specific mechanisms, particularly the role of insurance and financial derivatives in risk management.

Secondly, we found that financial development stimulates innovation in marine science and technology, acting as a stronger mediator than industrial structure upgrading. This result partially contrasts with Gao et al. (2022), who emphasized the importance of technological innovation in marine economic growth. While our study acknowledges the role of industrial upgrading, we found innovation to be a more potent channel for financial development to influence marine economic growth.

Thirdly, our analysis reveals that financial development facilitates the upgrading of the marine industrial structure, albeit with a smaller effect compared to innovation. This finding supports, but also refines, the work of Wang and Yang (2022), who identified industrial structure as a key factor in marine economic efficiency. Our results suggest that while industrial upgrading is important, it may not be the primary channel through which financial development promotes high-quality marine economic growth.

Lastly, we found that financial development promotes capital accumulation in the marine sector, with this effect being moderated by the level of marine capital investment. This interaction effect aligns with the findings of Sumaila et al. (2021) and Wang et al. (2023), who highlighted the importance of capital investment in marine economic development. However, our study extends this understanding by explicitly linking capital accumulation to financial development and quantifying their interactive effect.

This study aimed to investigate the relationship between financial development and high-quality growth in China's marine economy, focusing on how financial development influences the quality of marine economic growth and how this influence operates. We developed a comprehensive index system for measuring both financial development and high-quality development of the marine economy, analyzing data from 11 coastal provinces and cities from 2011 to 2020. Our analysis yielded several key findings:

(1). Financial development significantly promotes the high-quality progress of China's marine sector. This influence varies among different marine economic zones. The Eastern Marine Economic Zone demonstrates the strongest effect, followed by the Northern Marine Economic Zone, while the Southern Marine Economic Zone shows the weakest effect.

(2). We identified two key mediating factors: marine scientific research and the upgrading of marine industrial structure. Marine scientific research demonstrated a strong intermediary effect, suggesting that financial development significantly boosts marine economy quality by promoting innovation and research activities. The upgrading of marine industrial structure also serves as a mediator, albeit with a lesser effect.

(3). Marine capital investment positively moderates the link between financial development and marine economic growth, indicating that increased capital investment can amplify how financial development positively affects the marine economy.

(4). Other significant factors influencing the marine economic high-quality development include scientific research investment intensity, degree of economic openness, and per capita disposable income. Local financial expenditure showed a slight inhibitory effect, possibly due to inadequate local financial investment in the marine sector or allocation of financial resources to other industries.

(5). Provinces with a larger share of marine research and education services experienced a stronger influence of financial development on high-quality growth in the marine economy.

This research contributes to the existing literature by providing a focused analysis of China's marine sector, incorporating a multi-dimensional index system for measuring high-quality development. Our approach offers insights specific to coastal economic development, challenges one-size-fits-all models, and provides a more nuanced understanding of how financial development translates into high-quality marine economic growth.

Based on our findings, we propose several policy implications:

Given the strong influence of financial development on marine economic growth, policymakers should develop targeted financial policies, particularly in the Eastern Marine Economic Zone. These policies could include the establishment of specialized marine finance institutions or the creation of financial products tailored to the needs of marine industries.

Investment in scientific research in the Eastern Maritime Economic Zone is an important contribution to increasing the level of high value-added growth in the maritime economy. The important catalytic role of marine scientific research emphasizes the importance of increased investment in marine research and education. The establishment of marine high-tech zones and the prioritization of marine specializations in coastal universities can improve the quality of the marine workforce and promote innovation in the field.

Policies should be tailored to address regional disparities, enhancing financial development and its impact in the Southern Marine Economic Zone while enhancing the financial development of the Southern Marine Economic Zone and its impact.

Given its positive moderating effect, policies should be implemented to attract and facilitate marine capital investment, such as creating a favorable investment environment, offering incentives for marine industry investments, and developing diverse financing tools for marine sectors. It is imperative to use the benefits of exceptional ports fully, establish a network of ports around the Bohai Sea, focus on attracting FDI, and execute the revitalization of the Northern Marine Economic Zone in Bohai Bay.

The structure of the maritime industry needs to be optimized, with an emphasis on new maritime industries such as marine biomedicine, marine power, and the marine chemical industry. Special funds and preferential loan rates could guide capital flow to these high-R&D industries.

Sustainable development practices should be integrated into marine economic policies, especially in regions with high levels of marine sewage discharge, such as increasing investment in marine environmental governance and promoting energy conservation and emission reduction in marine industries.

The Southern Marine Economic Zone has noticeably increased due to the promotion of opening up to the global market. Given the positive impact of economic openness, policies should continue to promote international cooperation and openness in the marine economy sector.

Although this study provides valuable information, it has limitations that pave the way for future research. Future studies could expand the scope both geographically and temporally to enhance the generalizability of findings. A deeper exploration of unexplored mechanisms through which the financial industry influences real economic growth is needed. Investigating the long-term environmental impacts of financial development-driven marine economic growth, conducting comparative studies with other coastal nations, and exploring the potential of fin-tech and green finance in promoting sustainable marine economic development could offer new perspectives for policymakers and industry stakeholders, further contributing to our understanding of the complex dynamics driving high-quality growth in marine economies.

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

ZM: Conceptualization, Funding acquisition, Supervision, Writing – review & editing, Investigation. MP: Data curation, Formal Analysis, Methodology, Writing – original draft. DZ: Methodology, Writing – original draft. WC: Writing – original draft, Methodology, Formal analysis.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Social Science Foundation of China (NO.19BJY151).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fmars.2024.1463843/full#supplementary-material

Acheampong A. O. (2019). Modelling for insight: Does financial development improve environmental quality? Energy Econ. 83, 156–179. doi: 10.1016/j.eneco.2019.06.025

An H., Li J. (2020). Financial support for marine economic development and industrial structure optimization. J. Coast. Res. 110, 171–174. doi: 10.2112/JCR-SI110-041.1

Beck T., Levine R., Loayza N. (2000). Finance and the sources of growth. J. Financ. Econ. 58, 261–300. doi: 10.1016/S0304-405X(00)00072-6

Chen X., Yu Z., Liang C., Di Q. (2024). Where is the path to sustainable marine development? Evaluation and empirical analysis of the synergy between marine carrying capacity and marine economy high-quality development. Water 16, 394. doi: 10.3390/w16030394

Cisneros-Montemayor A. M., Moreno-Báez M., Reygondeau G., Cheung W. W. L., Crosman K. M., González-Espinosa P. C., et al. (2021). Enabling conditions for an equitable and sustainable blue economy. Nature 591, 396–401. doi: 10.1038/s41586-021-03327-3

Colgan C. S. (2013). The ocean economy of the United States: Measurement, distribution, & trends. Ocean Coast. Manage. 71, 334–343. doi: 10.1016/j.ocecoaman.2012.08.018

Ding L., Yang Y., Li H. (2021). Bidirectional evaluation and difference of high-quality development level of regional marine economy. Econ Geogr. 41, 31–39. doi: 10.15957/j.cnki.jjdl.2021.07.004

Engerman S. L., McKinnon R. I. (1974). Money and capital in economic development. J. Money Credit Bank. 6, 271. doi: 10.2307/1991031

Esteban M. D., Diez J. J., López J. S., Negro V. (2011). Why offshore wind energy? Renew. Energy 36, 444–450. doi: 10.1016/j.renene.2010.07.009

European Commission (2019). The EU blue economy report 2019 (Publications Office of the European Union). Available online at: https://data.europa.eu/doi/10.2771/21854 (Accessed June 24, 2024).

Feng M., Guan H., Wang Y., Liu Y. (2024). Research on the impact mechanism of scientific and technological innovation on the high-quality development of the marine economy. Front. Mar. Sci. 11. doi: 10.3389/fmars.2024.1341063

Gai M., He Y., Ke L. (2022). Research on the development quality of China’s marine economy. J. Nat. Resour. 37, 942–965. doi: 10.31497/zrzyxb.20220408

Gao P. (2020). The financial support for the development of marine economy. J. Coast. Res. 107, 169–172. doi: 10.2112/JCR-SI107-043.1

Gao S., Sun H., Wang J., Liu W. (2022). Evaluation and countermeasures of high-quality development of China’s marine economy based on PSO-SVM. Sustainability 14, 10749. doi: 10.3390/su141710749

Goldsmith R. W. (1969).Financial structure and development. In: No Title. Available online at: https://cir.nii.ac.jp/crid/1130000796185314688 (Accessed June 22, 2024).

Guo F., Ji. W., Wang F., Kong T., Zhang X., Cheng Z. (2020). Measuring China’s digital financial inclusion: index compilation and spatial characteristics. China Econ. Q. 19, 1401–1418. doi: 10.13821/j.cnki.ceq.2020.03.12

Guo J., Yuan X., Song W. (2022). Driving forces on the development of China’s marine economy: Efficiency and spatial perspective. Ocean Coast. Manage. 224, 106192. doi: 10.1016/j.ocecoaman.2022.106192

Han D., Cao Z. (2024). An evaluation and difference analysis of the high-quality development of China’s marine economy. Sustainability 16, 469. doi: 10.3390/su16010469

Hoegh-Guldberg O., Caldeira K., Chopin T., Gaines S., Haugan P., Hemer M., et al. (2023). “The ocean as a solution to climate change: five opportunities for action,” in The Blue Compendium: From Knowledge to Action for a Sustainable Ocean Economy. Eds. Lubchenco J., Haugan P. M. (Springer International Publishing, Cham), 619–680. doi: 10.1007/978-3-031-16277-0_17

Hung N. T. (2023). Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. Technol. Forecast. Soc Change 186, 122185. doi: 10.1016/j.techfore.2022.122185

Jiang X.-Z., Liu T.-Y., Su C.-W. (2014). China׳s marine economy and regional development. Mar. Policy 50, 227–237. doi: 10.1016/j.marpol.2014.06.008

Kaye Nijaki L., Worrel G. (2012). Procurement for sustainable local economic development. Int. J. Public Sect. Manage. 25, 133–153. doi: 10.1108/09513551211223785

Kumar R., Bilga P. S., Singh S. (2017). Multi objective optimization using different methods of assigning weights to energy consumption responses, surface roughness and material removal rate during rough turning operation. J. Clean. Prod. 164, 45–57. doi: 10.1016/j.jclepro.2017.06.077

Lau L.-S., Choong C.-K., Eng Y.-K. (2014). Carbon dioxide emission, institutional quality, and economic growth: Empirical evidence in Malaysia. Renew. Energy 68, 276–281. doi: 10.1016/j.renene.2014.02.013

Levine R. (1997). Financial development and economic growth: views and agenda. J. Econ. Lit. 35, 688–726.

Levine R. (2005). “Chapter 12 finance and growth: theory and evidence,” in Handbook of Economic Growth. Eds. Aghion P., Durlauf S. N. (North Holland: Elsevier), 865–934. doi: 10.1016/S1574-0684(05)01012-9

Levine R., Beck T. (1999). A New Database on Financial Development and Structure (Washington D.C.: The World Bank). doi: 10.1596/1813-9450-2146

Li B., Tian C., Shi Z., Han Z. (2020a). Evolution and differentiation of high-quality development of marine economy: A case study from China. Complexity 2020, e5624961. doi: 10.1155/2020/5624961

Li D., Wei Y. D., Miao C., Chen W. (2020b). Innovation, innovation policies, and regional development in China. Geogr. Rev. 110, 505–535. doi: 10.1080/00167428.2019.1684194

Li X., Zhou S., Yin K., Liu H. (2021). Measurement of the high-quality development level of China’s marine economy. Mar. Econ. Manage. 4, 23–41. doi: 10.1108/MAEM-10-2020-0004

Liu B., Xu M., Wang J., Xie S. (2017). Regional disparities in China’s marine economy. Mar. Policy 82, 1–7. doi: 10.1016/j.marpol.2017.04.015

Liu P., Zhu B., Yang M. (2021). Has marine technology innovation promoted the high-quality development of the marine economy? ——Evidence from coastal regions in China. Ocean Coast. Manage. 209, 105695. doi: 10.1016/j.ocecoaman.2021.105695

Liu Y., Han L., Pei Z., Jiang Y. (2023). Evolution of the coupling coordination between the marine economy and urban resilience of major coastal cities in China. Mar. Policy 148, 105456. doi: 10.1016/j.marpol.2022.105456

Lubchenco J., Gaines S. D. (2019). A new narrative for the ocean. Science 364, 911–911. doi: 10.1126/science.aay2241