- School of Economics and Management, Zhejiang Ocean University, Zhoushan, China

Marine carbon sink projects are important carriers for the development and utilization of marine carbon sink resources. The risk factors existing in the development process of marine carbon sink projects will significantly affect the behavior of the project subject, and then affect whether or not the project development can be conducted smoothly. Based on the evolutionary game method, this paper analyzes the behavior choice of each project subject under the risk condition, and explores the influencing factors that promote the change of its action probability. The results show the following: (1) Government subsidies can promote the development of marine carbon sink projects, but when the subsidies are too large, the government’s willingness decreases, which may lead to significant changes in the decisions of relevant practitioners. (2) The government pays more attention to image improvement, is not sensitive to risks, and always chooses active subsidies. In the case that the risk poses a great threat to the project, the behavior strategies of the relevant practitioners and investors will influence each other, and both sides will determine the behavior strategies that can obtain more returns according to the other side’s behavior decision. (3) The behavior of relevant practitioners and investors has an impact on the strategy of the demander. When the risk increases, the former has a greater impact on the demander’s choice not to buy marine carbon sink. Relevant policy suggestions are put forward: (1) the government should flexibly adjust the subsidy mechanism; (2) the government should enhance the influence and popularity of marine carbon sink projects; and (3) the government should reduce the risks faced by the practitioners.

1 Introduction

Rapid economic development has caused excessive emissions of greenhouse gases such as carbon dioxide. As the increasingly severe global warming situation becomes worse, countries have put forward their own targets of carbon neutral carbon peak (Li X. Q. et al., 2022), aiming to relieve environmental pressure by reducing carbon dioxide emissions and increasing carbon sink by relying on biological behavior. The essence of carbon sink by biological behavior is to use carbon sink to offset carbon emissions, which includes two categories: terrestrial carbon sinks and marine carbon sinks (Nellemann et al., 2009). Compared with terrestrial carbon sinks, marine carbon sink has a higher carbon fixation rate (Mcleod et al., 2011), a longer carbon storage time (Li J. et al., 2022), and a greater decarbonization potential (Sabine et al., 2004). Research shows that marine carbon dioxide storage accounts for approximately 55% of the global marine carbon capture (Zhang et al., 2022). It can be said that the ocean plays a vital role in absorbing and storing carbon dioxide (Zhuang et al., 2023). However, the development of marine carbon sinks is difficult, and neither the marine carbon sink enhancement technology nor the marine carbon capture and storage technology has been widely used (He et al., 2022a). However, the economic, ecological, and spatial effects of marine carbon sinks have attracted much attention in the carbon market (Bañolas et al., 2020). Marine carbon sink projects are one of the main forms of marine carbon sink development. Most of the developed marine carbon sink projects are fishery carbon sink projects and mangrove carbon sink projects (Zhang et al., 2020; He et al., 2023b), and by using the market mechanism to transform the ecological benefits of marine carbon sink into economic benefits, we can give full play to the positive role of marine ecosystems in coping with climate change (Yang et al., 2021; Wei et al., 2023).

Analyzing the behavior of relevant subjects is an important foundation for promoting the development of marine carbon sink projects. The existing research mainly discusses the behavior of subjects from the perspective of market transactions (Li M. X. et al., 2022). On the other hand, there are risks in the development process of marine carbon sink projects, such as natural risks, policy risks, human behavior risks, technical risks, and market risks. Existing research has shown that risks can have a huge impact on the development of marine carbon sink projects (He et al., 2022b; He et al., 2023b). Therefore, it is necessary to explore the behavioral choices of marine carbon sink project entities under risk conditions.

Different subjects adopt different strategies to avoid risks, and the essence of risk avoidance decisions is the result of the game between the relevant subjects (Giulia et al., 2023; Karol, 2023; Zhou et al., 2023; Zhang K. X. et al., 2023). Through the continuous game, the risk response level of the subject has been continuously improved (Masud et al., 2018; Chen et al., 2021; Li X. N. et al., 2022). In recent years, game theory has been increasingly applied in the study of marine carbon sinks. For example, He et al. used the evolutionary game method to construct a tripartite mathematical model of fishery practitioners, scientific research institutions, and the government, discussing the respective decisions of the three subjects (He and Zhang, 2023). Yu et al. compared the cost and benefit of independent and collaborative management models through game theory and concluded that regional collaborative management is more conducive to promoting marine carbon sink market transactions (Yu et al., 2023). Zhang et al. used the complex network evolutionary game, based on the assumptions of the WS small-world model on social network relationships, focused on the groups of fishermen, and explored the dynamic evolution law of cooperative behavior diffusion in the development of marine carbon sink fisheries (Zhang et al., 2023a). He et al. determined the decision of each entity to maximize the efficiency of blue carbon trading in the game between the demander, supply side, the government, and third-party institutions, and pointed out that high or low prices cannot achieve the goal of long-term blue carbon trading (He et al., 2023a). After constructing an evolutionary game model between the government and the supply side and demanders of blue carbon, Cao et al. combined specific cases of blue carbon credit and found that changes in government subsidies at different stages of the blue carbon trading market can promote the success rate of blue carbon trading (Cao et al., 2022). Zhang et al. first used evolutionary game theory to compare and demonstrate the actual effect and value of government regulation, media supervision, and the net benefits of marine carbon sinks on the disclosure of true information by high carbon emitting enterprises. Then, based on differential game theory, they explored the price formation of marine carbon sinks to improve the quality of carbon emission information disclosure by high carbon emitting enterprises and realize the value of marine carbon sink (Zhang et al., 2023b). However, in general, there are few studies on the risk response of marine carbon sink projects, especially the relevant behavior studies on the learning mode and risk response of marine carbon sink projects.

Considering that the behavior of the subject is a constantly changing process of evolutionary learning process, this paper selects the evolutionary game method due to the fact that evolutionary game theory is more suitable than traditional game theory in solving multiple equilibrium problems in the decision-making process, especially in the research on decision-making of behavioral subjects based on assumptions of bounded rationality and learning mechanisms (Fan et al., 2021; Zhao et al., 2022), discussing the game relationship of different subjects (enterprises and other marine carbon sink demanders, enterprises and fishermen, the government and other regulatory authorities, financial institutions, enterprises, and other investors). Based on this, countermeasures and suggestions to enhance the effectiveness of risk response for marine carbon sink projects have been proposed. The possible marginal contributions of this paper are as follows: (1) The government’s reward and punishment mechanism is introduced to explore the behavior strategies of each of the subjects and the interactions between each of the subjects under the influence of risk. (2) Based on the classic tripartite game model of marine carbon sink projects demanders, relevant practitioners, and the government, investors are introduced to conduct a four-party evolutionary game. Through simulation and analysis of the specific impacts of various relevant factors on the willingness of the four parties under risk conditions, the behavior choices of each party are clarified, and the application methods and approaches of the four-party evolutionary game method in the field of marine environment and policy research are expanded. (3) Considering the risks and the behavior characteristics of marine carbon sink subjects, analysis has been made to deduce how better to improve the risk response effect of marine carbon sink project subjects, so as to provide support for the smooth development of marine carbon sink projects.

The structure of the remaining part of this paper is as follows: Section 2 sets the parameters according to the basic assumptions and constructs the game matrix of the returns of the marine carbon sink demanders, relevant practitioners, governments, and investors in different circumstances. Section 3 analyzes the stability of the main body strategy, explores the stability of the system, and explores the risk response effect of the marine carbon sink project. Section 4 summarizes the contents of this research paper and gives countermeasures and suggestions to improve the risk response effect of the main body of the marine carbon sink projects.

2 Basic assumptions and model construction of the problem

2.1 Basic assumptions and basis

Although the common goal of each subject of marine carbon sink projects is to maximize their own interests, the specific interests of each of the subjects are different. The corporate image improvement due to the purchase of marine carbon sinks by the demander can play a great role in the development of the main business of the enterprise. At the same time, enterprises can buy marine carbon sinks to offset the carbon emissions from their own activities. Relevant practitioners adjust their development strategies according to the marine carbon sink price and the supply–demand relationship of the carbon sink market, and consider whether the government subsidies, marine carbon sink trading volume, the derivative value of marine carbon sink products, and the investment amount of investors can be higher than the development cost and the changing risk cost. The government needs to boost its image to gain popular support and uses policy tools to ensure smooth marine carbon sink trading to mitigate environmental problems and obtain environmental benefits. Investors will make stable investment decisions only when they ensure that the income from image enhancement, the amount of marine carbon sink transactions, and the economic return from the derivative value of marine products are higher than their investment and risk response expenditure. That is, the specific performance of the interests concerning investors, relevant practitioners, and demanders is different: investors consider the return on investment, the relevant practitioners consider increasing income and satisfying investors, the government gains public support by enhancing its image, and the demander considers how to meet the carbon emission reduction target without being punished by the government. Therefore, there is cooperation and competition among marine carbon sink demanders, relevant practitioners, the government, and investors, and they are constantly playing games on the benefits of marine carbon sink projects to achieve their most satisfactory results.

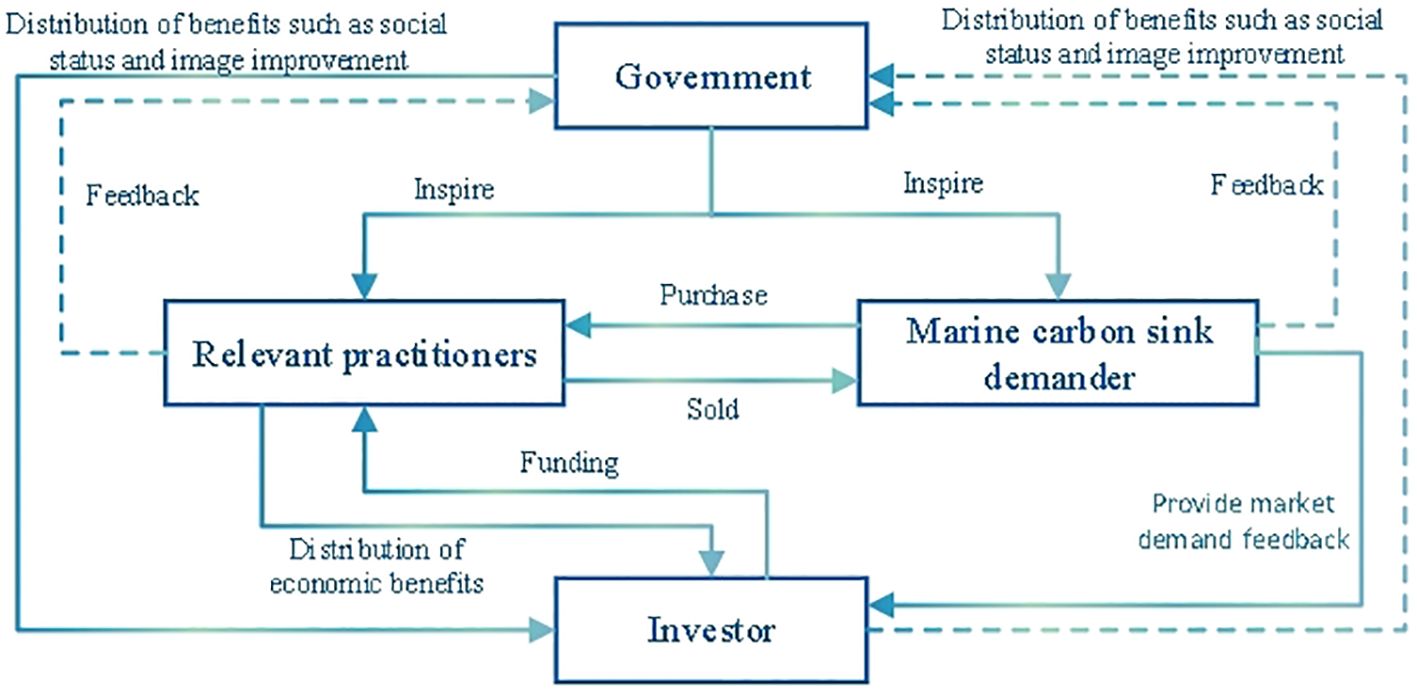

Accordingly, this paper summarizes the specific relationships between key subjects such as the demander, relevant practitioners, the government, and investors of marine carbon sink projects as shown in Figure 1.

Figure 1 Relationship between the demander, related practitioners, the government, and investors of marine carbon sink projects.

It is assumed that the subjects implementing or participating in the marine carbon sink project, namely, the marine carbon sink demanders, the relevant practitioners, the government, and the investors, are all limited and rational decision-makers. The probability that the demander chooses to buy the marine carbon sink is x, and the probability of choosing not to buy the marine carbon sink is , including ; the probability that the relevant practitioners will choose to develop the marine carbon sink is y, and the probability of choosing not to develop the marine carbon sink is , including ; the probability of the government choosing the incentive is ɡ and the probability of choosing no excitation is , including ; the probability of investors choosing to invest is z, and the probability of choosing not to invest is , including .

All the parameters are set as shown in Table 1, and some of the special parameters are explained in this paper. The government mainly plays a regulatory role in marine carbon sink trading by encouraging both supply and demand. Therefore, this paper sets the government incentive as L; among them, certain subsidies will be given to relevant practitioners who choose to develop marine carbon sinks, and the marine carbon sink demander will be punished for exceeding the limit of carbon dioxide emissions . The improvement of the ecological environment, social culture, and other aspects brought about by government incentives can enhance the image of the government, and investors also have similar considerations, hoping to build a better social image by participating in marine carbon sink projects. Therefore, this paper sets δ as the distribution coefficient of image improvement; the revenue of government image improvement is δF, and the return of investor image improvement is . For investors, it is also crucial to invest in marine carbon sink projects and get economic returns through the transaction volume of marine carbon sink Tr. In addition to image improvement and direct economic benefits, investors can also obtain some derivative value of marine carbon sink products V. For example, mangroves themselves can produce marine carbon sink and be used to develop tourism, fishery, and other industries (Watanabe et al., 2020; Chen, 2021). Here, the derivative value and the marine carbon sink trading volume are both related to investors and related practitioners, which need to be distributed in a certain proportion. Therefore, the distribution coefficient of economic income is set to τ, and investors can get the economic return of . In addition, the natural attribute of marine carbon sink increases the risk probability and risk impact degree of marine carbon sink projects, such as the loss caused by the risk caused by natural factors such as wind, storm, tide, and sea water temperature change. Thus, this paper divides the risk coefficient into and , representing the risk coefficient of practitioners and investors, respectively; the risk of marine carbon sink development undertaken by both subjects is and . For the demander, its purchase of marine carbon sinks can show the responsibility of the enterprise for environmental protection, virtually win the goodwill of consumers, and promote consumers to be more willing to buy the products of the enterprise, which is of great benefit for the improvement and development of corporate image Q.

2.2 Model building

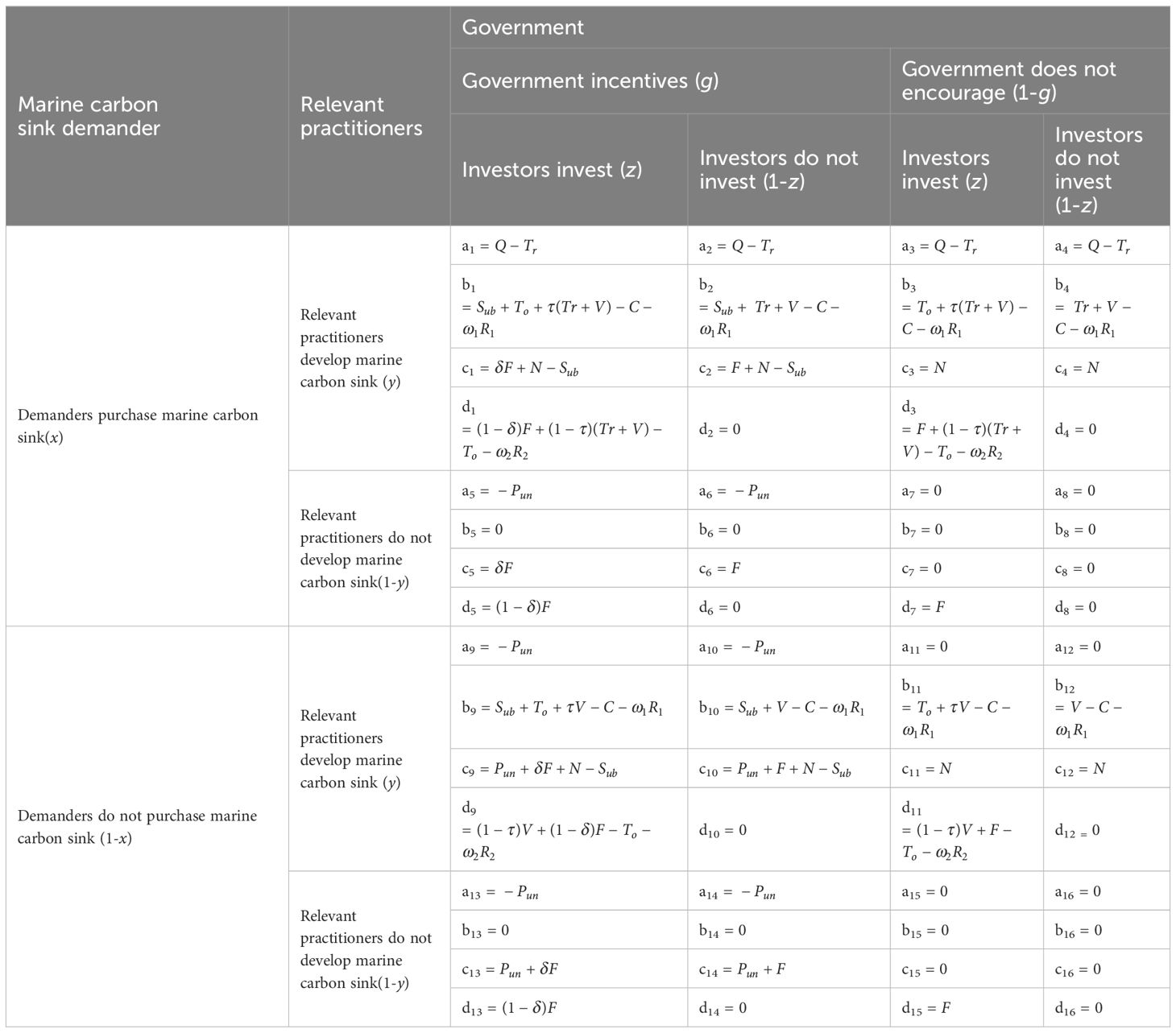

Based on the above parameters’ setting, the game matrix of the returns of the demanders, relevant practitioners, the government, and investors in different situations is listed in Table 2.

According to the game matrix, we can get the expected return of the four subjects after the decision and then calculate the average expected return. The specific process is shown in Equations 1–20.

(1) Suppose that the expected return of the marine carbon sink demander choosing to purchase marine carbon sink is , the expected income of not purchasing the marine carbon sink is , and the average expected income is , then the expected income of the marine carbon sink demander for purchasing the marine carbon sink is:

The expected income of the marine carbon sink demander who does not purchase the marine carbon sink is:

Average expected return of the marine carbon sink demander:

(2) Suppose that the expected return of relevant practitioners to choose to develop marine carbon sinks is , the expected return of not developing marine carbon sink is , and the average expected return is , then the expected return of relevant practitioners to develop marine carbon sink is:

Expected benefits of relevant practitioners not developing marine carbon sink:

Average expected return of relevant practitioners:

(3) Suppose that the expected return of the government choosing incentives is , the expected return of non-incentives is , and the average expected return is , then the expected return of government incentives is:

Expected return of government non-incentive:

Average expected return of the government:

(4) Suppose that the expected return of investors’ investment is , the expected return of investors’ non-investment is , and the average expected return is , then the expected return of investors’ investment is:

Expected return of investors not investing:

Average expected return of investors:

According to the income function of the above four parties, the corresponding replication dynamic equation is obtained to express the dynamic form of the subject behavior evolution, as follows:

3 Stability analysis and simulation implementation

3.1 Stability analysis of agent strategy

3.1.1 Strategies for the marine carbon sink demander

The replication dynamic equation of the behavior strategy of marine carbon sink demander is derived as follows:

According to the stability theorem of differential equations, when and , then the behavior strategy of the marine carbon sink demander is stable.

Proposition 1:

When , the marine carbon sink demander does not buy marine carbon sink as a stable strategy; when , the marine carbon sink demander buys marine carbon sink as a stable strategy; when , the marine carbon sink demander cannot determine the stability strategy, where the threshold value is . This proposition shows that the probability of the government choosing incentive is positively correlated with the choice of the marine carbon sink demander, that is, the increase of the probability of selecting incentive makes the marine carbon sink demander more inclined to choose to buy marine carbon sink. The reason is that the government will punish the marine carbon sink demander for not purchasing marine carbon sinks, resulting in excessive carbon emissions, and this punishment is greater than the expenditure of the demander on purchasing marine carbon sinks, forcing the demander to face the carbon emissions problem.

Prove:

Let , when , is an increasing function of ɡ. In this case, when , and , then is in the steady state; when , , and , then is in the steady state; when , , then any value of is a stable strategy; that is, the strategy choice of the marine carbon sink demander cannot be defined.

3.1.2 Strategies for relevant practitioners

The replication dynamic equation of the behavior strategy of relevant practitioners is derived as follows:

According to the stability theorem of differential equations, when and , then the behavior strategy of the marine carbon sink supplier is stable.

Proposition 2:

When , relevant practitioners do not develop marine carbon sink as a stability strategy; when , relevant practitioners develop marine carbon sink as a stability strategy; when , relevant practitioners cannot determine the stability strategy, where the threshold value is . When , relevant practitioners do not develop marine carbon sink as a stability strategy; when , relevant practitioners develop marine carbon sink as a stability strategy; when , relevant practitioners cannot determine the stability strategy, where the threshold value is . This proposition shows that when the government actively promotes the development of marine carbon sinks, the government will give certain subsidies to relevant practitioners for the development of marine carbon sinks, which can be used as additional income to help relevant practitioners achieve greater economic benefits. Therefore, relevant practitioners will also choose to actively develop marine carbon sink projects. On the other hand, the marine carbon sink market is greatly driven by the demander, and when the marine carbon sink demander has a strong willingness to purchase, the rise in carbon sink prices and the increase in demand can drive relevant practitioners to develop marine carbon sink projects, and when the marine carbon sink demander trading intention is insufficient, related practitioners will decline.

Prove:

Let , when is an increasing function of ɡ. When , and , then y = 0 is in the steady state; when , , and , then is in the steady state; when. , , then any value of is a stable strategy; that is, the strategy choice of relevant practitioners cannot be defined.

3.1.3 Strategies for the government

The replication dynamic equation of the behavior strategy of the government is derived as follows:

According to the stability theorem of differential equations, when and , then the behavior strategy of the government is stable.

Proposition 3:

When , government incentive is a stability strategy; when the stable strategy is no incentive; when , the government cannot determine the stability strategy, where the threshold value is . When , government incentive is a stability strategy; when , the stable strategy is no incentive; when , the government cannot determine the stability strategy, where the threshold value is . This proposition shows that when investors are less willing to invest, the government will provide subsidies to compensate for investors’ economic returns, thus pushing marine carbon sink trading smoothly. Considering the additional cost of buying marine carbon sinks, the demander will not actively buy the marine carbon sink to offset the carbon emission, which runs counter to the government’s concept of protecting the environment. At this time, the government as the regulator will use policy tools to turn the demander around to buy marine carbon sink through penalties.

Prove:

Let , when , is a subtraction function of ; when , and , then is in the steady state; when , , and , then is in the steady state; when , , any value taken is a stable strategy; that is, the government’s strategy choice is unknown. Similarly, when , is a subtraction function of x; when , and , then is in the steady state; when , and , then is in the steady state; when , , any value ɡ taken is a stable strategy; that is, the government’s strategy choice is unknown.

3.1.4 Strategies for the government

The replication dynamic equation of the behavior strategy of investors is derived as follows:

According to the stability theorem of differential equations, when and , then the behavior strategy of investors is stable.

Proposition 4:

When , investors’ stable strategy is not to invest; when , investors’ stable strategy is to invest; when , investors cannot determine the stability strategy, where the threshold value is . When , investors’ stable strategy is to invest; when , investors’ stable strategy is not to invest; when , investors cannot determine the stability strategy, where the threshold value is . This proposition shows that with the increasing willingness of the demander to buy marine carbon sink, the potential market scale of marine carbon sink trading is constantly expanding, and the probability of investors making investment also increases. In the process of trading marine carbon sinks, the government’s decisions will affect the implementation of investor behavior because of the distribution of image improvement income between the government and investors. The lower the government’s incentive willingness, the less the income from image improvement, and the greater the investment probability of investors.

Prove:

Let , when , is an increasing function of x. When , and , then is in the steady state; when , and , then z=1 is in the steady state; when , , any value z taken is a stable strategy; that is, the investors’ strategy choice is unknown. Similarly, when , is a subtraction function of ɡ; when , , and , then is in the steady state; when , and , then is in the steady state; when , , any value z taken is a stable strategy; that is, the investors’ strategy choice is unknown.

3.2 System stability analysis

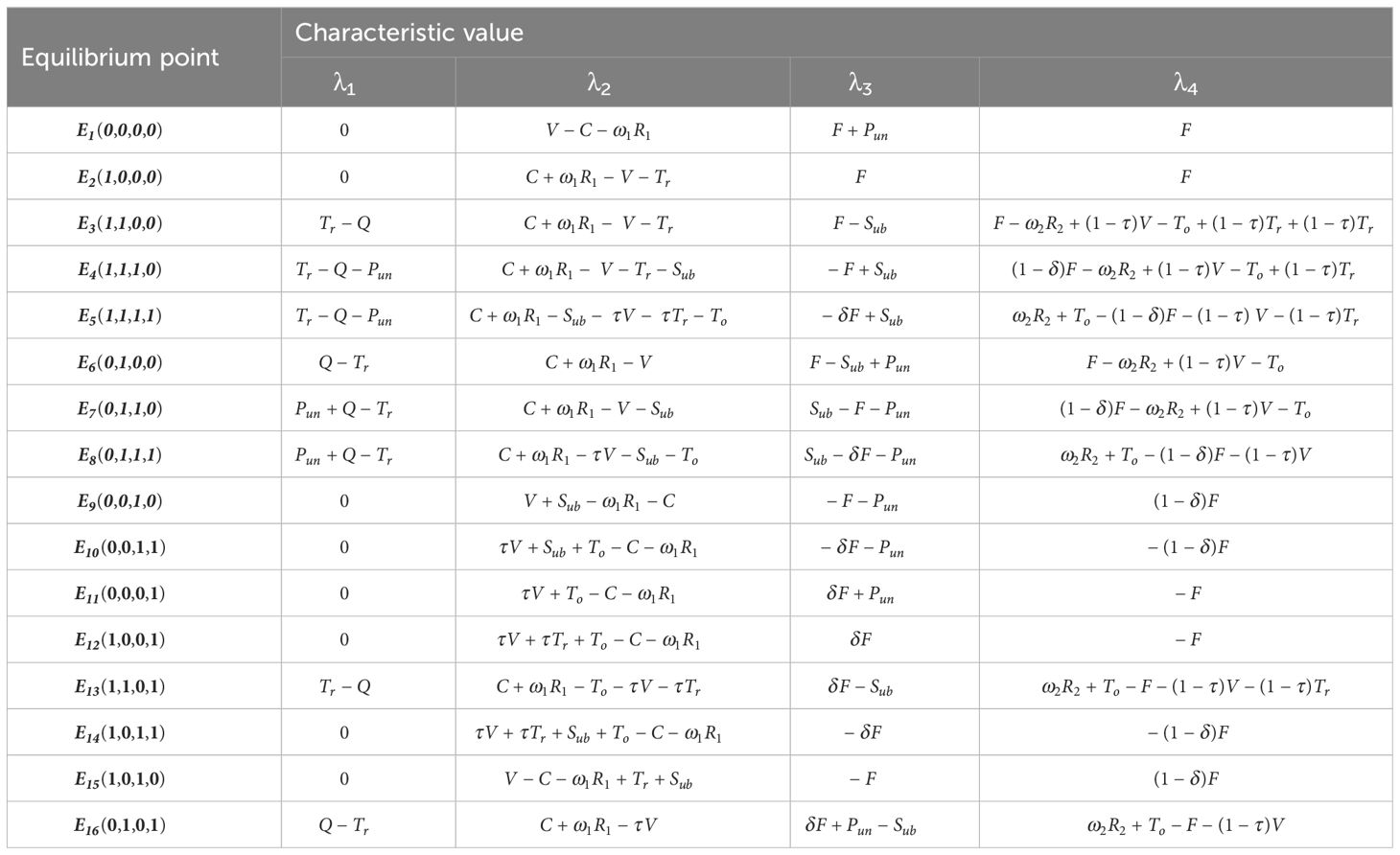

According to the conclusion of Ritzberger and Weibull (1995), in studying the progressive stability of the multigroup evolutionary game, one only needs to discuss , , , , , , , and . Therefore, this part adopts Lyapunov’s first rule and judges the stability of the above eight pure strategy points with the help of a Jacobian matrix (Friedman, 1998; Lyapunov, 2007; Yang, 2022). The specific rule is as follows: the eigenvalues of Jacobian matrix are less than 0, indicating that the equilibrium point is gradually stable. The Jacobian matrix of the four party evolutionary game system is shown in Equation (21).

where , , .

, , and .

, , , and .

, , , and .

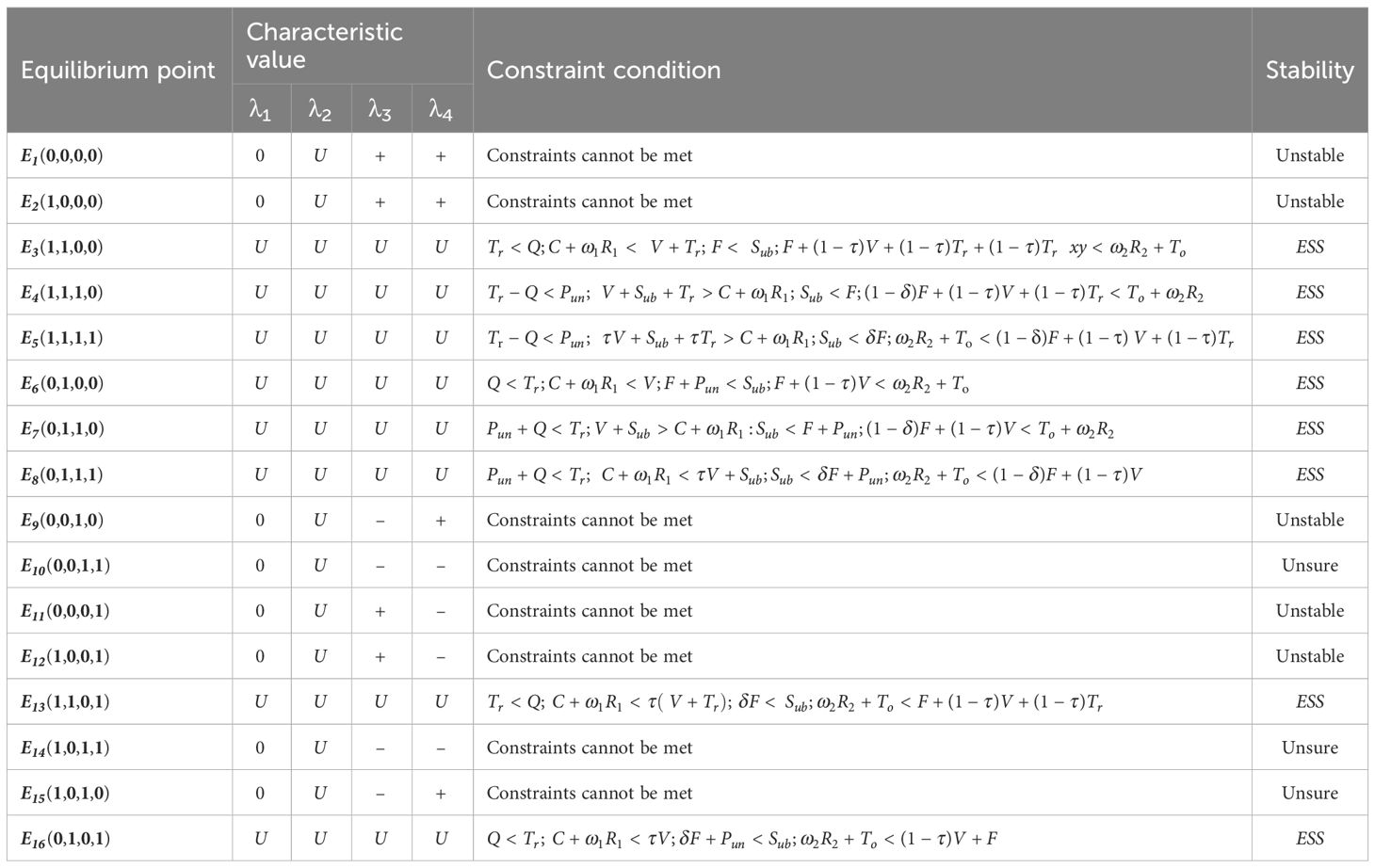

The equilibrium conditions of the system can be obtained from Table 3, as shown in Table 4. From the stability of the equilibrium point, when the four subjects choose positive strategies, that is, pure strategy point , the government needs to give a higher penalty for exceeding the limit. At the same time, the economic benefits of marine carbon sink products’ derived value, government subsidies, and marine carbon sink trading volume obtained by relevant practitioners are higher than their risks and development costs, and image enhancement and the equilibrium point can be established only when the amount of marine carbon sink transactions and the derivative value of marine carbon sink products are greater than their investment amount and risk expenditure. By comparing the stable point and unstable point, it can be seen that if the system wants to maintain a stable state, relevant practitioners must participate in the marine carbon sink project; otherwise, the system will fall into instability. The system will remain stable even when the other three parties are not involved and only relevant practitioners are involved, while the decisions of the other three parties cannot make the system stable or unstable.

Table 3 Eigenvalues of Jacobian Matrix (marine carbon sink demanders, related practitioners, the government, and investors).

3.3 Simulation analysis

According to the above analysis, the choice of the marine carbon sink demanders, relevant practitioners, the government, and investors in the process of evolutionary game will affect each other. In this paper, MATLAB 2020a software is used to simulate the strategy choice of each player in different situations to directly show the influence of the key elements in the replication dynamic system on the evolution process and results of the multi-party game. Refer to the existing research results (Wan et al., 2020; Wan et al., 2021; Wang et al., 2022; Giulia et al., 2023; Karol, 2023), and make the initial value ω1 = 0.2, ω2 = 0.2, δ = 0.5, τ = 0.85, C = 25, Sub = 10, Pun = 35, Q = 9, To = 19, F = 45, V = 6, Tr = 25, R1 = 32 and R2 = 12.

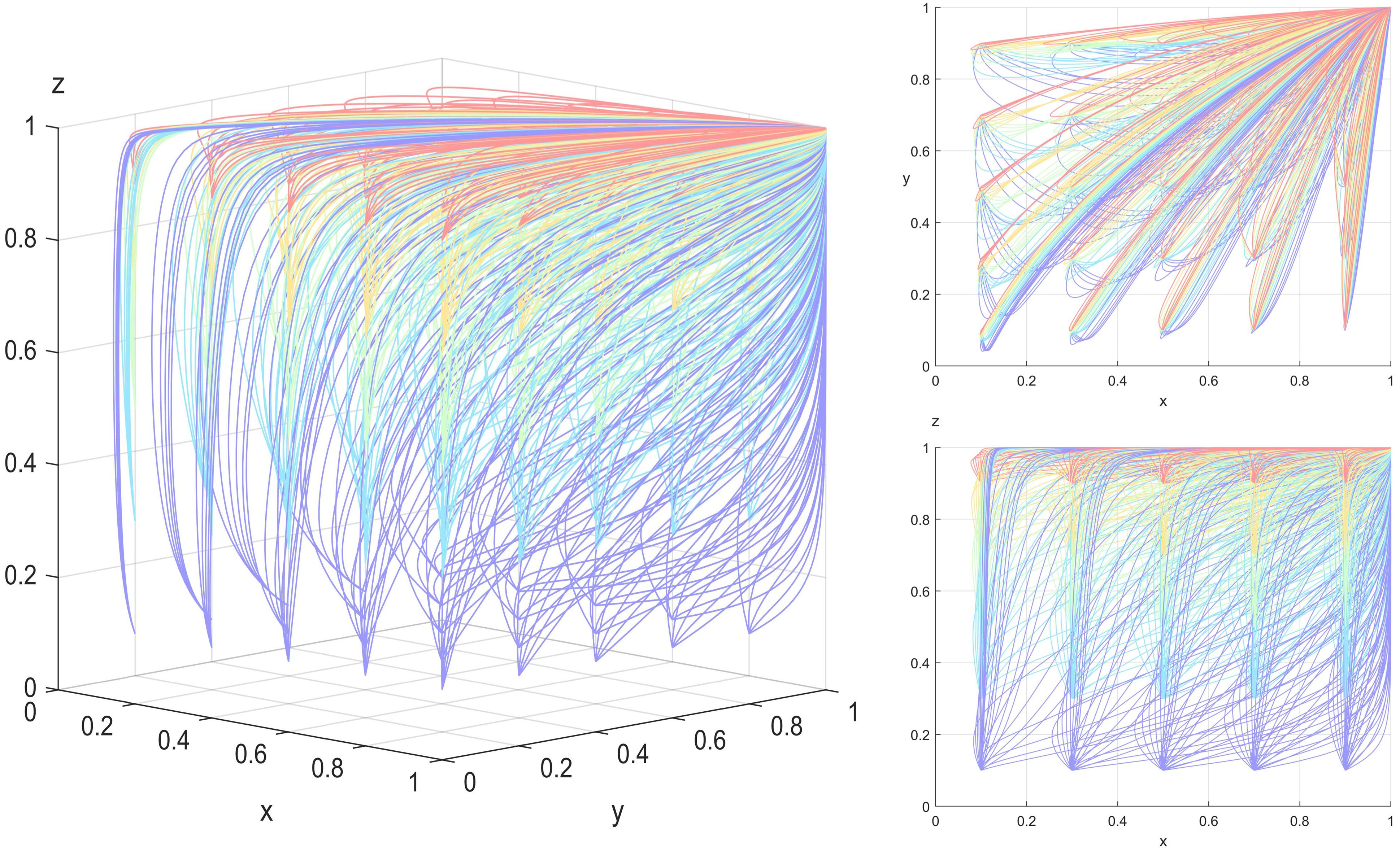

Starting from different combinations of initial strategies, we evolve over time 60 times to obtain the initial array evolution path result in Figure 2. It can be seen from the results that under the condition of low risk coefficient, when the government’s decision is stable to 1, that is, the government chooses the subsidy or adjusts the overlimit penalty, the system can reach a stable point when the demander, relevant practitioners, and investors of marine carbon sink all choose active strategies. At this time, the marine carbon sink demander has the demand to purchase marine carbon sink. Relevant practitioners adjust their strategies to develop marine carbon sink according to the changes in the supply and demand relationship of the carbon sink market so as to obtain more economic benefits. Investors are willing to invest based on the good prospects and great potential of the carbon sink market.

3.3.1 The impact of risk

(1) impact on the marine carbon sink demander, relevant practitioners, the government, and investors

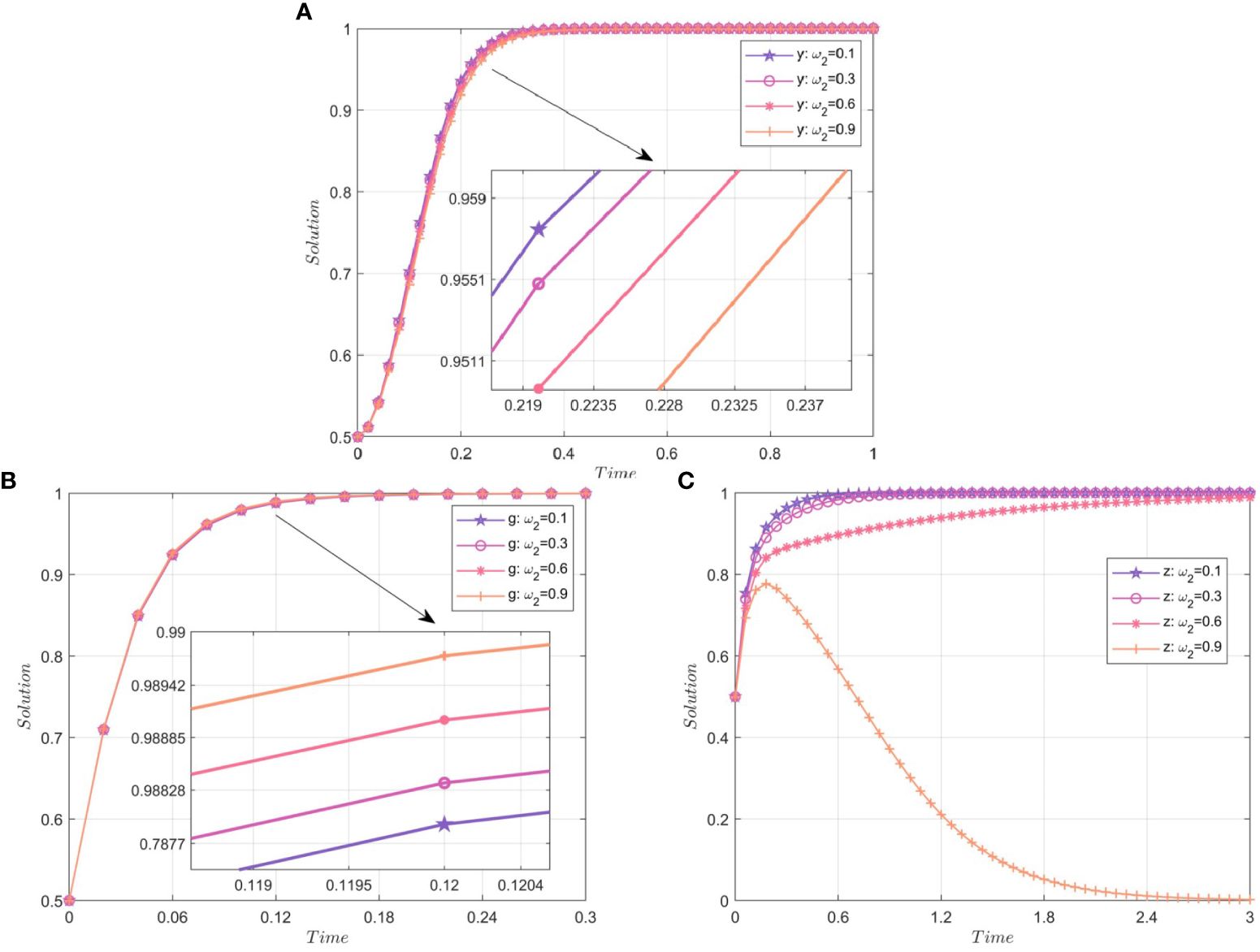

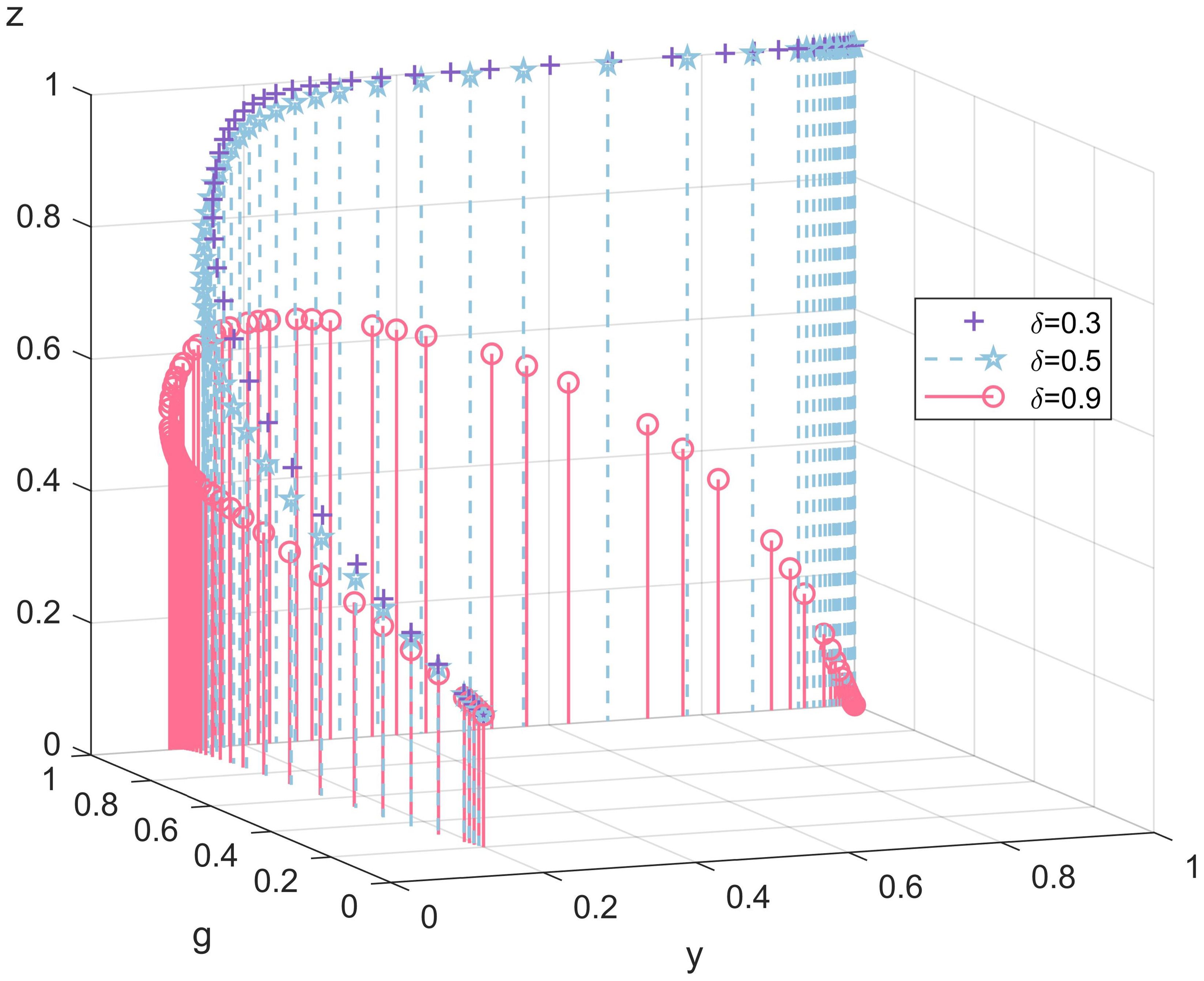

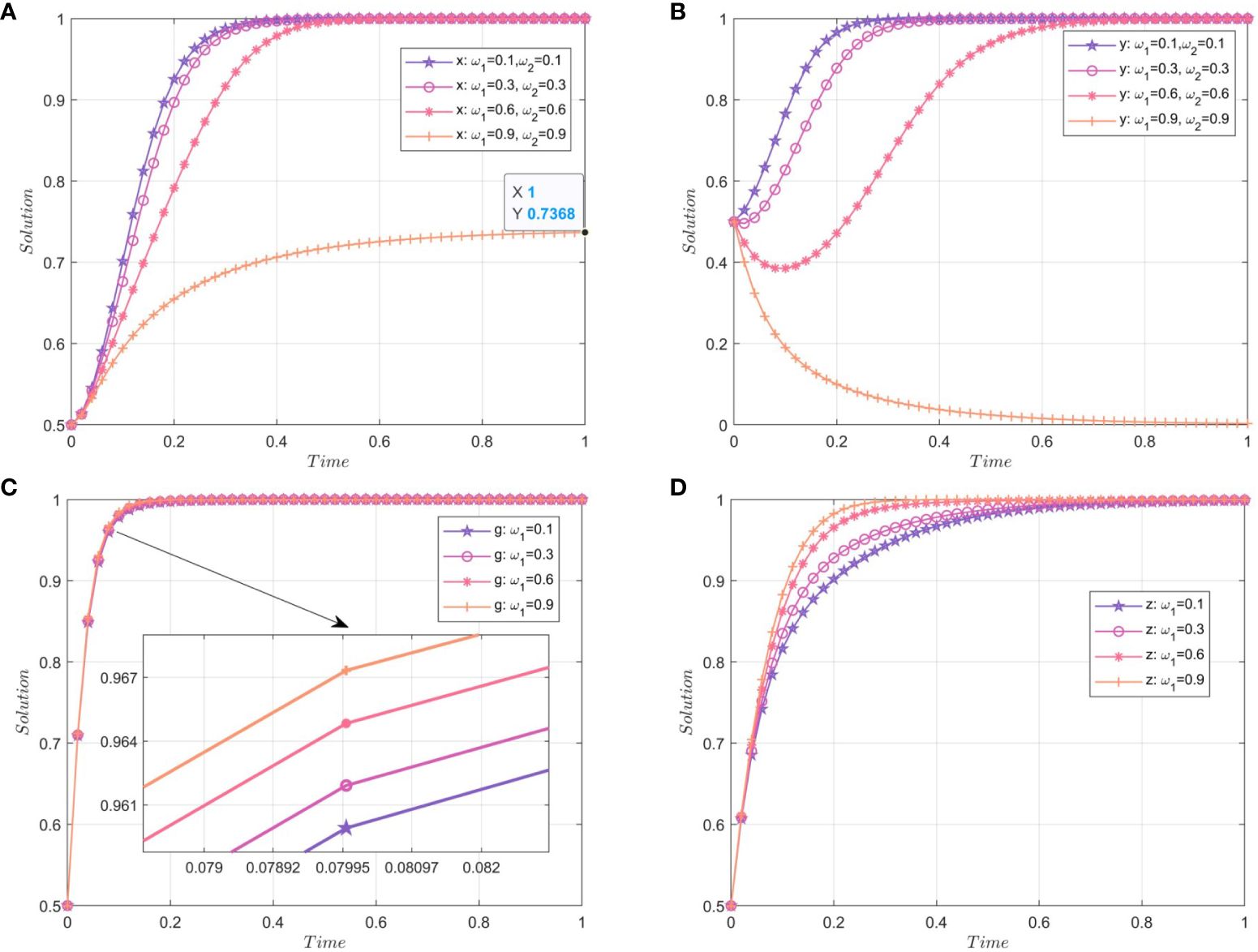

The remaining initial values remain unchanged, with , and , respectively, to obtain the influence of the risk coefficient change of the relevant practitioners on the square (Figure 3). According to Figure 3A when the risk coefficient borne by relevant practitioners changes from 0.1 to 0.9, the rate of the marine carbon sink demander to stabilize decisions gradually slows down. When the risk coefficient is 0.1, 0.3, and 0.6, the marine carbon sink demander will eventually choose to buy marine carbon sink. However, when the risk coefficient reaches 0.9, that is, when the relevant practitioners may choose not to develop the marine carbon sink, the final decision of the marine carbon sink demanders to trade the marine carbon sink is not to purchase the marine carbon sink. It can be seen that the risks faced by the relevant practitioners will significantly affect the decisions of the marine carbon sink demander. According to Figure 3B, when the risk coefficient of relevant practitioners is 0.6, the choice of their decision willingness fluctuates, with a gradual decrease followed by a steady increase to 1. If the risk coefficient increases again, the relevant practitioners will not develop the marine carbon sink. At this time, for the relevant practitioners, the cost (including risk and loss cost) of the development of the marine carbon sink is likely to be higher than the benefit. From Figure 3C regardless of the risk coefficient of the relevant practitioners, the government always makes the choice of incentive, unlike other cases; the higher the risk, the greater the probability of the government choosing the incentive. This may be because the government mainly plays a supervisory and management role in the development of marine carbon sinks. The willingness of relevant practitioners to develop marine carbon sinks will decrease due to the increased risk and damage to interests. For environmental protection considerations, the government increases subsidies to encourage relevant practitioners to develop marine carbon sinks. As can be seen from Figure 3D, because of the game of interest distribution with relevant practitioners, investors will make investments at all risk levels. In particular, the greater the risk coefficient is, the lower the development willingness of relevant practitioners, and investors are more willing to invest in order to obtain more direct economic income.

Figure 3 impact on of marine carbon sink demander (A), relevant practitioners (B), government (C) and investors (D).

(2) impact on relevant practitioners, governments, and investors

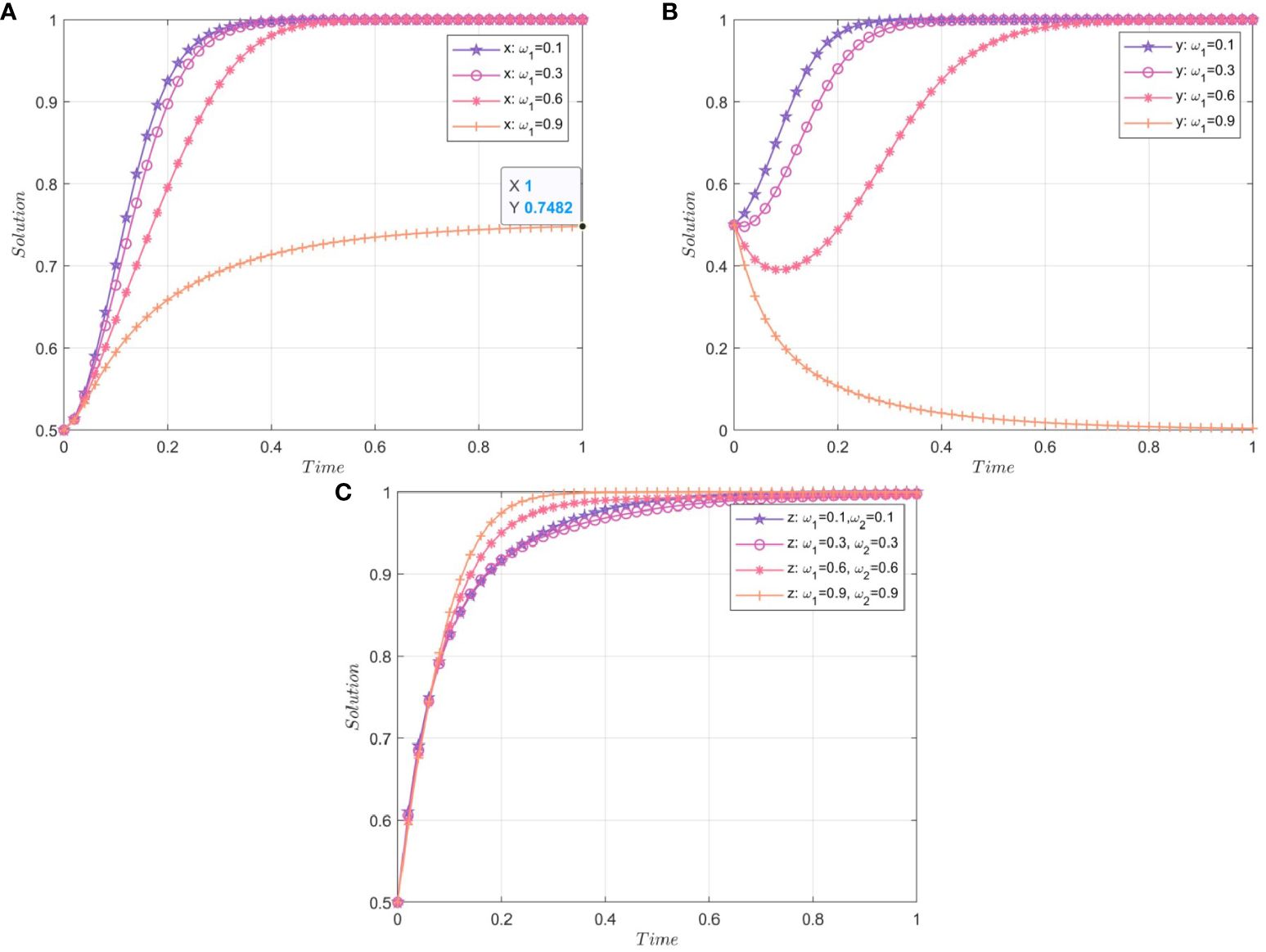

The remaining initial values remain unchanged, with , and , respectively, to obtain the impact of the risk coefficient of investors on relevant practitioners, governments, and investors (Figure 4). For the relevant practitioners (Figure 4A) and the government (Figure 4B), although the respective decisions are contrary to the change in the investor risk coefficient, they eventually stabilize. Among them, compared with the low risk coefficient of investors, the government shows more positive incentive willingness in the case of high risk coefficient of investors, which is exactly the same relationship with the risk coefficient of related practitioners. In order to actively promote the development of marine carbon sink to combat climate change, the government wants to encourage them to cope with the risks when relevant practitioners and investors shake their decisions due to risks. The decision-making willingness of relevant practitioners to develop marine carbon sinks is negatively correlated with the risk of investors, because of the competitive relationship between the two in the distribution of interests. The smaller the risk, the greater the probability that relevant practitioners will obtain a stable investment, and thus the willingness to develop marine carbon sinks is also higher. For relevant practitioners, having a stable source of funds can help deal with the risk of price fluctuations of factors of production such as labor, and provide a stronger guarantee for the development of marine carbon sink projects. In contrast, when the risk coefficient reaches 0.6, investors will still choose the strategy of investing in marine carbon sink projects for the sake of higher image and income. Once the risk coefficient is as high as 0.9, although a high image improvement income can be obtained in the short term, it will take decades for marine carbon sink projects from development to completion (Yang et al., 2021). In the long term, the loss caused by the risk may be greater. Therefore, investors finally choose to avoid risk, that is, not to invest in marine carbon sink projects.

(3) Impact of synchronous changes on marine carbon sink demanders, relevant practitioners, and investors

The remaining initial values remain unchanged, making and change synchronously to 0.1, 0.3, 0.6, and 0.9, respectively, and obtaining the impact of the risk coefficient on marine carbon sink demanders, relevant practitioners, and investors (Figure 5). For the whole system, it is more often a situation where multiple risks coexist and the risks change at the same time. As can be seen from the group of figures in Figure 5, when the two risk coefficients change simultaneously, the marine carbon sink demanders (a), relevant practitioners (b), and investors (c) show different decision choices, but the decision change trend is similar to that of Figure 3. The situation is slightly different when the risk coefficient is high, because then, the marine carbon sink demander is less willing to purchase marine carbon sinks under the synchronous change of two risk coefficients. This may be because the demander considers the possibility of smooth carbon trading to be low, and the high risk makes them hesitant, but they still have other types of carbon sinks to choose from and so they purchase other carbon sinks with a lower risk. If investors believe that the project risk is not high after evaluation, and relevant practitioners believe that the project risk is high, and the development willingness decreases, investors will increase their investment intensity and move towards a stable strategy faster in order to allocate more economic returns and obtain higher social status than the relevant practitioners.

Figure 5 Impact of and synchronous changes on marine carbon sink demander (A), relevant practitioners (B) and investors (C).

3.3.2 The impact of subsidies

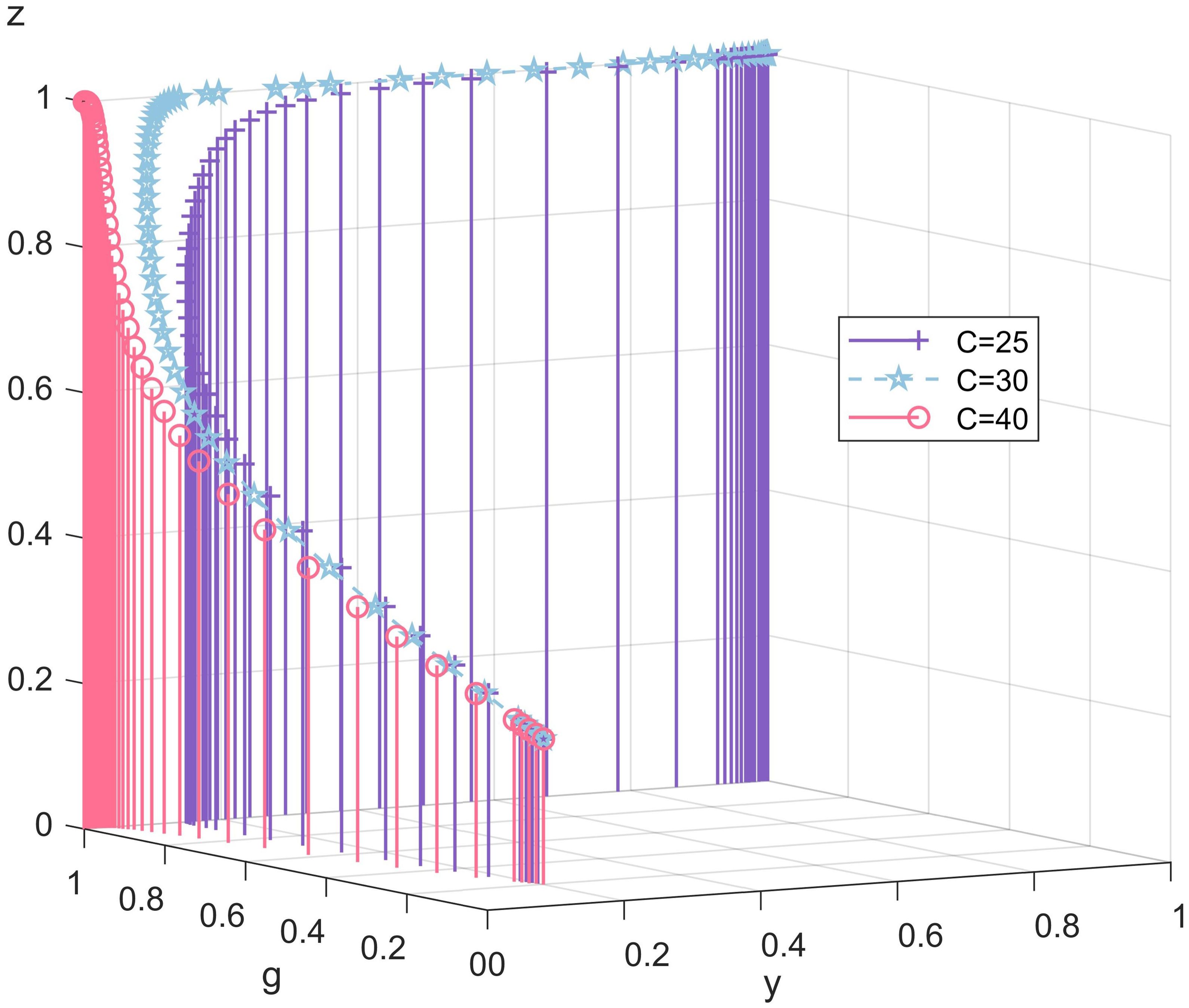

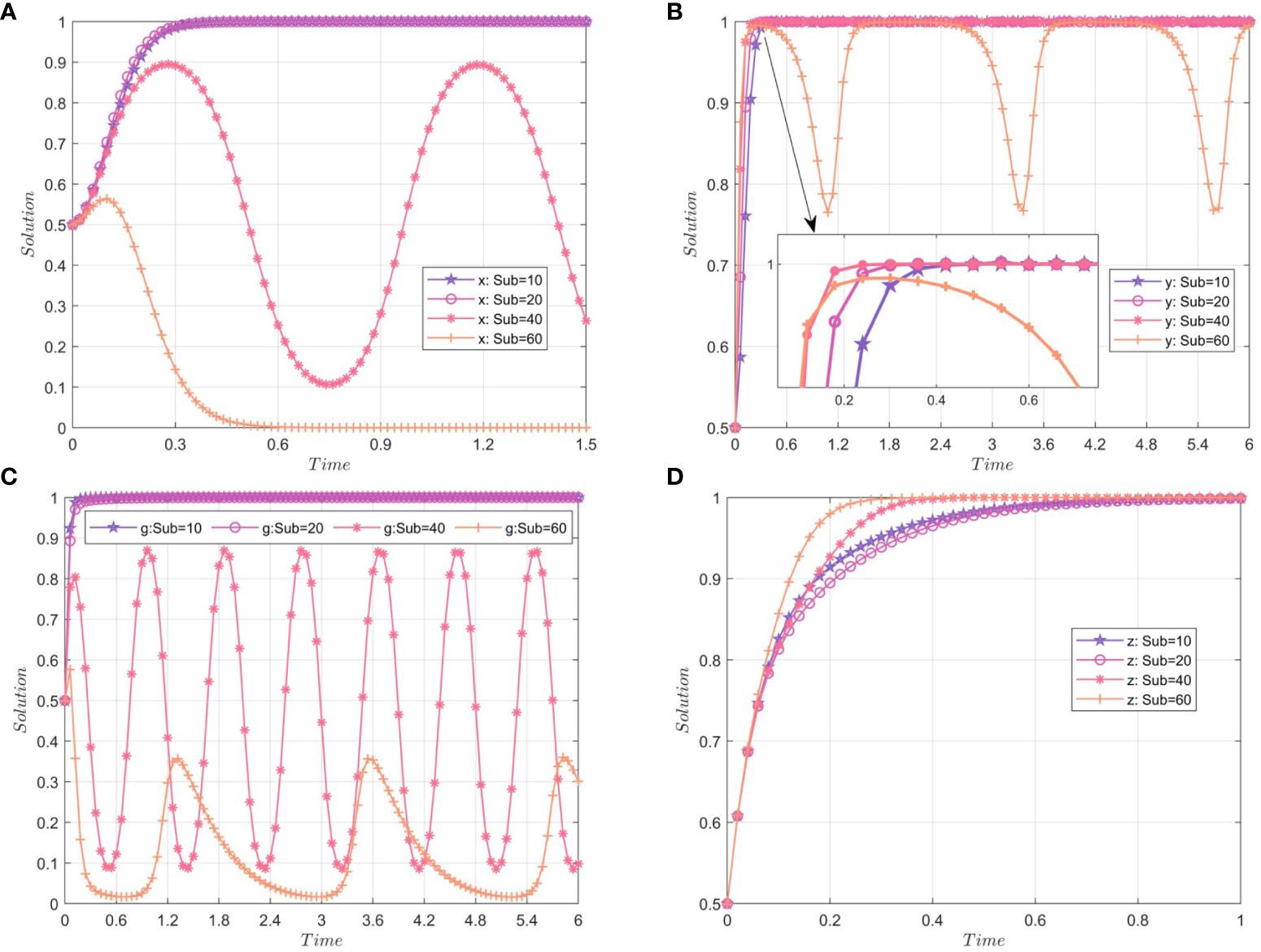

Under risk conditions, the government always shows the willingness to actively subsidize, and government subsidies become one of the benefits of relevant practitioners, demanders, and investors. In order to further explore the impact of subsidies on each subject, the remaining initial values remained unchanged, i.e., , , , and , and obtained the impact of government subsidies on marine carbon sink demanders (a), relevant practitioners (b), the government (c), and investors (d) (Figure 6). It can be seen that when the risk coefficient is low, the increase in the amount of subsidies helps relevant practitioners bear more development costs. Within a certain range, the higher the amount of subsidies, the greater the willingness of relevant practitioners to choose to develop marine carbon sinks. However, when the amount of subsidies is high (), the willingness of government incentives is reduced, falling into long-term unstable decision-making fluctuations, which will affect the decision-making of relevant practitioners. Once the decision of relevant practitioners to develop marine carbon sink becomes unknown, in order not to be punished by the government, the marine carbon sink demander will shift its purchase focus to terrestrial carbon sink, and the willingness to buy marine carbon sink may even be reduced to zero. At this time, only the investor’s investment willingness is always nearly stable, and the higher the subsidy amount, the faster the stabilization policy is because investors focus more on the effectiveness of behavior than whether to take action. In other words, even if the relevant practitioners do not develop marine carbon sink, investors can obtain certain image improvement income as long as they invest; thus, choosing investment is the most favorable decision.

Figure 6 The impact of subsidies on the marine carbon sink demander (A), relevant practitioners (B), government (C) and investors (D).

3.3.3 The impact of image improvement

Under the risk condition, image improvement is an important income for the government, the demander, and investors to develop marine carbon sink projects, which affects their willingness to act. In order to further study the impact of image improvement on each subject, the rest of the initial values remain unchanged, i.e., , and , to get the impact of image improvement on relevant practitioners, the government, and investors (Figure 7). It can be seen that when the risk coefficient is low, with the image enhancement coefficient increasing, the investment willingness of investors gradually decreases, and the incentive willingness of the government gradually increases. When the distribution coefficient is 0.3 and 0.5, the investment enthusiasm of investors is still high, because at this time, the government and investors have not shown a very big difference in the distribution of income from image improvement. Even if there is a difference, it is still within an acceptable range, so the strategies of both tend to be stable in the end. However, when the image income allocated by the government is much higher than that of the investors, that is, the government allocates 90% of the image income, the investor’s investment willingness drops to zero and he chooses not to invest. In the setting of this article, the relevant practitioners have no need for image improvement, only the pursuit of economic benefits, and so the change of image improvement coefficient has little impact on the relevant practitioners, and their decisions tend to be stable.

3.3.4 The impact of development costs

Under the risk condition, the income of each subject is closely related to the development cost, and when the income is greater than or far greater than the development cost, the subject will choose to develop the marine carbon sink project. In order to explore the impact of development cost on each subject, the remaining initial values remain unchanged, i.e., , and , to obtain the impact of cost on relevant practitioners, government, and investors (Figure 8). It can be seen that when the risk coefficient is low, the increase in development cost means that the profits of relevant practitioners in developing marine carbon sinks are reduced. As a rational economic man, the willingness of relevant practitioners to develop marine carbon sinks is reduced from 0.2 to 0, indicating that it is more beneficial for relevant practitioners not to develop marine carbon sinks at this time. Because the carbon storage time of the marine carbon sink is longer than that of the general land carbon sink, based on the consideration of the carbon sink effect, the government will tend to make the decision of developing the marine carbon sink regardless of the development cost. Similarly, the development cost will not directly affect the economic return of investors. Thus, generally, investors will choose to make positive decisions, but the decision of relevant practitioners not to develop marine carbon sinks will reduce the economic return that some investors can obtain from the project, which has a small impact on investors’ decisions.

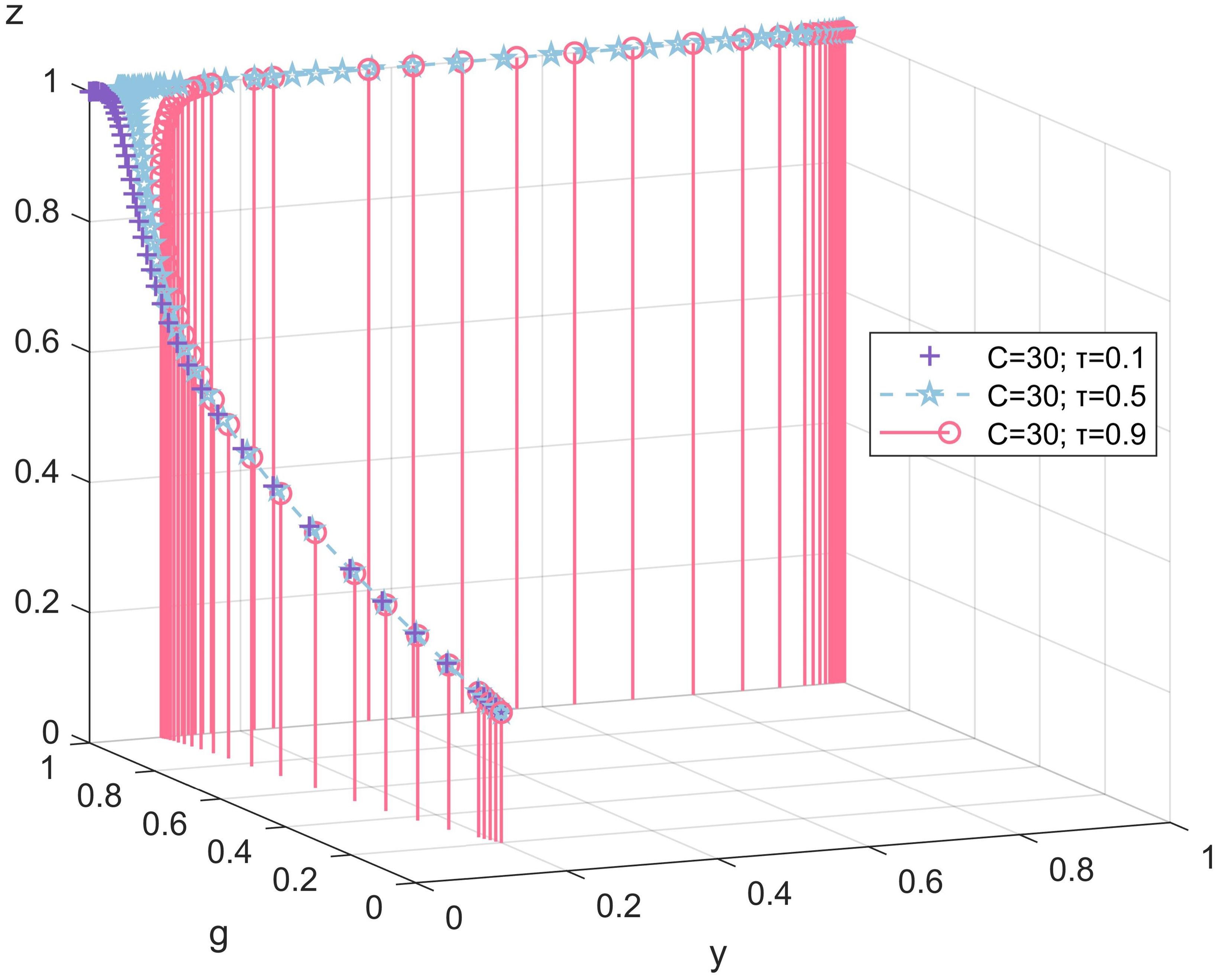

In order to further explore the impact of economic income distribution on the three parties in the case of high cost, this paper selects the special case of , keeping the rest of the initial values unchanged, making , and to get the impact of economic income distribution on relevant practitioners, the government, and investors (Figure 9). Under this cost setting, both the government and investors choose to make active decisions, and the relevant practitioners have a low willingness to develop. If the is small, investors can get more economic returns from the marine carbon sink projects. At this time, the relevant practitioners not only will face the considerable pressure of development cost, but also cannot get enough economic benefits. In order to avoid too much loss, the probability of choosing not to develop is greater. If the is large, the relevant practitioners can allocate more economic benefits and have more confidence and motivation to develop marine carbon sinks. Investors make up for the low distribution of economic returns by improving their higher image status, and the total returns still drive investors closer to positive strategies.

Figure 9 The impact of economic income distribution on relevant practitioners, government and investors in special circumstances.

4 Conclusions and countermeasures

4.1 Conclusions

This paper adopts the evolutionary game method to explore the game relationship and behavior mechanism of relevant practitioners, the government, investors, and demanders. After simulation and analysis, the influencing factors of the decision-making behavior of marine carbon sink project subjects under risk conditions are analyzed through feedback and adjustment. The willingness of each subject to take positive decisions and the impact of changes in various factors on their probability of behavior are analyzed. The main conclusions are as follows: (1) Government subsidies can promote the development of marine carbon sink projects, but when the subsidy amount is too large, the government is less willing, and even chooses not to subsidize, which may lead to significant changes in the decisions of relevant practitioners. (2) The government is not sensitive to the impact of risk changes, and always actively encourages relevant practitioners and investors. From the simulation results, it can be seen that the government pays more attention to the benefits of image improvement. Economic interests are the main driving force for the behavior of relevant practitioners and investors. When the risk poses a greater threat to the income, both parties will determine their own behavior strategies that can obtain more income according to the behavior decisions of the other party. (3) The strategies of relevant practitioners and investors will directly affect the behavior of the demander. Among them, the behavior choice of relevant practitioners, when faced with risks, has a greater impact on the demander, and the high risk increases the probability of the demander not buying marine carbon sink.

4.2 Countermeasures

The results of this research and simulation show that the risk has a great impact on the behavior choice of the subjects of a marine carbon sink project, and the subjects will adjust their behavior to deal with the risk. Accordingly, in order to ensure the smooth development of marine carbon sink projects, this paper puts forward the following relevant suggestions:

(1) Given that subsidies can partially make up for the losses caused by risks and significantly increase relevant practitioners’ willingness to participate in marine carbon sink projects, and since the behavior decisions of relevant practitioners affect the behavior of other subjects, the government should implement precise subsidies and differentiated subsidies. The government should pay attention to the adaptability and flexibility of the subsidy mechanism, and make dynamic adjustments based on the different types of marine carbon sink practitioners and the different output of marine carbon sink. Basic subsidies and incentive subsidies for a unit of marine carbon sink should be set, and the subsidy amount should be flexibly adjusted according to the effectiveness of project development, in order to improve the development willingness of practitioners (Shen et al., 2018). In addition, subsidies can help relevant practitioners share costs, indirectly reduce development costs to a certain extent, and enhance their confidence in responding to risks. Thus, the government can better play the role of subsidies by improving carbon market trading, formulating laws and regulations in the field of marine carbon sink, and improving the quality of professionals to further reduce the development costs of relevant practitioners.

(2) In order to encourage investors to choose positive strategies, the social influence of the development of marine carbon sink projects should be increased. Since most investors are banks and financial institutions, as the public recognition of marine carbon sink projects increases, they will be more inclined to handle savings, loans, and other businesses in these institutions participating in the development of marine carbon sink projects. In order to improve the public’s attention and recognition of marine carbon sink, we can rely on holding offline- and online-related activities to strengthen the publicity of marine carbon sink-related knowledge, and increase the proportion of marine carbon sink in carbon inclusion. In addition, the government also needs to provide some policy incentives to investors, with the goal of promoting the stability of the funding chain in project development progress and strengthening cooperation with investors.

(3) Because of the significant impact of risks faced by practitioners due to demander’s behavior choices in purchasing marine carbon sinks, it is necessary to reduce the risks faced by practitioners and thereby increase the willingness of the demander to buy marine carbon sinks. During the development process of marine carbon sink projects, relevant practitioners may face various risks such as invasion of diseases, pests, and alien species; natural disasters such as storm surge; inadequate government support policies; and high project development costs (He et al., 2023a). In this regard, the government should further improve the construction of a network system of marine climate observation, form a comprehensive observation and monitoring capacity of key elements of marine carbon sink development, and carry out an in-depth observation, early warning, a comprehensive investigation, and an evaluation of storm surge, waves, red tide, and other disasters, so as to provide technical support for effectively preventing natural risks of marine carbon sink. At the same time, it is necessary to clarify the work responsibilities of relevant management departments, establish a sound and efficient negotiation mechanism, and form a close multi-departmental and multi-level cooperative governance mechanism to reduce the impact of policy risks. In addition, it is necessary to optimize the management process of marine carbon sink projects, coordinate the services and management of the entire process of marine carbon sink projects, and strengthen the connection and coordination between resource development and market mechanisms, thereby reducing obstacles to market risks.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

YH: Conceptualization, Supervision, Writing – review & editing. YW: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was supported by the National Social Science Foundation of China (Grant No. 23BJY197).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ Although the demander also has risks, it may focus more on whether marine carbon sink can be supplied on time and whether prices will change, which can be included in the risks faced by relevant practitioners and investors. Therefore, this article will not separately consider the demander’s risks.

References

Bañolas G., Fernández S., Espino F., Haroun R., Tuya F. (2020). Evaluation of carbon sinks by the seagrass Cymodocea nodosa at an oceanic island: Spatial variation and economic valuation. Ocean Coast. Manage. 187, 105112–105112. doi: 10.1016/j.ocecoaman.2020.105112

Cao Y. M., Kang Z. Q., Bai J. D., Cui Y., Chang I.-S. H., Wu J. (2022). How to build an efficient blue carbon trading market in China? - A study based on evolutionary game theory. J. Clean. Prod. 367, 132867. doi: 10.1016/J.JCLEPRO.2022.132867

Chen G. C. (2021). China has successfully traded the first “blue carbon”. carbon sink project. J. Appl. Oceanography 40, 555–556. (in Chinese).

Chen J. L., Huang G. R., Chen W. J. (2021). Towards better flood risk management: Assessing flood risk and investigating the potential mechanism based on machine learning models. J. Environ. Manage. 293, 112810–112810. doi: 10.1016/j.jenvman.2021.112810

Fan W., Wang S., Gu X., Zhou Z., Zhao Y., Huo W. (2021). Evolutionary game analysis on industrial pollution control of local government in China. J. Environ. Manage. 298, 113499–113499. doi: 10.1016/j.jenvman.2021.113499

Friedman D. (1998). On economic applications of evolutionary game theory. J. Evol. Econ. 8, 15–43. doi: 10.1007/s001910050054

Giulia M. Z., Angela B., Claudia R., Alessandro P., Renata A. (2023). Traditional vs. novel approaches to coastal risk management: A review and insights from Italy. J. Environ. Manage. 346, 119003–119003. doi: 10.1016/j.jenvman.2023.119003

He Y. X., Hu Y. B., Xie S. M., Li C. L., Xu M., Chen X. Y. (2022b). Risk and impacts associated with marine carbon sink projects: an example from Guangdong,China. J. Coast. Res. 39, 246–256. doi: 10.2112/JCOASTRES-D-22-00041.1

He Y. X., Wang Y. W., Xie S. M. (2023b). Study on the risk measurement and evaluation of the whole life cycle of mangrove carbon sink project from the perspective of the supply subject: Take the Zhanjiang mangrove afforestation project as an example. Mar. Sci. Bull. 43, 248–264. (in Chinese).

He Y. X., Wang Y. W., Xie S. M., Luo W. L. (2022a). Research progress of marine carbon sink in China : Literature analysis based on CNKI(2006-2021). Mar. Economy 12, 1–16. doi: 10.19426/j.cnki.cn12-1424/p.20220630.002

He Y. X., Zhang F. X. (2023). A game study on the implementation of marine carbon sink fisheries in the context of carbon neutrality – Analysis of the tripartite behavior of fishery practitioners, research institutions, and the government. Mar. Policy 147, 105365. doi: 10.1016/j.marpol.2022.105365

He Y. X., Zhang F. X., Wang Y. W. (2023a). How to facilitate efficient blue carbon trading? A simulation study using the game theory to find the optimal strategy for each participant. Energy 276, 127521. doi: 10.1016/j.energy.2023.127521

Karol M. (2023). Sharing risk to avoid tragedy: Informal insurance and irrigation in village economies. J. Dev. Econ. 161, 103030. doi: 10.1016/J.JDEVECO.2022.103030

Li X. Q., Dong Z. F., Li X. L. (2022). International experiences and enlightenment of climate legislation towards carbon neutrality. Environ. pollut. Control 44, 261–265. doi: 10.15985/j.cnki.1001-3865.2022.02.021

Li J., Li M. D., Gong P. H., Guan C. T. (2022). Research progress on fishery carbon sinking associated with marine ranching. Prog. Fishery Sci. 43, 142–150. doi: 10.19663/j.issn2095-9869.20220118002

Li M. X., Xu C. C., Wang T., Hu J. (2022). Progress, challenges and development strategies of China’s marine carbon sink trading under the goal of carbon neutrality and emission peak. Sci. Technol. Manage. Res. 43, 193–200. (in Chinese).

Li X. N., Yi S. Y., Cundy A. B., Chen W. P. (2022). Sustainable decision-making for contaminated site risk management: A decision tree model using machine learning algorithms. J. Clean. Prod. 371, 133612. doi: 10.1016/j.jclepro.2022.133612

Lyapunov A. M. (2007). The general problem of the stability of motion. Int. J. Control 55, 531–534. doi: 10.1080/00207179208934253

Masud M. M., Sackor A. S., Alam A. S. A. F., Al-Amin A. Q., Ghani A. B. A. (2018). Community responses to flood risk management – An empirical Investigation of the Marine Protected Areas (MPAs) in Malaysia. Mar. Policy 97, 119–126. doi: 10.1016/j.marpol.2018.08.027

Mcleod E., Chmura G. L., Bouillon S., Salm R., Björk M., Duarte C. M., et al. (2011). A blueprint for blue carbon: toward an improved understanding of the role of vegetated coastal habitats in sequestering CO2. Front. Ecol. Environ. 9. doi: 10.1890/110004

Nellemann C., Corcoran E., Duarte C., Valdes L., Grimsditch G. (2009). Blue carbon. A rapid response assessment (GRID-Arendal, Norway: United Nations Environment Programme).

Ritzberger K., Weibull W. J. (1995). Evolutionary selection in normal-form games. Econometrica 63, 1371–1399. doi: 10.2307/2171774

Sabine C. L., Feely R. A., Gruber N., Key R. M., Lee K., Bullister J. L. (2004). The oceanic sink for anthropogenic CO2. Science 305, 367–371. doi: 10.1126/science.1097403

Shen J. S., Wang Z. P., Wang X. Q. (2018). A study on incentive subsidy of blue carbon in marine ranch. J. Ocean Univ. China(Social Sciences) 16-21, 1747–1748. doi: 10.16497/j.cnki.1672-335x.2018.02.003

Wan X. L., Li Q. Q., Qiu L. L., Du Y. W. (2021). How do carbon trading platform participation and government subsidy motivate blue carbon trading of marine ranching? A study based on evolutionary equilibrium strategy method. Mar. Policy 130, 104567. doi: 10.1016/J.MARPOL.2021.104567

Wang S., Liu C., Hou Y. T., Xue X. Z. (2022). Incentive policies for transboundary marine spatial planning: an evolutionary game theory-based analysis. J. Environ. Manage. 312, 114905. doi: 10.1016/j.jenvman.2022.114905

Wan X. L., Xiao S. W., Li Q. Q., Du Y. W. (2020). Evolutionary policy of trading of blue carbon produced by marine ranching with media participation and government supervision. Mar. Policy 312, 104302. doi: 10.1016/J.MARPOL.2020.104302

Watanabe K., Yoshida G., Hori M., Umezawa Y., Moki H., Kuwae T. (2020). Macroalgal metabolism and lateral carbon flows can create significant carbon sinks. Biogeosciences 17, 2425–2440. doi: 10.5194/bg-17-2425-2020

Wei Z. H. H., Jang X. Z. H., Zhao Z. H. B., Xu W. L., Guo L. Y., Zheng Q. Y. (2023). Can ocean carbon sink trading achieve economic and environmental benefits? Simulation based on DICE-DSGE model. Environ. Sci. pollut. Res. Int. 30, 72690–72709. doi: 10.1007/s11356-023-27435-x

Yang Z. (2022). Quadripartite evolutionary game of public participation in interactivetransboundary pollution control compensation. Chin. J. Manage. Sci., 1–14. doi: 10.16381/j.cnki.issn1003-207x.2021.1416

Yang Y., Chen L., Xue L. (2021). Top design and strategy selection of blue carbon market construction in China. China Population, Resources Environ. 31, 92–103. (in Chinese).

Yu L. H., Zhen S., Gao Q. (2023). Independent or collaborative management? Regional management strategy for ocean carbon sink trading based on game theory. Ocean Coast. Manage. 235, 106484. doi: 10.1016/j.ocecoaman.2023.106484

Zhang F. X., He Y. X., Wang Y. W., Xie S. M., Liu R. Z., Xu M. (2023b). Incentive effects of marine carbon sink on carbon emission disclosure: Ananalysis considering purchase price from a game-theoretic perspective. China Environ. Sci. 43, 4975–4987. doi: 10.19674/j.cnki.issn1000-6923.20230316.001

Zhang F. X., He Y. X., Xie S. M., Shi W. T., Zheng M. X., Wang Y. W. (2023a). Research on the game of fishermen’s cooperative behavior in developing marine carbon sink fisheries from a complex network perspective. Ocean Coast. Manage. 244, 106832. doi: 10.1016/j.ocecoaman.2023.106832

Zhang C., Shi T., Liu J., He Z., Thomas H., Dong H., et al. (2022). Eco-engineering approaches for ocean negative carbon emission. Sci. Bull. 67, 2564–2573. doi: 10.1016/j.scib.2022.11.016

Zhang K. X., Zhang X. T., Ding L. (2023). How to incentivize bank credit development in blue carbon projects? A study of refinancing mechanisms with evolutionary game. Ocean Coast. Manage. 241, 106671. doi: 10.1016/j.ocecoaman.2023.106671

Zhang X. X., Zheng S., Yu L. H. (2020). Green efficiency measurement and spatial spillover effect of China’s marine carbon sequestration fishery. Chin. Rural Economy, 91–110. (in Chinese).

Zhao T., Liu Z., Tooraj J. (2022). Developing hydrogen refueling stations: An evolutionary game approach and the case of China. Energy Economics 115, 106390. doi: 10.1016/j.eneco.2022.106390

Zhou J. X., Huang L. J., Shen G. Q., Wu H. Q., Luo L. Z. (2023). Modeling stakeholder-associated productivity performance risks in modular integrated construction projects of Hong Kong: A social network analysis. J. Clean. Prod. 423, 138699. doi: 10.1016/j.jclepro.2023.138699

Keywords: risk, marine carbon sink project, evolutionary game, behavior choice, coping strategy

Citation: He Y and Wang Y (2024) Research on subject behavior choice of marine carbon sink projects under risk conditions. Front. Mar. Sci. 11:1388636. doi: 10.3389/fmars.2024.1388636

Received: 20 February 2024; Accepted: 15 April 2024;

Published: 23 May 2024.

Edited by:

Yen-Chiang Chang, Dalian Maritime University, ChinaReviewed by:

Xiaolong Chen, Liaoning Normal University, ChinaM. Jahanzeb Butt, Shandong University, China

Copyright © 2024 He and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanwei Wang, d3l3Mjk1MjY0ODU5MkAxNjMuY29t

Yixiong He

Yixiong He Yanwei Wang

Yanwei Wang