- Department of Environmental Studies, University of Colorado-Boulder, Boulder, CO, United States

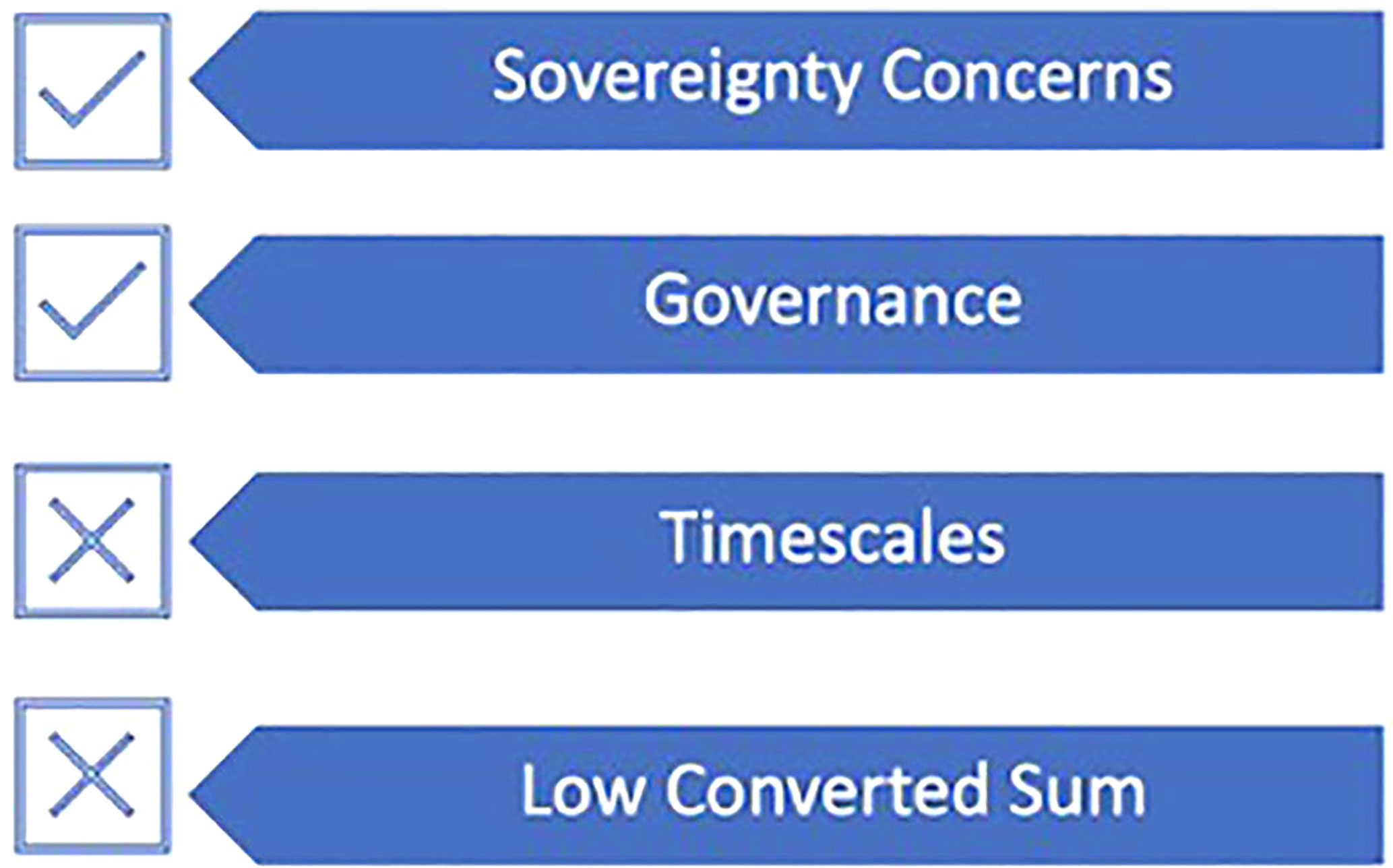

In the face of the threats posed to the oceans by a changing climate, the need for marine conservation programs grows rapidly. Scaling with this need demands sufficient funding to support ambitious conservation projects. This funding must be obtained from increasingly varied and innovative sources since private grants and government allocated funds has proved insufficient. Debt-for-nature swaps are a financial mechanism seeking to improve debt burden while setting up environmental programs. This method of debt restructuring has existed for decades, but is seeing a resurgence of use and interest in recent years. Here we present an exploratory case study of a Seychelles debt-for-nature swap which examines this financial mechanism’s ability to fund impactful conservation projects, particularly in marine Economic Exclusion Zones (EEZ) of Small Island Developing States (SIDS). The Seychelles finalized a conversion of their sovereign debt with Paris Club creditors and The Nature Conservancy as a broker in 2015 with the goal of creating a robust marine spatial plan (MSP). They received notable recognition for multiple novel aspects of this deal as well as the sheer scale of the marine space protected (400,000 sq. km), and thus serves as a robust case study to analyze if debt-for-nature swaps have evolved since its theoretical conception in 1984. Our research favors qualitative data by employing a case study approach which draws on semi-structured interviews with key informants, content analysis of online resources, and a literature review. This research suggests that while the model has yet to be cemented, the Seychelles case study is representative of a coming evolution in debt-for-nature swap practices. By examining the critical governance factors that were employed in the Seychelles, this research reveals key takeaways for future implementation and establishing national candidacy. The findings highlight debt status relative to the economy, political willpower, funding streams utilized, and the use of co-production practices. We show how the Seychelles case study demonstrates marked progress from the historical standard regarding sovereignty concerns and governance, but not concerning timescales and low converted sum. However, we note that this innovative debt-for-nature swap suggests that a new standard is possible and provides a new framework and set of best practices. In doing so, the Seychelles MSP can potentially lead the way for additional marine debt-for-nature swaps.

Introduction

Human pressures, including climate change, increasingly threaten the health of the global oceans, demanding increases in marine conservation initiatives, which requires more extensive resources and financing. While in 2017 roughly $25.5 billion USD was committed to Sustainable Development Goal (SDG) 14 which relates to conservation and sustainable use of the oceans, (Thompson, 2022; United Nations, 2022), an estimated US$174 billion annually will be required to adequately address the current level of ocean degradation (Johansen and Vestvik, 2020). But ocean financing is complicated, and actionable programs include a suite of political and social implications which will vary by program and by nation. Furthermore, the crux often lies beyond the initial funding since incorporating a strategic evaluation of how the financial streams will continue, and how programs will impact local economies, is critical to any project‘s success. Historically, conservation initiatives have collided with local economic norms as natural resources use is often limited - this forces a tradeoff for stakeholders between conservation and economic development (Brooks et al., 2013, pg. 2). Specifically in marine spaces, “the best ocean policies and practices can be undone by inadequate finance and economic externalities that undermine conservation and sustainable use” (Sumaila et al., 2021, pg. 9). Thus, studying cases of ocean finance allows a better understanding of the benefits and risks of different financial tools which can aid in conservation and sustainable development.

Here we specifically evaluate the efficacy of debt-for-nature swaps as a financial tool to support marine conservation using the case of the Seychelles, an island nation in the Indian Ocean. The Seychelles are one of the Small Island Developing States (SIDS), which collectively comprise 39 UN Member and 18 Non-UN Member States, identified as island nations, which are located in the Caribbean, Atlantic, Pacific, Indian Ocean and South China Sea and face unique social, economic, and environmental vulnerabilities (United Nations, 2023). While debt-for-nature swaps have been used on land as a conservation tool since the late 1980s, it was only applied to marine conservation in 2015 when the Seychelles finalized a new debt swap (Silver and Campbell, 2018). This case study presents an opportunity to investigate how a long established financial process can be newly adapted for marine spaces.

A debt-for-nature swap is defined as a “creative alternative funding mechanism to finance sustainable development projects in low-income countries” by “leveraging the debt of a low income country to obtain a commitment from that country to protect nature” - in return sovereign debt is forgiven and the savings in debt servicing are invested in environmental conservation (Mcgraw and Figueroa, 2018, pg.1). The idea of debt-for-nature swaps first arose in 1982 after Mexico defaulted on debt payments and there was fear that other nations would follow suit (Macekura, 2016). This demonstrated the intensity of the financial burden amidst developing economies, which may lead to environmentally destructive practices as a short-term revenue fix to long term development problems (Macekura, 2016). Two years later Thomas Lovejoy (then the vice-president of the World Wildlife Fund) wrote an op-ed in the New York Times which highlighted this inter-related problem of debt and countries “borrowing” from their natural resources to meet payments (Lovejoy, 1984). This article questioned if there was a way to use the debt crisis to additionally help an environmental one (Lovejoy, 1984) and subsequently introduced the now relatively common practice in the intersection of financial and conservation worlds: debt-for-nature swaps.

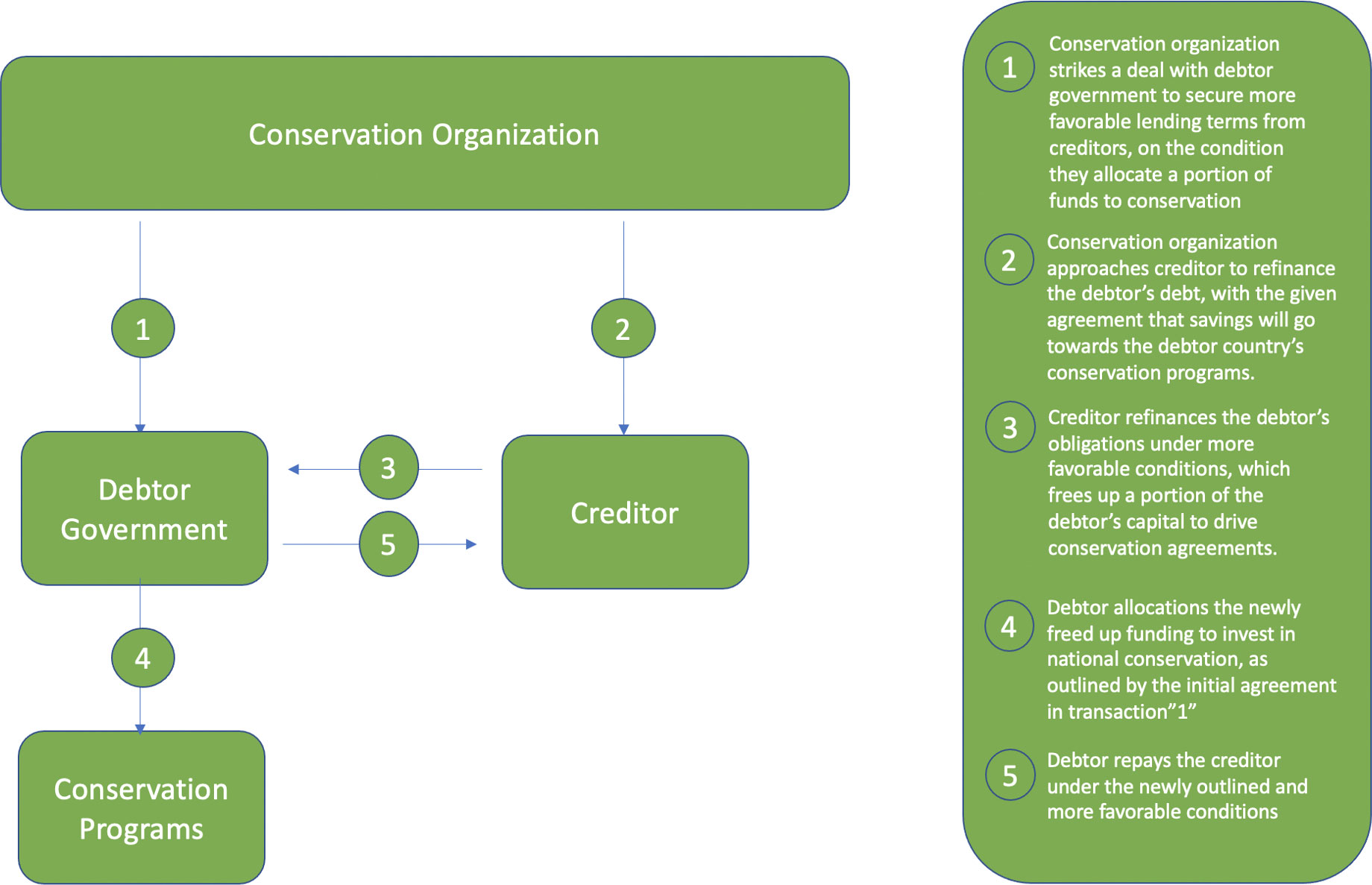

While there are different kinds of debt-for-nature swaps, this paper focuses on multilateral swaps where a third party broker (typically a non-governmental organization, NGO) raises funds to be used for the purchase of a portion of the debt at the now discounted value. The differential between the face value of debt and the current value at time of purchase frees up capital which can be put towards a national conservation program or commitment. The debt payments still owed are restructured to more favorable terms (e.g., in local currency, with reduced interest rates and longer timescales to repay) (Steele and Patel, 2020). Despite some common structures of debt-for-nature swaps (see Figure 1) the nuances of how these transactions actually occur (e.g., such as the terms negotiated, specific actions of each party, special purpose vehicles used, and timelines) vary from swap to swap. Each is negotiated uniquely according to the debtor’s specific economic/environmental dilemma and deeply influenced by political factors.

Figure 1 Drawn and adapted from the Ocean Finance Handbook (De Vos et al., 2020), this flowchart demonstrates an outline of the common structure of debt-for-nature swaps. The key provides additional depth to explain what the use of each specific transaction is.

A debt-for-nature swap allows the debtor nation not only financial allowances on their debt, but to also invest in their own sustainable future which can help grow the economy in the long term. This positive economic/conservation feedback loop may allow conservation financiers to multiply their impact in both economic and environmental need areas of developing nations. The benefits to the creditor are a politically and socially palatable way to write off a portion of debt which then limits the amount of loan loss reserves it must put aside - this then makes debt repayment more tenable by reducing the overall debt burden (Occhiolini, 1990). Finally, the creditor is essentially investing in the hope for more economic stability long term, of a country which will still owe them. Most debt swaps don’t write off entire debts, only portions, so the deal becomes financially beneficial to the creditor if the programs it implements strengthen the debtor nation’s gross domestic product (GDP) (i.e., ability to meet future debt payments of the remaining sum) (Post, 1990).

The Seychelles case study background

The Seychelles is a powerful case study illustrating debt-for-nature swaps and their defining characteristics. The Seychelles’ economic structure (discussed in detail in the Results and Discussion) and their Exclusive Economic Zone (EEZ) (which stands among the top 25 largest in the world and represents a biodiversity hotspot with two UNESCO World Heritage Sites) made it a highly attractive candidate for conservation planning. The island is characterized by their “blue economy” which emphasizes a heavy reliance on fisheries and marine tourism to support local livelihoods (SMSP, 2021). The net national commercial activity which is dependent on the ocean (i.e., tourism or fisheries) generates over 90% of the Seychelles GDP (FT/IFC, 2017). Further, as many as 23.1% of the 524 marine species living in the Seychelles, are threatened or near-threatened with extinction. As overfishing and climate change threaten these critical resources (Christ et al., 2020), the Seychelles was highly interested in finding novel ways to fund conservation efforts while simultaneously implementing sustainable economic practices and encouraging economic diversification (TNC, 2021). The blue economy is defined as “strategy for safeguarding the world’s oceans and water resources” that must “emerge when economic activity is in balance with the long-term capacity of ocean ecosystems” (Lee et al., 2020, pg. 1). This concept was the founding pillar upon which the Seychelles debt swap was created and is foundational to the inherent relationship between growth, development and protection of ocean resources.

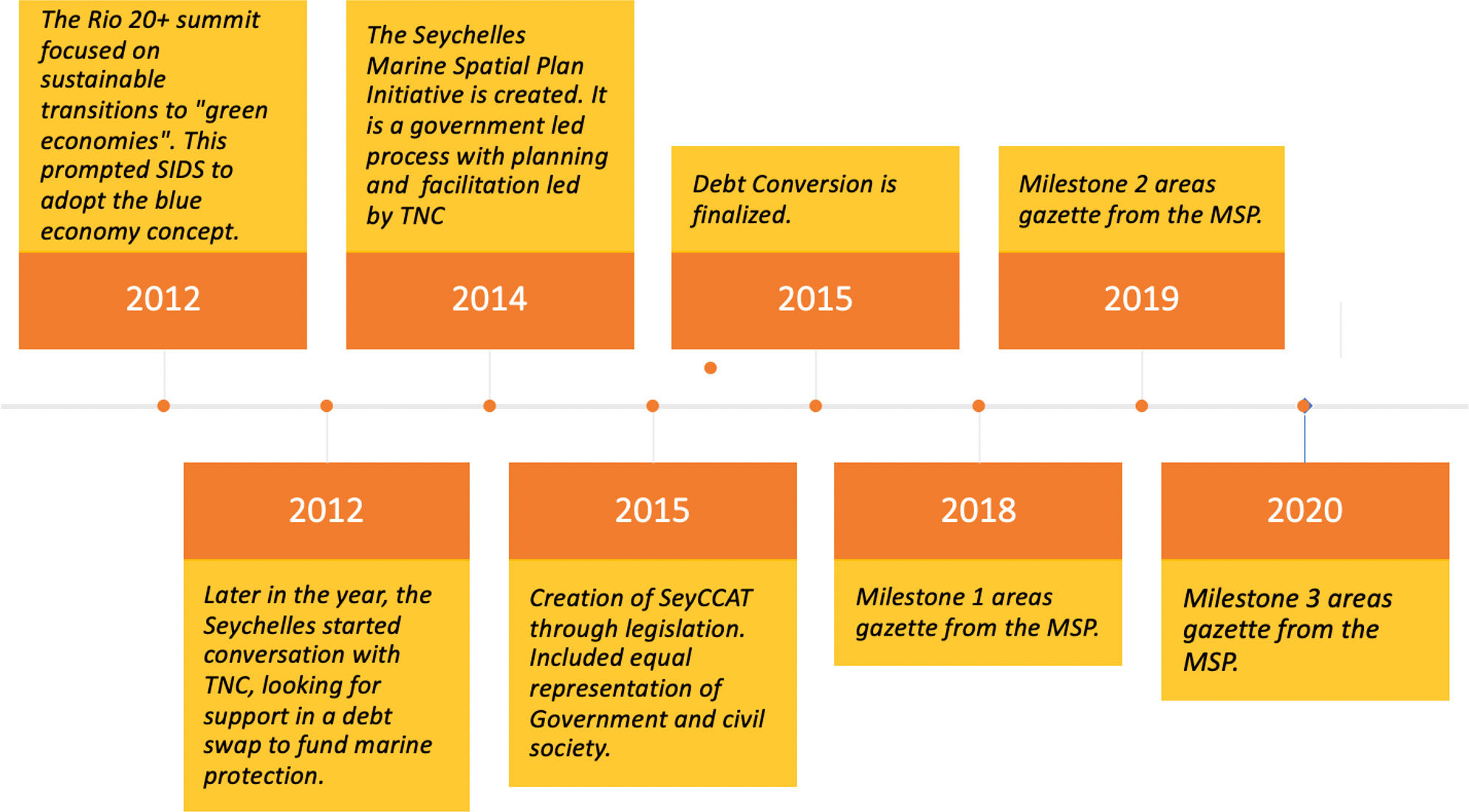

The Seychelles deal started in 2012 when the Seychelles government approached The Nature Conservancy (TNC) to negotiate a process which commenced over three years, resulting in a conservation planning process of a Marine Spatial Plan (MSP) which is still ongoing (Figure 2) (SMSP, 2021). The debt-for-nature swap stated that the Seychelles would allocate capital raised in the conversion to finance their recently determined goals from 2012: protecting “50% of all terrestrial areas and 30% of the Exclusive Economic Zone (EEZ) including 15% in fully protected areas … by employing an ecosystem-based approach to propose new MPAs [marine protected areas] in conjunction with improved management for uses and activities’’ (SMSP, “The Initiative”, 2021). The MSP, by definition, “analyses and allocates spatial and temporal distribution of human activities in marine areas to achieve ecological, economic, and social objectives’‘ (SMSP, 2021). The results were three established zones with designations of high protection, medium protection or multiple use (The Commonwealth, 2021). The initiative sought to use global best practices, scientific data, local expert knowledge, and stakeholder input to create a plan towards best use of the ocean, including what is known about its ecology (SMSP, 2021). The Seychelles government in conjunction with TNC created the Seychelles Conservation and Climate Adaptation Trust (SeyCCAT), an independent, nationally based, public-private trust fund. Further, the MSP has a governance framework which includes a steering committee, core team of government, TNC, and SeyCCAT representatives, and technical working groups with prominent stakeholder representatives - their goal being to drive sectorial advice and feedback as the plan develops (SMSP, 2021). This process demonstrates a commitment to co-production with long timescale integrations and milestones.

Figure 2 Timeline of the major events of the debt swap and Seychelles MSP thus far (2012-2021). Created based on SeyCCAT, TNC, and SMSP (https://seyccat.org/, https://www.nature.org/en-us/, https://seymsp.com/).

This case study provides an opportunity to investigate a possibly high impact model which could theoretically be adopted by other SIDS that have similar debt and climate change threats. As the COVID-19 crisis has drastically exacerbated many islands’ debt struggles, a renewed focus on sustainable debt mechanisms is timely; a deeper understanding of the process can provide insights in moving forward. Our research questions were: (1) What are the critical governance characteristics that facilitated the creation of the Seychelles debt-for-nature swap and best positioned it for potential success? (2) To what degree does this case study represent an evolution in debt-for-nature swap restructuring practices, potentially providing a new standard for conservation financing?

Methods

A case study includes multiple sources of evidence to draw inferences about the situation and favors qualitative analysis (Cox, 2015). Using a case study approach, our methods included secondary sources of data including a literature review and a content analysis of online resources, and primary data, including a select number of semi-structured interviews with key informants. The triangulation of information provided by these different sources offered a varied lens through which to analyze the case study (Jick, 1979).

Our initial research began as a literature review spanning from the 1980s to present. Keywords in the initial search included: “debt-for-nature swaps”, “debt restructuring”, and “debt-for-climate” to gain a foundational understanding of the concept and the financial incentives at play in many debt conversions. Later searches focused on “costs and benefits of debt-for-nature swaps” to further establish the criteria that would be used in the evaluation of our first research question. We selected additional search criteria to address our second research question, including “Seychelles Marine Spatial Plan”, “SeyCCAT” and “Seychelles debt-for-nature swap”. We also reviewed other sources of evidence, including the seymsp.com website (which hosts all Seychelles reported updates, frameworks, meeting minutes, and key players), news articles, and case studies documenting the details of this specific deal. These sources were further contextualized with relevant peer reviewed literature which have analyzed social, biological, and financial elements of this deal.

As part of our case study, we sourced a small number of interviews from key informants with expert knowledge of the deal. We sought representation from the main parties who negotiated the debt swap and the resulting governing structure: SeyCCAT, TNC (broker), and the Seychelles government (debtor). TNC and Nature Vest (the impact investing arm of TNC) worked as primary facilitators in the deal negotiations, structure, and now have representatives aiding in implementation. Our key informants were: Rob Weary (primary architect of the debt-for-nature swap from TNC, now independently contracting debt swaps), Joanna Smith (Marine Spatial Planning core team and representative from TNC) and Angelique Pouponneau (CEO of Seychelles Conservation and Climate Adaptation Trust).

We also used methods of comparative analysis to hold this case study as a benchmark against analogous historical case studies. By reviewing a series of previous case studies of debt-for-nature swaps, we determined patterns and standards which we then used as a baseline against which to compare the highlighted case study: the Seychelles. This method has been established in social science literature and is often referred to as “pattern testing” or “congruence testing” (George and Bennett, 2005; Yin, 2014). The official method for congruence testing involves measuring the defining features of a case to determine the extent to which they are congruent to a hypothesis or a theory. Here, we used this method to determine if this case study can be considered a deviation from a theoretical standard and criticisms of historical debt swaps, as outlined by literature and case studies. By either establishing or disestablishing congruence, we can make assumptions about the degree to which debt swaps have evolved from a social, environmental, and fiscal standpoint. The characteristics chosen for metrics of comparison are: sovereignty concerns, governance, timescales, and low converted sums. We acknowledge that with this method, it often takes more than one case study to more definitively determine a level of congruence, so the conclusions will be a suggestion at the possibility of evolution and will need to be substantiated with further studies.

Results and discussion

Part 1: Identifying the commonly cited characteristics

To address our first research question, “What are the critical governance characteristics that facilitated the creation of the Seychelles debt swap?”, we identified the most referenced characteristics from the primary interviews and secondary research. Our evaluation revealed the following key characteristics: the debt status relative to a blue economy, political willpower, financial processes, and the use of co-production practices. We elaborate on each of these characteristics below.

Debt status relative to a blue economy

A high debt to GDP ratio is detrimental to the financial stability of any nation but becomes vastly more important when considering the vulnerability of SIDS. Analysis of the Seychelles case study shows that this combination - debt burden and an economy which recognizes the value in their marine resources - is a national level criteria of nations who might seek to mimic this deal. SIDS, which include the Seychelles, are the nations deemed most susceptible to external shocks and climatic disasters with the most vulnerable sectors being tourism, fisheries, and water resources with a sensitivity to climate related events which can bring on economic losses as high as 40% each year (Robinson, 2020). This combined ecological, social, and economic vulnerability designates SIDS as at-risk well before factoring in the burden of high debt ratios. The financial strain of debt can leave a nation unable to invest in their own climate adaptation, economic resilience, and biological conservation practices. Debt swaps may offer one a palatable options - if designed and implemented well.

While theoretically a nation with any level of debt could instigate a debt conversion, if the nation is looking for a third-party broker (such as TNC) to facilitate, its debt burden would likely need to be significant. This seems a critical characteristic because there is so much opportunity for nations in need of debt restructuring that for an NGO to be interested, the impact must be evaluated as of the highest potential. Additionally, the more severe the debt crisis, the lower the market value the debt trades at because creditors recognize that, in this circumstance, it’s unlikely for them to get their initial loan back (Steele and Patel, 2020). The Seychelles debt was trading at 93.5 cents on the dollar, and while this is not as significant of a discount as some nations might have, without a discount, this mechanism would not work. The compounding effect of discounted debt is essential to make this financial mechanism appealing over simple grant writing or loans (Weary, personal communication, 2021). An alternative structure to ameliorate difficult finances is working with the interest rate since many commercial debts have high rates of 7-9%. In this scenario it may be worthwhile to buy the debt, even at face value, because an NGO’s cost of capital is (hypothetically) 5%. So, this means they are paying the debt at 5% cap, and charging the debtor nation 7%. This transaction leaves a 2% differential on both sides of the transaction which results in a satisfactory deal if a high enough quantity of debt is purchased. While this sort of transaction wouldn’t free up the same flows as a significant market discount, it’s another tool that is currently being considered (Weary, personal communication, 2021).

As discussed above, the Seychelles is a prime example of a blue economy. This concept is a critical component of both selection criteria for any of the SIDS looking to swap debt for marine conservation, and as the guiding pillar of the deal’s framework. The blue economy is highly correlated with SDGs 14-17 with the stipulation that stakeholders prioritize SDG 3 (Good Health and Wellbeing) and SDG 8 (Decent Work and Economic Growth) in the blue economy discourse (Lee et al., 2020, pg. 4). The Seychelles recognition of their blue economy is core to their national identity (The Commonwealth, 2018; SMSP, 2021). The Seychelles Strategic Policy Framework and Roadmap was published following the close of the debt conversion to outline their ocean based sustainable development plans from 2018 until 2030 (The Commonwealth, 2018; SMSP, 2021), noting that the Seychelles government considers the blue economy brand to be a “unique comparative advantage based on sustainability credentials” (The Commonwealth, 2018). In 2016, as payments on the debt swap and the MSP process were underway, the Seychelles government underwent a public process to declare a framework for their blue economy to “implement the concept at the national level as a framework to foster an integrated approach for sustainable development programmes” (The Commonwealth, 2019).

Political willpower

All of the interviews cited political will as one of, if not the biggest, factors in debt conversion success (Pouponneau, personal communication, 2021; Smith, personal communication, 2021; Weary, personal communication, 2021). Political will (while undefined by interviewees), in the context used, aligns with the following definition: “an amalgam including managers with adequate financial, technical and administrative capacity over sufficient periods of time, a political agenda with space for environmental issues, leadership in government and the community, manageable levels of corruption, and an environmentally well-informed community giving strong support for management actions’’ (Sale, 2015, pg 98). The debtor nation’s political will, in this scenario, would ideally be centered around conservation commitments to the degree that it stands as a priority against other significant political agendas such as short term economic sectors, or global relationships. The Seychelles was cited in interviews as an example of a nation who agreed up front to conservation commitments, however the negotiations and financial elements took time to iron out. In contrast, other government nations looking to institute a similar deal in their marine sector may face resistance from key fishing sectors which can delay momentum of negotiations. There will likely be a higher degree of political willingness during negotiations if local stakeholder interests are evaluated in a substantial way since governmental actors have local economies and stakeholder needs to contend with (Bennett and Dearden, 2014). An example of this is an upcoming Ecuador deal which threatened (from stakeholder perspectives) to detract from their most profitable fishing industry: tuna. To support negotiations, the 3rd party brokers used data from geo-tagged fishery activities to design the no-take areas so that only ~5-8% of the ocean area relative to the sector should be impacted. (Weary, personal communication, 2021). This type of evaluation could be conducted in early stages by the party spearheading the deal to build political will and to practice of co-production prior to implementation. Co-production is discussed later as another key characteristic of this deal, demonstrating that these characteristics are deeply interrelated when best applied.

Political will is a key enabling factor but may conversely be a barrier. There are examples of deals that were attempted, and nearly fully structured in the past couple of years, but failed to be completed because of a lack of political will. These cases had gone through negotiations, but ended up dissolving before nations were willing to fully commit (Weary, personal communication, 2021). Notably, there are many reasons that a nation may be hesitant to commit to a debt conversion or barriers to the process (see e.g., above discussion on the critiques on debt-for-nature swaps restructuring).

While political will has always been a relevant governance factor in debt swap cases, the Seychelles case study further demonstrates exactly how powerful it can be. The large conservation commitments of 400,000 sq. km (equivalent to the size of Germany) will create the 2nd largest marine protected space (after the Great Chagos Bank) in the Indian Ocean and among the largest in the world (MCI, 2022). So, while the financial amount of debt relief may not be groundbreaking, the conservation agreement is, and that aspect of the deal stems from the political will of the Seychelles government. This consideration has ties to the concepts from Fenton et al. (2014) who states that a nation with pre-existing adaptation or mitigation plans make attractive candidates for this sort of deal. This is likely because nations with such programs in place have a progressive government supporting these structures.

Financial processes

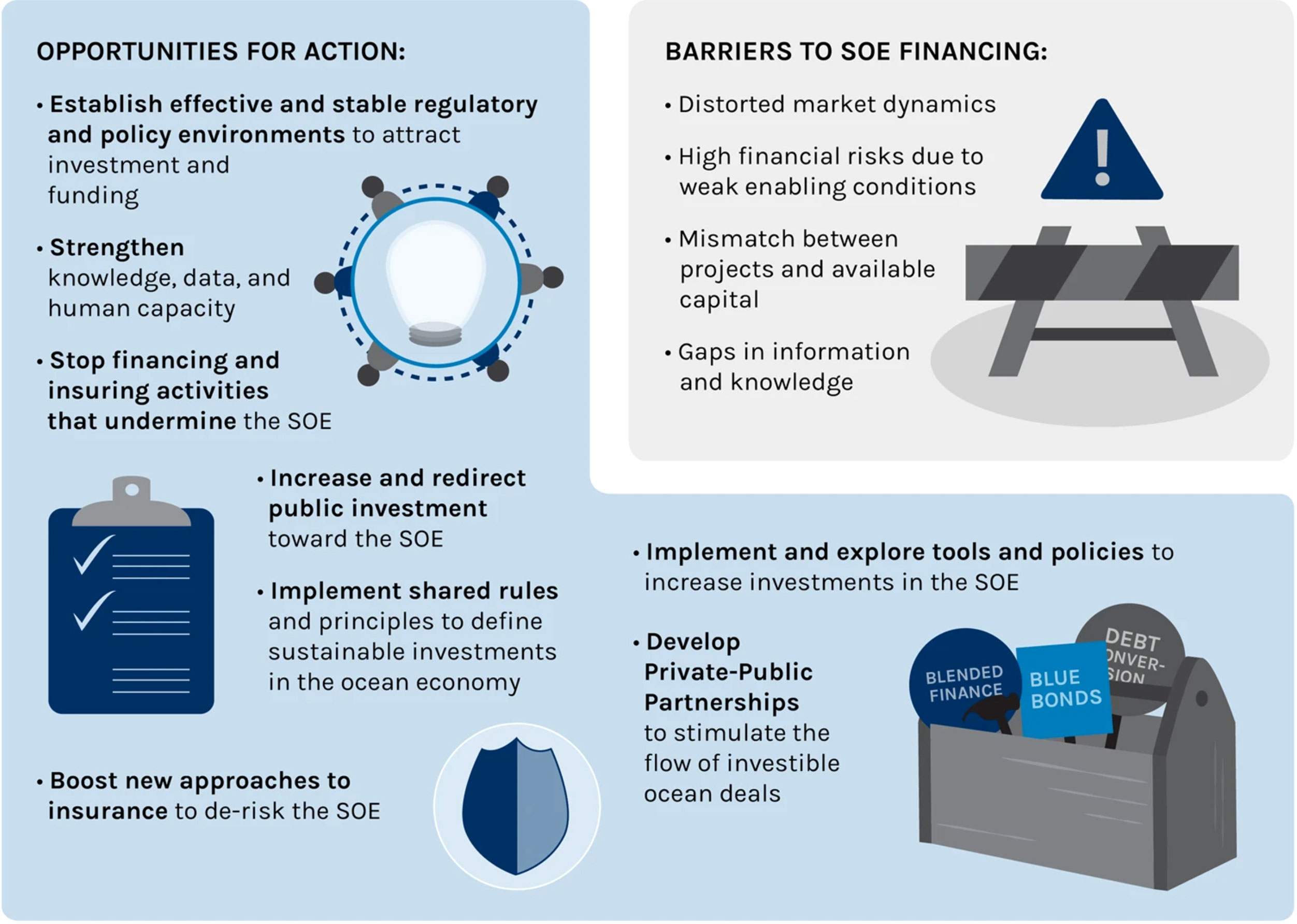

As with any large conservation initiative, securing the funding is among the most difficult parts. The major challenges in financing a sustainable ocean economy include “a weak enabling environment for attracting sustainable ocean finance, insufficient public and private investment in the ocean economy, and the relatively high-risk profile of ocean economic sectors” (Sumaila et al., 2021, pg. 9). The recommendations to overcome these barriers are the creation and mobilization of a “full suite of financial tools and approaches” including debt conversion, blue bonds, and blended finance (see Figure 3) and which particularly include “women, youth, and marginalized communities” (Sumaila et al., 2021, pg. 9). When discussing debt conversion potential, Sumaila et al. (2021) highlights the Seychelles case study as an example for how similar debt swaps could be designed.

Figure 3 This graphic (from Sumaila et al., 2021, designed by Patricia Tiffany Angkiriwang) highlights the tools recommended in their assessment of innovations which can best advance financing a sustainable ocean economy (SOE).

With the recommendation that debt swaps qualify as an innovative financing tool, comes the need for innovative financial processes to support the growing mechanism. Only recently have leaders in this space begun to devise how to generate the financial means to move large deals forward. The US has a Development Finance Corporation (DFC, formerly the Overseas Private Investment Corporation) which provides payment/loan guarantees and political risk insurance (DFC, 2022). Private insurers do exist, but their premiums could be two to three times higher than DFC, if they would even offer the insurance at all for some countries. Third party brokers are using this political risk guarantee to buy on the market with backing from the US government. This means the notes they issue can be rated at AA- (a metric of determining their creditworthiness) which allows them to raise the capital cheaply. Another recent breakthrough is the role investment banks are willing to play in the capital raising process. Funding historically relied on grant money but has transitioned to using loan capital funded by the capital markets. Standard Chartered, a major international investment bank, was the underwriter for the Seychelles’ Blue Bond capital raise and Credit Suisse is providing even larger capital guarantees for the deal in Ecuador (Weary, personal communication, 2021).

When an investment bank agrees to “ firm underwriting” a deal, they are providing assurances that the capital will be raised via a bond issuance. This avoids uncertainty in promising specific amount of capital, which can be a major obstacle in the negotiation process with the sovereign country. As Weary explained, (personal communication, 2021) Many major commercial banks can only offer “best efforts”, which means if they can only find buyers for a lesser sum of the bonds issued, the broker is put in a difficult spot when they show up with less funds for the deal than promised. The funding stream from the debt conversion being created from the bond issuance, underwrote by a major commercial investment bank and backed by USIDFC, are the key financial aspects deals can aspire towards with this new model - especially given the goal of larger capital commitments.

Financial processes are considered a key governance criteria in both the creation of the debt swap, but also the continued allocation of funds post swap. Once the conversion of debt is set, there must be institutions in place to not only manage the funds from a governance perspective but also guide the community in capitalizing upon implementation. One option is a trust fund such as SeyCCAT, but their role goes beyond just ensuring payments and directing money towards conservation. They have taken on a role to ensure the community is able and aware of the potential of the grant money. SeyCCAT holds stakeholder consultations while designing their requests for grant proposals and prioritizes diversity in its beneficiaries (Pouponneau, personal communication, 2021). In total, with proceeds from the blue bonds and the debt swap, SeyCCAT distributes $700,000 annually towards locally driven conservation projects (The Commonwealth, 2020).

In the case of the Seychelles, there has been some difficulties with accessibility and inclusivity for the SeyCCAT's funding stream. This comes from the Blue Grants Fund being supported by international donors and organizations who may not recognize the local challenges in applying for these grants. A cited example of this is the application form being based on a standard EU format which was unfamiliar and intimidating for local Seychellois who might otherwise apply for grants (The Commonwealth, 2020). This is where SeyCCAT (or any other analogous trust fund) can assume an intermediary role. SeyCCAT has, for example, removed language barriers through translation programs, conducted public island meetings and one-on-one meetings with community members (fisheries, young female entrepreneurs, public sector representatives, etc.), and dedicated resources to capacity building (The Commonwealth, 2020, Pouponneau, personal communication, 2021). The capacity building element involves holding sessions during the first application stage to cover project and budget writing skills, project management, monitoring and evaluation, as well as dedicated mentors to facilitate the application process (The Commonwealth, 2020).

SeyCCAT demonstrates that the role of the trust fund created out of the debt swap could go beyond simple money management to encourage community participation in the conservation funds available. However, this case study further demonstrates that this role is complex and must be adaptive to the unique problems faced by the community at large. A lack of original ideas in grant applications are noted as causing a pattern to emerge where one idea is copied with slight variations again and again. This may come from SeyCCAT’s request for grant proposals giving an example or theme that becomes overused (Pouponneau, personal communication, 2021). Additionally, the duration of grants is two years and behavioral change can take longer, so it may be difficult to strike the balance of following the stipulations outlined in donor/debt agreements and ensuring that the desired impact is actually achieved (Pouponneau, personal communication, 2021). A recent adjustment SeyCCAT has made is to hire monitoring and enforcement employees to follow the grant proposals more closely beyond just the application process, and initial satisfaction of the project - to evaluate the effectiveness of these initiatives and find measurables from a conservation, social, and economic perspective (Pouponneau, personal communication, 2021). This role is clearly nuanced as it needs to have a strong intuition of how the community is receiving these grant opportunities, they needs to drive achievement for sustainability solutions, but above all needs to remain financially stable to meet its fiscal mandates and continue providing funds in the long term (Pouponneau, personal communication, 2021).

An important consideration for future nations looking to implement a successful debt swap/conservation program is capacity building and strength of internal institutions. Any agreement is going to have specific disbursement periods and to best capitalize upon this, a nation could consider engaging in capacity building during negotiations so that once the deal is established, the local population is ready, educated, and capable of utilizing benefits (Bennett and Dearden, 2014). While trust funds have always been created as a standard outcome of debt swaps (OECD, 2007), the institution itself is not sufficient as it must be adaptive in its integration and implementation methods for capital disbursement. This role is highlighted as prominent in the segment of funding streams above, because an impediment to more free flow of capital supporting SDGs is the lack of measurement, reporting, and reliability which can be provided by a fund. Trusting that the governing institution is going to transact the money in a way which actively generates positive social returns is a strong incentive for future investment. A standardization in this process of operating and evaluating will only augment the model for greater scalability.

The use of co-production practices

The final core governance factor which facilitated the Seychelles swap, and its success, is their use of strong co-production practices and transparency. The Seychelles case study has been cited as a strong example of integrating stakeholders and applying their localecological knowledge (LEK) in the development of the MSP (Baker and Constant, 2020). Several studies from Seychelloise researchers demonstrated how well local artisanal fishers understood sustainability in fishing practices. Examples include fishers’ knowledge which led to informing key sites and vulnerable species in the Seychelles (Robinson et al., 2007) and key locality and temporal patterns of spawning aggregations (Robinson et al., 2004). Another example of LEK is the fishers use of traditional bamboo traps called Kayse which differ in structure depending on the depth of placement. Three different depths have different weights, constructions, and timing methods, all to ensure that there is space for juveniles to escape, and allows for prudent monitoring of by-catch (Baker and Constant, 2020). Multiple fishers also describe monsoon season (which affects their ability to reach many offshore areas) as a welcome respite for fish stocks and they even describe the phenomenon as “nature assisting [them]” to create a “biological rest” (Baker and Constant, 2020, Artisanal Fisher, C). These fishers had significant LEK to contribute, as well as dependence on the resources, so that their involvement in participatory planning was necessary.

Transparency, inclusivity and participation are listed as guiding principles for the Seychelles MSP and are “cornerstones of engagement, consultation, and communication with stakeholders and civil society” (SMSP, 2021). They have complex stakeholder frameworks, which are openly published online, including individuals and groups from energy, finance, fisheries, marine ecology, maritime security, terrestrial ecology, and tourism sectors. Each of those groups have between 2-12 associates listed under them, with their professional information provided. To replicate this degree of transparency in other cases, the government needs to support a participatory process, the stakeholders need to be calling for it, and the facilitators (in this case TNC) need to determine best practices that encourage co-production and transparency (Smith, personal communication, 2021). Smith (personal communication, 2021) said that while TNC and the MSP steering committee were all excited about the use of best practices, they were unaware how far it would lead. Since 2014 they have held over 265 meetings, ranging from one-on-one consultations, large assemblies, committee meetings, and workshops. This is exemplary practice in regard to stakeholder engagement. SeyCCAT has audits published yearly, a reservoir of published governing documents, archives, board meeting minutes, and updates, all available via their website (Pouponneau, personal communication, 2021; SeyCCAT, 2021a). This level of communication demonstrates not just transparency and stakeholder engagement but may also draw interest from further investors and partners down the line who can see the management in place.

Pouponneau (personal communication, 2021) mentioned that stakeholder engagement remains core to not only the design of a deal like this, but also the continued impact. She explained that SeyCCAT does stakeholder consultation in terms of designing their requests for proposals and aims for diversity in terms of grant beneficiaries (Pouponneau, personal communication, 2021). Furthermore, other stakeholders and technocrats can sit on the grants committee, and the conception of SeyCCAT was deliberate in giving out seats that exemplified the diverse economic and political structure of the nation (Pouponneau, personal communication, 2021). These seats on the grants committee mean that varied voices are all included in the decisions about where the money goes because while there are outlined stipulations, there is still variability for what the priorities year by year should be (Pouponneau, personal communication, 2021). This ongoing co-production is a significant lesson learned because even if co-production is used in striking the deal, the standard must be maintained in perpetuity for continued buy-in and socio-economic success to match the conservation.

Part 2: Analysis of debt swaps from 1980s to present

To address our second research question, “Does this case study represent an evolution in conservation financing?” we reviewed the major case studies and examples of debt swap cases primarily dated between 1987- to present (Bedarff et al., 1989; Hansen, 1989; Hrynik, 1990; Thapa, 1999; Gockel and Gray, 2011; Macekura, 2016; Steele and Patel, 2020). From this literature review, we identified patterns of common debt-for-nature swap criticisms which served as a baseline to compare the Seychelles case study.

Historical deal structures

Debt swaps have been utilized globally since 1987 to fund numerous conservation projects (Hrynik, 1990). For a timescale reference, between 1988 and 1990 the US generated donations amounting to 10 million dollars to relieve 69 million dollars of debt, but this total sum accrued over 14 different small deals (Thapa, 1999). This demonstrated that while there was early potential to accrue capital, its distribution ended up being sparse amongst many different nations.

The first 20 years represented the conception of debt-for-nature swaps and the subsequent inaugural deals, followed by the momentum of many subsequent swaps. There was a much higher volume of debt swaps in earlier decades and a notable waning in the use of this mechanism in the 2000s. There is also a lower number of case studies published and reviews written after the early 2000s as the interest and popularity in the mechanism seemed to have decreased from an academic perspective. Further, multiple studies also noted that the instrument became rather dormant (Fenton et al., 2014; Mitchell, 2015). A reason for this lull may have been the rise of debt prices in the secondary market and the enactment of other debt relief programs such as HIPC (Steele and Patel, 2020). This timeline of initial momentum, followed by a documented slowing, and current uptake in attention, intent, and progress do suggest that debt conversions have undergone an evolution to the point where they may perhaps deserve a rebranding and departure for the historical implications of “debt-for-nature”. Another factor in this new rise in popularity and attention may come from the COVID-19 crisis which drove national public debt and therefore higher risk to default in many nations (Nedopil et al., 2022). Below we elaborate on this theory by analyzing historical deal structures, main criticisms, and evidence of evolution to determine the degree of progression. This research question is valuable because historical perceptions can have modern implications if nations are wary of debt swaps. A more current academic baseline of the process can help re-establish a norm for the benefits and consequences, so that debt-for-nature swap candidates and parties can make informed decisions.

Central critiques

The earliest of attempts at structuring these debt swap deals saw varying levels of conservation success, but were often faulted for not restructuring enough capital to have a substantive impact on the net debt burden of the countries in question (Cassimon et al., 2010; Macekura, 2016). Beyond the financial records that set a historical standard, literature has also suggested a pattern of debt swaps being too small and riddled with high transaction costs compared to other financing instruments (Hansen, 1989; Thapa, 1999; Moye, 2001; Reilly, 2006; Silver and Campbell, 2018; UNDP, 2021). This key criticism leads to discussion about the net efficacy of debt swaps when only minor percentages of debt are reconstructed (Hansen, 1989). This issue has the potential to be exacerbated if debt swaps are not properly implemented and cause drastic limitations to local economies. This possibility comes with the assumption that the conservation agreements outlined in most swaps may be at at odds with the stakeholder usage of natural resources and commons (Bedarff et al., 1989; Nedopil et al., 2022). Scientific literature strongly outlines the importance of co-production practices which include local stakeholders in the planning, design, and implementation to achieve the highest rates of adoption, incorporate LEK, and prioritize the people who will be fiscally impacted in the near term (Brooks et al., 2013; Kittinger et al., 2014; Sterling et al., 2017).

Another consistent criticism of debt swaps is the possible detrimental social and political implications if governance is improperly instituted. Case studies in Bolivia, Costa Rica, and Madagascar have highlighted examples of farmers being displaced from their land, circumstances that drive locals closer to poverty, and restrictions against traditional foraging practices (Hassoun, 2012). For this reason, nations with mitigation or adaptation practices or commitments already in place may be the most attractive candidates for future swaps (Fenton et al., 2014).

There was also a concern, particularly in those early decades of conversions, that debt swaps led to sovereignty issues (especially in the case studies on forestry projects) where the creditor essentially controlled land areas of the debtor country (Moye, 2001). This issue persists as one of the more difficult critiques to evolve from, as many governments are still reluctant to link debt-for-nature swaps to policy change (Moye, 2001). Warland and Michaelowa (2015) argue that these reluctances are currently based more in perception than reality as this issue is now well included within negotiations. However, these perceptions pose a barrier if governments do not have direct ownership over the negotiation process. The debtor country playing a major role in allocating funds from the debt swap is important to avoid perceived state sovereignty issues and to properly align with national strategies and plans (Warland and Michaelowa, 2015).

Finally, debt conversions are a niche instrument but belong to a much larger category of conservation financing. There is a sentiment that conservation financing in general is “slow and clunky” with a tendency to be “performative” with “optimistic claims” which eventually bring in “low returns” (Dempsey and Suarez, 2016, p. 654). Dempsey and Suarez (2016) argue that this is why the “big big money” has yet to really appear on the conservation financing scheme. They further discuss the preexisting notions of for-profit conservation, highlighting that even as mechanisms evolve, bias may be a factor in convincing the private sector or individuals to engage (Dempsey and Suarez, 2016).

Evaluation of evolution

Our literature review offers a rough baseline by which we can evaluate our case study against the four commonly noted criticisms: sovereignty issues, governance, low sums converted, and timescales.

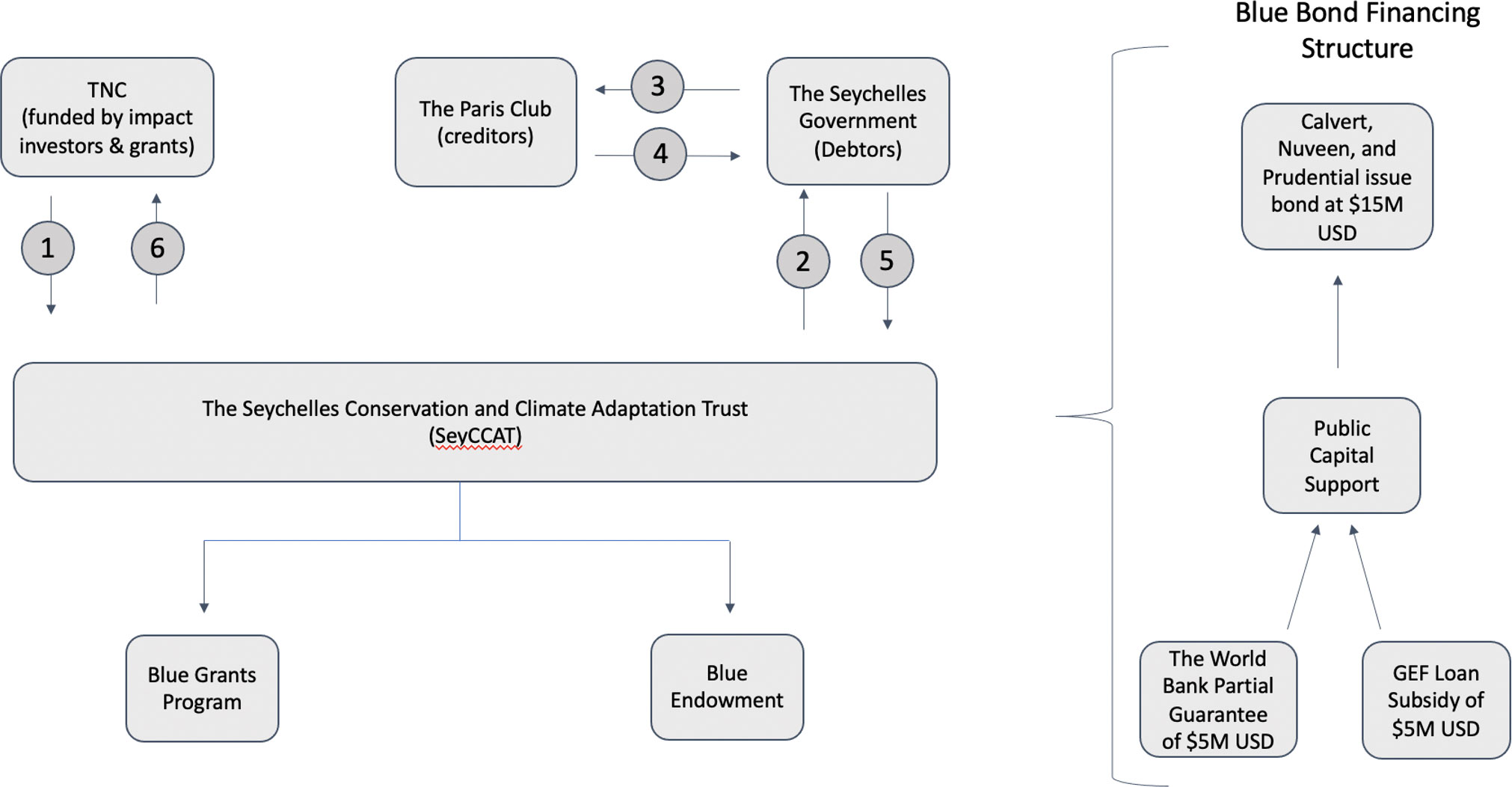

The 21.6 million deal in the Seychelles (depicted in Figure 4) redirects a portion of its current debt payments to fund nature-based solutions to climate change through SeyCCAT. The stated streams for redirected debt payments will go to: (1) finance marine and coastal management to increase resilience to the impacts of climate change, (2) capitalize an endowment to finance work to support adaptation in the future, and (3) repay impact investors (Payet, 2021). The timescale of debt repayment was changed from 8-20 years, and 70% of the debt will be payable in local currency rather than foreign currency, which would have caused a crushing exchange rate (TNC, 2021). The specifics of the Seychelles debt conversion, along with the subsequent blue bond issuance are elaborated upon below.

Figure 4 This diagram (created based on information in The Commonwealth, 2020) shows the specific transactions that took place throughout the Seychelles debt swap, as well as to finance the blue bond. There are many complex relationships and financers, and this simplified structure gives an understanding to how complex these deals can be, considering this took years to negotiate. The numbers signify the order in which transactions occur.

The Seychelles was a sustainably oriented nation prior to the debt conversion and already had ambitions to improve their resilience to climate change (SMSP, 2021). The government initiated the deal and individuals interviewed stated that the government was deeply involved and took ownership over the process (Pouponneau, personal communication, 2021; Smith, personal communication, 2021; Weary, personal communication, 2021). This helps ensure it does not fall into issues of real or perceived sovereignty infringement. To address governance, the MSP has been extraordinarily detailed in its transparency and use of stakeholder inclusion. As noted previously, the Seychelles Marine Spatial Plan Initiative website (central page for the MSP) provides transparency by including comprehensive information on its governance (SMSP, 2021). The MSP is presented as implementation according to zones with preset milestones visible to local, allowing for feedback and adaptation. While our interviewees spoke to the inclusivity and co-production in the MSP design (Pouponneau, personal communication, 2021; Smith, personal communication, 2021; Weary, personal communication, 2021), other research has pointed to contradictory results. Individuals in the fisheries sector have stated that their voices were not properly heard and that their input was not adequately reflected in the plan (Schutter and Hicks, 2019). The conflicting perspectives we note here demonstrate how difficult instituting co-production practices becomes with competing values and agendas. However, the documented meetings, and outlined processes presented in the Seychelles case, are a strong step in getting stakeholders around the table - evaluating the efficacy of those conversations is certainly more nuanced.

While this deal, in its overarching structure, suggests it will perform favorably against the historical standard of debt swaps, its small financial scale is a limiting factor which remains to cement the model. This is perhaps the element of this swap which least demonstrates an evolution from previous standards. In relative terms, 21.6 million USD isn’t a large amount of debt and doesn’t stand against that common criticism of the fiscal impact being too small. That said, the cost of the swap does not properly reflect the economic opportunity cost to the Seychelles in designating so much ocean as protected (Silver and Campbell, 2018). The Seychelles has very lucrative economic resources such as seafloor mineral/energy deposits - and this is the case in many other SIDS EEZs. With this factor in mind, it seems that the “durability of MSP zoning and LMPAs [large MPAs] will depend on the extent to which adequate attention has been given to economic activity in planning and implementation and whether local people are engaged as stakeholders” because it’s critical that they “feel that they are the beneficiaries over time” (Silver and Campbell, pg. 12., 2018).

Smith further noted that there are nuances often not considered by the general public when evaluating a plan as complex as the Seychelles MSP. For example, it’s difficult to consider the built-in price of proper implementation and the externality costs of not using best practices. She stated that TNC, SeyCCAT, and the Seychelles Government have made transparency, inclusion, and best governance practices the ultimate focus of their work and that to achieve these goals, there are extra costs and longer timescales (Smith, personal communication, 2021). While the upfront efficacy and results may look below the bar to some perspectives, there is a strong scientific consensus in the literature that best practices for co-production are necessities when long-term social and ecological goals are in mind (e.g., see above section on co-production).

From a strict numbers standpoint this case study falls short in demonstrating that modern debt-for-nature swaps are a tool in alleviating national financial burden. To further investigate the main critique of low converted sums, we looked at the recent creation and announcement of debt-for-nature swaps in the marine space. Belize worked with TNC to structure a deal which converted all of their commercial debt and a quarter of their total debt (553 million USD) in 2021. The savings created in the debt swap are allocated to provide 190 million in conservation funding over 20 years alongside the commitment under protection by 2026 (TNC, 2022). Another recently announced swap is proposed to more than double the no-take area in the Galapagos marine reserve out of a significant debt conversion that includes a substantial impact investment into the Galapagos. This will be the largest deal the US government (referring to political risk insurance) has ever supported on any project. These examples of recent and future debt swaps suggest an evolution that might remedy the biggest criticism of debt swaps overall. These forthcoming deals are evidence of scalability using methodology developed during the Seychelles deal. They contradict primary criticisms that debt swaps can’t support large enough sums to realize true impact. Additionally, the issue of high transaction costs are ameliorated with this progress since those costs are essentially fixed, and as the scale of deals increases, the percentage of transactional costs becomes more negligible. While it is possible to design these deals so all transaction costs are included, even if the country has to pay costs at close, its offset by the scale of savings (Weary, personal communication, 2021).

To determine specific characteristics of this debt swap evolution, our primary analysis focused on the novelty of the Seychelles case study in the deal’s structure, implementation methods, and results. While the skeleton structure of the deal is based on a long history of debt-for-nature frameworks, this case study has been lauded as particularly innovative (McFarland, 2021). This particular debt swap is the first to focus on marine resources, the first time a developing country creditor (South Africa) has entered a debt deal with another country from the Global South, the first debt swap designed explicitly for climate adaptation, and the first to include impact investing (McFarland, 2021). These deals are traditionally called “debt-for-nature” swaps, but the Seychelles has labeled its as a “debt-for-adaptation” swap (TNC, 2016). While the difference is subtle, it emphasizes that this deal is the first of its kind constructed with specific climate adaptation practices in mind. Designated as “pushing the boundaries of conservation financing” the Seychelles MSP won an award in 2017 from the Financial Times/International Finance Corporation for “Catalyzing Finance and Disruptive Technologies to Boost Sustainable Solutions” (FT/IFC, 2017). The plan is unique in its size, scope, and inclusion of local stakeholders. The Seychelles intends to fund conservation activities which can grow and adapt to the changing climate - the focus on adaptation means specifically building resilience to reduce the vulnerability of a community against the impacts of the changing climate (Pouponneau, personal communication, 2021). This specific and differentiated label (compared to past “debt-for-nature” swaps) is also a nod to the timing of the deal as it was created and marketed after the Paris Agreement. This was cited as giving the deal some momentum and a huge point of discussion was the commitment to adaptation (Pouponneau, personal communication, 2021). The need for climate adaptation practices is rapidly growing in SIDS as they are highly exposed to tropical storms, rising sea levels, and bleaching or acidification events which threaten their economy (Rambarran, 2018). When this exposure is coupled with burdensome sovereign debt, the economic risks become significant- highlighting the need for innovative financial mechanisms. Impact investing with its combination of private and public funds that leverage each other creates a new model for co-investment debt swaps in other areas of the world (Weary, personal communication, 2021). With this long list of novel aspects, the Seychelles deal may embody a new chapter, supported by an evolved framework and environment, for debt swaps globally and particularly for SIDS.

The Seychelles deal may indeed be a turning point to usher in a new frontier of debt swaps. While it was novel in many ways, including impact capital was a pioneering aspect of this evolution. From a debtor nation perspective, the impact investing is promising because it focuses on the social/financial element of sustainable development, and it could potentially bring progressive market relationships for the future beyond this deal. From the broker’s perspective, raising grant money often takes the vast majority of time and results in multi-year timescales. One further novelty that this case study highlights is the US DFC allowing brokers to use their political risk insurance policy as a form of credit enhancement.

In the 1980s and 1990s when the concept originated, bilateral and multilateral debt dominated the external portfolios for national debt, particularly in Caribbean SIDS (Rambarran, 2018). However, in recent decades there has been a shift towards more expensive commercial borrowing and domestic debt (Rambarran, 2018). This shift is augmented by the international ratings agencies assign new credit ratings to many SIDS, resulting in these nations relying heavily on commercial bond issues as a primary finance source (CDB, 2013; Rambarran, 2018). This is relevant because the deals evaluated in this research, such as the Seychelles conversion, are best applied to commercial debt. Public debt is often concessionary and doesn’t offer the same discounting features (such as debt trading below value on capital markets or interest rates differentials) that make these deals fiscally palatable (CBD, 2001) This is important for evaluating candidacy and opportunity because the structure of a nation’s debt is just as important as its sum for the purpose of conversion potential.

Our findings suggest that this case study does not wholly represent an evolution in conservation financing, but rather represents the opportunity for one (see Figure 5). The historical timeline analysis shows that there is a definitive uptick in interest in this type of deal and therefore potential, but not enough new model swaps have been completed to cement a new standard. The historical criticism analysis shows evolution in the inclusion of local stakeholders and sovereignty concerns, but not enough evolution in the timescales. Additionally, we cannot definitely analyze the historical critique of biological impact as it is beyond the scope of this research. For this environmental success to be truly determined, further research weighing the quantitative outputs of the MSP are needed (i.e., fish stock yield, coral reef regrowth, species abundance, reporting on the local sustainability projects funded by SeyCCAT). Finally, examination of the financial components of this deal illuminate impressive possibilities, hindered by a low converted sum (21.6M USD). The actual structuring of the deal itself, as discussed above, can be deemed an evolution in debt-for-nature swap practices. However, the final amount of debt restructured is too small to state that this specific case study is the hallmark for an evolution in debt-for-nature swaps.

Figure 5 This figure shows the simplified conclusions to our second research question which evaluates the recent evolution of debt-for-nature swaps. We find that the Seychelles case study demonstrates marked progress from the historical standard regarding sovereignty concerns and governance, but not concerning timescales and low converted sum.

All of this evaluation of historical standards against the Seychelles case study concludes that, in reference to our second research question, this debt-for-nature swap functions as evidence that a new standard is possible, a new set of best practices and frameworks exist, and that the historical bias of debt-for-nature swaps might be reconsidered. Indeed, the Seychelles case study lays the new potential groundwork of new financial structuring and governance best practices. This is supported by the subsequent swap in Belize and announced swap in Ecuador which used the same process, but scaled it to support more impactful sums of debt converted. In conclusion, this swap symbolizes potential for an evolution but the procedures need to be tested and it is likely because of this deal that there was appetite for larger deals - it had a critical part to play in conservation finance evolution, even if the case study itself doesn’t serve as the representation.

This paper had limitations concerning the quantity of qualitative data available, the timing relative to the very recent announcement of new relevant case studies, and a lack of quantifiable ecological impact from the MSP to evaluate the success of the conservation efforts. This research relies heavily on the perspectives of three interviewees who were able to speak to their experience in facilitating the swap, planning the MSP, and working at SeyCCAT. There were attempts to contact and interview a number of additional individuals, but it proved difficult to establish communication during the time period this research was limited too. The Ecuador debt swaps is still in production and the Belize debt swap has not been well studied, and thus more time is needed to see how these new deals play out. Further research will need to compare this case study and its suggestions for future implementation against latter swaps to establish a stronger baseline of recommendations and learnings. Finally, once there has been enough time for the ecological impacts of MSP initiatives to be properly documented, this will enhance future research’s ability to measure the global importance of debt-for-nature swaps and the relevance to SIDS.

Conclusion

The Seychelles case study has been hailed as a promising new case which provides hope for other SIDS facing similar struggles to fund climate adaptation in the face of a national debt crisis. The currently evolving structure of debt-for-nature swaps and lessons learned from ongoing case studies position the mechanism to scale when paired with the current global social, economic and political environment. COVID-19 has drastically impacted many nations commercial debt and this crisis has risen to become a pertinent topic on many global forum agendas. As solutions are being discussed, the timing is very opportune for this reinvigorated mechanism. However, with this timing comes the hope that deals don’t rush into implementation without gaining a holistic understanding of key lessons and takeaways from past examples. Debt-for-nature has a lot of potential, but without careful consideration and structures this potential could lead to adverse results (such as those outlined in the main criticisms section of this paper).

With this global environment demanding innovations in a well-established procedure for conservation finance, it is imperative to continue deeply analyzing the way this concept excels, falls short, and has opportunity to grow. This time represents a possible acceleration point in conservation financing as Environmental, Social, and Corporate Governance market forces are on the rise and there is revitalized interest in methods. With this potentially progressive time, comes the crucial stipulation that methods for design and implementation are refined to create hard standards for best practices. Successful debt-for-nature swaps now present a higher opportunity for impact than in the past because global markets are showing increased desire to diversify their impact investing portfolios. A nation with the conservation infrastructure created by a debt swap naturally attracts these investors.

The Seychelles deal proved intriguing enough to the financial world, that it attracted major attention from three major financial institutions. The World Bank, Prudential Financial, and Nuveen and Calvert Impact Capital each provided five million to fund the first sovereign blue bond issued to the Seychelles in 2018 (The Commonwealth, 2020). This suggests that the infrastructure created by a successful debt swap has the potential to draw interest from future investors down the line. This may be because the terms of the swap implement programmes and controlling entities - such as SeyCCAT - which presents a more stable foundation which private investment funds are willing to back due to decreased risk and higher impact potential. SeyCCAT is tasked with managing and allocating funding streams from both the debt swap, and the blue bond (SeyCCAT, 2021b). Furthermore, this Blue Bond is another first pioneered by the Seychelles - this demonstrates that a nation whose government is willing to prioritize innovation and sustainability has a lot of space for opportunity. The Seychelles issuing a Blue Bond - the first one in the world - is relevant despite being a separate entity from the actual debt conversion. The debt swap places the Seychelles on a better credit footing which allows them to issue the blue bond (Pouponneau, personal communication, 2021). The institutions, like SeyCCAT, created out of this deal have huge potential to take on a life of their own and that strength of infrastructure becomes a magnet for additional funding. Without the frameworks created by a debt conversion, the attention and security for investment seems like it would have been unlikely.

For this momentum on debt swaps to scale long term, other countries outside the US would need to have a change in their bilateral development banks policy and similarly for multi-lateral development banks. The use of political risk insurance cannot be overstated. It is this insurance mechanism used as a form of credit enhancement that allows banks to raise the capital so cheaply. (Weary, personal communication, 2021). Since this political risk insurance instrument wasn’t initially designed for debt conversion use, the development bank either needs to be flexibly progressive in their allowances or needs internal willpower to push amendments in a more favorable direction.

As evidenced by the amount of press found on this case study research, the Seychelles is in the spotlight. It has been an early adopter to this newly evolved era of debt-for-nature swaps and with that comes a responsibility to perform exemplarily. They have been elevated as a model of both hope and comparison for other SIDS. If there are ambitions for convincing other development finance institutions to amend their insurance policies, or for convincing potential nations that these debt swaps are in their best interests, the pioneer case studies need to succeed. This is not a burden held only by the Seychelles; the next group of adopters using these more innovative and nuanced swap instruments will collectively create the standard. By this logic, candidacy and governance characteristics are essential selection criteria. By virtue of having vulnerable ecological status and defaulting on high volumes of debt payments, any nation that becomes a case study holds inherent financial risk. While structures have been innovated to minimize this risk, there is a real possibility that a nation ill equipped to commit long-term to either the financial or conservation obligations should not be considered as a pioneering candidate. Capacity building is an important key consideration to better equip nations interested in following this case study. This is a relevant note when discussing potential future candidates and scaling because these nations should simultaneously be engaged in capacity building during deal negotiation - this way funds are fully taken advantage of for the entire period of disbursement (Pouponneau, personal communication, 2021).

This model is racing to scale because the subsidies it relies on comes with a cost should a nation fail in their commitments and trigger the use of the DFC Insurance - this might be a setback in this mechanism gaining momentum and global buy-in. This warning is to further emphasize the importance of diversification, selection criteria, use of best practices, and political will for execution - particularly in the next high impact/high capital deals. Once the model is established and bolstered by case study evidence it becomes stronger on its own. In a future where this model is solidified there is less reliance on things like an exceptionally progressive government (a key factor cited in the Seychelles deal, but difficult to consistently find or replicate). This prediction aligns with the theory that there are innovators and adopters as new ideas are accepted and implemented as the new credible norm.

Important for any early adopting nation under this emerging model is that they meet their financial obligations since this is the element under the highest scrutiny. They are proving the methodology and the framework - should they fail, it may set back the progression of fundraising and weaken the evidence needed to cement and promote these credit enhancement policies globally. In a circumvented way, it may be even more important for such a nation to meet its fiscal obligations before reaching its conservation milestones - this will, from a longer timescale and larger scope, ensure net better global conservation from debt swaps. Currently the Seychelles is balancing both these obligations very well and have met all their responsibilities in terms of debt payments and MSP Milestones. This only confirms that they exemplify both the selection criteria and execution prowess necessary to be a leading nation in this sphere.

The conclusions of this paper come with a call for further research in the coming years - and particularly research focusing on debt-for-nature potential in the marine space and with SIDS. Despite the Seychelles and Belize providing strong examples for analysis, a very recent publication examining debt-for nature swaps highlighted biodiversity priority areas within five major ecotones - none of which specified coral reef environments (Nedopil et al., 2022). To validate the assumptions made from this case study, they must be compared against the future reality of more debt-for-nature swaps in the marine space with a focus on SIDS. Establishing the vitality of the blue economy in island nations can help elevate the candidacy of SIDS for debt swaps so they are considered equally, if not more intriguing, as land-based debt conversions. While the purpose of this paper is not to draw up the framework for best practices in modern debt-for-nature swaps, the evidence that there is a momentum towards evolution in this space and an increase in marine debt-for-nature swaps means there is a need for critical research and tools as a guide.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Ethics statement

The studies involving human participants were reviewed and approved by University of Colorado Boulder, Office of Research Integrity, Institutional Review Board. The patients/participants provided their written informed consent to participate in this study. Written informed consent was obtained from the individual(s) for the publication of any potentially identifiable images or data included in this article.

Author contributions

MB: Conceptualization, methodology, investigation, visualization, writing -original draft, review & editing, funding acquisition. CMB: Methodology, supervision, writing -review & editing, funding acquisition. All authors contributed to the article and approved the submitted version.

Funding

This study was funded by the University of Colorado Boulder’s Undergraduate Research Opportunities Program.

Acknowledgments

We thank Roger Pielke and Daniel Kaffine for their valuable input into this study. We also thank our interviewees Robert Weary, Angelique Pouponneau, and Joanna Smith, without which this study would not have been possible. This study was funded in part by the University of Colorado Boulder’s Undergraduate Research Opportunities Program and the research received ethics approval from the University of Colorado at Boulder’s Institutional Review Board under Protocol 21-0162.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baker S., Constant N. L. (2020). Epistemic justice and the integration of local ecological knowledge for marine conservation: Lessons from the Seychelles. Mar. Policy 117, 103921. doi: 10.1016/j.marpol.2020.103921

Bedarff H., Holznagel B., Jakobeit C. (1989). Debt-for-nature swaps: Environmental colonialism or a way out from the debt crisis that makes sense? Verfassung Recht Und Übersee 22 (4), 445–459. doi: 10.5771/0506-7286-1989-4-445

Bennett N., Dearden P. (2014). From measuring outcomes to providing inputs governance. Mar. Policy 50 (A), 96–110. doi: 10.1016/j.marpol.2014.05.005

Brooks J., Waylen K. A., Mulder M. B. (2013). Assessing community-based conservation projects: A systematic review and multilevel analysis of attitudinal, behavioral, ecological, and economic outcomes. Environ. Evid. 2 (1), 2. doi: 10.1186/2047-2382-2-2

Cassimon D., Prowse M., Essers D. (2010). The pitfalls and potential of debt-for-nature swaps: A US-Indonesian case study. Global Environ. Change 21 (1), 93–102. doi: 10.1016/j.gloenvcha.2010.10.001

CBD (2001). Debt-for-Nature swaps - convention on biological diversity (Convention on Biological Diversity (CBD). Available at: https://www.cbd.int/doc/nbsap/finance/Guide_Debt_Nov2001.pdf.

CDB (2013). Public sector debt in the Caribbean: An agenda for reduction and sustainability (Caribbean Development Bank (CDB). Available at: https://www.caribank.org/publications-and-resources/resource-library/thematic-papers/study-public-sector-debt-caribbean-agenda-reduction-and-sustainability.

Christ H. J., White R., Hood L., Vianna G. M. S., Zeller D. (2020). A baseline for the blue economy: Catch and effort history in the republic of seychelles’ domestic fisheries. Front. Mar. Sci. 7. doi: 10.3389/fmars.2020.00269

Cox M. (2015). A basic guide for empirical environmental social science. Ecol. Soc. 20 (1), 63. doi: 10.5751/ES-07400-200163

Dempsey J., Suarez D. C. (2016). Arrested development? the promises and paradoxes of ‘Selling nature to save it.’. Ann. Am. Assoc. Geogr. 106 (3), 653–671. doi: 10.1080/24694452.2016.1140018

De Vos K., Hart B., Ryan K. (2020) The ocean finance handbook: World economic forum. Available at: http://www3.weforum.org/docs/WEF_FOA_The_Ocean_Finance_Handbook_April_2020.pdf.

Fenton A., Wright H., Afionis S., Paavola J., Huq S. (2014). Debt relief and financing climate change action. Nat. Climate Change, 4, 650–653m. doi: 10.1038/nclimate2303

FT/IFC (2017) Transformational business awards. financial times: International finance corporation. Available at: https://na.eventscloud.com/file_uploads/a218954b6a7384a46c957a07dd6c7596_NATUREVEST_WINNERS_PROFILE.pdf.

George A. L., Bennett A. (2005). Case studies and theory development in the social sciences (Cambridge, MA: MIT Press).

Gockel C., Gray L. (2011). Debt-for-Nature swaps in action: Two case studies in Peru. Ecol. Soc. 16 (3), 13. doi: 10.5751/ES-04063-160313

Hansen S. (1989). Debt for nature swaps–overview and discussion of key issues. Ecol. Econ. 1 (1), 77–93. doi: 10.1016/0921-8009(89)90025-6

Hassoun N. (2012). The problem of debt-for-Nature swaps from a human rights perspective. J. Appl. Philos. 29 (4), 359–377. doi: 10.1111/j.1468-5930.2012.00573.x

Hrynik T. J. (1990). Debt-for-Nature swaps: Effective but not enforceable. Case West. Reserve J. Int. Law 22 (1), 7.

Jick T. D. (1979). Mixing qualitative and quantitative methods: Triangulation in action. Adm. Sci. Q. 24 (4), 602–611. doi: 10.2307/2392366

Johansen D., Vestvik R. (2020). The cost of saving our ocean - estimating the funding gap of sustainable development goal 14. Mar. Policy 112, 103783. doi: 10.1016/j.marpol.2019.103783

Kittinger J., Koehn Z., Le Cornu E., Ban N., Gopnik M., Armsby M., et al. (2014). Putting people into ecosystem-based management. Front. Ecol. Environ. 12, 448–456. doi: 10.1890/130267

Lee K.-H., Noh J., Khim J. S. (2020). The blue economy and the united nations’ sustainable development goals_ challenges and opportunities. Environ. Int. 137, 105582. doi: 10.1016/j.envint.2020.105528

Macekura S. (2016). Crisis and opportunity: Environmental NGOs, debt-for-nature swaps, and the rise of “people-centered” conservation. Environ. History 22 (1), 49–74. doi: 10.3197/096734016X14497391602206

McFarland B. J. (2021). “Debt conversions,” in Conservation of tropical coral reefs (Cham: Palgrave Macmillan). doi: 10.1007/978-3-030-57012-5_13

Mcgraw D., Figueroa G. (2018). “Debt-for-Nature swaps,” in Max planck encyclopedia of international law. doi: 10.1093/law:epil/9780199231690/law-9780199231690-e1570

MCI (2022). “Largest marine protected areas,” in Marine protection atlas (Marine Conservation Institute). Available at: https://mpatlas.org/large-mpas/.

Mitchell T. (2015). “Debt swaps for climate change adaptation and mitigation,” in Commonwealth secretariat discussion paper. doi: 10.14217/5js4t74262f7-en

Moye M. (2001) Overview of debt conversion - development finance. Available at: https://www.development-finance.org/en/component/docman/doc_download/73-publication-4-debt-conversion.

Nedopil C., Yue M., Hughes A. (2022). Scaling debt for nature swaps - which nature, how much debt and who pays? Research Square [Preprint]. doi: 10.21203/rs.3.rs-1358929/v1

Occhiolini M. (1990). Debt-for-nature swaps (International Economics Dept., World Bank: Debt and International Finance Division).

OECD (2007). Lessons learned from experience with debt-for-Environment swaps in economies in transition. OECD Papers 7 (5), 1–65. doi: 10.1787/oecd_papers-v7-art15-en

Payet P. (2021). “Debt for nature swap and blue bond,” in The commonwealth. Available at: https://thecommonwealth.org/sites/default/files/inline/Patrick%20Payet_Seychelles-DfN%20Swap%20%26%20Blue%20Bonds.pdf.

Post M. (1990). The debt-for-Nature swap: A long-term investment for the economic stability of less developed countries. Int. Lawyer 24 (4), 1071–1098.

Rambarran J. (2018). Debt for climate swaps: Lessons for Caribbean SIDS from the seychelles’ experience. Soc. Econ. Stud. 67 (2/3), 261–291,319-320,324.

Reilly W. (2006). Using international finance to further conservation: The first 15 years of debt-for-Nature swaps. Oxford Press pp, 197–214. doi: 10.1093/0195168003.003.0010

Robinson S. (2020). Climate change adaptation in SIDS: A systematic review of the literature pre and post the IPCC fifth assessment report. WIREs Climate Change 11 (4), e653. doi: 10.1002/wcc.653

Robinson J., Isidore M., Marguerite M., Ohman M., Payet R. (2004). Spatial and temporal distribution of reef fish spawning aggregations in the Seychelles – an interview-based survey of artisanal fishers. West. Indian Ocean J. Mar. Sci. 3 (1), 63–69.

Robinson J., Marguerite M., Payet R., Isidor M. (2007). Investigation of the importance of reef fish spawning aggregations for the sustainable management of artisanal fisheries resources in Seychelles. 42p.

Sale P. (2015). Coral reef conservation and political will. Environ. Conserv. 42 (2), 97–101. doi: 10.1017/S0376892914000344

Schutter M., Hicks C. (2019). Networking the blue economy in Seychelles: pioneers, resistance, and the power of influence. J. Polit. Ecol. 26 (1), 425–447.

SeyCCAT (2021a). “Seyccat investment policy,” in Seychelles Climate and conservation adaptation and trust (SeyCCAT). Available at: https://seyccat.org/wp-content/uploads/2018/11/SeyCCAT-Investment-Policy_Sept-2018.pdf.

SeyCCAT (2021b) Our evolution. Available at: https://seyccat.org/our-evolution/.