94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Mar. Sci., 25 January 2022

Sec. Marine Conservation and Sustainability

Volume 8 - 2021 | https://doi.org/10.3389/fmars.2021.742846

John J. Bohorquez1*

John J. Bohorquez1* Anthony Dvarskas1

Anthony Dvarskas1 Jennifer Jacquet2†

Jennifer Jacquet2† U. Rashid Sumaila3†

U. Rashid Sumaila3† Janet Nye1,4†

Janet Nye1,4† Ellen K. Pikitch1

Ellen K. Pikitch1

Marine protected areas (MPAs) require sustained funding to provide sustained marine protection. Up until now government budgets, multi- and bi-lateral aid, and philanthropic grants have been commonly relied upon to finance the management and enforcement of MPAs. But new funding mechanisms, such as impact investments or blue carbon, are increasingly applied and developed. Here, we present a semi-structured review that identifies 11 or more sources of finance, 21 financial instruments and more than 75 potential combinations thereof that show the current diversity of financial mechanisms available to support MPA establishment and operations. Based on the review, we developed nearly 100 indicators reflecting environmental, governmental, socioeconomic, and management characteristics that can inform the appropriateness, and corresponding strengths and weaknesses, of applying these financial mechanisms to any given MPA. The outputs provide a series of recommendations for implementing new funding mechanisms and ways to improve the sustainability of in-place mechanisms. The findings were compiled into a replicable framework and excel tool that was pilot tested in May 2021 for Parque Nacional Natural Corales de Profundidad in Colombia that identified potential ways to improve upon financial mechanisms, including, hiring a full-time manager and potential alternative mechanisms like biodiversity offsets from fossil fuel exploration and exploitation, among several others. The research also identified barriers for implementing financial mechanisms that reflect broader systemic challenges for MPA finance worldwide.

Marine protected areas (MPAs) have received global attention for the potential to preserve, restore, and enhance resilience of marine ecosystems around the world (Sumaila, 1998; O’Leary et al., 2018; Grorud-Colvert et al., 2021). International environmental initiatives, including the Convention for Biological Diversity and UN Sustainable Development Goals, have included specific provisions for marine protection, including seeking to protect 10% of the ocean by 2020, and potentially 30% by 2030 (Convention on Biological Diversity, 2020). The economic benefits of achieving these targets would likely far outweigh the costs, potentially as much as 5-to-1 (Brander et al., 2020; Waldron et al., 2020). Yet of the more than 18,000 MPAs that protect 7.65% of the ocean1 (accessed March 8, 2021), recent research has suggested that the majority of MPAs, potentially 70% or more, fall short of their conservation goals (Thur, 2010; Edgar et al., 2014; Gill et al., 2017; Roberts et al., 2018, 2020). These are often called “paper parks” because they exist in legal terms but are practically non-existent and do little to conserve marine biodiversity (Thur, 2010; De Santo, 2012). Even MPAs in relatively wealthy countries and regions, including Australia with the second largest MPA network in the world, may not be performing as well as believed (Roberts et al., 2018, 2020).

Marine protected areas are spatial forms of marine protection that restrict harmful activities and need to be actively managed and enforced. While a number of factors may be responsible for inadequate protection, including a lack of political will or allocation of existing funding (e.g., McCook et al., 2010) it is clear that sustained funds is also a global problem. MPAs require investment for long term operations including staff salaries, equipment and fuel, and for activities including scientific monitoring, stakeholder communications, and others (Bohorquez et al., 2019; Brander et al., 2020; Pascal et al., 2021). A lack of financial support for operations, especially for staff salaries, has been linked to failures to reach conservation goals (Thur, 2010; Bos et al., 2015; Gill et al., 2017).

The financial shortfalls for MPAs mirror broader capacity gaps for conservation at large. Recent reports estimate that about $300–$967 billion USD needs to be invested in biodiversity conservation each year in order to reach and maintain global targets [including billions per year for MPAs (Brander et al., 2020)], of which only $52–$143 billion is estimated to be delivered (Bryan and Crossman, 2013; Huwyler et al., 2014; Deutz et al., 2020; Perry and Karousakis, 2020; Sumaila et al., 2020). MPAs are primarily supported by domestic government spending, which comprises 57–80% of total annual investment in biodiversity conservation (Deutz et al., 2020; Perry and Karousakis, 2020). Other major sources of finance have included official development aid (ODA), and private finance that includes philanthropic support. Philanthropy is especially significant for marine conservation where it provides a greater proportional share of support than for conservation in general (Huwyler et al., 2014; Berger et al., 2019; Wabnitz and Blasiak, 2019).

Public funds and philanthropic support are sometimes called “traditional” sources of finance (Gutman and Davidson, 2007; Naturevest and EKO, 2014; Deutz et al., 2020), and have long been considered insufficient and unreliable for delivering long term support required by MPAs. While many MPAs never receive adequate funds, others also suffer from inconsistent support where once adequate budgets may be cut potentially due to changes in political administrations, shifts in priorities [“donor fatigue” or “political boredom” (Pringle, 2017)], macroeconomic events, and plain lack of long term planning (Reid-Grant and Bhat, 2009; Thur, 2010; Ison et al., 2018; Davis, 2020; Cumming et al., 2021; Hogg et al., 2021; Phua et al., 2021). There has been coincident interest for identifying and implementing “alternative” financial mechanisms for MPAs, especially those that help MPAs generate their own income or help better secure financing from traditional sources for the long-term (Baird et al., 2017; Iyer et al., 2018; Silver and Campbell, 2018; Mallin et al., 2019; Femmami et al., 2021).

A series of peer reviewed and gray-literature publications in recent decades have outlined the different alternative financial mechanisms available for biodiversity conservation. Examples include works that specialize on a specific type of mechanism (Peters and Hawkins, 2009; Howard et al., 2017; Silver and Campbell, 2018; Pascal et al., 2021), and others that seek to evaluate a series of potential mechanisms like the BIOFIN catalog2 that provides guidance on over 150 “finance solutions” for biodiversity conservation (UNDP, 2018). Other works have also provided a structured “taxonomy” of financial mechanisms that provide a means of organizing and assessing the diversity of options available (Meyers et al., 2020).

However, MPAs are a unique form of conservation with distinct financial considerations from terrestrial PAs and other forms of marine conservation (Bohorquez et al., 2019). The frequent lack of property rights that may result in scarcer investable assets and income generating opportunities, in addition to logistic considerations for operating in a remote marine environment mean that many financial solutions in broader conservation finance literature (even marine conservation finance) may not be applicable for supporting MPA operations. And even those that are transferable may need to be interpreted in the unique management, scientific, and legal contexts of MPAs and marine environments. For example, blue carbon, blue/green bonds, and debt for nature swaps are financial mechanisms that have historically been used primarily for terrestrial conservation and have more recently been adapted for marine conservation including MPAs (Pendleton et al., 2012; Baird et al., 2017; Howard et al., 2017; Thiele and Gerber, 2017; Iyer et al., 2018).

Several publications, mostly gray literature, have provided valuable guidance on the array of financial mechanisms and strategies for MPAs (Living Oceans, 2014; Binet et al., 2015; Bos et al., 2015; Baird et al., 2017; OECD, 2017; Iyer et al., 2018; Femmami et al., 2021). But these publications have frequently focused on a pre-selected subset of financial mechanisms, and no one of them have fully captured the full diversity that may be available to managers. There are also many existing tools for evaluating MPA management and informing management decisions, but they do not include provisions to investigate finance in detail (Ervin, 2003; Pomeroy et al., 2004; Staub and Hatziolos, 2004; Belokurov et al., 2016). Exceptions include tools developed by the Conservation Finance Alliance and the Mediterranean Protected Area Network (MedPAN) in partnership with BlueSeeds (Conservation Finance Alliance, 2001; Binet et al., 2015; Femmami et al., 2021). But some of these are dated and even more recent ones address a limited selection of financial mechanisms and are regionally focused rather than global. There is thus a great need for a practical management tool that allows for MPA managers to synchronously evaluate the full scope of financial mechanisms available to support MPA operations, and consider the factors that may influence the success of any such mechanism for their respective MPA.

A semi-structured literature review was performed to: (1) assess the full array of potential financial mechanisms available to support MPA operations; and (2) develop a series of indicators that can be used to evaluate the feasibility for application of these mechanisms to any given MPA. Most of the indicators would be based on the political, socioeconomic, environmental, and management context of the MPA, and be easily answerable by MPA managers and practitioners while providing useful insight for the following questions:

(1) Which financial mechanisms might be most appropriate for the MPA and, therefore, should be prioritized for further research and potential implementation?

(2) What actions could be taken to increase the feasibility of some financial mechanisms that may not otherwise be appropriate for the MPA?

(3) What potential weaknesses or pitfalls may exist in financial mechanisms that currently support the MPA, and could some of these be addressed by decision makers?

The analytical framework was then incorporated into an Excel-based tool and applied to an existing MPA in the Colombian Caribbean to demonstrate its potential use and outputs for the benefit of other MPAs that may seek to apply this tool in the future.

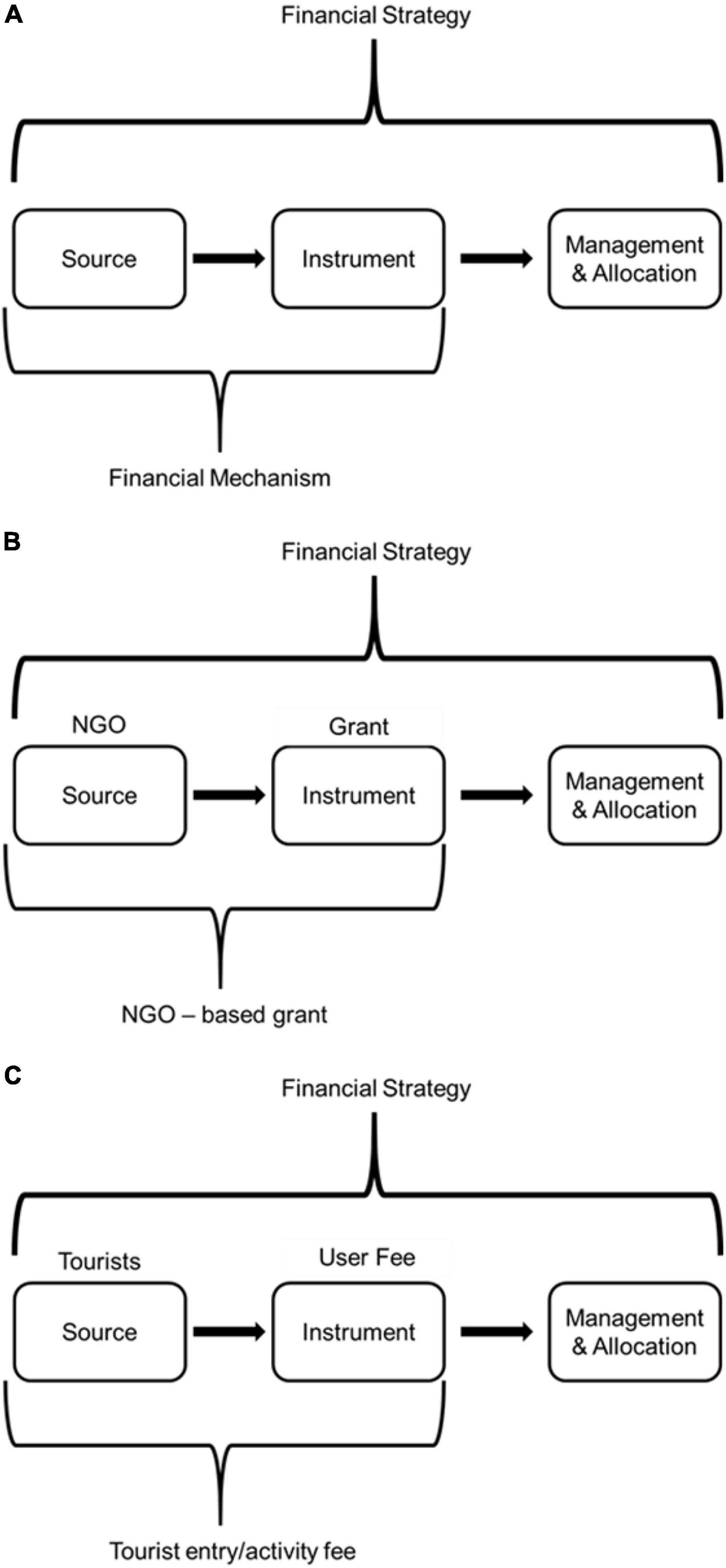

There is little consistency on what qualifies as a financial mechanism for protected areas (Gutman and Davidson, 2007), and other terms such as strategies, sources, and instruments are frequently used interchangeably in the conservation finance literature. For the purpose of this study, we considered an MPA’s financial strategy to be the cohesive integration of three moving parts: (1) sources; (2) instruments; and (3) budgeting and allocation (Figure 1). These are defined as follows:

Figure 1. Visualization of components of an MPA financial strategy, depicting (A) the theoretical approach, (B) example for NGO grants, and (C) example for entry or user fees for tourism.

Where finance is originated. This can include government institutions, NGOs, philanthropic organizations, private investors, various stakeholder groups representing different practices or industries from where funds can be leveraged (e.g., tourism, commercial fishing), and others.

The method in which financial resources are transferred from the source to the MPA’s management. This can include annual budgetary spending, grants, loans, user fees, and others.

How, once received by the MPA’s management, financial resources are managed and allocated, including for initial investment in equipment and other facilities.

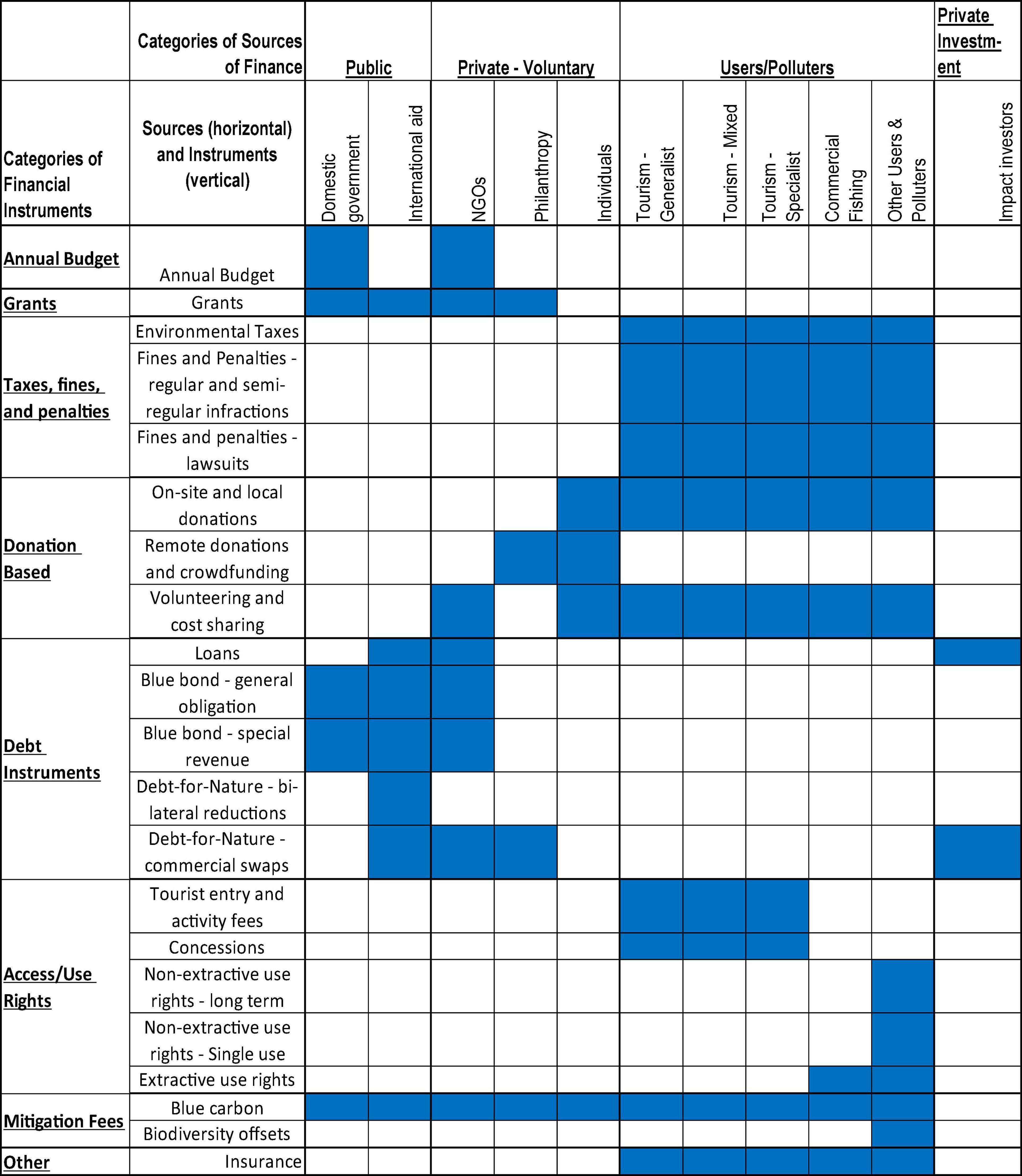

A financial mechanism is therefore the matching or pairing of at least one source with at least one instrument (Figure 1). Many financial strategies for MPAs rely on more than one mechanism, and single mechanisms can also rely on multiple sources and/or instruments working at once, such as the debt-for-nature swap in the Seychelles that combined grants and loans from NGOs, impact investors, and philanthropic organizations (Silver and Campbell, 2018; Sumaila et al., 2021). This review used a matrix-based approach that separated sources and instruments and evaluated how they may combine to form financial mechanisms.

An initial review of eight gray literature items was performed in 2018 to identify sources of finance and financial instruments that could support MPA operations (IUCN, 2000; Spergel and Moye, 2004; Emerton et al., 2006; Living Oceans, 2014; Naturevest and EKO, 2014; Binet et al., 2015; Baird et al., 2017; OECD, 2017). The review identified 27 sources and 40 instruments which were consolidated into representative groups of 11 or more sources and 21 instruments. The resulting organizational framework outlines different options available similar to the taxonomic approach used to organize broader conservation finance mechanisms in Meyers et al. (2020).

Each source of finance (with the exception of “other users and polluters,” see “Results” section) was subject to a three-step literature review from 2019 to 2021 that included peer reviewed and gray literature. Literature was identified starting with the range of sources first used to identify sources of finance, and also incorporated other sources previously known to the authors and from expert recommendation as well as keyword searches in Google Scholar and Web of Science (information on keyword searches are available in the relevant profiles in the Supplementary Material).

The indicators for sources of finance were designed to address factors that may reflect the willingness or likelihood of the source to contribute to or otherwise be leveraged to support the MPA using one or more financial instruments. For some sources of finance, e.g., tourism, these included more explicit preferences as indicated by evidence such as willingness to pay studies (Peters and Hawkins, 2009). For others, preferences had to be more subjectively interpreted based on evidence in the literature. Indicators were arranged into categories that reflected environmental, governance, socioeconomic, and management context, among other types of indicators.

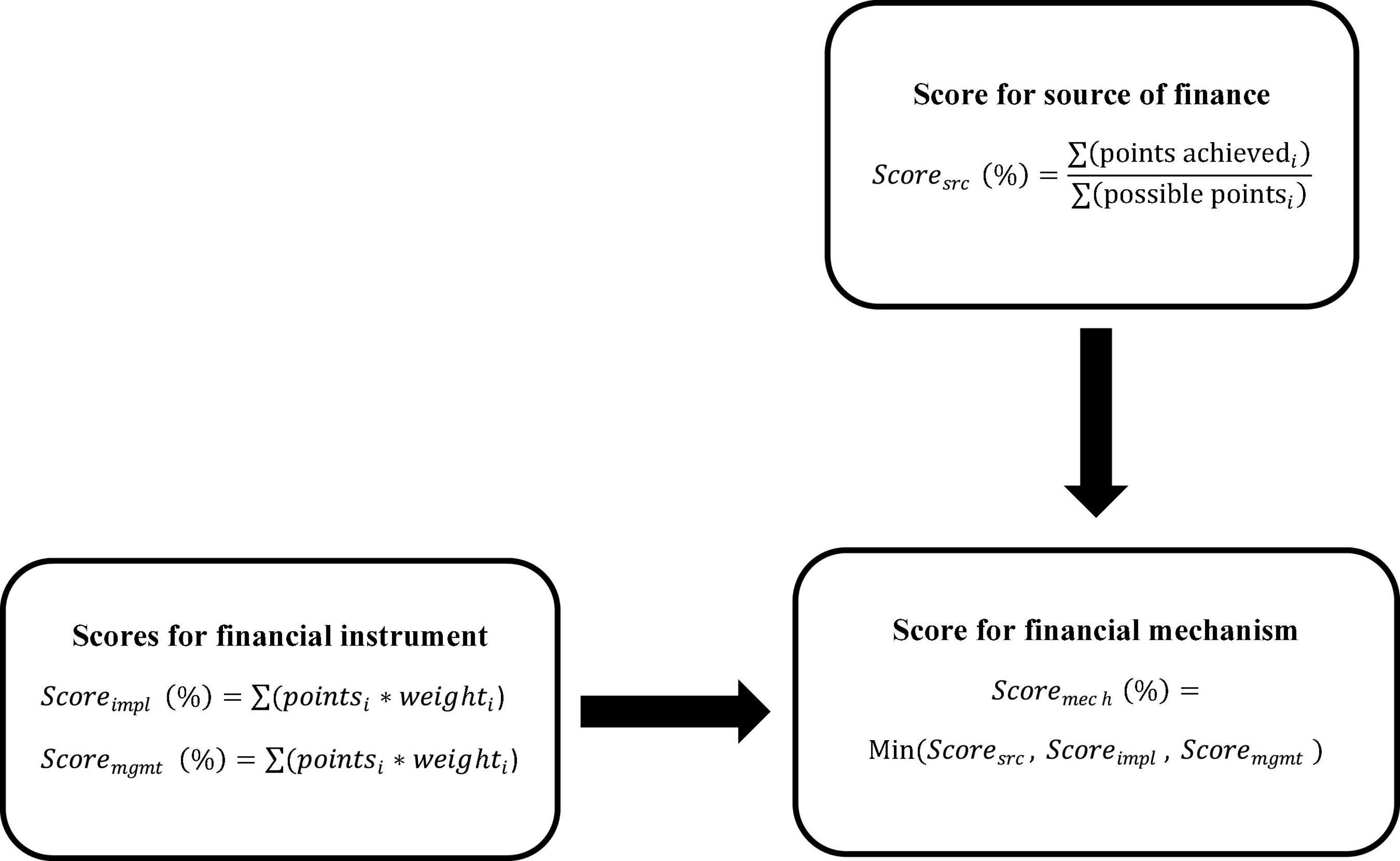

Each indicator was given a “priority rank” that reflected the importance of that indicator relative to others for the given source (high vs. moderate vs. low). Higher ranked indicators were allocated a greater number of possible points such that responses for that indicator had a greater influence on the final score for that source. We also included mandatory indicators that act as screeners such that their conditions must be met for the MPA to be eligible for that source of financing. Details and explanations for indicators were included in the profiles for each source of finance (see Supplementary Material).

The review, and corresponding supplementary profiles (see Supplementary Material, sections 3 and 4), also made note of other observations such as the history and popularity of the source for supporting MPAs and concrete examples of financial flows when available.

Each financial instrument was subject to a two-step literature review in 2020–2021. Literature was identified from the initial eight gray literature items for identifying instruments combined with resources previously known to the authors or provided by expert recommendation.

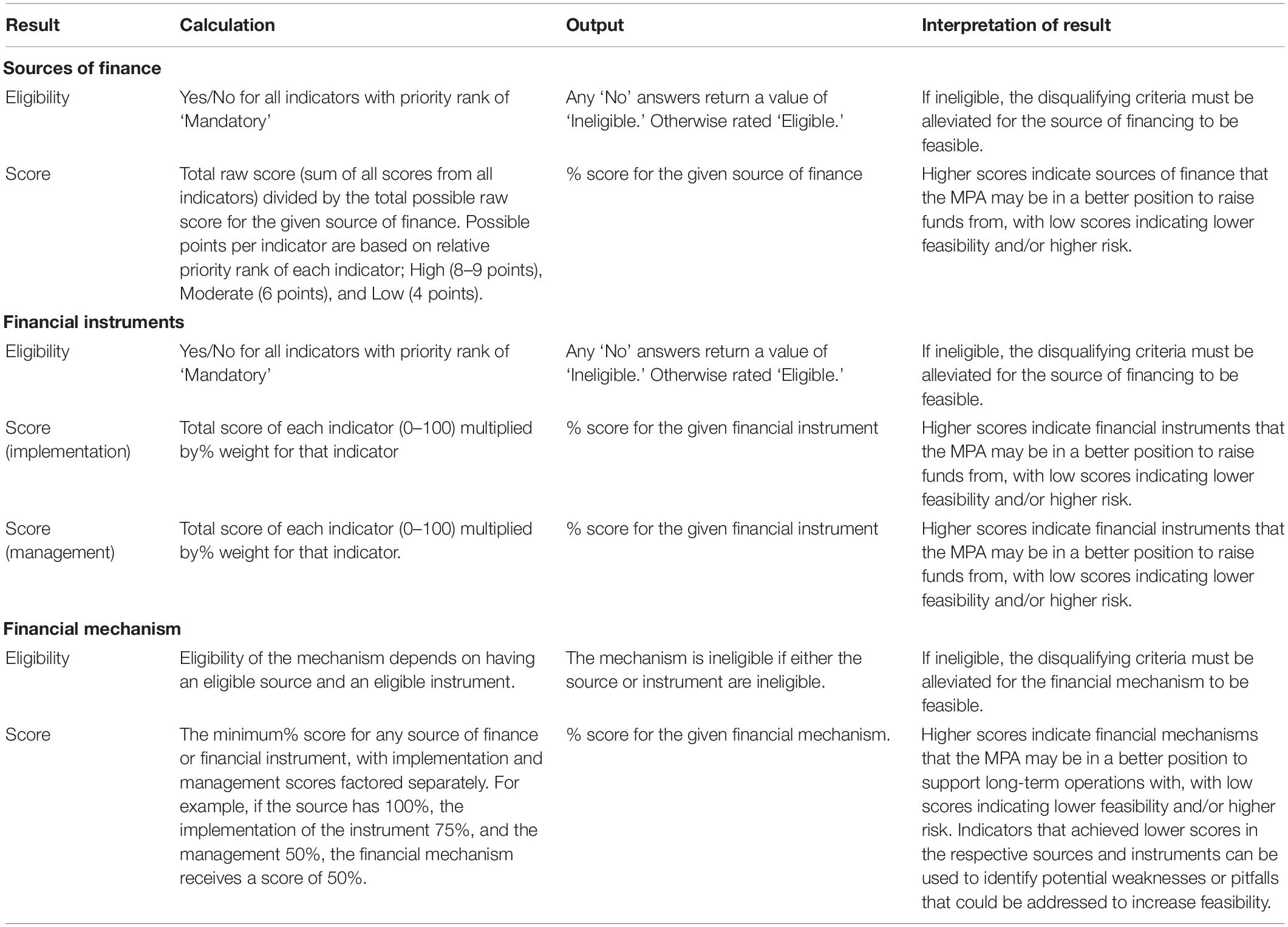

The indicators for financial instruments focused on the logistical considerations for implementing and managing instruments over time. This included indicators used to inform three different categories (see Table 1 for calculation methodology and Supplementary Material for specific indicators):

(i) Basic eligibility to identify any immediately disqualifying criteria;

(ii) Feasibility for implementation as a qualitative function of legislative barriers and other requirements for implementing the instrument against the MPA’s capacity

(iii) Feasibility for management and monitoring as a function of personnel and equipment requirements, and any other insightful indicators for assessing the potential to maintain and (if necessary) enforce the instrument over time.

Table 1. Description of calculations, outputs, and how to interpret results for eligibility requirements and scores for sources, instruments, and financial mechanisms.

Each indicator for implementation and management was provided a percent weight depending on its significance to the financial instrument such that more important indicators that are more influential to overall feasibility received a higher percentage (Table 1 and Figure 2). The reviews identified sources of finance that could be paired with each instrument, with particular attention toward case examples in the literature. All details on the reviews and descriptions of the instruments are available in their respective profiles in the Supplementary Material. We also tracked the range of funds potentially leveraged by logarithmic scale from thousands to hundreds of millions USD, the timeline required for implementation, and the personnel and capital requirements for implementing and managing the instruments that are indicative of the overall complexity of the instruments and corresponding mechanisms. Concrete examples of financial flows are also discussed for some instruments in the descriptions for their respective profiles.

Figure 2. Visual description of calculation methodologies and matrix approach for scoring financial mechanisms (mech) based on indicators (i) for individual sources of finance (src), and implementation (impl) and management (mgmt) of individual financial instruments.

Other MPA management tools, such as management effectiveness tracking tools, were reviewed to inform the structure of the financial mechanism tool. Preferred examples would provide a balance of information and complexity, while also being easy to use by practitioners. The tool would be globally transferable, thus the indicators would need to be universally understood and applicable, and if possible the framework itself be easily adjusted to changing circumstances as necessary.

The Rapid Assessment and Prioritization of Protected Area Management (RAPPAM) was designed around a series of basic questions and easily interpretable outputs, while also being flexible for varying contexts and access to information (Ervin, 2003). Notable features of RAPPAM include an emphasis on multiple choice questions (yes, maybe yes, no, maybe no), and a structured scoring method where the final score for each category is proportional to the potential raw score. This feature allows for categories with different numbers or indicators (and total potential raw scores) to be directly compared. This method also allows for questions to be omitted, and the total potential raw score reduced, if there is insufficient information for any one question or if it is otherwise unapplicable for that specific site. These features were applied to the financial mechanism evaluation tool (Table 1 and Figure 2).

Another influential MPA management tool was IUCN’s “How is your MPA doing?” which grouped indicators by environmental (“biophysical”), governance, and socioeconomic indicators, which influenced the organization of indicators for sources of finance in this review of financial mechanisms (Pomeroy et al., 2004).

In the interest of practicality, most indicators would be answered via Likert-scale multiple choice questions (strongly disagree, disagree, neither agree nor disagree, agree, strongly agree). Others were binary (Yes/No) or included factorial inputs based on established global indicators (e.g., Environmental Performance Index, Control of Corruption, and others). As the considerations for sources and instruments were distinct with different calculation methodologies (Table 1, Figure 2, and Supplementary Material), the tool was divided into two components to assess financial sources and instruments independently, and the results joined via a matrix approach (Table 1 and Figure 2). Final scores for feasibility were determined by the lowest% score across sources and instruments.

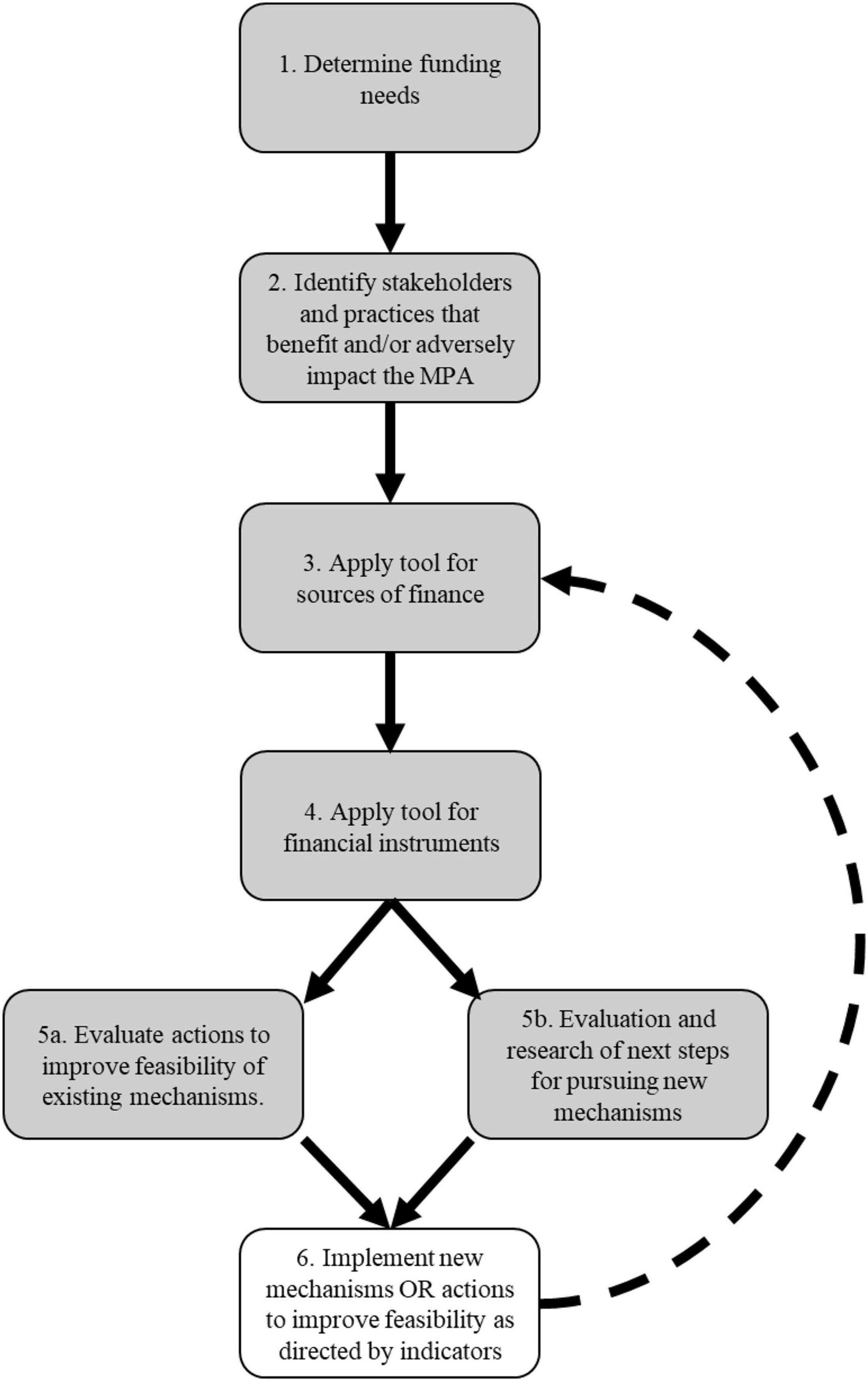

The Excel-based tool was applied to an existing MPA, Parque Nacional Natural Corales de Profundidad (PNN CPR) in Colombia. Figure 3 presents the steps for applying the tool and using the outputs to inform next steps for MPAs (steps 1–5 were conducted for PNN CPR).

Figure 3. Logical steps for using the excel tool for evaluating mechanisms and management actions that may follow. Shaded boxes were performed for the case example PNN CPR.

The indicators and corresponding questions for PNN CPR were answered by the first author [see Supplementary Material (excel sheets for PNN CPR)], with answers informed from substantial background research that included review of management materials [including the management plan (Del Pilar Marrugo Pascuales and Martínez Ledesma, 2016)] and direct stakeholder input from personal communication with staff and other stakeholders. Research steps included collection and review of historical financials (income and expenses), the management plan, and other documents and literature supplied by Colombia’s national parks program, Parques Nacionales Naturales de Colombia (PNN).

Stakeholder consultations consisted of semi-structured interviews with employees (n = 4) from PNN CPR in Cartagena and the Instituto de Investigaciones Marinas y Costeras (INVEMAR, a Colombian oceanographic institution) in Santa Marta. Interviews were conducted in-person and on-site in December 2019. Follow up communication was performed via the mobile messaging program WhatsApp. A survey was also distributed to additional participants, and completed by some of the initial interviewees retroactively, in March and April 2020 (n = 7) (Appendix IV, Bohorquez, 2021).

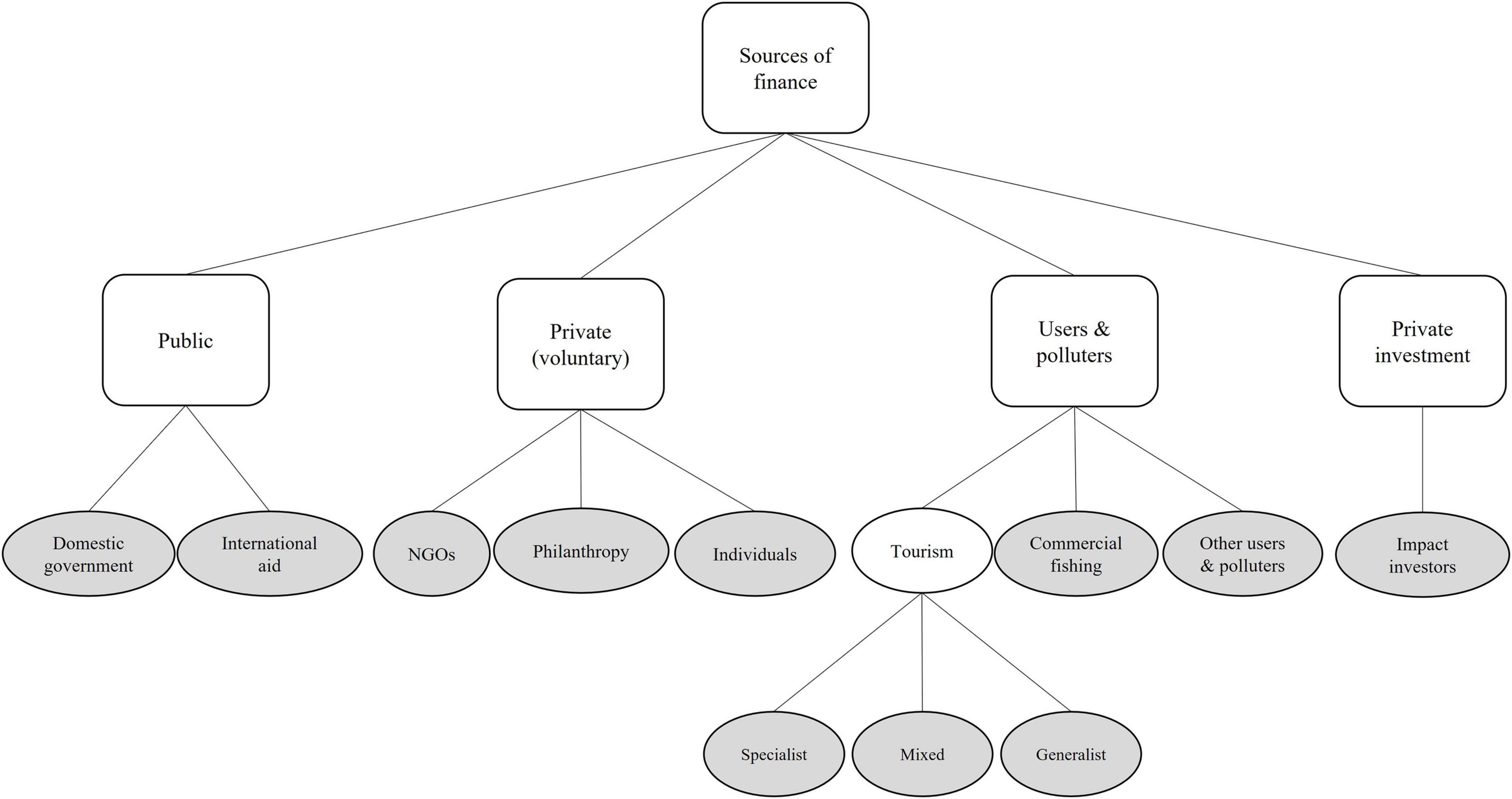

A total of 26 sources of finance for MPAs were identified and consolidated into a representative list of 11 or more sources across four categories (Figure 4), each with different sets of indicators for assessing the feasibility of leveraging funds from them.

Figure 4. Organizational chart of sources of finance compiled into the review. Sources with individual sets of indicators are represented by shaded ovals.

A total of 60 indicators were organized into six categories; environmental (n = 13), governance (n = 12), management (n = 14), performance (n = 5), socio-economic (n = 12), and other (n = 4) (see Supplementary Material). The evaluation tool for sources of finance is comprised of 88 multiple choice questions addressing these 60 indicators, with an average of 11 indicators per source. Full details on the indicators, including relevant sources, priority ranks, and rationales for inclusion are available in each source’s respective profile in sections 3 and 4 of the Supplementary Material.

The review found several types of industries and practices that either benefit from or are adversely impacting MPAs from which MPAs have been able to leverage funds. The category “users and polluters” was meant to encompass these potential sources based upon the “user pays” and “polluter pays” principles (Morris, 2002; Spergel and Moye, 2004; Iyer et al., 2018). Tourism and commercial fishing were two such industries found to be especially relevant to MPA finance (Sala et al., 2013), and were given their own sets of indicators.

Different types of tourists and tourism markets have different preferences that should be considered when weighing indicators for feasibility. Separate sets of indicators were compiled for three different types of tourism markets based on the Duffus and Dearden (1990) model for wildlife tourism reflecting specialist (or advanced) markets, generalist markets, and mixed markets with generalists and specialists (Duffus and Dearden, 1990; Augustine et al., 2016). Most indicators were shared across the different types of tourism markets, but the indicators were given different priority ranks between each kind (e.g., quality of the environment was more important for specialist markets, and ease of access was more important for generalist markets).

Commercial fishing, which may include varying scales from artisanal to industrial, was also analyzed. Though mechanisms that impose payments on fishers may only be appropriate for larger commercial or industrial scale activities. Smaller artisanal fisheries, including indigenous fisheries, may only be limited to in-kind support. The scope for commercial fishing also applied to activity outside the MPA and, if consistent with the MPA’s objectives, within the MPA’s boundaries. Payments for commercial fishing within an MPA’s boundaries may be controversial for many MPAs with the importance of no-take areas that would contradict this type of mechanism (Goñi et al., 2010; McCook et al., 2010; Edgar et al., 2014). But there are specific qualifying criteria in the tool for mechanisms permitting such activities where they must be consistent with the MPAs pre-existing conservation goals, and an MPA should not undermine those goals to accommodate a financial mechanism. Multi-use MPAs, including MPAs with no-take zones, may be able to leverage funds from fishing within their boundaries to support enforcement and management.

Other types of potential users and polluters from which funds have been leveraged for MPAs included pharmaceuticals, energy, shipping and transport, and others. This diversity makes capturing the full array of potential users and polluters difficult to define as nearly any maritime industry, or even land-based industries that impact the environment, can potentially be leveraged as a source of finance. To account for the potential range of sectors, as well as any that may newly emerge, a list of standardized indicators was developed than can be applied for any potential user or polluter (in addition to tourism and commercial fishing) that may be locally relevant for any given MPA.

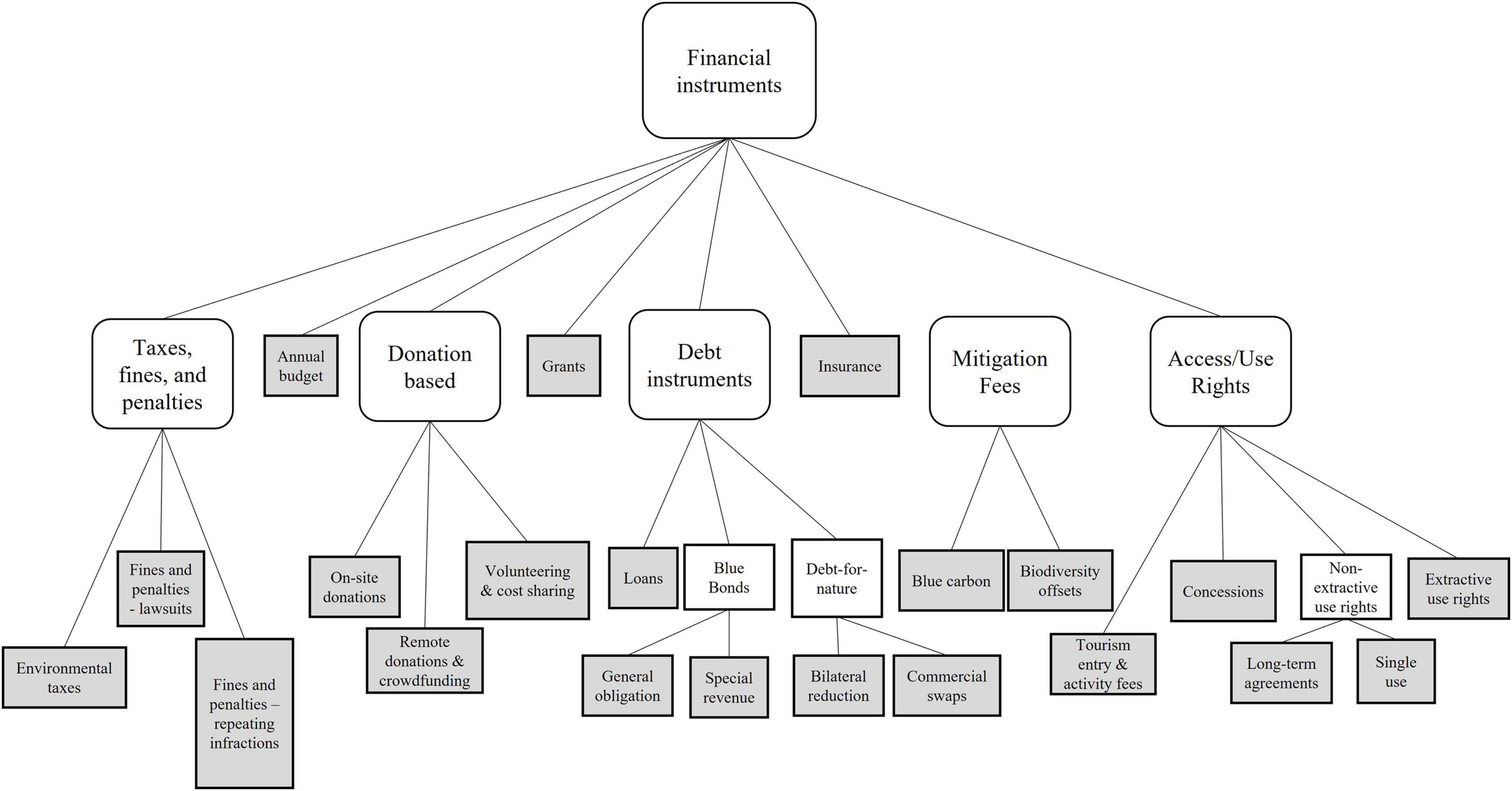

The review identified 40 financial instruments for supporting MPA operations that were consolidated into 21 representative instruments (Figure 5). A total of 37 indicators were developed across three evaluative criteria, 8 screening eligibility, 18 for implementation feasibility, and 11 for management feasibility. A total of 137 multiple choice questions were incorporated into the evaluation tool for financial instruments based on these 37 indicators (about 6–7 questions/indicators per instrument).

Figure 5. Organizational chart of financial instruments compiled in the review. Instruments with individual sets of indicators are represented by shaded rectangles.

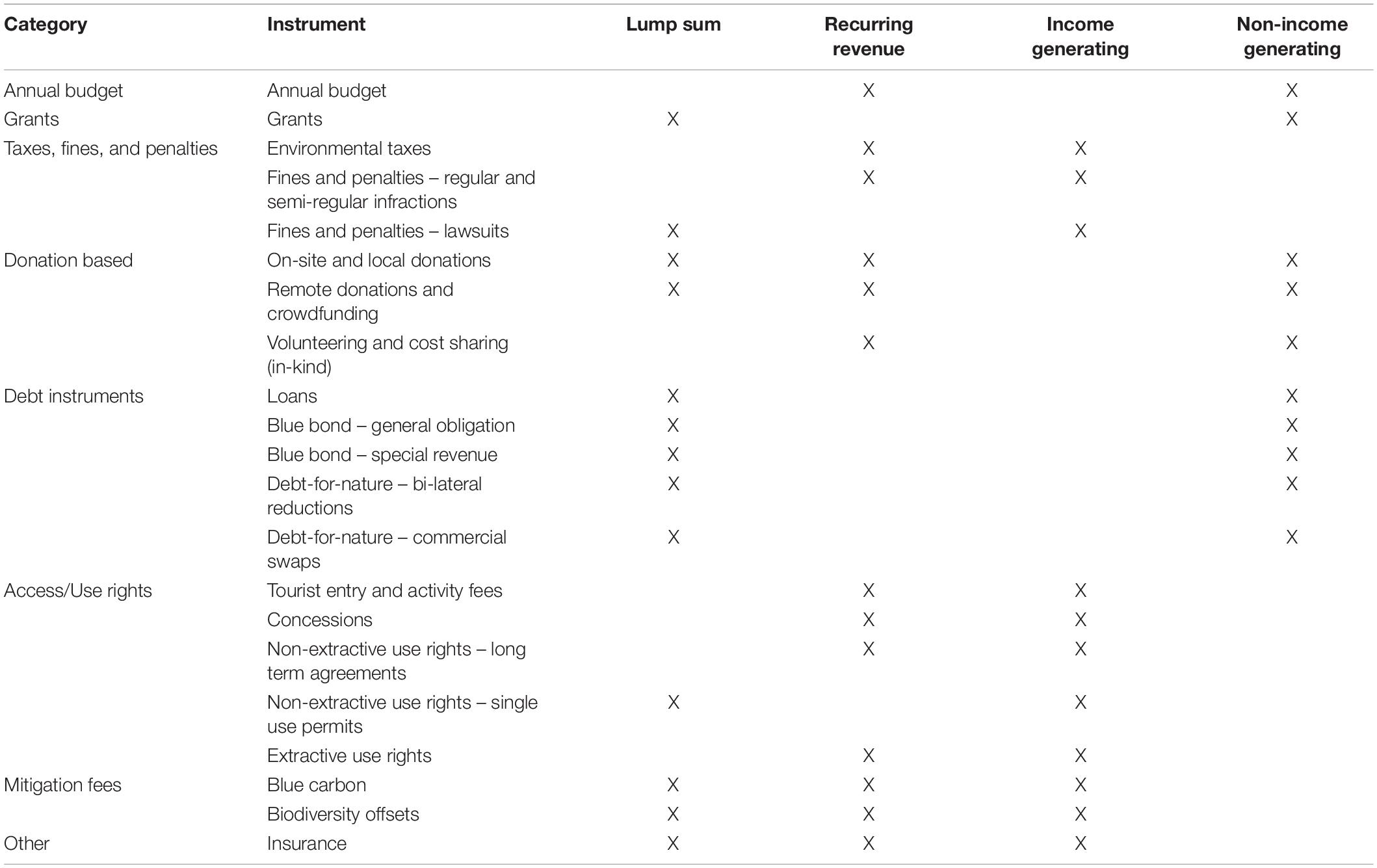

In addition to overarching categories, the review also organized financial instruments by whether they leveraged funds (1) continually over time as “recurring revenue” or (2) in single lump sum payments that could be used to capitalize trust funds (e.g., debt-for-nature swaps) or otherwise be allocated over periods of time (Table 2).

Table 2. Organization of financial instruments by lump sum vs. recurring revenue, and income generating vs. non-income generating.

Instruments were also differentiated by whether they could generate income for MPAs, referred to as “income generating” instruments. Examples include tourism entry fees, blue carbon, and taxes that often leverage funds from sources of finance in the “user and polluter” category. Of the 21 financial instruments, 8 could generate income from recurring revenue, 8 from lump sum payouts, and 5 had the potential to deliver funds through either option (Table 2).

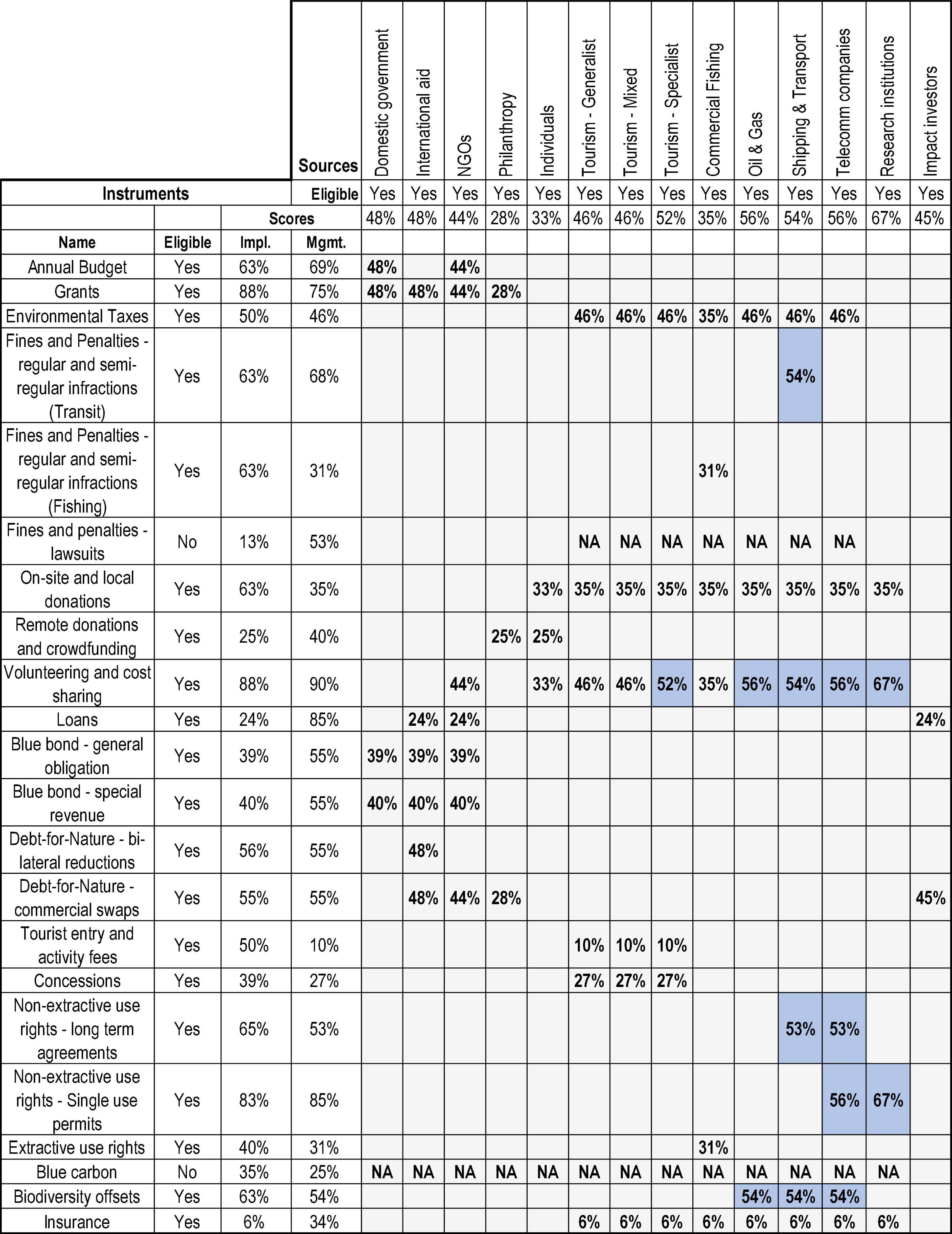

The review found that the 11 or more sources of finance and 21 financial instruments can form at least 57 different combinations (75 with the 3 different tourism markets factored separately) that represent the majority of options that MPAs can use to financially support operations worldwide (Figure 6). The feasibility of these possible combinations, and the financial mechanisms they comprise, can be evaluated for a given MPA using 97 indicators incorporated into 261 multiple choice questions. These figures do not include the potential to incorporate multiple types of users and polluters (which are likely for many MPAs), nor the potential highly complex financial mechanisms that involve multiple sources and/or instruments working together.

Figure 6. Matrix of potential interactions between sources of finance and financial instruments, blue cells indicate potential pairings.

Background and context for this MPA off Colombia’s Caribbean coast is provided in the Supplementary Material. PNN CPR is primarily supported by domestic government funds via annual budgets from the central treasury (PGN) and allocations from a dedicated fund for the Ministry of the Environment (Fondo Ambiental, FONAM). The MPA received an annual budget of US $106,192 in 2018, and we estimated a hypothetical minimum funding gap of between $70,000 and $150,000 USD/year as the target for increasing funds for purposes of this exercise (Chapter 5, Bohorquez, 2021). This would be equal to a $3.75 million lump sum endowment assuming a 4.0% distribution rate (Neely and Brister, 2010; Dahiya and Yermack, 2019). PNN CPR has also received grants from the German international development bank KFW for purchasing equipment and renovating offices and additional in-kind support from nearby research institutions and other government agencies for scientific monitoring and managing invasive species.

The review for PNN CPR identified 92 potential pairings between sources of finance and financial instruments (Figure 7). Of these, 72 were not constrained by eligibility requirements. 13 pairings returned scores of over 50% which we set as a threshold for potentially feasible mechanisms (though applications for other areas may differ). Of the three mechanisms that have supported the MPA past and present, volunteering and cost sharing from research institutions was the highest at 63%. Annual government budgets only scored 48% and grants from international aid scored 43%. Weaknesses and potential opportunities for improvement are presented and discussed in the Supplementary Material.

Figure 7. Results matrix for PNN CPR indicating scores for potential financial mechanisms as pairs of sources of finance and financial instruments. Scores equal to or above 50% are shaded in blue.

Results identified the following financial instruments, and the sources of finance from which they could feasibly leverage funds:

• Fines and penalties for regular or semi-regular infractions – leveraged from the shipping and transport industry;

• Volunteering and cost-sharing – leveraged from specialist tourism (sport fishers), oil and gas industry, shipping and transport industry, telecommunications companies, and research institutions;

• Non-extractive use rights (long term agreements) – leveraged from the shipping and transport industry (i.e., transit fees) and telecommunications companies (i.e., right of way fees);

• Non-extractive use rights (single use permits) – leveraged from telecommunications companies (i.e., fees for maintenance) and research institutions (i.e., research permits).

• Biodiversity offsets – leveraged from the oil and gas industry, the shipping and transport industry, and telecommunications companies.

Weaknesses that could be addressed and recommendations for improvement are further discussed in the Section “Findings and Future Steps for Parque Nacional Natural Corales de Profundidad” and in the Supplementary Material.

Financial mechanisms captured in this review include options that can raise outside revenue, generate funds on consistent year to year bases, raise large one-time quantities of finance to be managed over time, and other characteristics that collectively comprise the diversity of financial mechanisms to support MPA operations. The results reveal that, when the components that comprise financial mechanisms are broken out and reviewed independently, a much broader array of options for financing MPAs may be available than previous work on MPA finance would suggest.

This review identified at least 57 different combinations of sources and instruments, before even counting the three different types of tourism markets and additional “users and polluters,” that each represent financial mechanisms with different enabling conditions for success. Nor does this total account for the potential to have mechanisms that involve multiple sources and/or instruments functioning together, which may become more common with the rising popularity of blended finance mechanisms (Silver and Campbell, 2018; Virdin et al., 2018). The 11 or more sources and 21 instruments were also organized to consolidate different types of mechanisms for sake of practicality for the evaluation tool, but within them there can be many more types of sources and instruments [e.g., there are several of environmental taxes and similar economic instruments (Meyers et al., 2020)].

When applied to PNN CPR, these indicators and analytical framework identified several weaknesses in financial mechanisms that support the MPA. Indicators revealed that the current financial strategy for PNN CPR is reliant on financial mechanisms, primarily annual government budgets, that may be at risk of failure in the future and/or have major barriers that should be addressed if the MPA needs to increase funds from this mechanism in the future (see Supplementary Material, section 2). Some of these pitfalls may be addressable within PNN CPR and national PNN management and planning, including researching a broader diversity of potential economic benefits and hiring a full-time manager to improve fiscal management capacity and communication with higher levels of governance. Others barriers include conflicts with politically influential industries and indices like enforcement of contracts and control of corruption that reflect ambient conditions or systemic issues that are important to be aware of as factors that may affect the sustainability of mechanisms in the future, but are more difficult for decision makers to directly influence.

The analysis for PNN CPR also identified several feasible alternative financial mechanisms that could be prioritized for further investigation and raise additional resources (Supplementary Material, section 2). This included biodiversity offsets from the oil and gas industry and, possibly, telecommunications companies. Transit fees and/or fines for illegal marine transit could also be feasible mechanisms for this MPA. The MPA could also scale up volunteer and cost-sharing as a form of in-kind support across a wide diversity of stakeholders, which could significantly expand its management capacity.

National parks in Colombia also require permits for scientific research, which is a source of income for many MPAs but not yet PNN CPR. This presents another potential financial mechanism to support the park, but it may help to streamline the application process. Interviewees at INVEMAR expressed frustrations at the difficulty of navigating the permit process with the National Parks office, and for that reason reportedly avoid conducting research in MPAs managed by PNN. This is an example of a hurdle undermining feasibility that the indicators did not directly address but can be assessed when evaluating the indicators with additional context for the MPA.

The indicators of feasibility were designed to evaluate how well an MPA might meet the enabling conditions for financial mechanisms. They were also used in the application for PNN CPR to identify weaknesses that could be potential pitfalls, and to identify steps that management (site-level or higher) could take to improve the prospects for some alternative mechanisms. Some of the weaknesses identified for PNN CPR are not isolated to this example, and represent broader systemic barriers preventing MPAs from implementing financial mechanisms to improve financial sustainability.

Shortfalls in personnel was one of the most pressing limitations impacting PNN CPR. Four of seven survey participants (see the section “Materials and Methods”) specified lack of a full-time manager, with two describing how it may undermine fiscal management and other management processes (a full-time manager was eventually hired in December 2020 after completion of these surveys and this work reflects the state of the park as of the time of information gathering). MPA managers in Colombia’s national parks system are also responsible for communication with higher levels of management and governance, including for annual budgeting. Lack thereof for PNN CPR may have impeded communication with regional and national offices that govern the budget for the MPA. Experts elsewhere have similarly reported that MPAs around the world often lack of financial and communications personnel and expertise that challenges their ability to absorb and manage financial resources, as well as communicate financial needs to government decision makers (Davis, 2021). The same limitations for fiscal management can also impede the capacity for MPAs to implement new financial mechanisms (Davis, 2021), which was also observed to limit the capacity of PNN CPR to implement what would otherwise be much more feasible options. The result is a systemic perpetuating cycle where financial limitations further restrict many MPAs from researching and implementing options to improve financial sustainability, some of which can have significant transaction costs (Bos et al., 2015; Iyer et al., 2018).

The barrier to entry from limited capacity and expertise among MPA management is compounded by a lack of policy and legislative environments that facilitate investment and implementation of sustainable financial mechanisms (Sumaila et al., 2021). Capacity requirements for implementing many of these potential solutions, especially those with high transaction costs such as blue bonds, debt-for-nature swaps, or biodiversity offsets, could be mitigated by policy reforms to create a more conducive environment for investment and more mainstream integration of these mechanisms.

Further on policy development, many MPAs face legal and administrative barriers from raising non-governmental funds (Emerton and Tessema, 2001; Baird et al., 2017). The difficulty of surmounting these legal barriers depends in part on the government’s support of the MPA against other priorities. When interests are aligned, governments can be instrumental to facilitating new financial mechanisms. For example, legislation for the tourism entry fee system at the Bonaire National Marine Park, which it has depended on since 1992, was made possible because of provisions in a grant from Dutch overseas aid in 1991 that required the MPA become financially self-sustaining within 3 years. This gave the Bonaire government a mandate to craft the necessary legislation for the fee against strong pushback from some stakeholders, especially the dive industry (personal communication, Kalli De Meyer, former STINAPA Bonaire).

But governments can also actively block MPAs from raising external funds. For example, in 2015, the Bonaire government began restricting the national park’s management from enforcing the entry fee for cruise ship passengers, from which there were over 400,000 annual visitors in 2018 and 2019 (van Bets et al., 2017; Centraal Bureau voor de Statistiek, 2020). Alternatively, the park was given legal entitlement to $1.00 of a $3.00 per person head tax collected by the government (van Bets et al., 2017). But as of 2021, the government has yet to provide that tax income to the park’s management (personal communication, Kerenza Rannou, STINAPA Bonaire).

Even when MPAs do generate significant income from one or more mechanisms, they are frequently required to deliver income to government agencies with wider political mandates and the funds may not be sufficiently re-allocated to the MPA in return (Ransom and Mangi, 2010). For example, if PNN CPR were to implement an income generating mechanism, the funds would be delivered to the Ministry of the Environment limiting PNN CPR and PNN’s control over how these funds are used. Regardless, it may still be in the MPA’s interest to implement these mechanisms if generating income improves the prospects for the park to receive a higher budget. And as part of a broader MPA network, the financial sustainability of PNN CPR may influence the financial sustainability of other protected areas in Colombia’s national parks system. But many countries do not even route the funds through an environmental agency at all, instead sending them to the central treasury where they can be allocated for an even wider array of uses (Spergel and Moye, 2004; Iyer et al., 2018).

Shifting political priorities among government agencies is a constant financial risk for many MPAs. But steps can be taken to help mitigate these risks, such as dedicated trusts and provisions attached to grants and other support. For example, the Malpelo Sanctuary has a dedicated trust fund with provisions to retain government support while also being the only MPA in Colombia with a separate, dedicated source of financing outside of government resources (personal communication, Oscar Orrego of Fondo Acción). MPAs should ensure that they properly invest in outreach and communication to help retain political support, which includes community outreach to the extent that public perceptions may influence government decisions. Consideration of local community and indigenous rights must also be central to the development and implementation of any ocean-related financial mechanisms (Sumaila et al., 2021).

The framework and corresponding excel tool were designed so that indicators could be easily added, removed, or adapted as appropriate to account for site-level context. For example, fines and penalties for PNN CPR were analyzed separately (Figure 7) to accommodate the differing enforcement requirements when hypothetically leveraging against the marine transit industry (which could be monitored and enforced remotely) versus commercial fishing (which required an onsite presence). Some indicators for research institutions (taken from the general indicators for other users and polluters) had their weights reduced to zero for many that were not appropriate for this source of finance. Future applications should consider adapting the tool in a similar manner rather than relying on its initial template.

Users could also look to adapt the tool overtime to account for new knowledge about sources of finance and financial instruments that may result in adjusting indicators or adding new ones. The framework can also be expanded to account for new previously unutilized financial mechanisms that may arise in the future. For example, direct investment from the private sector has so far been limited to debt funds from impact investment groups (Althelia Ecosphere and USAID, 2016; Pascal et al., 2021), but this could be expanded to institutional investors and equity based investments that may arise in the future facilitated by vehicles like the Global Fund for Coral Reefs (Meyers et al., 2021).

This review and the resulting framework were designed to encompass a wide range of mechanisms and to be applied at a global scale. This required reaching a balance between applicability and level of detail assessed by the indicators and provided in the results and specifications. The indicators and results from applying the tool do not guarantee the success of high-scoring financial mechanisms, but rather help prioritize those mechanisms that are most likely to succeed, while outlining potential pitfalls or barriers to entry. MPA managers would then research the potential for those prioritized mechanisms in more detail, considering additional site-level context not addressed in the corresponding indicators.

The analysis and corresponding outputs were also limited by available literature. Conservation finance is a rapidly developing field, with mechanisms frequently being applied in new ways, or brand-new ones developed. But this financial mechanism framework and tool is designed to easily accommodate new considerations that would influence indicators of feasibility. And while PNN CPR provides an effective case example for demonstration, testing on additional MPAs will help further ground truth the tool’s underlying assumptions and applicability.

Lastly, the tool was primarily designed for use at the individual MPA level. But many financial mechanisms, like debt-for-nature swaps, may be more appropriate for broader MPA networks, or at least very large individual MPAs. But the assumptions on which the indicators of feasibility were based could be scaled up to higher levels, and therefore the tool could be used more broadly if adapted appropriately.

There are also some notable financing approaches not expressly included in this review. The first is public private partnerships, also known as PPP, 3P, or sometimes co-management. Some literature sources have described public private partnerships as a financial mechanism (Living Oceans, 2014), but they are better described as a general management approach where responsibilities are divided between public and private actors (Sumaila et al., 2021). But they can be very important to achieving financial sustainability and potentially foster opportunities for mechanisms like impact investing (Pascal et al., 2021).

Conservation trust funds are another tool that can be used to help MPAs achieve financial sustainability (Bonham et al., 2014). But based on this review’s methodology for the components of MPA financial strategies (Figure 1), trusts would be a method for managing funds or intermediaries that can channel funds through one or more of the mechanisms outlined in this review, but would not qualify as a financial mechanism as defined in the review. Instead, conservation trusts would be applied under the type of organization that is managing the trust (e.g., philanthropic foundations and NGOs).

This review identified and evaluated a series of 11 or more sources of finance and 21 financial mechanisms that, when combined, comprise the diversity of financial mechanisms that can raise funds to support MPA operations. The research outputs included a series of indicators of feasibility that were incorporated into an analytical framework that can help MPA practitioners make decisions about alternative mechanisms to pursue, and ways to strengthen the sustainability of those that are already supporting the MPA. This was demonstrated via a pilot test for the Colombian MPA, PNN CPR, for which biodiversity offsets from oil and gas and penalties and/or transit fees on marine transit were among the new mechanisms that could be incorporated for the park, among other options that may improve financial sustainability.

This work has produced a series of practical outputs and recommendations for a variety of practitioners. While financial shortfalls can hinder MPA performance by inhibiting personnel and enforcement capacity (Edgar et al., 2014; Gill et al., 2017), shortfalls in staff capacity can further impede proper management of financial resources, communication with higher level financial decision makers, and the ability for MPAs to research, implement, and manage financial mechanisms that will impact the effectiveness of the MPA in the long-term. MPA practitioners and decision-makers should seek out the many opportunities for improving financial acumen. In particular, they may increase capacity by collaborating with other MPAs, higher level governance, and outside organizations like NGOs or multilateral groups. Practitioners should also always strive to maintain positive government relations and political support even when not financially supported by government funds because governments have the legislative potential to both enable as well as restrict alternative financial mechanisms directly or indirectly.

For potential users of our financial mechanism evaluation tool, we recommend informing responses with as much detailed information as available, and participation of multiple stakeholder groups when possible, though the tool is still designed to function for minimal information. We also recommend that users do not hesitate to adjust the tool’s parameters as necessary to adapt for local context. Perhaps the greatest value of the tool is to enable users to be more intentional and strategic about financing MPAs. Finally, we also stress that the results are meant to prioritize and guide future efforts for alternative mechanisms and are not guarantees for success or failure.

As a consolidation of widely available literature, the profiles for the sources of finance and financial instruments are also important resources for learning about and applying these financial mechanisms specifically for MPAs, and many specific recommendations for respective sources and instruments are described therein (see Supplementary Material). The literature referenced in the profiles can also further guide readers to more detailed information about financial mechanisms and MPA finance.

Given the pressing need for sustainable mechanisms for financing MPAs, this tool will help MPA practitioners navigate important steps for researching and identifying options for improving financial sustainability. It also complements existing finance tools that focus more on budget and business plan development (Conservation Finance Alliance, 2001; Binet et al., 2015; Femmami et al., 2021). Continued application of this tool can spur development of a global dataset that may help advance our understanding of the strengths and limitations of financial mechanisms for MPAs around the world.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

JB performed the primary research underlying the document, and lead the writing and compilation of the manuscript and all Supplementary Material. AD and EP supervised and contributed to intellectual development of the research, as well as review, editing, and writing of the manuscript. JJ, US, and JN contributed equally to intellectual input on the research findings and review and editing of drafts of the manuscript. EP helped obtain the funding with which this work was supported. All authors contributed to the article and approved the submitted version.

This work was made possible by the generous support of Pamela M. Thye and John Frederick Thye, the Ocean Sanctuary Alliance (OSA), and the Institute for Ocean Conservation Science (IOCS).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The authors would like to thank staff of the following institutions based on Colombia that were essential to the development of this research and the case study application, in addition to those named as personal communications. From Parques Nacionales Naturales de Colombia; Carlos Mario Tamayo, Nery Londoño, Jorge Enrique Rojas, and Milena Marrugo, among others not named. From INVEMAR; Anny Zamora and Andrea Contreras. John Bejarano from UNDP and BIOFIN-Colombia. The content of this manuscript has previously appeared online in a dissertation by JB (see Bohorquez, 2021). The authors would also like to thank the reviewers for constructive and insightful feedback.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fmars.2021.742846/full#supplementary-material

Althelia Ecosphere and USAID (2016). USAID Partners With Althelia Sustainable Ocean Fund. Washington, DC: USAID.

Augustine, S., Dearden, P., and Rollins, R. (2016). Are changing diver characteristics important for coral reef conservation? Aquat. Conserv. Mar. Freshw. Ecosyst. 26, 660–673. doi: 10.1002/aqc.2574

Baird, B., Honey, M., Orgera, R., Patlis, J., Reheis-Boyd, C., Stauffer, P., et al. (2017). Protecting Our Marine Treasures: Sustainable Finance Options for U.S. Marine Protected Areas. Annapolis: Marine Protected Areas Federal Advisory Committee.

Belokurov, A., Baskinas, L., Biyo, R., Clausen, A., Dudley, N., Guevara, O., et al. (2016). Changing tides: climate adaptation methodology for protected areas (CAMPA) coastal and marine. Crit Care Nurs Q 33, 163–76. doi: 10.1097/CNQ.0b013e3181d91475

Berger, M. F., Caruso, V., and Peterson, E. (2019). An updated orientation to marine conservation funding flows. Mar. Policy 107:1. doi: 10.1016/j.marpol.2019.04.001

Binet, T., Diazabakana, A., Laustriat, M., and Hernandez, S. (2015). Sustainable Financing of Marine Protected Areas in the Mediterranean. A Guide for MPA Managers.

Bohorquez, J., Dvarskas, A., and Pikitch, E. K. (2019). Filling the data gap - a pressing need for advancing MPA sustainable finance. Front. Mar. Sci. 6, 1–14. doi: 10.3389/fmars.2019.00045

Bohorquez, J. J. (2021). Research, Development, and Application of a Financial Sustainability Assessment Tool for Marine Protected Areas. Dissertation or Thesis, New York, NY: ProQuest Dissertations Publishing

Bonham, C., Steininger, M. K., Mcgreevey, M., Stone, C., Wright, T., and Cano, C. (2014). Conservation trust funds, protected area management effectiveness and conservation outcomes: lessons from the global conservation fund. Parks 20, 89–100. doi: 10.2305/IUCN.CH.2014.PARKS-20-2.CB.en

Bos, M., Pressey, R. L., and Stoeckl, N. (2015). Marine conservation finance: the need for and scope of an emerging field. Ocean Coast. Manag. 114, 116–128. doi: 10.1016/j.ocecoaman.2015.06.021

Brander, L. M., van Beukering, P., Nijsten, L., McVittie, A., Baulcomb, C., Eppink, F. V., et al. (2020). The global costs and benefits of expanding Marine Protected Areas. Mar. Policy 116:103953. doi: 10.1016/j.marpol.2020.103953

Bryan, B. A., and Crossman, N. D. (2013). Impact of multiple interacting financial incentives on land use change and the supply of ecosystem services. Ecosyst. Serv. 4, 60–72. doi: 10.1016/j.ecoser.2013.03.004

Centraal Bureau voor de Statistiek, N. (2020). Cruise Passengers Bonaire, 2012-2020. Available online at: https://www.cbs.nl/en-gb/custom/2020/39/cruise-passengers-bonaire-2012-2020 [Accessed June 6, 2021]

Conservation Finance Alliance (2001). Financing Marine Protected Areas. Washington, DC: Conservation Finance Alliance.

Convention on Biological Diversity (2020). Report of the Open-Ended Working Group on the Post-2020 Global Biodiversity Framework on its Second Meeting. Rome: Convention on Biological Diversity.

Cumming, T., Seidl, A., Emerton, L., Spenceley, A., Kroner, G., Uwineza, Y., et al. (2021). Building sustainable finance for resilient protected and conserved areas: lessons from COVID-19. Parks 27, 149–160. doi: 10.2305/IUCN.CH.2021.PARKS-27-SITC.en

Dahiya, S., and Yermack, D. (2019). Investment Returns and Distribution Policies of Non-Profit Endowment Funds. Cambridge, MA: National Bureau of Economic Research. Available online at: https://www.nber.org/system/files/working_papers/w25323/w25323.pdf (accessed July, 2021).

Davis, J. (2020). MPAs, COVID-19, and the Coming Financial Crisis: What Impacts are Practitioners Already Seeing, and How are They Responding? MPA News. Available online at: https://octogroup.org/news/mpas-covid-19-and-coming-financial-crisis-what-impacts-are-practitioners-already/ (accessed December, 2021).

Davis, J. (2021). Why We Should be Optimistic About the Future of MPA Finance: Interview With Amílcar Guzmán Valladares and Viviana Luján Gallegos of Wolfs Company. MPA News, 1–5. Available online at: https://octogroup.org/news/why-we-should-be-optimistic-about-future-mpa-finance-interview-amilcar-guzman/ (accessed December, 2021).

De Santo, E. M. (2012). From paper parks to private conservation: The role of NGOs in adapting marine protected area strategies to climate change from paper parks to private conservation: the role of ngos in adapting marine protected area. J. Int. Wildl. Law Policy 15, 25–40.

Del Pilar Marrugo Pascuales, M., and Martínez Ledesma, C. (2016). Plan de manejo del Parque Nacional Natural Corales de Profundidad - 2016-2021. Cartagena: Parques Nacionales Naturales Decolombia.

Deutz, A., Heal, G. M., Niu, R., Swanson, E., Townshend, T., Li, Z., et al. (2020). Financing Nature: Closing the Global Biodiversity Financing Gap. The Paulson Institute, The Nature Conservancy, and the Cornell Atkinson Center for Sustainability.

Duffus, D. A., and Dearden, P. (1990). Non-Consumptive Wildlife-Oriented Recreation: A Conceptual Framework. Biol. Conserv. 53, 213–231. doi: 10.1016/0006-3207(90)90087-6

Edgar, G. J., Stuart-Smith, R. D., Willis, T. J., Kininmonth, S., Baker, S. C., Banks, S., et al. (2014). Global conservation outcomes depend on marine protected areas with five key features. Nature 506, 216–220. doi: 10.1038/nature13022

Emerton, L., Bishop, J., and Thomas, L. (2006). Sustainable Financing of Protected Areas. A Global Review of Challenges and Options. Gland: IUCN - International Union for Conservation of Nature. doi: 10.2305/IUCN.CH.2005.PAG.13.en

Emerton, L., and Tessema, Y. (2001). Economic Constraints to the Management of Marine Protected Areas: the Case of Kisite Marine National Park and Mpunguti Marine National Reserve, Kenya. Nairobi: IUCN.

Ervin, J. (2003). WWF Rapid Assessment and Prioritization of Protected Area Management Methodology. Gland, Switzerland: WWF.

Femmami, N., Le Port, G., Cook, T., and Binet, T. (2021). Financing Mechanisms: A Guide for Mediterranean Marine Protected Areas. Bordeaux. BlueSeeds, MAVA Foundation.

Gill, D. A., Mascia, M. B., Ahmadia, G. N., Glew, L., Lester, S. E., Barnes, M., et al. (2017). Capacity shortfalls hinder the performance of marine protected areas globally. Nature 543, 665–669. doi: 10.1038/nature21708

Goñi, R., Hilborn, R., Díaz, D., Mallol, S., and Adlerstein, S. (2010). Net contribution of spillover from a marine reserve to fishery catches. Mar. Ecol. Prog. Ser. 400, 233–243. doi: 10.3354/meps08419

Grorud-Colvert, K., Sullivan-Stack, J., Roberts, C., Constant, V., HortaCosta, B., Pike, E. P., et al. (2021). The MPA Guide: A framework to achieve global goals for the ocean. Science 373:861. doi: 10.1126/science.abf0861

Gutman, P., and Davidson, S. (2007). A Review of Innovative International Financial Mechanisms for Biodiversity Conservation with a Special Focus on the International Financing of Developing Countries’ Protected Areas. Available online at: https://www.cbd.int/financial/finplanning/g-palnfinancing-wwf2007.pdf (accessed June, 2019).

Hogg, K., Noguera-Méndez, P., and Semitiel-García, M. (2021). Lessons from three north-western Mediterranean MPAs: A governance analysis of Port-Cros National Park, Tavolara Punta-Coda Cavallo and Ustica. Mar. Policy 127:34. doi: 10.1016/j.marpol.2017.10.034

Howard, J., Fox, M., Mcleod, E., Thomas, S., Wenzel, L., and Pidgeon, E. (2017). The potential to integrate blue carbon into MPA design and management. Aquatic Cons Mar. Freshwat. Ecosyst. 27, 100–115. doi: 10.1002/aqc.2809

Huwyler, F., Kappeli, J., Serafimova, K., Swanson, E., and Tobin, J. (2014). Conservation Finance: Moving Beyond Donor Funding Toward an Investor-Driven Approach. Available online at: https://www.cbd.int/financial/privatesector/g-private-wwf.pdf (accessed June, 2017).

Ison, S., Hills, J., Morris, C., and Stead, S. M. (2018). Sustainable financing of a national marine protected area network in fiji. Ocean Coast. Manag. 163, 352–363. doi: 10.1016/j.ocecoaman.2018.07.011

Iyer, V., Mathias, K., Meyers, D., Victurine, R., and Walsh, M. (2018). Finance Tools for Coral Reef Conservation: A Guide. Available online at: https://static1.squarespace.com/static/57e1f17b37c58156a98f1ee4/t/5c7d85219b747a7942c16e01/1551730017189/50+Reefs+Finance+Guide+FINAL-sm.pdf (accessed December 2, 2018).

Living Oceans (2014). Sustainable Financing Options for a Marine Protected Area Network in British Columbia. Vancouver, BC: Living Oceans.

Mallin, M.-A. F., Stolz, D. C., Thompson, B. S., and Barbesgaard, M. (2019). In oceans we trust: Conservation, philanthropy, and the political economy of the Phoenix Islands Protected Area. Mar. Policy 107:10. doi: 10.1016/j.marpol.2019.01.010

McCook, L. J., Ayling, T., Cappo, M., Choat, J. H., Evans, R. D., De Freitas, D. M., et al. (2010). Adaptive management of the great barrier reef: a globally significant demonstration of the benefits of networks of marine reserves. Proc. Natl. Acad. Sci. 107, 18278–18285. doi: 10.1073/pnas.0909335107

Meyers, D., Bhattacharyya, K., Bray, B., Bohorquez, J., and Leone, S. (2021). The Global Fund for Coral Reefs: Investment Plan 2021. Available online at: https://static1.squarespace.com/static/57e1f17b37c58156a98f1ee4/t/60dcad139c3f6276dabb9b06/1625074968533/GFCR+Investment+Plan+2021_final.pdf (accessed July, 2021).

Meyers, D., Bohorquez, J., Cumming, T., Emerton, L., van den Heuvel, O., Riva, M., et al. (2020). Conservation Finance: A Framework. Charlottesville: CFA.

Morris, B. (2002). Transforming Coral Reef Conservation in the 21st Century Networks of Marine Protected Areas.

Naturevest, and EKO (2014). Investing in Conservation: A Landscape Assessment of an Emerging Market. The Nature Conservancy, EKO Asset Management.

Neely, W. P., and Brister, B. M. (2010). Credit crisis driven changes to asset allocation and spending rates for college endowments. Financ. Decis. 2010:5,Google Scholar

O’Leary, B. C., Ban, N. C., Fernandez, M., Friedlander, A. M., García-Borboroglu, P., Golbuu, Y., et al. (2018). Addressing criticisms of large-scale marine protected areas. Bioscience 68, 359–370. doi: 10.1093/biosci/biy021

OECD (2017). Marine Protected Areas: Economics, Management and Effective Policy Mixes. Paris: OECD Publishing. doi: 10.1787/9789264276208-en

Pascal, N., Brathwaite, A., Bladon, A., Claudet, J., and Clua, E. (2021). Impact investment in marine conservation. Ecosyst. Serv. 48, 199–220. doi: 10.1016/j.ecoser.2021.101248

Pendleton, L., Donato, D. C., Murray, B. C., Crooks, S., Jenkins, W. A., Megonigal, P., et al. (2012). Estimating global “‘blue carbon”’ emissions from conversion and degradation of vegetated coastal ecosystems. PLoS One 7:43542. doi: 10.1371/journal.pone.0043542

Perry, E., and Karousakis, K. (2020). A Comprehensive Overview of Global Biodiversity Finance. Paris: OECD.

Peters, H., and Hawkins, J. P. (2009). Access to marine parks: a comparative study in willingness to pay. Ocean Coast. Manag. 52, 219–228. doi: 10.1016/j.ocecoaman.2008.12.001

Phua, C., Andradi-brown, D. A., Mangubhai, S., Gabby, N., Mahajan, S. L., Larsen, K., et al. (2021). Marine protected and conserved areas in the time of COVID. Parks 27, 85–102. doi: 10.2305/IUCN.CH.2021.PARKS-27-SICP.en

Pomeroy, R. S., Parks, J. E., and Watson, L. M. (2004). How is your MPA doing? Ocean Coast Manag. 48, 485–502. doi: 10.1016/j.ocecoaman.2005.05.004

Pringle, R. M. (2017). Upgrading protected areas to conserve wild biodiversity. Nature 546, 91–99. doi: 10.1038/nature22902

Ransom, K. P., and Mangi, S. C. (2010). Valuing recreational benefits of coral reefs: the case of mombasa marine national park and reserve. Kenya. 45, 145–154. doi: 10.1007/s00267-009-9402-9

Reid-Grant, K., and Bhat, M. G. (2009). Financing marine protected areas in Jamaica: An exploratory study. Mar. Policy 33, 128–136. doi: 10.1016/j.marpol.2008.05.004

Roberts, K. E., Hill, O., and Cook, C. N. (2020). Evaluating perceptions of marine protection in Australia: Does policy match public expectation? Mar. Policy 112:103766. doi: 10.1016/j.marpol.2019.103766

Roberts, K. E., Valkan, R. S., and Cook, C. N. (2018). Measuring progress in marine protection: A new set of metrics to evaluate the strength of marine protected area networks. Biol. Conserv. 219, 20–27. doi: 10.1016/j.biocon.2018.01.004

Sala, E., Costello, C., Dougherty, D., Heal, G., Kelleher, K., Murray, J. H., et al. (2013). A general business model for marine reserves. PLoS One 8, 1–9. doi: 10.1371/journal.pone.0058799

Silver, J. J., and Campbell, L. M. (2018). Conservation, development and the blue frontier: the republic of seychelles’ debt restructuring for marine conservation and climate adaptation program. Int. Soc. Sci. J. 2018:12156. doi: 10.1111/issj.12156

Spergel, B., and Moye, M. (2004). Financing Marine Conservation. A Menu of Options. Washington, DC: WWF Center for Conservation Finance. doi: 10.1007/s00267-010-9460-z

Staub, F., and Hatziolos, M. E. (2004). Score Card to Assess Progress in Achieving Management Effectiveness Goals for Marine Protected Areas. Washington, DC: World Bank.

Sumaila, U. R. (1998). Protected marine reserves as fisheries management tools: a bioeconomic analysis. Fish. Res. 37, 287–296. doi: 10.1016/S0165-7836(98)00144-1

Sumaila, U. R., Rodriguez, C. M., Schultz, M., Sharma, R., Tyrrell, T. D., Masundire, H., et al. (2020). Investments to reverse biodiversity loss are economically beneficial. Curr. Opin. Environ. Sustain. 29, 82–88. doi: 10.1016/j.cosust.2018.01.007

Sumaila, U. R., Walsh, M., Hoareau, K., Cox, A., Teh, L., Abdallah, P., et al. (2021). Financing a sustainable ocean economy. Nat. Commun. 12:23168. doi: 10.1038/s41467-021-23168-y

Thiele, T., and Gerber, L. R. (2017). Innovative financing for the High Seas. Aquat. Conserv. Mar. Freshw. Ecosyst. 27, 89–99. doi: 10.1002/aqc.2794

Thur, S. M. (2010). User fees as sustainable financing mechanisms for marine protected areas: An application to the Bonaire National Marine Park. Mar. Policy 34, 63–69. doi: 10.1016/j.marpol.2009.04.008

van Bets, L. K. J., Lamers, M. A. J., and van Tatenhove, J. P. M. (2017). Governing cruise tourism at Bonaire: a networks and flows approach. Mobilities 12, 778–793. doi: 10.1080/17450101.2016.1229972

Virdin, J., Klaas de Vox, P. H., Hiller, J., Namrite, K., and Fitzgerald, T. (2018). Financing Fisheries Reform: Blended Capital Approaches in Support of Sustainable Wild-Capture Fisheries. Available online at: edf.org/blendedcapita (accessed February, 2018).

Wabnitz, C. C. C., and Blasiak, R. (2019). The rapidly changing world of ocean finance. Mar. Policy 107:3526. doi: 10.1016/j.marpol.2019.103526

Waldron, A., Adams, V., Allan, J., Arnell, A., Asner, G., Atkinson, S., et al. (2020). Protecting 30% of the Planet for Nature: Costs, Benefits and Economic Implications. Available online at: https://www.campaignfornature.org/protecting-30-of-the-planet-for-nature-economic-analysis (accessed July, 2020).

Keywords: marine protected areas, marine protected area finance, conservation finance, management tools, marine conservation, Parque Nacional Natural Corales de Profundidad, sustainable finance

Citation: Bohorquez JJ, Dvarskas A, Jacquet J, Sumaila UR, Nye J and Pikitch EK (2022) A New Tool to Evaluate, Improve, and Sustain Marine Protected Area Financing Built on a Comprehensive Review of Finance Sources and Instruments. Front. Mar. Sci. 8:742846. doi: 10.3389/fmars.2021.742846

Received: 16 July 2021; Accepted: 20 December 2021;

Published: 25 January 2022.

Edited by:

Lyne Morissette, M – Expertise Marine, CanadaReviewed by:

Siddhartha Pati, Skills Innovation & Academic Network (SIAN) Institute, IndiaCopyright © 2022 Bohorquez, Dvarskas, Jacquet, Sumaila, Nye and Pikitch. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: John J. Bohorquez, am9obi5ib2hvcnF1ZXpAc3Rvbnlicm9vay5lZHU=

†These authors have contributed equally to this work

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.