- School of Business and Economics, Faculty of Biosciences, Fisheries and Economics, UiT The Arctic University of Norway, Tromsø, Norway

This study investigates the relationships between industry-specific institutions, industry structure, and industry performance. The Norwegian Pelagic value chain’s harvesting industry and its processing industry comprised the empirical context. The study findings reveal that the harvesters (the fishers), on average, achieved nearly twice the return on assets relative to the processors. Furthermore, the fishers’ cash flow margin was, on average, more than eight times higher, and their annual growth rate was approximately 70% above the corresponding figures of the processing industry. This study argues that the two industries’ performance differences are related to the variations in their institutional setups. The processing industry is subject to the general Norwegian business environment, whereas the fish harvesting industry benefits from a sector-specific framework that supports its relative competitiveness. The fishers have collectively established a legally supported sales organization, thereby strengthening their bargaining power, vis-à-vis the processors (buyers). The fishers’ rivalry is curbed by catch share regulations, and incumbent fishers are protected from intruders through entry barriers, for example, license requirements. Moreover, the processing industry’s potential threat to vertically integrate upstream into the fish harvesting industry is blocked through legislation. Finally, in contrast to the processing industry, the fish input cost is free for the harvesting industry. This study concludes that the fish harvesting industry has gained a sustained competitive advantage over the processing industry, based on a more supportive industry-specific institutional framework.

Introduction

Institutional force being consistent across industries is an implicit premise in the business strategy literature (Elango and Dhandapani, 2020); institutions are thus commonly defined as a nation-level construct. This premise could also be valid for most industries in a seafood value chain, such as fish processing and fish exporting, as these industries are typically exposed to a free market-based institutional framework. However, the primary production, that is, the fish harvesting industry, is subject to a sector-specific institutional framework that is implemented to avoid overfishing and protect the fishers from a devastating internal rivalry (Birkenbach et al., 2017). This study examines whether industry-specific institutions have the potential to impact and cement profits in a specific part of a value chain. Therefore, this study defines institutions as an industry-level construct. The standpoint that industry-specific variations in institutional setups can impact industry performance has attracted scant attention from institutional scholars (Elango and Dhandapani, 2020). Thus, this study contributes to the broader discourse on the relationship between institutional contingencies, industry structure and dynamics, and industry outcomes (e.g., North, 1990; Peng, 2002; Porter, 2008; Peng et al., 2009; Chacar et al., 2010; Manikandan and Ramachandran, 2015).

This study argues, along with Peng et al. (2009), that institutions have the potential to shape the competitive forces both in and between industries and shift the power balance and profits among various industries in the same value chain. Thus, this study suggests that a fish harvesting industry embraced by a supportive sector-specific institutional framework will perform better than the related industries in the same value chain that are subject only to a generally free competition-based institutional framework. This study therefore empirically investigates whether different industries that are part of the same seafood value chain but enclosed by various institutional frameworks perform differently over time. Thus, the existence of an industry-specific institutional framework is a significant independent variable in the study.

The Norwegian pelagic value chain is the selected empirical context, particularly the harvesting and the processing industries. This context is particularly suitable to study the performance differences between vertical links in a value chain, as the fish processing industry cannot legally integrate upstream toward the harvesting industry (Isaksen, 2007). Thus, fishers and fish buyers operate separately and interact through an auction-based marketplace (Sogn-Grundvåg et al., 2019). The profound differences in institutional frameworks that embrace the harvesting industry on the one hand and the more free market-organized processing industry on the other hand motivated this study to pay attention to institutional differences when explaining performance variations between the two industries.

Scholars have recently sought more studies on the impact of institutions on industry performance in the strategic management literature (Peng et al., 2018; Elango and Dhandapani, 2020), as there is a remarkable consensus that institutions matter (North, 1990; Peng, 2002; Peng et al., 2008, 2009). This study however tackles the harder and more interesting issues related to what extent institutions matter and how they matter. Accordingly, this study integrates Porter’s (1980) industry viewpoint on strategy and Peng et al.’s (2009) institution-based perspective to gain a more holistic understanding of the relationships between industry-specific institutions, industry structures, and subsequent performance. This integrative approach allows the theoretical discussion to advance toward a more holistic model of industry dynamics and economic outcomes between related industries in a value chain.

Thus, this study bring industry-specific institutions to the forefront of the strategy literature research agenda. Rather than considering institutional variety as a national phenomenon, the study demonstrates how institutional diversity also can be included at the industry level. In doing so, the empirical findings of the study showed that the “profit pool” (i.e., the industry with the better profit) is cemented in the harvesting industry in the value chain studied. The understanding of how institutions have locked-in profits in a specific industry in a value chain by influencing its competitive forces is considered a significant theoretical contribution of the study. Insights into institutional contingency effects remain rare in the literature, although they are a potent source of future theory building (Elango and Dhandapani, 2020). The study furthermore follows Porter’s (2008) advice to systematically examine the antecedents to an industry’s competitiveness.

This study is further organized in the following order. Section “Theory and Hypothesis” reviews the theoretical framework of the study. Section “Institutional evolution” outlines the emergence of sector-specific institutions in the Norwegian pelagic harveting industry. Section “Material and Methods” describes the materials and methods. Section “Results” presents the results, section “Discussion” discusses the findings and their implications, while section “Conclusion” concludes the study.

Theory and Hypothesis

Although neoclassical economic theory predicts that competition allocates resources to the most profitable industries to achieve the highest returns, some industries are nevertheless more attractive than others. Rumelt (1991) argued that unequal returns over time mark the presence of barriers to resource flows between industries. The study of such barriers is a principal concern of industrial organization research when examining the structure of industries and markets. The industrial organization field extends the perfectly competitive neoclassical model by including transaction costs, limited information, and barriers to entry of new firms, all of which may be associated with imperfect competition (Williamson, 1991). Porter (1980, 2008) advanced the field of industrial economics when presenting his five forces framework to analyze the competitive dynamics of an industry and suggested that industry structure primarily determines the mid- and long-term profit potentials of an industry. The structure manifests itself through the existence and strength of each of five competitive forces: rivalry among competitors, bargaining power of suppliers, bargaining power of buyers, the threat of entry, and the threat of substitutes. He further argued that industry structure strongly influences how much profit is retained by a firm in an industry compared with that bargained away by its customers and suppliers, limited by substitutes, or constrained by potential new entrants. Porter’s primary focus is thus the relationship between industry structure and performance. However, this research stream is criticized for ignoring the context, history, and influence of institutions on performance (Narayanan and Fahey, 2005). Instead, a free market-based institutional framework is taken for granted. Laws and regulations are only regarded as “background,” as they are expected to be common to most industries.

The Nobel Prize-winning economic historian North (1990) criticizes both neoclassical and industrial economists for neglecting the importance of institutions when explaining long-term economic performance. He argued that institutions have the potential to significantly affect the performance of industries over time. For example, some resource-based industries develop institutions that stimulate growth and wealth creation for the stakeholders, whereas others do the opposite. North (1990), a representative of the new institutional economics perspective, defines institutions as “the rules of the game in society” or more formally “the humanly devised constraints that shape human interaction” (p. 3). Institutions represent the incentive structure in an economy, and organizations, such as commercial fishing vessels, will strive to exploit opportunities within their given institutional framework. Thus, institutions “matter.” He further argued that path dependence is key to understanding long-term economic performance. Path dependence results from increasing returns mechanisms that reinforce the direction of a given economic path of development. A path can be altered not only from decline to stagnation and growth (or vice versa) from intended institutional changes but also from unanticipated consequences of fishery policy choices and from external shocks such as a sudden drop in stock abundance.

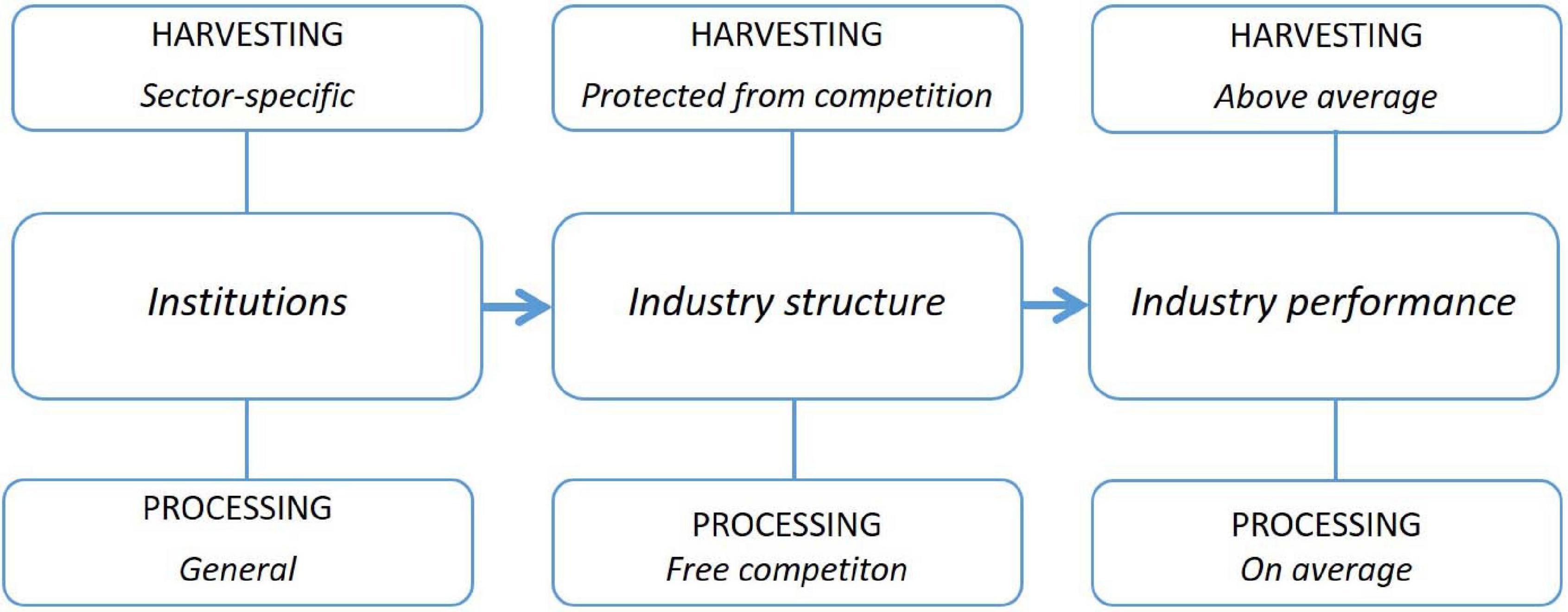

Building on the new institutional economics perspective, the emerging institution-based viewpoint of strategy argues that besides industry- and firm-level conditions, strategists and policymakers should consider the impacts of institutions when aspiring to understand performance differences between nations, industries, and firms. The theoretical argument of this study, illustrated in Figure 1, integrates the institution-based viewpoint of strategy (Peng, 2002; Peng et al., 2009) and the industry-based viewpoint of strategy (Porter, 1980, 2008) to explain long-term performance differences between industries in the same seafood value chain.

The framework in Figure 1 indicates relationships between an industry’s institutional framework, its structure, and its performance. If the institutional frameworks between the fish harvesting and the fish processing industries are significantly different, this aspect is expected to influence the competitive forces within these industries and shape their structures and performance potentials. Institutions thus have the potential to shift the power balance and profits between various industries in the same value chain. The fish harvesting industry, which is embraced by a package of supportive sector-specific institutions (see Table 1), will expectedly perform better than related industries in the value chain that are subject to a generally free competition-based institutional framework. Accordingly, the following hypothesis is posited in the present study:

H1: An industry with a specific and supportive institutional framework can gain an institution-based competitive advantage relative to other industries in the same value chain.

Porter (1980, 2008) argued that to understand the influences of institutions on an industry’s structure, one must analyze how specific government policies affect the competitive forces within the industry. For instance, license requirements raise barriers to entry a fishery and increase the incumbents’ profit potential (Bertheussen et al., 2021). Furthermore, government policies favoring a cooperative fisher-owned sales union will empower the fish harvesting industry and influence its performance relative to the fish processing industry (Jentoft and Finstad, 2018). Fish quotas that provide an institutional protection of the raw material market share of the fishers will lead to a less intense rivalry in this industry (Birkenbach et al., 2017).

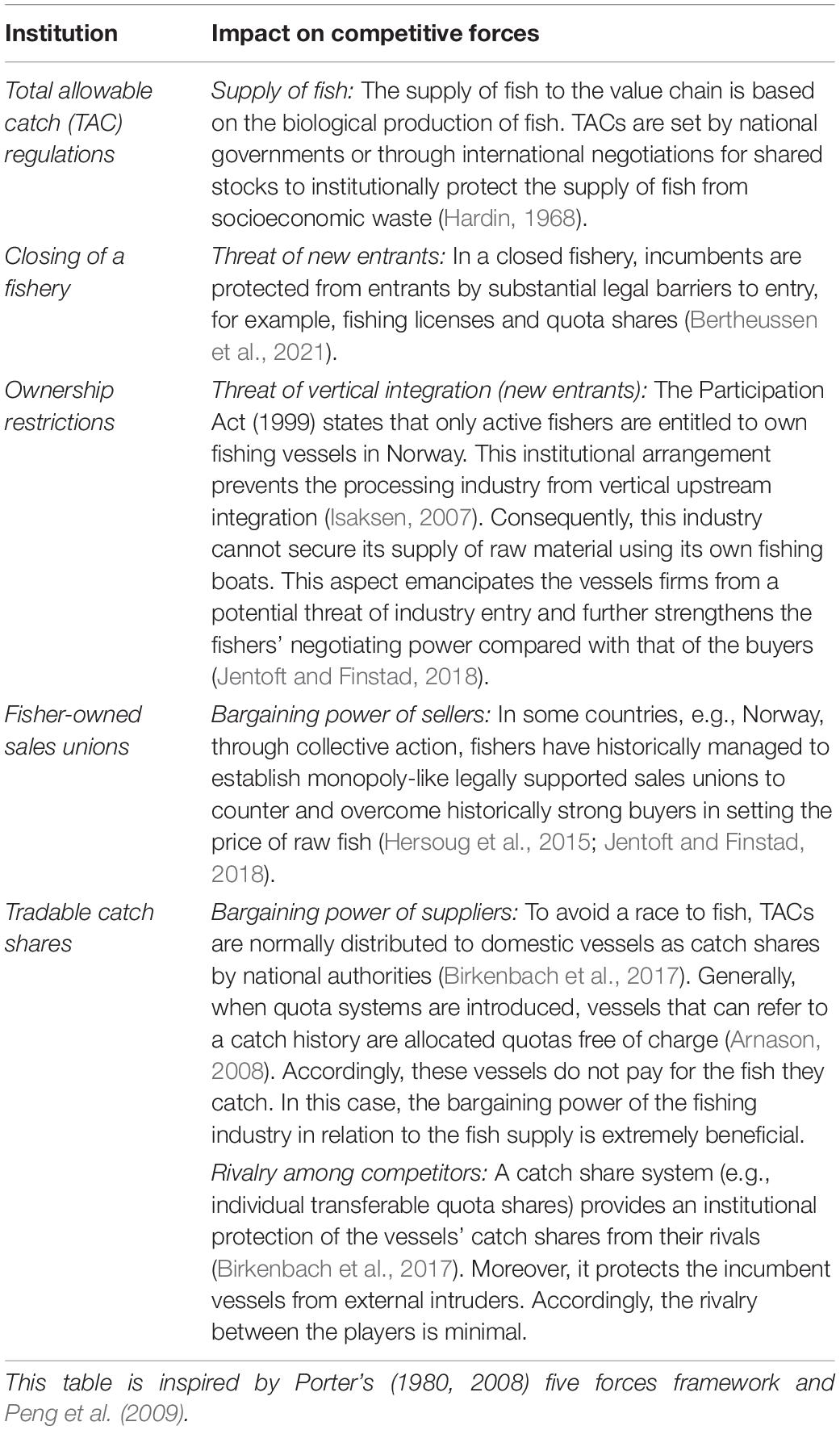

Table 1 provides an overview of sector-specific institutions expected to impact the structure and competitiveness of the Norwegian pelagic fish harvesting industry.

Institutional Evolution

This section describes the evolution of the industry-specific institutions outlined in Table 1.

Closing of the Fishery and Total Allowable Catch (TAC) Regulations

Building up catch capacity in the form of larger vessels and engines and more efficient fishing technology, such as echo sounders, power blocks, and purse seines, made the pelagic fishing fleet highly efficient (e.g., Bertheussen, 2021). In the 1960s, fishing access remained free. However, the herring stock was so overfished that it collapsed around 1970. Consequently, registration for purse seiners was stopped in 1970, and the fishery closed. Moreover, TAC quotas for herring were introduced in 1971, and the capture of Atlantic Scandinavian herring was totally banned in 1972. Additionally, in 1972, license requirements were introduced to the herring fishery (Christensen and Hallenstvedt, 2005). The introduction of catch and participation restrictions to the herring fishery guided a new era of the fisheries. Henceforth, resource management formed the foundation of fisheries, not economic or social objectives. Internationally, this factor was reflected in the establishment of 200-mile economic zones from 1977, the Convention on the Law of the Sea in 1982, and the FAO Code of Conduct for Responsible Fisheries in 1995 (Hallenstvedt and Dørum, d.u.). When the herring disappeared, the fishers shifted their attention to alternative fish species, such as blue whiting, capelin, and mackerel. However, this resulted in the overexploitation of these species, and hence, the introduction of new and stringent regulations was imperative (ibid.).

Ownership Restrictions

In the 1930s, a conflict arose between the fishing-owned coastal fleet and the emerging trawler fleet in the cod fishery. Who then should be allowed to own a fishing vessel: active fishers or external investors (Hallenstvedt and Dørum, d.u.)? In 1932, it was legally decided that only active fishers could obtain a trawl license. A decade later, the legislation was continued, and it was decided that only active fishers could own any Norwegian fishing vessel. The law on property rights to fishing vessels, the Participation Act, is still regarded by fishers as one of the mainstays of Norwegian fisheries policy (Jentoft and Finstad, 2018). This law provides active Norwegian fishers with an exclusive right to catch fish.

Fisher-Owned Sales Unions

In the interwar period, the international economic crisis led to price pressure on fish, which propagated through the value chain. The fishers had a weaker bargaining power than the buyers when they were to sell perishable fish, and they appeared as financial losers. Consequently, they collectively chose to organize to establish counterpower (Hersoug et al., 2015; Jentoft and Finstad, 2018). Thus, the Norwegian Fishermen’s Association was founded in 1926 as the fishers’ professional organization and political representative. As a result, the turnover of pelagic fish was taken over gradually by fisher-owned sales unions. The firsthand sales of herring was organized through “the herring sales organization” (Norges Sildesalgslag, originally “Storsildlaget” in 1927). Their exclusive right to sell herring was quickly legislated through the Herring Act in 1930 (Christensen and Hallenstvedt, 2005). This act has granted the fishers an exclusive right to set a minimum price in the firsthand market if they could not reach a consensus with the buyers. The act also prohibited the sale of herring from the fishers to the processing industry outside the mandated sales organization. This exclusive right still exists, and the fishers hence succeeded in establishing a herring sales monopoly (Hersoug et al., 2015; Jentoft and Finstad, 2018).

Fish auctions bring sellers and buyers together, and various fish species are generally available in various sizes, quantities, and qualities. Auctions can reduce transaction costs for sellers and buyers. They are organized typically by sellers, who aim to benefit from the competition by extracting the maximum revenue from buyers (Riley and Samuelson, 1981). Sellers usually decide the auction method and rules. In the 1970s, the Norwegian pelagic auction was established. The auction platform is owned and operated by Norges Sildesalgslag, which is the current sales union for Norwegian pelagic fishers (Sogn-Grundvåg et al., 2019).

Tradable Catch Shares

Individual non-tradable vessel quotas (IVQs) were introduced in 1978 for purse seiners fishing capelin and extended in the late 1980s to include mackerel and herring (Årland and Bjørndal, 2002). The IVQ system was modified in 1996 under the unit quota (UQ) scheme, aiming to reduce the number of vessels because the catch capacity still exceeded the available quota basis (Hersoug, 2005). In 2005, the UQ system was converted into a “structural quota” system as an additional measure to reduce catch capacity and increase efficiency. This system was a more flexible and market-oriented than the UQ system (Hannesson, 2013).

Norwegian Pelagic Value Chain

The Norwegian pelagic value chain shares the same supply base with mackerel, herring, capelin, and blue whiting as the main species caught, processed, and sold. In the pelagic sector, approximately 80% of the catch is taken by large seagoing vessels. The coastal fleet is therefore less significant (Asche et al., 2014). The fishing occurs when the fish quality is good, and the fleet achieves high catch rates. The quality of pelagic fish is determined primarily from the fat content of the fish and the presence of parasites and plankton. These are natural factors, and there are large quality variations in terms of season, fish species, and catch area (Sone et al., 2019; Bertheussen et al., 2020a).

The average pelagic production per processing plant was approximately 15,000 tons in 2012 (Asche et al., 2014). The onshore facilities compete for the raw material. This aspect has created overcapacity and plants that outbid each other to obtain sufficient raw materials (PwC., 2019). Besides overcapacity, the plants struggle with an uneven supply of raw materials during the year, as there are large seasonal variations in the pelagic fisheries. Additionally, TACs change from year to year. At present, the pelagic processing industry is mostly consolidated (PwC., 2019).

In 2019, approximately 22% of the Norwegian mackerel was exported directly to quality-conscious Japanese buyers. Thus, Japan is the best-paying market (Bertheussen et al., 2020a). China bought around 19% of the mackerel, where the majority of the fish was further processed and re-exported to Japan. In 2019, approximately 40% of the Norwegian mackerel exports were sold, directly or indirectly, to the Japanese market. Other essential markets were South Korea, Nigeria, and Turkey.

Materials and Methods

Research Design

This study investigates the long-term relationships between industry-specific institutions (independent variable), industry structure (intermediate variable), and industry performance (dependent variable) (see Figure 1). The Norwegian pelagic value chain’s harvesting industry was selected as the experimental group, and the processing industry in the same value chain was selected as the control group. This context is considered particularly suitable to study performance differences between vertical links in a value chain as the fish processing industry cannot legally integrate upstream toward the harvesting industry (Isaksen, 2007). The two industries thus operate separately and have coordinated their exchanges in auctions (Sogn-Grundvåg et al., 2019). The selected industries therefore only include “pure players,” that is, they focus on a single value chain activity such as fish harvesting and fish processing.

Furthermore, the two industries compared are exposed to the same general business environment because they are located in the same nation. The industries are also exposed to the same biological environment, as they are both part of the same seafood value chain. Thus, the more diverse the institutional settings, the better the prospect to isolate institutional factors accountable for performance differences between the selected industries. The harvesting industry is exposed to significant institutional influences, which are historically justified and aimed at contributing to sustainable fisheries (see Table 1 and section “Institutional Evolution”). The processing industry lacks corresponding institutional protection mechanisms, although the postharvest industry also depends on a sustainable harvesting sector. According to this study, their different institutional environments set these industries apart. Otherwise, it is argued that the sectors are comparable. Numerous factors can affect industry performance in the short term, whereas industry structure, as manifested by the competitive forces, sets industry performance in the medium and long terms (Porter, 1980, 2008). This study has consequently selected a relatively long time horizon of 15 years (2003–2017).

Sampling and Data Collection

The Norwegian Directorate of Fisheries (NDF) requires most fish vessel firms to report income and cost data annually per vessel (Vassdal and Bertheussen, 2020). This study uses this data set to gain insights into the profitability development of the pelagic harvesting industry. The NDF randomly selects a representative sample of vessels without replacement for its annual profitability surveys. The number of vessels that participate annually in this study is listed in the penultimate row in Table 3.

Table 3. Performance differences of the harvesting and processing industries in the Norwegian pelagic value chain in the period 2003–2017a.

The data source used to analyze the pelagic processing industry is the annual profitability study of the fish processing industry conducted by the Norwegian research organization Nofima (Nyrud and Bendiksen, 2019). Every year, Nofima surveys profitability and structural changes in the Norwegian fish processing industry. These profitability analyses are based on available annual accounts for every company in the processing industry. However, the Norwegian pelagic processing industry comprises two segments: the consumer industry and the meal and oil industry. As most of the herring and mackerel are for consumption, this study has selected to focus on the pelagic consumer industry. Pelagic production must generally account for more than 75% of a firm’s turnover to be included in this industry segment (Nyrud and Bendiksen, 2019). For a few large pelagic companies engaged in both types of processing activities, the revenues, expenses, and investments are distributed proportionally between the consumer industry and the meal and oil industry. The number of pelagic processing firms participating in this study is given in the last row in Table 3.

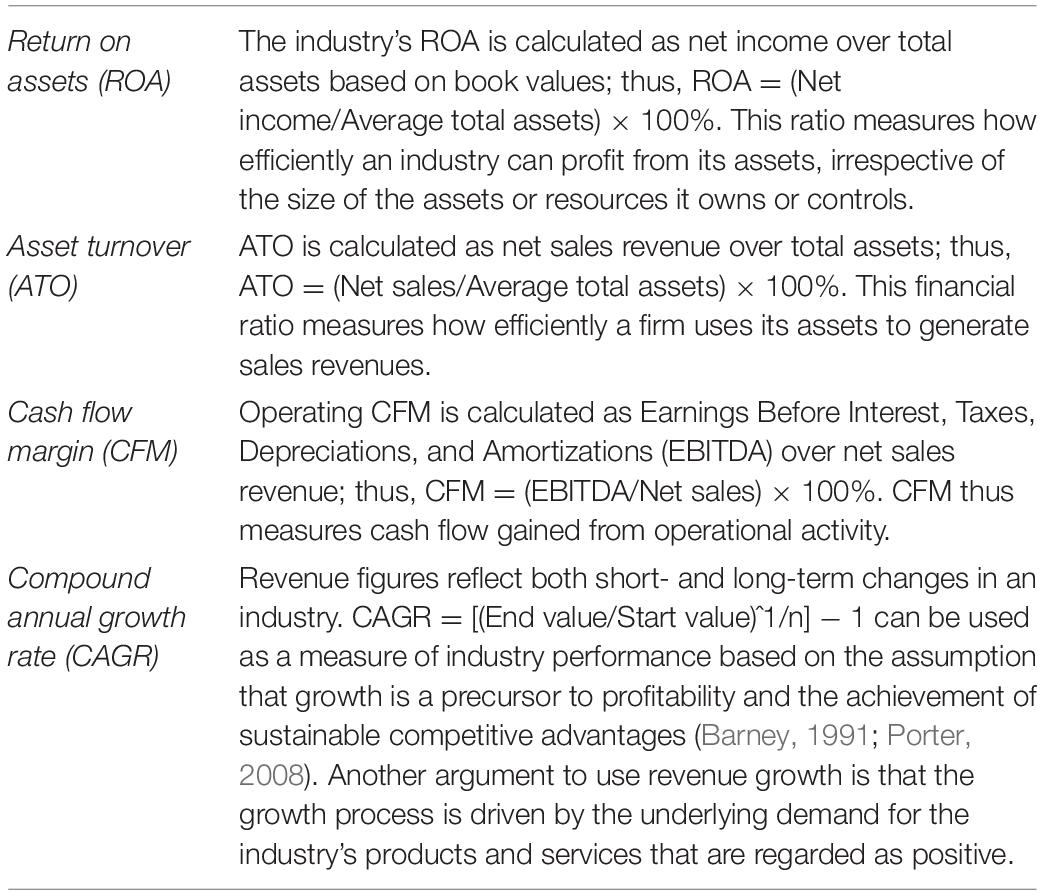

Data Processing/Calculations

This study examines and explains performance variations between the Norwegian pelagic value chain’s harvesting and processing industries (see Figure 1). The research design requires valid and reliable performance measures at the industry level. Performance is a multidimensional concept and can be measured by profitability, growth, or market share. This study applies multiple performance indicators, as outlined in Table 2. The primary operationalized dependent variable is the industry’s return on assets (ROA). ROA includes the industry’s total activity and enables the comparison of different industries (Magni, 2009; Penman, 2013). A weakness of this measure is that the wealth increase that occurred in the harvesting industry as a result of significant increases in quota prices during the study period (Flaaten et al., 2017; Hannesson, 2017) is not reflected in ROA calculations based on book values. If market values of quotas were used as a basis for the calculations, both the numerator (through quota revaluations) and the denominator (through greater quota assets valuation) would be larger, and the net impact on the ROA ratio would be positive. The book value-based ratio calculated in this study is therefore conservative for the harvesting industry. The processing industry has not benefited from a corresponding increase in the valuation of intangible quota assets during the study period. In this study, other performance measures supplement ROA calculations, such as asset turnover, cash flow margin, and revenue growth.

Results

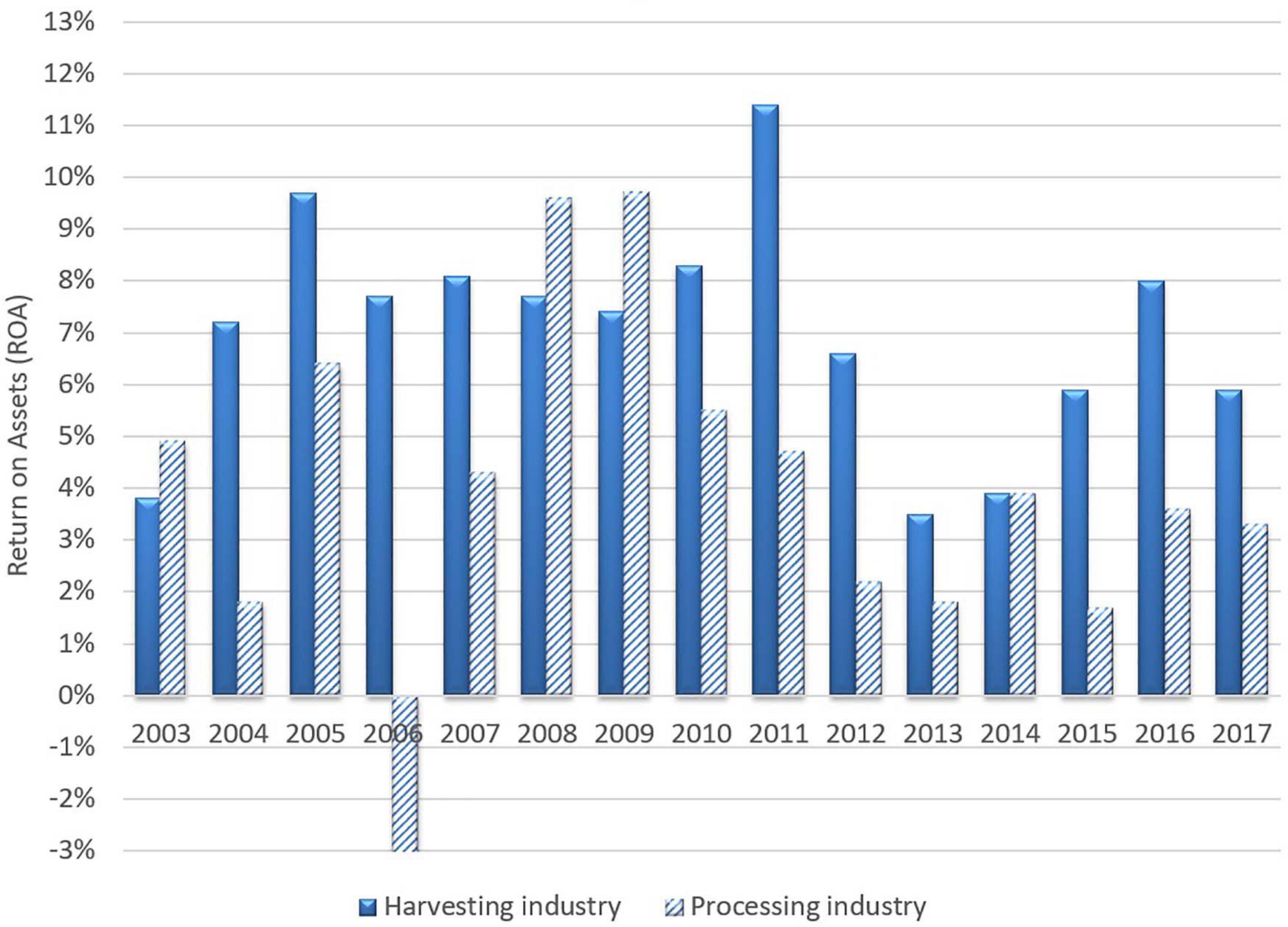

This section presents the empirical response to HI. The development of ROA in the industries studied is illustrated and compared in Figure 2.

Figure 2. Return on assets (ROA) of the fish harvesting industry and the fish processing industry of the Norwegian pelagic value chain in the period 2003–2017.

As shown in Figure 2, during the 15-year examination, the harvesting industry performed better in 11 years. In 2014, the two industries performed equally well, whereas in 3 years (2003, 2008, and 2009), the processing industry performed better. More key variables that describe the economic performance of the two industries are outlined in Table 3.

The findings are reported in Table 3. Subpoint a indicates that the processing industry’s competitive forces are more intense than those of the harvesting industry, as the economic result of the processing industry was a moderate average ROA of 4.0% during the 15-year study. This outcome is in stark contrast to the average of 7.0% in the harvesting industry, which indicates that the competitive forces in this industry are more agreeable.

The cash flow margins of the two industries (Table 3b) are hugely different, as the average is immense at 33.5% for the harvesting industry and a far more moderate 4% for the processing industry. This factor illustrates that processing is a low-margin business, whereas fishing is the opposite. However, asset turnover (Table 3c) is in favor of the processing industry, with an average of 179% compared with 20%. Finally, the findings in Table 3d, which are commented in table note 3, show that fishers capture the largest part of the industries’ revenue growth with an annual growth rate of 6.7% compared with 3.9% for the processing industry. An overall assessment of the results in Table 3 shows that three out of four performance indicators (3a, 3b, and 3d) favor the harvesting industry. Therefore, the findings of Table 3 demonstrate that the harvesting industry achieved profitability superior to that of the processing industry in the Norwegian pelagic value chain in the period studied.

Discussion

This study examined the relationships between industry-specific institutional frameworks, industry structures, and the performances of related industries in a disintegrated seafood value chain. The fish harvesting industry and the fish processing industry in the Norwegian pelagic value chain represent the empirical context. The hypothesis raised in this study was that an industry with a specific and supportive institutional framework can gain a sustained institution-based competitive advantage over other industries in the same value chain. The potential advantage is expected to materialize in higher profits. The study findings support the hypothesis, as the harvesting industry achieved a significant better ROA (p < 0.001) than the processing industry’s during the study period.

This study further argued that the performance differences observed can be related to the various industries’ institutional setups (see Figure 1). By having a more supportive institutional framework (see Table 1), the harvesting industry in the Norwegian pelagic value chain has gained an institution-based competitive advantage manifested as superior performance compared with the related processing industry (see Table 3). This study thus supported North’s (1990) statement that “institutions matter.” This finding is also consistent with the institution-based viewpoint of strategy and is considered a theoretical contribution of the present study, as insights into institutional contingency effects in general and industry-specific institutional effects in particular remain rare in the literature (Peng et al., 2009). Both North and Peng underlined the significant role of institutions in explaining enduring economic performance variations. However, the results contrast neoclassical economic theory, which claims that competitive industries can only expect equal economic returns over time. The findings also contrast the propositions of industrial economists who regard institutions as background only for industry competitiveness and performance (Bain, 1968).

This study demonstrated that in the selected empirical setting, “institutions matter” and the extent to which they matter economically for the industries involved. The discussion now turns to an interesting issue of how they matter. The argumentation is in line with Porter’s (2008) advice to systematically examine the antecedents to an industry’s competitive forces. This aspect is considered another theoretical contribution of the study.

The aim of introducing TAC regulations (a in Table 1) was to avoid the overexploitation of fish stocks and secure the entire value chain’s raw material supply (Birkenbach et al., 2017). Without TAC regulations, the value chain’s supply of fish will be at risk. Accordingly, the TAC institution is crucial to the supply of fish to both the harvesting and processing industries. Thus, TAC regulations can rarely explain why one specific industry of the same seafood value chain performs better than the other.

Closing a fishery (b in Table 1) aims to reduce excess capacity and make the fishery more profitable for the remaining stakeholders (Hersoug, 2005). Besides, closing a fishery neutralizes the threat from intruders (Porter, 2008) and prevents new entrants from obtaining a share of the biological value creation in captured fisheries. This aspect is beneficial to incumbent firms (Bertheussen et al., 2021). In the processing industry, which is subject to Norway’s general institutional business framework, there is a freedom of establishment. This industry therefore can face a threat of entry which is not beneficial.

The Participation Act states that only active fishers are entitled to own fishing vessels in Norway. This institutional arrangement prevents the processing industry from vertical upstream integration (c in Table 1; Isaksen, 2007). Therefore, this industry cannot secure its supply of raw material using its own fishing boats because any transaction has to occur through fish auctions operated on the conditions determined by the fishers (Sogn-Grundvåg et al., 2019).

Through collective action, the harvesting industry has managed to establish a monopoly-like cooperative sales union to counter and overcome historically strong buyers (d in Table 1). The fishers’ aim was to shift the balance of power and accordingly the competitive advantage in their favor via institutions (Hersoug et al., 2015; Jentoft and Finstad, 2018). The processing industry on the other hand has to compete for fish at fisher-owned auctions (Sogn-Grundvåg et al., 2019) for each purchase of raw materials. Vessels that historically were allocated catch shares for free do not pay for the fish caught. The bargaining power of the harvesting industry relative to their fish supply is, in this case, extremely beneficial as the fishers do not have to pay for its most crucial input (pelagic fish) in contrast to the processing industry.

In line with a more liberal fisheries policy (Holm and Henriksen, 2014), the Norwegian authorities introduced catch shares in the 1990s to protect the fishers’ profitability (subpoint e in Table 1). Without catch shares, each fisher would race to maximize his/her share of the TAC (Birkenbach et al., 2017). However, with an institutional protected catch share (Hannevig and Bertheussen, 2020), a fisher has nothing to gain by spending excessive effort to obtain his/her allocated catch. The individual transferable quota catch share system (i.e., vessel quotas) was introduced to remove excess capacity and internal rivalry in the pelagic harvesting industry. In comparison, the processing industry does not have institutional protection of its raw material market share, as it operates in a free-market and auction-based business environment. This study will next turn to discuss whether the probable institution-based competitive advantage of the fish harvesting industry has the potential to be sustainable.

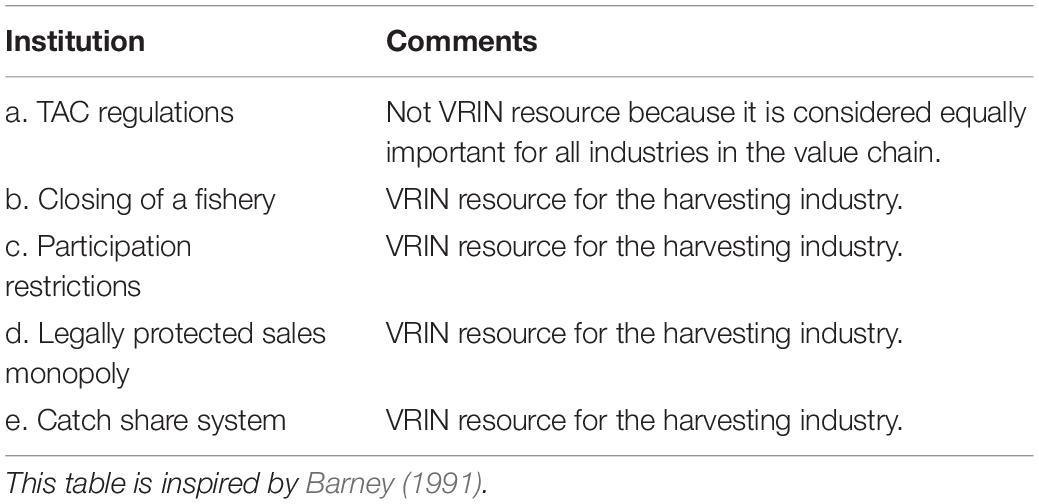

Is the Institution-Based Competitive Advantage of the Harvesting Industry Sustainable?

The resource-based viewpoint of strategy argues that resources that are valuable, rare, inimitable, and non-substitutable (“VRIN” resources) can support a firm in gaining a sustained competitive advantage (Barney, 1991). However, an industry, not a firm, is the present study’s level of analysis. Nevertheless, several empirical studies have used a firm perspective at other levels of analysis. For example, the firm perspective has been used by Hervás-Oliver and Albors-Garrigós (2007) to study business clusters, and Lawson (1999) used the firm perspective to conduct regional-level analysis. Therefore, in this study, the VRIN framework was applied at an industry level of analysis. When applying VRIN, an issue is whether the specific institutions of the harvesting industry (see a–e in Table 1) are VRIN and can thus give rise to a sustained institution-based competitive advantage of this industry compared with the related processing industry.

TAC regulations (a in Table 1) are valuable as an institution to ensure the ecological and economic sustainability of a commercial fishery (Hardin, 1968; Ostrom, 1990). However, as this institution is critical for the value creation of the whole Norwegian pelagic chain, it cannot give rise to one industry performing better than the other in the chain. Accordingly, TAC is supposed to be equally valuable to all industries in a seafood value chain and not a VRIN resource to any of the industries involved.

This study however considers the closing of a fishery (b in Table 1) as a VRIN resource for the harvesting industry, as it appears as a substantial threat to new entrants. Bertheussen et al. (2021) found that no new establishments have been set up in the Norwegian pelagic seagoing harvesting industry in the past 20 years.

The Participant Act (c in Table 1) aims to protect the fishers’ established right to harvest fish. This institution affects the balance of power between the two industries and thereby their relative competitive position, as the processing industry is prevented from integrating vertically upstream toward the harvesters. This aspect is a historically established right of the fishers, and in Norway, a political earthquake is probably needed to change this institutional arrangement (Grytås, 2013a). Accordingly, this right is regarded as a VRIN resource for the harvesting industry.

The fisher-owned sales union (d in Table 1) appears to have contributed significantly to a shift of power and profit from the processing to the harvesting industry. In this way, a specific sector in a seafood value chain has been able to create institution-supported bargaining power, which affects the fish prices set at auctions (Jentoft and Finstad, 2018; Sogn-Grundvåg et al., 2019). The fact that one industry in a value chain has been able to establish itself in the role of price setter instead of price taker probably has substantial performance implications. The Norwegian system of mandatory sales unions with monopoly power protected by law was invented during the economic crisis in the late 1930s. The unions have since survived and thrived, even in an era of increased globalization and market reforms. However, strong forces inside and outside Norway’s fishing industry aspire to take away the legal right from the sales unions to determine the minimum prices and the exclusive ownership that fishers have to these organizations (Grytås, 2013b). Nevertheless, the fisher-owned sales union is regarded as a VRIN resource for the harvesting industry in this study.

This study also found it unlikely that the catch share institution (Table 1) will be removed in the foreseeable future. Catch shares facilitate the neutralization of a destructive rivalry between the players, which is essential to ensure a sustainable economy for the fishers (Birkenbach et al., 2017). However, the political situations may be less liberal in the future and the extent to which quota trading will be allowed is more uncertain. Anyhow, several players have invested large amount of money in quota shares and matching vessel capacity based on a long-term business perspective (Bertheussen et al., 2020b). These stakeholders will expectedly use all available resources to oppose significant changes that underpin their original investment assumptions. Thus, in this study, the catch share system is regarded as a VRIN resource for the harvesting industry.

In brief, this study found it reasonable to conclude that the sector-specific institutions that support and protect the harvesting industry have proven to be VRIN for several decades. Such prominent institutions are barriers that hinder intruders from entering the industry (Bertheussen et al., 2021), catch share systems that curb rivalry (Birkenbach et al., 2017), and fisher-owned monopoly-like sales unions that create bargaining power (Hersoug et al., 2015; Jentoft and Finstad, 2018). Institutional change typically comprises marginal adjustments (North, 1990). This study showed that these institutions have helped to make the harvesting industry more attractive than the rivaling processing industry over time (see Table 4). The institutions involved show a significant degree of stability over decades. They have locked the value chain into a historical path that is hardly subject to discontinuous change (North, 1990). Therefore, this study concluded that the harvesting industry has gained a sustained institution-based competitive advantage over the processing industry in the Norwegian pelagic value chain.

Management Implications

This study demonstrated that institutions can lead different industries in the same value chain toward new ways of competing, which alter the competitive forces for the better for one industry and for the worse for another. When Norwegian fishers initially managed to establish a legally supported monopolistic sales union (Hersoug et al., 2015; Jentoft and Finstad, 2018), the two industries’ relative bargaining power changed. The sales union acts as a choke point with immense power because any fish transactions between fishers and buyers have to pass it. Extraordinary profit made in a specific industry in the same value chain often has choke points in the sense that particular business activities control the flow of profits throughout the chain (Gadiesh and Gilbert, 1998). Choke points therefore have vital strategic importance. This study illustrated that an industry that controls a choke point can influence the distribution of profits among its direct competitors. A strategic issue for a firm is thus whether the management can focus on the industry with the most significant profit potential. However, care has to be exercised here. One aspect is to determine such potential; another is to be successful in this more attractive industry considering the capabilities the organization already possesses. However, most companies are unable to achieve such a dramatic shift in their value chain positioning, no matter how attractive the profit concentration is in a related industry, because the entry barriers are high (Gadiesh and Gilbert, 1998; Bertheussen et al., 2021).

The nature of rivalry in an industry can be altered by mergers and acquisitions that introduce new capabilities and ways of competing (Porter, 2008). However, in the pelagic harvesting industry, strict quota trade restrictions put an effective stop to how much a fishing vessel firm is allowed to grow (Bertheussen et al., 2021). Conversely, in the pelagic processing industry, several significant mergers in recent years have resulted in a couple of large firms that control most of the sector (Asche et al., 2014; PwC., 2019). This aspect indicates that the stakeholders may attempt to realize the supply-side economies of scale. Supply-side economies of scale deter entry by forcing the eventual entrants to either enter the industry on a large scale or accept a cost disadvantage (Porter, 2008). Therefore, the threat of intruders seems to be minimal for both the harvesting industry and the related processing industry in the Norwegian pelagic value chain.

Expanding the entire value chain’s overall profit by raising the quality of the products sold creates win–win opportunities for multiple value chain stakeholders (PwC., 2019; Bertheussen et al., 2020a). However, expanding the pie does not reduce the industry structure’s importance (Porter, 1980, 2008). How the expanded pie is divided will ultimately be determined by competitive forces within and between the industries involved. In this study, the most successful industry was the one that expanded the profits made by the value chain in ways that allowed it to share disproportionately in the benefits.

Policy Implications

Porter (1980, 2008) claimed that industry structure grows out of a set of economic and technical characteristics that determine each competitive force’s strength. However, this study argued that barriers to entry, rivalry, and the seller and buyer’s bargaining power can be influenced immensely by the sector-specific institutional environment of an industry (see Figure 1). The profitability of a seafood industry is thus, to a large extent, a result of its institutional design, (Bertheussen and Vassdal, 2021) which is made up of small and large political decisions over time.

The current institutions of the Norwegian pelagic harvesting industry (see Table 1) were established to protect the fish resources against overfishing, curb the rivalry between fishers, and support their historically weak bargaining power (Hersoug et al., 2015; Jentoft and Finstad, 2018). Consequently, the extraordinary profit made (the “profit pool”; see Table 3) has shifted from the processing industry to the harvesting industry in the value chain studied. That institutions can move the profit pool and cement it in a particular part of a (seafood) value chain is a significant theoretical contribution of this study.

Despite extensive changes in the value chain and its environment, the fisher-owned sales union and the law that underpins this institution (the revised Raw Fish Act of 2013) have managed to appear relevant and legitimate by adapting continuously (Hersoug et al., 2015). Although this institutional design is context specific, the legal framework and the cooperative sales unions can perhaps offer some inspiration for similar institutional reforms in other parts of the world. This study demonstrated that the profit pool, through institutions, can be shifted and anchored to the industry that, in the public interest, has the greatest need for support.

Conclusion

In classic industry analyses, institutions operate at best in the background (Peng et al., 2009). This study, however, developed a theoretical model that includes industry-specific institutions as the independent variable, industry structure as the intermediate variable, and industry performance as the dependent variable. It is further hypothesized that an industry with a specific supportive institutional framework can acquire a sustained institution-based competitive advantage over other industries in the same value chain. To test the hypothesis, the study chose the harvesting and processing industries of the Norwegian pelagic value chain as its empirical context. The harvesting industry is surrounded by an industry-specific institutional framework, whereas the processing industry is exposed only to the general national institutional setup. Thus, in this study, the harvesting industry was chosen as the experimental group and the processing industry in the same value chain as the control group. Moreover, the two industries compared are disintegrated so that the economic returns from their respective activities are isolated. This factor reliably measures and compares the performance of each of the industries, as they are not involved in mixed business activities.

The findings showed that the harvesters (the fishers), on average, achieved nearly twice the ROA relative to the processors. Furthermore, the fishers’ cash flow margin was, on average, more than eight times higher, and their annual growth rate was approximately 70% above the corresponding figures of the processing industry. Based on the relatively long study period (15 years) and the fairly consistent findings presented, this study suggested that the better performance of the harvesting industry compared with the processing industry is related to a more supportive institutional framework of the former industry. The fishers have collectively established a legally supported sales organization, thus strengthening their bargaining power, vis-à-vis the processors (buyers); the fishers’ rivalry is curbed by catch share regulations, and incumbent fishers are protected from intruders through entry barriers, for example, license requirements. Moreover, the processing industry’s potential threat to vertically integrate upstream into the harvesting industry is blocked through legislation. Finally, in contrast to the processing industry, the fish input cost is free for the harvesting industry. This study therefore concluded that the best-performing industry has gained an industry-specific institution-based competitive advantage. The study further argued that the advantage is sustainable, as most of the institutions that form its basis have existed for many decades and are hardly exposed to discontinued change.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.fiskeridir.no/Yrkesfiske/Tall-og-analyse/Loennsomhet/Tidsserier and https://nofima.no/prosjekt/driftsundersokelsen-i-fiskeindustrien/.

Author Contributions

BB contributed to all sections of this manuscript.

Funding

The publication charges for this manuscript have been funded by a grant from the publication fund of UiT The Arctic University of Norway.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Årland, K., and Bjørndal, T. (2002). Fisheries management in Norway—an overview. Mar. Policy 26, 307–313. doi: 10.1016/s0308-597x(02)00013-1

Asche, F., Guttormsen, A., Nøstbakken, L., Roll, K., and Øglend, A. (2014). Organisering av verdikjeder i norsk sjømatnæring. [In Norwegian: Organization of Value Chains in the Norwegian Seafood Industry]. Stavanger: Report for the Ministry of Trade and Industry.

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Bertheussen, B. A. (2021). The role of institutions in the rebuilding of a collapsed fishery. Paper under Rev.

Bertheussen, B. A., Dreyer, B. M., Dreyer, S., and Evenseth, S. (2020a). Performance differences between nations exploiting a common natural resource: the Icelandic–Norwegian mackerel case? Mar. Policy 122:104269. doi: 10.1016/j.marpol.2020.104269

Bertheussen, B. A., Xie, J., and Vassdal, T. (2020b). Strategic investments in catch capacity and quotas: how costly is a mismatch for a firm? Mar. Policy 117:103874. doi: 10.1016/j.marpol.2020.103874

Bertheussen, B. A., Dreyer, B. M., and Hermansen, Ø, and Isaksen, J. R. (2021). Institutional and financial entry barriers in a fishery? Mar. Policy 123:104303. doi: 10.1016/j.marpol.2020.104303

Bertheussen, B. A., and Vassdal, T. (2021). Institution-based roots to fishing vessels profitability. Mar. Policy 123:104286. doi: 10.1016/j.marpol.2020.104286

Birkenbach, A. M., Kaczan, D. J., and Smith, M. D. (2017). Catch shares slow the race to fish. Nature 544, 223–226. doi: 10.1038/nature21728

Chacar, A. S., Newburry, W., and Vissa, B. (2010). Bringing institutions into performance persistence research: exploring the impact of product, financial, and labor market institutions. J. Int. Bus. Stud. 41, 1119–1140. doi: 10.1057/jibs.2010.3

Christensen, P., and Hallenstvedt, A. (2005). I kamp om havets verdier. Norges Fiskarlags historie. [Trondheim: In the struggle for the values of the sea. History of the Norwegian Fishers Association]. Trondheim: Norges Fiskarlag.

Elango, B., and Dhandapani, K. (2020). Does institutional industry context matter to performance? An extension of the institution-based view. J. Bus. Res. 115, 139–148. doi: 10.1016/j.jbusres.2020.04.037

Flaaten, O., Heen, K., and Matthíasson, T. (2017). Profit and resource rent in fisheries. Mar. Res. Econ. 32, 311–328. doi: 10.1086/692074

Gadiesh, O., and Gilbert, J. L. (1998). How to map your industry’s profit pool. Harv. Bus. Rev. 76, 149–159.

Grytås, G. (2013a). Motmakt og samfunnsbygger. Med Norges Råfisklag og torsken gjennom 75 år. [In Norwegian: Counterforce and community builder. With the Norwegian Raw Fish Association and cod for 75 years]. Trondheim: Akademika forlag.

Grytås, G. (2013b). “Råfisklova–tid for tale ved grava? [In Norwegian: The Raw Fish Act–time to talk at the grave?],” in Hvor går Nord-Norge? [In Norwegian: Where does Northern Norway head?], eds S. Jentoft, J.-I. Nergård, and K. A. Røvik (Stamsund: Orkana Akademisk).

Hallenstvedt, A., and Dørum, K. (d.u.). Norsk fiskerihistorie i Store norske leksikon på snl.no. Norwegian: Norwegian fishing history in Store norske leksikon on snl.no. Retrived May 27, 2021 from https://snl.no/Norsk_fiskerihistorie.

Hannesson, R. (2013). Norway’s experience with ITQs. Mari. Policy 37, 264–269. doi: 10.1016/j.marpol.2012.05.008

Hannevig, H., and Bertheussen, B. A. (2020). The exploitation-exploration dilemma of fishing vessels with institutionally protected quota shares. Front. Mar. Sci. 7:436. doi: 10.3389/fmars.2020.00436

Hardin, G. (1968). The tragedy of the commons. Science 162, 1243–1248. doi: 10.1126/science.162.3859.1243

Hersoug, B. (2005). Closing the Commons. Norwegian Fisheries from Open Access to Private Property. Delft, The Netherlands: Ebouron Academic Publishers.

Hersoug, B., Finstad, B.-P., and Christensen, P. (2015). The system of Norwegian fish sales unions–An anachronism or a successful adaptation to modern fisheries? Acta Boreal. 32, 190–204. doi: 10.1080/08003831.2015.1089670

Hervás-Oliver, J. L., and Albors-Garrigós, J. (2007). Do clusters capabilities matter? An empirical application of the resource-based view in clusters. Entrep. Region. Dev. 19, 113–136. doi: 10.1080/08985620601137554

Holm, P., and Henriksen, E. (2014). Mot en ny samfunnskontrakt. Rammevilkår, verdivalg og målkonflikter i sjømatsektoren [In Norwegian: Towards a New Social Contract: Environment, Values and Conflicting Objectives in the Seafood Sector]. Tromsø: Norges fiskerihøgskole og Nofima.

Isaksen, J. R. (2007). Upstream vertical integration and financial performance: the case of the Norwegian fish processing industry. Ph.D thesis. Tromsø: Norwegian College of Fishery Science, University of Tromsø.

Jentoft, S., and Finstad, B. P. (2018). Building fisheries institutions through collective action in Norway. Marit. Stud. 17, 13–25. doi: 10.1007/s40152-018-0088-6

Lawson, C. (1999). Towards a competence theory of the region. Cambridge J. Econ. 23, 151–166. doi: 10.1093/cje/23.2.151

Magni, C. A. (2009). Splitting up value: a critical review of residual income theories. Eur. J. Oper. Res. 198, 1–22. doi: 10.1016/j.ejor.2008.09.018

Manikandan, K. S., and Ramachandran, J. (2015). Beyond institutional voids: business groups, incomplete markets, and organizational form. Strateg. Manag. J. 36, 598–617. doi: 10.1002/smj.2226

Narayanan, V. K., and Fahey, L. (2005). The relevance of the institutional underpinnings of Porter’s five forces framework to emerging economies: an epistemological analysis. J. Manag. Stud. 42, 207–223. doi: 10.1111/j.1467-6486.2005.00494.x

North, D. C. (1990). Institutions, Institutional Change And Economic Performance. Cambridge: university press. doi: 10.1017/CBO9780511808678

Nyrud, T., and Bendiksen, B. I. (2019). Driftsundersøkelsen i fiskeindustrien. Driftsårene 2016 og 2017. [In Norwegian: Annual profitability Study for the Fish Processing Industry]. Report No.27/2019. Tromsø, Norway: Nofima.

Ostrom, E. (1990). Governing The Commons: The Evolution Of Institutions For Collective Action. Cambridge: Cambridge University Press. doi: 10.1017/CBO9780511807763

Peng, M. W. (2002). Towards an institution-based view of business strategy. Asia Pac. J. Manag. 19, 251–267.

Peng, M. W., Nguyen, H. W., Wang, J. C., Hasenhüttl, M., and Shay, J. (2018). Bringing institutions into strategy teaching. Acad. Manag. Learn. Educ. 17, 259–278. doi: 10.5465/amle.2017.0120

Peng, M. W., Sun, S. L., Pinkham, B., and Chen, H. (2009). The institution-based view as a third leg for a strategy tripod. Acad. Manag. Perspect. 23, 63–81. doi: 10.5465/amp.2009.43479264

Peng, M. W., Wang, D. Y. L., and Jiang, Y. (2008). An institution-based view of international business strategy: a focus on emerging economies. J. Int. Bus. Stud. 39, 920–936. doi: 10.1057/palgrave.jibs.8400377

Porter, M. E. (1980). Competitive Strategy: Techniques For Analysing Industries And Competitors. New York: Free Press.

Rumelt, R. P. (1991). How much does industry matter? Strateg. Manag. J. 12, 167–185. doi: 10.1002/smj.4250120302

Sogn-Grundvåg, G., Zhang, D., and Iversen, A. (2019). Large buyers at a fish auction: the case of the Norwegian pelagic auction. Mar. Policy 104, 232–238. doi: 10.1016/j.marpol.2018.06.011

Sone, I., Skåra, T., and Olsen, S. H. (2019). Factors influencing post-mortem quality, safety, and storage stability of mackerel species: a review. Eur. Food Res. Technol. 245, 775–791. doi: 10.1007/s00217-018-3222-1

Vassdal, T., and Bertheussen, B. A. (2020). Methodological issues in estimating the profit of the core catch business unit of a fishing vessel firm. MethodsX 7:100990. doi: 10.1016/j.mex.2020.100990

Keywords: fisheries industries, competitive advantage, industry-specific institutions, bargaining power, competitive forces, seafood value chain

Citation: Bertheussen BA (2021) Sustained Competitive Advantage Based on Industry-Specific Institutional Frameworks. Front. Mar. Sci. 8:697936. doi: 10.3389/fmars.2021.697936

Received: 20 April 2021; Accepted: 19 May 2021;

Published: 10 June 2021.

Edited by:

Kum Fai Yuen, Nanyang Technological University, SingaporeReviewed by:

Ahmed Imran Hunjra, Pir Mehr Ali Shah Arid Agriculture University, PakistanJiahui Liu, Nanyang Technological University, Singapore

Copyright © 2021 Bertheussen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Bernt Arne Bertheussen, YmVybnQuYmVydGhldXNzZW5AdWl0Lm5v

Bernt Arne Bertheussen

Bernt Arne Bertheussen