94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Mar. Sci. , 13 February 2020

Sec. Ocean Solutions

Volume 7 - 2020 | https://doi.org/10.3389/fmars.2020.00062

A correction has been applied to this article in:

Corrigendum: Marine Bioresource Development – Stakeholder's Challenges, Implementable Actions, and Business Models

Growth of the blue bioeconomy has potential for contributing positively toward economic growth, societal needs and multiple United Nations Sustainable Development Goals. However, organizations currently experience many challenges which limit success in this field. The aim of this paper is to identify trends in challenges linked to target end markets, stages in the value chain and organization types, to suggest potential solutions and link these to potential novel business models. A survey was completed by 58 organizations representing countries across four continents, and interviews were conducted with seven selected European start-ups/SMEs, to gather information regarding existing bottlenecks and to validate their business model. Results indicate that organizations targeting the pharmaceutical and nutraceutical sector experience a majority of challenges related to supply and technology, whereas organizations targeting the industrial biotechnology or agricultural industry experience more issues linked to market. Both bottom-up and top-down approaches could be applied in order to implement suggested actions. Analysis of the business model canvas used by start-ups/SMEs revealed potential for improvement. In particular, it was noted that review of the ‘revenue stream’ segment within the business model, specifically regarding alternatives to governmental funding, could be helpful for the long-term survival of these types of organizations.

Ocean and coastal ecosystems cover more than 70% of the Earth’s surface and provide humanity with economic and environmental services as well as natural capital (European Commission, 2019). The term ‘Blue Economy’ is described by the World Bank as ‘the development of oceanic economic activities in an integrated and sustainable way’ (World Bank, 2017). The European Commission suggests that Blue Economy encompasses all sectoral economic activities related to the oceans, seas and coasts. This includes established marine-based sectors, such as fisheries, offshore oil and gas, shipping and tourism, as well as emerging marine-related sectors, such as offshore wind, blue bioeconomy, marine minerals and desalination (European Commission, 2019). Blue Economy is recognized by the European Union as ‘indispensable to our future welfare and prosperity’ and as a ‘source of food, energy, transport or leisure, and as a driver for new jobs and innovation’ (European Commission, 2019). This gives an indication of the valuable potential opportunities that this topic can bring at the national, regional and international scale.

The marine environment hosts a diverse variety of biological resources, some of which possess properties with potential for development of marketable products and processes (Arrieta et al., 2010; Jaspars et al., 2016). The potential development of commercial products derived from marine bioresources can be considered as an element contributing toward growth of the blue bioeconomy. The German Bioeconomy Council1 defines bioeconomy as ‘the production and utilization of biological resources (including knowledge) to provide products, processes and services in all sectors of trade and industry within the framework of a sustainable economic system’2. Blue bioeconomy therefore refers to the same concept, but with a focus on biological resources originating from the aquatic environment. Blue bioeconomy is classified as an emerging and innovative sector within the Blue Economy, involving biotechnology and biofuels, with applications in a variety of market sectors (European Commission, 2019). The present study will focus on the blue bioeconomy sector.

The use of marine Bioresources as the source of biotechnological applications is generally defined as ‘Blue Biotechnology’ and is noted as one of the main components of blue bioeconomy (OECD, 2013; Ecorys, 2014; European Commission, 2019). It is predicted that the global market for products and processes generated through the application of Blue Biotechnology will grow from USD 3.5 billion in 2017 to USD 6.5 billion by 2024. Europe held the major share of the global blue biotech market in 20173. More than 560 companies and over 300 research groups are involved in this sector in the EU alone (European Commission, 2019). Blue Biotechnology not only has the potential to contribute toward economic growth, but also to create more jobs, support public health and environmental protection (through reduction in pollution and water usage), and facilitate multiple United Nations Sustainable Development Goals (SDGs), such as those associated with regulating the harvest of marine bioresources, ending overfishing (Goal 14: Life Below Water) and sustainable food production (Goal 2: Zero Hunger) (European Marine Board and Marine Biotechnology [ERANET], 2017; European Commission, 2019)4.

Marine Bioresources encompass a range of organisms, such as bacteria, fungi, other microorganisms, cyanobacteria, micro- and macro-algae, sponges, mollusks, other invertebrates, fish, fish co-products, plants, as well as compounds derived from these types of organisms (Vasconcelos et al., 2019). For example, approximately 30,000 compounds originating from marine Bioresources have been described, with recent discovery rates exceeding 1,000 compounds each year (Lindequist, 2016). Blue biotechnology has the potential to feed into a number of other biotechnology and industrial sectors, such as pharmaceutical, nutraceutical, cosmetics, industrial biotechnology, agricultural and others (OECD, 2013; Ecorys, 2014; Martins et al., 2014; Vasconcelos et al., 2019). Potential products/processes developed with the use of marine Bioresources can therefore include new medicines, drug ingredients, new foods and nutritional supplements, health and beauty supplements, anti-aging creams, biomaterials (such as bioplastic and other fossil based substitutes), textiles and feed for farm animals, but also as co-adjuvants and enhancers in many industrial and manufacturing processes improving their efficiency and reducing their environmental impact.

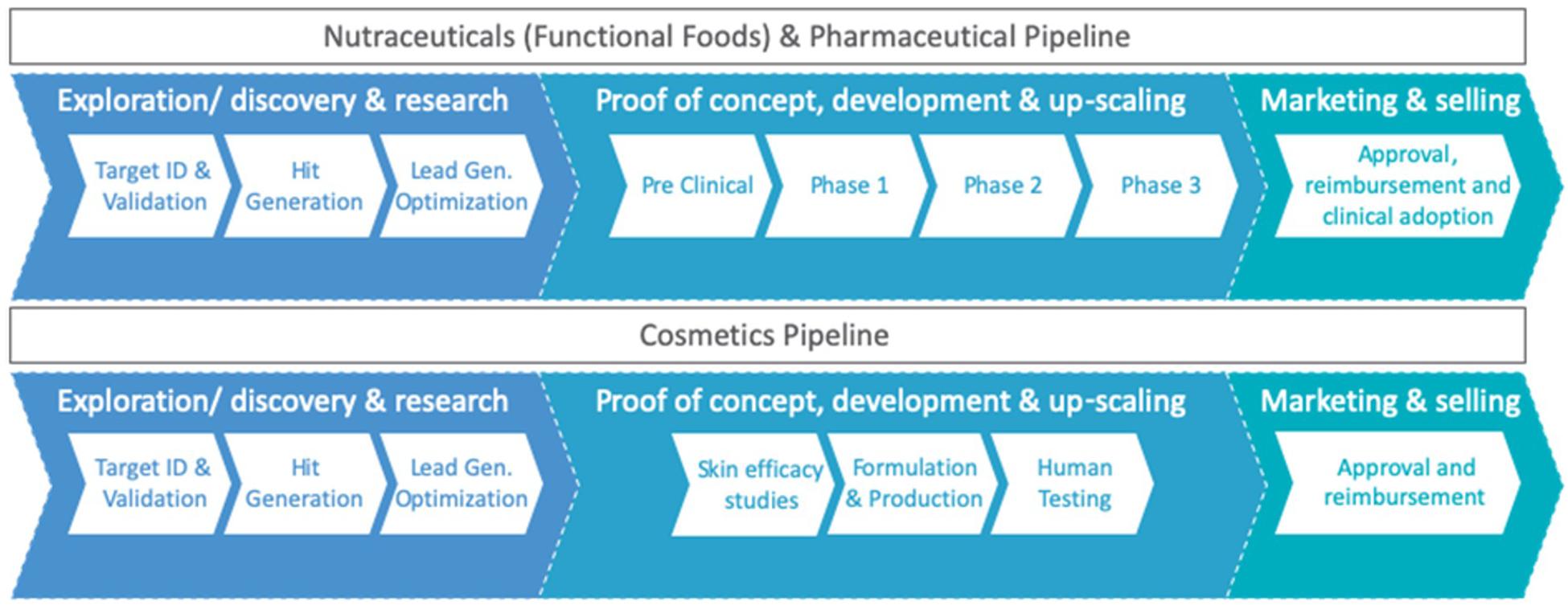

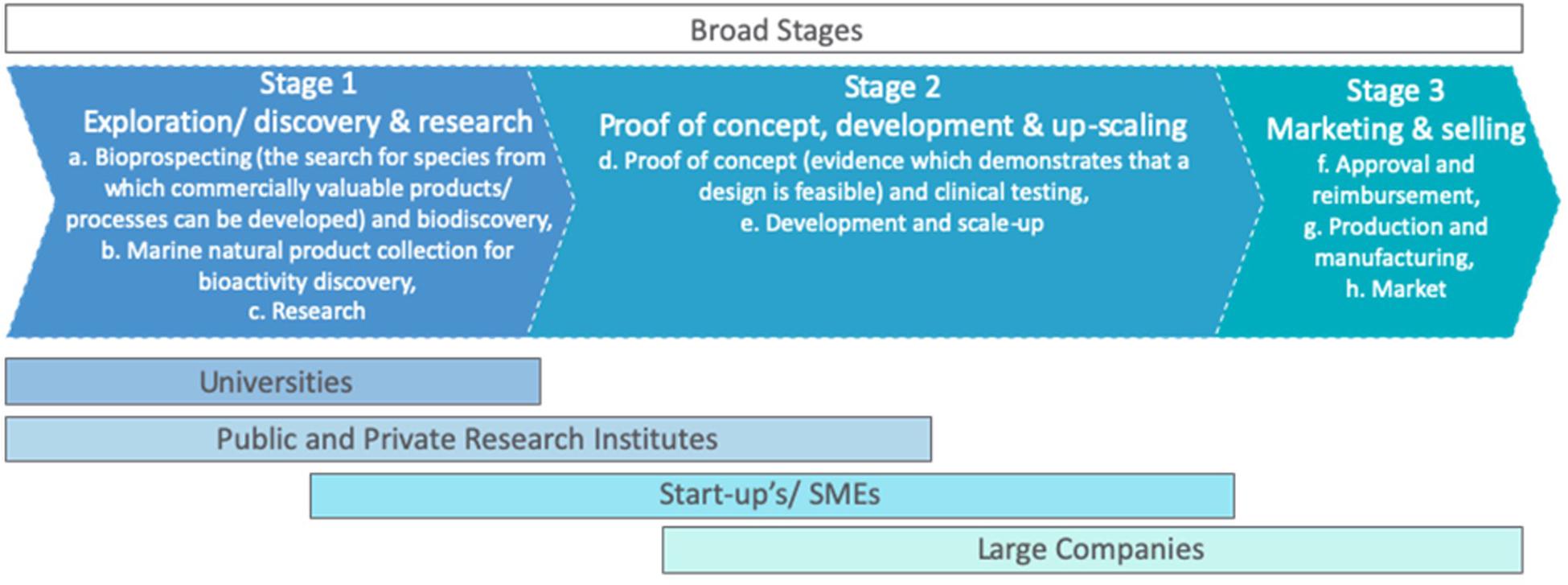

Marine Bioresources can either be sold as the final product per se, or they can be used as the raw material for further research and development (R&D). As such, it is useful to understand the value chain involved in the application of marine resources for different market sectors (see Figure 1). The value chain encompasses three main phases: firstly exploration/discovery and research (1), then demonstration of proof of concept, development, and upscaling (2), and lastly marketing and selling (including regulatory approval, reimbursement and clinical adoption if needed) of the new product (3). Different organizations are typically involved with specific phases (see Figure 2; Ecorys, 2014; Calado et al., 2018; Piña et al., 2018). Organizations involved in Blue Biotechnology include universities, public and private research institutes, start-ups, small- and medium-size enterprises (SME’s) and large companies. It is important to note that organizations can be involved in the development of products for multiple market sectors and across more than one stage within the value chain (Vasconcelos et al., 2019).

Figure 1. Depiction of the marine bioresource value chain, from initial stages of discoveiy of a resource (left-hand side of the diagram) through to marketing and selling (right-hand side of the diagram), adapted from Calado et al. (2018).

Figure 2. The composition of stakeholders involved at three broad stages (1,2, and 3) within the marine bioresource value chain. Survey participants were asked to select which particular phase(s) within the marine bioresource value chain that their organization was involved with (phases a–g). Very few organizations were involved in only one phase (a–h) within the value chain. Therefore, for the sake of this study, phases have been grouped into three broad stages (1–3). Figure adapted from Ecorys (2014) and Calado et al. (2018).

Scientific knowledge regarding marine Bioresources and their potential for commercial application is growing. However, many parts of the ocean remain considerably underexplored in comparison with terrestrial environments, and more exploration is needed to enhance the variety and availability of marine bioresources for R&D (European Marine Board and Marine Biotechnology [ERANET], 2017). As such, the emerging blue biotechnology sector is still relatively small compared to other fields of biotechnology (Jaspars et al., 2016). This trend may also be related to the number of different challenges that stakeholders currently experience when working with marine resources at various stages throughout the value chain (Calado et al., 2018; Ligtvoet et al., 2019; Vasconcelos et al., 2019). It is important to note that we still lack sufficient understanding of how we can make the most of our ocean resources without harming the marine ecosystems in which they are found (European Commission, 2019). In order to achieve a sustainable blue economy, extraction of value from the marine bioresources must be balanced with the long-term capacity of the oceans to endure such activities through, for example, the implementation of sustainable best practices. In other words, human activities need to be managed in such a way that does not damage the marine environment and where economic productivity is safeguarded, so that potential benefits may be sustained over time (European Commission, 2019). Human activities at present can be damaging due to a combination of factors, including a lack of detailed scientific information or knowledge, and technological inefficiency (Ligtvoet et al., 2019). By enhancing marine scientific knowledge, we will be in a better position to adapt current and future marine activities so that they cause less negative environmental impacts and provide more sustainable alternatives to current, land-based equivalents5 (European Commission, 2019). For example, cultivation of algae can provide sustainable, alternative sources for development of animal feed or fuels compared to traditional, land-based equivalents (Milano et al., 2016). In addition, enhanced understanding of marine ecosystems and how fish stocks respond to the establishment of ‘no-take zones’ may be useful to implement alternative fishing practices to avoid current trends in overfishing (Murray et al., 1999). By enhancing our understanding of the marine environment, we will be better able to determine which activities are most damaging and should be avoided (such as plastic pollution) in order to promote and restore long-term health, as well as sustainable use, of the oceans (European Commission, 2019).

As a result of findings gathered during review of the literature, as presented in the previous paragraphs, the marine environment provides humanity with many potential economic, environmental and societal benefits. However, at present, this potential is not being realized, as indicated by the small size and slow growth rate of the blue bioeconomy sector (European Commission, 2019). This is a problem in terms of neglecting opportunities for sustainable prosperity, for instance through enhancing economies, boost employment rates, reduce global food shortages and address environmental impacts linked to current industry practices. There are likely a number of poorly understood bottlenecks which currently limit marine bioresource development (Martins et al., 2014). The challenge here is that we lack detailed information regarding what these specific challenges are and what actions could potentially be taken to address them.

Whilst broad bottlenecks can be identified through a review of existing literature, there remains a lack of clarity regarding the specific issues that stakeholders experience and any trends or patterns that might be present amongst different groups. To address these gaps identified during literature review, the aim of this paper is firstly to identify the major challenges currently experienced by organizations involved in marine bioresource R&D worldwide, with a focus at the European level. Trends in challenges will be analyzed according to three key parameters:

(1) Different target end markets (for products/processes developed);

(2) Different stages in the marine bioresource value chain (i.e., early vs. mid vs. late in the value chain);

(3) Different organization types (i.e., university, public and private research institutes, start-up/SME or large company).

The second aim is to propose potential implementable actions that could be taken to tackle these specific challenges and to suggest how these could be incorporated into the business model used by blue based start-ups/SMEs. This study included analysis of the current business models used by start-ups/SMEs working with marine bioresources. The current research focuses only on the business model for start-ups/SMEs and not for large companies or other types of organizations. A ‘typical,’ currently representative business model for an ‘average’ marine bioresource start-up/SME will be proposed, as well as ways that the model could be improved by incorporating specific actions to address challenges.

The ultimate objective of this paper is to (propose business model strategies to) assist organizations with overcoming and avoiding some of the hurdles currently experienced, and to help marine bioresource organizations, in particular start-up’s/SMEs, to grow faster and more efficiently, as their Information and Communications Technology (ICT)/Artificial Intelligence (AI) counterparts do. In addition, the aim is also to provide policy makers with insight into the sector and lessons which may help them to better promote the blue bioeconomy.

In order to gather as much background information as possible about the field of marine bioresource development, this study began with a scoping literature review. The specific objective of reviewing the literature was to map the types of organizations involved, the types of marine bioresources used, the variety of target end products and markets, the steps involved in value chains linked to various target markets and potential associated bottlenecks. The data sources used included Pubmed, Embase, EurLex and Marine Biotechnology ERA-NET, BBI-JU6, blue bioeconomy Forum, with search keywords such as marine, bioresource, biotechnology, market, value chain, pipeline, organizations, SMEs, industry and challenges. The results of the literature review are presented in the introduction of this article (please see above).

A survey was then prepared, based on results found within the literature, with the aim of collecting further detailed information from organizations (involved in marine bioresource development) regarding challenges, target end market(s), position within the value chain, partnerships and business models. The survey was sent to a database of approximately 500 contacts by email to individuals, marine scientific networks, marine biotechnology mailing lists, innovation incubators and pharmaceutical societies, as well as by posting on LinkedIn and to an online biomarine business platform (the BioMarine Community website7). Purposive sampling method was conducted with the target of covering a wide geographical area, and sufficient representation from a variety of stakeholders to draw representative conclusions. A spreadsheet was used as a means to store and analyze the data gathered during the survey. The frequency with which different challenges were experienced, according to target end market, stages in the value chain and type of organization, was calculated and converted to a percentage of the total number of organizations.

The potential business model used by different European marine bioresource start-ups/SMEs was then investigated. A business model can be described as a company’s plan for how it will generate revenue and make profit, what products/services the business plans to manufacture and market, and how they plan to do so, including the expenses that will be incurred (Chesbrough, 2007). 7 start-ups/SMEs were selected based on active involvement in marine bioresource development/biotechnology, with representation from different countries within Europe (five Portuguese, one British and one Norwegian), different types of marine bioresources used and different target end markets. In addition, the 7 start-ups/SMEs were all active at the time of research and were chosen, in part, according to willingness of organization representatives to take part in interviews. All organizations selected here were classified as start-ups or SMEs. The reason for selecting start-ups/SMEs is that this organization type is viewed as the most promising, fastest growing and most innovative entity-type within the value chain8 ,9. At the same time, start-ups/SMEs may be considered a potential weak link within the development chain due to their temporary and highly risky/unstable nature and mission. As such, this organization type may represent greater potential opportunity for improvement than the other types of organizations here studied. Since SME’s can be difficult to distinguish from start-ups (there may be a gradual transition from start-up to SME status over time rather than a definitive cut-off point, and the two are not necessarily mutually exclusive), both will be considered together as one group in the context of this paper.

The Business Model Canvas was used as a tool and starting point for collecting information and performing analysis of elements of potential business models used by the seven European organizations and to create a clear picture of important, recurring aspects which could form the basis for the implementation of solutions or actions (Osterwalder and Pigneur, 2010). Elements of the Business Model Canvas include: customer segments, value propositions, channels, customer relationships, revenue streams, activities, resources, key partners and cost structure. Information included in the template originated from studying the website for each company and own collected information from previous networking activities with the selected companies. A Business Model Canvas was completed for each SME according to the authors own interpretation. The Business Model Canvases were then sent to a representative from each organization for their consideration and formed the basis of subsequent semi-structured interviews with one Chief Executive Officer/Chief Scientific Officer, Founder or Director of each of the seven SMEs. The interview involved verification and/or amendment of the authors interpretation of the business model. In addition, the interviews covered topics such as the focus of each start-up/SME on the biodiscovery value chain (on one or several phases), whether and to what extent business models are actually used when developing new products/processes and whether there are any links between models used and the type of marine bioresource used or product/process/target market sector targeted. The canvases were then analyzed for similarities and differences to one another, in order to ascertain the elements which may constitute a ‘typical’ business model for marine bioresource start-ups/SMEs.

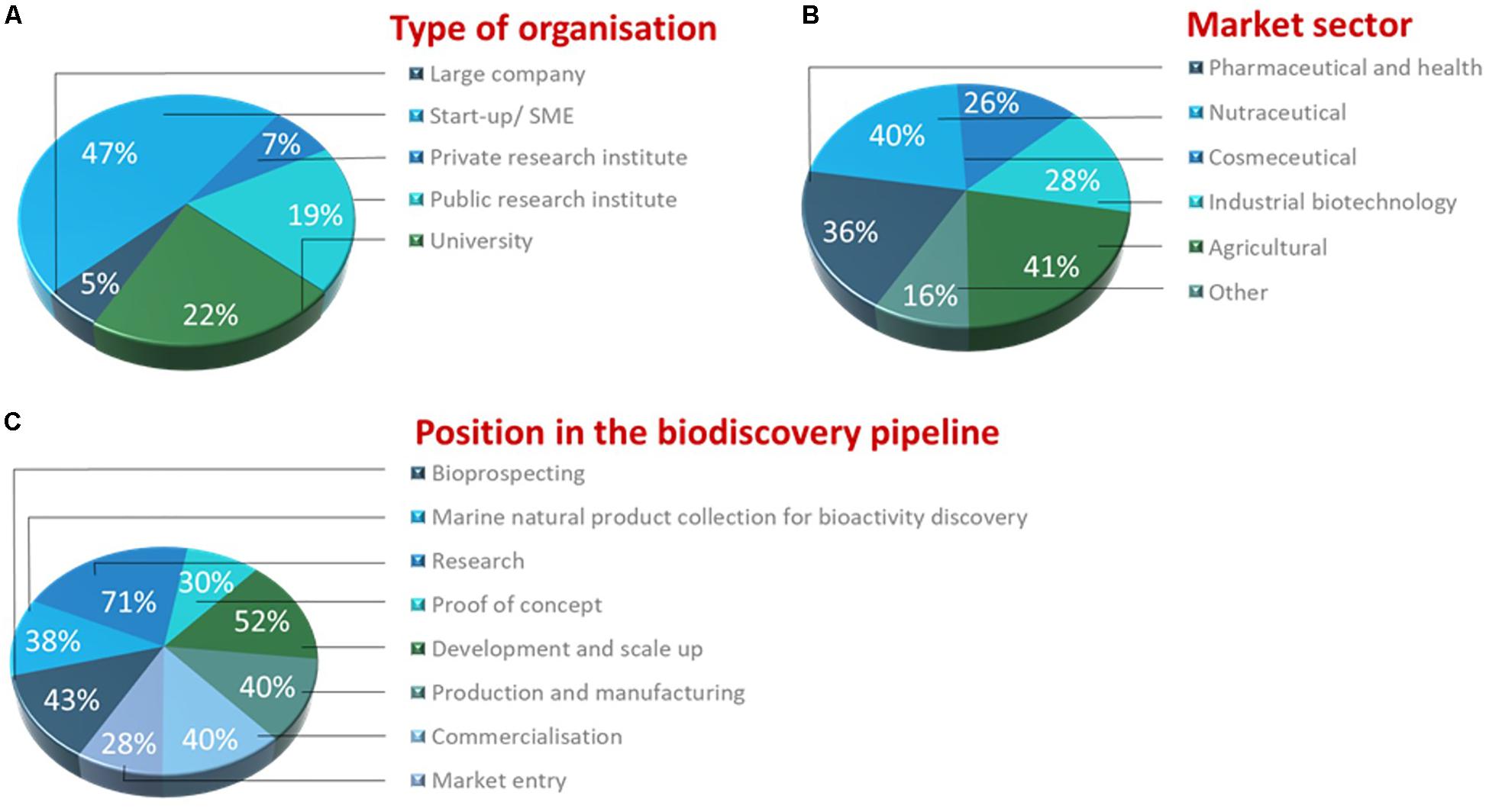

In total, 62 people from 58 different organizations and 23 countries across four different continents (Europe, Asia, Africa, and North America) responded to the survey (see Figure 3). The proportion of survey respondents according to organization type, target market sector and position in the marine bioresource value chain are displayed in Figure 4. Numbers mentioned in this paper account for removal of duplicate company responses. The survey received 62 responses from a total of 58 different organizations. Two different people responded for four organizations, leading to four duplicates. This was resolved by merging responses into one aggregate response per organization (later responses were deleted, but any additional information was added to the first response).

Figure 3. The survey was sent to approximately 500 individuals. The data collected represent 58 organizations, spread across 23 different countries (as indicated by the red points) and four different continents.

Figure 4. (A) Proportion of different organization types represented by survey respondents. (B) Proportion of different target end markets represented by survey respondents (some organizations were linked to more than one end market sector, therefore percentages total more than 100%). (C) Proportion of different phases within marine bioresource value chain represented by survey respondents (some organizations linked to more than one position in the pipeline, therefore percentages total more than 100%).

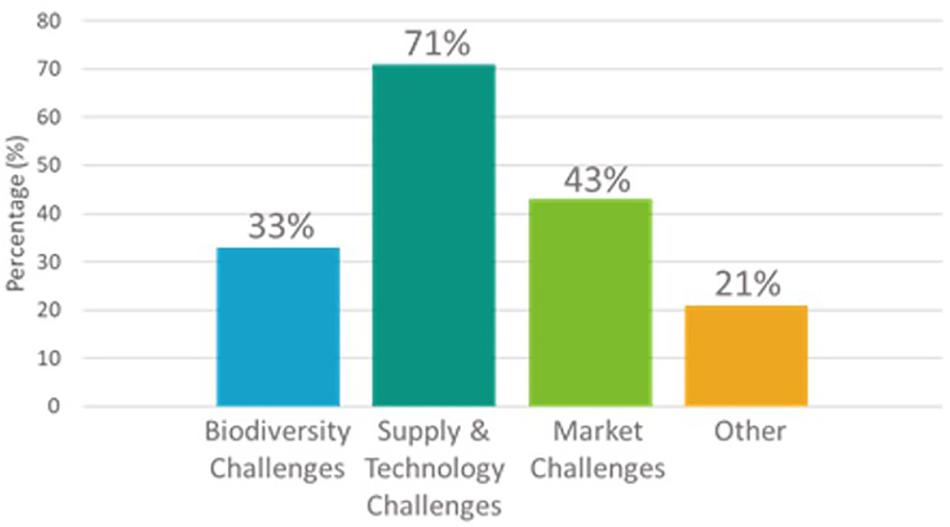

Survey participants were asked to consider whether their organization experiences specific challenges, as identified in the literature, which fall under three broad categories (biodiversity, supply and technology and/or market challenges), or any ‘other’ challenges (see Figure 5). These categories were selected for further study because they have been identified in previous literature as the main groups of challenges experienced by stakeholders working in the field of blue biotechnology (Martins et al., 2014). Biodiversity challenges are related to physically accessing marine resources, to the identification of biological material and the efficient screening of bioactive compounds. The supply and technology category encompass issues linked to the sustainable, large-scale production of pure bioactive compounds/other biomaterial. Market challenges include consideration for the processes and costs associated with developing a natural product into a marketable product (Martins et al., 2014). Other types of challenges which did not directly fall within the supply and technology, market or biodiversity categories were also reported, such as those associated with approval, research funding and regulation.

Figure 5. Hurdles identified as a result of the survey can be grouped into four main categories, namely challenges linked to biodiversity (experienced by 33% of survey participants), supply and technology (71%), market (43%), or ‘other’ (21%), such as those associated with approval, research funding and regulation.

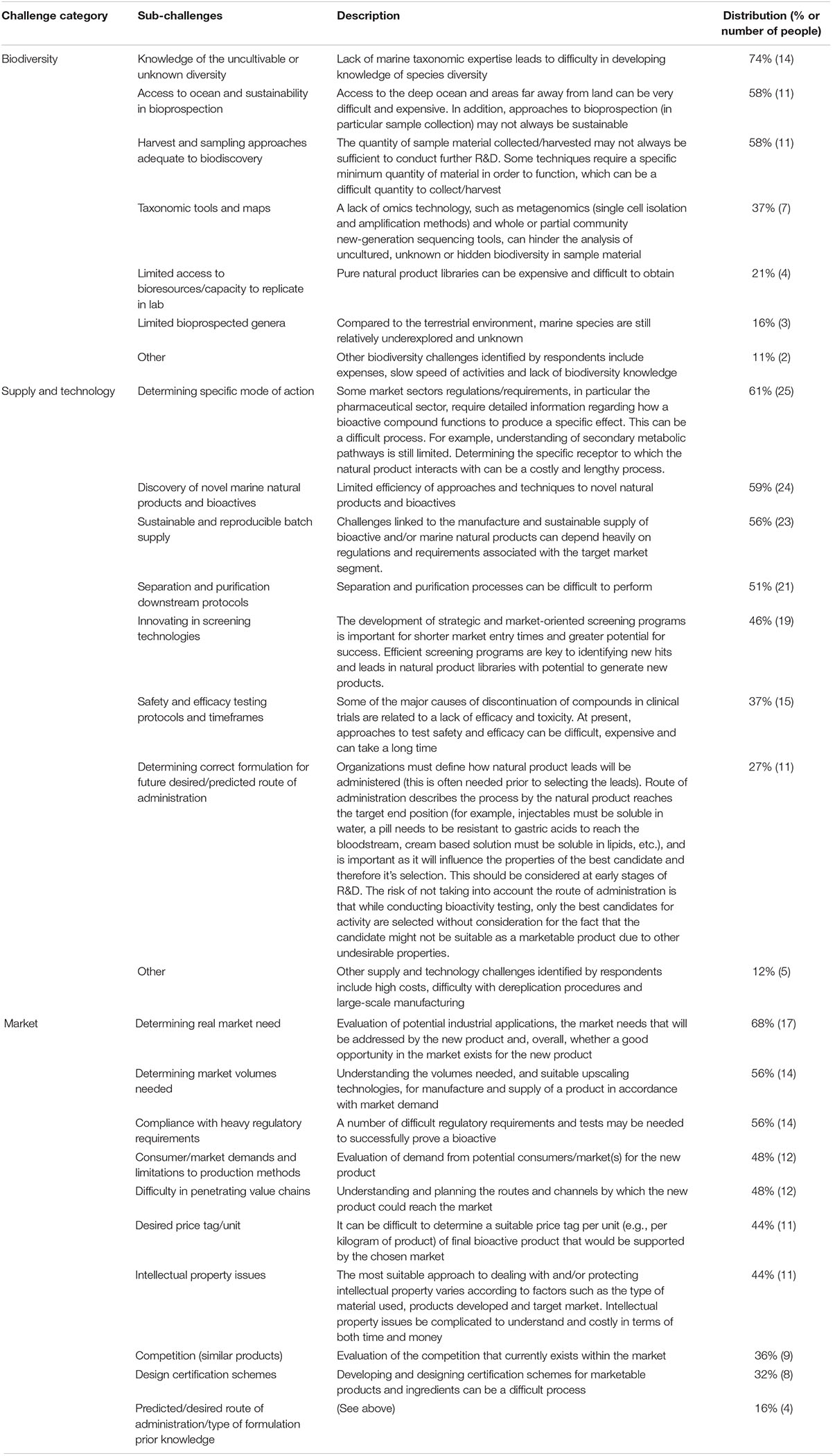

The most frequently experienced challenge category, as selected by 71% of survey respondents, was related to ‘supply and technology’ (see Figure 4). Within this category, more than half of the respondents indicated that they experience challenges related to ‘determining specific mode of action’ (61%). ‘Market challenges,’ with 43% of respondents, and ‘biodiversity challenges’ with 33% were the next most frequently experienced challenge categories. The most common market challenge encountered by respondents was ‘determining real market need’ (68%). The most common biodiversity challenge was ‘knowledge of the uncultivable or unknown diversity,’ as expressed by 74% of respondents. ‘Other’ challenges were experienced by 21% of participants. For an overview of the frequency with which respondents selected different sub-challenges within these three broad categories, see Table 1.

Table 1. Specific sub-challenges experienced by survey respondents related to, biodiversity, supply and technology, and market.

By linking challenges to the target end market, position within the pipeline and organization type, key trends were identified and are displayed in Figure 6 (and Supplementary Table S1). According to results collected during the literature review, there are many different market categories that marine bioresource organizations may target. These categories include the pharmaceutical market, nutraceutical market (including food additives for humans plus feed additives for animals), cosmetics market, industrial biotechnology market (including enzymes, paints/coatings, plastic packaging, biobased products or industries, such as bio-waste and reduction of carbon emissions), and agricultural market (including agriculture, aquaculture and fisheries). ‘Other’ market sectors may include environment and waste management, support for business and for bioprocess development services (within multiple sectors) (Martins et al., 2014; Vasconcelos et al., 2019).

Figure 6. Trends in challenges linked to (A) target end markets, (B) stages within the marine biodiscovery value chain, and (C) organization type.

Of the many market sectors identified in the literature review, five sectors (pharmaceutical and health, nutraceutical, cosmetics, industrial biotechnology and agricultural) together represent 92% of the total target end markets identified in the survey (see Figure 4B). However, no organizations within this study targeted the cosmetics sector only. Therefore, the remaining four categories only were studied and linked to challenges. Additionally, survey participants were asked to select which particular phase(s) within the marine bioresource value chain their organization was involved with (see stages a-h in Figures 2, 4C). Very few organizations were involved in only one phase (a–h) within the value chain. Therefore, for the sake of this analysis, phases have been grouped into three broad stages (Figure 2). Organizations were divided according to participation in only stage 1 [including: (a) bioprospecting and biodiscovery; (b) marine natural product collection for bioactivity discovery; and (c) research], stage 2 [including: (d) proof of concept and clinical testing, and; (e) development and scale-up], or stage 3 [including: (f) approval and reimbursement; (g) production and manufacturing, and; (h) market] phases of the marine biodiscovery value chain, so that challenges could be correlated to these distinct groupings (as described in Figure 6 and Supplementary Table S1). Entities involved in this study were fairly well distributed according to type of organization (see Figure 4A for proportions of organization types). The main patterns in challenges, as well as unique and specific issues, are described in Figure 6 and Table 1 (and in greater detail in Supplementary Table S1).

Once the challenges linked to target end market, stages in the value chain and organization type were identified by analysis of the survey results, potential causes for these challenges were investigated through literature review, as well as actions that could be taken in an attempt to reduce or avoid those issues in the future. These results are described below.

Here, we describe potential causes for the afore-mentioned challenges and implementable actions to attempt to solve specific bottlenecks according to target end market.

Organizations targeting this end market referred to having the greatest bottlenecks in association with supply and technology challenges. These are likely to be related to the unique nature of the value chain for the pharmaceutical and health market. Development of new products/processes for the pharmaceutical and health or nutraceutical sectors typically involves longer timeframes (on the order of decades) with stricter regulations regarding material within the supply chain than for the industrial biotechnology or agricultural markets (Calado et al., 2018). Supply and technology challenges such as ‘discovery of novel marine natural products and bioactives,’ ‘determining specific mode of action,’ and ‘sustainable and reproducible batch supply’ are likely to be important due to the fact that the material needed to develop products are typically rarer and more difficult to access. For example, it is more difficult to collect compounds from the deep sea or extreme marine environments at sufficient quantities to conduct R&D than it is to collect material for agricultural or industrial biotechnology uses, where less biodiversity is typically exploited, therefore providing greater opportunities for innovation (Calado et al., 2018).

‘Determining specific mode of action’ is an important supply and technology challenge. When new bioactive compounds are discovered, scientists may have some understanding of which processes (for example within cells) the compound is modulating. However, they may not necessarily know the specific target or mechanism of action by which the compounds function. In order to apply these bioactive compounds to the more regulated target markets (such as pharmaceuticals), information regarding specific mode of action is needed for approval. This process can be lengthy and expensive due to the extensive lab experiments and clinical trial phases involved.

Supply and technology challenges can also be seen as related to biodiversity challenges. For example, within the pharmaceutical sector, advanced technology is needed for rapid screening tools to identify hits (and novel lead structures) and to accelerate hit-to-lead processes. However, in order to do this, a constant and reliable supply of replicable biomass is needed to effectively isolate new compounds with therapeutic effects, and it is not always possible or guaranteed (Calado et al., 2018).

With regards to biodiversity challenges, sustainability can be promoted by making maximum use of marine samples stored in collections, repositories and biobanks, in accordance with best practices in identification and sample provenance (European Marine Board and Marine Biotechnology [ERANET], 2017).

To address challenges involving the ‘discovery of novel marine natural products and bioactives,’ Calado et al. (2018) suggest focusing on improving sampling strategies and techniques such as High-Throughput Screening (HTS) assays and dereplication, as well as genomic and metabolic profiling. This may help to promote access to the ocean’s rich biodiversity. ‘Sustainable and reproducible batch supply’ could be improved by concentrating on the (semi-) synthesis of active compounds or analogs, or perhaps by considering genetic engineering or even synthetic biology opportunities (Calado et al., 2018). These actions could also be applied to similar challenges experienced when targeting the nutraceutical and industrial biotechnology markets (see below).

A number of challenges experienced when targeting the nutraceutical sector are similar to those associated with the pharmaceutical and health market, and are likely to be caused by similar factors. For example, potential causes may include the unique nature of the target, strict regulations regarding material used or claims made, and rarity or difficulty in accessing the resource material. See the section above regarding potential causes of challenges experienced by the pharmaceutical and health market for more detail.

Although typically shorter than that for the pharmaceutical sector, the value chain for the nutraceutical sector can take many years and involves a number of different regulatory hurdles (Martins et al., 2014). Therefore, it is not surprising that some organizations targeting this market may experience some time of pre-revenue development before generating turnover or return on investment. For example, for a new food product to be accepted on to the EU Public Health Division list of approved foods can require a huge amount of time and work, despite the source material (e.g., an algae species) potentially being used for centuries in other regions.

A one-stop-shop space offering assistance for organizations to comply with legal requirements may help to ease regulatory challenges. Development of plans for organizations to generate short-term, more immediate income may help bridge the gap between initial funding and eventual return on investment once products are brought to market.

Competition with existing products can lead to a perception that the blue biotechnology sector is potentially ‘immature.’ However, this may be more associated with resistance to change from end-users (e.g., with use of eco-friendly antifouling paint instead of traditional antifouling paints, or buying a more expensive shampoo with a biobased plastic packaging instead of traditional, polluting, single use plastic bottles) or lack of awareness, despite regulation pressure. In addition, technology to produce large-scale quantities of particular biomass/material which is also heterogeneous in nature can take time to develop and may not exist in some fields yet. This can lead to supply challenges such as ‘sustainable and reproducible batch supply’ where consistency from batch to batch is required.

Supporting organizations when navigating complicated legal frameworks may help to limit regulatory challenges. Creating one-stop-shops for legal and regulatory information and support, as mentioned before, can be a very relevant action to overcome such challenges. Competition-related challenges, could potentially be eased by creating or strengthening relationships between research institutes and industry. Strengthened relationships may help to ensure that technological advances are utilized as efficiently as possible to meet potential market opportunities. Joint private sector, governmental and civil society stakeholder’ campaigns to improve consumer perception, awareness and understanding of value-added products developed from marine bioresources could prove useful in enhancing market entry of new products/processes (Calado et al., 2018).

Market challenges are likely due to the moderately saturated and highly competitive nature of this particular sector, as well as the lower margins and prices practiced. There are, for example, many agricultural companies (typically terrestrially based) selling the same or very similar products. The opportunity for organizations working in the agricultural sphere to produce and introduce something new and unique to the (global/national) market is less common than for pharmaceutical and health or nutraceutical markets (Calado et al., 2018). Whilst strong competition with land-based equivalents continues to exist, hurdles such as cost reduction may be experienced.

As noted above for the industrial biotechnology market, competition-related challenges, particularly for agricultural organizations competing with existing, land-based equivalents, could potentially be addressed by establishing relationships between research institutes and industry. Multidisciplinary collaboration projects (involving academic biologists, chemists, environmental scientists, engineers, private sector, lawyers and government representatives) could be useful to further advance knowledge and technology regarding optimal resources to cultivate for agricultural purposes. Companies which take the risk to look at this sector with a different perspective and create completely novel solutions and products in a blue ocean strategy, where the blue biotechnology has certainly a role, are in fact the ones with the greater potential for standing out from current status quo and trends in the sector and out performing current competition.

Here, we describe potential causes for the afore-mentioned challenges and implementable actions to attempt to solve specific bottlenecks according to stages in the biodiscovery value chain.

Organizations involved with stage 1 in the value chain are more likely to experience supply and technology challenges related to ‘discovery of novel marine natural products and bioactives’ and ‘determining specific mode of action’ than organizations involved with stage 2 (which may be more affected by bottlenecks linked to batch supply/upscaling). This would be expected, since organizations working at the earlier phases within the value chain are inherently involved in exploring for new compounds or resources with potential for R&D and innovation, perhaps already considering possible commercial application (Martins et al., 2014). This would likely also account for biodiversity challenges experienced at this stage, such as ‘knowledge of the uncultivable or unknown diversity.’

Starting with the end in mind (understanding what the final product/application is going to be and then planning backwards to identify the most suitable bioresource and production methodology) is a key strategy for these challenges. Enhanced understanding of the optimal types of resources for potential valorization may help academic researchers to focus their research with the aim of overcoming biodiversity-related challenges. For example, microbial based bioactives are more prone to succeed as pharmaceutical or nutraceutical end products, because the barrier to novel chemistry can be lower and easily manipulated in the lab by changing growth conditions. In addition, collaboration between academic researchers and the private sector to develop projects targeted at solving these specific supply and technology challenges can surely increase the odds of success for a given blue bioresource discovery program.

Organizations involved with stage 2 activities typically focus on developing procedures to produce large-/industrial scale quantities of product (e.g., compounds or enzymes). It is therefore not surprising that these organizations experience supply and technology challenges such as ‘sustainable and reproducible batch supply,’ since these are the key areas organizations tend to focus on and address at this stage.

Once again, it is paramount that the initial choice of bioresource type and production method is consistent with the final application. The same example of microbial bioresources versus macro organism bioresources is very valid, as the latter tend to be much more difficult to reproduce and to obtain the desired quantities from at the target market price range. Collaboration between academic researchers and the private sector to develop projects targeted at solving these specific supply and technology challenges can also be useful.

The large proportion of market challenges present at this stage is to be expected, since this is the stage when companies attempt to bring new products and processes to market (Martins et al., 2014). Difficulty in reaching out to clients and in communicating the added value of products is likely to contribute toward the specific market challenges experienced by marine bioresource organizations. Without raising consumer awareness regarding the sustainably produced products and associated advantages compared to existing competitors, it can be difficult to match competitor prices (Vasconcelos et al., 2019). In addition, difficulties in determining real market need and market volumes needed can hinder industrialization production lines and lead to poor market uptake for newly developed products.

Consistent market research and product validation, life-cycle assessment studies and early establishment of a targeted consumer awareness campaign may be useful steps to take to tackle the challenges experienced at stage 3.

Here, we describe potential causes for the afore-mentioned challenges and implementable actions to attempt to solve specific bottlenecks according to type of organization.

Start-ups/SMEs are typically involved in stage 2 and 3 of the marine biodiscovery value chain. Therefore, similar factors to those outlined above regarding stages 2 and 3 may apply here. Start-ups/SMEs in the field of blue bioeconomy are often thought to be more innovative and take greater risks than other organization types (Vasconcelos et al., 2019). This can involve development of new products or processes which have not yet been seen on the market before. Despite this positive aspect, innovation and creation of brand-new products/services can actually lead to difficulty in market/customer acceptance, reaching out to clients and in communicating the added value of products. This is likely to contribute toward market challenges. Without raising consumer awareness regarding the sustainably produced products and associated advantages compared to existing competitors, it can be difficult to match competitor prices (Vasconcelos et al., 2019). In addition, difficulties in determining real market need and market volumes needed can lead to poor market uptake for newly developed products, because there is a mismatch between the consumer needs and willingness to pay and the innovation price and solution presented.

A number of survey participants stated that they are working on something which they believe to be scientifically very interesting and innovative, but that they had not actually conducted any market research or validation of their business idea. Therefore, these organizations and their projects using marine Bioresources were likely not designed to meet specific market or actual consumer needs (and indeed a sufficient market may not even exist), but rather to continue conducting promising research on an academic project and generating important scientific knowledge. This is likely a large factor contributing to the high selection frequency of market challenges associated with ‘determining real market need’ (17% of participants).

Many market challenges associated with this organization type are likely to be linked with basic entrepreneurial hurdles. For example, new entrepreneurs typically dedicate a large amount of time to the development of new products, absent thorough prior analysis of the potential customers and target end markets. This can lead to challenges such as a lack of acceptance or demand (from customers and the market) for the final product and total failure upon start-up launch (Vasconcelos et al., 2019).

To overcome market challenges such as ‘determining real market needs’ and ‘determining market volumes needed,’ it may be useful for organizations to create and implement a product development plan at the beginning of the project. This plan should include analysis of the market needs and requirements (routes, channels, quantities, prices, etc.) and validation of the proposed business project, for example by sending out surveys (to gather information on whether specific groups of people would pay for the products and how much they would be willing to spend) and analyzing the results. With this information, it could be useful to develop a business model strategy which specifically targets consumer demands (Vasconcelos et al., 2019). This effort would help to better align scientific R&D with the needs and demands of target markets and consumers, enhancing potential for successful market-oriented development and facilitation of later commercialization if desired.

In order to help ensure that future generations of scientists are adequately equipped with the appropriate entrepreneurial and management knowledge needed to start and run a marine bioresource business, training in entrepreneurship and industrial skills could be further integrated into existing scientific courses and degree programs (Vasconcelos et al., 2019). Training should be informed by current market demands as well as industrial and economic needs and could even be partially conducted in an industrial setting with industry-academia partnerships. This point would, therefore, also be important for universities to consider (see section below).

Universities are typically involved in stage 1 activities associated with exploration and discovery of new compounds and R&D. Potential causes for supply and technology and biodiversity challenges experienced by universities are therefore likely to be similar to those for stage 1 organizations (see section on potential causes of stage 1 challenges above).

Biodiversity challenges may be associated with limited knowledge/awareness of scientific techniques or technology to access, produce and/or harvest material (Vasconcelos et al., 2019). Without knowledge of the specialized techniques or services available, such as access to robotics/remotely operated vehicles or capacity to replicate bioresources in the lab, it may be difficult to begin R&D on marine bioresources. In addition, the complicated rules and hurdles sometimes imposed to access bioresources stored at biobanks further limits access to raw material. It is also suggested that poor communication between stakeholders and difficulties in finding and developing partnerships may play a role in biodiversity challenges (Vasconcelos et al., 2019).

Development of longer-term projects focused on challenges and in collaboration with private sector partners (such as start-ups/SMEs and large companies) may help to address challenges regarding access to and production of material as well as facilitate communication and mutually beneficial knowledge-exchange between stakeholders.

A lack of collaboration or contact with the private sector may lead to the specific biodiversity and market challenges experienced by public research institutes. This could also result in a lack of focus in their associated business model.

In order to gather better understanding of the current, potential niche markets and consumer demands (at the national and/or regional level), detailed market studies could be conducted and made publicly available, or their access could be further supported by public funding agencies. Market demand is not only vital for business success, but is also critical for almost the whole value chain. Therefore, this information could be important for decision-making processes involving all marine bioresource stakeholders and organization types (Vasconcelos et al., 2019). This type of market research could also gather information regarding the markets that are already saturated with competitors, indicating markets that organizations should perhaps avoid targeting.

Private research institutes experience supply and technology challenges, such as ‘discovery of novel marine natural products and bioactives’ (see Table 1) as they tend to be born in connection with the industry itself. In addition, competition with existing, traditional products can lead to a perception that the blue biotechnology sector is ‘immature.’ However, this may actually be more associated with resistance to change from end-users. For further information on the ‘immature’ perception of the blue biotechnology sector, see the section above regarding potential causes of challenges experienced by the industrial biotechnology sector.

The creation/strengthening of relationships between different stakeholders could be helpful for overcoming supply and technology bottlenecks. By fostering close working relationships, tools and knowledge sharing between researchers from different but related fields and organization types, awareness and knowledge regarding specific, cutting-edge technology and methods to conduct scientific techniques could be enhanced. This may be particularly useful to promote discovery of novel marine natural products and bioactives, to determine specific mode of action and to enhance sustainable and reproducible batch supply (Vasconcelos et al., 2019).

Poor communication between stakeholders and difficulties in finding and developing partnerships may play a role in biodiversity challenges (Vasconcelos et al., 2019). However, due to the small sample size (only three large companies were involved in this survey), the significance of biodiversity challenges for this organization type cannot be determined. Market challenges are likely to be caused by similar factors to those associated with stage 3 challenges (see section above regarding potential causes of stage 3 challenges).

The creation of an interactive network (such as a ‘blue hub portal’) of partners could help to ensure that marine bioresource organizations remain informed of relevant, up-to-date information (Vasconcelos et al., 2019). This may be useful for resolving biodiversity and market challenges.

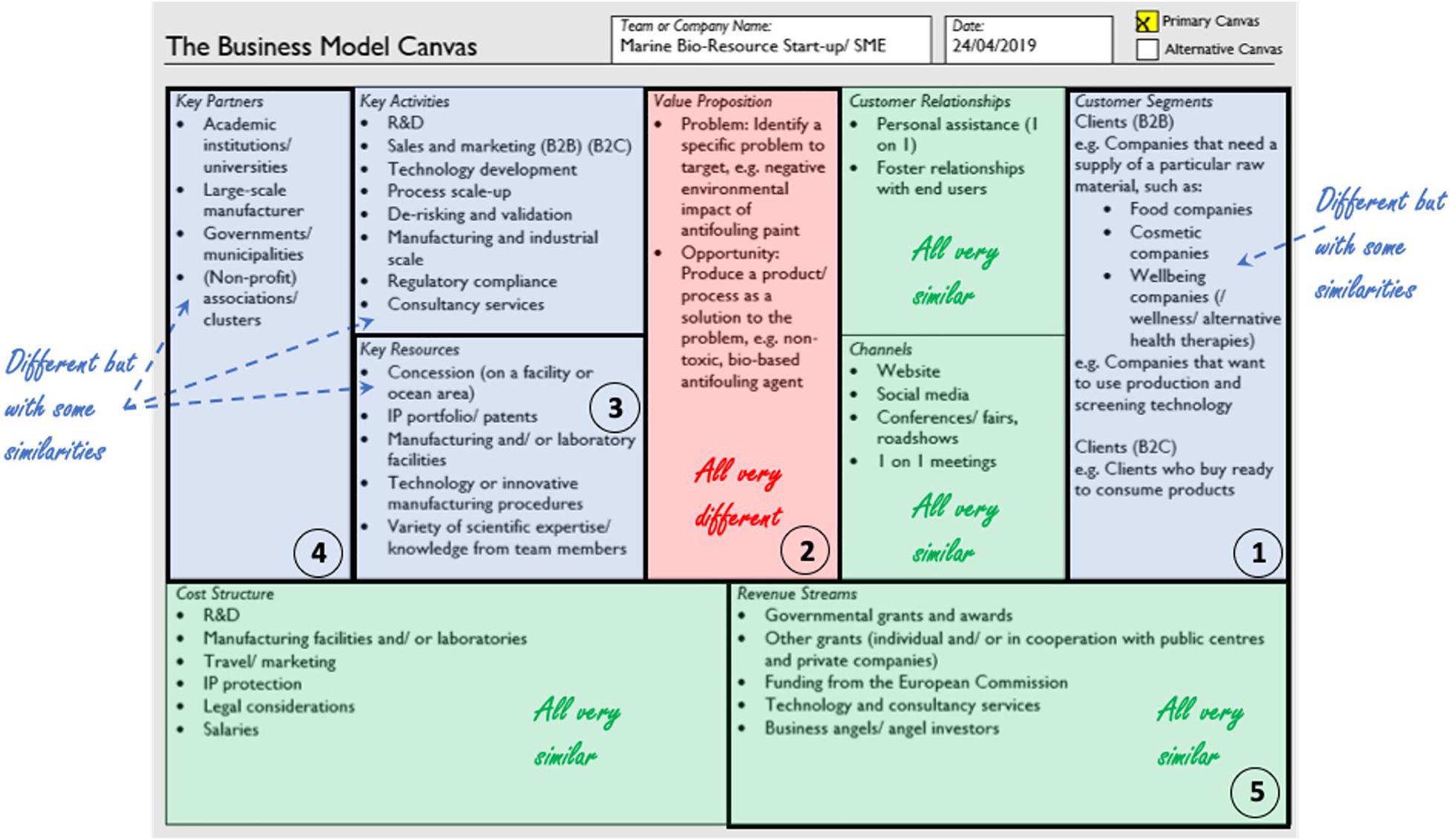

A Business Model Canvas was created and validated for each of the seven start-ups/SME’s interviewed. By analyzing the canvases, similarities and differences in segments between start-ups/SMEs were identified and are represented in Figure 7 as the features which may constitute a current, ‘typical’ business model for marine bioresource start-ups/SMEs. Each compartment within the business model canvas was then analyzed in turn as follows.

Figure 7. A Business Model Canvas representing the current, “typical” model used my marine bioresource start-ups/SME’s. Green boxes indicate sections of the business model which were very similar for all organizations interviewed. Blue boxes indicate sections which were different but with some similarities, and the red box indicates the section which was very different for all organizations interviewed. The bold, numbered boxes represent areas with potential for improvement, where implementable actions could be considered and applied.

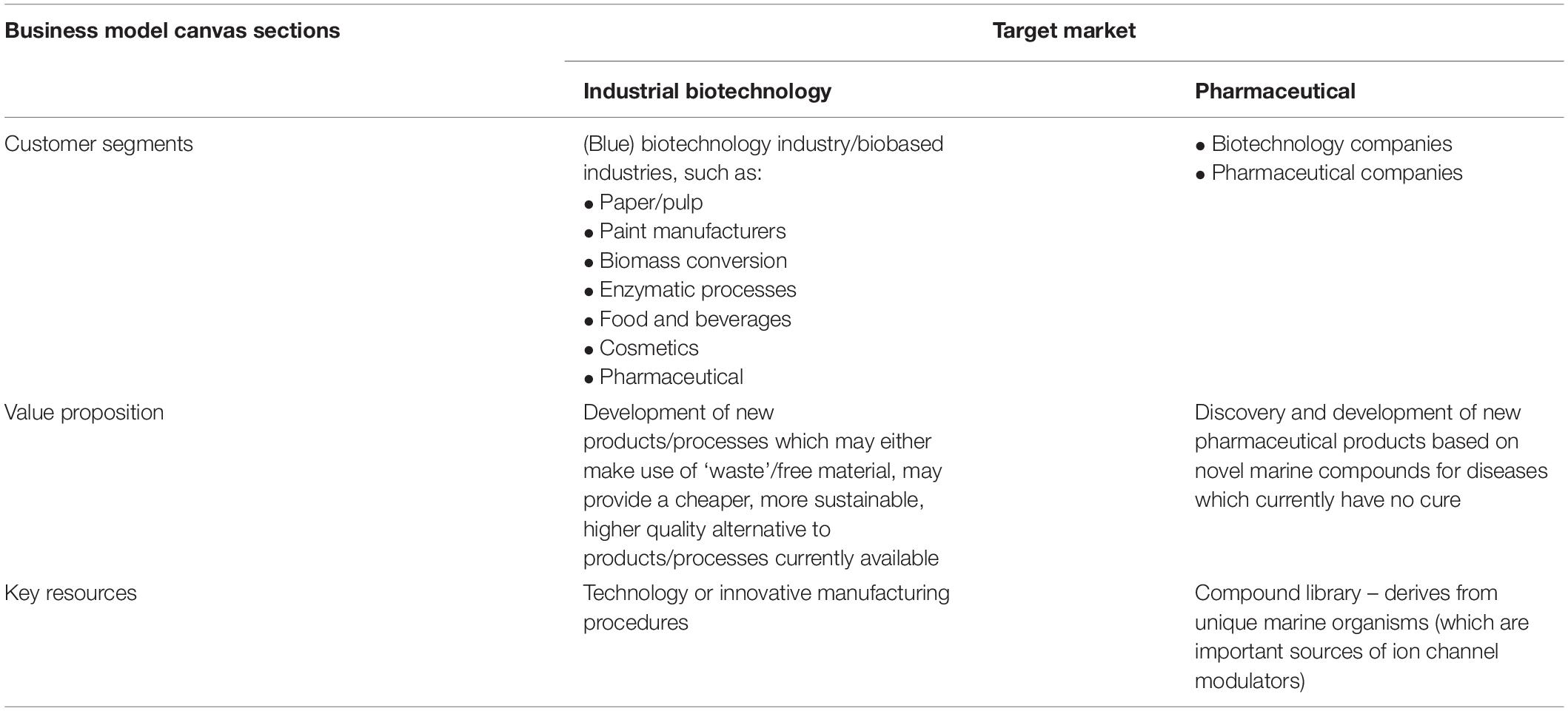

In general, the customer segment of each of the seven start-ups/SMEs interviewed were different to one another but had some similarities. The start-ups/SMEs interviewed in this study typically target multiple different markets/customer groups. These organizations are often more focused on business-to-business (B2B) exchange of products/services than business-to-customer (B2C) relationships. For example, some of the start-ups/SMEs studied in this project provide algae to biotechnology companies which may want to use the algae as a raw material for their own purposes. In addition, some start-ups/SMEs provide specific production and screening technology services to other businesses. Two of the start-ups/SMEs did include B2C relationships in their customer segment, for example by selling ready to consume algae products to individuals, restaurants or supermarket chains. See Table 2 for an example of differences in customer segments according to whether the target end market is the industrial biotechnology sector versus the pharmaceutical sector.

Table 2. The business model canvas of seven organizations interviewed in this study were grouped according to target end market, namely the industrial (algae-based) biotechnology sector versus the pharmaceutical industry.

Customer relationship segments were very similar for all of the seven start-up/SMEs interviewed. Personal assistance, such as 1 to 1 service, and fostering relationships with end-users appear to be the two most important forms of customer relation used by all of the marine bioresource start-ups/SMEs in this study.

Channel segments were very similar for all of the seven start-up/SMEs interviewed. The minimum requirements in terms of channels for all start-ups/SMEs analyzed in this study included a telephone number, email address and physical (office) address. In addition, many of the marine Bioresources start-ups/SMEs also included the following channels: a website (mostly for communication of product/processes in development or provided and contact information, but perhaps also for sales), social media (for news updates), conferences/fairs and roadshows (to help raise awareness of products/processes in development or provided or for customer acquisition) and 1 on 1 meetings with customers, influencers, users, investors or partners. Some also considered ‘direct sales’ as a form of channel.

The value proposition segment of each of the seven start-ups/SMEs were very different to one another. This was expected given the different sectors that each were operating in. The specific problem that each organization aims to address, along with the opportunity they target and the solution they propose to provide (in terms of a new product or service), are the most unique part of every start-up/SME. For example, one organization in this study attempts to solve the problem associated with current use of environmentally damaging antifouling paints by developing more environmentally friendly, non-toxic, biobased alternatives. Another company also aims to help mitigate potential negative environmental impacts linked to human activities, by providing ingredients that are produced with a smaller associated carbon footprint compared to traditional, land-based equivalents. One company focuses on providing more ethically acceptable, more sustainable and higher quality alternatives to currently used collagen material for cell culture in the lab. Other organizations concentrate on developing cost- and time-efficient alternatives to processes that are currently on the market, or more healthy/nutritious alternatives to equivalent products, such as high-quality algae food products. One start-up/SME in this study targets the societal problem regarding a lack of medicines available on to the market to treat or cure illnesses such as chronic pain, epilepsy and diabetes. This organization has therefore developed a business model specifically to address this need, with the aim of using different (marine) sources to look for innovative new pharmaceutical products to treat these types of illnesses (see Table 2). The start-ups/SMEs interviewed all focus on different topics. This is, therefore, the most difficult compartment within the business model canvas to identify trends in (because this is inherently different for every case), but it is clear that all are attempting to provide solutions to specific problems.

In general, the key activities segment of each of the seven start-ups/SMEs interviewed were different to one another, but had some similarities. Key activities tend to vary between organizations depending on the overarching focus and field of work. Unique activities (activities which other start-ups/SMEs in this study did not have) included: cultivation of algae/seaweed/cells/; manufacturing of the final products; customized system design; training; microbial strain screening; process development and optimization; sampling and monitoring; sample processing; species identification; bioactivity testing; experimental models (in vivo, ex vivo, etc.); experimental techniques; clinical trials. However, common activities (activities which are conducted by the majority or all of the start-ups/SMEs in this study) included: R&D; sales and marketing (B2B and perhaps also B2C); technology development; process scale-up, de-risking and validation; manufacturing at an industrial scale; regulatory compliance; consulting services and investment procurement.

The key resources segments of each of the seven start-ups/SMEs interviewed were different to one another, but had some similarities. As with key activities, key resources vary depending on the solution that each organization is attempting to provide. Unique resources (resources which other start-ups/SMEs in this study did not use) included: supply of strains (e.g., bacteria or microalgae); compound libraries; access to long-term oceanographic data (see Table 2 for an example of differences in key resources according to target end market). Some common resources (resources which are used by the majority or all of the start-ups/SMEs in this study) included: concession (e.g., on an aquaculture facility or an area of ocean space); intellectual property portfolio/patents (e.g., seaweed cultivation technology or application of bioactive molecules); manufacturing and/or laboratory facilities; technology or innovative manufacturing procedures (e.g., for large-scale production of microalgae or specific technology to be licensed out to industrial partners); variety of scientific expertise and knowledge provided by team members.

Key partner segments were different for each of the seven start-ups/SMEs interviewed, but had some similarities. Marine bioresource start-ups/SMEs typically appear to have more than one key partner, one of which is often an academic institute or university. Other common partners (partners which the majority or all of the start-ups/SMEs collaborate with) include: large-scale manufacturer; governments/municipalities; (non-profit) associations/clusters. Less common, more unique partners (partners which other start-ups/SMEs in this study did not collaborate with) depend on the type of company and products/processes developed, and included: product distributors (e.g., supermarkets, or companies that sell bulk biomass/finished products); suppliers of parts (e.g., metals, glass, plastic); regulatory compliance agencies; biotechnology companies and final marketing and distribution partners.

Cost structure segments were very similar for all of the seven start-up/SMEs interviewed. Typical costs for marine bioresource start-ups/SMEs to consider include: R&D; manufacturing facilities and laboratories; travel/marketing; human resources/salaries; IP protection and legal/regulatory associated costs. Less typical costs may involve payment for test sites and manufacturing of (engineering) systems.

Specific revenue stream segments were surprisingly similar for all of the seven start-up/SMEs interviewed. As with cost structure, revenue streams associated with marine bioresource start-ups/SMEs are fairly similar for all. Common revenue streams (revenue streams which the majority or all of the start-ups/SMEs included) are: governmental grants and awards; other grants (both individual and in cooperation with public centers and private companies); funding from the European Commission; technology and consultancy services; business angels/angel investors. Less common revenue streams include Venture Capital (VC) investment and sales from bulk biomass/bioproducts (sales of their own products).

Start-ups/SMEs experience a majority of challenges related to supply and technology and also to market. It is possible to link some of the specific sub-challenges to different sections of the business model canvas, according to the where and how these challenges are typically encountered. It is suggested by the authors that market challenges (such as market awareness and acceptance of new products or determining real market need and market volumes needed) could be associated with the customer segment and the value proposition (boxes 1 and 2 in Figure 7), whereas supply and technology challenges (such as determining specific mode of action and sustainable and reproducible batch supply) could be tied to the key resources and key partners (boxes 3 and 4, Figure 7). It is possible that if organizations have not dedicated time to think deeply about their business model and these four sections in particular, as indicated within the survey results, as well as a lack of market research and project validation with real market needs, then these associated challenges may result in the documented bottlenecks that these start-ups/SMEs face. These particular sections, plus key activities, tend to vary most between different organizations interviewed in this study.

Analysis of the revenue stream segment (box 5, Figure 7) suggests that, at present, blue biotechnology start-ups/SMEs are much more dependent on funding streams than on generating revenue. This is very different from what is seen in other, more thriving sectors, such as in the information technologies or web-based businesses. It is important to note that venture capital, business angels or any type of investment are not considered a revenue stream, but rather a part of the funding of a business. Furthermore, the current public incentives to join industry-academia projects or even to de-risk large private sector investments may form the basis of such reality in these newer sectors and may prove prejudicial in the long run as it may hinder or postpone the ability (or need) these companies have to go out and thrive into the real market with customer based sales. This discovery represents the clearest challenge identified within the current business model canvas for blue biotechnology start-ups/SMEs. This trend is likely to contribute to key specific challenges experienced by these start-ups/SMEs such as the long timescales involved prior to profitability, issues with long-term capital, sustainability and valorization of the companies and cost of development versus return on investment (ROI) or cost effectiveness, as mentioned by survey participants.

A review of existing literature revealed a number of actions which could be taken in an attempt to tackle the challenges identified (see section “Potential Causes and Implementable Actions”). These actions can be summarized and framed in terms of possible bottom-up approaches and top-down approaches, as described below (European Marine Board and Marine Biotechnology [ERANET], 2017; Ligtvoet et al., 2019; Vasconcelos et al., 2019).

Bottom-up approaches could be implemented by primary stakeholders, such as individual researchers or organizations involved in marine bioresource development, including producers and wholesalers (Vasconcelos et al., 2019). There are a few bottom-up actions that could be taken in an attempt to address many of the challenges reported in the survey. Firstly, stakeholders could foster active participation in national/regional networks, such as hubs/portals, and interact with other stakeholders. This could help individuals and organizations to build their network of contacts in the field, which may be useful when looking for advice and for when looking to establish new partnerships (Vasconcelos et al., 2019). In addition, it could be useful to foster collaborative projects with other organization types to develop solutions to specific shared challenges, particularly regarding supply and technology (Lindequist, 2016). It may also be advisable to take part in market studies to validate business ideas, to undertake market-oriented/entrepreneurial training as well as transfer of knowledge with partners (European Marine Board and Marine Biotechnology [ERANET], 2017).

In order to address and avoid market challenges, such as determining real market need and market volumes needed, we suggest it is important for start-ups/SMEs to consider the following questions when developing their business model:

(1) Who exactly might be interested in paying for the product and who are the potential customers (box 1 regarding Customer Segment in Figure 7)?

(2) What is the specific problem that the business can address and does the product provide a true and competing solution for this (box 2 regarding Value Proposition in Figure 7)?

(3) Can survey or questionnaire results be gathered to validate that the potential market exists and that the customer group would indeed buy the product, at what quantity and for what price (see boxes 1 and 2 in Figure 7; Trimi and Berbegal-Mirabent, 2012)?

Specific implementable actions that could be taken in an attempt to solve the challenges related to supply and technology (such as determining specific mode of action and sustainable and reproducible batch supply) are more difficult to find in the literature. Nonetheless, in order to limit supply and technology challenges, it may be useful for start-ups/SMEs to consider the following questions when developing their business:

(1) How can sampling and R&D techniques be made most efficient? Could efficiency be enhanced by investing time, money and human resources into developing methods and technology (box 3 regarding Key Resources in Figure 7; Vasconcelos et al., 2019)?

(2) Could efficiency be enhanced by collaborating and partnering with other specialist organizations, such as universities or other research institutes, to develop projects targeted at solving specific supply and technology challenges (box 4 regarding Key Partners in Figure 7; Lindequist, 2016)?

Top-down approaches may be developed and implemented by so-called ‘secondary stakeholders’ who are affected by or who can affect the actions of the primary stakeholders, including governmental bodies, public authorities, associations, clusters or associations. Top-down actions could be promoted through the implementation of policy procedures (such as specific funding requirements, guidelines and procedures) similar to those suggested by EU instruments, such as the European Innovation Council (EIC) accelerator program (formerly the SME Instrument)10 ,11 (Vasconcelos et al., 2019). Market studies could be conducted to evaluate potential niche national or regional markets and consumer demands as well as markets already saturated with competitors and help to identify blue ocean strategies or competing potential new solutions (Vasconcelos et al., 2019). Drivers to raise consumer awareness of innovative, sustainable, value-added blue biobased products could then be initiated to help improve market acceptance of new, marine derived products which fit into the niche markets and are in line with consumer demands. This may be considered as ‘consumer-oriented communication’ (European Marine Board and Marine Biotechnology [ERANET], 2017; Ligtvoet et al., 2019; Vasconcelos et al., 2019). Funding schemes better aligned with current market demands, using key criteria to evaluate preparedness for market entry, could help to alleviate market-related challenges. In addition, schemes could also be structured in a manner which attracts private sector involvement, perhaps by creating public-private partnerships (PPP), or following the example of blended financing options for SMEs of the recently launched EIC accelerator program (European Marine Board and Marine Biotechnology [ERANET], 2017). According to the 2017 European Marine Board policy brief, initiatives to tailor marine graduate training, perhaps by training scientists in market-oriented and entrepreneurial skills, may be useful for building capacity and a shift in professionals more tailored for a career in blue biotechnology (European Marine Board and Marine Biotechnology [ERANET], 2017). Promotion of access to shared infrastructure and services in a broad geographical network for start-ups/SME’s involved in marine bioresource development would be helpful for these types of organizations as they attempt to establish themselves (Lindequist, 2016).

By focusing on the four segments mentioned above [customer segment (1), value proposition (2), key resources (3), and key partners (4)], it may be possible for marine bioresource start-ups/SMEs to incorporate some of the suggested actions into their business model. This can be viewed as a bottom-up approach. However, in terms of the revenue stream segment (box 5, Figure 7), solutions may be addressed most appropriately from the top-down (rather than bottom-up). This is because, at present, these organizations appear to rely largely on governmental grants, publicly financed joint projects and awards as an important component for the revenue stream. However, this type of funding should be seen as an initial, de-risking investment that should help start-ups/SMEs to more rapidly and efficiently find their path to bring their products/solutions and services to market. Therefore, in order to encourage change, we suggest that if governments take the initiative to adapt how and at what stages of development this type of funding is awarded, this could have an effective and positive impact on how the revenue stream for start-ups/SMEs are built in the future.

This data likely also explains the challenges identified in the survey results regarding long-term financial stability and survival. In this context, it may be useful for governments and public financing agencies (on which these organizations can become too dependent) to consider how funding could be a mixture of public and private funding and also be gradually replaced with different, long-term revenue streams initiated by the companies themselves. This could be promoted through governmental requirements for companies to demonstrate not only how they plan to generate future revenue (as some governments already require), but also attach funding to certain entrepreneurial milestones rather than focusing on academic research results and outputs. Potential entrepreneurial milestones to consider could include the design of a profitable business model, identification of strategies for lead generation, strategies for increasing the number of transactions per client and a realistic, scalable market strategy plan. Other milestones could include the hiring and training of the core founder team, gaining authority in the industry and reaching a significant number of sales12. These entrepreneurial milestones may be useful for start-ups/SMEs in order to shift away from governmental funding and to leverage future revenue based on these business results. By addressing the revenue stream topic in a top-down fashion, perhaps by incorporating guidance and liaison with experienced business experts and mentors, key specific challenges such as ‘lack of knowledge regarding steps to take toward commercialization and difficulty in transferring knowledge output to commercial value’ could be effectively tackled (see section “Potential Causes and Implementable Actions”).

It is recognized that sustainable growth of the blue bioeconomy has the potential to positively influence current societal, economic and environmental challenges. As a result of the present study, key specific challenges which currently limit success in the development of marine bioresources and their market uptake have been identified and linked to three main factors, namely the target end market, stages within the value chain and type of organization. Results demonstrate that the types of challenges experienced do indeed differ according to these three factors and, therefore, the actions taken in an attempt to address them may also vary. By taking into account the current trends in challenges, as well as the potential causes and solutions, both bottom-up and top-down approaches could be applied in order to implement suggested actions. It is noted that review of the ‘revenue stream’ segment within the business model canvas used by marine bioresource start-ups/SMEs, in particular regarding alternatives to governmental funding, could be particularly helpful for the long-term survival and success of these types of organizations. As a result, the blue biotechnology sector, and start-ups/SMEs in particular, may be in a better position to resolve current bottlenecks at various stages within the value chain, paving the way for enhanced and sustainable growth of the blue bioeconomy.

All datasets generated for this study are included in the article/Supplementary Material.

JC and TV conceived the idea for the manuscript. Data curation, formal analysis, and investigation was completed by JC. JC and HV developed the research methodology and analyzed the results. JC led the writing and editing (with HV) of the manuscript. All authors contributed to this process and approved the final version of the manuscript.

This research was funded by Marie Curie, grant number H2020-MSCA-ITN-ETN: MarPipe GA 721421. Funding was also received from Research Unit grant from FCT, Portugal (to BioISI), grant number UID/MULTI/04046/2019. HV was funded by FCT, Portugal (to BioISI), Research Unit grant number UIDB/04046/2020.

JC and TV are employed by ABSint, but this research was conducted without commercial funding.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Many thanks the Marie Curie H2020 fund for supporting this research.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fmars.2020.00062/full#supplementary-material

Arrieta, J. M., Arnaud-Haond, S., and Duarte, C. M. (2010). What lies underneath: conserving the oceans’ genetic resources. Proc. Natl. Acad. Sci. U. S. A. 107, 18318–18324. doi: 10.1073/pnas.0911897107

Calado, R., Leal, M. C., Gaspar, H., Santos, S., Marques, A., Nunes, M. L., et al. (2018). “How to succeed in marketing marine natural products for nutraceutical, pharmaceutical and cosmeceutical markets,” in Grand Challenges in Marine Biotechnology, eds P. H. Rampelotto, and A. Trincone, (Cham: Springer), 317–403. doi: 10.1007/978-3-319-69075-9_9

Chesbrough, H. (2007). Business model innovation: it’s not just about technology anymore. Strategy Leadersh 35, 12–17. doi: 10.1108/10878570710833714

Ecorys (2014). Study in Support of Impact Assessment work on Blue Biotechnology. Tallahassee, FA: FWC. Final Report FWC MARE/2012706 – SC C1/2013/03.

European Commission (2019). The EU Blue Economy Report. 2019. Luxembourg: Publications Office of the European Union.

European Marine Board and Marine Biotechnology [ERANET] (2017). Marine Biotechnology: Advancing Innovation in Europe’s Bioeconomy. EMB Policy Brief No. 4. Belgium: European Marine Board

Jaspars, M., De Pascale, D., Andersen, J. H., Reyes, F., Crawford, A. D., and Ianora, A. (2016). The marine biodiscovery pipeline and ocean medicines of tomorrow. J. Mar. Biol. Assoc. U. K. 96, 151–158. doi: 10.1017/s0025315415002106

Ligtvoet, A., Maier, F., Sijtsma, L., Broek, B., Doranova, A., Eaton, D., et al. (2019). Blue Bioeconomy Forum – Roadmap for the Blue Bioeconomy in EU. Publications Office of the European Union, 1st Edn. Brussels: European commission, 64.

Lindequist, U. (2016). Marine-derived pharmaceuticals–challenges and opportunities. Biomol. Ther. 24, 561. doi: 10.4062/biomolther.2016.181

Martins, A., Vieira, H., Gaspar, H., and Santos, S. (2014). Marketed marine natural products in the pharmaceutical and cosmeceutical industries: tips for success. Mar. Drugs 12, 1066–1101. doi: 10.3390/md12021066

Milano, J., Ong, H. C., Masjuki, H. H., Chong, W. T., Lam, M. K., Loh, P. K., et al. (2016). Microalgae biofuels as an alternative to fossil fuel for power generation. Renew. Sustain. Energy Rev. 58, 180–197. doi: 10.1016/j.chemosphere.2013.11.023

Murray, S. N., Ambrose, R. F., Bohnsack, J. A., Botsford, L. W., Carr, M. H., Davis, G. E., et al. (1999). No−take reserve networks: sustaining fishery populations and marine ecosystems. Fisheries 24, 11–25. doi: 10.1577/1548-8446(1999)024<0011:nrn>2.0.co;2

OECD (2013). Marine Biotechnology: Enabling Solutions for Ocean Productivity and Sustainability. Paris: OECD Publishing.

Osterwalder, A., and Pigneur, Y. (2010). Business Model Generation: a Handbook for Visionaries, Game Changers, and Challengers. Hoboken, NJ: John Wiley & Sons.

Piña, M., Colas, P., Cancio, I., Audic, A., Bosser, L., Canario, A., et al. (2018). “The european marine biological research infrastructure cluster: an alliance of european research infrastructures to promote the blue bioeconomy,” in Grand Challenges in Marine Biotechnology, eds P. H. Rampelotto, and A. Trincone, (Cham: Springer), 405–421. doi: 10.1007/978-3-319-69075-9_10

Trimi, S., and Berbegal-Mirabent, J. (2012). Business model innovation in entrepreneurship. Int. Entrepreneursh. Manag. J. 8, 449–465.

Vasconcelos, V., Moeira-Silva, J., and Moreira, S. (eds) (2019). Portugal Blue Bioeconomy Roadmap – BLUEandGREEN. CIIMAR, Matosinhos, (pub), 68. Avaliable at: http://blueandgreen.ciimar.up.pt (accessed January 20, 2020).

Keywords: marine biological resources, blue bioeconomy, blue biotechnology, business models, value chain, market, biodiversity, supply and technology

Citation: Collins JE, Vanagt T, Huys I and Vieira H (2020) Marine Bioresource Development – Stakeholder’s Challenges, Implementable Actions, and Business Models. Front. Mar. Sci. 7:62. doi: 10.3389/fmars.2020.00062

Received: 25 October 2019; Accepted: 28 January 2020;

Published: 13 February 2020.

Edited by:

Gretta Pecl, Centre for Marine Socioecology, AustraliaReviewed by:

Lida Teneva, Independent Researcher, Sacramento, United StatesCopyright © 2020 Collins, Vanagt, Huys and Vieira. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jane Eva Collins, amFuZS5jb2xsaW5zQGFicy1pbnQuZXU=

†These authors share last authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.