- 1Department of Forestry and Environmental Resources, North Carolina State University, Raleigh, NC, United States

- 2Department of Crop and Soil Sciences, North Carolina State University, Raleigh, NC, United States

Industrial hemp (Cannabis sativa L. <0.3% THC), a non-psychoactive chemotype of cannabis, was reclassified and made legal for growing across the United States under the 2018 Farm Bill. Given that resources, knowledge, and interest for this novel crop are expanding rapidly, we explored the possibility of intercropping industrial hemp for fiber with loblolly pine (Pinus taeda) plantations, one of the most commercially widespread tree species in the southern United States. Following a previous greenhouse study confirming hemp’s ability to grow in pine-influenced soils, we examined the financial feasibility of this potential agroforestry system. We simulated the loblolly pine tree growth information using PTAEDA 4.0, a growth and yield model, and collected the enterprise budget data on hemp productivity, operating and fixed costs, and prices from various sources. Based on the capital budgeting analyses, results suggest that pine-hemp intercropping can yield higher economic returns –at least 25% higher net present value—than the conventional monoculture loblolly pine plantation. The early rotation cash flow and the complimentary benefits can result in a more financially viable loblolly pine plantation under the intercropping scenario. While new research continues to advance further with field trials and other analyses, this study provides valuable insights into the current market conditions and productivity level of industrial hemp cultivation that need to be addressed for hemp intercropping to succeed as an economically viable agroforestry investment.

1. Introduction

Industrial hemp (Cannabis sativa L <0.3% Tetrahydrocannabinol-THC) is an herbaceous, annual plant native to the temperate regions of central Asia (Fike, 2016). The plant is extremely fast growing, reaching ideal harvesting conditions at 90 to 120 days (Clarke, 2010). Hemp grows best in moist, yet well-drained soils that are deep, rich, and have a pH between 6.0 and 7.5 (Jeliazkov et al., 2019). Hemp is commonly known for its relationship and similarity to marijuana (Cannabis sativa > 0.3% THC), a high THC producing chemotype of the species. Though hemp produces significantly less THC (<0.3%) than marijuana which usually contains 1–20% of THC, both plants were legally considered similar in terms of drug enforcement (Cherney and Small, 2016). The 2018 Farm Bill has allowed for nationwide cultivation of hemp for fiber, Cannabidiol (CBD), and other commercial uses under close legal oversight (Abernethy, 2019), significantly differentiating it from marijuana.

Industrial hemp provides a plethora of useful products ranging from fibers for canvas and textiles to the seed for human and animal consumption, oils for CBD products, structural fibers for novel building techniques, and raw biomass (Cherney and Small, 2016). While historical uses of hemp for fiber have been replaced by paper, plastics, and other natural fibers such as cotton (ERS, 2000), hemp can be cultivated and harvested for its bast fibers, which is a viable raw material for a variety of textiles (Cherney and Small, 2016). With rising supports from policy and market perspectives, the hemp market has made a resurgence in the United States with the planted area increased by 2,284% between 2016 and 2019 (Dhoubhadel, 2021). As of 2021, industrial hemp has been planted on over 54,000 acres across the US with a production value estimated at $824 million (Nseir, 2022). A recent survey of organic farmers in North Carolina revealed that about 85% of farmers were interested and wanted to learn more about production practices, legality, and adapted cultivars of industrial hemp (Dingha et al., 2019).

Agroforestry is a form of intensive land management that seeks to optimize the benefits from the interactions introduced when trees are planted alongside one or more secondary crops (Nair et al., 2021). Some examples of modern agroforestry practices include silvopasture, windbreaks, and alley cropping (Idol, 2020). Agroforestry practices may yield significant returns to smaller landowners looking to maximize benefits on their land. Intercropping is a crucial agroforestry system that incorporates two or more crops within the same production area (Steppler and Nair, 1987; Martin-Guay et al., 2018). While not widely practiced throughout the western forestry systems, other cultures, especially indigenous communities, still implement intercropping practices within their forest production systems (Steppler and Nair, 1987). While hemp is often marketed as a sustainable, low-impact crop, repeated plantings of any crop could result in reduced yields and greater susceptibility to weeds and disease (Bullock, 1992). As such, it is important to rotate crops when farming in a monoculture system.

There are many ecological, societal, and economic benefits that may be derived from co-planting timber and agricultural crops. Several field studies have investigated different loblolly intercropping regimes including the mixed cropping of switchgrass (Panicum virgatum), oilseed crops, and maize. Loblolly-switchgrass intercrops were found to be financially viable (Albaugh et al., 2012, 2014; Susaeta et al., 2012). A Brazilian field study reported that intercropping maize for the first 3 years of a 22-year loblolly rotation is an economically viable practice that could help reduce pine planting costs (de Oliveira et al., 1998). Oilseed intercrops with loblolly pine found that the intercropping system possessed significantly higher economic returns, which vary by the discount rate, price, and yield (Akter et al., 2021). Similarly, an analysis of Peruvian silvopastoral systems examining silvopasture (pine and livestock) found that all of the silvopasture operations yielded higher returns than any pure crop, livestock, or tree system examined (Chizmar et al., 2020).

Complimentary benefit is often expressed within a production possibility frontier, which represents the various combinations of multiple commodity outputs, depicting the commodities to have complementary, independent, or competitive interactions (Savosnick, 1958). An example of a competitive interaction would be that of a weed and a crop competing for growing space, where one or both plants may be disadvantaged due to resource competition. Specifically, the shading effect from the pine forests could reduce hemp growth, and on the other hand, wider spacing in loblolly plantation would result in more unwanted hardwoods and lower pine volume. A potential benefit of hemp-loblolly intercropping may be expressed through weed and pest suppression. Pumariño et al. (2015) reported that both parasitic and non-parasitic weeds were substantially less abundant in agroforestry systems, and perennial intercrops also benefit from lower pest counts and crop damage. Within a pine-hemp intercropping scenario there are many possibilities for both competitive and complimentary interactions. In this study we presume that the reduced weed pressure, enhanced nutrient cycling, and fertilizer inputs instituted by the hemp will convey complimentary benefit for the growth and yield of the pines.

Loblolly pine is the most dominant commercial tree species in the southeastern United States with its adaptability to a variety of different soils and climatic factors. It can be managed in numerous ways and at varying intensities, such as different site preparation methods, the use of herbicide, intermittent thinnings, and various planting spacings. As interest and opportunity in hemp cropping consistently increases across the United States, intercropping this crop within loblolly pine plantations could provide an opportunity for diversified income, greater land use efficiency, and higher economic returns. By planting loblolly pine at a wider spacing, hemp can be intercropped in the alley between the trees; the space that would otherwise go unutilized in the early development of the pines. In the first 5 to 7 years preceding the canopy closure, industrial hemp can be sown, grown, and harvested between the rows of pine seedlings.

The main purpose of this study was to perform a financial analysis of the intercropping system of loblolly plantation along with industrial hemp in the southeastern US. Based on various capital budgeting criteria, we examined and compared the financial viability of standard monoculture and intercropping scenarios of loblolly pine plantations along with cultivating industrial hemp. As the market for industrial hemp continues to grow, there exists abundant opportunity for investment in this new, specialty crop even within the forestland. While more information on industrial hemp production is still evolving, the findings of the study based on early budget information of hemp production further advance the financial knowledge base required to accurately inform and assist landowners and other stakeholders who are interested in intercropping loblolly pine and industrial hemp or are seeking additional financial benefit from their pine operations.

2. Materials and methods

The capital budgeting analysis of various combinations of intercropping and monoculture cropping of loblolly pine and industrial hemp was accomplished using a growth and yield model and various secondary data sources including Cooperative Extension resources, the cooperation of Extension agents, and industry professionals from North Carolina. The loblolly pine growth information under various spacing options and other configurations was simulated using PTAEDA 4.0, a loblolly pine growth and yield model developed by the Forest Modeling Research Cooperative led by Virginia Tech, Blacksburg, VA, USA. Timber prices to estimate the revenues from timber harvests were obtained from North Carolina State University Extension Forestry’s price report, which were originally reported by the Timber-Mart South (NCSU Extension Forestry, 2021). We obtained the state-average pine stumpage product prices in North Carolina in the third quarter of 2021 as pulpwood at $9.99 /ton, chip-n-saw Saw at $16.71 /ton, and sawtimber at $30.85 /ton. Since all the numbers and results are presented in English units, Table 1 presents the conversion factors for English and SI (metric) units.

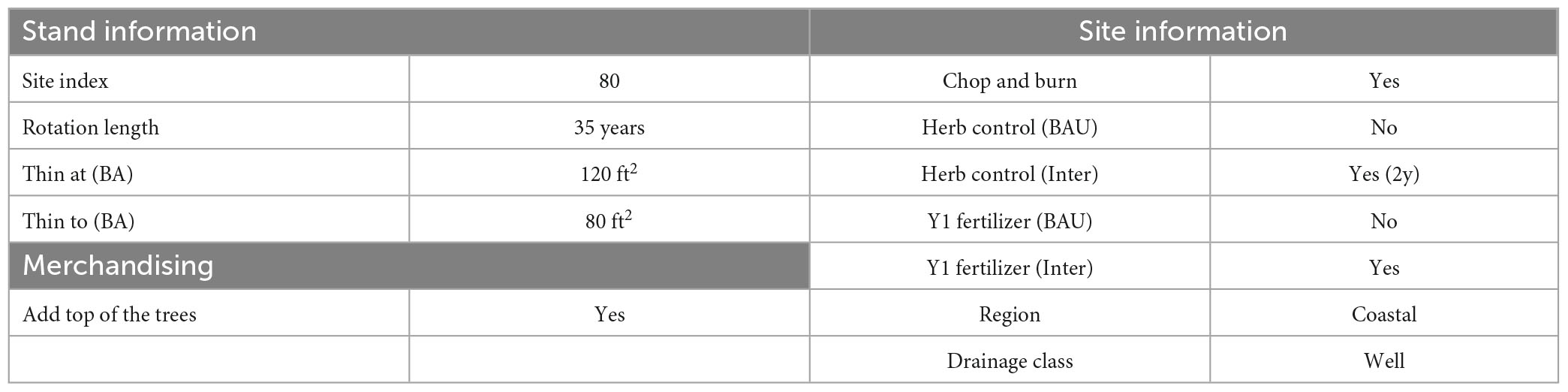

Table 1. Conversion factors from English to systems international (SI)-metric system of units (Source: Buffinton, 2023).

Loblolly pine plantations were examined in three different scenarios. The first scenario was a 10 feet (ft) by 8 ft spacing for planting (10 × 8 Business-as-Usual–BAU); a common planting density implemented throughout the southeastern US. The second scenario was a 20 ft by 5 ft spacing for planting (20 × 5 BAU); a less common density but still implemented for sawtimber production in a commercial scale. The third scenario was the pine and hemp intercropping: a 20 ft by 5 ft spacing with a complimentary benefit of hemp intercropping for the first 6 years of the timber rotation (20 × 5 intercrop, loblolly and hemp). All three stands were modeled with the same stand, site, and economic parameter inputs, excluding the changes made to accommodate complimentary benefits in the intercropped scenarios (Tables 2, 3). In the PTAEDA model, trees were modeled with assumptions that the land was in the Coastal Plains region, on a well-drained site, with a site index of 80 feet at the base age of 25 years, and rotation length of 35 years. Site preparation techniques were chop and burn with no herbaceous control, no hardwood control, and no fertilization for the BAU scenarios. The intercropped scenarios received 2 years of herbaceous control and initial fertilization. We considered thinning schedules in each scenario triggered by the basal area growth: sites were thinned when the stand basal area (BA) reached 120 ft2 per acre get the residual BA down to 80 ft2 per acre. Site preparation and other operational costs per acre were assumed as follows: $200 for stand establishment costs, thinning costs at 8% of the thinning revenue, harvest costs at the 10 % revenue of the final harvest, and annual costs covering property tax and maintenance expenses at $5 per year. These values are in the ranges of the prevailing rates reported by the North Carolina Forest Service Maggard (2021) and (NCFS, 2021).

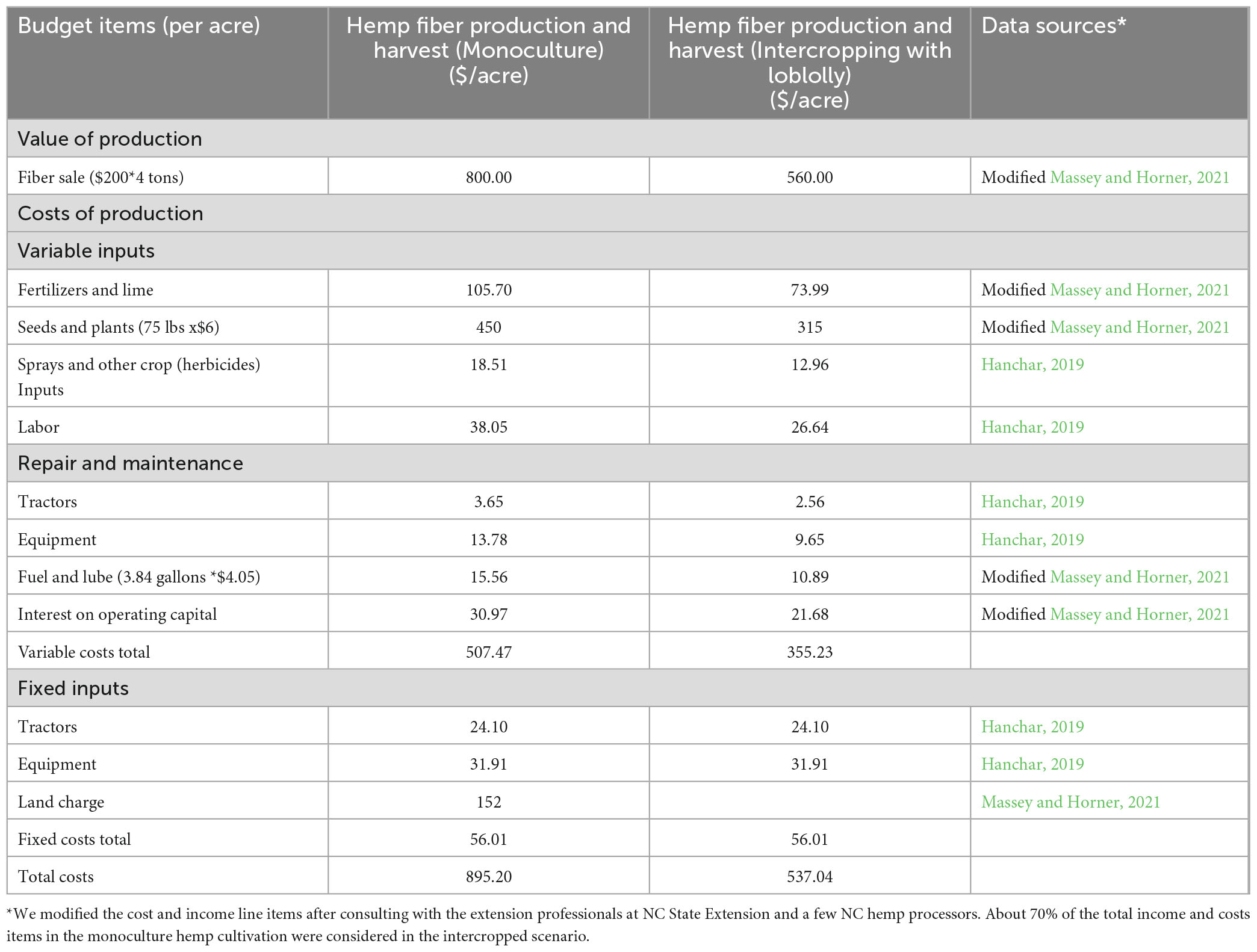

The enterprise budget data on potential income and cost items for fiber hemp cultivation, production, and sale were obtained from various sources. We collected most of the budget line items from the University of Missouri Extension’s Industrial Hemp Budget Generator (Massey and Horner, 2021) and Cornell CALS’ preliminary 2020 budgets (Hanchar, 2019), and updated the production, market price, and other costs data after consulting with the findings and testimony from NC State Extension professionals and personal communications with NC fiber hemp processors. Table 4 presents the detailed line items of production, price, and operating and fixed costs of growing hemp fiber on a per acre basis. Since the hemp industry is relatively new, the reported hemp productivity and the market price for hemp fiber varied considerably. Fiber hemp yields were primarily modeled at an assumed rate of 4 tons per acre for monoculture hemp and 2.8 tons per acre for intercropped hemp, corresponding to a roughly 30% loss of hemp productivity due to the space covered by the rows of pine seedlings in the first 6 years of the rotation. Final product prices were considered at $200 per ton, with alternate scenarios of $100, and $300 per ton. Seeds and plants inputs in a monoculture hemp cultivation were modeled at 75 pounds (lbs) per acre costing $6 per lb of seed. Nitrogen, phosphorus, and potassium fertilizers were included at 50 lbs/acre, 50 lbs/acre, and 40 lbs/acre, respectively, with costs of $0.70, $0.65, and $0.58 per lb each. Machinery and other rental rates as well as fixed costs tractors and other equipment required for the hemp operations were also considered. Compared to the monoculture hemp fiber budget, about 70% of most of the revenues and operating costs were assumed for the pine-hemp intercropping scenario. No land rent is considered in the intercropping scenario, as the land is already allocated for the pine plantation.

As a long-term investment with substantial upfront costs, economic analyses of the forestry practices often utilize capital budgeting and discounted cash flow approaches to determine the value of a forest investment accounting for the time value of money (Bullard and Straka, 2011). A discounted cash flow measures the value of an investment based upon the expected future cash flows it generates utilizing the expected present value of the investment (Bullard and Straka, 2011). Various capital budgeting criteria such as net present value (NPV) and land expectation value (LEV) are commonly applied in agroforestry investment analyses (Bruck et al., 2019; Chizmar et al., 2020; Akter et al., 2021). Along with NPV and LEV, we also estimated the Equivalent Annual Income (EAI) to annualize the forestry returns and the Benefit-Cost Ratio (BCR) to evaluate the scale of return on investment. The standard formula for these three criteria are as follows (Bullard and Straka, 2011; Chizmar et al., 2020):

Where, B and C represent the annual total benefits and costs in year n, respectively; and i denotes the assumed discount rate. In BCR, Bp and Cp denote the present value of benefit and cost, respectively. The discount rate not only incorporates the opportunity costs of any investment but also represents the risk and market situation in the discounted cash-flow analysis (Bullard et al., 2002). To estimate NPV, all the costs and returns of establishment, thinning, and harvests are discounted to the present time under the assumed discount rate. Similarly, LEV integrates the NPV of the number of future similar rotations in perpetuity for forested land. This perpetual value gives insight into the value of bare land were it to remain in use for the similar forestland use forever. Moreover, EAI presents returns on investment as though they were an annual cash flow. EAI is valuable in comparing investments of various lengths, or those of extended lengths, as it equalizes the returns as an annual payment. Another financial criterion, BCR, indicates the profitability index (Bullard and Straka, 2011), suggesting a total return potential of per dollar investment in any project. The profitable investment has a BCR value greater than 1, implying that there would be more net return over the project total costs.

Additionally, we conducted sensitivity analyses to assess how the profitability of a loblolly-hemp intercropping operation may alter with respect to the variability in hemp fiber yield and product sale price under the various discount rates. As hemp cultivation in a commercial scale is still in the early stage, the potential yield and market price may fluctuate along with the new technology and more formalized market chains and product uses. As these values fluctuate, the revenue of an investment will change as well, potentially changing its economic viability.

3. Results

3.1. Industrial hemp net income under various levels of projected yield and market prices

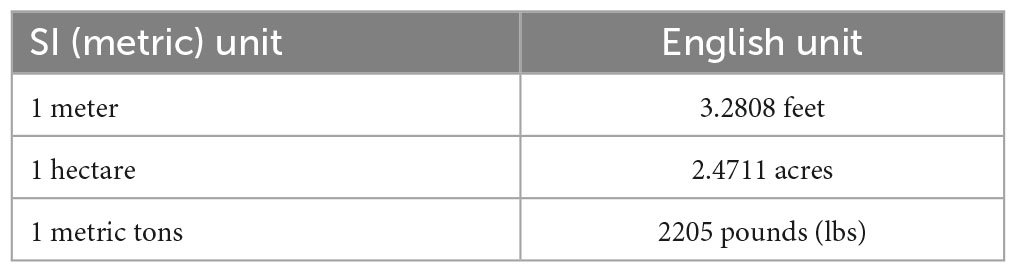

Based on the detailed operating and fixed costs for growing hemp under the intercropping scenario, Table 5 presents the possible net income from various combinations of potential yield of hemp fiber bales and the rates of market price. Anecdotally, the current price of industrial hemp for fiber ranges between $0.07 and $0.10 per pound for retted, baled stalks in North Carolina, which is equivalent to $140 and $200 per ton, respectively. Similarly, according to the experts we discussed about the current productivity, current yields of hemp in NC tend to fall between 2 and 5 tons per acre. This sensitivity analyses suggest that, under the assumed operating and fixed costs, it would not be feasible to intercrop hemp for fiber production with loblolly pine plantations if the yield per acre is lower 2.8 tons per year and the market price is below $200 per ton. The hemp fiber production could be profitable at the price of $300 per ton even if the yield ranges around 2 tons per acre.

Table 5. Hemp fiber net income from intercropping under varying productivity and market price levels.

3.2. Loblolly pine-hemp intercropping: capital budgeting analysis

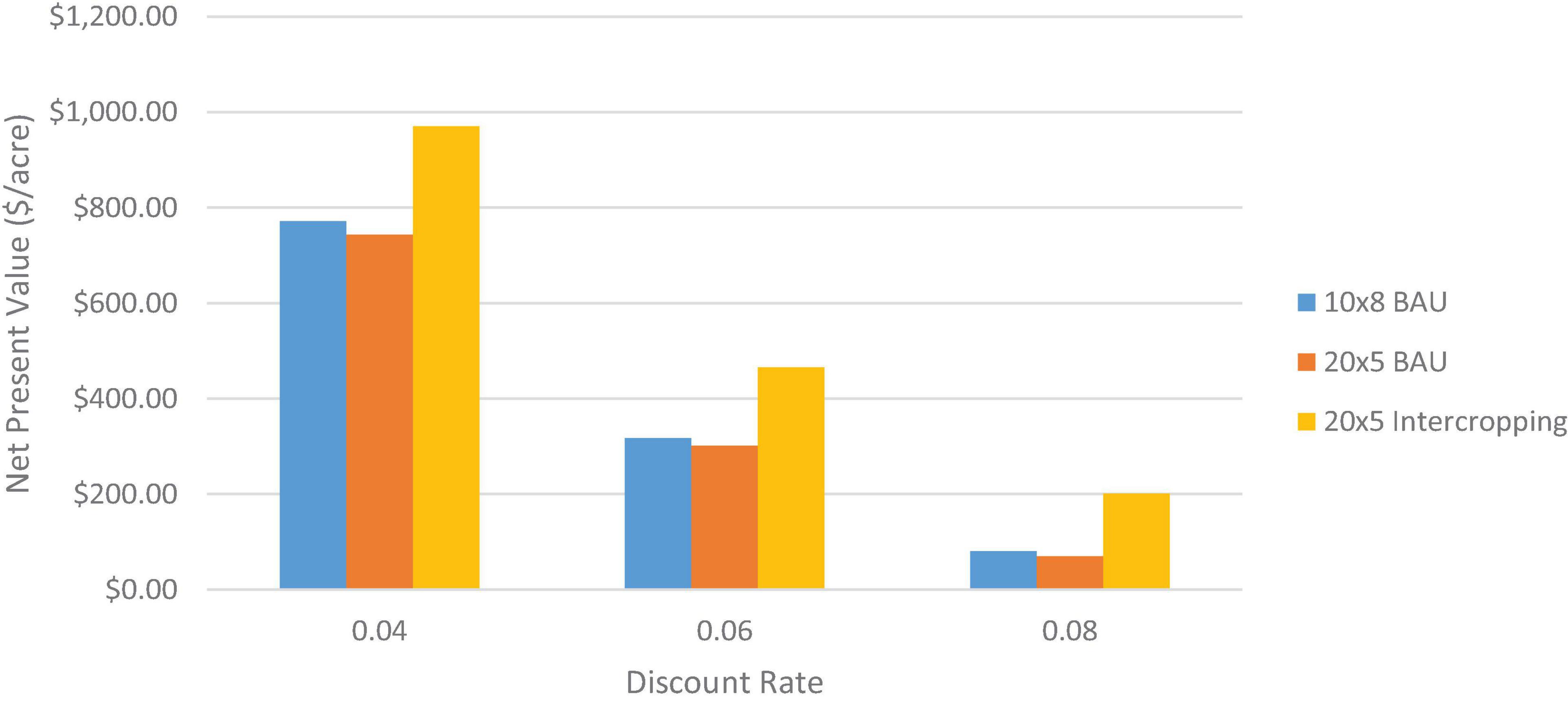

The NPV of three different scenarios of loblolly pine and hemp cultivation under three levels of discount rates is presented in Figure 1. In the baseline analysis of the intercropping scenario, we considered the hemp fiber productivity of 2.8 tons per acre at the market price of $200/ton. As expected, when hemp for fiber produces a positive net income annually for the first 6 years, the loblolly-hemp intercropping scenario is estimated to yield the largest net financial return when compared to monoculture loblolly pine plantations. At a 4% discount rate, NPV under the intercropping system is estimated to be $970.35 per acre, about 26% and 31% higher than the pine monoculture plantation with 10 × 8 and 20 × 5 spacing scenarios, respectively. The higher the discount rate representing the costs of capital, the lower the NPV. The estimated NPV from each scenario is found to decrease by over 80 % when the interest rate increases from 4 to 8%. Between the two monoculture pine plantation scenarios with different initial tree spacing, 10 × 8 BAU scenario consistently outperforms the wider spacing scenario of 20 × 5 BAU in terms of the net financial return represented by NPV.

Figure 1. Net present values (NPVs) from monoculture loblolly and intercropping scenarios under the discount rate of 4%, 6%, and 8%.

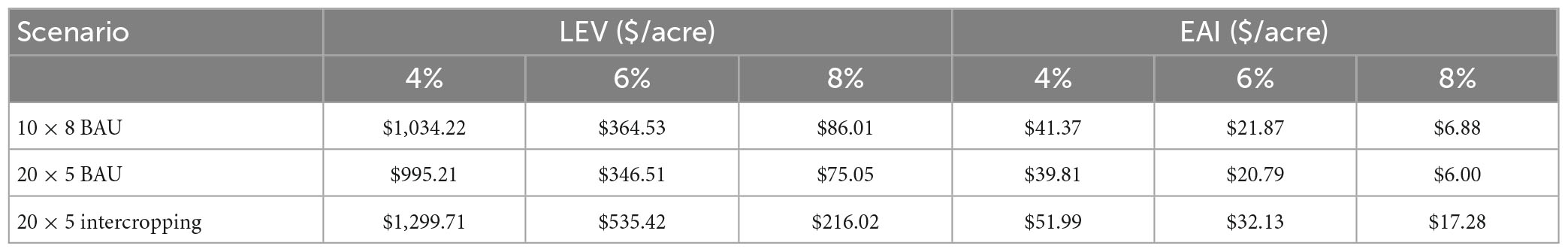

The estimated LEVs and equivalent EAIs from each scenario under three different discount rates are presented in Table 6. Consistent with the results from the NPV criterion, the 20 × 5 loblolly-hemp intercropping scenario is found to outperform the loblolly monoculture plantations. The estimated LEV for the 20 × 5 intercropping scenario is about 35% higher than the NPV for the same scenario at a 4% discount rate. The EAIs, which are equivalent to annual land rent, range from about $40/acre under 20 × 5 BAU scenario to $52 /acre under loblolly-hemp intercropping at 4% discount rate. Both LEVs and EAIs are found to decline substantially when the discount rate increases from 4 to 8%.

Table 6. Land expectation value (LEV) and equivalent annual income (EAI) of the evaluated scenarios under the discount rate of 4%, 6%, and 8%.

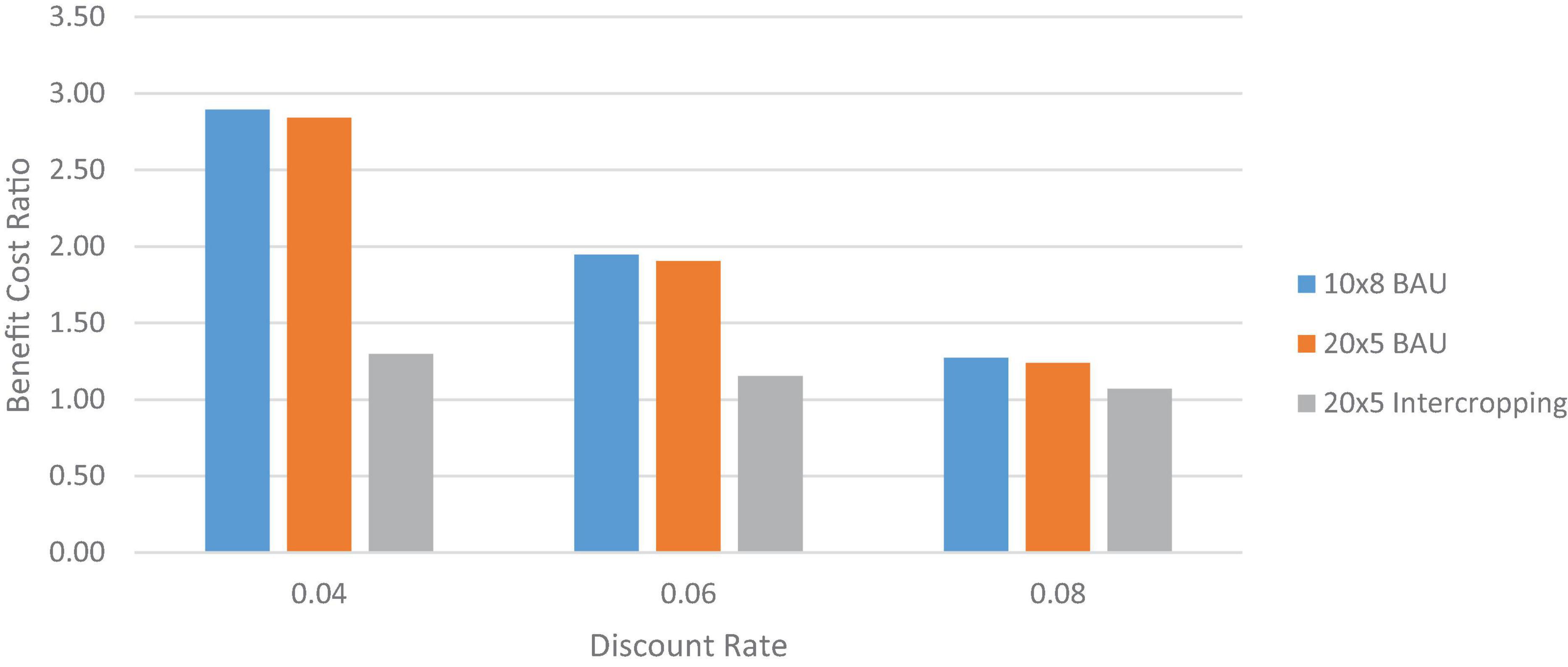

Figure 2 depicts the estimated BCR values associated with monoculture loblolly pine and hemp-loblolly intercropping scenarios under three discount rates. The estimated BCR values are consistently greater than one regardless of the combinations of a management scenario and interest rate. The BCR values are higher under the 10 × 8 pine monoculture scenario because pine plantations are less cost intensive than the row crops like industrial hemp. For instance, the total pine stand establishment costs including site preparation, seedling costs, and planting are usually around $200 per acre (Maggard, 2021), but growing hemp requires significant amounts of fixed and operating expenses as shown in Table 4. The estimated BCR value of 2.9 from the 10 × 8 BAU scenario infers that at 4% discount rate, every dollar invested in pine monoculture results in additional $1.9 in net return in the present value.

Figure 2. Benefit-Cost Ratio (BCR) from monoculture loblolly and intercropping scenarios under the discount rate of 4%, 6%, and 8%.

3.3. Loblolly-hemp intercropping under varying hemp productivity and market prices

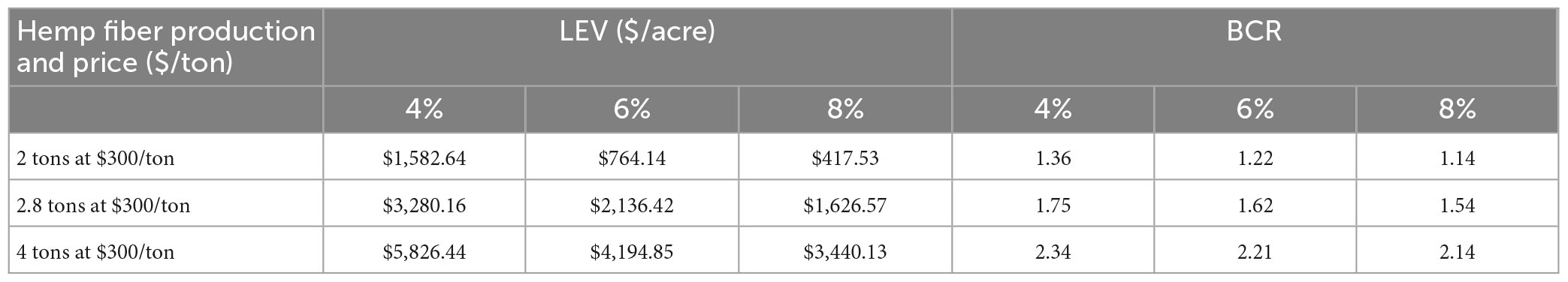

Given that the projected yield and market prices of industrial hemp vary widely as reported in various enterprise budgets, we conducted sensitivity analyses of the financial returns under various levels of hemp fiber yield and market price levels. The intercropping scenario is economically attractive with a higher market price of $300 per ton or $0.15 per lb even if the yield per season is 2 tons per acre (Table 7). The LEV could grow substantially if the yield increases from 2 tons to 2.8 tons/acre under the market price of $300/ton. This analysis suggests that the loblolly-hemp intercropping practice could be economically viable along with other complementary benefits from the interaction of the two crop systems.

Table 7. Financial analysis of loblolly-hemp intercropping under varying hemp production and price levels.

4. Discussion and conclusion

As federally reclassified and legalized by the 2018 Farm Bill, research opportunities for hemp have been greatly expanded in the last few years but knowledge on legal, agronomic, and economic challenges of growing industrial hemp in the U.S. is still limited (Mark et al., 2020). The main method of analysis used in this study was that of comparing business as usual (BAU) pine plantation scenarios to an intercropped scenario that conferred complimentary benefit to loblolly pine plantations but also entailed reduced yields for hemp due to reduction of arable land when intercropped with the long-term trees. Specifically, the results of this study indicate that hemp intercropping can provide greater economic benefit than BAU pine plantation management.

Based on capital budgeting analyses, we found that under the current market and productivity conditions along with underlying operating and fixed costs, loblolly pine and industrial hemp intercropping can provide greater benefit over standard, business as usual timber production practices. The early income generated from hemp cultivation not only increases the long-term efficacy of the investment, but also aids in offsetting the initial timber investment costs with early-rotation income from hemp for fiber. A significant portion of the land rent as a fixed cost (Table 4) could be avoided in the monoculture hemp system when the unused land between the rows of tree seedlings is widely available for the first 6 years. However, changes to market prices, other input costs such as fertilizer prices as well as market uncertainty can substantially alter the profitability of the intercropping scenario. Current fertilizer prices have, in some cases, more than tripled since the beginning of this study in 2020 reducing the revenue generated from growing hemp (Drotleff, 2022).

For this study, we assumed complimentary benefit for the pines but did not make any assumptions on how the hemp could be affected from intercropping with loblolly pine plantations. It is still not fully explored yet how hemp and loblolly pine would interact in an intercropped scenario. It is possible that complementary benefit for the hemp may be derived from this intercropping scenario. Previous studies have found various means by which agroforestry intercrops have conferred increased benefits from the interactions of the two crops. An analysis of a tropical agroforestry system found that the intercropping of Dalbergia sissoo (a N2-fixing tree), wheat, and Vigna sinensis (cowpea: a N2-fixing crop) improved soil organic matter, increased available soil nutrients, and enhanced soil microbial activity (Chander et al., 1998). Future field trials of loblolly-hemp intercropping will need to explore and identify the interactions between hemp and loblolly to ascertain any complimentary or competitive interactions between the two crops. Additionally, a future study should examine the benefit of winter legume cover cropping to offset nitrogen fertilizer inputs and enhance crop yields- an agronomic practice shown to provide these benefits to corn (Torbert et al., 1996). Leguminous cover cropping has been found to “improve nitrogen cycling and soil health while reducing the need for synthetic nitrogenous fertilizers” in agroforestry systems- a benefit that could aid substantially in combatting climbing fertilizer prices (Shults, 2017).

The success of an intercropping investment will be determined by the volume of hemp fiber produced. Should a competitive interaction between hemp and loblolly pine be found, it is possible that the resultant reductions in yield could render the investment infeasible. However, previous studies examining agroforestry intercropping have found various means by which complimentary benefit is conferred through intercropping, and several loblolly intercropping studies have evidenced independent interactions between loblolly and intercropped plants. As research and knowledge surrounding hemp cultivation continues to evolve through various experimental analyses, it is more likely that hemp yields may be increased through improved management techniques, such as crop rotations, or even the introduction of better hemp varieties suited for southeastern climates. While further research is required to understand the field interactions of pine and hemp intercropping, it appears likely that this agroforestry technique could be more financially profitable than the conventional monoculture pine plantation management techniques.

This study examines hemp growth and yields in an intercropped pine plantation through simulated data along with enterprise budget data of industrial hemp cultivation, as no field study for any form of hemp intercropping has been available yet. Due to its past, criminalized history there is very little knowledge or resources available for those who would grow or research hemp. Similarly, the novelty of this product has resulted in newly developing markets, which have crashed and fluctuated since their establishment. Moreover, recent, national sharp rises in fertilizer prices have also drastically affected the costs associated with growing hemp and many other crops. Additionally, genetic cultivars of hemp are limited, capping the potential of hemp to grow in warmer climates like the US Southeast or, potentially, to grow and thrive in intercropped environments. The uncertainty expressed through these knowledge gaps and the recent market fluctuations surrounding hemp cultivation have posed an issue in examining hemp returns now. Additionally, PTAEDA4.0 is a markedly conservative model that possesses certain limitations, especially regarding portraying agroforestry management. For example, beginning of rotation herbaceous control can only be expressed up to year two in this growth and yield model, whereas herbaceous control would be expressed throughout the 6 years of hemp cultivation. These simulations also produce conservative estimates of 20 × 5 ft growth and yield, with average tree diameters being considerably lower in the model than what could be expected from an actual 20 × 5 ft stand under similar site conditions.

Lastly, this study only examined one potential avenue of additional benefits from agroforestry practices in the long rotation. We theorized that hemp could be grown for the first 6 years before shading from canopy closure would begin to negatively affect hemp growth after which the stand would be managed as a pine monoculture. However, pine stands aged 7 years or older with a 20 × 5 ft spacing can often be managed as a silvopastoral system. Silvopasture, the inclusion of livestock within a forested system, was found to produce higher returns than any current conventional land use system in North Carolina (Chizmar et al., 2018; Bruck et al., 2019). These increased returns could be attributed to the enhanced productivity of both systems through complimentary benefits (Chizmar et al., 2018). There is potential for landowners to introduce silvopasture systems into their forested lands (themselves or through leases) after hemp intercropping is no longer feasible and receive further benefits from agroforestry practices throughout the pine rotation.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

TB, RP, ZL, and DS contributed to conception and design of the study. TB and RP organized the database and performed the statistical analysis with assistance from all authors and wrote the first draft of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

Funding

This research was funded by the National Need Fellowship from the United States Department of Agriculture, National Institute of Food and Agriculture, Award Number: 2020-38420-30717.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abernethy, A. (2019). Hemp production and the 2018 farm bill. Available online at: https://www.fda.gov/news-events/congressional-testimony/hemp-production-and-2018-farm-bill-07252019 (accessed July 25, 2019).

Akter, H. A., Dwivedi, P., Anderson, W., and Lamb, M. (2021). Economics of intercropping loblolly pine and oilseed crops for bio-jet fuel production in the Southern United States. Agrofor. Syst. 95, 241–255. doi: 10.1007/s10457-020-00584-5

Albaugh, J. M., Domec, J.-C., Maier, C. A., Sucre, E. B., Leggett, Z. H., and King, J. S. (2014). Gas exchange and stand-level estimates of water use and gross primary productivity in an experimental pine and switchgrass intercrop forestry system on the lower coastal plain of North Carolina, U.S.A. Agric. For. Meteorol. 192–193, 27–40. doi: 10.1016/j.agrformet.2014.02.013

Albaugh, J. M., Sucre, E. B., Leggett, Z. H., Domec, J.-C., and King, J. S. (2012). Evaluation of intercropped switchgrass establishment under a range of experimental site preparation treatments in a forested setting on the Lower coastal plain of North Carolina, U.S.A. Biomass Bioenerg. 46, 673–682. doi: 10.1016/j.biombioe.2012.06.029

Bruck, S. R., Bishaw, B., Cushing, T. L., and Cubbage, F. W. (2019). Modeling the financial potential of silvopasture agroforestry in Eastern North Carolina and Northeastern Oregon. J. For. 117, 13–20.

Buffinton, D. (2023). Conversion factors for English and SI (Metric) units. Available online at: https://extension.psu.edu/conversion-factors-for-english-and-si-metric-units (accessed April 13, 2023).

Bullard, S. H., and Straka, T. J. (2011). Basic concepts in forest valuation and investment analysis. Faculty Publications. Available online at: https://scholarworks.sfasu.edu/cgi/viewcontent.cgi?article=1460&context=forestry (accessed April 13, 2023).

Bullard, S. H., Gunter, J. E., Doolittle, M. L., and Arano, K. G. (2002). Discount rates for nonindustrial private forest landowners in Mississippi: how high a hurdle? South. J. Appl. For. 26, 26–31.

Bullock, D. G. (1992). Crop rotation. Crit. Rev. Plant Sci. 11, 309–326. doi: 10.1080/07352689209382349

Chander, K., Goyal, S., Nandal, D. P., and Kapoor, K. K. (1998). Soil organic matter, microbial biomass and enzyme activities in a tropical agroforestry system. Biol. Fertil. Soils 27, 168–172. doi: 10.1007/s003740050416

Cherney, J. H., and Small, E. (2016). Industrial hemp in North America: production, politics and potential. Agronomy 6:58. doi: 10.3390/agronomy6040058

Chizmar, S., Castillo, M., Pizarro, D., Vasquez, H., Bernal, W., Rivera, R., et al. (2020). A discounted cash flow and capital budgeting analysis of silvopastoral systems in the amazonas region of Peru. Land 9:353. doi: 10.3390/land9100353

Chizmar, S., Cubbage, F., Castillo, M., Sills, E., Abt, R., and Parajuli, R. (2018). “An economic assesment of silvopasture systems in the coastasl plain of North Carolina,” in Proceedings of the International Society of Forest Resource Economics 2018 Annual Meeting, Gatlinburg, TN.

Clarke, R. C. (2010). Traditional fiber hemp (cannabis) production, processing, yarn making, and weaving strategies—functional constraints and regional responses. Part 1. J. Nat. Fibers 7, 118–153. doi: 10.1080/15440478.2010.482324

de Oliveira, E. B., Schreiner, H. G., Graça, L. R., and Baggio, A. J. (1998). Intercropping of maize with loblolly pine in the state of Paraná, Brazil. Bol. Pesq. Flor. 37, 19–30.

Dhoubhadel, S. P. (2021). Challenges, opportunities, and the way forward for the U.S. hemp industry. Western economics forum, western agricultural economics association. Available online at: https://ideas.repec.org/a/ags/weecfo/315938.html (accessed January 19, 2023).

Dingha, B., Sandler, L., Bhowmik, A., Akotsen-Mensah, C., Jackai, L., Gibson, K., et al. (2019). Industrial hemp knowledge and interest among North Carolina organic farmers in the United States. Sustainability 11:2691. doi: 10.3390/su11092691

Drotleff, L. (2022). Fertilizer prices are through the roof. But hemp operators have sustainable ways to save. Hemp Industry daily. Available online at: https://hempindustrydaily.com/fertilizer-prices-are-through-the-roof-but-hemp-operators-have-sustainable-ways-to-save/ (accessed January 19, 2023).

ERS (2000). Industrial hemp in the United States: status and market potential. Econ. Res. Serv. 001E:43.

Fike, J. (2016). Industrial hemp: renewed opportunities for an ancient crop. Crit. Rev. Plant Sci. 35, 406–424. doi: 10.1080/07352689.2016.1257842

Hanchar, J. J. (2019). Economics of producing hemp in NY: fiber, grain, and dual purpose, projected costs and returns, preliminary 2020 budgets. College of Agriculture & Life Sciences. Available online at: https://hemp.cals.cornell.edu/resource/economics-producing-hemp-ny-fiber-grain-dual-purpose-projected-costs-returns-preliminary-2020-budgets/ (accessed March 15, 2023).

Idol, T. W. (2020). Example agroforestry systems. Available online at: https://www.ctahr.hawaii.edu/LittonC/PDFs/301_Agroforestry.pdf (accessed April 18, 2023).

Jeliazkov, V. D., Noller, J., Angima, S., Rondon, S., Roseberg, R., Summers, S., et al. (2019). What is industrial hemp? Oregon state university extension service. EM 9240. Available online at: https://catalog.extension.oregonstate.edu/sites/catalog/files/project/pdf/em9240.pdf (accessed January 19, 2023).

Maggard, A. (2021). Costs & trends of southern forestry practices 2020. Alabama cooperative extension system FOR-2115. Available online at: https://www.aces.edu/wp-content/uploads/2021/12/FOR-2115_CostsandTrendsofSouthernForestryPractices2020_121021L-G.pdf (accessed March 14, 2023).

Mark, T., Shepherd, J., Olson, D., Snell, W., Proper, S., and Thornsbury, S. (2020). Economic viability of industrial hemp in the United States: a review of state pilot programs, EIB-217. (Washington, DC: U.S. Department of Agriculture, Economic Research Service).

Martin-Guay, M.-O., Paquette, A., Dupras, J., and Rivest, D. (2018). The new green revolution: sustainable intensification of agriculture by intercropping. Sci. Total Environ. 615, 767–772. doi: 10.1016/j.scitotenv.2017.10.024

Massey, R., and Horner, J. (2021). Industrial hemp for fiber planning budget. University of Missouri Extension. Available online at: https://extension.missouri.edu/publications/g669 (accessed: July 1 2022).

Nair, P. K. R., Kumar, B. M., and Nair, V. D. (2021). “Definition and concepts of agroforestry,” in An introduction to agroforestry, ed. Springer (Cham: Springer). doi: 10.1007/978-3-030-75358-0_2

NCFS (2021). FY 2021-22 FDP prevailing rates. Forest development program. North Carolina Forest Service. Available online at: https://www.ncforestservice.gov/managing_your_forest/fdp.htm (accessed January 19, 2023).

NCSU Extension Forestry (2021). Quarterly price report: selling timber. NCSU Extension Forestry. Available online at: https://forestry.ces.ncsu.edu/forestry-price-data/ (accessed January 19, 2023).

Nseir, A. (2022). Value of hemp production totaled $824 million in 2021(News Release). National Agricultural Statistics Service (NASS). Available online at: https://www.nass.usda.gov/Newsroom/2022/02-17-2022.php (accessed January 19, 2023).

Pumariño, L., Sileshi, G. W., Gripenberg, S., Kaartinen, R., Barrios, E., Muchane, M. N., et al. (2015). Effects of agroforestry on pest, disease and weed control: a meta-analysis. Basic Appl. Ecol. 16, 573–582. doi: 10.1016/j.baae.2015.08.006

Savosnick, K. M. (1958). The box diagram and the production possibility curve. Ekonomisk Tidskrift 60, 183–197. doi: 10.2307/3438618

Shults, P. (2017). Exploring the benefits of cover crops to agroforestry tree plantations: an analysis of direct and indirect nitrogen transfer in alley cropping systems. Ph.D. thesis. East Lansing, ıMI: Michigan State University.

Steppler, H. A., and Nair, P. K. R. (eds) (1987). Agroforestry, a decade of development (ICRAF’s tenth anniversary 1977-1987). International Council for Research in Agroforestry. Available online at: http://apps.worldagroforestry.org/downloads/Publications/PDFS/B03842.pdf (accessed January 19, 2023).

Susaeta, A., Lal, P., Alavalapati, J., Mercer, E., and Carter, D. (2012). Economics of intercropping loblolly pine and switchgrass for bioenergy markets in the southeastern United States. Agrofor. Syst. 86, 287–298. doi: 10.1007/s10457-011-9475-3

Keywords: agroforestry, capital budgeting, breakeven analysis, hemp for fiber, intercropping

Citation: Barnes T, Parajuli R, Leggett Z and Suchoff D (2023) Assessing the financial viability of growing industrial hemp with loblolly pine plantations in the southeastern United States. Front. For. Glob. Change 6:1148221. doi: 10.3389/ffgc.2023.1148221

Received: 19 January 2023; Accepted: 14 April 2023;

Published: 02 May 2023.

Edited by:

Thomas J. Dean, Louisiana State University, United StatesReviewed by:

Antonio Carlos Ferraz Filho, Federal University of Piauí, BrazilStella Schons, Virginia Tech, United States

Copyright © 2023 Barnes, Parajuli, Leggett and Suchoff. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rajan Parajuli, cnBhcmFqdUBuY3N1LmVkdQ==

Thomas Barnes1

Thomas Barnes1 Rajan Parajuli

Rajan Parajuli David Suchoff

David Suchoff