- 1Huzhou Power Supply Company, State Grid Zhejiang Electric Power Co., Ltd, Huzhou, Zhejiang, China

- 2China Center for Energy Economics Research, School of Economics, Xiamen University, Xiamen, China

The impact of resource dependence on social economy and environment lacks empirical evidence at the micro level. This article uses data from A-share listed companies from 2011 to 2020 to construct an econometric model to empirically test the impact of resource dependence on ESG performance of enterprises. We find that the corporate ESG scores in regions with high resource dependence will decline. After a series of robustness tests such as replacing the dependent variable, controlling province time fixed effect, eliminating extreme effects, and eliminate provinces with high resource dependence, the conclusion of this article still holds. In addition, we alleviate the endogeneity problem caused by OLS estimation by constructing a dynamic panel model. Further analysis indicates that there are differences in the effect of resource dependence on enterprises sub-scores, with a significant negative impact on the environmental dimension and social dimension, and no significant impact on the governance dimension. It has a greater impact on the ESG score of SOEs and has no significant impact on non-SOEs. The empirical results of this paper enrich the research on the influencing factors of enterprise ESG performance, and further expand the research framework of the socio-economic consequences of enterprise resource dependence.

1 Introduction

For a long time, economists have launched a series of theoretical and empirical investigations on the “gospel theory” and “curse theory” of natural resource endowment. The “gospel theory” advocates that abundant natural resources are an important factor for economic growth, which is conducive to the rapid development of regional economy and the rapid accumulation of capital. According to the theory of new economic geography, the development of resource industries will attract the agglomeration of their upstream and downstream industries. The spatial agglomeration of industries saves transaction costs and helps to generate economies of scale, thereby promoting economic growth. Feyrer et al. (2017) used US data and found that resource extraction has a positive spillover effect on related industries. The benefits brought by the mining industry to the local area are higher than the mining costs. Resources are not a curse, but a blessing. Allcott and Keniston (2018) used micro data on the US manufacturing industry from 1969 to 2014 and found that resource prosperity contributes to the development of related manufacturing enterprises, while having no significant impact on non-related manufacturing enterprises. Asher and Novosad (2014) used data from India’s three economic censuses and instrumental variable method to study and found that the economic growth effect brought about by resource prosperity is extensive, with a positive spillover effect on surrounding towns 50km away from mines. The “curse theory” believes that regions with abundant resources will cause serious negative effects on long-term economic growth through intermediary crowding out effects (Gylfason, 2001), institutional deterioration effects (Bodea et al., 2016) and price fluctuation effects (Leong and Mohaddes, 2011; Su et al., 2023), which are not conducive to the sustainable development of local enterprises. On the other hand, the over-exploitation of natural resources will bring a series of environmental problems such as ecological environment damage and natural environment deterioration, and the efficiency of environmental pollution management varies greatly among regions (Zhao et al., 2022). Therefore, as the main body of pollution discharge and treatment, enterprises face many challenges in their development (Lin et al., 2021; Qin et al., 2022; Su et al., 2022a). In 2020, China has proposed the social and economic development goal of carbon peaking and carbon neutrality. In this context, higher demands are placed on corporate sustainability (Su et al., 2022b; Su et al., 2022c). Investors also incorporate the performance of enterprises in environmental and social aspects into their investment decision-making functions. Enterprise ESG index is the concrete embodiment of this emerging investment concept.

Enterprise ESG indicators are obtained by combining the performance of enterprises in three aspects: environmental, social and governance. In recent years, companies have shifted from the short-term goal of profit maximization to the long-term goal of sustainable ESG performance (Min and Mentzer, 2004; Studer et al., 2006). Stakeholder theory suggests that ESG emphasizes the coordinated development of economy, environment, and society, advocates long-term goal orientation, promotes the pursuit of maximizing social value by enterprises, and helps to build trust in uncertain environments; At the same time, enterprises actively practice the concept of sustainability, increase corresponding investments, and form ESG advantages, which have a strong externality on their own business development. ESG performance of enterprises has been a hot topic studied by many scholars in the past decade (Halbritter and Dorfleitner, 2015; Van Duuren et al., 2016; Gillan et al., 2021; Pedersen et al., 2021). The current empirical research on corporate ESG mainly focuses on two aspects: the economic impact of corporate ESG and the various factors that affect corporate ESG performance. Several studies showed that ESG has become an important source of corporate risk that can directly or indirectly affect a company’s financial performance as well as profitability (Friede et al., 2015; Aouadi and Marsat, 2018; Byun and Oh, 2018; Broadstock et al., 2021; Wong et al., 2021). For example, research by Cheng et al., (2014) and Ghoul et al. (2017) found that companies that focus on environmental, social and governance development are more likely to obtain financial resources needed for operating activities at a lower cost. In terms of factors influencing corporate ESG performance, some researchers have studied from the perspectives of socio-cultural and legal systems (Alsayegh et al., 2020; Chen et al., 2022) and internal corporate management factors (Cucari et al., 2018; McBrayer, 2018). The former includes factors such as the level of economic development (Cai et al., 2016), market liberalization (Chemmanur et al., 2020; Yang et al., 2022), social and media attention (Garcia et al., 2017; Burke, 2022), and the legal system (Liang and Renneboog, 2017). The latter includes factors as the board and CEO (Cronqvist and Yu, 2017; Hegde and Mishra, 2019), institutional investors (Dyck et al., 2019; Chen et al., 2020), and management tenure (McBrayer, 2018). For example, Doran and Ryan (2016) found that regulation and customer pressure are feasible mechanisms to encourage enterprises to fulfill social and environmental responsibilities, thus improving their ESG performance. This paper attempts to empirically study the relationship between resource dependence and corporate ESG performance from the perspective of the company’s external environment, that is, the resource dependence of the region where the company is located.

There is a large branch of literature revolving around the relationship between resource endowments and economic growth. Among them, the findings of Sachs and Warner, (1995) are the most representative. They selected the country-level variables of natural resources and economic growth, and studied the relationship between the two variables, finding that natural resources and economic growth were surprisingly negatively correlated, which overturned the traditional perceptions. Subsequently, Gylfason (2001); Papyrakis and Gerlagh, (2004) also found a monotonic negative relationship between resource stocks and economic growth in the long run for countries that use natural resources solely for economic development. There are also scholars who take a different view. For example, Boschini and Roine, (2007), Same (2008), and Haseeb et al. (2021) argue that natural resources are not the direct cause of the conundrum of economic growth problems in resource-based regions. A few studies have explored this issue from the perspective of corporate behavior. Torvik (2001) argues that in resource-rich countries, firms tend to engage in unproductive economic activities and benefit through rent-seeking, which is detrimental to economic growth. Lim and Morris (2022) found that state-owned enterprises can achieve higher-scale economies through production links with natural resources departments. In general, the existing research mainly verifies two questions: whether the resource curse exists and why it occurs. However, when investigating whether there is a resource curse in resource-based regions, we should not only consider the economic growth factor, the environmental consequences should be also included in the scope of the study (Boschni and Pettersson, 2007). Based on this, this paper comprehensively considers economic and environmental factors, and examines the impact of regional resource dependence caused by abundant resources on the ESG of its enterprises from the micro level.

The marginal contribution of this article is mainly reflected in the following aspects. Firstly, due to the fact that research on corporate ESG is still in its early stages, most studies on factors affecting corporate ESG are focused on the internal environment of the company. We discussed the impact of the external environment faced by the company, namely the resource dependence of the region where the company is located, on the ESG performance of the enterprise. This article explores the impact of enterprise resource dependence on its ESG performance from the perspective of enterprise resource acquisition, based on the theory of resource dependence. This article provides new empirical evidence for the literature on factors that affect corporate ESG performance. Secondly, current empirical studies on regional resource endowments and economic growth are mostly based on macro-level perspectives such as cross-country and domestic regions, while studies on resource endowments on micro-firm performance are still very limited. These studies have mostly focused on the economic performance of firms and rarely consider the environmental as well as social performance of firms. This paper provides micro-level evidence on this issue from the perspective of resource dependence on firm ESG performance. Last but not least, this paper further expands the research framework of the social and economic consequences of enterprise resource dependence. As an important consideration when making strategic decisions, resource dependence affects corporate social and environmental behavioral decisions, which in turn directly affects corporate ESG performance and has direct economic consequences.

Section 2 develops the theoretical hypothesis. Section 3 introduces the setting of the measurement model and the selection of variables. Section 4 shows the benchmark regression results and robustness test. Section 5 is a further analysis, exploring the impact of resource dependence on corporate ESG sub-score and the heterogeneity of the nature of enterprise ownership. Section 6 summarizes and puts forward policy recommendations and research prospects.

2 Theoretical hypothesis

“Resource curse” theory suggests that abundant natural resources do not show a significant contribution to economic development, but rather a hindering effect. Numerous studies have shown that the crowding out effect of natural resources on investment in technology innovation and human capital leads to the occurrence of the resource curse (Gylfason, 2001). Due to the economic division of labor and long-term path dependence, regions with higher natural resource abundance are more likely to move towards a resource-dependent economic development path. The more resource-rich regions have labor-intensive attributes, and the local production is characterized by low-technology content (Ethier, 1985). Resource-dependent firms tend to aim for high revenues in the short term by engaging in production activities that consume large amounts of natural resources, such as extraction the primary processing. These firms are usually less exposed to low growth and technology, and thus less motivated to invest in technology development (Li et al., 2020). The high income of the resource sector attracts more labor and capital, accelerating the transfer of funds from R&D to the primary product sector, causing the aggravation of the resource mismatch problem, which is not conducive to the technological innovation of enterprises, and to a certain extent hinders the green development of enterprises. Fulfillment of social, environmental and governance responsibilities by enterprises is an activity with significant externalities and high costs, and investors’ investment decision was made based on corporate ESG performance (Crifo et al., 2015; Alsayegh et al., 2020). Sufficient production resource guarantee enables enterprises to obtain higher revenues and achieve rapid development in the short term, with little demand for external investors. Therefore, enterprises with strong resource dependence lack the incentive to fulfill their social, environmental and governance responsibilities. On the other hand, resource-dependent enterprises usually adopt a crude production model with high input, high consumption, high pollution and low technological level. And their production activities are often accompanied by greater environmental destructiveness and difficulty in safe production, with high environmental management costs (Song et al., 2022). In areas of low resource abundance and dependence, firms are limited in their activities to obtain resources from external sources and rely more on resource accumulation and internal capital allocation, as well as technological innovation and organizational change to create opportunities (Zhang et al., 2022). At the same time, the low abundance and low dependence environment intensifies competition. At a time when low carbon development and environmental issues are widely emphasized, companies need to actively fulfill their social and environmental responsibilities and improve their ESG performance to gain an advantageous position in the market. Based on the above analysis, the rising dependence of companies on resources is not conducive to enhancing the fulfillment of integrated social, environmental and governance performance. Therefore, hypothesis one of this paper is proposed.

Hypothesis 1: The dependence of enterprises on resources is mainly characterized by the “resource curse”, which has a negative impact on the environmental, social and governance performance of enterprises.

Resource dependency is mainly reflected in the degree of importance and intensity of influence of resource-based industries on the industrial structure, employment structure, level of technological progress, development speed and direction of the regional economy, which means the level of status and role of resource-based industries in the regional economic development. Although natural resources can bring direct or indirect benefits to society (Pan et al., 2022), excessive dependence on natural resources and resource-based industries can create a “resource curse” effect (Gylfason and Zoega, 2006; Brunnschweiler and Bulte, 2008), and the long-term dependence of the production process on resources will squeeze out R&D activities and cause the outflow of technological factors, which is not conducive to the innovation of energy-saving and environmental protection technologies. In addition, in terms of the regional distribution characteristics of natural resources in China, the degree of marketization in areas with high resource dependence is relatively low, so in terms of marketization environment, compared to areas with low resource dependence, enterprises in areas with high resource dependence have less incentive to innovate and their technological innovation level is relatively low. On the other hand, the crude production of resource-dependent enterprises is accompanied by a large amount of pollution emissions, and the technological base is not sufficient to compensate for the environmental management costs of the enterprises; therefore, the resource dependence of enterprises is not conducive to the fulfillment of their environmental responsibilities.

Enterprises are the main body of social responsibility. Social responsibility refers to the active engagement in socially responsible behavior that goes beyond the economic and legal requirements of the firm (Wood, 1991), and refers to the need for firms to take social responsibility for employees, consumers, suppliers, communities, and the environment in addition to generating profits and taking economic responsibility for shareholders (Clarkson, 1995), The resource-based theory suggests that whether a company takes more social responsibility depends on its own resources and capabilities (Barney, 1991; Grant, 1991; Hart, 1995), and that it is difficult for a company to meet the demands of all stakeholders at the same time due to limited financial resources. Resource dependence theory suggests that among many stakeholders, a firm will first focus on and deal with the interests of those who hold key resources to ensure its continued survival, and effective corporate governance is a necessary factor in the firm’s goal of maximizing profits. For resource-dependent enterprises, in addition to improving the efficiency of corporate governance, their long-term path dependence on resources as the main factor for production, as well as the high income of the resource sector itself is more attractive to factors of production such as labor, social responsibility-related interest holders will not affect the development of the enterprise to a certain extent, therefore, enterprises lack the motivation and incentive to fulfill social responsibility. Moreover, the pollution effect generated by the crude development mode of resource-dependent enterprises has strong negative externality and adversely affects the living environment of the surrounding residents; therefore, the increase of resource dependence has a hindering effect on the performance of corporate social responsibility. Based on the above analysis, the increase of resource dependency of enterprises will reduce the environmental and social performance of enterprises, while the effect on corporate governance is not obvious. Therefore, the second hypothesis of this paper is proposed.

Hypothesis 2: The inhibitory effect of increased resource dependence on corporate ESG performance is mainly reflected in the hindering effect on corporate fulfillment of social and environmental responsibilities.

State-owned enterprises (SOEs) are the mainstay of the national economy and an important subject responding to various national policies. Their main purpose is not to maximize corporate profits, but to maximize the welfare of the whole society. As important bearers of social responsibility, they are responsible for society and the environment in the process of production and operation, and maximize the creation of comprehensive economic, social and environmental value to promote the sustainable development of the national economy. However, SOEs are owned by the local government, which makes it easier to obtain rent-seeking benefits and reduces the motivation of enterprises to build their own capabilities. Therefore, they are less efficient than non-SOEs (Nie and Jia, 2011). Moreover, most SOEs belong to energy industries such as power supply industry, oil and gas extraction industry, which consume more resources and emit more pollution. They enjoy government guarantees and financial support, and have many ways to obtain resources with less difficulty. Therefore, it is easier to form a resource-dependent development path and lack the motivation for technological innovation and green transformation. For non-SOEs, social, environmental and governance performance are important factors in attracting investors. In the fierce market competition, non-SOEs whose main goal is profit maximization have an accumulating effect (Huang et al., 2022), which makes them more motivated to fulfill their social and environmental responsibilities and improve their corporate governance efficiency. Based on the above analysis, the negative effect of resource dependence on the ESG rating of enterprises is mainly reflected in SOEs. Therefore, the third hypothesis of this paper is proposed.

Hypothesis 3: The effect of resource dependence on ESG performance is non-consistent for firms with different ownership properties, and the negative effect is particularly pronounced for state-owned enterprises.

3 Empirical strategy and data sources

3.1 Data sources

This paper uses the data of China’s A -share listed companies as a research sample. Among them, the corporate ESG data comes from Bloomberg Financial Terminal, and the rest of the data comes from the Wind database, China Stock Market & Accounting Research Database (CSMAR) and national statistics Bureau, etc. Before the empirical analysis, preliminary screening and processing of sample data are carried out: companies in the financial industry are excluded; ST companies are excluded; companies whose ESG scores are missing values are excluded; companies whose main financial management data are missing values are excluded. Based on data availability and excluding the impact of the 2008 financial crisis, this article has chosen 2011-2020 as the research interval for this article.

3.2 Model and variables

Using the data of all A-share listed companies from 2011 to 2020, this paper constructs the following measurement model to examine the relationship between resource dependence and corporate ESG scores. The baseline estimation model used in this paper is as follows:

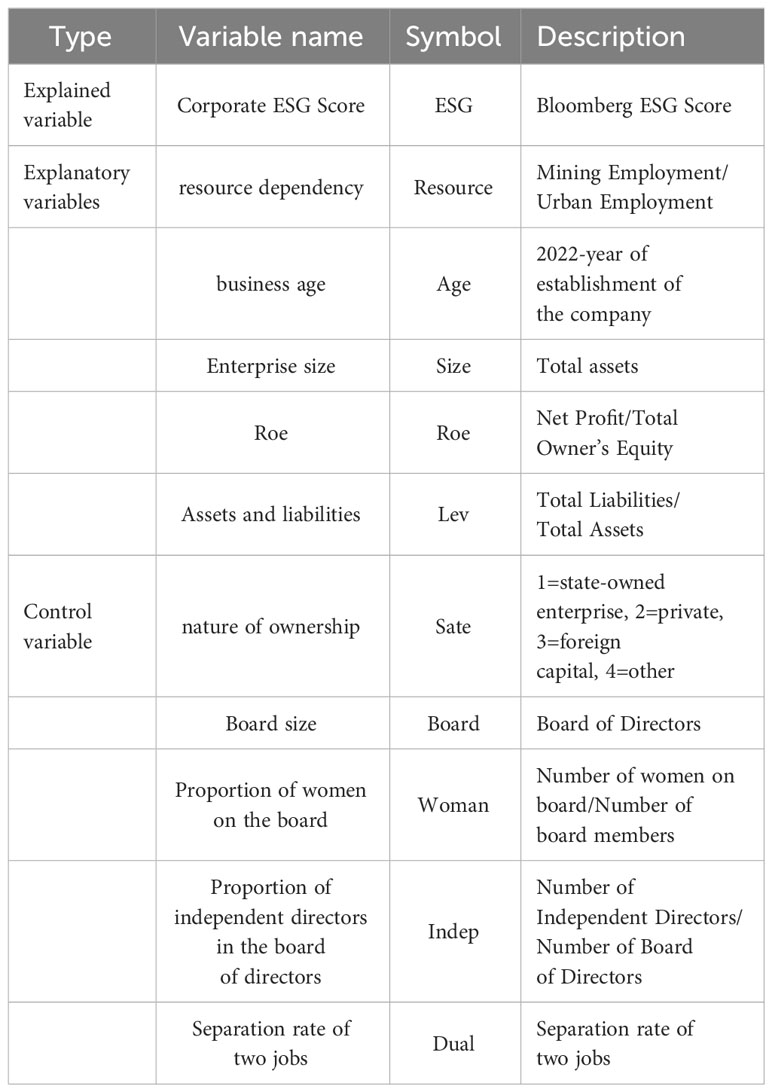

Among them, indicates ESG score of corporate i in year t, using Bloomberg ESG score. Since 2009, Bloomberg has collected information on environmental, social and governance disclosures of listed companies, and based on this, a comprehensive ESG score and three sub-scores have been formed, representing the overall ESG performance of listed companies and the sub-performance of environmental, social and governance. Bloomberg ESG scores range from 0-100, representing a scale from “disclosing the least amount of ESG data points” to “disclosing every ESG data point collected by Bloomberg”. The higher the score, the better the corporate ESG performance. represents the resource dependence at the provincial level. Previous studies have used indicators such as the proportion of fixed asset investment in the extractive industry (Xu and Wang, 2006) and the proportion of the mining industry in the total population (Li and Zou, 2018) to measure resource dependence. Drawing on Hu and Yan, (2019), we use the ratio of the employed population in the mining industry to the total urban employed population as a proxy variable. In order to avoid potential heteroscedasticity and skewness problems, we take the logarithm of this ratio. is the industry fixed effect, and is the year dummy variable. represents the control variables at the enterprise level. This paper draws on the research of Harjoto and Wang (2020) and selects the control variables according to other factors that may affect the ESG performance of enterprises: enterprise age, enterprise size, return on equity, asset-liability ratio, enterprise ownership nature, board size, proportion of female directors in the board of directors, proportion of independent directors in the board of directors, and separation rate of two positions. The definitions of the variables are shown in Table 1.

4 Empirical results

4.1 Descriptive statistics

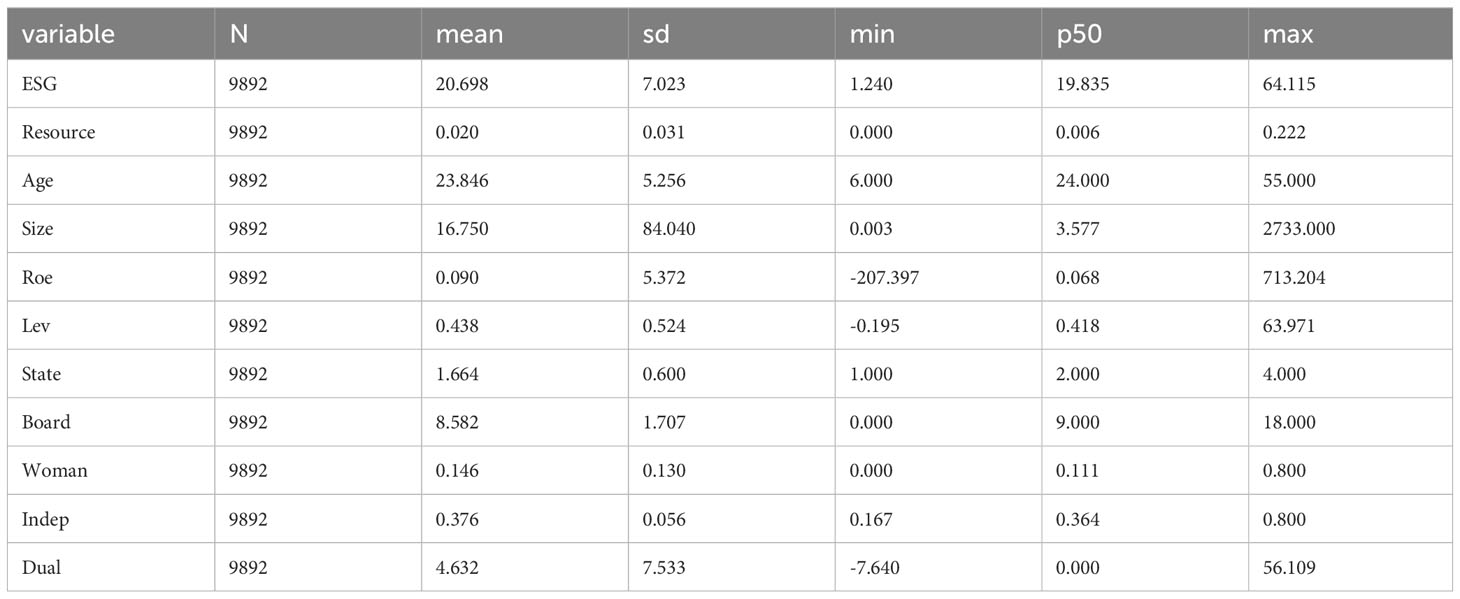

The descriptive statistics of the variables are shown in Table 2. In all samples, the mean value of corporate ESG score is 1.240, which is far lower than the median of 19.835, indicating that the ESG evaluation of sample companies is average and needs to be further improved. At the same time, the maximum value of the ESG score of the sample companies is 64.115, the minimum value is 1.240, and the standard deviation is 7.023. It can be seen that there are great differences in the ESG scores among the sample companies.

4.2 Benchmark regression results

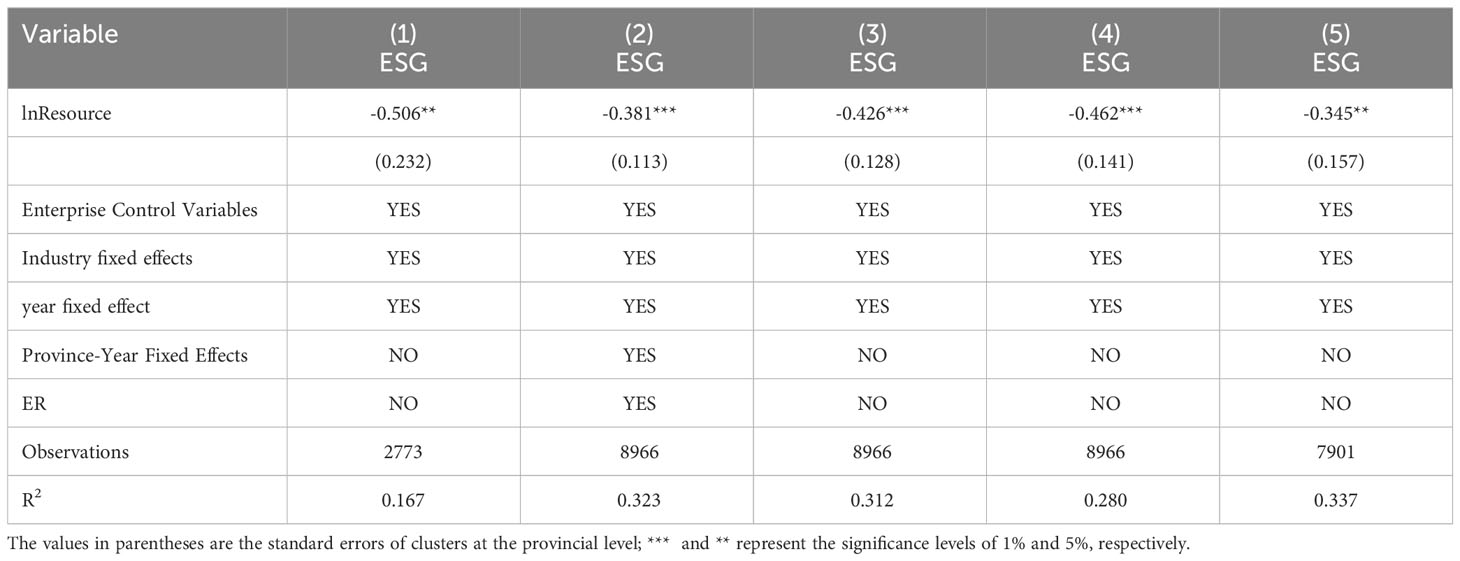

This part conducts regression analysis on the correlation between enterprise ESG score and resource dependence according to Equation 1, and the results are listed in Table 3. Column (1) is the regression result that only controls the industry-fixed effect. The regression result shows that resource dependence has a significant negative impact on the ESG score of enterprises. Column (2) further controls the year-fixed effect, and the coefficient of resource dependence is still significantly negative at the 5% level. Column (3) adds a series of control variables, and the coefficient is still significantly negative at the 1% level. The benchmark regression results show that resource dependence has a strong explanatory power on corporate ESG scores, that is, companies in areas with high resource dependence have worse ESG performance and sustainable development. From Table 3, the estimated value of the coefficient for resource dependency is 0.420, it means for every 10% increase in resource dependence, the ESG score of the enterprise decreases by 0.04%.

As far as the coefficients of the control variables are concerned, the coefficient of lnSize is positive and significant at the 1% level, indicating that larger firms are more likely to have the advantage of economies of scale and thus perform better in ESG scores. The coefficient of lnAge is significantly positive at the level of 1%, which indicates that the older the enterprise is, the stronger its motivation to pursue sustainability and the better its ESG performance. The coefficient of lnROE is significantly positive, which indicates that good company operations are conducive to improving a corporate ESG performance. The coefficient of lnLev is significantly negative at the level of 1%, which indicates that the higher the ratio of total liabilities to total assets, the less incentive a company has to improve its ESG performance. In addition, the significant positive correlation between Indep and the ESG score of the company indicates to some extent that independent directors play an important role in the long-term development of the company.

4.3 Robustness test

4.3.1 Replace the measurement of the explained variable

In order to test the reliability of the relationship between resource dependence and enterprise ESG score, we replace the measurement method of the explained variable to test the robustness. We use the ESG rating data of SynTao Green Finance as the proxy variable of enterprise ESG. Due to data availability, the time frame here is 2015-2020. Since 2015, SynTao Green Finance’s ESG rating has been used to rate the ESG performance of listed companies based on the public information of listed companies and the announcement documents of regulatory authorities. It is constructed from 3 primary indicators (environmental, social and governance), 13 secondary indicators and multiple tertiary indicators, which can comprehensively reflect the ESG performance of listed companies. The rating of SynTao Green Finance consists of ten grades: A+, A, A-, B+, B, B-, C+, C, C-, and D. We assign 1-10 to these ten grades from low to high. The first column of Table 4 is the regression result of SynTao Green Finance ESG rating as the explained variable. The regression result shows that the coefficient of resource dependence is still significantly negative, which is consistent with the benchmark regression result.

4.3.2 Controlling province-time fixed effect

Although we control for a range of control variables at the firm level, provincial-level influences on corporate ESG performance may still be missed in the benchmark regression analysis because our explanatory variables are resource-dependent data at the provincial level. Provinces may have different economic development trends and social environments over time. For example, provincial-level environmental regulations may impose energy-saving and emission reduction constraints on local enterprises, thereby affecting their ESG performance. Therefore, we will incorporate provincial-level environmental regulations (ER, ER is measured by the chemical oxygen demand emissions in the province where the enterprise is located) into the model for regression analysis. In addition, to avoid the impact of other provincial level economic and social environments that change over time on corporate ESG, we further add the interaction term of province and year to the model for regression analysis. The results in column (2) of Table 4 show that after controlling for the ER and province-year fixed effect, the coefficient of resource dependence is still significantly negative at the 1% level.

4.3.3 Eliminating extreme effects

Winsorization is a commonly used method for robustness testing, which replaces values beyond the set percentile with values at the percentile to effectively avoid the impact of extreme values on the model estimation results. This article winsorize 1% and 5% for continuous variables, and then re-regresses using the winsorized variable values. According to the regression results in columns (3) and (4) of Table 4, the estimated coefficient of resource dependence is significantly negative at the 1% level. Therefore, the conclusion that resource dependence has a negative impact on corporate ESG performance is still robust and reliable after eliminating extreme effects.

4.3.4 Eliminate provinces with high resource dependence

China has a vast territory, and the distribution of natural resources is very unbalanced among regions. There are many resource-based cities in the central and western regions. At the same time, from the descriptive statistical results, there is a large gap between the median and the maximum resource dependence level. In order to avoid the influence of extreme values on the benchmark regression results, we exclude resource-dependent provinces from the sample. The criteria for the exclusion of resource-based provinces here are first to select the first few provinces in descending order of the proportion of the mining industry in urban employment, and then refer to the list of national resource-based cities in the National Sustainable Development Plan for Resource-based Cities (2013-2020). Provinces with more resource-based cities and districts are supplemented. Finally, we exclude Shanxi, Liaoning, Xinjiang, Qinghai, Inner Mongolia, Heilongjiang, Guizhou, Shaanxi, and Ningxia for regression. The regression results are shown in Column (5) of Table 4. We can find that the coefficient of resource dependence is still significantly negative at the 1% level.

5 Further analysis

5.1 Dynamic panel model

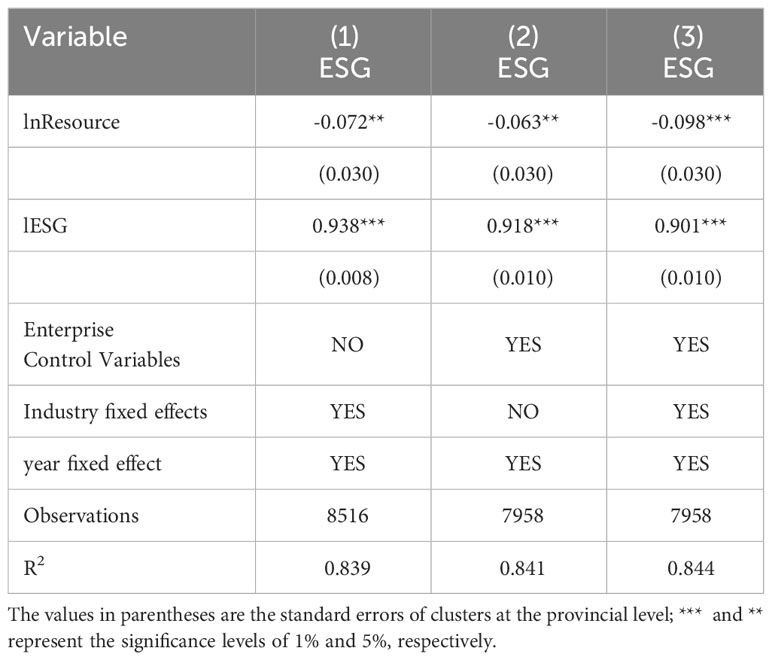

Due to the impact of previous ESG performance on current ESG performance, we use a dynamic panel model to measure the relationship between resource dependence and enterprise ESG performance through generalized moment estimation, in order to reduce estimation bias. In Equation 2, is the estimation coefficient, and represents a period of lag in the enterprise’s ESG, this variable can be set to control for the endogeneity caused by lagging ESG; is the estimated coefficient we are interested in. From the results in Table 5, the econometric results of generalized moment estimation show that the impact of resource dependence on firm’s ESG is still negative and significant.

5.2 The sub-item impact of resource dependence on ESG

Enterprise ESG indicators are composed of three aspects: environment, society and governance. Therefore, in order to uncover the black box of the impact of resource dependence on ESG performance, we regressed the three sub-indicators to resource dependence. The sub-item data of corporate ESG adopts the data of Bloomberg Financial Terminal, and the sample interval is 2011-2020. Referring to the method of Harjoto and Wang (2020), we construct the econometric model as Equation 3:

The explained variables are the sub-score of corporate environment, sub-score of corporate society and sub-score of corporate governance, and the control variables are the same as the benchmark regression model. The itemized regression results are shown in Table 6.

Column (1) of Table 6 is the regression result of ESG comprehensive score on resource dependence. Columns (2) - (4) are the regression results of the sub-scores of environment, society and governance on the resource dependence, respectively. The regression result in Column (2) is significantly negative and the absolute value of the coefficient is larger than that in Column (1), which indicates that the environmental performance of enterprises in regions with high resource dependence is poor. Similarly, the regression result of Column (3) is also significantly negative, and the absolute value of the coefficient is greater than the first two columns, indicating that corporate social performance in regions with higher resource dependence is worse. This may be due to the fact that firms in these regions face greater challenges in environmental and social dimensions. The coefficient in Column (4) is not significant, which shows that resource dependence has no impact on the corporate governance dimension, indicating that corporate governance is still more affected by internal factors.

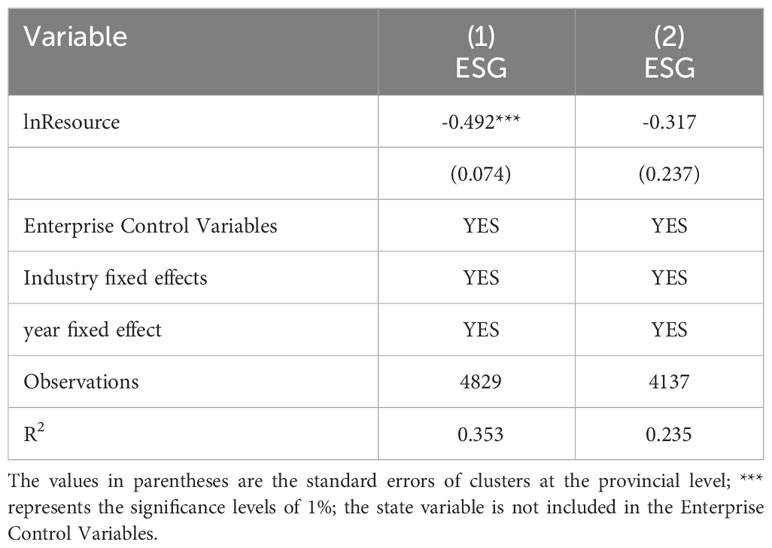

5.3 Heterogeneity in enterprise ownership

Compared with non-SOEs, SOEs are more affected by the local resources and environment, and thus the ESG performance of SOs may be more vulnerable to the impact of resource dependence. Based on this, this paper further explores the heterogeneous impact of resource dependence on ESG performance from the perspective of the nature of enterprise ownership. Column (1) of Table 7 shows the regression results of SOEs. It shows that the coefficient of resource dependence is significantly negative at the level of 1%, which indicated the ESG performance of SOEs is more affected by the local resource endowment. As for non-SOEs, they are more affected by market competition, and therefore pay more attention to their investment value. Non-SOEs are more motivated to win the favor of investors through good ESG performance. Therefore, investors’ attention to enterprise ESG performance will encourage non-SOEs to improve their ESG scores.

6 Conclusion

This article uses data from A-share listed companies from 2011 to 2020 to find that the higher the resource dependence of the company’s location, the worse the ESG performance of the enterprise. This conclusion still holds after a series of robustness tests. Through regression analysis of regional resource dependence from three dimensions: environment, society, and governance, it was found that resource dependence has a significant negative impact on environmental and social performance. In areas with high resource dependence, the negative impact on enterprises may outweigh the growth effect brought by resources. The sub sample regression results based on the nature of enterprise ownership indicate that the resource dependence of state-owned enterprises has a significant negative impact on their ESG scores. However, no significant correlation was found in the sample of non-state-owned enterprises. The reason may be that non-state-owned enterprises are more actively seeking the comprehensive development of ESG due to fierce market competition and financing pressure, offsetting the negative impact of resource dependence.

Based on the above analysis, we propose the following suggestions: Firstly, the particularity of the development of resource dependent regions determines that we cannot rely solely on market tools to enhance the enthusiasm and initiative of enterprises to fulfill social and environmental responsibilities. Government support and policy guidance are the practical conditions for promoting green transformation of enterprises. At the macro policy level, it is necessary to further enhance the stability of policies, form a foreseeable long-term benefit driven mechanism for the green transformation and development of enterprises, make improving social and environmental performance a consensus for the development of resource-based enterprises, and reduce the short-term risks and costs of companies fulfilling social and environmental responsibilities. At the micro policy level, in the short term, it is necessary to reduce the costs, risks, and uncertainties of implementing green transformation and fulfilling social and environmental responsibilities for high resource dependent enterprises through tilted allocation of production factors, tax incentives, and subsidies, so as to provide stable profit margins for enterprises that actively fulfill social and environmental responsibilities. At the local government level, it is necessary to continuously improve the software and hardware infrastructure of resource-based areas, actively promote the development of non resource-based enterprises, and reduce the resource dependence of regional development and the opportunity cost of green development for enterprises. Secondly, from the perspective of the capital market, relevant financial institutions should further improve their ESG ratings to provide investors with a reliable value investment foundation, thereby pointing the direction for the sustainable development of enterprises. Again, from the perspective of enterprises, resource-based state-owned enterprises are the economic mainstay of resource-based regions and the guarantee of national resource and energy strategic security. They will inevitably undertake new historical missions in the context of low-carbon transformation. On the one hand, resource-based state-owned enterprises need to improve resource utilization efficiency, enhance resource recycling level, achieve green transformation, and better fulfill social and environmental responsibilities. On the other hand, resource-based state-owned enterprises are large and strong. They should effectively drive the social and environmental performance of industries, improve the efficiency of industrial green transformation, drive the development of resource-based regional green transformation, and improve the regional environment through the positive externalities generated by their own green transformation.

This article attempts to analyze in depth the impact of resource dependence on corporate social and environmental performance when studying the relationship between resource dependence and corporate behavior. Some conclusions have been drawn, which are consistent with the research results of relevant literature and provide reference for future research ideas and directions. With the deepening of research on enterprise resource dependence and social environmental behavior, it is necessary to improve research methods and incorporate more influencing factors, mechanism channels, and situational factors into the analysis framework. For example, the micro mechanism of the impact of resource dependence on corporate ESG performance can be explored through field research. In addition, the theoretical model of resource dependent corporate behavior still needs further expansion. The vast majority of literature typically only considers one type of corporate behavior, and there are few studies that comprehensively consider the comprehensive impact of multiple corporate behaviors. Therefore, establishing a unified theoretical framework that considers the interaction between resource dependent corporate behavior from three aspects: social, environmental, and corporate governance, and measuring its relative importance, is an important direction for future research.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

YF: Formal Analysis, Methodology, Software, Writing – original draft. LF: Investigation, Software, Writing – review & editing. ZL: Methodology, Supervision, Validation, Writing – review & editing. WL: Conceptualization, Data curation, Writing – original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

Authors YF, LF, and ZL were employed by Huzhou Power Supply Company, State Grid Zhejiang Electric Power Co., Ltd.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

This study was supported by the Huzhou Power Supply Company research project “Research on ESG Evaluation Index System of Electric Power Enterprises”.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Allcott H., Keniston D. (2018). Dutch disease or agglomeration? The local economic effects of natural resource booms in modern America. Rev. Economic Stud. 85 (2), 695–731. doi: 10.1093/restud/rdx042

Alsayegh M. F., Abdul Rahman R., Homayoun S. (2020). Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 12 (9), 3910. doi: 10.3390/su12093910

Aouadi A., Marsat S. (2018). Do ESG controversies matter for firm value? Evidence from international data. J. Business Ethics 151 (4), 1027–1047. doi: 10.1007/s10551-016-3213-8

Asher S., Novosad P. (2014). “Digging for development: Mining booms and local economic development in India,” in Technical Report. Working Paper (Oxford University).

Barney J. (1991). Firm resources and sustained competitive advantage. J. Manage. 17 (1), 99–120. doi: 10.1177/014920639101700108

Bodea C., Higashijima M., Singh R. J. (2016). Oil and civil conflict: Can public spending have a mitigation effect? World Dev. 78, 1–12. doi: 10.1016/j.worlddev.2015.09.004

Boschini A. D., Roine P. J. (2007). Resource curse or not: a question of appropriability. Scandinavian J. Economics 109 (3), 593–617. doi: 10.1111/j.1467-9442.2007.00509.x

Broadstock D. C., Chan K., Cheng L. T., Wang X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi: 10.1016/j.frl.2020.101716

Brunnschweiler C. N., Bulte E. H. (2008). The resource curse revisited and revised: A tale of paradoxes and red herrings. J. Environ. economics Manage. 55 (3), 248–264. doi: 10.1016/j.jeem.2007.08.004

Burke J. J. (2022). Do boards take environmental, social, and governance issues seriously? Evidence from Media Coverage and CEO Dismissals. J. Business Ethics 176 (4), 647–671. doi: 10.1007/s10551-020-04715-x

Byun S. K., Oh J. M. (2018). Local corporate social responsibility, media coverage, and shareholder value. J. Banking Finance 87, 68–86. doi: 10.1016/j.jbankfin.2017.09.010

Cai Y., Pan C. H., Statman M. (2016). Why do countries matter so much in corporate social performance? J. Corporate Finance 41, 591–609. doi: 10.1016/j.jcorpfin.2016.09.004

Chemmanur T. J., Jiang D., Li W., Pittman J., Wang Z. T. (2020). Stock Market Liberalization and Corporate Social Responsibility: Evidence From a Quasi-Natural Experiment in China. doi: 10.2139/ssrn.1885569

Chen T., Dong H., Lin C. (2020). Institutional shareholders and corporate social responsibility. J. Financial Economics 135 (2), 483–504. doi: 10.1016/j.jfineco.2019.06.007

Chen Y. P. V., Zhuo Z., Huang Z., Li W. (2022). Environmental regulation and ESG of SMEs in China: Porter hypothesis re-tested. Sci. Total Environ. 850, 157967. doi: 10.1016/j.scitotenv.2022.157967

Cheng B., Ioannou I., Serafeim G. (2014). Corporate social responsibility and access to finance. Strategic Manage. J. 35 (1), 1–23. doi: 10.1002/smj.2131

Clarkson M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Acad. Manage. Rev. 20 (1), 92–117. doi: 10.5465/amr.1995.9503271994

Crifo P., Forget V. D., Teyssier S. (2015). The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. J. Corporate Finance 30, 168–194. doi: 10.1016/j.jcorpfin.2014.12.006

Cronqvist H., Yu F. (2017). Shaped by their daughters: Executives, female socialization, and corporate social responsibility. J. Financial Economics 126 (3), 543–562. doi: 10.1016/j.jfineco.2017.09.003

Cucari N., Esposito de Falco S., Orlando B. (2018). Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corporate Soc. Responsibility Environ. Manage. 25 (3), 250–266. doi: 10.1002/csr.1452

Doran J., Ryan G. (2016). The importance of the diverse drivers and types of environmental innovation for firm performance. Business strategy Environ. 25 (2), 102–119. doi: 10.1002/bse.1860

Dyck A., Lins K. V., Roth L., Wagner H. F. (2019). Do institutional investors drive corporate social responsibility? International evidence. . J. financial economics 131 (3), 693–714. doi: 10.1016/j.jfineco.2018.08.013

Feyrer J., Mansur E. T., Sacerdote B. (2017). Geographic dispersion of economic shocks: Evidence from the fracking revolution. Am. Economic Rev. 107 (4), 1313–1334. doi: 10.1257/aer.20151326

Friede G., Busch T., Bassen A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. finance investment 5 (4), 210–233. doi: 10.1080/20430795.2015.1118917

Garcia A. S., Mendes-Da-Silva W., Orsato R. J. (2017). Sensitive industries produce better ESG performance: Evidence from emerging markets. J. cleaner production 150, 135–147. doi: 10.1016/j.jclepro.2017.02.180

Ghoul S. E., Guedhami O., Kim Y. (2017). Country-level institutions, firm value, and the role of corporate social responsibility initiatives. J. Int. Business Stud. 48 (3), 360–385. doi: 10.1057/jibs.2016.4

Gillan S. L., Koch A., Starks L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corporate Finance 66, 101889. doi: 10.1016/j.jcorpfin.2021.101889

Grant R. M. (1991). The resource-based theory of competitive advantage: implications for strategy formulation. California Manage. Rev. 33 (3), 114–135. doi: 10.2307/41166664

Gylfason T. (2001). Natural resources, education, and economic development. Eur. economic Rev. 45 (4-6), 847–859. doi: 10.1016/S0014-2921(01)00127-1

Gylfason T., Zoega G. (2006). Natural resources and economic growth: The role of investment. World Economy 29 (8), 1091–1115. doi: 10.1111/j.1467-9701.2006.00807.x

Halbritter G., Dorfleitner G. (2015). The wages of social responsibility—where are they? A critical review of ESG investing. Rev. Financial Economics 26, 25–35. doi: 10.1016/j.rfe.2015.03.004

Harjoto M. A., Wang Y. (2020). Board of directors network centrality and environmental, social and governance (ESG) performance. Corporate Governance: Int. J. Business Soc. 20 (6), 965–985. doi: 10.1108/CG-10-2019-0306

Hart S. L. (1995). A natural-resource-based view of the firm. Acad. Manage. Rev. 20 (4), 986–1014. doi: 10.5465/amr.1995.9512280033

Haseeb M., Kot S., Iqbal-Hussain H., Kamarudin F. (2021). The natural resources curse-economic growth hypotheses: quantile-on-quantile evidence from top asian economies. J. Cleaner Production 279, 123596. doi: 10.1016/j.jclepro.2020.123596

Hegde S. P., Mishra D. R. (2019). Married CEOs and corporate social responsibility. J. Corporate Finance 58, 226–246. doi: 10.1016/j.jcorpfin.2019.05.003

Hu Y., Yan T. H. (2019). Resource dependency: curse on growth or poverty? China Population Resources and Environment 29(4), 137–46.

Huang H., Mbanyele W., Wang F., Song M., Wang Y. (2022). Climbing the quality ladder of green innovation: Does green finance matter? Technological Forecasting Soc. Change 184, 122007. doi: 10.1016/j.techfore.2022.122007

Li H., Zou Q. (2018). Environmental regulations, resource endowments and urban industry transformation: comparative analysis of resource-based and non-resource-based cities. Economic Res. J. 53 (11), 182–198.

Li W., Sun H., Dang K. T., Taghizadeh-Hesary F. (2020). The impact of environmental regulation on technological innovation of resource-based industries. Sustainability 12 (17), 6837. doi: 10.3390/su12176837

Liang H., Renneboog L. (2017). On the foundations of corporate social responsibility. J. Finance 72 (2), 853–910. doi: 10.1111/jofi.12487

Lim K. Y., Morris D. (2022). Thresholds in natural resource rents and stateowned enterprise profitability: cross country evidence. Energy Economics 106, 105779. doi: 10.1016/j.eneco.2021.105779

Lin Y., Huang R., Yao X. (2021). Air pollution and environmental information disclosure: An empirical study based on heavy polluting industries. J. Cleaner Production 278, 124313. doi: 10.1016/j.jclepro.2020.124313

McBrayer G. A. (2018). Does persistence explain ESG disclosure decisions? Corporate Soc. Responsibility Environ. Manage. 25 (6), 1074–1086. doi: 10.1002/csr.1521

Min S., Mentzer J. T. (2004). Developing and measuring supply chain management concepts. J. business logistics 25 (1), 63–99. doi: 10.1002/j.2158-1592.2004.tb00170.x

Nie H., Jia R. (2011). Productivity and resource misplacement in Chinese manufacturing enterprises. J. World Economy 7, 27–42.

Pan X., Song M., Wang Y., Shen Z., Song J., Xie P., et al. (2022). Liability accounting of natural resource assets from the perspective of input Slack—An analysis based on the energy resource in 282 prefecture-level cities in China. Resour. Policy 78, 102867. doi: 10.1016/j.resourpol.2022.102867

Papyrakis E., Gerlagh R. (2004). The resource curse hypothesis and its transmission channels. J. Comp. Economics 32 (1), 181–193. doi: 10.1016/j.jce.2003.11.002

Pedersen L. H., Fitzgibbons S., Pomorski L. (2021). Responsible investing: The ESG-efficient frontier. J. Financial Economics 142 (2), 572–597. doi: 10.1016/j.jfineco.2020.11.001

Qin M., Su C.-W., Zhong Y., Song Y., Lobonţ O.-R. (2022). Sustainable finance and renewable energy: Promoters of carbon neutrality in the United States. J. Environ. Manage. 324, 116390. doi: 10.1016/j.jenvman.2022.116390

Sachs J. D., Warner A. M. (1995). Natural resource abundance and economic growth. Natl. Bureau Economic Res. (Working Paper Series). doi: 10.3386/w5398

Same A. T. (2008). Mineral-rich countries and dutch disease: understanding the macroeconomic implications of windfalls and the development prospects the case of equatorial guinea. World Bank Policy Research Working Paper 4595.

Song M., Peng L. C., Shang Y. P., Zhao X. (2022). Green technology progress and total factor productivity of resource-based enterprises: A perspective of technical compensation of environmental regulation. Technological Forecasting Soc. Change 174, 121276. doi: 10.1016/j.techfore.2021.121276

Studer S., Welford R., Hills P. (2006). Engaging Hong Kong businesses in environmental change: drivers and barriers. Business strategy Environ. 15 (6), 416–431. doi: 10.1002/bse.516

Su C. W., Chen Y., Hu J., Chang T., Umar M. (2023). Can the green bond market enter a new era under the fluctuation of oil price? Economic Research-Ekonomska Istraživanja 36, 536–561. doi: 10.1080/1331677X.2022.2077794

Su C. W., Liu F., Qin M., Chnag T. (2022a). Is a consumer loan a catalyst for confidence? Economic Research-Ekonomska Istraživanja 36 (2), 2142260. doi: 10.1080/1331677X.2022.2142260

Su C.-W., Pang L.-D., Tao R., Shao X., Umar M. (2022c). Renewable energy and technological innovation: Which one is the winner in promoting net-zero emissions? Technological Forecasting Soc. Change 182, 121798. doi: 10.1016/j.techfore.2022.121798

Su C.-W., Yuan X., Tao R., Shao X. (2022b). Time and frequency domain connectedness analysis of the energy transformation under climate policy. Technological Forecasting Soc. Change 184, 121978. doi: 10.1016/j.techfore.2022.121978

Torvik R. (2001). Learning by doing and the dutch disease. Eur. Economic Rev. 45 (2), 285–306. doi: 10.1016/S0014-2921(99)00071-9

Van Duuren E., Plantinga A., Scholtens B. (2016). ESG integration and the investment management process: Fundamental investing reinvented. J. Business Ethics 138 (3), 525–533. doi: 10.1007/s10551-015-2610-8

Wong W. C., Batten J. A., Mohamed-Arshad S. B., Nordin S., Adzis A. A. (2021). Does ESG certification add firm value? Finance Res. Lett. 39, 101593. doi: 10.1016/j.frl.2020.101593

Wood D. J. (1991). Corporate social performance revisited. Acad. Manage. Rev. 16 (4), 691–718. doi: 10.5465/amr.1991.4279616

Xu K. N., Wang J. (2006). An empirical study of a linkage between natural resource abundance and economic development. Economic Res. J. 1, 78–89.

Yang L., Wang B., Luo D. (2022). Corporate social responsibility in market liberalization: Evidence from Shanghai-Hong Kong Stock Connect. J. Int. Financial Markets Institutions Money 77, 101519. doi: 10.1016/j.intfin.2022.101519

Zhang M., Yan T., Ren Q. (2022). Does innovative development drive green economic growth in resource-based cities? Evidence From China Front. Environ. Sci. 9. doi: 10.3389/fenvs.2021.745498

Keywords: resource dependence, enterprise ESG score, enterprise sustainable development, China, A-share listed companies

Citation: Fei Y, Fang L, Luo Z and Liang W (2024) Resource dependence and enterprise ESG performance: an empirical study based on A-share listed companies. Front. Ecol. Evol. 12:1344318. doi: 10.3389/fevo.2024.1344318

Received: 25 November 2023; Accepted: 22 January 2024;

Published: 05 February 2024.

Edited by:

Tsun Se Cheong, Hang Seng University of Hong Kong, Hong Kong SAR, ChinaCopyright © 2024 Fei, Fang, Luo and Liang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenjing Liang, bGlhbmd3ZW5qaW5nMTk5N0AxNjMuY29t

Yingqun Fei1

Yingqun Fei1 Wenjing Liang

Wenjing Liang