- 1College of Economics and Management, Nanjing Forestry University, Nanjing, China

- 2Business School, Nanjing Normal University, Nanjing, China

- 3School of Economics, Nanjing Audit University, Nanjing, China

- 4College of Information Management, Nanjing Agricultural University, Nanjing, China

- 5School of Economics and Management, Southeast University, Nanjing, China

Introduction: Environmental information disclosure is an important means to protect the ecological environment, and global climate change puts forward higher requirements for corporate environmental information disclosure. New energy companies play an important role in addressing climate change and environmental information disclosure, and should strengthen environmental information disclosure and actively participate in ecological environmental protection.

Methods: This paper selected Chinese new energy listed companies as the research sample to investigate the impact of green credit on corporate environmental information disclosure, and proposed and empirically tested the hypothesis on the mechanism of the effect of green credit on environmental information disclosure.

Results: The regression results indicated that green credit can effectively improve the quality of corporate environmental information disclosure, and this conclusion is still significantly valid after robustness test; The impact mechanism tests showed that green credit can change the level of corporate environmental information disclosure by controlling company size. This paper also tested the heterogeneity and adjustment effects, showing that the relationship between green credit and environmental information disclosure are affected by multiple factors.

Discussions: Combining the research of this paper and previous research results, it is found that the positive impact of green credit on corporate environmental information disclosure has been confirmed by academic research and practical verification. However, the implementation effect of green credit policy will be affected by the economic level, regional differences, and the comprehensive impact from companies, financial institutions and government departments.

1 Introduction

Environmental protection and sustainable development are topics of global concern. Companies are the main body of pollution emission and have a great responsibility in environmental protection. Corporate environmental information disclosure can effectively improve the asymmetry of environmental information, help investors and the public understand the contribution of companies in pollution prevention, and bring positive economic benefits to companies themselves (Khlif et al., 2015; Qiu et al., 2016). Corporate environmental information disclosure is not only affected by internal factors such as corporate environmental performance, but is also widely affected by external environmental factors such as social concerns and environmental events (Brammer and Pavelin, 2010; Cheng et al., 2017; Chen et al., 2022). Green credit originated in developed countries, and is believed to be a financial tool to reduce environmental risks, which helps to improve the market competitiveness of banks and other financial institutions (González, 2022; Wen et al., 2023a). Since 2007, Chinese government has successively launched a series of “green credit” policies and measures, encouraging banks to provide credit to environmentally friendly companies, in order to promote the greening of companies and the transformation of economic growth patterns by readjusting the social funds. By guiding financial resources toward green projects, green finance policy combines the external pressure characteristics of environmental regulation policies with the market function of optimal allocation of resources, and is an important policy tool to promote cleaner production transformation of polluting enterprises and promote green development (Chai et al., 2022; Shao and Huang, 2023). Under the background of green development transformation, it is of great practical significance and theoretical value to study the relationship between green credit and corporate environmental information disclosure (Zeng et al., 2023).

According to existing literature, green credit policies can increase the financing constraints and exit risks of polluting enterprises, force enterprises to transform cleaner production, and reduce corporate pollution by guiding the differentiated allocation of financial resources to environmentally polluting projects and environmentally friendly projects (Ge and Zhu, 2022; He et al., 2022). So most of the existing studies have selected listed companies in heavily polluting industries as research samples, but special attention should be paid to the non-renewable nature of traditional fossil energy and the increasingly prominent environmental problems, thus maintaining a balance between energy supply and environmental protection has become a key way to solve the problem (Wu et al., 2023; Gong et al., 2023a). As an important force in promoting energy transformation, reducing carbon emissions, and protecting the ecological environment, new energy enterprises also have high attention to environmental information disclosure. New energy enterprises play an important role and responsibility in environmental information disclosure, as their environmental behavior and information are directly related to global energy transformation, carbon emission reduction, and ecological environment protection (Yao et al., 2021). Since 2010, the new energy industry has become one of China’s seven strategic emerging industries. New energy is clean, renewable and environmentally friendly, and developing new energy industry to satisfy the energy needs of human society’s sustainable development is a vital step for environmental governance and ecological conservation (Wen et al., 2023b; Gong et al., 2023b). Listed companies are one of responsible bodies in China for issuing environmental reports and information disclosure. Listed companies in the new energy industry has become the future investment direction, with strong willingness and behavioral ability to disclose environmental information, and ought to be motivated to implement more compliant environmental information disclosure behaviors to win competitive advantages and development potential (Lai et al., 2022).

Although there have been a few studies on the relationship between green credit policies and corporate environmental information disclosure (Li and Chen, 2022), there is still room for further research and improvement in theoretical mechanisms and empirical methods. This paper will use new research samples to conduct a more detailed quantitative analysis on the effects and mechanisms of green credit on corporate environmental information disclosure. In addition, another important difference between this paper and existing literatures is that this paper measures corporate environmental information disclosure behavior from various perspectives to examine different characteristics of corporate environmental information disclosure under green credit policies (Hao et al., 2007; Cang et al., 2021). Compared with the existing relevant research, the marginal contribution of this paper is mainly reflected in the following aspects: (1) Previous researches have mostly focused on the influencing factors and economic performance of green credit, while researches related to environmental performance have mostly taken a macro perspective and are limited to qualitative analysis (Sun et al., 2019). This paper explored the environmental effects of green credit from a micro perspective and better expanded the existing research; (2) This paper not only discussed the impact of green credit on corporate environmental information disclosure, but also explored the transmission mechanism and the heterogeneous impact of regional and corporate characteristics on the relationship between the two, which ensures the credibility of the core conclusions of this paper; (3) This paper selected Chinese new energy listed companies as research samples, and the existing research on environmental information disclosure focuses more on polluting companies (Wang and Wang, 2023). Taking new energy companies as research samples can enrich the research fields of green credit and environmental information disclosure, provide empirical references for enhancing the environmental governance policy system, strengthening corporate environmental governance behavior, and improving policy efficiency (Li and Wang, 2023).

Environmental information disclosure by new energy listed companies is the most convenient way for the public and stakeholders to understand their environmental costs and environmental responsibility obligations, which is the main reason why new energy listed companies are selected as research samples in this paper. Therefore, empirical testing between green credit and environmental information disclosure based on data from listed companies in China’s A-share new energy industry has a practical foundation. The content of this paper is arranged as follows: The second part is a literature review and theoretical hypotheses; The third part is research design; The fourth part is the empirical results and analysis; The fifth part is the extended analysis and discussion; The sixth part is the research conclusion and policy recommendations.

2 Literature review and theoretical hypotheses

2.1 Literature review

2.1.1 Policy effects of green finance and green credit

The rise of green finance stems from environmental issues and sustainable development, and many countries use green finance to promote economic transformation (Liu et al., 2019). Green finance was first called “environmental finance”. Salazar (1998) believed that environmental finance is the combination of financial industry and environmental protection industry, with the aim of protecting the environment through finance. There are also studies focusing on the relationship between different financial products such as carbon futures and green bonds, as well as the spillover effects between the green bond market and other major financial markets (Ren et al., 2022; Wei et al., 2023). Green finance in China is regarded as an innovative financial model for the purpose of environmental protection as it provides financial support to green industries such as environmental pollution control and ecological protection via the financial industry, in order to solve problems such as climate change and environmental pollution (Hu et al., 2021). Green credit is an important part of the green financial system. At present, green credit has received much attention from financial institutions the world, and the most influential representative is the Equator Principles (Huang et al., 2022).

Most of the researches on green credit have focused on the economic effects of green credit policies. From the perspective of economic and industrial development, green credit has a positive impact on regional high-quality development (Soundarrajan and Vivek, 2016), and the rational allocation of green credit funds is conducive to the optimization and upgrading of industrial structure (Hu et al., 2023). From the perspective of commercial banks, green finance not only means the greening of their operation and management process, but is also reflected in their practical activities of combining environmental protection with credit, investment, and financing businesses, highlighting the strong relationship between finance and sustainable development (Jeon and Lim, 2013; Wang et al., 2023). From the perspective of companies, green credit not only provides financing convenience for green companies, but also effectively drives them to carry out technological innovation and improve the governance level of pollution emissions (Xie et al., 2019; Ren et al., 2023). The introduction of green credit policies can fully leverage the credit supervision function and have a significant impact on the production, operation, and environmental governance of companies (Li et al., 2022; Long et al., 2023). From the perspective of policy, some studies have argued that the green credit policy is essentially an environmental regulatory policy, which provides a new way to promote companies to practice environmental and social responsibility and achieve green and low-carbon transformation (Cormier et al., 2005). In addition, research on the uneven development of different regions in China has found that digital inclusive finance is of great significance in promoting the coordinated development of regional economies (Wang X. et al., 2022; Wang et al., 2023).

2.1.2 Corporate environmental information disclosure

Corporate environmental information disclosure can improve the internal and external information asymmetry of companies, and link environmental responsibility with the interests of companies by influencing social reputation and introducing external environmental supervision, which is an important means to urge companies to fulfill environmental responsibility and reduce pollution emissions (Ellili and Nobanee, 2023). Most scholars believe that the contents of environmental information disclosure should include environmental problems, impacts and corresponding countermeasures, as well as costs and benefits related to the environment (Cho and Patten, 2007). Patten and Trompeter (2003) used content analysis to study corporate environmental information disclosure, and found that the information disclosed by companies should include the emission and treatment of various pollutants, environmental risks, etc. Corporate environmental information disclosure, as a highly autonomous behavior of companies, is easily influenced not just by external pressures such as government regulation, but also by internal factors of the company (Liu and Anbumozhi, 2009). From the internal perspective of a company, corporate governance, corporate characteristics and industry classification can affect the quality and form of its environmental information disclosure (Kim and Lim, 2011; Chen et al., 2022); From an external perspective, environmental regulations, media attention, and government supervision can affect corporate environmental information disclosure (Akiyama, 2010; Jiang et al., 2021).

Different theories provide different explanations for the motivation of corporate environmental information disclosure. According to the signal transmission theory, there is a serious information asymmetry between the internal and external environmental information of companies. When the external appraisal of a company’s environmental performance has an impact on its value, the company can differentiate itself from those with poor environmental performance by disclosing environmental information (Clarkson et al., 2008). According to the legitimacy management theory, in order to maintain their own legitimacy, companies may manage the public’s awareness of their environmental performance by disclosing environmental information (Rockness, 1985). The worse the environmental performance, the more likely the companies are to disclose positive environmental information (Hughes et al., 2001). In contrast to the signal transmission theory, environmental information disclosure in legitimacy management theory is more like a tool for companies to mask and misdirect external perceptions of their own environmental performance.

2.1.3 Relationship between environmental information disclosure and corporate financing

Financing constraints limit the innovation and development of companies, and effective disclosure of environmental information can not only enhance the awareness of environmental protection, but also help companies improve their credibility and alleviate financing constraints (Yang et al., 2020). Most studies have found that corporate environmental information disclosure can improve corporate environmental and financial performance (Wang et al., 2016; Khatri and Kjaerland, 2023), and the more detailed the environmental information disclosed by companies, the easier it is to obtain bank loans (John and Reisz, 2020; Bharath et al., 2008; Goss and Roberts, 2011). On the one hand, the implementation of green finance policies such as the issuance of green bonds has actively improved the ESG performance of enterprises (Chen et al., 2023). On the other hand, the implementation of green credit policy encourages financial institutions to pay full attention to the fulfillment of companies’ environmental responsibilities, and encourages companies to actively disclose environmental information by effectively linking corporate financing needs with environmental responsibilities (Wang et al., 2019), which further improves the quality of corporate environmental information disclosure (Aizawa and Yang, 2010). With the implementation of China’s green credit policy, some scholars have begun to study the relationship between green credit and environmental information disclosure in the field of heavy pollution, believing that green credit can help improve the willingness and quality of environmental information disclosure (Shao et al., 2022).

2.2 Theoretical analysis and research hypotheses

2.2.1 Green credit and environmental information disclosure

After the implementation of green credit policies, due to the strong concealment of environmental information, bank creditors find it difficult to accurately grasp the environmental performance of companies, which can easily lead to credit mismatches in the credit decision-making process (Ane, 2012; Xu et al., 2023). In order to cope with public policy pressure and balance the company’s image and development interests (Denis and Michel, 2015), in order to obtain more bank loans, companies will tend to actively disclose environmental information and work to improve the quality of disclosure to gain their competitive advantage in the capital lending market (Darrell and Schwartz, 1997). Environmental information disclosure may increase corporate environmental spending (Ahmad and Mohamad, 2014), but the government also provides tax incentives or other development subsidies to environmentally friendly industries and companies. From the coverage areas of China’s green credit policy, new energy companies as a clean industry are the priority area for funding. Therefore, different types of companies, especially new energy listed companies, have the motivation to improve environmental information disclosure mechanisms (Luo et al., 2012). Based on this, this paper proposes Hypothesis 1.

Hypothesis 1: Green credit has a positive impact on the quality of environmental information disclosure of new energy companies.

2.2.2 Mechanism of green credit to improve the quality of environmental information disclosure

Under the guidance of green credit policies, commercial banks and other financial institutions actively expand the lending scale of low-pollution, low-energy-consumption and environmental protection companies such as new energy companies (Chang, 2015). With the preferential interest rate setting of green credit, companies can effectively alleviate financing constraints, stimulate green innovation vitality, rapidly expand and develop, and ultimately form a virtuous cycle of company scale expansion and financing constraint pressure reduction (Du et al., 2022). From the perspective of financing constraints, on the one hand, the implementation of green credit policies makes financial institutions more cautious when lending to companies, which will increase the difficulty for companies to obtain external financing and increase the level of corporate finance constraints; On the other hand, in order to reduce the difficulty and cost of external financing, companies will disclose environmental information more actively in order to gain market favor and avoid credit restrictions imposed by relevant regulatory authorities in the same time (Dawkins and Fraas, 2011). Therefore, higher levels of financing constraints can force companies to improve the quality of environmental information disclosure, and those companies with high quality environmental information disclosure face less financing constraints than those with low quality environmental information disclosure (Wang et al., 2020). Based on this, this paper proposes hypothesis 2:

Hypothesis 2: Green credit can effectively alleviate the financing constraint pressure of companies, and then promote the quality of environmental information disclosure by expanding the scale of companies.

2.2.3 Moderating mechanism of green credit’s impact on the quality of environmental information disclosure

Based on the above analysis, it can be preliminarily concluded that green credit can motivate companies to disclose environmental information. Combined with the practice of China’s new energy industry development, we want to further investigate the difference in the impact of enterprise nature and regional development differences on the corporate environmental information disclosure. Compared with state-owned companies, the business operations of non-state-owned companies are often more dependent on commercial loans and credit financing, so they pay more attention to the transparency and standardization of environmental information disclosure. Due to the huge management hierarchy and government background of state-owned companies, the impact of green credit on environmental information disclosure is weakened. In eastern China, where the degree of marketization is higher, companies are often more willing to accept the principle of environmental information disclosure and advanced environmental protection concepts, making it easier to achieve environmental protection goals (Richardson et al., 2001). At the same time, the governments’ regulatory system in the eastern region is also more complete, providing good legal support and guarantee for the effective operation of green credit policies and the lawful environmental information disclosure of enterprises.

In addition, this paper also aims to study the moderating effects of media pressure and company age. There is a symbiotic relationship between corporate environmental information disclosure and the product market and stock market (Aerts et al., 2008; Wang et al., 2013) Media exposure has a wide range of influence, and public preference is very likely to be changed by the signals released by the media, so that companies have to strengthen their sense of responsibility to face the pressure of public opinion and market risks, so as to better play the role of green credit. For newly established new energy companies, which often need to invest a lot of money for staff training and technology upgrading, green credit provides a way to promote environmentally friendly development and fulfill social responsibilities with the help of financial instruments (Healy and Palepu, 2001; Feng et al., 2018). Based on this, this paper proposes hypothesis 3:

Hypothesis 3: Geographical characteristics, ownership nature, media pressure and company age can affect the relationship between green credit and environmental information disclosure.

3 Research design and methods

3.1 Variable definition

3.1.1 Corporate environmental information disclosure

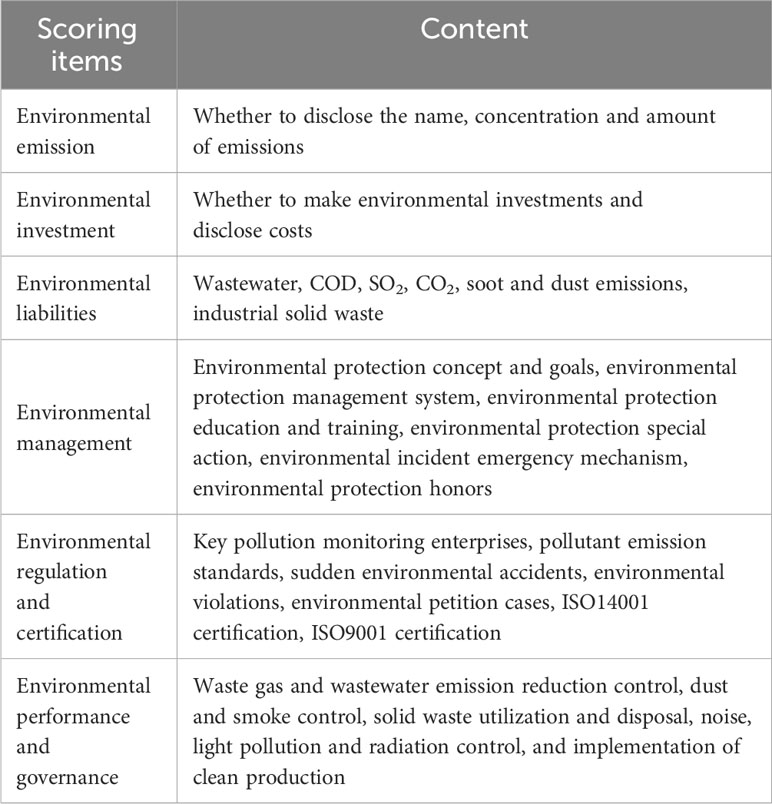

Referring to existing studies, this paper uses content analysis method to evaluate the content and quality of corporate environmental information disclosure (CEID), and transforms the disclosure information of companies’ environment-related investment and emissions, environmental liabilities and management into observable data according to specific evaluation system and scoring criteria (Table 1). According to whether the company lawfully discloses information and fulfills relevant obligations, it is divided into three levels: non-disclosed, qualitative description, and quantitative description, with scores of 0, 1, and 2 respectively. Then, the scores of each item are summed up to obtain the measurement indicators for CEID (Lin and Pan, 2023).

3.1.2 Green credit

The new energy industry is the key and priority area of green credit in China. Compared with other companies, new energy companies will bear less externality responsibilities in the production and operation process.

It is relatively easy for listed new energy companies to carry out external financing, and their funds mainly come from green credit applications from financial institutions. Moreover, since loans to support new energy production and manufacturing are an important component of green credit, this paper referred to existing research to measure the scale of green credit for companies based on the total annual loans of companies.

3.1.3 Control variable

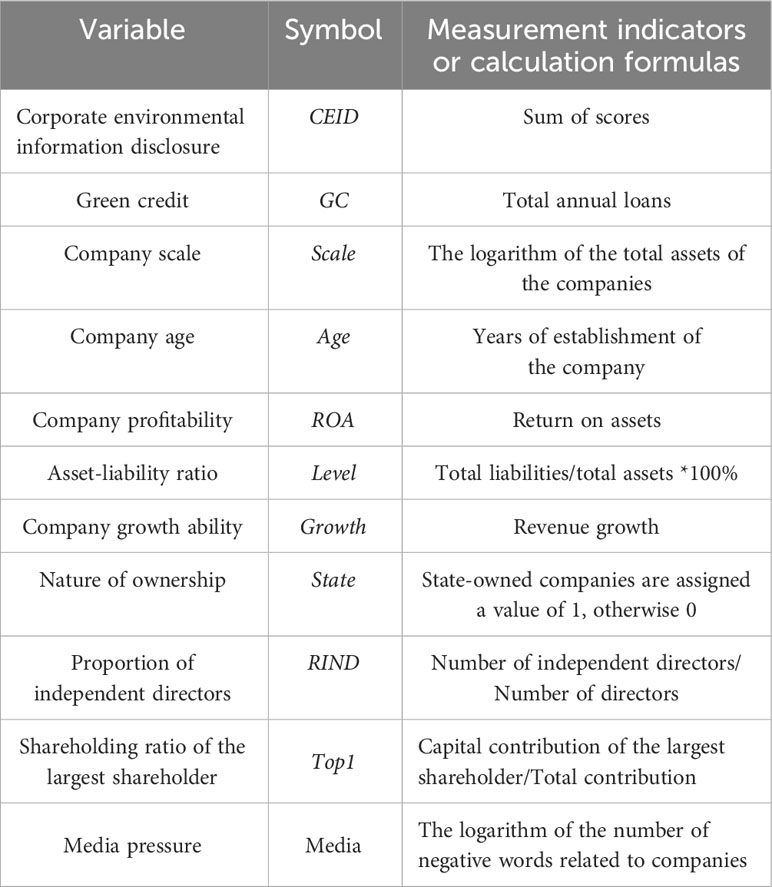

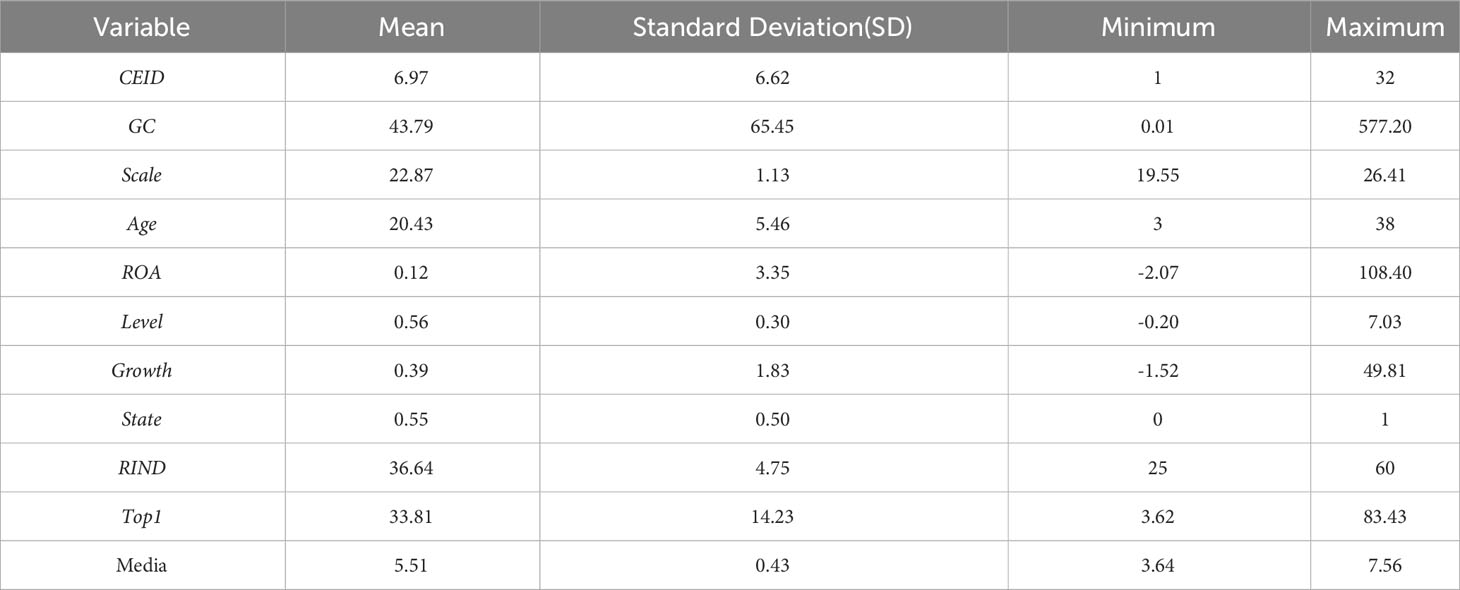

There are many factors that may affect the quality of CEID. Based on relevant research, the control variables selected in this paper include company scale, age if the company, company profitability, asset-liability ratio, company growth ability, nature of ownership, proportion of independent directors, shareholding ratio of the largest shareholder and media pressure (Darrell and Schwartz, 1997; Denis and Michel, 2015; Zhang et al., 2022). The explanations of explanatory variables, explained variables, and control variables are shown in Table 2. Descriptive statistics of the main variables are shown in Table 3. The data of Table 3 are from the annual reports, quarterly reports and interim reports of listed companies in the samples.

3.2 Sample selection and data sources

In this paper, 95 representative listed companies in the new energy industry in different fields of China’s Shanghai and Shenzhen stock markets from 2011 to 2021 are selected as research samples, avoiding companies such as ST and * ST which are not operating normally and have delisting risks at any time (ST stocks and * ST stocks are both stocks specially treated by the exchange). The environmental disclosure data comes from the annual reports of the sample companies and social responsibility reports, while other relevant data mainly comes from China Stock Market & Accounting Research Database (CSMAR) and the China Statistical Yearbook. The missing data is collected manually through the company’s official website or annual reports.

3.3 Model construction

To verify the relationship between green credit and corporate environmental information disclosure, the following regression model is established:

α1 is the focus of this article, if α1is positive, then green credit policies have a positive effect on corporate environmental information disclosure, and the more significant the results, the more significant the promoting effect; On the contrary, if α1 is negative, it indicates that the implementation of this policy is not conducive to improving the quality of environmental information disclosure. Controls represents other control variables that have an impact on corporate environmental information disclosure, Company represents individual fixed effect, and Year represents time fixed effect. In addition, α0 is a constant term and μ is a random disturbance term.

4 Analysis of empirical results

4.1 Baseline regression results

In the regression analysis, the fixed effects model (FEM) and the random effects model (REM) rejected the null hypothesis of hypothesis testing, indicating that both were superior to POLS regression. Continuing with the Hausman test, if the p-value is less than 0.01, the null hypothesis is rejected, indicating that a fixed effects model should be chosen in this sample.

Table 4 shows the regression results between GC and CEID. The second column shows the fixed effects regression results without adding control variables, the third column shows the fixed effects regression results after adding control variables, and the fourth column shows the random effects regression results. The results show that GC is significantly positive at a statistical level of at least 10%, indicating that green credit is generally beneficial for companies to better disclose environmental information. This verifies hypothesis 1.

4.2 Robustness test

Baseline regression analysis results show that green credit has a significant contributing effect on the improvement of corporate environmental information disclosure level. In order to ensure the robustness and credibility of the regression results, this paper conducts robustness tests using both variable replacement and endogeneity tests, respectively.

4.2.1 Variable replacement

Measuring the core variables by only one method and drawing conclusions is obviously not highly persuasive, so it is necessary to replace the measurement method of the relevant variables and conduct regression again to verify the robustness of the results. In order to further test the results found in this paper, the robustness test is carried out with reference to the treatment method proposed by Lv et al. (2016): the ratio of the total score of corporate environmental information disclosure to corporate capital reserve was taken as the new explained variable; The ratio of total loans and corporate capital reserve is used as a new explanatory variable. Capital reserve refers to a capital raising formed by the distribution of a company’s profits, which is used to maintain the company’s capital structure and meet the needs of future investment and development. The higher the capital reserve of the company, the better the financial situation of the company, and the easier it is to obtain loans and carry out sustainable business activities such as environmental protection.

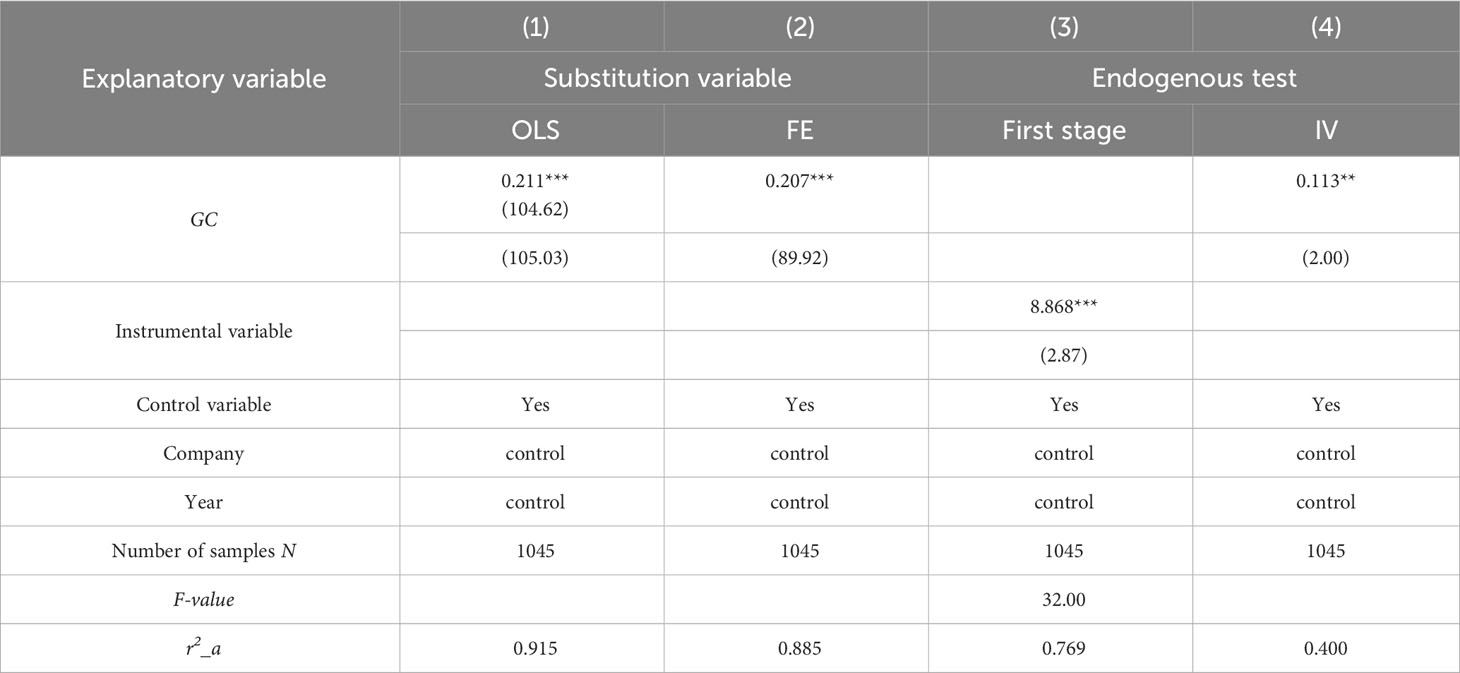

Under the premise that the degree of multicollinearity between variables is within the acceptable range, we found that the T-value obtained by hypothesis test of GC is large and the goodness of fit is high after model adjustment, indicating that GC has a very significant positive promoting effect on CEID, and the regression equation fits the observed value well. The regression results are shown in the first two columns of Table 4. We can find that whether using OLS regression or fixed effects models, the regression results are significantly positive at the 1% statistical level, indicating a significant positive correlation between green credit policies and corporate environmental information disclosure, which provides strong support for the above hypothesis and the results in Tables 4, 3 and makes the model more robust.

4.2.2 Endogenous problem

The potential endogeneity of the empirical analysis model in this paper may cause bias in the regression results, thus affecting the credibility of the conclusion. Endogeneity may be mainly manifested as a high correlation between explained variables and explanatory variables. For example, new energy companies are more willing to disclose environmental information in order to obtain green credit, and new energy companies, as the key supporting industry of China’s green credit, are also easier to obtain bank credit. In addition, some factors that are difficult to quantify, such as corporate culture and background, may be ignored in the process of empirical regression, and the above missing variables are also the main cause of endogeneity.

In order to solve the above endogenous problem that may exist, we use the Instrumental variables (IV) to solve it by two-stage least square method. Considering that an effective instrumental variable must meet the two conditions of correlation and exogenous, that is, the instrumental variables is highly correlated with the substituted explanatory variable and not correlated with the random error term. This paper refers to the method of Zhan (2021), and selects the financial background of senior executives of listed companies as the corresponding instrumental variables, that is, whether senior executives hold important positions in financial institutions. On the one hand, the development of a company is closely related to its executives, who can use their financial background to help companies obtain higher credit lines (Ciamarra, 2012); On the other hand, the financial background of company executives has little impact on CEID, and it is difficult to fundamentally change the disclosure status. So the two requirements of relevance and exogeneity are well satisfied. If a senior executive of a listed company holds a position that has some financial influence in a financial institution such as a bank, it is regarded as having a financial background and assigned a value of 1; otherwise, it is assigned a value of 0 (Li et al., 2023).

The regression results of endogenous test are shown in the last two columns of Table 5. The first-stage estimation results in column 3 show that the financial background of company executives is significantly positively correlated with green credit, and the F-value is greater than 10, indicating that there are no problems such as weak instrumental variables. The results of the two-stage regression in column 4 show that the estimated coefficient of green credit is significantly positive at the statistical level of 5%, indicating that green credit still has a significant promoting effect on CEID after the possible endogenous problems in the model are eliminated. Through further observation, it is found that compared with the baseline regression results of the random effects model, the impact effect of green credit is descended, which indicates that the problems such as variable omission and two-way causality cannot be ignored.

4.3 Heterogeneity analysis

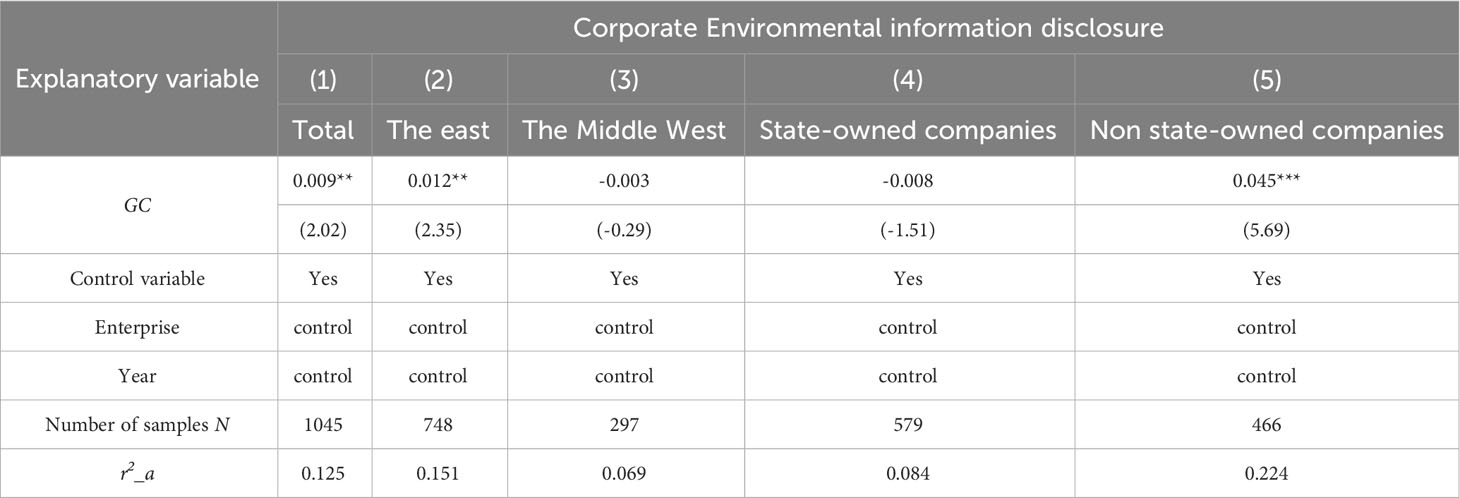

To investigate the relationship between green credit and corporate environmental information disclosure behavior, this paper conducted a heterogeneity analysis from two aspects of ownership nature and regional distribution, and explored the difference in effect of green credit policies on different types of companies, basing on the regional distribution and industry nature of China’s new energy industry.

4.3.1 GC, CEID and corporate geographic location

The unbalanced development of regional economy is a common problem in the economic development of all countries. The development level of different regions in China is obviously uneven, and the different factors such as the degree of marketization, the degree of government intervention and the investment environment lead to the differences in the effectiveness of law enforcement. Local governments in China are the main executors of environmental policies, and the implementation effect of green policies is also influenced by the efficiency of government policy implementation. In the economically developed eastern region, companies face significant competition and survival pressure, and environmental compliance may become an important part of company competitiveness. In contrast, in the central and western regions with a low degree of marketization, many companies prioritize expanding their scale and seizing the market, and mostly choose to reduce the transparency of environmental information disclosure. Moreover, insufficient government regulation and weak legal enforcement are not conducive to the effective implementation of local green credit, and also give some companies the opportunity to externalize environmental protection costs.

As shown in columns 2 and 3 of Tables 4, 5, the regression results show that the coefficient of green credit in the eastern region is significantly positive at the 5% level, while that of the central and western regions is not significant, indicating that the regional factors of companies have a non-negligible effect on the relationship between GC and CEID. It is worth noting that among the 1045 sample data selected in this paper, 748 are from the eastern region of China, which is not the result of intentional selection. Because the development level of the financial industry in the central and western regions is lower than that in the eastern region, the capacity of commercial banks and other financial institutions to provide green credit is also relatively weak, so the incentive effect is slightly lower than that in the eastern region. In addition, most of China’s new energy listed companies are located in densely populated areas such as Beijing, Jiangsu and Guangdong, where there are more business opportunities. The establishment of National Economic and Technological Development Zones and high-tech industrial development zones are concentrated here. In general, there is significant regional heterogeneity in the impact of green credit policies on the quality of corporate environmental information disclosure.

4.3.2 GC, CEID and the nature of company ownership

The close relationship between state-owned companies and local governments constitutes a natural bridge for them to borrow from banks and other financial institutions. In addition, state-owned companies enjoy special status and preferential policies in China’s economic system, which can effectively alleviate the pressure of insufficient funds. With the recognition and support of the government, banks have sufficient reasons to believe in the predictability of state-owned companies’ profits and the degree of their environmental protection, thus lowering their lending criteria (Li et al., 2019; Qi et al., 2021). In order to obtain green credit resources, non-state-owned companies have to strictly disclose information about environmental quality and governance results to maintain public image and social recognition, which leads to the heterogeneity of the relationship between GC and CEID. In addition, compared with non-state-owned companies, state-owned companies are more likely to face restrictions on administrative management and internal decision-making in the process of operation and management, thus reducing the openness and freedom to disclose more environmental information beyond the disclosure requirements of relevant regulations (Hu et al., 2018; Liu et al., 2022). Columns 4 and 5 in Table 6 are the results of grouping regression on the nature of company ownership. It can be seen that the regression result of non-state-owned companies is significant at the statistical level of 1%, but the regression result of state-owned companies is not significant, indicating that the promoting effect of green credit policies on environmental information disclosure of non-state-owned companies is significantly stronger than its effect on state-owned companies.

5 Extended analysis and discussion

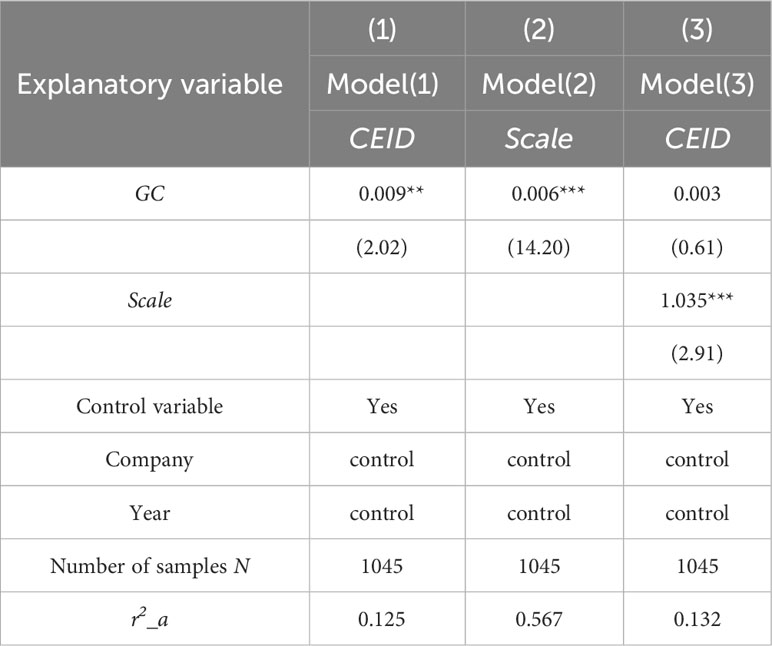

5.1 Mediating mechanism test

The fact that GC can promote CEID is fully verified above. Next, we would like to further study the transmission mechanism of GC on CEID. Corresponding to Hypothesis 2 of this paper, we speculate that company scale is a possible intermediary variable in this process. This paper tests this hypothesis with the intermediary effect model, and sets the following two models on the basis of Model 1:

In Model 1, the estimated coefficient of green credit is significantly positive. From the second column of Table 7, it can be seen that after replacing the explanatory variable from corporate environmental information disclosure with company scale, the estimated coefficient of green credit is significantly positive at the 1% statistical level, indicating that green credit effectively expands company scale. In Model 3, both explanatory variables and intermediary variables are included in the regression analysis, and the corresponding results are shown in column 3. The significance level of the estimated coefficient of green credit decreases from significant to insignificant. According to the coefficient determination method, at the statistical level of 1%, the variable of company scale has a significant full mediation effect. This verifies the impact path of “green credit growth–expansion of company scale–improvement of environmental information disclosure quality”.

Green credit can enable companies to obtain loans with low interest rates, reduce financing costs, invest more funds in technology innovation and scientifical research, help companies improve financing constraints, increase production efficiency, and enable companies to win market competitiveness, thereby expanding their scale. On the other hand, larger companies will face higher requirements and expectations from stakeholders on environmental responsibility, so companies need to disclose more and higher quality environmental information to obtain the recognition of stakeholders, so as to obtain and maintain the legitimacy of operation (Branco and Rodrigues, 2008). In addition, due to the existence of economies of scale, larger companies can shape a good social image for their products or services by disclosing high-quality environmental information at relatively low costs (Dorothée et al., 2013; Wickert et al., 2016), and improve public persuasiveness and visibility (Zhang et al., 2020). In summary, Hypothesis 2 is well verified.

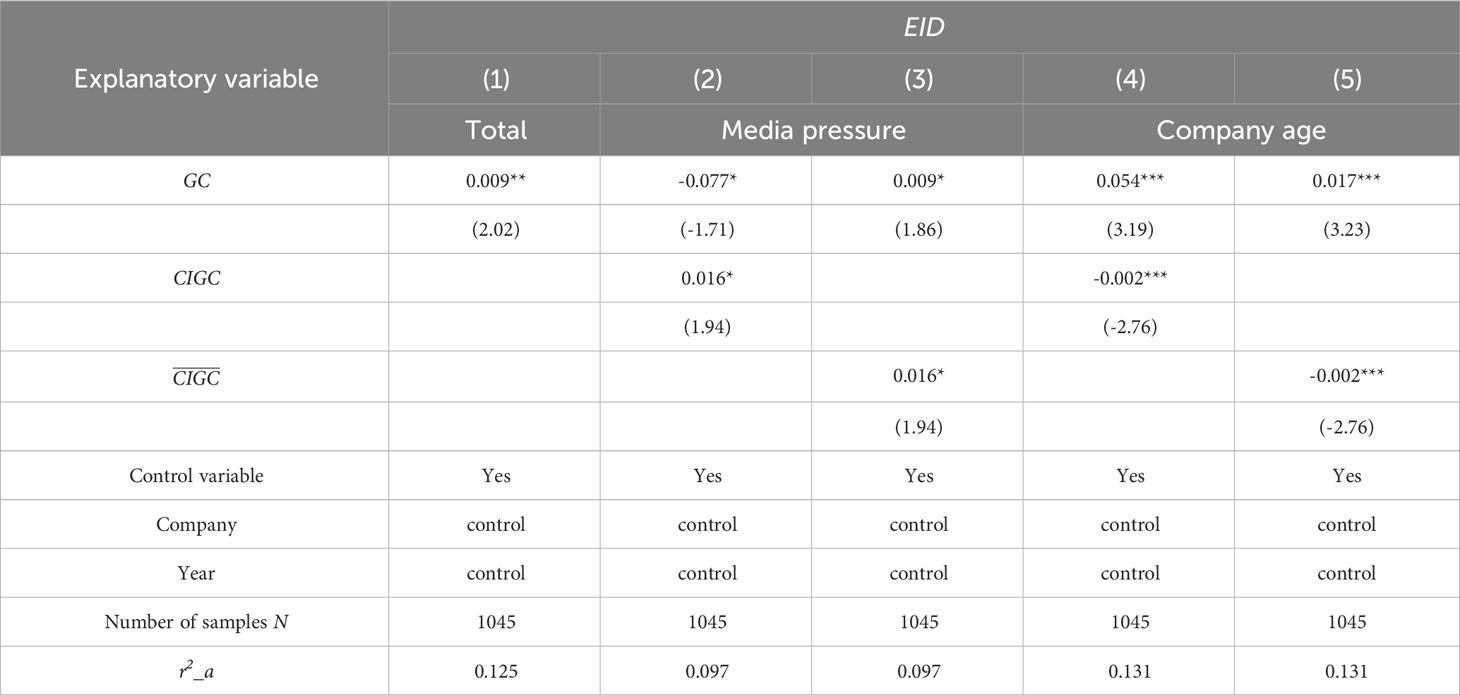

5.2 Moderating mechanism test

In regression analysis, the moderating effect can be taken into account by introducing an interaction term, and the interaction term between the moderating variable and the explanatory variable is marked as CIGC. In order to alleviate the possible high collinearity between interaction terms and explanatory variables and eliminate the bias generated by model estimation, we need to centralize the moderator variables and explanatory variables, that is, use variables to subtract sample mean to correct the above bias, and have no impact on the estimation results of the model. Mark the interaction term between the moderating variable and the explanatory variable after centralization as, and set Model 4 and Model 5 as follows:

5.2.1 GC, CEID, and media pressure

Companies not only bear the pressure of market competition, but also face the pressure from the society and the public. In recent years, the influence of media has become one of the research goals of scholars. The media can make useful supplements to the deficiencies of government and financial institution supervision. When companies that obtain green credit do not disclose environmental information as required, they are more likely to be criticized by the media. In order to protect their reputation and image, companies will provide more detailed and accurate environmental information to increase transparency and avoid negative reporting again (Rupley et al., 2012). In addition, companies actively disclose environmental information and hope to transmit positive signals through the media to obtain more green credit, which also helps to enhance social recognition and trust in companies and promote sustainable environmental development.

On this basis, this paper incorporates the cross term between media pressure and green credit into the regression model, and the test results are shown in column 3 of Table 5-3.

The coefficients of the interaction term and explanatory variables are significantly positive at the statistical level of 10%, indicating that media pressure has a promoting effect on the relationship between green credit and environmental information disclosure, that is, media pressure can effectively regulate the impact of green credit on corporate environmental information disclosure, and has a positive moderating effect.

5.2.2 Green credit, environmental information disclosure, and enterprise age

For those companies that have been established for a long time, their business scope has matured, their influence in the industry has gradually increased, and their brand advantages have gradually strengthened, which means that these companies may only rely on internal financing to meet the needs of daily operation and production, without necessarily obtaining green credit support from banks. In addition, some veteran companies may have formed a certain disadvantage path dependence. In this case, green credit is difficult to shake the internal management structure of companies and transform their internal organizational model, which makes it difficult for companies to adapt to the new changes in environmental protection concepts and regulations, thus reducing the requirements for environmental information disclosure. The number of listed Chinese new energy enterprises increased year by year during the sample study period, which lays a realistic foundation for us to investigate the impact of company age on green credit.

On this basis, this article incorporates the cross term between company age and green credit into the regression model, and the test results are shown in column 5 of Table 8. The interaction term is significantly negative and the explanatory variable is significantly positive, indicating that company age has an inhibitory effect on the relationship between GC and CEID. With the increase of company age, the influence of green credit on corporate environmental information disclosure weakens, which is a negative moderating effect. So far, we have fully verified Hypothesis 3.

5.3 Expanding discussion

5.3.1 Environmental information disclosure of state-owned companies

Generally speaking, state-owned companies should have a higher sense of social responsibility due to their greater access to government guarantees and financing facilities. Therefore, they are more likely to comply with government policy requirements, respond positively to green credit policies, and play an active role in environmental protection, energy conservation, and emission reduction. In this context, the relationship between government and companies has also become an important moderating factor for GC to affect CEID. The underlying economic logic is that in the process of implementing green credit policies, banks cannot treat all companies equally. They will selectively relax the lending standards for companies with a stronger governmental relation, while strictly enforce the lending standards for other companies, resulting in heterogeneity in the relationship between GC and CEID.

However, through the heterogeneity test, this paper finds that this is not the case, and the performance of state-owned companies in environmental information disclosure is significantly weaker than that of non-state-owned companies. Although non-state-owned companies are relatively weak in terms of credit financing and do not need to bear a lot of policy pressure, the market pressure they face cannot be ignored (Earnhart and Lízal, 2007). In order to gain market advantages and enhance their competitiveness through their differentiated characteristics, non-state-owned companies attach greater importance to environmental information disclosure. The proportion of state-owned companies and private companies in China’s new energy field is relatively equal, and state-owned companies should bear more responsibilities in environmental protection. Therefore, we need to pay more attention to the enthusiasm of state-owned companies in environmental information disclosure, and promote the sustainable development and environmental protection.

5.3.2 The opposite effect of company scale and age

The expansion of company scale is usually accompanied by the increase of resource utilization and environmental impact, so the role of GC in CEID becomes more important. Green credit requires the borrowing companies to disclose their environmental information, including environmental management system, emissions and waste treatment, to ensure that the environmental performance of the borrowing companies meets the standards, which helps the borrowing companies to strengthen environmental management and reduce environmental damage. However, the growth of companies is often accompanied by an increase in their age. The environmental management system of companies is relatively complete and does not require the use of green credit to strengthen, or the environmental requirements of green credit are not sensitive enough, which may have a certain negative impact on environmental protection. In addition, older companies have accumulated rich experience and resources, making it easier to obtain financing without overly considering the requirements of green credit. Therefore, the expansion of company scale may lead to a more important role of green credit in corporate environmental information disclosure, but this role may gradually weaken with the increase of company age.

Considering the inconsistency between company scale and company scale may affect the environmental disclosure through green credit, banks and other financial institutions should consider factors such as company scale, company age and environmental risks when reviewing green credit applications to ensure the positive environmental impact of green credit. As a financing method of financial institutions, green credit usually requires borrowing companies to disclose their environmental information to ensure that their environmental performance meets certain standards. Under this background, on the one hand, the increase in the scale of companies will make green credit play a stronger role in the disclosure of corporate environmental information, because financial institutions need to conduct stricter examination and supervision of companies. On the other hand, increasing the age of companies may reduce their awareness of environmental protection or improve their environmental management systems, thereby reducing the impact of GC on CEID (Lööf and Nabavi, 2014). From practice, compared with the influence of company scale, the influence of company age is small, and the positive influence of company scale is stronger, which is also consistent with the conclusion of the empirical analysis in this paper.

6 Conclusion and policy recommendations

This paper selects 95 representative listed companies in the new energy industry of China’s Shanghai and Shenzhen stock markets from 2011 to 2021 as research samples to test the impact and mechanism of green credit on corporate environmental information disclosure, aiming to provide useful reference for the system construction of promoting regional environmental sustainable development through green finance policies. The main conclusions of this paper are as follows: First, according to the findings of the empirical analysis, listed new energy companies that use green credit resources responsibly are more likely to disclose their environmental information. This finding suggests that the positive effects of green credit have permeated corporate values and moral standards, enhanced a sense of social responsibility, and increased the likelihood that these companies will voluntarily disclose their environmental information. It is clear that implementing green credit policy is one of the crucial tools for advancing environmental sustainability. Second, the mechanism test indicates that green credit mainly affects the behavior of corporate environmental information disclosure by alleviating financing constraints and forming scale effects. Through heterogeneity test and the moderating effect test of introducing cross terms, it is found that the relationship between green credit and corporate environmental information disclosure is significantly different due to multiple factors: The impact of green credit on environmental information disclosure in state-owned companies is weaker than that of non-state-owned companies; The excellent geographical location of companies is conducive to enhancing the promoting effect of green credit on environmental information disclosure; The media pressure faced by companies can significantly positively regulate the impact of green credit on corporate environmental information disclosure; Among the newly established new energy listed companies, the role of green credit in environmental information disclosure is significantly stronger. Third, combining the research of this paper and previous research results, it is found that the positive impact of green credit on corporate environmental information disclosure has been confirmed by academic research and practical verification. However, the implementation effect of green credit policy will be affected by the economic level, regional differences, and the comprehensive impact from companies, financial institutions and government departments. Therefore, the cooperation of all parties is required.

This article provides new ideas for leveraging the pollution control effects of green finance policies, and the research conclusions have certain practical significance and policy reference value. Firstly, from the perspective of policy formulation and implementation, the implementation of green credit policies should effectively link corporate financing needs with environmental performance, and use green credit as a carrier to stimulate companies to improve the level of environmental information disclosure. Secondly, banks and other financial institutions should regularly evaluate the effectiveness of green credit implementation, reasonably regulate the evaluation criteria for lending scale, consider regional and industrial differences, and make it more in line with China’s market-oriented system (Chen et al., 2020). Third, we should actively use the moderating mechanism(or effect) of institutional environment and media attention on the impact of green credit, and guide the media to reasonably supervise the environmental performance of companies, so as to promote the effective improvement of the overall level of corporate environmental information disclosure. Finally, government departments should rationalize the identification of green credit implementation standards to ensure that they are scientific and effective, and have reliability and operability for both companies and financial institutions. In addition, it is necessary to further optimize the reward and punishment system, strengthen the security, and establish third-party agencies to comprehensively evaluate the quality of corporate environmental information disclosure when necessary, so as to prevent false publicity and false disclosure (Wang et al., 2022).

It is worth noting that in the context of increasingly serious climate issues, the impact, risks, and sustainability disclosures of climate change are also receiving widespread attention. In January 2023, the Shenzhen Stock Exchange of China released the “White Paper on Environmental Information Disclosure of Listed Companies in the Shenzhen Stock Exchange”, which believes that environmental information disclosure should include environmental management, pollutant information, carbon emissions, and climate change management. Climate information disclosure refers to the disclosure of relevant information by enterprises or financial institutions to the public and regulatory authorities in addressing climate change and reducing carbon emissions. By guiding enterprises to pay attention to climate change issues, improving environmental protection measures, and implementing countermeasures, green credit can promote the quality and transparency of climate information disclosure by enterprises. Research from climate change has also begun to focus on green finance such as green bond market, believing that climate policy uncertainty has a short-term and sustainable impact on the volatility of green bond market (Yu et al., 2023). Therefore, we believe that in the future research on green finance and environmental information disclosure, we can promote the popularization and implementation of climate information disclosure on a global scale from the aspects of standard setting, disclosure quality, corporate performance, policy supervision and scientific and technological innovation, so as to better cope with the challenges brought by climate change.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

LG: Conceptualization, Formal Analysis, Methodology, Writing – original draft. WY: Conceptualization, Data curation, Methodology, Writing – original draft. XW: Conceptualization, Methodology, Supervision, Writing – original draft. XL: Writing – review & editing. CZ: Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aerts W., Cormier D., Magnan M. (2008). Corporate environmental disclosure, financial markets and the media: An international perspective. Ecol. Econ. 64 (3), 643–659. doi: 10.1016/j.ecolecon.2007.04.012

Ahmad N. N. N., Mohamad N. A. (2014). Environmental disclosures by the Malaysian construction sector: exploring extent and quality. Corporate Soc. Responsibility Environ. Manag. 21 (4), 240–252. doi: 10.1002/csr.1322

Aizawa M., Yang C. (2010). Green credit, green stimulus, green revolution? China’s mobilization of banks for environmental cleanup. J. Environ. Dev. 19 (2), 119–144. doi: 10.1177/1070496510371192

Akiyama T. (2010). CSR and inter-organisational network management of corporate groups: case study on environmental management of Sekisui House Corporation Group. Asian Business Manag. 9, 223–243. doi: 10.1057/abm.2010.4

Ane P. (2012). An assessment of the quality of environmental information disclosure of corporation in China. Syst. Eng. Procedia 5, 420–426. doi: 10.1016/j.sepro.2012.04.064

Bharath S., Sunder J., Sunder S. V. (2008). Accounting quality and debt contracting. Account. Rev. 83, 1–28. doi: 10.2308/accr.2008.83.1.1

Brammer S., Pavelin S. (2010). Factors influencing the quality of corporate environmental disclosure. Business Strategy Environ. 17 (2), 120–136. doi: 10.1002/bse.506

Baumann-Pauly D., Wickert C., Spence L. J., Scherere A. G. (2013). Organizing corporate social responsibility in small and large firms: size matters. J. Business Ethics 4, 693–705. doi: 10.1007/s10551-013-1827-7

Branco M. C., Rodrigues L. L. (2008). Social responsibility disclosure: a study of proxies for the public visibility of portuguese banks. Br. Account. Rev. 40 (2), 161–181. doi: 10.1016/j.bar.2008.02.004

Cang D., Chen C., Chen Q., Sui L., Cui C. (2021). Does new energy consumption conducive to controlling fossil energy consumption and carbon emissions?-Evidence from China. Resour. Policy 74, 102427. doi: 10.1016/j.resourpol.2021.102427

Chai S., Zhang K., Wei W., Ma W., Abedin MZ. (2022). The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 363, 132458. doi: 10.1016/j.jclepro.2022.132458

Chang K. (2015). The effect of environmental information disclosure on financial performance-empirical evidence from cross-sectional data of heavy-pollution industries in China. Collected Essays Finance Econ. 190 (1), 71–77.

Chen X., Li X., Huang X. (2022). The impact of corporate characteristics and external pressure on environmental information disclosure: a model using environmental management as a mediator. Environ. Sci. pollut. Res. 29, 12797–12809. doi: 10.1007/s11356-020-11410-x

Chen J., Yang Y., Liu R., Geng Y., Ren X. (2023). Green bond issuance and corporate ESG performance: the perspective of internal attention and external supervision. Humanit. Soc. Sci. Commun. 10 (1), 437. doi: 10.1057/s41599-023-01941-2

Chen F., Zhang K., Li W. (2020). A system dynamics simulation study on the efficiency of commercial banks from the perspective of green credit. Int. J. Econ. Stat. 8, 28–31.

Cheng Z., Wang F., Keung C., Bai Y. (2017). Will corporate political connection influence the environmental information disclosure level? Based on the panel data of A-shares from listed companies in Shanghai stock market. J. Business Ethics 143 (1), 209–221. doi: 10.1007/s10551-015-2776-0

Cho C. H., Patten D. M. (2007). The role of environmental disclosures as tools of legitimacy: A research note. Account. Organ. Soc. 32 (7), 639–647. doi: 10.1016/j.aos.2006.09.009

Ciamarra E. S. (2012). Monitoring by affiliated bankers on board of directors: evidence from corporate financing outcomes. Financial Manag. 41 (3), 665–702. doi: 10.1111/j.1755-053X.2012.01191.x

Clarkson P. M., Li Y., Richardson G. D., Vasvari F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Account. Organ. Soc. 33 (4), 303–327. doi: 10.1016/j.aos.2007.05.003

Cormier D., Magnan M., Van Velthoven B. (2005). Environmental disclosure quality in large German companies: economic incentives, public pressures or institutional conditions. Eur. Account. Res. 14 (1), 3–39. doi: 10.1080/0963818042000339617

Darrell W., Schwartz B. N. (1997). Environmental disclosures and public policy pressure. J. Account. Public Policy 16 (2), 125–154. doi: 10.1016/S0278-4254(96)00015-4

Dawkins C. E., Fraas J. W. (2011). Erratum to: beyond acclamations and excuses: environmental performance, voluntary environmental disclosure and the role of visibility. J. Business Ethics 99, 383–397. doi: 10.1007/s10551-010-0659-y

Denis C., Michel M. (2015). The economic relevance of environmental disclosure and its impact on corporate legitimacy: an empirical investigation. Business Strategy Environ. 24 (6), 431–450 doi: 10.1002/bse.1829.

Du M., Zhang R., Chai S., Li Q., Sun R., Chu W. (2022). Can green finance policies stimulate technological innovation and financial performance? Evidence from Chinese listed green enterprises. Sustainability 14 (15), 9287. doi: 10.3390/su14159287

Earnhart D., Lízal L. (2007). Direct and indirect effects of ownership on firm-level environmental performance. Eastern Eur. Econ. 45 (4), 66–87. doi: 10.2753/EEE0012-8775450403

Ellili N. O. D., Nobanee H. (2023). Impact of economic, environmental, and corporate social responsibility reporting on financial performance of UAE banks. Environ. Dev. Sustain. 25, 3967–3983. doi: 10.1007/s10668-022-02225-6

Feng Y., Chen H. H., Tang J. (2018). The impacts of social responsibility and ownership structure on sustainable financial development of China’s energy industry. Sustainability 10 (2), 301. doi: 10.3390/su10020301

Ge Y., Zhu Y. (2022). Boosting green recovery: Green credit policy in heavily polluted industries and stock price crash risk. Resour. Policy 79, 103058. doi: 10.1016/j.resourpol.2022.103058

Gong X., Feng Y., Liu J., Xiong X. (2023a). Study on international energy market and geopolitical risk contagion based on complex network. Resour. Policy 82, 103495. doi: 10.1016/j.resourpol.2023.103495

Gong X., Zhao M., Wu Z., Jia K., Xiong X. (2023b). Research on tail risk contagion in international energy markets -The quantile time-frequency volatility spillover perspective. Energy Econ. 121, 106678. doi: 10.1016/j.eneco.2023.106678

González F. (2022). Macroprudential policies and bank competition: International bank-level evidence. J. Financial Stabil. 58, 100967. doi: 10.1016/j.jfs.2021.100967

Goss A., Roberts G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. J. Banking Finance 35 (7), 1794–1810. doi: 10.1016/j.jbankfin.2010.12.002

Hao X., Zhang G., Chen Y. (2007). Role of BCHP in energy and environmental sustainable development and its prospects in China. Renewable Sustain. Energy Rev. 11 (8), 1827–1842. doi: 10.1016/j.rser.2005.12.007

He L., Gan S., Zhong T. (2022). The impact of green credit policy on firms’ green strategy choices: green innovation or green-washing? Environ. Sci. pollut. Res. Int. 29, 73307–73325. doi: 10.1007/s11356-022-20973-w

Healy P. M., Palepu K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets:A review of the empirical disclosure literature. J. Account. Econ. 31 (1–3), 405–440. doi: 10.1016/S0165-4101(01)00018-0

Hu H., Chang C., Dong M., Meng W., Hao Y. (2018). Does environmental information disclosure affect the performance of energy-intensive firms’ borrowing ability? Evidence from China. Energy Environ. 29 (5), 685–705. doi: 10.1177/0958305X18757766

Hu Y., Du S., Wang Y., Yang X. (2023). How does green insurance affect green innovation? Evidence from China. Sustainability 15 (16), 12194. doi: 10.3390/su151612194

Hu G., Wang X., Wang Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98 (3), 105134. doi: 10.1016/j.eneco.2021.105134

Huang X., Guo Y., Lin Y., Liu L., Yan K. (2022). Green loans and green innovations: evidence from China’s equator principles banks. Sustainability 20, 13674–13674. doi: 10.3390/su142013674

Hughes S., Anderson A., Golden S. (2001). Corporate environmental disclosures: are they useful in determining environmental performance. J. Account. Public Policy 20 (3), 217–240. doi: 10.1016/S0278-4254(01)00031-X

Jeon J. Q., Lim K. K. (2013). Bank competition and financial stability: A comparison of commercial banks and mutual savings banks in Korea. Pacif. Basin Finance J. 25, 253–272. doi: 10.1016/j.pacfin.2013.10.003

Jiang Z., Wang Z., Lan X. (2021). How environmental regulations affect corporate innovation? The coupling mechanism of mandatory rules and voluntary management. Technol. Soc. 65, 101575. doi: 10.1016/j.techsoc.2021.101575

John K., Reisz A. S. (2020). Temporal resolution of uncertainty, disclosure policy, and corporate debt yields. J. Corporate Finance 16 (5), 655–678. doi: 10.1016/j.jcorpfin.2010.05.002

Khatri I., Kjaerland F. (2023). Sustainability reporting practices and environmental performance amongst nordic listed firms. J. Clean. Prod. 418, 138172. doi: 10.1016/j.jclepro.2023.138172

Khlif H., Guidara A., Souissi M. (2015). Corporate social and environmental disclosure and corporate performance: Evidence from South Africa and Morocco. J. Account. Emerg. Econ. 5 (1), 51–69. doi: 10.1108/JAEE-06-2012-0024

Kim J. W., Lim J. (2011). H. IT investments disclosure, information quality, and factors influencing managers’ choices. Inf. Manag. 48 (2-3), 114–123. doi: 10.1016/j.im.2011.03.001

Lai X., Yue S., Chen H. (2022). Can green credit increase firm value? evidence from Chinese listed new energy companies. Environ. Sci. pollut. Res. 29 (13), 18702–18720. doi: 10.1007/s11356-021-17038-9

Li R., Chen Y. (2022). The influence of a green credit policy on the transformation and upgrading of heavily polluting enterprises: A diversification perspective. Econ. Anal. Policy 74, 539–552. doi: 10.1016/j.eap.2022.03.009

Li Q., Li T., Chen H., Xiang E., Ruan W. (2019). Executives’ Excess compensation, legitimacy, and environmental information disclosure in Chinese heavily polluting companies: the moderating role of media pressure. Corporate Soc. Responsibility Environ. Manage. 26 (1), 248–256. doi: 10.1002/csr.1676

Li S., Wang Q. (2023). Green finance policy and digital transformation of heavily polluting firms: Evidence from China. Finance Res. Lett. 55, Part A,103876. doi: 10.1016/j.frl.2023.103876

Li C., Wang X., Huang Y. (2023). Does the CFO serving as the secretary of the board affect the financial statement comparability?—evidence from China. Heliyon 9 (3), e16859. doi: 10.1016/j.heliyon.2023.e13609

Li S., Zhang W., Zhao J. (2022). Does green credit policy promote the green innovation efficiency of heavy polluting industries?—empirical evidence from China’s industries. Environ. Sci. pollut. Res. 29, 46721–46736. doi: 10.1007/s11356-022-19055-8

Lin B., Pan T. (2023). Financing decision of heavy pollution enterprises under green credit policy: Based on the perspective of signal transmission and supply chain transmission. J. Clean. Prod. 412, 137454. doi: 10.1016/j.jclepro.2023.137454

Liu X., Anbumozhi V. (2009). Determinant factors of corporate environmental information disclosure: an empirical study of Chinese listed companies. J. Clean. Prod. 17 (6), 593–600. doi: 10.1016/j.jclepro.2008.10.001

Liu X., Wang E., Cai D. (2019). Green credit policy, property rights and debt financing: quasi-natural. Experimental evidence from China. Finance Res. Lett. 29, 129–135. doi: 10.1016/j.frl.2019.03.014

Liu Y., Yang C., Zhou S., Zhang Y. (2022). Research on the impact of green credit policies on enterprise environmental information disclosure. Stat. Res. 39 (11), 73–87. doi: 10.19343/j.cnki.11–1302/c.2022.11.006

Long Y., Yang B., Liu L. (2023). Can green credit policy promote green innovation in renewable energy enterprises: evidence from China. Environ. Sci. pollut. Res. Int. 30 (41), 94290–94311. doi: 10.1007/s11356-023-29041-3

Lööf H., Nabavi P. (2014). Survival, productivity and growth of new ventures across locations. Small Business Econ. 43 (2), 477–491. doi: 10.1007/s11187-014-9553-9

Luo L., Lan Y., Tang Q. (2012). Corporate incentives to disclose carbon information: evidence from the CDP global 500 report. J. Int. Financial Manage. Account. 23 (2), 93–120. doi: 10.1111/j.1467-646X.2012.01055.x

Lv X. (2016). Government subsidies and enterprise technology innovation investment: evidence from listed companies in strategic emerging industries from 2009 to 2013. Soft Sci. 30 (12), 1–5. doi: 10.13956/j.ss.1001-8409.2016.12.01

Patten D. M., Trompeter G. (2003). Corporate responses to political costs: an examination of the relation between environmental disclosure and earnings management. J. Account. Public Policy 1, 83–94. doi: 10.1016/S0278-4254(02)00087-X

Qi J., Paulet E., Eberhardt-Toth E. (2021). Chinese bank managers’ perceptions of barriers to the implementation of green credit in corporate loan decision-making. Post Communist Econ. 1, 1–17. doi: 10.1080/14631377.2020.1867448

Qiu Y., Shaukat A., Tharyan R. (2016). Environmental and social disclosures: link with corporate financial performance. Br. Account. Rev. 48 (1), 102–116. doi: 10.1016/j.bar.2014.10.007

Ren X., Li Y., Yan C. h., Wen F., Lu Z. (2022). The interrelationship between the carbon market and the green bonds market: Evidence from wavelet quantile-on-quantile method. Technol. Forecast. Soc. Change 179, 121611. doi: 10.1016/j.techfore.2022.121611

Ren X., Xia X., Taghizadeh-Hesary F. (2023). Uncertainty of uncertainty and corporate green innovation - Evidence from China. Econ. Anal. Policy 78, 634–647. doi: 10.1016/j.eap.2023.03.027

Richardson A. J., Welker M. (2001). Social disclosure, financial disclosure and the cost of equity capital. Account. Organ. Soc. 26 (7-8), 597~616. doi: 10.1016/S0361-3682(01)00025-3

Rockness J. (1985). An assessment of the relationship between US corporate environmental performance and disclosure. J. Business Finance Account. 12 (3), 339–354. doi: 10.1111/j.1468-5957.1985.tb00838.x

Rupley K. H., Brown D., Marshall R. S. (2012). Governance, media and the quality of environmental disclosure. J. Account. Public Policy 31 (6), 610–640. doi: 10.1016/j.jaccpubpol.2012.09.002

Salazar J. (1998). Environmental finance: linking two world. Presented at a workshop on financial innovations for biodiversity bratislava. Scientific Report 1, 2–18.

Shao J., Huang P. (2023). The policy mix of green finance in China: an evolutionary and multilevel perspective. Climate Policy 23 (6), 689–703. doi: 10.1080/14693062.2023.2202181

Shao H. H., Wang Y. S., Wang Y., Li Y. J. (2022). Green credit policy and stock price crash risk of heavily polluting enterprises: Evidence from China. Econ. Anal. Policy 75, 271–287. doi: 10.1016/j.eap.2022.05.007

Soundarrajan P., Vivek N. (2016). Green finance for sustainable green economic growth in India. Agric. Econ. 62 (1), 35–44. doi: 10.17221/174/2014-AGRICECON

Sun J., Wang F., Yin H., Zhang B. (2019). Money talks: the environmental impact of China’s green credit policy. J. Policy Anal. Manag. 38 (3), 653–680. doi: 10.1002/pam.22137

Wang E., Liu X., Wu J., Cai D. (2019). Green credit, debt maturity and corporate investment-evidence from China. Sustainability 11 (3), 1–19. doi: 10.3390/su11030583

Wang H., Qi S., Zhou C., Zhou J., Huang X. (2022). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331, 129834. doi: 10.1016/j.jclepro.2021.129834

Wang B., Wang C. (2023). Green finance and technological innovation in heavily polluting enterprises: evidence from China. Int. J. Environ. Res. Public Health 20 (4), 3333. doi: 10.3390/ijerph20043333

Wang Z., Wang C., Feng T., Wang Y. (2023). The influence of the evolution of the innovative network on technical innovation from the perspective of energy transformation: Based on analysis of the new energy vehicle industry in China. Sustainability 15 (5), 4237–4242. doi: 10.3390/su15054237

Wang S., Wang H., Wang J., Yang F. (2020). Does environmental information disclosure contribute to improve firm financial performance? An examination of the underlying mechanism. Sci. Total Environ. 714, 136855. doi: 10.1016/j.scitotenv.2020.136855

Wang X., Xu X., Wang C. (2013). Public pressure, social reputation, inside governance and firm environmental information disclosure: The evidence from Chinese listed manufacturing firms. Nankai Business Rev. 16 (2), 82–91. doi: 10.3969/j.issn.1008-3448.2013.02.010

Wang M., Yu H. Y., Ahsan T. (2016). The impact of environmental information disclosure on business performance: Evidence from high-polluting industries in China. Eur. J. Business Manag. 8 (18), 13–21.

Wang X., Zhu Y., Ren X., Gozgor G. (2022). The impact of digital inclusive finance on the spatial convergence of the green total factor productivity in the Chinese cities. Appl. Econ. 55 (42), 4871–4889. doi: 10.1080/00036846.2022.2131721

Wei P., Yuan K., Ren X., Yan C., Lu Z. (2023). Time-varying spillover networks of green bond and related financial markets. Int. Rev. Econ. Finance 88, 298–317. doi: 10.1016/j.iref.2023.06.022

Wen F., Chen M., Zhang Y., Miao X. (2023a). Oil price uncertainty and audit fees: Evidence from the energy industry. Energy Econ. 125, 106852. doi: 10.1016/j.eneco.2023.106852

Wen F., Lin D., Hu L., He S., Cao Z. L. (2023b). The spillover effect of corporate frauds and stock price crash risk. Finance Res. Lett. 57, 104185. doi: 10.1016/j.frl.2023.104185

Wickert C., Scherer A. G., Spence L. J. (2016). Walking and talking corporate social responsibility: Implications of firm size and organizational cost. J. Manage. Stud. 53 (7), 1169–1196. doi: 10.1111/joms.12209

Wu B., Zhu P., Yin H., Wen F. (2023). The risk spillover of high carbon enterprises in China: Evidence from the stock market. Energy Econ. 126, 106939. doi: 10.1016/j.eneco.2023.106939

Xie J., Nozawa W., Yagi M., Fujii H., Managi S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Business Strategy Environ. 28 (2), 286–300. doi: 10.1002/bse.2224

Xu P., Ye P., Zhao F. (2023). Can green credit policy reduce corporate carbon emission intensity: Evidence from China’s listed firms. Corporate Soc. Responsibility Environ. Manage. 30 (5), 2623–2638. doi: 10.1002/csr.2506

Yang Y., Yao C., Li Y. (2020). The impact of the amount of environmental information disclosure on financial performance: The moderating effect of corporate internationalization. Corporate Soc. Responsibility Environ. Manag. 27 (6), 1–15. doi: 10.1002/csr.2010

Yao S., Pan Y., Sensoy A., Uddin GS., Cheng F. (2021). Green credit policy and firm performance: What we learn from China. Energy Econ. 101, 105415. doi: 10.1016/j.eneco.2021.105415

Yu J., Zhang M., Liu R., Wang G. (2023). Dynamic effects of climate policy uncertainty on green bond volatility: an empirical investigation based on TVP-VAR models. Sustainability 15 (2), 1692. doi: 10.3390/su15021692

Zeng Q., Tong Y., Yang Y. (2023). Can green finance promote green technology innovation in enterprises: empirical evidence from China. Environ. Sci. pollut. Res. 30, 87628–87644. doi: 10.1007/s11356-023-28342-x

Zhan H. (2021). How green credit affects corporate environmental information disclosure: an empirical test based on listed companies in heavy pollution industries. Nankai Econ. Res. 03, 193–207. doi: 10.14116/j.nkes.2021.03.012

Zhang Z., Su Z., Wang K., Zhang Y. (2022). Corporate environmental information disclosure and stock price crash risk: Evidence from Chinese listed heavily polluting companies. Energy Econ. 112, 106116. doi: 10.1016/j.eneco.2022.106116

Keywords: environmental information disclosure, ecological environment, green credit, new energy companies, heterogeneity analysis

Citation: Geng L, Yin W, Wu X, Lu X and Zhang C (2023) How green credit affects corporate environmental information disclosure: evidence from new energy listed companies in China. Front. Ecol. Evol. 11:1301589. doi: 10.3389/fevo.2023.1301589

Received: 25 September 2023; Accepted: 20 November 2023;

Published: 05 December 2023.

Edited by:

Xiaohang Ren, Central South University, ChinaCopyright © 2023 Geng, Yin, Wu, Lu and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaoxia Wu, bmp1d3V4aWFveGlhQDEyNi5jb20=

Limin Geng

Limin Geng Wenxin Yin2

Wenxin Yin2 Xueyuan Lu

Xueyuan Lu