94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Ecol. Evol. , 18 September 2023

Sec. Urban Ecology

Volume 11 - 2023 | https://doi.org/10.3389/fevo.2023.1265531

Environmental regulations may promote regional ecological evolution, but they also increase the need for financing green innovation activities. This study uses panel data from prefecture-level cities in China to examine the impact of fintech and environmental regulation on regional green innovation in the digital economy era. Empirical evidence shows that fintech significantly promotes regional green innovation, and fintech has a positive interaction effect with environmental regulation. While the evidence generally supports the role of environmental regulations in promoting green innovation, the evidence is insignificant in some models. The synergistic effect of fintech and environmental regulation on utility model green innovation is significant, but not on invention type green innovation. Climate policy, as a carbon regulatory policy, does not directly lead to green innovation, but it significantly collaborates with fintech to promote green innovation. The effects of fintech and environmental regulation on green innovation also have heterogeneity effects between resource-based and non-resource-based cities, and non-resource-based cities have a greater effect on achieving green innovation through fintech and environmental regulation. Our findings contribute to optimizing the coordination system between financial and environmental policies, thereby driving regional green innovation development with fintech in the digital age.

For nearly a century, the environmental destruction caused by the Industrial Revolution has posed a major challenge to global and human sustainable development (Hopwood et al., 2005). In particular, industrialization in developing countries with large populations has further aroused people’s attention to environmental issues. Various environmental policies are designed to reduce the damage to the ecological environment caused by economic and social activities (Haque and Ntim, 2018; Li and Wen, 2023). The challenges of climate change and sustainable development goals promote the industrial ecological revolution, but the industrial ecological development needs not only the support of infrastructure such as energy and transportation (Rehman and Islam, 2023a; Rehman et al., 2023a), but also the transformation of industrial production processes and business models. Environmental regulation drives the evolution of industrial ecology, the innovation and transformation technology involved in industrial ecology is relatively complex, and the information asymmetry of ecological industry makes it difficult to obtain financial support.

Essentially, the fundamental source of sustainable economic and social development is green innovation, which can ensure that ecological capital does not decline in the process of economic development. Although environmental regulation policies can force regional green innovation, they also cause economic growth pressure and make green innovation activities suffer from financing difficulties (Zhang and Zhao, 2022). In fact, many developing countries are therefore inclined to relax environmental policies in order to attract foreign investment and promote economic development (Ni et al., 2022). Hence, financial support for green innovation activities under the constraint of environmental goals has become an important issue for sustainable development. Fintech utilizes emerging digital technologies to empower financial institutions to develop green finance business and may provide financial support for green innovation (Xue et al., 2022). Fintech is the abbreviation for financial technology, mainly referring to the use of various technologies in the financial industry to innovate traditional financial products and service models, improve financial service efficiency, and reduce operating costs of financial institutions (Boot et al., 2021).

As a newly industrialized country, China has developed a series of environmental policies and a green preferred financial system in the process of industrialization and achieved outstanding results in sustainable industrialization (Guo and Hu, 2019; Gao et al., 2023). Under the constraints of increasingly stringent environmental targets, China has actively promoted the green and low-carbon transformation of the financial services economy and society, and has built a sound green financial system. In the digital era, China’s financial institutions employ advanced information technologies to promote financial product innovation and improve service efficiency, forming a new business form of financial technology (Zhou et al., 2022). In fact, fintech is an important means to realize the development of green finance in China (Muganyi et al., 2021), some studies have also revealed the role of fintech in supporting sustainable development (Li et al., 2022). Fintech can improve the adverse selection risk before financing activities and the moral hazard after financing, and greatly alleviate the information asymmetry in green project investment and financing.

Green innovation activities have two kinds of externality, knowledge spillover and pollution reduction, which make their investment lower than that of social welfare maximization (Xiang et al., 2022). Existing studies have extensively examined the role of environmental regulations or public policies in green innovation (Wen et al., 2022). There are two main paths for typical related research discussing the nexus of environmental regulation and green innovation. One is to discuss whether command-and-control type or market oriented environmental regulations are more effective in encouraging green innovation (Blackman et al., 2018; Zhang et al., 2020). Market oriented environmental regulations are always more efficient and more likely to stimulate the enthusiasm of enterprises for innovation, while government factors are crucial for cultivating green industries (Grillitsch and Hansen, 2019; Shao et al., 2023). The neutral view is that although market-oriented instruments are efficient, effective governments are equally important for green transformation (Zhou and Wang, 2022). Another discussion is about the innovation compensation effect and compliance cost effect caused by environmental regulations (Porter and Van der Linde, 1995), which may depend on the financial capabilities of the enterprise. Environmental policies can stimulate the motivation of enterprises to carry out green innovation activities, but they may also lead to financial difficulties and a lack of green innovation capabilities in enterprises (Xu et al., 2023a). Many studies therefore examine the supporting role of regional or corporate financial factors on green innovation (Abid et al., 2022; Zhang et al., 2022).

In the digital era, financial institutions can use digital technologies to reduce information asymmetry in green financing activities (Kong et al., 2022). Financial technology is a product of the integration of emerging digital technologies and finance, and some studies have focused on the role of financial technology in green innovation (Ghosh, 2020; Xue et al., 2022). This study is interested in empowering green innovation with the development of fintech in the digital era. Specifically, this study uses the regional panel data of prefecture-level cities in China from 2003 to 2021 to examine how fintech and environmental regulations affect regional green innovation. This study not only finds that fintech is an important enabler of regional green innovation, but also collaboratively drives regional green innovation with environmental regulation. The findings of this study confirm the positive role of fintech in addressing financing challenges in the green innovation sector. Nevertheless, in terms of incentives for green innovation, the development of fintech lags behind environmental regulations to a certain extent.

This study mainly contributes to the existing literature from the following aspects. Firstly, it provides theoretical insights for the digital financing theory of green innovation in the evolution of industrial ecology. Ecological innovation has complex technical characteristics and uncertain results (Meidute-Kavaliauskiene et al., 2021), which shows that the application of digital technology in the financial field can alleviate information asymmetry. Secondly, this study innovatively examines the coordination system between financial policy and environmental policy. The findings support that the coordinated development of financial and environmental policies can greatly activate regional green innovation vitality, and the law of regional green finance development is explained from the perspective of digital technologies. Thirdly, it would help China and other developing countries in the green transition formulate and optimize environmental and financial policies. This study finds that the development of fintech under the constraints of environmental regulations is crucial to the development of green innovation.

Green innovation is mainly driven by increasingly stringent environmental regulations, including administrative, market and voluntary types and various environmental regulations provide commercial basis for corporate green innovation behavior (Wu et al., 2020; Hu et al., 2021; Xu et al., 2023b). Environmental regulations from the government enable enterprises to carry out green innovation activities to reduce the cost of pollution discharge and compliance costs (Lin and Zhang, 2023), while market-based environmental regulations can help enterprises gain green competitive advantages (Hu et al., 2021)), and voluntary regulations enable enterprises to obtain green product premium or stakeholder support (Chithambo et al., 2022). Since Porter’s hypothesis was put forward (Porter and Van der Linde, 1995), a large number of studies have examined whether environmental regulation can promote the competitiveness of enterprises through green innovation, and relevant studies have found the potential differential effects of heterogeneous environmental regulations (Hojnik and Ruzzier, 2016; Hao et al., 2022). In addition, the specific effect of environmental regulation on green innovation depends on certain boundary conditions (Lin and Xie, 2023), such as human capital, financial capital, and legal environment.

The economic slowdown or financial distress caused by environmental regulations may be the key to restricting the Porter effect, and the crucial role of financial factors in green innovation has been discussed in the literature (Chen et al., 2021; Abid et al., 2022). Existing literature has shown that financial development can meet the financing needs of green innovation activities, thereby potentially promoting environmental performance and regional green development (Lv et al., 2021). Some literature also found that the pressure of environmental regulation may increase the financial distress of enterprises, thus restricting enterprises to carry out long-term innovation investment (Xu et al., 2023a). Therefore, some studies try to explore ways to enhance the efficiency of the financial system to enable green innovation of enterprises under regulatory constraints. It has resulted in a large body of literature examining the development of green finance and its role in financing support for green activities (Irfan et al., 2022; Rasoulinezhad and Taghizadeh-Hesary, 2022). These studies cannot explain the lagging or slow development of green finance in a large number of regions in the context of responsible business basis (Zhang et al., 2022).

Digital technology is an important support for improving the service efficiency of the financial system (Feng et al., 2022). Fintech is a specific form of financial institutions using digital technology to improve the efficiency of services (Lee et al., 2021; Wen and Liu, 2023), and relevant research has increasingly focused on the important role of fintech in supporting sustainable development (Xue et al., 2022). Ghosh (2020) found that digital finance is a core component of green finance development, which is also the reason for the rapid development of green finance in the era of digital economy. However, relevant studies have not examined the synergistic effects of environmental regulation and fintech on green development.

Financial technology is the integration of finance and technology in the era of digital economy, which greatly alleviates the information asymmetry of financing activities, thus improving the service efficiency of financial institutions (Lee et al., 2021). For example, financial institutions can avoid the prior adverse selection of financing activities by using the living habits information and credit records of financing demanders. In addition, financial institutions can require enterprises to use loan funds for specific purposes when providing financing services, and emerging digital technologies help financial institutions monitor the use of funds and business behavior of enterprises, which can avoid unethical behavior after corporate financing activities. Responsible commerce enhances the motivation for regional green innovation by driving the ecological development of industries, while fintech enhances regional green innovation capabilities by solving the financing challenges of industrial ecology. Figure 1 shows the theoretical mechanism of fintech and environmental impact on green innovation.

Sustainable development has become an important basis for global business activities, and enterprises have incentives to carry out green innovation activities, so as to gain green competitive advantages in the product market (Tan and Zailani, 2009). The evolution of industrial ecology requires a complex innovation process, which leads to significant information asymmetry in green project investment and financing activities (Lowe and Evans, 1995; Graedel, 1996). In fact, the biggest challenge of enterprise green innovation is the need to rely on long-term capital investment and the need to deal with the uncertainty of innovation results. These uncertain risks and intertemporal capital allocation need to rely on the support of financial institutions. Traditional finance is facing a huge challenge of information asymmetry in dealing with the uncertain risks of green innovation and meeting the long-term capital demand of green innovation. However, fintech can identify greenwashing projects and supervise green innovation behaviors, and alleviate the risk of uncertainty in the outcome and return of innovation. Therefore, it can be concluded that fintech may promote green innovation, and a theoretical hypothesis is proposed.

Hypothesis 1: Ceteris paribus, fintech can significantly boost regional green innovation.

Although responsible and sustainable management is the commercial basis of the global product market, various countries and regions have formulated different environmental policies according to their economic and social development and residents’ disposable income (Xie et al., 2023). Differences in the severity of environmental regulations may lead to differences in the role of fintech in generating green innovation. The fundamental purpose of financial institutions to develop fintech is to obtain higher profits. When environmental regulations in a region are relatively loose, fintech may even support enterprises to carry out innovation activities that are high in energy consumption or pollution (Anderson, 2001). On the contrary, if financial policies and environmental policies are coordinated, environmental policies give enterprises the willingness to green innovation, and financial policies give enterprises the ability to green innovation, the consistency of willingness and ability can promote regional or corporate green innovation. Hence, it raises the following hypothesis.

Hypothesis 2: Ceteris paribus, fintech and environmental regulation have a significant positive interaction effect on regional green innovation.

This study takes the relationship between fintech, environmental regulation and innovation of the prefecture-level cities in China as the object of analysis, and the sample consists of 4294 observations from 226 regions in 19 years from 2003 to 2021. Figure 2 display the geographical map of the research sample. The economic and social development variables involved in this study come from the information network of China’s Development Research Center of the State Council, whose data are all from China’s National Bureau of Statistics. Data on green innovation comes from the China National Intellectual Property Administration, which is the number of green patent applications from prefecture-level cities. The measurement of fintech is based on the text analysis of the content of Baidu news on the development of fintech, and Baidu is the world’s largest Chinese search engine. This study calculates the level of fintech development in each prefecture-level city. The variables of environmental regulation are calculated according to the annual government work report of each prefecture-level city, and the statistics of word frequency related to environment can measure the degree of attention of local governments to the environment. The larger the value of this variable, the stricter the government’s environmental regulations.

This study mainly focuses on two aspects of empirical analysis. One is to examine the impact of fintech and environmental regulations on regional green innovation, and the other is to examine how fintech and environmental regulations synergistically promote regional green innovation. It first constructs a panel regression model to examine the influencing factors of green innovation.

Where subscripts j and t represent the city and year, respectively. GPatentj,t refers to the dependent variable, which is the proxy variable for regional green innovation. In some regressions, green invention model innovation (GIMPatent) and green utility model innovation (GUMPatent) are used as alternative dependent variables. Fintechj,t and ERj,t are two independent variables of interest to this study, representing the development of fintech and environmental regulation, respectively. It also includes K control variables, where Controlk,jt and βk represent the k-th control variable and its regression coefficient, respectively. The last three terms of this model are urban fixed effects (γj), year fixed effects (τt), and random disturbance terms (ϵj,t). The robustness standard error and Driscoll Kraay standard error are used to overcome the threat of heteroscedasticity and cross-sectional correlation to estimation results (Rehman et al., 2023b).

This study also introduces the interaction term between fintech and environmental regulation, as shown in the following model.

Where the interaction item Fintech×ER is used to examine the synergistic effect between fintech and environmental regulation, and the meanings of other variables and parameters are consistent with model (1). If the coefficient α3 is significantly greater than zero, it indicates that there is a significant synergistic effect between fintech and environmental regulations on driving regional green innovation.

The dependent variable of this study is green innovation (GPatent), which is measured by the logarithm of the number of green patent applications in the region. Although patent applications may not necessarily be valid patents, they can timely depict the achievements of regional green innovation (Zhou and Wang, 2022). In addition, patents are divided into utility model and invention types. This study also used green utility patent applications (GUMPatent) and green invention patent applications (GIMPatent) to measure green innovation, and these variables are logarithmic.

The most interesting independent variable is the development of financial technology (Fintech), measured by the statistics of keywords in relevant fintech news reports. The more frequently news keywords are involved in the region, the higher the level of fintech development in the region (Wen and Liu, 2023). Another core dependent variable is environmental regulation (ER), which is measured by the number of environmental related keywords appearing in local government annual work reports. The work reports of local governments have elaborated more on environmental related issues, indicating that the region is paying more attention to environmental regulations. In order to overcome the potential endogeneity of environmental regulation variables that may lead to bias in estimation results, this study also uses the pilot policy for low-carbon cities (DID_Carbon) as a proxy variable for environmental regulation. Once a region implements intervention policies for low-carbon cities, the value of DID_Carbon is one, and in all other cases, it is zero. This study has also defined the dummy variable of whether it is a resource-based city ((RBCity) and incorporated it into the empirical model to examine the heterogeneity effects of different types of cities.

Table 1 presents the definitions of various variables in this study, including other factors that affect regional green innovation, which are considered control variables in the model. Referring to Meng and Zhang (2022), a series of factors such as economic development, trade openness, population and urbanization, financial development, industrial structure, and government size are taken as control variables. Economic development (lnRGDP) determines the economic support capacity for regional green innovation, measured as the logarithm of per capita gross domestic product. The population (lnPop) is a key factor in the generation of genius and creativity, which is also crucial for regional green innovation. The variables of lnPop in this study is measured by the logarithm of the number of registered residence population. Foreign direct investment (lnFDI), as one of the channels for international green technology spillovers, is measured by the logarithm of the number of foreign direct investment enterprises. Urbanization (Urban) leads to economic and social changes with potential impacts on green innovation, and it is defined as the proportion of urban permanent residents to the total population. The model also includes two structural factors, population structure (PStruct) and industrial structure (IStruct), which are measured by the proportion of the number of primary and secondary school students in the total population and the proportion of industrial added value to gross domestic product, respectively (Jiang et al., 2023). Green innovation has the dual externality of knowledge spillover and pollution reduction, which always requires government factors to achieve social optimization (Xu et al., 2023b). This study introduces the control variable of government size (GScale), which is defined as the ratio of the total amount of fiscal revenue and expenditure to the gross domestic product. Financial development (FD) is the fundamental condition for green innovation activities to receive financial support, which is defined as the ratio of the total year-end balance of deposits and loans from financial institutions to gross domestic product.

Table 2 shows some descriptive statistics for the relevant variables. This study has interpolated some missing value variables to ensure that all variables are balanced panels. The main variables have reasonable degrees of variation and value ranges, which ensures that these data can be used to reveal the relationships between variables. The last two columns of Table 2 also show the high correlation between fintech and green innovation, indicating that fintech may play a positive role in promoting regional green innovation. In addition, control variables and explanatory variables are strongly correlated with green innovation.

Figure 3 shows a sunflower chart that reveals the relationship between fintech, environmental regulation, and green innovation. Due to the use of urban level datasets in this study, it will result in high scatter density in some areas of the scatter plot, making it difficult to read. Sunflower charts can overcome this problem and better display the relationships related to variables. It can be found that green innovation is positively correlated with financial technology and environmental regulations. Although it may be consistent with the public’s view that financial policies and environmental policies contribute to promoting regional green innovation, this conclusion may suffer from the challenge of identifying causal relationships. For example, both fintech and environmental regulations are showing an increasing trend in value with green innovation, which requires controlling the interference of relevant trend characteristics.

Table 3 shows the regression results of the impact of fintech and environmental regulations on green innovation. Among them, columns (1) to (3) show the estimation results of the static panel model, while columns (4) to (5) control for the dynamic lag term of green innovation. Since green innovation is the result of long-term investment activities, it means that there is a time lag effect in green innovation. Therefore, incorporating the dynamic lag term into the regression model can avoid the interference of the long-term nature of green innovation activities on the estimated results. The static panel model is estimated by the dummy variable least square method, while the dynamic panel model is estimated by the estimator of the system generalized moment method.

It can be found that both in static and dynamic models, fintech significantly promotes regional green innovation at the 1% level, indicating that financial institutions have strengthened their ability to serve regional green transformation and development through emerging information technologies. However, there is no consensus on the role of environmental regulations in regional green innovation. Column (1) does not control for urban fixed effects, and the coefficient of ER in column (1) is negative, while the coefficients of ER in other columns are all positive. In addition, the coefficients of ER in the static panel model show a significant promoting effect on green innovation, while the coefficients in the dynamic panel model show that environmental regulation has an insignificant positive effect. Nevertheless, the results in Table 3 tend to support environmental regulations that are beneficial for regional green innovation. The inconsistency between fintech and environmental regulations on green innovation is also in line with existing studies. Environmental regulation generates a resource constraint mechanism (Zhang and Zhao, 2022), while financial technology forms an effective resource allocation mechanism (Xue et al., 2022). Hence, they may have varying effects on green innovation.

The relationship between other influencing factors and green innovation roughly conforms to the views of existing literature. Economic development and population size are both favorable factors for innovation, demonstrating a positive impact on green innovation. Although foreign direct investment may generate both green technology spillovers and pollution paradise effects, it has a significant positive impact on regional green innovation in China (Zheng et al., 2022). In the past two decades, China has actively promoted sustainable urbanization and industrialization, which have led to an increase in regional green innovation (Wang et al., 2018). It also reveals that the proportion of students in primary and secondary schools has an uncertain impact on green innovation. The scale of government and financial development are both conducive to regional green innovation, and these findings are consistent with China’s active advocacy of a promising government (Zhou and Wang, 2022). Government factors guide regional green development from various aspects, including strengthening financing support for green innovation activities through promoting financial development.

Referring to Zhou and Wang (2022), this study classifies green innovation into invention type and utility model, where the former is substantive innovation and the latter is strategic innovation behavior. The regression results of influencing factors of different types of green innovation are shown in Table 4. Columns (3) and (6) are the result of a dynamic panel regression model, while the other columns are the result of a static model. As shown in Table 4, fintech has a significant positive impact on both invention type and utility model of green innovation. The results demonstrate that fintech can lead to substantial green innovation in the region, given the difficulty and investment required for inventive innovation. However, environmental regulation has a heterogeneous effect on different types of green innovation, which can mainly promote utility model green innovation, but has insignificant impact on invention type green innovation. Due to the low potential economic value of utility model innovation, this is consistent with the findings of existing research, which suggest that environmental regulation may lead to strategic innovation rather than substantive innovation (Zhang et al., 2020; Liu and Dong, 2022).

According to theoretical expectations, environmental regulation targets green innovation, and fintech can only lead to green innovation under the constraints of environmental objectives. Therefore, this study further examines the interactive effects of environmental regulation and financial technology, so as to explore the collaborative mechanism of environmental policy and financial policy to promote green innovation. Specifically, Table 5 shows the impact of fintech, environmental regulations and their interactions on regional green innovation. Columns (1) and (2) do not control the dynamic lag term for green innovation, while the other columns control the dynamic lag term and are set as the dynamic panel model.

The results in Table 5 show that both environmental regulation and fintech may be ineffective in promoting regional green innovation, but they can synergistically promote green innovation. The interaction terms of fintech and environmental regulation (Fintech×ER) in Table 5 all have significant positive effects on green innovation at the significant level of 10%, indicating that the synergy mechanism of fintech and environmental regulation or hypothesis 2 is valid. The coefficients of environmental regulation (ER) are negative or insignificant, which mean that environmental regulation cannot lead to regional green innovation when the development of fintech is lagging behind. The coefficient of fintech (Fintech) is significant only in column (1), which does not control for other factors, but the coefficients of fintech in other columns are insignificant. These results imply that the positive promoting effect of fintech on green innovation cannot be separated from the constraints of environmental policies.

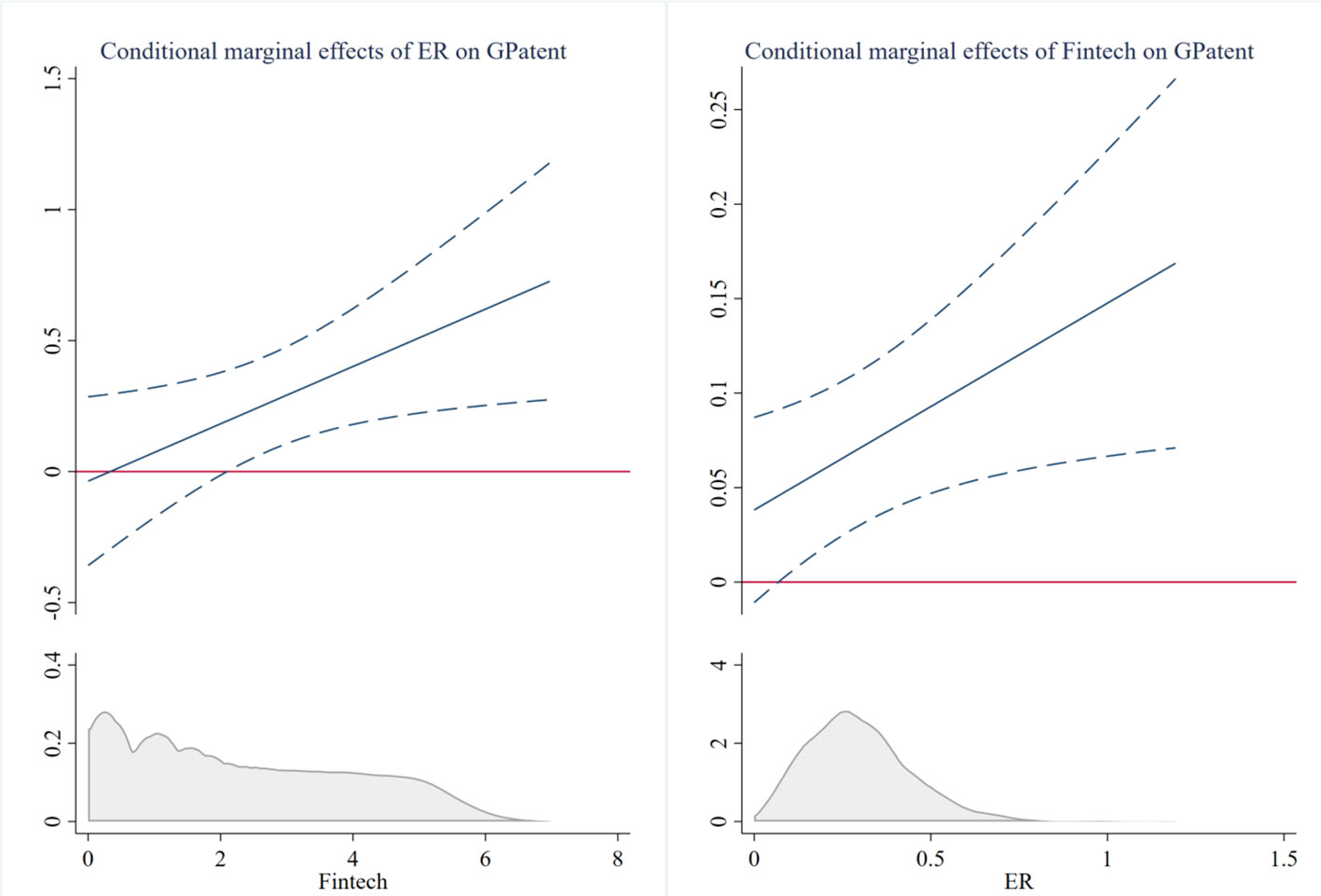

In order to clearly demonstrate the synergistic mechanism between fintech and environmental regulation, this study also shows the conditional marginal effect of fintech and environmental regulation on green innovation in Figure 4, and the marginal effects are calculated using the estimated results in column (2) of Table 5. The left figure in Figure 4 is the marginal effect of environmental regulation on green innovation conditioned by fintech, while the right figure is the marginal effect of fintech conditioned by environmental regulation. It can be found that both fintech and environmental regulation have an increasing marginal effect on regional green innovation with the increase of each other. In addition, a large part of the distribution of fintech is in the area where the marginal effect of environmental regulation is insignificant. It can be inferred that fintech development is not able to meet the financing needs of green innovation activities driven by environmental policies. On the contrary, the marginal effect of fintech is significantly positive for most values of environmental regulation. It is necessary to support fintech development to better unleash the potential of green innovation.

Figure 4 Conditional marginal effect of fintech, environmental regulation on green innovation. The dashed line represents the interval estimate at the 95% confidence level.

This study also wonders whether the synergy between fintech and environmental regulation has a heterogeneous effect on different types of green innovation. In this study, invention type green innovation (GIMPatent) and utility model green innovation (GUMPatent) are taken as dependent variables respectively, and the estimated results are shown in Table 6.

Table 6 shows that fintech and environmental regulation coordinate to promote utility model green innovation, but have insignificant impact on invention type green innovation. In columns (1) to (3), the coefficients of Fintech× ER are insignificant, while the coefficients of Fintech× ER in columns (4) to (6) are significantly greater than zero. The results mean that the synergistic effect of environmental regulation and fintech on promoting utility model green innovation has been verified, while the synergistic promotion mechanism for invention type green innovation is positive and insignificant. In China, financial policy is also an important means for local governments to restrict the environmental behavior of enterprises, and enterprises carry out strategic green innovation in order to obtain financial support under the financial dilemma of environmental regulation. Hence, empirical evidence shows that financial policy and environmental policy synergistically promote strategic green innovation, but have insignificant impact on substantive green innovation. On the contrary, the coefficients of Fintech are significant in columns (1) and (2). Fintech can improve the financial services capabilities of financial institutions and the ability to cope with information asymmetries, thus having a direct impact on substantive green innovation.

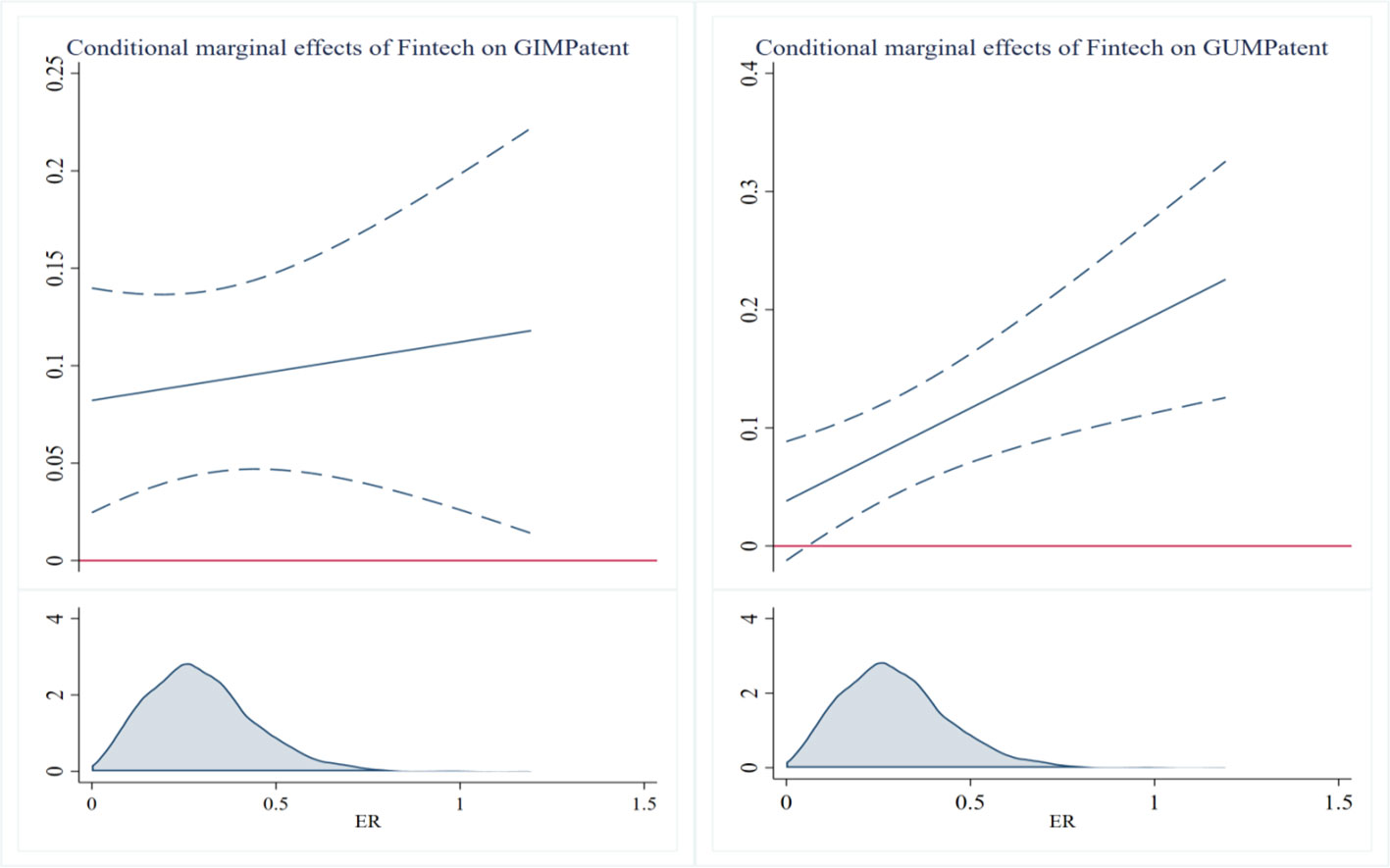

Figure 5 shows the conditional marginal effect of fintech on invention type and utility model green innovation. Whether it is invention type or utility model, fintech has a significant positive impact on green innovation. In the left subgraph of Figure 5, the conditional marginal effect of fintech on regional green innovation is significantly greater than zero, and the marginal effect increases slowly as environmental regulations become stricter. The commercial basis of substantial green innovation is not limited to a single region, and substantial green innovation is a key means to gain green competitiveness in the product market or global market under the sustainable commercial basis. However, these substantial green innovation activities need to be impacted by various uncertainties and require long-term investment. By improving the service capacity of the financial system, fintech can provide long-term financing support for substantive green innovation activities, and its positive impact on substantive green innovation is not affected by regional environmental policies. In the right subgraph of Figure 4, the conditional marginal effect of fintech on regional green innovation increases rapidly with the tightening of environmental regulations, and the conditional marginal effect is significantly positive under most of the value ranges of environmental regulations. It implies that strategic green innovation exists, and fintech is a type of financial policies that also tends to support enterprises that respond to environmental regulatory policies.

Figure 5 Conditional marginal effect of fintech on heterogeneous green innovation. The dashed line represents the interval estimate at the 95% confidence level.

Panel data may have the challenge of cross-sectional correlation, and some studies use sectional correlation panel autoregressive distributed lag model (CS-ARDL) to reveal the dynamic lag term and cross-sectional correlation (Rehman and Islam, 2023b; Rehman et al., 2023c; Rehman and Sohag, 2023). The Frees’ test of cross-sectional independence is 13.984, and the critical value for a 1% confidence level is 0.2601. This result shows that the perturbation term of the two-way fixed effect model may have cross-sectional correlation, and this study uses in-group estimators and Driscol-Kraay standard deviation to improve the robustness of the estimated results. The results are shown in Table 7. The results shown in Table 7 are consistent with the conclusions drawn in the previous section, which shows that hypotheses 1 and 2 are valid even when cross-sectional correlations are taken into account.

The measurement of environmental regulation has certain subjective characteristics, and this study introduces the pilot policy of constructing low-carbon cities as an alternative indicator of environmental regulation (Wen et al., 2023). A series of environmental regulation policies have been designed in low-carbon pilot cities in China to achieve green and low-carbon development, which can serve as an intervention experiment for environmental regulation. This study not only examines the impact of climate policy on green innovation, but also investigates the interaction effect of climate policy and fintech on green innovation. Table 8 shows the empirical results taking into account climate policies.

The empirical results show that the pilot policy of building low-carbon cities has insignificant impact on green innovation, but the interaction with fintech significantly promotes green innovation. It suggests that fintech can help regions constrained by climate policies to access financing for green innovation. In addition, although the pilot policy of low-carbon cities does not have a significant positive impact on invention type green innovation, it can promote utility model green innovation. The pilot policy of low-carbon city imposes strong constraints on regional green development, which also leads to the emergence of strategic green innovation behavior. When it takes the quasi-natural experiment of climate policy as the alternative indicator of environmental regulation, and the conclusions obtained are consistent with the previous ones. The findings in Table 8 also support the core view of this study, that financial policies need to be coordinated with environmental policies to ensure that regional transformation and upgrading activities can receive financial support.

Considering that differences in resource endowments may lead to heterogeneous development patterns (Rehman et al., 2023d), this study defines a dummy variable for whether a city is a resource-based city (RBCity) and examines the impact of fintech and environmental regulation on green innovation with sub-samples. Resource-based cities are defined according to the National Sustainable Development Plan for Resource Based Cities (2013-2020) of China. The sub-sample regression results based on the characteristics of resource endowments are shown in Table 9. The last two columns are used to test whether there is a significant difference in grouping coefficients by the method of interaction terms. Despite the differences in regression coefficients between the two groups of cities, empirical evidence does not show significant differences in the influencing factors of green innovation between the two groups of cities. Fintech has a positive impact on green innovation in different types of cities, but the coefficients of some columns are insignificant. In addition, fintech can play a greater role in promoting green innovation in non-resource-based cities, and only in non-resource-based cities does it have a positive interaction effect with environmental regulations on green innovation. The heterogeneity of cities with different endowment characteristics means that fintech development in resource-based cities may not be sufficient, thus preventing regional green innovation intentions from being translated into action.

Regional green innovation is the fundamental source of sustainable development, and various environmental regulation policies are designed to promote regional green innovation. The driving mechanism of regional green innovation under regulatory pressure has always been a puzzle for policymakers and environmental policy researchers (Hojnik and Ruzzier, 2016; Wang et al., 2023). The findings of this study support the positive effects of fintech in promoting green innovation and its interaction with environmental regulations. However, the role of fintech in promoting green innovation is based on the paradigm of economic and social responsibility and sustainable development.

The paradigm of responsibility and sustainable development promotes an increase in demand for green finance, and technology finance can solve the problem of conflicting interests among green finance entities, enabling producers, financial institutions, consumers, and investors to unanimously support green finance. Therefore, the role of technology finance in green innovation may be achieved through mechanisms that promote the development of green finance. Numerous studies have also shown that the development of green finance plays a crucial role in green transformation and development (Rasoulinezhad and Taghizadeh-Hesary, 2022). Nevertheless, the findings of this study are helpful to enrich the theory of sustainable development of financial services, which also distinguishes the relevant literature about green finance. Most studies support the effectiveness of green finance in promoting green development, but these studies do not know the feasible path to promote green finance development, resulting in a lack of operational policy implications. Our findings suggest that financial institutions can achieve their goal of developing green finance through technological means.

Consistent with the relevant research on green finance, it is also found that the strategic behavior of regional green innovation (Zhang et al., 2020). That is, the interaction between environmental regulation and fintech, leads to utility model innovation rather than inventive green innovation. Environmental regulation represents the will of local governments in green development, which is often supported by corresponding subsidy policies. Therefore, enterprises may cater to local governments and obtain subsidies or tax incentives by carrying out utility model green innovation. If it is using enterprise-level green innovation data, the evidence for strategic innovation behavior may be stronger. In any case, this study believes that the sustainable goal-oriented financial development cannot be achieved without the support of modern digital technology, because the application of digital technology in the financial field can greatly reduce the information asymmetry in the investment and financing of green projects (Xu et al., 2023a). In addition, although the collaborative mechanism of fintech and environmental regulation to promote green innovation is established, the perfection of the financial policy system in terms of regional green innovation lags behind that of the environmental policy system. It can be concluded that China’s environmental regulation policies are relatively strict, and the development of financial technology is relatively lagging behind, thus restricting the coordination of financial policies and environmental policies to promote green innovation.

This study innovatively integrates financial policy and environmental policy into the unified analytical framework of the motivation mechanism of green innovation. Specifically, it uses regional panel data from prefecture-level cities in China to examine the synergistic role of environmental regulation and fintech in driving green innovation. It is found that fintech significantly promotes regional green innovation, and it collaborates with environmental regulation to promote regional green innovation. It shows that the information asymmetry of industrial ecology and regional ecology can be alleviated by fintech, and the study contributes to the digital financing theory of complex technology industries. In addition, both fintech and environmental regulation have an increasing marginal effect on regional green innovation with the increase of each other. The conditional marginal effect of fintech on green innovation is basically significant and positive, while the conditional marginal effect of environmental regulation is insignificant in the longer value range of fintech. Digital technologies should have significant potential to drive the green transformation of the financial system.

Fintech and environmental regulation also have heterogeneous effects on different types of green innovation. Fintech can lead to substantial green innovation in the region, while environmental regulation mainly promotes utility model green innovation. In fact, green-preferred financial policies may be a crucial driver of green innovation within the constraints of strong environmental objectives. Besides, the synergistic effect of fintech and environmental regulation on utility model green innovation is significant, but not on invention type green innovation. Therefore, the challenge of environmental policies and environmentally friendly financial policies is that they may lead to strategic green innovation, which has a relatively limited effect on regional green transformation. This study also uses alternative indicators of the role of low-carbon city pilot policies in environmental regulation, which reach similar conclusions. In regional and industrial ecological evolution, this key measure needs to address the information asymmetry in green financing activities, rather than the motivation for green innovation.

Our findings contribute to the formulation and optimization of environmental and financial policies to stimulate regional green innovation. Firstly, it is necessary to actively play the role of emerging digital technologies to improve the ability of financial institutions to serve the green development. However, many developing countries, including China, are facing lagging financial development for green transformation, which makes the financing dilemma common in the process of regional green transformation (Irfan et al., 2022). It should support the use of emerging digital technologies by financial institutions. Secondly, governments need to strengthen the coordination of financial and environmental policies. The implementation of environmental policies and financial policies are always attributed to different administrative departments, which results in the insufficient release of the synergistic effect between the financial and environmental policies to drive green innovation (Xu and Kim, 2022). The government needs to set standards for industrial ecology to help enterprises obtain financing support for green transformation. Thirdly, the implementation of environmental policies and green preferred financial policies needs to consider the catering behavior of green innovators. Preferential policies should be used to support substantive green innovators rather than strategic green innovators. The government should develop a mechanism for disclosure and supervision of green projects.

Some limitations can be extended. For example, this can be done using long panel data to mitigate cross-sectional correlation challenges using the CS-ADRL model, while panel quantile regression can be used to examine heterogeneity effects. Despite attempts to overcome the endogeneity of environmental regulation, the endogeneity of fintech is not considered. In addition, the hypothesis of coordination between financial policies and environmental policies needs to be tested, which means that the specific mechanism can be explored by measuring the coordination between financial policies and environmental policies.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

LN: Conceptualization, Formal Analysis, Writing – original draft. YY: Formal Analysis, Writing – review & editing. HW: Methodology, Software, Supervision, Writing – review & editing.

The authors declare financial support was received for the research, authorship, and/or publication of this article. Special Project of Research on Digital Transformation of Smart Education and Teaching in Jiangsu Universities in 2022 (2022ZHSZ66).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abid N., Ceci F., Ahmad F., Aftab J. (2022). Financial development and green innovation, the ultimate solutions to an environmentally sustainable society: Evidence from leading economies. J. Clean Prod. 369, 133223. doi: 10.1016/j.jclepro.2022.133223

Anderson D. (2001). Technical progress and pollution abatement: an economic view of selected technologies and practices. Environ. Dev. Econ. 6 (3), 283–311. doi: 10.1017/S1355770X01000171

Blackman A., Li Z., Liu A. A. (2018). Efficacy of command-and-control and market-based environmental regulation in developing countries. Annu. Rev. Res. Econ. 10, 381–404. doi: 10.1146/annurev-resource-100517-023144

Boot A., Hoffmann P., Laeven L., Ratnovski L. (2021). Fintech: what’s old, what’s new? J. Financial Stab. 53, 100836. doi: 10.1016/j.jfs.2020.100836

Chen Y., Cheng L., Lee C. C., Wang C. S. (2021). The impact of regional banks on environmental pollution: Evidence from China's City commercial banks. Energy Econ. 102, 105492. doi: 10.1016/j.eneco.2021.105492

Chithambo L., Tauringana V., Tingbani I., Achiro L. (2022). Stakeholder pressure and greenhouses gas voluntary disclosures. Business Strat. Environ. 31 (1), 159–172. doi: 10.1002/bse.2880

Feng S., Zhang R., Li G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi: 10.1016/j.strueco.2022.02.008

Gao D., Li Y., Tan L. (2023). Can environmental regulation break the political resource curse: evidence from heavy polluting private listed companies in China. J. Environ. Plann. Manage. doi: 10.1080/09640568.2023.2218988

Ghosh K. (2020). Role of fintech in green finance and sustainable development. Gyan. Manage. J. 14 (2), 61–71. Available at: https://acspublisher.com/journals/index.php/gmj/article/view/187

Graedel T. E. (1996). On the concept of industrial ecology. Annu. Rev. Energy Environ. 21 (1), 69–98. doi: 10.1146/annurev.energy.21.1.69

Grillitsch M., Hansen T. (2019). Green industry development in different types of regions. Eur. Plann. Stud. 27 (11), 2163–2183. doi: 10.1080/09654313.2019.1648385

Guo C., Hu Y. (2019). China’s sustainable industrialization and its significance. Chin. J. Urban Environ. Stud. 7 (01), 1940003. doi: 10.1142/S2345748119400037

Hao Y., Guo Y., Wu H. (2022). The role of information and communication technology on green total factor energy efficiency: does environmental regulation work? Business Strat. Environ. 31 (1), 403–424. doi: 10.1002/bse.2901

Haque F., Ntim C. G. (2018). Environmental policy, sustainable development, governance mechanisms and environmental performance. Business Strat. Environ. 27 (3), 415–435. doi: 10.1002/bse.2007

Hojnik J., Ruzzier M. (2016). What drives eco-innovation? A review of an emerging literature. Environ. Innov. Soc. Transit. 19, 31–41. doi: 10.1016/j.eist.2015.09.006

Hopwood B., Mellor M., O'Brien G. (2005). Sustainable development: mapping different approaches. Sustain. Dev. 13 (1), 38–52. doi: 10.1002/sd.244

Hu Y., Sun S., Dai Y. (2021). Environmental regulation, green innovation, and international competitiveness of manufacturing enterprises in China: From the perspective of heterogeneous regulatory tools. PloS One 16 (3), e0249169. doi: 10.1371/journal.pone.0249169

Irfan M., Razzaq A., Sharif A., Yang X. (2022). Influence mechanism between green finance and green innovation: exploring regional policy intervention effects in China. Technol. Forecast. Soc. Change 182, 121882. doi: 10.1016/j.techfore.2022.121882

Jiang H., Chen Z., Liang Y., Zhao W., Liu D., Chen Z. (2023). The impact of industrial structure upgrading and digital economy integration on China's urban carbon emissions. Front. Ecol. Evol. 11, 1231855. doi: 10.3389/fevo.2023.1231855

Kong T., Sun R., Sun G., Song Y. (2022). Effects of digital finance on green innovation considering information asymmetry: An empirical study based on Chinese listed firms. Emerg. Markets Finance Trade 58 (15), 4399–4411. doi: 10.1080/1540496X.2022.2083953

Lee C. C., Li X., Yu C. H., Zhao J. (2021). Does fintech innovation improve bank efficiency? Evidence from China’s banking industry. Int. Rev. Econ. Finance 74, 468–483. doi: 10.1016/j.iref.2021.03.009

Li G., Wen H. (2023). The low-carbon effect of pursuing the honor of civilization? A quasi-experiment in Chinese cities. Econ. Anal. Policy 78, 343–357. doi: 10.1016/j.eap.2023.03.014

Li G., Zhang R., Feng S., Wang Y. (2022). Digital finance and sustainable development: Evidence from environmental inequality in China. Business Strat. Environ. 31 (7), 3574–3594. doi: 10.1002/bse.3105

Lin B., Xie J. (2023). Does environmental regulation promote industrial structure optimization in China? A perspective of technical and capital barriers. Environ. Impact Assess. Rev. 98, 106971. doi: 10.1016/j.eiar.2022.106971

Lin B., Zhang A. (2023). Can government environmental regulation promote low-carbon development in heavy polluting industries? Evidence from China's new environmental protection law. Environ. Impact Assess. Rev. 99, 106991. doi: 10.1016/j.eiar.2022.106991

Liu Q., Dong B. (2022). How does China’s green credit policy affect the green innovation of heavily polluting enterprises? The perspective of substantive and strategic innovations. Environ. Sci. Pollut. Res. 29 (51), 77113–77130. doi: 10.1007/s11356-022-21199-6

Lowe E. A., Evans L. K. (1995). Industrial ecology and industrial ecosystems. J. Clean Prod. 3 (1-2), 47–53. doi: 10.1016/0959-6526(95)00045-G

Lv C., Shao C., Lee C. C. (2021). Green technology innovation and financial development: Do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi: 10.1016/j.eneco.2021.105237

Meidute-Kavaliauskiene I., Çiğdem Ş., Vasiliauskas A. V., Yıldız B. (2021). Green innovation in environmental complexity: The implication of open innovation. J. Open Innovation: Technol. Market Complexity 7 (2), 107. doi: 10.3390/joitmc7020107

Meng F., Zhang W. (2022). Digital finance and regional green innovation: Evidence from Chinese cities. Environ. Sci. Pollut. Res. 29 (59), 89498–89521. doi: 10.1007/s11356-022-22072-2

Muganyi T., Yan L., Sun H. P. (2021). Green finance, fintech and environmental protection: Evidence from China. Environ. Sci. Ecotechnol. 7, 100107. doi: 10.1016/j.ese.2021.100107

Ni L., Li L., Zhang X., Wen H. (2022). Climate policy and foreign direct investment: evidence from a quasi-experiment in Chinese cities. Sustainability 14 (24), 16469. doi: 10.3390/su142416469

Porter M., Van der Linde C. (1995). Green and competitive: ending the stalemate. Harvard Business Rev. 73 (5), 120–133.

Rasoulinezhad E., Taghizadeh-Hesary F. (2022). Role of green finance in improving energy efficiency and renewable energy development. Energy Efficiency 15 (2), 14. doi: 10.1007/s12053-022-10021-4

Rehman F. U., Islam M. M. (2023a). Does energy infrastructure spur total factor productivity (TFP) in middle-income economies? An application of a novel energy infrastructure index. Appl. Energy 336, 120836. doi: 10.1016/j.apenergy.2023.120836

Rehman F. U., Islam M. M. (2023b). Financial infrastructure—total factor productivity (TFP) nexus within the purview of FDI outflow, trade openness, innovation, human capital and institutional quality: Evidence from BRICS economies. Appl. Econ. 55 (7), 783–801. doi: 10.1080/00036846.2022.2094333

Rehman F. U., Islam M. M., Miao Q. (2023a). Environmental sustainability via green transportation: A case of the top 10 energy transition nations. Transport Policy 137, 32–44. doi: 10.1016/j.tranpol.2023.04.013

Rehman F. U., Islam M. M., Miao Q., Metwally A. S. M. (2023b). Does transport infrastructure make South Asian economies growth more inclusive? An application of a new transportation infrastructure index. Res. Transportation Business Manage. 49, 101013. doi: 10.1016/j.rtbm.2023.101013

Rehman F. U., Islam M. M., Raza S. A. (2023c). Does disaggregate energy consumption matter to export sophistication and diversification in OECD countries? A robust panel model analysis. Renewable Energy 206, 274–284. doi: 10.1016/j.renene.2023.02.035

Rehman F. U., Islam M. M., Ullah M., Khan S., Rehman M. Z. (2023d). Information digitalization and renewable electricity generation: Evidence from South Asian countries. Energy Rep. 9, 4721–4733. doi: 10.1016/j.egyr.2023.03.112

Rehman F. U., Sohag K. (2023). Does transport infrastructure spur export diversification and sophistication in the G-20 economies? An application of CS-ARDL. Appl. Econ. Lett. 30 (14), 1861–1865. doi: 10.1080/13504851.2022.2083554

Shao H., Huang X., Wen H. (2023). Foreign direct investment, development strategy, and green innovation. Energy Environ. doi: 10.1177/0958305X231164674

Tan J., Zailani S. (2009). Green value chain in the context of sustainability development and sustainable competitive advantage. Global J. Environ. Res. 3 (3), 234–245.

Wang Q., Su M., Li R. (2018). Toward to economic growth without emission growth: The role of urbanization and industrialization in China and India. J. Clean Prod. 205, 499–511. doi: 10.1016/j.jclepro.2018.09.034

Wang Y., Zhou F., Wen H. (2023). Does environmental decentralization promote renewable energy development? A Local Government Competition Perspective. Sustainability 15 (14), 10829. doi: 10.3390/su151410829

Wen H., Chen S., Lee C. C. (2023). Impact of low-carbon city construction on financing, investment, and total factor productivity of energy-intensive enterprises. Energy J. 44 (2), 78–. doi: 10.5547/01956574.44.2.hwen

Wen H., Liu Y. (2023). Can fintech lead to the collaborative reduction in pollution discharges and carbon emissions? Sustainability 15 (15), 11627. doi: 10.3390/su151511627

Wen H., Wen C., Lee C. C. (2022). Impact of digitalization and environmental regulation on total factor productivity. Inf. Econ. Policy 61, 101007. doi: 10.1016/j.infoecopol.2022.101007

Wu W., Liu Y., Wu C. H., Tsai S. B. (2020). An empirical study on government direct environmental regulation and heterogeneous innovation investment. J. Clean Prod. 254, 120079. doi: 10.1016/j.jclepro.2020.120079

Xiang X., Liu C., Yang M. (2022). Who is financing corporate green innovation? Int. Rev. Econ. Finance 78, 321–337. doi: 10.1016/j.iref.2021.12.011

Xie B., Yang C., Song W., Song L., Wang H. (2023). The impact of environmental regulation on capacity utilization of China’s manufacturing industry: An empirical research based on the sector level. Ecol. Indic. 148, 110085. doi: 10.1016/j.ecolind.2023.110085

Xu L., Guo P., Wen H. (2023a). Increasing short-term lending for long-term investment under environmental pressure: Evidence from China’s energy-intensive firms. Environ. Sci. Pollut. Res. 30 (6), 14693–14706. doi: 10.1007/s11356-022-23190-7

Xu Q., Kim T. (2022). Financial constraints and corporate environmental policies. Rev. Financial Stud. 35 (2), 576–635. doi: 10.1093/rfs/hhab056

Xu L., Yang L., Li D., Shao S. (2023b). Asymmetric effects of heterogeneous environmental standards on green technology innovation: Evidence from China. Energy Econ. 117, 106479. doi: 10.1016/j.eneco.2022.106479

Xue Q., Bai C., Xiao W. (2022). Fintech and corporate green technology innovation: Impacts and mechanisms. Managerial Decision Econ. 43 (8), 3898–3914. doi: 10.1002/mde.3636

Zhang C., Cheng X., Ma Y. (2022). Research on the impact of green finance policy on regional green innovation-based on evidence from the pilot zones for green finance reform and innovation. Front. Environ. Sci. 10, 896661. doi: 10.3389/fenvs.2022.896661

Zhang J., Liang G., Feng T., Yuan C., Jiang W. (2020). Green innovation to respond to environmental regulation: How external knowledge adoption and green absorptive capacity matter? Business Strat. Environ. 29 (1), 39–53. doi: 10.1002/bse.2349

Zhang Y., Zhao Z. (2022). Environmental regulations and corporate social responsibility: Evidence from China's real-time air quality monitoring policy. Finance Res. Lett. 48, 102973. doi: 10.1016/j.frl.2022.102973

Zheng S., Zhou F., Wen H. (2022). The relationship between trade liberalization and environmental pollution across enterprises with different levels of viability in China. Emerg. Markets Finance Trade 58 (8), 2125–2138. doi: 10.1080/1540496X.2021.1961738

Zhou F., Wang X. (2022). The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Anal. Policy 74 (6), 365–381. doi: 10.1016/j.eap.2022.03.007

Keywords: fintech, environmental regulation, green innovation, utility model innovation, invention innovation

Citation: Ni L, Yu Y and Wen H (2023) Impact of fintech and environmental regulation on green innovation: inspiration from prefecture-level cities in China. Front. Ecol. Evol. 11:1265531. doi: 10.3389/fevo.2023.1265531

Received: 23 July 2023; Accepted: 04 September 2023;

Published: 18 September 2023.

Edited by:

Fei Fan, Wuhan University, ChinaReviewed by:

Jiachao Peng, Wuhan Institute of Technology, ChinaCopyright © 2023 Ni, Yu and Wen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Huwei Wen, d2VuaHV3ZWlAbmN1LmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.