- 1International Business School, Fuzhou University of International Studies and Trade, Fuzhou, China

- 2Faculty of Humanities and Social Sciences, Macao Polytechnic University, Macao, Macao SAR, China

- 3School of Public Affairs, Zhejiang University, Hangzhou, China

- 4International College, Ulaanbaatar Erdem University, Ulaanbaatar, Mongolia

- 5Nan’an Branch, Quanzhou Yixing Electrical Engineering Construction Co., Ltd., Quanzhou, China

Based on the fundamental logic of “green finance – improvement of ecological environment and new kinetic energy of economic development – sustainable development of economy and society”, this paper conducts quasi-natural experiments using panel data from 30 provinces and cities in China between 2013 and 2021. It explores the effects of pilot policies of the green finance reform and innovation pilot zone on the sustainable development of the economy and society through a double difference model. The study reveals that the establishment of the green finance reform and innovation pilot zone has a significant promoting effect on the sustainable development of the economy and society. This conclusion remains valid even after conducting a series of robustness tests. In further analysis, it is found that the promotion effect of the green finance reform and innovation pilot zone on sustainable development exhibits some temporal characteristics. It is particularly significant in regions with lower levels of financial development and industrialization but higher levels of technological innovation. Mechanism analysis indicates that the pathways through which the green finance reform and innovation pilot zone facilitates economic and social sustainable development are relatively singular, primarily revolving around the improvement of the ecological environment. The key contribution of this paper lies in demonstrating the crucial role of pilot policies in the field of sustainable economic and social development. Additionally, it offers new insights for strengthening the implementation effectiveness of green finance pilot policies.

1 Introduction

With the challenge of global climate change, achieving sustainable development in the economy and society has become a crucial issue worldwide. Improving the ecological environment and promoting green development are vital steps towards realizing the harmonious coexistence between humans and nature and enhancing sustainable economic and social development. Green finance, as a financial policy aimed at environmental protection, has emerged with the concept of sustainable development (Sun, 2021). It has gradually become a crucial measure for promoting the green development of the economy and society, significantly impacting the ecological industrial structure, green industrial enterprises, and the construction of ecological civilization. As a representative developing country, China has shifted its economic development mode from extensive to high-quality in recent years, embracing the concept of green development. Green finance plays a vital role in China’s sustainable economic and social development. In 2016, the People’s Bank of China, along with seven ministries and commissions, issued the Guidance on Building a Green Financial System, making China the first country to promote and establish a green financial system under the central government.

China’s green finance sector has experienced significant growth and continuous reform. Extensive efforts have been made to establish a comprehensive green financial system, focusing on top-level design, financial instruments, and policy systems. Notably, pilot policies within green finance have been advancing, with the pilot zones for green finance reform and innovation serving as a notable example. In 2017, the executive meeting of the State Council of China decided to establish eight pilot zones across five provinces and regions, namely Guangdong, Zhejiang, Jiangxi, Guizhou, and Xinjiang. Each pilot zone has its own unique characteristics and development focus, serving as both an innovative regional development model and a benchmark for the nation’s green financial progress. These pilot zones represent a stage of further development, incorporating top-down design and bottom-up pilot exploration. This approach facilitates the accumulation of replicable experience in green financial development, provides a platform for promoting comprehensive green development in the economy and society, and accelerates progress towards sustainability. It also contributes to accumulating replicable experience in green financial development, strengthening overall green development in the economy and society, and enhancing sustainability.

Quantitative studies on green finance primarily focus on two aspects. Firstly, they examine the economic benefits of green finance, specifically the impact of its development on economic growth (Ruiz et al., 2016; Muhammad et al., 2022; Yin and Xu, 2022; Zhou et al., 2022; Sheng and Haonan, 2023). Secondly, they investigate the ecological benefits of green finance, particularly its role in improving the ecological environment (Zhu et al., 2020; Ding et al., 2021; Dziwok and Jger, 2021; Ozili, 2021; Tma et al., 2021; Ao et al., 2023; Xu et al., 2023). Some scholars have also examined the influence of green financial development on green technological innovation (Zhang J. et al., 2022; Yang et al., 2023). However, these studies mainly focus on the overall development of green finance and its economic and ecological benefits. Notably, there is limited research on the policy implementation perspective of green finance, which presents an opportunity for further examination in this paper.

China has been implementing pilot zones for green finance reform and innovations for the past five years, making it a typical policy in the field. Evaluating the effectiveness of this policy is essential for future developments and achieving sustainable economic and social growth. This study utilizes panel data from 30 provinces and municipalities in China between 2013 and 2021. By employing a difference-in-differences (DID) model, the paper examines the impact of the establishment of these pilot zones on the sustainable development of the economy and society. The findings of this study contribute to the improvement of green finance’s role in promoting sustainable economic and social development.

The innovation and contribution of this paper are as follows: Firstly, it adopts a unique research perspective. Unlike existing studies that primarily examine the overall effects (economic or ecological) of green finance development, this paper takes a fresh approach by focusing on the pilot policy of green finance. It evaluates the impact of this pilot policy through its policy effects, thus addressing endogenous problems within the model and providing precise insights into the influence of green finance on sustainable economic and social development. Secondly, it establishes a research mechanism. This paper employs a comprehensive index system to evaluate economic and social sustainable development. It then selects the dimension index of sustainable development as the influencing factor for the green finance pilot policy. This approach eliminates issues of omission, repetition, and lack of economic logic support that may arise from subjective judgments in selecting the action mechanism. Lastly, it offers significant research findings. The analysis of regional heterogeneity and the examination of the action mechanism presented in this paper help explain the distinctive characteristics of pilot policies in China’s Green Finance Reform and Innovation Experimental Zone. Furthermore, it verifies the vital role of innovation-driven approaches in fostering the sustainable development of China’s economy and society in the present stage.

The remaining sections of this paper are organized as follows: Section 2 provides a comprehensive literature review on the research conducted on green finance and its correlation with sustainable economic development. In Section 3, the model utilized in this study is introduced, and the selection and measurement of variables are explained based on data availability and scientific rigor. Section 4 examines the outcomes of the benchmark regression and robustness tests, shedding light on the impact of the green finance pilot policy. Next, in Section 5, an in-depth exploration is conducted to analyze the mechanism of action. This section delves into the dynamic effects of pilot zones for green finance reform and innovations on both sustainable economic and social development. Finally, Section 6 summarizes the findings presented in this article and provides targeted recommendations and measures.

2 Literature review

Scholars have extensively researched the relationship between green financial development and sustainable economic and social development. Jeucken and Bouma (1999) emphasized the crucial role of financial institutions in promoting sustainable economic development. Other scholars have explored various connections between green finance and sustainability. For instance, Jha and Bakhshi (2019) investigated how green finance development contributes to economic and social sustainability in India. Ronaldo and Suryanto (2022) examined the relationship between green finance development and sustainable development in Indonesian fund villages, highlighting the significance of green finance in fostering sustainability. Afzal et al. (2022) analyzed the positive correlation between green finance and sustainable development across 40 European countries. Wang K. et al. (2022) demonstrated the global impact of green finance on sustainable development. Additionally, Ma et al. (2023) confirmed the positive influence of green finance development on sustainable development in China. The impact mechanism of green finance on sustainable development can be broadly categorized into two aspects: improvement of the ecological environment and optimization of energy structure through the application of renewable energy (Chen et al., 2023).

The development of green finance has been shown to contribute to the sustainable development of the economy and society by aiding in environmental improvement. Bai (2022) argues that green finance can help achieve the goal of “carbon peaking and carbon neutrality” while reducing the impact of climate change. Similarly, Liang and Song (2022) found that green finance in China improves the efficiency of carbon emissions and supports the “double carbon” goal. Wu and Song (2022) highlight the negative impact of green finance on carbon emissions, environmental pollution, and renewable energy. Liu and Xia (2022) emphasize the role of green financing and renewable energy in reducing carbon emissions. Li et al. (2023), using the Delphi method and fuzzy hierarchy analysis, underscore the importance of green finance as a key measure to minimize carbon emissions. Feng and Yang (2023) present results suggesting that green finance development helps reduce carbon emissions. On the topic of sustainable development in developing countries, Hunjra et al. (2023) find that green finance and environmental degradation have opposing effects, with green finance playing a significant positive role. Lastly, Mo et al. (2023) explore sustainable agricultural development and note the contribution of green finance in China by reducing carbon emissions.

The development of green finance and its impact on energy structure and renewable energy have been explored by several studies. Zhang and Wang (2019) found that green finance supports sustainable energy development across various dimensions, such as financial, economic, and environmental domains. Additionally, Sun and Chen (2022) discovered that the development of green finance positively influences the energy consumption structure and contributes to sustainable economic development. The detrimental effects of coal consumption on environmental pollution were highlighted by Wang et al. (2023), who also emphasized the positive impact of renewable energy on improving environmental efficiency and promoting sustainable economic development. Furthermore, Zhou and Li (2022) established a correlation between green finance development, renewable energy utilization, and overall sustainable development in China. However, the effects of these factors were noted to be time-varying and heterogeneous. Carbon emissions reduction was found to be a common outcome of green financial development, renewable energy adoption, and sustainable development, as highlighted by Zhang D. et al. (2022). Furthermore, Zhang J. et al. (2022) demonstrated that investments in green finance and renewable energy help mitigate the adverse effects of climate change by reducing carbon emissions. Xing et al. (2022) identified a negative correlation between green finance and carbon intensity, and they concluded that the utilization of renewable energy is predominantly influenced by policy drivers. Highlighting the channel of renewable energy transition, Lee et al. (2023) emphasized the contribution of green finance to sustainable economic and social development. Lastly, Bei and Wang (2023) argued that renewable energy plays a significant role in achieving sustainable economic and social development.

Several studies have investigated the impact of pilot zones for green finance reform and innovations. Liu and Wang (2023) and Sun et al. (2023) indicated that these pilot policies can promote green technological innovation. Wang et al. (2021) and Zhang et al. (2023) also demonstrated that these pilot zones contribute to regional green development. Huang and Zhang (2021) confirmed the beneficial effect of pilot zones on reducing environmental pollution. From a firm perspective, Chen et al. (2022) and Yan et al. (2022) explored the positive effects of pilot zones on firm performance and investment efficiency. Additionally, there have been studies on low-carbon pilot policies in the realm of green finance, particularly focusing on green technology innovation and low-carbon innovation (Wang J. et al., 2022; Pan et al., 2022; Yang, 2023). However, few scholars have examined the impact of these policies on industrial structure upgrading, energy efficiency, and high-quality economic development (Zheng et al., 2021; Gong et al., 2022; Song et al., 2022). It is necessary to further investigate these aspects to gain a comprehensive understanding of the impact of low-carbon pilot policies.

Existing studies have extensively explored green finance and sustainable development, specifically focusing on the impact of green finance pilot policies. However, these studies have primarily examined the overall development level of green finance. Additionally, research on green finance pilot policies has been skewed towards technological innovation and energy efficiency, neglecting their impact on sustainable economic and social development. Given this context, this paper aims to conduct a quasi-natural experiment to investigate the effects of green financial pilot policies on sustainable economic and social development within the pilot zones for green finance reform and innovations.

3 Methodology

3.1 Model construction

This paper is structured as follows. Firstly, we conduct benchmark regression and robustness tests to verify the impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. These tests also aim to demonstrate the reliability of the benchmark regression results. Secondly, we delve into an extended analysis that primarily addresses the issue of model selection bias. Additionally, we explore the dynamic changes and heterogeneity of the policy effects associated with the pilot zones for green finance reform and innovations. Finally, we analyze the action mechanism and discuss the internal functioning by which the green financial reform and innovation experimental zone influences the sustainable development of the economy and society. Through this analysis, we aim to provide valuable references for further improving the policy effects of the green financial reform and innovation experimental zone.

Pilot zones for green finance reform and innovation have been established in six provincial-level regions in China: Guangdong Province, Xinjiang Uygur Autonomous Region, Jiangxi Province, Zhejiang Province, Guizhou Province, and Gansu Province1. This paper utilizes the studies conducted by Fan et al. (2020), Yang et al. (2021), and Martins (2022) to empirically investigate the topic. The investigation primarily employs a difference-in-dfferences (DID) model, with the provincial areas where pilot zones for green finance reform and innovation have been established as the experimental group, while the remaining provincial areas serve as the control group. The model is:

The main explanatory variable in this study is Policy_Time, which is the intersection of two dummy variables: Policy and Time. The variable Policy determines whether a pilot zone for green financial reform and innovation has been established. It takes a value of 1 if such a pilot zone exists at the provincial level, and 0 otherwise. On the other hand, the variable Time represents a time dummy variable indicating the establishment of a pilot zone for green financial reform and innovation. Therefore, the primary focus of this paper is to examine the impact coefficient of Policy_Time. If the impact coefficient is significantly positive, it suggests that the pilot zone for green financial reform and innovation contributes to the enhancement of China’s sustainable development. Additionally, X represents the relevant control variables, while δ and λ represent the fixed effects for the different regions and time periods, respectively. The term ϵ represents the random disturbance term. Here, i denotes each provincial and urban area, and t denotes the year.

3.2 Variable selection

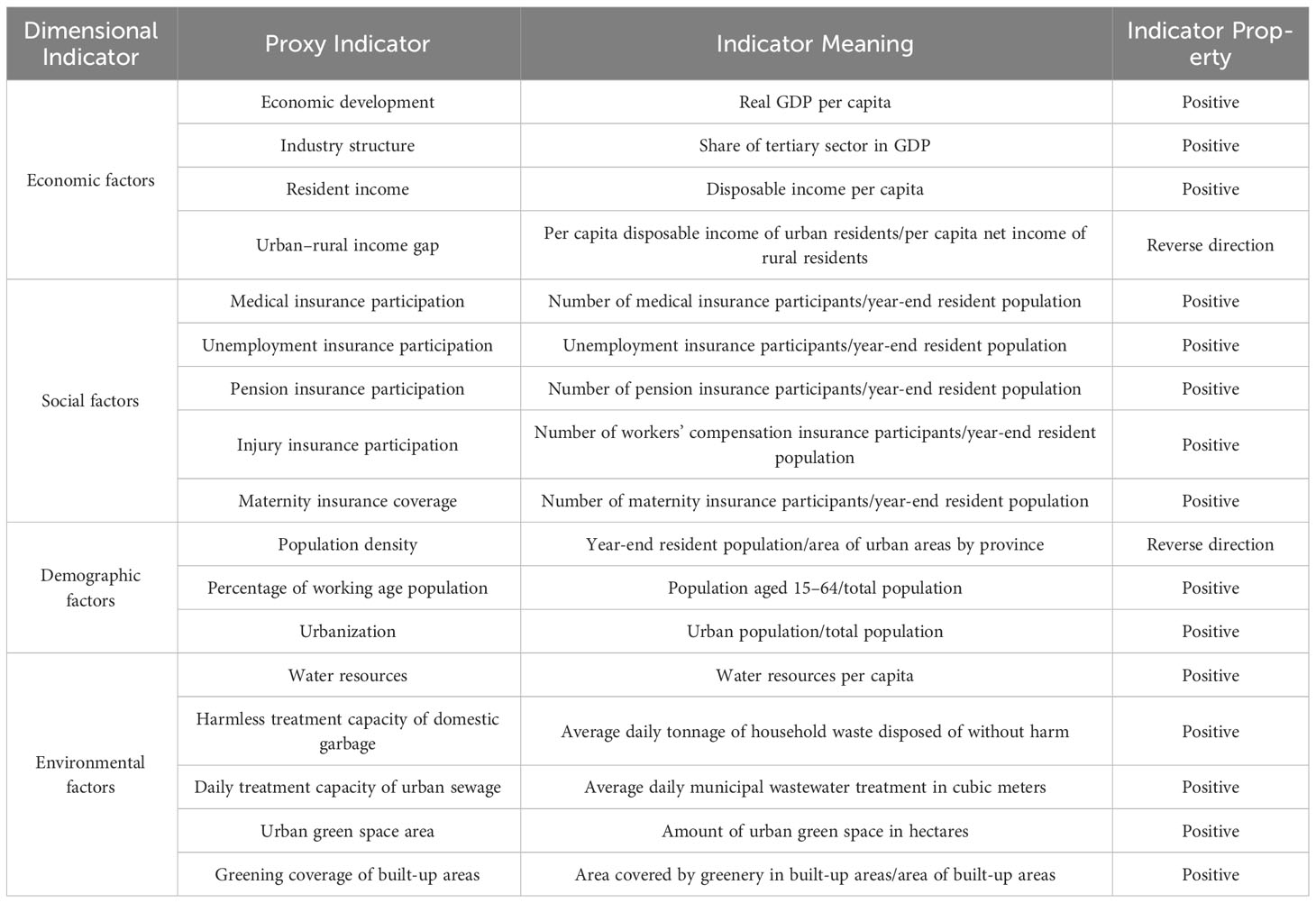

The DID model utilizes dummy variables as the core explanatory variables. Consequently, the selection of the variables being explained becomes relatively more crucial. This paper specifically examines the influence of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. It is essential to evaluate and measure the level of sustainable development accurately as it directly impacts the scientific validity of the conclusions. In line with the assessments made by Liao et al. (2020), Lin et al. (2020), and Guo et al. (2022) concerning the level of sustainable development, this study constructs a comprehensive index system to gauge the sustainable development of the economy and society. The comprehensive indicator system used in this study is presented in Table 1.

Compared to a singular level of economic development, sustainable development encompasses not only the progress of the economy and society but also places greater emphasis on their quality. Hence, this paper primarily evaluates the sustainable development of the economy and society across four dimensions: economy, society, population, and environment. In terms of the economy, this study primarily examines the scale, structure, results, and stability of economic and social development. To assess these aspects, the following basic indicators are selected: the ratio of real GDP per capita, the proportion of the tertiary industry to GDP, disposable income per capita, and disposable income per urban and rural residents. Regarding the population, the focus lies on population size, population structure, and urbanization development. Thus, the basic indicators chosen include population density, the proportion of the working-age population, and the proportion of the urban population. As for the environment, the main considerations involve resource stock, environmental management, and environmental conditions. Consequently, the basic indicators consist of the amount of water resources per capita, domestic waste and urban sewage treatment capacity, urban green space area, and green coverage rate. To summarize, the measurement of sustainable development in the economy and society comprises four dimensions with a total of 17 basic indicators.

The sustainable development of the economy and society is influenced by various factors (index system in Table 1). Hence, this paper focuses on four control variables selected from the following aspects: (1) government intervention level (GI), measured by the ratio of general budget expenditure of government departments to the GDP in each region; (2)openness (OP), measured by converting total foreign investment into RMB and calculating its ratio to GDP; (3) employment level (EL), measured by the inverse of the urban registered unemployment rate; and (4) human capital (MC), measured by the number of years of education per capita in each region.

3.3 Comprehensive index measurement

The measurement of comprehensive indicators can be categorized into two methods: subjective and objective weighting. The subjective weighting method mainly relies on the knowledge of experts and scholars with authority in the relevant fields to assign weights to each dimension of the composite indices. The specific process of assigning weights to the indicators of each dimension of sustainable development of economy and society runs as follows.

First, each basic index is averaged, and the correlation and variability of each basic index are retained while eliminating the difference in magnitude and magnitude between each index. The inverse indicators are first taken as the inverse and then averaged:

To explain the notation used in this study, let x represent the original value of the base indicator, E(x) denote the mean value of the base indicator, and y represent the value of the base indicator after averaging. The variables i and t still represent the province (city) and year, while j represents the jth base indicator.

Second, the coefficient of variation for each underlying index can be calculated as:

Here, c denotes the coefficient of variation, the corresponding sd denotes standard deviation, and m denotes the mean.

Finally, the coefficients of variation of each base indicator are normalized to obtain the weights of the base indicators:

Here, e denotes the weight of the base indicator, and Y denotes the composite indicator after cumulative summation; i.e., the sustainable development of economy and society.

3.4 Data sources and preliminary processing

To ensure consistency between the data before and after policy implementation, and considering that the latest relevant data is only available until 2021, this study focuses on the period from 2013 to 2021. The research sample includes 30 provincial regions in China, excluding Tibet, Hong Kong, Macao, and Taiwan due to data availability. The data pertaining to the sustainable development of the economy and society, as well as each control variable, are sourced from the official website of the National Bureau of Statistics of China and the China Statistical Yearbook from previous years. It should be noted that employment level and human capital are absolute value variables. Given the large range of values for human capital, a logarithmic transformation is applied in this paper. However, the employment level and other relative value variables are retained in their original form.

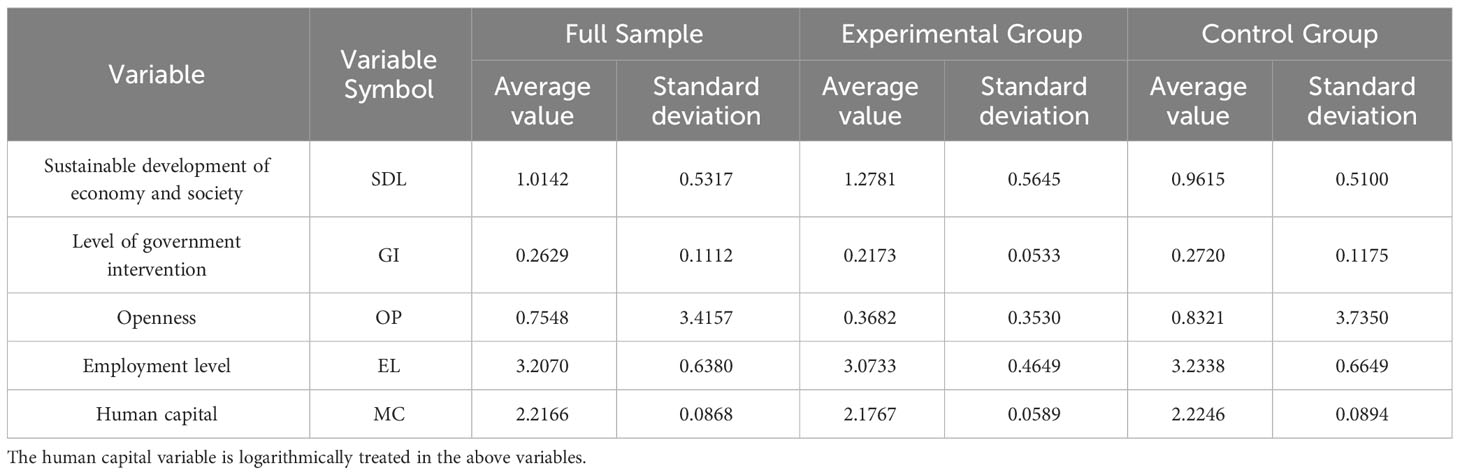

Table 2 displays the descriptive statistics and grouping results for each main variable studied. The average value for sustainable development of the economy and society is 1.0142. Specifically, the experimental group demonstrates a higher mean value for sustainable development level (1.2781), surpassing both the national average and the control group average. Further analysis reveals that although the experimental group exhibits a lower level of government intervention, its openness to the outside world is also significantly reduced compared to the control group. Moreover, the differences in employment level and human capital between the experimental group and the control group are relatively minor. These findings align with the varying degrees of government intervention and openness across different regions, which can be observed in the context of China’s economic and social development. As educational opportunities become increasingly equitable, the regional disparity in human capital gradually diminishes, subsequently leading to a decrease in the gap in employment levels between regions.

4 Analysis of empirical results

4.1 Basic regression

4.1.1 Analysis of baseline regression results

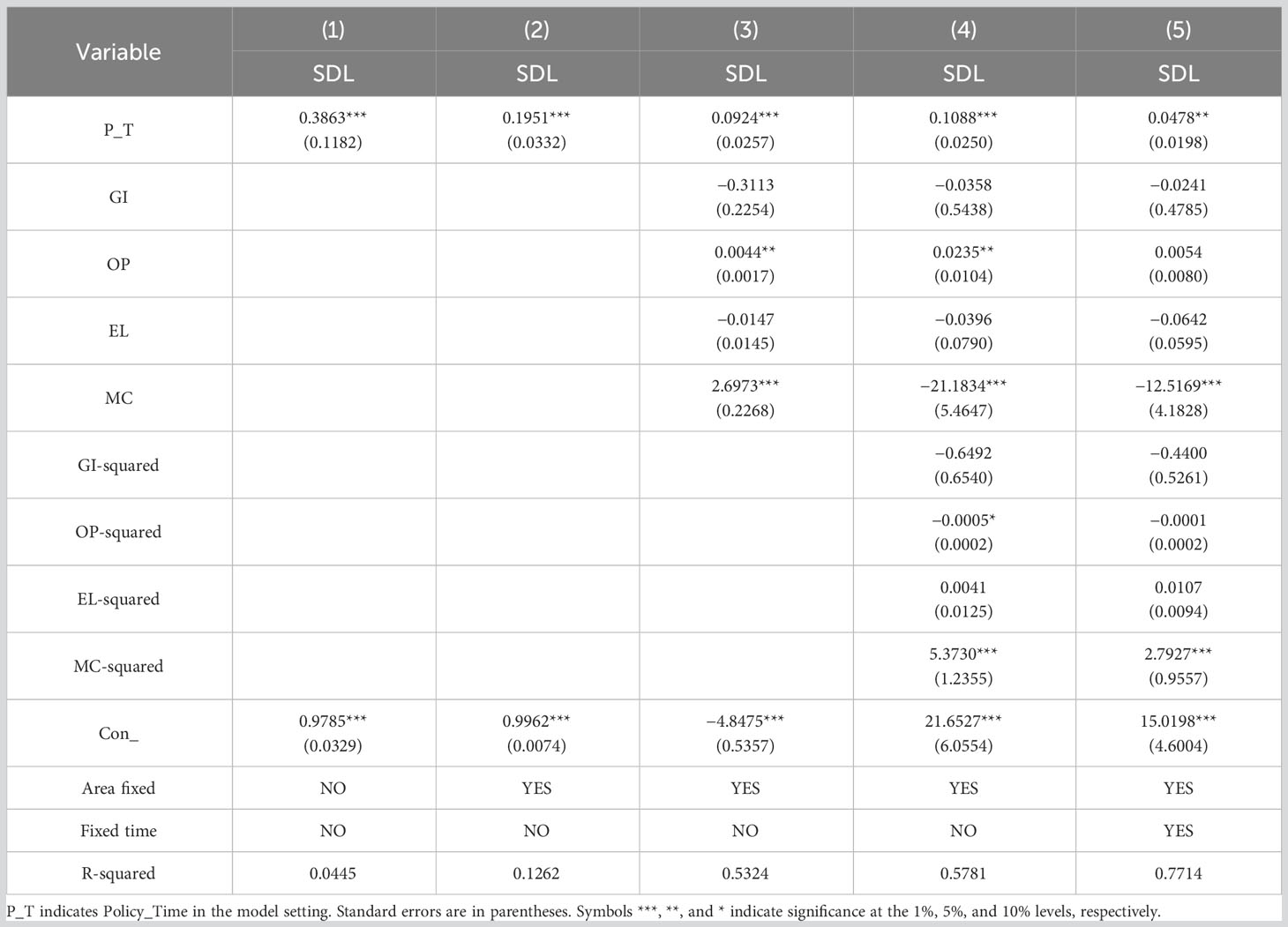

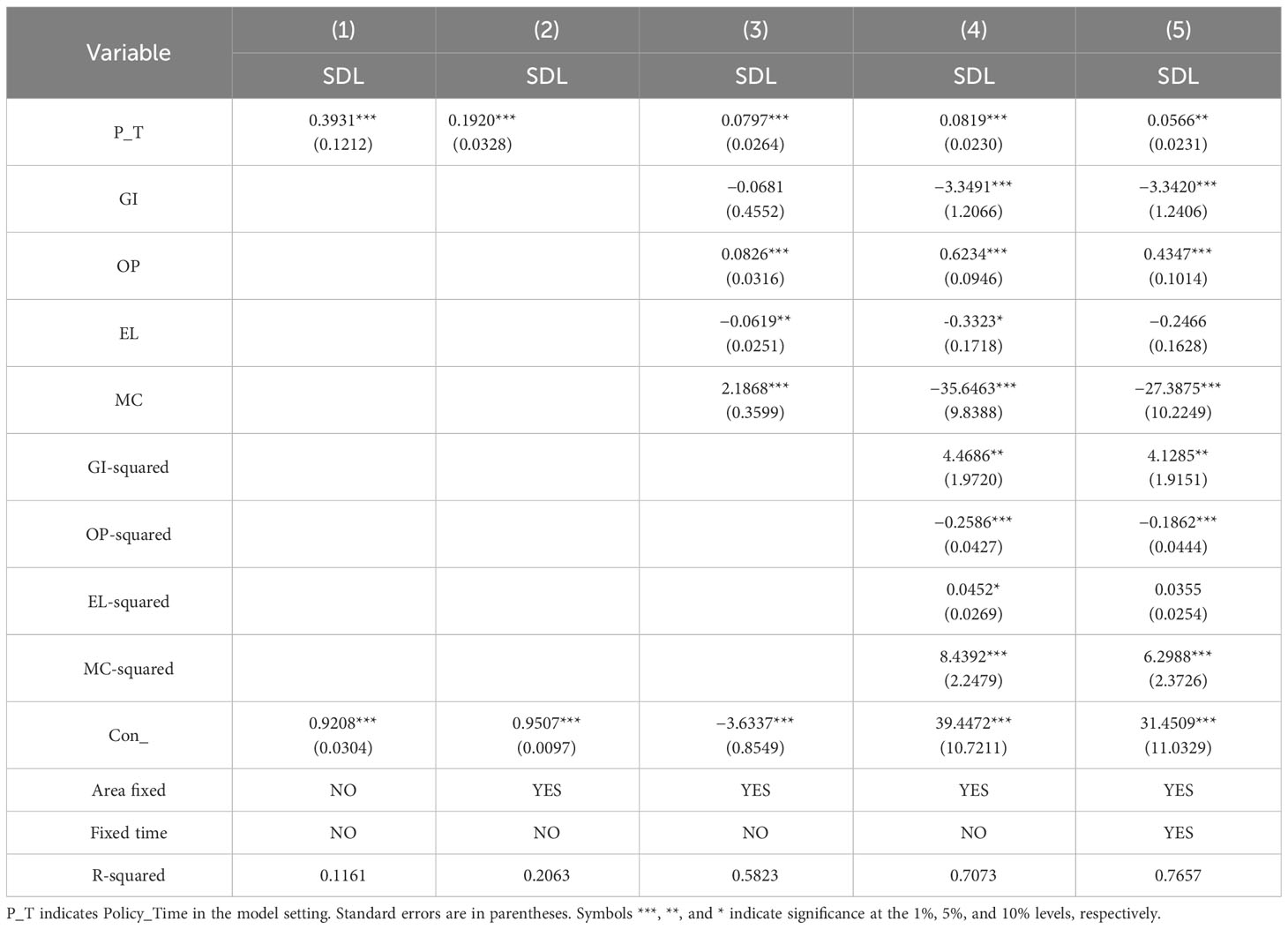

The baseline regressions were conducted using a DID model to examine the impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society, as described earlier in this paper. The results of the benchmark regression are presented in Table 3. Columns (2) to (5) display the regression results with the inclusion of area fixed effects, control variables, squared terms of control variables, and time fixed effects in the preceding columns, respectively. Despite variations in the regression process, all impact coefficients of P_T are greater than zero and statistically significant at the 1% or 5% level. This indicates that the establishment of pilot zones for green finance reform and innovations significantly promote sustainable development. This finding aligns with the conclusions drawn by Wen et al. (2021, 2023) and confirms the positive impact of green development on China’s economy and society, as evidenced by the boosting effect on total factor productivity of enterprises through green credit and low-carbon city policies.

Regarding control variables, although the coefficients of government intervention and employment level are not statistically significant, their effects align with expectations. Specifically, as the degree of government intervention and the unemployment rate increase, the level of sustainable development in the economy and society decreases. Additionally, the effects of openness and human capital also align with expectations. Higher levels of openness significantly promote sustainable development in the economy and society, while lower levels of human capital inhibit sustainable development. Only high levels of human capital can further enhance the level of sustainable development in the economy and society.

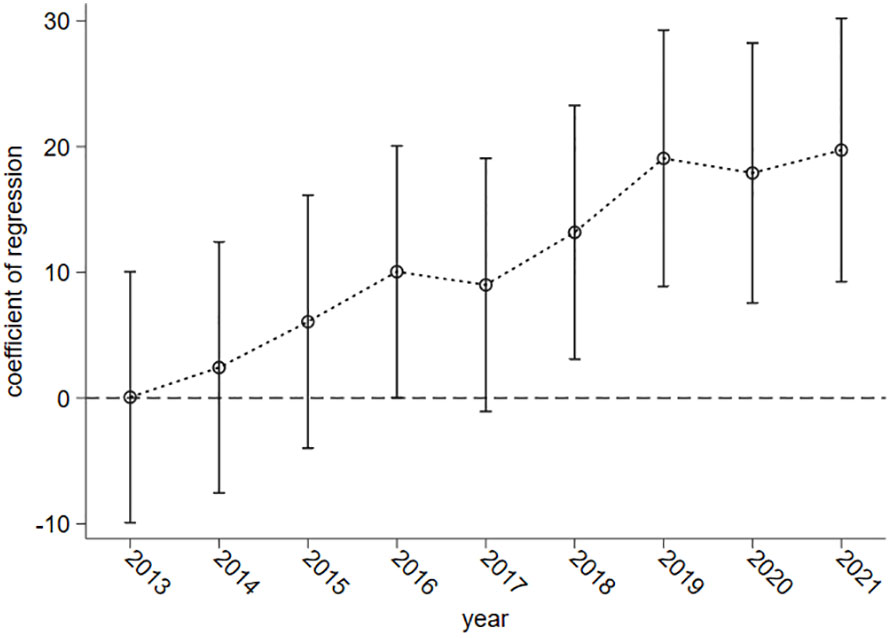

4.1.2 Parallel trend test

The baseline regression results indicate a significantly positive effect of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. To further validate these findings, this study employs a parallel trend test. To determine the timing of the implementation of the pilot zones for green finance reform and innovations in China, this paper uses 2017 as the benchmark for the time dummy variable. Before 2017, the pilot zones were not established, implying that their policy effect on the sustainable development of the economy and society should not exist within this timeframe. However, from 2017 onwards, the impact of the pilot zones on the sustainable development should become apparent.

Figure 1 displays the results of the parallel trend test. Prior to 2017, the confidence interval for the impact coefficient of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society primarily includes the value 0, despite its incremental nature. This suggests that the impact of establishing these pilot zones is not significantly different from zero. In other words, there is no substantial impact of the pilot zones on the sustainable development of the economy and society. However, beginning in 2017, although the confidence interval for the impact coefficient of the pilot zones also includes the value 0, it does not hold true for subsequent years. Furthermore, the impact coefficients for these years are all greater than 0, indicating a potential time lag in the impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. Nevertheless, it is evident that the policy does have an impact, and the establishment of these pilot zones can facilitate considerable improvements in the sustainable development of the economy and society. These test results align with expectations and validate the findings of the baseline regression.

4.2 Robustness tests

4.2.1 Placebo test

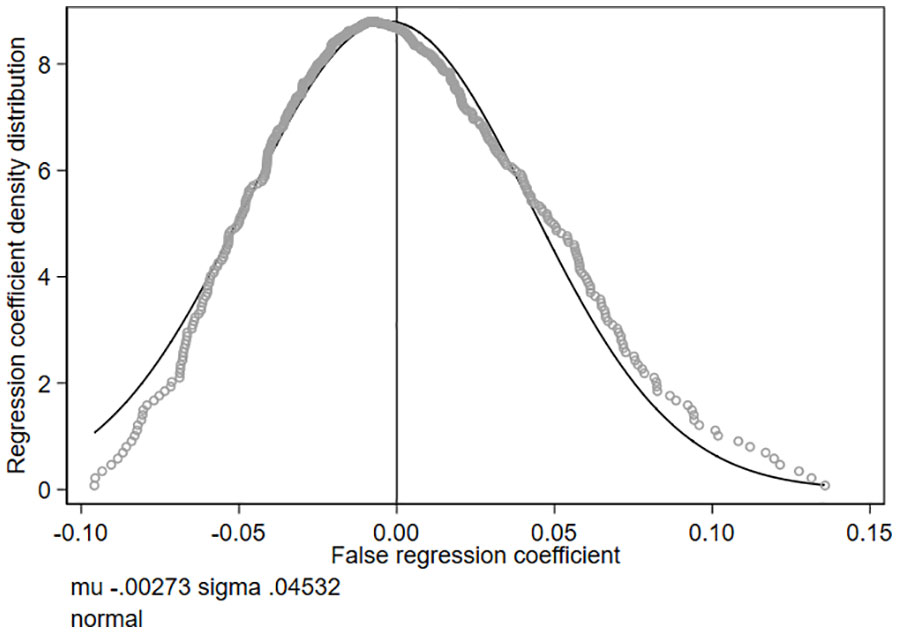

The construction of the benchmark model may overlook certain influential factors, thereby introducing bias into the regression results. To address this issue, this paper adopts a double randomized experiment approach, drawing inspiration from Li et al. (2016), to ensure the robustness of the benchmark regression results. The experimental process is as follows: Firstly, a new experimental group is formed by randomly selecting five provincial regions from the full sample, which serves as an extension to the existing experimental group of the benchmark regression model. Secondly, the policy implementation time is set to 2017, and a new policy implementation time frame of 2014–2021 is randomly selected for comparison. However, 2013 is excluded from the selection to ensure a minimum one-year data for policy implementation analysis. Next, a cross-product term is generated through the combination of the new experimental group and the new policy implementation time, and a regression analysis is conducted using the benchmark regression model. This entire process is repeated 500 times, producing a kernel density distribution plot of the new policy effect. By examining the kernel density distribution, it becomes possible to identify any significant influences that might have been disregarded in the benchmark regression model, thereby assessing the robustness of the benchmark regression results.

Figure 2 displays the results of the placebo test conducted in this paper. The kernel density distribution in Figure 2 presents the regression coefficients of the new policy effect (spurious policy effect) after 500 double randomized experiments. These coefficients are uniformly distributed around the approximate value of −0.18, which can be considered as 0. The regression coefficients of the new policy effect exhibit a normal distribution pattern, indicating that the baseline regression model utilized in this paper does not overlook the impact of important influencing factors on the sustainable development of the economy and society. Hence, the baseline regression results demonstrate a certain level of robustness. Furthermore, the establishment of pilot zones for green finance reform and innovations has a positive and credible impact on the sustainable development of the economy and society.

4.2.2 Consideration of the time lag of policy effects

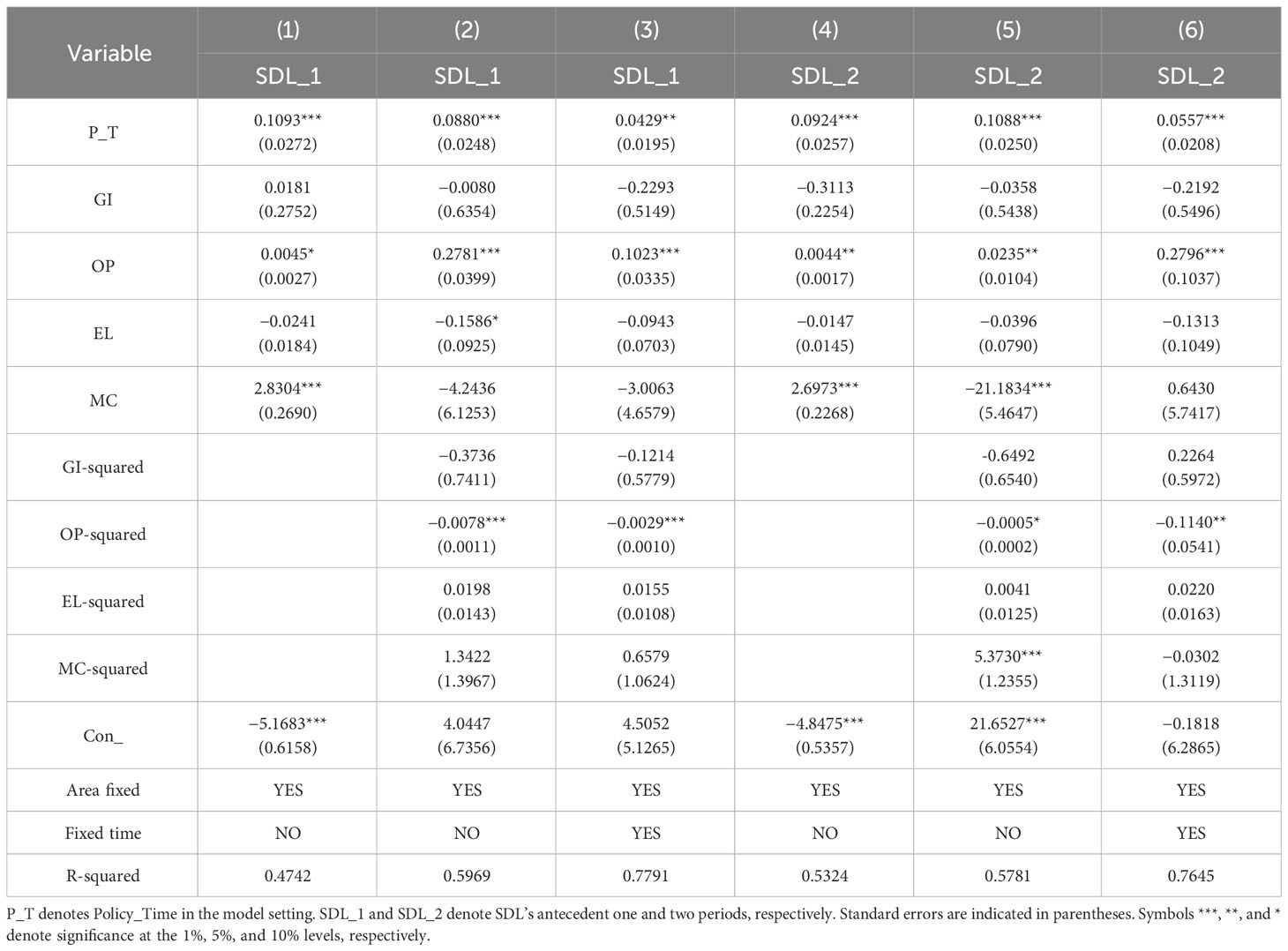

The previous paper’s parallel trend test suggests the possibility of a time lag in the impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. This aligns with the reality of economic and social progress, as it takes time for the establishment of such pilot zones and for the policy effects to transmit to the sustainable development of the economy and society. Taking this into account, this paper adopts the approach commonly used by scholars of altering the timing of policy shocks to investigate the future impact of the pilot zone for green financial reform and innovation on the sustainable development of the economy and society. By prioritizing the sustainable development of the economy and society, we can ascertain the time delay in the policy effects of the pilot zone for green financial reform and innovation, while also bolstering the credibility of the conclusions derived from the baseline regression results.

Table 4 presents the regression results obtained by prioritizing the sustainable development of the economy and society. In columns (1) to (3), the regression results reflect the front-loading of the sustainable development of the economy and society by one period. In columns (4) to (6), the regression results demonstrate the front-loading by two periods. It is observed that the positive impact of the pilot zones for green finance reform and innovations on the level of sustainable development remains consistent across different degrees of front-loading. Thus, it continues to promote the sustainable development of the economy and society. This suggests a time lag in the impact of establishing the pilot zones but also underscores their enduring positive influence. These findings further confirm the robustness of the baseline regression results.

4.2.3 Consideration of relevant policy interference

As a new financial development model, green finance plays a crucial role in promoting sustainable development in China. The development of green finance in China encompasses various dimensions. For instance, along with the establishment of pilot zones for green finance reform and innovations, certain regions have already taken steps towards carbon emissions trading. Beijing, Shanghai, Tianjin, Chongqing, Hubei, Guangdong, and Shenzhen became carbon emissions trading pilot regions as early as 2011. In 2016, Fujian also joined as the eighth trading pilot region, launching its carbon trading market. Both the carbon emissions trading pilot policy and the green financial reform and innovation pilot area policy contribute to environmental improvement during the process of sustainable economic and social development. Consequently, they jointly promote the sustainable development of the economy and society. It is worth considering that the implementation of the carbon emissions trading pilot policy may impact the policy implementation effect of the green financial reform and innovation pilot area. In other words, it may influence the green financial reform and innovation pilot area’s policy effect on the sustainable development of the economy and society. Therefore, this paper aims to conduct an additional robustness check to examine the potential impact of these policies on the topic at hand.

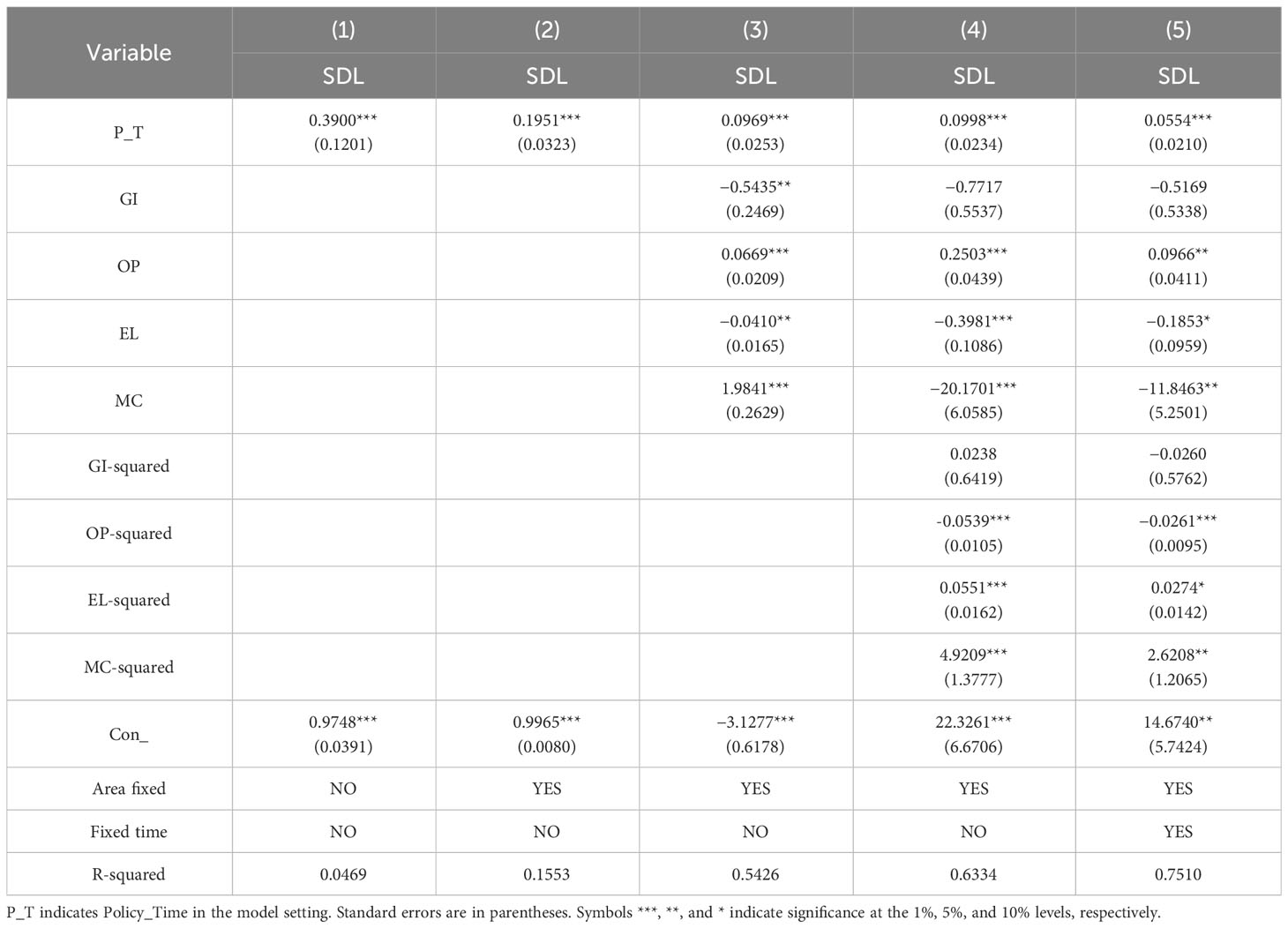

We have addressed the impact of the pilot carbon trading policy on the baseline regression results by excluding the pilot carbon trading region from the control group. In this paper, Guangdong is included in the experimental group as it became a pilot region for carbon emissions trading in 2011, which predates the research interval of this paper (2013 onwards). Thus, its data are retained in the research sample. The regression results, excluding the influence of the carbon emissions trading pilot policy, are presented in Table 5. In each instance of adding regression conditions, the coefficient of P_T consistently exceeds the value of 0 and is statistically significant. This indicates that the establishment of the green financial reform and innovation pilot area has a robust positive influence on the sustainable development of the economy and society. Notably, when considering column (5), which comprehensively incorporates regression conditions, and combining these findings with the benchmark regression results in Table 3, we observe that the impact coefficient of P_T in Table 5 is larger after excluding the influence of the carbon emissions trading pilot policy. This implies that the potential impact of the carbon emissions trading pilot policy indeed enhances the implementation of the pilot zones’ policy for green finance reform and innovations, while not altering the directional assessment of the benchmark regression’s conclusion. In summary, the overall effect is underestimated.

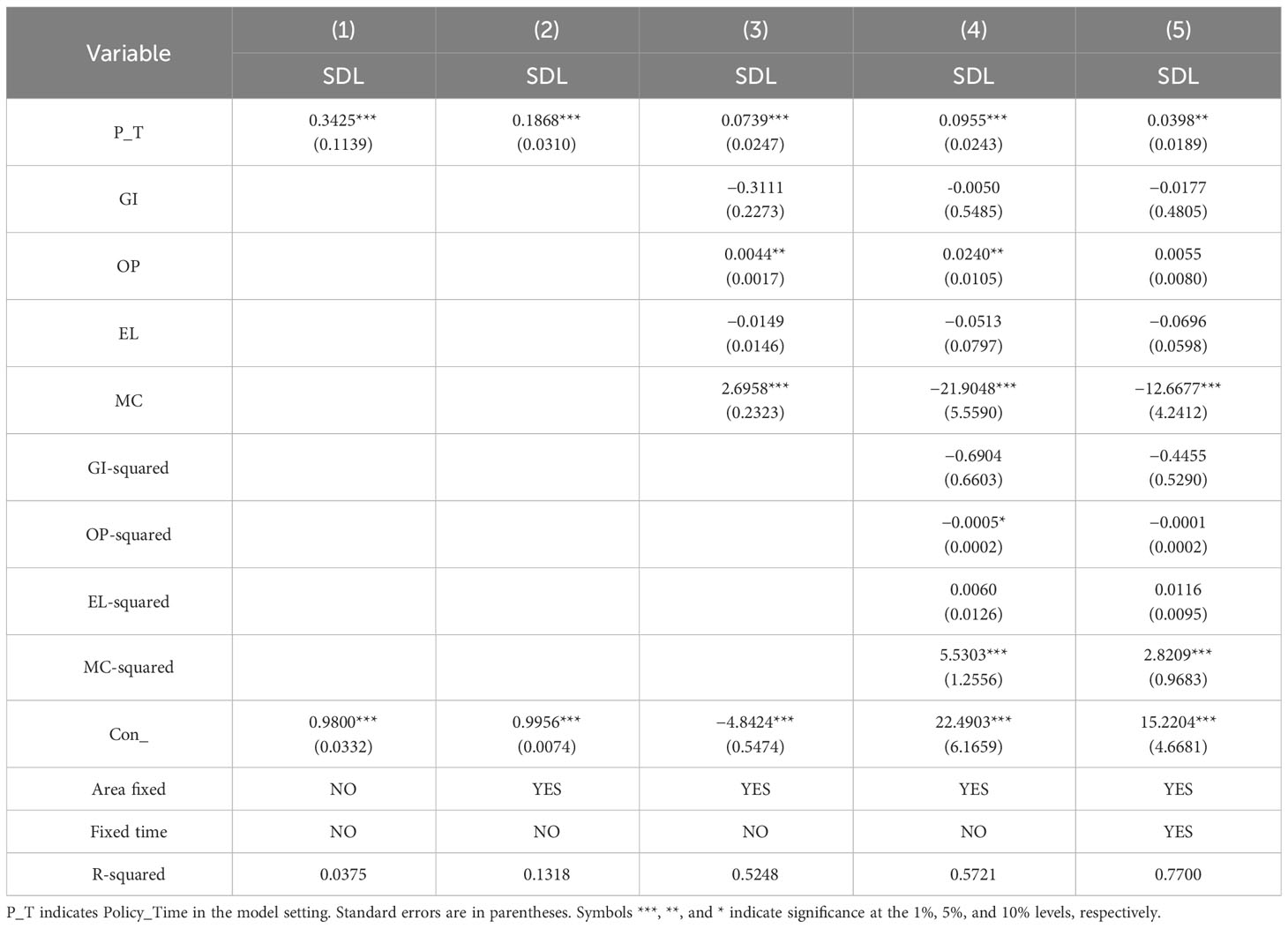

4.2.4 Consideration of the establishment of subsequent pilot zones

In a previous paper, the pilot zones for green finance reform and innovations did not include Gansu, which only became a part of it in 2019. This exclusion may have influenced the baseline regression results. To address this, we have included Gansu in the experimental group in this paper, and the corresponding results are presented in Table 6. The findings align with the outcomes of other robustness tests, indicating that the conclusions from the baseline regression remain unchanged even with the inclusion of Gansu in the experimental group. This reaffirms the significant positive impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society. The test results also demonstrate the robustness of the baseline regression and support the idea that any potential bias in the baseline regression model does not affect the results presented here. Overall, the setting of the baseline regression model is deemed reasonable.

5 Extended research and mechanism analysis

5.1 Extensive research

5.1.1 Baseline regression based on propensity score matching

The issue of unbalanced regional development in China is severe. Consequently, the establishment of pilot zones for green finance reform and innovations may vary between regions, as seen in factors like the level of government intervention and openness in the control variables. Consequently, when applying the DID model, there is a possibility of selection bias in the control group’s sample selection. To address this concern, we employ propensity score matching, which can appropriately address the issue. Thus, prior to the baseline regression, this paper pairs the experimental group with the control group, enabling the control group sample to serve as a more suitable reference object and enhancing the rationality of the counterfactual in the DID model.

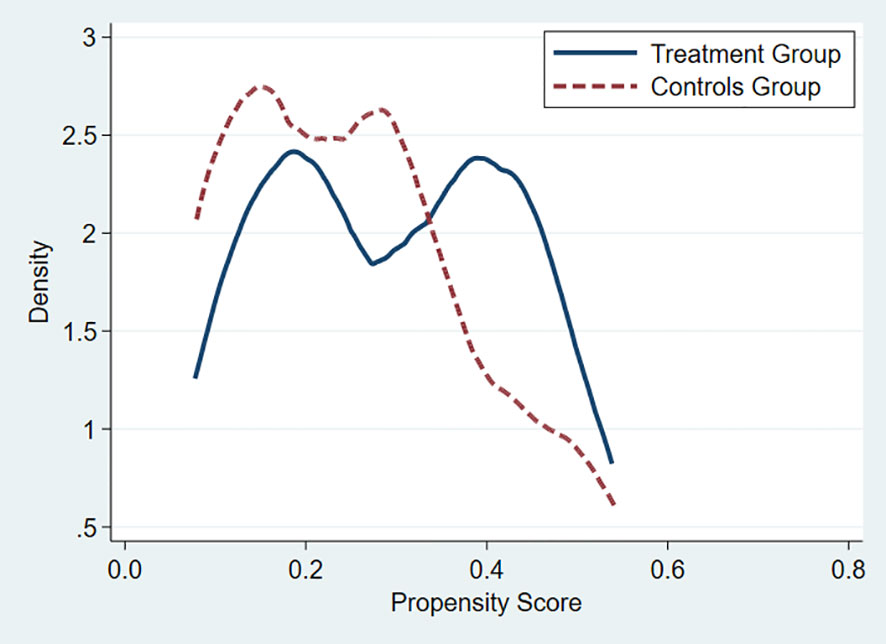

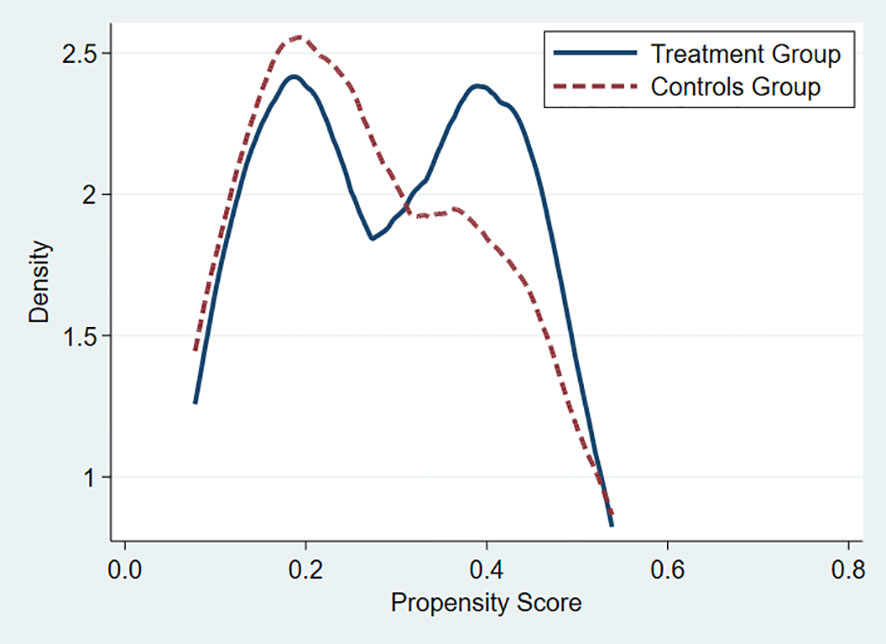

For propensity score matching, this study utilizes a 1-to-1 nearest-neighbor matching method. The P-value kernel density distributions of the experimental and control groups before and after matching are depicted in Figures 3, 4, respectively. Upon visual observation, it is evident that the P-value kernel density distribution characteristics of the experimental group and the control group differ significantly prior to the propensity score matching. However, after propensity score matching, the discrepancy between the P-value kernel density distribution characteristics of both groups considerably diminishes, thereby indicating the effectiveness of the selected propensity score matching method in this paper.

Table 7 displays the regression results following propensity score matching. Upon considering area fixed effects, control variables, squared terms of control variables, and time fixed effects in succession, it becomes apparent that the impact coefficients of P_T are all positive at the 1% or 5% significance level, albeit with some variation in magnitude. This further supports the notion that the establishment of pilot zones for green finance reform and innovations has a significantly positive effect on both the sustainable development of the economy and society, as well as the overall enhancement of sustainable development in the pilot zone location. In column (5), when comparing these results with the baseline regression results in Table 3, it is evident that the policy effect of the establishment of pilot zones for green finance reform and innovations is even more pronounced after propensity score matching than without it. This suggests that the initial regression results may have underestimated the true impact to some extent. Consistently, this finding aligns with the robustness test, wherein a more suitable control group is selected, mitigating the underestimation and amplifying the actual policy effects resulting from the establishment of pilot zones for green finance reform and innovations.

5.1.2 Dynamics of policy effects

After passing validity and a series of robustness tests, the effect of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society remains consistent. This confirms the rationality of the baseline regression model and the reliability of the results. Additionally, through a time lag test, it is observed that there may be a delay in the impact of these pilot zones on sustainable development. Consequently, this paper further examines the dynamic changes in their effect.

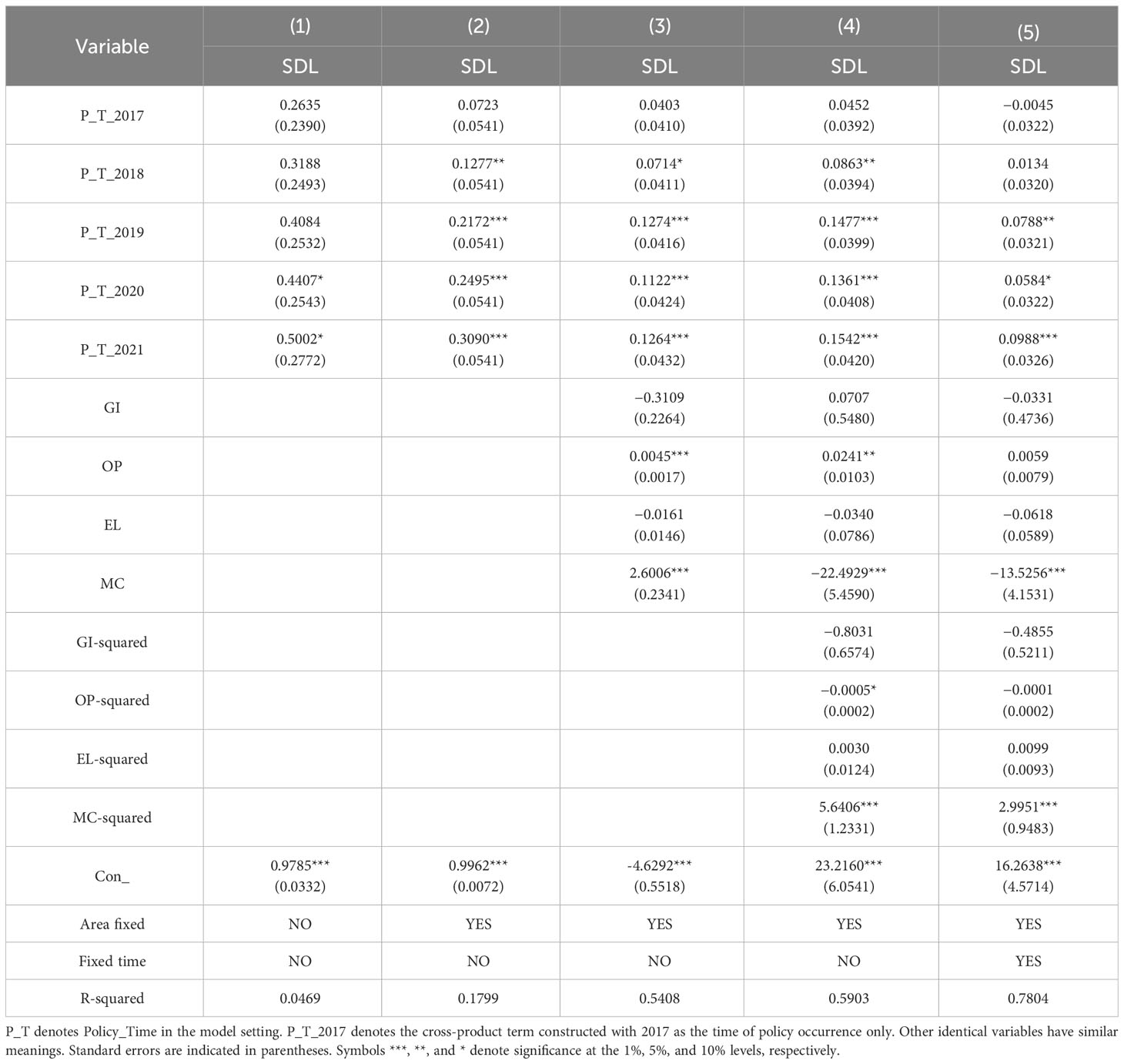

The pilot zones for green finance reform and innovations were implemented in 2017. To further investigate the changes in policy effect over time, this study introduces time dummy variables for each year from 2017 to 2021 (e.g., Time_2017 takes the value 1 for the year 2017 and 0 for all other years). By multiplying the dummy variable (Policy) of the experimental group, a key variable reflecting the policy effect across all years is obtained and subsequently subjected to regression analysis.

The results are depicted in Table 8, where it is evident from column (5) that in the initial two years (2017 and 2018) following the establishment of the pilot zones for green finance reform and innovations, there was no significant impact on the sustainable development of the economy and society. It was only in the subsequent years (2019–2021) that the establishment of the pilot zone began to effectively and positively contribute to the sustainable development of the economy and society. This finding further highlights the existence of a time lag in the policy effect of the pilot zone for green financial reform and innovation. Such a delay is closely linked to the time required for setting up the pilot zone and the transmission of policy effects, aligning with the present economic and social development reality.

5.1.3 Heterogeneity analysis of policy effects

This paper aims to analyze the heterogeneous effects of pilot zones for green finance reform and innovations on the sustainable development of the economy and society under different development environments. The study focuses on variables such as the level of financial development, degree of industrialization, and level of technological innovation, which are correlated with sustainable development. For instance, the level of financial development is measured as the financial sector’s value added as a percentage of GDP, while the level of industrialization is expressed as the industry’s value added as a percentage of GDP. Additionally, the level of technological innovation is represented by the logarithm of technology market turnover. To effectively examine the effects of green financial reform and innovation pilot zones, this paper utilizes the mean level of development environment as the criterion for grouping. For example, the regions above the mean level of financial development are classified as the high financial development group, while the remaining regions are categorized as the low financial development group. Regression analysis is then performed within each group, followed by a comparison of the policy effects between the groups. It is important to note that although the experimental group in this paper consists of fewer provincial areas, the grouping based on the three development environments enables an effective division.

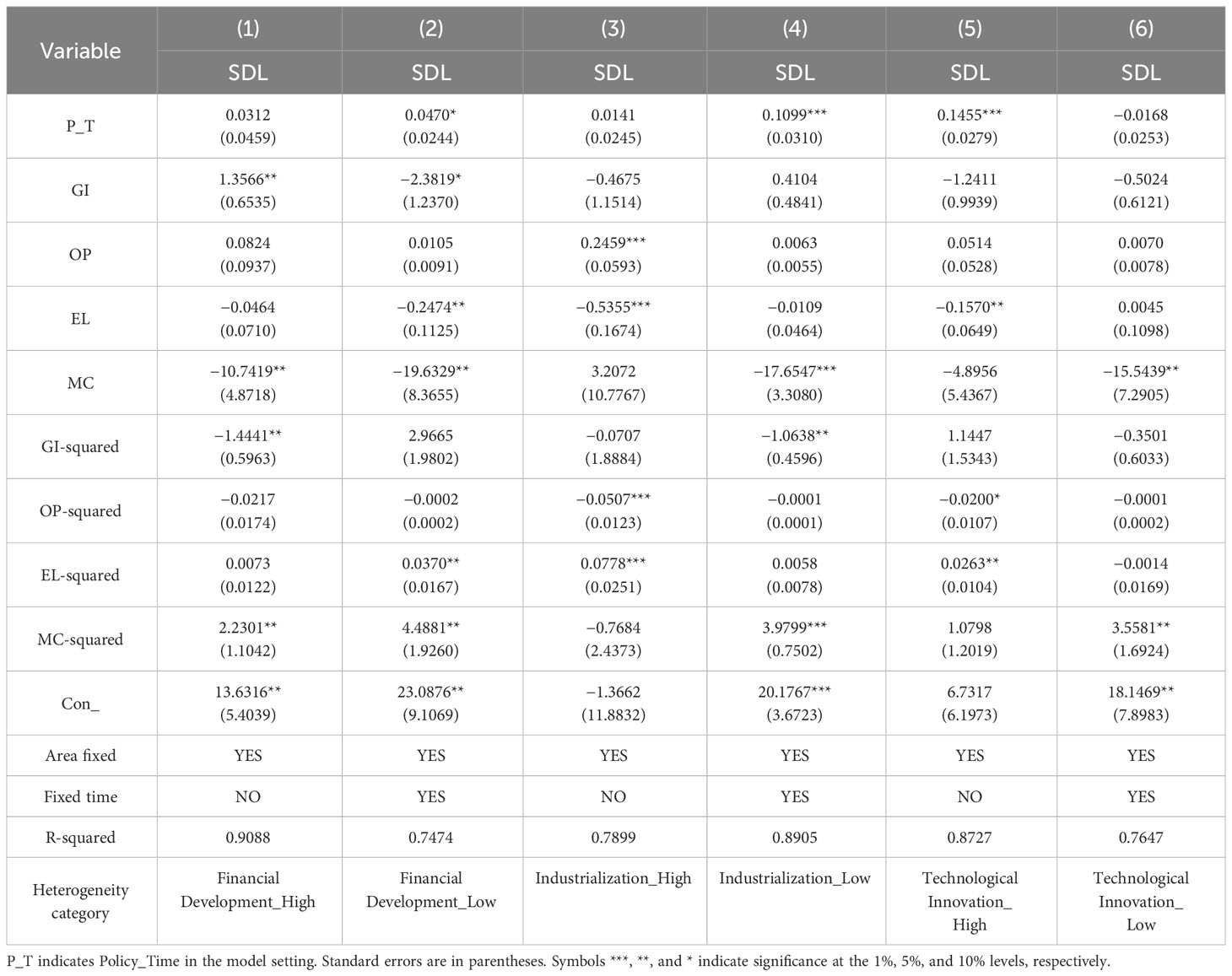

Table 9 shows the varying impacts of pilot zones for green finance reform and innovations on the sustainable development of the economy and society across different development environments. The findings reveal that the establishment of these pilot zones only yields a significantly positive effect on sustainable development in regions characterized by lower levels of financial development, lesser industrialization, and higher levels of technological innovation. These results are comprehensible as regions with higher levels of financial development and industrialization naturally exhibit relatively advanced sustainable economic and social development. Consequently, the policy effects of pilot zones for green finance reform and innovations are not as prominent in such areas. Moreover, considering that innovation plays a crucial role in driving sustainable development, the effects of these policy measures will also be substantial in regions with higher levels of technological innovation. Hence, the policy effects of pilot zones for green finance reform and innovations will tend to be more pronounced in regions with greater levels of technological innovation, given the importance of innovation as a driving force for sustainable development.

Table 9 Differences in the policy effects of the establishment of the test area under different relevant factors.

5.2 Mechanism analysis

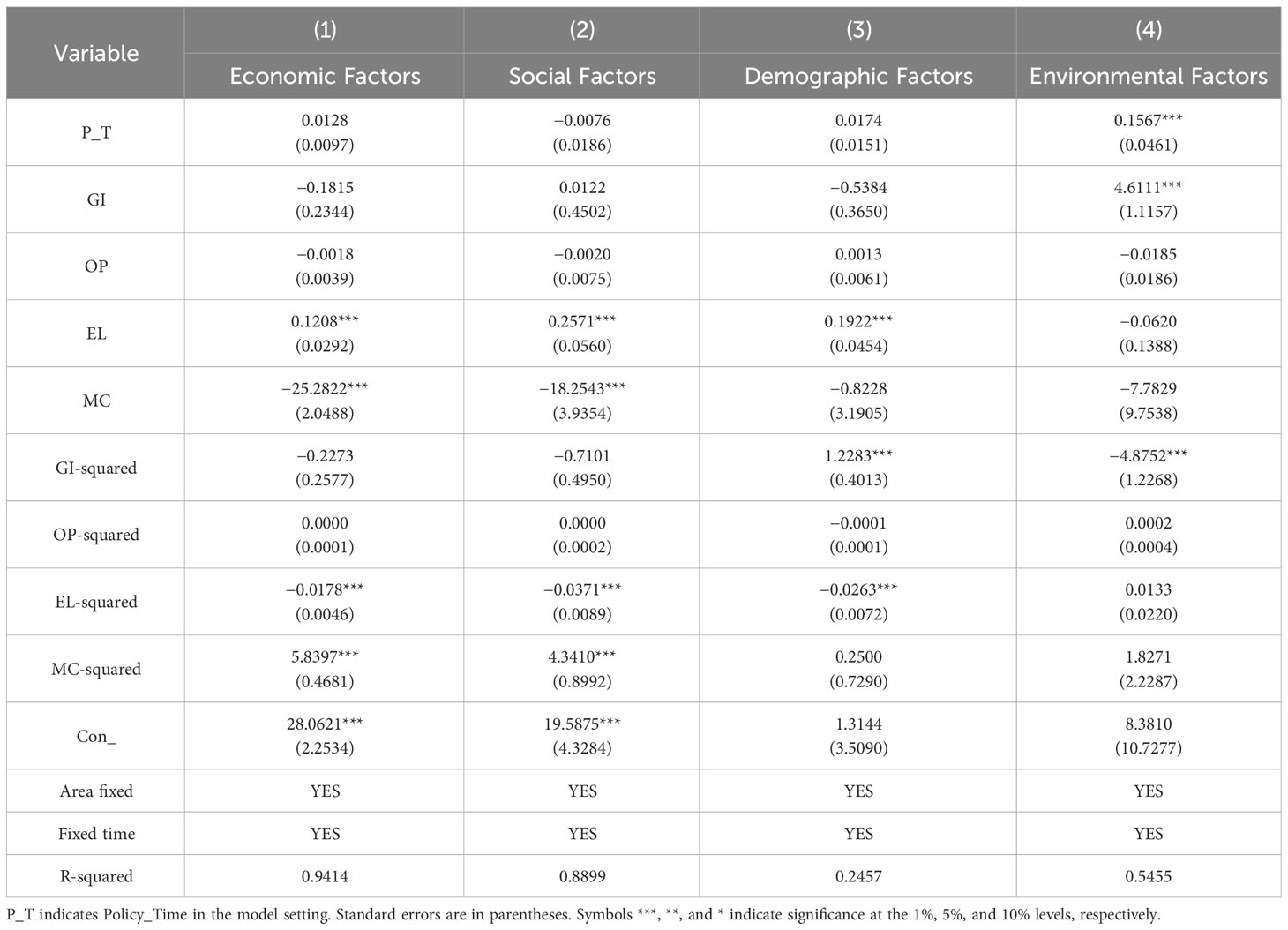

During the process of pilot zones for green finance reform and innovation, the sustainable development of the economy and society encompasses various indicators across different dimensions such as economic factors, social factors, demographic factors, and environmental factors. Therefore, this paper aims to analyze the impact of establishing green financial reform and innovation pilot zones on indicators of sustainable economic and social development based on the mechanism research conducted by Li and Wen (2023). Additionally, this paper seeks to explain the policy effects resulting from the establishment of these pilot zones. The above analysis of the mechanism offers several advantages. Firstly, by examining the impact of pilot zones on each dimensional indicator, we can better understand the influence of composite indicators through individual dimensions, which is in line with economic logic. Secondly, exploring the impact of pilot zones on each dimensional indicator allows for a more detailed examination of the policy effects, thereby gaining deeper insights into their overall impact.

Table 10 presents the effects of establishing pilot zones for green finance reform and innovation on the dimensions of sustainable economic and social development. After accounting for regional and time fixed effects, control variables, and their squared terms, it is found that the establishment of these pilot zones does not significantly impact economic, social, and demographic factors in sustainable development. However, there is a notably positive effect on environmental factors. This outcome aligns with the principles of green financial development and supports the concept of green development. Unlike traditional financial industry growth that primarily focuses on economic expansion, green financial development emphasizes improving the quality of the ecological environment and promoting sustainable economic and social progress while maintaining a harmonious coexistence between humans and nature. These findings also shed light on the heterogeneous policy effects of the green financial reform and innovation pilot zones across different developmental environments. Regions with lower levels of financial development and industrialization tend to have lower levels of environmental pollution. Consequently, with the support of high technological innovation, the establishment of the pilot zones has a more pronounced positive effect on the ecological environment in these areas.

Table 10 Impact of the establishment of the pilot area on the dimensional factors of the sustainable development of economy and society.

The regression results in Table 10 also explain the heterogeneous policy effect of the green financial reform and innovation pilot zone across different development environments. It is observed that regions with lower levels of financial development and industrialization tend to have lower levels of environmental pollution. In these areas, supported by higher levels of technological innovation, the establishment of the pilot zone has a more significant positive impact on the ecological environment. Additionally, the results indicate that the channels affecting the sustainable development of the economy and society in the green financial reform and innovation experimental zone are limited, suggesting that there is room for China to further enhance the policy impact of establishing these experimental zones in the future.

6 Conclusions and recommendations

With the transformation of China’s main social contradiction and economic development stage, it has become crucial to enhance the sustainable development of the economy and society. In this context, green finance emerges as the primary driver for promoting the green development of the economy and society. This study aims to explore the impact of establishing pilot zones for green finance reform and innovations on the sustainable development of the economy and society in China. To achieve this, a DID model is constructed using sample data from 30 provincial-level regions in China from 2013 to 2021. The findings are refined and supplemented through robustness testing, expansion analysis, and impact mechanism analysis. The results are as follows:

Firstly, the establishment of pilot zones for green finance reform and innovations significantly contributes to the improvement of the sustainable development level of the economy and society. This finding remains consistent after conducting a series of robustness tests, including placebo tests, considering the time lag of policy effects, excluding relevant policy interference, and improving the precision of model settings.

Secondly, the establishment of pilot zones for green finance reform and innovations has a lagging effect on the enhancement of sustainable development in the economy and society. The positive promotion effect of the pilot zones on sustainable development is significant only in areas with lower levels of financial development, lower degrees of industrialization, and higher levels of technological innovation.

Thirdly, the establishment of green financial reform and innovation pilot zones primarily promotes the sustainable development of the economy and society by improving environmental factors, and its influence channel is relatively singular.

Based on the above research findings, several suggestions are put forth to further enhance the sustainable development of the economy and society:

Firstly, the government should carefully summarize the policy experience of the green finance pilot zones, expand the implementation scope of the green financial pilot policies, and continuously promote the green transformation development model. By building upon the practical experience of the pilot zones, increasing the number of green finance pilot areas, and improving the green finance pilot policies and reform and innovation programs, the promotion effects on the sustainable development of the economy and society can be strengthened.

Secondly, the central government should consider the spatial layout of each region, formulate green finance pilot policies according to local conditions, and encourage differentiated development of green finance in each region. The impact of the pilot zones for green finance reform and innovations on sustainable development is currently too singular. Hence, it is necessary to consider factors such as resource endowment, financial development level, industrial development characteristics, and other factors unique to different regions. The one-size-fits-all implementation of green finance pilot policies should be avoided. By implementing differentiated and distinctive regional green financial support initiatives, the impact channels of green finance pilot policies can be expanded, and their implementation effects can truly be realized.

Finally, the authorities should enhance policy support for technological innovation and establish a long-term mechanism for enhancing green technology. Innovation-driven approaches are crucial in leveraging the policy effect in the pilot areas. Therefore, government departments should broaden the scope of policy support, favor green technology innovation, and guide funding towards green technology breakthrough projects and science and technology endeavors with high pollution reduction potential. Moreover, environmental regulations placed on highly polluting and energy-consuming enterprises should be strengthened, compelling these enterprises to undergo technological transformations and process improvements. This will also encourage green innovation across all sectors of the economy and society.

The sustainable development of the economy and society is a long-term and continuous process that requires extensive research. This paper specifically examines the importance of green finance for sustainable development from a policy perspective. However, there are still areas that can be improved. For instance, the specific circumstances of cities, districts, and counties in the research sample were not fully considered due to limited data availability. Additionally, the research methodology did not account for the demonstration effect of green financial policies. The evaluation of policy effectiveness in this paper is based on provincial data, which fails to capture the full impact of environmental policies and only focuses on influential ones like the carbon emission trading policy. In future studies, the spatial effects of green financial policies will be thoroughly explored, highlighting their role in policy implementation. Moreover, the implementation of green finance policies will be analyzed in conjunction with the level of green finance development in different regions, providing a comprehensive understanding of the driving force behind sustainable economic and social development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

GL: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Writing – original draft. JL: Funding acquisition, Project administration, Supervision, Writing – review & editing. YS: Conceptualization, Investigation, Methodology, Software, Writing – review & editing. HC: Investigation, Resources, Validation, Visualization, Writing – review & editing. HC: Funding acquisition, Project administration, Supervision, Writing – review & editing.

Funding

This research was funded by Macao Polytechnic University.

Acknowledgments

The authors are grateful to the editor and the reviewers of this paper, especially the professors from the Macau Polytechnic University on the topic of political and economic development and social governance in Macau have provided inspiration and guidance for this paper.

Conflict of interest

Author HoC was employed by the Quanzhou Yixing Electrical Engineering Construction Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ The five provincial-level regions, Guangdong Province, Xinjiang Uygur Autonomous Region, Jiangxi Province, Zhejiang Province, and Guizhou Province, established pilot programs in 2017 and belong to the same batch of pilot zone establishment programs. Gansu Province was established as a pilot zone for green financial reform and innovation in November 2019. Based on the reasonableness of the data during the study, Gansu Province was not included as an experimental group in the benchmark regression.

References

Afzal A., Rasoulinezhad E., Malik Z. (2022). Green finance and sustainable development in Europe. Econ. Research-Ekonomska Istraživanja 1), 5150–5163. doi: 10.1080/1331677X.2021.2024081

Bai X. (2022). Exploring the sustainable development path of a green financial system in the context of carbon neutrality and carbon peaking: evidence from China. Sustainability 23), 15710–15710. doi: 10.3390/SU142315710

Bei J., Wang C. (2023). Renewable energy resources and sustainable development goals: Evidence based on green finance, clean energy and environmentally friendly investment. Resour. Policy. doi: 10.1016/J.RESOURPOL.2022.103194

Chen Z., Hu L., He X., Liu Z., Chen D., Wang W. (2022). Green financial reform and corporate ESG performance in China: empirical evidence from the green financial reform and innovation pilot zone. Int. J. Environ. Res. Public Health 22), 14981–14981. doi: 10.3390/IJERPH192214981

Chen J., Li L., Yang D., Wang Z. (2023). The dynamic impact of green finance and renewable energy on sustainable development in China. Front. Environ. Sci. 10, 1097181. doi: 10.3389/FENVS.2022.1097181

Ding X., Cai Z., Fu Z. (2021). Does the new-type urbanization construction improve the efficiency of agricultural green water utilization in the Yangtze River Economic Belt? Environ Sci Pollut Res. 28, 64103–64112. doi: 10.1007/s11356-021-14280-z

Dziwok E., Jäger J. (2021). A classification of different approaches to green finance and green monetary policy. Sustainability 13 (21), 11902. doi: 10.3390/SU132111902

Fan X., Xu Y., Nan Y., Li B., Cai H. (2020). Impacts of high-speed railway on the industrial pollution emissions in China: evidence from multi-period difference-in-differences models. Kybernetes. 49 (11), 2713–2735. doi: 10.1108/K-07-2019-0499

Feng H., Yang F. (2023). Does environmental psychology matter: role of green finance and government spending for sustainable development. Environ. Sci. Pollut. Res. 30, 39946–39960. doi: 10.1007/S11356-022-24969-4

Gong Q., Tang X., Wang X. (2022). Can low-carbon pilot city policies effectively promote high-quality urban economic development? Quasi-Natural Experiments Based Sustain. 22), 15173–15173. doi: 10.3390/SU142215173

Guo J., Ma S., Li X. (2022). Exploring the differences of sustainable urban development levels from the perspective of multivariate functional data analysis: a case study of 33 cities in China. Sustainability 14 (19), 12918. doi: 10.3390/SU141912918

Huang H., Zhang J. (2021). Research on the environmental effect of green finance policy based on the analysis of pilot zones for green finance reform and innovations. Sustainability 13 (7), 3754. doi: 10.3390/SU13073754

Hunjra A. I., Hassan M. K., Zaied Y. B., Managi S. (2023). Nexus between green finance, environmental degradation, and sustainable development: Evidence from developing countries. Resour. Policy. doi: 10.1016/J.RESOURPOL.2023.103371

Jeucken M., Bouma J. J. (1999). The changing environment of banks. Greener Management International. 1999, 20–35. doi: 10.9774/GLEAF.3062.1999.au.00005

Jha B., Bakhshi P. (2019). Green finance: fostering sustainable development in India. Int. J. Recent Technol. Eng. 8 (4), 2277–3878. doi: 10.35940/ijrte.d8172.118419

Lee C., Wang F., Lou R., Wang K. (2023). How does green finance drive the decarbonization of the economy? Empirical evidence from China. Renewable Energy, 671–684. doi: 10.1016/J.RENENE.2023.01.058

Li P., Lu Y., Wang J. (2016). Does flattening government improve economic performance? evidence from China. J. Dev. Econ. 123, 18–37. doi: 10.1016/j.jdeveco.2016.07.002

Li C., Solangi Y. A., Ali S. (2023). Evaluating the factors of green finance to achieve carbon peak and carbon neutrality targets in China: a Delphi and fuzzy AHP approach. Sustainability 15 (3), 2721. doi: 10.3390/SU15032721

Li G., Wen H. (2023). The low-carbon effect of pursuing the honor of civilization? A quasi-experiment in Chinese cities. Econ. Anal. Policy, 343–357. doi: 10.1016/J.EAP.2023.03.014

Liang J., Song X. (2022). Can green finance improve carbon emission efficiency? Evidence from China. Front. Environ. Sci. 10, 955403. doi: 10.3389/FENVS.2022.955403

Liao Y., Ma Y., Chen J., Liu R. (2020). Evaluation of the level of sustainable development of provinces in China from 2012 to 2018: a study based on the improved entropy coefficient-topsis. Sustainability 12. doi: 10.3390/su12072712

Lin W., Hong C., Zhou Y. (2020). Multi-scale evaluation of Suzhou city’s sustainable development level based on the Sustainable Development Goals framework. Sustainability. 12 (3), 976. doi: 10.3390/su12030976

Liu S., Wang Y. (2023). Green innovation effect of pilot zones for green finance reform: evidence of quasi natural experiment. Technological Forecasting and Social Change 2023 (186), 122079. doi: 10.1016/J.TECHFORE.2022.122079

Liu Y., Xia L. (2022). Evaluating low-carbon economic peer effects of green finance and ict for sustainable development: a chinese perspective. Environ. Sci. pollut. Res. 30 (11), 30430–30443. doi: 10.1007/S11356-022-24234-8

Ma H., Miao X., Wang Z., Wang X. (2023). How does green finance affect the sustainable development of the regional economy? Evidence from China. Sustainability 4), 3776–3776. doi: 10.3390/SU15043776

Martins H. C. (2022). Competition and esg practices in emerging markets: evidence from a difference-in-differences model. finance Res. Lett. 46. doi: 10.1016/j.FRL.2021.102371

Mo Y., Sun D., Zhang Y. (2023). Green finance assists agricultural sustainable development: evidence from China. Sustainability 3), 2056–2056. doi: 10.3390/SU15032056

Muhammad S., Ahmad A. M., Ch P., Hong M. N., Quang N. T., Hien P. T. T. (2022). How green finance and financial development promote green economic growth: deployment of clean energy sources in South Asia. Environ. Sci. pollut. Res. Int. 29 (43), 65521–65534. doi: 10.1007/S11356-022-19947-9

Ozili P. K. (2021). Digital finance, green finance and social finance: is there a link? (Social Science Electronic Publishing). doi: 10.2478/FIQF-2021-0001

Pan A., Zhang W., Shi X., Dai L. (2022). Climate policy and low-carbon innovation: evidence from low-carbon city pilots in China. Energy Econ. 2022 (112), 106129. doi: 10.1016/J.ENECO.2022.106129

Ronaldo R., Suryanto T. (2022). Green finance and sustainability development goals in Indonesian Fund Village. Resour. Policy. 78, 102839. doi: 10.1016/J.RESOURPOL.2022.102839

Ruiz J., Arboleda C. A., Botero S. (2016). A proposal for green financing as a mechanism to increase private participation in sustainable water infrastructure systems: the Colombian case. doi: 10.1016/j.proeng.2016.04.058

Sheng X., Haonan D. (2023). Green finance, industrial structure upgrading, and high-quality economic development-intermediation model based on the regulatory role of environmental regulation. Int. J. Environ. Res. Public Health 20 (2), 1420–1420. doi: 10.3390/IJERPH20021420

Song J., Wang J., Chen Z. (2022). How low-carbon pilots affect chinese urban energy efficiency: an explanation from technological progress. Int. J. Environ. Res. Public Health 23, 15563–15563. doi: 10.3390/IJERPH192315563

Sun Y., Sun Y., Li X. (2021). Constructing a green financial innovation system with the PPP environmental protection industry fund. International Journal of Technology Management 85, 319–332. doi: 10.1504/IJTM.2021.115272

Sun H., Chen F. (2022). The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 76, 102588. doi: 10.1016/J.RESOURPOL.2022.102588

Sun X., Zhang A., Zhu M. (2023). Impact of pilot zones for green finance reform and innovations on green technology innovations: evidence from Chinese manufacturing corporates. Environ. Sci. pollut. Res. 30, 43901–439013. doi: 10.1007/S11356-023-25371-4

Tma B., Yan L. A., Hps C. (2021). Green finance, fintech and environmental protection: evidence from China. Environ. Sci. Ecotechnol. doi: 10.1016/J.ESE.2021.100107

Wang J., Liu Z., Shi L., Tan J. (2022). The impact of low-carbon pilot city policy on corporate green technology innovation in a sustainable development context—evidence from chinese listed companies. Sustainability 14 (17), 10953. doi: 10.3390/SU141710953

Wang K., Zhao Y., Jiang C., Li Z. (2022). Does green finance inspire sustainable development? Evidence from a global perspective. econ. Anal. Policy, 412–426. doi: 10.1016/j.EAP.2022.06.002

Wang Y., Zhao N., Lei X., Long R. (2021). Green finance innovation and regional green development. Sustainability 13 (15), 8230. doi: 10.3390/SU13158230

Wang Z., Teng Y.-P., Wu S., Chen H. (2023). Does green finance expand China’s green development space? Evidence from the ecological environment improvement perspective. Systems 11 (7), 369. doi: 10.3390/systems11070369

Wen H., Chen S., Lee C. C. (2023). Impact of low-carbon city construction on financing, investment, and total factor productivity of energy-intensive enterprises. Energy J. 44, (2). doi: 10.5547/01956574.44.2.HWEN

Wen H., Lee C. C., Zhou F. (2021). Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 105099. doi: 10.1016/J.ENECO.2021.105099

Wu D., Song W. (2023). Does green finance and ICT matter for sustainable development: role of government expenditure and renewable energy investment. Environ Sci Pollut Res. 30, 36422–36438. doi: 10.1007/S11356-022-24649-3

Xing L., Li J., Yu Z. (2022). Green finance strategies for the zero-carbon mechanism: public spending as new determinants of sustainable development. Front. Environ. Sci. 10, 925678. doi: 10.3389/FENVS.2022.925678

Xu J., She S., Gao P., Sun Y. (2023). Role of green finance in resource efficiency and green economic growth. Resour. Policy 81, 103349. doi: 10.1016/J.RESOURPOL.2023.103349

Yan C., Mao Z., Ho K. (2022). Effect of green financial reform and innovation pilot zones on corporate investment efficiency. Energy Econ. doi: 10.1016/J.ENECO.2022.106185

Yang G. (2023). Can the low-carbon city pilot policy promote firms’ low-carbon innovation: Evidence from China. PloS One 1), e0277879. doi: 10.1371/JOURNAL.PONE.0277879

Yang A., Huan X., Teo B. S. X., Li W. (2023). Has green finance improved China’s ecological and livable environment?. Environ Sci Pollut Res. 30, 45951–45965. doi: 10.1007/s11356-023-25484-w

Yang B., Zhan X., Tian Y. (2021). Evaluation on the effect of the transformation policy of resource-exhausted cities-an empirical analysis based on the difference-in- difference. doi: 10.1016/J.EGYR.2021.09.177

Yang G., Zhang J., Zhang J. (2023). Can central and local forces promote green innovation of heavily polluting enterprises? Evidence from China. Environ. Sci. Pollut. Res. 11, 1194543. doi: 10.3389/fenrg.2023.1194543

Yin X., Xu Z. (2022). An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 75. doi: 10.1016/J.RESOURPOL.2021.102476

Zhang D., Mohsin M., Taghizadeh F. (2022). Does green finance counteract the climate change mitigation: asymmetric effect of renewable energy investment and R&D. Energy Econ. 113, 106183. doi: 10.1016/J.ENECO.2022.106183

Zhang B., Wang Y. (2019). The effect of green finance on energy sustainable development: a case study in China. Emerging Markets Finance Trade 57 (12), 3435–3454. doi: 10.1080/1540496x.2019.1695595

Zhang H., Wang Y., Li R., Si H., Liu W. (2023). Can green finance promote urban green development? Evidence from green finance reform and innovation pilot zone in China. Environ. Sci. Pollut. Res. 30, 12041–12058. doi: 10.1007/S11356-022-22886-0

Zhang J., Yang G., Ding X., Qin J. (2022). Can green bonds empower green technology innovation of enterprises? Environ. Sci. pollut. Res. Int. doi: 10.1007/S11356-022-23192-5

Zheng J., Shao X., Liu W., Kong J., Zuo G. (2021). The impact of the pilot program on industrial structure upgrading in low-carbon cities. J. Clean. Prod. (prepublish). (290), 125868. doi: 10.1016/J.JCLEPRO.2021.125868

Zhou M., Li X. (2022). Influence of green finance and renewable energy resources over the sustainable development goal of clean energy in China. Resour. Policy 2022 (78), 102816. doi: 10.1016/J.RESOURPOL.2022.102816

Zhou H., Xu G. (2022). Research on the impact of green finance on China’s regional ecological development based on system GMM model. Resour. Policy 75, 102454. doi: 10.1016/j.RESOURPOL.2021.102454

Zhou G., Zhu J., Luo S. (2022). The impact of fintech innovation on green growth in China: mediating effect of green finance. Ecol. Econ. 193, 107308. doi: 10.1016/J.ECOLECON.2021.107308

Keywords: green finance pilot policy, sustainable development, difference-in-differences model, extended study, pilot zones for green finance reform and innovations

Citation: Lin G, Lam JFI, Shi Y, Chen H and Chen H (2023) Revisiting the linkage between green finance and China’s sustainable development: evidence from the pilot zones for green finance reform innovations. Front. Ecol. Evol. 11:1264434. doi: 10.3389/fevo.2023.1264434

Received: 20 July 2023; Accepted: 05 September 2023;

Published: 27 September 2023.

Edited by:

Chuanbao Wu, Shandong University of Science and Technology, ChinaCopyright © 2023 Lin, Lam, Shi, Chen and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Huangxin Chen, Y2h4NDE3MTIyQDE2My5jb20=; Johnny F. I. Lam, ZmlsYW1AbXB1LmVkdS5tbw==

Guochao Lin1

Guochao Lin1 Hongxi Chen

Hongxi Chen Huangxin Chen

Huangxin Chen