- Accounting School, Harbin University of Commerce, Harbin, China

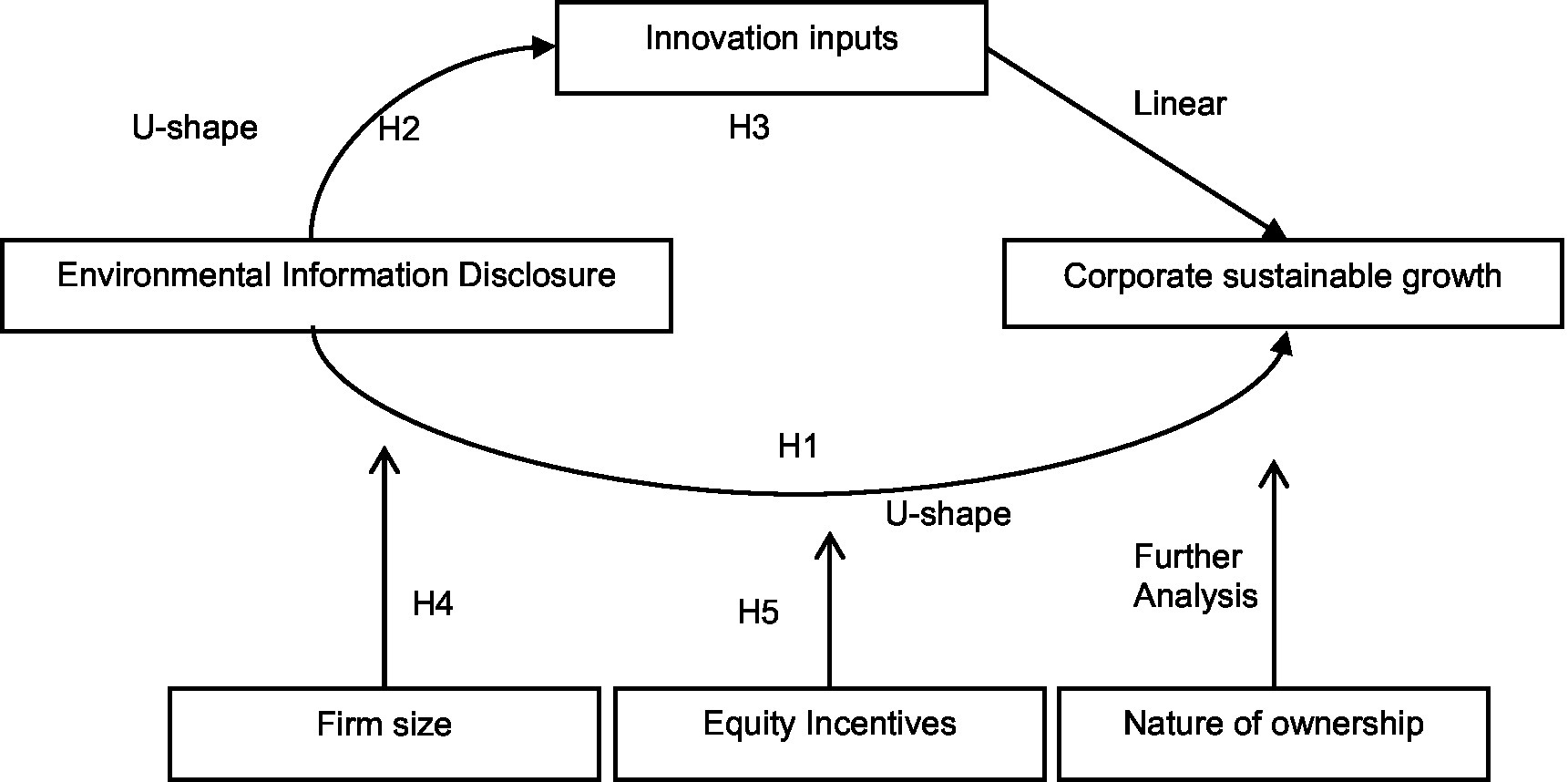

Due to the increasing rate of economic development and the increasingly serious problem of environmental degradation, environmental information disclosure has become an important basis for promoting carbon peaking and carbon neutrality, and an important way for enterprises to carry out green governance to achieve sustainable development. This study uses empirical research methods to analyze the relationship between environmental information disclosure and corporate sustainable growth in the context of green governance using panel data of Chinese A-share listed companies in Shanghai and Shenzhen from 2012 to 2021. The empirical tests conclude that there is a U-shaped relationship between environmental information disclosure and corporate sustainable growth, which decreases and then increases, and the U-shaped relationship is transmitted through innovation inputs. The U-shaped relationship between environmental information disclosure and corporate sustainable growth is weakened by firm size and enhanced by equity incentives. In addition, further group analysis reveals that the above U-shaped relationship is more significant in non-state enterprises than in state-owned enterprises.

1. Introduction

The United Nations Framework Convention on Climate Change (UNFCCC) and the Paris Agreement has come to an agreement on the principles and goals of the international community to jointly address climate change, requiring all parties to work toward limiting temperature rises to 1.5°C based on the principle of common but differentiated responsibilities. However, the global response to climate change still faces many challenges. The 27th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP27) is held in Sharm El Sheikh, Egypt, on November 6, 2022. China anticipates that COP27 will advocate that all parties translate their national autonomous contribution targets into solid actions, fully and accurately implement the principles and goals of the UNFCCC and the Paris Agreement, make significant progress on the adaptation and financing issues that most concern developing countries, and promote the creation of a fair, reasonable, cooperative, and win-win global green governance system to address climate change. The Chinese government has aggressively transformed its method of governing, put the green idea into practice, and elevated green governance to a prominent position in light of the current historical context. Enterprises, the primary cause of environmental concerns, must pay attention to environmental issues and carry out their obligations for environmental governance in addition to using social resources and generating income for society. Environmental information disclosure is viewed by many nations as an essential tool for enhancing the execution of company green initiatives and creating corporate green governance systems, and it has slowly evolved into a development trend for global responsible governance. Environmental information disclosure now fully expresses many market participants’ rights to know about environmental pollution and to take part in environmental governance, making it not only a crucial part of enterprises’ own green governance activities but also a crucial way for the outside world to understand enterprises.

Academics have begun to focus primarily on the study of environmental information disclosure in this backdrop. On the one side, researchers have dug into the variables that affect how environmental information is disclosed. According to the Xin et al. (2020), a random effects regression analysis of manufacturing enterprises revealed ownership structure, debt level, industry type, and firm size as significant determinants of environmental information disclosure. The average age of executives and executive excess remuneration, respectively, might favorably enhance environmental information disclosure, as per research by Ma et al. (2019) and Li et al. (2019). In addition to these, stringent external environmental legislation, media attention, and political factors all increase environmental information disclosure (Garcia-Sanchez et al., 2013; Wang, 2020; Zheng et al., 2020). On the other side, environmental information disclosure has had some economic consequences for companies as a voluntary instrument for environmental regulation, however research on this topic is conflicting. Odriozola and Baraibar-Diez (2017) found by analysis that environmental disclosure has a significant impact on corporate reputation. The argument in support of environmental information disclosure is that it can persuade non-compliant corporations to reduce emissions by reorganizing their capital elements and upgrading their energy structure, which will have a favorable influence on their businesses’ economies (Li et al., 2019; Wang L. et al., 2020; Wang S. et al., 2020; Yongliang et al., 2020; Daqian et al., 2021). Under the opposite viewpoint, environmental disclosure has an offsetting impact on corporate performance since it increases the expense of environmental management and drives investors to respond negatively (Yang et al., 2020) which is detrimental for corporate development (Jia and ZhongXiang, 2022). Pedron et al. (2020) even argue that environmental information disclosure is irrelevant to accounting returns due to the short duration. A review of the existing literature reveals that existing studies on the economic consequences of environmental disclosure remain highly controversial, and exploring the potential mechanisms of their different effects is still of significant academic value. In view of this, this paper proposes a nonlinear relationship between environmental disclosure and sustainable corporate growth and examines the transmission mechanism of innovation inputs.

In accordance with the theory of sustainable development, development is not just a financial preoccupation, and economic growth that exclusively focuses on production value cannot grasp the essence of development. Based on the idea, economic development must be carried out while ensuring environmental protection, ongoing resource utilization, and perpetual coordination between the economy, environment, and resources. In January 2016, the United Nations officially launched the 2030 Agenda for Sustainable Development, which involves three dimensions of sustainable development-the environmental dimension, the social dimension, and the economic dimension. In the context of advocating sustainable development, it is of considerable theoretical and practical value to study how to use environmental information disclosure as an important vehicle for the environmental governance dimension, which in turn has an impact on corporate sustainable growth. Dameng et al. (2021) concluded that environmental information disclosure is a signal to uphold environmental responsibility after examining how environmental information disclosure affects sustainability from the standpoint of green innovation, which makes it easier for businesses to raise capital and, as a result, promotes corporate green innovation. However, this perspective is not comprehensive in studying corporate sustainable growth, and environmental information disclosure not only conveys positive information to the market, but also generates negative impacts that are detrimental to corporate sustainable growth, such as increased disclosure costs and exposure of environmental management deficiencies, which are not discussed in existing studies. This paper argues that the relationship between environmental information disclosure and corporate sustainable growth is more complex and non-linear in nature. In order to fill the gap of the existing studies, this study aims to verify that there is a complex U-shaped relationship between environmental information disclosure and sustainable corporate growth in a sample of a-share listed companies in Shanghai and Shenzhen from 2012 to 2021, which first decreases and then increases. We also examine the mediating role of innovation investment in this relationship and the moderating role of firm size and equity incentives, and further compare the differences in the U-shaped relationship between state-owned and non-state-owned firms.

This research provides three contributions to previous literature. First of all, it fills a gap in the investigation of the influence on corporate sustainable growth that merits additional investigation in the existing research on the economic consequences of environmental information disclosure, which is primarily focused on short-term economics and the conclusions are highly contentious. In order to explain the conflicting phenomena of economic effects in earlier studies and to render the research findings more in line with objective reality, this study suggests a more intricate U-shaped link between environmental information disclosure and corporate sustainable growth. In contrast to previous recent studies that use questionnaires or single indicators to do this, this research uses content analysis to quantify environmental information disclosure and updates the scoring technique to give new variable measures (Ricky et al., 2022). Secondly, the mechanism of the non-linear relationship between environmental information disclosure and corporate sustainable growth is further explored, which extends the understanding of existing studies on the path of the role of environmental information disclosure. It is clarified that the U-shaped relationship arises because of the reciprocal effects of environmental information disclosure on the strengths and weaknesses of firms. It is also found that innovation inputs are the main transmission factor of this relationship, i.e., the U-shaped effect of environmental information disclosure on innovation inputs and then the positive linear effect of innovation investment on corporate sustainable growth is the key to the total U-shaped effect. In addition, based on the above study, firm size and equity incentives are included in the analysis framework to reveal the differential factors affecting the U-shaped effect of environmental information disclosure on corporate sustainable growth. This allows companies to comfortably implement environmental disclosure strategies in different contexts. Finally, China is a significant actor in international environmental governance whereas previous studies are biased toward industrialized nations. The world’s largest developing country is China. This study employs Chinese firms as its research sample in order to enhance the theoretical framework of environmental information disclosure in the Chinese setting. When it comes to environmental governance, other developing countries can use the study’s conclusions as a guide.

2. Mechanistic analysis and hypotheses

2.1. The relationship between environmental information disclosure and corporate sustainable growth

The “Environmental Information Disclosure Measures,” which outlined legal requirements for environmental information disclosure at the enterprise and governmental levels, were made public by China’s Environmental Protection Bureau (EPA) in 2007. This marked an informational stage in China’s pollution control and green governance of corporate transformation. Corporate environmental information disclosure, in contrast to general information disclosure, refers to the practice of releasing and accepting public oversight of the environmental impacts and environment-related performance data caused by an enterprise’s production and operation process. The society is informed in a genuine manner about the enterprise’s environmental policies, aims, environmental inputs, environmental liabilities, environmental benefits, etc. Environmental information disclosure is a powerful tool for companies to demonstrate their commitment to green governance. It also serves as a crucial foundation for the practice of sustainable development, the promotion of carbon peaking, and the advancement of carbon neutral activity.

According to signaling theory, Hepei and Zhangbao (2022) show that negative news exposed by environmental information will damage the producer’s reputational image leading to increased production costs, but with the strengthening of environmental management, it will prompt firms to take the initiative to optimize resource allocation and enhance green total factor productivity, which is beneficial to corporate sustainable growth. So, depending on the level of environmental management, environmental information disclosure may have positive or negative effects on industrial green growth, ultimately leading to a U-shaped or inverted U-shaped nonlinear effect. This paper argues that there exists a U-shaped link between environmental information disclosure and the sustainable growth of firms. The increase in the cost of environmental information disclosure leads to the ban on the corporate sustainable growth, when the higher the level of environmental information disclosure, the worse the corporate sustainable growth. From another angle, however, the resource advantage makes environmental information disclosure and corporate sustainable growth positively correlated, the higher the level of environmental information disclosure, the stronger the corporate sustainable growth.

The gains of environmental protection, according to conventional neo-classical economists, must necessarily be offset by higher private costs for industries and decreased competitiveness. Increasing societal benefits will inevitably come at the expense of manufacturers since environmental protection activities try to internalize harmful environmental externalities, and the resulting implied offsetting relationship will negatively affect development (Ricky et al., 2022). The externalities, particularly the negative externalities, that define environmental information is connected to the detrimental effects of environmental information disclosure on corporate sustainable growth. When corporations disclose environmental data, the public is simultaneously exposed to the results of environmental management and environmental harm. Numerous sectors with significant energy consumption and pollutant emissions have had detrimental effects on China’s environment (Tao et al., 2020). Environmental management flaws and environmental damage fines will almost certainly negatively impact a company’s reputation, which is bad for business growth. Additionally, the incentive of environmental information disclosure forces companies to change their original optimal production resource allocation, which increases the investment in environmental management and adds additional operating costs and economic burdens to companies (Bing et al., 2020), while sacrificing other projects with more investment potential and increasing opportunity costs (Lijun et al., 2021), which is prone to resource misallocation due to economic risks and inhibits corporate sustainable growth.

Different from the study previously given, a number of theories explain the encouraging effect of environmental information disclosure on the corporate sustainable growth. First of all, according to the theories of signal transmission, the disclosure of environmental information by businesses to the public and many investors is a sort of green governance signal. It has the ability to concurrently intervene in a variety of investments and financing decisions made by investors, financial institutions, and other stakeholders (Yu et al., 2018). Leveraging resources derived through public trust may help achieve first-mover advantage, increase barriers to market entrance (Ricky et al., 2022), improve market performance, and promote environmental company development (Ricky et al., 2022). The external governance pressures that businesses experience causes them to actively disclose environmental information in a way that more closely aligns with public expectations. This improves market competitiveness and increases corporate green goodwill. Finally, environmental information disclosure is a policy requirement put forward by the government to polluting enterprises, and the transmission of environmental information can improve the government’s recognition of the enterprise. The higher the government’s recognition of the enterprise, the stronger the government protection faced by the enterprise’s development, the easier it is to obtain government support for relevant planning approval procedures as well as development measures, and the business risks of the enterprise are mitigated, which likewise promotes the corporate sustainable growth.

Environmental information disclosure does have some inhibitory effects on corporate sustainable growth, but the benefits it receives in terms of resources are growing. As environmental information disclosure increases, the impact of the latter will gradually outweigh the former, having different effects on businesses’ ability to develop sustainably. Consumers and investors are unable to judge businesses fairly when they provide less environmental information (Ricky et al., 2022), which may lower the ease of financing and social trust of businesses, drive up expenses, and lessen the effectiveness of resource allocation. However, the agency issue in the management process is decreased, information asymmetry’s negative effects are significantly lessened, and the advantage of resource acquisition gradually grows as the degree of environmental information disclosure increases. The space for the inhibitory impact to operate is now progressively shrinking, the inhibitory effect is being mitigated, and the promotion effect is becoming progressively more pronounced (Xiaoling et al., 2023). When environmental information disclosure reaches a high level, strong environmental governance signals can be sent, corporate reputation and image are stable, and it is easier to capitalize on investor confidence to get more outside investment and financing benefits. Disclosure of environmental information is becoming more important in encouraging the corporate sustainable growth. In conclusion, the U-shaped impact of environmental information disclosure on the corporate sustainable growth is caused by the inhibitory effect, which predominates when the level of environmental information disclosure is small, and the promoting effect, which takes the lead when the level of environmental information disclosure is large. This conclusion is based on the superposition of the two effects. As a result, the following hypothesis is put forth:

H1: Environmental information disclosure and corporate sustainable growth have a U-shaped relationship.

2.2. The mediating effect of innovation inputs on the relationship between environmental information disclosure and corporate sustainable growth

For enterprises, technical innovation is the key to development, and the environmental information disclosure has the dual effects of crowding out innovation inputs and fostering them (Ricky et al., 2022). The few resources are a reflection of the crowding out effect that environmental information disclosure has on innovation inputs. Businesses will strengthen their environmental management investments, scale up their environmental protection investments, and control and reduce pollutant emissions in order to quickly meet local governments’ regulatory requirements in the short term and avoid facing legal repercussions (Qinglin and Huaqi, 2022). The competitive cash flow impact will result in a crowding out effect on innovation inputs (Ricky et al., 2022). Environmental information disclosure, however, may also help to mitigate harmful elements in the innovation process and encourage innovative inputs as a powerful corporate governance device (Jiang et al., 2021). The firm, as an organization entrenched in the resource dependency relationship, has the problem of resource constraint, which indicates that the enterprise survival depends on its capacity to acquire external resources, according to the study of resource dependence theory. The cumulative effect of environmental information disclosure can strengthen the capacity of the company to acquire resources, enhance the enterprise’s desire to innovate, and boost stakeholders’ general impression of the enterprise (Ricky et al., 2022). It is challenging for the public to properly comprehend environmental information due to low levels of environmental information dissemination, and at this point, the crowding-out effect on innovation inputs is greater than the promotion effect, making environmental information disclosure unfavorable to enterprise innovation investment. When environmental information disclosure is at a medium to high level, the promotion effect gradually appears, promoting the level of innovation inputs to increase. Therefore, the inputs in innovation by businesses displays a trend of dropping and then growing when environmental information disclosure changes from a low to high degree. Thus, the following hypothesis is put forth:

H2: The relationship between environmental information disclosure and innovation inputs is U-shaped.

The Theory of Economic Development, J. Schumpeter’s Ger-man-language treatise from 1912, was the first to discuss innovation. He contends that internal factors, chief among them innovation, are what cause the capitalist system to disrupt the preexisting equilibrium and achieve the new one. Innovation inputs and outputs may aid businesses in gaining long-term competitive advantages and are crucial to their growth. According to the analysis of innovation theory, firms, as micro-component units of macro-economy, inputs in technological innovation can improve the original production efficiency and production technology, forming an innate competitive advantage and intangible resources with path dependency (Yujuan and Lu, 2022), and contribute to the corporate sustainable growth. In addition, the increase in innovation inputs will also send positive signals to the market, raise investors’ expectations for the development of the firm, and reduce financing constraints (Ricky et al., 2022). Thus, it is clear that innovation investment has a positive impact on the corporate sustainable growth.

The crowding out effect will lower the innovation inputs and impede the corporate sustainable growth, according to the study above, when the environmental information disclosure is at a low level. The reputation advantage plays a role when the amount of environmental information disclosure is at a medium-high level, and the favorable resources encourage businesses to invest in innovation, which also encourages corporate sustainable growth. In other words,the U-shaped correlation between environmental disclosure and corporate sustainable growth is a consequence of the U-shaped effect of environmental disclosure on innovation inputs, which in turn has an impact on corporate sustainable growth. On the basis of this, the following hypothesis is put forth:

H3: The U-shaped association between environmental information disclosure and corporate sustainable growth is mediated by innovation inputs.

2.3. The moderating effect of firm size on the relationship between environmental information disclosure and corporate sustainable growth

Depending on their own resources and capacities, businesses have vastly varying responses to the dual implications of environmental information disclosure on corporate sustainable growth. Firm size is the core index to de-scribe the amount of enterprise resources and ability, which determines the degree of response of corporate sustainable growth to the effect of environmental information disclosure. The higher the scale of listed firms compared to small businesses, the greater the influence of their business practices on society (Ricky et al., 2022), and they are more likely to attract public notice and become the subject of government regulation (D’Amato and Falivena, 2020). Therefore, enterprises must actively address stakeholder demands and expectations for environmental responsibility in order to secure exclusive investment from stakeholders to support sustainable growth of companies (Cheng et al., 2021). In order to gain and keep the legitimacy of operation, more and better environmental information might be published in order to win over stakeholders (Acabado et al., 2020). As a result, the cost of environmental information disclosure increases with firm size, but larger enterprises are also better equipped to minimize marginal cost due to the scale impact of resource utilization, which lessens the deterrent effect of cost growth on sustainable development. For the promotion effect, once a large-scale enterprise with a good reputation is formed, social evaluation will be relatively stable (Yusof et al., 2020), making the positive halo effect of the reputation of a large enterprise less effective than that of a small enterprise. The promotion impact of environmental information disclosure on the long-term development of businesses is diluted the higher the degree of environmental information disclosure, the smaller the marginal benefit of good reputation in bigger organizations.

To sum up, when environmental information disclosure is below the threshold, the higher cost forces businesses to use resources to create scale advantages to lower marginal costs and mitigate the detrimental effects of environmental information disclosure on the long-term sustainability of their operations. When environmental information disclosure is above the threshold, as the degree of environmental information disclosure increases, the development-related resources obtained by the halo effect generated by good reputation of small-scale enterprises have more marginal compensation effect on the disclosure cost. At this time, the promotion of corporate sustainable growth is furthered by the function that environmental information disclosure plays. Based on this, the following hypothesis is proposed:

H4: The U-shaped relationship between environmental information disclosure and corporate sustainable growth is negatively moderated by firm size.

2.4. The moderating effect of equity incentives on the relationship between environmental information disclosure and corporate sustainable growth

Research on equity incentives is a current topic in several disciplines, including management and economics, and has an increasingly prominent role and place in the capital markets. As a corporate incentive, equity incentives will result in the management benefit encroachment impact and benefit synergy effect. The compensation received cannot cover the cost of disclosure when the level of environmental information disclosure falls below the threshold, which hinders the corporate sustainable growth. When management equity incentive grows and control rights are acquired, the monitoring role of businesses in relation to management weakens. The demand for reputation and exercise profit will cause the management benefit encroachment effect and exacerbate the inhibition effect of environmental information disclosure on the management benefit encroachment effect if the management does not meet the exercise conditions to promote the corporate sustainable growth through their duty responsibility and diligence.

The increase in equity incentive will prevent the conflict of interest resulting from the unreasonable distribution of residual control and residual income caused by incomplete contracts when environmental information disclosure is higher than the threshold (Umeair et al., 2021). The compensation of stakeholders’ resources generated by good reputation covers the cost of disclosure and promotes the corporate sustainable growth. Equity incentives provide a connection between management’s interests and the enterprise’s long-term worth in this situation (Xu, 2019). It will boost management’s motivation and decrease their self-interest (Jones et al., 2019). Additionally, it encourages businesses to meet their environmental obligations through green governance and to make financial and economic decisions that support corporate sustainable growth (Zhao and Lin, 2020). Therefore, the “benefit synergy” effect improves the contribution of environmental information disclosure to encouraging t corporate sustainable growth when the environmental information disclosure is higher than the threshold value.

In conclusion, the rise in equity incentive exacerbates the negative impact of environmental information disclosure in corporate sustainable growth when it is below the threshold. The greater the equity incentive when the environmental information disclosure is over the threshold, the greater the beneficial impact of environmental information disclosure on corporate sustainable growth. On the basis of this, the following hypothesis is suggested.

H5: The U-shaped association between environmental information disclosure and corporate sustainable growth is positively moderated by equity incentives.

In summary, the conceptual model of this paper is shown in Figure 1.

3. Data and empirical model

3.1. Data collection and the sample

This paper takes the 2012–2021 Shanghai and Shenzhen A-share listed companies as the initial sample, and excludes the delisting warning sample companies (ST and *ST). To avoid the effect of extreme values, the sample firms were subjected to a one-percent tailing. The websites of the Shanghai and Shenzhen stock exchanges, annual reports of listed companies, independent corporate social responsibility reports, sustainability reports, and environmental reports are used to gather environmental information disclosure data for listed companies. The CSMAR database provided the financial data. Finally, from this article, 19,207 samples of data were gathered.

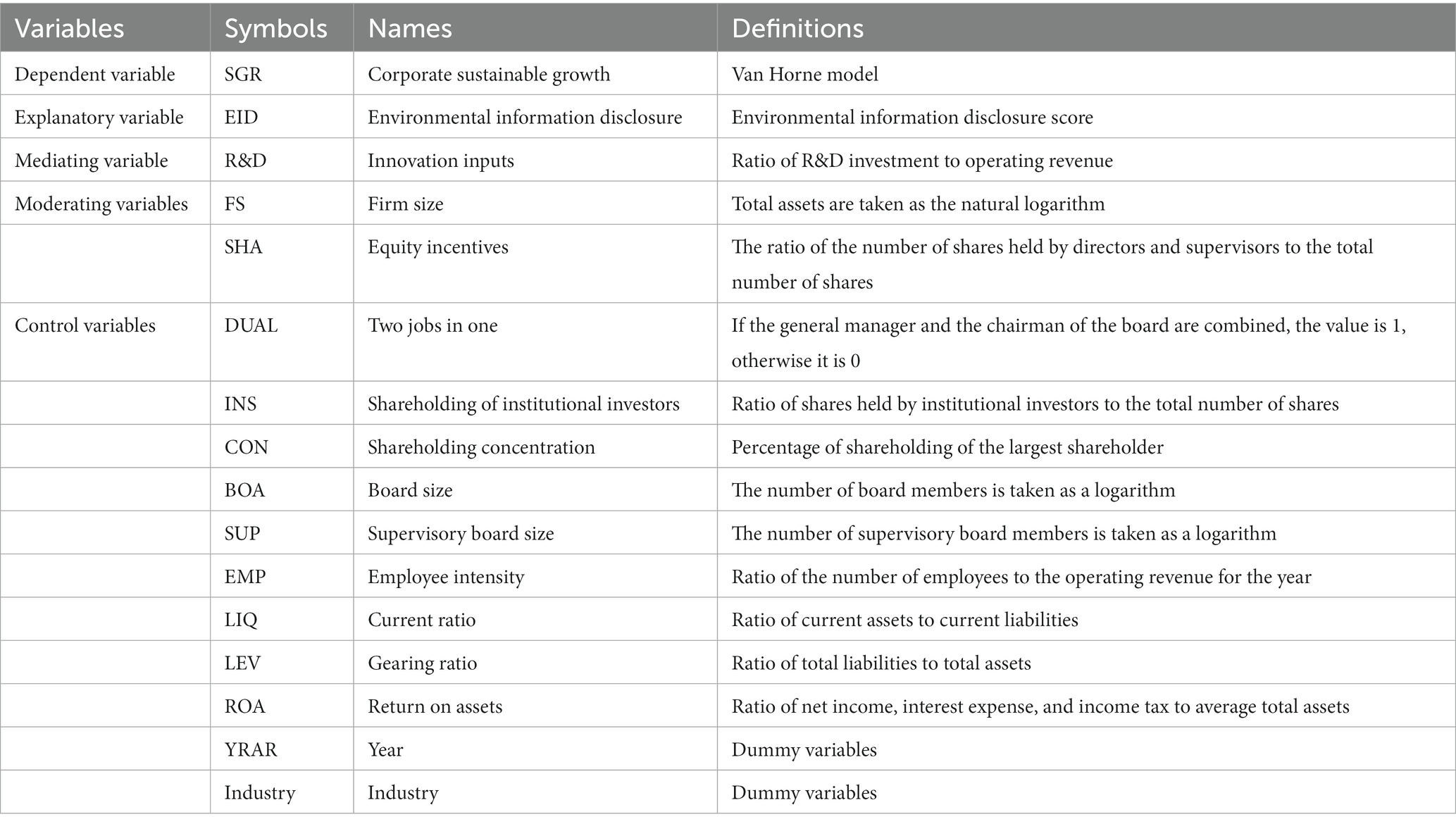

3.2. Definition of main variables

3.2.1. Dependent variable: corporate sustainable growth

Corporate sustainable growth. Robert C. Higgins, an American finance expert, proposed the sustainable growth model in 1977, which introduced the sustainable growth issue from qualitative analysis to quantitative analysis. However, many experts and scholars have taken a negative attitude toward this model, arguing that the assumptions of the model are too harsh and not in line with the actual operating conditions of enterprises. Therefore, many scholars have tried to change the assumptions or relax the basic conditions to make it more consistent with the actual situation of enterprises. Among them, the most typical one is the static and dynamic model of sustainable growth proposed by James-C-Van Horne in 1988 (Burger and Hamman, 1999).The Van Horn and Higgins sustainable growth models are the most often used methods for evaluating a corporate sustainable growth. Although simple and straightforward, the Higgins sustainable growth model is poorly matched with the business environment of enterprises and ignores their dynamic growth. The Van Horn sustainable growth static model is used to construct the sustainable growth index of enterprises, which measures the sustainable growth capability of listed companies. The specific calculation is as follows:

Sustainable growth rate = net sales margin * asset turnover * ending equity multiplier * earnings retention rate/(1 – net sales margin * asset turnover * ending equity multiplier * earnings retention rate).

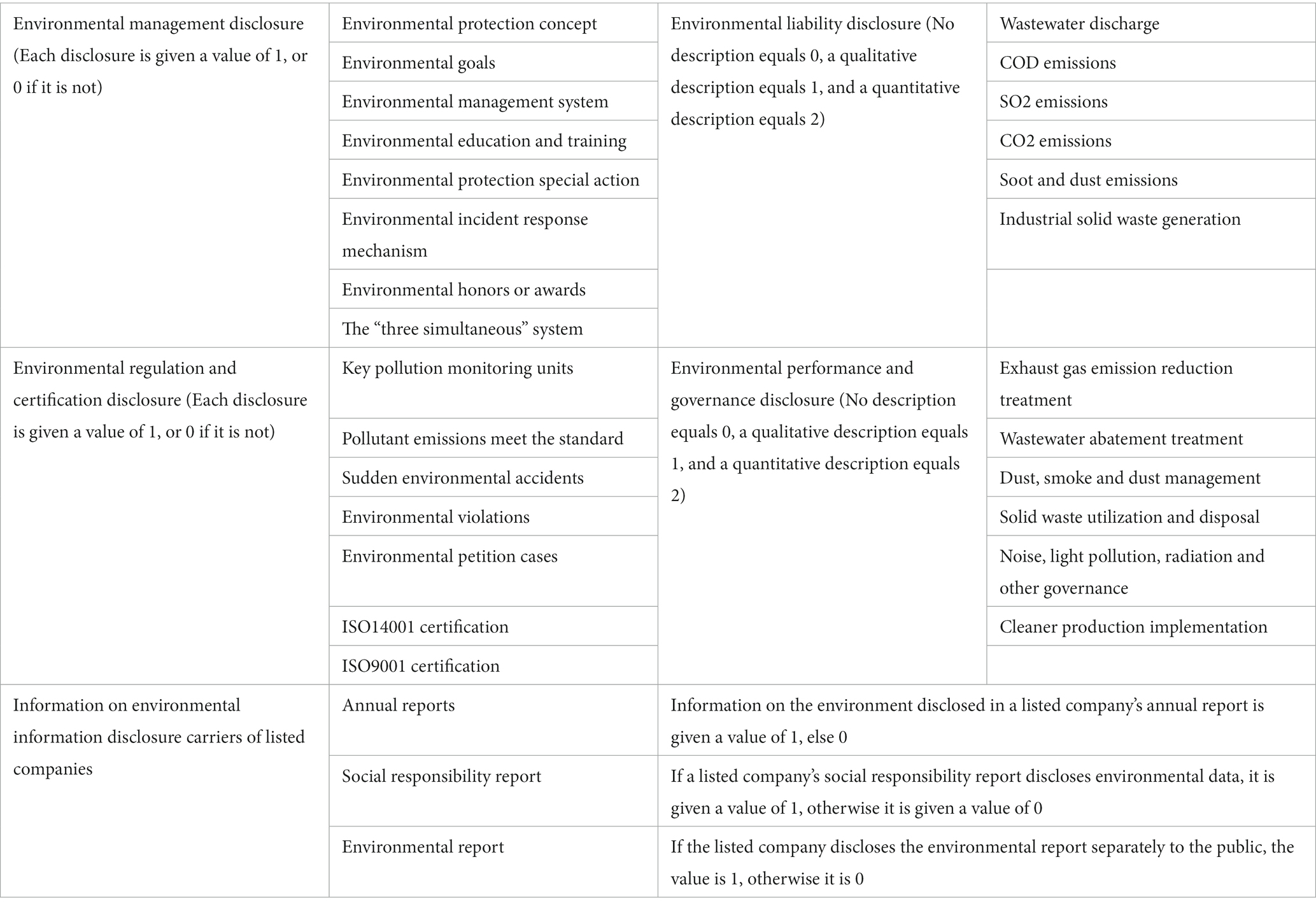

3.2.2. Explanatory variable: environmental information disclosure

Environmental information disclosure. While earlier researchers measured environmental information disclosure by the total number of sentences or even words related to environmental information in the annual report, studies related to environmental information disclosure have recently measured environmental information disclosure by the content and extent of environmental disclosure of enterprises (Mendes et al., 2018; Fonseka et al., 2019; Tadros and Magnan, 2019). Based on the nine environmental information contents of “the State encourages voluntary disclosure of enterprises” in China’s Environmental Information Disclosure Measures (Trial), the dis-closure criteria of listed companies’ environmental information disclosure guidelines [Supervision (2008) No. 18] and listed companies’ environmental information disclosure guidelines (2010 Draft for Public Opinions) published by Shanghai Stock Exchange, as well as the annual reports of listed companies, The sample businesses’ environmental information disclosure material is broken down into the following five categories for score evaluation: (1) environmental management disclosure; (2) environmental liability disclosure; (3) environmental regulation and certification disclosure; (4) environmental performance and governance disclosure; and (5) information on the carrier of environmental information disclosure.

The details of the assignment are displayed in Table 1, and once the five indicators of each firm are evaluated and added together, the score of environmental information disclosure of each sample company is determined. We first calculate the maximum possible score of environmental information disclosure for each sample company, which is 42. The actual score of environmental information disclosure for the company is then divided by the maximum possible score of environmental information disclosure in order to reflect the level of environmental information disclosure of various companies. The degree of environmental information disclosure increases with a higher score. The following is the calculating formula:

3.2.3. Mediating variable: innovation inputs

Innovation inputs. The logarithm of Innovation investment amount, the ratio of R&D investment to total assets, and the ratio of R&D investment to primary business income are the three metrics currently used to quantify innovation investment (Jingchang et al., 2021). Because of several reasons, including unreasonable expectations brought on by China’s unsatisfactory capital market, the absolute quantity of R&D investment is not comparable. This study takes the ratio of innovation investment to revenue as a measure of the level of innovation investment, with a bigger ratio indicating a higher level of innovation investment (Xu et al., 2020).

3.2.4. Moderating variables: firm size and equity incentives

Firm size. Depending on the research goal and the data’s accessibility, there are numerous relevant firm size measurements. The three most frequently used indicators in prior studies are sales, number of employees, and total assets. Other indicators to measure enterprise scale include cost of sales, number of subsidiaries, market value of stocks and bonds, and enterprise added value (George et al., 2021; Ricky et al., 2022). In general, total assets are the resources that a corporation may now manage, and they are represented by the sum of liabilities and owners’ equity. The logarithm of total assets is used in this study as a measurement.

Equity Incentives. The model of equity incentives in practice is complicated. Common models of equity incentive settlement include equity options, restricted shares, performance stocks, employee stock ownership plans, etc. (Jones et al., 2019; Martin et al., 2019). But no matter what kind of incentive mode will eventually be reflected in the incentive object shareholding ratio changes. Using the method of Denton et al. (2018) for reference, this paper measures the intensity of management equity incentive by using the proportion of the total shares held by directors, supervisors and senior managers in the total share capital.

3.2.5. Control variables

The following control variables were chosen with reference to prior research literature in order to minimize the influence of potential variables on the study’s findings and to control other elements that affect the corporate sustainable growth (Osazuwa et al., 2017; Radu and Francoeur, 2017; Mendes et al., 2018; Fonseka et al., 2019). Two jobs in one, which is given a value of 1 when the general manager and chairman are in the same position and a value of 0 when they are not. Shareholding of institutional investors, measured by the ratio of the number of shares held by institutional investors to the total number of shares. Shareholding concentration as shown by the proportion of shares held by the largest shareholder. By calculating the logarithm of the number of board members and supervisory board members, respectively, the size of the board of directors and the supervisory board is determined. Employee intensity is determined by dividing the total number of employees by the annual operating income. The ratio of current assets to current liabilities is known as the current ratio. The ratio of total liabilities to total assets is known as the gearing ratio. Return on assets is calculated by dividing the company’s annual earnings by the total asset value. In addition, annual and industry dummy variables are set in this paper to control for annual and industry fixed effects, and the definitions of each variable are detailed in Table 2.

3.3. Regression model

The following model is set up in this paper based on the aforementioned analysis in order to validate the non-linear relationship between environmental information disclosure and corporate sustainable growth, the mediating effect of innovation inputs, and the moderating effect of firm size and equity incentives.

When studying U-shaped relationships, researchers usually use the above model and focus on whether β2 is significant (Lind and Mehlum, 2010). According to the step-by-step procedure, the first step is to ensure that β2 is significant and the direction is consistent with theoretical expectations; the second step is that the slope of the relationship between Y and X must be steep enough at the minimum and maximum values of the independent variable; and the third step is that the 95% confidence interval of the turning point -β1/2β2 should be within the range of the values of the independent variable. Based on this, this study constructs a regression model to test the u-shaped relationship first, and then verifies the extreme value confidence interval by robustness test.

4. Results

4.1. Descriptive statistics and correlation analysis of variables

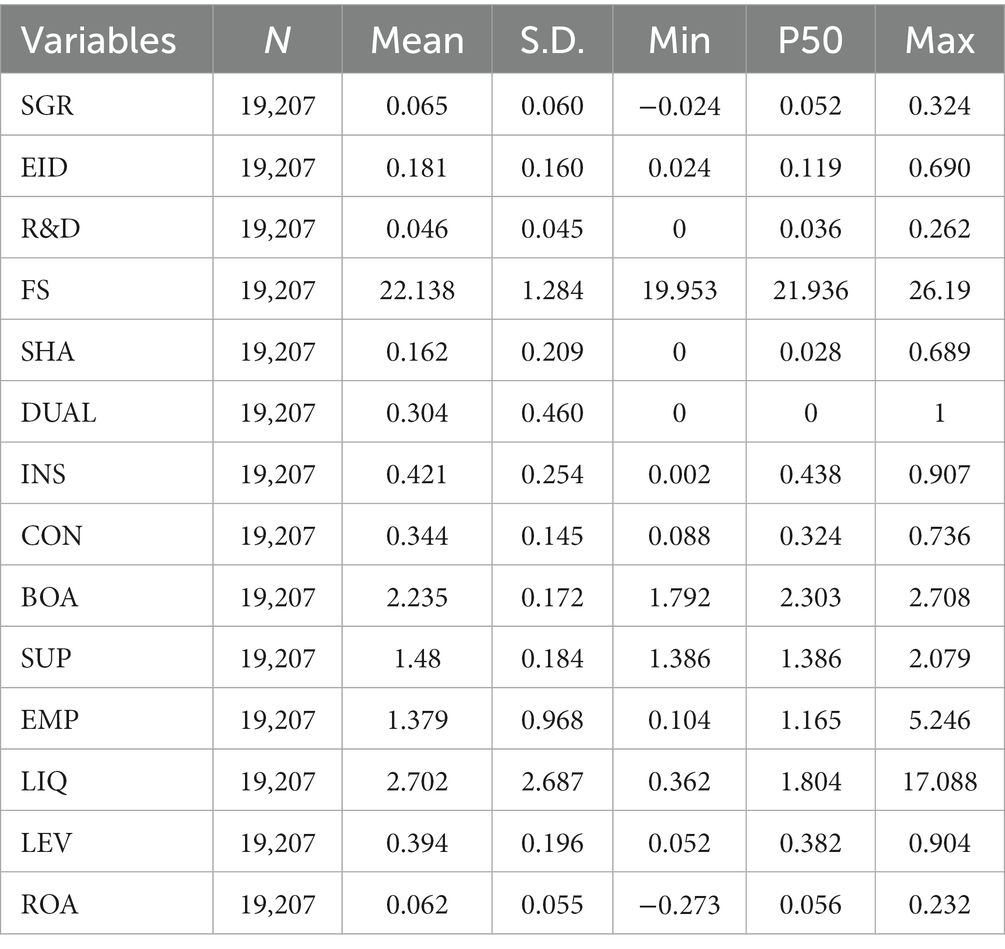

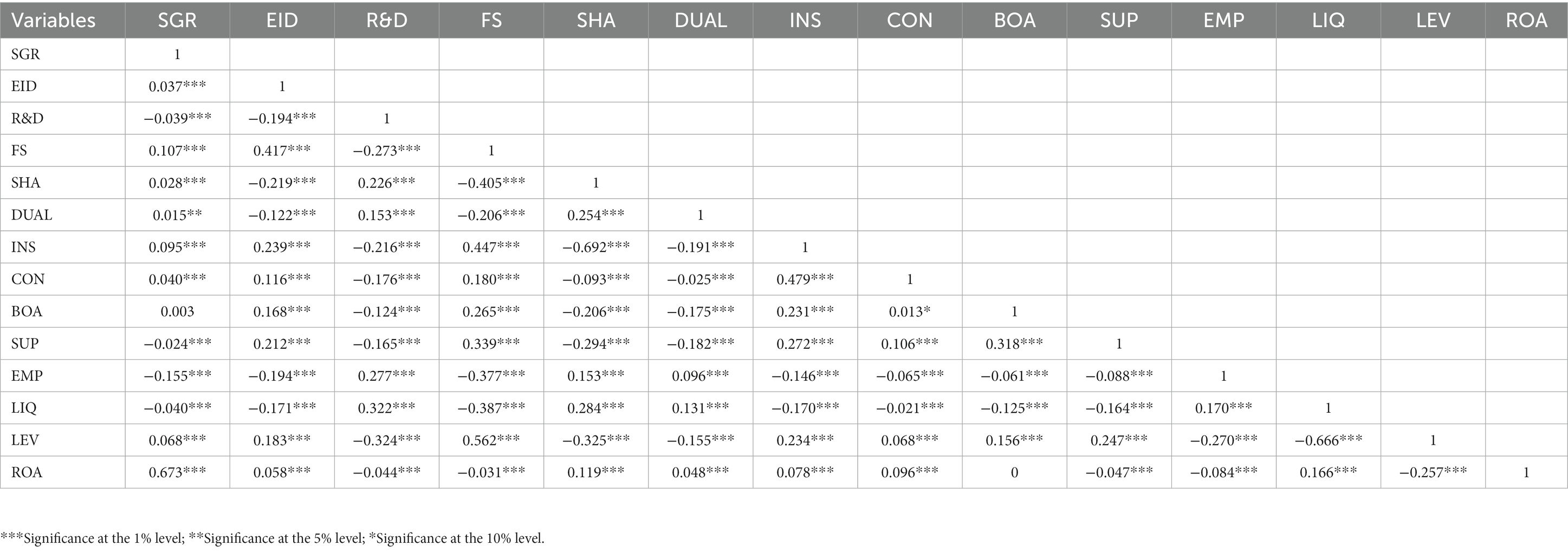

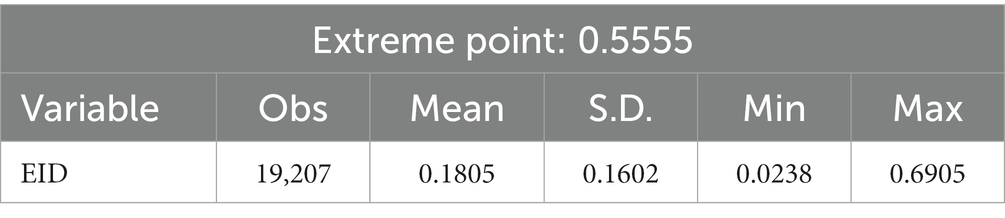

The findings of the descriptive analysis for the 19,207 samples are displayed in Table 3. The corporate sustainable growth of Chinese listed firms is inconsistent, as seen by the sample corporate average sustainable growth rating of 0.065, which ranges from −0.024 to 0.324. The average score for environmental information disclosure is 0.181, which is a low overall level. As a result, improving environmental information disclosure has important practical ramifications for the study in this article. Table 4 displays the findings from the study of the association between the variables in this essay. The correlation coefficient between corporate environmental information disclosure and corporate sustainable growth is 0.037, and it passes the 1% significance level test, according to statistical results of the correlation between the variables. The specific link warrants additional investigation since the correlation coefficient between innovation inputs and corporate sustainable growth was −0.039 and passed the 1% significance level test. The majority of the other control variables have a substantial positive correlation with the explained variable, as do company size and equity incentive. In this research, the variance inflation factor (VIF) values are further assessed to prevent the issue of multi-collinearity among variables. The measured findings show that there is no significant multicollinearity among the variables because all of the VIF values are less than 10, which is consistent with the measured results.

4.2. Analysis of regression

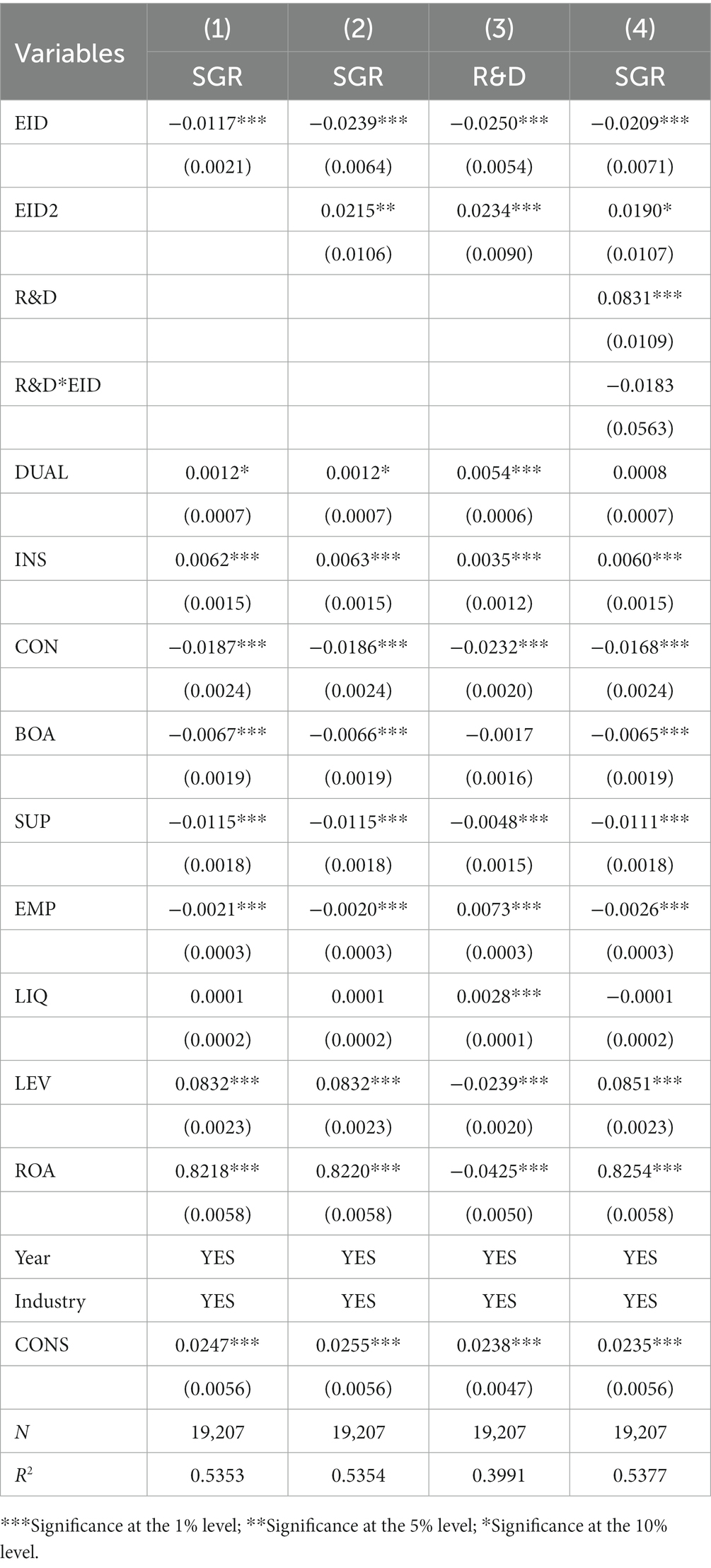

In order to determine if environmental information disclosure and corporate sustainable growth are related, this study first employs the linear regression approach. The results are displayed in Table 5. The findings of the linear relationship test show that corporate sustainable growth is hampered by the environmental information disclosure. The quadratic component of environmental information disclosure is then used in this research in order to build Model 2 and test the U-shaped connection in accordance with the more intricate nonlinear relationship of mechanism analysis. Results reveal that there is a U-shaped association between environmental information disclosure and corporate sustainable growth, with the coefficient of the quadratic component being 0.0215 and passing the significance test. To put it another way, corporate sustainable growth has a tendency of falling and then increasing with an increase in environmental information disclosure, which supports hypothesis 1.

The combination of the two positions of general manager and chairman can help to lessen the principal agent problem and advance the long-term sustainability of the company, according to the regression results of the control variables, which show that the coefficient of the variable of two positions in one is significantly positive at the 10% level. The coefficient of institutional investors’ shareholding is notably positive at the 1% level, showing that the more institutional investors participate in a business, the more they support its long-term growth. At the 1% level, share concentration, board size, supervisory board size, and employee intensity all show strongly negative trends, demonstrating that too many redundant members and excessive share size are detrimental to corporate sustainable growth. The fact that enterprises with high gearing often have fewer financing limitations and have more capital may help to explain why the coefficient of gearing variable is notably positive at the 1% level. The improvement in business profitability can offer the essential financial security for sustainability, as shown by the coefficient of the return on assets variable being considerably positive at the 1% level.

Additionally, models 3 and 4 validate the intrinsic influence mechanism of the U-shaped relationship. The findings indicate a nonlinear link between environmental information disclosure and innovation inputs. The second term’s coefficient in Model 3 is markedly positive, demonstrating that environmental information disclosure over the threshold can encourage innovation inputs, which means that the U-shaped influence effect holds. In model 4, the coefficient of the quadratic term with significance declines, the coefficient of the innovation inputs variable is significantly positive, and the coefficient of the interaction term between environmental information disclosure and innovation inputs is not significant. This shows that the link between innovation inputs and corporate sustainable growth is unaffected by the contingent effect of environmental information disclosure. In conclusion, innovation input functions as a mediator in the U-shaped link between environmental information disclosure and corporate sustainable growth. In other words, by affecting the innovation inputs, environmental information disclosure affects corporate sustainable growth, which verifies hypotheses 2 and 3.

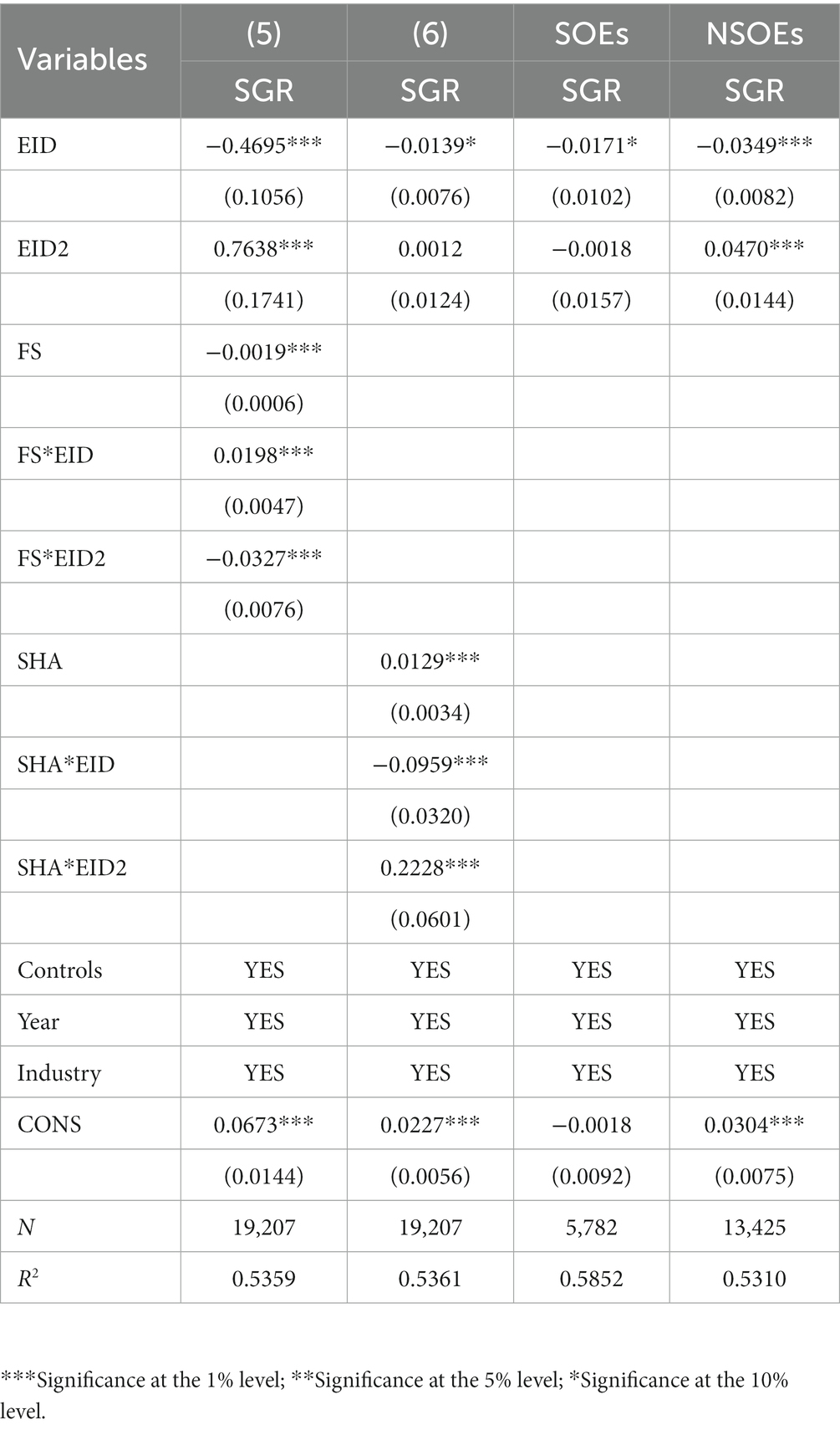

Table 6 displays the test findings for the moderating impact of firm size and equity incentives. Model5 is the regression result of adding the moderating variable firm size. The coefficient of the interaction term between firm size and environmental information disclosure is significantly negative, which shows that firm size moderates the impact of environmental information disclosure on corporate sustainable growth and that the moderating effect is negative, i.e., firm size weakens the effect of environmental information disclosure on corporate sustainable growth, supporting hypothesis 4. Model 6 is the regression result of adding the moderating variable equity incentives. The quadratic interaction term’s coefficient is significantly positive, demonstrating that equity incentives have a positive moderating effect on the U-shaped relationship between environmental information disclosure and corporate sustainable growth. This finding supports hypothesis 5, which states that equity incentives strengthen the role of environmental information disclosure on corporate sustainable growth.

4.3. Robustness testing

4.3.1. Endogeneity

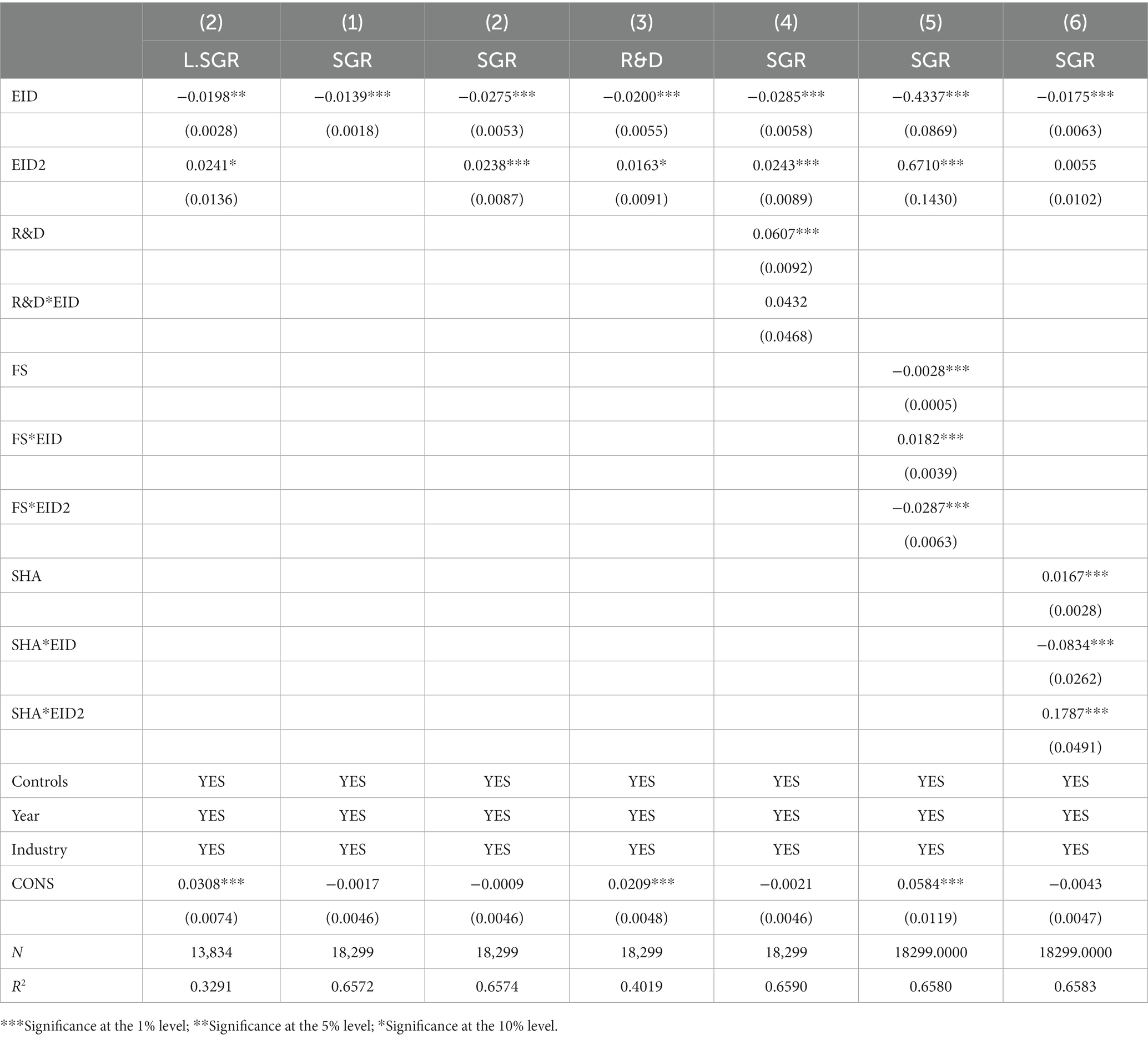

This article employs a one-period lagged sustainability indicator to examine the outcomes provided in Table 7 in order to reduce the endogeneity issue and also to determine if the usefulness of environmental information disclosure is sustainable. The regression results are in line with the initial study and lend credence to hypothesis 1.

4.3.2. Substitution of dependent variables

This work chooses replacement variables for robustness testing to reduce the possibility of regression outcomes from a single measure. Sustainable growth rate is calculated using the following formula:

The opening balance and closing balance are averaged to get the aforementioned average balance. Table 7 displays the test’s results, which are robust and leave the key conclusions unaltered.

4.3.3. Changing the sample interval

In this paper, considering the spread of the new crown epidemic and economic depression since 2020, the 2012–2019 A-share listed companies in Shanghai and Shenzhen are selected to test the main, mediating and moderating effects, which are not different from the above results. The manufacturing companies in the sample with high environmental impact are also selected for regression analysis, and the results remain robust. The results are not presented due to space limitation.

4.3.4. Further verification of the U-shaped relationship

The transformation method is used to evaluate the U-shaped relation. Table 8 displays the U TEST results. As can be observed, the sample’s minimum value is 0.0238 and its maximum value is 0.6905, with the extreme point for the major impact predicted to be 0.5555. The first U TEST hypothesis is disproved since the tested extreme point falls inside the data range. As a result, we believe that the relationship is U-shaped. It affirms the robustness of the U-shaped link between the environmental information disclosure and the corporate sustainable growth.

4.4. Further analysis

Enterprises are under greater and more scrutiny as a result of growing government regulation, media examination, and public inspection. Due to a lack of resources and the rising costs associated with environmental infractions by businesses, non-state-owned enterprises (NSOEs) must demonstrate a greater sense of environmental governance reform and environmental pioneer statement. In order to meet the requirement of winning over investors and consumers through environmental information disclosure, they are more driven to make modifications to their current environmental facilities, production processes, and emission practices. However, state-owned enterprises (SOEs) generally have poor decision-making efficiency, multiple redundant assets and other lethargic phenomena. This difference makes it difficult for SOEs to carry out green governance. The efficiency of implementing social responsibility through environmental information disclosure is lower than that of NSOEs, so that they are not as sensitive to the economic consequences of environmental information disclosure as NSOEs.

Therefore, with different nature and sensitivity of corporate ownership, the effect of environmental information disclosure on corporate sustainable growth is also different. SOEs receive government subsidies when their environmental information disclosure falls below the threshold, which also lessens the negative consequences of their environmental information disclosure on corporate sustainable growth compared to NSOEs. Because NSOEs are more profit-oriented and are forced to expend more effort due to a lack of corporate resources to have the possibility of achieving corporate sustainable growth, the effect of environmental information disclosure on corporate sustainable growth is also stronger than that of SOEs when it is above the threshold. To examine the heterogeneity of the major impacts in this study, which is based on the Chinese setting, the sample was split into SOEs and NSOEs. The results are shown in Table 6. SOEs do not have significant coefficients in the second term of environmental information disclosure. Due to their unique status, Chinese SOEs often respond to increasing government guidance and looser financial restrictions. The ability of SOEs to disclose environmental information is distorted by the government’s involvement in resource allocation and is less economically sensitive, making the effect insignificant. However, in Table 6, it can be seen that the coefficient of the quadratic term is significant for NSOEs. The impact of environmental information disclosure on long-term corporate sustainability can be more accurately described among NSOEs. Therefore, the U-shaped effect of environmental information disclosure on the corporate sustainable growth of non-SOEs is more significant compared to SOEs.

5. Conclusion and discussions

In environmental management, the paradox of “each party is concerned and each party is working independently” still exists. A new “One Planet” concept of green governance must be developed under the cosmology of One Planet, which can objectively reflect the status of environmental governance of listed companies as key actors of green governance. This study tests and draws the following findings using A-share listed businesses from 2012 to 2021 in Shanghai and Shenzhen as examples. First, environmental data disclosure affects innovation inputs and corporate sustainable growth in a U-shaped manner, respectively. Additionally, innovation inputs are used to conduct the U-shaped interaction between environmental information disclosure and the corporate sustainable growth. Further investigation reveals that firm size, equity incentives, and type of property rights influence the U-shaped association between environmental information disclosure and corporate sustainable growth. When a company is small, its equity incentive intensity is high, and it is not state-owned, the U-shaped link between environmental information disclosure and corporate sustainable growth is more significant. This is in contrast to the few studies that focus on examining the propagation mechanisms in terms of innovation subsidy effects and social media attention effects and use board characteristics to test their moderating role, with previous studies ignoring the role of innovation inputs (Consuelo et al., 2021). This paper complements the mediating path role of innovation inputs and verifies the moderating role of equity incentives and firm size. It helps firms to clarify the intrinsic mechanism and context of the role in order to better respond to their sustainable growth strategies.

5.1. Theoretical and practical implications

The findings of this paper also have important theoretical and practical values. First, it expands and enriches the existing research on the economic consequences of environmental information disclosure, clarifies its role path and mechanism of action, and makes its inquiry system more complete. Secondly, this research offers some insight into corporate environmental management. Governments in China are aggressively promoting green governance and speeding up the publication of environmental data at the moment. This study discovers a U-shaped link between environmental information disclosure and corporate sustainable growth, showing that enterprises need to break the threshold to achieve sustainability, which lengthens their cycle. Businesses must weigh the pros and cons of significant cost–benefit decisions when disclosing environmental information and understand the significance of ongoing environmental information disclosure. Enterprises must also modify firm size and equity incentives in accordance with their internal governance environment if they want to continue their long-term growth. Finally, this research offers some insight into how government policy is created. When an enterprise’s environmental information disclosure falls below the threshold value, the company must disclose it in order to avoid penalties, which drives up the cost of complying with environmental laws and regulations and discourages investment in new ideas. Through other industrial policies like environmental subsidies, governments may support innovation and corporate sustainable growth. When an enterprise’s environmental information disclosure exceeds a threshold value, a governance boundary between the government and the enterprise should be established. Following the environmental information disclosure, the external monitoring role should be fully utilized to give the enterprise a true image of environmental protection and to create favorable conditions for the enterprise to obtain external financing.

5.2. Limitations and future directions

Although the present study is meaningful, it also has some limitations. Firstly, based on various scoring criteria, the content analysis approach used to assess environmental information disclosure yields diverse findings. Because environmental information disclosure is subjective, the accuracy of the analysis’s findings may suffer. Secondly, there are several types and characteristics of environmental information disclosure, and this work does not examine them in further detail per context. It will be feasible to categorize the released information into different categories as the context for environmental information disclosure gets richer and more standardized, and the effects of each particular type may then be further investigated in future research. Finally, the study conducted in this paper on environmental information disclosure in developing nations may not be relevant in other nations with distinct cultural climates and economic systems, hence more testing is required to show that the research approach is repeatable and generalizable.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MW: software. MW and JZ: writing-review and editing—original draft. JZ: supervision. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by the National Social Science Foundation Project “Research on green governance mechanism and policy guarantee of landscape village integration from the perspective of rural revitalization,” grant number 21BJY189.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acabado, D. R., Branca, A. S., Catalão-Lopes, M., and Pina, J. P. (2020). Do distinct CSR categories have distinct determinants? The roles of market structure and firm size. Eur. Manag. Rev. 17, 5–17. doi: 10.1111/emre.12341

Ahmad, N., Li, H.-Z., and Tian, X.-L. (2019). Increased firm profitability under a nationwide environmental information disclosure program? Evidence from China. J. Clean. Prod. 230, 1176–1187. doi: 10.1016/j.jclepro.2019.05.161

Bing, Z., Jing, W., Sidai, G., Mingxia, H., and Jing, W. (2020). Environmental regulation and financial performance of Chinese listed companies. PLoS One 15:e0244083. doi: 10.1371/journal.pone.0244083

Burger, J. H., and Hamman, W. D. (1999). The relationship between the accounting sustainable growth rate and the cash flow sustainable growth rate. S. Afr. J. Bus. 30, 101–109. doi: 10.4102/sajbm.v30i4.761

Cheng, D., Jianjun, Y., Lawrence, L., and Tian, M. (2022). Exploring the antecedents and consequences of effectuation in NPD: the moderating role of firm size. Tech. Anal. Strat. Manag. 34, 832–846. doi: 10.1080/09537325.2021.1926966

Cheng, D., Jianjun, Y., Zhongfeng, S., and Shuman, Z. (2021). The double-edged sword impact of effectuation on new product creativity: the moderating role of competitive intensity and firm size. J. Bus. Res. 137, 1–12. doi: 10.1016/j.jbusres.2021.06.047

Consuelo, P. M., Isabel, G., and Inmaculada, B. (2021). Corporate social and environmental disclosure as a sustainable development tool provided by board sub-committees: do women directors play a relevant moderating role? Bus. Strateg. Environ. 30, 3485–3501. doi: 10.1002/bse.2815

D’Amato, A., and Falivena, C. (2020). Corporate social responsibility and firm value: do firm size and age matter? Empirical evidence from European listed companies. Corp. Soc. Responsib. Environ. Manag. 27, 909–924. doi: 10.1002/csr.1855

Dameng, H., Yuanzhe, H., and Changbiao, Z. (2021). Does environmental information disclosure affect the sustainable development of enterprises: the role of green innovation. Sustainability 13:11064. doi: 10.3390/su131911064

Daqian, S., Caiqi, B., and Huiyuan, X. (2021). Deterrence effects of disclosure: the impact of environmental information disclosure on emission reduction of firms. Energy Econ. 104:105680. doi: 10.1016/j.eneco.2021.105680

Denton, C., Gary, F., Stacey, K., and Manuel, S. J. (2018). How Powerful CFOs Camouflage and Exploit Equity-Based Incentive Compensation. J. Bus. Ethics 153.

Fonseka, M., Rajapakse, T., and Richardson, G. (2019). The effect of environmental information disclosure and energy product type on the cost of debt: evidence from energy firms in China. Pac. Basin Financ. J. 54, 159–182. doi: 10.1016/j.pacfin.2018.05.001

Garcia-Sanchez, I., Frias-Aceituno, J., and Rodriguez-Dominguez, L. (2013). Determinants of corporate social disclosure in Spanish local governments. J. Clean. Prod. 39, 60–72. doi: 10.1016/j.jclepro.2012.08.037

George, S., Priscila, F., AnneMarie, M., and Susan, M. (2021). The relationship between gender and promotion over the business cycle: does firm size matter? Br. J. Manag. 33, 806–827. doi: 10.1111/1467-8551.12458

Guangqin, L., Qing, X., and Jiahong, Q. (2022). Environmental information disclosure and green technology innovation: empirical evidence from China. Technol. Forecast. Soc. Change 176:121453. doi: 10.1016/j.techfore.2021.121453

Hepei, Z., and Zhangbao, Z. (2022). How does environmental regulation affect the green growth of China’s Citrus industry? The mediating role of technological innovation. Int. J. Environ. Res. Public Health 19. doi: 10.3390/IJERPH192013234

Hi, S. Y., Esther, L. R., and Na, L. W. (2022). Does company size matter in corporate social responsibility? An examination of the impact of company size and cause proximity fit on consumer response. Int. J. Advert. 41, 284–308. doi: 10.1080/02650487.2020.1850997

Jarrod, H., Conor, O. K., and Urs, D. (2022). High performance work systems and innovation in New Zealand SMEs: testing firm size and competitive environment effects. Int. J. Hum. Resour. Manag. 33, 3324–3352. doi: 10.1080/09585192.2021.1894213

Jia, M., and ZhongXiang, Z. (2022). Corporate environmental information disclosure and investor response: evidence from China's capital market. Energy Econ. 108:105886. doi: 10.1016/j.eneco.2022.105886

Jiang, C., Zhang, F., and Wu, C. (2021). Environmental information disclosure, political connections and innovation in high-polluting enterprises. Sci. Total Environ. 764:144248. doi: 10.1016/j.scitotenv.2020.144248

Jingchang, H., Jing, Z., and June, C. (2021). Environmental regulation and corporate R&D investment—evidence from a quasi-natural experiment. Int. Rev. Econ. Financ. 72, 154–174. doi: 10.1016/j.iref.2020.11.018

Jones, C. D., Jolly, P. M., Lubojacky, C. J., Martin, G. P., and Gomez-Mejia, L. R. (2019). Behavioral agency and corporate entrepreneurship: CEO equity incentives & competitive behavior. Int. Entrep. Manag. J. 15, 1017–1039. doi: 10.1007/s11365-019-00576-7

Li, Q., Li, T., Chen, H., Xiang, E., and Ruan, W. (2019). Executives' excess compensation, legitimacy, and environmental information disclosure in Chinese heavily polluting companies: the moderating role of media pressure. Corp. Soc. Responsib. Environ. Manag. 26, 248–256. doi: 10.1002/csr.1676

Lijuan, W., Chenglin, Q., and Shanyue, J. (2022). Environmental protection and sustainable development of enterprises in China: the moderating role of media attention. Front. Environ. Sci. 10:966479. doi: 10.3389/fenvs.2022.966479

Lijun, L., Jiayu, J., Jiacong, B., Yazhou, L., Guanghua, L., and Yingkai, Y. (2021). Are environmental regulations holding back industrial growth? Evidence from China. J. Clean. Prod. 306:127007. doi: 10.1016/j.jclepro.2021.127007

Lind, J. T., and Mehlum, H. (2010). With or without U? The appropriate test for a U-shaped relationship. Oxf. Bull. Econ. Stat. 72, 109–118. doi: 10.1111/j.1468-0084.2009.00569.x

Liping, W., Ying, L., and Chuang, L. (2022). Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 322:116127. doi: 10.1016/j.jenvman.2022.116127

Ma, Y., Zhang, Q., Yin, Q., and Wang, B. (2019). The influence of top managers on environmental information disclosure: the moderating effect of Company’s environmental performance. Int. J. Environ. Res. Public Health 16:1167. doi: 10.3390/ijerph16071167

Martin, G. P., Wiseman, R. M., and Gomez-Mejia, L. R. (2019). The ethical dimension of equity incentives: a behavioral agency examination of executive compensation and pension funding. J. Bus. Ethics 166, 595–610. doi: 10.1007/s10551-019-04134-7

Mendes, F. S., Cezar, B. A., and Ricardo, N. L. (2018). The influence of boards of directors on environmental disclosure. Manag. Decis. 57. doi: 10.1108/MD-11-2017-1084

Odriozola, M. D., and Baraibar-Diez, E. (2017). Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Responsib. Environ. Manag. 24, 121–132. doi: 10.1002/csr.1399

Osazuwa, N. P., Che-Ahmad, A., and Che-Adam, N. (2017). Political connection, board characteristics and environmental disclosure in Nigeria. Adv. Sci. Lett. 23, 9356–9361. doi: 10.1166/asl.2017.10480

Qinglin, B., and Huaqi, C. (2022). Environmental regulation, financial resource allocation, and regional green technology innovation efficiency. Discret. Dyn. Nat. Soc. 2022, 1–11. doi: 10.1155/2022/7415769

Pedron, A. P. B., Macagnan, C. B., Simon, D. S., and Vancin, D. F. (2020). Environmental disclosure effects on returns and market value. Environment, Development and Sustainability. Environ. Dev. Sustain. 23.

Radu, C., and Francoeur, C. (2017). Does innovation drive environmental disclosure? A new insight into sustainable development. Bus. Strateg. Environ. 26, 893–911. doi: 10.1002/bse.1950

Ricky, K. C. Y., Lai, J. W. M., and Namwoon, K. (2022). Strategic motives and performance implications of proactive versus reactive environmental strategies in corporate sustainable development. Bus. Strateg. Environ. 31, 2127–2142. doi: 10.1002/bse.3011

Tadros, H., and Magnan, M. (2019). How does environmental performance map into environmental disclosure? Sustain. Account. Manag. Policy J. 10, 62–96. doi: 10.1108/SAMPJ-05-2018-0125

Tao, G., Wei, Q., Jinye, L., and Xionglei, H. (2020). The impact of environmental regulation efficiency loss on inclusive growth: evidence from China. J. Environ. Manag. 268:110700. doi: 10.1016/j.jenvman.2020.110700

Umeair, S., Fukai, L., Tingyun, P., Jing, L., and Taoqeer, N. (2021). Managerial equity incentives portfolio and the moral hazard of technology investment. Tech. Anal. Strat. Manag. 33, 1435–1449. doi: 10.1080/09537325.2021.1876223

Wang, Q. (2020). Public attention, government subsidies and corporate environmental disclosure: empirical evidence from listed Chinese enterprises in heavy-pollution industries. Int. J. Sustain. Dev. Plan. 15, 301–308. doi: 10.18280/ijsdp.150306

Wang, L., Li, C., and Li, S. (2020). Can environmental information disclosure regulate the relationship between environmental cost and enterprise value? Int. J. Environ. Pollut. 67:95. doi: 10.1504/IJEP.2020.117787

Wang, S., Wang, H., Wang, J., and Yang, F. (2020). Does environmental information disclosure contribute to improve firm financial performance? An examination of the underlying mechanism. Sci. Total Environ. 714:136855. doi: 10.1016/j.scitotenv.2020.136855

Wenzhi, C., Shi, C., and Tingting, W. (2022). Research of the impact of heterogeneous environmental regulation on the performance of China’s manufacturing enterprises. Front. Environ. Sci. 10:948611. doi: 10.3389/fenvs.2022.948611

Xiangyan, M., Mingyuan, T., Fanchao, K., and Shuai, L. (2022). The effect of environmental information disclosure on green total factor productivity: evidence from quasi-natural experiments on cities in China. Sustainability 14:13079. doi: 10.3390/su142013079

Xiaoling, O., Jiaying, L., Chuanwang, S., and Yan, C. (2023). Measure is treasure: revisiting the role of environmental regulation in Chinese industrial green productivity. Environ. Impact Assess. Rev. 98:106968. doi: 10.1016/j.eiar.2022.106968

Xie, Z., Qu, L., Lin, R., and Guo, Q. (2022). Relationships between fluctuations of environmental regulation, technological innovation, and economic growth: a multinational perspective. J. Enterp. Inf. Manag. 35, 1267–1287. doi: 10.1108/JEIM-02-2021-0104

Xin, C., Xiaoxia, L., and Xiaoyi, H. (2020). The impact of corporate characteristics and external pressure on environmental information disclosure: a model using environmental management as a mediator. Environ. Sci. Pollut. Res. Int. 29, 12797–12809. doi: 10.1007/s11356-020-11410-x

Xu, J. (2019). Equity incentives and crash risk in China’s A-share market. Asia Pac J Risk Insur 13. doi: 10.1515/apjri-2018-0025

Xu, J., Wang, X., and Liu, F. (2020). Government subsidies, R&D investment and innovation performance: analysis from pharmaceutical sector in China. Tech. Anal. Strat. Manag. 33, 535–553. doi: 10.1080/09537325.2020.1830055

Yang, Y., Yao, C., and Li, Y. (2020). The impact of the amount of environmental information disclosure on financial performance: the moderating effect of corporate internationalization. Corp. Soc. Responsib. Environ. Manag. 27, 2893–2907. doi: 10.1002/csr.2010

Yanli, S., Baotong, L., Xiuping, Y., and Enyu, W. (2022). Research on technological innovation investment, financing constraints, and corporate financial risk: evidence from China. Math. Probl. Eng. 2022, 1–13. doi: 10.1155/2022/5052274

Yongliang, Y., Jin, W., and Yi, L. (2020). The impact of environmental information disclosure on the firm value of listed manufacturing firms: evidence from China. Int. J. Environ. Res. Public Health 17:916. doi: 10.3390/ijerph17030916

You, O., Fei, Y., and Kimhua, T. (2022). The effect of strategic synergy between local and neighborhood environmental regulations on green innovation efficiency: the perspective of industrial transfer. J. Clean. Prod. 380:134933. doi: 10.1016/j.jclepro.2022.134933

Yu, E. P. Y., Guo, C. Q., and Luu, B. V. (2018). Environmental, social and governance transparency and firm value. Bus. Strateg. Environ. 27, 987–1004. doi: 10.1002/bse.2047

Yujuan, Z., and Lu, Z. (2022). Innovation input on Enterprise value: based on the moderating effect of ownership structure. Emerg. Mark. Financ. Trade 58, 1078–1088. doi: 10.1080/1540496X.2021.1928492

Yusof, N. A., Tabassi, A. A., and Esa, M. (2020). Going beyond environmental regulations—the influence of firm size on the effect of green practices on corporate financial performance. Corp. Soc. Responsib. Environ. Manag. 27, 32–42. doi: 10.1002/csr.1771

Zhao, X., and Lin, D. (2020). Managerial equity incentives and RD investments in emerging economies: study based on threshold effects. Asian J. Technol. Innov. 29, 325–348. doi: 10.1080/19761597.2020.1800496

Keywords: green governance, environmental information disclosure, corporate sustainability, innovation inputs, U-shaped relationship

Citation: Zhang J and Wang M (2023) Does environmental information disclosure drive corporate sustainable growth? A new insight into U-shaped relationship. Front. Ecol. Evol. 11:1189052. doi: 10.3389/fevo.2023.1189052

Edited by:

Magdalena Klimczuk-Kochańska, University of Warsaw, PolandReviewed by:

Jintao Lu, Taiyuan University of Science and Technology, ChinaKristina Rudžionienė, Vilnius University, Lithuania

Lingli Qing, Guangzhou College of Commerce, China

Copyright © 2023 Zhang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jinsong Zhang, aHNkemhqc0AxNjMuY29t

Jinsong Zhang*

Jinsong Zhang* Mengmeng Wang

Mengmeng Wang