- School of Accountancy, Hubei University of Economics, Wuhan, China

In recent years, the backbone of China's market economy has involved controlling corporate carbon emissions and reducing environmental pollution. This study aimed to investigate the relationship between the characteristics of senior managers and the carbon emission performance of enterprises. The empirical study used panel data on high-emission industries operating in the China A-shares market from 2014 to 2017. The results showed that the natural age, education level, and professional background of senior managers in high-emission enterprises were negatively correlated with the carbon emission performance of enterprises. However, in the case of large enterprises, there is no strong relationship between the natural age of executives and carbon emission performance, while professional background and education level are negatively correlated with carbon emission performance. However, natural age is significantly related to carbon emission performance in small and medium-sized enterprises. In the regional classification of enterprises, the natural age and professional background of the core executives of high-emitting enterprises in the eastern region are negatively correlated with carbon emission performance, while the professional background of the core executives of high-emitting enterprises in the central and western regions is positively correlated with carbon emission performance. Moreover, the natural age and educational level of executives are negatively correlated with carbon emission performance. To measure the carbon emission performance of an enterprise, the study used the balanced scorecard evaluation system (CEP). Meanwhile, it innovatively classifies and sorts the sample companies based on their overall size and distribution area, and analyzes the carbon performance and executive characteristics from two perspectives. The study provides suggestions and countermeasures for companies in China, especially those in high-emission industries, to help reduce pollution.

1. Introduction

As an important part of corporate governance in the production and operation of a firm, management undoubtedly controls, to a large extent, decisions related to the firm, either directly or indirectly by influencing controlling shareholders. Since the introduction of higher-order theory in 1984, numerous studies have found that managers of firms have different behavioral choices and psychological characteristics depending on their background characteristics, which affect their decisions and performance, including the performance of corporate environmental protection. From this perspective, corporate socially responsible behavior can be predicted using certain characteristics of the executive team, such as age, education, tenure, and gender (Arslan et al., 2022). Elsayih et al. (2021) used the average age of the executive team as an independent variable of the study in a comprehensive industry sample and found a significant positive relationship with corporate economic performance indicators. In terms of education, Ding et al. (2020) demonstrated that CEOs with MBA degrees can significantly contribute to corporate carbon emissions. In terms of professional background, Fan (2016) found that executives with management training and business education can promote environmental pollution prevention behaviors and improve corporate carbon performance. Some scholars have also studied the factors affecting carbon emission performance at the macro level. Li et al. (2021a,b) showed that economic growth and economic structure are the most important positive and negative factors affecting carbon emissions. Liu (2023) found that, under the carbon neutral scenario, carbon emissions can be better controlled through carbon neutral and carbon peak strategies.

Most scholars still focus on the relationship between executive team characteristics and corporate financial performance, but pay less attention to this area of corporate social responsibility. The available research results show that research on carbon emission performance is still limited to the impact of differences in property rights on the results, but does not further expand the research system to the scale and spatial area of the enterprise. In addition, the research on the relationship between core management characteristics and carbon performance has not yet been unified, and there is a lack of research specifically focused on enterprises in specific high-emission industries in China.

This study focuses on companies in China's high-emission industry and innovatively classifies and sorts the sample companies based on their overall size and distribution area to analyze their carbon emission performance and executives' characteristics from two perspectives, which broadens existing research ideas. In addition, to measure the carbon emission performance of corporate management dimensions from multiple perspectives, we designed a balanced scorecard evaluation system (CEP) that is intended to fill gaps in existing literature related to the CEP evaluation system. This study can provide more reasonable and effective suggestions for the setting of core management personnel in terms of controlling the carbon emission performance of enterprises and helping listed companies in China to make greater contributions to protecting the environment and reducing emissions.

The structure of the article is arranged as follows: Section 2 presents the research hypothesis based on the literature review, Section 3 presents the research design, Section 4 presents the empirical results and analyses, and finally, Section 5 presents the corresponding countermeasure analysis based on the summary of the empirical results.

2. Theoretical analysis and research hypothesis

Age is the most basic statistical characteristic of a person. With the accumulation of social experience and management experience, older executives are more stable and even conservative, tend to be more risk-averse, generally act strictly within the legal and even ethical framework, and therefore actively assume social responsibility. Related research has shown that, as people get older, they pay closer attention to environmental issues and have more positive environmental awareness and behavior. As people grow older, their moral evaluation standards will also increase. Therefore, older executives have more mature moral values compared to younger executives. Based on Maslow's hierarchy of needs theory, Ferrat (2021) found that, as CEOs grow older, their sense of responsibility to society will gradually increase and they will be willing to take on more social responsibilities. Second, increasing age brings more experience accumulation; compared with younger executives, older executives have more accumulated experience and are more adaptable in the face of the increasingly tightening regulatory environment (Li et al., 2021a,b). Huffman and Hegarty (1993) study demonstrated that, as the age of a chairperson grows, the quantity and quality of the frequency and disclosure of corporate environmental information increases. As the difference between the age of executives and the average age increases, the level of corporate environmental information disclosure increases accordingly (Chu et al., 2021).

In contrast, from the perspective of the size of enterprises, with the expansion of assets and the rapid increase of business revenue, the public opinion and regulatory environment in which the social responsibility and ethical awareness of enterprises are located are becoming more stringent. Therefore, large enterprises with more sound management modes and management systems will pay more attention to management experience and management stress resistance than small and medium-sized enterprises, thus resulting in the relationship between the natural age of executives and the carbon performance of enterprises. Simultaneously, owing to the different geographical conditions in the eastern, central, and western regions of China, there are obvious differences in the economic development strengths, the modes of management, and the philosophy of enterprises; moreover, there may be differences in the awareness and ability to fulfill social responsibilities. Specifically, due to its unique advantages in transportation, material distribution, and information exchange, the eastern region attracts more entrepreneurs of different ages and experts in related fields, who use more advanced international management experience to create value for the company and become the main source of China's economic development. On the contrary, due to the limitations of talent exchange and economic development, enterprises in the central and western regions tend to be more conservative in the selection and deployment of management personnel and pay more attention to management experience; hence, age is more likely to be the main consideration in management staff selection.

Therefore, we assume that:

Hypothesis 1 (H1a). Corporate carbon performance improves as the natural age of public company executives increases.

Hypothesis 1 (H1b). The relationship between the natural age of senior managers and carbon performance is stronger in large firms than in SMEs.

Hypothesis 1 (H1c). The relationship between the age of core senior managers and carbon performance is stronger in firms in the midwest than in those in the east.

It is generally presumed that the education level can reflect the cognitive ability of an individual and that it has a positive relationship with learning power, insight, and information processing ability. Executives with higher education levels can still maintain a clear mind in the face of a complex market environment, which is conducive to making correct decisions. In addition, the accumulation of knowledge brought by education provides executives with more macro-awareness and big-picture awareness in management, as well as a stronger sense of responsibility. Therefore, they generally consider various factors, such as corporate, stakeholders, consumers, and society, before making decisions. Cui et al. (2022), after a practical survey, found that, from the perspective of fulfilling social responsibility and environmental obligations, better-educated executive teams and higher-educated executive teams manage companies that have a greater chance of success in implementing corporate reforms, bringing better reputation, and providing corporate growth ability to the company. Higher levels of education lead to greater awareness of ethics and social responsibility. This motivates better-educated people to make higher-quality environmental disclosures (George Wilson et al., 2015). Chinese scholar Fu (2017) found a significant positive correlation between entrepreneurs' education and CSR disclosure status based on a survey of private enterprises in Zhejiang province. Gjerløv-Juel (2019) found that well-educated managers were more likely to make decisions concerning taking up jobs, receiving services, and buying shares and that they would consider the company's reputation, business ethics, and social responsibility and hence would be more likely to disclose high-quality environmental information. Guo et al. (2019) argued that the higher the education level, the more rational and objective executives would be in making decisions, and those with higher education levels and higher social status compared to others would be more concerned about issues such as environmental protection and food safety. Han (2019) found that the higher the proportion of executive team members who had graduated from prestigious universities, the better the CSR performance.

Compared with small and medium-sized enterprises, large enterprises have a larger base of assets, revenue, and net profit and grow faster. Therefore, they are more strict and cautious about the educational requirements of staff and the selection of management personnel. In addition, they also have obvious advantages in terms of corporate reputation, employee welfare, and business sustainability compared with small and medium-sized enterprises, using which they can attract managers with higher education levels to participate in corporate governance. From the layouts of various enterprises in different regions of China, the eastern region is in a more prominent position in the country in the fields of transportation and human communication, and coupled with its higher level of economic development and regional tolerance, it also provides more favorable prerequisites for enterprises to attract high-level talents. Thus, the proportion of high-level talents with postgraduation or above in the overall management of enterprises is higher in the eastern region than in any other region.

Based on the above analysis, we make the following assumptions:

Hypothesis 2 (H2a). As the level of education of executives of listed companies increases, the carbon performance of companies will improve.

Hypothesis 2 (H2b). The relationship between the educational level of senior managers and carbon performance is stronger in large enterprises than in small and medium-sized enterprises.

Hypothesis 2 (H2c). The relationship between the educational level of core senior managers and carbon performance is stronger in the eastern region than in the central and western regions.

Executives with higher education, especially those with management backgrounds, are also usually more focused on long-term benefits and future development prospects than senior managers of other professions and are not easily moved by short-term interests; although environmental governance has higher short-term costs, it has higher long-term economic and social performance, and corporate managers with long-term vision usually put more attention on corporates. Haselhuhn et al. (2022) found that CEOs with MBA degrees showed significantly higher carbon performance than CEOs without academic backgrounds in 482 companies listed on the New York Stock Exchange. Li et al. (2021a,b) demonstrated that executives with a master's degree in business administration had a more significant positive impact on corporate carbon performance than those with other professional backgrounds; simultaneously, highly educated executives paid more attention to corporate environmental pollution issues and were more motivated to improve corporate carbon performance than executives with a lower education level (Li et al., 2020). Liang (2019) investigated the relationship between professional education and students' learning ability and found that management education promotes the improvement of cognitive ability, innovation ability, judgment ability, and values (Li, 2019).

With the increasing connection between enterprises in modern society, the internal control system and the financial system required by large enterprises must be more stringent than those of SMEs due to the complexity of their business. Influenced by the training program and curriculum, executives whose professional background is in finance and management have a clear advantage in the theoretical foundation and practical experience of business management compared with others. At the same time, due to the influence of the human environment and economic layouts in the eastern region, the number of financial enterprises is higher and is attracting more management talents. However, the western region, where heavy industry is the main focus, mainly attracts engineering-based talents to enhance and upgrade the technical strength of enterprises, accelerate the efficiency of industrial production, and create higher value for enterprises, thus paying more attention to senior managers from engineering backgrounds.

Hypothesis 3 (H3a). Corporate executives with economics and management majors perform better in terms of corporate carbon performance.

Hypothesis 3 (H3b). The relationship between the professional background of senior managers and carbon performance is stronger in large companies than in SMEs.

Hypothesis 3 (H3c). The relationship between the professional background of core senior managers and carbon performance is stronger in the eastern region than in the central and western regions.

3. Research design

3.1. Data sources and sample selection

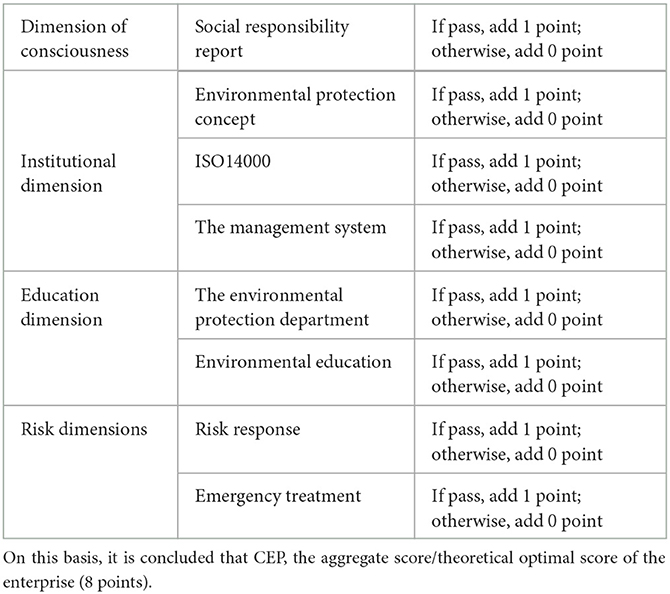

Regarding the definition of high-emission industries, reference is made to the “Guidelines for Disclosure of Environmental Information of Listed Companies (Draft for Comments)” issued by the Ministry of Ecology and Environment in 2010, and according to the 2012 edition of the SFC's “Guidelines for the Classification of Listed Companies by Industry”, 16 categories of industries, including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, chemical, petrochemical, building materials, paper, brewing, pharmaceutical, fermentation, textile, tannery, and mining, are classified as high-emission industries. Due to the limitation of space and research time, this study intends to use the 2014–2017 data from the extractive industry, the coal industry, and the chemical industry as the research samples of listed companies in high-emission industries in China and exclude other abnormal samples such as incomplete data, ST or *ST, and long-term negative equity to get 30 valid samples. The data of the independent variable CEP were all collected manually. The data on whether the enterprises have obtained ISO14000 environmental management standard certification were taken from the official website of CNCA (China National Certification and Accreditation Administration) and the data on environmental pollution were from the Public Environment Research Center. In addition to the above-mentioned websites, the annual reports of enterprises and social responsibility reports were also used. “ISO14000,” “environmental protection system,” “environmental training”, and other keywords were searched to supplement the data in this study. Meanwhile, the data related to the main characteristics of the executives of listed companies and corporate financial indicators were obtained from the CSMAR database and Sina Finance to ensure the integrity and fairness of the data. Table 1 shows the carbon emission performance evaluation system based on BSC.

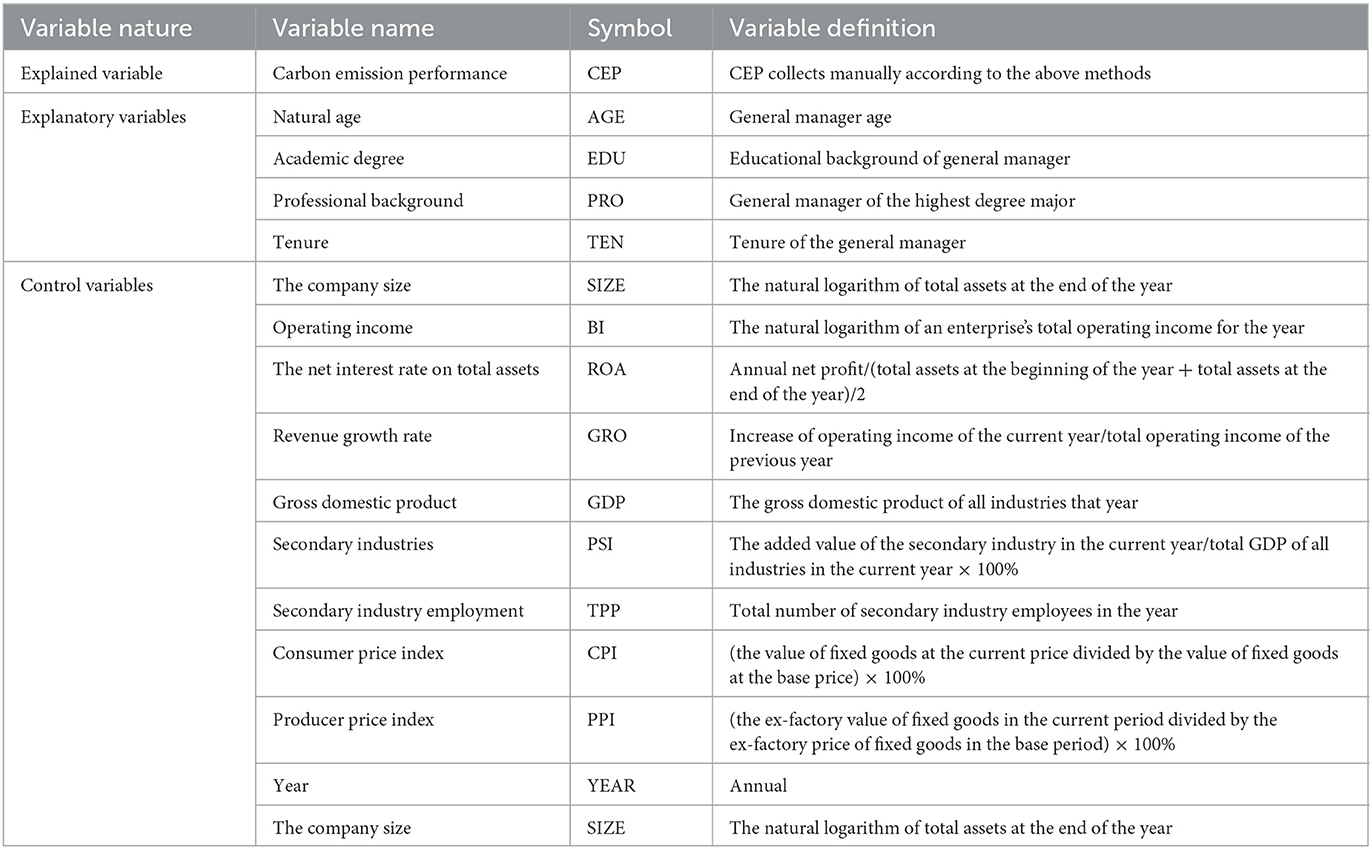

3.2. Variable design

3.2.1. Explained variable declaration

Carbon emission performance is the main object of this study and the specific measurement indexes that are mainly referred to are the carbon emission performance assessment standard developed by the International Organization for Standardization (ISO) in 1999 according to the ISO14031 system, which provides a reference basis for organizations to carry out internal environmental management and carbon emission performance assessment. The ISO 14031 standard does not define specific carbon performance indicators but rather provides a structural framework. Based on the environmental protection philosophy and environmental protection system, this study innovatively develops a set of accounting systems for corporate carbon emission performance indicators, mainly from the perspective of the environmental protection strategy of the management of companies. Specifically, we compiled the annual reports and social responsibility reports of enterprises and then filtered out eight dimensions based on the principles and framework of the balanced scorecard. These eight dimensions were used to examine the carbon emission performance of the management of enterprises. Table 2 provides a description of the variables used. The specific evaluation system and the corresponding criteria are as follows.

3.2.2. Explanatory variables

Ethical growth is often accompanied by age, experience, and risk appetite stabilization. In an empirical study, Lin and Zhou (2021) found a negative relationship between executive team age and CSR (corporate social responsibility reporting) disclosure, but it did not pass the significance test. In a study of the influence of executive team characteristics on CSR information disclosure, Liu et al. (2022) found that there is a significant positive correlation between the age and education of the executive team on CSR information disclosure. As age and experience increase, managers are satisfied with the process of accumulation of money and power, and there may be a tendency to weaken the pursuit of it. Instead, they are more enthusiastic about reputation and spiritual realization and thus focus and fulfill more on CSR. Ma and Chen (2022) found that the older the average age of the executive team, the better the corporate social responsibility performance. Similarly, a study by Zhang et al. (2022) found that the proportion of executives' age over the average age is positively related to the performance of the environmental responsibility disclosure system; the older the executive age, the better the firm's carbon performance. The logarithm of the average natural age (AGE) of the independent variable firm executive characteristics is used as the main indicator in this paper.

Education level affects an individual's perceptions, values, and behaviors. Highly educated executives are more concerned about the long-term benefits and prospects of the company, the realization of their self-worth, and the interests of multiple parties such as consumers and community members. Meng and Yang (2017) used empirical methods to investigate the relationship between the intensity of corporate environmental R&D investment and corporate performance, which was positive in firms with highly educated managers and negative in firms with less educated managers. Qin (2012) argued that, as the social capital possessed by corporate executives and the education level of the firm continues to increase, the firm can obtain better results in terms of carbon performance. The independent variable in this study is the average educational level of the company's executive team (EDU), which is used as the main indicator, where “2,” “3,” “4,” and “5” are used in this study according to the level of education. “2,” “3,” “4,” and “5” are used as proxies for the company's senior executives' specialist degree, bachelor's degree, master's degree, and doctoral degree, respectively, to facilitate the regression study of panel data. The professional background reflects the level of professional qualification or competence of the executive. Compared with other professional backgrounds, managers with professional background in management may be more adept at making the most appropriate decisions for the enterprise even under the complex economic environment and tend to have a higher sense of social responsibility based on the basic goal of corporate profitability: paying more attention to the green development of the enterprise and pursuing the long-term benefits of the enterprise. Li (2019) selected some enterprises in China's electronic information industry as a sample and reported that the professional background of members was significantly and positively related to corporate performance. Kang et al. (2011) found that executive background characteristics such as age, years of service, professional background, and career experience can have an impact on managerial style, which affects corporate environmental efficiency indicators. The independent variable in this study is the average professional background of the company's executive team. Using (PRO) as the main indicator, considering that the professional backgrounds of executives in the sample data are mainly concentrated on engineering, economics, and management, according to the degree of similarity with management disciplines, “1,” “2,” and “3” were used as proxies for the professional backgrounds of the company's executives in engineering, economics, and management.

3.2.3. Control variables

Compared with small and medium-sized enterprises, large enterprises require more social resources and obtain greater economic benefits, while facing more political pressure and the need to assume greater social and environmental responsibilities (Yu et al., 2017). The larger the company and the better its performance, the more media scrutiny and public attention it receives and the more resources it has to improve its carbon emission performance (Wu et al., 2018). Chen et al. (2022) analyzed that the environmental regulation index plays a significant role in promoting green development. Investors of companies are deeply concerned about the financial performance of companies, and the degree to which a company pays attention to environmental issues depends largely on economic performance (Yang et al., 2022). In general, the higher the economic performance, the stronger the awareness of the social responsibility of the company and the more motivated it is to improve its carbon emission performance (Tian et al., 2020); simultaneously, changes in macroeconomic factors will also have an impact on the carbon emission performance of the company. Moreover, from the perspective of the production method, as the gross domestic product increases, the overall production capacity and the actual annual output value of society will also increase, and the attention of consumers and regulators to the social responsibility of listed companies will also increase, thus indirectly urging and accelerating the management of enterprises to further set up programs and plans to control carbon emission performance. Shao et al. (2022) found that social media legitimacy pressure significantly enhances corporate carbon disclosure. However, enterprises with better business performance are generally more willing and able to fulfill social responsibility; therefore, a company's operating income and return on net assets may have an impact on the carbon emission performance of enterprises; the value added of the secondary industry, mainly traditional manufacturing, will have an impact on the carbon emission performance of enterprises. Ying et al. (2022) found that the tightening of environmental regulations had a significant net negative effect on the innovation behavior of heavily polluting firms, with a significant decrease in their innovation inputs. The value added of the secondary industry, mainly traditional manufacturing, and the proportion of the number of employees in the total industry reflect, to a certain extent, the proportion of high-emission enterprises in the total business entities. Based on this, the initial indicators of firm size, total operating income, operating income growth rate, total net asset margin, real GDP, the proportion of secondary industry and consumer price index, and the stated year are used as control variables in this study.

3.3. Model construction

This study investigates the relationship between the carbon performance of companies and the characteristics of company executives, such as age, professional background, and education level, and analyzes the influences of executive characteristics on the carbon performance of listed companies in the high-emission industry through a multiple linear regression model based on the research hypothesis and other factors that may affect the dependent variable of the model. The model is as follows:

where β0 represents the constant term of the model; β1−β13 are the regression coefficients of the model, and the sign of the coefficient represents the direction of the correlation between the independent variable and the dependent variable. ε is the random disturbance term of the regression model.

4. Empirical research

4.1. Descriptive statistics

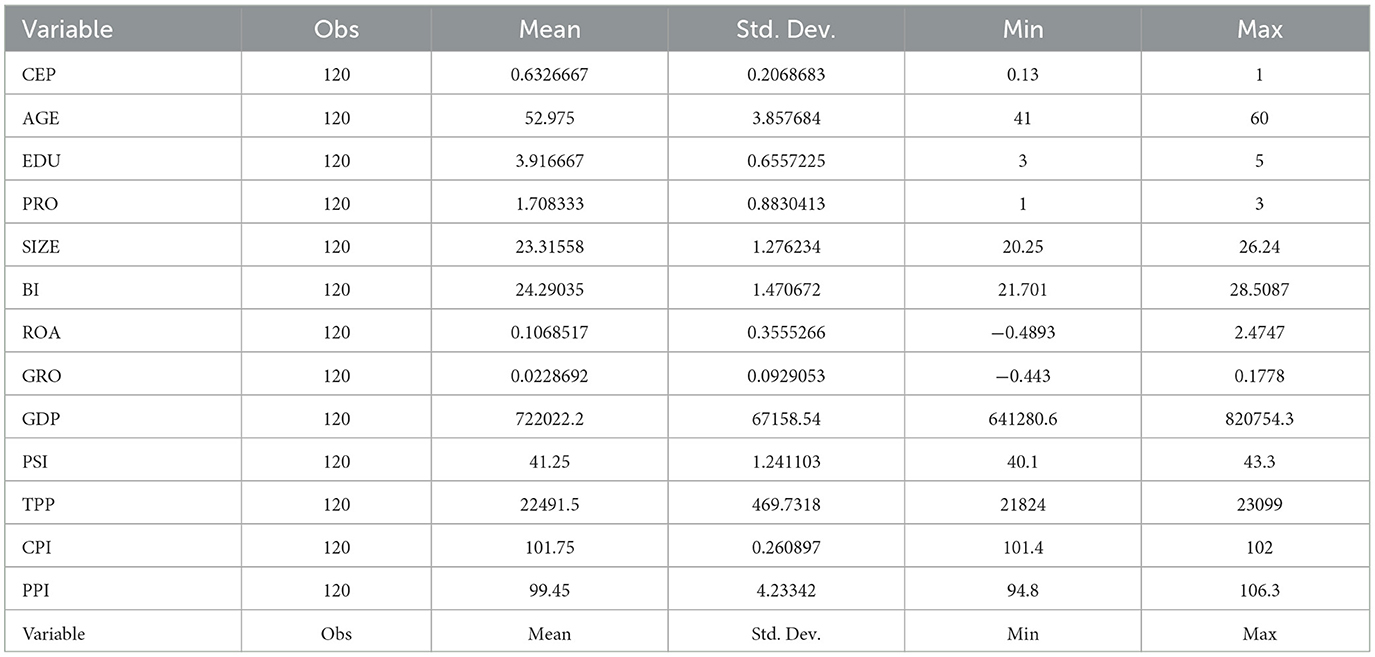

Table 3 describes and analyzes the extreme value, mean, and fluctuation of the dependent variable (carbon emission performance) and the independent variables (natural age, education level, and professional background) in the sample panel data regression model: the maximum value of carbon emission performance is 1.00, the minimum value is 0.13, and the mean value is 0.63, thus reflecting that the difference between different companies in carbon emission performance is still very high and that the proportion of companies with higher carbon emission performance is also very high in the whole. The standard deviation of this variable is 0.21, which indicates that even among companies in the same or similar industry, the amount of emission of pollutants may vary due to the differences in the types of products produced, production processes, production procedures, and management's attitude toward social responsibility. The minimum value of the independent variable is 41 years old and the maximum value is 60 years old. The average age is close to 53 years old, with a standard deviation of 3.86 years, indicating that the average age of the executive team in the sample data is generally around 40–60 years old. In general, managers in this age group are in the golden period of personal development, in terms of management experience, professional reserve, social experience, and stress resistance, and are also the more prominent in the team and organization. The average education level is roughly 3.92, while the standard deviation is only 0.66, which indirectly reflects that the senior management of the sample companies is generally at master's degree level. The average value of professional background of the sample data is 1.71, while the standard deviation is 0.88, which indicates that employees with professional backgrounds in economics and management are more likely to become the main managers of the company. Regarding the macroeconomic factors, the minimum value of GDP is 641,286,000 yuan and the maximum value is 820,743,000 yuan, which indicates that there is still a large gap between the different annual GDP, which will be one of the main factors affecting the dependent variable. Meanwhile, the minimum value of the producer price index (PPI) is 94.8 and the maximum value is 106.3, which indicates the operating cost of enterprises in different time periods. Second, the standard deviations of operating income and total asset size are 1.47 and 1.28, respectively, while the mean values are roughly 23.32 and 24.29, indicating that the difference between the sizes of the business scale of enterprises in the same industry is not very obvious.

4.2. Analysis of regression results

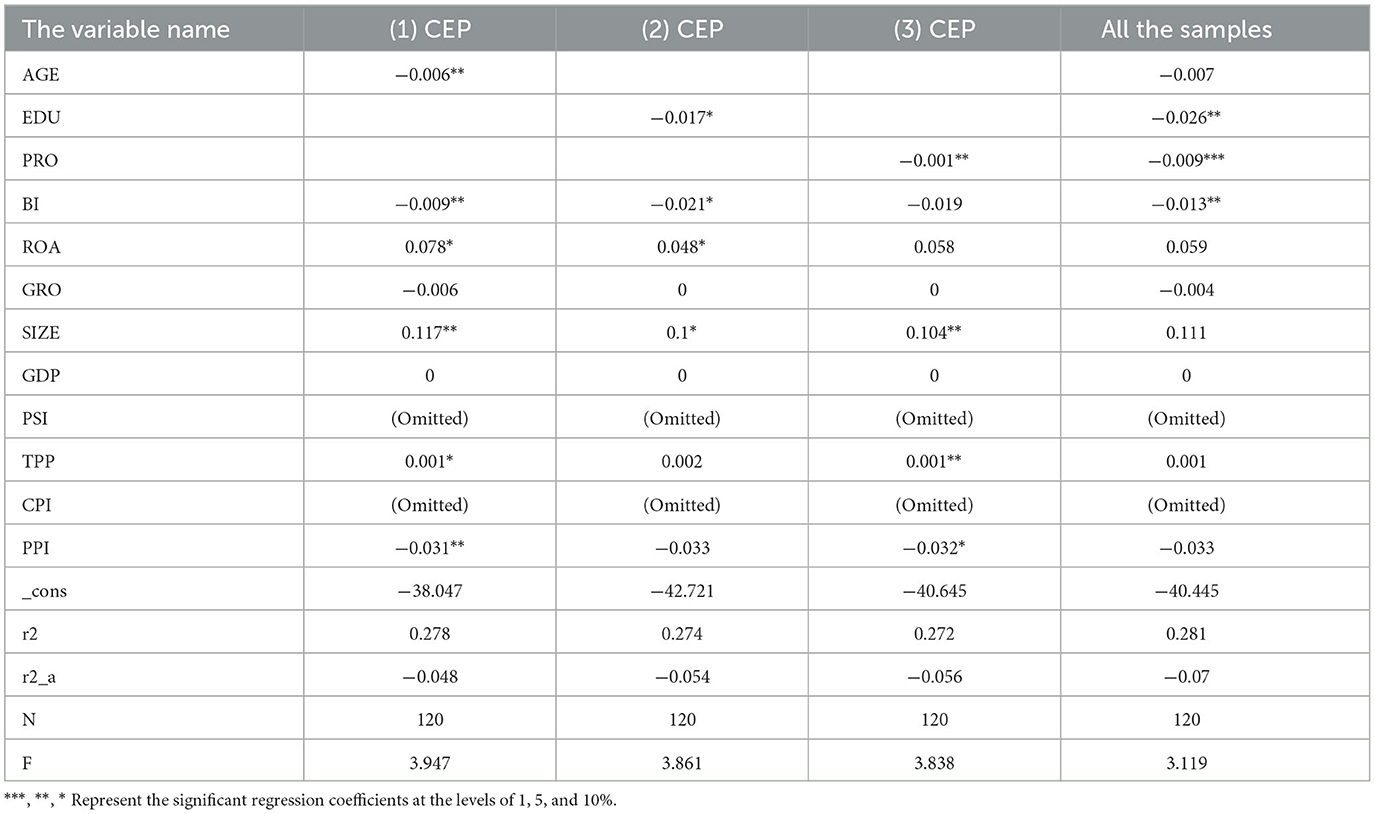

As can be seen from Table 4, the overall significance of the model is 27–28% and the p-value is <0.01, indicating that the overall significance of the model is strong and the fit is good. Under the fixed-effects model, the regression coefficient of the natural age of executives is −0.006 and it is significant at the 5% level, indicating a negative relationship between the natural age of executives and carbon emission performance. It is the opposite of original hypothesis 1, indicating that as the age of executives grows, they become more conservative in their perceptions, and those with longer tenure may prefer to maintain their original system and achievements compared to making contributions to the environmental protection cause, and therefore, may have a negative impact on the carbon emission performance of the enterprise; however, at the same time, the regression coefficients of the educational level and professional background of executives are −0.017 and −0.001, respectively, and both are significant within the 10% level, which are different from both original hypotheses 3 and 2, indicating that the carbon emission performance of high-emission-listed companies decreases with the increase in the average educational level of the management team. However, due to the lack of technical ability and background, managers with management or economics background are more passive in the specific implementation plans and technologies of carbon emission performance control. In addition, among the control variables studied, the overall size of the enterprise and the return on net assets are positively correlated with carbon emission performance and are significant at the 5% level, indicating that they will affect the carbon emission performance to a certain extent and the larger and more efficient enterprises will be more willing and able to reduce carbon emissions. This indicates that the increase in the price of raw materials and labor will, to a certain extent, increase the operating cost of enterprises and reduce their net profit, which indirectly affects the ability and willingness of enterprises to control their carbon emission performance, while the relationship between the two is not very strong.

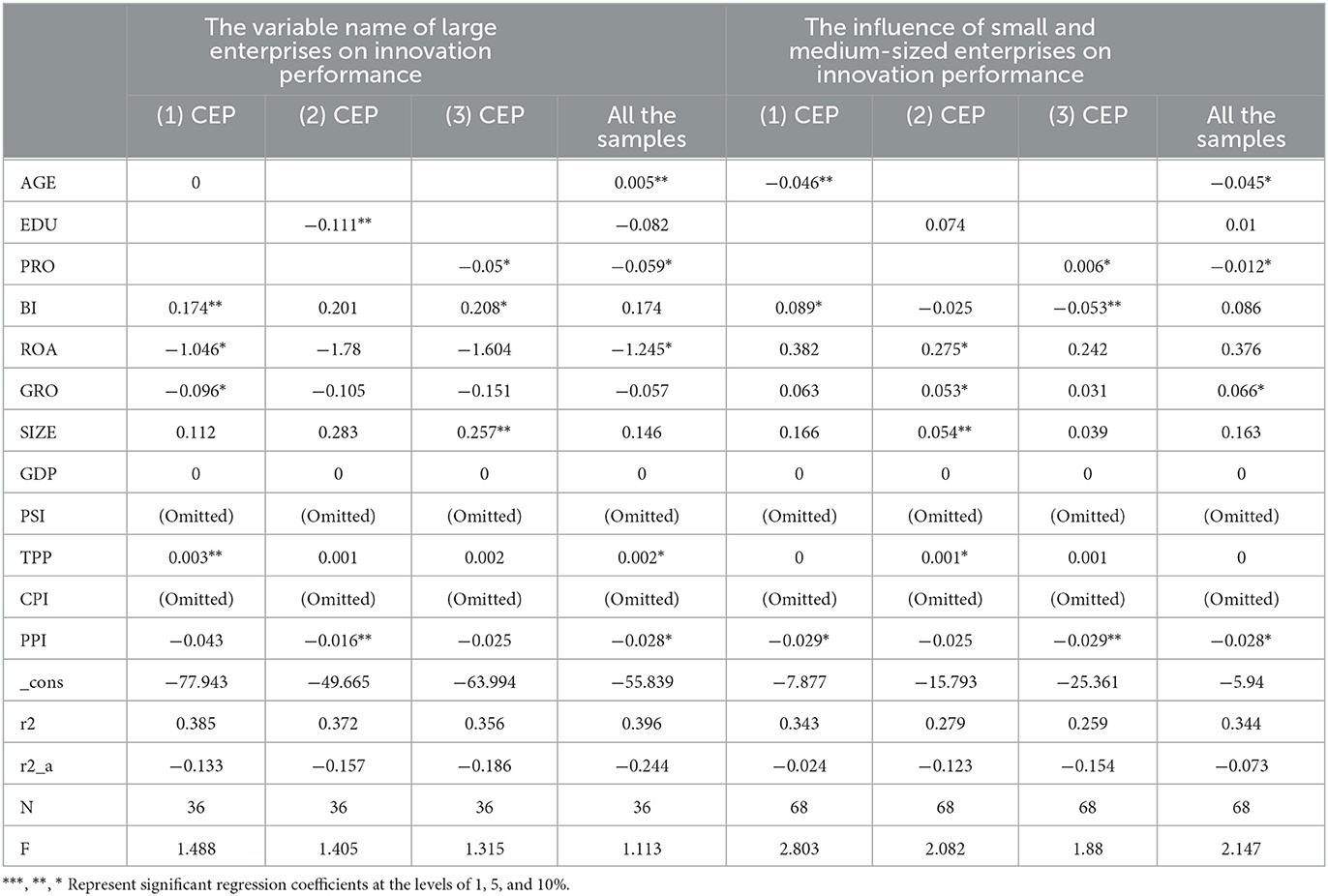

Table 4. Regression test of executive characteristics and carbon emission performance (excluding the nature of equity and enterprise size).

As can be seen from Table 5, the R2 of small and medium-sized enterprises is higher than that of large enterprises and the goodness of fit is stronger, probably because the financial situation and profitability level of large enterprises are better than those of small and medium-sized enterprises, in general. However, unlike the lack of liquidity of enterprises, the main bottleneck that restricts the development of small and medium-sized enterprises, the main dilemma faced by large enterprises is the competitive pressure of international technology and industry. From the specific regression results, the correlation coefficients between the natural age of the executive team and the carbon emission performance of large enterprises tend to be close to 0, indicating that natural age is not the main factor affecting the environment; however, the correlation coefficients between education level and professional background and carbon emission performance are −0.111 and −0.05, respectively, and both are significant at the 10% level, indicating that there is still a negative relationship between the main independent variables and carbon emission performance. The correlation coefficients are 0.046 and 0.006, respectively, which is mainly because, in private capital-held SMEs, the management philosophy and vision of the managers are constantly updated and broadened with the increase of their natural age (Fan, 2016). The longer the tenure, the more they recognize the importance of strengthening their innovation ability and enhancing their R&D strengths in terms of industrial competition. In addition, the more educated the senior managers, the deeper their mastery of enterprise production and management theories and the more they pay attention to technological innovation, meaning they will improve to some extent the innovation performance. Among the control variables, the net interest rate on total assets and the size of total assets are also positively correlated with the innovation performance of enterprises, mainly because enterprises with larger capital and better economic efficiency have more economic strength and research teams to engage in scientific and technological research and development, which improve the innovation performance of enterprises. However, macroindicators such as gross domestic product and producer price index are roughly the same as those described in the previous section.

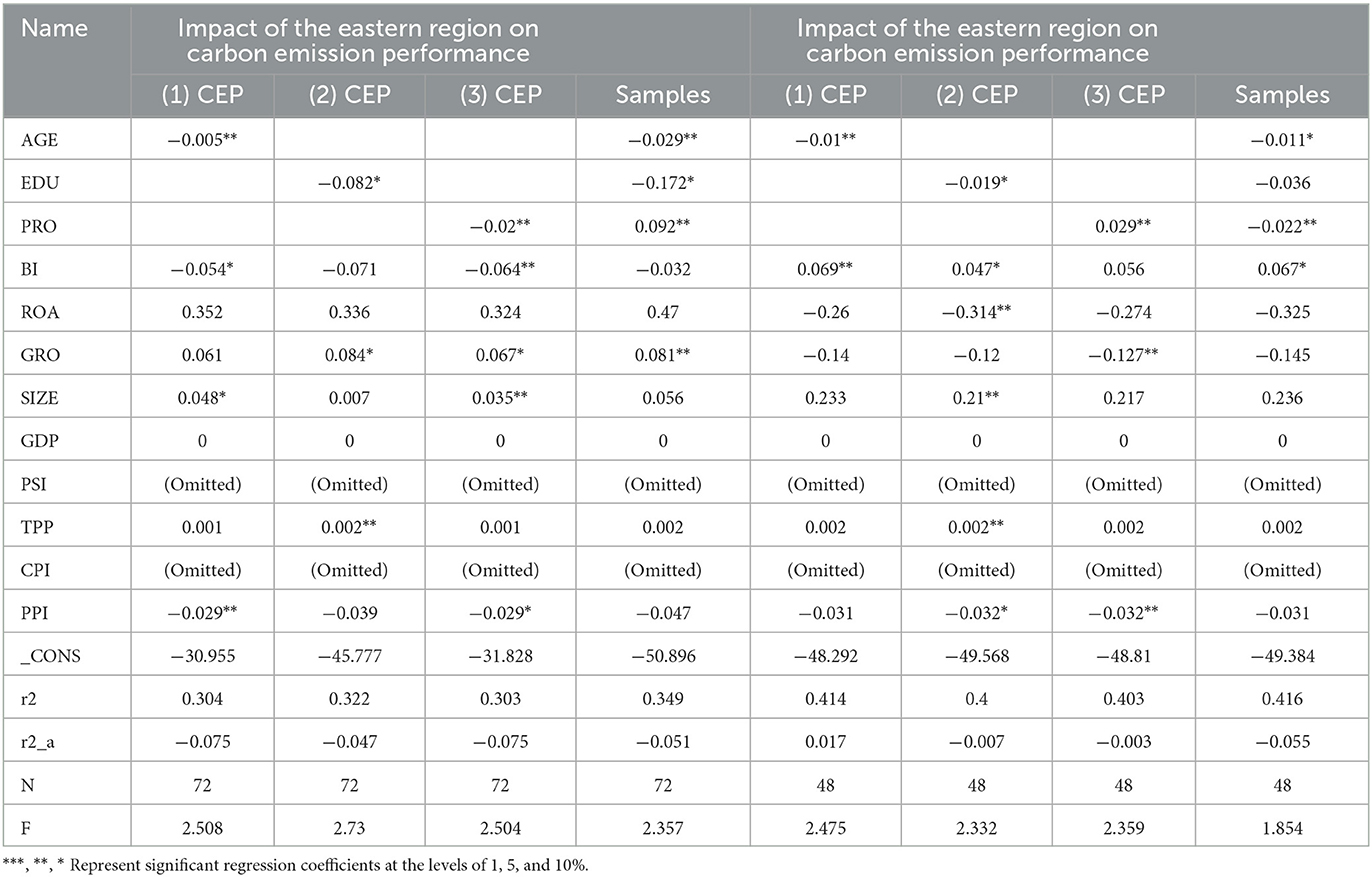

Table 6 shows the regression results from a subregional perspective. The adjusted R2-values of the regression results for enterprises in the central and western regions are ~40–41%, and the overall goodness of fit of the equation is better than that of the eastern region. This is probably because the eastern region has been developing for a long time and is in the late stage of high-quality economic development, technology, and innovation, which are no longer the main factors to improve the innovation performance of enterprises (Fu, 2017). In addition, due to the priority development and strong support policies of the state for the central and western regions in recent years, enterprises can enjoy various support and preferences for their investments in innovation and R&D; therefore, the management will put more effort into innovation and R&D. The regression coefficient of the main explanatory variable, professional background of executives, is 0.029, and the variable is significant at the 10% level or less, which verifies the original hypothesis 3, that is, executives with management background have a more global and long-term strategic vision in enterprise development than those with other majors. They are also more likely to focus their future core competencies on industrial innovation and technology research and development, thus enhancing the innovation performance of the company. However, the regression coefficient of the natural age of executives is −0.01 and significant at the 10% level, indicating that the innovation performance of enterprises is closely related to the natural age of executives, i.e., the younger the natural age of senior managers in privately held companies is more likely to have a more complete awareness and view of environmental protection.

5. Discussion and conclusion

5.1. Theoretical contributions

Using the above data, the multiple linear regression model analyzed the relationship between the characteristics of executives (natural age, professional background, tenure, and education level) and the control variables of operating income and asset size, and carbon emission performance. In contrast to other recent literature, which has involved studies on the impact of macroelements on carbon performance (Zhou and Liu, 2020; Shao et al., 2022), this study focused on the micro level. The relationship between the natural age of core executives in large enterprises and the carbon emission performance of large enterprises is not strong; however, professional background and education level have a negative relationship with carbon emission performance. In small and medium-sized enterprises, natural age is significantly correlated with carbon emission performance. In the regional classification of enterprises, the core executives of high-emitting enterprises in the eastern region are negatively correlated with carbon emission performance in terms of tenure, natural age, and professional background, while those in the central and western regions are positively correlated with carbon emission performance in terms of professional background and natural age. Moreover, the educational level of executives is negatively correlated with carbon emission performance. The findings of this study provide some important policy insights that will enable China to explore the low carbon transition of economic development and achieve the goal of carbon peaking and carbon neutrality.

5.2. Practical implications

By studying the influence of the characteristics of executives on corporate carbon performance, this study anticipates that the research results will provide ideas and methods for current regulators to formulate and introduce regulations and policies. These research findings could also help companies to effectively build and integrate their executive teams, optimize their senior governance structure, improve the resource allocation of top management, and promote sustainable development from the perspective of controlling corporate carbon performance. Therefore, we make the following recommendations in terms of laws and regulations, the internal senior management setup, and the environmental protection of enterprises.

Laws and regulations in turn have a direct impact on the environmental accounting practices of enterprises, and the environmental behavior of enterprises and the environmental decisions they make follow the provisions of the law. Although current regulations, such as the Environmental Protection Law and the Accounting Law in China, have, to a certain extent, institutionally strengthened the supervision of enterprises, especially listed companies, by environmental regulators, there is less knowledge on carbon emission performance, and there is a lack of specific standards and reward and punishment systems for carbon emission performance evaluation. In addition, due to the light penalties and the lack of responsibility of the personnel in the relevant functional departments, these laws and regulations often face difficulties in the implementation and lack of enforcement in the actual implementation process; hence, the environmental pollution problems in China are becoming increasingly widespread and serious. Therefore, China urgently needs to establish and improve a set of laws and regulations on carbon emission performance.

From the perspective of age, enterprises should give more consideration to older executives instead of blindly pursuing young management teams. From the perspectives of professional background, corporate governance, and human resources can favor executives with professional backgrounds in engineering and science when conducting management screening, which can enrich and optimize the professional backgrounds of enterprise management personnel, enhance and improve the production level and efficiency of enterprises, and improve the carbon emission performance of enterprises. From the perspective of education, since carbon emission performance will improve with the improvement of the education of senior management members, enterprises, especially the senior management of listed companies, should improve their education level, and at the same time, enterprises should focus on the education level when selecting managers. From the perspective of tenure, the research findings indicate that appropriate transfer of business managers may affect the stability of management but it can promote the improvement of carbon emission performance to a certain extent. The transfer system of state-owned enterprises, which is now implemented in China, can strengthen the supervision of internal management and control within local enterprises and also drive enterprises to invest more in environmental protection and improve the carbon emission performance of the whole industry to a certain extent.

Improving the selection and incentive mechanism of key senior managers and reconfiguring the composition of the organization's management team in terms of their natural age, professional background, tenure, and educational level will strengthen the cohesiveness of the management team and improve the carbon performance of the enterprise, thus making an important contribution to the sustainable development of the enterprise and society.

In particular, for enterprises involved in high energy consumption and high pollution industries, both management and ordinary staff should have proper knowledge and understanding of environmental issues while pursuing the maximization of economic benefits for the enterprise to facilitate the smooth implementation of environmental protection work. Nevertheless, the government should introduce corresponding policies to encourage enterprises to vigorously cultivate or introduce environmental talents, set up specialized environmental management agencies from top to bottom, and slowly improve the carbon performance of enterprises with technological changes and professional environmental management tools. The relevant government departments should set up special institutions and personnel to regularly assess the carbon performance of enterprises in their areas of responsibility, especially the departments or main leaders of high-emission enterprises, actively accept the supervision of the public, and stop production in time and rectify the more polluting production lines. Moreover, a strict reward and punishment mechanism should be implemented, and individuals and departments with high carbon performance should be rewarded, and those with low carbon performance should be punished to make an effort at improving the carbon emission performance of enterprises.

Furthermore, to supervise the environment, it is not enough to rely only on the power of the government and enterprises. The level of environmental protection in our society depends on the strength of the environmental awareness of the members of society; therefore, it is necessary to strengthen the education of the general population on environmental protection and lay a solid foundation for environmental protection so that environmental pollution and other problems can be managed well.

5.3. Limitations and directions for future research

Finally, it should be noted that, due to the limited availability of data, this study only examined the influence of executive characteristics on carbon performance at the level of firms in high-emitting industries. The exploration of carbon performance–related issues at other industry levels would complement research at the high-emissions industry level, thus helping firms to fully grasp key bottlenecks in the development of China's low-carbon economic transition. Therefore, a global examination of related issues at the firm level should also be an important direction to expand subsequent research.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This study was supported by the National Social Science Fund of China Research on multi-dimensional poverty reduction mechanism, utility, and promotion mechanism of farmer cooperative supply chain finance (20BGL068) and the Humanities and Social Sciences Fund of the Ministry of Education Research on the formation mechanism, evaluation, and control mechanism of Internet supply chain financial operation risk: Based on Symbiosis Theory (19YJC630108).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arslan, H. M., Chengang, Y., Bilal Siddique, M., and Yahya, Y. (2022). Influence of senior executives characteristics on corporate environmental disclosures: a bibliometric analysis. J. Risk Finan. Manag. 15, 136. doi: 10.3390/jrfm15030136

Chen, H., Yang, Y., Yang, M., and Huang, H. (2022). The impact of environmental regulation on China's industrial green development and its heterogeneity. Front. Ecol. Evol. 10, e967550. doi: 10.3389/fevo.2022.967550

Chu, J., Shao, C., Emrouznejad, A., Wu, J., and Yuan, Z. (2021). Performance evaluation of organizations considering economic incentives for emission reduction: a carbon emission permit trading approach. Energy Econ. 101, 105398. doi: 10.1016/j.eneco.2021.105398

Cui, X., Sun, M., Sensoy, A., Wang, P., and Wang, Y. (2022). Top executives' great famine experience and stock price crash risk. Res. Int. Bus. Finan. 59, 101564. doi: 10.1016/j.ribaf.2021.101564

Ding, L.-L., Lei, L., Zhao, X., and Calin, A. C. (2020). Modelling energy and carbon emission performance: a constrained performance index measure. Energy 197, 117274. doi: 10.1016/j.energy.2020.117274

Elsayih, J., Datt, R., and Hamid, A. (2021). CEO characteristics: do they matter for carbon performance? An empirical investigation of Australian firms. Soc. Respons. J. 17, 1279–1298. doi: 10.1108/SRJ-04-2020-0130

Fan, S. M. (2016). Characteristics of Executive Team, Carbon Emission Performance and Corporate Value. Yunnan University of Finance and Economics.

Ferrat, Y. (2021). Carbon emissions and firm performance: a matter of horizon, materiality and regional specificities. J. Clean. Prod. 329, 129743. doi: 10.1016/j.jclepro.2021.129743

Fu, W. J. (2017). Carbon Emission Performance, Characteristics of Executive Team and Corporate Value. Yanshan University.

George Wilson, A., Franck, C. T., Terry Mueller, E., Landes, R. D., Kowal, B. P., Yi, R., et al. (2015). Predictors of delay discounting among smokers: Education level and a Utility Measure of Cigarette Reinforcement Efficacy are better predictors than demographics, smoking characteristics, executive functioning, impulsivity, or time perception. Addict. Behav. 45, 124–133. doi: 10.1016/j.addbeh.2015.01.027

Gjerløv-Juel, P. (2019). Executive turnover – Firms' subsequent performances and the moderating role of organizational characteristics. Eur. Manag. J. 37, 794–805. doi: 10.1016/j.emj.2019.04.004

Guo, S. J., Lu, Y. X., and Chang, J. P. (2019). Overseas background of senior executives, salary gap and investment in enterprise technology innovation - an empirical analysis based on PSM. East China Econ. Manag. 33, 138–148. doi: 10.19629/j.cnki.34-1014/f.180721001

Han, B. J. (2019). Characteristics of executive team, equity nature and investment efficiency of enterprises. J. Jilin Instit. Technol. 35, 57–65. doi: 10.19520/j.cnki.issn1674-3288.2019.03.010

Haselhuhn, M. P., Wong, E. M., and Ormiston, M. E. (2022). Investors respond negatively to executives' discussion of creativity. Org. Behav. Hum. Decision Proc. 171, 104155. doi: 10.1016/j.obhdp.2022.104155

Huffman, R. C., and Hegarty, W. H. (1993). Top management influence on innovations: effects of executive characteristics and social culture. J. Manag. 19, 549–574. doi: 10.1016/0149-2063(93)90004-7

Kang, K.-H., Lee, H.-W., and Park, K.-K. (2011). Characteristics of attention/executive function deficits in patients with mild cognitive impairment and sleep apnea syndrome. Alzheimer's Dement. 7, S248–S249. doi: 10.1016/j.jalz.2011.05.708

Li, A., Huang, C., Feng, X., Li, Y., Yang, H., Wang, S., et al. (2021a). Upgradation of sludge deep dewatering conditioners through persulfate activated by ferrous: compatibility with sludge incineration, dewatering mechanism, ecological risks elimination and carbon emission performance. Environ. Res. 211, 113024. doi: 10.1016/j.envres.2022.113024

Li, L., Zhang, S., Cao, X., and Zhang, Y. (2021b). Assessing economic and environmental performance of multi-energy sharing communities considering different carbon emission responsibilities under carbon tax policy. J. Clean. Prod. 328, 129466. doi: 10.1016/j.jclepro.2021.129466

Li, Q. (2019). Research on the Correlation Between Executive Characteristics and Carbon Emission Performance. North China University of Technology.

Li, W., Wang, W., Gao, H., Zhu, B., Gong, W., Liu, Y., et al. (2020). Evaluation of regional metafrontier total factor carbon emission performance in China's construction industry: analysis based on modified non-radial directional distance function. J. Clean. Prod. 256, 120425. doi: 10.1016/j.jclepro.2020.120425

Liang, Q. Q. (2019). An empirical study on the relationship between characteristics, heterogeneity and team performance of senior management teams – taking G group as an example. Sci. Technol. Econ. 32, 75–79. doi: 10.1016/j.jbef.2019.100523

Lin, B., and Zhou, Y. (2021). Does the Internet development affect energy and carbon emission performance? Sustain. Prod. Consump. 28, 1–10. doi: 10.1016/j.spc.2021.03.016

Liu, J. (2023). Path analysis of energy economic management standardization in the context of carbon neutralization and carbon peak. Front. Ecol. Evol. 11, e1155401. doi: 10.3389/fevo.2023.1155401

Liu, X., Tao, X., Wen, Y., and Zeng, Y. (2022). Improving carbon emission performance of thermal power plants in China: an environmental benchmark selection approach. Comput. Indust. Eng. 169, 108249. doi: 10.1016/j.cie.2022.108249

Ma, S., and Chen, Z. (2022). Low-carbon development of livestock in China: evolution, predicaments and paths ahead. Low Carbon Econ. 13, 53–69. doi: 10.4236/lce.2022.132004

Meng, X. S., and Yang, L. Y. (2017). Manager effect of environmental information disclosure and carbon emission performance improvement of enterprises – based on data analysis of heavy polluting enterprises in China from 2011 to 2015. J. Guizhou Univ. Finance Econ. 6, 70–81. doi: 10.14134/j.cnki.cn33-1336/f.2017.10.003

Qin, B. (2012). The influence of firm and executive characteristics on performance-vested stock option grants. Int. Bus. Rev. 21, 906–928. doi: 10.1016/j.ibusrev.2011.10.004

Shao, S., Fan, M. T., and Yang, L. L. (2022). Economic restructuring, green technical progress, and low-carbon transition development in China: an empirical investigation based on the overall technology Frontier and spatial spillover effect. J. Manag. World. 38, 46–69+4–10. doi: 10.13956/j.ss.1001-8409.2022.06.04

Tian, G., Zhou, S., and Hsu, S. (2020). Executive financial literacy and firm innovation in China. Pacific-Basin Finan. J. 62, 101348. doi: 10.1016/j.pacfin.2020.101348

Wu, H.-C., White, S., Rees, G., and Burgess, P. W. (2018). Executive function in high-functioning autism: Decision-making consistency as a characteristic gambling behaviour. Cortex 107, 21–36. doi: 10.1016/j.cortex.2018.01.013

Yang, L., Liu, J., Fan, Z., and Yang, D. (2022). Governance of executive personal characteristics and corporate performance based on empirical evidence based on machine learning. J. Ambient Intellig. Human. Comput. 8655–8665. doi: 10.1007/s12652-021-03623-w

Ying, N., Yao, L., Jihong, X., and Daqing, W. (2022). Environmental regulation and corporate innovation behavior based on the “double carbon” strategy – empirical analysis based on A-share listed companies of heavy pollution industries on the Shanghai and Shenzhen stock exchanges. Front. Ecol. Evol. 10, e935621. doi: 10.3389/fevo.2022.935621

Yu, N. T., Fan, S. M., and Zheng, Y. (2017). Characteristics of executive team, carbon emission performance and corporate value – an empirical study based on listed companies in China's chemical industry. Finan. Res. 2, 68–78. doi: 10.19808/j.cnki.41-1408/f.2017.05.006

Zhang, W., Liu, X., Wang, D., and Zhou, J. (2022). Digital economy and carbon emission performance: Evidence at China's city level. Energy Policy 165, 112927. doi: 10.1016/j.enpol.2022.112927

Keywords: environmental governance, executive characteristics, pollutant emission, enterprise performance, environmental pollution

Citation: Liu X, He M, Zhang S, Zhuang Z and Cai C (2023) Can senior executive characteristics improve carbon emission performance? Evidence from China. Front. Ecol. Evol. 11:1076163. doi: 10.3389/fevo.2023.1076163

Received: 21 October 2022; Accepted: 08 May 2023;

Published: 11 July 2023.

Edited by:

Haiyue Liu, Sichuan University, ChinaCopyright © 2023 Liu, He, Zhang, Zhuang and Cai. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mengqi He, aGVtZW5ncWkwN0Bmb3htYWlsLmNvbQ==

Xun Liu

Xun Liu Mengqi He

Mengqi He