- School of Law and Business, Wuhan Institute of Technology, Wuhan, China

This paper examines the impact of the interactive development of inward foreign direct investment (IFDI) and outward foreign direct investment (OFDI) [two-way foreign direct investment (FDI)] on regional environmental technology by using data from 30 provinces and cities in China from 2004 to 2017. To overcome the possible endogeneity problem of the model, the system generalized moment estimation method (system GMM) is used to estimate the model. The results show the following: First, two-way FDI could inhibit the progress of regional environmental technology. Second, the results of the regional heterogeneity test show that the development of two-way FDI interaction promotes the environmental technology in the eastern region, but inhibits the environmental technology in the central and western regions of China. Third, the heterogeneity test results of the two-way FDI interactive development degree show that the two-way FDI interactive development in China promotes environmental technology in high-interactive areas, but inhibits environmental technology in low-interactive areas. Finally, the results of the phased heterogeneity test show that as China’s two-way FDI interactive development gradually increases, its inhibitory effect on regional environmental technology gradually declines. Therefore, it is believed that in the future, China should further strengthen inward FDI and OFDI, realize the benign interaction of two-way FDI, and finally promote the progress of regional environmental technology.

Introduction

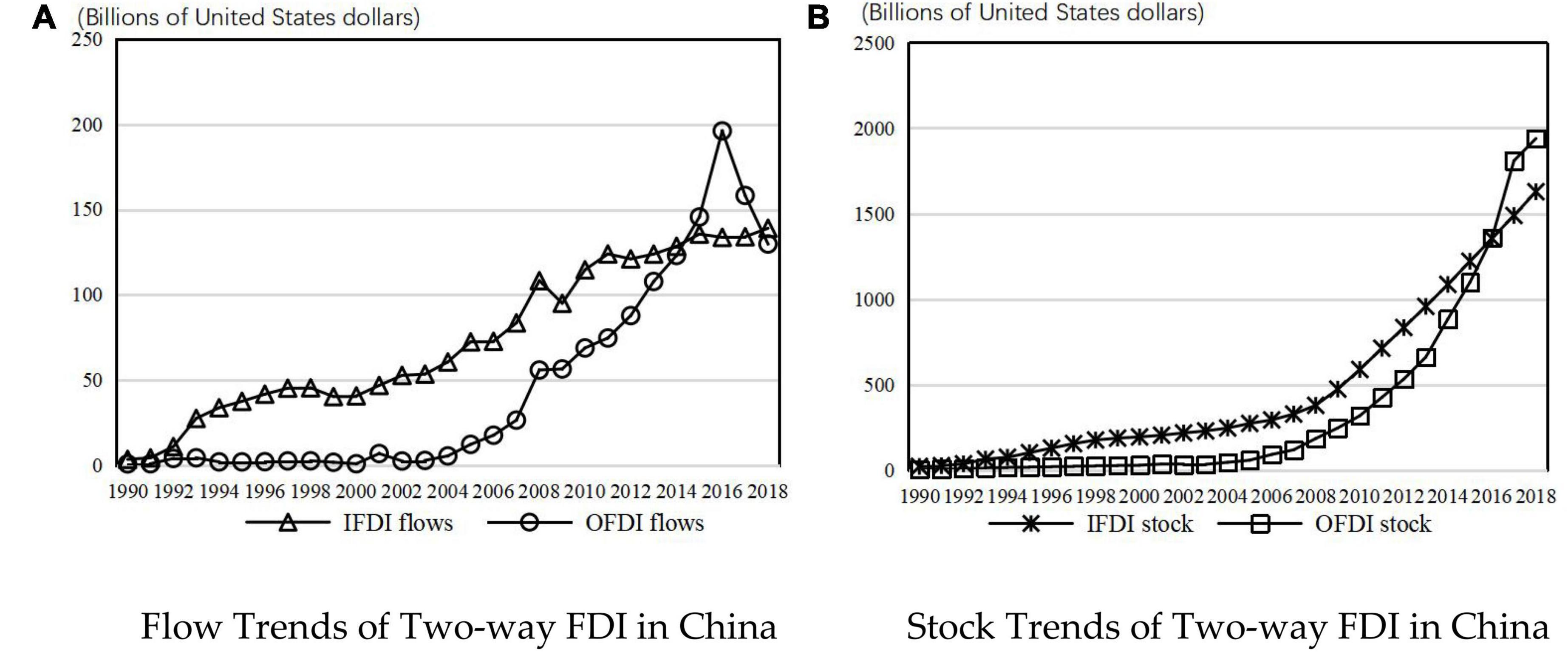

Since 1978, China’s economy is booming. However, the investment development model of “three to one supplement (processing supplied materials, assembly supplied parts, processing supplied samples and compensation trade)” and “two ends outside (It refers to the export-oriented economic form in which raw materials come from abroad and products are sold abroad)” has inevitably brought tremendous pressure on China’s resources and environment (Gong et al., 2019). The report of the 19th National Congress also points out that pollution control is the key to future economic development, and emphasizes that green technology innovation will become a new economic growth point. Therefore, the importance of guiding environmental technology upgrading to improve environmental quality cannot be ignored (Irandoust, 2016; Ganda, 2019). The improvement of environmental technology mainly comes from two aspects, one is the increase in domestic R&D inputs (Jiao et al., 2018) and another is the introduction of exogenous techniques (Dong et al., 2019; Zhou et al., 2019). Due to the large gap between China’s environmental technology level and developed countries (Piperopoulos et al., 2018), access to foreign advanced technology through technology spillover is an important way to promote China’s environmental technology progress (Yang et al., 2016). In general, a number of developing countries expect technology spillover and technology transfer through bilateral investment (Muhammad and Khan, 2019). As a major bilateral investment country, China’s flows and stocks of inward foreign direct investment (IFDI) and outward foreign direct investment (OFDI) both show a simultaneous growth trend (Figure 1), and the interactive relationship between them has become a new feature of economic development in China (Dunning, 1981). Investment development path theory also points out that IFDI will promote OFDI development through technology spillover effects (Yao et al., 2016). With the improvement of a country’s economic development level, the interaction effect of its bilateral investment will also gradually rise. Are there interaction effects between two-way foreign direct investment (FDI) in China? If it exists, how can we scientifically guide the interactive development of two-way FDI and enhance its international technology spillover effect to promote China’s regional environmental technology? Answering the above questions will help to improve China’s environmental technology based on promoting China’s two-way FDI interactive development.

Figure 1. Flow and stock trends of two-way foreign direct investment (FDI) in China. (A) Flow trends of two-way FDI in China; (B) Stock trends of two-way FDI in China.

From the existing research, there are abundant studies based on the effects of IFDI on environmental technology. Some studies suggest that IFDI, as an important engine of economic growth, is not only conducive to the growth of employment in the host country but also promotes the improvement of production technology and environmental technology in the host country (Demena and Afesorgbor, 2020). Zhu et al. (2016) believed that since foreign enterprises have more advanced technology, IFDI is conducive to the improvement of environmental technology in the host country. Yuan and Xiang (2018) analyzed the data of China’s manufacturing industry from 2003 to 2014 and found that IFDI would promote the environmental technological progress of China’s manufacturing industry through the technology spillover effect. Demena and Afesorgbor (2020) also reached a similar conclusion that IFDI will promote the environmental technology progress of the host country through the technology spillover effect because it has cleaner production technology. Qiu et al. (2021) investigates the impact of IFDI on environmental technology of the industrial sectors in 30 provinces in China and found that IFDI exerts a “pollution heaven” effect on environmental technology in eastern and central China. Yu et al. (2021) studies the impact of IFDI on environmental technology based on the data of 285 Chinese cities from 2003 to 2017. The result shows that IFDI plays a positive role in promoting environmental technology in high-high and high-low cluster cities. However, some scholars believe that the environmental technology effect of IFDI is not obvious (Zhu and Bang, 2007), because if the introduced IFDI is resource-seeking rather than bringing advanced technology, it may inhibit environmental technology and increase the regional environmental load (Ai et al., 2015).

Existing research has paid less attention to OFDI’s impact on the environmental technology of the home country. In general, OFDI is considered a key factor in promoting technological upgrading in enterprises (Cheng and Yang, 2017; Buckley, 2018). Through OFDI in technology-intensive and knowledge-intensive countries, enterprises can promote their technological progress through the reverse technology spillover effect (Chen et al., 2012; Cozza et al., 2015), and further improve the company’s environmental technology (Yang et al., 2013). Li et al. (2016) and Cheng and Yang (2017) believe that through outward FDI, enterprises are conducive to the integration of tangible and intangible assets of subsidiaries in the host country, and finally promote the improvement of environmental technology in the home country through reverse technology spillover effect. Through the analysis of panel data from 30 provinces and cities in China, Zhou et al. (2019) also found that the OFDI of China will promote the increase of environmental technology, but there is a large heterogeneity among the provinces.

By organizing the existing literature, it can be found that scholars based on international direct investment technology spillover effect analysis are unidirectional, and their theoretical paradigm and empirical research are carried out separately. Few literature takes the impact of IFDI and OFDI coordinated development on environmental technology into consideration. Under the condition of an open economy, both IFDI and OFDI are important forms for a country to participate in international economic activities. At present, the coordinated development situation between the two is becoming more and more obvious. This will affect a country’s environmental technology to a certain extent. Therefore, the impact of one-way analysis IFDI or OFDI on regional environmental technology progress is easy to cause inconsistency in estimation results, which leads to a large deviation of estimation results. The main contribution of this paper is that: first, the impact of coordinated development of two-way FDI on China’s technological progress deep dive into the environmental technology level. Second, incorporating IFDI and OFDI into the same analysis framework systematically sorted out the mechanism of the two-way FDI coordinated development affecting regional environmental technological progress. Third, the regional heterogeneity of the two-way FDI interactive development affecting environmental technology has been proved empirically.

Theoretical mechanisms

Given the background that China has become a big bilateral investment country and the degree of interactive development between IFDI and OFDI (referred to as two-way FDI) is rising, it will inevitably have an impact on regional environmental technology. Specifically:

Mechanism of inward foreign direct investment affecting regional environmental technology

Grossman and Krueger’s (1995) decomposition model points out that regional environmental pollution mainly depends on a production scale, industrial structure, and environmental technology. In other words, any factors that affect the production scale, industrial structure, and environmental technology of the region, such as the level of economic development, human capital, the intensity of government regulation, and resource endowment, will change the pollution situation of the region. The inflow of FDI is often accompanied by the expansion of the production scale. At the same time, different types of IFDI will affect regional environmental technology to a certain extent. Therefore, IFDI is considered to be one of the important factors affecting regional environmental technology. Generally speaking, the technology spillover effect of resource-seeking IFDI is limited. Such IFDI will not only bring rapid economic development to the host country but also accelerate the increase of energy consumption in the host country, which is not conducive to the improvement of environmental technology. By guiding market-seeking IFDI into the high-tech industry, it is conducive to promoting the upgrading of environmental technology in the host country. From the reality of China, the IFDI introduced by it is mainly resource-seeking, and there is less high-tech green IFDI.

Mechanism of outward foreign direct investment affecting regional environmental technology

On one hand, through OFDI, the home country enterprises are embedded in the R&D resource-intensive areas of the host country, can absorb the advanced environmental technologies of the host country through the R&D resource sharing and technology cluster mechanism, and then feed them back to the home country through the talent flow and R&D achievement feedback mechanism, forming a win-win situation of economic development and environmental protection. On the other hand, the impact of OFDI carried out by enterprises in the home country on environmental technology in the same industry and related industries will be transmitted in a larger range due to the industrial linkage effect, thus comprehensively affecting the environmental technology in the home country. However, the size and direction of OFDI on the home country’s environmental technology are also related to OFDI’s investment motivation. For resource-seeking OFDI, its promotion effect on environmental technology in the home country is not significant, but technology-seeking OFDI can effectively promote the improvement of environmental technology in the home country through the technology feedback mechanism. From the reality of China, there is no sufficient evidence to show that China’s OFDI is to seek reverse technology spillovers, which is not conducive to the improvement of regional environmental technology.

Mechanism of two-way foreign direct investment interactive development affecting regional environmental technology

First of all, two-way FDI interactive development will promote regional environmental technology progress. On one hand, if the technology spillover effect of IFDI inflow is obvious and can significantly improve the environmental technology of the host country, the technology spillover effect will effectively reduce the emission reduction cost of domestic enterprises. Domestic enterprises will invest more capital to enhance their competitiveness of enterprises, and competitive advantage is the basis of OFDI. On the other hand, because OFDI has a greater initiative in the investment of funds, home enterprises through R&D resource sharing and technology cluster mechanisms absorb advanced environmental technology of host countries through OFDI, embedding in R&D resource-intensive areas of host countries, and then through talent flow and R&D results in feedback mechanism back to home countries, ultimately promoting economic development. Greater home country economic power will help attract more IFDI. There is a benign interaction between IFDI and OFDI at this time, and the level of interactive development between them has increased significantly, which is conducive to the progress of regional environmental technology.

Second, the development of two-way FDI interaction will inhibit the progress of regional environmental technology. First, if the introduced IFDI is mainly a resource-seeking type, it will bring a large number of pollution emissions to the host country and the environmental technology obtained by IFDI technology spillover effect may lag behind. The main reason is that to ensure their monopoly position in advanced technology, developed countries will tend to conduct internalization transactions to prevent the diffusion of core technologies, including environmental technologies. Therefore, in this context, the introduction of IFDI environmental technology spillover effect is limited (Narula and Marin, 2003), which, while bringing rapid development to the host country’s economy, will also accelerate the energy consumption of the host country, which is not conducive to the formation of the competitiveness of the host country enterprises. On the other hand, given the background of supply-side structural reform, encouraging enterprises to “go forward international” and promoting the international transfer of production capacity are important channels to alleviate domestic overcapacity. However, such OFDI is not conducive to reverse technology spillover effect, which leads to no significant promotion of home country environmental technology. Therefore, to improve the environmental quality of our country, it is necessary for home country enterprises to invest more funds to reduce emissions, which will squeeze R&D investment to a certain extent, which is not conducive to the formation of regional absorptive capacity. To restrain IFDI positive technology spillover effect, the development of two-way FDI interaction is limited, and regional environmental technology is inhibited.

To sum up, it can be found that the impact of two-way FDI interactive development on regional environmental technology is related to the types of IFDI and OFDI. Judging from the reality of China, at present, the IFDI types introduced by China are mainly resource-seeking, China’s OFDI is mainly distributed in Asia, and the industry distribution is mainly concentrated in the secondary industry. Therefore, the technology spillover effect of this kind of IFDI and OFDI is limited, which is not conducive to the improvement of the development degree of IFDI and OFDI interaction, and finally inhibits the regional environmental technology.

Model setting and data description

Model setting

To systematically investigate the impact of China’s two-way FDI interaction development on regional environmental technology, measurement model is set as follows (Qiu et al., 2021):

where i and t denote Chinese province and time (year). lntecit represents the environmental technology. Because environmental technology may have temporal summation, lagged lntecit is introduced. lnIDFDIit represents the two-way FDI interactive development degree. Xit represents other variables that affect regional environmental technology, including domestic R&D investment (lnRDit), human capital (lnHit), environmental regulation (lnERSit), trade openness (lnTRit), regional economic development level (lnGDPit), and factor intensity (lnKLit).

The variable construction is as follows:

Environmental technology

The current widely used is the environmental technology measurement method, mainly for the decomposition of SBM (Slacks-based model) to obtain environmental efficiency values. However, Song and Wang (2013) pointed out that environmental efficiency is affected by both environmental technology and environmental regulations. Therefore, using environmental efficiency indicators to replace environmental technology will lead to unreliable estimation results. This paper draws lessons from He (2006) and Zhang and Jiang (2013a,b, 2014). First of all, China is regarded as region A, which can be defined as:

Among them, WAt represents China’s pollution emissions in year t, expressed in terms of total carbon emissions. YAt represents China’s gross domestic product (GDP) in year t. Therefore, the national pollution emission intensity pluA0 in the base period can be regarded as a technical benchmark. Then, the theoretical value of pollution emission can be expressed as:

The ratio of the theoretical value to the actual value of the regional pollution emission is defined as the regional environmental technological progress index:

If tecit > 1, it means that the actual pollution emission in the area is lower than the theoretical value of pollution emission under the reference technology level, that is to say, the environmental technology in the area is higher than the reference technology level. If tecit = 1, it means that the actual pollution emission in the area is equal to the theoretical value of pollution emission given the reference technology level, that is to say, the environmental technology in the area is equal to the reference technology level. If tecit < 1, it means that the actual pollution emission in the area is higher than the theoretical value of pollution emission under the reference technology level, that is to say, the environmental technology in the area is lower than the reference technology level. The larger the index, the higher the regional environmental technology level.

Since the technical reference system applied by Tec is the national average technical level in the base year, it reflects the technological progress of the relevant regions relative to the national average technology in the base year. This technological progress includes two driving forces: One is the change in the national average technological level caused by technological progress, which can be regarded as the overall progress of environmental protection technology. The second is the change in the degree of relative technological differences between regions due to the differences in environmental supervision, environmental protection investment capacity, and technological capacity. Therefore, compared with the absolute value of carbon intensity, this index can better reflect the relative changes in environmental technology.

The degree of interactive development of two-way foreign direct investment

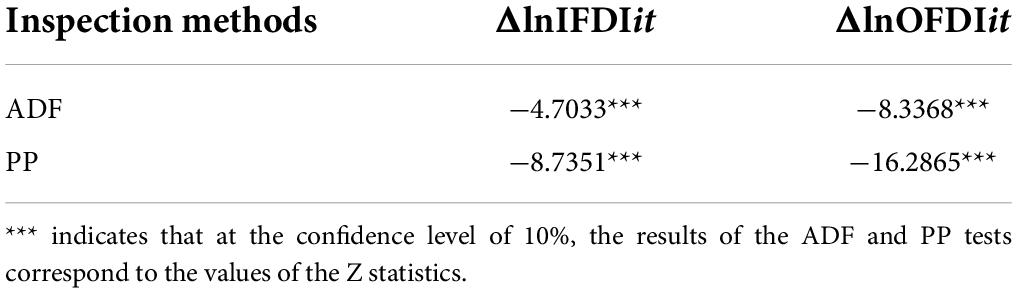

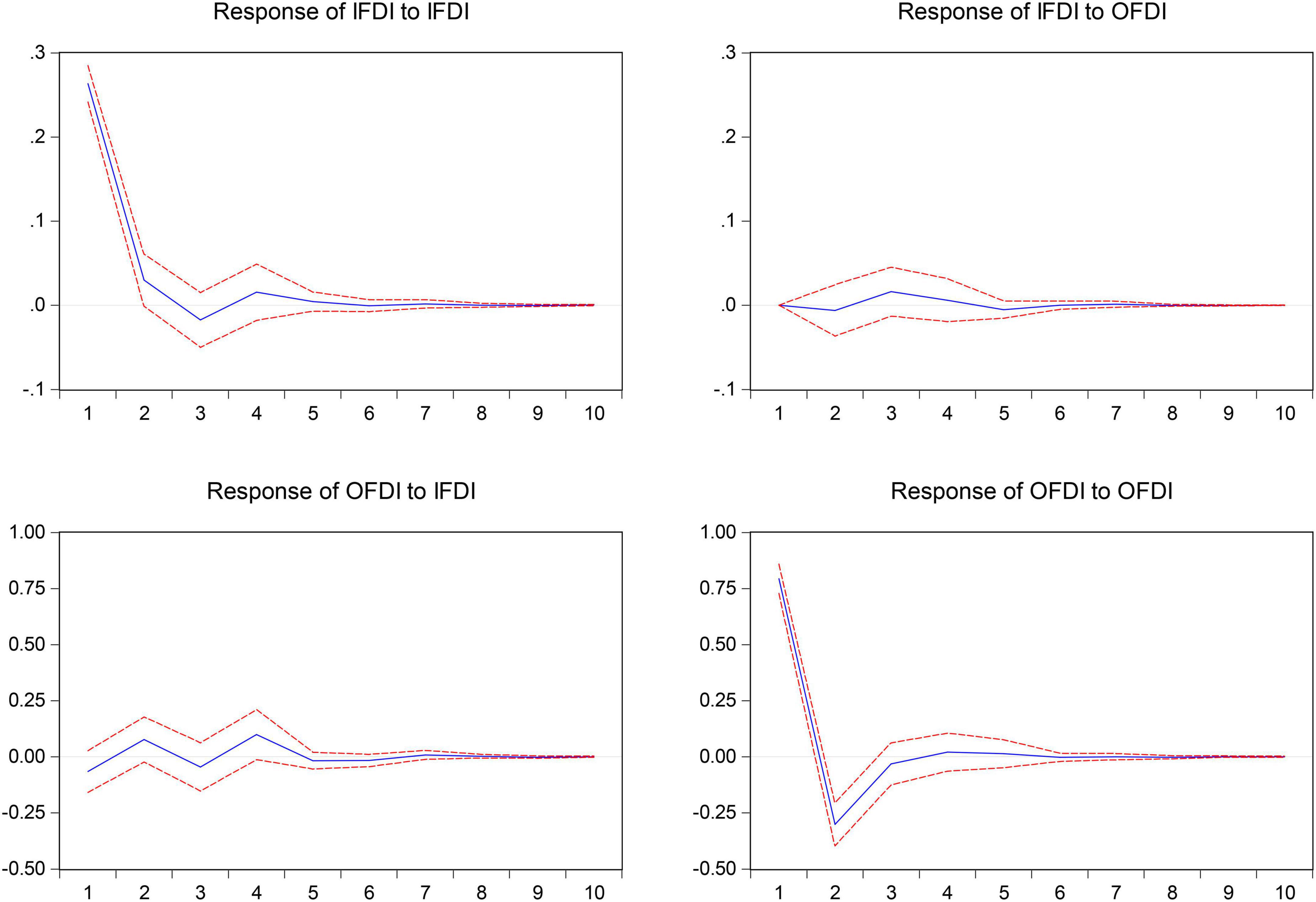

Inward foreign direct investment data comes from the China Statistical Yearbook, and OFDI data comes from the Statistical Bulletin of China’s OFDI. First, the stationarity of variables is tested. As shown in Table 1, it can be found that both IFDI and OFDI are stationary sequences. Second, the interaction effect between IFDI and OFDI is analyzed by the impulse response function. As shown in Figure 2, it can be found that there is a significant interaction effect between IFDI and OFDI. When the IFDI is impacted by an exogenous unit, a significant fluctuation is generated.

Figure 2. Pulse response function diagram. The blue line is the impulse response estimates for a horizon of up t time, and the two red lines are the one-standard error confidence bands.

This paper uses the coupling coordination function (Huang et al., 2018; Gong and Liu, 2020; Li et al., 2021) to measure the degree of interaction of two-way FDI. The formula is as follows:

. Among them, IFDIit and OFDIit represents the IFDI and OFDI flow of each province in the t period, and α and β represents the weights of IFDI and OFDI, respectively. Since the synchronization between the introduction of IFDI and the OFDI of each province in China is becoming more and more obvious at this stage, the value of the set sum is 0.5. At the same time, the adjustment coefficient γ is set to 2 (Huang et al., 2018; Gong and Liu, 2020).

Other control variables

Domestic R&D investment (lnRDit): This paper uses the regional R&D funds internal expenditure measurement and the data from the statistical yearbooks of the provinces. Human capital (lnHit): This paper draws on the method of Barro and Lee (1993) and measures the stock of human capital by the average years of education of the labor force. The data on the education level of employees in various regions comes from the “China Labor Statistics Yearbook.” The environmental regulation (lnERSit) is measured by the total investment in environmental pollution control in each region, and the data are from the National Bureau of statistics. Trade openness (lnTRit): Using the proportion of the total import and export trade of each region in GDP to measure. The data are from China Statistical Yearbook. Regional economic development level (lnGDPit): Using regional GDP to measure. The GDP data of each province comes from the Statistical Yearbook of China. The factor intensity (lnKLit) is measured by the ratio of fixed capital stock to the number of employees at the end of the year, in which the fixed capital stock in each region is calculated by the perpetual inventory method.

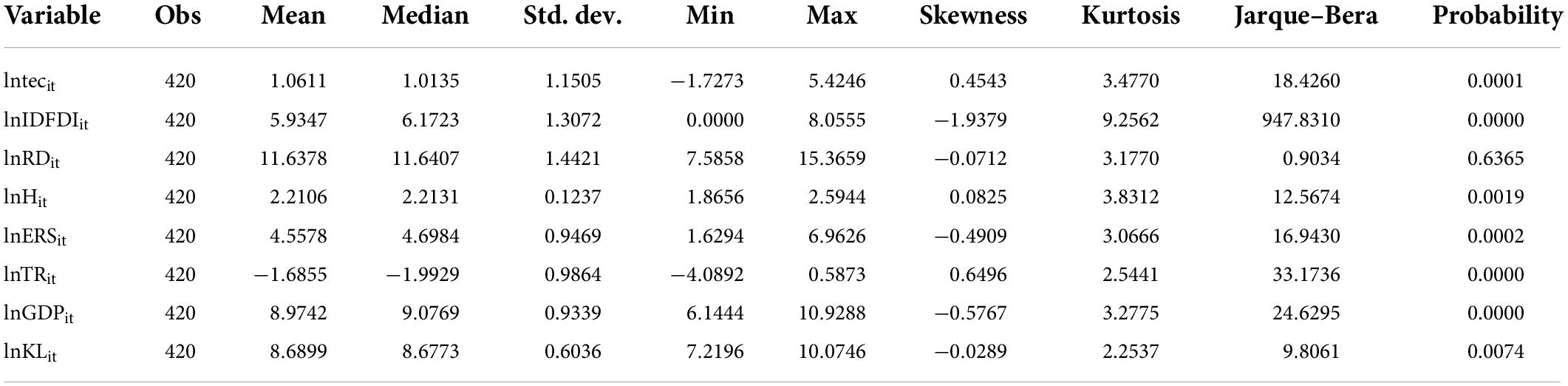

Data description

Limited to the integrity and availability of data, this paper selects the data of 30 provinces and cities except Hong Kong, Taiwan, Macao, and Tibet for empirical analysis from 2004 to 2017. The descriptive statistics of the data are shown in Table 2.

Empirical analysis

Estimation strategy

Theoretical research shows that there is a correlation between the coordinated development of two-way FDI and environmental technology. Therefore, this paper further verifies the theoretical relationship between variables through empirical analysis. Due to a large number of existing studies have shown that macro variables such as environmental technology and coordinated development of two-way FDI series are non-stationary I(1) processes (Huang et al., 2018). To ensure the stationarity of panel data and prevent false regression problems in the analysis process (Jaunky, 2011), panel unit root and co-integration tests are performed on each variable to judge whether there is a long-term stable equilibrium relationship between environmental technology and coordinated development of two-way FDI. On this basis, in order to examine the correlation between variables, this paper further reports the results of the correlation coefficient matrix. Finally, this paper uses the generalized method of moments (GMM) method for regression estimation of the model.

The most commonly used methods for parameter estimation of panel data are fixed effect and random effect models. However, the dynamic panel data model in this paper may have endogenous problems caused by the correlation between the lag term of the explained variable and the random disturbance term. Solving the endogenous problem of the dynamic panel model and ensuring the unbiased consistency of the estimation results, these two traditional methods are not effective. At this time, the GMM method is a better choice.

This method applies to models with a lag period of explained variables, endogenous of part or all explained variables, and heteroscedasticity and serial correlation models that may have different random disturbance terms in each section individually.

Whether the GMM estimation results are consistent or not depends on whether the instrumental variables are effective. Therefore, the Sargan test must be carried out for the over-identification limitation of instrumental variables, and the Arellano–Bond test must be used to judge the rationality of instrumental variable selection. If Sargan test results accept the null hypothesis, that is, the instrumental variables are valid (P-value of Sargan statistic ≥0.1), and Arellano–Bond test results show that there is no second-order sequence correlation in the random error term (that is, the value of AR (1) statistic <0.1 and P-value of AR (2) statistic >0.1), then it indicates that the instrumental variables are valid and the model setting is reasonable.

Therefore, this paper mainly uses the GMM method to regress the model and conduct a statistical test on whether the selected instrumental variables are effective.

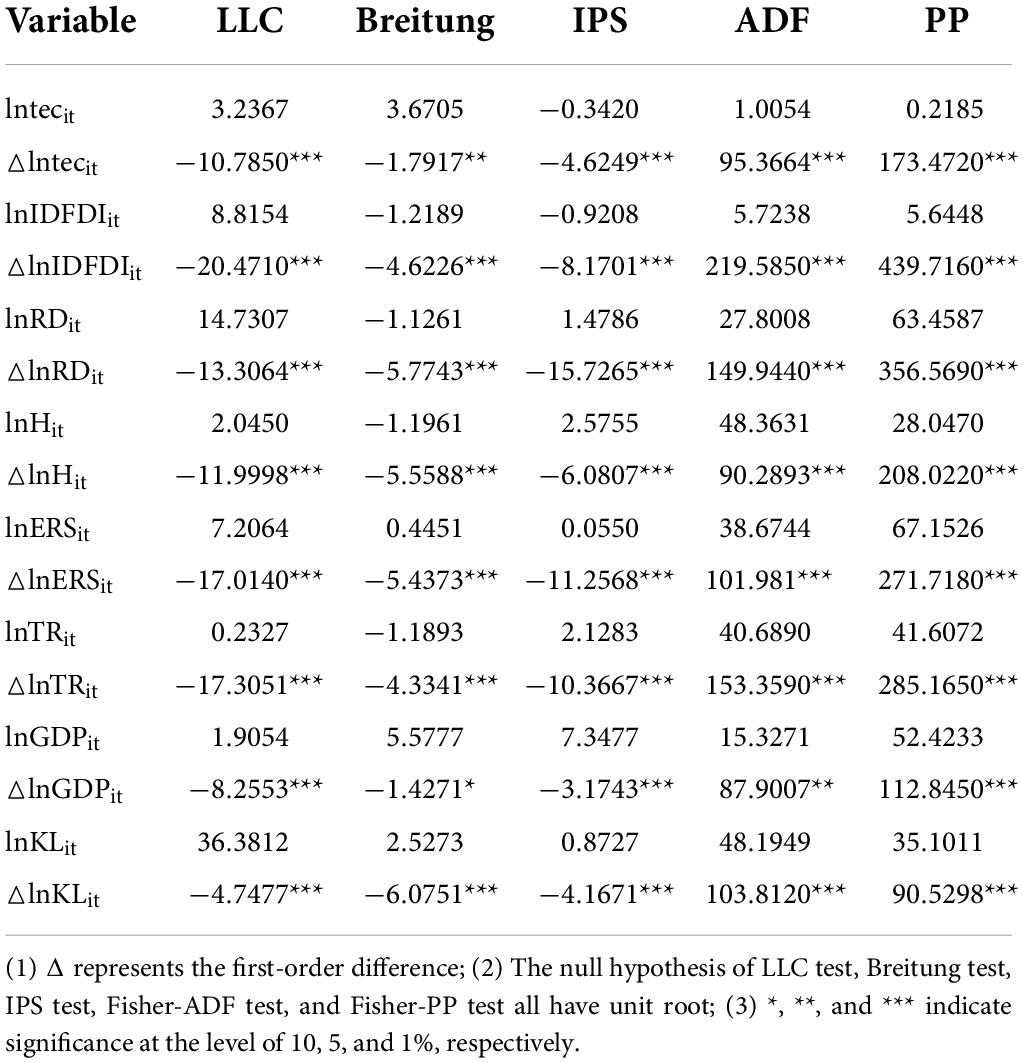

Benchmark regression

Before analysis, this paper first carries out a unit root test on the data, and the results are shown in Table 3. It can be found that all variables are first-order single integer sequences.

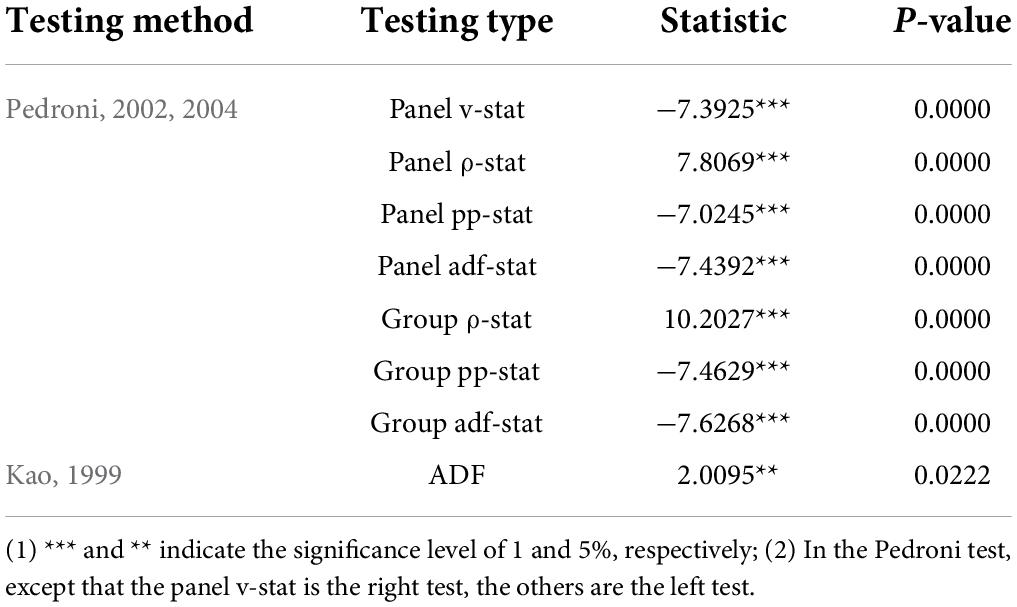

To further study whether there is a long-term relationship between variables, this paper further conducts a cointegration analysis, and the results are shown in Table 4. We find that the test statistics reject the original assumption that “there is no cointegration relationship” at the 5% significance level, and there is a significant cointegration relationship between non-stationary variables.

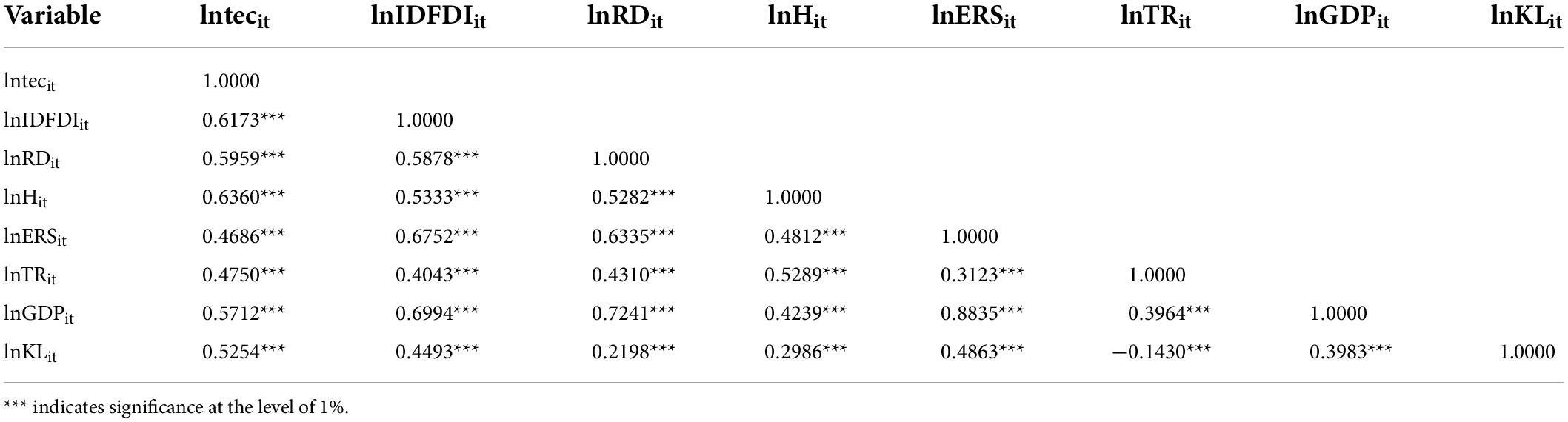

To further investigate the correlation between variables, Table 5 portrays the correlation matrix.

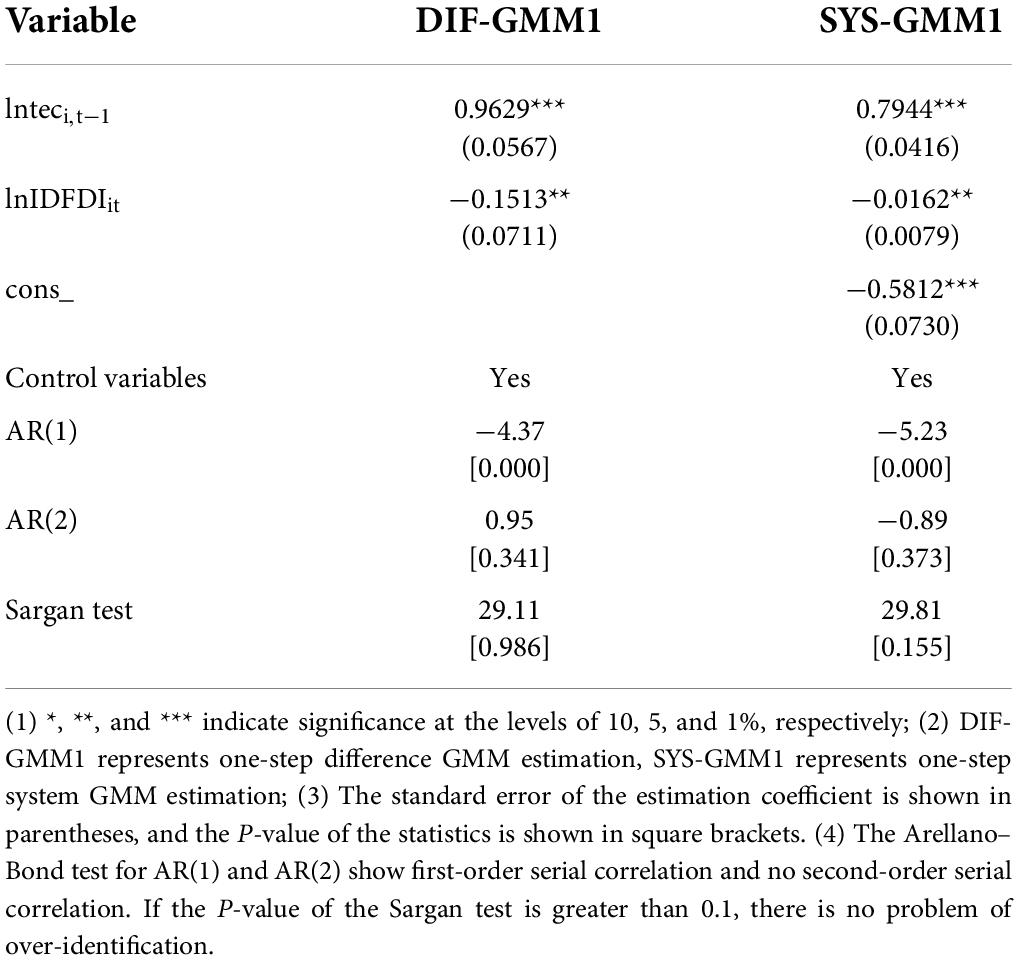

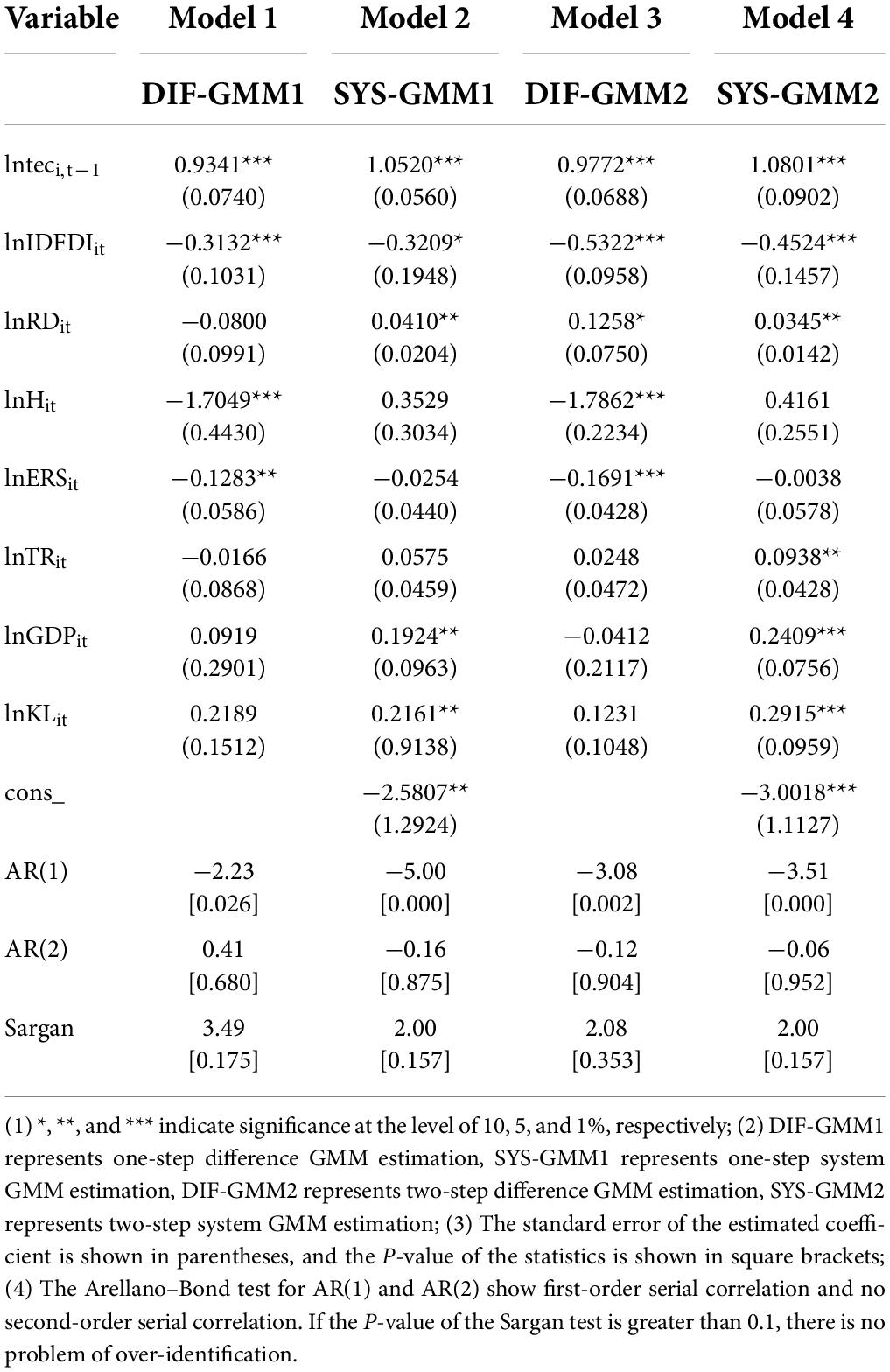

From the results in Table 5, we can see that there is a significant correlation between variables. Therefore, this paper further carries out regression analysis on the data to investigate the degree of interaction between variables. To overcome the possible endogeneity problem of the model, the GMM is used to estimate the model. The generalized moment estimation method can be divided into one-step GMM and two-step GMM (two-step). Under the condition of limited samples, the two-step method estimated the standard deviation existence of downward bias. Considering the limitations of sample data in the case of sub-samples and ensuring the consistency of model estimation, this paper mainly estimates based on the one-step GMM method in the benchmark model and sub-sample regression model. To ensure the robustness of the results, two-step GMM estimation results are given in the benchmark regression at the same time. The results are shown in Table 6.

Table 6. Environmental technology effects of two-way foreign direct investment (FDI) interactive development.

It can be seen from the regression results that, first, the impact of environmental technology on the current environmental technology is positive and all of them have passed the test at the level of 1%, indicating that the progress of environmental technology has a certain cumulative nature.

Second, the degree of two-way FDI interaction will inhibit the progress of China’s environmental technology. The reasons are as follows: First of all, the IFDI introduced by China in the past are mainly resource-seeking, rather than technical IFDI, and resource-seeking IFDI are mainly marginal industries that fail to meet the environmental regulation standards of their home countries. These foreign-funded enterprises are bound to bring a lot of energy consumption while putting China’s environment into production as a cheap factor. In the case of a clear definition of property rights, pollution emissions need a certain cost. Therefore, in the case of competition between enterprises, foreign enterprises are unlikely to transfer their core environmental technology to the host country. Second, China’s goal of OFDI technology acquisition is not clear, and the goal of investing in developing countries is still to access natural resources and use their cheap labor to occupy the market, which leads to less significant technology spillover effects. At the same time, the theory of appropriate technology shows that some advanced technologies in developed countries are mostly tailored to them, and their technology spillover effects only affect countries or regions with similar technologies (Li and Jin, 2011). Therefore, when the technology gap between China and host countries is too large, its OFDI to developed countries cannot play a positive role. Therefore, in this long-term extensive growth model, the degree of interaction between IFDI and OFDI is very limited, which inhibits China’s environmental and technological progress.

Third, from other control variables: The impact of R&D on environmental technology is positive, indicating that the improvement of R&D investment will promote the progress of environmental technology. The impact of human capital on environmental technological progress is negative. This may be due to the dislocation of human resource allocation caused by the expansion of college enrollment and the high-educated labor enters a position that can be filled by low-educated labor, thereby inhibiting the progress of environmental technology (Wang and Hu, 2013). Environmental regulation will restrain the progress of environmental technology in the region (Lin and Xu, 2019), the reason is that the rise of environmental regulation increases the cost of emission reduction, so it will inhibit the enterprise environmental technology. The degree of regional trade openness will promote environmental technological progress (Jin et al., 2019). The increase in regional economic development level will promote the improvement of environmental technology. Factor intensity will promote regional environmental technological progress, indicating that the higher the degree of the capital intensity of enterprises, the more conducive to promoting enterprise environmental technological innovation; this conclusion is consistent with Wan, who holds that capital deepening is conducive to promoting the progress of green technology level and technical efficiency of the industry (Wan and Zhu, 2013).

Heterogeneity analysis

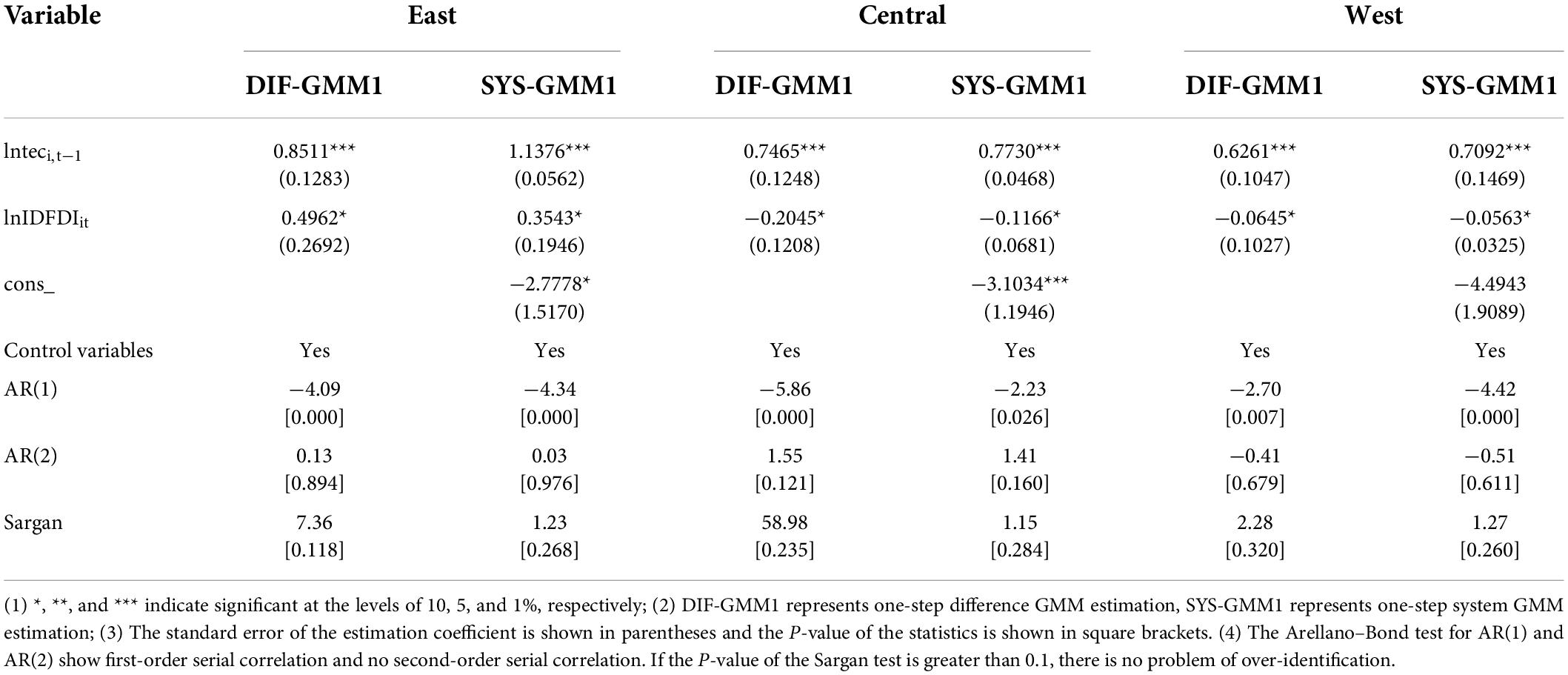

Regional heterogeneity analysis

Since there are great differences in the energy structure, economic development level, and the degree of two-way FDI interaction development in various provinces, cities, and autonomous regions of China, a single examination of the environmental and technological effects of two-way FDI interaction development from a national perspective may ignore the heterogeneity between regions. According to the characteristics, there are great differences in the coordinated development degree of two-way FDI and environmental technology among the eastern, central, and western regions of China. The environmental technology of Beijing, Shanghai, Tianjin, Guangdong, Hainan, and other regions in the eastern region is much higher than that of other regions. Therefore, to investigate the differences in the impact of the coordinated development of two-way FDI in eastern, central, and western regions on environmental technology, this paper further divides China into three regions: East, Central, and West, and estimates the model by systematic GMM method, as shown in Table 7.

Table 7. Environmental technology effects of two-way foreign direct investment (FDI) interactive development in the subregion.

According to the regression results in Table 6, it can be found that, first of all, the influence of environmental technology in the delayed phase on the current environmental technology is positive, but this positive effect is the largest in the eastern region, the second in the central region, and the smallest in the western region. This may be related to the level of regional economic development and its own environmental technology.

Second, the interactive development of two-way FDI only has a significant positive effect on the environmental technology in the eastern region. Every 1% increase in the interactive development of two-way FDI will promote 0.3543–0.4962% increase in the regional environmental technology level. The reason is that the scale of IFDI and OFDI in the eastern region is relatively large, and some industries in the eastern region gradually shift to the central and western regions. For example, IFDI in Beijing, Shanghai, Jiangsu, Zhejiang, Guangdong, and other places in the eastern region exceeded $15 billion in 2017, and the amount of OFDI traffic is also far higher than that in the central and western regions. The eastern region pays more attention to high-quality regional economic development and tends to introduce green and high-tech IFDI. At the same time, OFDI has greater initiative. From the perspective of technological innovation incentives, the level of human resources (In 2017, the human capital index of Beijing, Tianjin, Shanghai, Zhejiang, and other places in the eastern region all exceeded 10, much higher than some regions in the central and western regions.) and R&D capabilities (In 2017, the R&D investment in Beijing reached 74,123.98 million yuan, that in Shanghai reached 32,048.62 million yuan, and that in Jiangsu reached 16,456.58 million yuan. In the central region, Hubei is only 8,194.65 million yuan and Hunan is only 3,180.66 million yuan. Qinghai in the western region is only 292.48 million yuan, Ningxia is only 234.33 million yuan, and Xinjiang is only 973.43 million yuan) in the eastern region are relatively high, and it has a high degree of marketization, which can make better use of the cutting-edge technologies that OFDI can access for secondary innovation. Therefore, in the process of “going out,” the eastern region is more inclined to develop technology-seeking OFDI. This high-quality development of IFDI and OFDI will promote each other, and ultimately form the role of interactive development of IFDI and OFDI to effectively promote regional environmental technology progress.

Third, the impact of lnIDFDIit on the environmental technology in the central and western regions is significantly negative. For every 1% increase in lnIDFDIit, the environmental technology level in the central region decreases by 0.1166–0.2045%, and the environmental technology level in the western region decreases by 0.0563–0.0645%. The reason is that, on one hand, China’s central and western regions not only undertake the industrial transfer of the eastern region but also introduce IFDI based on resource-seeking (Yue et al., 2022). These enterprises are not conducive to the progress of environmental technology. On the other hand, due to the low level of regional economic development, the scale of OFDI is relatively small, and the flow to the region is mainly to develop countries, which is not conducive to the progress of regional environmental technology. Therefore, lnIDFDIit in the central and western regions will inhibit the progress of regional environmental technology.

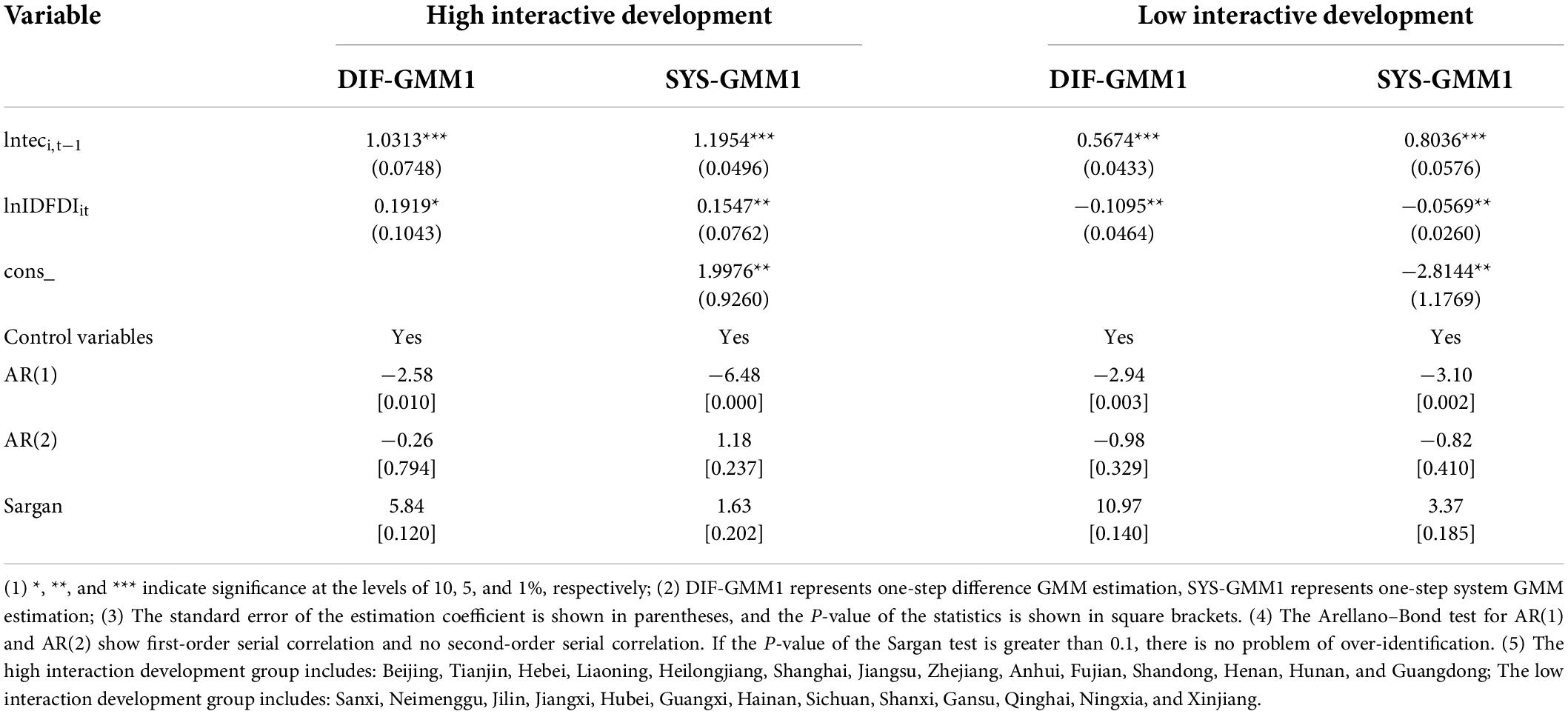

Heterogeneity analysis of score interactive development degree

It can be seen from the data characteristics that the regions with relatively low coordinated development of two-way FDI are mainly the central and western regions, which may be related to the regional location, economic development level, openness, and other factors. Then, is there a big difference in the impact of the coordination degree of two-way FDI on environmental technology? To systematically analyze the impact of different two-way FDI interactive development degrees on environmental technology, this paper further classifies 30 provinces and cities in China into high-interactive development degree group and low-interactive development degree group. If the average two-way FDI interactive development degree is higher than the overall average of two-way interactive development degree in China, the region is divided into high-interactive development degree groups and vice versa, and the regression results are shown in Table 8.

Table 8. Heterogeneity analysis of the development degree of two-way foreign direct investment (FDI) interaction.

The regression results in Table 4 show that, first of all, the delayed phase of environmental technology will promote the current high interactive development area of environmental technology. Because of this, the economic level of the two-way FDI high interactive development area is relatively high, and the economic development level determines the regional environmental technology to a certain extent. Second, the promotion effect of two-way FDI interaction development on regional environmental technology only occurs in areas with a high degree of interactive development. At this time, the degree of two-way FDI interaction development increases by 1% point, and the regional environmental technology will rise by 0.1547–0.1919% points. For the low interactive development area, the degree of two-way FDI interaction development will significantly inhibit the regional environmental technology and passed the test at the significant level of 5%. The reason is that in areas with a high degree of two-way FDI interaction development, the scale and structure of its IFDI and OFDI are relatively reasonable. It will promote the rise of environmental technology.

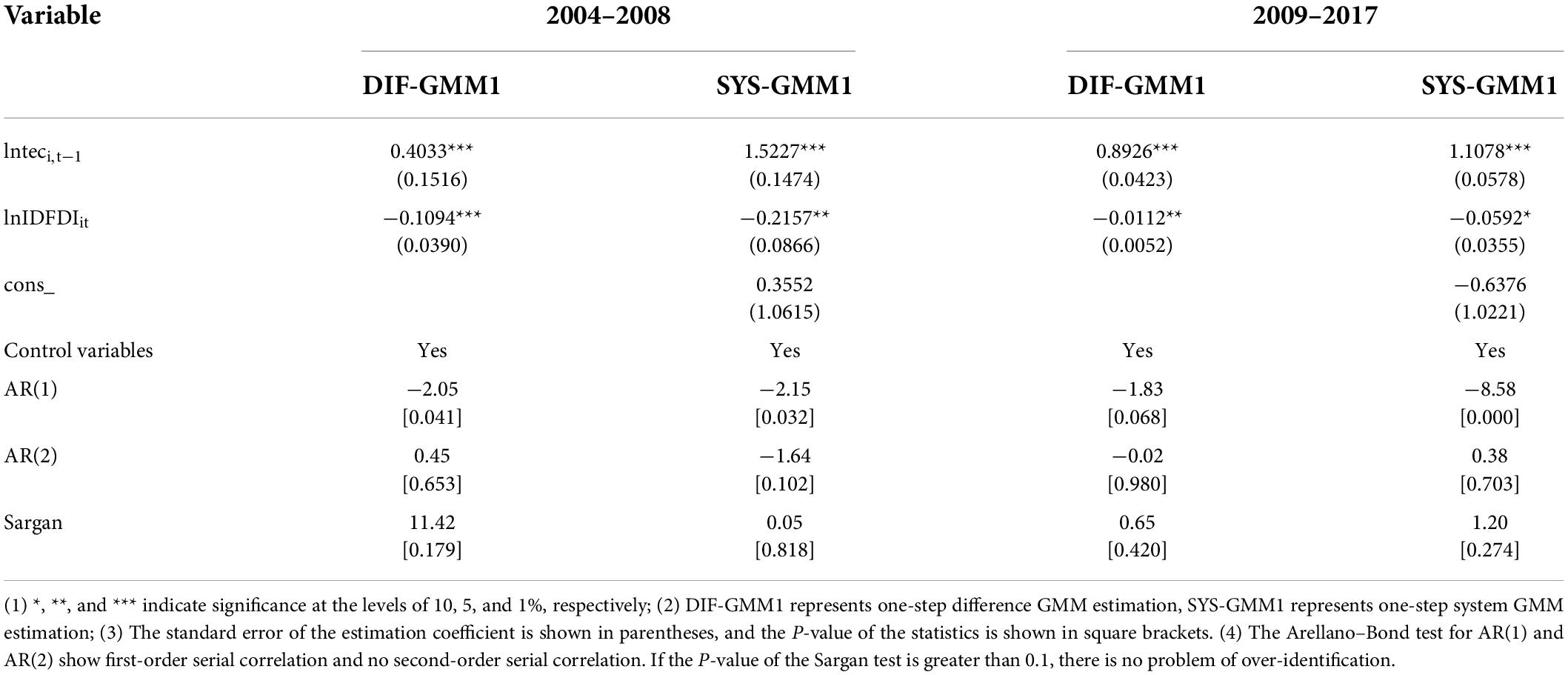

Phased heterogeneity test

In fact, the 2008 financial crisis had a great impact on the global economy, and China is no exception. The financial crisis has not only had a great impact on China’s economy but also on China’s IFDI and OFDI as an open country. Then, is there a big difference between the impact of two-way FDI interactive development on environmental technology before 2008 and after 2008? To systematically analyze whether there are differences in the impact of two-way FDI interactive development level on China’s environmental technology in different stages, this paper takes the 2008 financial crisis as the time node. The impact of two-way FDI interactive development on China’s environmental technology in 2004 to 2008 and 2009 to 2017 is investigated. The results are shown in Table 9.

Table 9. Environmental technology effects of phased two-way foreign direct investment (FDI) interactive development.

Table 8 shows that China’s two-way FDI interactive development level has inhibited environmental technology during 2004–2008, and passed the test at a significant level of 5%. At this point, for every one percentage point increase in the level of two-way FDI coordinated development, it will lead to a decrease of 0.1094–0.2157% points in environmental technology in the region. Between 2009 and 2017, China’s level of two-way FDI interaction increased by one percentage point, It will lead to a decrease of 0.0112–0.0592% points in regional environmental technology. It shows that, during the sample period, China’s two-way FDI interactive development level of environmental technology gradually decreased. The reason is that, in recent years, on the basis of increased IFDI and OFDI, keeping adjusting the IFDI and OFDI structures effectively promotes the level of interaction between the two and finally promote the reduction of its negative impact on environmental technology.

Robustness test

To verify the robustness of the results in Table 5, this paper uses IFDI stock and OFDI stock to replace IFDI flow and OFDI flow variables, recalculates the degree of interactive development of two-way FDI in various regions, and carries out regression analysis. The results are shown in Table 9. It can be found that the coefficient size, symbol, and significance level of the variables do not change significantly. Therefore, the regression results in Table 10 are considered to be robust.

Conclusion and policy recommendations

Based on the data of 30 provinces, cities, and autonomous regions in China from 2004 to 2017, this paper empirically tests the influence of two-way FDI interactive development level on the progress of environmental technology and analyzes the heterogeneity from the angles of the region, degree of interactive development, time stage, and so on. First, the interactive development of two-way FDI in China inhibits the progress of regional environmental technology. Second, from the perspective of regional heterogeneity, the development of two-way FDI interaction promotes the environmental technology in the eastern region but inhibits the environmental technology in the central and western regions. Third, from the heterogeneity of the degree of development of two-way FDI interaction, the interactive development of two-way FDI will promote the environmental technology in highly interactive development areas but will inhibit the environmental technology in low interactive development areas. Fourth, from the point of view of stage heterogeneity, with the increasing degree of development of two-way FDI interaction in China, the inhibitory effect of two-way FDI interaction development on regional environmental technology has decreased.

Although this study has drawn rich conclusion, it also has certain limitations. Limited by the availability of data, the empirical analysis data used in this study is panel data from 30 provinces and cities in China. If data on prefecture-level cities or double-digit industry data in China can be further collected, this study will be more targeted. Therefore, if we can break through the limitation of data availability in future, we can conduct further in-depth research on China’s prefecture-level city data or specific industry data, which will help formulate more specific policy recommendations, and this research can also be used as an effective reference.

In summary, this paper puts forward the following policy recommendations: Strengthen the level of interactive development between two-way FDI. On the IFDI side, we should make clear the purpose of attracting investment, focus on introducing foreign capital with high technology level, and pay attention to the spillover effect of IFDI environmental technology, so as to slow down the emission reduction cost of domestic enterprises and improve their competitiveness, thus promoting their OFDI. On the OFDI side, we should focus on multi-oriented investment motivation, pay attention to mutual benefit and win-win with the host country, promote the progress of environmental technology in the home country through reverse technology spillover effect, and enhance the overall economic strength of the home country. Then, introduce more high-tech IFDI to form a benign interaction between IFDI and OFDI, and ultimately promote environmental technology.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MG designed the study, analyzed the data, and wrote the manuscript. ZY collected the data and coordinated the data analysis. Both authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the grants from National Natural Science Foundation of China (Grant 72104189).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ai, H., Deng, Z., and Yang, X. (2015). The effect estimation and channel testing of the technological progress on China’s regional environmental performance. Ecol. Indic. 51, 67–78. doi: 10.1016/j.ecolind.2014.09.039

Barro, R. J., and Lee, J. W. (1993). International comparisons of educational attainment. J. Monetary Econ. 32, 363–394. doi: 10.1016/0304-3932(93)90023-9

Buckley, P. J. (2018). Internalisation theory and outward direct investment by emerging market multinationals. Manag. Int. Rev. 58, 195–224. doi: 10.1007/s11575-017-0320-4

Chen, V. Z., Li, J., and Shapiro, D. M. (2012). International reverse spillover effects on parent firms: Evidences from emerging-market MNEs in developed markets. Eur. Manag. J. 30, 204–218. doi: 10.1016/j.emj.2012.03.005

Cheng, C., and Yang, M. (2017). Enhancing performance of cross-border mergers and acquisitions in developed markets: The role of business ties and technological innovation capability. J. Bus. Res. 81, 107–117. doi: 10.1016/j.jbusres.2017.08.019

Cozza, C., Rabellotti, R., and Sanfilippo, M. (2015). The impact of outward FDI on the performance of Chinese firms. China Econ. Rev. 36, 42–57. doi: 10.1016/j.chieco.2015.08.008

Demena, B. A., and Afesorgbor, S. K. (2020). The effect of FDI on environmental emissions: Evidence from a meta-analysis. Energy. Policy 138:111192. doi: 10.1016/j.enpol.2019.111192

Dong, Y., Shao, S., and Zhang, Y. (2019). Does FDI have energy-saving spillover effect in China? A perspective of energy-biased technical change. J. Clean. Prod. 234, 436–450. doi: 10.1016/j.jclepro.2019.06.133

Dunning, J. (1981). Explaining the international direct investment position of countries: Towards a dynamic or developmental approach. Rev. World Econ. 117, 30–64. doi: 10.1007/BF02696577

Ganda, F. (2019). The impact of innovation and technology investments on carbon emissions in selected organisation for economic Co-operation and development countries. J. Clean. Prod. 217, 469–483. doi: 10.1016/j.jclepro.2019.01.235

Gong, M., and Liu, H. (2020). Coordinated development of China’s two-way FDI, industrial structure evolution and environmental pollution. J. Int. Trade 110–124.

Gong, M., Liu, H., and Jiang, X. (2019). How does two-way FDI of China industrial sectors affect the total emission reduction efficiency. Ind. Econ. Res. 114–126.

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110, 353–377. doi: 10.2307/2118443

He, J. (2006). Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 60, 228–245. doi: 10.1016/j.ecolecon.2005.12.008

Huang, L., Liu, D., and Xie, H. (2018). Research on the harmonious of outward foreign direct investment and inward foreign direct investment. China Ind. Econ. 80–97.

Irandoust, M. (2016). The renewable energy-growth nexus with carbon emissions and technological innovation: Evidence from the Nordic countries. Ecol. Indic. 69, 118–125. doi: 10.1016/j.ecolind.2016.03.051

Jaunky, V. C. (2011). The CO2 emissions-income nexus: Evidence from rich countries. Energy Policy 39, 1228–1240. doi: 10.1016/j.enpol.2010.11.050

Jiao, J., Jiang, G., and Yang, R. (2018). Impact of R&D technology spillovers on carbon emissions between China’s regions. Struct. Change Econ. D 47, 35–45. doi: 10.1016/j.strueco.2018.07.002

Jin, W., Zhang, H., Liu, S., and Zhang, H. (2019). Technological innovation, environmental regulation, and green total factor efficiency of industrial water resources. J. Clean. Prod. 211, 61–69. doi: 10.1016/j.jclepro.2018.11.172

Kao, C. (1999). Spurious regression and residual-based tests for cointegration in panel data. J. Econom. 90, 1–44. doi: 10.1016/S0304-4076(98)00023-2

Li, J., Li, P., and Wang, B. (2016). Do cross-border acquisitions create value? Evidence from overseas acquisitions by Chinese firms. Int. Bus. Rev. 25, 471–483. doi: 10.1016/j.ibusrev.2015.08.003

Li, M., and Jin, Z. (2011). R&D, absorption capacity and reverse technology spillover of foreign direct investment: An empirical study based on interprovincial panel data in China. Int. Trade Issues 124–136.

Li, Q., Zhao, Y., Li, S., and Zhang, L. (2021). Spatial-temporal characteristics of the coupling coordination of social security and economic development in China during 2002-2018. Reg. Sustain. 2, 116–129. doi: 10.1016/j.regsus.2021.04.001

Lin, B., and Xu, M. (2019). Exploring the green total factor productivity of China’s metallurgical industry under carbon tax: A perspective on factor. J. Clean. Prod. 233, 1322–1333. doi: 10.1016/j.jclepro.2019.06.137

Muhammad, B., and Khan, S. (2019). Effect of bilateral FDI, energy consumption, CO2 emission and capital on economic growth of Asia countries. Energy Rep. 5, 1305–1315. doi: 10.1016/j.egyr.2019.09.004

Narula, R., and Marin, A. (2003). FDI spillovers, absorptive capacities and human capital development: Evidence from Argentina. Res. Memo. 10, 199–218.

Pedroni, P. (2002). Critical values for cointegration tests in heterogeneous panels. Oxf. B Econ. Stat. 61, 653–670. doi: 10.1111/1468-0084.61.s1.14

Pedroni, P. (2004). Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Economet. Theor. 20, 597–625. doi: 10.1017/S0266466604203073

Piperopoulos, P., Wu, J., and Wang, C. (2018). Outward FDI, location choices and innovation performance of emerging market enterprises. Res. Policy 47, 232–240. doi: 10.1016/j.respol.2017.11.001

Qiu, S., Wang, Z., and Geng, S. (2021). How do environmental regulation and foreign investment behavior affect green productivity growth in the industrial sector? An empirical test based on Chinese provincial panel data. J. Environ. Manage. 287:112282. doi: 10.1016/j.jenvman.2021.112282

Song, M., and Wang, S. (2013). Analysis of environmental regulation, technological progression and economic growth from the perspective of statistical tests. Econ. Res. J. 48, 122–134.

Wan, L., and Zhu, Q. (2013). The impact of R&D inputs on industrial green TFP growth-from empirical data from China’s industry for 1999 to 2010. Econ. Dev. 20–26.

Wang, S., and Hu, Z. (2013). Study on productivity effect of service industry two-way FDI–panel threshold model estimation based on human capital. Financ. Res. 39, 90–101.

Yang, S., Chen, K., and Huang, T. (2013). Outward foreign direct investment and technical efficiency: Evidence from Taiwan’s manufacturing firms. J. Asian Econ. 27, 7–17. doi: 10.1016/j.asieco.2013.04.007

Yang, Z., Shao, S., Yang, L., and Liu, J. (2016). Differentiated effects of diversified technological sources on energy-saving technological progress: Empirical evidence from China’s industrial sectors. Renew. Sust. Energ. Rev. 72, 1379–1388. doi: 10.1016/j.rser.2016.11.072

Yao, S., Wang, P., Zhang, J., and Ou, J. (2016). Dynamic relationship between China’s inward and outward foreign direct investments. China Econ. Rev. 40, 54–70. doi: 10.1016/j.chieco.2016.05.005

Yu, D., Li, X., Yu, J., and Li, H. (2021). The impact of the spatial agglomeration of foreign direct investment on green total factor productivity of Chinese cities. J. Environ. Manage. 290:112666. doi: 10.1016/j.jenvman.2021.112666

Yuan, B., and Xiang, Q. (2018). Environmental regulation, industrial innovation and green development of Chinese manufacturing: Based on an extended CDM model. J. Clean. Prod. 176, 895–908. doi: 10.1016/j.jclepro.2017.12.034

Yue, L., Miao, J., Ahmad, F., Draz, M., Guan, F., Chandio, A., et al. (2022). Investigating the role of international industrial transfer and technology spillovers on industrial land production efficiency: Fresh evidence based on directional distance functions for Chinese provinces. J. Clean. Prod. 340:130814. doi: 10.1016/j.jclepro.2022.130814

Zhang, Y., and Jiang, D. (2013a). FDI, environmental regulation and energy consumption: An empirical test based on energy intensity decomposition. J. World Econ. 36, 103–123.

Zhang, Y., and Jiang, D. (2013b). FDI, government regulation and industrial air pollution: An empirical test based on the decomposition of industry structure and technological progress. J. Inter. Trade 102–118.

Zhang, Y., and Jiang, D. (2014). FDI, government regulation and the water pollution in China–an empirical test based on the decomposition of industry structure and technological progress. China. Econ. Q. 13, 491–514.

Zhou, Y., Jiang, J., Ye, B., and Hou, B. (2019). Green spillovers of outward foreign direct investment on home countries: Evidence from China’s province-level data. J. Clean. Prod. 215, 829–844. doi: 10.1016/j.jclepro.2019.01.042

Zhu, H., Duan, L., Guo, Y., and Yu, K. (2016). The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: Evidence from panel quantile regression. Econ. Model. 58, 237–248. doi: 10.1016/j.econmod.2016.05.003

Keywords: inward foreign direct investment, outward foreign direct investment, two-way FDI interactive development, environmental technology, heterogeneity

Citation: Gong M and You Z (2022) Environmental technology effect of two-way foreign direct investment interactive development in China. Front. Ecol. Evol. 10:954614. doi: 10.3389/fevo.2022.954614

Received: 27 May 2022; Accepted: 18 July 2022;

Published: 08 August 2022.

Edited by:

Xander Wang, University of Prince Edward Island, CanadaReviewed by:

Kevin Zhang, Illinois State University, United StatesJiajia Zheng, Henan University, China

Copyright © 2022 Gong and You. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhe You, eW91emhlQHdpdC5lZHUuY24=

Mengqi Gong

Mengqi Gong Zhe You

Zhe You