Corrigendum: Does climate change affect enterprises' ability to sell their products?

- 1College of Economics and Management, China Three Gorges University, Yichang, China

- 2School of Accountancy, Hubei University of Economics, Wuhan, China

- 3School of Economics and Management, Wuhan University, Wuhan, China

- 4Department of Finance, Shenzhen Ji Yatou Biotechnology Co., Ltd., Shenzhen, China

Based on local cities’ climate change data and the operating income data of Chinese listed enterprises from 2008 to 2019, we study the impact of climate change on enterprises’ sales ability and analyze its subsequent influence on their sales revenue from three dimensions: inside enterprises, the supply side and the demand side. The results show that climate change reduces enterprises’ sales revenue. From enterprises’ internal perspective, climate change reduces production efficiency, increases management costs and the impact on the cost of sales is not obvious. From the demand side, climate change increases business risks and reduces transactions between large customers and enterprises. The share of sales from large customers is reduced, but no obvious impact is observed for small customers. On the supply side, climate change reduces business credit levels, which in turn reduces sales revenue. A heterogeneity analysis shows that the impact of climate change on sales revenue is more obvious in private enterprises, enterprises with weak internal controls and enterprises in central and western regions of China.

Introduction

Two important problems are currently affecting our climate. First, the global average temperature is increasing annually. Second, extreme weather is becoming increasingly common and the frequency of heat waves in some regions has more than doubled and is expected to increase nearly five times in the next 50 years (Lau and Nath, 2012). Thus, climate change is one of the important challenges facing the world today with a significant socio-economic impact on peoples’ lives (Pankratz et al., 2019). Humans live in a warming natural environment; hence, global warming is the most prominent feature of climate change. Increasingly severe global warming and related patterns seriously threaten human development. In 2018, the United Nations Intergovernmental Panel on Climate Change (IPCC) released the Special Report on Global Warming of 1.5°C, which attracted great attention from governments, experts and the public. Positive measures have been taken worldwide to cope with climate change risks, such as the 2016 Paris Agreement signed by 178 contracting parties, which outlines unified actions for all countries to take in addressing global climate change.

In addition, the Blue Book on Climate Change in China 2021 observed that China is one of the most sensitive and significant areas affected by global climate change. Hence, the Chinese government has promulgated a double strategy to meet two carbon targets: that is, the ‘carbon peak’ and ‘carbon neutral’ targets. It is challenging for Chinese enterprises to meet the mandatory ‘double carbon’ global climate risk target; however, the target also provides opportunities. Therefore, achieving high-quality development and improving the security of people’s livelihood, in addition to maintaining carbon peak and carbon neutral simultaneously, has become an important problem worldwide. Accordingly, the impact of climate change at the microenterprise level also requires in-depth research.

Some scholars have discussed the macroeconomic effects of climate change, such as the effect of the increase in average temperature on agriculture (Schlenker et al., 2005; Schlenker and Roberts, 2009; Zhang et al., 2017), industrial output or economic growth (Dell et al., 2012), health or mortality (Heutel et al., 2021), international trade (Jones and Olken, 2010), labor or total factor productivity (Letta and Tol, 2019; Patle et al., 2020), and have found that all factors have a negative impact. However, few have considered the impact of climate change on microenterprises’ economic activities. Climate change has brought many levels of risk to countries and enterprises, including physical risk (e.g., the Zhengzhou flood disaster, severe storms, droughts and extremely high temperatures). Government policies related to climate change have been established (e.g., expected energy efficiency standards, carbon trading schemes and the double carbon policy) in addition to regulatory risks (e.g., green reputation, changing consumer behavior and increasing humanitarian needs). These differing risks have significant impacts on enterprises’ daily business activities, such as procurement, production, sales and value chain creation, which are further affect enterprises’ overall competitiveness.

Growth in operating income shows that the scale of the enterprise is expanding, which can more effectively reflect the senior executives’ operational behavior and is the starting point of all enterprises’ business activities (Dechow and Dichev, 2002). Unlike profit, operating income is not easily manipulated and the index of operating income is often more dependable. In enterprise valuation, the price-to-sales ratio is more objective than the price-to-earnings ratio (Du and Ping, 2005). Climate change affects enterprises’ production and operational activities; therefore, it is likely to also cause fluctuations in enterprises’ sales revenue. Using factory-level data from American enterprises, however, Addoum et al. (2020) did not find that extreme high temperatures were related to factory productivity and sales income. Addoum et al. (2020) speculated that this was because enterprises in developed countries have easy access to enough resources to withstand temperature changes. As the largest developing country in the world, China has a relatively tight energy supply compared with Western developed countries and enterprises have relatively limited access to cheap resources. Does climate change impact Chinese enterprises’ sales ability? This is the core problem of our paper.

First, climate change generally affects the productivity and production time of employees in production and sales departments, which subsequently affects their enterprises’ production and sales capacity. The occurrence of extreme climate events further increases the uncertainty of enterprises’ internal and external environment, including their operational risk, which subsequently reduces their sales ability. Second, due to increasingly severe climate change, local governments in China tend to adopt market-distorting policies and measures because of the external pressure from the central government to reduce emissions and their governors’ motivation to pursue promotion, such as supplying electricity at different times during extreme temperatures, forced power rationing and implementing differentiated electricity prices. These actions increase enterprises’ production and management costs, affect enterprises’ production efficiency and reduces their sales ability. Third, if customers realize that the regions where enterprises are based are at greater risk of climate change, they will reduce their purchase quantities and purchase products from enterprises in regions with a lower risk of climate change, which will directly affect enterprises’ product sales ability. Therefore, it is theoretically possible to study the impact of climate change on enterprises’ sales ability.

Climate change occurs in the natural environment, which is generally an external consideration for enterprises. Managers cannot control the time and place of climate change, which avoids the issue of reverse causality problems. In addition, climate change and extreme weather events are random and complex; therefore, they are very difficult for enterprises to predict. Enterprises cannot easily change their production location in anticipation of climate change because of the high cost of moving. As a result, most enterprises passively accept climate shocks and reduce their underestimation of the impact of climate risk following relocation. Hence, we can explore the relationship between climate change and enterprises’ sales ability by empirical method and draw the corresponding conclusions.

Based on local cities’ climate change data and the operating income data of Chinese listed enterprises from 2008 to 2019, we study the impact of climate change on enterprises’ sales ability and its subsequent influence on their sales revenue from three dimensions: inside enterprises, the supply side and the demand side. The results show that climate change reduces enterprises’ sales revenue. From the internal perspective of enterprises, climate change reduces production efficiency, increases management costs and the impact on the cost of sales is not obvious. From the demand side, climate change increases business risks, reduces transactions between large customers and enterprises and reduces the share of sales from large customers but has no obvious impact on small customers. On the supply side, climate change reduces business credit levels, which in turn reduces sales revenue. A heterogeneity analysis shows that the impact of climate change on sales revenue is more obvious in private enterprises, enterprises with weak internal controls and enterprises in central and western regions of China.

This paper contributes to the literature in the following aspects. (1) Enterprises’ uncertainty risks were previously mainly focused on the institutional or market environment. Following the literature on China’s capital market, we find that climate risks, as an important aspect of business risks, also affect enterprises’ micro-business behavior. (2) We break through the traditional framework of economic policy and enterprise systems to show that the climate change has a significant impact on enterprises’ sales ability. This finding not only deepens our understanding of enterprises’ decision-making about climate risk, but also enriches the product marketing literature. (3) Climate change studies have been mainly conducted at the macro level; however, we expand research on the economic impact of climate change to the microenterprise level. Huang et al. (2018) empirically observed the impact of climate change on enterprises’ financing choices and found that the vendor–customer channel facilitates enterprises’ product sales ability, which verifies the transmission mechanism of climate change affecting product sales ability. This finding not only deepens our theoretical understanding of the economic consequences of climate change at the micro level, but also provides the necessary theoretical basis and experiential reference for reducing enterprises’ overall risk.

In the following section, the results of our literature review are presented, in addition to a discussion of our proposed hypothesis. The research design is outlined in the third section, while the empirical results are given in the fourth section. The mechanism analysis and heterogeneity analysis are discussed in the fifth section. Finally, the sixth section presents our conclusions and suggestions.

Literature review and hypothesis

Economic consequences of climate change

Multiple economic consequences of climate change have been explored in the literature. Climate can have a negative impact on the macro economy. For example, Nordhaus (2006) showed that climate was one of the key variables to explain the differences in per capita income between Africa and richer parts of the world. In addition, temperature is one of the main measures of climate change. Dell et al. (2009) found that countries with higher average temperature had lower per capita income level and growth rate. Hsiang (2010) studied 28 Caribbean Basin countries and observed that high temperatures had a negative impact on economic output and labor productivity, and the impact on non-agricultural industries was higher than that on agricultural industries. Dell et al. (2012) also found that per capita income in developing countries dropped by 1.4 percentage points for every 1°C increase in average temperature. Bansal and Ochoa (2011) illustrated the negative impact of temperature on economic and stock market growth, where the impact on low latitude countries was greater than that in high latitude countries. In 2018, the IPCC issued the Special Report on Global Warming of 1.5°C, which noted that the increasing global average temperature and sustained climate change will have a negative impact on economic activity and output. Burke et al. (2015) estimated that continuous global warming may reduce the world’s average income by 23% by 2100. In addition, Thamotheram (2015) showed that global stock portfolios would lose 5–20% of their value if the temperature increased by ≥4°C.

Climate change and enterprises’ sales ability

The growth of operating income often means the expansion of the scale of the enterprise, which can more effectively reflect the operating conditions of the enterprise, and is the starting point for all business activities of the enterprise (Dechow and Dichev, 2002). Revenue depends on employees who are affected by climate change. In addition, high-temperature weather reduces enterprise investment, productivity, household income and total economic output (Xie, 2017; Traore, 2018; Zhang et al., 2018; Li et al., 2021; Somanathan et al., 2021).

Climate change has a negative impact on enterprises’ internal production and business activities. First, climate change may reduce worker productivity. Employees’ cognitive and physical performance sustain negative effects when affected by extreme temperatures (Pilcher et al., 2002; Seppanen et al., 2006). Both cognitive decline and physical discomfort reduce productivity. Second, extreme temperatures reduce employees’ available working hours compared with comfortable temperatures. Severe weather conditions reduce employees’ productive motivation. In addition, If the working hours remain the same, it is easier for the physical capacity of employees to reach the limit in extreme weather conditions, so that companies have to reduce the number of hours employees work, so climate change will have a persistent negative impact on working hours (Graff Zivin and Neidell, 2014). In a study of Indian enterprises, Somanathan et al. (2021) found that hot weather decreased employees’ productivity and increased their absenteeism rate. Employees are a valuable resource for enterprises; therefore, declines in employee productivity and working hours will affect enterprises’ normal operations and reduce production.

In addition, climate change may force enterprises to place more stringent limits on their energy use. After experiencing increasingly severe ecological problems, the Chinese government has promulgated major strategies, such as constructing an ecological civilization and setting ‘double carbon’ emission reduction targets. To achieve the established emission reduction and energy saving goals, however, local governments must conduct administrative activities, such as rationing power, because of the pressure from the central government to be held accountable during performance appraisals and their governors’ pursuit of promotion.

Considering the dominant high polluting and high energy consumption development model used in the Chinese manufacturing industry, the original intention underlying the ‘double carbon’ targets is to not only introduce green management practices and improve the natural environment but also promote the transformation of development models in ‘dual high’ industries, such as those with high energy consumption and high pollution. However, local governments’ poor decisions tend to have a negative impact on enterprises’ daily production and operations, in addition to local residents’ daily life. In addition to its negative impact on employee productivity and energy supply, climate change increases enterprises’ production and management costs. Mishra and Singh (2010) and Pechan and Eisenack (2014) found that electricity prices (water supply) would increase (decrease) in extremely high temperatures, which would increase enterprises’ production costs. To maintain temperatures in the workplace at an appropriate level during extremely high or low temperatures and reduce the impact on production and operations, enterprises must increase their air-conditioning expenditure, in addition to providing cooling or warming supplies to their production and management departments. Electricity prices may also rise during extreme temperatures, which further increases production and management costs. The higher costs of temperature management reduce enterprises’ cash flow and adversely affect their internal production and operational activities. In short, climate change reduces employee productivity and increases energy consumption, production costs and administrative expenses, which subsequently decreases enterprises’ production and operational capacity and ultimately has a negative impact on their sales ability.

Suppliers’ extension of business credit to enterprises also decreases following climate change because extreme temperatures increase the uncertainty of enterprises’ production and operations compared with normal climate conditions. Thus, climate change damages enterprises’ ability to operate and increases their management risk, which subsequently reduces their bargaining power and commercial credit with their suppliers. If the climate changes drastically, suppliers may consider that they have increased operational risks and subsequently reduce their cash discounts and other credit policies to encourage their buyers to pay in advance. Thus, climate change has a negative impact on enterprises’ suppliers, that is, their procurement business. First, enterprises must pay their suppliers earlier. Second, the suppliers’ discount rates enjoyed by enterprises decrease, which increases enterprises’ production costs and weakens their sales ability. Therefore, climate change reduces enterprises’ sales revenue.

Li et al. (2021) showed that high temperatures have a negative impact on enterprises’ export quantity. First, the inconvenient environmental conditions for transportation induced by climate change have a negative impact on customers’ purchase and payment intentions. During extreme temperatures, customers will reduce their travel and purchase expenditure. These lower purchase intentions will reduce enterprises’ sales income. Moreover, climate change will lead customers stickiness decrease when the customers perceive that enterprises are at great management risk due to the high climate risk. These customers will change their purchase decisions in response to the higher climate risk in the enterprises’ area and avoid purchasing the enterprises’ products, which will reduce these enterprises’ sales revenue.

Second, climate change will also reduce sales department employees’ enthusiasm, which will have a negative impact on their enterprises’ sales. Thus, climate change directly reduces enterprises’ sales revenue by reducing their customers’ purchase intentions and sales employees’ enthusiasm. Hence, climate change indirectly weakens enterprises’ sales ability by reducing their production and operational capacity and the level of commercial credit they can receive, which negatively affects their sales revenue directly by reducing their customers’ purchase intentions and payment ability, in addition to sales employees’ enthusiasm.

Based on the above analysis, we propose the following hypothesis:

H1: Climate change has a negative impact on enterprises’ sales ability.

Climate change is usually quite slow; therefore, its short-term effects may not be directly observed in business operations or the market environment. However, the warming climate further aggravates the risk of extreme weather and climate events (CMA Climate Change Centre, 2021). In addition, China’s climate risk index is rising. In 2020, the global average temperature was 1.2°C higher than the pre-industrial level. Although the development of modern industrial civilization greatly accelerated the rate of climate change, the extent of temperature change is still relatively small and it is difficult for residents and businesses to notice any significant change over time. As noted above, while scholars have extensively documented the economic impacts of climate change at the business level, it remains unknown whether slow climate change significantly affects enterprises’ short-term sales ability.

Moreover, business operators, suppliers and customers may not consider the impact of climate risk (Andersson et al., 2016; Barnett, 2019); therefore, climate change has a very weak impact on enterprises’ short-term production, operations and sales. Even when extreme weather events become more intense, managers may still focus on their short-term financial performance because of the impact on stakeholders (such as customers and employees). Therefore, managers tend to ignore the long-term economic impact at the operating level because it is difficult for climate change to have a severe short-term effect on their business. Managers may not consider the natural environment and do not take measures to deal with climate change risks; therefore, they will not consider the impact of climate risk on their stakeholders (e.g., employees, suppliers, and customers). In addition, managers may not consider the economic consequences of differences in climate risk in different regions in their decision-making practices; therefore, climate risk does not influence enterprises’ sales ability. Thus, we obtain our second hypothesis:

H2: Climate change has no effect on enterprises’ sales ability.

Research design

Sample selection and data sources

Using climate change data from local cities, we select Chinese listed enterprises from 2008 to 2019 as our research sample. We screen the initial sample as follows. First, we exclude financial, special treatment (ST) and particular transfer (PT) enterprises. In the literature, ST refers to enterprises experiencing abnormal financial conditions. PT refers to a special transfer service designed to provide a distribution channel for suspended stocks. Second, to avoid the influence of extreme values on our research conclusions, we reduce all continuous variables by 1% in the upper and lower quartiles. We obtain climate data from the Daily Data Set of China Surface Climatic Data collected from 842 datum and general surface meteorological observation stations operated by the National Meteorological Information Centre. We also obtain other financial data from the China Stock Market and Accounting Research database.

Model design and definition of the main variables

To test the above research hypotheses, we refer to Zhang et al. (2017) in constructing the following empirical model:

where an enterprise’s product sales ability (Lnincome) is the natural logarithm of sales revenue. Detatem is the independent variable for climate change. Climate warming has the biggest impact on the natural ecosystem; therefore, climate change is measured by climate warming (Montzka et al., 2011). Following Deschenes and Greenstone (2007), we use the absolute value of the temperature difference over 3 years as the measurement value. The calculation formula for Detatem is the absolute value of the average temperature of each prefecture-level city in the current year after subtracting the average temperature of the past 3 years (Wang and Chen, 2014).

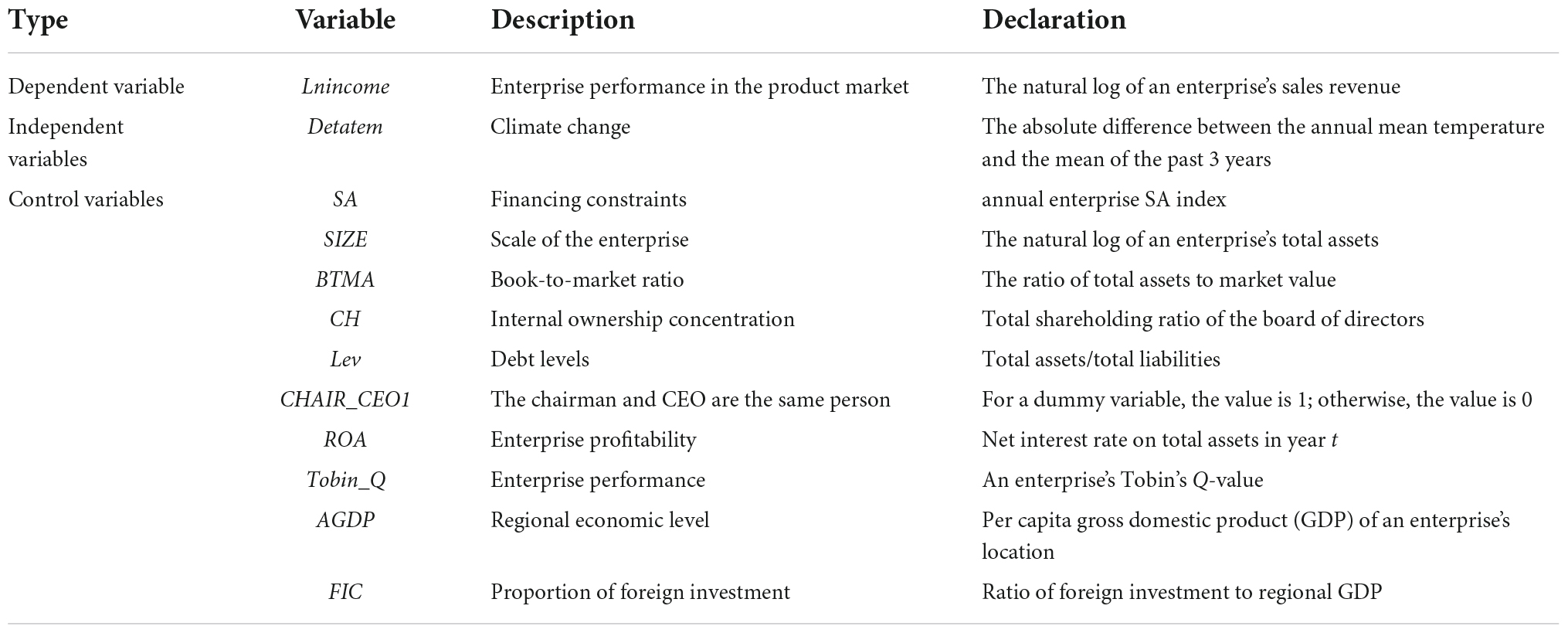

Table 1 reports the variable definitions. At the enterprise level, the control variables include the financing constraints (SA); enterprise size (SIZE), which is measured by the natural logarithm of total assets; book-to-market ratio (BTMA); directors’ shareholding ratio (CH); the debt level of the enterprise (Lev); CHAIR_CEO is set to 1 if the chairman and CEO are the same person, and otherwise 0; return on assets (ROA); Tobin_Q indicates the Tobin’s Q-value of the enterprise. At the regional level, the control variables include regional per capita gross domestic product (AGDP); and the proportion of foreign investment (FIC). In addition, we control for year and industry fixed effects.

Empirical results

Descriptive statistics

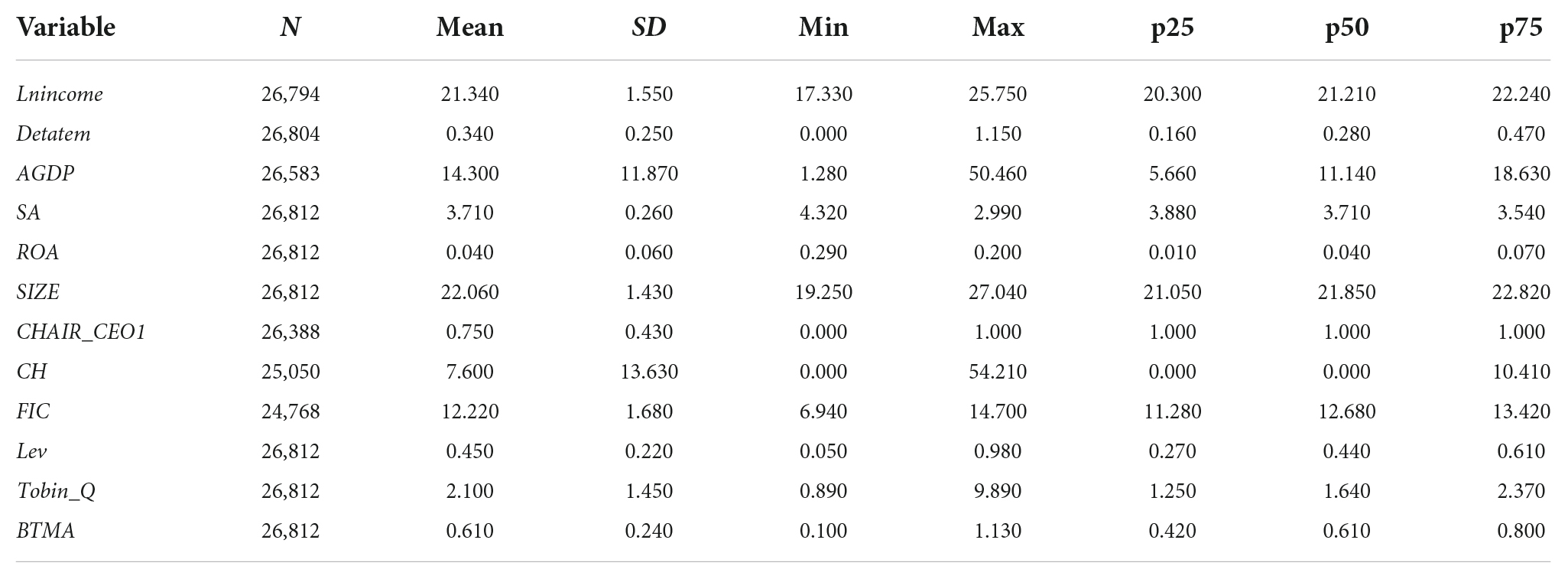

Table 2 reports the descriptive statistics of the variables. From 2008 to 2019, the mean Lnincome is 21.34 and the median is 21.21, indicating that the income of Chinese listed enterprises generally changes over time. The mean value of Detatem is 0.34, which reflects an annual average temperature change of 0.34°C in Chinese cities. The average SA index of Chinese listed enterprises is −3.71, ROA is 4%, Lev is 45% and BTMA is 0.61. About 75% of the enterprises’ chairman and CEO in our sample are the same person.

Correlation analysis

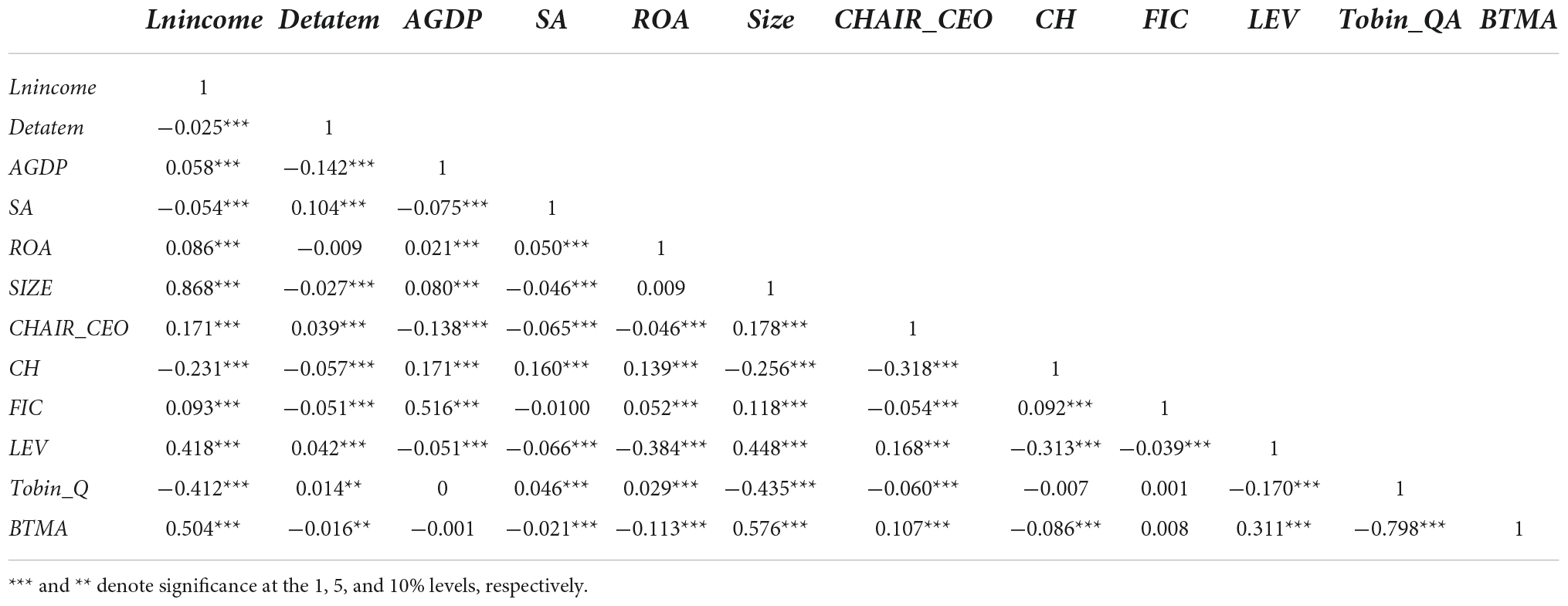

Table 3 presents the correlation coefficient matrix for the main variables. As shown in Table 3, the correlation coefficient between Lnincome and Detatem is significant and negative, indicating that the greater the climate change, the lower the enterprise’s sales income, which preliminarily verifies H1. Considering the control variables at the enterprise level, SA and Tobin_QA are negatively correlated with sales revenue, while ROA, SIZE, Lev, and BTMA are positively correlated with sales revenue. At the regional level, AGDP and FIC are positively correlated with sales revenue.

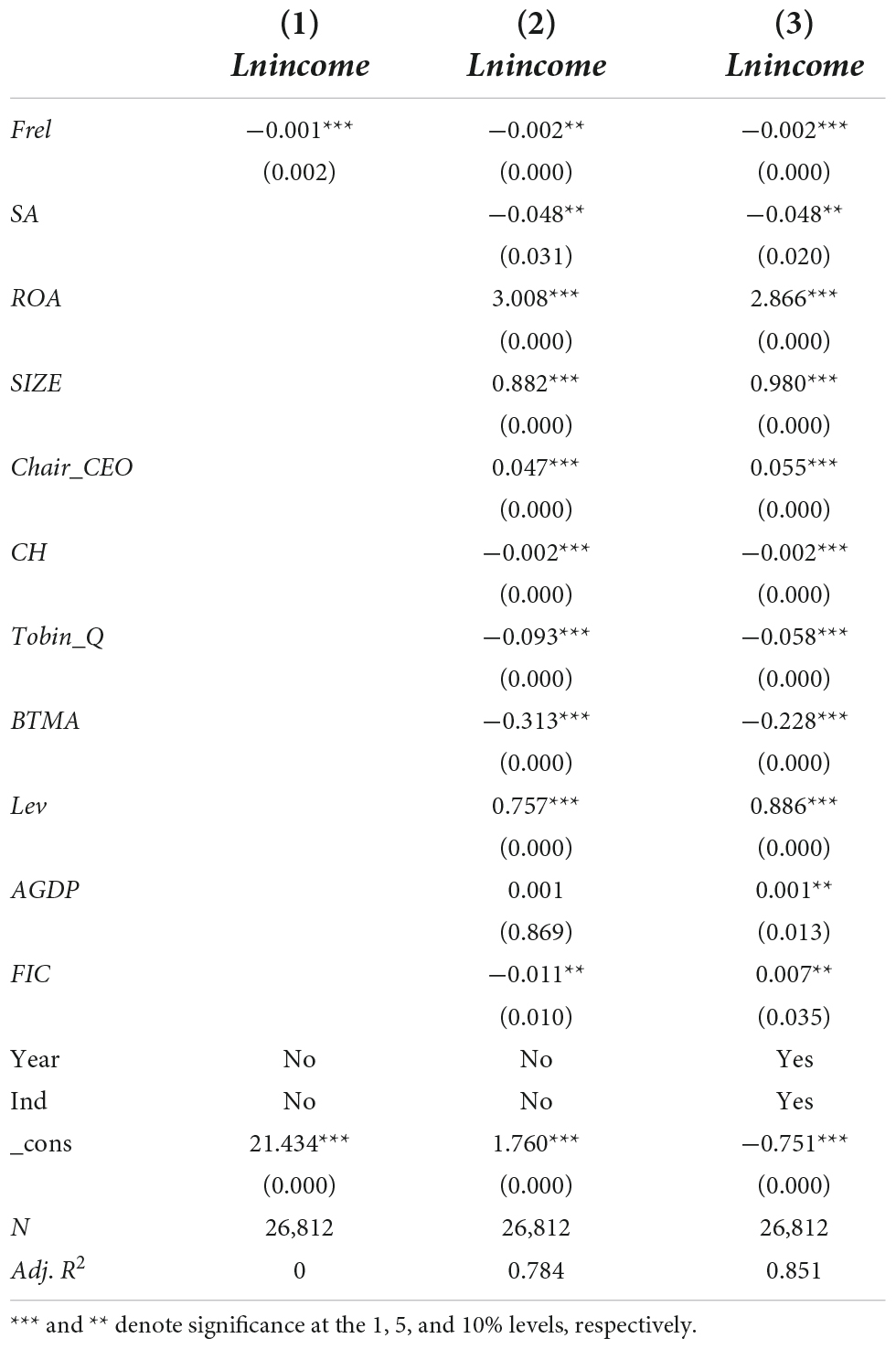

Regression analysis

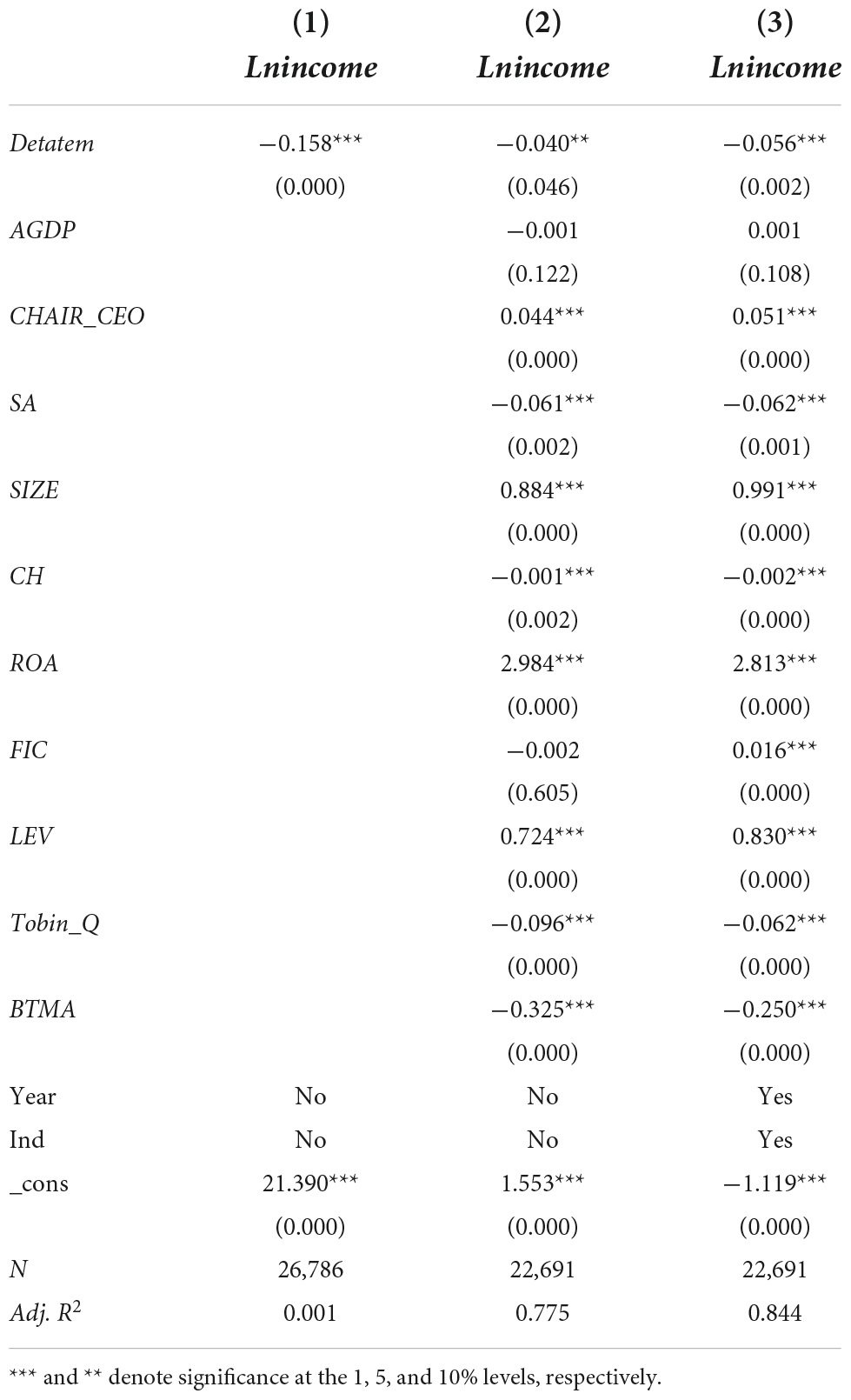

Columns (1) to (3) of Table 4 show the regression results of no control variable, adding control variables but no industry and time fixed effects and all control variables are added. The robust standard errors is in brackets. Detatem has a significant and negative correlation with Lnincome, which indicates that when climate change is more intense and the average temperature changes, enterprises’ sales ability is affected and their sales income decreases with a corresponding deterioration of their product performance in the market. These results support H1. In terms of the control variables, when an enterprise combines two businesses, the smaller the SA index, the larger the size, the lower the shareholding ratio of the board of directors, the higher the profit margin on total assets, the higher the asset–liability ratio and the lower the Tobin’s Q-value or book-to-market ratio, the higher the enterprise’s sales revenue. The sign and significance of the correlation coefficients after controlling for year and industry fixed effects are consistent with these results.

Robustness tests

Alternative measures of climate extremes

Climate change currently causes two major problems for enterprises: an increase in average temperature and the increasing frequency of extreme weather. Therefore, we adopt a new climate change measurement index and use the number of days with extremely low temperatures in the current year in an enterprise’s location (Frel) as the explanatory variable. The control variables and fixed effects in the model remain unchanged to ensure the robustness of the results. Table 5 shows the empirical results, where the coefficient of Frel is significant and negative in Columns (1) to (3), indicating that enterprises’ sales revenue decreases following an increase in extremely low temperatures and worsening climate change.

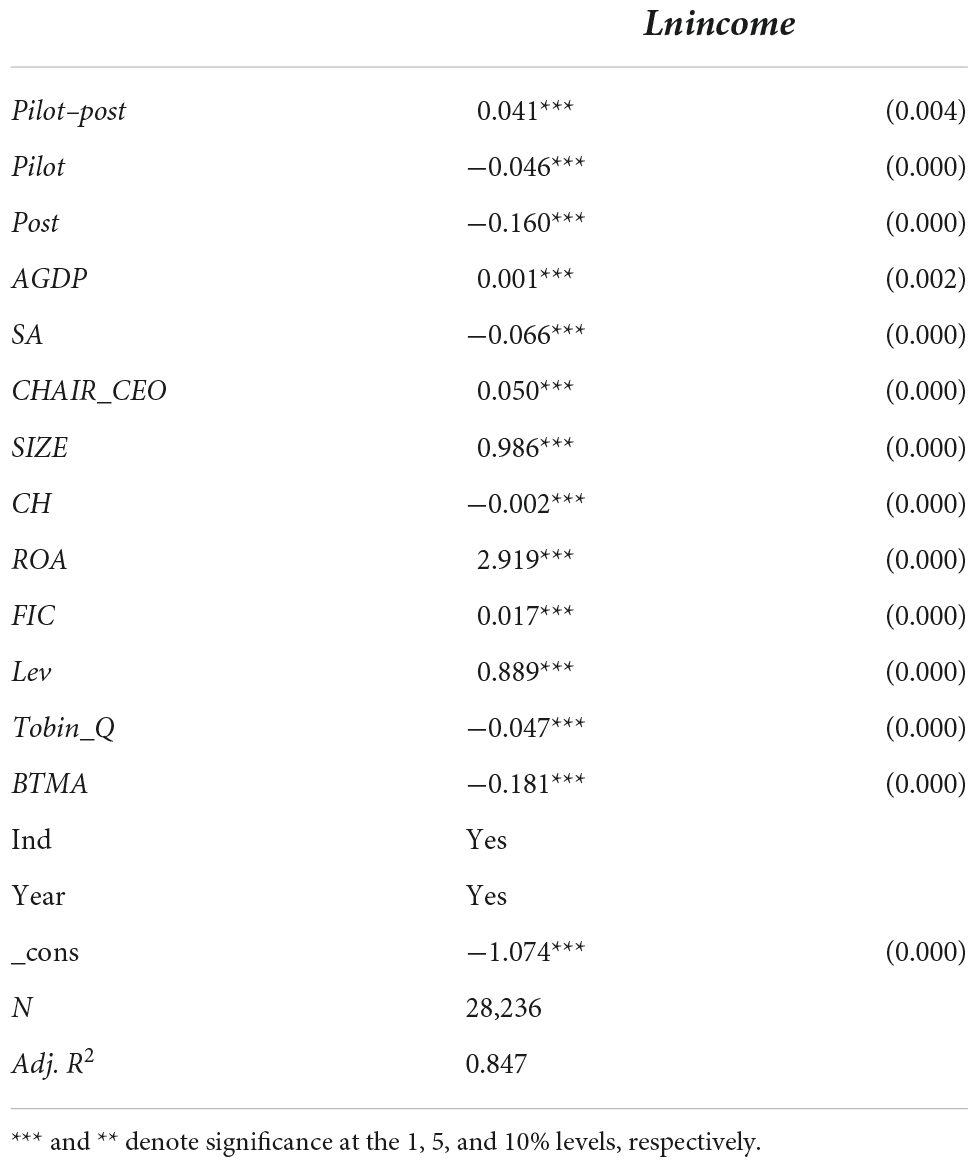

Impact of low-carbon city pilot policy on sales revenue

In 2010, China promulgated a low-carbon city pilot policy to deal with the impact of economic development on the ecological environment. In August 2010, eight cities joined the first batch of national low-carbon pilot cities. In November 2012, the National Development and Reform Commission named 28 low-carbon pilot cities. When waste gas and waste water emissions are strictly restricted, the climate environment is improved in low-carbon pilot cities, which has a positive impact on enterprises’ sales revenue. Hence, we introduce the low-carbon city pilot policy as an exogenous shock in this paper. The value of Pilot is 1 if a city or province is a pilot area for the first two batches of pilot cities and otherwise 0. In addition, Post is a dummy variable before and after the pilot policy. The value of Post is 1 during the low-carbon city pilot period (i.e., after 2012) and 0 during the non-pilot period. Table 6 presents the empirical results.

In Table 6, the coefficient of Pilot-Post which means the interaction term between Pilot and Post is significant and positive, indicating that enterprises’ sales revenue increases with climate improvement in low-carbon cities. The low-carbon pilot cities have effectively restrained climate change and significantly promoted growth in enterprises’ sales revenue. This result supports the conclusion that climate change has a significant and negative correlation with enterprises’ sales ability.

Impact of temperature variation difference on sales revenue

In this paper, we adopt a new climate change measurement index. We use the absolute value of the difference between the average temperatures of the current year and the past 4, 5, and 6 years as explanatory variables (Detatem4, Detatem5, and Detatem6, respectively). To ensure the robustness of the results, the control variables and fixed effects in the model remain unchanged. Table 7 shows the empirical results. In Table 7, Columns (1) to (3) show that regardless of which alternative method is used to measure climate change as the new explanatory variable, the coefficients of Detatem4, Detatem5, and Detatem6 are significant and negative. This indicates that enterprises’ sales ability decreases following the aggravation of climate change, which is consistent with the main regression results.

Mechanism and heterogeneity analyses

Mechanism

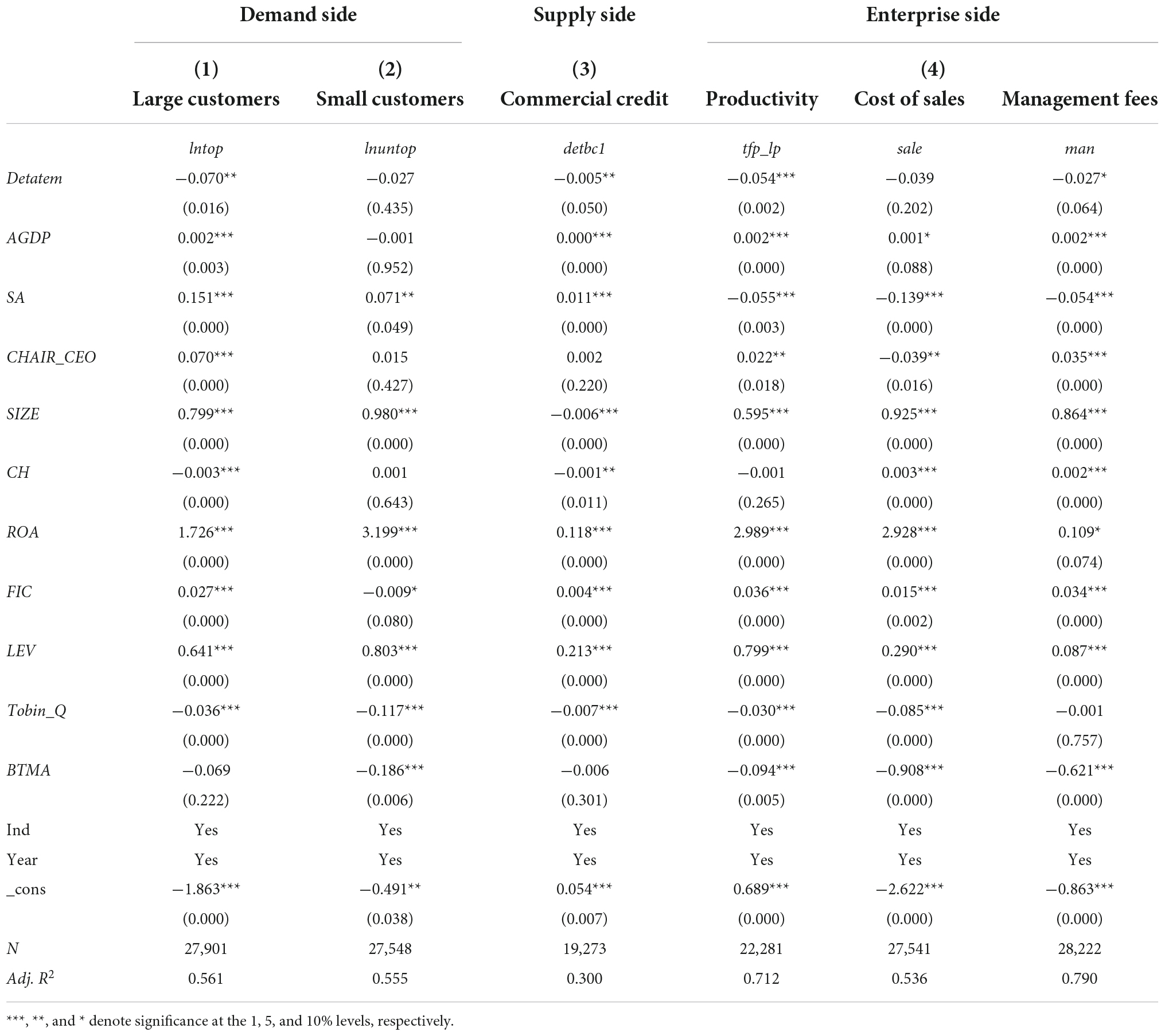

According to the above theoretical analysis, we believe that the higher operational and financial risks caused by climate change reduce enterprises’ production efficiency and credit level, leading to a reduction in enterprises’ sales income. We now focus on the internal mechanism of the impact of climate change on enterprises’ sales revenue using three pathways: namely, enterprise, enterprise demand and enterprise supply.

As shown in the regression results of Table 8, the coefficient of Detatem in Column (1) is significant and negative, while that in Column (2) is negative but not significant. This indicates that the increase in temperature significantly reduces the share of sales from large customers, but has no significant impact on the share of sales from small customers. Increasing temperatures will cause huge business risks for enterprises and affect the transactions between enterprises and their large customers, which reduces the transaction share from large customers in addition to enterprises’ sales revenue.

On the supply side, as shown in Column (3) of Table 8, the coefficient of Detatem is significant and negative, indicating that the increase in temperature significantly reduces enterprises’ level of business credit, affects suppliers’ provision of materials and thus weakens enterprises’ competitiveness in the product market and subsequently reduces their sales revenue.

As shown in Column (4) of Table 8, the coefficient of Detatem is significant and negative from the internal perspective of enterprises, which indicates that increasing temperatures significantly reduce enterprises’ productivity. When the temperature rises, employees’ work efficiency and working hours decrease. Column (4) also shows that climate change significantly increases enterprises’ management and production costs and decreases their production efficiency and sales income.

Heterogeneity analysis

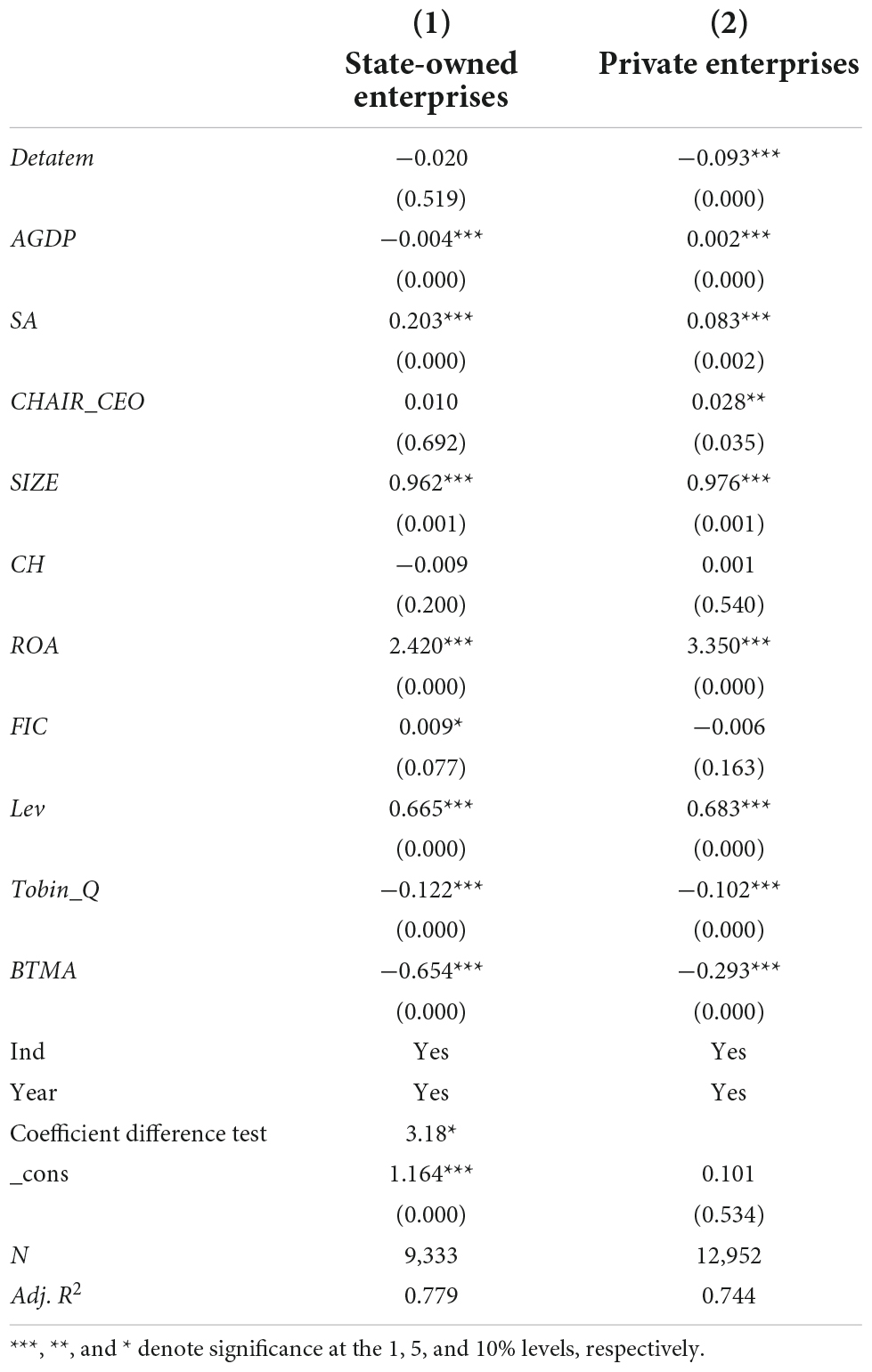

Climate change, ownership nature, and sales revenue

State-owned enterprises usually have important strategic positions and more external resources than private enterprises. In addition, state-owned enterprises’ operating goals are more political than they are economic. When temperatures rise, state-owned enterprises receive more government support and resources than private enterprises do. In addition, their suppliers and customers do not change significantly. Therefore, their sales are likewise not affected significantly. To test this conjecture, we divide the total sample into state-owned enterprises and private enterprises according to their equity and use Model (1) to conduct the respective regression analyses. Table 9 shows the results of the regression analyses.

In Column (2) of Table 9, for private enterprises, the coefficient of Detatem is significant and negative, indicating that climate change has a significant and negative influence on private enterprises’ sales revenue. In contrast, for state-owned enterprises, the coefficient of Detatem is not significant in Column (1), indicating that climate change has no significant influence on state-owned enterprises’ sales revenue. The combined results of Columns (1) and (2) indicate that climate change has a greater impact on the sales ability of private enterprises than on that of state-owned enterprises.

Climate change, regional economy, and sales revenue

Enterprises in more economically developed regions are likely to be less affected by climate change than those in less economically developed regions because they have the resources and capabilities to withstand extreme weather events. At the same time, the ecological environment in central and western China is relatively fragile and the ability to cope with climate change is relatively weak, especially in western China. The ecological environment in the west has a poor congenital foundation and strong external interference. The vulnerability and damage degree of its ecological environment are still in a relatively severe stage. All of these factors magnify the climate risks faced by enterprises in central and western China. Therefore, the negative impact of climate change on enterprises’ sales revenue in central and western China should be greater than that in eastern China.

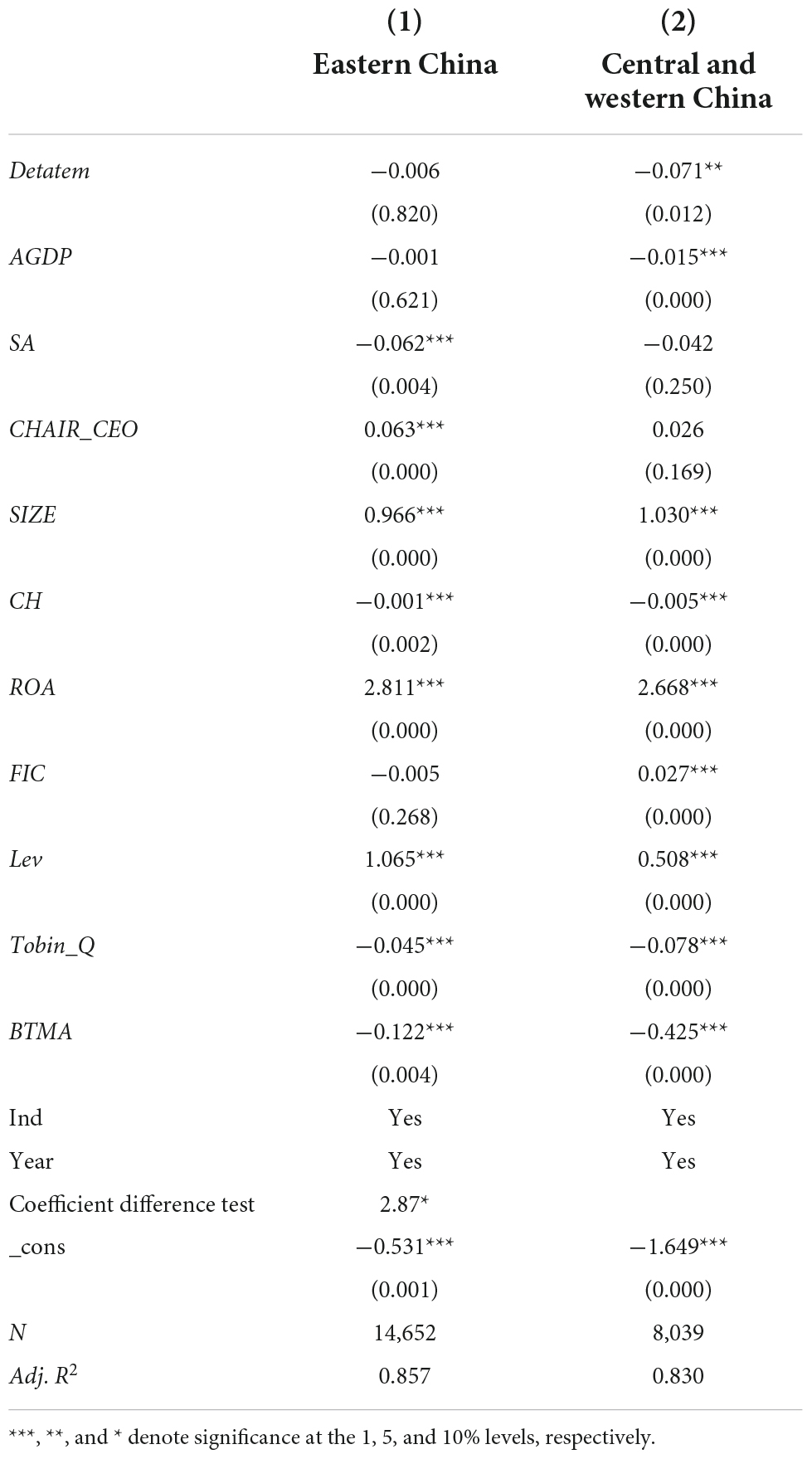

To test this conjecture, we divide the sample into eastern China and central and western China according to local enterprises’ economic situation and use Model (1) to conduct the regression analyses. Table 10 shows the results. The coefficient of Detatem in central and western China is significant and negative, indicating that climate change has a significant and negative impact on enterprises’ sales revenue in central and western China. However, the coefficient of Detatem in eastern China is not significant, indicating that the effect of climate change on enterprises’ sales revenue in eastern China is not significant. The combined results of Columns (1) and (2) in Table 10 show that climate change has a greater impact on enterprises’ sales ability in economically underdeveloped areas than in more economically developed areas.

Climate change, internal controls, and sales revenue

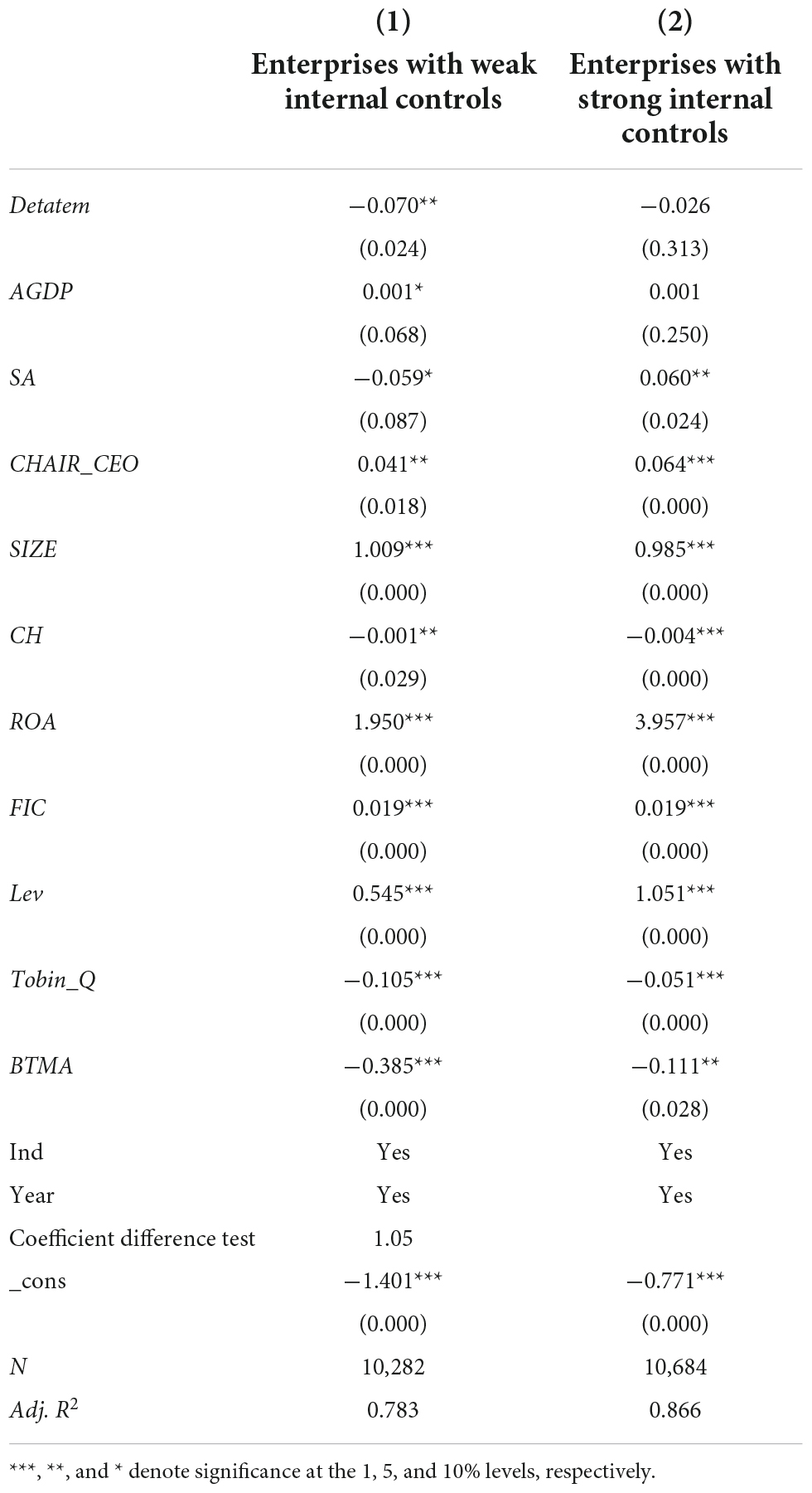

Compared with enterprises with weak internal controls, enterprises with strong internal controls have more timely and effective decision-making feedback and implementation during climate change events. In addition, enterprises’ internal controls enable all employees to participate in corporate governance, which can effectively alleviate their multilayer agency problem and improve operating efficiency. Therefore, climate change may have a stronger impact on the sales revenue of enterprises with weak internal controls than those with strong internal controls. Table 11 shows the empirical regression results. We divide the sample into two groups according to the degree of internal control. In the subsample of enterprises with weak internal controls, the coefficient of Detatem is significant and negative, while that for enterprises with strong internal controls is not significant. The combined results of Columns (1) and (2) show that climate change has a greater negative impact on enterprises with weak internal controls than on enterprises with strong internal controls.

Conclusion and implications

Conclusion

Following the aggravation of climate change and the frequent occurrence of extreme climate events, the impact of climate change has become a critical issue that cannot be ignored in academic and practical circles. Many conclusions have been drawn on the macroeconomic impact of climate change, but there is little discussion of the microeconomic impact of climate change, and empirical research at the enterprise level is still in its infancy. China is currently the world’s largest industrial country; thus, it is pursuing carbon peak and carbon neutral policies vigorously. These ‘double carbon’ targets help China to transform its economy toward green and sustainable development and promote the construction of a beautiful China and global climate governance. These efforts fully demonstrate that China is deeply involved in the fight against global climate change. Maintaining ecological security and achieving green development is currently a challenging socio-economic consensus globally. In China, it is difficult to achieve a balance between environmental governance and economic operations, in addition to simultaneously promoting carbon emission reduction targets and economic transformation processes, especially in combination with China’s strategic task of high-quality economic development and construction of an ecological civilization. Therefore, this paper provides important findings for the literature on the economic impact of climate change on microenterprises.

We use Chinese listed enterprises from 2008 to 2019 as a sample and conduct an empirical study controlling for industry and time fixed effects in the model. We find that climate change has a significant and negative impact on enterprises’ sales ability. We use difference-in-differences and variable substitution to demonstrate the robustness of our research findings. Furthermore, the mechanism of the impact of climate change on enterprises’ sales ability is analyzed from three dimensions: that is, inside enterprises, the demand side and the supply side. We also find that climate change has a greater impact on private enterprises than on state-owned enterprises. In addition, the impact of climate change on enterprises in less developed areas is greater than that in developed areas. Finally, the impact of climate change on enterprises with weak internal controls is greater than for enterprises with strong internal controls.

Implications

As one of the countries with the largest variety, intensity and frequency of climate disasters in the world, China faces a particularly prominent risk of climate change. Climate change may affect China’s ecological environment, economic development, national security, and even society stability. China is facing challenges in addressing climate change and has made many efforts to control it. When determining major national strategies and overall layout of the construction of ecological civilization, China has taken carbon peaking and carbon neutrality into account and promote the “dual carbon” work in all areas of society. On the one hand, China has gradually reduced coal consumption and actively promoted the transformation of its energy structure. By 2020, China’s share of coal in energy consumption has fallen from nearly 70% in 2012 to 57%. On the other hand, China has launched online trading in the carbon market, which has played an optimal role in the allocation of energy resources. In the same year, the Ministry of Ecology and Environment of the People’s Republic of China promulgated the ‘Administrative Measures for Carbon Emissions Trading’ (Trial Implementation), officially launching China’s carbon market. Physical risks such as climate change (e.g., floods, droughts, severe storms, and extreme heat), policy changes and regulatory changes (e.g., corporate reputation), changes in consumer behavior and increased humanitarian needs will affect businesses, such as procurement, production, sales and more. Due to the randomness and complexity of climate change, companies are basically unable to avoid risk by predicting climate change, and can only passively accept climate change. In the long run, the comprehensive competitiveness is bound to be affected. Based on the above analysis, we made the following recommendations from the perspective of enterprise, society, and government.

Recommendations from the enterprise perspective

First, raising the awareness of climate change among managers. Enterprises should strengthen the training of managers on climate change, so that they can understand climate change issues and how to deal with relevant risk. Senior managers should establish a high degree of climate risk awareness and improve climate change response capabilities.

Second, improving the level of internal control of the enterprises. Climate change has adversely impacted the sales capacity of enterprises by affecting demand-side, supply-side and internal production and operation activities. Enterprises should improve the quality of internal control to reduce the adverse impact of climate change on enterprise sales.

Third, improving the technical level and establish emission reduction plans that balance the interest of enterprise and climate change risk. The enterprise should pay attention to relevant policies to address climate change at the national and even international levels. Under the guidance of macro climate change measures, adopt new production models (e.g., research and development of low-carbon technologies in the production process, purchasing applicable low-carbon production technologies, etc.) and operating methods (e.g., expanding green industrial chains, integrating emerging low-carbon technologies markets etc.). Enterprise should optimize their production and operation structure, reduce production costs, and improve their comprehensive competitiveness.

Recommendations from social perspective

First, raising the awareness of Chinese residents on climate change issues. Propaganda related to climate change can be strengthened by printing brochures and setting up relevant websites. Residents should also actively participate in climate change governance and pay attention to climate change issues.

Second, improving the observation capability and meteorological service level of climate change. The meteorological department needs to continuously improve the meteorological monitoring technology, provide more real, reliable and applicable meteorological data, and actively cooperate with local enterprises to develop new meteorological services (e.g., early warning of climate disasters, etc.) for them and provide effective support for them to cope with climate change.

Recommendations from government perspective

First, the government should improve the response mechanism to climate change and the rescue mechanism for enterprises under climate disasters, and coordinate the promotion of economic development and green governance. Local government needs to build a comprehensive climate change response mechanism as well as climate disaster prevention and control mechanism. They should strive to act in respond quickly before or at the early stage of meteorological disasters caused by climate change, and take necessary measures to minimize the impact to local enterprises and society. Local government in areas with high climate risk and economically underdeveloped areas should strengthen their awareness of green governance, establish the concept of green development, and establish climate change response mechanism.

Second, strengthening the awareness of cooperation, promoting interregional cooperation to cope with climate change. We find that the sales ability of enterprises in developed regions is less affected by climate change. On this basis, the developed areas can form a supporting mechanism with underdeveloped areas to strengthen cooperation and exchange between regional governments and provide resources and technologies to underdeveloped areas to deal with climate change. Only in this way can they maintain their own green development advantages while improving the ability of underdeveloped areas to cope with climate change.

Third, continue to promote and improve policies and actions related to carbon emission reduction. We confirm that low-carbon city pilots have a positive effect on reducing the economic impact of climate change, indicating that the “double carbon” goal is not only a major strategy for the construction of ecological civilization, but also a practical need to meet the demand of green development. Carbon Peak Action can reduce the adverse impact of carbon emission on residents’ daily life and natural environment, have a long-term positive impact on business operation. It can boost the comprehensive green transformation of economic and social development, provide a Chinese solution for achieving high-quality economic development and global green governance.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/supplementary material.

Author contributions

SY: conceptualization, methodology, and software. CC: data curation and writing—original draft preparation. SZ: visualization and investigation. PY: supervision and writing—reviewing and editing. All authors contributed to the article and approved the submitted version.

Funding

This study was supported by National Social Sciences Foundation of China “Research on the Causes and Effects of Fluctuations in Global Value Chain Participation and China’s Control Countermeasures” (21CJY015).

Conflict of interest

PY was employed by Shenzhen Ji Yatou Biotechnology Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Addoum, J. M., Ng, D. T., and Ortiz-Bobea, A. (2020). Temperature shocks and establishment sales. Rev. Financ. Stud. 33, 1331–1366. doi: 10.1093/rfs/hhz126

Andersson, M., Bolton, P., and Samama, F. (2016). Hedging climate risk. Financ. Anal. J. 72, 13–32. doi: 10.2469/faj.v72.n3.4

Bansal, R., and Ochoa, M. (2011). Temperature, aggregate risk, and expected returns. Cambridge, MA: National Bureau of Economic Research. doi: 10.2139/ssrn.1572654

Barnett, J. (2019). Global environmental change I: Climate resilient peace? Prog. Hum. Geogr. 43, 927–936. doi: 10.1177/0309132518798077

Burke, M., Hsiang, S. M., and Miguel, E. (2015). Global non-linear effect of temperature on economic production. Nature 527, 235–239. doi: 10.1038/nature15725

CMA Climate Change Centre (2021). Blue Book on Climate Change in China (2021). Beijing: Science Press.

Dechow, P. M., and Dichev, I. D. (2002). The quality of accruals and earnings: The role of accrual estimation errors. Account. Rev. 77, 35–59. doi: 10.2308/accr.2002.77.s-1.35

Dell, M., Jones, B. F., and Olken, B. A. (2009). Temperature and income: Reconciling new cross-sectional and panel estimates. Am. Econ. Rev. Pap. Proc. 99, 198–204. doi: 10.1257/aer.99.2.198

Dell, M., Jones, B. F., and Olken, B. A. (2012). Temperature shocks and economic growth: Evidence from the last half century. Am. Econ. J. 4, 66–95. doi: 10.1257/mac.4.3.66

Deschenes, O., and Greenstone, M. (2007). The economic impacts of climate change: Evidence from agricultural output and random fluctuations in weather: Reply. Am. Econ. Rev. 97, 354–385. doi: 10.1257/aer.97.1.354

Du, H., and Ping, S. (2005). The Positive Analysis of Using P/S Ratio in A Share Market. J. Central Univ. Financ. Econ. 2005:4.

Graff Zivin, J., and Neidell, M. (2014). Temperature and the allocation of time: Implications for climate change. J. Labor Econ. 32, 1–26. doi: 10.1086/671766

Heutel, G., Miller, N. H., and Molitor, D. (2021). Adaptation and the mortality effects of temperature across US climate regions. Rev. Econ. Stat. 103, 740–753. doi: 10.1162/rest_a_00936

Hsiang, S. (2010). Temperatures and cyclones strongly associated with economic production in the Caribbean and Central America. Proc. Natl. Acad. Sci. U.S.A. 107, 15367–15372. doi: 10.1073/pnas.1009510107

Huang, H. H., Kerstein, J., and Wang, C. (2018). The impact of climate risk on firm performance and financing choices: An international comparison. J. Int. Bus. Stud. 49, 633–656. doi: 10.1057/s41267-017-0125-5

Jones, B. F., and Olken, B. A. (2010). Climate shocks and exports. Am. Econ. Rev. 100, 454–459. doi: 10.1257/aer.100.2.454

Lau, N.-C., and Nath, M. J. (2012). A model study of heat waves over North America: Meteorological aspects and projections for the twenty-first century. J. Clim. 25, 4761–4784. doi: 10.1175/JCLI-D-11-00575.1

Letta, M., and Tol, R. S. J. (2019). Weather, climate and total factor productivity. Environ. Resour. Econ. 73, 283–305. doi: 10.1007/s10640-018-0262-8

Li, C., Cong, J., and Yin, L. (2021). Extreme heat and exports: evidence from Chinese exporters. China Econ. Rev. 66:101593. doi: 10.1016/j.chieco.2021.101593

Mishra, A. K., and Singh, V. P. (2010). A review of drought concepts. J. Hydrol. 391, 202–216. doi: 10.1016/j.jhydrol.2010.07.012

Montzka, S. A., Dlugokencky, E. J., and Butler, J. H. (2011). Non-CO2 greenhouse gases and climate change. Nature 476, 43–50. doi: 10.1038/nature10322

Nordhaus, W. D. (2006). Geography and macroeconomics: new data and new findings. Proc. Natl. Acad. Sci. U.S.A. 103, 3510–3517. doi: 10.1073/pnas.0509842103

Pankratz, N., Bauer, R., and Derwall, J. (2019). Climate Change, Firm Performance, and Investor Surprises. Maastricht: Maastricht University. doi: 10.2139/ssrn.3443146

Patle, G. T., Kumar, M., and Khanna, M. (2020). Climate-smart water technologies for sustainable agriculture: A review. J. Water Clim. Change 11, 1455–1466. doi: 10.2166/wcc.2019.257

Pechan, A., and Eisenack, K. (2014). The impact of heat waves on electricity spot markets. Energy Econ. 43, 63–71. doi: 10.1016/j.eneco.2014.02.006

Pilcher, J. J., Nadler, E., and Busch, C. (2002). Effects of hot and cold temperature exposure on performance: A meta-analytic review. Ergonomics 45, 682–698. doi: 10.1080/00140130210158419

Schlenker, W., Hanemann, W. M., and Fisher, A. C. (2005). Will US agriculture really benefit from global warming? Accounting for irrigation in the hedonic approach. Am. Econ. Rev. 95, 395–406. doi: 10.1257/0002828053828455

Schlenker, W., and Roberts, M. J. (2009). Nonlinear temperature effects indicate severe damages to US crop yields under climate change. Proc. Natl. Acad. Sci. U.S.A. 106, 15594–15598. doi: 10.1073/pnas.0906865106

Seppanen, O., Fisk, W. J., and Lei, Q. H. (2006). “Effect of temperature on task performance in office environment,” in Proceedings of the 5th International Conference on Cold Climate Heating, Ventilating and Air Conditioning, Berkeley, CA.

Somanathan, E., Somanathan, R., Sudarshan, A., and Tewari, M. (2021). The impact of temperature on productivity and labor supply: evidence from Indian manufacturing. J. Polit. Econ. 129, 1797–1827. doi: 10.1086/713733

Thamotheram, R. (2015). The case for forceful stewardship (Part 1): The financial risk from global warming. New York, NY: Social Science Electronic Publishing.

Traore, N. (2018). “Temperatures, productivity, and firm competitiveness in developing countries: evidence from Africa,” in Paper presented at the Agricultural and Applied Economics Association, Washington, DC.

Wang, H., and Chen, Q. (2014). Impact of climate change heating and cooling energy use in buildings in the United States. Energy Build. 82, 428–436. doi: 10.1016/j.enbuild.2014.07.034

Xie, V. (2017). Heterogeneous firms under regional temperature shocks: Exit and reallocation, with evidence from Indonesia. San Diego, CA: University of California.

Zhang, P., Deschenes, O., Meng, K., and Zhang, J. (2018). Temperature effects on productivity and factor reallocation: Evidence from a half million Chinese manufacturing plants. J. Environ. Econ. Manage. 88, 1–17. doi: 10.1016/j.jeem.2017.11.001

Keywords: climate change, rising temperatures, sales power, company ability, product selling

Citation: Yu S, Cai C, Zhang S and You P (2022) Does climate change affect enterprises’ ability to sell their products? Front. Ecol. Evol. 10:944964. doi: 10.3389/fevo.2022.944964

Received: 16 May 2022; Accepted: 27 July 2022;

Published: 11 August 2022.

Edited by:

Ruidong Chang, University of Adelaide, AustraliaReviewed by:

Jiufeng Wei, Shanxi Agricultural University, ChinaMuhammad Safdar Sial, COMSATS University, Islamabad Campus, Pakistan

Copyright © 2022 Yu, Cai, Zhang and You. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Cheng Cai, Y2FpY3NtaWxlQGhidWUuZWR1LmNu

Siming Yu

Siming Yu Cheng Cai

Cheng Cai Shuocheng Zhang3

Shuocheng Zhang3