94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Ecol. Evol., 26 April 2022

Sec. Urban Ecology

Volume 10 - 2022 | https://doi.org/10.3389/fevo.2022.869971

This article is part of the Research TopicTowards 2030: Sustainable Development Goal 9: Industry, Innovation and Infrastructure. A Sociological PerspectiveView all 9 articles

Chinese firms are advancing their internationalization process at a surprisingly rapid pace, which is at odds with the descriptions of mainstream theories of corporate internationalization, such as the internalization theory and the eclectic theory of international production. In this context, a large number of existing literatures have examined the learning-by-export effect but have not agreed on its advantages. In the framework of recombinatory view of innovation, we integrate the resource-based view and the institution-based view, taking Chinese industrial enterprises as the research object, taking the export intensity and the output value of new products as the main indicators. We using the fixed effect model based on the Chinese Industrial Enterprise Database construction with China’s Marketization Index. Then this study aims to examine the relationship between exports and innovation. Research results show a non-linear effect, that is U-shaped relationship between exports and innovation; furthermore, the relationships are influenced by institutional factors at the provincial level. The institutional development level is a reverse mechanism of relationship between exports and innovation; when the institutional development level is higher, the relationship between exports and innovation has an inverted U shape. The findings enhance the understanding of export innovation from the perspective of resources and institutions, and export enterprise innovation management can benefit from its significant insights.

As an effective means of organizational learning, exporting provides companies with the opportunity to acquire knowledge from other places (Xie and Li, 2018; Dangelo et al., 2020). This phenomenon of acquiring knowledge from exports is called “learning by exporting” (Wang and Ma, 2018; Ipek, 2019; Dangelo et al., 2020), which means that exporters have access to advanced foreign knowledge, which, if effectively absorbed, will greatly enhance the innovation capabilities of firms (Golovko and Valentini, 2011; Love and Manez, 2019; Dangelo et al., 2020). However, compared with enterprises in developed markets, Chinese exporters, as enterprises in emerging markets, face two deficiencies in converting information advantages into innovation advantages (Xie and Li, 2018). On the one hand, companies often lack resources such as strong technological capabilities, excellent absorptive capacity and close relationships with customers, which makes it difficult for companies to rely on their proprietary advantages to advance their internationalization process (Li et al., 2010; Smith, 2014; Wang et al., 2018). On the other hand, companies usually also face adverse effects such as source country disadvantage or latecomer disadvantage (Wei et al., 2016; Wang et al., 2018). Even so, Chinese firms are advancing their internationalization process at a surprisingly rapid pace, which is at odds with the descriptions of mainstream theories of corporate internationalization, such as the internalization theory and the eclectic theory of international production (Kim et al., 2020). This apparent difference has been considered one of the “big questions” in recent years in the study of corporate internationalization (Buckley et al., 2017).

To theoretically explain the phenomenon that firms are able to grow in international markets despite the lack of proprietary advantages of the firm, the literature discusses it from the perspective of the resource-based view (Barney, 1991) or the institutional-based view (Peng et al., 2008). The literature based on the resource-based view perspective follows the logic of the prevailing theory and analyzes the sources of the firm’s proprietary advantage at the micro level (Chen et al., 2016); however, because the perspective assumes institutional homogeneity, this may obscure the understanding of how institutions help or hinder innovation in exporting firms (Corredoira and Mcdermott, 2014). The institutional-based view provides a theoretical perspective for discussing the role of institutions in corporate export learning at the macro level (Xie and Li, 2018).

However, the resource-based and institutional-based views still fall short in independently explaining the following two issues: (1) At the micro level, How does export affect innovation? (2) At the macro level, does the level of institutional development facilitate or hinder innovation by exporters? This study aims to integrate the resource-based view and the institutional-based view based on the framework of recombinatory view of innovation to investigate the above two issues.

The recombinatory view of innovation considers that the forces of both the novelty from acquiring knowledge and the cost of recombining this knowledge influence the effectiveness of innovation (Davis and Eisenhardt, 2011; Balachandran and Hernandez, 2018). This extends the application of resource and institutional perspectives to the study of export innovation in emerging market firms. On the one hand, in the recombinatory view of innovation, resources are not simply used to promote innovation by increasing the export intensity of firms. The linear relationship between higher firm export intensity and better innovation performance does not simply apply to the emerging market environment. Since innovation is influenced by both knowledge acquisition and knowledge recombination factors, this study finds a non-linear effect, that is U-shaped relationship between firm export intensity and innovation. On the one hand, since institutions will also act on both knowledge acquisition and knowledge recombination, the level of institutional development does not simply facilitate or hinder innovation in emerging market exporters either. This study finds a reversal mechanism in the relationship between export intensity and innovation, which will be able to reverse the U-shaped relationship between export intensity and innovation when the level of institutional development is high. The above findings extend previous work in the literature on learning through exporting by showing that the effectiveness of learning through exporting can be influenced not only by factors internal to the firm but also by external macrolevel institutional factors.

Knowledge is regarded as a valuable resource in both domestic and international markets, therefore, learning has become a crucial issue in the international business environment (Evangelista and Mac, 2016; Ipek, 2019). In this context, export is defined as a learning process. In this process, the enterprises collect information about the export environment timely and accurately (Brouthers et al., 2009). By contacting the export market, enterprises can accelerate the accumulation of market information and technical knowledge (Salomon and Shaver, 2005), so as to enhance the effect of export learning (Love and Ganotakis, 2013). Enterprises often obtain more technology and knowledge in the international market through export than in the domestic market, thus forming information arbitrage (Kogut, 1989), this is the basic mechanism for transforming tangible goods into intangible knowledge (Xie and Li, 2018).

The accumulation of market and technical knowledge often promotes the performance of export enterprises. Early empirical research on export learning at the enterprise level mainly focused on finding the causal relationship between export and enterprise productivity (Wagner, 2007). From the perspective of international trade theory, these studies found that the performance of export enterprises was better than that of non-export enterprises (Bernard and Jensen, 1999). Theoretically, there are two mechanisms to explain the relationship between export and performance. One is self-selection effect (Melitz, 2003), that is, only those enterprises with high productivity will choose to export (Bernard et al., 1995; Bernard and Jensen, 1999; Van Biesebroeck, 2005). The other is the export learning effect. Many empirical studies have tested these two effects, among which the self-selection effect is supported by a large amount of evidence (Eaton et al., 2004; Yang and Mallick, 2010) however, the results of export learning effect are inconsistent. Some studies have found evidence of the effect of export learning (Sun and Hong, 2011; Mallick and Yang, 2013), However, some studies have not found that exports have a significant impact on enterprise productivity (Sharma and Mishra, 2011; Luong, 2013). In order to solve the above disputes, the existing literature has made efforts in two aspects. On the one hand, it is committed to explaining the mechanism of export learning effect, on the other hand, it is committed to shifting the focus of research from the impact of exports on productivity to the impact of innovation (Chittoor et al., 2015; Xie and Li, 2018).

At the enterprise level, the research on export and innovation found that enterprises in developed markets and emerging markets are likely to benefit from export learning (Li et al., 2010; Bratti and Felice, 2012; Xie and Li, 2018). Compared with foreign direct investment and other ways to achieve internationalization, exports involve relatively few commitments, risks and management skills (Cassiman and Golovko, 2011). Therefore, export is usually the first step for emerging market enterprises seeking international sales (Luo and Tung, 2007). Learning income from export is one of the policies that many emerging market governments encourage exports, including the establishment of export processing zones, export tax incentives, export quality inspection and other policies (Xie and Li, 2018). In emerging markets, there are many ways to learn through exports. For example, in order to ensure the quality and performance of imported goods, foreign importers may transfer extensive knowledge about production technology, quality and cost control measures, customer needs, and even competitive product information (Wu et al., 2007). However, emerging market enterprises may not benefit as much from exports as developed market enterprises (Navasaleman, 2011).

Two main viewpoints help to explain the relationship between export and innovation. The resource-based view mainly focuses on the internal operation of export enterprises and the specific attributes of companies (Sousa et al., 2008). The institutional-based view emphasizes the influence of the institutional environment from which export enterprises come (Peng et al., 2008). In the research based on the resource-based view, the classic view is that those enterprises with specific resources and capabilities usually have competitive advantages (Sousa et al., 2008; Chen et al., 2016). These documents implicitly assume that the market environment and institutional environment faced by export enterprises are homogeneous, stable and consistent (Peng et al., 2008). The stronger the ability of the enterprise, the better the export performance. Most of these studies are carried out in the environment of developed markets, and the institution is only used as a background factor. Therefore, enterprise scale, enterprise capability and experience have become the key factors to determine export performance (Majocchi et al., 2005; Pla-Barber and Alegre, 2007).

The institutional-based view follows the definition of institution in New Institutional Economics and holds that institution is the constraint designed by human beings and shaping interpersonal interaction (North, 1990). Institution is the structure and activity of regulation, norm and cognition, which can provide stability and significance for social behavior (Scott, 1995). The institutional-based view divides the institution into formal institution and informal institution, and regards culture as a part of informal institution (Peng et al., 2008). Institutions have a great impact on people’s behavior, as well as the strategy and performance of organizations (DiMaggio and Powell, 1983).

Compared with the resource-based view, which takes the institution as the background condition, the basic idea of the institutional-based view comes from the thinking that the institution determines what enterprises can do in the process of formulating and implementing strategies and building competitive advantage (Peng et al., 2008). The institutional-based view transforms the emphasis on more detailed description of culture and institution in the literature (Leung et al., 2005) into a clear strategic focus of enterprises, that is, to discuss how the institution affects the enterprise strategy and performance (Peng et al., 2008). The institutional-based view focuses on the relevant research of emerging markets and emphasizes that there are great differences in the institutional framework between emerging markets and developed markets. Therefore, in addition to resources and other factors, we should pay more attention to the impact of institutional differences on enterprise strategies (Chacar and Vissa, 2005; Peng et al., 2008).

Many scholars regard innovation as a new combination of existing knowledge (Cohen and Malerba, 2001; Fleming, 2001), this conceptual view holds that innovation is not only the search for new knowledge, but also an effort to combine the old and new components in a novel way (Fleming, 2001). Enterprises with multiple knowledge sources may obtain more different inputs and reorganize them to obtain more effective opportunities to improve innovation, so as to carry out high-quality and valuable innovation (Wang et al., 2011). Therefore, innovation is regarded as a process of reorganization, through this reorganization, enterprises find novel knowledge and integrate it in an original way (Davis and Eisenhardt, 2011). The novelty of knowledge acquisition and the cost of integration affect the process of reorganization (Balachandran and Hernandez, 2018), On the one hand, the diversity and non-redundancy of knowledge acquired through external connections will have a positive impact on innovation (Srivastava and Gnyawali, 2011), on the other hand, this knowledge needs to be reorganized in some original way. Since it is not easy to reinterpret these knowledge and integrate these different ideas, the integration of knowledge may be costly (Kogut and Zander, 1993; Szulanski, 1996). The result of innovation will be determined by the net effect between the two forces (Balachandran and Hernandez, 2018).

For emerging market export enterprises, the first step is to obtain overseas knowledge through export (Bratti and Felice, 2012; Alcacer and Oxley, 2014), the second step is to deal with knowledge acquired through exports, which may involve extensive adaptation and combine it with relevant local knowledge (Corredoira and Mcdermott, 2014). The resources and institutions play a role in both steps. On the one hand, according to the eclectic theory of international production, the export intensity of enterprises is affected by the ability of enterprises. The stronger the ability of enterprises, the higher the export intensity (Sousa et al., 2008). On the other hand, local institutions are an important source of local knowledge (Corredoira and Mcdermott, 2014), it affects the combination of external knowledge and local knowledge, which has an impact on the process of knowledge reorganization (Xie and Li, 2018).

The above literature provides a solid theoretical basis for this study. First of all, exports have created channels to learn from overseas, but how to apply this knowledge to innovation is a complex matter. A survey of this process may help explain how some emerging market companies earn more from exports than others. Secondly, the resource-based view and institutional-based view provide different research perspectives for analyzing the relationship between enterprise export and innovation, the combination of the two will provide richer explanatory power for the study of the relationship between enterprise export and innovation. Finally, by dividing the forces affecting innovation into two aspects, the recombinatory view of innovation expands the perspective of analysis and provides an analytical framework for the integration of resource-based view and institutional-based view.

Exporting is one of the important channels for firms to internationalize (Wang and Ma, 2018), and exporting firms are usually exposed to new technologies and market knowledge from abroad that is more available than at home, which allows for information arbitrage (Kogut, 1989), and the accumulation of diverse knowledge about markets and technologies tends to promote the innovative performance of exporting firms (Xie and Li, 2018). The resource-based view emphasizes that the more capable a firm is, the more it tends to export and the stronger is its performance (Sousa et al., 2008; Chen et al., 2016). Most of these studies were undertaken in developed market environments, so it can be implicitly assumed that the institutional environment faced by exporting firms is to some extent homogeneous, stable and consistent and that the factors determining firms’ export strategies are firm size, firm technology and capabilities, rather than the institutional environment faced by firms (Majocchi et al., 2005; Pla-Barber and Alegre, 2007). Therefore, based on the resource-based view, the relationship between exports and innovation is more inclined to be seen as linear, and empirical studies provide evidence for a linear relationship between exports and innovation (Ellis et al., 2011).

However, when the recombinatory view of innovation is introduced into the export-innovation relationship, the impact of exporting on innovation is determined by two forces: The knowledge acquired through exporting and the cost of recombining this knowledge, and the net effect of both forces determines the performance of exporting (Balachandran and Hernandez, 2018). In this view, the impact of exports on innovation should be more complex, and the linear relationship of the previous literature would be difficult to effectively describe the relationship between exports and innovation; therefore, the recombinatory view of innovation implies the possibility of a non-linear relationship between exports and innovation.

The recombinatory view of innovation argues that firms with multiple sources of knowledge may have access to more diverse inputs and that recombining them can give them more effective opportunities for high-quality and valuable innovation (Faems et al., 2010; Wang et al., 2011). Access to a variety of knowledge resources creates a diverse knowledge base internally, but new knowledge may be useless if the company fails to integrate it with its own knowledge (Savino et al., 2017). Thus, effective integration of domestic and foreign knowledge is a key mechanism that influences firm innovation (Corredoira and Mcdermott, 2014), and the presence of this mechanism may make the relationship between exporting and innovation exhibit a non-linear relationship. Several empirical studies also provide evidence for a non-linear relationship between exports and firm performance (Chiao et al., 2006; Corredoira and Mcdermott, 2014; Wang and Ma, 2018).

Specifically, on the relationship between exports and innovation, the literature based on the recombinatory view of innovation argues that while exports create avenues for learning from abroad, how to apply this knowledge to innovation is a complex matter (Xie and Li, 2018). The net effect of exports on innovation is likely to be negative if firms do not have the necessary technological capabilities, absorptive capacity and domestic resources to take full advantage of foreign spillover benefits or to meet the demand for more advanced products abroad (Smith, 2014). This result suggests that firm innovation may decline even if export intensity is increased if firms have insufficient capabilities; an increase in export intensity will benefit firm innovation only if firms have strong capabilities.

Synthesizing the above analysis, we infer a U-shaped relationship between exports and innovation and propose the following hypothesis.

H1:There is a U-shaped relationship between corporate exports and innovation.

Institutions influence to some extent the resource environment of the economy and thus the resources and capabilities of the firms embedded in that environment (Jackson and Deeg, 2008). The research literature on emerging markets argues that firms’ export strategies are largely related to the institutional environment and that when the institutional environment changes, firms’ strategies change accordingly (Xie and Li, 2018). In fact, changes in the institutional environment can either improve or impair performance, and such changes may be reflected in multiple dimensions and by various indicators (Sousa et al., 2008; Chen et al., 2016). When progress is made in any or all of the dimensions, it is reasonable to assume that the institutional environment is improving (Wang and Ma, 2018). The literature usually considers institutions as resources and as the main determinants of transaction costs (Jackson and Deeg, 2008), and these roles of institutions influence the relationship between export and innovation by affecting the forces of both knowledge acquisition and costs of the restructuring process (Xie and Li, 2018).

Institutional improvements affect the relationship between exports and innovation by reducing the cost of recombining. According to the basic view of transaction cost economics, transaction costs tend to discourage the trading and restructuring of knowledge (Williamson, 1975). In the institutional environment of the home country, knowledge search, contracting and monitoring can be costly in the absence of a well-established market intermediary (Xie and Li, 2018). Therefore, according to the recombinatory view of innovation, the institutional environment will facilitate the transfer and reorganization of knowledge by reducing the transaction costs of knowledge (Jackson and Deeg, 2008; Xie and Li, 2018).

When there is a lack of specialized intermediaries, such as brokers, law firms, accounting firms, consulting firms, and industry associations in the home country’s institutional environment, this institutional void could greatly affect the capital, factor and product markets of emerging economies (Khanna and Palepu, 2010). It will then be expensive and sometimes impossible to find potential counterparties, to smoothly and efficiently enter into contracts and to execute signed contracts. This is particularly difficult when there is knowledge involved in the transaction. Intermediaries are often required to play a pricing, trust-building and recognition role in such transactions. Although informal systems such as relationships may sometimes replace market intermediaries, they are usually less efficient in facilitating transactions between unfamiliar parties (Peng, 2003).

When the institutional environment in the home country is improved, effective market intermediaries are expected to improve the innovation ability of export enterprises more than non-export enterprises by facilitating knowledge flows, intermediating between buyers and sellers of knowledge, and providing complementary expertise and resources to reduce interaction costs (Kostinets, 2014). Market intermediaries can significantly reduce the transaction costs involved in sourcing from multiple knowledge sources, seeking and helping exporters with adaptation and restructuring efforts, which will help exporters build on knowledge acquired through exports as well as on innovative knowledge acquired locally (Xie and Li, 2018).

Through the above analysis, it can be found that institutional improvements will be able to positively influence the relationship between exports and innovation. However, the institutions influence on the export-innovation relationship by reducing transaction costs is only one aspect of the institutional influence effect; on the other hand, institutions will also influence the export-innovation relationship by affecting exporters’ access to knowledge. In this aspect of knowledge acquisition, institutions will have a reverse impact on exporting firms for the following reasons.

First, if the institutional environment in the home country is improved, more firms will enter the market due to reduced trade frictions and government restrictions, leading to more intense market competition (Hermelo and Vassolo, 2010). Those exporters pursuing an expansionary strategy may find the domestic market more attractive and thus further increase their capabilities in the domestic market (Wang and Ma, 2018). Under such conditions, institutional improvements reduce the positive component of the innovation-influencing power of innovation restructuring by making it less attractive to acquire knowledge abroad and thus will probably attenuate the positive innovation-influencing effect of firms’ export intensity.

Second, when institutional improvements make the home country’s market more open, the information advantage of exporters may be offset by alternative access to overseas knowledge. Foreign direct investment (FDI) enterprises may come with their products and investments, and they bring overseas knowledge that can be shared with local partners or counterparties. Even local firms that are not directly related to multinational firms benefit from the demonstration effect and the unconscious knowledge spillover that results from the movement of people. In addition, all firms in a more open institutional environment would have better opportunities to seek knowledge abroad by importing technology and capital goods or even by investing abroad (Luo and Tung, 2007; Khanna and Palepu, 2010), which would reduce the effect of firms that acquire knowledge through exports.

Third, according to the description of the Uppsala model, the internationalization process of firms follows a gradual development phase of exports, overseas sales, and FDI, in which empirical market knowledge is an important driving force (Johanson and Vahlne, 2009; Wu, 2019). Thus, institutional improvements are likely to change the means of acquiring knowledge by inducing firms to shift from exports to FDI, which is a possible reason for a reduction in the export learning effect (Genin et al., 2020; Kim et al., 2020; Yang et al., 2020). Overall, the available literature provides evidence that when home country institutions are improved, firms will likely no longer simply rely on exports for innovation (Wang et al., 2020).

In summary, although institutions play an influential role in both aspects of the restructuring process, the reduction in transaction costs may hardly offset the reduction in the information advantage that firms obtain through exporting. On the one hand, when firms shift from exports to FDI, this can result in higher costs in the economy (Witt and Lewin, 2007), which will partially offset the positive effects of lower transaction costs. On the other hand, as the system improves, domestic competition also increases, placing higher demands on firms to innovate (Wang and Ma, 2018), which will partially offset the positive effects of lower transaction costs. Therefore, we expect that the improvement of the system will create an inversion mechanism that will reverse the effect of exports on innovation from the original U-shaped effect to an inverted U-shaped effect. To this end, the following hypothesis is proposed.

H2:There is a reversal mechanism in the U-shaped relationship between exports and innovation. Specifically, as institutions continue to improve, the U-shaped relationship between exports and innovation will continue to smooth out until an inversion occurs, where the impact of exports on innovation shifts to an inverted U-shaped effect in a higher institutional development environment relative to a lower institutional development environment.

Through the above analysis, we know that export creates a channel for learning from overseas, but how to apply this knowledge to innovation is a complex task. A survey of this process may help explain how emerging market companies benefit from exports. The recombinatory view of innovation holds that the acquisition of knowledge and the cost of recombining this knowledge affect innovation, We use this logic as the basis for building a conceptual model, By using the recombinatory view of innovation, this paper integrates the resource-based view and the institution-based view into a framework to analyze the relationship between export and innovation. According to the resource-based view, export is conducive to the acquisition of knowledge, so export can promote innovation. However, the reorganization of new knowledge will also incur costs, therefore, we believe that the impact of exports on innovation is non-linear and there is a U-shaped effect. Based on the institution-based view and the recombinatory view of innovation, institutions have an impact on both the acquisition of knowledge and the cost of reorganization, we infer that the level of institutional development may reverse the U-shaped effect of exports on innovation. To sum up, we build the following conceptual model, as shown in Figure 1.

The research data for this paper are obtained from the China Industrial Enterprise Database published by the National Bureau of Statistics of China, and the China Marketization Index published by the National Economic Research Institute, and the two databases are combined. First, the Chinese Industrial Enterprise Database records all state-owned and industrial enterprises with main business revenue above 5 million RMB, and this paper uses the sample from 2000 to 2013 and is organized according to the literature (Nie et al., 2012; Tian and Yu, 2013; Li et al., 2018). Second, the China Marketization Index is organized into a provincial panel data format according to the total index, spanning the period 2000–2013. Since the calculation method of this index was adjusted after 2008, to reconcile the differences of the market-based index before and after 2008, the study of Bai and Liu (2018) was referred to and controlled by setting dummy variables. Finally, the China Industrial Enterprise Database was matched with the China Marketization Index by the name of the province (municipalities and autonomous regions) where the enterprises were located and merged into the data analyzed for the paper. Since some records in the China Industrial Enterprise Database were missing the names of provinces (municipalities and autonomous regions), these records with missing values were deleted in the merging process, and the final merged data had a total of 648,936 records, spanning the period 2004–2013.

The dependent variable was firm innovation. The value of change in firm innovation was calculated as the dependent variable, calculated as the current value of new product output minus the new product output of the year prior to the firm’s initial export (Wang and Ma, 2018). The calculation formula is:

where “cinno” is the enterprise innovation, “xcpcz” is the current new product output value, and “inno0” is the new product output value of the year before the enterprise’s initial export.

The independent variable is export intensity. Export intensity is calculated by dividing the value of export deliveries by the value of industrial sales output. The calculation formula is:

where “EI” is export intensity, “ckjhz” is export delivery value, and “gyxscz” is industrial sales value. In the specific analysis, the lagged one-period value of “EI” and “EI_lag1” is generated as the independent variable.

The moderating variable is institutional change. Using the total China Marketization Index, institutional change is identified at the provincial level. The rate of institutional change at the provincial level is calculated using 3 years as a window period. Calculated by subtracting the marketability index of the current period from the marketability index of the two lagged periods and dividing by the marketability index of the two lagged periods (Wang and Ma, 2018) The calculation formula is:

where “rmar_c” is the regime change, “marketind” is the current period total marketind index, and “mar_lag2” is the two-period lagged term of the current period total marketind index.

Control variables. This paper also controls for firm size, firm age, industry growth rate, and industry competition (Wang and Ma, 2018; Xie and Li, 2018). where “firmsize” is firm size, calculated using the logarithm of total assets. “Firmage” is firm age, calculated using the annual variable minus start-up time. “Ind_growth” is the industry growth rate, calculated using the average sales growth rates of firms in the same industry. “HHI” is industry competition, calculated using the Herfindahl-Hirschman Index. The calculation formula is:

where “i” and j” denote companies, “k” denotes industries, and “sales” are company sales.

To analyze the impact of exports on firm innovation and the moderating role of institutional change, the following analytical model was constructed:

Among them, model (1) is the benchmark model to test the U-shaped relationship between exports and firm innovation, and model (2) is the benchmark model to test the moderating role of institutional development. cinnoitis the enterprise innovation change value in the current period, EIit−1 is the lagged period value of enterprise export intensity, is the squared term of the lagged period of enterprise export intensity, rmar_ci is the institutional change value of the province where the enterprise is located, and “D” is the set of control variables.

In this paper, we estimate model (1) and model (2) using a fixed effects model with panel data, which can effectively mitigate the endogeneity problem due to omitted variables by using panel data. Since export and innovation may also have two-way causality, which will also bring endogeneity, this paper alleviates the endogeneity brought by two-way causality in two ways. First, in the baseline model analysis, the independent variables of model (1) and model (2) are the one-period lag of export intensity; second, in the robustness analysis, by setting the second-period lag of export intensity as the instrumental variable, the regression using the instrumental variables method is performed as a robustness test to demonstrate the empirical evidence after mitigating the two-way causality.

Regarding the U-shaped relationship, according to Lind and Mehlum (2010) and Haans et al. (2016) the U (inverted U) relationship was tested in three steps. Taking model (1) as an example for illustration; in the first step,α2 must be significant and is determined by the sign of whether it has a U or inverted U shape. In the second step, the slope of the curve must be steep and significant at the two endpoints of the curve within the range of values of the independent variable. Taking the U-shaped curve as an example, the slope of the curve should be significantly negative when the independent variable takes the minimum value and significantly positive when the independent variable takes the maximum value. In the third step, the inflection point of the curve must lie within the range of values of the independent variable.

Regarding the test for the moderating effect of the U-shaped relationship, referring to the study by Haans et al. (2016), a judgment is made in two ways; on the one hand, it is necessary to test whether the inflection point of the curve is shifted to the left or to the right. The calculation formula is:

If the sign of formula (3) is positive, it is shifted right, and if the sign is negative, it is shifted left. On the other hand, it is necessary to check whether the shape of the curve is steeper or flatter. Steeper denotes a positive sign of α5, and flatter denotes a negative sign of α5, or even a reversal of the curve shape occurs (Haans et al., 2016). In the analysis process, a 1% winsorize was applied to all variables to remove the effect of outliers. The analysis software was stata15.

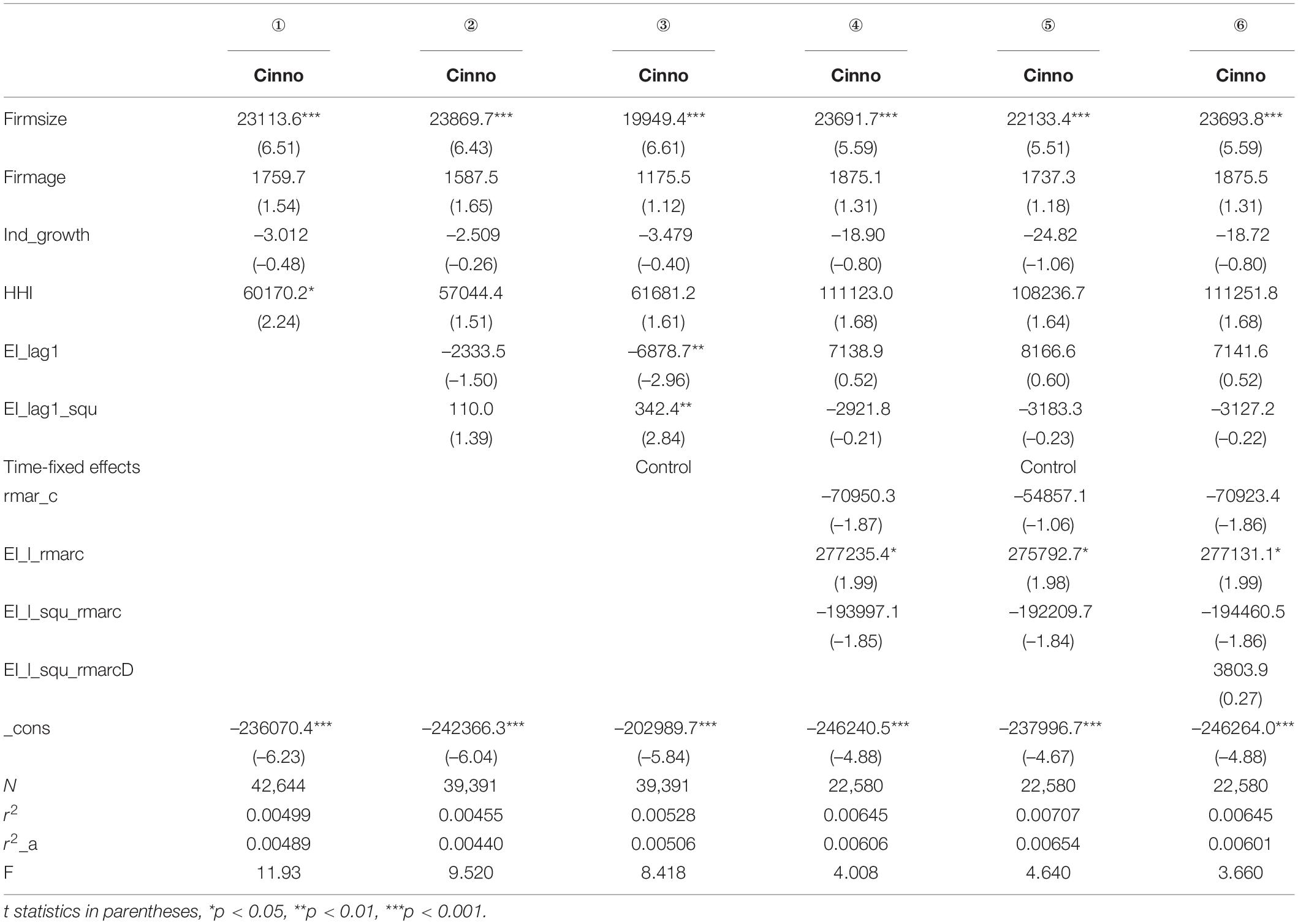

Tables 1, 2 report information on the correlation coefficients, means, and standard deviations of the main variables in the model. Table 3 reports the results of the analysis of the relationship between exports and innovation and the moderating role of institutional development. In the analysis in Table 3, records with zero export intensity were removed from the sample to clearly demonstrate the relationship between exports and innovation; therefore, all results reported in Table 3 are for exporting firms. In the robustness analysis, we add records with zero export intensity back into the sample to demonstrate the robustness of the results.

Table 3. Results of the analysis of the relationship between exports and innovation and the moderating role of institutional development.

Model ① adds only control variables. Model ② adds a first-order term with a one-period lag of export intensity and a squared term based on model ① and does not observe a significant U-shaped relationship between exports and innovation (α2 = 110.0,p = 0.166). In model ③, controlling for time fixed effects, the results show that the coefficient of the squared term of export intensity is positive and significant (α2 = 342.4,p < 0.01). This result satisfies the first step in testing for a U-shaped effect, as suggested by Lind and Mehlum (2010), and later by Haans et al. (2016). In the second and third steps, we applied the utest command in stata to check (Lind and Mehlum, 2010; Pollok et al., 2019). The test results of the U-shaped effect show that the slope of the curve is negative and significant at the left end where the exit strength takes the minimum value(slope =−6878.69,p < 0.01)and positive and significant at the right end where the exit strength takes the maximum value (slope = 6890.426,p < 0.01). The 95% confidence interval for the inflection point value is (9.2786296; 11.60694), which is within the range of values taken for the exit intensity after tailing (0, 20.10667). Therefore, both the second and third steps are also satisfied. The “utest” command also gives the significance level of the overall test for the U-shaped effect, and the results show that the U-shaped effect is significant (p < 0.01). H1 is supported.

Models ④-⑥ report the results of the moderating effect of institutional development. The results of model ④ show that the coefficient of the interaction term between the squared term of export intensity and institutional development is negative and significant at the level of 0.1 (α5 = −193997.1,p = 0.062), indicating the presence of the moderating effect of institutional development. Further analysis shows that when the regime moves from a lower to a higher level, the sign of the result calculated according to equation (3) is negative and the point of inflection of the curve shifts to the left; the sign of α5is negative, the curve form is gradually flattened, and finally the inversion of the form occurs, reversing from a U-shaped relationship to an inverted U-shaped relationship. Figure 2 shows the results of inflection point movement and curve inversion. When institutional development is at a low level, there is a U-shaped relationship between export intensity and enterprise innovation. When the institutional development is at a high level, the relationship between export intensity and enterprise innovation has reversed, from the U-shaped relationship to the inverted U-shaped relationship. Model ⑤ controls for time-fixed effects, and the results are consistent with model ④. Model ⑥ controls for the effect of inconsistent marketization index indicators around 2008 and still finds an inverse effect of institutional development on the U-shaped effect. H2 is supported.

Table 4 reports the results of the analysis of the instrumental variables, which are export intensity lagged by two periods. Among them, model ①include exporters and non-exporters, and model② include exporters only. Bout of model ① and model ②are 2SLS, the results show that the coefficient of the squared export intensity term is positive and significant (α2 = 90227.1,p < 0.05)in model ①; and the coefficient of the squared export intensity term is positive and significant (α2 = 140528.1,p < 0.01)in model ②. The above models were tested by utest order, and the U-shaped effects of model ①was significant at the level of 0.1(p = 0.0625); the U-shaped effects of model ② was significant (p < 0.01). It shows that the analysis using the instrumental variables approach is still able to observe a significant U-shaped effect between exports and innovation.

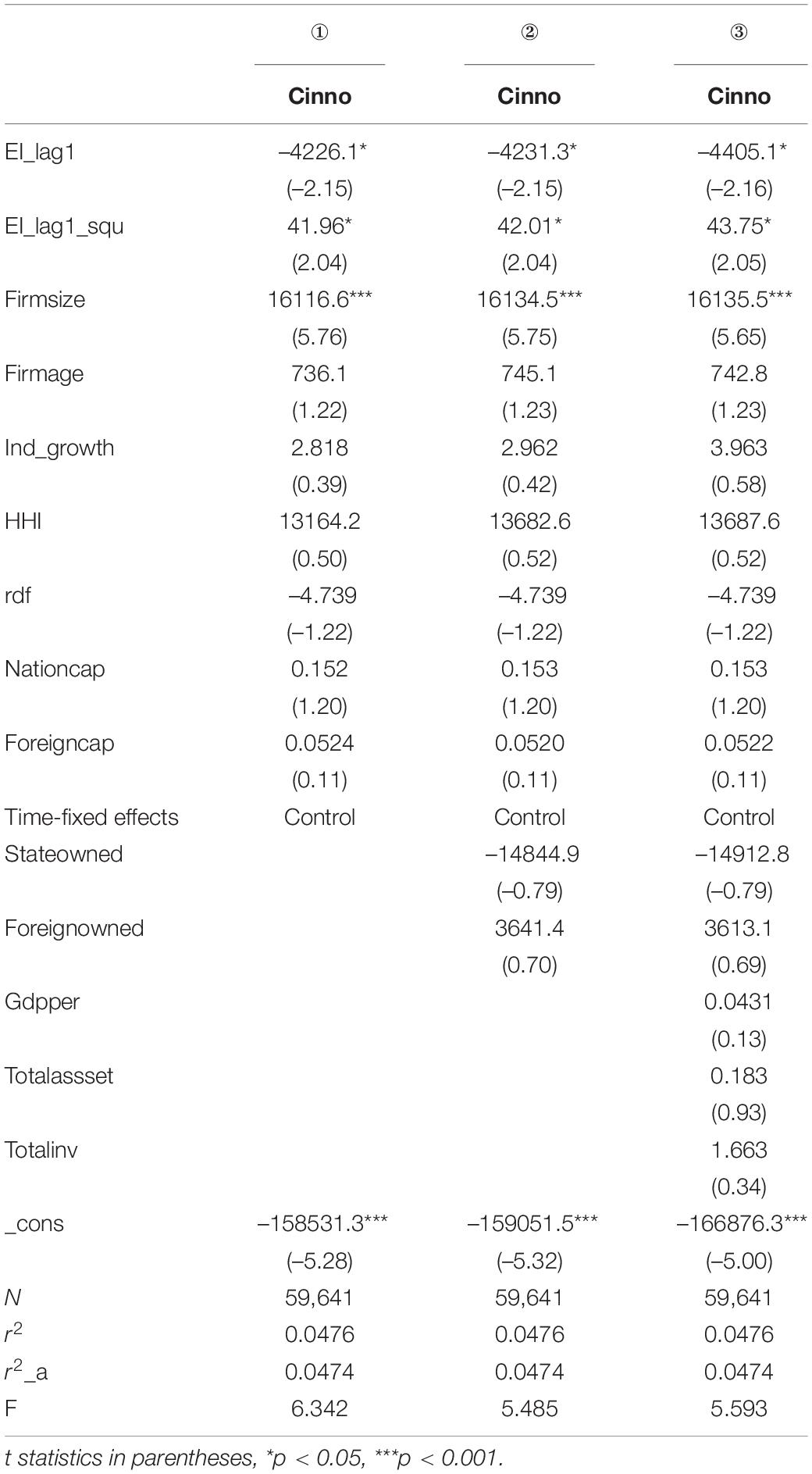

This paper mainly examines the relationship between export and innovation, and analyzes how the provincial level institution affects the relationship between export and innovation. In fact, in addition to institutional factors, there are other factors at the provincial level that may affect the innovation of enterprises, Therefore, in the robustness analysis, we further controlled some factors to check the robustness of the main results. Table 5 reports the results of adding control variables in the U-shaped relationship between exports and innovation. Among them, model ① further controls enterprise R & D (rdf), national capital (nationcap), and foreign capital (foreigncap) at the enterprise level. Model ② controls whether it is a state-owned enterprise (stateowned) or a foreign-owned enterprise (foreignowned) on the basis of model ①. Model ③ further controls the per capita GDP(Gdpper), total provincial assets (totalassset) and total investment (totalinv) at the provincial level. It can be seen from the results that the U-shaped effect of export is significant in the three models, indicating that the U-shaped effect of export on innovation is robust.

Table 5. The results of U-shaped relationship between export and innovation with added control variables.

In the analysis of the benchmark model, we only analyzed the data of exporting enterprises and did not include the enterprises with zero export intensity in the analysis. In the robustness analysis, we included the enterprises with zero export intensity in the sample and analyzed the data containing exporting and non-exporting enterprises, and the results are shown in Table 6. In model ②, the coefficient of the squared term of export intensity is positive and significant (α2 = 23.44,p < 0.05), and the utest test results show that the U-shaped relationship between exports and innovation is significant (p < 0.05). Model ③ controls for time fixed effects, and the results show that the coefficient of the squared term of export intensity is positive and significant (α2 = 52.35,p < 0.01), and the utest test shows that the U-shaped relationship between exports and innovation is significant (p < 0.01).

In the analysis of the benchmark model, an inversion mechanism is found in the relationship between exports and innovation, where exports and innovation show a U-shaped relationship when institutional development is at a low level and reverse to an inverted U-shaped relationship when institutional development is at a high level. To further observe the reversal mechanism of the U-shaped effect, in the robustness analysis, we observe the performance of the export-innovation relationship by splitting the sample. We calculate the mean and standard deviation of the marketability index by taking the subsample with the marketability index less than the mean minus one standard deviation as the low institutional development group and the subsample with the marketability index greater than the mean plus one standard deviation as the high institutional development group. The relationship between exports and innovation is observed separately in the sample of the two groups, and since the missing values of firm innovation are higher in the group with a low level of institutional development, we report the results of the analysis only for the group with a high level of institutional development. The results in Table 7 show that the coefficient of the squared export intensity term is negative and significant at the level of 0.1 when the sample includes exporters and non-exporters; the results of the utest test show that exports show an inverted U-shaped relationship with innovation, which is significant at the level of 0.1 (p < 0.1). The coefficient of the squared export intensity term is negative and significant (p < 0.05) when the sample includes only exporting firms; the utest test shows an inverted U-shaped relationship between exports and innovation, which is significant (p < 0.05). It shows that when looking only at the part of the sample with a higher level of institutional development, it is still possible to find a reversal of the export-innovation relationship, from the original U-shaped relationship to an inverted U-shaped relationship.

This paper discusses the relationship between export and innovation of emerging market enterprises. The basic logical starting point is that compared with non-export emerging market enterprises, emerging market export enterprises have advantages in information arbitrage (Xie and Li, 2018). Emerging market export enterprises expect to transfer advanced technology from abroad through export to avoid high-cost and high-risk R&D (Fagerberg and Godinho, 2005). However, although some emerging market export enterprises have actively participated in the fierce international market competition, their innovation performance still lags behind the market leaders (Navasaleman, 2011).

First, along the basic logic of the resource-based view, the stronger the ability of export enterprises, the higher the export intensity and the better the innovation performance. The test of H1 in this paper extends this logic. Our empirical results show that there is a U-shaped relationship between export intensity and innovation. It is not that the higher the intensity of exports, the higher the performance of innovation. In emerging markets, the relationship between exports and innovation is not a simple linear relationship, this result is different from the linear relationship found by research based on developed markets. We introduce the recombinatory view of innovation into the analysis to explain the differences in the relationship between export and innovation observed in emerging and developed markets. The recombinatory view of innovation suggests the existence of two forces that affect the performance of innovation: The novelty of acquiring knowledge through exporting and the cost of recombining knowledge (Davis and Eisenhardt, 2011). Since the exports of developed market firms are based on the firm’s proprietary advantages (Dunning, 2001), these firms have the ability to acquire new knowledge and the resources to reorganize it (Smith, 2014). In contrast, emerging market exporters are at a disadvantage in terms of resources and capabilities (Wang et al., 2018), and if firms’ capabilities are insufficient, even if these firms enhance their export intensity, they do not have advantages in terms of acquiring new knowledge and reducing recombining costs, and exporting does not lead to an increase in innovation. Only when firms have certain capabilities can they build a knowledge base through exporting and be able to reduce the cost of reorganizing knowledge. Thus, in our data, a U-shaped relationship between exporting and innovation is observed.

Second, by introducing the institution-based view, we argue that appropriate institutional arrangements are important if firms want to increase their innovation capacity through exports. Modern technological updates require new and fundamental changes in the institution (Fagerberg and Godinho, 2005). We measure the development of the system in terms of changes in China’s Marketization Index at the provincial level, and in this perspective, observe a very interesting change in the relationship between exports and innovation. The evidence provided in test H2 suggests that institutional development at the provincial level is a reversal mechanism that affects the relationship between firm exports and innovation. When the regime changes more slowly, the relationship between exports and innovation is U-shaped; however, when the regime changes more or faster, the relationship between exports and innovation will reverse, from a U-shaped relationship to an inverted U-shape. This result suggests that in regions where the institution is developing faster, firms can no longer rely on exports alone to meet the requirements of innovation, when outward investment may be a more desirable form of internationalization. The results show that the improvement of the institution will have a positive impact on the relationship between export and innovation. However, the impact of institutions on the relationship between exports and innovation by reducing transaction costs is only one aspect of the impact of institutions. On the other hand, the institution will also affect the relationship between export and innovation by affecting the acquisition of knowledge by export enterprises. Although the institution has an impact on both aspects of the reorganization process, the reduction of transaction costs may be difficult to offset the reduction of information advantages obtained by enterprises through exports. On the one hand, when enterprises shift from export to foreign direct investment, it will cause higher costs in economy (Witt and Lewin, 2007), this will partially offset the positive effect of reducing transaction costs. On the other hand, with the improvement of the institution, domestic competition also increases, which puts forward higher requirements for enterprise innovation (Wang and Ma, 2018), this will also partially offset the positive effect of reducing transaction costs. Therefore, the improvement of the institution has formed a reversal mechanism, reversing the impact of exports on innovation from the original U-shaped effect to the inverted U-shaped effect.

This paper discusses the relationship between firm exports and innovation based on the resource-based view and the institutional-based view, which correspond to two types of factors affecting export learning, with the resource-based view focusing on the internal factors of firms and the institutional-based view focusing on the external institutional environment of firms. We integrate the resource-based view with the institutional-based view by applying the recombinatory view of innovation, which views innovation as an original combination of existing knowledge. The basic idea is that the outcome of exported on innovation depends on two forces, one being the knowledge acquired by the firm through exporting and the other being the cost of recombining that knowledge, with both resource and institutional factors influencing both forces and the net effect of both forces determining the effectiveness of innovation. Therefore, we believe that there is a non-linear influence between export and innovation, and the institution moderate this non-linear relationship. We tested the above basic hypotheses at the firm level using data from the Chinese Industrial Enterprise Database, and through empirical analysis, the following conclusions were obtained: (1) There is a U-shaped relationship between enterprise exports and innovation. When the export intensity of enterprises is at a low level, exports negatively affect enterprise innovation; when the export intensity of enterprises is at a high level, exports positively affect enterprise innovation. (2) There is a reversal mechanism in the U-shaped relationship between firm exports and innovation, and the level of institutional development can reverse the relationship between exports and innovation. When the level of institutional development is low, there is a U-shaped relationship between firm exports and innovation; when the level of institutional development is high, the relationship between firm exports and innovation reverses and transforms into an inverted U-shaped relationship.

In an emerging market environment such as China, we use the recombinatory view of innovation to integrate the resource-based view with the institutional-based view to discuss the factors that influence the relationship between firm exports and innovation. According to the resource-based view, the stronger the firm’s capabilities, the higher the firm’s export intensity and the better the performance of the exporting firm will be. Based on this underlying logic, we tested the impact of firms’ export intensity on innovation and found a U-shaped relationship between export intensity and innovation. The institutional-based view discusses the impact of the firm’s external institutional environment on corporate strategy, and based on this perspective, we examine the moderating effect of the level of institutional development on the export-innovation relationship at the provincial level and find that there is an inversion mechanism in the U-shaped relationship between export intensity and innovation, with the level of institutional development being able to invert the U-shaped relationship between exports and innovation. These findings enhance our understanding of the relationship between firm exports and innovation and make the incremental contribution to the existing literature in two ways.

(1) By introducing the recombinatory view of innovation into the analysis of the export-innovation relationship, we provide a plausible explanation for the finding of a U-shaped relationship between firm exports and innovation, which makes an incremental contribution to the literature on the application of the resource-based view to explain the firm learning effect at the micro level. In a developed market environment, where there is a reasonable assumption to view the institutional environment as homogeneous and stable, the resource-based view provides a clear explanatory logic for the export-innovation relationship, and since the institution serves only as a background, it is very clear that the factors influencing the export-innovation relationship originate from heterogeneous resources and capabilities within the firm. However, in an emerging market environment, exporters often do not have the above resource advantages. Therefore, even if the discussion is conducted at the micro level, relying only on the resource-based view will hardly provide a reasonable explanation for the relationship between firm exports and innovation. We enter the recombinatory view of innovation into the analysis and argue that the forces of both exported acquired knowledge and the cost of reorganizing knowledge determine the effectiveness of innovation. By introducing this perspective, a plausible explanation for the U-shaped relationship between exports and innovation is provided, thus enhancing the understanding of the relationship between exports and innovation.

(2) The institution-based view can provide a multilevel perspective to explain the relationship between firm exports and innovation at the macro level. By combining the recombinatory view of innovation with the institution-based view, we infer that there is a reversal mechanism for the U-shaped relationship between firm exports and innovation, and we check this inference using data from the Chinese Industrial Enterprise Database and China’s Marketization Index and find that the level of institutional development can reverse the U-shaped relationship between exports and innovation. This finding makes an incremental contribution to the literature that applies the institution-based view to explain the learning effect of firms’ exports. The basic idea of the institution-based view is that institutions influence the strategy and performance of firms. Based on this view, we can infer that institutions will affect the relationship between firm exports and innovation. However, when the relationship between exports and innovation is U-shaped, the role of institutions has not yet been explained by sound theoretical explanations or by empirical evidence. By combining the recombinatory view of innovation with the institution-based view, we find that institutions influence both the acquisition of exported knowledge and the cost of knowledge recombination, providing a plausible theoretical perspective to explain changes in the relationship between exports and innovation. Empirically, we find that the level of institutional development at the provincial level can invert the U-shaped relationship between exports and innovation, which also provides new empirical evidence on how institutions actually affect the relationship between exports and innovation.

The findings of this paper also have implications for business managers. First, exporting does not naturally lead to an increase in innovation capacity. Our research has led firm managers to recognize that there are two forces that affect the export learning effect of a firm: one is the knowledge acquired through exports, and the other is the cost of restructuring this knowledge. Enterprises wanting to turn the information advantage brought by exports into innovation advantages need to work on both access to knowledge and the cost of restructuring knowledge. For enterprises, on the one hand, they can learn and accumulate knowledge through export. On the other hand, they should also stimulate their ability of independent innovation through export. Second, a company’s strategy should shift as the institutions evolve. Our results show that the relationship between exports and innovation is reversed at different levels of institutional development, a result that prompts managers of firms to pay attention to the role of the institutional environment external to the firm in influencing the firm’s strategy. Enterprises need to timely evaluate the institutional development level of the place where they are located. For example, enterprises can hire professional consulting institutions or use the official data of the National Commerce Department to study and judge the institutional situation faced by enterprises in order to develop corresponding innovation strategies. Finally, for the internationalization strategy of enterprises, exporting is not the only way to enhance corporate innovation; when the level of institutional development changes, establishing overseas sales companies and foreign direct investment may be a more appropriate way to internationalize.

There are also limitations to our study. First, we argue, based on the logic of the resource-based view, that the higher the capacity of the firm is, the stronger the export intensity. Based on this, we hypothesized a U-shaped relationship between export intensity and innovation, checked this hypothesis using data from the Chinese Industrial Enterprise Database and found a U-shaped relationship between export intensity and innovation. However, the relationship between firm capabilities and export intensity has not been tested in this paper, and future research could further examine the relationship between firm capabilities, resources, etc. and firm exports. Second, we hypothesize that the level of institutional development is the inversion mechanism of the U-shaped relationship between exports and innovation, and we test this hypothesis at the provincial level using combined data from the Chinese Industrial Enterprise Database and China’s Marketization Index. However, in dealing with China’s Marketization Index, we only used the aggregate index and did not examine the impact of differences in institutional development across dimensions. Future research could theoretically discuss the role of the impact of different dimensions of institutions and test this using dimensional indicators of the marketization index. Third, China’s Industrial Enterprise database only provides the output value of new products, which limits our measurement of enterprise innovation. Future research can consider using patent data to measure enterprise innovation. Finally, the data analyzed in this paper are up to 2013, and although the Chinese Industrial Enterprise Database provides a large sample of studies for this paper, we have not yet observed the effect of institutional development on the export-innovation relationship after 2013. Because of the preliminary evidence already provided in this study, future studies may choose to use data from public companies to observe the latest changes.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

XC and PL contributed to conceptualization, formal analysis, funding acquisition, methodology, and writing—original draft preparation. LF contributed to data curation and formal analysis. YJ contributed to data curation, formal analysis, and writing—original draft preparation. XH contributed to conceptualization, formal analysis, funding acquisition, investigation, and writing—original draft preparation. All authors contributed to the article and approved the submitted version.

This work was supported by the National Social Science Key Foundation of China (17AJL012 and 21AJY004), the National Natural Science Foundation of China (72062001 and 71872055), 2021 Special project of Guangxi science and technology development strategy research (GuiKeZL21140019).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Alcacer, J., and Oxley, J. (2014). Learning by supplying. Strat. Manage. J. 35, 204–223. doi: 10.1002/smj.2134

Bai, J., and Liu, Y. (2018). Can foreign direct investment improve resource mismatch in China. China Industr. Econ. 1, 60–78.

Balachandran, S., and Hernandez, E. (2018). Networks and innovation: accounting for structural and institutional sources of recombination in brokerage triads. Organiz. Sci. 29, 80–99. doi: 10.1287/orsc.2017.1165

Barney, J. B. (1991). Firm resources and sustained competitive advantage. J. Manage. 17, 99–120. doi: 10.1177/014920639101700108

Bernard, A. B., and Jensen, J. B. (1999). Exceptional exporter performance: cause, effect, or both? J. Int. Econ. 47, 1–25. doi: 10.1093/nar/gkv106

Bernard, A. B., Jensen, J. B., and Lawrence, R. Z. (1995). Exporters, jobs, and wages in US manufacturing: 1976-1987. brookings papers on economic activity. Microeconomics 1995, 67–119. doi: 10.2307/2534772

Bratti, M., and Felice, G. (2012). Are exporters more likely to introduce product innovations? World Econ. 35, 1559–1598. doi: 10.1111/j.1467-9701.2012.01453.x

Brouthers, L. E., Nakos, G., Hadjimarcou, J., and Brouthers, K. D. (2009). Key factors for successful export performance for small firms. J. Int. Mark. 17, 21–38. doi: 10.1509/jimk.17.3.21

Buckley, P. J., Doh, J. P., and Benischke, M. H. (2017). Towards a renaissance in international business research? Big questions, grand challenges, and the future of IB scholarship. J. Int. Bus. Stud. 48, 1045–1064. doi: 10.1057/s41267-017-0102-z

Cassiman, B., and Golovko, E. (2011). Innovation and internationalization through exports. J. Int. Bus. Stud. 42, 56–75. doi: 10.1057/jibs.2010.36

Chacar, A., and Vissa, B. (2005). Are emerging economies less efficient? Performance persistence and the impact of business group affiliation. Strat. Manag. J. 26, 933–946. doi: 10.1002/smj.478

Chen, J., Sousa, C. M. P., and He, X. (2016). The determinants of export performance: a review of the literature 2006-2014. Int. Mark. Rev. 33, 626–670. doi: 10.1108/imr-10-2015-0212

Chiao, Y., Yang, K., and Yu, C. J. (2006). Performance, internationalization, and firm-specific advantages of smes in a newly-industrialized economy. Small Bus. Econ. 26, 475–492. doi: 10.1007/s11187-005-5604-6

Chittoor, R., Aulakh, P. S., and Ray, S. (2015). Accumulative and assimilative learning, institutional infrastructure, and innovation orientation of developing economy firms. Global Strat. J. 5, 133–153. doi: 10.1002/gsj.1093

Cohen, W. M., and Malerba, F. (2001). Is the tendency to variation a chief cause of progress? Industr. Corp. Chan. 10, 587–608. doi: 10.1111/j.1365-2214.2012.01423.x

Corredoira, R. A., and Mcdermott, G. A. (2014). Adaptation, bridging and firm upgrading: how non-market institutions and MNCs facilitate knowledge recombination in emerging markets. J. Int. Bus. Stud. 45, 699–722. doi: 10.1057/jibs.2014.19

Dangelo, A., Ganotakis, P., and Love, J. H. (2020). Learning by exporting under fast, short-term changes: the moderating role of absorptive capacity and foreign collaborative agreements. Int. Bus. Rev. 2020:101687. doi: 10.1016/j.ibusrev.2020.101687

Davis, J. P., and Eisenhardt, K. M. (2011). Rotating leadership and collaborative innovation: recombination processes in symbiotic relationships. Administr. Sci. Quart. 56, 159–201. doi: 10.1177/0001839211428131

DiMaggio, P. J., and Powell, W. W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am. Soc. Rev. 1983, 147–160. doi: 10.2307/2095101

Dunning, J. H. (2001). The eclectic (OLI) paradigm of international production: past, present and future. Int. J. Econ. Bus. 8, 173–190. doi: 10.1080/13571510110051441

Eaton, J., Kortum, S., and Kramarz, F. (2004). Dissecting trade: firms, industries, and export destinations. Am. Econ. Rev. 94, 150–154. doi: 10.1257/0002828041301560

Ellis, P. D., Davies, H., and Wong, A. H. (2011). Export intensity and marketing in transition economies: evidence from China. Industr. Mark. Manage. 40, 593–602. doi: 10.1016/j.indmarman.2010.10.003

Evangelista, F., and Mac, L. (2016). The influence of experience and deliberate learning on SME export performance. Int. J. Entrepreneur. Behav. Res. 22, 860–879. doi: 10.1108/IJEBR-12-2015-0300

Faems, D., De Visser, M., Andries, P., and Van Looy, B. (2010). Technology alliance portfolios and financial performance: value-enhancing and cost-increasing effects of open innovation. J. Prod. Innov. Manage. 27, 785–796. doi: 10.1111/j.1540-5885.2010.00752.x

Fagerberg, J., and Godinho, M. M. (2005). “Innovation and catching-up,” in The Oxford Handbook of Innovation, eds J. Fagerberg, D. Mowery, and R. Nelson (Oxford, Hong Kong: Oxford University Press).

Fleming, L. (2001). Recombinant uncertainty in technological search. Manage. Sci. 47, 117–132. doi: 10.1287/mnsc.47.1.117.10671

Genin, A. L., Tan, J., and Song, J. (2020). State governance and technological innovation in emerging economies: state-owned enterprise restructuration and institutional logic dissonance in China’s high-speed train sector. J. Int. Bus. Stud. 2020, 1–25. doi: 10.4337/9781781003824.00008

Golovko, E., and Valentini, G. (2011). Exploring the complementarity between innovation and export for SMEs growth. J. Int. Bus. Stud. 42, 362–380. doi: 10.1057/jibs.2011.2

Haans, R. F. J., Pieters, C., and He, Z. (2016). Thinking about U: theorizing and testing U- and inverted U-shaped relationships in strategy research. Strat. Manage. J. 37, 1177–1195. doi: 10.1002/smj.2399

Hermelo, F. D., and Vassolo, R. (2010). Institutional development and hypercompetition in emerging economies. Strat. Manage. J. 31, 1457–1473. doi: 10.1002/smj.898

Ipek, I. (2019). Organizational learning in exporting: a bibliometric analysis and critical review of the empirical research. Int. Bus. Rev. 28, 544–559. doi: 10.1016/j.ibusrev.2018.11.010

Jackson, G., and Deeg, R. (2008). Comparing capitalisms: understanding institutional diversity and its implications for international business. J. Int. Bus. Stud. 39, 540–561. doi: 10.1057/palgrave.jibs.8400375

Johanson, J., and Vahlne, J. (2009). The uppsala internationalization process model revisited: from liability of foreignness to liability of outsidership. J. Int. Bus. Stud. 40, 1411–1431. doi: 10.1057/jibs.2009.24

Khanna, T., and Palepu, K. G. (2010). Winning in Emerging Markets: A Road Map for Strategy and Execution. Harvard: Harvard Business Press.

Kim, H., Wu, J., Schuler, D. A., and Hoskisson, R. E. (2020). Chinese multinationals’ fast internationalization: financial performance advantage in one region, disadvantage in another. J. Int. Bus. Stud. 1–31.

Kogut, B. (1989). Research notes and communications a note on global strategies. Strat. Manage. J. 10, 383–389. doi: 10.1002/smj.4250100407

Kogut, B., and Zander, U. (1993). Knowledge of the firm and the evolutionary theory of the multinational corporation. J. Int. Bus. Stud. 24, 625–645. doi: 10.1057/palgrave.jibs.8490248

Kostinets, Y. V. (2014). Core factors of intermediary services market development. Actual Problems Econ. 154, 172–177.

Leung, K., Bhagat, R. S., Buchan, N. R., Erez, M., and Gibson, C. B. (2005). Culture and international business: recent advances and their implications for future research. J. Int. Bus. Stud. 36, 357–378. doi: 10.1057/palgrave.jibs.8400150

Li, J., Chen, D., and Shapiro, D. (2010). Product innovations in emerging economies: the role of foreign knowledge access channels and internal efforts in chinese firms. Manage. Organiz. Rev. 6, 243–266. doi: 10.1111/j.1740-8784.2009.00155.x

Li, L., Xian, G., and Bao, Q. (2018). Does “importing” promote “going out”? –The impact of foreign investment on Chinese enterprises’ outward foreign direct investment. Econ. Res. J. 53, 142–156.

Lind, J. T., and Mehlum, H. (2010). With or without U? The appropriate test for a U shaped relationship. Oxford Bull. Econ. Statist. 72, 109–118. doi: 10.1111/j.1468-0084.2009.00569.x

Love, J. H., and Ganotakis, P. (2013). Learning by exporting: lessons from high-technology SMEs. Int. Bus. Rev. 22, 1–17. doi: 10.1016/j.ibusrev.2012.01.006

Love, J. H., and Manez, J. A. (2019). Persistence in exporting: cumulative and punctuated learning effects. Int. Bus. Rev. 28, 74–89. doi: 10.1016/j.ibusrev.2018.08.003

Luo, Y., and Tung, R. L. (2007). International expansion of emerging market enterprises: a springboard perspective. J. Int. Bus. Stud. 38, 481–498. doi: 10.1057/palgrave.jibs.8400275

Luong, T. A. (2013). Does learning by exporting happen? Evidence from the automobile industry in China. Rev. Dev. Econ. 17, 461–473. doi: 10.1111/rode.12043

Majocchi, A., Bacchiocchi, E., and Mayrhofer, U. (2005). Firm size, business experience and export intensity in SMEs: a longitudinal approach to complex relationships. Int. Bus. Rev. 14, 719–738. doi: 10.1016/j.ibusrev.2005.07.004

Mallick, S., and Yang, Y. (2013). Productivity performance of export market entry and exit: evidence from I ndian firms. Rev. Int. Econ. 21, 809–824. doi: 10.1111/roie.12072

Melitz, M. J. (2003). The impact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71, 1695–1725. doi: 10.1111/1468-0262.00467

Navasaleman, L. (2011). The impact of operating in multiple value chains for upgrading: the case of the Brazilian furniture and footwear industries. World Dev. 39, 1386–1397. doi: 10.1016/j.worlddev.2010.12.016

Nie, H., Jiang, T., and Yang, R. (2012). Current use and potential problems of industrial enterprise database in China. J. World Econ. 35, 142–158.

North, D. C. (1990). Institutions, Institutional Change and Economic Performance. New York: Cambridge University Press.

Peng, M. W. (2003). Institutional transitions and strategic choices. Acad. Manage. Rev. 28, 275–296. doi: 10.2307/30040713

Peng, M. W., Wang, D. Y. L., and Jiang, Y. (2008). An institution-based view of international business strategy: a focus on emerging economies. J. Int. Bus. Stud. 39, 920–936. doi: 10.1057/palgrave.jibs.8400377

Pla-Barber, J., and Alegre, J. (2007). Analysing the link between export intensity, innovation and firm size in a science-based industry. Int. Bus. Rev. 16, 275–293. doi: 10.1016/j.ibusrev.2007.02.005

Pollok, P., Luttgens, D., and Piller, F. T. (2019). Attracting solutions in crowdsourcing contests: the role of knowledge distance, identity disclosure, and seeker status. Res. Policy 48, 98–114. doi: 10.1016/j.respol.2018.07.022

Salomon, R. M., and Shaver, J. M. (2005). Learning by exporting: new insights from examining firm innovation. J. Econ. Manage. Strat. 14, 431–460. doi: 10.1111/j.1530-9134.2005.00047.x

Savino, T., Petruzzelli, A. M., and Albino, V. (2017). Search and recombination process to innovate: a review of the empirical evidence and a research agenda. Int. J. Manage. Rev. 19, 54–75. doi: 10.1111/ijmr.12081

Sharma, C., and Mishra, R. K. (2011). Does export and productivity growth linkage exist? Evidence from the Indian manufacturing industry. Int. Rev. Appl. Econ. 25, 633–652. doi: 10.1080/02692171.2011.557046

Smith, S. W. (2014). Follow me to the innovation frontier? Leaders, laggards, and the differential effects of imports and exports on technological innovation. J. Int. Bus. Stud. 45, 248–274. doi: 10.1057/jibs.2013.57

Sousa, C. M., Martínez López, F. J., and Coelho, F. (2008). The determinants of export performance: a review of the research in the literature between 1998 and 2005. Int. J. Manage. Rev. 10, 343–374. doi: 10.1111/j.1468-2370.2008.00232.x

Srivastava, M. K., and Gnyawali, D. R. (2011). When do relational resources matter? Leveraging portfolio technological resources for breakthrough innovation. Acad. Manage. J. 54, 797–810. doi: 10.5465/amj.2011.64870140

Sun, X., and Hong, J. (2011). Exports, ownership and firm productivity: evidence from China. World Econ. 34, 1199–1215. doi: 10.1111/j.1467-9701.2011.01373.x

Szulanski, G. (1996). Exploring internal stickiness: impediments to the transfer of best practice within the firm. Strat. Manage. J. 17, 27–43. doi: 10.1002/smj.4250171105

Tian, W., and Yu, M. (2013). Corporate export intensity and trade liberalization of imported intermediate goods: an empirical study from Chinese firms. Manage. World 1, 28–44.

Van Biesebroeck, J. (2005). Exporting raises productivity in sub-saharan African manufacturing firms. J. Int. Econ. 67, 373–391. doi: 10.1016/j.jinteco.2004.12.002

Wagner, J. (2007). Exports and productivity: a survey of the evidence from firm-level data. World Econ. 30, 60–82. doi: 10.1371/journal.pone.0236926

Wang, C., Kafouros, M., Yi, J., Hong, J., and Ganotakis, P. (2020). The role of government affiliation in explaining firm innovativeness and profitability in emerging countries: evidence from China. J. World Bus. 55:101047. doi: 10.1016/j.jwb.2019.101047

Wang, C. F., Chen, L., and Chang, S. (2011). International diversification and the market value of new product introduction. J. Int. Manage. 17, 333–347. doi: 10.1007/s11356-020-11375-x

Wang, T., Jia, Y., Wang, K., and Cui, N. (2018). Internationalization strategies of Chinese firms: a perspective of firms in emerging economies. China Industr. Econ. 5, 176–193.

Wang, W., and Ma, H. (2018). Export strategy, export intensity and learning: integrating the resource perspective and institutional perspective. J. World Bus. 53, 581–592. doi: 10.1016/j.jwb.2018.04.002

Wei, J., Wang, S., and Yang, Y. (2016). To whom isomorphism? The response of Chinese multinational firms’ overseas subsidiaries to institutional duality. Manage. World 10, 134–149.

Williamson, O. E. (1975). Markets and Hierarchies: Analysis and Antitrust Implications, Vol. 86. New York: The Free Press.

Witt, M. A., and Lewin, A. Y. (2007). Outward foreign direct investment as escape response to home country institutional constraints. J. Int. Bus. Stud. 38, 579–594. doi: 10.1057/palgrave.jibs.8400285

Wu, F., Sinkovics, R. R., Cavusgil, S. T., and Roath, A. S. (2007). Overcoming export manufacturers’ dilemma in international expansion. J. Int. Bus. Stud. 38, 283–302. doi: 10.1057/palgrave.jibs.8400263

Wu, X. (2019). Multinational enterprises: research trajectories since hymer. Foreign Econ. Manage. 041, 135–160.

Xie, Z., and Li, J. (2018). Exporting and innovating among emerging market firms: the moderating role of institutional development. J. Int. Bus. Stud. 49, 222–245. doi: 10.1057/s41267-017-0118-4

Yang, M. M., Li, T., and Wang, Y. (2020). What explains the degree of internationalization of early-stage entrepreneurial firms? A multilevel study on the joint effects of entrepreneurial self-efficacy, opportunity-motivated entrepreneurship, and home-country institutions. J. World Bus. 55, 101–114. doi: 10.16972/apjbve.12.5.201710.101

Keywords: exports, innovation, institutional development, U-shaped effect, reversal mechanism

Citation: Cao X, Li P, Fan L, Jiang Y and Huang X (2022) The U-Shaped Effect and Its Reversal Mechanism of Export and Innovation—Evidence From Chinese Industrial Enterprises. Front. Ecol. Evol. 10:869971. doi: 10.3389/fevo.2022.869971

Received: 05 February 2022; Accepted: 30 March 2022;

Published: 26 April 2022.

Edited by:

Magdalena Klimczuk-Kochańska, University of Warsaw, PolandCopyright © 2022 Cao, Li, Fan, Jiang and Huang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuan Jiang, amlhbmd5dWFueXVhbjcyMkBxcS5jb20=; Xiaozhi Huang, aHhpYW96aGlAbWFpbDMuc3lzdS5lZHUuY24=

†These authors share first authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.