94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 03 February 2025

Sec. Environmental Economics and Management

Volume 13 - 2025 | https://doi.org/10.3389/fenvs.2025.1512889

Examining the relationship and its dynamics between green finance and rural revitalisation is crucial for achieving an equitable, sustainable economy and low-carbon transition. This paper develops a comprehensive evaluation system for green finance and rural revitalisation, utilising data from 31 provinces in China from 2000 to 2020, and reveals the coordinated relationship and spatial characteristics. From the system theory, the coordinated and interacting relationship between green finance and rural revitalisation and its geographic features are also described in this paper. The results show that green finance levels have significantly increased across 31 provinces in China. The rural revitalisation process is also moving forward, and there is mutual reinforcement that creates a balance of harmonious symbiosis and positive interaction between green finance and rural revitalization. The relationship between the two also exhibits distinct stages and notable regional disparities, resulting in a spatial and temporal pattern characterised by ‘high east, sluggish middle, and delayed in the west.’ At the same time, a pattern of green finance development has appeared in the demonstrative unit of development. However, to enable the revitalisation of rural areas through green policies, it must accelerate the development of rural revitalisation and provide more robust and focused policy support.

The urgency of climate change and the frequent occurrence of extreme disasters that result from it have a significant impact on the global economy, energy systems, and social structures, thereby undermining societal wellbeing and human health. To mitigate the adverse effects of climate change on human wellbeing and growth, nations have carried out various actions aimed at reducing the associated risks. Green finance (GF), a crucial component of climate mitigation policies within the financial system, has increasingly garnered the attention of governments and scholars alike. Research indicates that GF significantly contributes to carbon emissions reduction (Meo and Abd Karim, 2022) and ecological footprint elimination (Bakry et al., 2023), particularly in Asia (Khan et al., 2022). The findings underscore the essential function of GF in reaching net-zero emission objectives and improving environmental quality, offering direction for policymakers to effectively tackle global climate issues and advance sustainable development worldwide (Khan et al., 2022; Lee et al., 2022).

In China, GF is pivotal in advancing green innovation, facilitating sustainable economic development, and addressing climate change. Simultaneously, green financing has exhibited significant promise in mitigating greenhouse gas emissions and advancing renewable energy initiatives, thus making a crucial contribution to sustainable development. From 2019 to 2023, China’s total green loan amount increased by 22.03 trillion CNY; green bond issuance exceeded 2 trillion CNY; and the cumulative turnover of carbon emission permits in China’s carbon trading market topped 10 billion CNY1. The advancement of GF is critically important for fostering the establishment of China’s green financial system, facilitating green development, enabling the ecological transformation of the economy and society, and achieving a Chinese-style modernisation characterised by harmonious coexistence between humanity and nature.

Alongside the objectives of climate change and sustainable development, establishing a just and equitable social structure has been an aim of the United Nations for sustainable development. China has attained significant progress in rapid urbanisation and industrialisation, yet it also confronts challenges such as underdeveloped rural areas and an expanding urban-rural divide (Liu et al., 2020; Long et al., 2022; Niu et al., 2023). Furthermore, urban expansion and population migration have resulted in the depletion of rural labour, the depopulation of the countryside, and the neglect of farmland, alongside environmental hazards and resource scarcity within the agricultural system. These factors have significantly hindered modernisation and development in rural areas, obstructing the attainment of equitable and sustainable development (Chen et al., 2020; Hossain et al., 2023). To combat rural decline and mitigate disparities in wellbeing, governments must advocate for ‘rural revitalisation (RR)', foster grassroots efforts, relocate uninhabitable settlements, and formulate scientific revitalization strategies. This is crucial for attaining the sustainable development objectives of food security, poverty alleviation, social fairness, and environmental conservation. Despite the increasing focus on sustainable agriculture and rural development, agricultural production, the rural ecosystem, and farmers’ welfare require a more comprehensive approach. Consequently, rural RR programs are essential to guarantee equitable access to resources and services for both rural and urban inhabitants (Qu et al., 2021).

RR necessitates government endorsement, strategic scientific plans, and extensive engagement from various societal sectors. GF plays a crucial role in the implementation of RR strategies, offering robust support for the attainment of sustainable development objectives like ensuring food security, eradicating poverty (Zhao et al., 2023), promoting social equity, and protecting the environment (Mo et al., 2023). To guarantee equal access to resources and services for both rural and urban residents and to facilitate RR through GF that supports the diverse development of agriculture and ecology, several banks have initiated credit support in the GF sector. For instance, CITIC Bank2 has offered financial assistance for green agricultural initiatives across various cities and counties, contributing to the advancement of green agriculture and renewable energy projects while promoting the sustainability of rural industries.

Implementing GF policies can facilitate environmental protection and ecological restoration projects, enhance the rural ecological environment (Mo et al., 2023), support the green transformation of rural industries (Han et al., 2023), and elevate the quality of life for residents (Yuan et al., 2024). Furthermore, GF contributes to reducing the income disparity between urban and rural regions, as well as addressing the issue of uneven development between these areas. GF also facilitates the provision of loans and investments that aid in the development of rural infrastructure and enhancement of public services, thereby fostering economic growth and social advancement in rural regions. This initiative will improve rural residents’ living standards and attract talent back to rural areas, thereby mitigating labour losses and addressing the issue of rural depopulation. Also, speeding up the revitalisation of rural areas makes social and economic conditions better for the growth of GF. This makes rural residents more aware of sustainable development and encourages more people to get involved in promoting and using GF. Furthermore, the achievement of RR can enhance the efficiency of ecologically sustainable investment and diminish the ecological footprint of financial development.

China’s 14th Five-Year Plan has clearly defined the development goals of green finance, emphasizing the need to strengthen the supporting role of green financial tools for the green innovation and development of enterprises, promote the efficient utilization of natural resources and achieve ecological environment protection. The implementation of the Rural Revitalization (RR) strategy has further strengthened the impetus for agricultural modernization, especially in the direction of green agriculture. The policy coordination and cooperation between green finance and rural revitalization will effectively promote the green transformation and sustainable development of the rural economy.

GF is integral to RR, contributing significantly to the achievement of its objectives and the promotion of sustainable rural development. The advancement of RR also brings plenty of opportunities for GF. However, the current literature has not sufficiently addressed the relationship between GF and RR, and it rarely examines these two topics together. This paper looks at 31 Chinese provinces and cities (but not Taiwan, Hong Kong, or Macau because of the data limitation), creates a full system for judging the GF and RR development, and figures out how they have changed over time. It also examines the coordination relationship between the two objects and their spatial changes from a system theory perspective, providing a solid foundation for future low-carbon transitions and equitable economic growth. The findings indicate a significant increase in GF across 31 provinces in China, as well as a steady improvement in RR, with both factors contributing to a degree of regional coordinated development. However, in China, the relationship between GF and RR is characterized by stages and notable regional disparities, exhibiting a spatial and temporal pattern of “faster in the east, slow in the middle, and declay in the west.” Simultaneously, in the designated areas of the 14th Five-Year Plan, a GF development model is emerging; however, the level of RR requires enhancement, necessitating more robust and tailored policy support to facilitate RR through GF.

The reason why the research selects the time span from 2000 to 2020 is based on the fact that the rural tax and fee reforms starting from 2000 (especially the abolition of the agricultural tax) have had a significant impact on rural revitalization (RR). As you mentioned, “China’s rural revitalization and urbanization began in 1980″, which is indeed the case. However, during the period from 1982 to 1997, China’s agricultural policies focused on improving agricultural productivity, promoting market-oriented reforms and stabilizing the foundation of the rural economy, and did not involve systematic measures for green transformation and environmental protection. Therefore, based on the principles of the availability and validity of research data, it is quite appropriate to set the research time span as from 2000 to 2020, which can comprehensively and accurately reflect the relationship between rural revitalization (RR) and green finance (GF).

This paper offers marginal contributions in the following areas: First, this paper develops a comprehensive indicator system for GF and RR, employing the Entropy-TOPSIS method to assess the development levels of both. It offers more thorough and objective evidence of practice compared to prior studies. Second, it systematically examines the coordination between GF and RR, adding to the literature on sustainable rural development. Finally, this paper investigates the coordinated development pattern of GF and RR using a coupled coordination degree model integrated with geographic information, thereby contributing to the existing literature on regional coordinated development research.

The remainder of this paper is organised as follows: Section 2 reviews the pertinent literature on GF and RR; Section 3 outlines the data and methodology employed; Section 4 presents the conclusions; and Section 5 summarises the findings and suggests relevant policy implications.

The current discussion on GF and RR consists of three main components: (1) the definition of GF and associated research; (2) the conception of RR and its impacts; and (3) the connection between GF and RR. As a result, this subsection aims to clarify the concepts of GF and RR, along with their relevant studies.

First, GF is based on “green” preferences, which means that when financial institutions make investment and financing decisions, they fully consider environmental factors, making them invest more funds in sustainable development businesses and projects, such as protecting the environment, saving energy and lowering emissions, and recycling resources (Alharbi et al., 2023). Meanwhile, they reduce investments in polluting and energy-intensive businesses and projects, fostering sustainable economic growth (GF) serves not only as a market mechanism but also as an institutional framework designed to direct social capital towards supporting the growth of green industries through financial services, such as loans, private equity funds, bonds, stocks, and insurance (Chai et al., 2022). Through the development of financial markets, GF not only facilitates access to funds for environmental projects but also supports technological innovation and market expansion. Developed financial markets can more effectively attract funds to green projects and enhance the impact of GF on environmental protection (Al Mamun et al., 2022). It also provides financial products like green loans, green bonds, and green investment funds to support environmental protection projects, clean energy initiatives, and technologies focused on energy-saving and emission-reduction (Lin and Ma, 2022). This financial model aims to reduce environmental pollution and promote the sustainable use of resources, thereby promoting the integrated development of economic and environmental aspects (Feng et al., 2022).

GF not only plays a crucial role in environmental protection but also contributes positively to economic development. It facilitates green investment and technological innovation, promoting economic restructuring and sustainable development. Studies also have shown that GF can create a mutually beneficial outcome between economic growth and environmental sustainability (Lee and Lee, 2022). By enhancing the information transparency framework, GF can mitigate the information gap between investors and enterprises and enhance the financial market’s transparency. This assists investors to more precisely evaluate the risks and rewards of environmental protection projects, thus improving the efficiency of capital allocation (Zhou and Zhang, 2023). GF also has significant long-term benefits in supporting a green economy and environmental protection, especially in developing countries, which often face greater environmental challenges and resource pressures. Meanwhile, existing studies have found that GF can also help to enhance the rural ecosystem (Mo et al., 2023), facilitate the green transformation of rural industries (Han et al., 2023), eliminate poverty (Zhao et al., 2023), and enhance residents’ quality of life (Yuan et al., 2024). These studies demonstrate that GF advancement can significantly aid rural development, narrow the urban-rural gap, and bring about true rural renewal.

GF not only plays an important role in environmental protection, but also has a positive impact on economic development. It promotes economic restructuring and sustainable development by promoting green investment and technological innovation. Studies have shown that GF can achieve a win-win situation between economic growth and environmental optimization (Lee and Lee, 2022). By improving the information disclosure mechanism, GF reduces the information asymmetry between investors and enterprises and enhances the transparency of the financial market. This helps investors more accurately assess the risks and rewards of environmental projects, thus improving the efficiency of capital allocation (Zhou and Zhang, 2023).

However, for China’s RR, the advantages of GF in promoting rural development are more prominent. First, GF helps improve the rural ecological environment by providing financial support for environmental projects (Mo et al., 2023). This is particularly important because rural areas face greater challenges in environmental protection and sustainable development. Secondly, GF helps green transformation of rural industries, promotes the transformation of agricultural production methods in the direction of green and low-carbon, enhances the added value of agricultural products and increases farmers’ income (Han et al., 2023). In addition, GF can also provide financial support for poor groups in rural areas and promote poverty alleviation (Zhao et al., 2023). These studies show that GF not only improves efficiency in resource allocation, but also directly promotes the economic development of rural areas and helps to realize RR.

These advantages indicate that GF plays a crucial role in RR strategy, and its unique financial mechanism combined with environment-oriented policies provides a new impetus for achieving green transformation, ecological protection and economic growth in the countryside.

Second, RR is a multi-dimensional concept covering a wide range of topics from socio-economic development to ecological protection, aiming to comprehensively enhance the standard of living and sustainability in rural communities (Geng et al., 2023), which usually involves enhancing the quality of life and economic conditions in rural communities in a variety of ways to ensure the sustainable development of rural communities. Existing studies have mostly discussed the RR in five aspects: economic prosperity, environmental livability, civilized cultural vitality, efficient governance, and prosperous living (Han, 2020). The implementation of RR policies helps to win the battle against poverty (Xu et al., 2022), strengthens the foundation of policies pertaining to agricultural and rural growth, and moreover contributes to the process of modernisation and policies for the growth of rural regions, helping to achieve the goal of equitable and sustainable development. RR also contributes to advancing the transformation of land ownership arrangements and enhancing the agricultural land market (Guo and Liu, 2021), which is of enormous significance to the realisation of premium rural advancement. Simultaneously, the multidimensionality of the RR goal helps to build a green countryside, Policies aim to bridge the divide between urban and rural communities, create more ecological and livable environments for production and daily life, and support the economic progress and expansion of China’s rural communities (Yang et al., 2021), helping to achieve common prosperity and high-quality development. Simultaneously, accelerating the RR process can foster more favorable social and economic conditions for the growth of GF. This, in turn, can raise the awareness of rural residents about sustainable development (Cai et al., 2024) and encourage more groups to participate in the promotion and application of GF. Furthermore, RR can enhance the effectiveness of ecologically sustainable investment and reduce the environmental footprint of financial development.

Finally, there is a strong coordinated and interactive relationship between GF and RR. GF, as an important tool for RR, not merely promotes ecological sustainability but also enhances financial and societal wellbeing Among other things, the EU has improved rural areas’ economies through the adoption of eco-friendly payments and agricultural environmental and climate actions (Jezierska-Thöle et al., 2022). In the post-epidemic era, the Chinese government has advanced sustainable energy and environmental protection projects in rural areas by implementing GF initiatives, which has enhanced the vitality of the rural economy while improving environmental quality and strengthening policies focus on the encouragement of sustainable finance products (Li et al., 2021). Simultaneously, existing studies have also found that GF, through various forms of green investment with rural eco-industrial parks and other forms of green investment, can help in enhancing the rural ecological ecosystem (Mo et al., 2023), and help the green transformation of rural industries (Han et al., 2023). The implementation of GF also helps to build rural industries (Irungu et al., 2023), eliminate poverty (Zhao et al., 2023), and further improve the quality of life of residents (Yuan et al., 2024), which will greatly accelerate the process of RR. At the same time, the acceleration of RR will also help to fuel the development of GF. Firstly, RR can help the non-urban economy develop (Yang et al., 2021), increase rural income, and open up the market for GF in the countryside. Secondly, RR can also help to improve residents’ awareness of sustainable behaviour and expand the scale of the rural GF market. Finally, the construction of ecological and livable structures as part of RR aims to increase the financial demand to support ecological advancement in rural regionsthereby creating an opportunity for green financial development in rural areas.

The above analysis shows that research on GF and RR usually lacks comprehensiveness and fails to fully understand the practical challenges and complexities faced by GF and RR. Simultaneously, the insufficient discussion of these two factors hinders a thorough understanding of the coordination and interaction between GF and RR. This lack of understanding impedes the process of coordinated regional development, as well as guiding the adjustment and formulation of future policies. Therefore, this paper investigates the spatial evolution characteristics of GF and RR by developing a comprehensive indicator evaluation system. From the standpoint of systems theory, it also showcases the coordination and interaction between the two, as well as their regional characteristics, providing crucial insights into the green transition to a low-carbon economy and ensuring the coordination of regional development processes.

The above analysis shows that the above literature describes the challenges of insufficient funding for GF as well as insufficient allocation of funds, and also analyzes the uncertainty of unstable policy support as well as inadequate systems. For example, the shortage of knowledge and skills due to insufficient education and skills training in rural areas, the long return cycle of ecological investment, and the development paradox of promoting ecological protection at the expense of short-term economic benefits. Research studies on GF and RR usually lack comprehensiveness and fail to fully understand the real challenges and complexities facing GF and RR. Discussions on the coordination and interaction between the two are not yet sufficient, and thus the interaction and coordination between different development policies cannot be properly understood, which is not conducive to grasping the process of coordinated regional development as well as the adjustment and promotion of future policies. Therefore, this paper discusses the spatial evolution characteristics of GF and RR by establishing a comprehensive indicator evaluation system, and demonstrates the coupled interaction between the two and their regional characteristics from the perspective of system theory, which provides important insights into the green low-carbon transition and coordinated regional development.

GF is a multi-dimensional organic systematic concept that covers various dimensions such as green capital, infrastructure, green market construction, green policy support, and so on. Therefore, this paper describes the progress status of GF using a comprehensive evaluation system, drawing on previous research (Xu et al., 2022), and aligning it with the practical establishment in China’s GF sector. Table 1 illustrates the calculation details for the advancement stage of GF in this study across seven aspects: green credit, green investment, green insurance, green debt, green support, green funds, and green equity. Indicators are considered to be effective in reflecting green investment activity in financial markets based on international green finance standards and previous research. Indicators are weighted on the basis of their market impact and capitalization to ensure that the index provides a comprehensive picture of the market performance of green finance.

RR, a multi-dimensional and comprehensive concept, covers the harmonized advancement of the rural economy, society, politics, and ecological system, and other fields. Simple analysis of a single latitude lacks both scientific and practical significance; therefore, multi-dimensional comprehensive measurement is necessary. This paper fully draws on previous studies (Xiong et al., 2024) establish the assessment index structure. Meanwhile, it combines the requirements of the Chinese government for RR and the actual situation, ffrom economic vitality, environmental sustainability, cultural enrichment, administrative efficiency, and affluent life, across five dimensions, to develop an integrated evaluation framework. The specific details is shown in Table 2.

Given the accessibility and accuracy of the data, this paper measures the level of GF and RR in 31 provinces in China from 2000 to 2020, using data from multiple sources, including statistical yearbooks and reports from the Bureau of Statistics, Ministry of Science and Technology, and other official publications in China.

This paper first constructed the weights of GF and RR indicators at all levels employing the entropy-based weighting approach, a technique frequently used in recent research (Chen, 2021), to provide detailed information on the coordinated development of GF and RR. On this basis, this paper, in conjunction with the TOPSIS method, computed the degree of deviation from or near the optimal and suboptimal ideal values for each indicator to determine the advancement stage of GF and RR. Furthermore, the coupling coordination analysis model is applied to examine the coordinated development process of GF and RR in China.

To calculate the weight based on the entropy model, the data should be standardised at first, which makes every data fall into the interval of [0, 1]. Based on different directions of influence, the different standardising methods are applied in this paper. Specific details are as follows:

First, an original data matrix is constructed, in which M represents different provinces and N represents the index value of each indicator for GF and RR (Equation 1).

For the indicator which give a positive promotion to GF or RR, the standardize formula is (Equation 2):

Otherwise, the negative indicator standardize function is (Equation 3):

Next, the normalized data is used to calculate the proportion of every index value of every provinces under various indicators (Equations 4, 5):

Then, compute the entropy value for each metric, named

Where,

Here, the weight of every indicator is calculated (Equation 9):

On this basis, the TOPSIS approach is utilized to assess the progress of GF and RR. Compared with other models, it could reflect its distance to the optimal development goals. To apply this method the normalized data

For the indicator which give a positive promotion to GF or RR (Equations 12, 13):

For the indicator which give a minus effects on GF or RR (Equations 14, 15):

Then, determine the weighted Euclidean distance from the evaluation target to the optimal or the worst solution. Named as

Last, calculate the relative distance calculate the distance between the assessment target and the ideal reference point

The larger of the value

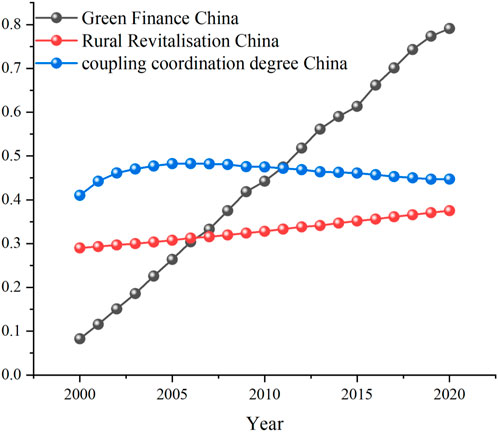

From 2000 to 2020, China has achieved remarkable development in GF and RR. Among them From Figures 1, 2 for the years 2000 and 2020, it can be concluded that, the GF index has grown significantly from 0.083 in 2000 to 0.791 in 2020 (All indices are averaged over all provinces in China for the year), reflecting the Chinese government’s active efforts to put into practice the concept of GF, implement GF policies, enhance the awareness of financial institutions and investors of sustainable investment, and strengthen international cooperation on GF. From Figures 2, 3 for the years 2000 and 2020, it can be concluded that, Although the overall growth of the RR Index is relatively slow, only increasing from 0.328 in 2000 to 0.335 in 2020, the steady growth shows the government’s continuous efforts in promoting agricultural modernization, improving rural infrastructure, and comprehensive governance. It also implies that further improvement in the level of RR requires more public policy support as well as special financial inputs. Meanwhile, from Figures 2, 4 for the years 2000 and 2020, it can be concluded that, the level of interaction and alignment between them has gradually risen from 0.415 in 2000 to 0.423 in 2020, indicating that the policy complementarity and coordination between GF and RR have risen consistently each year, and together they have promoted the sustainable development of the environment and the economy. These changes signify that China’s strategic adjustments in support of GF and RR policies have gradually borne fruit, and that the two complement each other, together becoming an important pillar of sustainable economic development and providing valuable experience and demonstrations at home and abroad.

Figure 2. Spatial and temporal evolution of GF, RR, coupling coordination degree development in China from 2000 to 2020.

However, relevant evidence suggests that China’s development in GF and RR is characterized by distinct stages. As can be seen in Figure 2, at the start of the study period, both RR and GF were at a low level (the GF index was 0.083, and the RR index was 0.328). The degree of coordination between the two was also low (the coupling degree of coordination was 0.415), resulting in an extremely uncoordinated situation. This is due to the fact that China had not yet established a mature financial system, and the concept of GF was still in its infancy. As a country that relies heavily on agriculture, the focus on agricultural production and historical accumulation from ancient times sets the foundation for RR at a significantly higher level than that of GF, resulting in a lack of better coordinated development.

In 2010, the GF index increased significantly to 0.443, showing that the government and the market have increased their awareness and actions in supporting environmentally friendly projects. Although the RR index increased only slightly to 0.328, policy continuity and structural adjustment are gradually taking place, and the degree of coordination between the two is steadily increasing. In 2020, the GF index increased further to 0.791, and the RR index increased steadily to 0.335. The index steadily increases to 0.335, while the overall degree of coupling and coordination rises to 0.423, indicating significant progress in tandem and complementing each other’s development.

In particular, the GF index is almost ten times higher than that of 2000, This not only demonstrates the growing maturity of China’s GF policies and market mechanisms but also highlights the emphasis the Chinese government places on sustainability. Simultaneously, the heightened degree of coupling and coordination between GF and RR policies suggests a closer integration in their implementation, efficiently fostering China’s dual aims of environmental sustainability and economic progress. This trend not only demonstrates the effectiveness of the policies but also reflects China’s outstanding contribution to the global green development and RR fields.

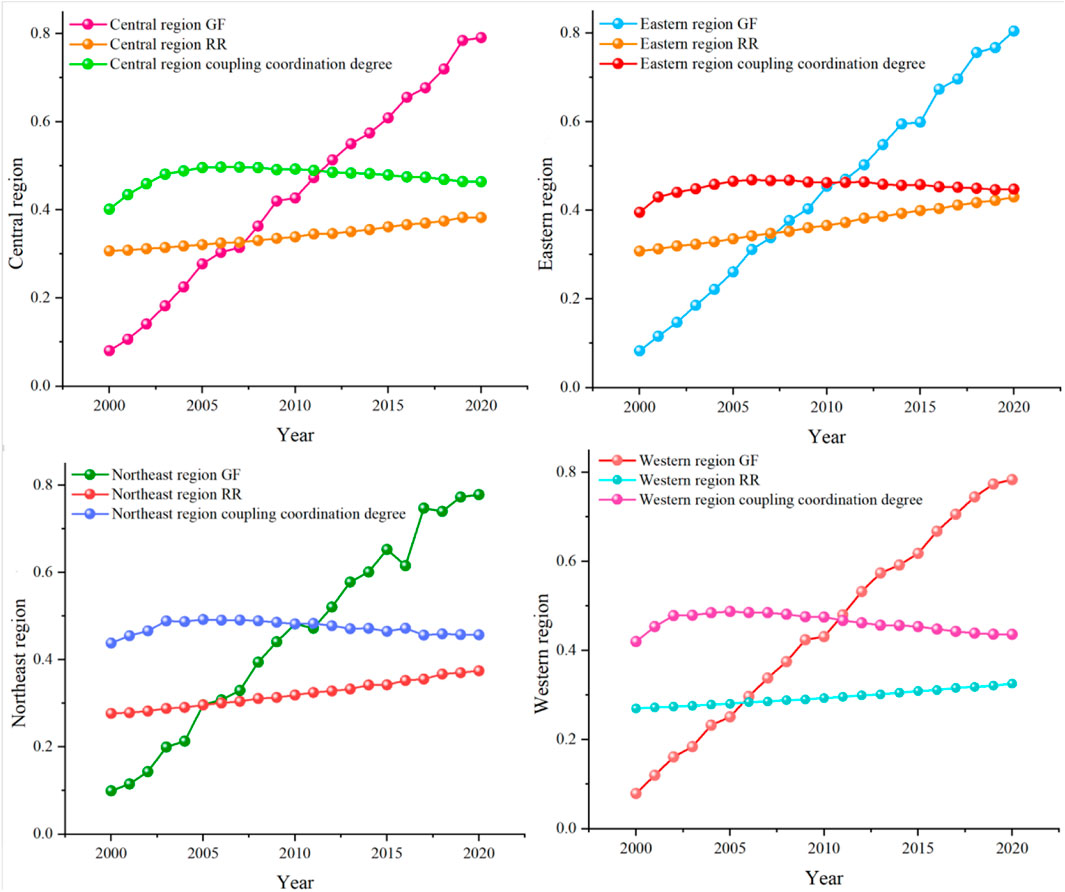

As can be seen in Figures 5, 6, apart from stage-specific characteristics, the growth of GF and RR in China also has significant regional characteristics Among them, the eastern region shows strong growth in all three indicators, accompanied by the GF index growing from 0.081 to 0.810 and the RR index rising from 0.316 to 0.397, with the coupling coordination degree increasing to 0.447, which demonstrates that the maturity of the region’s financial markets and policy innovation practices have given a strong boost to GF and RR.

Figure 5. Regional line graph of the degree of coordination of the coupling of green finance and rural revitalization (Eastern, central, north-eastern, western).

The northeastern region’s GF index rose from 0.099 in 2000 to 0.868 in 2021, reflecting growth in GF and government investment. The RR index fluctuates considerably over this period, reaching 0.496 in 2017 and falling slightly to 0.314 in 2021, which leads to strong fluctuations in the degree of coordination between the two, dropping back to 0.430 in 2020, suggesting that the northeast region needs to put in place stronger green policies to drive RR with GF and ultimately achieve a harmonious co-existence between the two. The level of RR in the central region has been relatively stable, fluctuating around 0.350, but the GF index grows from 0.085 to 0.791, which shows a significant momentum for catching up and a significant rise in the overall degree of coordination.

Alternatively, the western region exhibits strong development potential, as evidenced by its GF and RR index, which have increased from 0.084 to 0.310 to 0.785 and 0.342, respectively. This growth rate markedly outpaces that of other areas, and the sustained increase in the degree of coupling also reflects the region’s effective efforts to promote policy synergies and the development of regional characteristics. Overall, these results and data not only showcase the various strategies and effectiveness of different regions in promoting sustainable development and environmental protection, but also emphasize the necessity for policy adjustment and optimization in China’s balanced regional development. This underscores the need for China to formulate distinct regional policies to promote sustainable development and environmental protection.

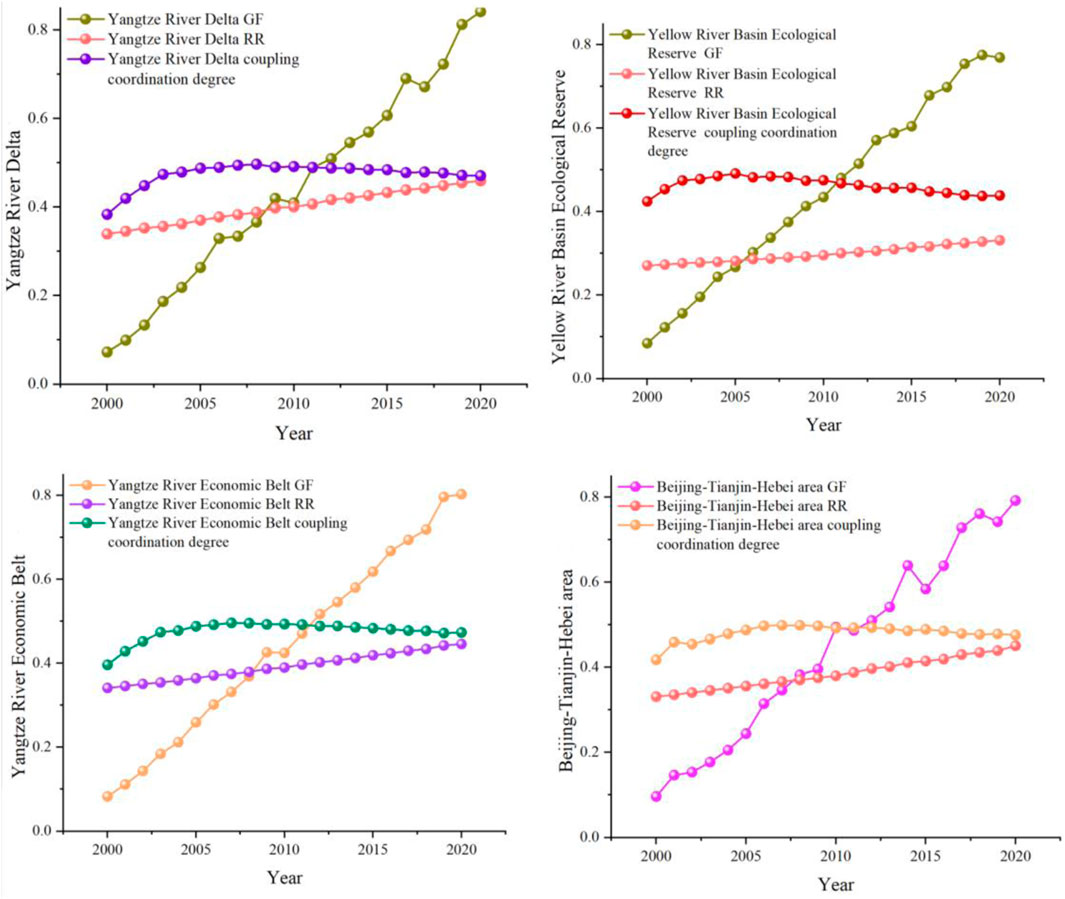

Looking at smaller typical regional units (the Yangtze River Economic Belt, the Beijing-Tianjin-Hebei area, the Yangtze River Delta, along with the Yellow River Basin Ecological Reserve mentioned) in 14th Five-Year Plan in China, for example, As can be seen in Figures 6, 7, these units show significant development trends and regional differences in the GF index, RR index and coupling coordination. Among them, the GF index has increased significantly in all regions, particularly in the Beijing-Tianjin-Hebei and Yangtze River Delta regions, where the GF index of Beijing-Tianjin-Hebei increased from 0.097 in 2000 to 0.818 in 2020, while the Yangtze River Delta rose from 0.070 in 2000 to 0.828 in 2020, which shows the advanced state of their economic growth and vibrant financial markets and reflects the economic development and strong support for green financial policies in these regions. Meanwhile, the RR index in Beijing-Tianjin-Hebei continues to grow, rising from 0.379 in 2000 to 0.424 in 2020, which also demonstrated the development potential for RR.

Figure 7. Regional line graph of the degree of coordination of the coupling of green finance and rural revitalization (the Yangtze River Economic Belt, the Beijing-Tianjin-Hebei area, the Yangtze River Delta, along with the Yellow River Basin Ecological Reserve mentioned).

However, the Yangtze River Delta and the Yellow River Basin face challenges in the development of RR, with the Yangtze River Delta declining from 0.213 in 2000 to 0.309 in 2020 and the Yellow River Basin declining from 0.336 in 2000 to 0.294, demonstrating the complexity of rural development under the pressure of urbanisation and ecological protection. However, it is encouraging to see that the GF The index for the Yangtze River Delta rises rapidly, ranging from 0.070 to reach 0.828, and that in the Yellow River Basin increases from 0.090 to 0.782, which reflects the importance attached in building a sustainable financial system, while the highly developed financial market provides strong support for it. However, the slight decline in the RR index and stagnation in the level of coupling coordination emphasises that this area still needs to strengthen its resource constraints and policy implementation.

Furthermore, the Yangtze River Economic Belt’s GF index grows from 0.076 in 2000 to 0.794 in 2020, thanks to the country’s strategic focus on the region and investment in green projects. Meanwhile, the RR index steadily improves, increasing from 0.299 to 0.383, reflecting the sustained efforts of local governments. However, the slower progress of coordinated development in the region, from 0.407 in 2000 to 0.439 in 2020, indicates a need for further strengthening of the integration between GF and RR. These findings not only demonstrate the specific challenges and achievements of different regions but also provide valuable insights for future policymaking, especially on how to more effectively integrate GF and RR policies for sustainable development.

This study evaluated the development of GF and RR in China through the establishment of a complete and objective integrated evaluating systemny by utilising the Entropy-TOPSIS technique. It also examines the current state of coordination and interaction between GF and RR initiatives use the linked coordination degree model. The findings are as follows:

(1) There has been a significant increase in GF across 31 provinces in China, and the process of RR is progressing, leading to regional mutual reinforcement and coordinated development. By facilitating sustainable development initiatives, GF significantly boosts RR. China’s GF initiatives have markedly enhanced infrastructure development and ecological preservation in rural regions, diminishing carbon emissions and elevating environmental quality. Simultaneously, RR can contribute to the advancement of green financing in a constrained manner, facilitating improved policy interaction and coordinated regional growth.

(2) In China, the correlation between GF and RR exhibits a phased progression and notable regional disparities, manifesting a spatial and temporal pattern characterized by “elevated in the east, sluggish in the middle, and slower in the west.” Despite China’s notable progress in advancing GF and RR, a disparity persists between policy execution and actual demand in specific regions. The western regions face numerous limitations in the allocation and execution of policy resources. The enduring effects and sustainability of green financial policies require enhancement, particularly in the alignment of financial flows and policy execution.

(3) A framework for GF development has emerged in the specified regions outlined in the 14th Five-Year Plan, covering the Yangtze River Economic Belt, Beijing-Tianjin-Hebei, the Yangtze River Delta, and the Yellow River Basin Ecological Reserve; however, the progress of RR remains insufficient, necessitating enhanced and tailored policy support to facilitate RR through GF.

This study offers pertinent policy implications in light of the aforementioned conclusions:

(1) In the central and western parts of the country, increase GF assistance. In western regions with more severe environmental conditions, such as Tibet and Qinghai, the government should enhance policy support and financial assistance, particularly in the innovation and promotion of green financial products. It can draw upon the successful experiences of the eastern coastal regions to create financial tools such as green credit facilities and green bonds to support local initiatives like ecological agriculture and renewable energy development.

(2) Encourage the cohesive growth of urban and rural regions and facilitate RR: the advancement of GF must consider the equilibrium between urban and rural regions, avoiding the disproportionate distribution of resources and funds to cities. Utilise GF to facilitate rural infrastructure development, enhance education, healthcare, and other public services, draw talent back to rural communities, and encourage the cohesive growth of both urban and rural regions.

(3) Facilitate the innovative implementation of agricultural green technologies, such as eco-friendly pesticides and water-efficient irrigation systems, to improve agricultural productivity and the quality of the rural ecosystem. At the same time, cultivate eco-agriculture and rural tourism to achieve a win-win situation benefiting both economic growth and environmental sustainability.

(4) Enhance the efficacy and consistency of policy execution. When formulating policies, it is essential to thoroughly assess the local context and improve the adaptability and relevance of the policies. Moreover, the persistence of GF policies and the sustained deployment of capital are crucial for guaranteeing policy efficacy; thus, the government must enhance oversight and coordination of local implementation at the policy level.

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary Material.

YG: Conceptualization, Methodology, Project administration, Resources, Software, Writing–original draft, Writing–review and editing. XH: Data curation, Investigation, Validation, Visualization, Writing–review and editing, Project administration, Resources. BS: Formal Analysis, Funding acquisition, Software, Supervision, Writing–review and editing. FZ: Formal Analysis, Investigation, Validation, Writing–review and editing. SS: Conceptualization, Funding acquisition, Resources, Supervision, Visualization, Writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research was funded by Yantai Social Science Federation, grant number 2024-XCZX-009.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The authors declare that no Generative AI was used in the creation of this manuscript.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fphar.2025.1512889/full#supplementary-material

1Data source: https://assets.kpmg.com/content/dam/kpmg/cn/pdf/zh/2023/05/sustainable-financial-development-in-china-white-paper.pdf, 2024-9-28

2Data source: https://www.citicbank.com/about/companynews/banknew/message/202401/t20240129_3528056.html, 2024-9-28

Alharbi, S. S., Al Mamun, M., Boubaker, S., and Rizvi, S. K. A. (2023). Green finance and renewable energy: a worldwide evidence. Energy Econ. 118, 106499. doi:10.1016/j.eneco.2022.106499

Al Mamun, M., Boubaker, S., and Nguyen, D. K. (2022). Green finance and decarbonization: evidence from around the world. Finance Res. Lett. 46, 102807. doi:10.1016/j.frl.2022.102807

Bakry, W., Mallik, G., Nghiem, X. H., Sinha, A., and Vo, X. V. (2023). Is green finance really ?green?? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew. Energy 208, 341–355. doi:10.1016/j.renene.2023.03.020

Cai, M. J., Ouyang, B., and Quayson, M. (2024). Navigating the nexus between rural revitalization and sustainable development: a bibliometric analyses of current status, progress, and prospects. Sustainability 16, 1005. doi:10.3390/su16031005

Chai, S. L., Zhang, K., Wei, W., Ma, W. Y., and Abedin, M. Z. (2022). The impact of green credit policy on enterprises' financing behavior: evidence from Chinese heavily-polluting listed companies. J. Clean. Prod. 363, 132458. doi:10.1016/j.jclepro.2022.132458

Chen, K. Q., Long, H. L., Liao, L. W., Tu, S. S., and Li, T. T. (2020). Land use transitions and urban-rural integrated development: theoretical framework and China's evidence. Land Use Policy 92, 104465. doi:10.1016/j.landusepol.2020.104465

Chen, P. Y. (2021). Effects of the entropy weight on TOPSIS. Expert Syst. Appl. 168, 114186. doi:10.1016/j.eswa.2020.114186

Feng, S. L., Zhang, R., and Li, G. X. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. Dyn. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Geng, Y. Q., Liu, L. W., and Chen, L. Y. (2023). Rural revitalization of China: a new framework, measurement and forecast. Socio-Econ Plan. Sci. 89, 101696. doi:10.1016/j.seps.2023.101696

Guo, Y. Z., and Liu, Y. S. (2021). Poverty alleviation through land assetization and its implications for rural revitalization in China. Land Use Policy 105, 105418. doi:10.1016/j.landusepol.2021.105418

Han, J. (2020). Prioritizing agricultural, rural development and implementing the rural revitalization strategy. China Agric. Econ. Rev. 12, 14–19. doi:10.1108/caer-02-2019-0026

Han, X., Wang, Y., Yu, W. L., and Xia, X. L. (2023). Coupling and coordination between green finance and agricultural green development: evidence from China. Finance Res. Lett. 58, 104221. doi:10.1016/j.frl.2023.104221

Hossain, M., Park, S., and Shahid, S. (2023). Frugal innovation for sustainable rural development. Technol. Forecast. Soc. Change 193, 122662. doi:10.1016/j.techfore.2023.122662

Irungu, R. W., Liu, Z. M., Liu, X. G., and Wanjiru, A. W. (2023). Role of networks of rural innovation in advancing the sustainable development goals: a quadruple Helix case study. Sustainability 15, 13221. doi:10.3390/su151713221

Jezierska-Thöle, A., Gwiazdzinska-Goraj, M., and Dudzinska, M. (2022). Environmental, social, and economic aspects of the green economy in polish rural areas-A spatial analysis. Energies 15, 3332. doi:10.3390/en15093332

Khan, M. A., Riaz, H., Ahmed, M., and Saeed, A. (2022). Does green finance really deliver what is expected? An empirical perspective. Borsa Istanb. Rev. 22, 586–593. doi:10.1016/j.bir.2021.07.006

Lee, C. C., and Lee, C. C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Lee, C. C., Li, X. R., Yu, C. H., and Zhao, J. S. (2022). The contribution of climate finance toward environmental sustainability: new global evidence. Energy Econ. 111, 106072. doi:10.1016/j.eneco.2022.106072

Li, X. F., Yang, H., Jia, J., Shen, Y., and Liu, J. Q. (2021). Index system of sustainable rural development based on the concept of ecological livability. Environ. Impact Assess. Rev. 86, 106478. doi:10.1016/j.eiar.2020.106478

Lin, B. Q., and Ma, R. Y. (2022). How does digital finance influence green technology innovation in China? Evidence from the financing constraints perspective. J. Environ. Manage 320, 115833. doi:10.1016/j.jenvman.2022.115833

Liu, Y. S., Zang, Y. Z., and Yang, Y. Y. (2020). China's rural revitalization and development: theory, technology and management. J. Geogr. Sci. 30, 1923–1942. doi:10.1007/s11442-020-1819-3

Long, H. L., Ma, L., Zhang, Y. N., and Qu, L. L. (2022). Multifunctional rural development in China: pattern, process and mechanism. Habitat Int. 121, 102530. doi:10.1016/j.habitatint.2022.102530

Meo, M. S., and Abd Karim, M. Z. (2022). The role of rural revitalization in reducing CO2 emissions: an empirical analysis. Borsa Istanb. Rev. 22, 169–178. doi:10.1016/j.bir.2021.03.002

Mo, Y. L., Sun, D. H., and Zhang, Y. (2023). Green finance assists agricultural sustainable development: evidence from China. Sustainability 15, 2056. doi:10.3390/su15032056

Niu, B., Ge, D. Z., Sun, J. W., Sun, D. Q., Ma, Y. Y., Ni, Y. L., et al. (2023). Multi-scales urban-rural integrated development and land-use transition: the story of China. Habitat Int. 132, 102744. doi:10.1016/j.habitatint.2023.102744

Qu, Y. B., Jiang, G. H., Ma, W. Q., and Li, Z. T. (2021). How does the rural settlement transition contribute to shaping sustainable rural development? Evidence from Shandong, China. J. Rural Stud. 82, 279–293. doi:10.1016/j.jrurstud.2021.01.027

Xiong, Z. B., Huang, Y. Z., and Yang, L. Y. (2024). Rural revitalization in China: measurement indicators, regional differences and dynamic evolution. Heliyon 10, e29880. doi:10.1016/j.heliyon.2024.e29880

Xu, Y., Li, S. S., Zhou, X. X., Shahzad, U., and Zhao, X. (2022). How environmental regulations affect the development of green finance: recent evidence from polluting firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020

Yang, J., Yang, R. X., Chen, M. H., Su, C. H., Zhi, Y., and Xi, J. C. (2021). Effects of rural revitalization on rural tourism. J. Hosp. Tour. Manag. 47, 35–45. doi:10.1016/j.jhtm.2021.02.008

Yuan, X., Zhang, J., Shi, J., and Wang, J. (2024). What can green finance do for high-quality agricultural development? Fresh insights from China. Socio-Economic Plan. Sci. 94, 101920. doi:10.1016/j.seps.2024.101920

Zhao, J., Wang, J. D., and Dong, K. Y. (2023). The role of green finance in eradicating energy poverty: ways to realize green economic recovery in the post-COVID-19 era. Econ. Change Restruct. 56, 3757–3785. doi:10.1007/s10644-022-09411-6

Keywords: green finance, rural revitalization, coordination, regional development, social development

Citation: Gao Y, Hua X, Sokolov BI, Zhao F and Shen S (2025) Offset or harmonious coexistence: untangling the interrelationship between green finance and rural revitalisation. Front. Environ. Sci. 13:1512889. doi: 10.3389/fenvs.2025.1512889

Received: 17 October 2024; Accepted: 17 January 2025;

Published: 03 February 2025.

Edited by:

Mobeen Ur Rehman, Keele University, United KingdomCopyright © 2025 Gao, Hua, Sokolov, Zhao and Shen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiang Hua, eGlhbmdodWFzbWlsZUAxNjMuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.