- 1Institute of History and Culture, Chengdu Sport University, Chengdu, China

- 2Development and Liaison Office, Zhejiang University, Zhejiang, China

- 3College of Psychology, Stony Brook University, Stony Brook, NY, United States

- 4Business School, Zheng Zhou University, Zhengzhou, Henan, China

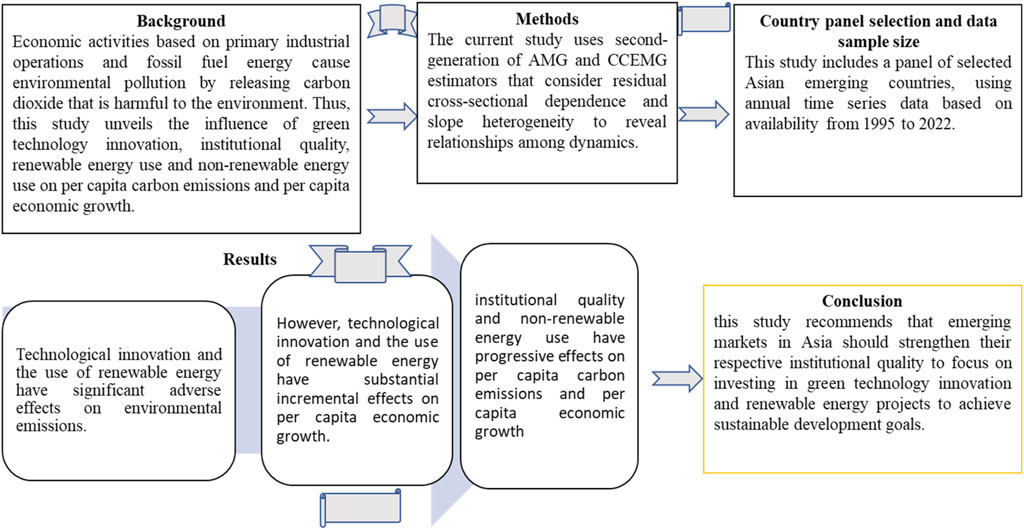

Economic activities based on primary industrial operations and fossil fuel energy cause environmental pollution by releasing carbon dioxide that is harmful to the environment. Green technological innovation and institutional quality are considered important tools to reduce environmental emission levels and promote economic growth. However, there are few studies that explore the role of technological innovation and institutional quality in exacerbating environmental pollution from the perspective of emerging Asian countries. Thus, this study unveils the influence of green technology innovation, institutional quality, renewable energy use and non-renewable energy use on per capita carbon emissions and per capita economic growth in emerging Asian countries from 1995 to 2022. The current study uses second-generation augmented mean group and common correlated effects mean group panel methods, taking into account residual cross-sectional dependence and heterogeneity to reveal long term relationship between dynamics. The analysis results emphasize that every 1% expansion of technological innovation can strongly reduce per capita carbon dioxide emissions by 0.329%, while effectively boosting per capita economic growth by 0.397%. However, every 1% improvement in institutional quality can effectively promote per capita carbon dioxide emissions and per capita economic growth by 0.243% and 0.362% respectively. Moreover, renewable energy strongly reduces environmental emissions and promotes economic enhancement, while non-renewable energy considerably stimulates environmental pollution and economic progress. Based on the revealed exploration, this study recommends that emerging markets in Asia should strengthen their respective institutional quality to focus on investing in green technology innovation and renewable energy projects to achieve sustainable development goals.

1 Introduction

In recent years, global warming, climate change and ecological hazards have become the most pressing economic issues. Global warming and climate change are primarily driven by greenhouse gas emissions. On the other hand, carbon dioxide (CO2) emissions, as the core element of greenhouse gases, have attracted widespread attention in the environmental literature (Gur, 2022). The expansion of fossil fuel energy use has triggered a surge in carbon dioxide (CO2) emissions, necessitating an immediate shift to compressing CO2 emissions to achieve sustainable development goals (IEA, 2024). Also, there is an urgent need for sustainable growth, affordable clean energy, sustainable production, technological innovation and sustainable consumption, which are all elements of the Sustainable Development Goals (such as SDGs 7, 8, 9, 12 and 13) set by the United Nations to address climate change (United Nations, 2015). Thus, on a global scale, mitigating carbon emissions is considered a major issue of concern to many countries. The introduction of green technological innovation is one of the key indicators to reduce carbon emissions, while improving green productivity, energy efficiency, growth rate, and promoting the transformation of the world’s economic development model (Dong et al., 2022; Lin and Ma, 2022). Green technology innovation is the latest technological innovation that limits the use of fossil fuel energy, reduces pollutant emissions, promotes the development of green economy, and ultimately improves environmental quality (Obobisa et al., 2022). Green technology innovation produces clean energy that can replace fossil fuel energy and is less harmful to the environment than fossil fuels, while the application of green technology can produce green products that reduce energy use and environmental pollution (Jaiswal et al., 2022). In addition, green technology innovation contributes to the development of renewable energy and helps economies optimize the use of renewable energy (Fang, 2023). The green technology innovation and renewable energy development encountered in recent years are important measures for emerging economies to reduce environmental emissions and achieve long-term economic growth and environmental sustainability (Fang et al., 2022). Thus, a potential remedy to condense environmental pollution and make productive economic activities in developing economies more sustainable is to invest in green technological innovations.

In addition to developing green technological innovations, quality system construction also helps formulate environmental protection measures and improve environmental quality by reducing carbon dioxide emission levels (Obobisa et al., 2022). Countries are recently making efforts to combat exploitation, strengthen financial management and develop environmental context by establishing sound and effective institutional frameworks. An effective and sound system in a country can significantly control environmental pollution (Ren et al., 2023). However, as some researchers acknowledge, developing economies need more effective institutions to curb greenhouse gas emissions by implementing strong strategies and clear directives (Fekete et al., 2021; Hassan et al., 2020). The positive impacts of high-quality institutions have been documented to outweigh their negative impacts, particularly in curbing crime and corruption in emerging economies, but research shows that their impact and consequences on the environment are limited. Thus, revealing the environmental impact of green technology innovation and institutional quality in developing Asian economies is the main purpose of this study.

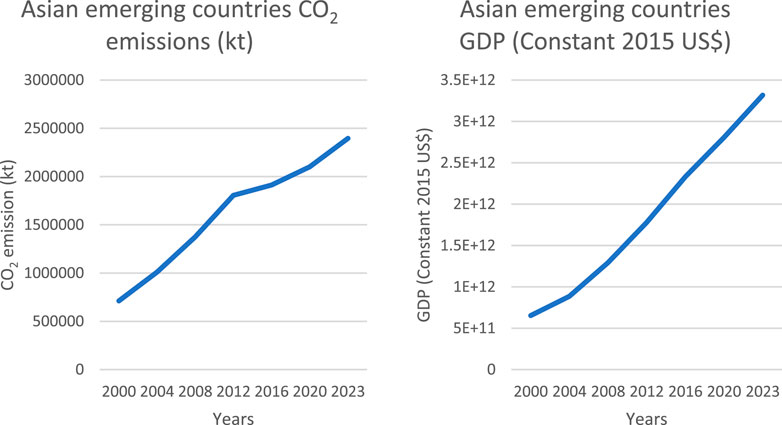

There are several reasons for choosing emerging countries in Asia for this study. First, emerging countries in Asia (China, India, Thailand, Philippine, Viet Nam, Malaysia, and Indonesia) have experienced strong economic trends, rapid technological progress, and globalization over the past decade. However, such large-scale economic development also comes with environmental impacts (Zaidi et al., 2019). With the improvement of productivity levels in developing countries in Asia, environmental pollution problems are becoming increasingly serious, as shown in Figure 1. According to the Asian Development Bank (2023), greenhouse gas emissions in emerging Asia have grown much faster than the global average since the 1980s. Emerging Asia’s share of global emissions doubled from 22% in 1990 to 44% in 2019 and is more likely to remain at the same level by mid-century if current strategies continue. Secondly, Asia’s emerging economies account for more than half of the world’s population and consume more than half of the world’s primary energy. Demographic changes over the past 30 years have been critical to the region’s ability to translate its economic goals into accelerated growth. But this strong growth momentum is not without challenges. As emerging Asia’s economies prosper, its emissions burden is also soaring. The region currently accounts for 51% of global carbon emissions and is the main contributor to annual greenhouse gas emissions (World Economic Forum, 2023b).

Figure 1. CO2 emission (kt) and GDP (Constant 2015 US$) in Asian emerging countries from 2000 to 2023. Sources: Source: Authors’ calculation from Development Indicators (WDI) database.

From a global perspective, emerging economies in Asia have leading non-fossil energy resources, but are still plagued by energy shortages, destructive externalities of climate change, technological backwardness, and institutional fragility (World Economic Forum, 2023a). In addition, Asia’s emerging economies tend to be far away from the technological frontier, reflecting a huge technological innovation gap. As a result, inventors in emerging Asian countries do not have the ability to patent their inventions, and due to insufficient investment in R&D, the level of innovation has not yet reached expectations (Park and Kim, 2022). It has been noted that Asian emerging countries pay less attention to the contribution effects of institutional panic and technological innovation to the environment and growth. Technological backwardness and weak institutions in Asia’s emerging economies have been blamed on rising carbon dioxide emissions caused by the use of fossil fuel energy in production processes (Wang M. et al., 2023). Thus, the environmental and growth performance of emerging Asian countries may be affected by future advances in institutional and technological innovation. In this context, it is crucial to reveal how high-quality institutions and green technology innovation affect economic growth and the environment in emerging Asian countries.

However, the impact of institutional quality and green technology innovation on the environment and growth has not been fully studied in the context of emerging Asian countries. First, in theory, the more environmentally relevant technologies and effective institutions there are, the greater the chances of boosting growth and lowering emissions levels (Haque and Ntim, 2018), but there are few empirical studies in emerging Asian countries to support this. Second, most past studies have focused on the relationship between technological innovation and carbon emissions, considering developed economies rather than developing economies, because innovation in less developed or developing economies is not enough to affect environmental pollution. Technological innovation in emerging Asian countries is worthy of study due to the increase in knowledge spillovers from global exchanges. Hence, this study aims to reveal the impact of institutional quality and green technology innovation on environmental hazards and economic growth in emerging Asian countries. Third, institutional quality and environmentally relevant technological advances can pave the way for achieving the goals of improving environmental quality through increased energy efficiency and enhanced green growth (Amin et al., 2023; Calar and Askin, 2023). The goals of achieving sustainable environment and green growth through the adoption of environment-related technologies and institutional quality are highly consistent with the Sustainable Development Goals (SDGs). Thus, this study can explore innovative ideas and breakthrough impacts to effectively adapt the way to ensure the Sustainable Development Goals (SDGs) such as SDG-7 (Use of Renewable Energy), SDG-8 (Sustainable Growth), SDG-9 (Sustainable Environment-Growth), SDG-12 (Sustainable Consumption) and SDG-13 (Nurturing Environmental Values). Fourth, the current study employs heterogeneous techniques to account for cross-sectional dependence and slope heterogeneity for a more robust analysis, unlike past studies that ignored these issues. The results of this study can be considered helpful in formulating mandatory strategies and guiding emerging economies to familiarize themselves with factors that may be important in promoting economic growth and mitigating environmental pollution.

2 Literature review

2.1 Green technological innovation and environmental degradation nexus

The focus on green technology innovation has become mainstream as environmental scientists and policymakers debate whether technological innovation is the right way to reduce environmental pollution. Environmental and energy-related challenges can be addressed through green technology innovation as one of the specific strategies and tools (Ahmed Z. et al., 2022). In addition, green technology innovation can also reduce carbon dioxide emissions by empowering countries to optimize and upgrade the use of renewable resources (Edziah et al., 2022). Nonetheless, researchers remain controversial as they provide different results on the bilateral link between green technology innovation and environmental pollution levels. Such as, Aydin and Degirmenci (2024) used the AMG estimator to conclude that green technology innovation and technology diffusion are two key factors promoting environmental quality in EU countries during the period 1990–2018. Aneja et al. (2024) reveal that clean energy and green technology innovations can significantly sustain the environmental status of G-20 countries using CS-ARDL from 1992 to 2018. Chien (2024) used the CUP-BC and CUP-FM methods to conclude that there is a progressive relationship between technological innovation, carbon finance, renewable energy utilization and carbon neutrality in E7 countries from 2006 to 2020. Meirun et al. (2021) using the (BARDL) method report that from 1990 to 2018, both short- and long-term green technology innovations can significantly compress Singapore’s carbon emissions and promote economic growth. However, other studies are based on the premise that the expansion of green technology innovation can stimulate CO2 emissions. Such as, Adebayo and Kirikkaleli (2021) used wavelet tools from the first quarter of 1990 to the fourth quarter of 2015 and argued that globalization and technological innovation have worsened environmental quality, while the use of renewable energy has alleviated environmental pollution in Japan. Lin and Ma (2022) reported that green technology innovation could not directly reduce carbon dioxide emissions in 264 prefecture-level cities in China from 2006 to 2017. Similarly, Khattak et al. (2020) empirically concluded that from 1980 to 2016, using the CCEMG method, green technology innovation failed to compress carbon emission levels, while the use of renewable energy can significantly reduce carbon emissions in China, India, Russia, South Africa. Du etal. (2019) used a fixed effects model of 71 economies during the period 1996–2012 to prove that green technology innovation can significantly promote carbon dioxide emissions in low-income countries, while green technology innovation can compress carbon dioxide emissions for high-income countries.

The green technology innovations in the above literature review do not show consistency in compressing carbon dioxide emissions. Thus, the impact of green technology innovation on carbon emissions in the empirical literature is inconclusive and needs further research. Moreover, the impact of green technology innovation on environmental pollution is not widespread in the context of emerging economies in Asia, so this study focuses on emerging economies in Asia.

2.2 Green technological innovation and economic growth nexus

The most important alternative policy for sustainable development is green growth, and the fundamental role in determining green growth is the adoption of green technological innovations or environment-related technologies (Mahmood et al., 2022; Danish and Ulucak, 2020; Ali et al., 2024) used advanced panel data estimation techniques to conclude that environment-related technologies make a significant and positive contribution to green growth in BRICS countries. Using the CS-ARDL model covering 1992 to 2018, Aneja et al. (2024) determined that promoting clean energy and green technologies can promote economic growth and environmental protection in G-20 countries. Meirun et al. (2021) report that green technology innovation can significantly boost Singapore’s economic growth and reduce CO2 emissions in both the short and long term from 1990 to 2018 using the novel bootstrapped autoregressive distributed lag (BARDL) technique. Using VECM during 2001–2016, Pradhan et al. (2020) also pointed out that entrepreneurship and technological innovation can powerfully promote the long-term economic growth of Euro countries. Jiang et al. (2024) used a novel panel approach over the period 1989–2021 and concluded that the use of environmentally relevant technologies and renewable energy sources helps mitigate CO2 emissions and promote economic growth in advanced economies. Koseoglu et al. (2022) also concluded that environmentally relevant technologies can significantly reduce the ecological footprint while promoting economic growth in the top 20 green innovative countries. Likewise, Chen and Tanchangya (2022) used the ARDL model to reveal the significant contribution of environmental technology to China’s short-term and long-term green economic growth.

Nonetheless, the above literature clearly shows that environmental technologies play a fundamental role in promoting green growth. However, further investigation is needed to understand whether and how technological innovation affects green growth in emerging Asian countries.

2.3 Institutional quality and environmental hazards nexus

There is growing interest in the recent literature on the importance of institutional quality for environmental sustainability. Government institutions play an important role in determining a country’s environmental quality, as countries with less efficient environmental regulations experience increased pollution regardless of their GDP levels (Egbetokun et al., 2020; Le and Ozturk, 2020). Countries with good institutional quality can shift their use of fossil fuel energy to renewable energy to achieve a sustainable environment and sustainable economic growth (Saadaoui and Chtourou, 2023; Abbass et al., 2022; Abbass et al., 2024). This argument is supported by many researchers, such as Khan and Rana (2021), who reported that better economic institutions and financial development helped 41 Asian countries reduce environmental pollution from 1996 to 2015 using the panel VECM method. Using AMG and CCEMG estimators for the period 1995–2017, Haldar and Sethi (2021) conclude that institutional quality moderates the use of renewable energy, thereby reducing environmental harm in developing countries. Likewise, Jahanger et al. (2022) reveal that renewable energy and democracy using the FMOLS approach robustly overcame environmental hazards in 69 developing countries from 1990 to 2018. However, there are studies, which have demonstrated progressive effect of institutional quality on carbon dioxide emission. However, some studies have shown that institutional quality has a progressive effect on carbon dioxide emissions. For instance, Obobisa et al. (2022) used AMG and CCEMG methods to derive the positive effects of institutional quality, fossil fuel energy use, and economic growth on CO2 emissions in 25 African countries during the period 2000–2018. Yang et al. (2022) use Driscoll Kraay regression for 1984–2016 to identify significant contributions of energy use, institutional quality and industrialization expansion to CO2 emissions in all models for 42 developing countries. Using AMG and CCEMG methods covering 1990 to 2014, Le and Ozturk (2020) demonstrate that energy use, globalization, financial development, and institutional quality contribute to CO2 emissions in 47 emerging and developing economies.

Institutional quality in the above literature review also does not show consistency in compressing CO2 emissions. Thus, the influence of institutional quality on carbon emissions in the empirical literature is inconclusive and needs further research. Moreover, the influence of institutional quality on environmental pollution is not universal in the context of emerging economies in Asia, so this study focuses on emerging economies in Asia.

2.4 Institutional quality and economic growth nexus

Institutional Quality is fundamental to achieving Sustainable Development Goal (SDG) 16, which aims to build sunny, productive and accountable institutions, maintain peaceful and inclusive societies, and provide opportunities for integrity. Only countries that uphold strong institutions and the rule of law can develop economic growth, fight corruption, and defend human rights (Uddin et al., 2023). Akinlo (2024) used a two-step GMM method to reveal that only corruption control and rule of law are institutional quality indicators that can stimulate economic growth in sub-Saharan African (SSA) countries from 1998 to 2018. Ahmed F. et al. (2022) used FMOLS and DOLS methods from 2000 to 2018 to reveal that institutional quality and financial development are the driving factors that promote green economic growth in South Asian economies in the long run. Likewise, Shikur (2024) concluded that institutional quality significantly contributed to long-term green growth in African countries during 1996–2021. Shahzad et al. (2022) used FMOLS and DOLS methods to conclude that institutional quality strongly contributed to economic growth in 28 OECD countries during the period 1990–2019. Omoke et al. (2020) also empirically report that institutional quality can reduce the negative long-term impact of import trade on Nigeria’s economic growth from 1984 to 2017 using the ARDL approach. The dividends of trade openness can be easily translated into growth-enhancing activities through the adoption of high-quality institutions and good governance.

In summary, there is currently a lack of literature that simultaneously considers the environmental and economic growth sustainability of emerging economies in Asia from the perspectives of institutional quality and green technology innovation. Hence, this study contributes to the existing literature by considering green technology innovation and institutional quality to examine their impact on economic growth and environmental degradation in Asian emerging countries.

3 Model construction, variable measurement, and their data sources and methods

3.1 Theoretical framework and model construction

Research supports the adverse impact of green technology innovation on environmental harm (Edziah et al., 2022; Aydin and Degirmenci, 2024; Chien, 2024; Aneja et al., 2024), and the incremental effects of green technology innovation on green growth (Mahmood et al., 2022; Danish and Ulucak, 2020; Aneja et al., 2024; Jiang et al., 2024). Likewise, the literature supports the adverse effects of institutional quality on environmental hazards (Egbetokun et al., 2020; Le and Ozturk, 2020; Khan and Rana, 2021; Jahanger et al., 2022), and the positive effects of institutional quality on economic growth (Uddin et al., 2023; Akinlo, 2024; Ahmed F. et al., 2022; Shikur, 2024; Shahzad et al., 2022). This study follows the above literature to reveal the impact of green technology innovation and institutional quality on environmental hazards and economic growth. The study also included renewable and non-renewable energy consumption in the model as additional explanatory controls for a more robust and thorough analysis. The proposed econometric models can be derived as:

PCO2 reflects per capita carbon dioxide emissions, PGDP, denotes Per Capita Gross Domestic Product; TI, IQ, RE and NRE signify technological innovation, institutional quality, renewable energy and non-renewable energy respectively. Where, α, i, t, and ε stands for coefficients of the variable, time period, countries and random error terms respectively.

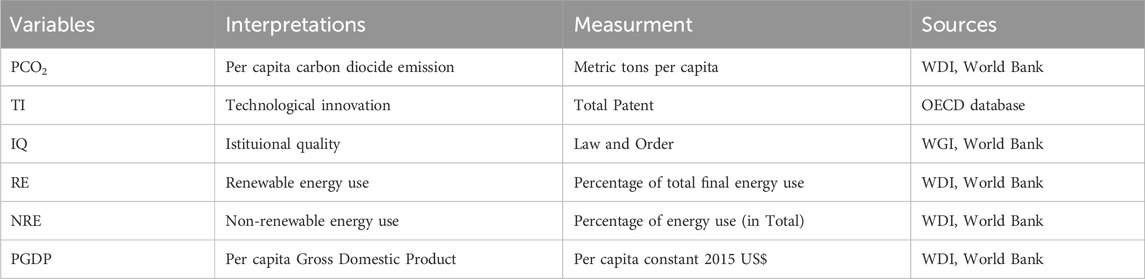

3.2 Measurements of panel variables and their data sources for retrieval

This study aims to explore the impact of green technology innovation, institutional quality, non-renewable energy use and renewable energy use on per capita carbon dioxide emissions and per capita GDP in emerging Asian countries. In empirical research, the most commonly used proxy indicator of environmental pollution among various pollutants is carbon dioxide (CO2) emissions. Carbon dioxide emissions have long been considered the dominant greenhouse gas, accounting for more than 70% of annual global emissions and exacerbating climate change (Lamb et al., 2021). Thus, CO2 emissions can be used as a proxy for environmental pollution in the current study due to their large contribution to global greenhouse gas reserves. Per capita CO2 emissions can be measured in metric tons per capita (Li et al., 2021). Researchers use different indicators to measure green technology innovation and institutional quality (Sun et al., 2019; Obobisa et al., 2022). Currently, many researchers use the patent index to measure green technology innovation (Maasoumi et al., 2021; Lv et al., 2021), while rules and laws have been used to measure institutional quality (Samadi and Alipourian, 2021; Khan et al., 2022). This study continues previous research by using patent index and law and order as proxies for green technology innovation and institutional quality respectively. The use of non-renewable energy (also called fossil fuel energy) and renewable energy can be measured as a percentage of total final energy use. Per capita Gross Domestic Product (GDP) is used as proxy for per capita economic growth and can be measured in constant 2015 US$ (Zhu et al., 2024; Ali et al., 2023). Data for all the variables mentioned above from 1995 to 2022 can be retrieved from the OECD database and the World Bank World Development Indicators (WDI) and Worldwide Governance Indicators (WGI), as shown in Table 1.

3.3 Econometric techniques for estimation

Cross-sectional dependence and slope heterogeneity are two key issues that need to be addressed before conducting panel data analysis, and ignoring them may lead us to perform spurious regression analyses (Ali et al., 2022; Cheng and Yao, 2021). Thus, in the panel data of this study, cross-sectional correlation can be tested using Pesaran (2015) CD test, Pesaran et al. (2008a) scaled LM method, and Breusch and Pagan (1980) LM approach in the first stage. After confirming the cross-sectional dependence and slope heterogeneity in the panel data, the stationarity of each variable in the second stage can be revealed by following the Pesaran (2007) cross-sectional Im, Pesaran and Shin (CIPS) unit root test. Cointegration between panel heterogeneous variables can be revealed in the third stage using Westerlund (2007) cointegration tests. In the final stage of research analysis, the second-generation robust augmented mean group estimation (AMG) method of Bond and Eberhardt (2013) and the common correlated effects mean group (CCEMG) method of Pesaran (2006) can be used for long-term coefficient estimations. The AMG and CCEMG methods are more robust to long-term coefficient estimates based on taking into account cross-sectional correlations and slope heterogeneity.

3.3.1 Cross sectional correlation test

Due to the unceasing upgrading of trade openness, economic integration and globalization, panel data are more prone to cross-sectional dependence (CD). Thus, in order to improve the accuracy and strength of estimates, it becomes crucial to eliminate the problem of cross-sectional dependence of panel data. This study follows Pesaran (2015) CD test, Pesaran et al. (2008) scaled LM method, and Breusch and Pagan (1980) LM method to disclose cross-sectional dependence in panel data. The above methods of checking cross-sectional correlation can be measured by Equations 3–6.

3.3.2 Slope heterogeneity test

Although slope homogenity dynamics are assumed to be uniform, panel data estimation results may be misleading or spurious due to the existence of heterogeneity. Thus, in a panel data cross-section, slope homogeneity or slope heterogeneity can be found using the Pesaran and Yamagata (2008b) slope heterogeneity (SH) test. The slope heterogeneity test was first initiated by Swamy (1970) and later updated by Pesaran and Yamagata (2008b). Pesaran and Yamagata heterogeneity test measurements can be represented by the following Equations 7, 8.

Š is the Swamy test statistic highlighted in the equation above, and K represents the number of independent variables.

3.3.3 Panel unit root tests

Finding the unit root properties of each panel variable after detecting cross-sectional dependence and slope heterogeneity is crucial for robust analysis. Panel data with cross-sectional dependence may lead us to obtain spurious results using first-generation unit root tests (Ali and Xiangyu, 2023; Sun et al., 2023). Thus, Pesaran (2007) proposed the second-generation CIPS unit root test and the covariate-augmented Dickey Fuller (CADF) test, which are more suitable for detecting unit roots in panel data with cross-sectional dependence. These tests explain the dynamics by revealing the use of mean hysteresis cross sections and unified first-order differential cross sections. Important features of the covariate-augmented Dickey Fuller (CADF) test have been shown in Equations 9, 10:

Where

The CIPS unit root test equations highlighted below rely heavily on the CADF statistic.

3.3.4 Westerlund Co-integration Test

It is critical to explore cointegration among panel dynamics in the series after elucidating the unit root properties of each panel variable in the series. The most appropriate cointegration test for panel data with cross-sectional dependence and slope heterogeneity is the second generation Westerlund (2007) cointegration test (Ali et al., 2023; Liu et al., 2023). The cointegration test of Westerlund (2007) can solve the problem of cross-sectional dependence and slope heterogeneity of panel data, so this study can use this test. The error correction mechanism (ECM) related to the Westerlund cointegration test have been expressed in Equation 11:

where,

The expression for the panel Westerlund test statistic is highlighted in Equations 14, 15:

Where

3.3.5 Methods for estimating long-term panel variable coefficients

The common correlated effects mean group (CCEMG) evaluator introduced by Pesaran (2006) and the augmented mean group (AMG) estimator suggested by Bond and Eberhardt (2013) are robust methods for estimating long-run panel variable coefficients. The robustness of the AMG and CCEMG methods is based on these tests, accounting for cross-sectional dependence and slope heterogeneity issues. There are two main stages associated with the AMG estimator. The model proposed in the first stage of this study is shown in Equations 1 and 2 is estimated in difference form (first differential) by the following panel regression model of Equations 16, 17 using T-1 dummy variables:

where Δ

The parameter

Where, lnΔ

It can be inferred that country-specific average parameter estimates are examined after adjustment for the ηt cross-sectional panel model specified in Equation 19 above. Thus, the individual independent variable parameters specified in the proposed research model can be estimated based on the following relationships in Equation 20.

where

Likewise, the CCEMG method also takes into account cross-sectional correlation and slope heterogeneity. Cross-sectional dependence in the CCEMG method is modeled taking into account the average value of the cross-sectional independent factors. Explicitly, unobserved common factors can be accounted for by averaging across cross sections. The CCEMG statistics of the model variables proposed in this study can be expressed in Equations 21, 22:

where

4 Interpretation of estimation results

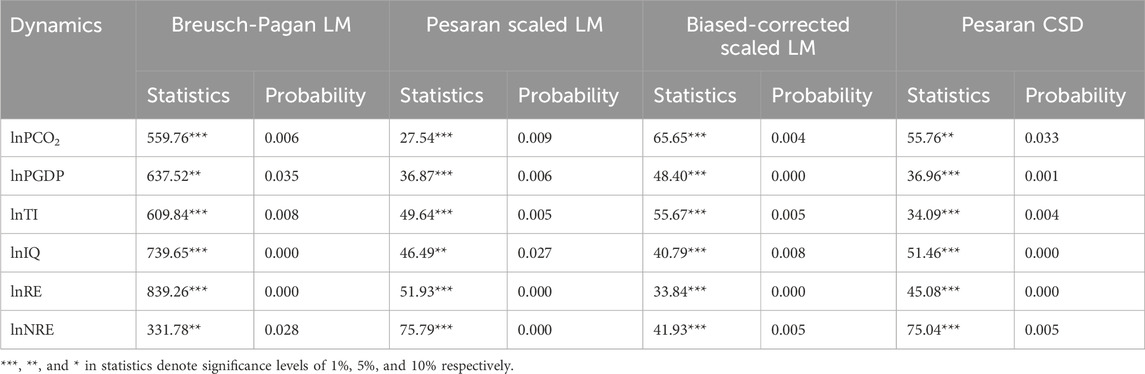

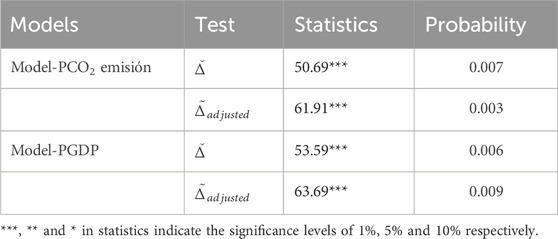

In the initial stage of analysis, it is crucial to find out the issues of cross-sectional correlation and homogeneity of slope parameters, so from the panel cross-section correlation method, it can be seen that the panel variables of the entire model are significant, as shown in Table 2. The significance of the panel variable parameters allows us to reject the null hypothesis of no cross-section, thereby confirming that there is a cross-sectional correlation problem with the panel variables. The issue of slope homogeneity in panel data can be tested using the delta (

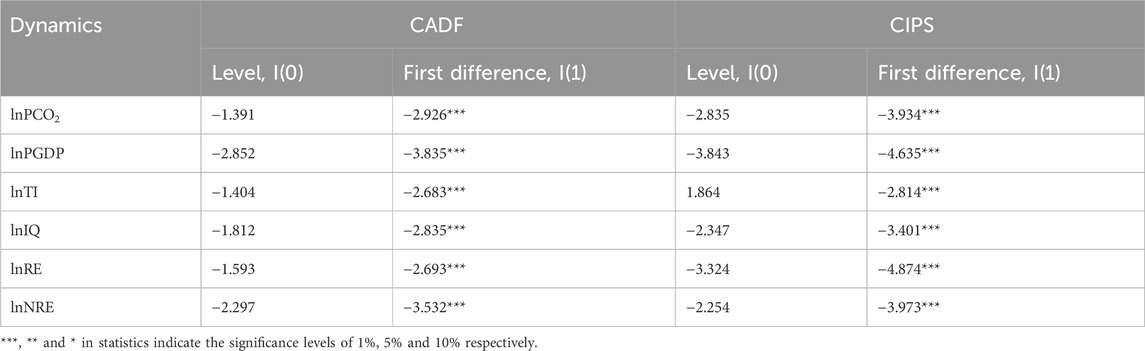

After identifying the cross-sectional correlation and slope heterogeneity problems in panel data, it is also an important step to test the unit root properties of each panel variable through the panel unit root tests. Thus, for panel data with problems of cross-sectional correlation and slope heterogeneity, using the second-generation CADF and CIPS unit root tests is the most appropriate method recommended by the literature. The first generation LLC, MW, and IPS unit root tests do not account for cross-sectional correlation and slope heterogeneity issues, so using these tests in panel data may lead to spurious regression analyses. CIPS and CADF unit root tests consider cross-sectional correlation and slope heterogeneity and can be used in this study, and the results are shown in Table 4. The entire set of variables in the model encounters unit root problems at the I(0) level, whereas these dynamics transform to stationary levels after the first differentiation I(1).

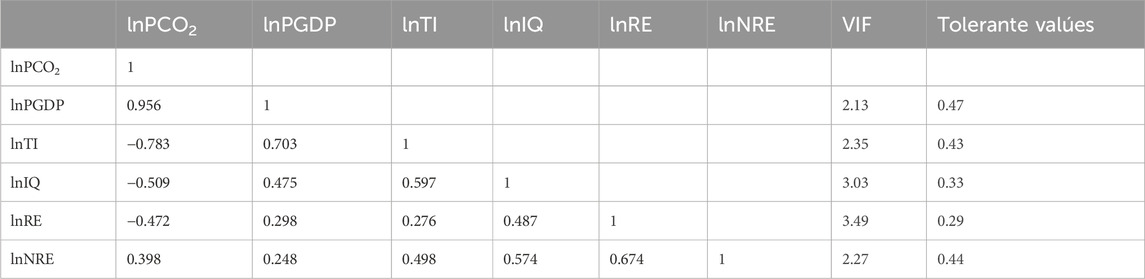

Table 5 highlights the results of panel variable correlation and multi-collinearity issues, showing that per capita carbon dioxide emissions are negatively related to green technology innovation, institutional quality and renewable energy, but positively related to per capita GDP and non-renewable energy use. More explicitly, per capita carbon dioxide emissions trend downward as institutional quality, green technology innovation, and renewable energy use increase, while per capita carbon dioxide emissions boost as per capita GDP and non-renewable energy use expand. GDP per capita is increasingly correlated with green technology innovation, institutional quality, and the use of renewable and non-renewable energy. The multicollinearity problem was checked through VIF and tolerance check. The results highlight that the values of each explanatory factor of VIF are all lower than 5, and the values of each explanatory factor of tolerance check are all higher than 0.2, proving that there is no multicollinearity in the model variables.

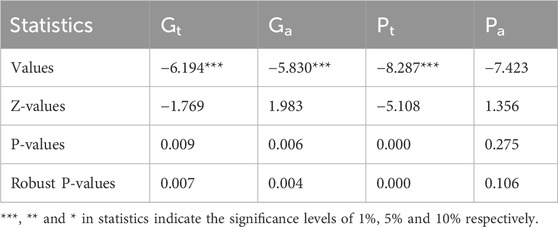

Another critical step after examining the unit roots of each panel dynamics is to explore cointegrating relationships among the panel variables. Thus, the Westerlund cointegration test is applied to achieve this goal. The results in Table 6 show a strong evidence of cointegration among panel variables in both models based on the significance of panel and group statistics with 100 bootstrap replications.

Table 6. Estimating long-run cointegration via Westerlund (2007) cointegration test.

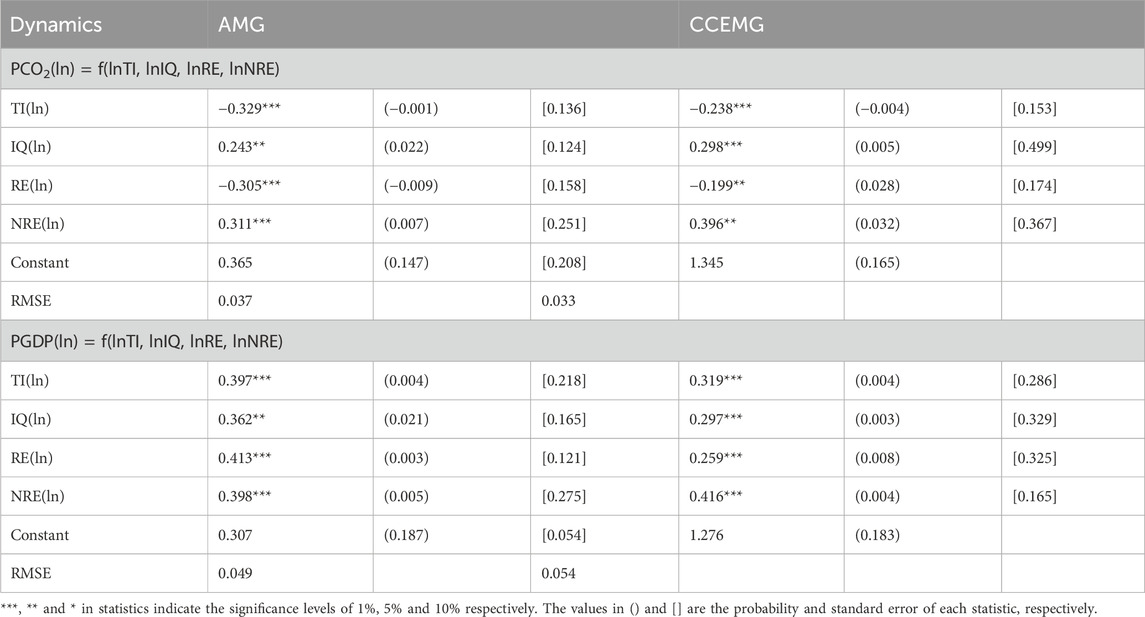

Establishing long-run cointegration relationships among panel variables opens the way to determining long-run coefficient estimates. Thus, this study uses AMG and CCEMG estimators to reveal the impact of technological innovation, institutional quality, renewable and non-renewable energy consumption on per capita carbon emissions and economic growth. The AMG and CCEMG estimators are more robust and efficient based on treating undiscovered mutual factors as common dynamic processes and taking into account cross-sectional dependence and slope heterogeneity issues in panel data. Thus, this study follows the results of the AMG and CCEMG processes.

It can be seen from the results of the AMG method established in Table 7 that with the improvement of technological innovation, per capita carbon emissions have been significantly compressed, and per capita economic growth has been greatly promoted. The technological innovation coefficients calculated by AMG and CCEMG are −0.329 and −0.238 respectively, which means that for every 1% expansion of technological innovation, the per capita carbon dioxide emissions can be reduced by 0.329% for AMG and 0.238% for CCEMG respectively, thereby cultivating environmental worth of Asian emerging economies. If the AMG method is adopted, every 1% increase in technological innovation can significantly increase per capita economic growth by 0.397%; if the CCEMG method is adopted, per capita economic growth can be promoted by 0.319%. The result of the negative impact of technological innovation on per capita carbon dioxide emissions is in good agreement with Edziah et al. (2022); Degirmenci (2024); Aneja et al. (2024); Meirun et al. (2021), while contradicting Lin and Ma (2022); Khattak et al. (2020); Du et al. (2019). The finding of the gradual impact of technological innovation on per capita economic growth is very consistent with the views of Mahmood et al. (2022), Danish and Ulucak (2020), Aneja et al. (2024), Meirun et al. (2021), Pradhan et al. (2020), and Jiang et al. (2024). It can be seen that green technology innovation will contribute to every additional carbon emission reduction and will also help the economic and industrial structures of emerging Asian countries to transform into a more sustainable and dynamic direction. However, most emerging Asian economies tend to be further away from the technological frontier, leaving a huge technology gap. In addition, most investors in emerging Asian countries are unable to transfer technology, have insufficient investment in R&D, and the level of innovation has not yet reached expectations. Thus, with the advancement of green technology innovation, the environmental quality of emerging economies in Asia can be improved in the near future.

The coefficients of institutional quality on environmental harm and economic growth are progressive and significant, which means that institutional quality has a large contribution to per capita carbon emissions and economic growth in emerging economies in Asia. The institutional quality coefficients calculated by AMG and CCEMG are 0.24 and 0.29 respectively, which means that for every 1% expansion of institutional quality, the per capita carbon dioxide emissions can be promoted by 0.243% for AMG and 0.298% for CCEMG respectively, thereby damaging the environmental quality of Asian emerging economies. Likewise, If the AMG method is adopted, every 1% increase in institutional quality can significantly increase per capita economic growth by 0.362%; if the CCEMG method is adopted, per capita economic growth can be promoted by 0.297%. The result of the gradual impact of institutional quality on per capita carbon dioxide emissions is in good agreement with Obobisa et al. (2022), Yang et al. (2022), and Le and Ozturk (2020), while contradicting Egbetokun et al. (2020), Le and Ozturk (2020), Saadaoui and Chtourou (2023), and Khan and Rana (2021). The finding of the asymptotic impact of institutional quality on per capita economic growth is very consistent with the views of Uddin et al. (2023), Akinlo (2024), Shikur (2024), Shahzad et al. (2022), and Omoke et al. (2020). The results clearly reflect the weaker institutional quality in Asian emerging economies in supporting environment-related technologies to sustain environment and growth. However, the existing institutional quality support in emerging economies in Asia is based on the use of non-renewable energy to increase productivity levels, which on the one hand promotes economic growth, but on the other hand pollutes the environment.

Furthermore, renewable energy has been shown to have a significant adverse impact on per capita CO2 emissions. More precisely, a 1% increase in renewable energy use reduces CO2 emissions per capita by 0.305% and 0.199% respectively. This result authenticates the latest research results of Ali et al. (2022), Ali and Xiangyu (2023), Liu et al. (2023), and Zhong et al. (2024). The renewable energy utilization coefficient is significantly positive for per capita economic growth, reflecting the significant role of renewable energy in promoting per capita economic growth in emerging Asian countries. More specifically, when renewable energy use increases by 1%, the per capita economic growth considered by the AMG method significantly augmented by 0.413%, and the per capita economic growth considered by the CCEMG method significantly promoted by 0.259%. Emerging Asian countries have few of the world’s largest reserves of solar, wind and hydro renewable energy, and many still use solar power despite its potential to generate geothermal and hydroelectric energy. Furthermore, few Asian emerging countries have recently committed to pursuing renewable energy as an alternative to traditional fossil fuels to address the ongoing challenges of sustainable energy supply and pollution reduction, and to achieve desirable environmental quality. Thus, emerging countries in Asia urgently need to improve environmental quality by supporting the continued development of modern sustainable energy innovations such as renewable energy. In addition, in the long term, the environmental performance of emerging Asian countries could be improved through regulations that encourage a shift from fossil fuels to renewable energy.

Furthermore, non-renewable energy sources have a significant and progressive impact on per capita CO2 emissions and per capita economic growth. Specifically, for every 1% increase in non-renewable energy in emerging Asian countries, per capita carbon emissions can significantly increase by 0.311% and 0.396%. Likewise, a 1% upsurge in the use of non-renewable energy can also considerably promote per capita economic growth by 0.398% and 0.416%. These results are in line with Ali et al. (2023), Zhang et al. (2023), Wang Q. et al. (2023), and Ali et al. (2022). Economic activities, infrastructure and various economic projects in emerging Asian countries rely heavily on fossil fuel energy, leading to a surge in carbon emissions and environmental pollution. The results thus serve as a wake-up call for environmental scientists and policymakers to accelerate Asia’s transition to renewable energy by halting the use of climate-altering fossil fuels.

5 Concluding remarks and policy implication

Strong interdependence among countries and growing economic activity lead to the pursuit of social and economic progress. These economic activities based on primary industrial operations and fossil fuel energy cause environmental pollution by releasing carbon dioxide that is harmful to the environment. Asia’s emerging economies aim to promote economic progress by focusing on strategies and economic activities based on fossil fuel energy that poses a threat to a sustainable environment. An effective mechanism to consolidate emission reduction levels and promote growth is to improve institutional quality and develop green technological innovation. To this end, this study reveals the impact of institutional quality and technological innovation as well as control factors, renewable and non-renewable energy use on per capita carbon dioxide emissions and per capita economic growth for seven emerging countries in Asia during the period 1995–2022. The current study uses AMG and CCEMG methods as dynamic heterogeneous processes with potential residual cross-section dependence and occurrence of heterogeneity.

This empirical study contributes to the environment and growth literature by summarizing the role of technological innovation and institutional quality in reducing CO2 emissions, promoting economic growth, and achieving sustainable environment and growth. Furthermore, the study provides necessary policy recommendations for the Sustainable Development Goals (SDGs 7, 8, 9, 12 and 13) based on interesting empirical results. The long-term estimation results of the AMG and CCEMG methods show that with the innovation of green technologies and the use of renewable energy, per capita carbon dioxide emissions have been significantly reduced and per capita economic growth has been significantly improved. Additionally, as fossil fuel energy use and institutional quality improve, per capita CO2 emissions and economic growth also increase significantly. It is crucial to extrapolate from the above important results that CO2 emissions from emerging Asia will continue to increase as economic growth relies heavily on the use of fossil fuel energy. In addition, emerging Asian countries are expected to face harsh environmental conditions as their economic development relies more on cheap, dirty energy sources such as fossil fuels. Thus, by developing technological innovation and transitioning from fossil fuel energy to renewable energy, environmental hazards in emerging Asian countries can be condensed and the goal of carbon neutrality can be achieved.

Sustainable development is widely considered to be the reduction of carbon emissions through the use of renewable energy and green technology innovation. Comprehensive investment in renewable energy and green technology innovation, coupled with prudent management of economic activity, can help emerging countries in Asia compress environmental emission levels. In this regard, emerging Asian governments should prioritize investments in green technology innovation and promote the use of renewable energy at the commercial and household levels by providing incentives such as renewable energy price subsidies to address environmental degradation. In addition, industries should recognize the environmental impact of their activities and promote a sustainable environment and growth through the use of renewable energy and enhanced development of technological innovation. At present, the quality of institutions for reducing carbon dioxide emissions in emerging Asian countries is weak. Thus, if emerging countries in Asia want to reduce environmental emissions and achieve climate goals, it is crucial to carry out institutional reforms. In addition, policymakers should strengthen institutional quality and develop effective strategies to promote sustainable development and growth by condensing the negative environmental impacts of institutional quality in emerging Asian countries.

This study focuses on technological innovation as a key factor in compressing environmental emission levels. However, environment-related technologies is another important factor that can also be tested in future studies to reduce carbon emissions in emerging Asian countries. Furthermore, this study could be extended by considering developed or developing countries on other continents and extending the sample data period.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://data-explorer.oecd.org/vis?df[ds]=DisseminateFinalDMZ&df[id]=DSD_PAT_DEV%40DF_PAT_DEV&df[ag]=OECD.ENV.EPI&dq=.A.TOT%2BENV_PAT.PATN.TWO.&pd=1995%2C2021&to[TIME_PERIOD]=false&ly[cl]=TIME_PERIOD&ly[rw]=REF_AREA; and from WDI, World Bank, which can be accessed through https://databank.worldbank.org/source/world-development-indicators.

Author contributions

RZ: Data curation, Methodology, Formal Analysis, Validation, Investigation, Visualization, Software, Writing–review and editing. . LJ: Conceptualization, Data curation, Formal Analysis, Software, Validation, Writing–original draft, Investigation, Methodology, Resources, Writing–review and editing. YL: Conceptualization, Investigation, Project administration, Resources, Supervision, Validation, Visualization, Writing–original draft. XG: Conceptualization, Data curation, Investigation, Methodology, Project administration, Resources, Validation, Visualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Generative AI statement

The author(s) declare that no Generative AI was used in the creation of this manuscript.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbass, K., Qasim, M. Z., Song, H., Murshed, M., Mahmood, H., and Younis, I. (2022). A review of the global climate change impacts, adaptation, and sustainable mitigation measures. Environ. Sci. Pollut. Res. 29, 42539–42559. doi:10.1007/s11356-022-19718-6

Abbass, K., Zafar, M. W., Khan, F., Begum, H., and Song, H. (2024). COP 28 policy perspectives: achieving environmental sustainability through FDI, technological innovation index, trade openness, energy consumption, and economic development in N-11 emerging economies. J. Environ. Manag. 369, 122271. doi:10.1016/j.jenvman.2024.122271

Adebayo, T. S., and Kirikkaleli, D. (2021). Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: application of wavelet tools. Environ. Dev. Sustain. 23 (11), 16057–16082. doi:10.1007/s10668-021-01322-2

Ahmed, F., Kousar, S., Pervaiz, A., and Shabbir, A. (2022). Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanb. Rev. 22 (1), 189–196. doi:10.1016/j.bir.2021.03.005

Ahmed, Z., Ahmad, M., Murshed, M., Shah, M. I., Mahmood, H., and Abbas, S. (2022). How do green energy technology investments, technological innovation, and trade globalization enhance green energy supply and stimulate environmental sustainability in the G7 countries? Gondwana Res. 112, 105–115. doi:10.1016/j.gr.2022.09.014

Akinlo, T. (2024). Does institutional quality modulate the effect of capital flight on economic growth in sub- Saharan Africa? J. Money Laund. Control 27 (1), 60–75. doi:10.1108/jmlc-02-2023-0026

Ali, A., Radulescu, M., and Balsalobre-Lorente, D. (2023). A dynamic relationship between renewable energy consumption, nonrenewable energy consumption, economic growth, and carbon dioxide emissions: evidence from Asian emerging economies. Energy Environ. 34 (8), 3529–3552. doi:10.1177/0958305X231151684

Ali, A., Radulescu, M., Lorente, D. B., and Hoang, V. N. V. (2022). An analysis of the impact of clean and non-clean energy consumption on economic growth and carbon emission: evidence from PIMC countries. Environ. Sci. Pollut. Res. 29 (34), 51442–51455. doi:10.1007/s11356-022-19284-x

Ali, A., and Xiangyu, G. (2023). Renewable energy generation, agricultural value added and globalization in relation to environmental degradation in the five most populous countries in Asia. Energy and Environ 0 (0). doi:10.1177/0958305X231199152

Ali, A., Xiangyu, G., Radulescu, M., and Nassani, A. A. (2024). The impact of China-US technological innovation, transportation, and power generation on energy, environment, and economic growth sustainability. Sci. Rep. 14 (1), 28712. doi:10.1038/s41598-024-80193-9

Amin, N., Shabbir, M. S., Song, H., Farrukh, M. U., Iqbal, S., and Abbass, K. (2023). A step towards environmental mitigation: do green technological innovation and institutional quality make a difference? Technol. Forecast. Soc. Change 190, 122413. doi:10.1016/j.techfore.2023.122413

Aneja, R., Yadav, M., and Gupta, S. (2024). The dynamic impact assessment of clean energy and green innovation in realizing environmental sustainability of G-20. Sustain. Dev. 32 (3), 2454–2473. doi:10.1002/sd.2797

Asian Development Bank (2023). Global warning: Asia is critical to addressing climate change. Available at: https://blogs.adb.org/blog/global-warning-asia-critical-addressing-climate-change. (Accessed April 14, 2024)

Aydin, M., and Degirmenci, T. (2024). The impact of clean energy consumption, green innovation, and technological diffusion on environmental sustainability: new evidence from load capacity curve hypothesis for 10 European Union countries. Sustain. Dev. 32 (3), 2358–2370. doi:10.1002/sd.2794

Bond, S., and Eberhardt, M. (2013). Accounting for unobserved heterogeneity in panel time series models. Univ. Oxf. 1 (11), 1–12.

Breusch, T. S., and Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. Rev. Econ. Stud. 47 (1), 239–253. doi:10.2307/2297111

Calar, A. E., and Askin, B. E. (2023). A path towards green revolution: how do competitive industrial performance and renewable energy consumption influence environmental quality indicators? Renew. Energy 205, 273–280. doi:10.1016/j.renene.2023.01.080

Chen, L., and Tanchangya, P. (2022). Analyzing the role of environmental technologies and environmental policy stringency on green growth in China. Environ. Sci. Pollut. Res. 29 (37), 55630–55638. doi:10.1007/s11356-022-19673-2

Cheng, Y., and Yao, X. (2021). Carbon intensity reduction assessment of renewable energy technology innovation in China: a panel data model with cross-section dependence and slope heterogeneity. Renew. Sustain. Energy Rev. 135, 110157. doi:10.1016/j.rser.2020.110157

Chien, F. (2024). The role of technological innovation, carbon finance, green energy, environmental awareness and urbanization towards carbon neutrality: evidence from novel CUP-FM CUP-BC estimations. Geosci. Front. 15 (4), 101696. doi:10.1016/j.gsf.2023.101696

Danish, U. R., and Ulucak, R. (2020). How do environmental technologies affect green growth? Evidence from BRICS economies. Sci. Total Environ. 712, 136504. doi:10.1016/j.scitotenv.2020.136504

Dong, F., Zhu, J., Li, Y., Chen, Y., Gao, Y., Hu, M, et al. (2022). How green technology innovation affects carbon emission efficiency: evidence from developed countries proposing carbon neutrality targets. Environ. Sci. Pollut. Res. 29 (24), 35780–35799. doi:10.1007/s11356-022-18581-9

Du, K., Li, P., and Yan, Z. (2019). Do green technology innovations contribute to carbon dioxide emission reduction? Empirical evidence from patent data. Technol. Forecast. Soc. Change 146, 297–303. doi:10.1016/j.techfore.2019.06.010

Edziah, B. K., Sun, H., Adom, P. K., Wang, F., and Agyemang, A. O. (2022). The role of exogenous technological factors and renewable energy in carbon dioxide emission reduction in Sub-Saharan Africa. Renew. Energy 196, 1418–1428. doi:10.1016/j.renene.2022.06.130

Egbetokun, S., Osabuohien, E., Akinbobola, T., Onanuga, O. T., Gershon, O., and Okafor, V. (2020). Environmental pollution, economic growth and institutional quality: exploring the nexus in Nigeria. Manag. Environ. Qual. An Int. J. 31 (1), 18–31. doi:10.1108/meq-02-2019-0050

Fang, W., Liu, Z., and Putra, A. R. S. (2022). Role of research and development in green economic growth through renewable energy development: empirical evidence from South Asia. Renew. Energy 194, 1142–1152. doi:10.1016/j.renene.2022.04.125

Fang, Z. (2023). Assessing the impact of renewable energy investment, green technology innovation, and industrialization on sustainable development: a case study of China. Renew. Energy 205, 772–782. doi:10.1016/j.renene.2023.01.014

Fekete, H., Kuramochi, T., Roelfsema, M., den Elzen, M., Forsell, N., Höhne, N., et al. (2021). A review of successful climate change mitigation policies in major emitting economies and the potential of global replication. Renew. Sustain. Energy Rev. 137, 110602. doi:10.1016/j.rser.2020.110602

Gür, T. M. (2022). Carbon dioxide emissions, capture, storage and utilization: review of materials, processes and technologies. Prog. Energy Combust. Sci. 89, 100965. doi:10.1016/j.pecs.2021.100965

Haldar, A., and Sethi, N. (2021). Effect of institutional quality and renewable energy consumption on CO2 emissions− an empirical investigation for developing countries. Environ. Sci. Pollut. Res. 28 (12), 15485–15503. doi:10.1007/s11356-020-11532-2

Haque, F., and Ntim, C. G. (2018). Environmental policy, sustainable development, governance mechanisms and environmental performance. Bus. Strategy Environ. 27 (3), 415–435. doi:10.1002/bse.2007

Hassan, S. T., Khan, S. U. D., Xia, E., and Fatima, H. (2020). Role of institutions in correcting environmental pollution: an empirical investigation. Sustain. Cities Soc. 53, 101901. doi:10.1016/j.scs.2019.101901

IEA (2024). Major growth of clean energy limited the rise in global emissions in 2023. Available at: https://www.iea.org/news/major-growth-of-clean-energy-limited-the-rise-in-global-emissions-in-2023. (Accessed August 3, 2024)

Jahanger, A., Usman, M., and Balsalobre-Lorente, D. (2022). Linking institutional quality to environmental sustainability. Sustain. Dev. 30 (6), 1749–1765. doi:10.1002/sd.2345

Jaiswal, K. K., Chowdhury, C. R., Yadav, D., Verma, R., Dutta, S., Jaiswal, K. S., et al. (2022). Renewable and sustainable clean energy development and impact on social, economic, and environmental health. Energy Nexus 7, 100118. doi:10.1016/j.nexus.2022.100118

Jiang, Y., Hossain, M. R., Khan, Z., Chen, J., and Badeeb, R. A. (2024). Revisiting research and development expenditures and trade adjusted emissions: green innovation and renewable energy R&D role for developed countries. J. Knowl. Econ. 15 (1), 2156–2191. doi:10.1007/s13132-023-01220-0

Khan, H., Khan, S., and Zuojun, F. (2022). Institutional quality and financial development: evidence from developing and emerging economies. Glob. Bus. Rev. 23 (4), 971–983. doi:10.1177/0972150919892366

Khan, M., and Rana, A. T. (2021). Institutional quality and CO2 emission–output relations: the case of Asian countries. J. Environ. Manag. 279, 111569. doi:10.1016/j.jenvman.2020.111569

Khattak, S. I., Ahmad, M., Khan, Z. U., and Khan, A. (2020). Exploring the impact of innovation, renewable energy consumption, and income on CO2 emissions: new evidence from the BRICS economies. Environ. Sci. Pollut. Res. 27, 13866–13881. doi:10.1007/s11356-020-07876-4

Koseoglu, A., Yucel, A. G., and Ulucak, R. (2022). Green innovation and ecological footprint relationship for a sustainable development: evidence from top 20 green innovator countries. Sustain. Dev. 30 (5), 976–988. doi:10.1002/sd.2294

Lamb, W. F., Wiedmann, T., Pongratz, J., Andrew, R., Crippa, M., Olivier, J. G., et al. (2021). A review of trends and drivers of greenhouse gas emissions by sector from 1990 to 2018. Environ. Res. Lett. 16 (7), 073005. doi:10.1088/1748-9326/abee4e

Le, H. P., and Ozturk, I. (2020). The impacts of globalization, financial development, government expenditures, and institutional quality on CO2 emissions in the presence of environmental Kuznets curve. Environ. Sci. Pollut. Res. 27 (18), 22680–22697. doi:10.1007/s11356-020-08812-2

Li, R., Wang, Q., Liu, Y., and Jiang, R. (2021). Per-capita carbon emissions in 147 countries: the effect of economic, energy, social, and trade structural changes. Sustain. Prod. Consum. 27, 1149–1164. doi:10.1016/j.spc.2021.02.031

Lin, B., and Ma, R. (2022). Green technology innovations, urban innovation environment and CO2 emission reduction in China: fresh evidence from a partially linear functional-coefficient panel model. Technol. Forecast. Soc. Change 176, 121434. doi:10.1016/j.techfore.2021.121434

Liu, Y., Ali, A., Chen, Y., and She, X. (2023). The effect of transport infrastructure (road, rail, and air) investments on economic growth and environmental pollution and testing the validity of EKC in China, India, Japan, and Russia. Environ. Sci. Pollut. Res. 30 (12), 32585–32599. doi:10.1007/s11356-022-24448-w

Lv, C., Shao, C., and Lee, C. C. (2021). Green technology innovation and financial development: do environmental regulation and innovation output matter? Energy Econ. 98, 105237. doi:10.1016/j.eneco.2021.105237

Maasoumi, E., Heshmati, A., and Lee, I. (2021). Green innovations and patenting renewable energy technologies. Empir. Econ. 60 (1), 513–538. doi:10.1007/s00181-020-01986-1

Mahmood, N., Zhao, Y., Lou, Q., and Geng, J. (2022). Role of environmental regulations and eco-innovation in energy structure transition for green growth: Evidence from OECD. Technological Forecasting and Social Change 183, 121890.

Meirun, T., Mihardjo, L. W., Haseeb, M., Khan, S. A. R., and Jermsittiparsert, K. (2021). The dynamics effect of green technology innovation on economic growth and CO2 emission in Singapore: new evidence from bootstrap ARDL approach. Environ. Sci. Pollut. Res. 28, 4184–4194. doi:10.1007/s11356-020-10760-w

Obobisa, E. S., Chen, H., and Mensah, I. A. (2022). The impact of green technological innovation and institutional quality on CO2 emissions in African countries. Technol. Forecast. Soc. Change 180, 121670. doi:10.1016/j.techfore.2022.121670

Omoke, P. C., Opuala-Charles, S., and Nwani, C. (2020). Symmetric and asymmetric effects of financial development on carbon dioxide emissions in Nigeria: Evidence from linear and nonlinear autoregressive distributed lag analyses. Energy Exploration & Exploitation 38 (5), 2059–2078.

Park, T., and Kim, J. Y. (2022). An exploratory study on innovation policy in eight Asian countries. J. Sci. Technol. Policy Manag. 13 (2), 273–303. doi:10.1108/jstpm-03-2021-0036

Pesaran, M. H. (2006). Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74 (4), 967–1012. doi:10.1111/j.1468-0262.2006.00692.x

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 22 (2), 265–312. doi:10.1002/jae.951

Pesaran, M. H. (2015). Testing weak cross-sectional dependence in large panels. Econ. Rev. 34 (6-10), 1089–1117. doi:10.1080/07474938.2014.956623

Pesaran, M. H., Ullah, A., and Yamagata, T. (2008a). A bias-adjusted LM test of error cross-section independence. Econ. J. 11 (1), 105–127. doi:10.1111/j.1368-423x.2007.00227.x

Pesaran, M. H., and Yamagata, T. (2008b). Testing slope homogeneity in large panels. Journal of econometrics 142 (1), 50–93.

Pradhan, R. P., Arvin, M. B., Nair, M., and Bennett, S. E. (2020). The dynamics among entrepreneurship, innovation, and economic growth in the Eurozone countries. J. Policy Model. 42 (5), 1106–1122. doi:10.1016/j.jpolmod.2020.01.004

Ren, S., Du, M., Bu, W., and Lin, T. (2023). Assessing the impact of economic growth target constraints on environmental pollution: does environmental decentralization matter?. J. Environ. Manag. 336, 117618. doi:10.1016/j.jenvman.2023.117618

Saadaoui, H., and Chtourou, N. (2023). Do institutional quality, financial development, and economic growth improve renewable energy transition? Some evidence from Tunisia. J. Knowl. Econ. 14 (3), 2927–2958. doi:10.1007/s13132-022-00999-8

Samadi, A. H., and Alipourian, M. (2021). Measuring institutional quality: a review. Editor N. Faghih, and A. H. Samadi, Dynamics of institutional change in emerging market economies: theories, concepts and mechanisms, Contributions to Economics. Springer. doi:10.1007/978-3-030-61342-6_6

Shahzad, U., Madaleno, M., Dagar, V., Ghosh, S., and Doğan, B. (2022). Exploring the role of export product quality and economic complexity for economic progress of developed economies: Does institutional quality matter?. Change and Economic Dynamics 62, 40–51. doi:10.1016/j.strueco.2022.04.003

Shikur, Z. H. (2024). Economic freedom, institutional quality, and manufacturing development in African countries. J. Appl. Econ. 27 (1), 2321084. doi:10.1080/15140326.2024.2321084

Sun, X., Ali, A., Liu, Y., Zhang, T., and Chen, Y. (2023). Links among population aging, economic globalization, per capita CO2 emission, and economic growth, evidence from East Asian countries. Environ. Sci. Pollut. Res. 30, 92107–92122. doi:10.1007/s11356-023-28723-2

Sun, H., Edziah, B. K., Sun, C., and Kporsu, A. K. (2019). Institutional quality, green innovation and energy efficiency. Energy Policy 135, 111002. doi:10.1016/j.enpol.2019.111002

Swamy, P. A. (1970). Efficient inference in a random coefficient regression model. Econ. J. Econ. Soc. 38, 311–323. doi:10.2307/1913012

Uddin, I., Ahmad, M., Ismailov, D., Balbaa, M. E., Akhmedov, A., Khasanov, S., et al. (2023). Enhancing institutional quality to boost economic development in developing nations: new insights from CS-ARDL approach. Res. Glob. 7, 100137. doi:10.1016/j.resglo.2023.100137

United Nations (2015). United nations sustainable development goals. 2015. Available at: https://sdgs.un.org/goals. (Accessed June 25, 2024)

Wang, M., Hossain, M. R., Mohammed, K. S., Cifuentes-Faura, J., and Cai, X. (2023). Heterogenous effects of circular economy, green energy and globalization on CO2 emissions: policy based analysis for sustainable development. Renew. Energy 211, 789–801. doi:10.1016/j.renene.2023.05.033

Wang, Q., Ali, A., Chen, Y., and Xu, X. (2023). An empirical analysis of the impact of renewable and non-renewable energy consumption on economic growth and carbon dioxide emissions: evidence from seven Northeast Asian countries. Environ. Sci. Pollut. Res. 30, 75041–75057. doi:10.1007/s11356-023-27583-0

Westerlund, J. (2007). Testing for error correction in panel data. Oxf. Bull. Econ. Statistics 69 (6), 709–748. doi:10.1111/j.1468-0084.2007.00477.x

World Economic Forum (2023a). Why Southeast Asia will be critical to the energy transition. Available at: https://www.weforum.org/agenda/2023/01/why-southeast-asia-critical-energy-transition/. (Accessed June 25, 2024)

World Economic Forum (2023b). Why the battle for net-zero may be won or lost by corporate Asia. Available at: https://www.weforum.org/agenda/2023/04/how-corporate-asia-sits-at-the-centre-of-the-climate-crisis-but-also-its-solution/. (Accessed June 26, 2024)

Yang, B., Ali, M., Hashmi, S. H., and Jahanger, A. (2022). Do income inequality and institutional quality affect CO2 emissions in developing economies? Environ. Sci. Pollut. Res. 29 (28), 42720–42741. doi:10.1007/s11356-021-18278-5

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., and Hou, F. (2019). Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 228, 533–543. doi:10.1016/j.jclepro.2019.04.210

Zhang, T., Yin, J., Li, Z., Jin, Y., Ali, A., and Jiang, B. (2023). Retracted: a dynamic relationship between renewable energy consumption, non-renewable energy consumption, economic growth and CO2 emissions: evidence from Asian emerging economies. Front. Environ. Sci. 10, 1092196. doi:10.3389/fenvs.2022.1092196

Zhong, X., Ali, A., and Zhang, L. (2024). The influence of green finance and renewable energy sources on renewable energy investment and carbon emission: COVID-19 pandemic effects on Chinese economy. J. Knowl. Econ, 1–24. doi:10.1007/s13132-024-01732-3

Zhu, K., Ali, A., Zhang, T., and zada, M. (2024). An empirical investigation of the impact of energy consumption, globalization and natural resources on ecological footprint and economic growth, evidence from China, Japan, South Korea and China Taiwan. Energy Environ. 0 (0). doi:10.1177/0958305X241251421

Keywords: green technological innovation, institutional quality, per capita CO2 emission, per capita GDP, Asian emerging countries

Citation: Zhang R, Jing L, Li Y and Guo X (2025) The role of technological innovation and institutional quality in environmental and economic growth sustainability in emerging Asian countries. Front. Environ. Sci. 12:1510120. doi: 10.3389/fenvs.2024.1510120

Received: 12 October 2024; Accepted: 09 December 2024;

Published: 06 January 2025.

Edited by:

Ken’ichi Matsumoto, Toyo University, JapanReviewed by:

Kashif Abbass, Riphah International University, PakistanXiaochun Zhao, Anhui University, China

Copyright © 2025 Zhang, Jing, Li and Guo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xu Guo, eHVndW8xOTkxQG91dGxvb2suY29t

Ruiyue Zhang1

Ruiyue Zhang1 Xu Guo

Xu Guo