- National Tax Institute of STA, Dalian, China

Reducing carbon dioxide emissions and achieving carbon neutrality have become hot topics of global concern. China has elevated its response to climate change to a national strategic level, where the green tax system plays a crucial role in implementing the dual-carbon strategy. This paper systematically analyzes the green tax systems of the Organisation for Economic Co-operation and Development (OECD)—encompassing environmental pollution taxes, energy taxes, vehicle and transportation taxes, and resource taxes. Based on this analysis, it proposes that China should establish a multifaceted green tax system including environmental protection tax, resource tax, and farmland occupation tax. Furthermore, it suggests an integrated approach combining systematic tax incentives such as corporate income tax, value-added tax, consumption tax, and vehicle purchase tax. This comprehensive green taxation framework, covering development, production, consumption, and emission stages, aims to drive high-quality green economic and social development through both tax incentives and restrictions, implementing a “dual-driving” mechanism. This study provides a basic framework and practical path for building a green tax system in China, especially studying the sources of different green taxes and their interrelationships, which enriches the theoretical and practical values related to taxation.

Background

On 6 November 2022, the World Meteorological Organization (WMO) released the provisional report “Global Climate in 2022.” The report highlighted that climate disasters, including extreme heat, torrential rains, floods, and droughts, were particularly evident in 2022, globally causing various epidemics and public health events. In 2023, extreme heatwaves, droughts, and devastating floods impacted millions worldwide, resulting in incalculable losses. Extreme weather and global warming have become issues that all nations need to confront collectively. On 22 September 2020, President Xi Jinping solemnly declared at the 75th United Nations General Assembly General Debate, “China will increase its nationally determined contributions, adopt more vigorous policies and measures, and strive to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060 (Xi, 2020).” The report of the 20th National Congress of the Communist Party of China in October 2022 clearly stated the need to optimize the tax structure, develop green and low-carbon industries, and actively and steadily advance carbon peaking and carbon neutrality for high-quality development.

Since the reform and opening-up, China has vigorously developed high-emission industries like steel and transportation to drive rapid economic growth, leading to a swift increase in China’s carbon emissions. After joining the WTO, China, as the “world’s factory,” saw its economy soar, accompanied by an accelerated increase in energy consumption and carbon dioxide emissions. By 2006, China became the country with the highest carbon emissions globally. In 2021, China’s total carbon emissions reached 11.9 billion tons, accounting for 33% of the global total. In 2022, China’s carbon dioxide emissions were 114.77 tons, roughly the same as in 2021, with a slight decrease of 0.2%, mainly due to reduced steel and cement production and decreased carbon emissions in transportation due to COVID-19 control policies.1 China still has a significant distance to reach its “carbon peak.”

Social and environmental problems such as global warming, waste pollution, and air pollution are intensifying, and thus the concepts of green, low-carbon, and sustainable are receiving increasing attention from scholars and researchers around the world (Tian et al., 2023). For example, enhancing carbon sink levels and reducing carbon emissions are two essential pathways to achieve the dual-carbon goals. The report of the 20th National Congress of the Communist Party of China once again emphasized China’s dual-carbon objectives, outlining specific plans in areas such as dual control of carbon emissions, energy revolution, improving the carbon market, and enhancing carbon sink capabilities. According to the United Nations Framework Convention on Climate Change, a carbon sink refers to any process, activity, or mechanism that removes greenhouse gases, aerosols, or greenhouse gas precursors from the atmosphere using natural resources such as soil, oceans, and plants, or man-made repositories. The concept opposite to a carbon sink is a carbon source, which includes various greenhouse gas emission sources in nature and human production and life processes. Achieving the dual-carbon goals involves, on the one hand, adjusting the energy structure, reducing the consumption of fossil fuels such as coal, oil, and natural gas, promoting the development of clean energy like solar, wind, and biomass, and improving the reuse level of waste steel and slag; and on the other hand, developing carbon capture technology, accelerating the promotion and application of carbon removal technologies and processes such as carbon capture, utilization, and storage. Moreover, encouraging afforestation and other ecological protection measures to enhance the carbon sink capacity of ecosystems.

China has elevated its response to climate change to a national strategic level, and policymakers urgently need to broaden their thinking in terms of carbon reduction pathways, mechanisms, and policy choices. It is necessary to establish a correct view of economic development and an effective resource allocation mechanism, with taxation being a vital mechanism for resource allocation. For example, China has recognized that the steel industry and construction industry need to reduce its generated carbon dioxide (Liang et al., 2021; Zhang et al., 2021). Thus, the unit carbon emission tax can serve as an efficient mean in reducing the carbon emissions produced by various industries and improving the environmental sustainability (Dulebenets, 2018). While taxes serve both revenue and regulatory functions, a balance between these functions must be specially considered in the current green tax system, because the green tax could affect operations (Elmi et al., 2023). As corrective taxes, priority should be given to the regulatory function over the revenue function.

The regulatory function of the green tax system has two aspects: On one hand, taxing enterprises’ carbon emission behaviors makes them bear the environmental costs of their emissions, thereby encouraging them to reduce the use of fossil fuels or improve energy efficiency. On the other hand, taxing natural ecosystems like forests, grasslands, wetlands, and tidal flats enhances the carbon sink resources’ ability to absorb carbon dioxide, aiding the achievement of carbon neutrality goals. Additionally, tax incentives are used to encourage low-carbon development, guiding enterprises to increase their research and innovation in energy-saving and environmental protection technologies, and promoting the transformation and upgrading of industrial and energy structures. In short, the green tax system can facilitate the realization of dual-carbon goals through both restrictive and incentivizing policies (Deng and Chen, 2022).

International experiences in green taxation policies

In 1972, the “Polluter Pays” principle, also known as the “PPP” principle, proposed by the Organisation for Economic Co-operation and Development (OECD), became one of the theoretical foundations for green taxation (OECD, 1989). Today, the utilization of green tax revenues primarily falls into two categories: earmarked funds for specific purposes and integration into the general budget. Most Western countries adopt the earmarked fund approach, directly using green tax revenues for environmental protection or efficient resource and energy utilization. This approach is based on the environmental nature of green taxes and the ease of implementation due to lower initial tax rates, which has proven to be effective in achieving environmental and social benefits. The OECD broadly categorizes green taxes into four types: environmental pollution taxes, energy taxes, vehicle and transportation taxes, and resource taxes, with each country having its distinct green tax system.

Environmental pollution taxes

These taxes are levied on the emission of pollutants and include sulfur tax, nitrogen tax, garbage tax, noise tax, shopping bag consumption tax, ozone depletion tax, etc. In the 1980s, the Netherlands introduced a garbage tax and an excess manure tax to address waste pollution. Given the country’s developed livestock industry, the excess manure tax was aimed at raising environmental awareness among farmers and keeping livestock numbers within reasonable limits. In 1987, Denmark introduced a garbage tax based on the weight of garbage delivered to waste treatment plants, with the tax burden being the same for both businesses and individuals. In Denmark, waste treatment is categorized into three types: the most environmentally friendly and tax-free is recycling; followed by incineration, which is taxed due to air pollution; and the most taxed is landfill, which causes pollution to air, soil, groundwater, and other environmental resources.

Energy taxes

These taxes are levied on the extraction, use, and emission of energy sources. Nordic countries started imposing energy taxes early, with Denmark introducing an energy tax in 1977, Sweden in the 1970s, and the Netherlands in 1988, combining prevention and incentives. To encourage investments in non-fossil energy projects, the Netherlands offers a range of tax relief policies, such as an energy efficiency investment subsidy program. If approved to participate in this program, companies can enjoy a tax reduction of 11.5% of the total investment on average, up to a maximum of 45.5%. The program can also be combined with tax-exempt policies for green investment income, allowing interest and dividend incomes to be tax-free. After continuous reforms and improvements by various countries, the energy tax system has become more comprehensive, including further detailed taxes like carbon tax and fuel tax for vehicles. Germany underwent a profound ecological tax reform in 1999, taxing mineral energy sources, natural gas, and electricity, successively imposing environmental taxes. Tax revenues are used for renewable energy projects, with the remaining part returned as tax rebates, reducing pension insurance expenses for market entities and incrementally increasing related subsidies.

Vehicle and transportation taxes

These taxes are levied on the purchase, sale, use, and road use of motor vehicles and ships. For instance, how to prevent the pollution from ships have become an important issue in China (Xiao et al., 2024a; Xu et al., 2024a; 2024b; 2024c). The Dutch government has introduced special taxes on motor vehicles in order to reduce the pollution of the environment by motor vehicle emissions. For example, it introduced a car mileage tax in 2012 as an alternative to the tax on new car purchases. Sweden’s motor vehicle tax varies according to the type, weight, and fuel type used. Although fuel prices in the United States are relatively low, there are many types of taxes related to the ownership and use of cars. Taxes related to car usage primarily include car usage tax, tire tax, car sales tax, and taxes on imported crude oil and its products. In the process of collecting these taxes, both the federal and state governments have their specific areas and ensure efficient tax administration, providing substantial financial support for environmental governance.

Resource taxes

Resource taxes refer to taxes levied on the extraction and use of natural resources, including mineral resource taxes, natural gravel taxes, tap water taxes, hunting license fees, etc. In 1970, the Netherlands became one of the first countries to impose a water resource tax, including water pollution taxes and groundwater taxes, with the regional water boards, not the Dutch tax authorities, responsible for collection and usage. The revenue from the water pollution tax is specifically used for controlling various types of water pollution, while the income from the groundwater tax is used for surface water quantity control and quality testing. The earmarked nature of these taxes has enhanced public awareness of green taxation and enabled regional water boards to more effectively carry out water resource protection and pollution prevention activities.

In the United States, Louisiana imposes different taxes on various natural resources, including petroleum extraction tax, natural gas extraction tax, and non-petroleum mineral extraction taxes on coal, ores, salt, sulfur, etc. Besides the value-based rate for the petroleum extraction tax, other taxes are levied based on quantity. Russia underwent a comprehensive tax reform in 2001, establishing a new natural resource tax system. This system replaced the previous fees and royalties on mineral resource extraction and consumption taxes on petroleum and condensate gas. Some countries have designed special taxes for resource extraction, such as mine usage fees, levied based on the value of production or the area of the mine, as seen in countries like Canada, Norway, Australia, and Argentina (Kou and Gao, 2013).

Carbon taxes

With the opening of the national carbon trading market, the government all the world actively promotes the carbon quota policy to achieve carbon emission reduction (Xiao and Cui, 2023; Xiao et al., 2024b). Thus, the importance of carbon taxes in the green taxation reform process of various countries cannot be overlooked. A comprehensive green taxation system must include carbon tax as a key type to achieve carbon peak and carbon neutrality goals. Although most countries have incorporated carbon taxes into energy taxes, targeting fossil fuels such as coal, standard gas oil, liquid petroleum, and natural gas based on either the carbon dioxide emission equivalent or direct carbon dioxide emissions, with a fixed tax rate levied per quantity. However, the author believes that to highlight the carbon reduction orientation of carbon taxes and send a more direct decarbonization signal to taxpayers and the outside world, it is necessary to thoroughly analyze the development experiences of carbon taxes in different countries.

As an effective tool for promoting carbon reduction, the carbon tax is one of the important forms of carbon pricing mechanisms, usually complementing quantitative emission reduction tools—carbon emission rights trading—to further expand the coverage of the carbon pricing mechanism. Its main policy goals include: first, limiting taxpayers’ fossil energy consumption through taxation, thereby reducing greenhouse gas emissions; second, incentivizing the development and use of clean and renewable energy through tax tools to achieve a regulatory effect that emphasizes both incentives and constraints (Research Group of Institute of Fiscal Science, Ministry of Finance, 2009). Since the 1990s, Sweden and Finland have started imposing carbon taxes, followed by other countries internationally.

From 1991, Sweden began imposing high carbon taxes on households and individuals, prompting Swedes to opt more for public transport or bicycles. Under the effect of the carbon tax, Sweden’s per capita carbon dioxide emissions rapidly decreased year by year. In 1999, upon joining the European Union and to align with the current EU emissions trading system, Sweden modified the scope of its carbon tax. In 2009, the Energy Tax Ordinance, formed through tax reforms, revised parts of the original bill, resulting in the current carbon tax (Yu and Hu, 2023). In 2004, the Netherlands fundamentally formed its carbon energy tax system, imposing fuel environmental tax on energy products, energy regulation tax, and energy consumption tax on small-scale consumers, as well as a quasi-donation tax (Wang, 2013).

In October 2012, with the introduction of the petroleum coal tax, Japan became the first Asian country to implement a carbon tax. The Japanese carbon tax follows the principle of “low tax rate, wide scope, and broad exemptions,” with all fossil fuels being taxable and the tax rate gradually increasing in stages, along with related exemption policies to reduce the tax burden on taxpayers (Hou and Li, 2023). In 2018, Singapore enacted the Carbon Pricing Act and started imposing a carbon tax in January 2019, becoming the first Southeast Asian country to introduce a carbon tax. The Singapore carbon tax system introduced a low tax rate transitional framework, giving existing emissions-intensive trade-exposed (EITE) companies more time to adapt to a low-carbon economy, with quotas determined based on efficiency standards and decarbonization goals (Liu et al., 2022). On 1 June 2019, South Africa officially enacted the Carbon Tax Act, becoming the first African country to implement a carbon tax. The act is implemented in two phases: the first phase from 1 June 2019, to 31 December 2022, with the government introducing a series of tax exemptions and subsidies, adopting a relatively moderate carbon tax standard, and promising that the carbon tax would not affect electricity prices during the first phase. The second phase will continue from 2023 to 2030, with specific policies to be determined based on the assessment of the effects of the earlier policies. Overall, South Africa’s carbon tax focuses on the industrial, power, construction, and transportation sectors, covering 80% of the country’s greenhouse gas (GHG) emissions (Huang et al., 2023).

In 2022, the New Zealand government released the “Agricultural Emissions Pricing” consultation document, planning to introduce the world’s first agricultural greenhouse gas emission tax to reduce methane emissions in New Zealand. Nearly half of New Zealand’s greenhouse gas emissions (mainly methane) come from agriculture, which has been exempted from the New Zealand carbon emissions trading scheme. The tax plan will take effect on 1 January 2025, but the pricing has not yet been finalized. New Zealand Prime Minister Jacinda Ardern stated that the funds raised from the proposed tax would be used for agricultural development, providing funding for new technologies, research, and incentive programs for farmers. While reducing agricultural carbon emissions, New Zealand also released its first emission reduction plan, implementing a 15% tax credit for eligible emission reduction R&D expenditures, supporting businesses in R&D related to low-emission technologies and transformations. Efforts are being made to decarbonize transportation, aiming to have at least 30% of the country’s light vehicles be electric by 2035. Clean car discounts are continued to encourage the purchase of low-emission vehicles and investment in electric vehicle charging infrastructure, providing financial and tax support for middle- and low-income families to purchase electric vehicles after scrapping high fuel consumption cars. In 2022, Colombia approved a tax reform bill, including coal mining, sales, and imports in the carbon tax scope from 1 January 2023. While imposing carbon tax on conventional energy, Colombia also provides tax incentives for businesses using unconventional energy (such as green energy), such as applying accelerated depreciation of assets. Taxpayers can also modify the maximum annual depreciation rate (up to 33.3%) each year.

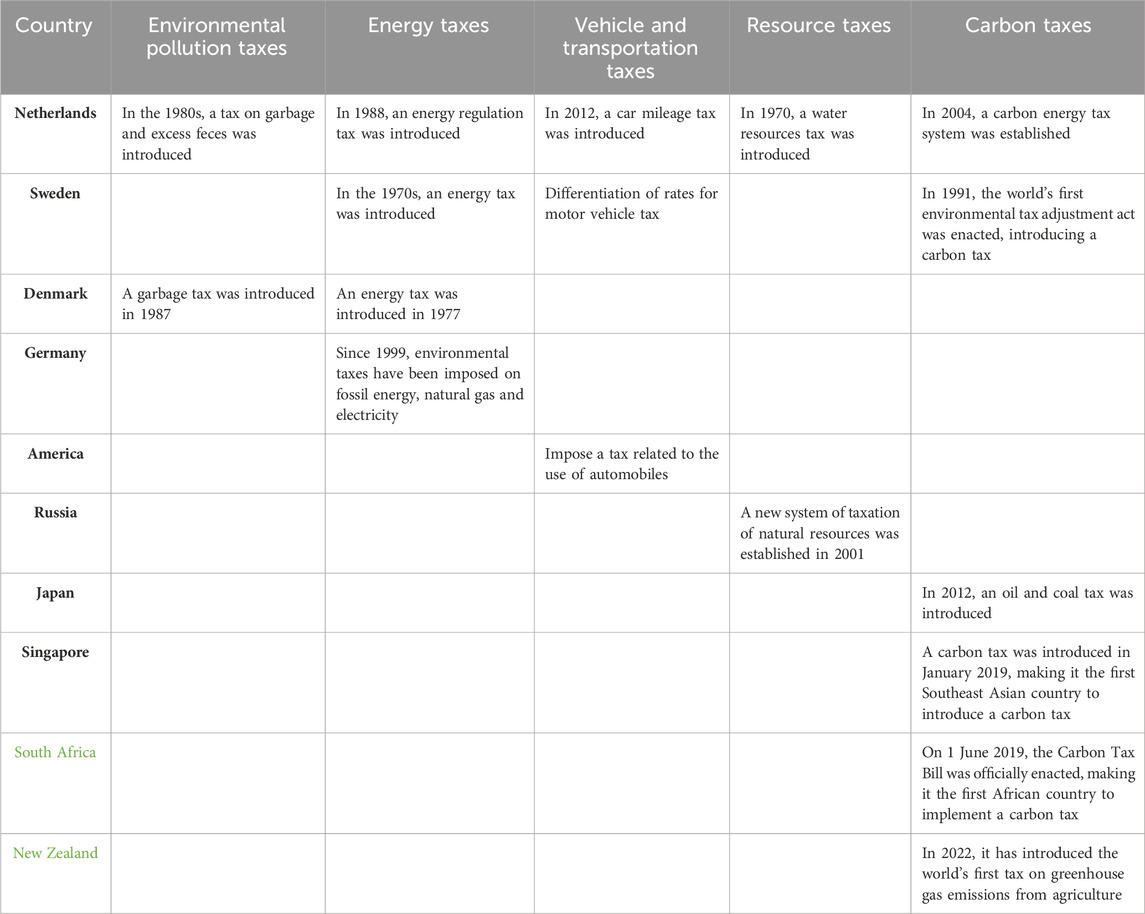

On 18 April 2023, the European Parliament passed the world’s first “carbon border tax,” namely, the European Union Carbon Border Adjustment Mechanism (CBAM), which officially took effect on 16 May 2023. The period from 2023 to the end of 2025 serves as a transition period, during which imported products are exempt from carbon border tax but need to report carbon emissions. According to CBAM, the EU imposes additional carbon border adjustment fees on specific products imported from outside the EU, covering six major industries: electricity, steel, aluminum, cement, chemicals, and hydrogen. After the transition period, from 2026 onwards for 8 years, the EU will implement related taxes in stages and proportions (Huang et al., 2023). Table 1 shows a comparison of countries in terms of the green tax policies.

Analysis of China’s green tax system

Current status of China’s green tax system

Since the 18th National Congress of the Communist Party of China, the construction of China’s green tax system has entered a new stage. A preliminary framework has been established, encompassing various green taxes such as the Environmental Protection Tax, Resource Tax, and Farmland Occupation Tax under a “multi-tax governance” approach. This is complemented by a combination of systematic tax incentives including Corporate Income Tax, Value-Added Tax, Consumption Tax, and Vehicle Purchase Tax, covering aspects of development, production, consumption, and emission. The system aims to drive high-quality green economic and social development through “dual-driving” mechanisms of tax incentives and restrictions.

Implementation of green taxes

The Chinese green tax system primarily includes the Environmental Protection Tax, Resource Tax, and Farmland Occupation Tax, supplemented by Consumption Tax (eight categories), Vehicle Purchase Tax, Vehicle and Vessel Tax, Urban Land Use Tax, and Urban Maintenance and Construction Tax. The “Environmental Protection Tax Law of the People’s Republic of China,” effective from 1 January 2018, applies to enterprises, institutions, and other producers and operators that directly discharge taxable pollutants within China and its jurisdictional waters. Since its implementation, the national cumulative implementation of Environmental Protection Tax incentives and reductions has reached 56.4 billion yuan. The data shows that the pollution equivalent per ten thousand GDP has decreased from 1.16 in 2018 to 0.73 in 2022, a reduction of 37% (Wei, 2023). The “Farmland Occupation Tax Law of the People’s Republic of China,” effective from 1 September 2019, applies to units and individuals within China who occupy farmland for construction or non-agricultural activities. The “Resource Tax Law of the People’s Republic of China,” effective from 1 September 2020, applies to units and individuals that develop taxable resources within China and its jurisdictional waters. This law established a tax rate based primarily on value and secondarily on quantity, covering 164 tax items including energy, metals, non-metals, and water and gas mineral resources, encompassing all currently discovered minerals and salts. These laws promote the rational development and comprehensive utilization of resources, protecting limited natural resources and improving land use efficiency.

Revenue from green taxes

From 2018 to 2022 (see Table 2), the total revenue from Environmental Protection Tax, Resource Tax, and other eight categories of taxes reached 14.07 trillion yuan, accounting for 17.41% of the total tax revenue, which is relatively low. The trend over time shows a stable increase, with Resource Tax seeing a higher growth rate in 2021 and 2022, at 30.40% and 48.09% respectively. In contrast, the Vehicle Purchase Tax decreased by 31.86% in 2022, while the Vehicle and Vessel Tax slightly increased. The data indicates that the tax revenue from the vehicle purchase phase decreased, but the holding phase did not, suggesting significant incentives for new energy vehicles in China. In terms of tax structure, the share of these eight categories in total tax revenue is low, with the three main green taxes accounting for less than 3%. Specifically, the share of the Environmental Protection Tax has always been below 0.15%; the Resource Tax showed a growing trend, exceeding 2% in 2022; the Farmland Occupation Tax decreased compared to previous years, accounting for less than 8%. Overall, both the total amount and the proportion of green tax revenue are low, indicating a limited role in revenue generation and regulation.

Tax incentive policies

On 31 May 2022, the State Taxation Administration of China released the “Guidelines for Tax and Fee Incentive Policies to Support Green Development,” which outlined 56 tax and fee incentive policies supporting green development in four aspects: environmental protection, energy conservation and environmental protection, encouraging comprehensive utilization of resources, and promoting low-carbon industry development. These include tax incentive policies for environmental protection, such as periodic reduction or exemption of corporate income tax for qualified environmental protection projects, tax credit for investments in specialized environmental protection equipment, and a preferential tax rate of 15% for third-party enterprises engaged in pollution control. Energy conservation tax incentives include VAT exemptions for contract energy management projects, periodic reductions or exemptions of corporate income tax for energy and water-saving projects, tax credit for investment in specialized energy and water-saving equipment, VAT exemption for drip irrigation products, exemption of vehicle and vessel tax for new energy vehicles, 50% reduction of vehicle and vessel tax for energy-saving vehicles, exemption of vehicle purchase tax for new energy vehicles, and consumption tax exemption for energy-saving and environmentally friendly batteries and coatings. Incentives for comprehensive resource utilization include immediate VAT refunds for new wall materials, consumption tax exemption for biodiesel produced from waste animal and vegetable oils, and industrial oils produced from waste mineral oils. Incentives for low-carbon industry development include exemption of corporate income tax for income obtained by the China Clean Development Mechanism Fund and tax reduction for projects implementing the Clean Development Mechanism, immediate VAT refunds for wind power generation, exemption of urban land use tax for parts of nuclear power stations and hydroelectric stations, and exemption from various fees and funds for distributed photovoltaic power generation.

Limitations of China’s green tax system

Insufficient consideration of carbon reduction in the current green tax system

The scope of green taxes like the Environmental Protection Tax and Resource Tax is too narrow to fully realize their ecological effects. For instance, the taxable pollutants for the Environmental Protection Tax only include atmospheric pollutants, water pollutants, solid pollutants, and noise, excluding volatile organic compounds and radioactive pollutants. The tax categories and rates mainly follow those used for the “pollution fee” system, not updated according to the current situation of pollutant emissions by enterprises and the cost of ecological governance and restoration. The taxable resources for the Resource Tax mainly include coal, crude oil, natural gas, iron ore, limestone, sandstone, and water resources (pilot), excluding renewable resources like forests, grasslands, tidal flats, and deserts, which does not facilitate intensive use of these resources or improve overall carbon sequestration capabilities. The green tax categories for Consumption Tax include refined oil, small cars, motorcycles, batteries, and coatings but exclude major fossil fuels like coal and natural gas.

Limited role of current green taxes in guiding behavioral change

Behavioral change is a crucial support measure for carbon neutrality, but the settings for taxpayers and tax collection phases in the current green tax categories are not conducive to the regulatory role of taxation. In China’s green tax system, the Environmental Protection Tax targets pollutant emissions, defining taxpayers as enterprises, institutions, and other producers and operators that directly emit taxable pollutants within the territory and jurisdictional waters of the People’s Republic of China. This does not include ordinary residents, and currently, there is no garbage tax in China. While the tax collection and management of natural persons are more challenging, excluding them from the scope of Environmental Protection Tax payers is not conducive to creating a green and environmentally friendly social atmosphere. The Consumption Tax is an additional tax levied on top of the generally collected VAT, which can convey national policy directions and regulate consumer behavior. However, due to the need for ease of tax collection and revenue organization, most of the Consumption Tax collection phases in China are at the production stage, making it difficult for consumers to perceive the tax cost included in consumer goods, thereby minimally impacting consumption decisions.

Need to strengthen the coverage of green tax incentive policies

The 56 incentive policies released in the “Guidelines for Tax and Fee Incentive Policies to Support Green Development” cover six items for environmental protection, 20 for promoting energy conservation and environmental protection, 21 for encouraging comprehensive resource utilization, and nine for promoting low-carbon industry development. The coverage of tax incentives related to environmental protection and low-carbon industry development is insufficient. For example, in the low-carbon industry development-related tax incentives, there is a policy of 50% immediate VAT refund for wind power generation, but similar tax policies do not support photovoltaic power generation (expired as of 31 December 2018), bioenergy, and other new energy-saving and emission-reducing products. Currently, carbon capture, utilization, and storage (CCUS) and other carbon reduction technologies are developing rapidly, but there are no corresponding tax exemptions or deductions to support investment in equipment and technical services. From the distribution of tax categories, various incentive policies are scattered across VAT, corporate income tax, resource tax, and consumption tax, but there is a lack of corresponding support in personal income tax. For example, there are no tax incentives similar to those for corporate income tax for investments in environmental protection and energy and water-saving specialized equipment, which does not stimulate the investment willingness of individual proprietorships, partnerships, small business entities, and families to upgrade and update in environmental protection and energy conservation.

High external dependency in the administration of green taxes

The administration of green taxes relies on collaborative governance and is highly dependent on external department management and information. For example, the Environmental Protection Tax depends on the ecological environment department for monitoring and sharing information on taxable pollutants, while the Resource Tax and Farmland Occupation Tax depend on the natural resources management department for relevant information. The lack of a well-coordinated mechanism between different departments and an incomplete information-sharing platform can lead to inefficient operation throughout the tax collection process. Additionally, when confirming the eligible entities and scope of some tax incentive policies, specific technical indicators and other conditions need to be clarified by relevant departments. Taking the tax credit policy for specialized equipment for energy and water-saving and environmental protection as an example: the “Catalog of Special Equipment for Energy and Water Saving and Environmental Protection for Corporate Income Tax Incentives” details the equipment categories, names, performance parameters, application areas, and implementation standards. During the implementation of tax incentive policies, if the tax authority cannot accurately determine whether the specialized equipment purchased by enterprises meets the conditions stipulated in the tax incentive policies, it can request the development and reform, industrial and information technology, and environmental protection departments at the city level (inclusive) or above to entrust professional institutions to issue technical assessment opinions, with the relevant departments expected to actively cooperate (Li et al., 2023).

Pathways for implementing China’s green tax system

Progressive and comprehensive adjustment to “greenify” the existing tax system

The existing green tax system should undergo “progressive” reforms, involving adjustments to various green tax categories’ taxpayers, taxable objects, tax items, rates, and tax incentives, promoting a further upgrade in the greening of the tax system.

Expanding the tax base of certain green taxes

The tax items and rates for the Environmental Protection Tax should be updated based on the actual emission of pollutants and the cost of ecological governance and restoration. This includes incorporating volatile organic compounds and radioactive pollutants into the scope of taxable pollutants, fully leveraging the tax’s role in controlling emissions. Forests, playgrounds, wetlands, deserts, and other ecologically functional natural resources should be included in the Resource Tax scope to improve the efficiency of resource extraction and use, and enhance carbon sequestration capabilities. Fossil fuels like coal and natural gas that contribute to carbon emissions should be included under the Consumption Tax to facilitate adjustments in the energy structure. Referencing the “Comprehensive Catalogue of Environmental Protection” for high-pollution, high-environmental risk products, items like disposable plastic products and luxury decoration materials should be included in the Consumption Tax scope. Additionally, as tax digitalization advances and tax collection management capabilities improve, new green taxes such as the carbon tax should be introduced at an appropriate time, taking into account taxpayer affordability and lessons from developed countries.

Shifting the tax collection phase of certain taxes

Tax collection phases for taxes with green regulatory functions should be set at the final sales stage, making the tax rates of taxable objects clear to decision-makers and thus influencing consumer decisions, promoting green tax-driven behavioral change. Practically, the collection phase for green tax items under the Consumption Tax should gradually shift to the retail phase. Expanding the taxpayer base for the Environmental Protection Tax, and drawing from international experience in garbage tax collection, should explore taxing ordinary residents on pollutant emissions to reduce the economic cost and carbon emissions from waste disposal in residential areas, fostering a green and environmentally friendly atmosphere across society.

Expanding the coverage of green tax incentives

Various forms of tax relief and credits should be adopted for clean energy, carbon reduction technologies, etc., to fully utilize the positive incentives of taxation. Implement immediate VAT refunds for industries like photovoltaic power, wind power (already implementing a 50% immediate VAT refund policy), hydrogen power, nuclear power, and biomass power generation. For taxpayers engaged in low-carbon transformations of traditional fossil fuel equipment (processes), investment in related carbon reduction equipment should be eligible for a certain percentage of corporate or personal income tax credit, with an appropriate increase in the investment credit ratio. For carbon reduction technology, implement periodic reductions or exemptions of corporate income tax for enterprises engaged in R&D in this field. Simultaneously, strengthen the negative list management of tax incentive policies, excluding enterprises exceeding certain carbon emission standards from general tax incentives like tax credit refunds and small profit enterprise benefits.

Shared governance, collaborative management, and building a green tax governance system

Strengthening cooperation and consolidating green tax governance

Strengthen cooperation between tax authorities and various government regulatory departments, establish joint working groups at all levels, and create regular communication and cooperation mechanisms. The high external dependency in green tax collection and management relies heavily on data support from external departments for tax base determination and condition verification. To ensure the implementation of all green tax policies, cooperation between tax authorities and departments like industry and information technology, development and reform commissions, science and technology, finance, natural resources, ecological environment, and commerce is essential. On one hand, through inter-departmental cooperation, align current green tax policies with various dual-carbon related guidance catalogs published by different departments, such as the “Catalog of Special Equipment for Energy and Water Saving and Environmental Protection for Corporate Income Tax Incentives” issued by the Ministry of Finance, State Taxation Administration, National Development and Reform Commission, Ministry of Industry and Information Technology, and Ministry of Environmental Protection. On the other hand, when formulating green tax policies, issue them jointly with all relevant departments, clarifying the cooperation obligations and defining the responsibilities of each department.

Building an information platform for green tax data sharing

Establish a tax data sharing and information exchange mechanism and build a national unified platform for tax-related information communication and sharing. According to the Environmental Protection Tax Law and Resource Tax Law, tax authorities should have established a tax information sharing platform and working cooperation mechanism with ecological environment and natural resource departments to strengthen collection management. Based on existing cooperation, tax authorities should rely on the construction of the Golden Tax Phase IV system, open data interfaces of relevant information systems, and further integrate tax collection management systems with ecological environment, natural resources, and environmental protection department monitoring data. On one hand, broaden the cooperation scope of the tax information sharing platform and working cooperation mechanism, including all management departments related to green taxes and enriching shared information content, such as various industry catalogs and regulatory penalty records, to provide data support for strengthening green tax collection management and implementing various tax incentive policies. On the other hand, fully explore the value of tax data, utilize taxpayer declarations and invoice data, establish a carbon-related data foundation covering taxpayers’ business situations, technological equipment, energy consumption, and emissions, and timely push relevant carbon data to departments like ecological environment for regulatory data support.

Conclusion

China’s green tax system has been completed, with environmental protection tax, resource tax and arable land occupation tax as its main components, supplemented by consumption tax (eight tax items), vehicle purchase tax, vehicle and vessel tax, urban land use tax and urban maintenance and construction tax. It plays a positive role in promoting green and high-quality economic and social development. However, in the green tax system, the design of its green taxes is deficient in the consideration of carbon emission reduction factors, the setting of taxation links, the coverage of tax incentives, and the autonomy of collection and management, which leads to the insufficient role of green taxes in organizing revenues and guiding behaviors. This paper analyzes the deficiencies of the current green taxes one by one, and puts forward policy suggestions from the dimensions of tax policy designation and tax system governance. These policy suggestions provide references and ideas for the tax authorities to improve the green tax system and strengthen the green tax management. In addition, this study can provide guidelines for the future development of various industries and enterprises’ operations, which need to pay more attention to their negative impacts on the environment, for which they need to bear more operating costs. It is hoped that with the help of tax collection to change their business and production behavior.

There are also some shortcomings in this paper. This paper is a general analysis of various types of green tax systems, but it does not analyze a single variety of taxes and their impacts deeply. The next step will be an in-depth analysis of different types of tax types.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

HL: Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1https://www.mee.gov.cn/hjzl/sthjzk/

References

Deng, L., and Chen, B. (2002). The goal of "carbon peak and carbon neutral" and the construction of green tax system. Tax Econ. Res. 27 (1), 1–7.

Dulebenets, M. A. (2018). A comprehensive multi-objective optimization model for the vessel scheduling problem in liner shipping. Int. J. Prod. Econ. 196, 293–318. doi:10.1016/j.ijpe.2017.10.027

Elmi, Z., Li, B., Fathollahi-Fard, A. M., Tian, G., Borowska-Stefanska, M., Wisniewski, S., et al. (2023). Ship schedule recovery with voluntary speed reduction zones and emission control areas. Transp. Res. Part D 125, 103957. doi:10.1016/j.trd.2023.103957

Hou, Z., and Li, M. (2023). Comparative analysis and experience of carbon tax preferential policies and supporting measures in Japan, britain and Sweden. J. Hunan Tax. Coll. 36 (05), 3–10.

Huang, Q., Xu, X., and Tang, Q. (2023). International experience and implications of carbon tax collection and management. Financ. Econ. 7, 71–80.

Kou, T., and Gao, W. (2013). International experience and future policy concepts of resource tax reform. J. Northeast Univ. Finance Econ. 6, 56–62.

Li, R., Zhao, L., Lu, L., and Yuan, H. (2023). Reflections on building a green tax system to help build a beautiful China. Tax Res. 5, 106–111.

Liang, X., Lin, S., Bi, X., Lu, E., and Li, Z. (2021). Chinese construction industry energy efficiency analysis with undesirable carbon emissions and construction waste outputs. Environ. Sci. Pollut. Res. 28, 15838–15852. doi:10.1007/s11356-020-11632-z

Liu, C., Zou, X., Mao, L., Wang, Y., Deng, Y., Dong, W., et al. (2022). The structure, function and regulation of protein tyrosine phosphatase receptor type J and its role in diseases. Wuhan. Finance 2, 8–15. doi:10.3390/cells12010008

Research Group of Institute of Fiscal Science, Ministry of Finance. (2009). Detailed technical report on the study of carbon tax in China.

Tian, G., Lu, W., Zhang, X., Zhan, M., Dulebenets, M. A., Aleksandrov, A., et al. (2023). A survey of multi-criteria decision-making techniques for green logistics and low-carbon transportation systems. Environ. Sci. Pollut. Res. 30, 57279–57301. doi:10.1007/s11356-023-26577-2

Wang, Z. (2013). Experience and insights of EU environmental tax reform. Int. Econ. Trade Explor. 10, 73–83.

Xi, J. (2020). Speech at the general debate of the 75th session of the united nations general assembly. Bull. State Counc. People's Repub. China 28, 5–7.

Xiao, G., and Cui, W. (2023). Evolutionary game between government and shipping enterprises based on shipping cycle and carbon quota. Front. Mar. Sci. 10. doi:10.3389/fmars.2023.1132174

Xiao, G., Wang, T., Shang, W., Shu, Y., Biancardo, S. A., and Jiang, Z. (2024b). Exploring the factors affecting the performance of shipping companies based on A panel data model: a perspective of antitrust exemption and shipping alliances. Ocean Coast. Manag. 253, 107162. doi:10.1016/j.ocecoaman.2024.107162

Xiao, G., Yang, D., Xu, L., Li, J., and Jiang, Z. (2024a). The application of artificial intelligence technology in shipping: a bibliometric review. J. Mar. Sci. Eng. 12, 624. doi:10.3390/jmse12040624

Xu, L., Yang, Z., Chen, J., Zou, Z., and Wang, Y. (2024b). Spatial-temporal evolution characteristics and spillover effects of carbon emissions from shipping trade in EU coastal countries. Ocean Coast. Manag. 250, 107029. doi:10.1016/j.ocecoaman.2024.107029

Xu, L., Zou, Z., Chen, J., and Fu, S. (2024c). Effects of emission control areas on sulfuroxides concentrations: evidence from the coastal ports in China. Mar. Pollut. Bull. 200, 116039. doi:10.1016/j.marpolbul.2024.116039

Xu, L., Zou, Z., Liu, L., and Xiao, G. (2024a). Influence of emission-control areas on the eco-shipbuilding industry: a perspective of the synthetic control method. J. Mar. Sci. Eng. 12, 149–215. doi:10.3390/jmse12010149

Yu, X., and Hu, R. (2023). Development and implications of Swedish carbon tax in the context of dual carbon. J. Hebei Inst. Environ. Eng. 33 (3), 32–39.

Keywords: dual-carbon target, green taxation, public policy, China, environment policy

Citation: Liu H (2024) Constructing and implementing a green taxation system in China under the dual-carbon target. Front. Environ. Sci. 12:1392244. doi: 10.3389/fenvs.2024.1392244

Received: 27 February 2024; Accepted: 14 May 2024;

Published: 03 June 2024.

Edited by:

Jihong Chen, Shenzhen University, ChinaReviewed by:

Guangnian Xiao, Shanghai Maritime University, ChinaMaxim A. Dulebenets, Florida Agricultural and Mechanical University, United States

Copyright © 2024 Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hehe Liu, bGl1aGVoZTY0QDE2My5jb20=

Hehe Liu

Hehe Liu