- 1Central South University, Changsha, China

- 2Shandong University, Jinan, China

- 3Fuzhou University, Fuzhou, China

- 4Tongji University, Shanghai, China

The transition to a green, sustainable economy is largely reliant on corporate investment in the realm of environmental protection. Utilizing the adoption of the third phase of the Golden Tax Project (GTPIII) in China as a quasi-natural experiment, this paper examines how corporate environmental investment changes in response to greater tax enforcement. Our results reveal that tougher tax enforcement significantly lowers corporate environmental investment. Such an effect is stronger for firms faced by high financial constraints and those operating in non-heavy-polluting industries. Moreover, the mechanism analysis indicates that the higher tax burden induced by greater tax enforcement is the potential channel. Overall, this paper shows that stricter tax enforcement could potentially result in adverse spillover effects on corporate environmental investment, which warrants attention in tax collection practices.

1 Introduction

Corporate environmental investment (hereafter CEI) is crucial for reducing pollutant emissions and achieving a green transformation of the economy (Zahan and Chuanmin, 2021; Ren et al., 2022). In the past few decades, environmental issues, such as air pollution and waste water, have posed tremendous threats to people’s livelihoods and economic growth (Lu et al., 2023). It is widely recognized that corporates should assume the primary responsibility for environmental protection because pollutants and carbon emissions mainly stem from industrial activities in the corporate sector (IPCC, 2014; Huang and Lei, 2021; Kong et al., 2023a). Thus, corporates are supposed to make substantial investments in environmental protection.

CEI might be sensitive to corporates’ financial condition if corporates are short of internal cash flow. Comparing to conventional corporate investment such as investment in machinery and equipment (Alliance, 2013), CEI produces little short-term economic benefit but consumes great financial resources (Liu et al., 2021; Liu et al., 2022a; Wang et al., 2023b). Many managers face intense short-term performance pressure from investors (Brochet et al., 2015; Kraft et al., 2018). Therefore, profit-driven managers and corporates are likely to cut CEI when there is a lack of internal cash flow.

Tax enforcement, as documented in recent studies, is one factor that might result in greater tax burden and thus tighter financial condition in firms (Slemrod, 2019; Liu et al., 2022a; He and Yi, 2023). Tax enforcement refers to the application of measures to ensure better tax compliance (Slemrod, 2019), with a focus on audit probability and tax evasion penalties (Carrillo et al., 2017). Indeed, many countries such as China are strengthening their tax enforcement in the recent decade, aiming to reduce tax evasion and increase tax revenue (Feng et al., 2022). Given tax enforcement is found to affect corporate performance (He and Yi, 2023), it is critical for policymakers to fully understand the exact impact that tax enforcement may have on corporates. Prior literature generally focus on the governance role of tax enforcement (Desai et al., 2007; Xu et al., 2011; Zhang et al., 2022a), which benefits corporates’ financial reporting quality (Hanlon et al., 2014), the informativeness of earnings (Zhao, 2023), investment efficiency (Zhang et al., 2023), corporate donation (Zhao, 2022), and reduce accounting misstatements (Li and Ma, 2021) as well as financial irregularities (Feng et al., 2023). However, little attention has been paid to the potential adverse effect of tax enforcement in corporates, especially in the domain of corporate environmental performance. Existing studies reveal that greater tax enforcement deters tax evasion, consequently increasing the tax burden borne by corporates (Slemrod, 2019; Li and Ma, 2021; Liu et al., 2022a). This results in a reduction in the availability of financial resources, as their internal cash flow diminishes (Feng et al., 2022). Since CEI is costly, firms facing greater tax burden might also choose to cut such environmental investment in order to save internal cash flow (Liu et al., 2022a; Feng et al., 2022). Despite of great importance to policymakers, unfortunately, whether greater tax enforcement has a detrimental effect on CEI still remains uninvestigated. To fill the gap, this paper investigates the influence of tax enforcement on CEI.

The specific contextual factors that firms operate within might moderate the relation between tax enforcement and CEI. Specifically, we expect that firms’ financial constraints, namely, their inability to access external funds, would amplify the negative effect of tax enforcement on CEI. Companies that face financial constraints rely more on internal financial resources. Therefore, they are more likely to cut environmental investment when there is insufficient internal cash flow resulting from greater tax enforcement. Besides, we anticipate the crowding-out effect of tax enforcement might be weaker in heavy-polluting industries. Since pollutants are primarily emitted by firms in heavy-polluting industries, more stringent regulations apply to these firms (Liu et al., 2022a; Wang et al., 2023b). Therefore, these firms are forced to maintain the essential environmental investment. In contrast, firms in other industries encounter comparatively less environmental supervision (Wang et al., 2023b). Thus, in contrast to firms operating in other industries, firms within heavy-polluting industries are less likely to cut environmental investment because they are more prone to be penalized for violating environmental regulations.

We employ a quasi-natural experiment, i.e., the adoption of the third phase of the Gold Tax Project (GTPIII) in China, to explore the impact of tax enforcement on CEI. GTPIII is a comprehensive digital taxation management system that encompasses all kinds of taxes, aiming to fight tax evasion and enhance tax collection efficiency (Zhao, 2022). During 2013 to 2016, China gradually implemented GTPIII in each region (provinces, autonomous regions, and municipalities). Importantly, GTPIII oversees the complete procedures of tax collection as well as facilitating tax evasion detection in collaboration with third parties (Xiao and Shao, 2020). Using big data as a tool, GTPIII greatly enhances tax inspection and monitoring, thus strengthening tax enforcement of tax authorities. Therefore, many prior studies have used the implementation of GTPIII to capture greater tax enforcement (Li et al., 2020; Zhao, 2023). In line with these studies, we also employ the adoption of GTPIII to proxy more stringent tax enforcement. Since the adoption of GTPIII is independent of local economic circumstances and corporate behaviors (Zhao, 2022), this setting is desirable to test our hypotheses.

Employing the staggered difference-in-differences (DID) approach, we explore the role of tax enforcement in shaping CEI. For observations in each year, the treatment group comprises corporates that are headquartered in regions affected by GTPIII, while the control group includes the rest of the corporates that are not affected by GTPIII. Consistent with our hypothesis, the empirical findings reveal that stronger tax enforcement exerts a significant negative effect on CEI. Specifically, in comparison to the control group, corporates in the treatment group experience a decrease in environmental investment of around 36%, which is economically significant. Our findings hold for PSM-DID approach and a series of robustness tests. Moreover, the influence of tax enforcement is stronger for firms that are financially constrained and those firms operate within non-heavy-polluting industries. Further mechanism analysis indicates that the reduction in CEI could be attributed to the greater tax burden induced by greater tax enforcement.

This paper contributes to three streams of literature. First, we identify tax enforcement as a determinant of CEI, adding to the existing body of research on the factors that affect CEI. While it is well documented that the influencing factors of CEI mainly include stakeholder pressure (Liu and Wu, 2009; Liao and Shi, 2018), firm traits (Bhuiyan et al., 2021), characteristics of top executives and the board (Hu and Yang, 2021; Jia et al., 2021) as well as environmental regulations like tax policies (Liu et al., 2022a; Brown et al., 2022; Cheng et al., 2022; Qian et al., 2023), few studies have considered the role of tax enforcement in influencing corporate environment performance. Comparing to the most relevant studies that concentrate on how environmental tax implementation and tax rate changes affect corporate environmental performance (Li et al., 2021; Liu et al., 2022a; Cheng et al., 2022; Kong et al., 2023b; Qi et al., 2023), this paper focuses on the effect of tax enforcement. Specifically, we show that tax enforcement is a non-negligible factor that reduces CEI, which warrant attention from tax authorities.

Second, this study sheds new light on the effect of tax enforcement at the firm-level. In the literature, most relevant studies center on the governance role that tax enforcement plays in firms (Xu et al., 2011; Zhang et al., 2022b). However, there is a scarcity of research that investigate the potential negative spillover effects at the firm level. To fill this void, two recent studies show that tax enforcement results in a greater tax burden and higher liquidity constraints, which crowds out labor demand (Liu et al., 2022b) and social security contributions (Feng et al., 2022). Building on the idea that tax enforcement might have negative effect on corporate internal financial resources, this paper further demonstrates that stricter tax enforcement might also crowd out CEI.

Third, our study extends the understanding regarding the economic outcomes of adopting big data technology to enhance tax enforcement, which is of great importance for policy implications. Recent research suggests that the utilization of big data technology is conducive to tax collection (Li et al., 2020; He and Yi, 2023). In contrast, this paper uncovers that it might result in undesired outcomes concerning firms’ environmental performance.

2 Institutional background, literature review and hypotheses

2.1 Institutional background

In 1994, the State Administration of Taxation of China (SAT) started the implementation of a new tax system. Value-added tax (VTA) is the principal form of taxation within this system, with VAT invoices serving as the primary tax withheld certificates. To address the tax fraud problem that plagues VTA tax collection, the SAT launched a tax administration information system named Golden Tax Project (GTP), aiming to manage VAT invoices information and strengthen VAT enforcement. The project consisted of three phases, namely, GTPI, GTPII and GTPIII. By integrating the internet and big data, tax authorities are able to utilize timely, comprehensive, and accurate information from multiple sources to monitor corporate tax noncompliance. Indeed, GTP has effectively mitigated false VAT invoices as well as tax evasion practices associated with tax credits (Li et al., 2020; Wang et al., 2023a).

The first and second phases of Golden Tax Project were implemented countrywide in the year of 1996 and 2003 respectively. GTPIII was initially piloted in 2013 in the provinces of Chongqing, Shanxi, Shandong, before being gradually implemented across China. In 2014, GTPIII expanded to three additional provinces: Guangdong, Henan, and Inner Mongolia. In 2015, GTPIII further covered 14 other provinces including Hebei, Ningxia, Guizhou, Yunnan, Guangxi, Hunan, Qinghai, Hainan, Tibet, Gansu, Anhui, Xinjiang, Sichuan, Jilin. By the end of 2016, GTPIII was fully adopted nationwide. The staggered adoption of GTPIII in different regions and years provides us with a quasi-natural experiment setting to test our predictions1.

GTPIII not only enables the tax authority to effectively track corporates’ economic activities by monitoring invoices in a real-time way, but also allows verification using information from third parties such as banks. More importantly, GTPIII has powerful information processing and analysis capabilities. It automatically compares indicators among corporates vertically and horizontally, aiding tax authorities in the identification of firms that pose a high risk of tax sheltering. According to Zhao (2023) and Li et al. (2020), the adoption of GTPIII serves as an exogenous shock that enhances tax enforcement of tax authorities. In particular, GTPIII enhances the tax enforcement of tax administrators by improving the effectiveness of tax inspection and monitoring (Li et al., 2020).

2.2 Influencing factors of CEI

In an effort to address pollution and emissions problems, many studies have examined the driving forces of CEI. According to Ding et al. (2023), the relationship between external influencing factors and CEI can be comprehended as an outcome of evaluating the economic, environmental benefits and costs. Due to negative environmental externalities, most firms are reluctant to engage in environmental investments (Tang et al., 2013; Huang and Lei, 2021; Yang, 2023). Therefore, current research focuses primarily on the factors that exert external pressure on firms to promote CEI.

Pressure from the government, which urges firms to protect the environment, is widely acknowledged as the crucial driving factor of CEI. Existing studies indicate that corporates increase their environmental investment in reaction to government policies, regulations and laws such as carbon emission trading policy (Yang, 2023), government environmental inspection (Wang et al., 2022; Qian et al., 2023) and environment protection tax (Liu et al., 2022a; Brown et al., 2022; Cheng et al., 2022). Likewise, Xu and Yan (2020) document a positive association between firms’ political connections and their environmental investment. Besides pressure from the government, CEI might also be driven by pressure from the public. For example, it is established that public appeal is a key determinant of CEI (Liao and Shi, 2018). Liu and Wu (2009) also show that firms tend to make more voluntary environmental investments as a result of heightened environmental consciousness among consumers.

Except for the aforementioned factors, existing literature has identified some other drivers that affect CEI. Given the boards have the responsibility of overseeing corporate investments, it is plausible that internal governance factors could influence the decision-making process regarding environmental investments. In regard to this, Bhuiyan demonstrate that corporates tend to make more environmental investment when they have environmental committees and a larger percentage of independent directors (Bhuiyan et al., 2021). In addition, characteristics of top executives and the board may also impact CEI. For example, firms with CEOs who have moral names are found to enhance CEI (Jia et al., 2021). Likewise, female board directors are positively associated with CEI (Hu and Yang, 2021).

Moreover, it is straightforward to see that a lack of financial resources in firms may hinder CEI. In line with this notion, Jiang et al. (2022) show that digital finance enables corporates to make more financial investments, which leads to a lack of financial resources for CEI. From the angle of available financial resources, likewise, this paper examines whether tax enforcement crowds out CEI.

2.3 Tax authority enforcement and CEI

In studying how tax enforcement impacts firm outcomes, many researchers have documented that tax enforcement by tax authorities deters tax non-compliance (Hoopes et al., 2012; Gupta and Lynch, 2016; Li et al., 2020; Feng et al., 2023), which increases firms’ tax burden (Carrillo et al., 2017; Slemrod, 2019; Liu et al., 2022a; He and Yi, 2023). For example, Xiao and Shao (2020) demonstrate that stricter tax enforcement induced by the third phase of China’s Golden Tax Projects reduces corporates’ tax noncompliance behaviors and leads to a rise in the income tax burden in the treatment regions. In line with this, Li and Ma (2021) present further empirical support for the positive association between tax enforcement and the tax burden borne by firms.

Due to the increased tax burden resulting from stricter tax enforcement (Feng et al., 2022), corporates may reduce their CEI in order to conserve internal cash flow for other profitable investments. The underlying logic is straightforward. It is well-documented that environmental investment does not yield immediate profits, but rather consumes substantial financial resources and involves a high level of risk (Liu et al., 2021; 2022a; Wang et al., 2023b). As environmental protection investment contributes little to firms’ performance in the short run, profit-oriented firms and managers facing more stringent tax enforcement might opt to reduce environmental investment to save internal financial resources (Brochet et al., 2015; Kraft et al., 2018). Indeed, it has been found that tougher tax enforcement crowds out corporates’ social security contributions and labor demand (Liu et al., 2022a; Feng et al., 2022). Therefore, we propose Hypothesis 1 as follows:

H1:. Stricter tax enforcement has a negative effect on CEI.

2.4 The moderating effect of financial constraints

The financial constrains that firms face may strengthen the relationship between tax enforcement and CEI. Financial constraints refer to financial obstacles that restrict firms from accessing formal external funds. If a firm is financially constrained, it mainly uses its internal cash flows to fund investment activities (Fazzari et al., 1987). According to the literature (Guariglia and Liu, 2014; Zhang et al., 2019a; Tian and Lin, 2019), firm’s capacity to engage in environmental investments is impeded by financial constraints because of inadequate financial resources. In the case that stricter tax enforcement strengthens firms’ tax burden, firms that lack external financial resources are more likely to cut environment protection expenditures to save internal cash flow or to optimize current firm performance. Hence, it is reasonable to believe that firms’ financial constraints would moderate the nexus between tax enforcement and CEI. Therefore, we propose Hypothesis 2:

H2:. The effect of tax enforcement on CEI is stronger for financially constrained firms than for those that are less financially constrained.

2.5 The moderating effect of industry attributes

We anticipate the relation between tax enforcement and environmental investment could be stronger if a firm operates within heavy-polluting industries. In China, firms operating within the heavy-polluting industries are the primary polluters that negatively impact the ecological environment (Liu et al., 2022a; Zhang et al., 2022a). Consequently, these companies are obligated to comply with stringent environmental protection laws and other environmental protection regulations. In addition, they are also closely supervised by external stakeholders who urge companies to fulfill their environmental responsibilities (Wang et al., 2023b). Thus, firms that operate in heavy-polluting industries are more probable to be punished for violating environmental regulations and are obligated to maintain essential environmental investments. In contrast, firms in non-heavy-polluting industries face much less supervision and demands to protect the environment. Therefore, when tax enforcement strengthens firms’ tax burden, firms in heavily polluting industries are less inclined to cut their green expenditures, as compared to firms operating in non-heavy-polluting industries. Hence, we propose:

H3:. The effect of tax enforcement on CEI is stronger for firms in non-heavy-polluting industries than for those in heavy-polluting industries.

3 Data and methodology

3.1 Data and sample

We use Chinese A-share listed firms from 2009 to 2018 to explore the nexus between tax enforcement and CEI. It allows us to assess the effects of stricter tax enforcement induced by the adoption of GTPIII, while avoiding introducing many confounding factors. Firms operate in the financial sector, and those with abnormal leverage conditions (higher debts than total assets, negative leverage ratios) are excluded. We also drop observations from ST, *ST and PT firms. Consequently, our sample comprises 3372 firm-year observations. The initiation year for the third phase of the Gold Tax Project in each region is manually collected. Other data is retrieved from China Stock Market and Accounting Research (CSMAR) database. To remove the impact of extreme values, all continuous variables are winsorized at the 1% and 99% tails.

3.2 Variables

3.2.1 Tax enforcement (GTP)

Since the phase-in implementation of GTPIII occurred in different regions (provinces, autonomous regions and municipalities) in different years, we capture tax enforcement with

3.2.2 Environmental investment (Envlnv)

Referring to Huang and Lei (2021) and Ding et al. (2023), environmental investment (

3.2.3 Moderating variables

High financial constraints (

Heavy-polluting industries (

3.2.4 Other variables

Following Zhang et al. (2019a), a vector of variables is controlled for: (1) return on total assets (

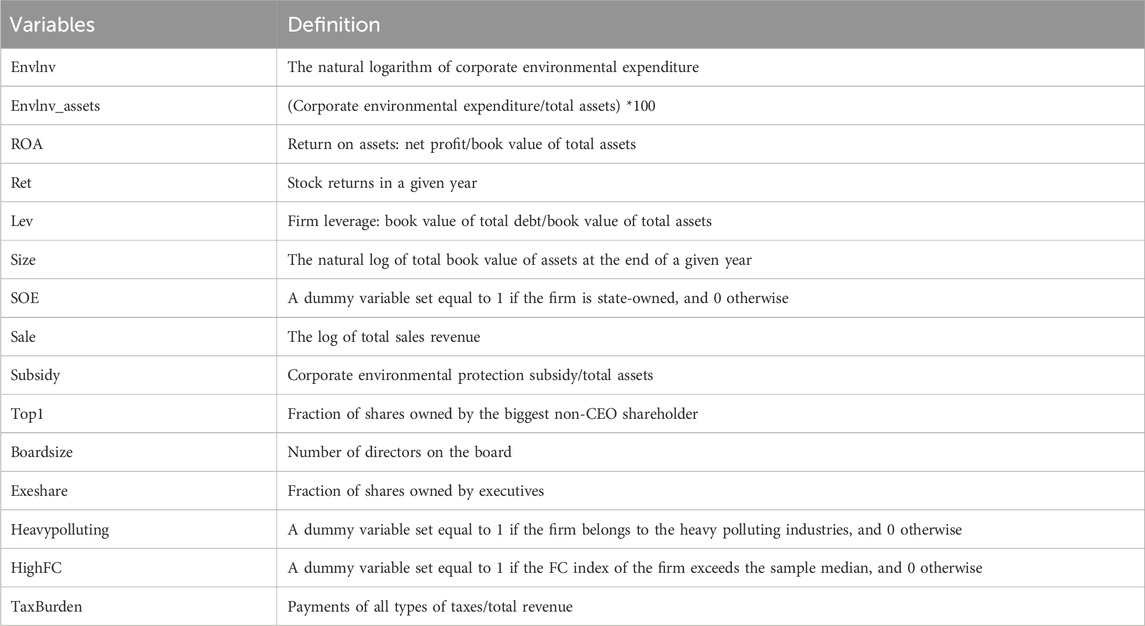

Table 1 presents the detailed definitions of all variables.

3.3 Methodology

Following Zhao (2023), we use a staggered DID method to estimate the potential impact of tax enforcement on CEI. The specification is as follows:

where

4 Empirical results

4.1 Descriptive statistics

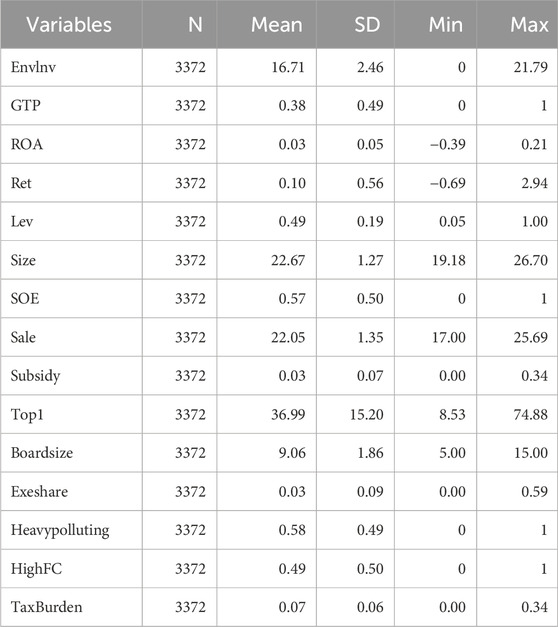

We report the descriptive statistics in Table 2. The mean logarithmic value of environmental investment is 16.71, equivalent to RMB 18,074,271. In our sample, about 38% of the observations implemented GTPIII. On average, 58% of observations are from firms that operate in heavy-polluting industries. In addition, approximately half of the observations, specifically 49%, are from firms that are experiencing high financial constraints.

4.2 Primary results

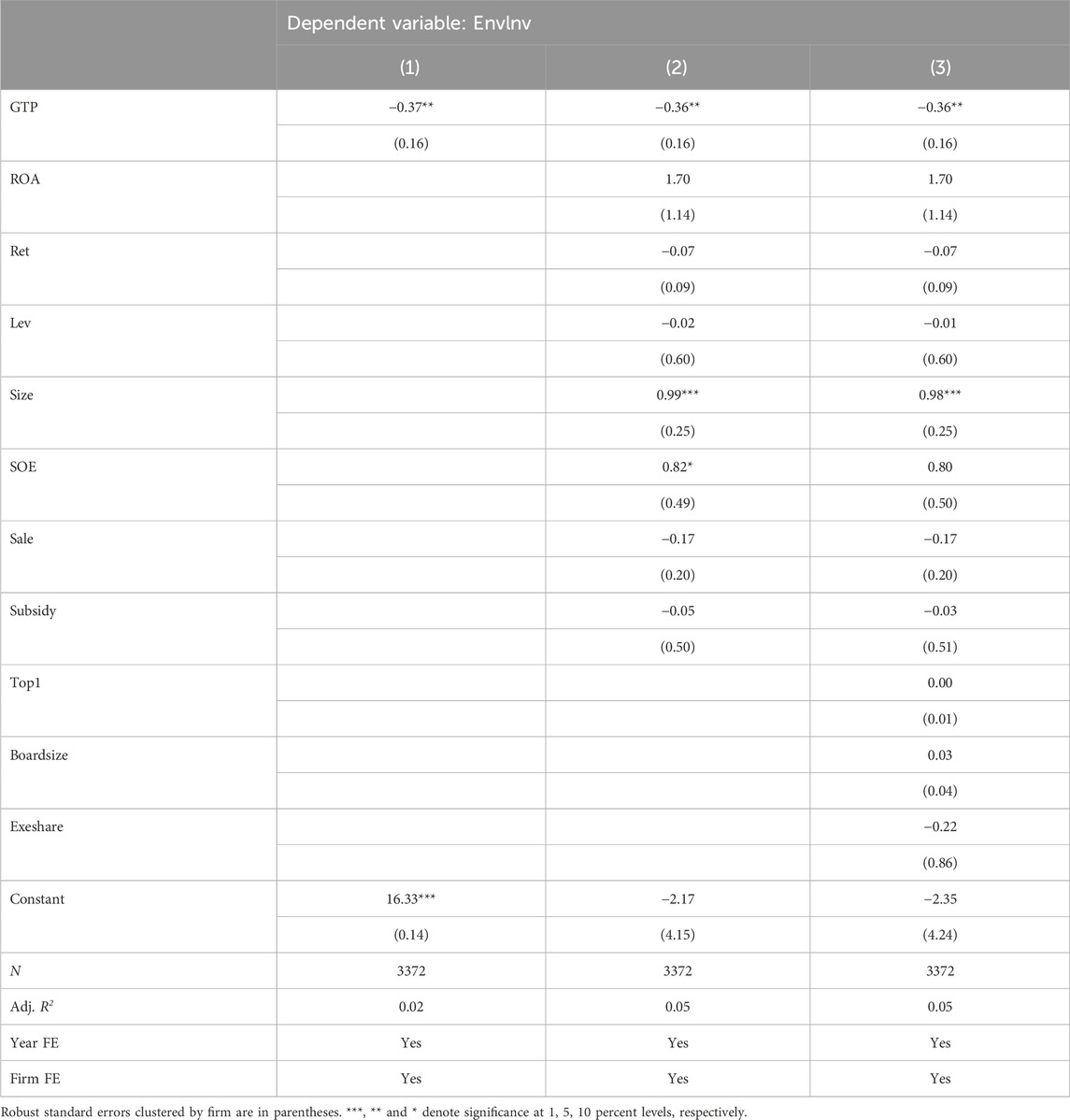

Table 3 reports the results of DID estimation. Column (1) of Table 3 only controls for time and firm fixed effects. We additionally account for firm characteristics and firm governance variables in the subsequent two columns. The coefficients of

4.3 Robustness checks

4.3.1 Parallel trend checking

The validity of our primary finding is contingent upon the fulfillment of the parallel trend assumption. In other words, the treatment group should exhibit a similar trend of CEI as compared to the control group prior to the adoption of GTPIII, eliminating the concern that pre-existing factors drive our findings. In this regard, dynamic estimation is conducted to examine whether the parallel trend assumption is satisfied. In line with Kong and Zhu (2022), we use the following model:

where

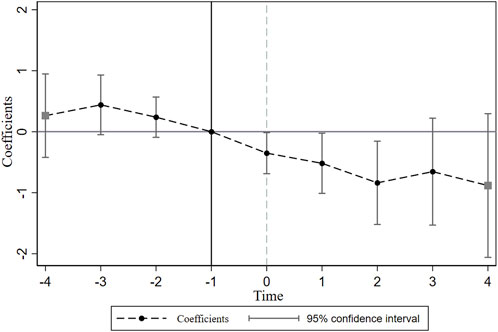

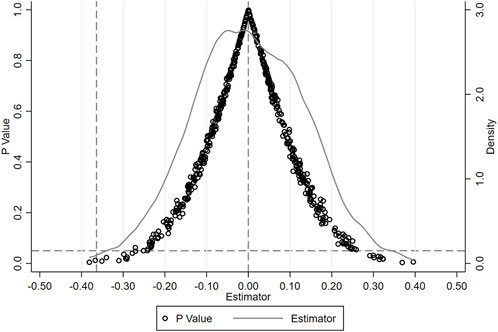

The coefficient estimates of the timeline variables are plotted in Figure 1. We find insignificant estimated coefficients of

4.3.2 Placebo test

We perform a placebo test to eliminate the concern that some confounding factors randomly drive our primary results. Specifically, a pseudo treatment variable

4.3.3 PSM-DID results

To tackle the potential selection bias issue and further validate the estimation results of DID analysis, we adopt the Propensity Score Matching (PSM) technique before the DID analysis (PSM-DID). To construct a propensity score that captures the probability of a firm being impacted by GTPIII, we employ non-dummy independent variables described in Section 3.2.4. We conduct Kernel matching to match each treatment firm to a control firm that has the closest propensity score (without replacement). Specifically, we follow prior literature and conduct Kernel matching in two ways: (1) matching by transforming panel data to cross-sectional data (2) matching by each year separately (Böckerman and Ilmakunnas, 2009). The covariate balance test results are shown in Supplementary Table SA1, revealing that firms in the treated group and control group exhibit nearly identical characteristics: t-statistics of the mean difference test are mostly statistically insignificant.

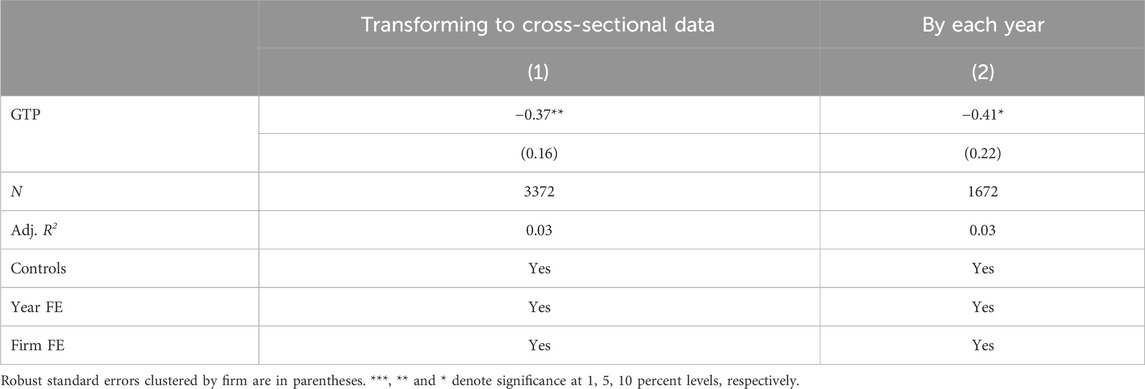

After the PSM procedure, we re-conduct the DID analysis and present the PSM-DID results in Table 4. Specifically, column (1) reports the result using samples matched by transforming panel data to cross-sectional data, while column (2) provides the result using samples matched by year. In column (1)–(2), the coefficients of

4.3.4 Additional robustness tests

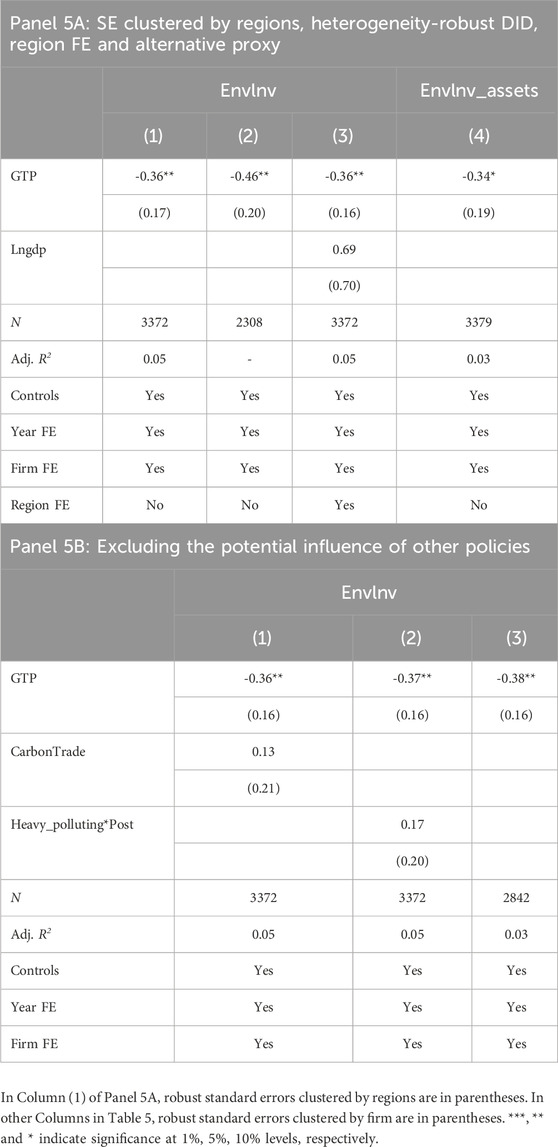

Standard errors clustered at region level. In Table 2, the standard errors (SE) are clustered at the firm level, in accordance with the extensive body of literature (Yagan, 2015; Zwick and Mahon, 2017; Li et al., 2020). Since the implementation of GTPIII is launched at the region level, firms within the same region might be correlated. Hence, the standard errors are clustered at the region level as an alternative way of clustering. Column (1) of Panel 5A reports the result, which reveals our main findings are robust to alternative clustering.

Heterogeneity-robust DID. Recent studies suggest that TWFE estimates could be biased (Baker et al., 2022; Roth et al., 2023). We employ the approach proposed by Borusyak et al. (2022) to address this concern and present the result in column (2) of Panel 5A. Clearly, our primary findings still hold.

Control for province fixed effect. In our baseline specification, we further include the province fixed effect and GDP per capita in each province to control for province-level confounding factors. Column (3) of Panel 5A reveals that the influence of tax enforcement on CEI holds to province fixed effect, implying the robustness of our main findings.

Alternative measure of environmental investment. Following Zhang et al. (2019b), we further evaluate the robustness of our main results employing an alternative proxy of CEI (

Excluding the impact of other policy shocks. During our sample period, China carried out several other policies to control pollution and carbon emission, including: (1) carbon emission trading policy piloted in 2011, (2) the new Environmental Protection Law introduced in 2015, (3) environmental tax reform launched in20182. Specifically, we construct

4.4 Heterogeneity tests

4.4.1 The moderating effect of financial constraints

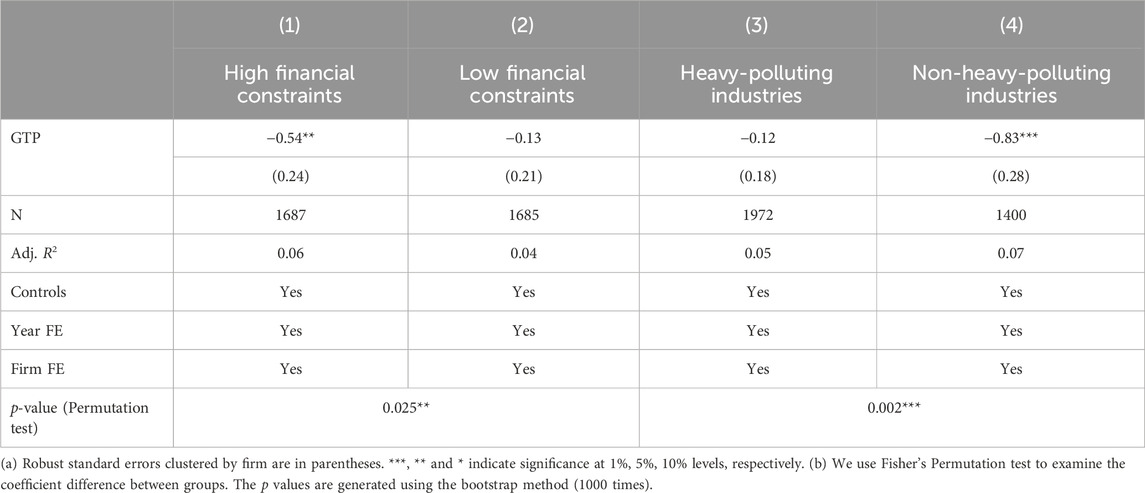

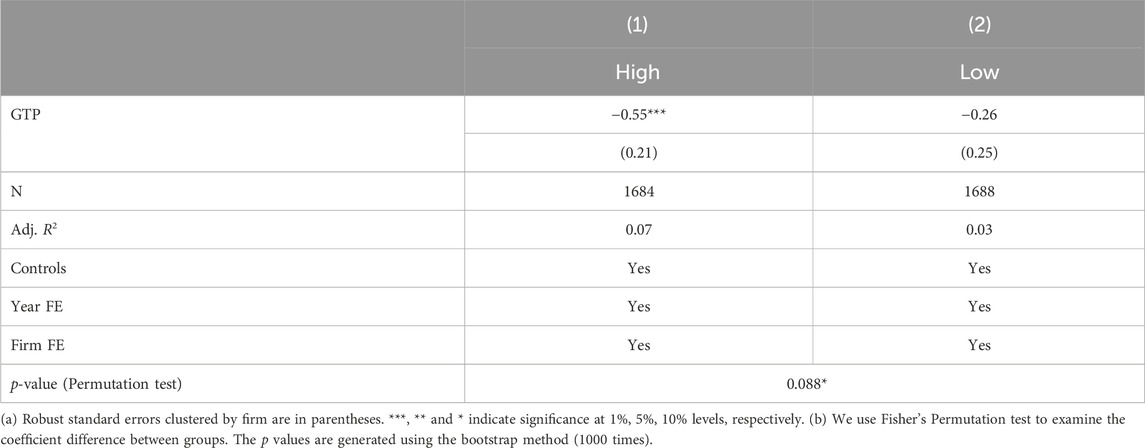

We further study the moderating effect of financial constraints facing firms. Firms are categorized into the high (low) financial constraints group if a given firm’s FC index is greater than the sample median. Our results using subsamples with high and low financial constraints are displayed in columns (1)–(2) of Table 6.

In the high financial constraints group, the coefficient estimate (−0.54) is significant at 1% level. However, we find a smaller and insignificant coefficient in low financial constraints group. We further demonstrate a significant difference in estimated coefficients between subsamples with high and low financial constraints (Permutation test, p = 0.025). These results confirm H2, demonstrating that the more a firm is financially constrained, the stronger the crowding-out effect of stricter tax enforcement.

4.4.2 The moderating effect of industry attributes

Heavy-polluting enterprises are subject to strict environmental protection regulations and supervision. Thus, firms in heavy-polluting industries may respond differently to tougher tax enforcement concerning corporate environmental investment, as compared to those firms in industries with low pollution levels. To explore whether industry attributes moderates the relation between tax enforcement and CEI, we split all firms into two groups based on the classification of firms as being in the heavy-polluting industries or not.

The last two columns of Table 6 present the subsample estimation results, which indicate a much more significant and larger effect of tax enforcement for enterprises in non-heavy-polluting industries. Specifically, as shown in Column (3), the coefficient of

5 Potential mechanism

In sum, our results reveal that stricter tax enforcement results in a decrease in CEI. We propose that the increased tax burden caused by tougher tax enforcement might be the channel whereby tax enforcement takes effect. The idea is that more stringent tax enforcement increases firms’ tax burden (Slemrod, 2019; Feng et al., 2022; He and Yi, 2023). Consequently, firms are inclined to retain internal cash flow by limiting CEI due to its lack of immediate profitability, need for a large amount of financial resources, and high level of risk (Liu et al., 2021; Liu et al., 2022a; Wang et al., 2023a). If this channel works, we anticipate observing that tax enforcement exerts a larger crowding-out impact on CEI in firms with a greater overall tax burden.

Following Liu and Liu (2013) and Li and Ma (2021), we proxy firms’ overall tax burden with a variable

6 Conclusion and policy implications

6.1 Research conclusion

Environmental pollution and climate change caused by industrial activities greatly threaten the sustainable development of human society. To deal with the pollution problem, many countries have implemented tax policies to encourage CEI. While tax enforcement largely affects the efficacy of tax policies, the role that tax enforcement plays in influencing CEI remains unknown. Using the adoption of GTPIII in China as a quasi-natural experiment, this study sheds light on the nexus between tax enforcement and CEI. The research sample comprises Chinese listed firms, covering the period from 2009 to 2018. Employing the staggered DID approach, we find that corporates reduce their environmental investment in response to greater tax enforcement. This impact is stronger for corporates that are financially constrained and firms that operate within non-heavy-polluting industries. We present additional evidence about the potential mechanisms. The empirical findings support our conjecture that the heightened tax burden induced by greater tax enforcement acts as the potential channel through which CEI is crowded out.

6.2 Policy implications

Our findings suggest several policy implications that might help promote CEI in China and other developing countries facing similar issues. First, while tougher tax enforcement using big data technology undoubtedly contributes to tax collection, it is important to recognize and address the potential negative spillover effects regarding corporate environmental expenditures. To encourage CEI, it is crucial to take measures to alleviate the increased burden caused by greater tax enforcement. To this end, the government could potentially implement tax credits that encourage environmental investment when strengthening tax enforcement. Another potential policy approach could be the implementation of preferential treatment enacted by governments, such as the provision of environmental subsidies.

Second, our findings indicate the impact of tax enforcement on CEI is greater in financially constrained corporates. It suggests that policies could be designed to ease the financial constraints encountered by firms in order to mitigate the negative effect on CEI. For example, the implementation of policies that facilitate corporates to utilize capital market tools, such as green bonds, could prove beneficial to alleviate the adverse impact of tax enforcement.

Third, the enforcement of environmental regulations and the supervision of polluting activities that contribute to environmental degradation ought to be strengthened. Our study reveals that the adverse influence of tax enforcement centers in non-heavy-polluting firms. This result suggests that stringent environmental supervision is critical to maintaining CEI.

6.3 Limitations

While this paper sheds light on how tax enforcement shapes CEI, nonetheless, we acknowledge there are some limitations that should be considered. First, this study employs listed firms as the research sample, rather than a more comprehensive sample covering unlisted firms. Considering that listed firms generally exhibit lower financial constraints in comparison to unlisted firms, the real impact of tax enforcement on CEI might be underestimated. Second, this paper focuses on the Chinese context, an emerging market where economic growth takes precedence over environmental protection. Therefore, the extent to which the effect of tax enforcement extends to developed nations remains questionable. Future research should investigate the generalizability of our findings by examining larger or cross-national samples.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

LH: Data curation, Formal Analysis, Methodology, Writing–original draft, Writing–review and editing. LX: Investigation, Methodology, Resources, Writing–review and editing. KD: Funding acquisition, Supervision, Validation, Writing–review and editing. YR: Methodology, Software, Supervision, Writing–review and editing. CZ: Supervision, Validation, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research is supported by National Natural Science Foundation of China (Grant No. 71910107001), Natural Science Foundation of Shandong Province (Grant No. ZR2021QG070), Natural Science Foundation of Fujian Province (2023J05098), Social Science Foundation of Fujian Province (FJ2023C035).

Acknowledgments

We thank Diqiang Chen for his helpful comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2024.1374529/full#supplementary-material

Footnotes

1One may worry that the effect of GTPIII is biased by the first and second phases of GTP. We posit that this is not likely to happen as the difference-in-difference method allows us to remove the potential effect of the previous two phases and determine the clean effect of GTPIII.

2It refers to the adoption of the Environmental Protection Tax Law of China.

3The Environmental Protection Law mainly affects the heavy-polluting industries. Therefore, we consider firms in these industries as the treatment group, while firms in the rest of industries as the control group.

References

Alliance, G. G. A. (2013). The Green Investment Report: the ways and means to unlock private finance for green growth.

Baker, A. C., Larcker, D. F., and Wang, C. C. Y. (2022). How much should we trust staggered difference-in-differences estimates? J. Financial Econ. 144, 370–395. doi:10.1016/j.jfineco.2022.01.004

Bhuiyan, Md. B. U., Huang, H. J., and de Villiers, C. (2021). Determinants of environmental investment: evidence from europe. J. Clean. Prod. 292, 125990. doi:10.1016/j.jclepro.2021.125990

Borusyak, K., Jaravel, X., and Spiess, J. (2022). Revisiting event study designs: robust and efficient estimation. Available at SSRN 2826228.

Brown, J. R., Martinsson, G., and Thomann, C. (2022). Can environmental policy encourage technical change? Emissions taxes and R&D investment in polluting firms. Rev. Financial Stud. 35, 4518–4560. doi:10.1093/rfs/hhac003

Carrillo, P., Pomeranz, D., and Singhal, M. (2017). Dodging the taxman: firm misreporting and limits to tax enforcement. Am. Econ. J. Appl. Econ. 9, 144–164. doi:10.1257/app.20140495

Cheng, B., Qiu, B., Chan, K. C., and Zhang, H. (2022). Does a green tax impact a heavy-polluting firm’s green investments? Appl. Econ. 54, 189–205. doi:10.1080/00036846.2021.1963663

Desai, M. A., Dyck, A., and Zingales, L. (2007). Theft and taxes. J. Financial Econ. 84, 591–623. doi:10.1016/j.jfineco.2006.05.005

Ding, Q., Huang, J., and Chen, J. (2023). Does digital finance matter for corporate green investment? Evidence from heavily polluting industries in China. Energy Econ. 117, 106476. doi:10.1016/j.eneco.2022.106476

Fazzari, S., Hubbard, R. G., and Petersen, B. C. (1987). Financing constraints and corporate investment.

Feng, C., Ye, Y., and Bai, C. (2023). Tax enforcement and corporate financial irregularities: evidence from China. Int. Rev. Financial Analysis 88, 102697. doi:10.1016/j.irfa.2023.102697

Feng, C., Ye, Y., and Tao, Y. (2022). Tax authority enforcement and corporate social security contributions: evidence from China. Finance Res. Lett. 49, 103094. doi:10.1016/j.frl.2022.103094

Guariglia, A., and Liu, P. (2014). To what extent do financing constraints affect Chinese firms’ innovation activities? Int. Rev. Financial Analysis 36, 223–240. doi:10.1016/j.irfa.2014.01.005

Gupta, S., and Lynch, D. P. (2016). The effects of changes in state tax enforcement on corporate income tax collections. J. Am. Tax. Assoc. 38, 125–143. doi:10.2308/atax-51301

Hanlon, M., Hoopes, J. L., and Shroff, N. (2014). The effect of tax authority monitoring and enforcement on financial reporting quality. J. Am. Tax. Assoc. 36, 137–170. doi:10.2308/atax-50820

He, Y., and Yi, Y. (2023). Digitalization of tax administration and corporate performance: evidence from China. Int. Rev. Financial Analysis 90, 102859. doi:10.1016/j.irfa.2023.102859

Hoopes, J. L., Mescall, D., and Pittman, J. A. (2012). Do IRS audits deter corporate tax avoidance? Account. Rev. 87, 1603–1639. doi:10.2308/accr-50187

Hu, L., and Yang, D. (2021). Female board directors and corporate environmental investment: a contingent view. Sustainability 13, 1975. doi:10.3390/su13041975

Huang, L., and Lei, Z. (2021). How environmental regulation affect corporate green investment: evidence from China. J. Clean. Prod. 279, 123560. doi:10.1016/j.jclepro.2020.123560

IPCC (2014). Climate change 2013: the physical science basis: working group I contribution to the fifth assessment report of the intergovernmental panel on climate change. China: Cambridge University Press.

Jia, F., Li, G., Lu, X., and Xie, S. (2021). CEO given names and corporate green investment. Emerg. Mark. Rev. 48, 100808. doi:10.1016/j.ememar.2021.100808

Jiang, Y., Guo, C., and Wu, Y. (2022). Does digital finance improve the green investment of Chinese listed heavily polluting companies? The perspective of corporate financialization. Environ. Sci. Pollut. Res. 29, 71047–71063. doi:10.1007/s11356-022-20803-z

Kong, D., Liu, J., Wang, Y., and Zhu, L. (2023a). Employee stock ownership plans and corporate environmental engagement. J. Bus. Ethics 189, 177–199. doi:10.1007/s10551-023-05334-y

Kong, D., Xiong, M., and Qin, N. (2023b). Tax incentives and firm pollution. Int. Tax Public Finance 30, 784–813. doi:10.1007/s10797-022-09731-3

Kong, D., and Zhu, L. (2022). Governments’ fiscal squeeze and firms’ pollution emissions: evidence from a natural experiment in China. Environ. Resour. Econ. 81, 833–866. doi:10.1007/s10640-022-00656-3

Li, B., and Ma, C. (2021). Can tax enforcement affect misstatements? From the perspective of tax account and non-tax account misstatements. Asia-Pacific J. Account. Econ. 28, 357–374. doi:10.1080/16081625.2019.1618718

Li, J., Wang, X., and Wu, Y. (2020). Can government improve tax compliance by adopting advanced information technology? Evidence from the Golden Tax Project III in China. Econ. Model. 93, 384–397. doi:10.1016/j.econmod.2020.08.009

Li, P., Lin, Z., Du, H., Feng, T., and Zuo, J. (2021). Do environmental taxes reduce air pollution? Evidence from fossil-fuel power plants in China. J. Environ. Manag. 295, 113112. doi:10.1016/j.jenvman.2021.113112

Liao, X., and Shi, X. (2018). Public appeal, environmental regulation and green investment: evidence from China. Energy Policy 119, 554–562. doi:10.1016/j.enpol.2018.05.020

Liu, C.-Y., and Wu, C.-H. (2009). Environmental consciousness, reputation and voluntary environmental investment. Aust. Econ. Pap. 48, 124–137. doi:10.1111/j.1467-8454.2009.00366.x

Liu, G., Liu, Y., and Zhang, C. (2022a). Tax enforcement and corporate employment: evidence from a quasi-natural experiment in China. China Econ. Rev. 73, 101771. doi:10.1016/j.chieco.2022.101771

Liu, G., Yang, Z., Zhang, F., and Zhang, N. (2022b). Environmental tax reform and environmental investment: a quasi-natural experiment based on China’s Environmental Protection Tax Law. Energy Econ. 109, 106000. doi:10.1016/j.eneco.2022.106000

Liu, J., and Liu, F. (2013). Fiscal centralization, government control and corporate tax burden: evidence from China. China J. Account. Stud. 1, 168–189. doi:10.1080/21697221.2013.870367

Liu, Y., Wang, A., and Wu, Y. (2021). Environmental regulation and green innovation: evidence from China’s new environmental protection law. J. Clean. Prod. 297, 126698. doi:10.1016/j.jclepro.2021.126698

Lu, M., Daixu, L., Peng, W., and Ruiqi, M. (2023). Heterogeneous environmental regulation tools and green economy development: evidence from China. Environ. Res. Commun. 5, 015007. doi:10.1088/2515-7620/acb1f9

Qi, Y., Zhang, J., and Chen, J. (2023). Tax incentives, environmental regulation and firms’ emission reduction strategies: evidence from China. J. Environ. Econ. Manag. 117, 102750. doi:10.1016/j.jeem.2022.102750

Qian, X., Ding, H., and Ding, Z. (2023). Governmental inspection and firm environmental protection expenditure: evidence from China. Econ. Model. 123, 106284. doi:10.1016/j.econmod.2023.106284

Ren, S., Hao, Y., and Wu, H. (2022). How does green investment affect environmental pollution? Evidence from China. Environ. Resour. Econ. 81, 25–51. doi:10.1007/s10640-021-00615-4

Roth, J., Sant’Anna, P. H. C., Bilinski, A., and Poe, J. (2023). What’s trending in difference-in-differences? A synthesis of the recent econometrics literature. J. Econ. 235, 2218–2244. doi:10.1016/j.jeconom.2023.03.008

Slemrod, J. (2019). Tax compliance and enforcement. J. Econ. Literature 57, 904–954. doi:10.1257/jel.20181437

Tang, G., Li, L., and Wu, D. (2013). Environmental regulation, industry attributes and corporate environmental investment. Account. Res. 6.

Tian, P., and Lin, B. (2019). Impact of financing constraints on firm’s environmental performance: evidence from China with survey data. J. Clean. Prod. 217, 432–439. doi:10.1016/j.jclepro.2019.01.209

Wang, J., Dong, H., and Xiao, R. (2022). Central environmental inspection and corporate environmental investment: evidence from Chinese listed companies. Environ. Sci. Pollut. Res. 29, 56419–56429. doi:10.1007/s11356-022-19538-8

Wang, J., Ke, D., and Lai, X. (2023a). Tax enforcement and corporate social responsibility: evidence from a natural experiment in China. Emerg. Mark. Finance Trade 59, 542–560. doi:10.1080/1540496X.2022.2097066

Wang, L., Chen, C., and Zhu, B. (2023b). Earnings pressure, external supervision, and corporate environmental protection investment: comparison between heavy-polluting and non-heavy-polluting industries. J. Clean. Prod. 385, 135648. doi:10.1016/j.jclepro.2022.135648

Xiao, C., and Shao, Y. (2020). Information system and corporate income tax enforcement: evidence from China. J. Account. Public Policy 39, 106772. doi:10.1016/j.jaccpubpol.2020.106772

Xu, W., Zeng, Y., and Zhang, J. (2011). Tax enforcement as a corporate governance mechanism: empirical evidence from China. Corp. Gov. An Int. Rev. 19, 25–40. doi:10.1111/j.1467-8683.2010.00831.x

Xu, X., and Yan, Y. (2020). Effect of political connection on corporate environmental investment: evidence from Chinese private firms. Appl. Econ. Lett. 27, 1515–1521. doi:10.1080/13504851.2019.1693692

Yagan, D. (2015). Capital tax reform and the real economy: the effects of the 2003 dividend tax cut. Am. Econ. Rev. 105, 3531–3563. doi:10.1257/aer.20130098

Yang, S. (2023). Carbon emission trading policy and firm’s environmental investment. Finance Res. Lett. 54, 103695. doi:10.1016/j.frl.2023.103695

Zahan, I., and Chuanmin, S. (2021). Towards a green economic policy framework in China: role of green investment in fostering clean energy consumption and environmental sustainability. Environ. Sci. Pollut. Res. 28, 43618–43628. doi:10.1007/s11356-021-13041-2

Zhang, D., Du, W., Zhuge, L., Tong, Z., and Freeman, R. B. (2019a). Do financial constraints curb firms’ efforts to control pollution? Evidence from Chinese manufacturing firms. J. Clean. Prod. 215, 1052–1058. doi:10.1016/j.jclepro.2019.01.112

Zhang, L., Chen, W., and Peng, L. (2023). The impact of tax enforcement on corporate investment efficiency: evidence from the tax administration information system. Account. Finance 63, 1635–1669. doi:10.1111/acfi.12921

Zhang, L., Peng, L., Fu, X., Zhang, Z., and Wang, Y. (2022a). Alternative corporate governance: does tax enforcement improve the performance of mergers and acquisitions in China? Corp. Gov. An Int. Rev. 31, 647–666. doi:10.1111/corg.12485

Zhang, Q., Yu, Z., and Kong, D. (2019b). The real effect of legal institutions: environmental courts and firm environmental protection expenditure. J. Environ. Econ. Manag. 98, 102254. doi:10.1016/j.jeem.2019.102254

Zhang, Z., Zhang, B., and Jia, M. (2022b). The military imprint: the effect of executives’ military experience on firm pollution and environmental innovation. Leadersh. Q. 33, 101562. doi:10.1016/j.leaqua.2021.101562

Zhao, L. (2022). Corporate philanthropy as a response to greater tax enforcement. Account. Bus. Res. 54, 33–54. doi:10.1080/00014788.2022.2149456

Zhao, L. (2023). The effect of tax authority enforcement on earnings informativeness. Eur. Account. Rev. 32, 197–216. doi:10.1080/09638180.2021.1947337

Keywords: tax enforcement, corporate environmental investment, tax burden, financial constraints, heavy-polluting industry

Citation: He L, Xu L, Duan K, Rao Y and Zheng C (2024) Does tax enforcement reduce corporate environmental investment? evidence from a quasi-natural experiment. Front. Environ. Sci. 12:1374529. doi: 10.3389/fenvs.2024.1374529

Received: 23 January 2024; Accepted: 10 April 2024;

Published: 02 May 2024.

Edited by:

Liang Xu, Southwestern University of Finance and Economics, ChinaReviewed by:

Chang Liu, Southwestern University of Finance and Economics, ChinaLilian Li, Jiangxi University of Finance and Economics, China

Copyright © 2024 He, Xu, Duan, Rao and Zheng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chuanzhen Zheng, Y2h1YW56aGVuLnpoZW5nQGZveG1haWwuY29t

Lu He1

Lu He1 Kaifeng Duan

Kaifeng Duan Chuanzhen Zheng

Chuanzhen Zheng