- 1Institute of International Relations, Marie Curie-Sklodowska University, Lublin, Poland

- 2Department of Sociology and Political Science, Norwegian University of Science and Technology, Trondheim, Norway

This review article provides a comprehensive multidisciplinary and in-depth analysis of how the idea of Global Carbon Markets (GCM) has evolved from the Kyoto Protocol to the Paris Agreement and the post-Paris Agreement period (2015–2022) and why no real consensus has been reached after 25 years of negotiations, based on the categorisation of different arguments from different authors. We apply a semi-systematic review to 32 scientific articles, special reports, and relevant websites to analyse the failure in reaching international consensus on GCM. We apply three dichotomies, market vs. non-market-based approaches, top-down vs. bottom-up and national vs. international level. There are two striking findings. First (out of the articles that can easily be placed along all three dichotomies), there is an overwhelming majority of articles combining market-based, top-down, and international level explanations. This is however countered by a second finding, namely, that there is also a clear historical trend which is unlikely to change away from top-down and towards bottom-up approaches since the Paris agreement, combined with a movement towards more non-market-based and national approaches.

1 Introduction

Since the Kyoto protocol (KP) in 1997, carbon markets have emerged as a main politico-economic tool in global efforts to address climate change (Böhm et al., 2012). The idea of Global Carbon Markets (GCM) was first introduced under the KP as one of the so-called flexibility mechanisms, i.e., the joint implementation schemes and clean development mechanism. These are mechanisms that constitute attractive options due to their potential to exploit cost-effective mitigation potential and activate the private sector (Höhne et al., 2015). The Paris Agreement (PA) provides for global markets by acknowledging that states, if working together to implement their Nationally Determined Contributions (NDCs), may exchange mitigation outcomes under their own authority, and utilize new mitigation mechanisms. However, implementation has yet to be determined, both nationally and internationally, and the Parties disagree on major points. This creates challenges, not only in terms of creating markets that allow and accommodate international remittances, but also in terms of the long-term connecting of markets across multiple domestic jurisdictions (Stavins and Stowe, 2017). Although GCM discussions have been part of the COP climate meetings for more than 20 years, there is little to suggest that GCM will be implemented in the foreseeable future. There have been national and regional attempts to create carbon markets, but no success at the global level in implementing a functioning market.

By carbon markets we understand markets in which carbon credits are obtained and sold within defined standards to cost-effectively reduce the emission of carbon dioxide (CO2) and other greenhouse gases (Ozcan and Ozturk, 2019). GCM are made up of voluntarily interconnected markets producing and trading broadly similar products, where the markets are interconnected enough for major price differences between regions to be arbitraged (Pollitt, 2019). We argue that GCM is the evolution of the KP’s international carbon market during the post-Kyoto phase, following the inclusion of cooperative mechanisms in the PA to promote greater international co-operation and improve the cost-effectiveness of GHG emission reductions through the disposition of Article 6 (Ar6) of the PA and its various market and non-market mechanisms. GCM is thus a further development of international cooperation on the carbon market cooperation, as the GCM links different systems and can thus facilitate the transition from the flexibility of the KP to the cost efficiency of the PA and cross-border rules. Therefore, the GCM continues and supports international co-operation on emission reductions under the PA, reduces price volatility and lowers costs by improving access to cost-effective emission reduction options. We see GCM as a mechanism that fits into the toolkit of UNFCCC negotiations that promote and advance international cooperation to facilitate emissions reductions.

There are many reasons why GCM is a worthy focus for a review article. GCM is an important potential component of NDCs, which is the key process Ar6 of the PA, allowing countries to be more ambitious by being more flexible; the global market could be used for international climate finance, independent of national contributions; and the mechanisms of the GCM, domestic and other carbon pricing policies are used to implement the international offers domestically and enhance global climate action.

We proceed as follows. Section 2 presents the methodology, Sections 3–6 constitute a historical description of how the debate on GCM, including key concepts and developments, has evolved, organized around the COPs, and ending with the 2021 COP 26. Section 7 discusses the main arguments and reasons for GCM implementation failure. Here, as a simple heuristic by which to organize the literature, we suggest three very basic dichotomies derived from the political economy literature, market vs. non-market approaches, top-down vs. bottom-up processes, and national and international level approaches. Section 8 provides a summary of the discussion and 9 a brief conclusion. The approaches towards GCM have varied over time and there is still no consensus on how to implement it. There are however two striking findings. First, the overwhelming majority of articles attempting to explain the failure to implement GCM combine market-based, top-down, and international level explanations. This is, however, countered by a second finding, namely, that there is also a historical trend–which is unlikely to change–essentially since the PA, away from top-down and towards bottom-up approaches. This is combined with a possible movement towards more non-market-based and national approaches. Thus, in trying to explain the failure of the implementation of a GCM, since the PA there has been a shift in the literature. Since the PA, much of the literature has focused on Ar6, which has created an environment that enables international cooperation on carbon markets. The observed shift from top-down to bottom-up is essentially a shift from the flexible mechanisms of the KP to the cost-effectiveness instruments under Ar6 of the PA.

2 Methodology

Hart (1998) defines the literature review as “the use of ideas in the literature to justify the particular approach to the topic, the selection of methods, and demonstration that this research contributes something new”. Among the types of reviews, we find systematic, semi-systematic, and integrative reviews. This is a semi-systematic review. The semi-systematic, sometimes narrative, review approach is structured for issues that have been conceptualized in a variety of ways and in different disciplines. Semi-systematic reviews often look at how research within a selected field has progressed over time or how a topic has developed across research traditions. Specifically, the analysis aims to recognize and explain applicable research patterns that have consequences for the topic under study and to synthesize those using meta-narratives (Wong et al., 2013). A thematic or content analysis is commonly used and can be broadly defined as a method for identifying, analysing, and reporting patterns in the form of themes within a text (Braun and Clarke, 2006).

Our main objective is to investigate the function of carbon markets in climate change negotiations with a focus on why the implementation of GCM has been mainly unsuccessful. We have used databases such as Google Scholar, Web of Science, and Scopus to search for qualitative social science publications and research papers in peer-reviewed English language journals for specialised research on carbon markets and climate change (e.g., Climate policy journal, Journal of Economic Perspectives, WIREs Climate Change, Carbon Management). To narrow down the list of possible literature and the search for journals and articles, we have used the search term “GCM” for the period 2008-2021. We used 2008 as our starting year, inspired by critical points made by Michael Wara in his Nature article “Is the global carbon market working?”, where he discussed the success and failure of the Clean Development Mechanism (CDM) (Wara, 2007).

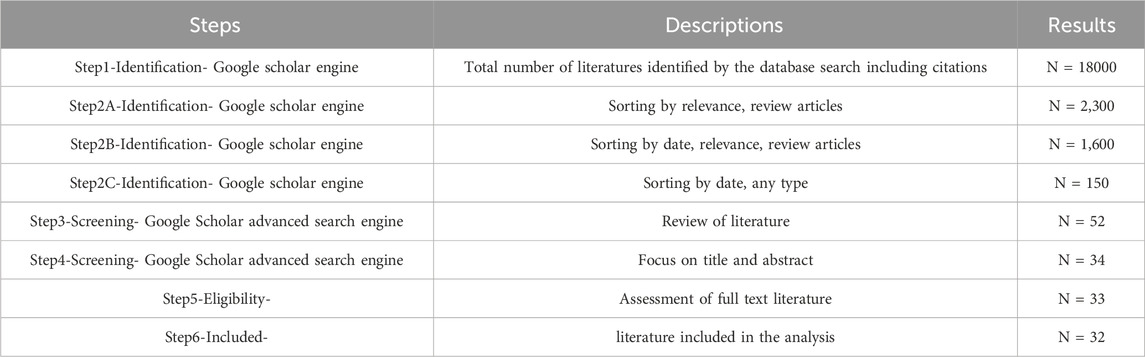

Our original search, based on the Google Scholar engine yielded roughly 18,000 results. Both empirical and theoretical articles were considered. In a second step, we developed a simple search strategy based on the Google Scholar engine, with inclusion and exclusion criteria on three levels, with the aim of identifying the number of relevant articles and narrowing them down (see Table 1, below (2A, 2B, 2C)).

In step 2A, we selected the following options one by one: We selected sort “by relevance” in the Google Scholar field search to find and match search keywords- + review articles; these studies have a literature review or refer to the literature review- + global “carbon markets”. This brought us down to about 2,300 articles. For step 2B, we applied this strategy and selected the following options one by one: 2008-2021 + sort by relevance-we selected the “by relevance” option in the Google Scholar field search to find and match search keywords- + review articles-these studies have a literature review or refer to the literature review- + global “carbon markets”. This yielded roughly 1,600 articles. In step 2C, we selected the following options one by one: 2008-2021 + sort by date + any type. We selected “any type” in Google Scholar to filter the search results by any type of literature + global “carbon markets”. This brought us down to approximately 150 articles.

In step 3, we narrowed the selection to articles with a literature review in one form or another, as sorted through the individual boxes of Google Scholar’s advanced search engine with all words (review carbon markets), with the exact phrase (carbon markets), with at least one of the words (review), where my words occur–we selected “Where my words occur” in Google Scholar to find the words in the body of the article, not just in the title of the article (=anywhere in the literature).

In the final steps, we focused on exact titles and abstracts as follows: with all the words (global carbon markets), with the exact phrase (carbon markets), with at least one of the words (review), where my words occur–we selected “where my words occur” in Google Scholar to find the words in the body of the article, not just in the title of the article—(anywhere in the article) and it showed us global carbon markets review “carbon markets”. We then read the 33 selected pieces and excluded books and works published in non-English-speaking countries. Finally, we focused exclusively on qualitative studies published in peer-reviewed English language journals (i.e., the topic of the study followed this string: Global carbon markets + Kyoto Protocol + Kyoto mechanisms + Paris Agreement + Article6). This took us down to 32.

We conducted an in-depth analysis by reading and coding the 32 articles to identify and extract constitutive concepts based on GCM background (Sections 3–6), argumentation patterns (Section 7.1), approaches and/or dichotomies (Section 7.2). We also manually coded the literature to develop three dichotomies based on a semi-systematic review. Section 7.2 and its subsections describe our process of literature review from unstructured information to a structured and theoretically grounded three-level lens.

3 Background: the starting point of the global carbon market

The starting point for carbon markets was article 4.2 of the UNFCCC1 with its joint implementation Greenhouse Gas Emissions (GHG) mitigation rule, initiated by mainly Western countries seeking to create a window for the development of market mechanisms. Newell et al. (2013) claims the KP as the birthplace of GCM: European and other developed countries wanted to take action to reduce GHGs under the KP, and a global carbon trading market was a key approach. In the 1995 COP1 climate conference in Berlin, a pilot phase of “Activities Implemented Jointly” (AIJ) was launched (Korppoo, 2005). At the COP2 in Geneva, representatives and delegates constructed policies to speed up the negotiation process. The US announced that it would accept legally binding agreements if other states did, calling for all states to contribute (Rosenzweig, 2016). The KP was adopted at the 1997 COP3 in Kyoto and Article 3 set a market demand for GHGs by imposing binding reductions (Michaelowa and Schmidt, 1997). In the KP, the 38 countries listed in the so-called Annex I shall, on the basis of Article 3 (1) and (1 bis) of the KP, individually or jointly, ensure that their aggregate anthropogenic carbon dioxide equivalent emissions of the GHGs listed in Annex A do not exceed their assigned amounts, calculated according to their quantified emission limitation and reduction commitments inscribed in Annex B and following the provisions of this Article, to reduce their overall emissions of gases by at least 5 percent below 1990 levels in the commitment period 2008-2012. The KP established GHG reduction targets for 38 developed states and economies in transition–Annex B Parties to the Protocol. These mitigation targets were enounced in countries’ emissions allowances (Shishlov et al., 2016). Countries that have committed to limiting or reducing their GHGs under the KP must achieve their targets primarily through national action. As an additional means to achieve these goals, the KP introduced three supplementary mechanisms, namely, the emission targets of Annex B countries, to initiate the creation of GCM. Annex B Parties could use the GCM and its three market mechanisms for emissions trading, as set out in Article 17 of the KP, to optimise economic efficiency in meeting their carbon reduction or limitation targets (Morgan, 2006). We can link various Kyoto mechanisms and markets to the GCM. These flexible mechanisms, such as the CDM under the GCM, are an effective synergy between developed and developing countries, providing an opportunity to reduce emissions and learn about and benefit from the GCM and Kyoto mechanisms. Thus, annex B Parties might use three market mechanisms to optimize the economic efficiency of meeting their carbon reduction or restriction goals.

3.1 International emission trading (IET)

IET is a bilateral cap-and-trade system trading pre-assigned allowances among mitigating states (Annex I Parties) to enable flexibility to help countries reach their Kyoto commitments. Kyoto also allowed issuance and trade under the IET of removal units (Carbon Markets under the Kyoto Protocol, 2018).

3.2 The clean development mechanism (CDM)

CDM is a program-based, baseline-and-credit system at the enterprise level. It allows projects in non-mitigating states to produce carbon savings (Certified Emission Reductions, or CER) that can be purchased by governments and private sector institutions and thus asserted by mitigating countries for compliance reasons (Cole, 2010).

3.3 Joint implementation (JI)

JI helps projects to produce carbon assets identified as Emission Reducing Units (ERUs) among mitigating countries. For KP compliance purposes ERUs created in one country may be claimed by another. JI has two channels: channel one enables states to produce ERUs without international supervision; and channel 2, in which the JI Supervisory Committee oversees the initiatives and the generated emission-reducing units (Shishlov et al., 2012).

These mechanisms are the basis for the regulated global compliance carbon market. Based on the 2007 analysis of the World Bank, the JI market of the KP traded only 41 million tonnes (Mt) of carbon. To meet the protocol obligations states have established emission trading systems. The largest of these is the EU Emission Trading Scheme (EU ETS) which allows trading between EU member states via the above mechanisms. By the end of its first year of trading, the EU ETS had transacted an estimated 362 Mt of carbon credits, worth approximately €7.2 billion (US$9 billion). The explosive growth of the global compliance carbon market under the KP has meant that prices for carbon credits have been extremely volatile. Between 2009 and 2018, the price rarely exceeded €20 per metric tonne of carbon and dropped to only €3 in 2013. However, in the post-Covid economic recovery, from 2021 to early 2023 the price of emission allowances rose to €70-100. From March 2023 onwards, they fell by more than €15 per tonne due to the acceleration of the European Green Deal and the inclusion of nuclear power and natural gas as green energy sources (Trading Economics, 2024; Wojciechowski et al., 2023).

4 Toward an effective new GCM: Ar6 and the establishment of the carbon market system under the PA

Copenhagen (COP15, 2009) did little to advance the development of a GCM. A disappointing meeting in combination with an underperforming EU ETS and a worldwide economic crisis, left the GCM idea in a critical state. Also, the largest emitters seemed to have no strong interest in emissions reductions. However, with Cancun (COP16, 2010) and Durban (COP17, 2011) came new promise. In Cancun it was agreed to consider setting up market mechanisms to increase the cost-effectiveness of mitigation measures and develop market mechanism rules (Gao et al., 2019). The creation of a new market mechanism was a red line for many Parties–no new market mechanism, no Durban deal. COP17 formally recognized two international carbon markets. CDM and JI would proceed as attempts to gain increased efficiency by providing more efficient and consistent regulation (Marcu, 2012b).2 Post-Durban, there was however little progress,3 until COP21 in Paris reintegrated international carbon markets (Koakutsu et al., 2016).

Article 6 (Ar6) of the PA provides for voluntary cooperation between Parties to implement their NDCs. Therefore, Ar6 mechanisms are supplementary—“a basis for creating new linkages between different jurisdictions to reduce the current fragmentation of carbon markets” (World Bank Group, 2019: 11).

To Leggett (2020), Ar6 allows for the use of market mechanisms as an additional mechanism to achieve GHG reductions at the lowest possible cost and in line with sustainable development (Article 6.1). To substantiate and support this approach, a study by the Public Policy Research Institute of the US Congress argues that Ar6 allows the use of market mechanisms to achieve GHG reductions at the lowest possible cost and consistent with sustainable development. Some scholars (e.g., Blum, 2019) believe that Ar6 provides incentives for the creation of a GCM. Moreover, carbon markets enable countries to meet the climate targets of their NDCs (Schneider and Stephanie, 2019). Ar6 developed two international carbon markets under Articles 6.2e6.3 Cooperative Approaches and the Sustainable Development Mechanism under Articles 6.4e6.7 (UNFCCC, 2015). Articles 6.2 and 6.3 form the basis for the right to manage and use internationally transferred mitigation outcomes among Parties as a particular case of “cooperative strategies” in their NDCs. 6.2 states that Parties participating in internationally transferred mitigation outcomes “shall promote a sustainable environment and ensure environmental integrity”. In this context, paragraphs 6.2 and 6.3 are “transfer paragraphs”, which provide the means for a process that may lead to convergence of domestic carbon prices over time (Marcu, 2016). Articles 6.4 and 6.7 are mechanisms that contribute to the reduction of GHGs and support sustainable development (Marcu, 2016).

5 GCM beyond the PA: the contribution of COP24

The threshold for the PA to come into effect–formal adoption by 55 states representing at least 55 percent of global emissions–was reached by 4 October 2016. By the end of the 2016 COP22 in Marrakech, it had been ratified by 111 states accounting for more than 75% of global emissions (UNFCCC, 2021). Marrakech was a turning point. On GCM, countries took ambitious action in which the Parties formulated long-term, low-carbon development strategies (PA, Article 4.19). They also sought to facilitate the widespread exchange of resources, knowledge, and experiences with deep decarbonisation planning. The result was a commitment by 22 countries, 15 cities, 17 states, and 196 businesses. In addition, the US, Mexico, Germany, and Canada had already published their own strategic documents (Danyluk, 2017). At COP23 - the climate meeting in Bonn in 2017 - governments took the next step towards an operating system to realise the potential of the PA, including the PA Adaptation Fund. The Fund represents the Parties’ call for the PA to help decarbonize nations, as well as adjust and develop resistance to climate change (Peet et al., 2017). A delegate representing the Alliance of Small Island States (AOSIS), for instance, argued, that the Adaptation Fund is a critical component of the financial architecture for decarbonizing of the economy. Developing states highlighted specific features of the Fund to underpin their support.

Within three years of the PA, the Intergovernmental Panel on Climate Change (IPCC) had released a special report on 1.5 degrees of global warming, as requested at Paris (Erbach, 2019). In 2018, COP24 took place in Katowice, Poland, where an international rulebook for the efficient implementation of the PA was implemented. However, Ar6 was the one item on the agenda not to join the rulebook (COP24, 2018).

Within the Transparency Framework (PA, Art. 13), the Parties could only agree on minimum requirements to safeguard the environmental integrity of Ar6 (Obergassel et al., 2018:9). The Parties worked through multiple issues and established common ground on many. Advancement on carbon markets was seized in two sets of reports: The draft texts on Article 6.2, 6.4 and 6.8 negotiated upon by the Subsidiary Body for Scientific and Technological Advice (SBSTA 49), and the written recommendations on the three agenda items of the Katowice presidency. The Parties decided on a variety of draft issues, but continued to face stumbling blocks, leaving Ar6 without formal agreement on GCM or international collaboration. Centralized process and double-counting problems remain extremely controversial in the accounting of international transfer under Article 6.4. Problems, such as the transfer of CDM programs, credits, and methodologies to Article 6.4, the share of adaptation proceeds imposed under Article 6.4, and the liability of Reducing Emission from Deforestation and forest Degradation (REDD+), also remain available. Thus, the full implementation of Ar6 was postponed until the 2019 COP25. Thus, carbon markets remained in limbo (Greiner et al., 2019).

6 The COP25 summit: GCM in limbo

The 2019 COP25 occurred under the administration of the Chilean government but was eventually hosted in Madrid. A central goal was to complete issues on the full operationalization of the PA rulebook. The climate change conference included the 51st meetings of the subsidiary implementation body and the SBSTA to help strengthen both commitments and address issues related to the sustainable development framework, market mechanisms and non-market Ar6 mechanisms in the context of the PA (Asadnabizadeh, 2019).

COP25 also aimed at developing a process for GCM (under Ar6 of the PA). It had an important role in bringing the PA into force and paving the way for more ambitious carbon reduction commitments at COP26. COP25 aimed to develop guidelines on the development of international carbon markets (KPMG, 2019), with global cooperation on GCM cooperation the top priority. After leaving COP24 without results on Ar6, negotiators continued to work towards an agreement before countries focused on preparing their next crucial round of NDCs (Hanafi, 2019). At the forefront was GCM and carbon trading rules, as set out in Ar6. Talks however failed to generate results (Kouchakji, 2020).

Ar6 loomed large over the event, and the guidelines for global market mechanisms in the PA also earned conspicuous attention from environmental NGOs, underscoring the prominence of the issue (IETA, 2019). Patricia Espinosa, Executive Secretary of UNFCCC, emphasized that “We need to be clear that the conference did not result in agreement on the guidelines for a much-needed carbon market–an essential part of the toolkit to raise ambition that can harness the potential of the private sector and generate finance for adaptation”. The main obstacles against agreement on GCM were: first, rules to prevent double counting, where both the states buying emissions reductions and the states selling them could end up counting these reductions in their own NDC targets; second, smoother transition of carbon credits from the Kyoto mechanism into the PA; and third, the ‘share of proceeds’ that would be set aside for climate change adaptation in vulnerable countries. Additionally, Australia and Brazil demanded a carryover of Kyoto credits, while Brazil also wanted to use double counting (Chandramouli, 2019; Streck, 2020).

The GCM marathon continued in 2021. After a 1-year Covid hiatus, COP26 was hosted in Glasgow, Scotland. It yielded the Glasgow Climate Pact, a plethora of high-level sectoral pledges, and a set of decisions that complete the Paris Rulebook by operationalizing Ar6. Parties approved decisions on three elements of Ar6: article 6.2 (cooperative approaches involving the use of internationally transferred mitigation outcomes for NDCs); 6.4 (a mechanism that contributes to mitigation and supports sustainable development); and 6.8 (non-market approaches) (IETA, 2021:3). In 2028, consideration will be given to whether additional safeguards or restrictions on the use of credits under 6.2 should be applied. A supervisory authority under article 6.4 will start work in 2022 and develop methodologies and administrative requirements. A Glasgow committee on non-market approaches has been established for the development of climate cooperation under article 6.8.4 Thus, at COP26, the GCM idea made some definite forward steps, but the big breakthroughs necessary for the new NDC pledges to become reality still elude us. Ahonen et al. (2022) similarly argue that the negotiations on carbon markets from Kyoto to Paris that was not successful at COP24 in Katowice in 2018, persisted at COP25 in Madrid in 2019 and could only be partially resolved at COP26 in 2021. True, Glasgow addressed double counting of carbon credits bought and sold through the multilateral mechanism advocated in paragraph 6.4 of the Agreement. However, double counting arising from voluntary commitments by the private sector commitments remain outside the system (Hunter et al., 2021).

7 Discussion

In the following, we first provide a selective overview of some of the most important GCM arguments with respect to the failure of GCM implementation. Thereafter, we suggest three dichotomies all derived from the political economy literature that these arguments can be organized according to: market vs. non-market mechanisms, top-down vs. bottom-up processes, and national vs. international level. We obviously do not suggest that this is the only way to organize the literature. Our purpose is to provide a simple heuristic by which to narrow down the field to more easily be able to say something about where the literature puts the blame for the failure of GCM implementation. We do not present any overarching theoretical framework, but we believe that our heuristic holds immediate relevance for GCM, as well as captures some historical trends in the development of GCM. Non-market approaches have been an issue of contention with respect to GCM for a couple of decades already. The tension between bottom-up and top-down solutions has been obvious since the inception of the COP system, and a tension where we see a clear tendency since the PA that solutions are ever more sought bottom-up than through overarching, mutually binding frameworks from major international conferences. Finally, there is some overlap between the previous dichotomy and the national vs. the international level. However, in the latter we focus on the actual behaviour of major national actors and the leadership (or lack thereof) exhibited by such actors in influencing the development of GCM. This is another dichotomy that is highly relevant for GCM, as there is little doubt that the active agency of major actors is often a requirement for policy change. It goes without saying that not all the 32 articles reviewed were easily categorized along these dichotomies. We do however think that this organization gives us a decent overall view of the literature.

7.1 A select overview of substantive GCM arguments

Here, we seek to provide a summary of the arguments about GCM in the context of the issues discussed in Sections 3–6. We then outline core arguments from the COP debates, showcasing the many different views on GCM and GCM implementation failure. Our aim is to demonstrate that GCM are not simply automatically formed. On the contrary, a plethora of theoretical and empirical arguments have been considered in UNFCCC negotiations.

1997 through 2001 saw several COP meetings but negotiations were economically inefficient and politically impractical. Neither of the standard market-based environmental policy instruments were viable: a tradable permit system would be inefficient, and an emissions tax politically unrealistic (McKibbin and Wilcoxen, 2002). Schiermeier (2012) argues that the seeds of Kyoto’s problems (COP3) were planted long before the treaty. The 1995 COP1 in Berlin divided the world into two. There would be a set of rich states with ambitious climate responsibilities and a set of less-developed states without responsibilities. This did not sit well with US politicians. Many policy experts believe that the UNFCCC and the KP failed to win over the biggest polluters because it was linked to ethical and environmental rationales. To Roger Pielke (cited in Schiermeier, 2012, p. 658) “making energy more expensive is a political liability everywhere. When emission reductions run up against economic growth, economic growth will inevitably win out. There is no magical solution, so you better set yourself tangible goals that are not doomed to clash with the iron laws of politics”. Kutney (2014) agrees and asserts that the dominant macro factor is economics. In assessing the leading naions’ motives, economic drivers determined the climate policies of most.

Pearse and Böhm (2014) point out that the carbon market failed to deliver its core aim to reduce GHGs. They argue that carbon pricing has functioned as a political barrier to other action: carbon trading is not a “first step” toward broader reform. Instead, it locks in emissions increases and serves as an excuse to abandon other energy policies that make more substantive contributions to decarbonization. Neither the KP nor the EU ETS provide much incentive for long-term low-carbon investment. While it is too early to conclude on the EU ETS, the findings of Pearse and Böhm (2014) are backed up by Sæther (2021), who finds no impact on emissions from the EU ETS. Designing policy instruments to concentrate on the least-cost emission reductions in the short term might be suboptimal in the long term if these reductions lead to locking-in of carbon-intensive technologies for the next decade (Hepburn, 2007). Lilliestam et al. (2021; 2022) make it clear that the relationship between carbon pricing and decarbonization is complex. While existing carbon pricing schemes have sometimes reduced emissions, they find no evidence that carbon pricing systems have triggered zero-carbon investments, and consistent evidence that they have not. They conclude that the effectiveness of carbon pricing in stimulating innovation and zero-carbon investment remains a purely theoretical argument not backed by empirical evidence.

Keohane and Raustiala (2008) emphasize that effective climate change mitigation requires political commitment. Economists may design strategies to minimize emissions, but this matters little if negotiation results are ambiguous without substantive agreement. These problems cannot be solved without political and institutional procedures by states. Bultheel et al. (2016) claim that climate governance is vital for understanding the failure of the carbon market. The KP produced a constrained climate framework while the PA enabled new avenues for multilateral cooperation on carbon market issues. Institutional inertia has also been key. New market mechanisms and commitments were tabled as the US was planning a federal cap-and-trade market, with an almost tenfold increase in demand for carbon offsets compared to the EU ETS. The delays and downscaling of expectations for carbon market rules and commitments such as cap-and-trade schemes in other industrialized countries are, in part, a response to the failure of legislation on climate change in the US (Reyes, 2011).

Schneider and Stephanie, (2019) identified and narrated the lack of environmental integrity over the pre-steps of the PA. They argue that environmental integrity is a key principle for an effective carbon mechanism. Redmond and Convery (2014) have shown that the KP and post-KP mechanisms shaped fragmented GCM landscapes based on differing approaches. Interest and response vary across groups of countries, and there have been delays in making progress on a unifying framework. Countries finance their carbon pledges domestically. However, for some countries, pledged actions are contingent upon international financing.

Brown (2011) discusses the significance for GCM with respect to Cancun (COP16). His assessment is that climate summits constitute neither a success for nations seeking to reduce their emissions, nor do they put the world on a safe climate path, let alone a just and equitable transition to a sustainable development model. This is because of coalition-building and disagreements among nations. Aklin and Mildenberger (2020) consider domestic politics far more important for success with respect to combating climate change, including the GCM, than international climate treaties. Thus, a lack of multilateralism has led multiple failed attempts to forge a global solution to GCM. Nordhaus (2010) also focuses on the economic aspects post-Copenhagen. His main point is the lack of harmonized carbon taxes, a feature shunned in negotiations among other things because of the US position. Thus, despite over 15 years of high-level UN efforts for binding agreements on emissions reductions, each annual meeting has failed to reach a global agreement.

Rockström et al. (2017) point out that within the PA alarming inconsistencies remain between science-based targets and national commitments towards carbon markets whereas Gills and Morgan (2019) focus on the role of the economic system regardless of the carbon market. There is the tendency for worldwide economic growth to be incompatible with the emissions reductions necessary within the timeframe available to us. In contrast to the literature that evaluates the carbon market by energy and climate variables, the failure of the carbon market can also be seen as an implementation failure of the rules of the PA. Negotiations will only be successful if players can reach consensus on the modalities, procedures, and guidelines that will assist all Parties in complying with their PA obligations. Lázaro-Touza (2016) stipulates contextual factors that can be expected to lead to implementation failure. First, insufficient advances in mitigation commitments compared to the 2°C benchmark and insufficient adaptation finance efforts; second, advances in the competitiveness and deployment of renewable energy; third, unforeseen political events, such as the US Trump Presidency; and fourth, issues between developed and developing countries over allocation responsibilities.

Other research shows that implementing existing pledges according to a robust rule book assisted by market mechanisms had problems. There was divergence between developed and developing countries on the issue of pre-2020 ambitions and on finance (Winkler and Depledge, 2018). Further, Ar6 cooperation and the relationship with NDCs’ commitments are exacerbated by a lack of transparency. The main problem is that the Parties are shaping their activities in a way that reflects their national interests in the negotiations (Greiner et al., 2019). The 2019 COP25 was one of the most contentious summits, with Ar6 a major problem. Christoph Bals, policy director of NGO Germanwatch, told Aljazeera (2019) that the continuing conflict about carbon markets, including “the US, Australia and Brazil, where the business model is strongly connected with the fossil fuel industries” had been very visible.

Both Obergassel et al. (2018) and Newell and Taylor (2020) mention two major concerns in the negotiations: First, Brazil was pushing for Article 6.4 emission reductions exports being exempt from corresponding adjustments, while most other Parties rejected this, highlighting that it would lead to double counting. Second, Brazil with Australia, pushed for the trading of Kyoto-era credits, which to most countries was interpreted as promoting measures to use old carbon credits to meet new climate targets. Most deemed this unacceptable (Amaral, 2019). A related argument is that the biggest emitters hampered GCM negotiations. Nicolás (2019), in discussing the failure to agree on Ar6, highlights that beyond Canada and the EU, no major emitters made new, ambitious pledges. Instead of leading the charge for more ambition, the large emitters were “missing in action or obstructive” (Anderson, 2019). Hook (2019) commented that geopolitical tension and the low profile of the US and China severely handicapped carbon market negotiations.

7.2 Three dichotomies

Alternatively, this study proposes a three-stage process using literary analysis to evaluate sections of the literature. The first stage includes the formulation of market-based vs. non-market-based approaches, the development of non-market-based approaches and their transfer to the main objective of this study. The second involves a top-down and bottom-up approach. The criteria that explain the failure of the carbon market are identified by this approach: binding obligations to reduce emissions and individual states. The failure of international agreements for a legally binding agreement (top-down architecture) has hindered the successful development of the carbon market. The bottom-up approach, on the other hand, consists of a state-specific task force to reduce GHGs. The failure of states to pursue NDC policies has raised the question of the desirability of bottom-up architecture to address GCM, and the IPCC Sixth Assessment Report shows that only 24 countries are actually reducing their emissions. Finally, in the third stage, we look at approaches at the national and international level and what this says about the failure of GCM.

7.2.1 Market-based vs. non-market-based approaches

By market-based approaches we mean CDM, JI, and emissions trading, while non-market-based mechanisms (NMAs) are instruments without internationally transferable units. Here we find the Framework for Various Approaches (FVAs) to promote cost-effective mitigation measures. While FVAs also include market-based approaches, the NMAs can be understood as mitigation activities carried out in one country with voluntary participation and directly accounted for in another country, without issuing internationally transferable units to participants in the mitigation activities. FVAs are needed not only to create an efficient, liquid global carbon market, but also for emerging national carbon markets to function properly. It is difficult for many national carbon markets to be liquid on their own, and a market without liquidity will be dysfunctional and send the wrong price signals. Although not well understood or defined, it is likely to emerge as a key component of GCM (Marcu, 2012a).

Market-based approaches are already well-defined. NMAs are much broader, with very different ideas, and have not yet been defined with principles (UNFCCC, 2012). To Pearse and Böhm (2014), FVAs can be highly efficient by accounting for elements otherwise not included: First, FVAs seek to set rules and guidelines for different approaches to achieving mitigation strategies and policies that reduce and avoid GHG emissions; second, FVAs seek to ensure the environmental integrity of the approaches it covers and address related international issues (e.g., unit transfers or enhanced mitigation ambition); third, FVAs seek to enable the Parties to meet their UNFCCC commitments and targets.

Carbon prices can be categorized as either market- or NMAs and are found in six of the 32 articles. Carbon prices seek to reduce emissions at the lowest possible cost, making them market-based instruments. However, the Parties that negotiated the PA also created a framework for NMA mechanisms focusing on fiscal measures. These are instruments such as imposing taxes to discourage emissions and putting a price on carbon. In this sense, carbon prices are not market-based. These measures are instruments such as levying taxes to discourage emissions and putting a price on carbon. In this sense, carbon prices are not market-based, but NMA. In this article, we consider carbon pricing a special case of market-based instruments.

18 of the 32 articles focus explicitly on market or non-market-based approaches. Market-based constitutes the vast majority, with 16, whereas only two distinct NMAs were identified. The most prominent market-based approaches are Van Kooten (2004), Brown (2011), Dellink et al. (2011), Kutney (2014), Pearse and Böhm (2014), Hawkins (2016), Greiner et al. (2019). For the NMAs, see Winkler and Depledge (2018) and Ecofys and Vivid Economics (2017).

Market-based approaches have been utilized successfully to studying GCM implementation failure. Some studies (McKibbin and Wilcoxen, 2002; Nordhaus, 2010; Pearse and Böhm, 2014) assess KP mechanisms such as carbon prices, CDM, and JI, and confirm that mitigation through the KP mechanisms have substantially influenced the failure of GCM implementation. McKibbin and Wilcoxen (2002) conclude that the KP would force emissions below 1990 levels regardless of the costs and benefits of doing so, while only marginally reducing the rate of warming. Moreover, the KP implied very high prices for emission permits, potentially putting enormous stress on the world trade system. The trade balance for a developed country that imports emissions permits would deteriorate significantly, potentially resulting in increased exchange rate volatility. Thus, some of the explanations above (McKibbin and Wilcoxen, 2002; Pearse and Böhm, 2014) have been an easy way to evaluate GCM implementation failure.

In contrast to market-based studies that suggest mechanisms such as the EU ETS, articles dealing with the PA system have a greater role for non-market approaches such as FVAs. In addition, Ar6 plays a significant role for understanding GCM failure, including article 6.8, which sets up a work program for non-market approaches. These apply to the PA period, where non-market-based approaches are projected to persist beyond the KP mechanism.

In recent years, the problems faced by the KP have encouraged the Parties to explore non-market approach options under Ar6. Parties widely accept that non-market-based solutions are essential post-2020. Thus, what we also see is a movement over time, with non-market-based explanations becoming more prominent.

Among the market-based approaches we identify two main arguments. First, the carbon price and trading system, and second, the KP system. The first main argument focuses on the roles of the carbon trading system. The most cited references are McKibbin and Wilcoxen (2002), Hepburn (2007), Keohane and Raustiala (2008), Nordhaus (2010), Dellink et al. (2011), Pearse and Böhm (2014), Kutney (2014), and Hawkins (2016). Hepburn (2007) states that the market-based approaches from the KP did not increase the scope of emissions trading within the EU ETS to cover more countries, more sectors of companies, and longer time periods, which caused the failure of carbon trading within the GCM. Criticism was raised by the UN bureaucracy over the potential for a possible linking with the EU ETS, and in the US Regional Greenhouse Gas Initiative, which covers emissions from the power sector in the north-eastern United States, and from Australia. Pearse and Böhm (2014) argue that market-based approaches have flawed practices at their core and cannot be reformed: carbon markets can be interpreted as failures in not having delivered on their main objective, to reduce GHGs.

The second main argument focuses on the KP system. Schiermeier (2012) asserts that climate treaties must take a more pragmatic approach than the KP. Market-based approaches had inequitable carbon targets within the KP and failed to win over the biggest polluters because they relied on a mix of ethical and environmental rationales rather than economic ones. Benessaiah (2012) explains that the KP market-based approaches were not carefully designed to evolve along with GCM and the dynamic social-ecological systems. Market-based mechanisms and voluntary carbon markets require enabling and connecting institutions…while remaining flexible to rapidly changing social-ecological systems” (Benessaiah, 2012, p. 4). Greiner et al. (2019) specify that carbon markets therefore remain in limbo, with the KP mechanisms having lost their incentive function. Some studies focus on the role of countries. Nordhaus (2010) highlights how problems for GCM implementation arose because the Kyoto and Copenhagen regimes adopted cap-and-trade structures. Cap-and-trade would for instance require globally designed environmental policies with most countries contributing. The rich countries would need to bring along the poor, the unenthusiastic, and the laggards with the necessary carrots and sticks to get all on board.

Regarding NMAs, Winkler and Depledge (2018) argue that after over 170 countries with officially registered NDCs adopted the PA, we know that even if all formulated NDC targets are met, temperatures will still rise almost 3°C. The PA has also been shaken by incidents such as the 2016 election of Donald Trump as US president and news that the Trump administration would ‘cease all implementation’ of the PA and withdraw from the treaty. COP23 (2017) explains that the actors are unable to reach consensus on modalities, procedures and guidelines that will assist all Parties in complying with their PA obligations, including GCM. Postponing critical decisions until later COPs was not good, as momentum for implementation, including GCM, must be maintained (COP23, 2017).

Of the academic fields that have dealt with the failure of GCM implementation, two stick out: climate politics and economics. Four articles (McKibbin and Wilcoxen, 2002; Hepburn, 2007; Pearse and Böhm, 2014; Hawkins, 2016) are within the field of climate politics, with five (Van Kooten, 2004; Nordhaus, 2010; Dellink, Briner and Clapp, 2011; Bultheel et al., 2016; Ecofys and vivid Economics, 2017) from economics. For the NMAs, the footprint of economists is naturally smaller. Here the focus has rather been on analysing climate policy and climate negotiations, primarily by political scientists.

7.2.2 Top-down vs. bottom-up approaches

We define top-down approaches as attempts at imposing overarching, mutually binding frameworks for emissions reductions from major international conferences, whereas bottom-up refers to emissions reductions efforts primarily initiated and monitored by individual states. Of the 32 articles, we classify 15 as top-down, and 17 as bottom-up.

The top-down approach is embodied in the KP with its emphasis on creating binding commitments. For effective reductions, this approach brought specific enforcement mechanisms such as cap-and-trade and carbon prices. Bottom-up approaches can be identified primarily from the PA onwards, such as NDCs and Ar6. Both were new GCM measures established through the PA. Ar6 provides the opportunity for states to cooperate on a voluntary basis when implementing NDCs. The PA created a long-term future for carbon markets through Ar6. Stua et al. (2022) argue that the PA, through Ar6, provides the legal framework for the creation of international regulations to govern the carbon market through a GCM. Ar6 international market-based provisions and mechanisms, in conjunction with domestic market-based policy instruments, are poised to play a central role in delivering the NDCs of many countries. Ar6 and the NDCs contribute to the development of criteria and mechanisms for mitigation, which reflect the growing change for addressing climate change impacts, including GCM. Such ideas have been derived from the post-KP or PA periods. Thus, there is a clear historical development in the sense that the KP with subsequent efforts were mostly top-down, while bottom-up efforts have become dominant since the PA. Bottom-up approaches are now dominant in dealing with GCM.

Top down-explanations are found with McKibbin and Wilcoxen (2002), Van Kooten (2004), Hepburn (2007), Keohane and Raustiala (2008), Nordhaus (2010), Dellink et al. (2011), Cozier (2011), Brown (2011), Schiermeier (2012), Pearse and Böhm (2014), Kutney (2014), Bultheel et al. (2016), Lázaro-Touza (2016), Hawkins (2016), and Greiner et al. (2019). These 15 explanations are primarily connected to the KP system. Van Kooten (2004) argues that the protocol will fail to solve the GCM issue because it has too many loopholes, inadequate governance structures, and insufficient compliance provisions, and that most countries will be unable to meet their own Kyoto obligations. Or, if they do, the costs of compliance for GCM will be unacceptably high. Most states have less incentive to sign up for any future international agreements because current policies do little to reduce emissions and avert global warming (Van Kooten, 2004). To further support this argument, Rosen (2015) argues that the KP is a clear case of institutional failure, as the short timeframe for action, the binding targets, the emission reduction measures and the provisions for future commitment periods have led to short-sighted behaviour by member states. For another top-down explanation, see Bultheel et al. (2016), who state that GCM failed as part of the KP because in real life the flexibility mechanisms revealed limitations as political and economic tools, even if they shaped and implemented an international emission trading system of carbon for states.

In contrast, bottom-up explanations focus on how the lack of integration and disagreement between countries have led to the failure of GCM. Of the 32 pieces of literature, such arguments are found in Rockström et al. (2017), COP23 (2017), Ecofys and Vivid Economics (2017), Winkler and Depledge (2018), Amaral (2019), Obergassel et al. (2018), Aljazeera (2019), and Streck et al. (2019). One strand of literature emphasizes that negotiators have not managed to find common ground across negotiation items ranging from mitigation action to ensuring transparency and follow-up, including “global stock takes,” climate finance and technology transfer. The Paris rules may prove more robust and sustainable than those of the KP in building on accountability, trust, and compliance for GCM (Streck et al., 2019).

Five of the 15 top-down studies are from the field of economics. In contrast, the bottom-up approaches tend towards political science and law, focusing on climate policy (Rockström et al., 2017; Obergassel et al., 2018; Winkler and Depledge, 2018; Amaral, 2019), climate change and economics (Ecofys and Vivid Economics, 2017; Aljazeera, 2019; environmental law (Streck et al., 2019), and international relations and geography (Newell and Taylor, 2020).

7.2.3 National level vs. international level approaches

The final lens through which we analyse GCM implementation failure, is national vs. international level. This extends from among other things the role of the USA and its leadership/lack of leadership, through international climate change negotiations and agreements, to the international level. Disagreements between developed and developing countries (China, India, and Brazil the foremost) constitute one main branch of examples on the international level. Nicolás (2019) argues that almost 200 countries failed to agree on Ar6. Nicolás (2019) also notes that while the EU (except Poland) and Canada has committed to climate neutrality by 2050, until recently, no other big emitters had made similar pledges. And China, India, and smaller developing states are demanding economic support from wealthy states to finance climate goals.

27 of the 32 studies are at the international, with only five at the national level. However, these five all occur towards the end of our time-period. Compared to the KP and post-KP, the PA and post-PA period represents a clear development and change in approach. Moving away from KP emission mechanisms such as IET, JI, and CDM–all international level mechanisms–scholarship on the PA and post-PA period relies on individual national targets such as NDCs for GHG mitigation. The GCM literature exhibits two main international level explanations: The KP system; and disagreements between developed and developing states. Among the first we count McKibbin and Wilcoxen (2002), Van Kooten (2004), Keohane and Raustiala (2008), Dellink et al. (2011), Schiermeier (2012), and Redmond and Convery (2014). McKibbin and Wilcoxen (2002) argue that the principal international policy instrument of the KP should be a system of internationally tradable emissions permits. They emphasize that a main problem with the KP, however, is that no individual government has an incentive to police the agreement.

The second strand of international level explanations focuses on disagreements between developed and developing states. Brown (2011) focuses on the failure of developed nations to reduce greenhouse gases. Brown believes that developed nations must take more ethically responsible positions on an urgently needed global climate change solution.

On the national level we find Hepburn (2007), Hawkins (2016), Winkler and Depledge (2018), Aljazeera (2019), and Newell and Taylor (2020). These authors focus on the role of specific states. Newell and Taylor (2020) argue that the problem of reducing GHGs based on GCM can be traced back to politicians. We had a conjuncture where presidents Trump in the US, Bolsonaro in Brazil, Putin in Russia, and Prime Ministers Modi in India, Morrison in Australia, and Johnson in the UK all either doubted the scientific basis of climate change, or actively sabotaged more aggressive action to address it. Newell and Taylor (2020) believe that a broader geopolitical and economic context of right-wing populism, deepening marketization, and financialization of responses to climate change are of relevance to the GCM issue.

On the international level the field of economics dominates, with Van Kooten (2004), Nordhaus (2010), Pearse and Böhm (2014), Ecofys and Vivid Economics (2017) as the main contributors; followed by policy (e.g., Keohane and Raustiala, 2008; Redmond and Convery; 2014; Rockström et al., 2017; Obergassel et al., 2018), ethics (Brown, 2011), and science and technology studies (Cozier, 2011). On the national level we find economics articles (Aljazeera, 2019); policy articles (Hepburn, 2007; Hawkins, 2016; Winkler and Depledge, 2018); and international relations, and geography articles (Newell and Taylor, 2020).

8 Summary

Integrating the three dichotomies and adding the substantive arguments about GCM implementation failure, we can summarize them into one system-level and one state-level argument: On the system level many scholars focus on the KP and its mechanisms, i.e., the emissions trading system, JI, and CDM, whereas on the state level, the main arguments centre around the lack of integration and on disagreements between countries. The most critical arguments on the KP system and its mechanisms have received much attention (e.g., McKibbin and Wilcoxen, 2002; Van Kooten, 2004; Hepburn, 2007; Nordhaus, 2010; Benessaiah, 2012; Schiermeier, 2012; Pearse and Böhm, 2014; Bultheel et al., 2016; Amaral, 2019; Greiner et al., 2019). These arguments have changed only slightly since the KP, for three main reasons: First, the KP does not have a flexible mechanism and most countries will be unable to meet their own Kyoto obligations (Van Kooten, 2004). Second, other studies provide additional arguments on GCM failure. Both Benessaiah (2012) and Bultheel et al. (2016) confirm the results from earlier and the problems of the KP system and its mechanism. Benessaiah (2012) singles out the governance system within the KP. She argues that the KP carbon markets are not designed to carefully evolve along with a dynamic social-ecological systems, but that they need enabling and connecting institutions. Third, Bultheel et al. (2016) assess the compatibility of the commitments under the KP. Cost-effective low-carbon transition was not the intention of the KP. The constrained climate framework advocated by the KP is the essential element in GCM failure.

In another sense, with the PA and its emphasis on NDCs, the field has moved away from this first group of arguments towards the second most frequent argument in the literature: Focusing more on the state and less on the system, integration and disagreement between countries is crucial to how the literature now understand the failure of GCM implementation (e.g., Keohane and Raustiala, 2008; Kutney, 2014; Hawkins, 2016; COP23, 2017; Ecofys and Vivid Economics, 2017; Schneider and Stephanie, 2019; Obergassel et al., 2018; Streck et al., 2019; Nicolás, 2019; Anderson, 2019). In the words of Hawkins (2016: 20): “While these initiatives, as well as Article 6, are certainly crucial for laying the political and technical foundations for carbon market clubs, they need to be complemented by more dedicated and focused efforts. The EU, New Zealand, South Korea, and Switzerland, as well as Canada and the subnational US schemes, are currently the most likely candidates for initiating a carbon market club.” Obergassel et al. (2018) argue that lack of cooperative action under Ar6 is the reason for GCM implementation failure. The obstructive power of a handful of countries delays and blocks the process, even overturning the PA to move in a direction with far less ambition. To Streck et al. (2019) GCM failure is associated with a lack of accountability, trust, and compliance between countries. Countries did not manage to find common ground across negotiation items ranging from mitigation action to ensuring transparency and follow-up, including “global stocktakes,” climate finance and technology transfer. Moreover, developing countries did not receive enough assistance to comply.

Finally, we simultaneously apply the dichotomies. First, we present three two-by-two matrices to show how the different dichotomies can be paired. Only 18 of the articles were easily placed along all the three dichotomies, thus the figures in the matrices vary. They do however leave a general impression of a field where market explanations dominate, as do international level approaches (Table 2).

Of the 18 easily placed articles, one combination stands out. Articles that combine a market-focus, a top-down approach, and an international level focus account for 13 out of 18. Here we emphasise McKibbin and Wilcoxen (2002), Van Kooten (2004), Keohane and Raustiala (2008), and Kutney (2014) as typical of the entire literature. Keohane and Raustiala (2008:1) argue that “the difficulties of negotiating national emissions quotas, coherently linking national regulatory systems, monitoring implementation, avoiding renegotiation, and ensuring compliance with international commitments” can be seen as the main problems. These cannot be solved together without the political commitment and willingness of heads of state to bear the necessary costs.

This is a review article; thus, our goal is not to provide personal assessments of the articles and arguments analysed. We do however think that one substantive argument shines through, and we find ourselves in agreement with it. Thus, along with major parts of the literature, we suggest that the failure of GCM implementation at the UNFCCC negotiations is due to countries at the state level “not aiming high” when it comes to national regulations, building regulations and policies, i.e., regulatory and economic instruments to reduce GHGs–leading to a certain amount of fatigue. In terms of climate negotiations, too many have perceived of GCM as a “small potato”. On the international level, this requires the biggest emitters to exercise “coercive power” in the international negotiations. This, they have been reluctant to do. Thus, GCM has been caught between the lack of domestic effort at the state level and a lack of external pressure from the biggest actors at the international level.

9 Conclusion

GCM has been an issue since before the very first COP meeting and has seen various developments since the KP. GCM has been at the heart of the carbon neutrality concept, as achieving net-zero carbon dioxide emissions can be done through removal or offsetting. Disagreements between developed and developing countries about joint implementation for reducing GHGs was an issue already at the outset. The compromise that was made was that a pilot phase would be started, during which projects were referred to as Activities Implemented Jointly. This continued for the KP and post-KP. During this stage, GCM experienced the establishment of new mechanisms, such as IET and CDM, for achieving the KP objectives. States with KP commitments (Annex B Parties) accepted targets for limiting or reducing emissions. IET, as set out in Article 17 of the KP, permits Parties with emission units to spare to sell their excess capacity to states that are over their targets. In addition, CDM is a part of emission reduction targets under the KP, which allows emission-reduction projects in developing countries to earn CER credits. IET and CDM constitute a summary of how GCM is meant to assist countries to obtain their emission targets under the KP.

In seeking to organize the explanations for the failure of GCM implementation, we employed three dichotomies as organizational tools; market-based vs. non-market based, top-down vs. bottom-up, and national vs. international. From the COP1 onwards, including the KP and the PA, GCM has remained an issue with little consensus. There is a plethora of arguments why GCM has failed. What is striking is that when combining the three dichotomies, one combination contains the overwhelming majority of articles, namely, market-based, top-down, and international. What is however also striking is that this is countered by a historical trend away from top-down and towards bottom-up approaches since the PA. This is unlikely to change. There is also a possible trend away from market-based towards non-market-based solutions. COP26 may have brought us closer to a resolution on GCM, but for now GCM remains an important but throughout a period of more than 25 years unresolved component of the climate policy puzzle.

This study obviously has limitations. First and foremost, negotiations under the UNFCCC are continuously ongoing. Thus, we cannot provide a final answer as to the failure of GCM implementation. Each year we observe small steps and changes in terms of regulation and policy making. This is an ongoing process with no defined or declared end point, with new data arriving every year. This does however not take away from the usefulness in providing an assessment of GCM, based on where we stand today. The failure of GCM implementation reveals the complexness of climate negotiations. For instance, after more than 2 decades, non-market-based approaches (NMAs) are still being discussed in the UNFCCC negotiations, as part of Ar6, without any decision having been made. Thus, NMAs are still not taken seriously enough to be genuinely pursued by countries under the UNFCCC. At COP28 in Dubai there was only a slow discussion between countries on the text for voluntary carbon markets. This “carbon market blockage” makes it difficult to move forward with the implementation of GCM. There is much to suggest that there are major polluters, such as China and India that oppose the idea and nature of carbon markets and whose emissions and national policies are not compatible with carbon market mechanisms to achieve climate targets. This has led other major parties, such as the EU and the US, to also not be very motivated to pursue GCM. If COP29 in Azerbaijan and COP30 in Brazil lead to more transparency and clearer guidelines for Ar6.4 rules and to a formal function for Ar6.4 and non-market-based approaches, this will signal welcome progress for the implementation of GCM.

Irrespective of this review, we believe that future research on carbon market policy and negotiations ought to focus more on the analysis of voluntary carbon market agreements–a crucial tool for mobilizing climate finance for climate action–as well as the negotiating texts of Ar6.4 and NMAs and the definitions used by parties to define and clarify them, to formally progress and implement GCM.

Author contributions

MA: Formal Analysis, Investigation, Writing–original draft, Writing–review and editing, Methodology, Project administration. EM: Conceptualization, Formal Analysis, Funding acquisition, Supervision, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

Ar6, Article 6; CDM, Clean Development Mechanism; CER, Certified Emission Reductions; COP, Conference Of Parties EU ETS European Union Emissions Trading System FVAs, Framework for Various Approaches; GCM, Global Carbon Markets GHG Greenhouse gases; IET, International Emission Trading; IPCC Intergovernmental Panel on Climate Change; JI, Joint Implementation; KP Kyoto Protocol NDC, Nationally Determined Contributions; NMA, Non-Market-based Approach; PA, Paris Agreement; REDD+., Reducing Emissions from Deforestation and forest Degradation Definition; SBSTA Subsidiary Body for Scientific and Technological Advice; UNFCCC, United Nations Framework Convention on Climate Change.

Footnotes

1See Article four commitments under FCCC/INFORMAL/84 GE.05-62220 (E) 200705 here: https://unfccc.int/resource/docs/convkp/conveng.pdf.

2Several decisions were made regarding carbon markets CDM/JI. Draft decision-/COP17/CMP7 Modalities and procedures for carbon dioxide capture and storage in geological formations as clean development mechanism project activities under UNFCCC (https://unfccc.int/files/meetings/durban_nov_2011/decisions/application/pdf/cmp7_carbon_storage_.pdf) and Draft decision -/COP17/CMP7 Guidance on the implementation of Ar6 of the Kyoto Protocol (https://unfccc.int/files/meetings/durban_nov_2011/decisions/application/pdf/cmp7_guidance_article6.pdf).

3See Koakutsu et al. (2016), e.g., Decision 1/CP.19 Further development of the Durban Platform (https://unfccc.int/resource/docs/2013/cop19/eng/10a01.pdf).

4Chapter III. Governance of the framework, Glasgow Climate Pact: 4. The Glasgow Committee on Non-market Approaches is hereby established to implement the framework and the work programme by providing Parties with opportunities for non-market-based cooperation to implement mitigation and adaptation actions in their NDCs.

References

Ahonen, H., Kessler, J., Michaelowa, A., Espelage, A., and Hoch, S. (2022). Governance of fragmented compliance and voluntary carbon markets under the Paris Agreement. Polit. Gov. 10 (1). doi:10.17645/pag.v10i1.4759

Aklin, M., and Mildenberger, M. (2020). Prisoners of the wrong dilemma: why distributive conflict, not collective action, characterizes the politics of climate change. Glob. Environ. Polit. 20 (4), 4–27. doi:10.1162/glep_a_00578

Aljazeera (2019). COP25 summit fails to address key carbon markets issue. Available at: https://www.aljazeera.com/news/2019/12/COP25-summit-fails-address-key-carbon-markets-issue-191215145030619.html> (Accessed December 16, 2019).

Amaral, K. (2019). COP25: No deal on UN carbon markets as A number of countries reject loopholes – carbon market watch. Available at: https://carbonmarketwatch.org/2019/12/15/COP25-no-deal-on-un-carbon-markets-as-a-number-of-countries-reject-loopholes/> (Accessed December 15, 2019).

Anderson, D. (2019). Why the COP25 carbon market discussion failure matters. Greenbiz.com. Available at: https://www.greenbiz.com/article/why-COP25-carbon-market-discussion-failure-matters> (Accessed December 17, 2019).

Asadnabizadeh, M. (2019). Development of UN framework convention on climate change negotiations under COP25: article 6 of the Paris agreement perspective. Open Political Sci. 2 (1), 113–119. doi:10.1515/openps-2019-0012

Benessaiah, K. (2012). Carbon and livelihoods in Post-Kyoto: assessing voluntary carbon markets. Ecol. Econ. 77, 1–6. doi:10.1016/j.ecolecon.2012.02.022

Blum, M. (2019). The legitimation of contested carbon markets after Paris – empirical insights from market stakeholders. J. Of Environ. Policy &Amp; Plan. 22 (2), 226–238. doi:10.1080/1523908x.2019.1697658

Böhm, S., Misoczky, M., and Moog, S. (2012). Greening capitalism? A marxist critique of carbon markets. Organ. Stud. 33 (11), 1617–1638. doi:10.1177/0170840612463326

Braun, V., and Clarke, V. (2006). Using thematic analysis in psychology. Qual. Res. Psychol. 3, 77–101. doi:10.1191/1478088706qp063oa

Brown, D. A. (2011). An ethical analysis of the Cancun climate negotiations outcome. Dilemat Éticas climáticas en tiempo de crisis (6).

Bultheel, C., Morel, R., and Alberola, E. (2016). Climate governance and the Paris Agreement: the bold gamble of transnational cooperation. Institute for Climate Economics. Available at: https://www.i4ce.org/wp-core/wp-content/uploads/2016/11/16-11-03_I4CE-Climate-Brief-40_Cooperative-approaches-Paris-agreement.pdf.

Carbon Markets under the Kyoto Protocol (2018). International Bank for reconstruction and development/the World Bank. Available at: http://worldbank.org/climatechangeTheWorldBank.

Chandramouli, K. (2019). Talks on carbon markets put climate future in a fix. Mongabay-India. Available at: https://india.mongabay.com/2019/12/article-6-COP-25-talks-on-carbon-markets-put-climate-future-in-a-fix/.

Cole, J. (2010). Genesis of the CDM: the original policymaking goals of the 1997 Brazilian proposal and their evolution in the Kyoto protocol negotiations into the CDM. Int. Environ. Agreements Polit. Law, Econ. 12 (1), 41–61. doi:10.1007/s10784-010-9132-8

COP23 (2017). Institut de la Fran CO Phonies pour le développement durable. Available at: http://www.ifdd.franCOPhonie.org.

COP24 (2018). The conference of the parties creates a 'Paris rulebook. DFGE - Inst. Energy, Ecol. Econ. Available at: https://dfge.de/COP24/.

Cozier, M. (2011). Restoring confidence at the Cancun climate change conference. Greenh. Gases Sci. Technol. 1 (1), 8–10. doi:10.1002/ghg3.10

Danyluk, D. (2017). COP 22 report outcomes of the U.N. Climate change conference. Toronto: World Federation of Engineering Organizations.

Dellink, R., Briner, G., and Clapp, C. (2011). The Copenhagen Accord/Cancun agreements emission pledges for 2020: exploring economic and environmental impacts. Clim. Change Econ. 02 (01), 53–78. doi:10.1142/s2010007811000206

Ecofys and Vivid Economics (2017). State and trends of carbon pricing 2017. Washington DC: International Bank for Reconstruction and Development/the World Bank.

Erbach, G. (2019). COP24 climate change conference: outcomes. China: European Parliamentary Research Service.

Gao, S., Li, M., Duan, M., and Wang, C. (2019). International carbon markets under the Paris Agreement: basic form and development prospects. Adv. Clim. Change Res. 10 (1), 21–29. doi:10.1016/j.accre.2019.03.001

Gills, B., and Morgan, J. (2019). Global Climate Emergency: after COP24, climate science, urgency, and the threat to humanity. Globalizations 17 (6), 885–902. doi:10.1080/14747731.2019.1669915

Greiner, S., Chagas, T., Krämer, N., Michaelowa, A., Brescia, D., and Hoch, S. (2019). Moving towards next generation carbon markets – observations from Article 6 pilots. Climate Focus and Perspectives. Available at: https://www.climatefinanceinnovators.com/wp-content/uploads/2019/03/Moving-toward-next-generation-carbon-markets.pdf.

Hanafi, A. (2019). COP 25: carbon markets in the spotlight. Climate. Available at: http://blogs.edf.org/climate411/2019/12/03/COP-25-carbon-markets-in-the-spotlight/.

Hawkins, S. (2016). Carbon market clubs under the Paris climate regime. International centre for trade and sustainable development. Available at: https://www.greengrowthknowledge.org/sites/default/files/downloads/resource/Carbo.

Hepburn, C. (2007). Carbon trading: a review of the Kyoto mechanisms. Annu. Rev. Environ. Resour. 32 (1), 375–393. doi:10.1146/annurev.energy.32.053006.141203

Höhne, N., Warnecke, C., Day, T., and Röser, F. (2015). Carbon market mechanisms role in future international cooperation on climate change. New Clim. Inst.

Hook, L. (2019). UN climate talks stymied by carbon markets' 'ghost from the past'. The Climate Center. Available at: https://theclimatecenter.org/un-climate-talks-stymied-by-carbon-markets-ghost-from-the-past/.

Hunter, D., Salzman, J., and Zaelke, D. (2021). Glasgow climate summit: COP26. Suppl. 6th Edition1 Int. Environ. Law Policy.

IETA (2019). COP25 summary report. Available at: https://www.ieta.org/resources/Documents/IETA-COP25-Report_2019.pdf.

IETA (2021). COP26 summary report. Available at: https://www.ieta.org/resources/Resources/COP/COP26-Summary-Report.pdf.

Keohane, R., and Raustiala, K. (2008). Toward a post-kyoto climate change architecture. SSRN Electron. J. doi:10.2139/ssrn.1142996

Koakutsu, K., Amellina, A., Rocamora, R., and Umemiya, C. (2016). Operationalizing the Paris agreement article 6 through the joint crediting mechanism (JCM). Inst. Glob. Environ. Strategies (IGES). Available at: https://www.iges.or.jp/en/publication_documents/pub/discussionpaper/en/5484/Operationalizing_the_Paris_Agreement_Article_6_through_the_JCMKey_Issues_for_Linking_Market_Mechanisms_and_the_NDCs.pdf.

Korppoo, A. (2005). Russian energy efficiency projects: lessons learnt from Activities Implemented Jointly pilot phase. Energy Policy 33 (1), 113–126. doi:10.1016/s0301-4215(03)00207-6

Kouchakji, K. (2020). Climate emergency: COP25 talks fail to keep up with reality. Int. bar Assoc. Available at: https://www.ibanet.org/article/DE622B54-589A-48CA-BE03-61AF66523DD9.

KPMG (2019). COP25: key outcomes of the 25th UN climate conference. Available at: https://assets.kpmg/content/dam/kpmg/xx/pdf/2019/12/COP25-key-outcomes-of-the-25th-un-climate-conference.pdf.

Lázaro-Touza, L. (2016). Climate change in COP 22: irreversibility of action and rulebook development despite the elephant in the room. Fund. Real Inst. Elcano. Available at: http://www.realinstitutoelcano.org/wps/portal/rielcano_en/contenido?WCM_Globalcontext=/elcano/elcano_in/zonas_in/ari88-2016-lazarotouza-climate-change-COP22-irreversibility-action-rulebook-development.

Leggett, J. A. (2020). The united nations framework convention on climate change, the Kyoto protocol, and the Paris agreement. Congressional Research Service. Available at: https://www.everycrsreport.com/files/20200129_R46204_d496a7f6b79412253cfb14e.

Lilliestam, J., Patt, A., and Bersalli, G. (2021). The effect of carbon pricing on technological change for full energy decarbonization: a review of empirical ex-post evidence. WIREs Clim. Change 12, e681. doi:10.1002/wcc.681

Lilliestam, J., Patt, A., and Bersalli, G. (2022). On the quality of emission reductions: observed effects of carbon pricing on investments, innovation, and operational shifts. A response to van den Bergh and Savin (2021). A response van den Bergh Savin (2021). Enviromental Resour. Econ. 83, 733–758. doi:10.1007/s10640-022-00708-8

Marcu, A. (2012a). A framework for various approaches under the UNFCCC. Centre For Eur. Policy Stud. Carbon Mark. Forum (CMF). Available at: https://unfccc.int/resource/docs/2012/smsn/ngo/271.pdf.

Marcu, A. (2012b). Expanding carbon markets through new market-based mechanisms. Centre Eur. Policy Stud. Available at: http://file:///C:/Users/ADS/Desktop/GCM.%20Revision2022/SSRN-unfccc%20evidence.pdf.

Marcu, A. (2016). Carbon market provisions in the Paris agreement (article 6). Centre for European policy studies. Available at: https://www.ceps.eu/ceps-publications/carbon-market-provisions-paris-agreement-article-6/.

McKibbin, W., and Wilcoxen, P. (2002). The role of economics in climate change policy. J. Econ. Perspect. 16 (2), 107–129. doi:10.1257/0895330027283

Michaelowa, A., and Schmidt, H. (1997). A dynamic crediting regime for joint implementation to foster innovation in the long term. Mitig. Adapt. Strategies Glob. Change 2 (1), 45–56. doi:10.1007/bf02437056

Morgan, J. (2006). Carbon trading under the Kyoto protocol: risks and opportunities for investors. Fordham Environ. Law Rev. 18 (1).

Newell, P., and Taylor, O. (2020). Fiddling while the planet burns? COP25 in perspective. Globalizations 17 (4), 580–592. doi:10.1080/14747731.2020.1726127

Newell, R., Pizer, W., and Raimi, D. (2013). Carbon markets 15 Years after Kyoto: lessons learned, new challenges. J. Of Econ. Perspect. 27 (1), 123–146. doi:10.1257/jep.27.1.123

Nicolás, E. (2019). COP25 ends with no deal on carbon markets. EU observer. Available at: https://euobserver.com/environment/146925.

Nordhaus, W. (2010). Economic aspects of global warming in a post-Copenhagen environment. Proc. Of Natl. Acad. Sci. 107 (26), 11721–11726. doi:10.1073/pnas.1005985107