- 1Postdoctoral Research Station of Northeast Asia Service Outsourcing Research Center, Harbin University of Commerce, Harbin, China

- 2School of Economics and Management, Harbin University, Harbin, China

- 3Party and Government Office, Harbin University, Harbin, China

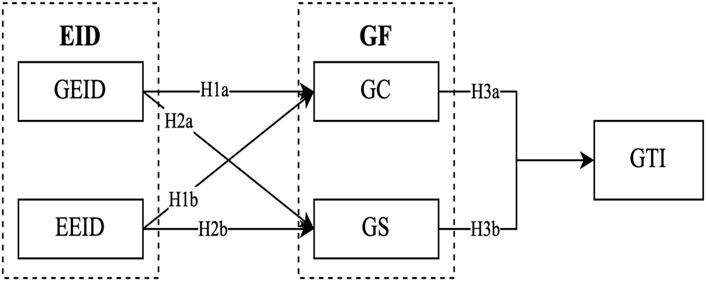

Environmental information disclosure (EID) is integral to government environmental policies and corporate social responsibilities. The current research presents a theoretical model that analyses the connection between EID, green finance, and green technological innovation (GTI). The required data was collected through a structured questionnaire, and final data analysis was performed using 230 valid responses. Structural equation modeling (SEM) combined with artificial neural networks (ANN) is used in the present framework to analyze constructs’ linear and non-linear relationships. The empirical analysis found that government EID significantly improved the value of green securities (GS) and green credit (GC), aided considerably by enterprises’ openness about environmental practices. Green securities and GC are also used, which has a good impact on the development of GTI. Green financing is critical when linking environmental disclosure with green technologies in businesses. The results reveal the mediating role of GC and GS in the relationship between the two aspects of EIDs (EEID and GEID) and GTI, providing a new perspective on how EID influences GTI through financial mechanisms. The findings contribute to a more comprehensive understanding of the intricate interplay between EID, green finance, and GTI, providing valuable insights for policymakers, businesses, and investors working toward sustainable development.

1 Introduction

The consequences of the rapid rise of the global industrial economy—including ecological devastation, pollution, energy use, and resource scarcity—can be seen everywhere. This is because of economic globalization, population growth, and the consumerist way of life (Wang and Zhao, 2021). The “Chinese miracle” of economic growth that has occurred in China after the reform and opening-up is remarkable. China’s rapid economic expansion is attributable primarily to the country’s high energy usage (Du Mo et al., 2022). Taking action to protect the environment from the effects of climate change has gained international support. Achieving sustainable development of natural resources and human civilization is an urgent and critical topic, considering the worldwide change from traditional to green and sustainable economic models (Ge et al., 2023).

Similarly, corporations have increased their focus on establishing environmentally conscious policies and innovation strategies, prioritizing sustainable practices in response to rising worries about climate change and diminishing resources (Lin, 2022). The degree of green innovation (GI) implementation significantly affects environmental issues (Roper and Tapinos, 2016). The proliferation of ICTs has facilitated international trade, financial development, and a range of other economic initiatives that have contributed to the expansion of the global economy in the context of globalization (Wang et al., 2023a). Many studies about the impact of ICTs on environmental challenges and carbon emissions are drawn from the literature and focus on the positive or negative ecological consequences of their expansion (Q Wang et al., 2023b). Similarly, the penetration of spillover characteristics of artificial intelligence (AI) forests environmental innovation, thereby achieving SDGs (Wang et al., 2024). Moreover, the growth of the financial sector has provided funding, venture capital, and loans for startups. This facilitates the use of innovative technologies and creative business models while helping creative businesses succeed in the digital economy. As a result, studying how to encourage GI has become increasingly important across various fields (Hu et al., 2022; Abbas et al., 2023). Furthermore, EID is essential among the many forms of non-governmental environmental regulation (Du L. et al., 2022; Xiong et al., 2023). The EID method has been implemented and improved with the help of digital technology to compensate for the shortcomings of government regulation and market-based incentives.

In addition, by encouraging more government investment in environmental protection, publicizing environmental data may help lessen the impact of air pollution on economic growth (Yongsheng and Zhang, 2020). Furthermore, some academics argue that the GI effect of EID can be inferred from the policy’s positive effects on reducing pollution and carbon emissions (Liu and Zhu, 2020; Zhang and Feng, 2020). Businesses’ bottom lines can benefit from more money spent on energy efficiency and environmental preservation thanks to EID, improving quality and efficiency. According to the study of Zhang et al. (2021), the impact of EID on the economic performance of China’s national key monitoring enterprises is significantly negative in the short term, but significantly positive in the long term. Pan and Fu (2022) verified the promoting effect of informal environmental regulation on GI through quasi-natural experiments. Wang and Wang (2021) selected the implementation of Ambient Air Quality as a policy impact to retest the GI effect of EID. EID has been shown to dramatically lower local sulfur dioxide (SO2) emissions and enhance the removal rate of SO2 in surrounding areas. As noted by Zhong et al. (2021), who also drew attention to the spatial spillover impact. Improvements in EID systems are highly congruent with the growth of green finance.

The EID system of listed firms and bond-issuing organizations has been gradually enhanced in practice as the issue of green securities has entered a new stage. Zhu et al. (2021a) provide evidence that green bonds can successfully stimulate the technological upgrading of polluting sectors, demonstrating the synergy between formal environmental legislation and green finance. In this context, environmental regulation can boost green bonds’ original advantages. According to Tan et al. (2022), progress in green finance helps improve the global green value chain. Therefore, there is potential for both parties to benefit from encouraging GI. Based on our research, most academics focus on estimating the policy impact of EID, while others investigate the link between green finance and GI. However, using a unified framework, little research examines the connection between EID and green finance to answer the following research questions.

1. What is the relationship between open data about the environment and advancements in environmentally friendly technology?

2. Does green financing act as a go-between for sharing data about the environment and creating new environmentally friendly products?

This study aims to use empirical analysis to respond to the abovementioned problems and improve the assurance of environment, policy, and financial support for GTI.

The key innovation of this study is to examine the interaction among EID, green financing comprehensively, and GTI using advanced analytical techniques such as structural equation modeling (SEM) and artificial neural networks (ANN). By combining these approaches, the study provides a nuanced understanding of how environmental transparency affects green financial flows and technological innovation in sustainability. In addition, this study explores the mediating role of GS and GC in the relationship between EID (EEID and GEID), green financing, and GTI, which is a novel contribution in this field. This innovative approach reveals the mechanisms by which environmental disclosure drives financial decision-making and fosters technological progress, providing valuable insights for policymakers, businesses, and investors seeking to promote sustainable development. The rest of the paper provides the literature review, methodology, results, and discussion that leads towards the conclusion and recommendations of this study.

2 Literature review

2.1 GTI

By sorting out the relevant literature on GTI, it is found that as early as 1994, Braun and Wield began to study GTI. They agree that GTI is an innovative technology that can protect the ecological environment by improving enterprises’ resource utilization rate (Braun and Wield, 1994). It aims to promote sustainable development by reducing reliance on non-renewable energy sources and avoiding negative environmental impacts. It can help countries reduce ecological impacts, achieve sustainable economic growth, and improve environmental quality (Zhou et al., 2023). With the gradual deepening of research, the concept of GTI has gradually enriched from the initial cost-oriented innovation of technology, products, and processes to the current stage of technological-oriented innovation to promote the production of green products. The GTI aims to achieve SDGs, allocate resources, and protect the environment by reflecting the outside world and reducing the controversies that may occur during implementation (Wang et al., 2021; Qu and Liu, 2022). As a result, many companies adopt a “green” philosophy, considering environmental issues and technological developments more. From the perspective of the development mode of GTI, scholars divide GTI into different development modes and believe that GTI refers to one that can coordinate the economy and environment to achieve sustainable development of enterprises (Zhou et al., 2023). In summary, GTI focuses on how creative businesses use innovative technologies to attain sustainable development through altered resource use patterns and enhanced innovation capacity through adherence to environmental and economic development standards.

GTI has been widely studied; however, more is needed to know how it affects economic development in different parts of the world. Although it is well known that GTI plays an important role in promoting sustainable development, reducing ecological impacts, environmental regulations, and improving environmental quality (Niu et al., 2023; Yan et al., 2024). The literature also suggested that the Eastern region has benefited greatly, but the effect of the Central and Western regions on economic development has not been significant (Ozkan et al., 2023). GTI is estimated to improve energy efficiency in most economies. However, it fluctuates between countries and requires special attention when adopting green innovation, energy efficiency, and sustainable environmental policies (Song et al., 2024). Meanwhile, GTI’s dual externalities in environmental governance and knowledge spillover put first movers at a competitive disadvantage and face sunk costs (Shao et al., 2024). Countries with advantages in high-value-added, knowledge-intensive fields are better positioned to develop green technologies than countries with resource - and labor-intensive advantages (Lin et al., 2024). Technological design is critical to address environmental challenges and promote sustainable development. This raises the question of how GTI benefits are distributed differently in different places and how these differences can be addressed within the region. By examining how innovations affect regional differences in economic development, researchers can provide important insights to businesses, policymakers, and other stakeholders in adopting and implementing GTIs to achieve SDGs.

2.2 EID

EID stems from information asymmetry theory, which reflects the demands of stakeholders for mastering the actual environmental governance situation of enterprises, including the financial impact of environmental activities, environmental performance, and environmental matters. It is an important manifestation of environmental responsibility (Jia and Chen, 2019). This theory can be applied to EIDs to show how environmental data sharing can impact stakeholder relationships and encourage more informed decision-making. Furthermore, EID procedures impact environmental disclosure to reduce information gaps between management and shareholders, enhance accountability, and align interests. The study by Su et al. (2023) shows that the transparency of environmental information can also reduce the information asymmetry inside and outside the enterprise. It helps external investors understand the enterprise’s business situation on time and curb non-productive investment behavior. As a kind of informal environmental regulation, the government or enterprises are the main body of EID. Government EID (GEID) refers to the disclosure of environmental information and intelligence obtained by administrative organs by using public resources and exercising public power to the public through acceptable means, allowing citizens, legal persons, and other organizations to understand, grasp and grasp and preserve such information. Enterprise EID (EEID) refers to the behavior of enterprises to publicly disclose their environmental information for a certain period to the public so that the public can fully understand the performance of enterprises’ environmental and social responsibilities and through laws and regulations to compel enterprises to regularly disclose their environmental information and accept the supervision of the public.

According to the theory of sustainable development, the emphasis on economic growth limited to productive value is insufficient to grasp the true meaning of development, which transcends financial considerations (Zhang and Wang, 2023). The 2030 Agenda for Sustainable Development, adopted by the United Nations in January 2016, is a comprehensive framework that formalizes the complex concept of sustainable development. The idea of truly sustainable development emphasizes the sustainable and balanced consumption of resources while harmoniously combining social wellbeing, innovation, environmental protection, and economic prosperity (Jiatong et al., 2021; Wang et al., 2023c). The study of Feng et al. (2020) reveals complex relationships between EID and environmental quality in both short - and long-term sustainable development, suggesting a “beggar-thy-neighbor” and zero-sum game scenario among local governments. EID is a key component of building a good ecological environment and is widely regarded as the most direct way for enterprises to manage the environment (Guo et al., 2024; Liu et al., 2024). Encouraging the modernization of environmental governance systems requires accurate and comprehensive EID that can be used to inform the market about their governance performance and environmental management strategies (Li et al., 2024). As a strategy to integrate economic development and haze pollution control, China’s environmental information disclosure has received increasing attention. By promoting GTI through EID, China aims to achieve a win-win situation between economic growth and environmental protection (Feng et al., 2021; Niu et al., 2023). This approach not only promotes innovation and reduces pollution, but also improves China’s competitiveness in the global market by positioning the country as a leader in sustainable development.

In essence, the extended theoretical framework supports a technique that goes beyond traditional indicators and emphasizes the interdependence between the many dimensions of GTI. This concept holds that there is a linear relationship between EID and sustainable development. However, this study proposes a more complex nonlinear dynamic model. EID is a powerful tool for enterprises to promote green governance. Several factors, including stakeholder perceptions, corporate strategies, and evolving regulations, influence how information is received. This provides an important foundation for promoting the growth of carbon peaking, sustainable development, and carbon-neutral enterprises (Wang et al., 2023b; Li et al., 2023). Our research aims to provide more comprehensive information to encourage flexibility when integrating environmental disclosure strategies into business sustainability. Therefore, it adds to the theoretical foundation for sustainable development and provides useful insights for communities, businesses, and politicians working to create a more resilient and balanced future.

2.3 Green finance

Salazar (1998) first put forward the concept of environmental finance. He believes that environmental finance is the intersection of the financial industry and environmental projects, and the demand for environmental protection will guide the direction of innovation of financial instruments. Green finance facilitates the reallocation of capital from carbon-emitting projects to cutting-edge technology projects, thereby mitigating environmental degradation (Yu et al., 2021). Expanding the flow of funds from governments, businesses, and the non-profit sector to sustainable development initiatives is known as “green finance” (Ahmed et al., 2023). One way to achieve this goal is to promote investments that increase long-term resilience and sustainability, such as initiatives to address climate change, encourage resource efficiency, or assist sustainable development (Huwei et al., 2023). Considering the sustainable development of human society predicated on adherence to resource conservation and environmental protection, the predominant perspective on green finance is that it is an innovative financial tool (Bakry et al., 2023). This guides individual and institutional investors, enterprises, and governments in participating in the realization of green development goals. This includes green securities (GS) and green credit (GC).

GS refers to securities issued by enterprises following the law to raise funds to support green industries and repay principal and interest as agreed (Naeem et al., 2024). As a new financing tool with dual attributes of “economic benefits” and “environmental benefits,” green bonds have played a positive role in promoting China’s economic development to achieve green transformation and increasing green financing channels for enterprises (Chen, 2019). Green subsidy programs encourage green production practices, which can increase investment in green innovation and improve environmental performance (Xu et al., 2020). Compared with conventional bonds, the investment direction of green bond funds must be related to the established green projects, so regulators put forward higher disclosure requirements for their environmental information (Cai, 2018). Green stocks are also an important component of green financial instruments. The number of environmental protection enterprises and their market value in shares is a good measure of the financing ability of green projects in the region in the secondary circulation market.

GC refers to preferential loans financial institutions provide for the green industry. These green industries refer to environmental protection industries, including pollutant treatment, environmental protection equipment manufacturing, and the new energy and high-tech industries (Shapira et al., 2014). The GC review system emphasizes the word “green” more. GC also requires the public’s attention and supervision to track enterprises’ development in this way constantly. GC regulations are also important in promoting the transition of highly polluting enterprises to environmentally friendly operations (He et al., 2024). Studies have shown that green credit plays an important role in improving the performance of ecosystem governance, reducing carbon emissions, and promoting environmental protection (Lin and Pan, 2024; Long, 2023). To a certain extent, enterprises must assist banks in regularly disclosing relevant information, including the use and effectiveness of funds. GC focuses more on ecological benefits and pursues a win-win situation between environmental and commercial benefits.

3 Research hypotheses

3.1 EID on green finance

3.1.1 The impact of EID on GC

For GC, a green financing tool with economic and environmental benefits, banking financial institutions mostly rely on information disclosure to understand the environmental information of enterprises (Wang, 2021). Full and detailed disclosure of GEID not only helps financial institutions strictly assess and monitor environmental and social risks arising from the production and operation of enterprises but also strengthens the information transparency of green bonds and weakens investors’ expectations of default risk of green bonds (Du et al., 2022; Hu et al., 2022). At the same time, the issuing enterprise fully informs the specific investment direction of the raised funds and the expected economic and environmental benefits of the green project through EEID. This can significantly enhance financial institutions’ control over enterprises’ business activities. It also facilitates financial institutions in predicting risks, making decisions, and reducing the risk expectations of financial institutions for enterprises. Based on the above analysis, this paper puts forward the following assumptions.

H1a:. GEID is conducive to GC financing for enterprises.

H1b:. EEID is conducive to GC financing for enterprises.

3.1.2 The impact of EID on green securities

Green projects often have large investment scales, long construction cycles, and certain environmental risks. Enterprises issuing GS have an information advantage, while securities investors have an information disadvantage. According to the theory of information asymmetry, securities investors, as the Party of “information disadvantage,” often assess the target bonds in multiple directions before making investment decisions, focusing on the solvency of issuing enterprises and the expected risk situation of securities and putting forward risk compensation accordingly (Mavlanova et al., 2012; Hu, 2022). Accordingly, the more sufficient environmental information the government releases, the more helpful it is to alleviate the information asymmetry in the market (Ahmad et al., 2023). The quality of information impacts securities pricing in terms of investors’ risk prediction and securities’ liquidity expectations. When issuing enterprises do not publish or publish the relevant environmental information about GS, investors will raise risk expectations or make wrong investment decisions due to “uncertain” factors, which is not conducive to the issuance of GS. Based on the above analysis, this paper puts forward the following assumptions.

H2a:. GEID is conducive to GS financing of enterprises.

H2b:. EEID is conducive to GS financing of enterprises.

3.2 Green finance on GTI of enterprises

3.2.1 The impact of GC on urban GTI

Enterprises can apply to banks for GC for specific areas, and such funds often have different approval criteria and channels, so the success rate of financing is much higher than that of traditional financial instruments (Zhu et al., 2021b). Solving the financial constraint problem of green enterprises is conducive to expanding enterprises’ production scale. After long-term accumulation, a scale effect is formed, increasing green output, reducing carbon emissions, and improving carbon emission efficiency (Xu et al., 2020). On the contrary, some argue that green finance is more like an external capital constraint for enterprises with high pollution and energy consumption. Green finance is a top-down policy tool, which is not only reflected in the fact that financial institutions represented by banks are constantly raising the loan threshold of those enterprises and reducing their credit lines (Wang and Wang, 2021). However, when it affects the investment logic of market investors, it guides social funds from those enterprises to green enterprises by establishing a first-level weather vane of the capital market (Jia and Liu, 2022). Based on the above analysis, this paper puts forward the following assumption.

H3a:. GC has a positive impact on enterprises’ GTI.

3.2.2 The impact of green securities on GTI of enterprises

Green environmental protection projects, such as clean production and eco-environmental industries, often have the characteristics of a long R&D cycle, high risk, and slow profit recovery in the early stages (Xu et al., 2020). Traditional financial investment activities often avoid the investment of such projects, so most green environmental protection enterprises are facing financial difficulties. The special characteristics of green securities are conducive to solving the problem of financial difficulties, which optimizes the green image of enterprises and improves their value of enterprises. At the same time, the issuance of green securities reduces information asymmetry, thus alleviating the loan discrimination of banks against innovative enterprises and promoting the growth of green industries. Green securities can effectively alleviate the term mismatch problem, enhance enterprises’ ability to optimize the term structure of funds, and alleviate the investment constraints caused by term mismatch (Ying and Jiahao, 2022). After easing financing constraints, enterprises issuing green securities have more funds for green technology investment and green project development. Listed enterprises issuing green bonds can promote GI by alleviating financing constraints. The following hypothesis is proposed in this study based on the discussion above.

H3b:. GS plays a positive role in promoting urban GI.

3.3 The mediating role of green finance

Improving EID’s quality will reduce banks’ environmental risk expectations for green projects and enterprise operations. With the quality of information disclosure, investors’ expected benefit level of green projects will be significantly improved (Yang, 2022). For credit applicants, actively disclosing information or improving the quality of information disclosure is an important way to strengthen effective communication with banks and enhance banks’ awareness of enterprises. High-quality information disclosure is beneficial for stakeholders such as green securities investors to fully understand the environmental information status of the issuing enterprise, as well as the expected progress of green projects (Cheng, 2014). They can have precise control over the investment of securities raised funds, accurately measure investment risks and expected returns, enhance market attention to green securities, increase securities subscription rates, and help enterprises further reduce issuance credit spreads and financing costs. Green finance can allocate capital, and enterprises obtain green capital support through financial products such as GC and green bonds to carry out technological innovation (Ouyang et al., 2023). The operation mode of risk sharing and benefit sharing in the green financial market reduces the risk of technological research and development of enterprises. It enhances innovation subjects’ enthusiasm and confidence (Yang, 2023). Green finance can urge enterprises to disclose relevant environmental information through securities institutions and banking institutions, thus stimulating enterprises to carry out technological innovation of clean energy (Junbing et al., 2023). Positive technological progress, such as the innovation of new energy technology and the research and development of environmental protection materials.

Similarly, it is conducive to eliminating backward technological products, reducing dependence on traditional fossil energy, ultimately reducing carbon emissions, and improving carbon emission efficiency. On the other hand, it can improve the environmentally friendly output of enterprises and exert scale effect, promote the transformation of technological progress benefits to economic output benefits, and thus achieve the ultimate goal of low-carbon economic development. Based on the above analysis, this paper puts forward the following assumptions.

H4a:. GC mediates GEID and GTI.

H4b:. GC mediates EEID and GTI.

H4c:. Green securities mediates between GEID and GTI.

H4d:. Green securities mediate between EEID and GTI.

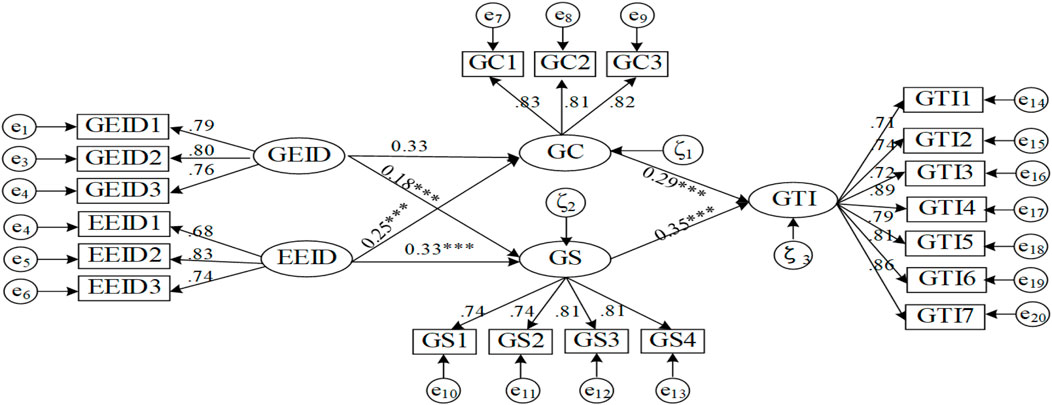

Based on the above, the research framework is presented in Figure 1.

4 Empirical research design

4.1 Questionnaire design

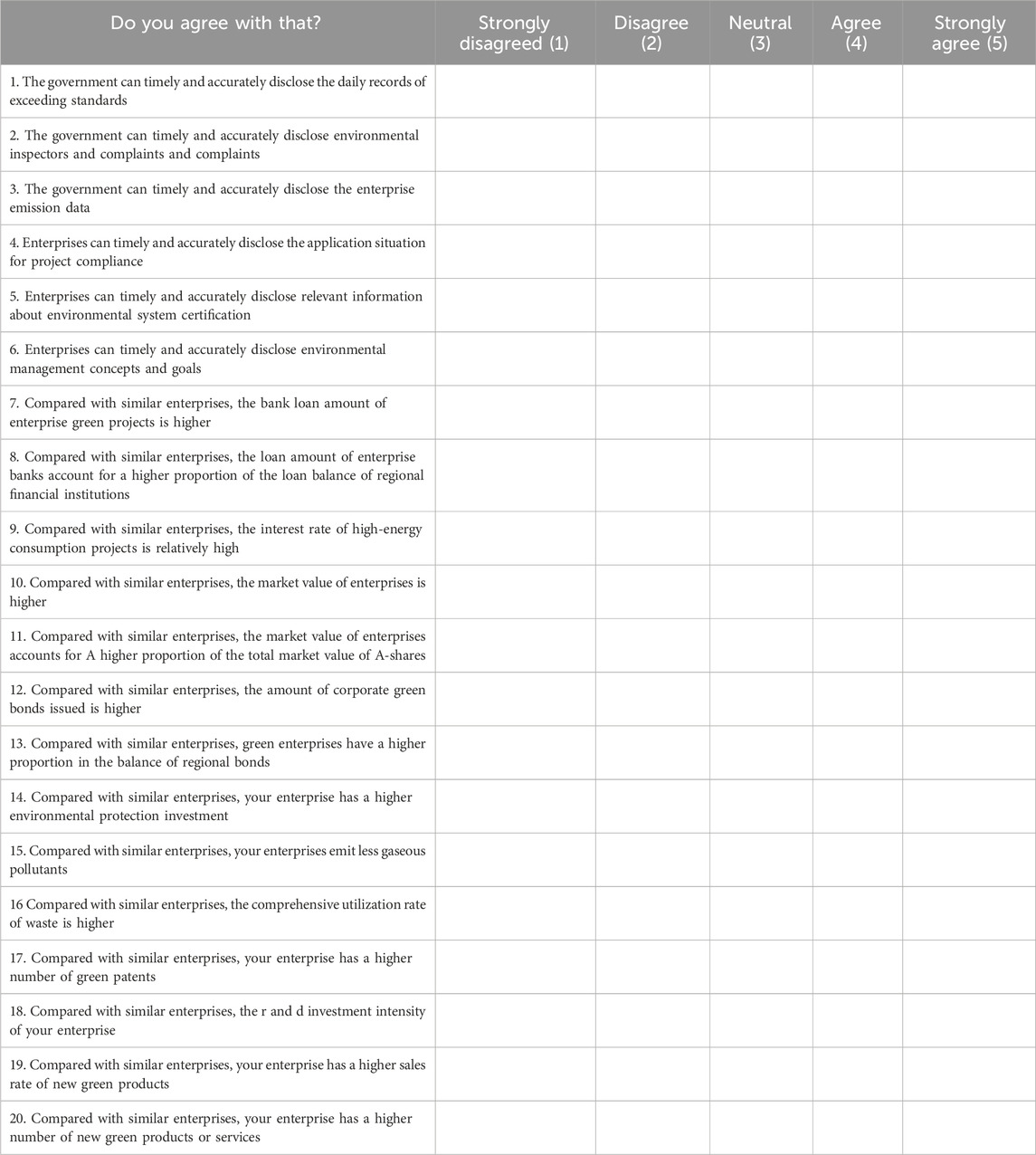

The questionnaire was divided into two parts: Industry and sociodemographic characteristics, which include information such as gender, age, education, position, and enterprise area, which were collected in the first part. In the second part, there are questions about the research factors. Each criterion and its corresponding measures are clearly described in the questionnaire instructions. Respondents recorded their responses by assigning a five-point Likert scale to each topic.

Measurement of EID level: This paper uses content analysis to evaluate the quality of EID and measures the level of government EID from three aspects: regulatory information, interactive response, and emission data. Enterprise environmental information is measured from three aspects: project compliance review, information related to environmental system certification, environmental management concept, and objectives, and graded according to these indicators (Tian et al., 2016; Du, 2022).

Measurement of GC: Based on the careful consideration of time continuity and the availability of data at the provincial level, this paper selects the bank loans of A-share listed environmental protection enterprises, their proportion in the loan balance of regional financial institutions, and the proportion of interest on high-energy consuming industries as positive indicators of GC. This measures the financial support of commercial banks to green environmental protection enterprises from absolute and relative perspectives to measure the development level of regional GC (Han and Liu, 2023).

Measurement of green securities: Currently, most scholars analyze the development scale of green securities from the stock perspective. Hence, this paper selects the market value of environmental protection enterprises, their proportion in the total market value of shares, and the number of green bonds issued by environmental protection enterprises. Moreover, their proportion in the balance of regional bonds is an indicator to measure the scale of green securities. This study measures the ability of environmental protection enterprises to finance the capital market from both relative and absolute perspectives. This serves as a measurement indicator for the region’s development level of GC (Wu and Zhang, 2023).

GTI performance refers to some achievements directly produced by technological innovation activities, which can be objectively measured and perceived. Indicators such as environmental performance, innovation performance, social performance, and economic performance can be selected to reflect the performance of GTI (Gar cía-Granero et al., 2018; He et al., 2019; Gao and Zhang, 2021).

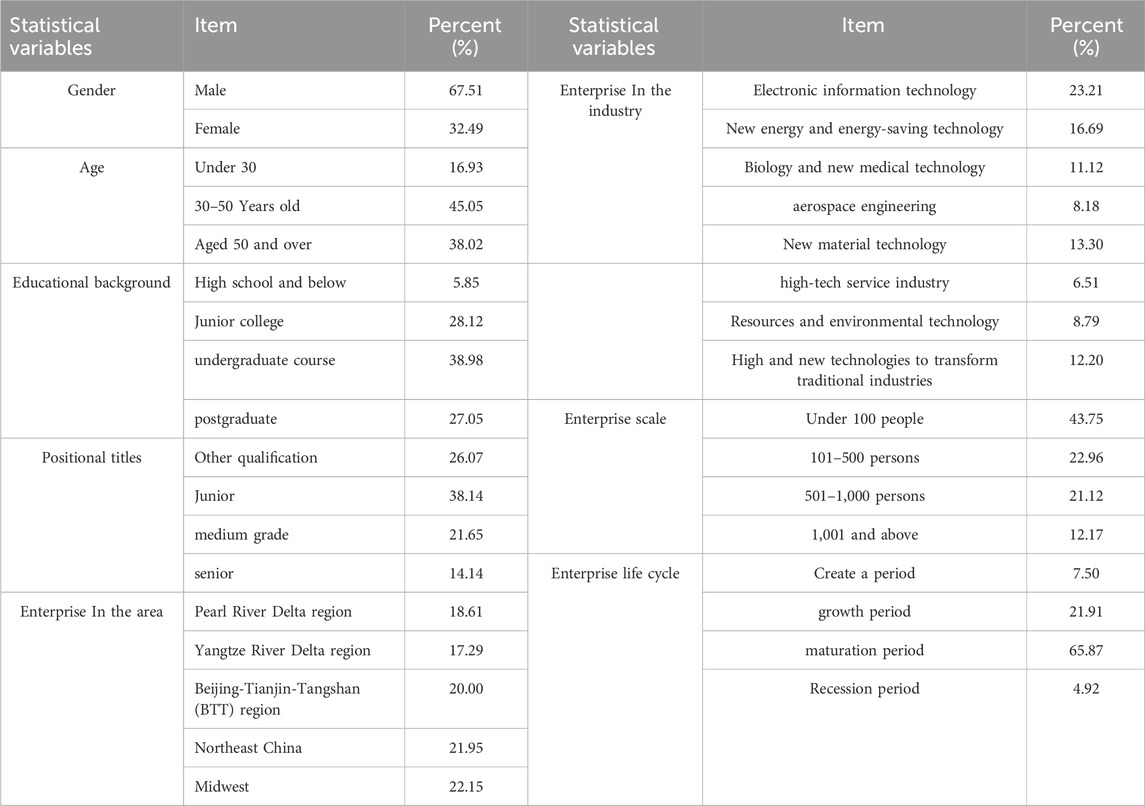

4.2 Research approach and data collection

Current research uses a positivist paradigm approach to examine causality. This approach represents traditional research techniques and assumptions that are more appropriate for quantitative research than qualitative research. To make the results universal and repeatable, and facilitate the multi-factor investigation, this study adopts the survey method based on the questionnaire. A pilot questionnaire was drafted and shared with a panel of experts to carefully evaluate and refine the indicators, questions, and wording. The questionnaire was independently translated into Chinese and English by language experts using a back-to-back translation method. The explanatory elements of this study include EID and green finance, which affect GTI. In this paper, the questionnaire was distributed and recovered with the help of the local government authorities, who get the questionnaire and the contact information by e-mail or collect the questionnaire through the paper questionnaire site and collect it on the spot (see questionnaire in Appendix A). To ensure the accuracy of the information collected, the questionnaire is used by the executive directors and senior managers responsible for green technology innovation activities within the enterprise. A total of 300 questionnaires were distributed, and 241 questionnaires were recovered. Excluding 11 invalid questionnaires, 230 valid questionnaires were used in the final data analysis. Demographics are shown in Table 1.

4.3 Data analysis methods

This study used a multi-analysis method combining structural equation modeling (SEM) and artificial neural network (ANN). SEM provides several benefits by eliminating random measurement errors and concurrently monitoring the link between variables and latent variables. As a result, it is possible to achieve more precise answers than with conventional regression analysis. While SEM has found widespread usage in empirical analysis, its limited scope is due to its focus on linear relationships between variables. Some researchers have attempted to address this shortcoming of SEM by adding interactive or quadratic terms to SEM to reflect better the non-linear relationship between variables (Tuu and Olsen, 2010). However, the resulting SEM model is too complex, with the drawbacks of low calculation, poor stability, and difficult estimation of large parameters, making its widespread application problematic.

An ANN model can discover the complex linear and nonlinear correlation between variables. It can also automatically modify the connection weights between network nodes to adapt to the nonlinear relationship between variables, realizing the tasks of function approximation, data clustering, pattern classification, and optimization calculation (Shahzad et al., 2020). Moreover, the ANN model outperforms linear analysis in terms of making predictions. There is currently no theoretical justification for the path and degree of effect between factors and neurons, as the structure of the ANN model is mostly defined by experience, and the neuron nodes often adopt the fully linked connection mode. Although ANNs are sometimes considered “black box” models because of the complexity of their internal operations, it is not entirely true to say that an ANN model cannot be used to test hypotheses or that it is difficult to determine their accuracy (Liébana-Cabanillas et al., 2017). According to the results above, SEM has greater latitude in accurately reflecting the causal relationship between variables than ANN. Still, it has greater difficulty handling the non-linear relationship between variables. The neural network model’s input is derived from the significant variables found in the SEM, which raises model accuracy.

Therefore, the authors used a modeling approach integrating SEM and ANN to verify the proposed hypotheses and theoretical models. Testing the impact mechanism of information disclosure on GTI performance using the SEM and then analyzing the impact mechanism using the SEM and ANN are both part of the integrated modeling process for the impact mechanism. A model test was conducted using SEM with parameter estimation and hypothesis testing technologies to determine the chain of events by which information disclosure affects the effectiveness of GTI. With SEM as the foundation, we build an ANN model’s topology and set up an SEM-ANN to put our resulting hypotheses to the test.

5 Results

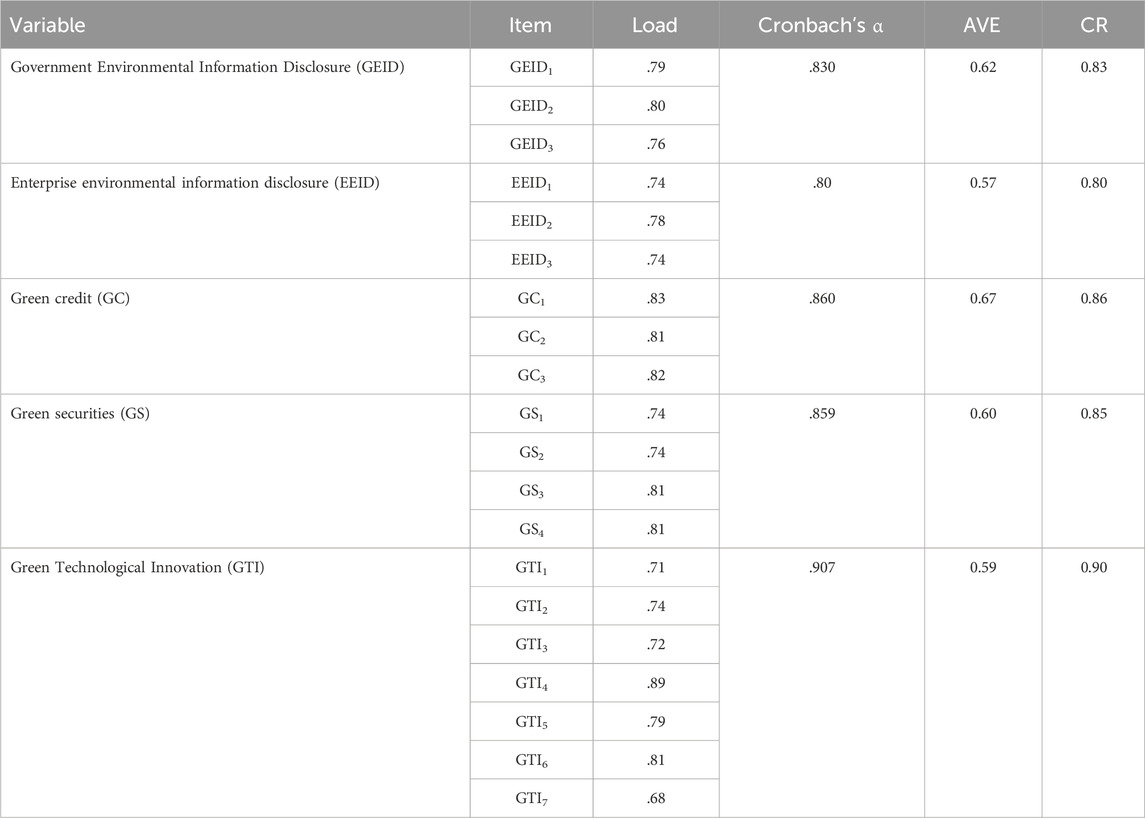

5.1 Evaluation of measurement model

This article employs reliability analysis and SPSS to check the dependability of all variables. In this paper, we conducted a confirmatory factor analysis using the SEM and AMOS 23.0 on the theoretical measurement model encompassing all variables to examine their convergence validity, discriminant validity, and reliability. Table 2 displays the outcomes of the tests.

Each variable has a Cronbach’s alpha value greater than the threshold of 0.70, suggesting that the latent variable is reliable, as determined by the reliability analysis. Overall adaptation indicators of the measurement model met the requirements, as shown by the results of the confirmatory factor analysis of the model, which showed that C2/DF = 1.031, less than 2.0; RMSE = 0.012, less than 0.05; GFI = 0.924, CFI = 0.998, and TLI = 0.997 all exceeded the prescribed critical value of 0.90. It demonstrates that the data sample fits the measurement model well. Additional factor analysis demonstrated that all measures had factor loads greater than the threshold of 0.70, indicating that the variables had strong convergent validity. Good combination reliability (CR) can exist when the CR value for a given variable is more than 0.70. Good discrimination validity is shown when a variable’s average variance extraction value (AVE) is more than 0.50. The validity structure of the variable measurement model is sound, allowing for further investigation.

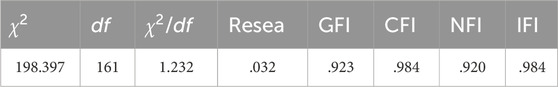

To evaluate the structural model, AMOS is used to analyze the sample data by SEM, and the overall fit coefficient between the structural model and the survey data is shown in Table 3.

From Table 3, from the absolute fitting index, the chi-square index (<2) value is 1.232, less than 2, and the root mean square residual (RMSEA) value is 0.032, less than 0.05. The hypothetical model is a good fit for the measured data. From the perspective of relative fitting indicators, the incremental fitting index (IFI), comparative fitting index (CFI), and normative fitting index (NFI) are all greater than the standard of 0.9. The overall fit between the structural model constructed in this paper and the empirical data is acceptable. The model-fitting path is shown in Figure 2.

5.2 Analysis of SEM path

In SEM, the symbol and significance of the path coefficient of the relationship between variables are realized. The sign of the coefficient is positive and significant, indicating a significant positive impact between variables, and the sign is negative and significant, indicating a significant negative impact between variables. If the coefficient is not significant, there is no significant impact. Table 4 comprehensively summarizes the path coefficient of the model that EID affects the performance of GTI through green finance.

The measurement model results reveal that GEID has a high explanatory power to GC, with a value of 0.52 demonstrating its variance. In particular, the influence of government information disclosure on GC is negligible; the path coefficient is 0.33, T = 3.76, and p > 0.05. A positive and statistically significant relationship exists between enterprise information sharing and GC (0.18, T = 2.28, p0.05).

The explanatory power of information disclosure to green securities is 0.42, indicating that information disclosure has a strong explanatory power to green securities. The path coefficient of government information disclosure on green securities is 0.25, T = 3.36, p < 0.05; that is, government information disclosure significantly impacts green securities. The path coefficient of enterprise information disclosure to green securities is 0.33, T = 3.57, p < 0.05; that is, enterprise information disclosure has a significant positive impact on green securities.

The explanatory power of green finance for GTI is 0.68, indicating that green finance has a strong explanatory power for GTI. More specifically, GC’s path coefficient on GTI performance is 0.29, T = 2.28, p < 0.05; GC significantly impacts GTI. The path coefficient of GC on green technology performance is 0.35, p < 0.05; green securities significantly positively impact GTI.

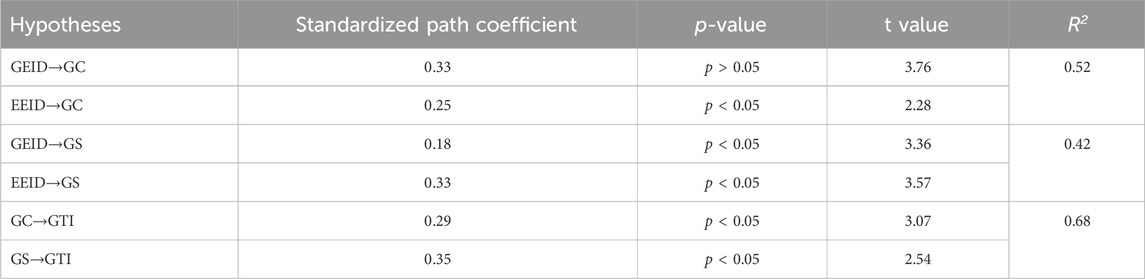

This paper uses the SEM analysis method to test the integrated model. According to the verification results and the insignificant impact (the impact of government information disclosure on GC) being excluded, the adjusted relationship model between EID, green finance, and GTI is shown in Figure 3.

5.3 Empirical analysis based on SEM–ANN

5.3.1 Establishment of a neural network model based on SEM

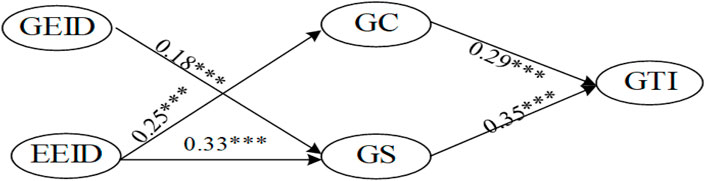

To enhance the ability to interpret model parameters, not all nodes are connected. Important predictive variables identified by SEM were used as inputs to the model. The integrated model tested by the SEM has three dependent variables because the neural network model requires no connection between network nodes on the same layer. Therefore, this study decomposes the impact mechanism model adjusted based on the SEM into three ANN models.

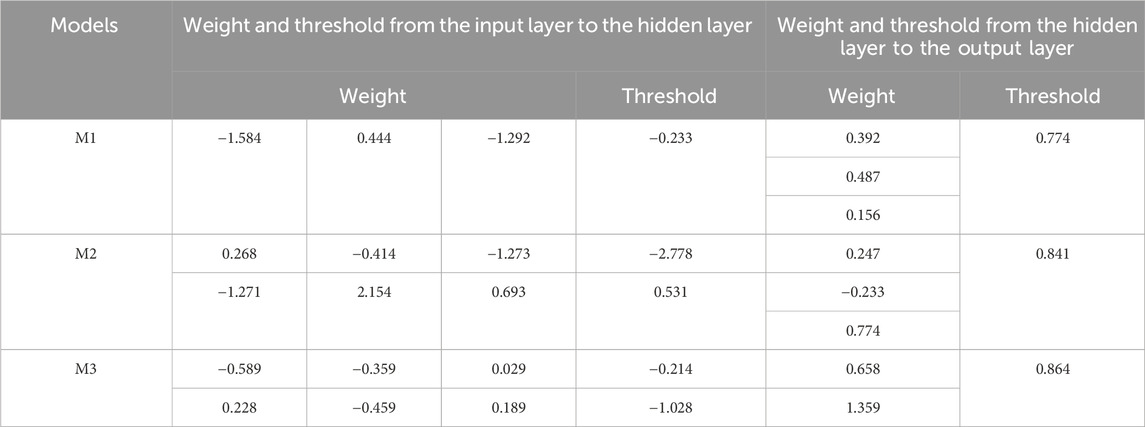

M1 comprises one input of GEID and one output of GC; M2 consists of two inputs of government EID, enterprise EID, and one output of green securities; M3 comprises two inputs of GC and green bonds and one output of GTI.

Neural networks with one hidden layer can represent any continuous function with arbitrary accuracy, and practice has shown that using more than two hidden layers is unnecessary. Therefore, the hidden layer of this model is set as one layer. There is no clear rule on the number of neurons in the hidden layer. In the specific design, the more practical way is to train and compare the number of different neurons and then add a little margin appropriately. By training and comparing the number of different neurons, the number of neuron nodes in the hidden layer of each model is set to 3, and the neural network structure is shown in Figure 4.

5.3.2 Results of SEM-ANN model fitting

To improve the learning efficiency and convergence speed of the network, the data are processed before they enter the BP neural network, and the value of each variable is the average value of the corresponding measurement item score, which is normalized. The specific normalization formula is as follows:

In the formula, xi is the normalized value; Xj is the original value; Xmin is the minimum value in the variable; Xmax is the maximum value in the variable. The neural network toolbox of the application sets the algorithm and indicators for the application. The input layer uses the transit activation function, the output layer uses the purelin activation function, and the model training function selects the trainlm function. The maximum training frequency is 2000. The training target error is ε = 0.001, and the learning rate is 0.1 to ensure training accuracy. The traditional BP algorithm neural network model uses random initialization. In contrast, the IMRFO algorithm neural network model proposed in this paper uses the optimal network weights and thresholds obtained through IMRFOA iterative selection for initialization. Based on the parameters of the network to be optimized and the specific objectives of optimizing by combining weight values and thresholds, as well as the relevant experimental results in the literature, the key parameters in the IMRFO algorithm are set as follows: initialization space dimension = 2, population size = 15, and a maximum number of iterations = 2000.

The model is trained and tested by standardized data, in which the first 80% of the data set is selected as the training data set, the model is trained, and the last 20% of the data set is selected as the test data set to test and verify the model. This paper uses the MRFO algorithm to optimize the BP neural network program. After testing, the optimization results are stable, and the difference between the predicted results is small. The optimum process with the smallest error is selected. When it is iterated 2000 times, the optimum solution is obtained.

Enter net. iw (1, 1), net. b (1), net. lw (2, 1) and net. b (2) in the command bar to obtain the optimal weight and threshold, as shown in Table 5. The optimal weight and threshold are used as the initial weight and threshold of the BP neural network, and test data evaluate the model’s performance. For each measurement index in each model, the judgment coefficient R2 is greater than 0.5, the root mean square error (RMSE) is less than 0.1, and the average absolute error (ABE) and average relative error (ARE) are less than 0.2. It shows that after 2000 iterations, each model achieved a good convergence effect, and the fitting effect of each model was good.

Information about the relationship between input and output is extracted from the connection weight of the neural network. The weight calculation method proposed by Ma Fanglan et al. (2020) is used to calculate the value of the connection weight matrix trained by the neural network, and the influence weight of input variables on output variables can be obtained. In M1, the weight of the impact of government EID on GC is 0.259; in M2, the impact weights of government EID on GC and green securities are 0.352 and 0.023; in M3, the impact weights of green securities and GC on GTI are 0.296 and 0.393 respectively. Based on the structured neural network model test, the impact mechanism model of EID on GTI is established.

6 Discussion

The findings of the SEM test on the relationship between EID and funding via GC s indicate no statistically significant relationship, contradicting the paper’s null hypothesis H1a. The explanation could be that financial institutions do not primarily rely on government information disclosure to collect environmental information about loan firms when reviewing these enterprises’ credentials. SEM-ANN results show that GC financing is significantly influenced by enterprises’ willingness to share information about their environmental practices, proving that H1b is correct. This is consistent with the findings of Du et al. (2022), who found that providing more details about the conditions in which businesses operate boosts financial institutions’ ability to monitor and manage risk and the confidence of their clients. This unexpected pattern challenges preconceived notions in the field and deepens our understanding of how financing mechanisms are influenced by environmental information.

SEM and neural network test results verify the positive correlation between government and enterprise information disclosure and GS financing. This highlights the critical role of government transparency and the important impact of information disclosure in facilitating the financing of GS, particularly about EIDs. GS financing is aided by disclosing sufficient information to the public, reducing market information asymmetry. For example, businesses implementing thorough EID procedures level the playing field for investors while promoting environmental sustainability. As a result, investors can make informed judgments based on reliable information in a more competitive and fair market. Therefore, both H2a and H2b are supported, as hypothesized. This finding supports the conclusion reached by Hu (2022). These results highlight the importance of enterprises and governments providing information to support GS financing. In addition to supporting sustainable operations, transparency plays an important role in financial decisions in the GS market. This has implications for businesses, governments, and investors who want to regulate, promote, and profit from sustainable finance. For instance, when a government publishes detailed environmental data, it can attract more investors to its green finance projects, thus increasing the funds available for environmentally friendly infrastructure projects. This demonstrates the mutually beneficial link that exists between environmental stewardship, sustainable financing, and EID.

Green securities and GC have a significant positive impact on the performance of GTI, as shown by the results of the SEM test and the neural network model test, verifying hypotheses H3a and H3b about the relationship between green financing and GTI. According to Zu et al. (2021), businesses that have been able to issue green securities and acquire GC have more money to put towards green technology investment and green project development. However, this surprising pattern shows that environmental sustainability and financial viability are complementary, showing that businesses using green finance improve their economic position in addition to supporting environmentally friendly projects. This mutual reinforcement demonstrates the strategic integration of financial and ecological objectives and illustrates how organizations can combine responsible environmental practices with economic growth. For example, manufacturing firms can improve their financial performance by issuing green security of GC to finance the installation of solar panels at their facilities, thereby reducing their carbon footprint and long-term energy bills. These results highlight how green finance can be used as a tool to improve financial viability and environmental sustainability.

Assuming the verification of hypothesis H4b, green securities are posited to mediate the association between government EID and GTI within the context of the interplay between EID, green finance, and GTI. Assuming the testing of hypothesis H4c, it can be posited that green securities mediate the correlation between enterprises’ disclosure of environmental information and the advancement of GTI. The verification of hypothesis H4d confirms that GC is a mediator in the correlation between enterprises’ disclosure of environmental information and the promotion of GTI. Open disclosure of companies’ environmental initiatives may persuade financiers to support them (Xu et al., 2020). As a result, investors can choose to allocate their funds to environmentally friendly securities, thereby promoting technological advances that contribute to the goal of transparency. In addition to prior literature, validating these nexuses provides novel perspectives on how green finance mediates between enterprise and government EID and the growth of GTI. These results provide a more comprehensive understanding of how environmental disclosure affects green financing and technological innovation.

7 Implications and future directions

7.1 Policy implications

Based on the study’s findings, we give concrete implications that can help numerous government agencies enhance GTI. To begin, a system must be implemented to guarantee the accuracy of publicly available environmental data. The main body of EID should be gradually transferred from the government to enterprises, and the scope of the disclosure should broaden from heavy-polluting enterprises to light ones. This can be accomplished with the help of modern technologies like digital means and big environmental data, which will help us better promote environmental protection. As a second step, we must enhance the current green financial system. First, we need to incentivize GC more strongly. This will provide a key opportunity to accelerate the transition to a more sustainable financial system. Policymakers can encourage financial institutions to allocate capital to eco-friendly businesses, promoting green innovation and mitigating environmental degradation. Tax incentives or lower lending rates for projects with clear environmental benefits are effective strategies to encourage GC.

Second, we need to lower the price at which banks and businesses can produce green bonds. Making it cheaper for companies and banks to issue green bonds could make them much more attractive and accessible, which would encourage funding for eco-friendly initiatives. In addition, projects such as the Climate Bonds Initiative (CBI) aim to provide certification for eligible projects and standardize the process of issuing green bonds. The issuance process can be simplified, and administrative procedures can be reduced, which helps reduce the overall cost of issuing green bonds.

Third, we need to inspire the development of a wide range of GC businesses. Governments and financial authorities can support establishing financial institutions focused on GC. Policymakers can accelerate the transition to a more resilient and sustainable economy by assisting green bond issuers, GC institutions, green venture capital firms, and innovative fintech businesses.

Fourth, we need to develop unique green bond products. Creating novel financial instruments tailored to specific environmental objectives, industries, or projects is the process of developing unique green bond products. Sector-specific green bonds may appeal to investors who want to generate profits while supporting environmentally friendly causes such as clean transportation, sustainable agriculture, or renewable energy. These bonds can potentially attract a wider range of investors and provide more access to financing for environmental projects.

Fifth, we need to encourage the green transformation of traditional banking institutions. Promoting the green transformation of traditional banking institutions means providing incentives and assistance to these institutions to enable them to incorporate sustainable practices into their investment and operational plans.

Finally, we need to ensure that all businesses have access to capital for investment. Conversely, we need to lessen the burden on taxpayers by cutting down on the price of government oversight while simultaneously increasing pollution compensation for consumers. Green bonds and innovation-driven development initiatives can assist in funding environmental transparency efforts.

7.2 Limitations and future recommendation

Despite the study’s valuable outcomes, its sample size, geographic spread, and time limits on its subjects may limit generalization. It must be acknowledged that while this research has produced valuable results, the imposition of a time limit on its subjects raises a critical issue that could hamper the broad applicability or generalization of its findings. Because the time limits chosen during the study did not adequately describe the dynamic nature of some situations, it could lead to a poor grasp of the issue. Over a long period, participants’ behavior and reactions may change when they become aware that they are being watched briefly. Therefore, a long-term study must be conducted to see how better EID and additional green money affect the development of new environmentally friendly technologies.

There is much complexity surrounding the effect of publicizing environmental data on developing new eco-friendly technologies, and this paper has several flaws. Adopting appropriate methods to address the technical issues, investigating the direct impact of EID on GTI, and delving deeper into other factors of the relationship between EID and GTI, such as the innovation and technology transformation capabilities of enterprises, are all promising avenues for future study. We will keep looking into additional possible ways environmental transparency leads to green technical innovation.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Ethics statement

Written informed consent was obtained from the individual(s) for the publication of any potentially identifiable images or data included in this article.

Author contributions

JF: Data curation, Formal Analysis, Funding acquisition, Writing–review and editing. CY: Conceptualization, Data curation, Formal Analysis, Software, Writing–original draft, Writing–review and editing. WX: Data curation, Funding acquisition, Investigation, Methodology, Resources, Writing–review and editing.

Funding

We acknowledge that this work was supported by the Reform and Development of Local Colleges and Universities Fund Talent Training Project (Research on digital technology enabling high-quality development of manufacturing industry in Heilongjiang Province). Heilongjiang Province Philosophy and Social Science Research and Planning Project (Project No. 21JYB142), Heilongjiang Province Philosophy and Social Science Research and Planning Project (Project No. 22GLC279), Heilongjiang Province Ecological and Environmental Protection Scientific Research Project (HST2022ZC008).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, A., Luo, X., Shahzad, F., and Wattoo, M. U. (2023). Optimizing organizational performance in manufacturing: the role of IT capability, green supply chain integration, and green innovation. J. Clean. Prod. 423, 138848. doi:10.1016/j.jclepro.2023.138848

Ahmad, M. M., Hunjra, A. I., Islam, F., and Zureigat, Q. (2023). Does asymmetric information affect a firm's financing decisions? Int. J. Emerg. Mark. 18 (9), 2718–2734. doi:10.1108/ijoem-01-2021-0086

Ahmed, D., Hua, H. X., and Bhutta, U. S. (2024). Innovation through green finance: a thematic review. Curr. Opin. Environ. Sustain. 66, 101402. doi:10.1016/j.cosust.2023.101402

Bakry, W., Mallik, G., Nghiem, X. H., Sinha, A., and Vo, X. V. (2023). Is green finance really “green”? Examining the long-run relationship between green finance, renewable energy and environmental performance in developing countries. Renew. Energy 208, 341–355. doi:10.1016/j.renene.2023.03.020

Braun, E., and Wield, D. (1994). Regulation as a means for the social control of technology. Technol. Analysis Strategic Manag. 6 (3), 259–272. doi:10.1080/09537329408524171

Cai, D. (2018). Environmental Information disclosure study on green bonds. Financ. Horiz. (12), 84–89.

Cheng, Y. (2014). Environmental information disclosure based on green securities: overseas experience and enlightenment — from the environmental accidents of listed companies. J. Xinjiang Univ. Philosophy, Humanit. Soc. Sci. Ed. 42 (02), 43–47. doi:10.13568/j.cnki.issn1000-2820.2014.02.002

Chin-Hsien, Yu, Xiuqin, Wu, Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Du, L., Wang, F., and Tian, M. (2022b). Environmental information disclosure and green energy efficiency: a spatial econometric analysis of 113 prefecture-level cities in China. Front. Environ. Sci. 1232. doi:10.3389/fenvs.2022.966580

Du, Mo, Shanglei, C., Wei, W., Shuqi, W., and Zhilong, Li (2022a). Will environmental information disclosure affect bank credit decisions and corporate debt financing costs? Evidence from China's heavily polluting industries. Environ. Sci. Pollut. Res. Int. 29 (31), 47661–47672. doi:10.1007/s11356-022-19229-4

Du, Y. (2022). Environmental information disclosure, pollutant discharge, and ecological civilization construction. Statistics Decision-Making 38 (21), 184–188. doi:10.13546/j.cnki.tjyjc.2022.21.036

Feng, Y., and He, F. (2020). The effect of environmental information disclosure on environmental quality: evidence from Chinese cities. J. Clean. Prod. 276, 124027. doi:10.1016/j.jclepro.2020.124027

Feng, Y., Wang, X., and Liang, Z. (2021). How does environmental information disclosure affect economic development and haze pollution in Chinese cities? The mediating role of green technology innovation. Sci. total Environ. 775, 145811. doi:10.1016/j.scitotenv.2021.145811

Gao, J., and Zhang, W. (2021). Research on the influence of green finance on the ecology of industrial structure in China — empirical test based on systematic GMM model. Econ. Horiz. (02), 105–115.

Gar cía-Granero, E. M., Piedra-Munoz, L., and Galdeano-Gómez, E. (2018). Eco-innovation measurement: a review of firm performance indicators. J. Clean. Prod. 191, 304–317. doi:10.1016/j.jclepro.2018.04.215

Ge, Y., Chen, Q., Qiu, S., and Kong, X. (2023). Environmental information disclosure and stock price crash risk: evidence from China. Front. Environ. Sci. 11, 177. doi:10.3389/fenvs.2023.1108508

Guo, B., Feng, Y., and Wang, X. (2024). The effect of environmental information disclosure on carbon emission. Pol. J. Environ. Stud. 33 (2), 1681–1691. doi:10.15244/pjoes/173106

Han, L., and Liu, S. (2023). How does green credit policy affect sustainable development capacity of enterprises in China? J. Glob. Inf. Manag. (JGIM) 31 (1), 1–19. doi:10.4018/jgim.320487

He, F., Duan, L., Cao, Y., and Wen, S. (2024). Green credit policy and corporate climate risk exposure. Energy Econ. 133, 107509. doi:10.1016/j.eneco.2024.107509

He, W., Chen, H., and Wang, Z. (2019). Empirical study on the dynamic relationship between green finance development and carbon emission. — test based on VAR model. J. Guizhou Normal Univ. Soc. Sci. Ed. (01), 99–108.

Hu, H., Chang, C.-P., Dong, M., Meng, W.-Na, and Yu, H. (2018). Does environmental information disclosure affect the performance of energy-intensive firms' borrowing ability? Evidence from China. Energy and Environ. 29 (5), 685–705. doi:10.1177/0958305x18757766

Hu, R., Shahzad, F., Abbas, A., and Xu, N. (2022). Empirical analysis of the impact of industrial internet development environment on open green innovation of manufacturing enterprises. Front. Environ. Sci. 10, 947675. doi:10.3389/fenvs.2022.947675

Hu, T. (2022). Green preference of the capital market, green innovation of enterprises and total factor productivity. Res. Tech. Econ. Manag. (03), 57–62.

Huwei, W., Shuai, C., and Chien-Chiang, L. (2023). Impact of low-carbon city construction on financing, investment, and total factor productivity of energy-intensive enterprises. Energy J. 44 (2), 79–102. doi:10.5547/01956574.44.2.hwen

Jia, K., and Chen, S. (2019). Could campaign-style enforcement improve environmental performance? Evidence from China's central environmental protection inspection. J. Environ. Manag. 245, 282–290. doi:10.1016/j.jenvman.2019.05.114

Jia, Y., and Liu, C. (2022). Research on the impact of green finance on environmental governance. Environ. Sci. Manag. 47 (04), 10–14.

Jiatong, W., Li, C., Murad, M., Shahzad, F., and Ashraf, S. F. (2021). Impact of social entrepreneurial factors on sustainable enterprise development: mediating role of social network and moderating effect of government regulations. Sage Open 11, 215824402110306. doi:10.1177/21582440211030636

Junbing, H., Lufeng, An, Peng, W., and Guo, L. (2023). Identifying the role of green financial development played in carbon intensity: evidence from China. J. Clean. Prod. 408, 136943. doi:10.1016/j.jclepro.2023.136943

Li, R., Wang, Q., Li, L., and Hu, S. (2023). Do natural resource rent and corruption governance reshape the environmental Kuznets curve for ecological footprint? Evidence from 158 countries. Resour. Policy 85, 103890. doi:10.1016/j.resourpol.2023.103890

Li, Y., Shen, G., and Yang, Y. (2024). The value of environmental information disclosure: evidence from China’s carbon-reduction policy. Appl. Econ. Lett., 1–6. doi:10.1080/13504851.2024.2333455

Liébana-Cabanillas, F., Marinković, V., and Kalinić, Z. (2017). A SEM-neural network approach for predicting antecedents of m-commerce acceptance. Int. J. Inf. Manag. 37 (2), 14–24. doi:10.1016/j.ijinfomgt.2016.10.008

Lin, B., and Pan, T. (2024). The impact of green credit on green transformation of heavily polluting enterprises: reverse forcing or forward pushing? Energy Policy 184, 113901. doi:10.1016/j.enpol.2023.113901

Lin, S. (2022). Can environmental information disclosure improve urban green economic efficiency? New evidence from the mediating effects model. Front. Environ. Sci. 747. doi:10.3389/fenvs.2022.920879

Lin, S., Zhou, Z., Hu, X., Chen, S., and Huang, J. (2024). How can urban economic complexity promote green economic growth in China? The perspective of green technology innovation and industrial structure upgrading. J. Clean. Prod. 450, 141807. doi:10.1016/j.jclepro.2024.141807

Liu, M., and Zhu, W. (2020). Heterogeneity analysis of the "Porter effect" triggered by different environmental regulation tools — is based on the perspective of local government competition. Eco-economy 36 (11), 143–150.

Liu, X., Cai, S., Wang, Y., and Sun, Y. (2024). A comparative study of environmental information disclosure between banks in net-zero banking alliance and China. Technol. Forecast. Soc. Change 202, 123324. doi:10.1016/j.techfore.2024.123324

Ma, F., He, Y., Shangping, Li, Yanmei, M., and Shi, L. (2020). BP network method for weight determination in the evaluation of foliation performance of sugarcane harvester. J. Guangxi Univ. Nat. Sci. Ed. (03), 233–237.

Mavlanova, T., Benbunan-Fich, R., and Koufaris, M. (2012). Signaling theory and information asymmetry in online commerce. Inf. Manag. 49 (5), 240–247. doi:10.1016/j.im.2012.05.004

Naeem, M., Hamid, K., Ahmad, W., and Rasool, F. (2024). Casual and dynamic linkage between economic growth and green financial development in Pakistan. Int. J. Bus. Econ. Aff. 9 (1), 28–39. doi:10.24088/IJBEA-2024-91003

Niu, S., Zhang, J., Luo, R., and Feng, Y. (2023). How does climate policy uncertainty affect green technology innovation at the corporate level? New evidence from China. Environ. Res. 237, 117003. doi:10.1016/j.envres.2023.117003

Ouyang, H., Guan, C., and Yu, Bo (2023). Green finance, natural resources, and economic growth: theory analysis and empirical research. Resour. Policy 83, 103604. doi:10.1016/j.resourpol.2023.103604

Ozkan, O., Khan, N., and Ahmed, M. (2023). Impact of green technological innovations on environmental quality for Turkey: evidence from the novel dynamic ARDL simulation model. Environ. Sci. Pollut. Res. 30, 72207–72223. doi:10.1007/s11356-023-27350-1

Pan, X., and Fu, W. (2022). Environmental information disclosure and regional air quality — quasi-natural experimental analysis based on PM_ (2.5) monitoring. Financial Res. 48 (05), 110–124. doi:10.16538/j.cnki.jfe.20220113.402

Qu, K., and Liu, Z. (2022). Green innovations, supply chain integration and green information system: a model of moderation. J. Clean. Prod. 339, 130557. doi:10.1016/j.jclepro.2022.130557

Roper, S., and Tapinos, E. (2016). Taking risks in the face of uncertainty: an exploratory analysis of green innovation. Technol. Forecast. Soc. Change 112, 357–363. doi:10.1016/j.techfore.2016.07.037

Salazar, J. (1998). Environmental finance: linking two worlds. a Workshop Financial Innovations Biodivers. Bratislava 1, 2–18. https://www.scirp.org/reference/referencespapers?referenceid=2806043

Shahzad, F., Xiu, G., Khan, M. A. S., and Shahbaz, M. (2020). Predicting the adoption of a mobile government security response system from the user's perspective: an application of the artificial neural network approach. Technol. Soc. 62, 101278. doi:10.1016/j.techsoc.2020.101278

Shao, Y., Xu, K., and Shan, Y. G. (2024). Leveraging corporate digitalization for green technology innovation: the mediating role of resource endowments. Technovation 133, 102999. doi:10.1016/j.technovation.2024.102999

Shapira, P., Gök, A., Klochikhin, E., and Sensier, M. (2014). Probing “green” industry enterprises in the UK: a new identification approach. Technol. Forecast. Soc. change 85, 93–104. doi:10.1016/j.techfore.2013.10.023

Song, A., Rasool, Z., Nazar, R., and Anser, M. K. (2024). Towards a greener future: how green technology innovation and energy efficiency are transforming sustainability. Energy 290, 129891. doi:10.1016/j.energy.2023.129891

Su, W., Wei, N., Yuan, Z., and Guo, S. (2023). The impact of environmental information disclosure on the efficiency of enterprise capital allocation. Sustainability 15 (14), 11215. doi:10.3390/su151411215

Tan, X., Peng, M., Yin, J., and Zongfeng, X. (2022). Does local governments' environmental information disclosure promote corporate green innovations? Emerg. Mark. Finance Trade 58 (11), 3164–3176. doi:10.1080/1540496x.2022.2033723

Tian, X. L., Guo, Q. G., Han, C., and Ahmad, N. (2016). Different extent of environmental information disclosure across Chinese cities: contributing factors and correlation with local pollution. Glob. Environ. Change 39 (39), 244–257. doi:10.1016/j.gloenvcha.2016.05.014

TuuOlsen, H. H. S. O. (2010). Non-linear effects between satisfaction and loyalty: an empirical study of different conceptual relationships. J. Target. Meas. Analysis Mark. 18 (3/4), 239–251. doi:10.1057/jt.2010.19

Wang, G., Zhang, H., Zeng, S., Meng, X., and Lin, H. (2023). Reporting on sustainable development: configurational effects of top management team and corporate characteristics on environmental information disclosure. Corp. Soc. Responsib. Environ. Manag. 30, 28–52. doi:10.1002/CSR.2337

Wang, H., Cui, H., and Zhao, Q. (2021). Effect of green technology innovation on green total factor productivity in China: evidence from spatial durbin model analysis. J. Clean. Prod. 288, 125624. doi:10.1016/j.jclepro.2020.125624

Wang, Q., Ge, Y., and Li, R. (2023b). Does improving economic efficiency reduce ecological footprint? The role of financial development, renewable energy, and industrialization. Energy and Environ., 0958305X231183914. doi:10.1177/0958305x231183914

Wang, Q., Hu, S., and Li, R. (2023a). Could information and communication technology (ICT) reduce carbon emissions? The role of trade openness and financial development. Telecommun. Policy 48, 102699. doi:10.1016/j.telpol.2023.102699

Wang, Q., Sun, T., and Li, R. (2024). Does artificial intelligence promote green innovation? An assessment based on direct, indirect, spillover, and heterogeneity effects. Energy and Environ., 0958305X231220520. doi:10.1177/0958305x231220520

Wang, Q., Wang, L., and Li, R. (2023c). Trade openness helps move towards carbon neutrality—insight from 114 countries. Sustain. Dev. doi:10.1002/sd.2720

Wang, Q., and Zhao, C. (2021). Dynamic evolution and influencing factors of industrial green total factor energy efficiency in China. Alex. Eng. J. 60 (1), 1929–1937. doi:10.1016/j.aej.2020.11.040

Wang, X., and Wang, Y. (2021). GC policy promotes green innovation research. Manag. World 37 (06), 173–188+11. doi:10.19744/j.cnki.11-1235/f.2021.0085

Wu, S., Zhang, J., and Elliott, R. J. R. (2023). Green securities policy and the environmental performance of firms: assessing the Impact of China's pre-IPO environmental inspection policy. Ecol. Econ. 209, 107836. doi:10.1016/j.ecolecon.2023.107836

Xiong, L., Long, H., Zhang, X., Yu, C., and Wen, Z. (2023). Can environmental information disclosure reduce air pollution? Evidence from China. Front. Environ. Sci. 11, 100. doi:10.3389/fenvs.2023.1126565

Xu, H., Mei, Q., Shahzad, F., Liu, S., Long, X., and Zhang, J. (2020). Untangling the impact of green finance on the enterprise green performance: a meta-analytic approach. Sustainability 12 (21), 9085. doi:10.3390/su12219085

Yan, Z., Yu, Y., Du, K., and Zhang, N. (2024). How does environmental regulation promote green technology innovation? Evidence from China's total emission control policy. Ecol. Econ. 219, 108137. doi:10.1016/j.ecolecon.2024.108137

Yang, C., and Zhu, S. (2022). Evaluation, analysis and Suggestions of banking environmental information disclosure under the background of green finance — based on the disclosure data of 54 listed banks. North. Finance (12), 33–40. doi:10.16459/j.cnki.15-1370/f.2022.12.013

Yang, X., Mo, W., Yan, Li, and Jiang, Y. (2023). Research on the policy effect and mechanism of green finance to reduce environmental pollution: micro evidence from 285 cities in China. Environ. Sci. Pollut. Res. 30, 70854–70870. doi:10.1007/s11356-023-27187-8

Ying, W., and Jiahao, F. (2022). Green bonds promote green innovation research in enterprises. Financial Res. (06), 171–188.

Yongsheng, Li, and Zhang, X. (2020). Is environmental information disclosure conducive to China's tough battle against pollution? Environ. Manag. China 12 (01), 87–94.

Yu, C. H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Yu, W. (2020). Environmental information disclosure, credit scale and credit cost. Acad. J. Bus. Manag. 2 (5), 37–51. doi:10.25236/AJBM.2020.020505

Zhang, H., and Feng, F. (2020). Can informal environmental regulation reduce carbon emissions? — a quasi-natural experiment from environmental information disclosure. Econ. Manag. Res. 41 (08), 62–80. doi:10.13502/j.cnki.issn1000-7636.2020.08.005

Zhang, J., and Wang, M. (2023). Does environmental information disclosure drive corporate sustainable growth? A new insight into U-shaped relationship. Front. Ecol. Evol. 11, 1189052. doi:10.3389/fevo.2023.1189052

Zhang, Q., Chen, W., and Feng, Y. (2021). The effectiveness of China's environmental information disclosure at the corporate level: empirical evidence from a quasi-natural experiment. Resour. Conservation Recycl. 164, 105158. doi:10.1016/j.resconrec.2020.105158

Zhong, S., Li, J., and Zhao, R. (2021). Does environmental information disclosure promote sulfur dioxide (SO2) remove? New evidence from 113 cities in China. J. Clean. Prod. 99, 126906. doi:10.1016/j.jclepro.2021.126906

Zhou, J., Zhou, Y., and Bai, X. (2023). Can green-technology innovation reduce atmospheric environmental pollution? Toxics 11 (5), 403. doi:10.3390/toxics11050403

Zhou, Y., and Long, R. (2023). Has green credit improved ecosystem governance performance? A study based on panel data from 31 provinces in China. Sustainability 15 (14), 11008. doi:10.3390/su151411008

Zhu, X., Huang, Y., Zhu, S., and Huang, H. (2021a). Technological innovation and spatial difference of China's polluting industries under the influence of green finance. Geogr. Sci. 41 (05), 777–787. doi:10.13249/j.cnki.sgs.05.005

Zhu, X., Zhu, S., Huang, Y., and Huang, H. (2021b). How does green finance affect urban environmental pollution in China? — take the haze pollution as an example. Trop. Geogr. 41 (01), 55–66. doi:10.13284/j.cnki.rddl.003303

Appendix A

Keywords: environment, innovation, development, SEM, information disclosure

Citation: Feng J, Yu C and Xufeng W (2024) Untying the nexus between environmental information disclosure, green finance, and green technological innovation: a multi-analytical (SEM-ANN) approach. Front. Environ. Sci. 12:1360901. doi: 10.3389/fenvs.2024.1360901

Received: 24 December 2023; Accepted: 30 April 2024;

Published: 20 May 2024.

Edited by:

Rongrong Li, China University of Petroleum (East China), ChinaReviewed by:

Yang Wang, Yunnan Normal University, ChinaHong-Dian Jiang, China University of Geosciences, China

Copyright © 2024 Feng, Yu and Xufeng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jiaying Feng, ZmVuZ2ppYW55aW5nMTk5MEAxMjYuY29t; Cheng Yu, Y2hlbmd5MjAyMzA2MjAyM0AxNjMuY29t

Jiaying Feng

Jiaying Feng Cheng Yu

Cheng Yu Wu Xufeng3

Wu Xufeng3