94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 15 May 2024

Sec. Environmental Economics and Management

Volume 12 - 2024 | https://doi.org/10.3389/fenvs.2024.1323282

This article is part of the Research Topic Digital Governance, Ecological Resilience and Resident Well-Being View all 7 articles

Under the trend of synergistic development of digitalization and greening, this paper investigates the impact of enterprise digital transformation on audit fees and its mechanism, by using textual analysis and performing empirical tests on the data of Chinese listed companies from 2007 to 2021. It is found that enterprise digital transformation significantly increases audit fees, and green innovation partially mediates this process. The study results are robust, even after a series of robustness tests. When financing constraints and environmental regulations are low, the mediating role of green innovation between digital transformation and audit fees is more significant. In addition, green innovation has a stronger mediating role between the use of underlying technology and audit fees, while green substantive innovation has a stronger mediating role between digital transformation and audit fees. This study investigates the effect of enterprise digital transformation on audit fees from the standpoint of green innovation. It offers a new perspective on how accounting firms make audit pricing decisions, provides guidance for enterprise digital transformation and green innovation, and gives an opportunity for China to promote the synergistic transformation and development of digitalization and greening to achieve the dual-carbon goal.

At present and in the future, China will prioritize the development of the real economy and adopt a digital strategy to optimize the economic structure. This will facilitate the deep integration of the digital economy and the real economy. Because of this, digital transformation is becoming the primary strategic behavior of enterprises (Ritter and Pedersen, 2020), presenting both opportunities and challenges for auditors. Auditors are an independent third party in the capital market and respond to the digital transformation of enterprises. Existing literature investigates this topic from the perspective of information technology application (Pincus et al., 2017; Yang et al., 2020). However, digital transformation is a business model involving various digital technologies, including artificial intelligence, cloud computing, blockchain, big data, and digital technology applications. It is not limited to a specific information technology application. Currently, clients tend to use big data and complex analytics to remain competitive, which is causing concern among auditors. This trend is expected to increase the urgency for auditors to adopt new technologies (Appelbaum et al., 2017). However, it is unclear whether the digital transformation of companies will have an influence on auditing.

Moreover, China proposed the goals of “carbon peaking” and “carbon neutrality” (i.e., “dual carbon”) at the 75th session of the UN General Assembly to promote green development and harmony between humans and nature. Meanwhile, China has also emphasized the accelerated synergistic transformation of “digitalization” and “greening” by 2023. The rapid development of the digital economy has extended enterprises’ digital transformation to the field of green governance. Green innovation is the primary driving force for enterprises to take green development and fulfill social responsibility in the field of green governance (Zhang et al., 2023). Enterprise innovation and green innovation are both high-risk investment activities due to their long cycle, large investment, and high uncertainty (Xu and Wang, 2017). In this context, the question arises: does the digital transformation of enterprises related to green innovation affect the audit risk? This study investigates the path and mechanism of enterprise digital transformation on audit fees from the intermediary perspective of green innovation. The aim of this study is to provide a theoretical basis and empirical evidence for accelerating digitalization and actively achieving the goal of “double carbon”.

The study has three main contributions to research and practice. Firstly, the existing literature has not investigated the mechanism of digital transformation on audit fees. By taking green innovation as a mediating variable, our study opens the “black box” of the mechanism between digital transformation and audit fees under the “dual carbon” goal. This enriches the research on the influence mechanism of enterprise digital transformation on audit fees. Secondly, unlike existing studies that mainly focus on the positive influence of digital transformation, this study investigates the cost and risk differences of digital transformation auditing as a theoretical explanation and attempts to investigate the potential negative influence that digital transformation may have on auditors. This investigation will promote the study of the “risk-boosting theory” of digital transformation, and it has practical significance and policy implications for recognizing and coping with the short-term side effects of digital transformation. Additionally, this study distinguishes the mediating role of green innovation between digital transformation and audit fees in different contexts through green substantive and strategic innovation. This provides a new perspective for green innovation research and guidance for enterprises to choose the right green innovation strategic plan.

Digital transformation is a strategic change in the era of the digital economy. Enterprises utilize various digital technologies to improve their production methods, business models, and organizational structures. It is a vital strategic decision that brings economic consequences to enterprises. Previous studies have indicated that implementing enterprise digital transformation can improve the transparency of internal information, enhance resource allocation efficiency in the capital market, optimize investment decisions, increase competitiveness, reduce the possibility of significant deficiencies in internal control, and prevent surplus management (Masli et al., 2010; Morris and Laksmana, 2010; Dorantes et al., 2013; Chen et al., 2014; Chen, 2018).

Nevertheless, some studies propose the “risk-boosting theory” considering the risk of digital transformation. For instance, Yang D. M. et al. (2020), Zhai and Li (2022) argue that in the early stages of digital transformation, enterprises invest heavily in digital technology, resulting in changes and conflicts with old processes and systems. This, in turn, increases the strategic and operational risks of the enterprise. Furthermore, as digital transformation continues to develop, the increased control of internal enterprise information by digital technology significantly facilitates surplus management, which will lead to an increase in the absolute value of enterprises’ actionable accrued profits (Brazel and Dang, 2008). Such developments have a great impact on auditors’ professional judgment in complex environments, such as digital transformation (Brazel and Agoglia, 2007). It is evident that digital transformation is a strategic decision that combines high risks and high benefits.

Existing research suggests that scholars are currently investigating the economic consequences of digital transformation. However, there is still relatively scarce literature from the audit perspective on the digital transformation of enterprises. Only a few researchers focus on the impact of enterprise information technology applications on audit fees, such as Pincus et al. (2017), who tested the impact of Enterprise Systems (ES) on audit fees in the US and Canada and found a negative correlation. Yang X. D. et al. (2020) pointed out that the use of information technology by firms affects the risk of material misstatement and audit fees for audits. Wu et al. (2022) measured the informatization degree of enterprises by breaking down intangible assets disclosed in their annual reports and found a significant increase in audit fees. However, digital transformation is a business model that does not refer to a specific information technology application; instead, it involves various digital technologies, including artificial intelligence, cloud computing, blockchain, big data, and digital applications. Existing studies find it challenging to comprehensively measure enterprise digital transformation practices by only relying on intangible asset details disclosed in annual reports.

Auditors have identified higher audit risks due to the complexity of clients’ operations and the shift from traditional ledger-oriented auditing to risk-oriented auditing, as enterprises face increasingly complex strategic decisions and economic environments (Bell et al., 2008). In this case, according to risk-oriented audit theory, auditors should concentrate on a company’s strategic decisions regarding digital transformation, gather more audit evidence, and increase audit inputs and risk premiums. This, in turn, affects audit fees. Therefore, our study investigates the influence of digital transformation on audit costs and risks.

Digital transformation will increase audit costs. First, auditing standards such as Independent Auditing Standard No. 20 - Auditing in a Computer Information Systems Environment and Chinese Auditing Standard for Certified Public Accountants No. 1633 - The Impact of E-Commerce on the Audit of Financial Statements all require auditors to understand the client’s information technology environment at the risk assessment stage. With the progress of enterprise digital transformation, its information systems become more complex. With the auditor’s established IT capabilities, the increasing updating of IT infrastructures and iterative upgrading of high-end software require auditors to expand the scope of substantive procedures and seek the advice and assistance of IT specialists, leading to higher audit communication costs (Brazel and Agoglia, 2007; Qin, 2014). Second, Digital Ecosystem Theory (DET) argues that with the extensive application of digital technology, the interdependent relationships among stakeholders are connected by digitalization, which often causes a collective stampede during crises (Valdez-De-Leon, 2019). Therefore, with the deepening of digitalization transformation, accounting firms will also strengthen their investment in the construction of intelligent auditing to strengthen the professional competence of auditors in digital technology auditing. For instance, accounting firms need to purchase a large amount of hardware and software related to IT auditing and pay for the associated training costs (Qin, 2014), which are finally borne by their clients.

Additionally, Bible et al. (2005) found that compared to working in a traditional paper-based environment, auditors are more uncomfortable performing audit procedures in paperless systems, because they not only face the challenge of sifting through large amounts of data but also the challenge of collecting sufficient and appropriate audit evidence. In this case, auditors need to spend a certain amount of time adapting to the updated digital audit environment, which will increase audit time and decrease audit efficiency.

Digital transformation will increase audit risk. First, the digital integration ability theory argues that enterprises need to use digital technology to coordinate and integrate internal resources in the process of digital transformation (Helfat and Raubitschek, 2018). In this context, the professional barriers created by digital technology in rapid iteration implicitly hinder managers from manipulating opportunistic behavior, which will affect the quality of financial statement disclosures (Farooqi et al., 2014) and exacerbate the information asymmetry between auditors and clients. Due to the lack of corresponding knowledge reserves and experience base, auditors may find it challenging to effectively identify excess management behavior under the manipulation of management that exploits software and technological advantages, which will increase the difficulty of auditing and increase the risk of audit failure (Li et al., 2012).

Secondly, digital transformation will lead to changes in the business model and operation mode of enterprises, while the internal control system corresponding to digitalization is still in the exploration stage, digital transformation may cause the failure of internal control (Ling et al., 2022), which cannot be reflected in the current statement timely. This will prevent auditors from making accurate judgments on the information related to the digital transformation of enterprises, further increasing the risk of audit.

Thirdly, multiple uncertainties exist in the process of digital transformation, such as conducting in-depth digital information research, coordinating communication efforts across diverse departments, integrating resources, and other challenges to be addressed by enterprises, which lead to operational and financial reporting risks (Porter and Heppelmann, 2015; Han et al., 2016). Therefore, the blind adoption of digital technology may cause enterprises to fall into the “IT trap”, declining business performance and increasing audit risk. Additionally, other companies may replicate the success of digital transformation firms, resulting in a “cohort effect” (Du et al., 2023). This can potentially lead to deficient management strategies and biased understandings, which in turn cause systemic risks related to strategic transformation that can have far-reaching impacts on financial statements (Danielsson et al., 2021). Therefore, auditors should charge a substantial risk premium.

To sum up, the digital transformation of enterprises is likely to increase the communication costs, training costs, and audit hours of digital audits, and digital technologies can easily lead to excess management practices, internal control failures, business operation risks, financial reporting control risks, and systemic risks in rapid iterations, leading auditors to obtain audit cost reimbursement and risk compensation through higher audit fees. Considering this, Hypothesis 1 is proposed in this paper.

H1. All else being equal, the greater the degree of digital transformation, the higher the audit fees charged by the auditor.

Green innovation refers to the improvement of technologies, products, and processes to reduce the consumption of natural resources and alleviate the negative impact on the environment in the production process to achieve the goal of “double carbon”. With the widespread application of new technologies such as artificial intelligence, cloud computing, blockchain, big data technology, and digital technology, digitalization is gradually becoming an important growth point for green innovation in micro-enterprises.

Firstly, data resource-sharing platforms such as financial sharing centers can create an ecosystem among enterprises. The innovation entities in the system can interact and empower one another, thus realizing business-financial integration, transparency in business processes, and standardization of information and data. Such platforms will increase channels for enterprises to disclose information of ESG and encourage management, external investors, and government to perform online supervision of the resource consumption and environmental pollution of enterprises (Li et al., 2022), further reducing the environmental governance costs and R&D risks of enterprises. Especially in the context of the dual-carbon goal, the above changes will enhance the competitive advantage of sustainable development for enterprises and strengthen the support of investors and government for green innovation behavior of enterprises.

Secondly, digital transformation enables the expansion of channels both inside and outside an enterprise, allowing for direct acquisition, collection, and utilization of more data. It reduces the costs of information gathering greatly. It is beneficial for financial institutions to screen energy-efficient and environmentally friendly enterprises, thereby increasing the amount of green credit given to them and subsequently providing financial security for their green innovations (Veselovsky et al., 2018). Therefore, these institutions can decrease financing constraints.

Finally, digital transformation promotes the construction of innovation networks and facilitates the sharing of cutting-edge technologies for green innovation. This provides a learning platform for businesses to investigate green innovation and inspires them to develop innovative green business models. Additionally, Zhou et al. (2022) pointed out that the synergy between digital technology and green innovation technology promotes the construction of a carbon trading market. Yang X. D. et al. (2020) stated that this promotes the output of green environmental protection technology and reduces the carbon emissions of enterprises. Further, this accelerates the construction of a new model that emphasizes resource-saving and environmentally friendly approaches. Consequently, it reduces energy consumption and optimizes the energy structure while providing stable support for green innovation. Therefore, Hypothesis 2 is proposed in this paper.

H2. All other things being equal, the greater the degree of digital transformation of enterprises, the higher the degree of green innovation.

In recent years, digital transformation has provided new opportunities for green innovation in enterprises. However, in the process of green innovation, enterprises are faced with uncertainties such as R&D failure, innovation results are difficult to adapt to the market, and the risk of innovation is very high. Risk is an important factor that affects the auditor’s fee decision (Bell et al., 2001). The more an enterprise invests in green innovation, the more likely it is to fall into financial difficulties due to a lack of funds (Cheng et al., 2016), which causes the auditor to face greater audit risk. Meanwhile, enterprise earning uncertainty is increasing, and auditors must devote more time and effort to serving their clients. The deep pockets theory indicates that auditors generally charge a significant risk premium to mitigate audit risk due to the audit expectation gap.

First, green innovation activities will reduce funds. Green innovation is not achieved overnight and requires much financial support, and the time lag of green innovation results suggests poor and uncertain R&D capital turnover (Jones, 2007). More green innovation may crowd out the funds needed for the production and operation of the firm. Enterprise cash could be reduced due to green innovations, and this affects the operations of companies. The higher the business risk of the company, the higher the risk of audit material misstatement, and consequently, higher audit fees will be charged by the auditor.

Second, listed companies typically engage in R&D whitewashing behaviors (Wang et al., 2019). Some enterprises do not aim for substantive innovation but instead are policy “support-seeking” through green innovation to obtain government subsidies and policy benefits (Zhang et al., 2018). The incentive distortion effect caused by such strategic innovation increases the audit risk faced by auditors.

Again, the long duration cycle and high uncertainty of innovation, as well as the difficulty in assessing the technical feasibility and market diffusion, may cause the enterprise’s investment in green innovation to become a sunk cost in the short term. This can easily cause the management to fail to meet the short-term evaluation targets and manipulate the surplus due to performance pressure (Cooper, 1981; Chen et al., 2008). Meanwhile, the recognition and measurement of R&D expenses are still highly subject to subjective estimation, and the imperfect disclosure mechanism of enterprises’ green innovation information makes it difficult to regulate. All these problems further increase the possibility of earnings management (Bedard and Johnstone, 2004), which increases the difficulty of auditing and leads to a higher inspection risk, and the auditor will charge a high risk premium.

Therefore, in the process of enterprises using digitalization to promote green innovation, digital transformation will increase operational risks and thus the risk of material misstatement, lead to higher detection risks by promoting excess management practices, and thus increase audit risks. In this context, due to their heightened risk awareness, auditors will increase their audit efforts, invest more human, material, and financial resources, apply more substantive procedures, assess and respond to risks of material misstatements and detection risk arising from green innovation, and utilize the work of experts when it is necessary to obtain more sufficient audit evidence to ensure the reasonableness of the audit opinion, which will further increase the audit fees. As shown in Figure 1. Considering this, Hypothesis 3 is proposed in this paper.

H3. There is a partial mediating effect of green innovation in the influence of digital transformation on audit fees.

This study selects A-share listed companies in Shanghai and Shenzhen from 2007 to 2021 as samples in the following approach: (a) Delete financial listed companies, (b) delete ST, *ST companies, and (c) delete listed companies with incomplete key data. Then, 26,919 observations are obtained. To avoid the potential impact of extreme values on the research results, the quantiles of continuous variables at 1% and 99% are winsorized. Excel and Stata14 are employed for relevant data processing. The data on digital transformation is obtained by obtaining keywords from annual reports of listed companies through Python; the data on green innovation is collected from the CNRDS database and the State Intellectual Property Office of China (SIPO); the data on audit fees and other control variables are collected from the CSMAR database and annual reports of listed companies.

According to Cheng et al. (2016), audit fees (Lnfee) are represented as the natural logarithm of audit fees disclosed in the annual reports of listed companies.

Referring to the research conducted by Yao and Zhou (2023), digital transformation (LnDIGITAL) is measured through text analysis by using a Python crawler tool to determine the frequency of keywords related to digitalization in the annual reports of listed companies. Meanwhile, Wu et al. (2021) established a digital transformation feature thesaurus that summarizes the frequency counts of digitization words in five dimensions: artificial intelligence technology, cloud computing technology, blockchain technology, big data technology, and application of digital technology. Then, they took the natural logarithm of this total metric plus 1. The specific thesaurus is presented in the Appendix A.

According to Li and Xiao (2020) and Ma et al. (2021), the variable green innovation (LnGreTotal) is represented as adding 1 to the number of green patents (including green invention patents and green utility model patents) applied by enterprises in the current year and then taking the natural logarithm.

After the study by Simunic (1980), company size (Size), inventory ratio (Lnv), and accounts receivable ratio (AR) have been widely used as a proxy for the complexity of the audit engagement, which affects the scope and time of the auditor’s performance of audit procedures.

Return on total assets (ROA) and loss (Loss) reflect the profitability of the company, while leverage ratio (Lev) and current ratio (CR) reflect the solvency of the company. The weaker a company’s profitability and solvency, the greater its operational and financial risks, and the higher the risk premium required by the auditor (Simunic, 1980).

Book-to-market ratio (BM) indicates the investment value of the listed company, and enterprise growth (Growth) indicates the continuity of the listed company’s operating income. Both indicators can reflect the client’s ability to continue operations, which is a focus of the auditor’s risk assessment procedures. If the client’s continuing operations are subject to significant uncertainty, the auditor needs to focus on it and perform more audit procedures (Herbohn et al., 2007).

Board size (Board), the proportion of independent directors (Ind), the proportion of management shareholding (Hold), and management compensation (Lnsalary) indicate the level of enterprise governance of the client. Lennox (2005) found that management shareholding has a great impact on the demand for high-quality audits of listed companies. Carcello et al. (2002) pointed out that independent directors, for their reputation protection, demand high-quality audits. Therefore, the level of enterprise governance is also one of the factors that auditors consider in their pricing decisions.

Opinion reflects the type of audit opinion issued by the auditor, while a non-standard audit opinion indicates that there are certain issues with the financial report and the audit risk is relatively high. Simunic (1980) found that the release of non-standard opinions affects the market price of the client and concluded that the audit fees are positively correlated with the qualified opinions. Therefore, referring to the existing research on the impact factors of audit fees (Cheng et al., 2016; Wu et al., 2022), this paper selects the above control variables from the levels of enterprise finance, enterprise governance, and accounting firms, respectively. Meanwhile, this paper also controls the influence of industry and year. The specific definitions of other related variables are presented in Table 1.

To investigate the relationship among enterprise digital transformation, green innovation, and audit fees, according to the mediation effect test proposed by Wen and Ye (2014), this paper constructs models (1)–(3).

Model (1) tests the influence of enterprise digital transformation on audit fees. If α1 is significantly positive, it indicates that enterprise digital transformation can increase audit fees, and Hypothesis 1 is verified. Model (2) tests the influence of enterprise digital transformation on green innovation. If α1 is significantly positive, it indicates that enterprise digital transformation can promote green innovation, and Hypothesis 2 is verified. If there is a mediating effect, the product of α1 in model (2) and α2 in model (3) (i.e., α1 × α2) is positively correlated with α1 in model (3), indicating that green innovation plays a partial mediating role between digital transformation and audit fees, and Hypothesis 3 is verified.

Table 2 shows that the mean and the median of Lnfee are 13.69 and 13.592, respectively, indicating that audit fees are approximately normally distributed with a standard deviation of 0.728, and this result is consistent with the research of Wu et al. (2022). The mean and the standard deviation of LnDIGITAL are 0.936 and 1.175, respectively, indicating that digital transformation has significant dispersion characteristics. In particular, the median is lower than the mean and shows a right-skewed feature. The minimum and the maximum values are 0 and 5.247, respectively, which reflects great differences in digital transformation levels among companies, and this result is consistent with the research of Yao and Zhou (2023). The minimum and the maximum values of green innovation (LnGreTotal) are 0 and 7.342, respectively, suggesting that there are great differences in green innovation levels. The median is 0, which shows that more than half of the sampled companies have no green innovation output and that the current overall level of green innovation among Chinese listed companies is not high. This result is consistent with the research of Li and Xiao (2020).

As listed in Table 3, the coefficient (0.023) of digital transformation (LnDIGITAL) in Model 1 is significantly positive at the 1% level. In terms of economic significance, when there is an increase of one standard deviation in the enterprise digital transformation, the standard deviation of audit fees will increase by 0.037. This is because enterprise digital transformation will increase the complexity of auditing, and much uncertainty will increase audit difficulty, audit fees, and audit risks. As a result, auditors will charge a risk premium, and thus Hypothesis 1 is validated. At this stage, the capital market still faces great challenges brought about by digital transformation, which has certain practical and political implications for understanding and dealing with the short-term negative impacts of the digital transformation process.

The coefficient (0.071) of digital transformation (LnDIGITAL) in Model 2 is significantly positive at the 1% level. In terms of economic significance, when the digital transformation improves by one standard deviation, the green innovation of enterprises will increase by 0.0897 standard deviations. This is due to the timeliness and sharing characteristics of digital transformation, which helps to break down the barriers of data and information, improve the efficiency of information processing and circulation, enhance the asymmetry of information, enable enterprises to disclose environmental information at a smaller cost; meanwhile, it helps enterprises to optimize the green innovation mode, break through the core technology of green innovation, and then promote the green innovation of enterprises. Therefore, Hypothesis 2 is verified.

The product of the coefficient of Digital Transformation (LnDIGITAL) in Model 2 (0.071) and the coefficient of Green Innovation (LnGreTotal) in Model 3 (0.013) is positive at the 1% level, and it is in the same sign direction as the coefficient of digital transformation (LnDIGITAL) in Model 3 (0.022). It suggests that green innovation plays a partial mediating role between digital transformation and audit fees. Therefore, Hypothesis 3 is confirmed. The research has demonstrated that audit fees will be increased due to green innovation. The study expands the boundaries of research on factors affecting audit fees, helps understand how enterprise digital transformation and green innovation affect audit pricing decisions, and provides a theoretical basis and experience for promoting the synergistic development of digitalization and greening and active implementation of the “dual-carbon” strategy.

Since some enterprises have not undergone digital transformation, this study may suffer from endogeneity problems caused by sample self-selection (Zhou et al., 2022). To eliminate the possible sample selection bias, this study adopts the Heckman two-stage model for endogeneity testing. Specifically, in the first stage, the explanatory variable, i.e., digital transformation intensity of enterprises (LnDigital1), is constructed, and probit regression is performed to calculate the inverse Mills ratio. It is defined as LnDigital1 = 1 when the digital transformation intensity of enterprises is larger than the industry median, and otherwise, LnDigital1 = 0.

Meanwhile, this study controls the exclusionary constraint variable (LnDigital2), following the practice of Lennox et al. (2012). This variable is defined as the intensity of digital transformation of other companies in the same industry and in the same period. The successful experience of digital transformation will be imitated by other enterprises, resulting in “cohort effect” (Du et al., 2023). As a result, the intensity of digital transformation of other companies in the same period and industry will affect the intensity of enterprise digital transformation, while it does not have a direct impact on the audit fees.

In Table 4, the first column presents the test results in the first stage of Heckman’s two-stage regression. The exclusionary constraint variable (LnDigital2) is −0.0001 and significant at the 1% level, which meets the requirement for selecting exclusionary constraint variables. The last three columns report the test results in the second stage of Heckman’s two-stage regression. The coefficients of digital transformation (LnDIGITAL) are 0.022 and 0.066 in Models 2 and 3, respectively. The product of the coefficient of digital transformation (LnDIGITAL) in Model 3 (0.066) and the coefficient of green innovation (LnGreTotal) in Model 4 (0.012) are positive and in the same sign direction as the coefficient of digital transformation in Model 4 (LnDIGITAL), which is 0.021, and all the above coefficients are significantly positive at the 1% level. The results indicate that the conclusions of the research still hold after controlling for sample selection bias in digital transformation.

To avoid the potential reverse causation problem, this study delays the explained variable digital transformation by one period (LnDIGITALt-1), and the results are listed in Table 5. The coefficients of digital transformation (LnDIGITALt-1) in Model 1 and Model 2 are 0.018 and 0.080, respectively, which are significantly positive. The product of the coefficient of digital transformation (LnDIGITALt-1) in Model 2 (0.080) and the coefficient of green innovation (LnGreTotal) in Model 3 (0.013) is positive, it has the same sign direction as the coefficient of digital transformation in Model 3 (the coefficient of LnDIGITALt-1 is 0.017), and all of the above coefficients are significant at the 1% level. It demonstrates that the conclusions of this study are robust.

In 2020, the American Institute of Certified Public Accountants (AICPA) issued a report, namely, the Impact of COVID-19 Pandemic - Potential Audit Challenges, which highlighted the challenges faced by auditors due to government-mandated control measures. It resulted in limited audit coverage and difficult on-site audits, potentially affecting audit pricing decisions. Therefore, to mitigate any potential effects of the COVID-19 outbreak in 2020 and 2021 on our results, the regression analyses were reconducted using data from 2007 to 2019. The results are listed in Table 6. The coefficients of digital transformation (LnDIGITAL) in Models 1 and 2 are 0.021 and 0.069, respectively, which are significantly positive at the 1% level. The product of the coefficient of digital transformation (LnDIGITAL) in Model 2 (0.069) and the coefficient of green innovation (LnGreTotal) in Model 3 (0.016) is positive at the 1% level, and it is in the same sign direction as the coefficient of digital transformation (LnDIGITAL) (0.020). It suggests that the results are robust.

This study follows the research of Zhou et al. (2022) and chooses the duration of green innovation (Oip) as the mediating variable and green innovation output index (Oin) as the proxy variable. The specific measurement method is to compare the green innovation output index (Oin) before and after.

The comparison results are presented in Table 7. The coefficients of digital transformation (LnDIGITAL) and green innovation output indicator (Oip) in Models 1 and 2 are 2.956 and 0.016 respectively, and the coefficient of green innovation output indicator (Oip) is 0.001. All the above coefficients are significant at the 1% level. It indicates that the regression results are robust.

The baseline regression results demonstrate that digital transformation significantly increases audit fees. Does this conclusion hold for firms with different characteristics? To answer this question, this paper investigates aspects of both financing constraints and environmental regulations to provide theoretical references for further understanding the interaction between enterprise digital transformation and audit fees.

Resource constraint theory suggests that companies are constrained by limited resources in the process of green innovation. With the acceleration of digitalization and greening processes, many enterprises are constrained by their internal resources and capabilities, making it difficult to provide the resources required for green innovation. Existing studies have found that enterprises implementing green innovation policies may encounter market failures such as environmental externalities, path dependence, and capital market imperfections (Xu and Cui, 2020). It may further increase the degree of enterprise financing constraints and hinder enterprises from engaging in green innovation. Therefore, this paper argues that the degree of enterprise financing constraints is closely related to the mediating effect of green innovation, and enterprises with a high degree of financing constraints may find it difficult to play a mediating role in green innovation.

To investigate the influence of the degree of financing constraints on the mediating effect of enterprise green innovation, this study refers to the research of Tan and Xia (2011). Specifically, the KZ index is employed to measure the degree of financing constraint in enterprises, and samples are classified into high groups and low groups based on the median of the KZ index. Samples greater than the median are classified into the high financing constraint group, while those less than the median are classified into the low financing constraint group.

The results are shown in Table 8, in the low financing constraint group, the coefficients of LnDIGITAL in Models 1 and 2 are 0.022 and 0.079, respectively. The product of the coefficient of LnDIGITAL in Model 2 (0.079) and the coefficient of LnGreTotal in Model 3 (0.018) is positive (0.020) and has the same sign, and all the above coefficients are significant at the 1% level. The result indicates that green innovation plays a partial mediating role between digital transformation and audit fees. The coefficient of LnGreTotal in Model 6 (0.004) is not significant in the group with high financing constraint group, suggesting that it is difficult for green innovation to play a mediating effect between digital transformation and audit fees for samples in this group. Under the trend of “dual synergy” of digitalization and greening, enterprises should make comprehensive changes in strategic management, organizational structure, human resources, infrastructure, etc., which is a process with high investment cost, long duration, significant uncertainty, and a high probability of change failure. Banks are relatively cautious when approving loans for enterprises, making it difficult to meet their capital needs. This means that enterprises facing financing constraints, due to capital pressure, will find it difficult to support the development of green innovation, which in turn affects the realization of the intermediary effect of green innovation.

Classical economics believes that environmental regulations increase the production costs of enterprises, which can squeeze out the capital that could have been used for R&D, thereby affecting the comprehensive competitiveness of enterprises (Gray, 1987), and this is manifested as the “cost of compliance effect”. Tu et al. (2019) found that the increase in pollutant discharge fees did not achieve the expected emission reduction effect, nor did it have a significant impact on the innovation output of enterprises, and the innovation compensation effect proposed in Porter’s hypothesis was not observed. Zhang and Lv (2018) also pointed out that green production regulations can inhibit the R&D and innovation of enterprises, and the strict implementation of green production regulations is one of the reasons why companies are not actively engaged in R&D and innovation. Therefore, this paper argues that the degree of environmental regulation is closely related to the mediating effect of green innovation, and enterprises with a high degree of environmental regulation may find it difficult to play the mediating role of green innovation.

To investigate the influence of the degree of environmental regulation on the mediating effect of green innovation, this paper employs the method proposed by Liu et al. (2023), and measures the degree of environmental regulation by the proportion of investment in pollution control of waste gas and waste water in the year in the region where the listed company is located to the proportion of the industrial output value of that year and takes the median of the degree of environmental regulation as the standard; then samples larger than the median are classified into the high environmental regulation group, and those smaller than the median are classified into the low environmental regulation group.

As shown in Table 9, in the low environmental regulation group, the coefficients of LnDIGITAL in Models 2 and 3 are 0.017 and 0.068, respectively. The product of the coefficient of LnDIGITAL in Model 2 (0.068) with the coefficient of LnGreTotal in Model 3 (0.019) is positive, and it has the same sign with the coefficient of LnDIGITAL in Model 3 (0.016). All the above coefficients are significant at the 1% level, indicating that green innovation plays a partial mediating role between digital transformation and audit fees. In the high environmental regulation group, the coefficient (0.004) of LnGreTotal in Model 6 is insignificant, suggesting that green innovation is difficult to play a mediating role between digital transformation and audit fees in this group.

The findings of this paper not only support the “cost of compliance effect” of environmental regulation but also validate the view of Zhang and Lv (2018) that enterprises facing environmental regulation pressure tend to use or purchase existing emission reduction technologies and meet the minimum technical standards set by the state to reduce enterprise costs. However, this inhibits the enthusiasm for enterprise green innovation and makes it difficult for environmental regulation to significantly improve the level of enterprise green innovation, thus affecting the mediating effect of green innovation.

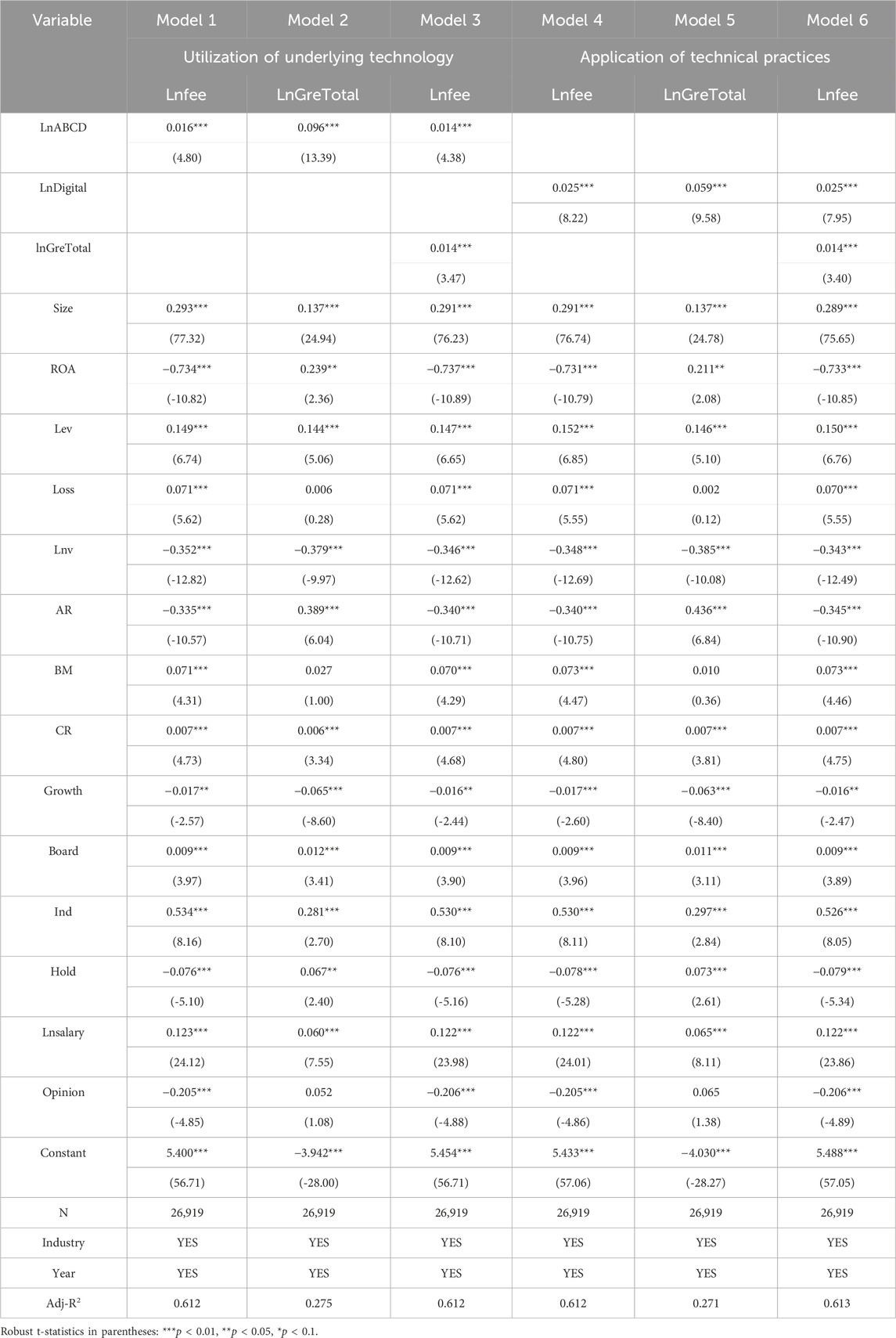

In the digital transformation process, enterprises will transform and update green innovation technology systems through the application of underlying technology for energy saving and emission reduction. Meanwhile, they will gradually expand from underlying technology to practical applications in market scenarios. The goal of enterprise digital transformation is to realize mature innovation outputs and applications in the capital market and focus on the integration of digital and green ecological technologies to promote the comprehensive green sustainable development of enterprises. Therefore, based on the research of Wu et al. (2021), this paper discusses digital transformation from two perspectives: utilization of underlying technology and application of technical practices. Specifically, utilization of underlying technology (LnABCD) mainly includes the thesaurus composed of core underlying technology architectures such as artificial intelligence, blockchain, cloud computing, and big data, while application of technical practices (LnDigital) refers to the thesaurus of digital technology application for digital transformation, see Appendix A for details.

As listed in Table 10, both the utilization of underlying technology and the application of technical practices can promote green innovation and affect audit fees. To be specific, the mediating effect of green innovation between the utilization of underlying technology and audit fees accounts for 8.4% of the total effect1, and the mediating effect of green innovation between the application of technical practices and audit fees accounts for 3.3% of the total effect2. It indicates that green innovations are more able to mediate between the utilization of underlying technology and audit fees than the application of technical practices.

Table 10. Regression of digital transformation: utilization of underlying technology vs. application of technical practices.

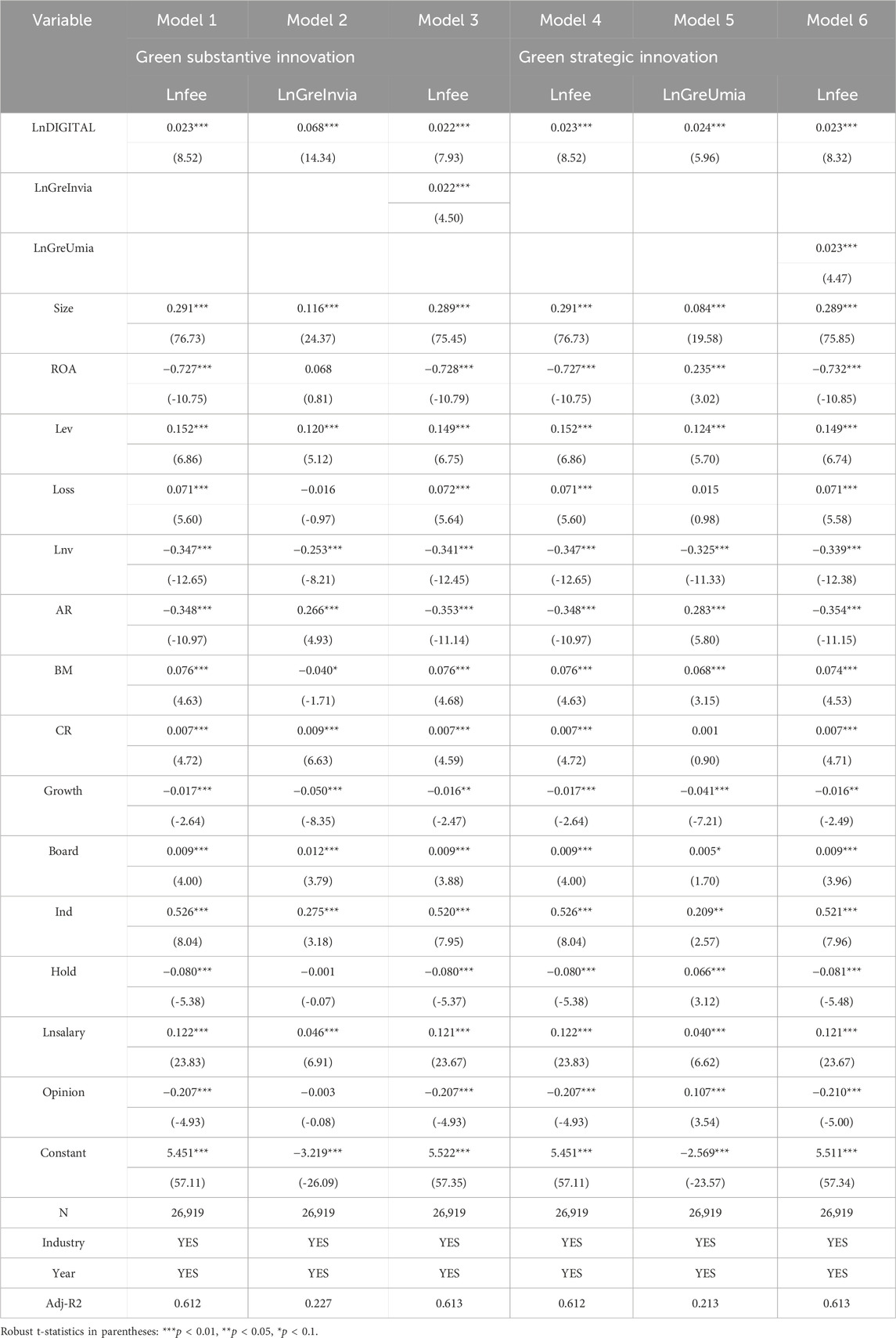

Existing research finds that there is a significant increase in patent applications by companies, but invention patents do not increase a lot, indicating the pursuit of “quantity” (strategic innovation) while ignoring “quality” (substantive innovation) (Li and Zheng, 2016). So, with the impact of digital transformation on audit fees, what types of green innovation behaviors are more important?

According to Li and Zheng (2016), green innovation is discussed in terms of green substantive innovation (which focuses on the quality of green innovation) and green strategic innovation (which focuses on the quantity of green innovation). The former is measured by the natural logarithm of the number of green invention patents applied for by enterprises plus one (LnGreInvia), while the latter is measured by the natural logarithm of the number of green utility model patents applied for by enterprises plus one (LnGreUmia).

The results are presented in Table 11. Both green substantive innovation and green strategic innovation can serve as intermediaries between digital transformation and audit fees. Specifically, the intermediary effect of green substantive innovation between digital transformation and audit fees accounts for 6.5% of the total effect3, while the intermediary effect of green strategic innovation between the two accounts for 2.4% of the total effect4. It demonstrates that green substantive innovations are more able to mediate between digital transformation and audit fees than green strategic innovations.

Table 11. Regression of green innovation: green substantive innovation vs. green strategic innovation.

This study investigates the impact of enterprise digital transformation on audit fees. Firstly, it is found that the digital transformation of enterprises increases audit fees and promotes green innovation significantly, and green innovation plays a partial mediating role between digital transformation and audit fees. Secondly, heterogeneity analysis indicates that green innovation plays a more obvious mediating role between digital transformation and audit fees with a low degree of financing constraints and environmental regulation. Thirdly, further investigation of digital transformation shows that green innovation plays a higher mediating role between the utilization of underlying technology and audit fees. Moreover, green substantive innovations play a higher mediating role between digital transformation and audit fees. These findings provide new insights into enterprise digital transformation and audit fees for listed companies and accounting firms in the Chinese stock market. Additionally, this study is also instructive for emerging market economies to properly deal with enterprise digital transformation.

Based on the above conclusions, this paper provides the following policy recommendations:

Firstly, accounting firms and auditors should actively address the audit risks brought about by the digital transformation of enterprises. Necessary measures should be taken to mitigate these risks. The digital transformation of enterprises increases the auditor’s audit cost and audit risk, which in turn significantly increases the audit fee. Therefore, when making pricing decisions for audits, it is important to fully consider the level of digital transformation within the enterprise to avoid the risk of material misstatement caused by such transformation. Meanwhile, the firm and auditor should improve their professional competence in digital auditing, develop novel methods and tools for digital auditing, formulate strategies for digital audit applications, create big data audit analysis platforms, and strengthen research and development of digital audit-related software. These measures will help to timely identify material misstatement risks that may occur during the client’s digital transformation and allow for the achievement of “economic police”.

Secondly, enterprises should accelerate the effective empowerment of digital transformation to promote green innovation and drive sustainable development. Also, enterprises should pay attention to the operational and financial risks associated with digital transformation and choose a digital strategy that is suitable for their development based on their actual situation. It is vital to minimize any negative impacts of digital transformation. Enterprises undergoing digital transformation should improve their level of environmental information disclosure to reduce internal and external information asymmetry. This will provide necessary support and guarantees for green innovation. Enterprises facing high financing constraints or environmental regulations should be more proactive in responding to the digital economy and activating the potential for synergistic development of digitalization and greening.

The limitations of this study are: (a) This study employs the annual report text analysis method to measure the digital transformation indicators of enterprises and discusses the relationship between digital transformation and audit fees. However, the time of digital transformation is not the same for different enterprises. An interesting and important question is whether there is a difference in the auditor’s pricing decisions of enterprises before and after digital transformation. (b) According to the foreign research literature and practical experience, the digitalization level of accounting firms may affect the auditor’s pricing decision, but due to the availability of relevant data, this study does not analyze this. (c) Because of the “double-edged sword” effect of enterprise digital transformation, the impact of enterprise digital transformation on the capital market may not be a simple linear relationship, future research will discuss the non-linear relationship to allow for a more comprehensive understanding of the complexity and diversity of digital transformation. Additionally, this paper only investigates the economic impact of enterprise digital transformation from the perspective of audit fees, then whether enterprise digital transformation will affect audit quality is also a selective topic of interest, and further discussion of the relationship between them helps to establish a complete research network.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

PL: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Validation, Writing–original draft. XZ: Formal Analysis, Funding acquisition, Investigation, Project administration, Resources, Supervision, Validation, Writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. We acknowledge the helpful comments from anonymous reviewers. XZ acknowledges the financial support from the National Social Science Foundation of China (23BMZ131). PL acknowledges the financial support from the General Program of Humanities and Social Sciences Research in colleges and universities of Henan province (2024-ZDJH-327), and Soft Science Research Program of Henan Province (242400412066). The usual caveats apply.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

18.4% = (0.096 × 0.014)/0.016% × 100%.

23.3% = (0.059 × 0.014)/0.025% × 100%.

36.5% = (0.068 × 0.022)/0.023% × 100%.

42.4% = (0.024 × 0.023)/0.023% × 100%.

Appelbaum, D., Kogan, A., and Vasarhelyi, M. A. (2017). Big data and analytics in the modern audit engagement: research needs. Auditing:A J. Pract. Theory 36 (4), 1–27. doi:10.2308/ajpt-51684

Bedard, J. C., and Johnstone, K. M. (2004). Earnings manipulation risk, corporate governance risk, and auditors’ planning and pricing decisions. Account. Rev. 79 (2), 277–304. doi:10.2308/accr.2004.79.2.277

Bell, T. B., Doogar, R., and Solomon, I. (2008). Audit labor usage and fees under business risk auditing. J. Account. Res. 46 (4), 729–760. doi:10.1111/j.1475-679X.2008.00291.x

Bell, T. B., Landsman, W. R., and Shackelford, D. A. (2001). Auditors’ perceived business risk and audit fees: analysis and evidence. J. Account. Res. 39 (1), 35–43. doi:10.1111/1475-679X.00002

Bible, L., Graham, L., and Rosman, A. (2005). The effect of electronic audit environments on performance. J. Account. Auditing Finance 20 (1), 27–42. doi:10.1177/0148558X0502000102

Brazel, J. F., and Agoglia, C. P. (2007). An examination of auditor planning judgements in a complex accounting information system environment. Contemp. Account. Res. 24 (4), 1059–1083. doi:10.1506/car.24.4.1

Brazel, J. F., and Dang, L. (2008). The effect of ERP system implementations on the management of earnings and earnings release dates. J. Inf. Syst. 22 (2), 1–21. doi:10.2308/jis.2008.22.2.1

Carcello, J. V., Hermanson, D. R., Neal, T. L., and Riley, R. A. (2002). Board characteristics and audit fees. Contemp. Account. Res. 19 (3), 365–384. doi:10.1506/CHWK-GMQ0-MLKE-K03V

Chen, X., Lee, C. W. J., and Li, J. (2008). Government assisted earnings management in China. J. Account. Public Policy 27 (3), 262–274. doi:10.1016/j.jaccpubpol.2008.02.005

Chen, Y. (2018). Blockchain tokens and the potential democratization of entrepreneurship and innovation. Bus. Horizons 61 (4), 567–575. doi:10.1016/j.bushor.2018.03.006

Chen, Y. H., Smith, A. L., Cao, J., and Xia, W. (2014). Information technology capability, internal control effectiveness, and audit fees and delays. J. Inf. Syst. 28 (2), 149–180. doi:10.2308/isys-50778

Cheng, J. C., Lu, C. C., and Kuo, N. T. (2016). R&D capitalization and audit fees: evidence from China. Adv. Account. 35, 39–48. doi:10.1016/j.adiac.2016.05.003

Cooper, R. G. (1981). The components of risk in new product development: Project New Prod. R&D Manag. 11 (2), 47–54. doi:10.1111/j.1467-9310.1981.tb00449.x

Danielsson, J., Macrae, R., and Uthemann, A. (2021). Artificial intelligence and systemic risk. J. Bank. finance 140, 106290. doi:10.1016/j.jbankfin.2021.106290

Dorantes, C. A., Li, C., Peters, G. F., and Richardson, V. J. (2013). The effect of enterprise systems implementation on the firm information environment. Contemp. Account. Res. 30 (4), 1427–1461. doi:10.1111/1911-3846.12001

Du, X., Lou, J., and Hu, H. Y. (2023). Peer effect of enterprise digital transformation in the network constructed by supply chain common-ownership. China Ind. Econ. 4, 136–155. doi:10.19581/j.cnki.ciejournal.2023.04.009

Farooqi, J., Harris, O., and Ngo, T. (2014). Corporate diversification, real activities manipulation, and firm value. J. Multinatl. Financial Manag. 27, 130–151. doi:10.1016/j.mulfin.2014.06.010

Gray, W. B. (1987). The cost of regulation: OSHA,EPA and the productivity slowdown. Am. Econ. Rev. 77 (5), 998–1006.

Han, S., Rezaee, Z., Xue, L., and Zhang, G. H. (2016). The association between information technology investments and audit risk. J. Inf. Syst. 30 (1), 93–116. doi:10.2308/isys-51317

Helfat, C. E., and Raubitschek, R. S. (2018). Dynamic and integrative capabilities for profiting from innovation in digital platform-based ecosystems. Res. Policy 47 (8), 1391–1399. doi:10.1016/j.respol.2018.01.019

Herbohn, K., Ragunathan, V., and Garsden, R. (2007). The horse has bolted: revisiting the market reaction to going concern modifications of audit reports. Account. Finance 47 (3), 473–493. doi:10.1111/j.1467-629X.2007.00216.x

Jones, D. A. (2007). Voluntary disclosure in R&D intensive industries. Contemp. Account. Res. 24 (2), 489–522. doi:10.1506/G3M3-2532-514H-1517

Lennox, C. (2005). Management ownership and audit firm size. Contemp. Account. Res. 22 (1), 205–227. doi:10.1506/K2CG-U6V0-NPTC-EQBK

Lennox, C. S., Francis, J. R., and Wang, Z. (2012). Selection models in accounting research. Account. Rev. 87 (2), 589–616. doi:10.2308/accr-10195

Li, C., Peters, G., Richardson, V. J., and Watson, M. W. (2012). The consequences of information technology control weaknesses on management information systems: the case of Sarbanes-Oxley internal control reports. MIS Q. 36 (1), 179–203. doi:10.2307/41410413

Li, J., Chen, L., Chen, Y., and He, J. W. (2022). Digital economy, technological innovation, and green economic efficiency:Empirical evidence from 277 cities in China. Manag. Decis. Econ. 43 (3), 616–629. doi:10.1002/mde.3406

Li, Q. Y., and Xiao, Z. H. (2020). Heterogeneous environmental regulation tools and green innovation incentives: evidence from green patents of listed companies. Econ. Res. J. 55 (9), 192–208.

Li, W. J., and Zheng, M. N. (2016). Is it substantive innovation or strategic innovation? Impact of macroeconomic policies on micro-enterprises’ innovation. Econ. Res. J. 51 (4), 60–73.

Ling, H., Xu, H. N., Li, P., and Wu, J. T. (2022). Can enterprise digital transformation curb audit risk? Sci. Decis. Mak. 10, 33–47.

Liu, C., Pan, H. F., Li, P., and Feng, Y. X.(2023).Impact and mechanism of digital transformation on the green innovation efficiency of manufacturing enterprises in China. China Soft Sci. 4,121–129.

Ma, Y. Q., Zhao, L. K., Yang, H. Y., and Tang, G. Q. (2021). Air pollution and corporate green innovation: based on the empirical evidence of A-share listed companies in heavy polluting industries. Industrial Econ. Res. 6, 116–128. doi:10.13269/j.cnki.ier.2021.06.009

Masli, A., Peters, G. F., Richardson, V. J., and Sanchez, J. M. (2010). Examining the potential benefits of internal control monitoring technology. Account. Rev. 85 (3), 1001–1034. doi:10.2308/accr.2010.85.3.1001

Morris, J. J., and Laksmana, I. (2010). Measuring the impact of enterprise resource planning (ERP) systems on earnings management. J. Emerg. Technol. Account. 7 (1), 47–71. doi:10.2308/jeta.2010.7.1.47

Pincus, M., Tian, F., Wellmeyer, P., and Xu, S. X. (2017). Do clients' enterprise systems affect audit quality and efficiency? Contemp. Account. Res. 34 (4), 1975–2021. doi:10.1111/1911-3846.12335

Porter, M. E., and Heppelmann, J. E. (2015). How smart, connected products are transforming companies. Harv. Bus. Rev. 93 (10), 96–114.

Qin, R. S. (2014). Research about influence of big data and cloud computing to audit. Auditing Res. 6, 23–28.

Ritter, T., and Pedersen, C. L. (2020). Digitization capability and the digitalization of business models in business-to-business firms:Past,present,and future. Ind. Mark. Manag. 86, 180–190. doi:10.1016/j.indmarman.2019.11.019

Simunic, D. A. (1980). The pricing of audit services:Theory and evidence. J. Account. Res. 18 (1), 161–190. doi:10.2307/2490397

Tan, Y., and Xia, F. (2011). Stock price and the investment of listed companies in China:The research from the integration of earnings management and investors’ sentiment. Account. Res. 8, 30–39+95.

Tu, Z. G., Zhou, T., Chen, R. J., and Gan, T. Q. (2019). Environmental regulatory reform and high-quality economic development: based on adjustments of pollution charge for industry. Res. Econ. Manag. 40 (12), 77–95. doi:10.13502/j.cnki.issn1000-7636.2019.12.007

Valdez-De-Leon, O. (2019). How to develop a digital ecosystem: a practical framework. Technol. Innov. Manag. Rev. 9 (8), 43–54. doi:10.22215/timreview/1260

Veselovsky, M. Y., Pogodina, T. V., Ilyukhina, R. V., Sigunova, T. A., and Kuzovleva, N. F. (2018). Financial and economic mechanisms of promoting innovative activity in the context of the digital economy formation. Entrepreneursh. Sustain. Issues 5 (3), 672–681. doi:10.9770/jesi.2018.5.3(19)

Wang, L. F., Wang, Y., and Hou, Q. C. (2019). Law, R&D “window dressing” and organizational efficiency. Nankai Bus. Rev. 22 (2), 128–141+185.

Wen, Z. L., and Ye, B. J. (2014). Analyses of mediating effects: the development of methods and models. Adv. Psychol. Sci. 22 (5), 731–745. doi:10.3724/sp.j.1042.2014.00731

Wu, F., Hu, H. Z., Lin, H. Y., and Ren, X. Y. (2021). Enterprise digital transformation and capital market performance:Empirical evidence from stock liquidity. J. Manag. World 37 (7), 130–144+10. doi:10.19744/j.cnki.11-1235/f.2021.0097

Wu, W. Q., Zhao, Y., and Su, Z. H. (2022). Corporate IT construction and audit fees:New evidence in the era of digitalization. Auditing Res. 1, 106–117.

Xu, J., and Cui, J. B. (2020). Low-carbon cities and firms’ green technological innovation. China Ind. Econ. 12, 178–196. doi:10.19581/j.cnki.ciejournal.2020.12.008

Xu, J. C., and Wang, M. (2017). Can enterprise innovation improve audit quality? Account. Res. 12, 80–86+97.

Yang, D. M., Xia, X. Y., Jin, S. Y., Lin, D. Y., and Ma, Q. (2020a). Big date,block chain and audit fees of listed companies. Auditing Res. 4, 68–79.

Yang, X. D., Wu, H., Ren, S., Ran, Q. Y., and Zhang, J. N. (2020b). Does the development of the internet contribute to air pollution control in China? Mechanism discussion and empirical test. Struct. Change Econ. Dyn. 56, 207–224. doi:10.1016/j.strueco.2020.12.001

Yao, Y. F., and Zhou, L. (2023). Could enterprise digitization influence key audit matters decision-making? Auditing Res. 1, 123–135.

Zhai, H. Y., and Li, Q. R. (2022). Does the digital transformation of enterprises improve audit quality?An empirical test of time-varying DID model. J. Audit Econ. 37 (2), 69–80.

Zhang, C. Y., and Lv, Y.(2018).Green production regulation and enterprise R&D innovation: impact and mechanism research.Bus. Manag. J. 40(1),71–91. doi:10.19616/j.cnki.bmj.2018.01.005

Zhang, Y., Cheng, Y., and She, G. M. (2018). Can government subsidy improve high-tech firms’ independent innovation? Evidence from Zhongguancun firm panel data. J. Financial Res. 10, 123–140.

Zhang, Z. N., Qian, X. Y., and Cao, X. W. (2023). Research on the green innovation effect of enterprise digital transformation: substantive innovation or strategic innovation? Industrial Econ. Res. 1, 86–100. doi:10.13269/j.cnki.ier.2023.01.003

Zhou, X. F., Han, L., and Xiao, X. (2022). The impact of digital economy on sustained green innovation of enterprises under the "Dual Carbon" goal: based on the mediation perspective of digital transformation. Secur. Mark. Her. 11, 2–12.

Referring to the study of Wu et al. (2021), a thesaurus of keywords for digital transformation is listed, except for the expressions with negative words such as “did not", “no”, “not”, etc. Before the keywords, which are found through full-text search in the management discussion and analysis section of annual financial reports or annual reports of listed companies.

Keywords: digital transformation, audit fees, green innovation, financing constraint, environmental regulation

Citation: Lou P and Zhou X (2024) Digital transformation, green innovation, and audit fees. Front. Environ. Sci. 12:1323282. doi: 10.3389/fenvs.2024.1323282

Received: 19 October 2023; Accepted: 22 April 2024;

Published: 15 May 2024.

Edited by:

Yantuan Yu, Guangdong University of Foreign Studies, ChinaCopyright © 2024 Lou and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaohui Zhou, emhvdXhpYW9odWlAeW5uaS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.