Corrigendum: Impact of carbon emission difference on the dual-channel fresh produce supply chain with capital constraints

- School of Management, Harbin University of Commerce, Harbin, China

The difference in carbon emissions has an important impact on the decision-making of dual-channel fresh produce supply chain financing. We set up a Stackelberg game model of a dual-channel supply chain under the financing strategy of banks and retailers to study the optimal operation decision and financing strategy selection. Our analysis results show that when the retailer’s interest rate and the carbon emission difference met certain conditions, the supplier always chooses the financing strategy of retailers.

1 Introduction

In recent years, with the rapid development of e-commerce and the rise of online shopping (Dominici et al., 2021), fresh enterprises have opened up direct online sales channels and formed a dual-channel model of fresh agricultural products that integrates online and offline (Wang et al., 2017; He et al., 2019). Suppliers wholesale products offline to retailers in the dual-channel model. Suppliers also plan to open new online sales channels (He et al., 2021). For example, COFCO, a well-known agricultural product supplier in China, opened stores on Taobao.com to sell agricultural products online while selling offline. Meicai, a fresh company in China, launched a small program called “Meicai Mall” to open a direct sales channel, adding 800,000 new users per week (Zheng F et al., 2021).

Cold chain logistics is a key link for fresh food suppliers. Fresh produce suppliers maintain agricultural products freshness by designing cold chain logistics networks (Dulebenets et al., 2016), adjusting vehicle scheduling schemes (Pan et al., 2021; Dulebenets and Ozguven, 2017; Theophilus et al., 2021; Zheng Q et al., 2021) and optimizing cold chain transportation routes (Qi and Hu., 2020). This leads to high cost of preservation of fresh produce (Yan et al., 2020).A lack of funds is not conducive to stable supplier development. For example, China’s leading fresh company, “Dai Luobo” officially declared bankruptcy in October 2021 because of a break in the capital chain during the operation of the supply chain.

Traditionally, fresh produce suppliers apply for loans from banks to relieve capital pressure, such as in the “China Shandong Shouguang Financing Model.” Suppliers apply for loans from banks based on retailers’ order contracts. Suppliers then use the bank’s loans to produce, preserve freshness, and deliver the order of agricultural products. This traditional bank financing strategy has problems such as a slow approval process and delayed arrival time. When suppliers are financially constrained, they may lead to the suppliers not be able to effectively guarantee supply and cause other members of the supply chain to suffer from order delay losses. Retailers, one of the supply chain members, provide financing support for capital-constrained suppliers to enhance the reliability of the supply chain (Zhen et al., 2020). For example, China’s JD.com Jingnongdai and Alibaba’s Wangnongdai. Under this financing strategy, retailers are not only responsible for the acquisition and sales of fresh product distribution channels but also provide financing services for suppliers in the early stages of agricultural production. It effectively solves the problems of difficult and expensive financing for fresh produce suppliers. However, retailers’ financing services may influence the operational decisions of a dual-channel fresh supply chain. The dual identities of retailers (participants in the direct sales channel and providers of financing services) add to the complexity of the decision-making process in a dual-channel fresh supply chain.

Due to the increasingly prominent global environmental problems, sustainable development has been widely accepted. Carbon dioxide emissions have been the primary source of extreme environmental pollution (Rehman et al., 2021). Environmental degradation is not conducive to sustainable economic development (Dagar et al., 2022). The Intergovernmental Panel on Climate Change (IPCC) of the United Nations has pointed out that the massive emissions of CO2 gases will cause a series of environmental and social problems. The implementation of climate change and low-carbon policies has increased consumers’ environmental awareness. They consider the environmental impact of products when purchasing them (Xie et al., 2021). Consumers prefer sustainable brands. They buy products based on their social and environmental impacts (Hamni et al., 2021; Ma et al., 2021). Selling products through distribution and online direct sales channels may generate different carbon emissions, which makes channels with lower carbon emissions more attractive to consumers with low carbon and environmental awareness. Carbon emissions dfference affect consumers’ channel selection behavior when purchasing a product. Thus, a question arises: Which financing strategy should a capital-constrained supplier choose, taking into account both the carbon emissions difference and the dual identity of the retailer?

We consider the impact of carbon emission differences and retailers’ dual identity on the financing strategies of capital-constrained suppliers, which can extend theoretical research on supply chain operation management. We investigated two interesting research questions.

(1) How do retailers’ dual roles influence the operational decisions of suppliers and retailers, taking into account carbon emissions difference?

(2) Which financing strategy is most suitable for suppliers?

In order to solve the above problems, we studied the operation strategy of the dual-channel fresh agricultural product supply chain. Stackelberg games are used to solve the problems. As the leader of the Stackelberg game, the supplier decides the fresh-keeping effort, wholesale price, and sales price of the direct sales channel, while the retailer, as a follower, decides the sales price of the distribution channel. First, we study the optimal decision of the supply chain under bank financing and retailer financing. Secondly, we discuss the influence of important parameters on supply chain decision-making and profit. Finally, we compare the optimal decision and profit under the two financing modes.

Specifically, we have contributed to current knowledge in several directions. First of all, compared with the previous single-channel research, we studied the dual-channel supply chain, which is more in line with the changes in the supply chain under the background of Internet development. Secondly, unlike previous studies that only considered the financial constraints on suppliers, we considered the impact of carbon emissions differences on supply chain decision-making. Finally, this paper constructs a supplier-led Stackelberg game model and discusses the impact of carbon emissions differences on the optimal decision-making of the supply chain under different financing modes. This model broadens the research ideas of dual-channel supply chains in the context of supply chain finance and enriches relevant research theories.In the next section, we review the literature on carbon emission differences, dual-channel supply chains for fresh produce, and supply chain finance. Section 3 describes the theoretical model. In Section 4, we explore a situation in which suppliers are not financially constrained. Section 5 discusses equilibrium decisions under bank and retailer financing strategies. We compare the financing strategies in Section 6. We introduce sensitivity analysis in Section 7. Section 8 summarizes the findings of this study.

2 Literature review

We review the literature in three areas: carbon emission differences, dual-channel fresh produce supply chains, and supply chain finance. Although our work involves a large number of relevant studies published over the past years, few have explored the effect of carbon emission differences on the dual-channel fresh produce supply chain’s operational decisions when the supplier is financially constrained. Most research has focused on issues beyond the retailer’s financing role in dual-channel supply chains.

2.1 Carbon emissions difference

In recent years, scholars have paid attention to the combination of carbon emissions and supply chain. The low carbon preference of consumers will affect market demand (Sun et al., 2020; Liu J et al., 2021), thereby making the impact of carbon emissions on supplier decision-making more significant.Some scholars studied the channel selection strategy of the dual channel supply chain considering carbon emissions (Yang et al., 2018; Ghosh et al., 2020), the optimal decision-making problem of the supply chain under the influence of carbon emissions (Qi et al., 2018; Cao et al., 2020; Yan et al., 2021) and the supply chain coordination problem under the influence of carbon emissions (Wang C et al., 2020; Wang Z et al., 2020; Hosseini-Motlagh et al., 2021). In addition to these conventional decision-making factors, Aljazzar et al. (2018) included carbon emission costs in the decisions of supplier members to improve the environment and profits of the supply chain. Jiang et al. (2022) studied the optimal decision of supply chain members by considering both channel preference and low carbon sensitivity of consumers. These papers mainly regard carbon emissions as cost constraints or influencing factors, but do not consider the carbon emissions difference between channels. The research of Che et al. (2021) shows that the demand and profit of online and offline channels are related to carbon emissions. Shahmohamma et al. (2020) believed that compared with traditional offline sales channels, online sales channels have less carbon emissions and are more conducive to the environment.

The above scholars explained that carbon emissions will affect the optimal strategy of the dual channel supply chain, and there will be carbon emissions difference between the two channels. However, scholars have not conducted in-depth research on the impact of channel carbon emissions differences on supply chain decision-making.

2.2 Dual-channel fresh produce supply chain

In recent years, the dual-channel supply chain of fresh agricultural products has attracted extensive attention in marketing and operation management literature. Relevant researches mainly focus on channel selection, pricing decision, coordination, and optimization. Zheng F et al. (2021) studied the optimal channel selection strategy considering the preservation efforts of supply chain members. Liu et al. (2018) and others built a dynamic game model of a fresh agricultural product dual-channel supply chain considering consumer preferences and studied the impact of variables on agricultural product supply decisions. Perlman et al. (2019) analyzed a dual-channel supply chain consisting of two suppliers providing heterogeneous agricultural products and studied the price decision problem under market competition. Song et al. (2018) and Zhang and Ma. (2021) found that consumers’ high sensitivity to freshness can improve the decision-making of the supply chain’s freshness preservation efforts, thereby improving the supply chain’s profits.

Yan et al. (2021) studied the optimal pricing strategy and profit of supply chain members under dual channels, taking into account the impact of freshness preservation level on perishable products and suppliers’ online channel operating costs. Zheng et al. (2022) show that the price discount contract can well coordinate the profits of the dual channel supply chain of fresh agricultural products in the case of quantity loss. And the corresponding optimal discount rate channel price sensitivity coefficient is related.

The above research mainly discusses the channel selection, optimal decision-making, and supply chain coordination of dual-channel supply chain under the influence of freshness preservation characteristics. However, few studies have explored how the business decisions and optimal profits of the members of the dual-channel fresh product supply chain change under the influence of financial constraints.

2.3 Supply chain financing

Effective financial instruments have a strong and positive impact on economic growth (Shahzad et al., 2022) and can reduce unsustainable practices that improve environmental quality (zhang, 2022).Supply chain finance relies on the advantages of the Internet to effectively alleviate the financial constraints in the operation of the main body. Related research on supply chain finance mainly focuses on the external and internal financing modes of the supply chain. The external financing model refers to the provision of financing services by third-party financial institutions (e.g., commercial banks) to supply chain members with capital constraints. Under the external financing model, bankruptcy risks and default costs affect bank loan prices and the main decision-making of the supply chain (Kouvelis and Zhao, 2011; Yang et al., 2017; Kang et al., 2021). Luo et al. (2016) believe that financing risk can be effectively reduced through a risk guarantee mechanism. Banks have an optimal risk-guarantee ratio. Kouvelis and Zhao (2016) compare and analyze supply chain coordination contracts when banks provide loans with competitive prices and explain the applicable conditions of repurchase contracts, quantity discount contracts, and revenue-sharing contracts. This promotes the efficiency of capital constrained supply chains.

The internal financing mode of the supply chain means that when suppliers are constrained by funds, it affects the sales revenue of other members of the supply chain. Thus, other members are willing to provide financial support to their suppliers. Supply chain internal financing has greater flexibility in supply chain contract terms (Tang et al., 2018), facilitates suppliers to increase production (Gupta and Chen, 2020), and significantly improves farmers’ welfare and overall supply chain profits (Yi et al., 2021). Furthermore, Jiang and Liu. (2022) focused on the impact of credit scores on decision-making under different financing modes when comparing bank financing and intra-supply chain trade credit. The above studies have carried out relevant research on equilibrium decision-making under external and internal financing of the supply chain, and a comparative analysis under different financing modes. Studies indicate that different financing methods under capital constraints affect equilibrium decision making. However, it focuses on the financial constraints of supply chain members under a single channel, and does not consider the demand for fresh agricultural products.

Through literature review, it can be found that scholars have conducted a lot of research on carbon emission differences, dual channel fresh agricultural product supply chain, and supply chain financing. However, few studies have considered the impact of carbon emission differences on the decision-making of the dual-channel supply chain of capital-constrained fresh agricultural products. Therefore, based on the above research and practice background, in the low carbon economy environment, this paper comprehensively considered the carbon emissions difference and the fact that suppliers are financial constraints, built a dual-channel supply chain decision-making model, and analyzed the optimal decision-making and financing strategies among supply chain members.carbon emissions difference.

3 Model description

A two-stage dual-channel supply chain consisting of a single supplier and a single retailer is considered. The Stackelberg game is formed between the supplier and the retailer (Zhang et al., 2022). The supplier is the leader of the game, and the retailer is the follower of the game. In the first stage of the game, the supplier decides the fresh-keeping efforts of fresh agricultural products, the wholesale price of agricultural products in the distribution channel, and the sales price of agricultural products in the direct channel. In the second stage, the retailer decides the selling price of agricultural products in the distribution channel according to the supplier’s decision. In this dual-channel supply chain, the supplier is financially constrained and the retailer is financially sufficient. In fact, the supplier can relieve financial pressure in the following two ways:Bank financing strategy: The supplier provides loans to banks prior to production. After the end of the sales period, the principal and interest of the bank loan are repaid.

Retailer financing strategy: The supplier signs a distribution channel acquisition contract with the retailer before production, and applies to the retailer for financing based on the acquisition order. The principal and interest of the retailer’s loan are repaid after the end of the agricultural product sales period.

The difference between the two financing strategies is that the retailer sells agricultural products through distribution channels and provides financing services to the supplier under the retailer financing strategy. The retailer’s financing parameters directly affect its decision-making and profits.

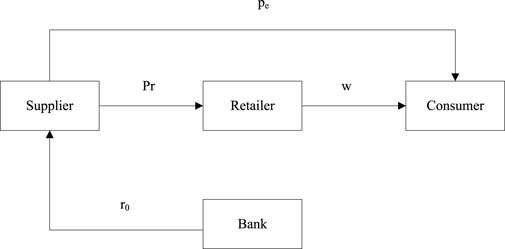

The supply chain operational processes of the two financing strategies are shown in Figure 1 and Figure 2.

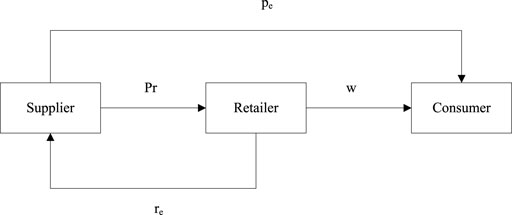

The decision-making of the supplier and retailer is analyzed based on the Stackelberg game. The model is shown in Figure 3: First, the retailer decides whether to provide financing services for the supplier. The retailer’s interest rate is

In practice, fresh produce suppliers usually apply relevant fresh-keeping technologies to ensure the freshness of products and increase consumer demand. Let the freshness expression of fresh products be.

This paper mainly studies the impact of carbon emission difference on the supplier and the retailer. Therefore, it is considered that the carbon emissions of products sold through distribution channels and online direct sales channels are the same in the production process, so the standardization is 0 (Wan et al., 2019), only the carbon emissions generated during the transportation process of each channel are considered.Let the unit carbon emission difference between distribution channels and online direct sales channels be

Where

4 Bechmark without captional constraint

In this section, we analyze the equilibrium decision in the absence of financial constraints. The supplier sells fresh produce through both the direct online and traditional distribution channels. In the traditional distribution channel, the supplier will wholesale the agricultural product to the retailer at price

Lemma 1. Without capital constraints, the optimal decisions of the supplier and retailer are:

The optimal profits of the supplier and retailer are

Proposition 1.Without capital constraints,

Proposition 1 shows that when the supplier is not capital constrained, the decision making of the supplier and retailer should consider the carbon emissions difference between the distribution and online direct sales channels. The greater the difference in unit carbon emissions, the higher is the carbon cost per unit of products sold. Therefore, the supplier increases the wholesale price of the distribution channels and the sales price of the direct sales channels. This affects the retailer’s distribution channel’s sales price decision. When both the sales price under the distribution channel and the online direct sales channel are rising, the supplier will increase fresh-keeping efforts to attract consumers to buy; otherwise, it will reduce market demand.

Proposition 2.Without capital constraints,

Proposition 2 indicates that when the supplier is not capital constrained, the decisions of the supplier and retailer are not only affected by the carbon emissions difference between the distribution and online direct sales channels, but also by consumers’ environmental awareness. When other parameters are given, the higher the environmental awareness of consumers, the greater is the impact on the demand for fresh products in distribution channels. To attract consumers, the retailer lowers the selling price in the distribution channels. Because of channel competition, in which retailers lower the selling price in the distribution channel, the supplier also chooses to lower the selling price in the direct sales channel. At the same time, to achieve the goal of reducing costs and increasing profits, the supplier will reduce fresh-keeping efforts and increase the wholesale prices of the distribution channels.

Therefore, suppliers and retailers should adjust their decisions appropriately in response to carbon emissions difference and consumers’ environmental awareness. Existing studies have found that the decision making of the supplier and retailer is influenced by cost, consumer channel preference, and shipping time (Zi et al., 2021; Yadav et al., 2021; Lejarza et al., 2021). This study further finds that the decision making of the supplier and retailer is also affected by factors such as carbon emissions differences and consumers’ environmental awareness.

5 Financing with bank or retailer

This section analyzes the equilibrium decision-making of the capital-constrained dual-channel fresh produce supply chain under the bank financing and retailer financing strategies.

5.1 Bank financing Strategy (BF)

Under the BF, the supplier applies for a loan from the bank at the interest rate

Lemma 2.Under the BF, the optimal decisions of the supplier and retailer are:

Proposition 3. When the supplier is capital constrained, under the BF,

Proposition 3 shows that, similar to the situation without capital constraints, the higher the carbon emission difference between the distribution channel and the online direct sales channel, the higher the optimal decision of the supplier and retailer under the BF.

Proposition 4. When the supplier is capital constrained, under the BF, with an increase in consumers’ environmental awareness,

Proposition 4 shows that, similar to the situation without capital constraints, an increase in consumers’ environmental awareness leads to a decrease in the sales volume of the distribution channel under the BF. The retailer reduces the distribution channel’s sales price to attract consumers. In contrast to the situation without capital constraints, with an increase in consumers’ environmental awareness, the supplier will increase the price of online direct sales under the BF. The supplier increases fresh-keeping efforts and reduces wholesale prices to meet consumer preferences and maintain the stability of the dual-channel supply chain.

5.2 Retailer financing Strategy

Under the RF, the retailer’s income structure has changed, mainly including the income from the sale of agricultural products through the distribution channel, the income shared by the direct sales channel, and the income from financing.

Lemma 3.Under the retailer financing model, the equilibrium decisions of the supplier and retailer are

6 Financing strategy preference analysis

In the previous section, we analyzed equilibrium decision making and optimal profit under different financing strategies. When considering the carbon emission difference of the channel, it is still a challenge to analyze and compare the optimal profit function and obtain the financing preferences of the supplier and retailer. Therefore, we apply a numerical analysis to obtain optimal financing strategies. In order to simplify the calculation and refer to related research on dual-channel supply chain (Chiang et al., 2003), the parameters are set as follows:

We define the profit difference as

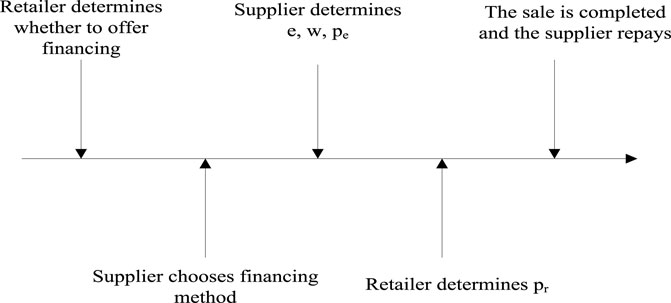

Figures 4A–C show the impact of the retailer’s interest rate, carbon emission difference, and consumer environmental awareness, respectively, on the financing strategy of the capital-constrained dual-channel fresh produce supply chain.

FIGURE 4. (A). Impact of retailer’s interest rates on financing strategies (B). Impact of carbon emission difference on financing strategies (C). Impact of consumers’ environmental awareness on financing strategies.

Figure 4A shows the effect of a retailer’s interest rate on the financing strategy. When

Figure 4A also shows that when

Figure 4B shows the effect of carbon emission differences on financing strategies

Figure 4B also shows that when

Figure 4C shows the impact of consumer environmental awareness on the financing strategies. Let

7 Sensitivity analysis

Next, we analyze the impact of some major parameters on the decision making and profit of the dual-channel fresh produce supply chain.

7.1 Impact of Retailer’s interest rates on decision-making and profits

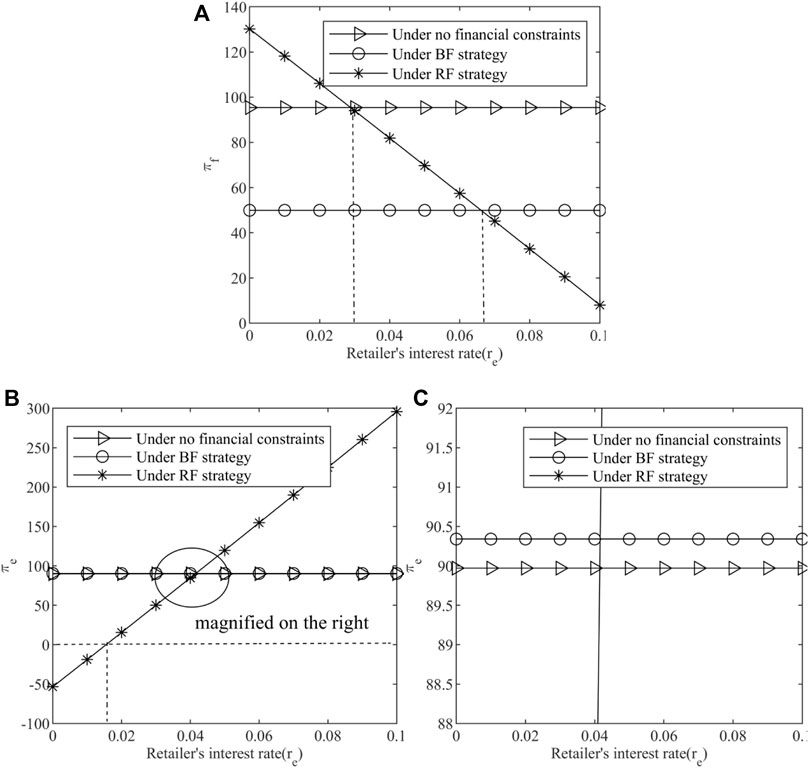

Figure 5 shows the impact of the retailer’s interest rate on the supplier’s and the retailer’s profits. As the retailer’s interest rate increases, the supplier’s profit decreases, and the retailer’s profit increases. This is reasonable. Suppose the retailer raises interest rates, and the supplier’s overall cost increases, which ultimately reduces the supplier’s profits. On the other hand, the retailer boosts loan profits through higher interest rates, further boosting the retailer’s overall earnings.

FIGURE 5. (A) Impact of retailer’s interest rate on supplier’s profit (B,C) Impact of retailer’s interest rate on retailer’s profit.

Figure 5A also reveals that the profit of the supplier under the BF is lower than that without the capital constraint. When the retailer’s interest rate is lower than a certain threshold, the profit of the supplier under the RF is not only higher than that under the BF but also higher than that without capital constraints. Therefore, the supplier pays special attention to the retailer’s interest rate in the early stages of production. Only when the retailer’s interest rate is lower than a certain value, the supplier will obtain high returns by choosing the retailer’s financing strategy, otherwise, it will choose the BF.

Figures 5B, C also show that the profit of the retailer under rhe BF is always higher than that without capital constraint, but the difference is small. That is when the supplier selects the BF, the retailer is not exposed to financing risks. At this time, the profit of the retailer increases. If the retailer sets a higher interest rate, the profit of the retailer under the RF conditions will be higher than that under the BF conditions and will be higher than that without capital constraints. Therefore, the retailer is willing to provide financing to suppliers only when they accept higher interest rates. Besides, even if the retailer does not provide financing for suppliers, they tend to cooperate with suppliers with limited financial resources.

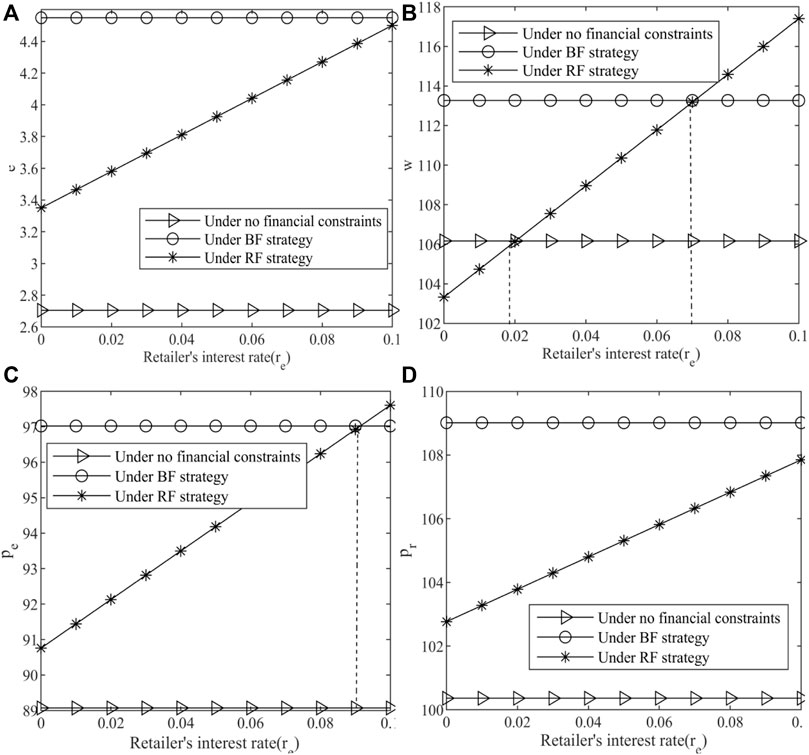

Figure 6 shows the impact of the retailer’s interest rate on the optimal decision.

FIGURE 6. (A) Impact of retailer’s interest rate on fresh-keeping efforts (B) Impact of retailer’s interest rate on wholesale price decisions in distribution channels. (C) Impact of retailer’s interest rate on selling prices in the direct sales channel (D) Impact of retailer’s interest rate on the selling price in the distribution channel.

Figure 6A shows the impact of the retailer’s interest rate on fresh-keeping efforts. It can be seen that: 1) The fresh-keeping efforts under the RF and the BF are higher than those without capital constraints. This shows that even if the cost increases owing to capital constraints, the supplier will still increase its fresh-keeping efforts. 2) With an increase in the retailer’s interest rate, the decision-making of the supplier’s fresh-keeping efforts under the RF increases. If the retailer sets a higher interest rate, the decision-making of the fresh-keeping effort under the RF will be higher than that under the BF. That is to say, even if the cost of the supplier increases, the supplier will also improve the preservation efforts. Reducing the cost by reducing the preservation work will damage the supplier’s income.

Figure 6B depicts the effect of the retailer interest rate on wholesale price decisions in distribution channels. It can be seen that: 1) The wholesale prices of the supplier under the RF are always higher than those without capital constraints. 2) If the retailer sets a lower interest rate, the wholesale price of the supplier under the RF is lower than that without capital constraints. 3) With an increase in the retailer’s interest rate, the wholesale price of the supplier increases, and only when the retailer sets a higher interest rate will the wholesale prices of the supplier under the RF be higher than that under the BF. In practice, the retailer provides the supplier with financing services at a lower interest rate, which effectively solves the supplier’s capital constraints problem. Simultaneously, the RF can improve the retailer’s negotiation ability on wholesale price contracts and wholesale fresh agricultural products from the supplier at lower prices, thereby reducing costs and increasing efficiency.

Figure 6C depicts the effect of the retailer’s interest rate on selling prices in the direct sales channel. It can be seen that: (1) In the direct sales channel, the sales price of the supplier under the RF and the BF is always higher than that without capital constraints (2) As the retailer’s interest rate increases, the direct sales channel’s sales price increases. If the retailer sets a higher interest rate, the sales price of the direct sales channel under the RF is higher than that under the BF, which indicates that capital constraint causes the supplier’s cost to increase. Therefore, regardless of the choice of retailer financing strategy or bank financing strategy, the supplier will appropriately increase the sales price of the direct sales channels. In practice, an increase in financing costs leads the supplier to pass on costs to consumers by raising selling prices.

Figure 6D depicts the effect of the retailer’s interest rate on the selling price in the distribution channel. It can be seen that: (1) The sales price of the distribution channel under the RF and the BF is always higher than that without capital constraints. (2) As the retailer’s interest rate increases, the sales price of the distribution channel increases, and the price under the RF is always lower than that under the BF. This is because the retailer obtains financing benefits while providing financing services to the supplier. Therefore, retailers are willing to reduce sales prices appropriately to improve market competitiveness.

7.2 Impact of crbon emissions difference on decision-making and profits

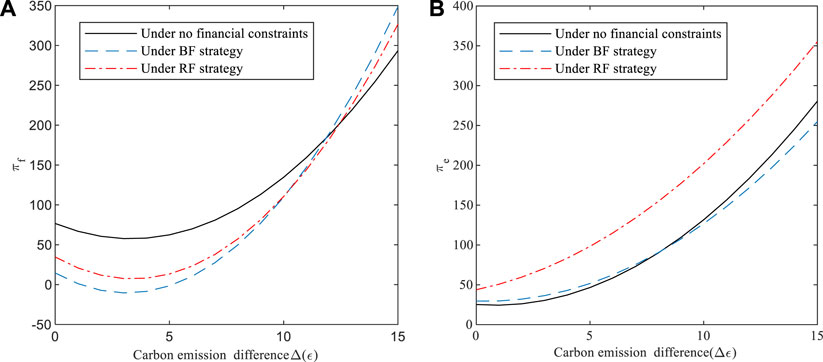

Figure 7 depict the impavt of the carbon emission difference on the profits of the supplier and retailer. With an increase in the carbon emission difference, the profits of both the supplier and retailer first decrease and then increase.

FIGURE 7. (A) Impact of carbon emission differences on the supplier’s profit (B) Impact of carbon emission difference on the retailer’s profit.

Figure 7A depicts the effect of carbon emission differences on the supplier’s profit. With the increase of carbon emission difference between channels, the profits of suppliers first decreased and then increased. When the carbon emissions difference is small, the supplier’s profit under the RF is higher than that under the BF, and both are lower than that without capital constraints. When the carbon emission difference is greater than a certain value, the profit of the supplier under the BF is higher than that under the RF, and the profit of the supplier under the BF and the RF is higher than that without financial constraints. This shows that when the carbon emissions difference between channels is higher than a certain threshold, financial constraints will enable suppliers to obtain higher profits.Figure 7B depicts the impact of the carbon emission difference on the retailer’s profit. With the increase in carbon emission difference between channels, retailers’ profits increase. The profit of retailers under the RF is always higher than that under the BF and under no financial constraints. This is because consumers’ awareness of environmental protection and the increase of carbon emissions in distribution channels will increase consumers’ demand for direct marketing channels, thus increasing the profits that retailers obtain through financing. When the carbon emissions difference between channels is small, the profit of retailers under the BF is lower than that without capital constraints. When the carbon emissions difference between channels is higher than a certain threshold, the profit of retailers under the BF is higher than that without capital constraints. This shows that the greater the difference in carbon emissions, the stronger the willingness of retailers to provide financing services for suppliers. When the difference in carbon emissions is low, retailers tend to cooperate with suppliers with financial constraints.

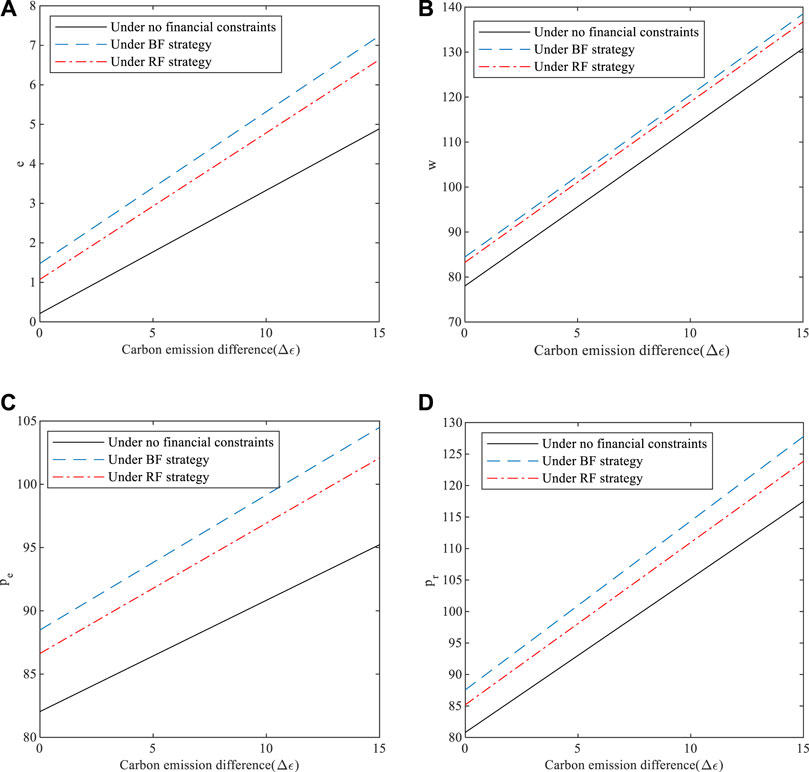

Figure 8 shows the impact of carbon emission difference on optimal decision-making.

FIGURE 8. (A) Impact of carbon emission differences on fresh-keeping efforts (B) Impact of carbon emission difference on wholesale prices by the distribution channel (C) Impact of carbon emission difference on the direct sales channel sales price (D) Impact of carbon emission differences on the distribution channel sales prices.

Figure 8A depicts the effect of carbon emission differences on fresh-keeping efforts. It can be seen that: (1) As

Figure 8B depicts the effect of the carbon emission difference on wholesale prices by the distribution channel. It shows that: (1) With the increase in

Figure 8C depicts the effect of carbon emission difference on the direct sales channel sales price. It reveals that: (1) With the increase in

Figure 8D depicts the effect of carbon emission differences on the distribution channel sales prices. (1) With the increase in

7.3 Impact of consumers’ environmental awareness on decision-making and profits

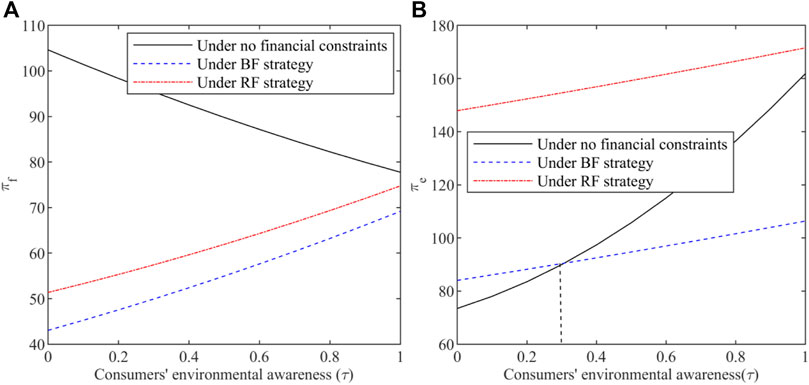

Figure 9 shows the impact of consumers’ environmental awareness on suppliers’ and retailers’ profits. Whether the supplier is financially constrained changes the trend of the impact of consumer environmental awareness on the profits of the supplier and the retailer.

FIGURE 9. (A) Impact of consumers’ environmental awareness on supplier’s profit (B) Impact of consumers’ environmental awareness on retailer’s profit.

Figure 9A shows the impact of consumers’ environmental awareness on suppliers’ profits. In the case of no financial constraints, the supplier’s profit declines with an increase in the consumers’ environmental awareness. The profit of the supplier under the RF and the BF increases with an increase in consumers’ environmental awareness. The profit of the supplier under the RF is always higher than that under the BF. This shows that no matter how consumers’ environmental awareness changes, financial constraints always reduce suppliers’ profits. The higher the consumer’s awareness of environmental protection, the more beneficial to the suppliers with financial constraints.

Figure 9B shows the impact of consumers’ environmental awareness on the retailer’s profit. With an increase in consumers’ environmental awareness, the retailer’s profit increases under the RF, bank financing strategy, and without capital constraints. The retailer’s profit under the RF is always higher than that under the BF without capital constraints. When consumers’ environmental awareness is low, the retailer’s profit under the bank financing strategy is higher than that without capital constraints. This shows that no matter how consumers’ environmental awareness changes, the RF strategy is always beneficial to retailers. When consumers have low awareness of environmental protection, retailers tend to cooperate with suppliers with financial constraints.

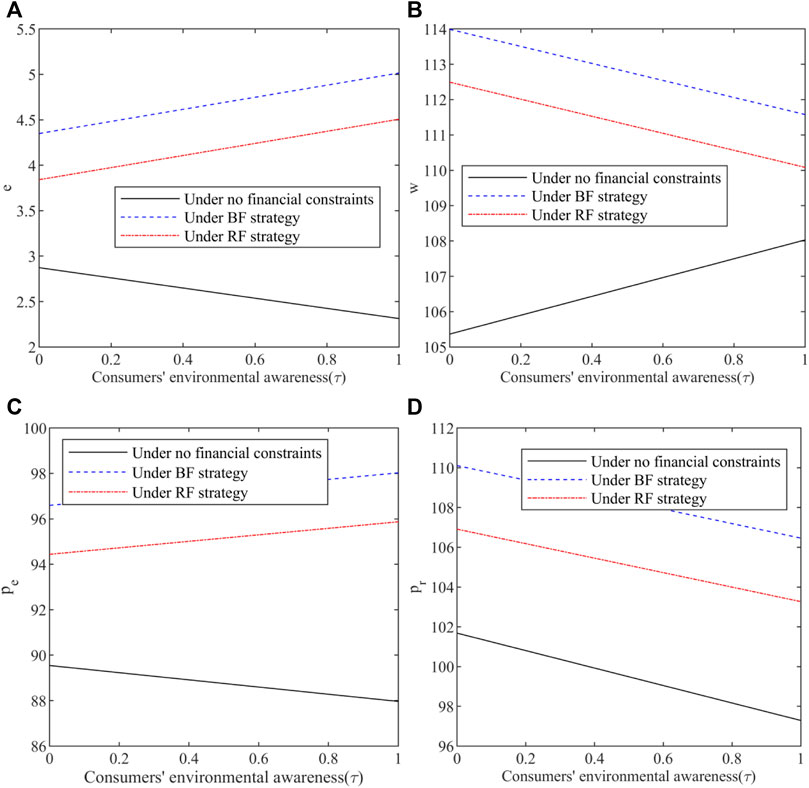

Figure 10 shows the impact of consumers’ environmental awareness on on optimal decision-making.

FIGURE 10. (A) Impact of consumers’ environmental awareness on fresh-keeping efforts (B) Impact of consumers’ environmental awareness on wholesale prices in the distribution channels. (C) Impact of consumers’ environmental awareness on sales prices in the direct sales channels (D) Impact of consumer environmental awareness on sales prices in the distribution channels.

Figure 10A the impact of consumers’ environmental awareness on fresh-keeping efforts. It can be seen that: (1) The fresh-keeping efforts without capital constraints decrease with the increase in consumers’ environmental awareness, but are always higher than those under the RF and the BF. (2) The fresh-keeping efforts under the RF and the BF increase with an increase in consumers’ environmental awareness. The fresh-keeping efforts under the BF were always higher than those under the RF. This is because, without financial constraints, consumers’ awareness of environmental protection has increased, the demand for distribution channels has decreased, and suppliers reduced costs by reducing fresh-keeping efforts to maintain revenue. Under financial constraints, when the demand is reduced due to the environmental awareness of consumers, the financing cost of suppliers is reduced, which will encourage suppliers to increase their freshness preservation efforts to improve the sale.

Figure 10B depicts the effect of consumers’ environmental awareness on wholesale prices in the distribution channels. (1) The distribution channel wholesale prices without capital constraints increase with an increase in consumers’ environmental awareness, and it is always lower than the distribution channel wholesale prices under the RF and bank financing strategies. (2) The distribution channel wholesale prices under the RF and the BF decrease with an increase in consumers’ environmental awareness. The wholesale prices of the distribution channel under the BF were always higher than those under the RF. This is because without financial constraints, with the increase in consumers’ awareness of environmental protection, suppliers maintain their profits by raising wholesale prices. Under financial constraints, the financing cost of suppliers decreases, which will encourage suppliers to reduce wholesale prices to increase sales.

Figure 10C depicts the effect of consumers’ environmental awareness on sales prices in the direct sales channels. It reveals that: (1) The direct channel sales price without capital constraints decreases with an increase in consumers’ environmental awareness, but it is always lower than that under the RF and the BF. (2) The direct channel sales prices under the RF and the BF increase with an increase in consumers’ environmental awareness. The direct channel sales price under the BF is always higher than under the RF. This is because, without financial constraints, consumers’ awareness of environmental protection has reduced the sales price of distribution channels. At this point, suppliers need to reduce the sales price of direct sales channels to improve the competitiveness of sales channels. In the case of financial constraints, the cost increases due to the increased efforts of suppliers to keep fresh. In order to improve revenue, suppliers should increase the sales price of direct sales channels.

Figure 10D depicts the effect of consumer environmental awareness on sales prices in the distribution channels. It can be seen that: (1) The distribution channel sales price under the RF, BF, and without capital constraints decreases with an increase in consumer environmental awareness. (2) The distribution channel sales prices under the RF and the BF are higher than those without capital constraints. The distribution channel sales price under the BF is always higher than that under the RF. This is because no matter whether the supplier is financially constrained or not, the increase in consumers’ awareness of environmental protection will drive retailers to reduce the sales price of distribution channels to improve their competitiveness.

8 Conclusion

Many studies have been conducted on carbon emission reduction, supply chain finance, and the dual-channel fresh produce supply chain. However, few studies have explored the interaction between carbon emission differences, financial constraints, and dual-channel fresh produce supply chain operations. In addition, the retailer, as a participant in traditional distribution channels, directly influences the supply chain’s operational decisions by providing loan services to the supplier. The difference in carbon emissions indirectly affects the operational decisions of the supply chain by affecting the purchasing intentions of environmentally conscious consumers. Therefore, this study investigates suppliers’ financing strategy preferences and analyzes how retailers’ interest rates, carbon emissions differences, and consumers’ environmental awareness affect operational decisions in dual-channel fresh food supply chains.

8.1 Theroretical results

In order to solve the optimal decision-making problem and optimal financing strategy problem of suppliers and retailers when considering carbon emission differences, we established dual-channel supply chain models under the BF and the RF based on practical examples. Our theoretical analysis shows that only when the retailer’s interest rate and the carbon emission difference are within a certain range, the RF will enable the supplier and the retailer to obtain a “win-win.” In other words, the retailer is willing to provide financing services to the capital-constrained supplier. The supplier is more inclined to choose the RF than the BF when faced with two financing strategies. Consumers’ environmental awareness will only affect the supplier and retailer’s operational decisions and not the supplier’s financing selection strategy. This insight can guide capital-constrained suppliers in choosing financing mechanisms in a dual-channel fresh supply chain.

In addition, this study shows that, When the retailer’s interest rate and carbon emissions difference increase, the supplier should increase the direct channel sales price decision, the distribution channel wholesale price decision, and the fresh-keeping effort decision, and the retailer should increase the distribution channel sales price. Under financial constraints, when consumers’ awareness of environmental protection increases, suppliers should increase the decision on sales price and preservation efforts of direct sales channels, and reduce the decision on the wholesale price of distribution channels, which is contrary to the situation without financial constraints. Retailers should reduce the sales price decision of distribution channels, which is the same as the situation without financial constraints. This shows that suppliers’ financing behavior, carbon emission differences, and consumers’ environmental awareness have a significant impact on suppliers’ and retailers’ decision-making.Our study is similar to that of Shi et al. (2021), but with some improvements, (Shi et al., 2021), studied the choice of financing between bank credit and trade credit for retailers with limited funds. Liu M et al. (2021) studied the impact of factors such as overconfidence on decision-making in a capital-constrained supply chain. Gu et al. (2021) considered the financing choice strategy when a financially constrained manufacturer and competitor played a game at the same time. None of the above scholars have considered the carbon emissions difference between channels and consumers’ environmental awareness. This study considers carbon emission differences and consumers’ environmental awareness when building the model and analyzes the impact of these factors on the optimal decision-making and financing selection strategies of supply chain participants. Our theoretical results are more conducive to promoting the sustainable development of agricultural supply chains in a low-carbon economic environment.

8.2 Management insights

Based on the above results, we provide the following management insights.

First, when the supplier chooses financing strategies, he or she should not only pay attention to interest rates but also to the difference in carbon emissions between channels. When the retailer’s interest rate is within an acceptable range, if the carbon emission of the distribution channel is slightly larger than that of the direct sales channel, the supplier will choose the RF; otherwise, he will choose the BF.

Second, retailers should set lower interest rates or destabilize the supply chain. In this case, the supplier’s financing cost is reduced and the supplier should lower the wholesale prices to transfer a portion of the profit to the retailer. Owing to lower wholesale costs, the retailer lowers the selling prices in distribution channels. Considering competition between channels, the price of the supplier’s direct sales channel should also decrease. Simultaneously, to reduce costs, suppliers should reduce fresh-keeping efforts.

Finally, the supplier and retailer must consider consumers’ environmental awareness when making their decisions. Higher environmental awareness among consumers reduces sales through distribution channels. In this case, the supplier without financial constraints should reduce wholesale prices and the retailer should reduce sales prices through distribution channels to attract consumers to buy fresh produce through distribution channels. Owing to competition between channels, the price and preservation efforts of the supplier’s direct sales channel should also decrease. It is worth noting that a supplier with capital constraints will still increase the wholesale price of distribution channels and the sales price of direct sales channels owing to the impact of capital costs. The retailer earns money from the loan; therefore, even if the supplier increases the wholesale price in the distribution channel, he or she should lower the selling price in the distribution channel to attract consumers.

In addition, we put forward the following management suggestions for the fund constrained dual channel supply chain of fresh agricultural products.

(1) Suppliers should carry out green innovation in the transportation mode of agricultural products to improve the low-carbon, environmental protection and green level of products as much as possible, so that consumers can get a good sense of experience in the use process, so that consumers are more willing to pay for green.

(2) Retailers should innovate the financing mode to better provide financial support for suppliers, so as to encourage suppliers with financial constraints to carry out green transport mode innovation.

(3) The government should actively carry out innovative practices of carbon market financing. Promote the coordinated development of green transformation of enterprises.

8.3 Future research directions

This study has the following limitations. First, this paper does not consider the carbon emissions of retailers, but only considers the carbon emissions of suppliers in the transportation process of different channels. Future research could consider retailers’ marketing efforts for low-carbon products. Second, this study only considers a dual-channel fresh supply chain consisting of a single financially constrained supplier and a single well-funded retailer. In reality, each supplier may have multiple retailers. There is competition among retailers. Therefore, in the future, the two-channel optimization operation strategy of the one-to-many capital constraint of the fresh supply chain can be discussed.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

SB: Conceptualization; Methodology; Supervision. XJ: Formal analysis and investigation; Writing—original draft preparation; Writing—review and editing.

Funding

This work was supported in part by the National Natural Science Foundation of China (Grant No. 71671054); Heilongjiang Provincial Natural Science Foundation Joint Guidance Project (Grant No. LH 2021G014); Heilongjiang Philosophy and Social Sciences Research Planning Project (Grant No. 20GLB114, 21GLC187); Harbin University of Commerce 2021 Graduate Innovative Research Fund Project (Grant No. YJSCX 2021-690HSD); Heilongjiang Natural Science Foundation Joint Guidance Project (Grant No. LH2022G014).

Acknowledgments

We would like to thank reviewers and the editor-in-charge for valuable time on the article. And we are grateful to all the foundations that support us.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aljazzar, S. M., Gurtu, A., and Jaber, M. Y. (2018). Delay-in-payments - a strategy to reduce carbon emissions from supply chains. J. Clean. Prod. 170, 636–644. doi:10.1016/j.jclepro.2017.08.177

Cao, K., He, P., and Liu, Z. (2020). Production and pricing decisions in a dual-channel supply chain under remanufacturing subsidy policy and carbon tax policy. J. Operational Res. Soc. 71 (8), 1199–1215. doi:10.1080/01605682.2019.1605471

Che, C., Chen, Y., Zhang, X., Zhao, L., Guo, P., and Ye, J. (2021), Study on emission reduction strategies of Dual-Channel supply chain considering green finance, Front. Environ. Sci. 9, 687468. doi:10.3389/fenvs.2021.687468

Chiang, W. K., Chhajed, D., and Hess, J. (2003). Direct marketing, indirect profits: A strategic analysis of Dual-Channel supply-chain design. Manag. Sci. 49 (1), 1–20. doi:10.1287/mnsc.49.1.1.12749

Dagar, V., Ahmed, F., Waheed, F., Bojnec, S., Kamran, M. K., and Shaikh, S. (2022). Testing the pollution haven hypothesis with the role of foreign direct investments and total energy consumption. Energies 15 (11), 4046. doi:10.3390/en15114046

Dominici, A., Boncinelli, F., Gerini, F., Marone, E., Ozguven, E. E., Moses, R., et al. (2021). Determinants of online food purchasing: The impact of socio-demographic and situational factorsIntermodal freight network design for transport of perishable products. J. Retail. Consumer Serv. J. Optim. 605 (04), 102473120–102473139. doi:10.1016/j.jretconser.2021.102473Dulebenets10.4236/ojop.2016.54013

Dulebenets, M. A., and Ozguven, E. E. (2017). Vessel scheduling in liner shipping: Modeling transport of perishable assets. Int. J. Prod. Econ. 184, 141–156. doi:10.1016/j.ijpe.2016.11.011

Dulebenets, M. A., Ozguven, E. E., Moses, R., and Ulak, M. B. (2016). Intermodal freight network design for transport of perishable products. OJOp 5 (04), 120. doi:10.4236/ojop.2016.54013

Ghosh, S. K., Seikh, M. R., and Chakrabortty, M. (2020). Analyzing a stochastic dual-channel supply chain under consumers’ low carbon preferences and cap-and-trade regulation. Comput. Ind. Eng. 149, 106765. doi:10.1016/j.cie.2020.106765

Gu, C., Wei, J., and Wei, Y. (2021). Sourcing under competition: The implications of supplier capital constraint and supply chain co-opetition. Transp. Res. Part E Logist. Transp. Rev. 149, 102262. doi:10.1016/j.tre.2021.102262

Gupta, D., and Chen, Y. (2020). Retailer-direct financing contracts under consignment. Manuf. Serv. Operations Manag. 22 (3), 528–544. doi:10.1287/msom.2018.0754

Hamni, A., Panuju, A. Y. T., and Ambarwati, D. A. S. (2021). Understanding consumers’ behaviour for reducing environmental and social impact through sustainable product design – a Study case of vehicles usage in Indonesia. Earth Environ. Sci. 739 (1), 012052. doi:10.1088/1755-1315/739/1/012052

He, B., Gan, X., and Yuan, K. (2019). Entry of online presale of fresh produce: A competitive analysis. Eur. J. Oper. Res. 272 (1), 339–351. doi:10.1016/j.ejor.2018.06.006

He, Y., Xu, Q., and Shao, Z. (2021). Ship-from-store” strategy in platform retailing. Transp. Res. Part E Logist. Transp. Rev. 145, 102153. doi:10.1016/j.tre.2020.102153

Hosseini-Motlagh, S., Ebrahimi, S., and Jokar, A. (2021). Sustainable supply chain coordination under competition and green effort scheme. J. Operational Res. Soc. 72 (2), 304–319. doi:10.1080/01605682.2019.1671152

Jiang, W., Xu, H,L., Chen, Z. S., Govindan, K., and Chin, K. S. (2022). Financing equilibrium in a capital constrained supply Chain: The impact of credit rating. Transp. Res. Part E Logist. Transp. Rev. 157, 102559. doi:10.1016/j.tre.2021.102559

Jiang, Y., and Liu, C. (2022). Research on carbon emission reduction and blockchain investment under different dual-channel supply chains. Environ. Sci. Pollur R. 2022, 1–18.

Kang, K., Gao, S., Gao, T., and Zhang, J. (2021). Pricing and financing strategies for a green supply chain with a risk-averse supplier. IEEE Access 9, 9250–9261. doi:10.1109/ACCESS.2021.3050130

Kouvelis, P., and Zhao, W. (2016). Supply chain contract design under financial constraints and bankruptcy costs. Manage. Sci. 62 (8), 2341–2357. doi:10.1287/mnsc.2015.2248

Kouvelis, P., and Zhao, W. (2011). The newsvendor problem and price-only contract when bankruptcy costs exist. Prod. Oper. Manag. 20 (6), 921–936. doi:10.1111/j.1937-5956.2010.01211.x

Lejarza, F., Pistikopoulos, I., and Baldea, M. (2021). A scalable real-time solution strategy for supply chain management of fresh produce: A Mexico-to-United States cross border study. Int. J. Prod. Econ. 240, 108212. doi:10.1016/j.ijpe.2021.108212

Li, T., Zhang, R., Zhao, S., and Liu, B. (2019). Low carbon strategy analysis under revenue-sharing and cost-sharing contracts. J. Clean. Prod. 212, 1462–1477. doi:10.1016/j.jclepro.2018.11.282

Liu, J., Yang, Y., and Yu, Y. (2021). Ordering and interest rate strategies in platform finance with an overconfident and commerce retailer. Transp. Res. Part E Logist. Transp. Rev. 153, 102430. doi:10.1016/j.tre.2021.102430

Liu, M., Li, Z., Anwar, S., and Zhang, Y. (2021). Supply chain carbon emission reductions and coordination when consumers have a strong preference for low-carbon products. Environ. Sci. Pollut. R. 28 (16), 19969–19983. doi:10.1007/s11356-020-09608-0

Liu, Z., Yu, Z., Zhang, S., and Peng, J. (2018). Three stage game research of dual-channel supply chain of fresh agricultural products under consumer preference. Int. J. Comput. Sci. Math. 9 (1), 48–57. doi:10.1504/IJCSM.2018.10011731

Luo, P., Wang, H., and Yang, Z. (2016). Investment and financing for SMEs with a partial guarantee and jump risk. Eur. J. Oper. Res. 249 (3), 1161–1168. doi:10.1016/j.ejor.2015.09.032

Ma, S., He, Y., Gu, R., and Li, S. (2021). Sustainable supply chain management considering technology investments and government intervention. Transp. Res. Part E, Logist. Transp. Rev. 149, 102290. doi:10.1016/j.tre.2021.102290

Pan, F., Fan, T., Qi, X., Chen, J., and Zhang, C. (2021). Truck scheduling for cross-docking of fresh produce with repeated loading. Math. Probl. Eng. 2021, 5592122. doi:10.1155/2021/5592122

Perlman, Y., Ozinci, Y., and Westrich, S. (2019). Pricing decisions in a dual supply chain of organic and conventional agricultural products. Ann. Oper. Res. 1-16. doi:10.1007/s10479-019-03169-3

Qi, C., and Hu, L. (2020). Optimization of vehicle routing problem for emergency cold chain logistics based on minimum loss. PhysCommun-Amst. 40, 101085. doi:10.1016/j.phycom.2020.101085

Qi, Q., Wang, J., and Xu, J. (2018). A Dual-Channel supply chain coordination under carbon cap-and-trade regulation. Int. J. Env. Res. Pub. He. 15 (7), 1316. doi:10.3390/ijerph15071316

Rehman, A., Ma, H., Ozturk, I., Murshed, M ., and Dagar, V. (2021). The dynamic impacts of CO2 emissions from different sources on Pakistan’s economic progress: A roadmap to sustainable development. Environ. Dev. Sustain 23, 17857–17880. doi:10.1007/s10668-021-01418-9

Shahmohammadi, S., Steinmann, Z. J. N., Tambjerg, L., van Loon, P., King, J. M. H., and Huijbregts, M. A. J. (2020). Comparative greenhouse gas footprinting of online versus traditional shopping for fast-moving consumer goods: A stochastic approach. Environ. Sci. Technol. 54 (6), 3499–3509. doi:10.1021/acs.est.9b06252

Shahzad, U., Madaleno, M., Dagar, V., Ghosh, S., and Doğan, B. (2022). Exploring the role of export product quality and economic complexity for economic progress of developed economies: Does institutional quality matter? Struct. Change Econ. Dyn. 62, 40–51. doi:10.1016/j.strueco.2022.04.003

Shi, J., Li, Q., Chu, L. K., and Shi, Y. (2021). Effects of demand uncertainty reduction on the selection of financing approach in a capital-constrained supply chain. Transp. Res. Part E Logist. Transp. Rev. 148, 102266. doi:10.1016/j.tre.2021.102266

Song, Z., He, S., and An, B. (2018). Decision and coordination in a Dual-Channel three-layered green supply chain. Symmetry 10 (11), 549. doi:10.3390/sym10110549

Sun, L., Cao, X., Alharthi, M., Zhang, J., Taghizadeh, H., and Mohsin, M. (2020). Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J. Clean. Prod. 264, 121664. doi:10.1016/j.jclepro.2020.121664

Tang, C. S., Yang, S. A., and Wu, J. (2018). Sourcing from suppliers with financial constraints and performance risk. Manuf. Serv. Operations Manag. 20 (1), 70–84. doi:10.1287/msom.2017.0638

Theophilus, O., Dulebenets, M. A., Pasha, J., Lau, Y., Fathollahi-Fard, A. M., and Mazaheri, A. (2021). Truck scheduling optimization at a cold-chain cross-docking terminal with product perishability considerations. Comput. Industrial Eng. 156, 107240. doi:10.1016/j.cie.2021.107240

Wan, G. Y., Cao, Q., and Yi, C. (2019). Impact of carbon footprint difference on retailer’s channel selection strategy. Syst. Engineering-Theory&Practice 41 (01), 92. doi:10.12011/SETP2020-0298

Wang, C., Peng, Q., and Xu, L. (2020). Decision and coordination of a low-carbon supply chain considering environmental tax policy on consumers. Kybernetes 50 (8), 2318–2346. doi:10.1108/K-05-2020-0318

Wang, Z., Brownlee, A. E. I., and Wu, Q. (2020). Production and joint emission reduction decisions based on two-way cost-sharing contract under cap-and-trade regulation. Comput. Ind. Eng. 146, 106549. doi:10.1016/j.cie.2020.106549

Wang, Z., Yao, D., and Yue, X. (2017). E-business system investment for fresh agricultural food industry in China. Ann. Oper. Res. 257 (1-2), 379–394. doi:10.1007/s10479-015-1830-8

Xie, J., Liu, J., Huo, X., Meng, Q., and Meng, C. (2021). Fresh food dual-channel supply chain considering consumers’ low-carbon and freshness preferences. Sustainability-Basel. 13 (11), 6445. doi:10.3390/su13116445

Yadav, V. S., Singh, A. R., Raut, R. D., and Cheikhrouhou, N. (2021). Design of multi-objective sustainable food distribution network in the Indian context with multiple delivery channels. Comput. Ind. Eng. 160, 107549. doi:10.1016/j.cie.2021.107549

Yan, B., Fan, J., Wu, J. W., Zhang, T., and Zhang, Y. (2021). Channel choice and coordination of fresh agricultural product supply chainOptimal pricing and green decisions in a dual-channel supply chain with cap-and-trade regulation. RAIRO-Oper Res.Environmental Sci. Pollut. Res. 55 (2), 282081–2822518. doi:10.1051/ro/2021014Yang10.1007/s11356-021-18097-8

Yan, B., Chen, X., Cai, C., and Guan, S. (2020). Supply chain coordination of fresh agricultural products based on consumer behavior. Comput. Oper. Res. 123, 105038. doi:10.1016/j.cor.2020.105038

Yang, H., Zhuo, W., and Shao, L. (2017). Equilibrium evolution in a two-echelon supply chain with financially constrained retailers: The impact of equity financing. Int. J. Prod. Econ. 185, 139–149. doi:10.1016/j.ijpe.2016.12.027

Yang, L., Wang, G., and Chai, Y. (2018). Manufacturer’s channel selection considering carbon emission reduction and remanufacturing. J. Syst. Sci. Syst. Eng. 27 (4), 497–518. doi:10.1007/s11518-018-5378-4

Yi, Z., Wang, Y., and Chen, Y. J. (2021). Financing an agricultural supply chain with a capital-constrained smallholder farmer in developing economies. Prod. Oper. Manag. 30 (7), 2102–2121. doi:10.1111/poms.13357

Zhang, C., Khan, I., Dagar, V., Saeed, A., and Zafar, M. W. (2022). Environmental impact of information and communication technology: Unveiling the role of education in developing countries. Technol. Forecast. Soc. Change 178, 121570. doi:10.1016/j.techfore.2022.121570

Zhang, K., and Ma, M. (2021). Differential game model of a fresh Dual-Channel supply chain under different return modes. IEEE Access 9, 8888–8901. doi:10.1109/ACCESS.2020.3045039

Zhen, X., Shi, D., Li, Y., and Zhang, C. (2020). Manufacturer’s financing strategy in a dual-channel supply chain: Third-party platform, bank, and retailer credit financing. Transp. Res. Part E Logist. Transp. Rev. 133, 101820. doi:10.1016/j.tre.2019.101820

Zheng, F., Pang, Y., Xu, Y., and Liu, M. (2021). Heuristic algorithms for truck scheduling of cross-docking operations in cold-chain logistics. Int. J. Prod. Res. 59 (21), 6579–6600. doi:10.1080/00207543.2020.1821118

Zheng, Q., Wang, M., and Yang, F. (2021). Optimal channel strategy for a fresh produce E-Commerce supply chain. Sustainability-Basel. 13 (11), 6057. doi:10.3390/su13116057

Zheng, X., Chen, Y., and Liu, Y. (2022). The coordination of multi-stage discounts in a dual channel fresh agricultural produce supply chain: Minimizing the loss of quantity and QualityEmission reduction strategies of a low-carbon supply chain considering product substitution and government subsidy. Sustainability-BaselFrontiers Environ. Sci. 1410 (4), 2174. doi:10.3390/su14042174Zhan10.3389/fenvs.2022.894659

Keywords: capital constraint, financing strategies, carbon emissions difference, supply chain decision, dual-channel

Citation: Bai S and Jia X (2023) Impact of carbon emission difference on the dual-channel fresh produce supply chain with capital constraints. Front. Environ. Sci. 11:977995. doi: 10.3389/fenvs.2023.977995

Received: 25 June 2022; Accepted: 23 January 2023;

Published: 02 February 2023.

Edited by:

Larisa Ivascu, Politehnica University of Timișoara, RomaniaReviewed by:

Maxim A. Dulebenets, Florida Agricultural and Mechanical University, United StatesMuhammad Kamran Khan, Bahria University, Pakistan

Copyright © 2023 Bai and Jia. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xuelian Jia, jxl7933@126.com

Shizhen Bai

Shizhen Bai Xuelian Jia

Xuelian Jia