- 1School of Business Administration, Henan University of Animal Husbandry and Economy, Zhengzhou, China

- 2School of Finance and Accounting, Henan University of Animal Husbandry and Economy, Zhengzhou, China

- 3E-Business Management, The University of Warwick, Coventry, United Kingdom

Energy structure transformation is the only way for China to achieve the “dual carbon” goal, and one of the difficulties faced by energy transformation is financing. In the context of China’s steadily promoting the high-level opening-up of financial industry, this paper uses the panel data of China’s provincial level from 2010 to 2019 to systematically examine the impact of financial opening-up on the transformation of energy structure. The results show that: 1) Financial openness has a significant positive impact on the energy structure transition; 2) In different stages of energy structure transformation, as the main driving force in the initial stage of energy structure transformation is the government’s policy support, with the continuous maturity of energy structure transformation, the impact of financial openness on energy structure transformation gradually increases; 3) With different levels of economic development, the driving effect of financial openness is also different. The lower the level of economic development is, the stronger the driving effect of financial openness on energy structure transformation is due to the lack of financing channels. This paper provides a theoretical basis for China’s energy structure transformation, and also provides rich policy implications for promoting China’s financial industry to open up at a high level.

1 Introduction

The “dual goals” of carbon peak by 2030 and carbon neutrality by 2060 are an inevitable requirement for China to cope with climate change and an important deployment for China to formulate its medium—and long-term development strategy. The consumption of coal, oil and other petrochemical energy is the main source of global greenhouse gases. In order to achieve the goal of “dual carbon,” it is necessary to accelerate energy transformation, transform the coal-based energy structure, and promote the development of non-fossil energy.

Although the overall trend of energy structure transformation is optimistic and positive, in order to achieve the “dual carbon” goal and control climate change, the field of energy structure transformation needs a lot of financial support. According to the Global Energy Transition Outlook report of the International Renewable Energy Agency, in order to achieve the goal of the Paris Agreement and control the increase in global average temperature above pre-industrial levels to less than 1.5°C, the global energy transition will require investment of 570 million US dollars per year by 2030, showing that the funding gap for energy transition is huge. For China, there is also a huge gap in green investment and financing. According to the Green Finance for Carbon Neutrality released by China International Capital Corporation Limited, in order to achieve carbon neutrality, China’s green investment and financing gap is about 540 billion yuan per year from 2021 to 2030. In the absence of policy intervention, the investment and financing gap for renewable energy will rise rapidly to 310 billion yuan per year after 2031. Such a huge demand for investment and financing has become a severe challenge for the transformation of energy structure under the “dual carbon” goal.

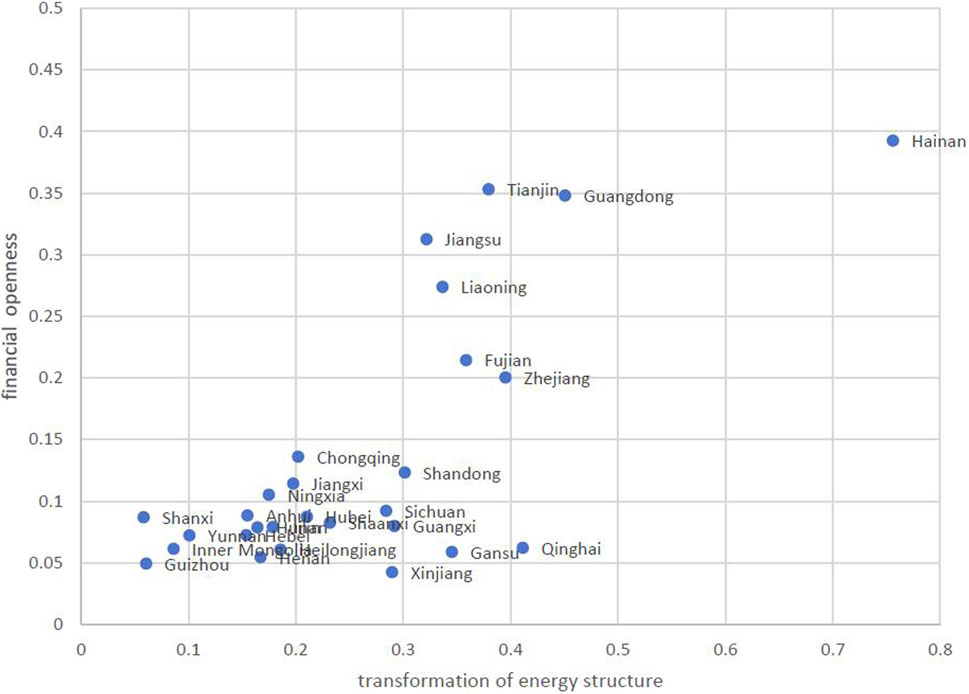

Figure 1 provides an intuitive description of the relationship between financial openness and the transformation of the energy mix. The horizontal and vertical coordinates in Figure 1 are measured by the energy structure transformation index and the financial openness level constructed in Section 3.2, which are the average energy structure transformation index and the average financial openness level of 30 provinces in China from 2010 to 2019, respectively. As can be seen from Figure 1, there is a significant positive correlation between the level of financial openness and the energy structure transformation of 30 provinces in China. Whether financial openness is conducive to energy structure transformation, and whether this effect varies in different stages of energy structure transformation and different levels of economic development, need more rigorous demonstration. In order to better answer the previous questions, this paper uses the panel data of 30 provinces in China from 2010 to 2019 to analyze the internal relationship between financial openness and energy structure transformation at the provincial level, as well as whether there is heterogeneity in the relationship between the two.

The existing research mainly focuses on the impact of policy factors, carbon emissions, economic development and other factors on the energy structure transition, but there is still a lack of discussion on the impact of financial openness on the energy structure transition. Therefore, this paper will take China’s provincial data as the research object, explore the impact of financial openness on energy structure transformation, and conduct regional heterogeneity analysis. Its main contributions include: 1) Using China’s provincial data to study the impact of financial openness on energy structure transformation, it can more accurately observe the impact of financial openness in China, and realize the comparison of characteristics in different regions. 2) In quantitative research, we distinguish different stages of energy structure transformation and different levels of economic development to explore the dynamic evolution of the driving effect of financial openness, and use the panel threshold model to study the evolution characteristics of the marginal effect of financial openness. The driving factors of energy structure transformation are multi-dimensional and dynamic, so the discussion by development stage can be more consistent with the reality and the law of industrial development. 3) The research conclusions provide empirical evidence for steadily expanding the institutional opening of the financial sector, improving the facilitation of cross-border investment and financing, and attracting more foreign financial institutions and long-term capital to facilitate the transformation of energy structure; At the same time, it provides policy inspiration for deepening international cooperation in green finance, improving the green financial system, and helping to achieve the goal of “dual carbon,” which has strong practical significance.

The rest of this paper is arranged as follows: the second part is literature review and research hypothesis; The third part, empirical design, variables and data; The fourth part, benchmark regression, robustness test and heterogeneity results analysis; Finally, conclusions and policy recommendations are presented.

2 Literature review and research hypotheses

2.1 Influencing factors of energy structure transformation

In the context of the “dual carbon” target, many scholars have carried out quantitative research on the influencing factors of energy structure transformation. Although the conclusions are not consistent, the research on the influencing factors mainly focuses on the following five aspects: economic factors, policy factors, environmental factors, energy factors and social factors. 1) Policy factors. The change in production technology represented by the steam engine was the driving force of the first energy transition, the invention and promotion of the internal combustion engine was the driving force of the second energy transition, and policy factors may be one of the main driving forces of this energy transition (Cansino et al., 2010; Bai et al., 2023; Yu et al., 2023a; Liu and Peng, 2022); 2) Energy factors. Some scholars believe that the price of fossil energy and national energy endowment will affect the transformation of energy structure (Sadorsky, 2009b; Su and Tan, 2023; Yu et al., 2023b; Guo et al., 2023); 3) Environmental factors. Environmental factors mainly refer to that the emission of carbon dioxide, sulfur dioxide and other exhaust gases will affect the transformation of energy structure Bai et al. (2023), and Werner and Lazaro, (2023) believes that environmental regulation will affect the transformation of energy structure. 4) Economic factors. Most scholars believe that economic development can promote the transformation of energy structure Bai et al. (2023), and Tian et al. (2022) studied the impact of economic recovery on the transformation of energy structure; 5) Social factors. Rosenbloom et al. (2018) believed that public education would improve people’s awareness of environmental protection and help promote energy structure transformation, while Kuamoah (2020) believed that the lack of infrastructure was one of the obstacles to energy transformation. It is worth noting that although the role of finance in the transformation of energy structure has gradually attracted the attention of scholars, the research mainly focuses on the impact of domestic financial development on it and the qualitative risk level.

Most existing studies have found that financial development has a positive impact on the transformation of energy structure (Ding et al., 2023), and its driving effect on finance only stays at the level of financial development, without considering financial openness. Although financial openness brings benefits such as lowering financing costs and improving risk aversion, cross-border capital may also bring disadvantages such as economic and financial turbulence. Then, for the energy structure transformation with a long investment cycle and a large amount of financial support, what is the impact of foreign capital on it? This is a question worth investigating. This paper will take China’s provincial-level data as samples to study the impact of financial openness on energy structure transition, and further explore the heterogeneity of financial openness driving effect in different energy transition stages and different levels of economic development.

2.2 Mechanism and heterogeneity driven by financial openness

(1) The working mechanism driven by financial openness.

Compared with traditional fossil energy, non-fossil energy depends more on financial development. The main reason is that compared with fossil energy, the production cost of non-fossil energy has its uniqueness, which is mainly reflected in the following aspects: 1) The production technology of non-fossil energy is still very immature, many production fields still need further exploration and innovation, and the research and development of technology has a lot of uncertainties, that is, great risks. In addition to the government’s financial support, it also needs financial support from the financial sector to make up for the shortage of funds; 2) Non-fossil energy construction not only has a relatively large initial investment scale, but also has a relatively high operating cost, which requires a lot of financing needs and support from the financial field; 3) Although compared with fossil energy, the investment cycle and time span of non-fossil energy are greatly shortened, it still belongs to the investment with a long cycle. Such financing services such as medium - and long-term loans are easier to obtain from foreign banks to ensure smooth project implementation.

The impact of financial openness on the transformation of energy structure is mainly reflected in the following three aspects: 1) Expand financing channels. On the one hand, the flow of international capital can effectively relieve the pressure of capital shortage in the process of local economic development; On the other hand, the entry of foreign financial institutions and the intensification of competition in the financial industry can provide more abundant financial products and provide more capital services and financing opportunities for energy transition enterprises. 2) Improve the return on investment. On the one hand, abundant financial products and financing channels can improve the anti-risk ability of energy transition enterprises; On the other hand, a perfect financial market can help enterprises better integrate resources and promote the efficient operation of investment activities. 3) Increase R&D investment of enterprises. Funds in the financial market tend to flow to technical fields with high or potential returns, while R&D of energy transition enterprises requires long-term sustainable and stable investment; therefore, relatively sufficient sources of funds will affect the R&D investment decisions of energy transition enterprises and increase R&D investment. Based on this, this paper proposes:

Hypothesis 1: Financial openness is conducive to promoting the transformation of energy structure.

(2) Heterogeneity driven by financial openness in different stages of energy structure transition

Although there are differences in the paths and ways of energy structure transformation in China’s provinces, the government’s policy support is still the initial driving force for China’s energy structure transformation. The supporting policies for energy structure transformation can be roughly divided into two types: the first is the supply-side driven policy, which leads to the R&D input for energy structure transformation from the supply side, such as the establishment of power system adapted to new energy generation, the development of smart grid and electric vehicles, and the subsidy policy for renewable energy development. The second is demand-pull policy, which leads to capacity investment in renewable energy from the demand side and indirectly promotes the transformation of energy structure. For example, Renewable energy quota system and Tax Credit policies (including Production Tax Credit and Investment Tax Credit), tax subsidies, etc.

In the early stage of energy structure transformation, the market mechanism is certainly immature at this time, and the development of renewable energy mainly depends on the policy support of the government. It is difficult for financial openness to play a role through the market mechanism, and the role driven by financial openness is quite limited (Aklin and Urpelainen, 2013; Kim and Park, 2018). In the initial stage, the main problem of non-fossil energy development is that the use cost is too high due to the lack of technological innovation, which makes non-fossil energy maintain a high price and cannot compete with traditional petrochemical energy in the market. Therefore, the initial stage of non-fossil energy development is faced with the problems of market failure and insufficient funds. Government support is particularly important at this stage. At the same time, in the early stage of energy structure transformation, on the one hand, due to the high uncertainty of non-fossil energy technology innovation and high investment risk, the profit-driving behavior of financial institutions will turn to the less risky areas for investment, which will also have a “crowding out effect” on non-fossil energy; On the other hand, under the condition of market failure, it is also difficult for financial subjects to play their financing mechanism in the transformation of energy structure. Under the effect of dual forces, financial openness may have an inhibitory effect on energy structure transformation in the early stage.

In the growth and maturity stages of energy structure transformation, the market mechanism is gradually improved, and the strength of government support policies is gradually weakened, while the role of finance through perfect market mechanism can better promote energy structure transformation (Amuakwa-Mensah and Nasstrom, 2022). At this time, the technological progress of non-fossil energy gradually reduces the use cost, and its price can compete with the traditional fossil energy in the energy market. With the continuous improvement of cost competitiveness, the large-scale production of non-fossil energy is gradually realized, and the consumption of non-fossil energy accounts for a higher and higher proportion in the total energy consumption. Therefore, in this stage, the role of the market is gradually enhanced, and the government support policy is gradually weakened. In a sound market mechanism, financial subjects can create diversified financing channels to serve the development of non-fossil energy, reduce its financing costs, and continuously promote the transformation of energy structure. Based on this, this paper proposes:

Hypothesis 2: In the initial stage of energy structure transformation, the main driving force of energy structure transformation is government policy support, while the driving effect of financial openness is weak, and may even be inhibiting; In the growth and maturity stages of the energy structure transformation, the market mechanism is constantly improved, and the financial openness may have a significant positive impact on the energy structure transformation, and with the deepening of the energy structure transformation, this promoting effect will be strengthened.

(3) Heterogeneity driven by financial openness at different levels of economic development

Provinces with different levels of economic development have different impact paths and ways of financial openness on energy structure transformation. On the one hand, the process of energy structure transformation from research and development to investment and construction needs a lot of financial support; On the other hand, compared with the economically developed regions, the financial industry in the economically underdeveloped regions is relatively backward. Both the banking industry and the securities industry have relatively small overall scale, low level of development, imperfect financial system, extensive development mode, low operation quality and imperfect market mechanism. This makes the need for funds for energy structure transformation in less economically developed regions more urgent. To a certain extent, financial openness can break the barriers of sino-foreign trade financing, reduce financing costs, help to increase the rate of foreign direct investment, and thus promote the process of energy structure transformation. At the same time, from the perspective of economics, financial opening is conducive to the improvement of financial system and market mechanism, and helps to provide a good financial environment and better financial support for the energy structure transformation in economically underdeveloped regions. Based on this, this paper proposes:

Hypothesis 3: The financing capacity of less developed regions is greatly insufficient, but the transformation of energy structure needs a large amount of financial support. Therefore, the need for financial openness is more urgent in economically underdeveloped regions, that is, the lower the level of economic development is, the greater the impact of financial openness on the transformation of energy structure is.

3 Empirical design, variables and data

3.1 Model specification

In order to verify the relationship between financial openness and energy structure transformation, this paper constructs a two-way fixed effect model of time and region. The model is set as follows:

Where

In order to verify the heterogeneous impact of financial openness on energy structure transition, artificially dividing the interval of the variable “energy structure transition (or economic development level)” will cause estimation errors. The threshold panel model proposed by Hansen (1999) divides the interval of the variable according to the characteristics of the data itself. This endogenous interval division method can avoid artificial subjective factors and make the estimation more accurate. Therefore, this section uses the method proposed by Hansen (1999) to study the differences in the impact of financial openness on energy structure transition in different energy structure transition levels (or economic development levels).

Firstly, we introduce the most basic threshold panel model, that is, the setting of single threshold panel model, which is expressed as follows:

Where

According to econometric theory, it is possible for models to have multiple threshold values. As for the multi-threshold panel model, this paper first extends to the double-threshold panel model for a brief introduction, which is expressed as:

On this basis, the panel models with more thresholds can be extended, which will not be described here.

3.2 Variables and data description

(1) Explained variable: energy structure transition (

Where

(2) Explanatory variable: financial openness (

Where

(3) Control variables. 1) Policy factor (

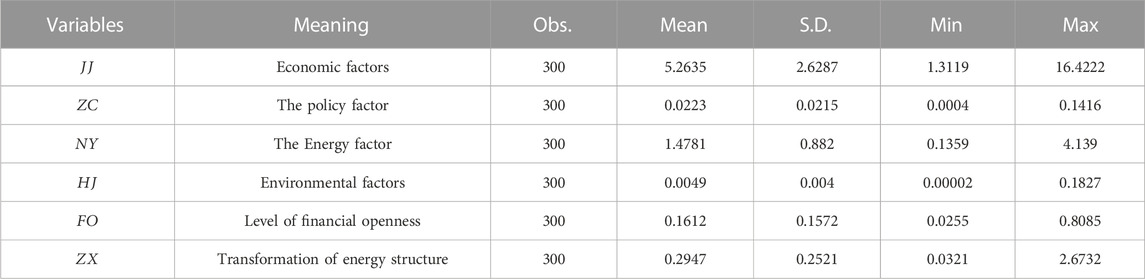

The data in this paper are the panel data of 30 provinces in China from 2010 to 2019. Due to the serious lack of data in Tibet, the data of this province were excluded, and individual missing data were supplemented by interpolation method. The data mainly come from the “China Financial Database,” “China Macroeconomic Database,” “China Energy Database” and “China Environment Database” in EPS data platform. The descriptive statistics of the variables are shown in Table 1. As can be seen from Table 1, the minimum, maximum and average values of energy structure transformation are 0.0321, 2.6732 and 0.2947, respectively, indicating that the level of energy structure transformation among provinces in China is generally low and the gap is large. The minimum, maximum and average values of financial openness are 0.0255, 0.8085 and 0.1612 respectively, indicating that China’s financial openness also has problems of low overall level and large gap between regions.

4 Analysis of empirical results

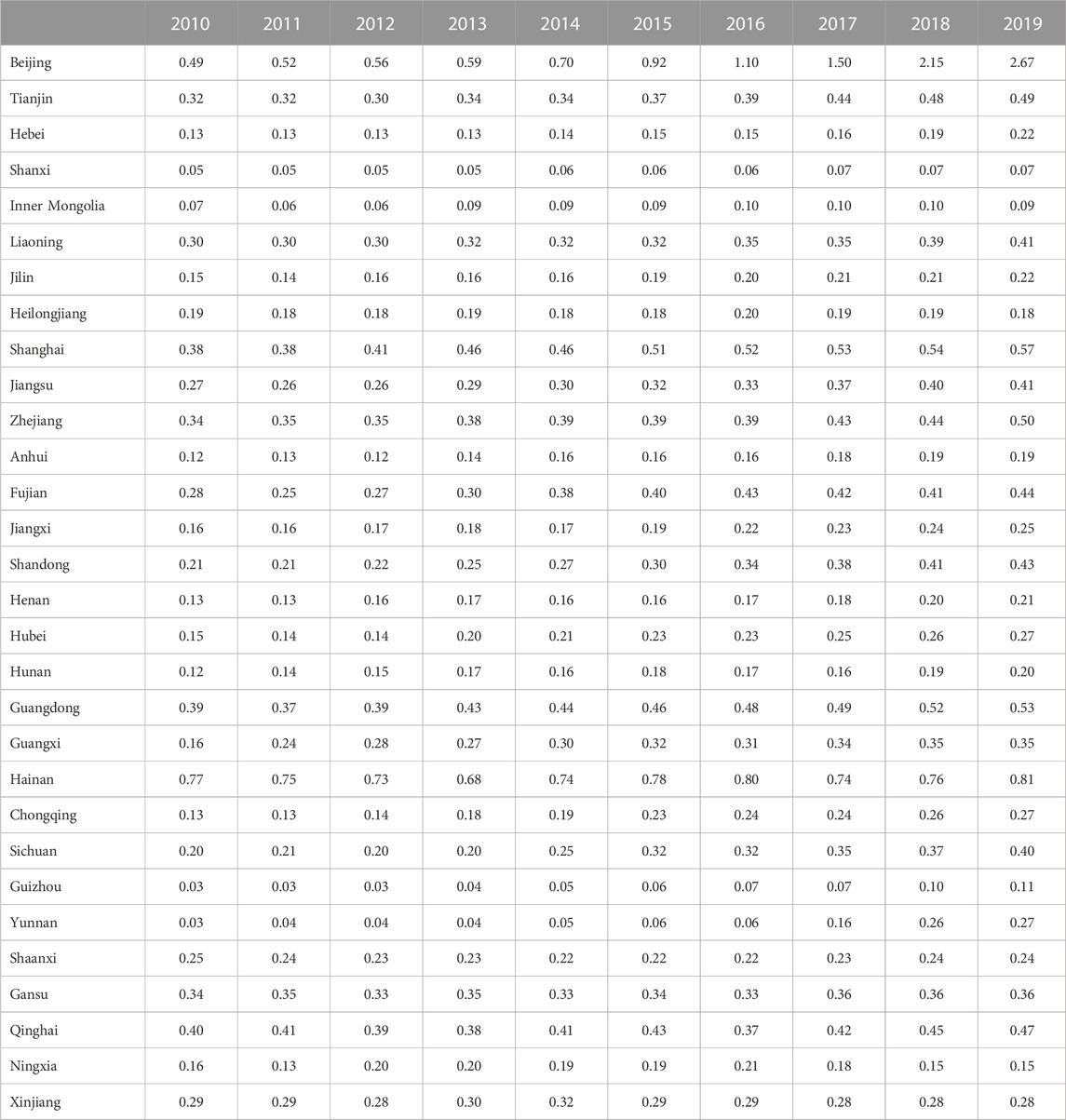

4.1 Status quo of China’s energy structure transformation

The energy structure transformation level of 30 provinces in China during 2010–2019, calculated according to the energy structure transformation index constructed in Section 3.2, is shown in Table 2. As can be seen from Table 2: From the perspective of time trend, the energy structure transformation level of each province is basically gradually improved with the passage of time, which intuitively indicates that all parts of China are steadily promoting the energy structure transformation; From the horizontal point of view, the highest is Beijing, Beijing as the capital of China, the energy structure transformation should be at the forefront. Shanghai, Zhejiang, Guangdong and Hainan also have a high level of energy structure transformation, all above 0.5. These provinces are located in coastal areas and can make full use of their geographical advantages to achieve energy transformation, such as offshore wind power generation. Shanxi and Inner Mongolia have the lowest level of energy structure transformation, both below 0.1. These two places are China’s large coal-power provinces and also the provinces with the highest net energy output. In the past, a large amount of resources were consumed in economic construction, leading to environmental degradation, and the economic growth model needs to be changed urgently. For a long time, China’s economic and social development depends on coal resources, coal has become an important basic energy and industrial raw materials, reliable type of energy security. Although, in recent years, the proportion of coal consumption has declined, but the rich coal, poor oil, less gas energy resource endowment and non-fossil has not been reliable alternative to the status quo of traditional resources have determined that the coal-based energy structure is difficult to change in the short term, coal will still be the “ballast stone” “stabilizer” of energy supply. Therefore, the transformation degree of energy structure in these regions is not high.

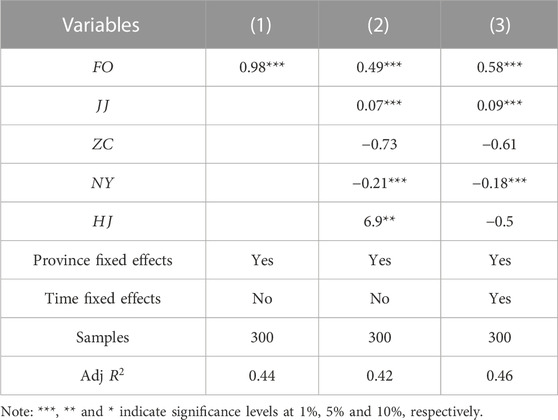

4.2 Average impact of financial openness on energy structure transition

Columns (1)–(3) of Table 3 respectively report the impact of financial openness on energy structure transition without adding control variables, adding control variables and two-way fixed effects. From the estimation results, it can be seen that there is a significant positive relationship between financial openness and energy structure transition. It can be seen from Column (3) of Table 3 that the average effect of financial openness on the energy structure transition is 0.58, which is significant at the level of 1%. That is, for every 1 unit increase in financial openness, the energy structure transformation will increase by 0.58 units. The above structure shows that in the process of energy consumption structure transformation, the openness of the financial industry is conducive to energy structure transformation, that is, Hypothesis 1 is verified.

4.3 Robustness test

In the part of robustness test, this paper mainly uses the replacement of core explanatory variables, the addition and reduction of control variables and the random effect model to test the robustness of the empirical results.

(1) Replacing core explanatory variables. In order to further eliminate the impact of the measurement error of financial openness index on the empirical results, this paper uses the proportion of FDI in GDP to measure financial openness for robustness test, and the results are still robust.

(2) Increase or decrease of control variables. In order to test whether different control variables will affect the empirical estimation results, this paper adopts the stepwise regression method, gradually adding control variables for regression, and the results of the core explanatory variable financial openness are still robust.

(3) Random effect model. In order to test whether the adoption of different panel models will affect the empirical estimation results, this paper uses the random effect model for estimation, and the results are still robust.

4.4 Analysis of heterogeneity

4.4.1 The effect of financial openness in different development stages of energy structure transition

On the basis of Table 3, we further explore the average effect of financial openness in different stages of energy transition. The higher the energy structure transition index is, the higher the proportion of oil and gas replacing coal and non-fossil energy replacing fossil energy in this region is, and the more mature the energy transition in this region is. In this paper, the threshold panel model of Hansen (1999) is used to divide the interval of variables according to the characteristics of the data itself for parameter estimation.

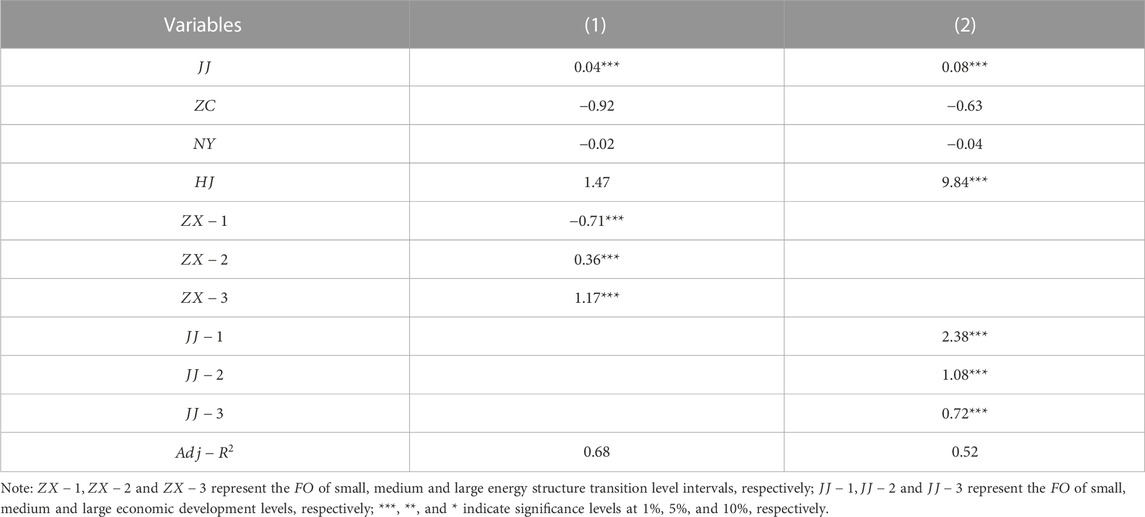

Since the threshold value and its number in the threshold model are unknown, in order to determine the form of the model, this section first determines the possible number of thresholds and their values through the corresponding algorithms and procedures according to the characteristics of the data. The regression results show that the double threshold model should be used for analysis. The two threshold estimates for the dual threshold model are 0.25 and 0.53, respectively. According to these two threshold values, the energy structure transformation of each province can be divided into three types: the initial stage of transformation, the growth stage of transformation and the maturity stage of transformation. Column (1) of Table 4 shows the regression results of the model under the double threshold.

It can be seen from Column (1) of Table 4 that in the early stage of energy structure transition, the estimated coefficient of financial openness is significant at the significance level of 1%, and its value is −0.71. In the growth period of energy structure transformation, the estimated coefficient of financial openness is significant at the 1% significance level, and its value is 0.36. In the mature period of energy structure transition, the estimated coefficient of financial openness is significant at the 1% significance level, and its value is 1.17. Obviously, 1.17 > 0.36>−0.71, which indicates that with the continuous maturity of energy structure transformation, the impact of financial openness on energy structure transformation is gradually enhanced. That is, Hypothesis 2 is verified.

4.4.2 The effect of financial openness at different levels of economic development

On the basis of Table 3, we further explore the average effect of financial openness at different levels of economic development. The threshold panel model of Hansen (1999) is still adopted, and the regression results show that the double threshold model should be used for analysis. The two threshold estimates for the dual threshold model are 4.11 and 7.63, respectively. According to these two threshold values, we can divide the economic development level of each province into three types: underdeveloped, moderately developed and developed. Column (2) of Table 4 shows the regression results of the model under the double threshold.

It can be seen from Column (2) of Table 4 that in economically underdeveloped regions, the estimated coefficient of financial openness is significant at the 1% significance level, and its value is 2.38. In the growth period of energy transition, the estimated coefficient of financial openness is significant at the 1% significance level, and its value is 1.08. In the maturity period of energy transition, the coefficient estimate of financial openness is significant at the 1% significance level, and its value is 0.72. Obviously, 2.38 > 1.08>0.72, which indicates that the more backward the economy is, the stronger the driving effect of financial openness on energy structure transformation is. That is, Hypothesis 3 is verified.

5 Conclusion and policy recommendations

This paper uses the panel data model of 30 provinces in China from 2010 to 2019 to examine the impact of financial openness on the transformation of energy structure, in order to provide theoretical support and policy reference for promoting the steady opening of financial market and helping to achieve the goal of “dual carbon”. The results show that: 1) From the current situation of China’s energy structure transformation, it can be seen that coastal cities have a higher level of energy transformation, while resource-based cities such as Shanxi have a lower level of energy transformation; 2) In general, financial openness is conducive to energy structure transformation; 3) In the initial stage of energy structure transformation, the main driving force of energy structure transformation is government policy support, while the driving effect of financial openness is weak, and may even be inhibiting; In the growth and maturity stages of the energy structure transformation, the market mechanism is constantly improved, and the financial openness may have a significant positive impact on the energy structure transformation, and with the deepening of the energy structure transformation, this promoting effect will be strengthened. 4) The financing capacity of less developed regions is greatly insufficient, but the transformation of energy structure needs a large amount of financial support. Therefore, the need for financial openness is more urgent in economically underdeveloped regions, that is, the lower the level of economic development is, the greater the impact of financial openness on energy structure transformation is. Based on this, this paper puts forward the following policy suggestions:

(1) Opening up the financial market in a steady and orderly manner. Adhering to the equal emphasis on “bringing in” and “going global,” by promoting the high-level opening up of the financial industry, it can promote the deepening reform of China’s financial industry, make the power of long-term capital and institutional investors continue to grow, attract overseas institutions and investors to participate in the transformation of energy structure, which will help enrich the participants of the financial market and optimize the financial supply. Provide rich financing channels for the transformation of energy structure and help further deepen the transformation of energy structure.

(2) Enhance innovation and diversity of financial products and broaden financing channels for energy structure transformation. In the process of energy structure transformation, one of the biggest problems is the difficulty of financing, which is more difficult for economically underdeveloped regions. The financing problem should not only rely on the guidance and incentive of the government, but also play the role of the financial market, especially foreign capital. First, actively promote the growth of green credit business for the transformation of energy structure. We will encourage financial institutions to invest more capital in green industries through tax cuts and targeted RRR cuts. Second, we will continue to deepen international cooperation in green finance, actively participate in the formulation of international standards in relevant fields, jointly incubate pilot and test projects, and explore the construction of a green finance market ecosystem.

(3) Give full play to the complementary advantages of government policies and financial institutions. In the initial stage of energy structure transformation, the main driving force of energy structure transformation is government policy support. However, with the deepening of the transformation of energy structure, it is necessary to make full use of the advantages of financial institutions, promote government-bank cooperation, give full play to the advantages of both sides in policy, information, resources and capital, explore diversified financial cooperation models, and jointly contribute to the transformation of energy structure.

(4) Pay attention to the reduction and withdrawal of traditional industries in resource-based areas to make up for the vacancy. Most industries in resource-based areas are closely related to fossil energy. On the one hand, resource-based areas should rely on local resource endowments, establish a multi-energy complementary comprehensive energy supply industry chain, establish and improve the exit compensation mechanism, and guide the steady transformation of industries. On the other hand, resource-based areas can reduce the risk of transition to a greater extent through the coordinated development of fossil energy and renewable energy.

(5) Both supply and demand sides should make concerted efforts to promote the transformation of energy structure. On the one hand, from the supply side, we should vigorously develop new and renewable energy such as wind power, hydropower, photovoltaic power generation and nuclear power, and zero and low-carbon energy production bases such as natural gas. We should promote various new energy projects, build a multi-energy complementary, safe and efficient energy system, and effectively lead the green transformation of energy. On the other hand, from the demand side, we should actively transform the growth drivers, change the growth mode, adjust the industrial structure, and limit the development of industries with high energy consumption. On the micro level, under the premise of comprehensive consideration of safety, economy, environmental protection and other factors, consumers’ lifestyle and consumption mode should be guided to shift to the direction of low energy consumption, low pollution and low emissions. Supply and demand sides work together to promote the transformation of energy structure.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

XJ: Conceptualization, Methodology, Resources, Validation, Writing–review and editing. WX: Data curation, Software, Writing–original draft. KW: Supervision, Writing–review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by General Progect of the National Social Science Foundation of China (No. 20BJY248).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1346594/full#supplementary-material

References

Aklin, M., and Urpelainen, J. (2013). Political competition, path dependence, and the strategy of sustainable energy transitions. Am. J. Political Sci. 57 (3), 643–658. doi:10.1111/ajps.12002

Amuakwa-Mensah, F., and Näsström, E. (2022). Role of banking sector performance in renewable energy consumption. Appl. Energy 306, 1–22. doi:10.1016/j.apenergy.2021.118023

Bai, W., Zhang, L., Lu, S., Ren, J., and Zhou, Z. (2023). Sustainable energy transition in Southeast Asia: energy status analysis, comprehensive evaluation and influential factor identification. Energy 284. doi:10.1016/j.energy.2023.128670

Cansino, J. M., Pablo-Romero, M. del P., Román, R., and Yñiguez, R. (2010). Tax incentives to promote green electricity: an overview of EU-27 countries. Energy Policy 38, 6000–6008. doi:10.1016/j.enpol.2010.05.055

Ding, W., Du, J., Kazancoglu, Y., Mangla, S. K., and Song, M. (2023). Financial development and the energy net-zero transformation potential. Energy Econ. 125 (C). doi:10.1016/j.eneco.2023.106863

Fernández, A., Klein, M. W., Rebucci, A., Schindler, M., and Martín, U. (2016). Capital control measures: a new dataset. Imf Econ. Rev. 64 (3), 548–574. doi:10.1057/imfer.2016.11

Guo, D., Li, Q., Liu, P., Shi, X., and Yu, J. (2023). Power shortage and firm performance: evidence from a Chinese city power shortage index. Energy Econ. 119. doi:10.1016/j.eneco.2023.106593

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: estimation, testing, and inference. J. Econ. 93 (2), 345–368. doi:10.1016/S0304-4076(99)00025-1

Kim, J., and Park, K. (2018). Effect of the clean development mechanism on the deployment of renewable energy: less developed v.s. Well-developed financial markets. Energy Econ. 75, 1–13. doi:10.1016/j.eneco.2018.07.034

Liu, P., and Peng, H. (2022). What drives the green and low-carbon energy transition in China? an empirical analysis based on a novel framework. Energy 239. doi:10.1016/j.energy.2021.22450

Rosenbloom, D., Meadowcroft, J., Sheppard, S., Burch, S., and Williams, S. (2018). Transition experiments: opening up low-carbon transition pathways for Canada through innovation and learning. Can. Publ. 44, 368–383. doi:10.3138/cpp.2018-020

Sadorsky, P. (2009a). Renewable energy consumption and income in emerging economies. Energy Policy 37 (10), 4021–4028. doi:10.1016/j.enpol.2009.05.003

Sadorsky, P. (2009b). Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ. 31 (3), 456–462. doi:10.1016/j.eneco.2008.12.010

Su, X., and Tan, J. (2023). Regional energy transition path and the role of government support and resource endowment in China. Renew. Sustain. Energy Rev. 174 (C), 113–150. doi:10.1016/j.rser.2023.113150

Tian, J., Yu, L., Xue, R., Zhuang, S., and Shan, Y. (2022). Global low-carbon energy transition in the post-COVID-19 era. Appl. Energy. 307. doi:10.1016/j.apenergy.2021.118205

Werner, D., and Lazaro, L. L. B. (2023). The policy dimension of energy transition: the Brazilian case in promoting renewable energies (2000–2022). Energy Pol. 175. doi:10.1016/j.enpol.2023.113480

Yu, J., Liu, P., Fu, D., and Shi, X. (2023a). How do power shortages affect CO2 emission intensity? Firm-level evidence from China. Energy 282. doi:10.1016/j.energy.2023.128927

Keywords: financial openness, transformation of energy structure, “dual carbon” targets, heterogeneity, China

Citation: Jia X, Xu W and Wang K (2024) Financial openness and energy structure transformation. Front. Environ. Sci. 11:1346594. doi: 10.3389/fenvs.2023.1346594

Received: 29 November 2023; Accepted: 18 December 2023;

Published: 08 January 2024.

Edited by:

Jian Yu, Central University of Finance and Economics, ChinaReviewed by:

Weihai Huang, Nanjing Agricultural University, ChinaLongjian Yang, Central University of Finance and Economics, China

Copyright © 2024 Jia, Xu and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Wenjing Xu, ODA5OTVAaG51YWhlLmVkdS5jbg==

Xianjun Jia1

Xianjun Jia1 Wenjing Xu

Wenjing Xu