95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 10 January 2024

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1323888

This article is part of the Research Topic Collaborative economy CE5P (Planet, People, Partnership, Prosperity, Peace) View all 6 articles

Under the Belt and Road Initiative (BRI), promoting green innovation in enterprises has been the central focus of the developmental strategy for China and countries along the Belt and Road to ensure sustainable development in line with the UN Sustainable Development Goals (SDGs) related to the environment and development. This paper examines the driving factors and heterogeneous mechanisms of the BRI in green technology innovation, especially in collaborative vs. independent innovation modes, utilizing a multi-period difference-in-difference model (DID) and micro-level panel data of Chinese listed enterprises spanning from 2007 to 2021. We find that the BRI has significantly stimulated the number of green innovations of participating enterprises, primarily through the adoption of collaborative innovation mode, and the BRI policies are more likely to induce green innovation behavior of enterprises with high research and development (R&D), high quality of environmental information disclosure, and non-state-owned enterprises (SOEs), as well as in heavy-polluting industries. The implementation of the BRI has led to increased support from the government, financial institutions, and scientific research organizations to the participating enterprises, which helps alleviate their financial constraints and enhance patent transformation efficiency, and thus facilitate green innovation. These results are robust across different regression specifications. This study contributes to the existing literature on BRI’s environmental impact and green innovation with firm-level evidence, and has important policy implications for the Chinese government when promoting green innovation and internationalization of Chinese enterprises.

The Belt and Road Initiative (BRI), which was launched in 2013, is a China-led global infrastructure developmental strategy aiming at promoting economic development and inter-regional economic, strategic, and cultural connectivity across the Eurasian continent and Africa, and later extended to Latin America (Hall and Krolikowski, 2022). Despite some achievements, the BRI has attracted considerable debate and conjecture over the past decade (Lai et al., 2020). Given that the BRI involves large-scale, trillions of dollars of investments in infrastructure, there is no doubt that the initiative faces significant environmental challenges, especially in terms of the ecological environment (Li et al., 2022; Zhang et al., 2023). To address the environmental sustainability issue, the BRI International Green Development Coalition (BRIGC) was established during the second Belt and Road Forum in April 2019. Its primary aim is to ensure long-term green and sustainable development, aligned with the UN Sustainable Development Goals. The drive toward greening the BRI enjoys support from leading innovative economies (Jiang et al., 2021). Many participating countries have taken the opportunity of the BRI to strengthen cooperation with the Chinese government and enterprises in new energy, environmental protection, and green infrastructure, creating a sound atmosphere for green innovation (Xin et al., 2022).

Green innovation refers to the innovative activities in which countries or enterprises use advanced technology to reduce the destructive pollution of the ecological environment and improve the utilization rate of resources, promoting the coordinated development of the economy, society, and environment (Li et al., 2022). Based on the patent application process, the innovation modes can be divided into independent innovation and collaborative innovation. The former refers to the autonomous innovation activities conducted by enterprises, including research and development (R&D), technological innovation, and product innovation, and the latter involves innovation collaboration between enterprises. The choice of innovation modes is determined by the enterprise’s unique internal and external factors. It is believed that with the implementation of BRI-related policies and initiatives, forward-thinking Chinese enterprises are more likely to engage in green technology innovation for sustainable development (Wang et al., 2023).

This study aimed to investigate empirically the driving factors and heterogeneous mechanism of green technology innovation and innovation modes of Chinese enterprises by constructing a multi-period DID model using panel data covering the listed enterprises in China from 2007 to 2021. The baseline empirical results show that compared to the enterprises without any BRI-related investments (the control group), those engaged in BRI investment projects (the treatment group) have significantly increased the number of green innovation patents, largely through the collaborative innovation mode. Various robustness tests confirm this finding. Furthermore, the heterogeneity analysis of enterprise characteristics provides evidence that the BRI facilitates green technology innovation, particularly in the collaborative innovation mode, for enterprises that are privately owned with high levels of R&D investment and high-quality environmental information disclosure, and favors independent green innovation for enterprises operating in heavy-pollution industries. It was also found that the government, financial, and scientific research institutions play important roles in driving green technology innovation through financial and technical support to enterprises participating in the BRI investments.

This study implies three major contributions to existing research on the BRI and green innovation. First, in contrast to most of the existing literature which focuses on the macroeconomic and industry-level impacts of the BRI, this study provides new evidence using firm-level panel data to address the concerns about BRI’s environmental impact of technological innovation and innovation modes for enterprises. Second, with a different setting from the one-period DID model, this paper uses a multi-period DID model with a series of robustness tests and firm-level data at different times to assess the policy effects of the BRI on green innovation in both collaborative and independent modes. The multi-period DID model is more appropriate to the public diplomacy narratives of the BRI and its implementation process, given its capability of capturing the impacts of irregular and inconsistent policy shocks. Finally, it provides policymakers with important policy implications for the role played by the government and financial institutions in facilitating green financing and improving the efficiency of patent transformation, which helps advance the understanding of the transmission mechanism of the BRI in increasing green innovation under different modes.

The rest of this paper is arranged as follows: Section 2 provides a brief literature review and sets the research hypotheses; Section 3 discusses the methodology and the model specification in this study; Sections 4, 5 discuss the empirical results and conduct a robustness check by considering the heterogeneity by incorporating enterprises’ R&D investment level, ESG score, ownership, and industry pollution level. The final section concludes with some policy implications.

A large number of existing studies have studied the economic and environmental influence of the BRI at the country and industry levels. At the country level, studies have found that the BRI can promote trade and investment cooperation between China and countries along the Belt and Road, and generate positive spillover on economic growth (Chen et al., 2019). As most of the countries along the Belt and Road are rich in natural resources, they are more inclined to develop resource-based industries, and hence face increasing environmental problems arising from massive consumption of fossil fuels (Tian et al., 2019). The greening of the BRI drives the participating countries’ green and sustainable economic growth through promoting energy efficiency and reducing carbon emission, facilitating the transition of the BRI countries from the high energy input and high emission-based developmental model to a green growth model (Jiang et al., 2021).

At the industrial level, some studies apply Kojima’s comparative advantage theory (Kojima, 1973) to the outbound investment of Chinese enterprises, and report that the BRI will promote the adjustment of comparative advantage industries and help transfer the excess capacity in China. With the implementation of the BRI, it was found that Chinese enterprises have increased investment in environmental and infrastructure projects to promote the upgrading of industrial structure and improvement of environmental performance in countries along the route (Cheng and Qi, 2021); they are also instrumental in promoting the flow of factors of production and drive BRI countries to prioritize the allocation of factors of production to green and efficient production sectors (Rauf et al., 2020). Most recently, some studies tend to examine the impact of the BRI on enterprise operations, and report that the BRI can help improve the internal control process of enterprises, expand the scale of R&D investment, optimize the ownership structure, improve total factor productivity, and achieve technological innovation breakthroughs (Liu and Aqsa, 2020). Enterprises can also obtain external funds through the BRI and take the opportunity to adapt to the environmental regulation and financing rules of the international market and green transformation (Lai et al., 2020).

Green innovation refers to the development of advanced technologies by enterprises considering environmental protection, which is conducive to the improvement of enterprise performance and national economic growth. Numerous factors influence the green innovation of enterprises, and the existing literature primarily examines the external environment and internal driving forces of enterprises (Li et al., 2022).

External environmental factors include financing environment, market environment, industrial environment, and policy environment, among others. First, green innovation requires financial support from multiple channels. A favorable financing environment ensures sufficient cash flow for enterprises to sustain their R&D investments, even when the output of scientific and technological achievements is uncertain (Yu et al., 2021; Zeqiraj et al., 2022). In addition, diversification and stability in financing channels also significantly enhance the efficiency of green innovation (Xiang et al., 2022). Second, the market environment plays a crucial role in influencing the green innovation activities of enterprises (Qiu et al., 2020). The demand for green products and services in the market or the institution investors not only directly impacts the innovation efforts of enterprises but also fosters knowledge sharing among them, indirectly promoting green innovation (Ali et al., 2019). Third, the diversification of enterprise industries and specialization in technological fields directly affect the efficiency of green innovation (Perruchas et al., 2020). The relative position of enterprises in the industrial chain and their ability to collaborate with other entities also influence the transfer of knowledge (Wang and Hu, 2020). Last, the policy environment has a significant impact on the green innovation of enterprises. The way and degree of policy support, as well as the developmental stage and industry of the enterprise, contribute to the heterogeneity of this impact (Qi et al., 2021).

Among the internal driving forces, enterprise culture and multiple resource allocations also play a direct role in shaping green innovation activities. First, corporate culture encompasses the values held by employees. Different cultures lead to diverse practices and outcomes in green innovation within enterprises (Weng et al., 2015). In particular, during the stage of green transformation, companies with a strong emphasis on social responsibility are more likely to engage in green innovation activities (Yang et al., 2022). Second, as businesses expand and gain market share, they often adjust the allocation of knowledge, manpower, capital, and other resources. This includes integrating internal knowledge resources, increasing investments in research and development, training professionals, addressing technological gaps, and expanding comparative advantages in technology (Wu et al., 2022). Moreover, obtaining external knowledge resources through collaboration and leveraging different sources of knowledge is vital for enhancing the quality and quantity of green technology within enterprises simultaneously.

As micro-participants in the green BRI, enterprises play a crucial role in promoting green innovation and achieving low-carbon transformation (Geng and Lo, 2022). From the perspective of government policy support, participating enterprises can benefit from government certification support and financial assistance. These measures help enterprises access financing more easily, alleviate liquidity constraints, and ensure the sustainability of green R&D investment. In practice, the Chinese government has provided various types of policy support, including green credit from banks (Coenen et al., 2021), operational industry funds (Liu et al., 2020), and tax incentives (Peng et al., 2022). Moreover, the green BRI also sends a signal to the international market that the Chinese government supports the green transformation of enterprises. This will enhance the attention of international investors toward environmentally friendly enterprises and attract external funds for enterprises to carry out green innovation.

From the perspective of the competitive environment of enterprises, there are significant differences in politics, economy, and culture among countries along the Belt and Road. To meet the diverse demand for green products in the international market, participating enterprises need to enhance their product competitiveness through innovation (Borsatto and Amui, 2019). According to the theory of technical trade barriers, enterprises must navigate the uncertain policy environment and address green trade barriers in different countries simultaneously (Hu et al., 2022). Therefore, to overcome trade barriers, enterprises need to actively increase environmental expenditures, bridge gaps in low-carbon technologies, and embrace social and environmental responsibilities (Ayob et al., 2023).

According to the Porter hypothesis, the rising environmental costs will compel enterprises to engage in green innovation activities, improve resource utilization efficiency, and reduce pollutant emission. In particular, in the uncertain international environment, participating enterprises adopt green outbound investment strategies to expand their presence in the international market and allocate green R&D project funds between home and host countries effectively (Liu et al., 2022). This approach helps leverage the comparative advantages of different markets, achieve economies of scale, and harness the positive role of market competition in driving green innovation for enterprises (Zhang et al., 2023). Based on the theoretical review, we propose the following hypothesis:

Hypothesis 1. (H1). The BRI has significantly improved the green innovation performance of enterprises.

Generally, enterprise innovation models are divided into independent and collaborative innovation. Independent innovation refers to enterprises utilizing their own knowledge elements for research and development, whereas collaborative innovation involves enterprise restructuring and using their internal knowledge resources innovatively in collaboration with external knowledge resources (Wang et al., 2019; Rabadán et al., 2020). Previous studies have demonstrated that compared with traditional innovation, green innovation necessitates greater knowledge resources and capital investment (Cao et al., 2023). It is also more susceptible to external environmental uncertainties, carries higher risks, and entails longer cycles. Consequently, in the process of establishing a green BRI, the potential for green cooperation and innovation plays a crucial role. Moreover, during participation in international market competition, enterprises are influenced by various factors, including industrial policy adjustments, disparities in resource endowments, technological knowledge foundations, and knowledge integration capabilities (Katsikeas et al., 2019; Salunke et al., 2019). As a result, enterprises exhibit significant heterogeneity in their selection of technological innovation models.

From the perspective of industrial supply-chain policies and resource endowments, there are significant differences in the emerging advantageous industries, overcapacity industries, and supporting industries which are supported by different regions (Ju et al., 2015). Enterprises located in regions with a complete industrial supply chain leverage the BRI to explore new markets, allocate funds toward the research and development of core technologies, and typically opt for independent innovation models to reinforce the leading role of advantageous industries (Cinnirella and Streb, 2017). However, during periods of industry fluctuations or decline, technical support from other enterprises becomes necessary for BRI construction enterprises. In such cases, integrating the supply chain of upstream and downstream enterprises through collaborative innovation modes facilitates faster breakthroughs in technological bottlenecks, enhances enterprise competitiveness in new markets, and leads to greater profits (Wang and Hu, 2020).

From the perspective of technological knowledge foundation and knowledge integration ability, countries along the Belt and Road have gradually developed networks of knowledge, technology, and innovation. The characteristics of enterprises within these networks directly influence their choice of innovation models (Shi et al., 2020). Enterprises with abundant knowledge accumulation in green technology can quickly integrate resources, coordinate supply chains, provide social value judgment information, and possess the ability to innovate independently in the short term (Wu and Si, 2022). However, BRI construction enterprises have relatively weak knowledge accumulation in green technology. When they have limited connections with other entities in the network, they tend to adopt a collaborative innovation mode. This mode enables them to strengthen the continuous transformation of green products and address their own technological shortcomings through knowledge spillover effects, thereby enhancing overall innovation efficiency. Based on the above theoretical review, we propose the following hypotheses:

Hypothesis 2a. After the implementation of the BRI, the participating enterprise carrying out green innovation through collaborative mode has significantly increased.

Hypothesis 2b. After the implementation of the BRI, the participating enterprise carrying out green innovation through independent mode has significantly increased.

Different from the existing research, this study constructs a multi-period DID model to verify the impact of the BRI on green technology innovation in Chinese enterprises. The multi-period DID model assumes that the time points at which all samples in the treatment group are affected by policy shocks are not completely consistent, which is more in line with the actual situation of China’s BRI (Wang et al., 2023). Therefore, this study constructs the following model:

where

Further analyzing the mechanism of action, this study uses a mediating effect model to test the transmission mechanism of the BRI in increasing the innovation of enterprises, mainly including two paths: alleviating financial constraints and improving the efficiency of patent achievement conversion. The specific models are as follows:

The mediating variables are enterprise financial constraints (hereafter KZ) and innovation transformation efficiency (hereafter Trans), respectively.

This study selects financial data and green patent technology data of Chinese listed enterprises from 2007 to 2021 as research samples, to analyze the micro-impact of the BRI on green innovation of enterprises. Starting from January 2007, Chinese listed enterprises were required to disclose mandatory information in the annual reports by the new accounting standards. The content of environmental information disclosure becomes quantitative indicators, and the motivation for companies to voluntarily disclose information is increasing, which has improved the accuracy of financial data. Therefore, the sample selection began in 2007.

Financial data of all listed enterprises participating in the BRI are from the Wind database and CSMAR database. This study conducts the following data processing. We excluded samples with missing ST, *ST, and financial data, and also removed those samples from the financial industry that went public that year. To eliminate heteroscedasticity, we take the natural logarithm of all continuous variables and perform tail reduction at the 1% and 99% levels. Finally, a balanced panel of data consisting of 12,585 observations was obtained.

This study gauges the green innovation behavior of enterprises by assessing the number of patents they have applied for in the field of green technology (Hao and He, 2022; Xin et al., 2022). Compared to the proxy indicator of R&D investment costs, this study takes a more comprehensive approach by including both invention patents and utility model patents, which measure the R&D process and innovation outcomes of the enterprise. The method for constructing this indicator is outlined below:

Number of green technology innovations (Ginno): The data on enterprise green patents are obtained from the CIRD sub-database of the CNRDS database. This database is categorized based on the International Patent Classification (IPC). To identify green patents, the list of green patents published by the World Intellectual Property Organization (WIPO) was used in this study. The patent identification numbers are refined to the smallest level and matched with the CIRD font classification statistics. Therefore, the total number of green patents is obtained by including the count of green invention applications, green utility model applications, and granted patents.

In addition, we focus on the knowledge spillover effect of the BRI when we assess the benefits of the enterprise choice of independent innovation mode or collaborative innovation mode. As discussed earlier, innovation activities can be classified into independent innovation and collaborative innovation. Generally, enterprises tend to adopt independent innovation to have better control over innovation costs and strategic decisions. However, in the context of the BRI, companies may have a strong interest in carrying out collaborative green technology innovation to align with international green standards and meet the requirements of low-carbon transformation. This allows for technology spillover effects and better matching of output products with the international market, catering to the needs of international investors. This study aimed to compare the green patent construction of individual applicants and collaborative applicants (two or more applicants) to explore the differences in the organizational form of green technology innovation under the BRI.

Determination of the policy impact time (

Sample selection for treatment groups (

Control variables according to existing studies were selected in this study. At the company level, variables such as asset size (Size), financial level (Lev), ownership concentration (Top10), return on equity (Roe), finance expense (Fexp), general and administrative expense (GAexp), growth rate of total assets (Growth), R&D expenditure (RDexp), and number of executions (Igov) were used as control variables in this study. Finally, to control unknown heterogeneity in the model, we control for the year and industry dummies. The list of all the variables is summarized in Table 1.

Table 2 presents the descriptive statistics of the main variables. Among them, green innovation (Ginno) has a mean of 1.152 with a variance of 1.502, whereas both independent innovation (Indep) and collaborative innovation (Collab) have a mean of 1.017 and 0.362 with a variance of 1.405 and 0.938, respectively. The gap between the two variables is smaller than that of total invention patents, which reflects the jaggedness between the number of independent and the collaborative ones. In addition, the average enterprise debt ratio (Lev) is 0.482, and 52.054% of the sample enterprises are higher than this value, which reflects the representative of the sample selection.

The correlation coefficient of the main variable indicates that the BRI is positively correlated with all three types of green innovation at a 1% significant level, thus preliminary verifying Hypothesis 1. In addition, as shown in Supplementary Table S1, the correlation coefficients between each explanatory variable and the dependent variable are all less than 0.5; the variance inflation factor (VIF) results with a maximum value of 1.61 indicate that there is no serious problem of multi-collinearity among our variables.

Starting from the quasi-natural experiment of the implementation of the BRI, we estimate the multi-period DID model specified in the previous section to examine the impact of the BRI on green innovation in enterprises. Table 3 reports the estimation results, in which columns (1)–(3) do not include control variables, whereas columns (4)–(6) provide benchmark regression models after controlling for enterprise characteristics. The results indicate that after using the least squares dummy variable (LSDV) technology to control for industrial and annual fixed effects, regardless of whether the enterprise characteristic variable is included, the coefficient of

In addition, the regression results of the control variables, as reported in columns (4)–(6), show that the coefficients of enterprise size, general and administrative expenses, and R&D expenditure are significant with expected signs, indicating that large-scale and financially self-sufficient enterprises have stronger green innovation motivation. On the other hand, the ownership concentration and the finance expense coefficients are significantly negative. The possible explanation is that due to the high cost of technological innovation, the long capital occupation period, and the potential risk of asymmetric investment return, the principal–agent problems occur when the short-sighted managers of enterprises with a high degree of ownership concentration or capital constraint act in their interests, which will weaken the momentum of green innovation. In addition, after adding the control variables reflecting the characteristics of the enterprise, the adjusted R2 values increased to 0.372, 0.334, and 0.215, indicating the explanatory power of our model.

To assess the overall impact of the BRI quasi-natural experiment more accurately, we consider the influencing factors that drive investment decisions related to BRI participation, encompassing financial constraints, production efficiency, and various other pertinent elements. Referring to existing literature, PSM-DID was further used to mitigate the potential bias caused by this impact.

A control group was constructed in this study with observation characteristics similar to those participating BRI enterprises to solve the problem of selection bias in the sample. Specifically, the nearest neighbor matching and kernel matching methods are used to determine the weights of matching indexes. The propensity score was estimated by variables such as the leverage ratio, the proportion of top 10 shareholders, the growth rate of net assets, and the intensity of R&D investment, and the regression result was obtained by the logit model. In Table 4, columns (1)–(3) present the nearest neighbor matching results, and the matching mode is 1:6; columns (4)–(6) present the results of the kernel matching method. The empirical results are consistent with the baseline empirical results, indicating that the BRI has a significant positive impact on enterprises to improve the quantity of green innovation and the formation of collaborative innovation.

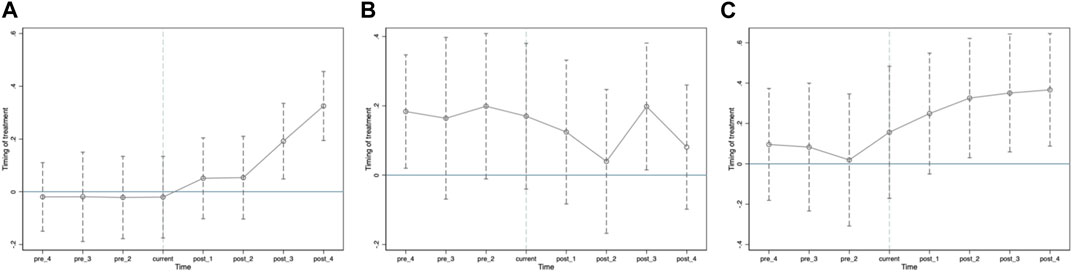

The premise of using the DID method is that the treatment group and the control group must meet the common parallel trend test, implying that if the BRI policy is not implemented, there is no systematic difference in the change in the time trend of enterprise green innovation. Therefore, the parallel trend of the number of green innovations and the mean value of the structural characteristics of independent and collaborative innovation in enterprises during 2010–2017 was examined in this study.

Figures 1A, C show that the sample group classification under the form of green innovation quantity and collaborative innovation meets the requirement of the parallel trend before the BRI policy. The coefficients of both in 2010–2013 are smaller than those after 2013, and the regression coefficients of the two periods after the BRI are significantly positive at the 95% confidence interval and gradually expand (the coefficient in 2017 is higher than that in 2016). The results suggest that the BRI has a positive impact on the green innovation behavior of enterprises in the long term. In contrast, Figure 1B shows that the coefficient in the form of independent innovation does not satisfy the parallel trend test, which is consistent with the previous theoretical analysis.

FIGURE 1. Parallel trend test. (A) Impact coefficient of the BRI on corporate green innovation, (B) impact coefficient of the BRI on independent innovation, and (C) impact coefficient of the BRI on collaborative innovation.

We turn to the robustness check of the results by using an alternative measure for green innovation. To better determine whether the weight of green innovation in all innovation patents has increased, we use the relative proportion index instead of the quantity indicator mentioned earlier, which is defined as the ratio of the number of green patent applications in that year over the number of all patent applications (Ginno_ratio). The calculation method for the independent innovation rate and collaborative innovation rate of patents is the same. The regression results in columns (1)–(3) of Table 5 show that the enterprises participating in the BRI continue to enhance their overall and collaborative green transformation power, which proves the robustness of the regression results.

In addition, there are notable differences in the level of economic development, investment and financing policies, and degree of financial easing across the provinces in China (Xin et al., 2022; Liu and Yang, 2023). These confounding factors may interfere with the research results. Therefore, we include the fixed effects of provinces, years, and industries in the model estimations. The results in columns (4)–(6) of Table 5 indicate that after controlling for provincial characteristics, the overall and collaborative green innovation coefficients of enterprises participating in the BRI show an upward trend, further proving the robustness of our conclusions.

We continue the robustness check by conducting a placebo test on the baseline regression results. We lead the policy-impacted time point by 1 and 2 years, respectively, and add the virtual policy impact variable to the benchmark regression equation as the control variable. The results show that whether the policy shock time is led by 1 or 2 years, the coefficient of the realized policy shock variable is still positive and significant after adding the dummy variables of policy shock. The regression results also indicate that 2013 as the BRI policy impact starting point is reasonable.

To assess the placebo test results, we conducted a simulation by randomly allocating the BRI policy shock dummy variable to each enterprise and then run regression analysis on the dummy policy shock variables using three dependent variables to obtain the regression coefficients of the dummy policy shock variables. The above process is repeated 500 times, and the distribution of policy impact regression coefficients is shown in Figure 2. Comparing it with the regression coefficients of actual BRI policy impact variables, the results further demonstrate the robustness and credibility of the benchmark regression results. The regression coefficients of the virtual policy shock variables in Figures 2A–C are all very close to zero. The coefficients obtained from the regression of the three explained variables on the virtual policy shock variables are significantly different from the regression coefficients of the actual BRI policy shock variables, which can exclude the interference of unobserved variables and non-random factors on the estimation results.

FIGURE 2. Placebo test. (A) Random density distribution of green innovation of enterprises, (B) random density distribution of independent innovation of enterprises, and (C) random density distribution of the collaborative innovation of enterprises.

To further examine the heterogeneous impact of the BRI on enterprises’ green innovation and to provide targeted suggestions for incentive green innovation, we conduct the heterogeneity regressions based on four micro-characteristics of enterprises, namely, R&D investment level, ESG score, ownership, and industry pollution level.

Table 6 reports the estimation results of the enterprise R&D investment level of the BRI on their green innovation. Columns (1) and (2) show the empirical results of the influence of the BRI on the number of green patent applications for enterprises under high or low R&D investment levels, respectively. It was found that the influence coefficient of the BRI on enterprises with strong R&D investment is equal to 0.070, which is significant at the 5% level, but the influence coefficient of enterprises with weak R&D investment is not significant. Similarly, columns (3)–(6) show the influence of the BRI on independent innovation and collaborative innovation under the sample of strong and weak R&D investment levels. Among them, the influence coefficient of the BRI on the collaborative innovation of enterprises engaged in R&D investment is 0.121, and it is significant at the 5% level. The results suggest that the BRI can promote high R&D investment enterprises to carry out green innovation, especially for collaborative innovation.

The explanation is as follows: the level of R&D investment largely reflects the willingness and ability of the green innovation of an enterprise. An enterprise with high R&D investment is generally associated with strong liquidity and innovation vitality. To better adapt to the environmental changes of the BRI, renovation active enterprises are more likely to move up to the high-end industrial supply chain based on their core technologies and product innovations, which will allow them to gain regional market recognition. Thus, this will form a virtuous circle of technological innovation and market recognition.

Table 7 reports the estimation results of the heterogeneous influence of the BRI on enterprises with a high ESG score. Columns (1), (3), and (5), respectively, show the empirical results of the influence of the BRI on the number of green patent applications, independent innovation, and collaborative innovation of enterprises with high ESG scores. The influence coefficients of the BRI on green innovation, independent innovation, and collaborative innovation of enterprises with high ESG scores are 0.121, 0.074, and 0.092, respectively, and they are significant at least at the 5% significant level. The results suggest that the BRI can significantly increase the number of green patent applications, independent innovation, and collaborative innovation for enterprises with high ESG scores. The finding is consistent with our casual observation that the BRI is likely to attract and encourage the renovation capable enterprises with high ESG scores to participate, which in turn further motivates their green technology innovation power.

This can be explained as follows: at the World Climate Conference in Copenhagen in 2009, China announced that its carbon emissions per unit of GDP would be reduced in 2020 by 40%–45% compared to that in 2005. Since then, the Chinese government has implemented measures to encourage enterprises to adopt and accelerate the transition to a low-carbon model. Higher ESG enterprises help reduce agency costs and information asymmetry between firms and investors, and ultimately enhance the level of stock liquidity and shareholder wealth. This motivates and drives firms to go further “green,” especially in green technology innovation.

China’s state-owned enterprises (SOEs) play an important role in the implementation of the BRI, especially in large-scale overseas infrastructure projects. Compared with non-SOEs, SOEs are financially less constrained and enjoy a privileged position in the domestic financial market (Qi et al., 2018; Qi et al., 2021), which provides them with financial advantage in engaging in large-scale R&D investment and new-product production and circulation (Jiang et al., 2022). Given their privileged position in the political economic system and low autonomy and accountability, SOEs are normally viewed to have a lower level of risk management practice and awareness, as well as SOEs are innovation-motivated when compared to the non-SOEs. On the other hand, although the non-SOEs have a high flexible decision-making mechanism, they are usually credit- and manpower-constrained, which leads to low willingness to participate in green transformation. The BRI can help alleviate the financial and human resource constraints of non-SOEs through an expanded market access along the BRI route, which allows non-SOEs to build and gain substantial momentum in innovation.

Table 8 presents the estimation results of the ownership-based heterogeneous influence of the BRI on innovation; in particular, columns (2), (4), and (6), respectively, report the empirical results of the BRI influence on non-SOEs’ number of green patent applications, independent innovation, and collaborative innovation. The coefficients of the BRI are 0.195, 0.176, and 0.122, respectively, and they are all significant at the 1% level. The results suggest that the BRI can significantly increase the number of green patent applications, independent innovation, and collaborative innovation for China’s non-SOEs. The finding lends support to our proposition that the BRI can help alleviate non-SOE financial and human resource constraints through expanded market access along the BRI route and promote non-SOE innovation momentum. However, given that China’s SOEs cover a wide range of strategic sectors, especially in heavy-polluting industries and utilities such as coal, steel, and cement, and also face complex problems such as overcapacity and technical bottlenecks, the heterogeneous results can be possibly biased. Therefore, it is necessary to conduct some further analyses about the heterogeneous influence brought by the characteristics of heavy-polluting industries in the next sub-section.

To deal with the endogenous problem, we run a triple difference (DDD) model by Supplementary Eq. S1 to assess the heterogeneous impact of the BRI on green innovation in China’s heavy-polluting industries only, and Table 9 reports the results. Table 9 shows that the coefficient of Treat*Post*Indpoll is significantly positive in the overall green innovation and independent innovation forms, and both are significant at the 5% level. The results are consistent with the early findings that the BRI has significantly enhanced the level of green innovation in Chinese heavy-polluting industries, due to the greening of the BRI and increasingly the environmental governance.

In summary, our heterogeneity analysis provides additional information about the impact of the BRI on firm green innovation. The BRI can promote green innovation, especially the collaborative mode of green innovation, for the participating enterprises with high R&D and high ESG scores, as well as enterprises in the heavy-polluting industries. In addition, as the BRI can help alleviate non-SOE financial and human resource constraints due to the expanded market access, the initiative can significantly enhance non-SOE green innovation, in particular, in both the collaborative and independent modes.

To further advance our understanding of the transmission mechanism of the BRI in increasing green innovation, we assess the impact of the BRI on the level of green innovation by first considering the easing of the financial constraints of firms and then the efficiency improvement of innovation transformation.

We estimate Eqs 2, 3 to assess BRI’s transmission mechanism in increasing green innovation by considering alleviating the financial constraints of the firms, and Table 10 reports the estimation results. Table 10 shows that the cross-term coefficient is significantly positive in column (1), indicating that enterprises’ participation in the BRI is helpful in improving good capital liquidity and alleviating financial constraints. Then, in columns (2) and (4), it was found that the coefficient of the interaction item is significantly positive at least at the 5% significant level, but the coefficient of the KZ index is not significant, so the Sobel test is needed. Sobel test values are significant at the 1% level, which shows that financial constraints have partial mediation effects in the aforementioned mechanism.

The possible reasons are as follows: As an enterprise’s participation in the BRI construction may send positive signals to international investors, it helps enhance its public recognition and reputation, and attract foreign investment through enlarged financing channels and market access. On the other hand, the regional governments and financial institutions in China also provide favorable fiscal incentives and financial supports to enterprises participating in the BRI construction, including providing low interest rate green loans and reducing trade tariffs, which helps alleviate the financial constraint of those enterprises related to the BRI. Thus, the BRI can help ease the financial constraints of enterprises and promote the green innovation transformation of enterprises.

Table 11 shows the estimation results on the transformation channels of patent achievements. It can be observed that the coefficient of interaction is significantly positive in column (1), indicating that enterprises participating in the BRI can improve the efficiency of patent technology transformation. Then, in columns (2), (3), and (4), the coefficients of mediating variables are 0.103, 0.088, and 0.063, respectively, and they are all significant at the 1% level, which suggests that the transformation of patent achievements has produced a full mediation effect in the aforementioned mechanism. The findings are consistent with our causal observation. On the one hand, enterprises participating in the BRI can transfer excess production capacity and technological advantages effectively through tech-innovation channels to gain the needed liquidity support for their R&D expenditures. On the other hand, to participate in the BRI, enterprises need to gain access to the advanced technological means in BRI countries. This will help facilitate knowledge spillovers and technology transfer, and enhance the efficiency of patent conversion. As a consequence, technological progress and improved efficiency of the patent transformation through BRI participation will promote eco-efficiency and the total factor productivity (TFP) of firms. Thus, the BRI plays an instrumental role in bringing in and driving out patent technology transfer and improving the efficiency of patent transformation.

This paper empirically examines the driving factors and heterogeneous mechanisms influencing green technology innovation and innovation modes among Chinese listed enterprises participating in BRI projects. To capture the impact of inconsistent policy shocks, we construct a multi-period DID model using panel data of Chinese listed enterprises spanning from 2007 to 2021. The primary findings can be summarized as follows:

First, the BRI positively impacts the number of green innovation patent applications and significantly promotes collaborative innovation. Several robustness checks confirm this finding. Second, it is noteworthy that the BRI promotes non-SOEs, and enterprises with high R&D investment and ESG scores to engage in green technology innovation, especially in the collaborative innovation mode. The BRI also favors the green innovation of enterprises in heavy-polluting industries, especially for their independent innovation. Finally, it was found that the sources of the BRI influence on enterprises’ green innovation largely stem from government support, financial institutions, and scientific research institutions aiding enterprises involved in BRI construction. This support operates through two channels: easing financial constraints and enhancing the efficiency of patent transformation.

Our findings have several important policy implications. First, to promote firms “going global and going green” along the Belt and Road, the government should focus on certain policy measures intended to alleviate the financial constraints of firms and improve the efficiency of patent transformation of the enterprises. Second, the BRI promotes green innovation of enterprises not only in terms of quantity but also in quality through enhanced connectivity along the Belt and Road and improved efficiency of innovation resource allocation and spillover effects. Our results suggest that enterprises, especially in the heavy-polluting industries, can enhance their collaborative and green innovation and transformation in both the upstream and downstream of the industrial supply chain by actively participating in the BRI investment projects. Finally, the enterprises, especially non-SOEs, should take advantage of the BRI which can help alleviate their financial and human resource constraints through expanded market access along the Belt and Road, and promote their innovation momentum. This will also help firms transfer excess production capacity facilitate, and hence enhance the efficiency of patent conversion. Technological progress and improved efficiency of innovation transformation through BRI participation will promote eco-efficiency and further improve the TFP of firms.

This study has several limitations that suggest future research opportunities. First, this study mainly focused on the impact of the BRI on enterprises’ green innovation from the perspective of financial constraints and patent transformation, but there is reason to think that this is not the only way. For example, some external and macro-factors such as institutional regulation and economic policy uncertainty (EPU) may also affect the explanatory power of the research. Second, due to the limitation of data availability, the research sample only covers Chinese listed enterprises, excluding non-listed enterprises, especially those small and medium-sized enterprises (SMEs) with strong innovative vitality. These could be considered in the future research.

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

BL: formal analysis, funding acquisition, investigation, project administration, software, visualization, and writing–original draft. ZiZ: conceptualization, data curation, methodology, resources, and writing–original draft. ZhZ: supervision, validation, and writing–review and editing.

The authors declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Ministry of Education of the China Youth Fund Program, No. 22YJCZH075, and Zhejiang Gongshang University Institute of East Asian Studies Key Research Project, No. 22ZDDYZS01.

The third author wishes to acknowledge financial support from the Sumitomo Foundation.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1323888/full#supplementary-material

Ali, H. S., Zeqiraj, V., Lin, W. L., Law, S. H., Yusop, Z., Bare, U. A. A., et al. (2019). Does quality institutions promote environmental quality? Environ. Sci. Pollut. Res. 26, 10446–10456. doi:10.1007/s11356-019-04670-9

Ayob, A. H., Freixanet, J., and Shahiri, H. (2023). Innovation, trade barriers and exports: evidence from manufacturing firms in ASEAN countries. J. Asia Bus. Stud. 17, 203–223. doi:10.1108/JABS-05-2021-0185

Borsatto, J. M. L. S., and Amui, L. B. L. (2019). Green innovation: unfolding the relation with environmental regulations and competitiveness. Resour. Conserv. Recycl. 149, 445–454. doi:10.1016/j.resconrec.2019.06.005

Cao, X., Zhao, F., Wang, Y., Deng, Y., Zhang, H., and Huang, X. (2023). The Belt and Road Initiative and enterprise green innovation: evidence from Chinese manufacturing enterprises. Front. Ecol. Evol. 11, 1176907. doi:10.3389/fevo.2023.1176907

Chen, Y., Fan, Z., Zhang, J., and Mo, M. (2019). Does the connectivity of the belt and road initiative contribute to the economic growth of the belt and road countries? Emerg. Mark. Finance Trade 55, 3227–3240. doi:10.1080/1540496X.2019.1643315

Cheng, S., and Qi, S. (2021). The potential for China’s outward foreign direct investment and its determinants: a comparative study of carbon-intensive and non-carbon-intensive sectors along the Belt and Road. J. Environ. Manage. 282, 111960. doi:10.1016/j.jenvman.2021.111960

Cinnirella, F., and Streb, J. (2017). The role of human capital and innovation in economic development: evidence from post-Malthusian Prussia. J. Econ. Growth 22, 193–227. doi:10.1007/s10887-017-9141-3

Coenen, J., Bager, S., Meyfroidt, P., Newig, J., and Challies, E. (2021). Environmental governance of China’s belt and road initiative. Environ. Policy Gov. 31, 3–17. doi:10.1002/eet.1901

Geng, Q., and Lo, K. (2022). China’s Green Belt and Road Initiative: transnational environmental governance and causal pathways of orchestration. Environ. Polit. 32, 1163–1185. doi:10.1080/09644016.2022.2156176

Hall, T. H., and Krolikowski, A. (2022). Making sense of China’s belt and road initiative: a review essay. Int. Stud. Rev. 24, 023. doi:10.1093/isr/viac023

Hao, J., and He, F. (2022). Corporate social responsibility (CSR) performance and green innovation: evidence from China. Finance Res. Lett. 48, 102889. doi:10.1016/j.frl.2022.102889

Hu, Y., Li, Y., Sun, J., Zhu, Y., Chai, J., and Liu, B. (2022). Towards green economy: environmental performance of belt and road initiative in China. Environ. Sci. Pollut. Res. 30, 9496–9513. doi:10.1007/s11356-022-22804-4

Jiang, M., Qi, J., and Zhang, Z. (2022a). Under the same roof? The Green Belt and Road Initiative and firms’ heterogeneous responses. J. Appl. Econ. 25, 316–338. doi:10.1080/15140326.2022.2036566

Jiang, Q., Ma, X., and Wang, Y. (2021). How does the one belt one road initiative affect the green economic growth? Energy Econ. 101, 105429. doi:10.1016/j.eneco.2021.105429

Jiang, W., Zhang, H., and Lin, Y. (2022b). Trade sustainability and efficiency under the belt and road initiative: a stochastic frontier analysis of China’s trade potential at industry level. Emerg. Mark. Finance Trade 58, 1740–1752. doi:10.1080/1540496X.2021.1925246

Ju, J., Lin, J. Y., and Wang, Y. (2015). Endowment structures, industrial dynamics, and economic growth. J. Monet. Econ. 76, 244–263. doi:10.1016/j.jmoneco.2015.09.006

Katsikeas, C., Leonidou, L., and Zeriti, A. (2019). Revisiting international marketing strategy in a digital era: opportunities, challenges, and research directions. Int. Mark. Rev. 37, 405–424. doi:10.1108/IMR-02-2019-0080

Kojima, K. (1973). A macroeconomic approach to foreign direct investment. Hitotsubashi J. Econ. 14, 1–21. Available at: http://www.jstor.org/stable/43295560 (Accessed August 21, 2023).

Lai, K. P. Y., Lin, S., and Sidaway, J. D. (2020). Financing the Belt and Road Initiative (BRI): research agendas beyond the “debt-trap” discourse. Eurasian Geogr. Econ. 61, 109–124. doi:10.1080/15387216.2020.1726787

Li, B., Hu, J., Chen, G., Xiao, D., and Cheng, S. (2022a). The environmental effects of regional economic cooperation: evidence from the Belt and Road Initiative. Front. Environ. Sci. 10, 1020502. doi:10.3389/fenvs.2022.1020502

Li, M., Tian, Z., Liu, Q., and Lu, Y. (2022b). Literature review and research prospect on the drivers and effects of green innovation. Sustainability 14, 9858. doi:10.3390/su14169858

Liu, H., and Aqsa, M. (2020). The impact of OFDI on the performance of Chinese firms along the ‘Belt and Road. Appl. Econ. 52, 1219–1239. doi:10.1080/00036846.2019.1659501

Liu, W., Zhang, Y., and Xiong, W. (2020). Financing the belt and road initiative. Eurasian Geogr. Econ. 61, 137–145. doi:10.1080/15387216.2020.1716822

Liu, Y., and Yang, Z. (2023). Can data center green reform facilitate urban green technology innovation? Evidence from China. Environ. Sci. Pollut. Res. 30, 62951–62966. doi:10.1007/s11356-023-26439-x

Liu, Z., Liu, G., and Zhang, P. (2022). Does the Belt and Road Initiative increase the green technology spillover of China’s OFDI? An empirical analysis based on the DID method. Front. Environ. Sci. 10, 1043003. doi:10.3389/fenvs.2022.1043003

Peng, Y., Akbar, M. W., Zia, Z., and Arshad, M. I. (2022). Exploring the nexus between tax revenues, government expenditures, and climate change: empirical evidence from Belt and Road Initiative countries. Econ. Change Restruct. 55, 1365–1395. doi:10.1007/s10644-021-09349-1

Perruchas, F., Consoli, D., and Barbieri, N. (2020). Specialisation, diversification and the ladder of green technology development. Res. Policy 49, 103922. doi:10.1016/j.respol.2020.103922

Qi, G., Jia, Y., and Zou, H. (2021a). Is institutional pressure the mother of green innovation? Examining the moderating effect of absorptive capacity. J. Clean. Prod. 278, 123957. doi:10.1016/j.jclepro.2020.123957

Qi, J., Liu, H., and Zhang, Z. (2021b). Exchange rate uncertainty and the timing of Chinese outward direct investment. Int. Rev. Econ. Finance 76, 1193–1204. doi:10.1016/j.iref.2019.11.008

Qi, J., Zhang, Z., and Liu, H. (2018). Credit constraints and firm market entry decision: firm-level evidence from internationalizing Chinese multinationals. North Am. J. Econ. Finance 46, 272–285. doi:10.1016/j.najef.2018.04.012

Qiu, L., Hu, D., and Wang, Y. (2020). How do firms achieve sustainability through green innovation under external pressures of environmental regulation and market turbulence? Bus. Strategy Environ. 29, 2695–2714. doi:10.1002/bse.2530

Rabadán, A., Triguero, Á., and Gonzalez-Moreno, Á. (2020). Cooperation as the secret ingredient in the recipe to foster internal technological eco-innovation in the agri-food industry. Int. J. Environ. Res. Public. Health 17, 2588. doi:10.3390/ijerph17072588

Rauf, A., Liu, X., Amin, W., Rehman, O. U., Li, J., Ahmad, F., et al. (2020). Does sustainable growth, energy consumption and environment challenges matter for Belt and Road Initiative feat? A novel empirical investigation. J. Clean. Prod. 262, 121344. doi:10.1016/j.jclepro.2020.121344

Salunke, S., Weerawardena, J., and McColl-Kennedy, J. R. (2019). The central role of knowledge integration capability in service innovation-based competitive strategy. Ind. Mark. Manag. 76, 144–156. doi:10.1016/j.indmarman.2018.07.004

Shi, G., Ma, Z., Feng, J., Zhu, F., Bai, X., and Gui, B. (2020). The impact of knowledge transfer performance on the artificial intelligence industry innovation network: an empirical study of Chinese firms. PLOS ONE 15, e0232658. doi:10.1371/journal.pone.0232658

Tian, X., Hu, Y., Yin, H., Geng, Y., and Bleischwitz, R. (2019). Trade impacts of China’s Belt and Road Initiative: from resource and environmental perspectives. Resour. Conserv. Recycl. 150, 104430. doi:10.1016/j.resconrec.2019.104430

Wang, C., and Hu, Q. (2020). Knowledge sharing in supply chain networks: effects of collaborative innovation activities and capability on innovation performance. Technovation 94–95, 102010. doi:10.1016/j.technovation.2017.12.002

Wang, H., Su, Z., and Zhang, W. (2019). Synergizing independent and cooperative R&D activities: the effects of organisational slack and absorptive capacity. Technol. Anal. Strateg. Manag. 31, 680–691. doi:10.1080/09537325.2018.1543867

Wang, S., Zhang, M., and Chen, F. (2023). Unveiling the impact of Belt and Road Initiative on green innovation: empirical evidence from Chinese manufacturing enterprises. Environ. Sci. Pollut. Res. 30, 88213–88232. doi:10.1007/s11356-023-28503-y

Weng, H.-H., Chen, J.-S., and Chen, P.-C. (2015). Effects of green innovation on environmental and corporate performance: a stakeholder perspective. Sustainability 7, 4997–5026. doi:10.3390/su7054997

Wu, J., Xia, Q., and Li, Z. (2022). Green innovation and enterprise green total factor productivity at a micro level: a perspective of technical distance. J. Clean. Prod. 344, 131070. doi:10.1016/j.jclepro.2022.131070

Wu, X., and Si, Y. (2022). China’s belt and road initiative and corporate innovation. Finance Res. Lett. 48, 103052. doi:10.1016/j.frl.2022.103052

Xiang, X., Liu, C., and Yang, M. (2022). Who is financing corporate green innovation? Int. Rev. Econ. Finance 78, 321–337. doi:10.1016/j.iref.2021.12.011

Xin, P., Zhao, M., and Bai, Y. (2022). Does the belt and road initiative promote green innovation quality? Evidence from Chinese cities. Sustainability 14, 6060. doi:10.3390/su14106060

Yang, N., Wang, J., Liu, X., and Huang, L. (2022). Home-country institutions and corporate social responsibility of emerging economy multinational enterprises: the belt and road initiative as an example. Asia Pac. J. Manag. 39, 927–965. doi:10.1007/s10490-020-09740-y

Yu, C.-H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Zeqiraj, V., Sohag, K., and Hammoudeh, S. (2022). Financial inclusion in developing countries: do quality institutions matter? J. Int. Financ. Mark. Inst. Money 81, 101677. doi:10.1016/j.intfin.2022.101677

Zhang, J., Li, P., Liza, F. F., Ahmad, F., Lv, C., and Cao, Z. (2023a). How does the belt and road initiative affect the carbon emissions of China’s cities? Front. Environ. Sci. 10, 1066122. doi:10.3389/fenvs.2022.1066122

Keywords: Belt and Road Initiative, green innovation, Chinese listed enterprises, difference-in-difference model, collaborative vs. independent innovation modes

Citation: Li B, Zhang Z and Zhang Z (2024) The impact of the Belt and Road Initiative on green innovation and innovation modes: empirical evidence from Chinese listed enterprises. Front. Environ. Sci. 11:1323888. doi: 10.3389/fenvs.2023.1323888

Received: 18 October 2023; Accepted: 21 December 2023;

Published: 10 January 2024.

Edited by:

Shigeyuki Hamori, Kobe University, JapanCopyright © 2024 Li, Zhang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zijing Zhang, emlqaW5nNjY2QG91dGxvb2suY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.