94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 03 January 2024

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1302809

This article is part of the Research TopicNexus Between Innovations, Environmental Challenges and Labor MobilityView all 13 articles

To cope with the emissions permit trading program, industrial firms have to change production decisions, which may affect their pollution discharge, labor demand, and workers’ wage earnings. Using a time-varying difference-in-differences framework together with robustness checks, this research explores the impacts of the SO2 emissions trading scheme (SETS) on SO2 emissions, employment, and wages of industrial firms in China. It was noted that the program resulted in a remarkable decline not only in SO2 emissions but also in labor demands and wages. The mechanism analyses further show that emissions reduction is mainly driven by fossil energy input decrease rather than by desulfurization technology. The negative effects of employment and wages are driven by the negative output effect and insufficient technology rather than by the environmental substitute effect. Our findings contribute to the improvement of the market-oriented environmental permit trading program and development of regulated firms in developing countries.

Since the reform and opening up in 1978, the economy of China has advanced a lot. However, long-run growth has brought serious environmental challenges. According to the Environmental Performance Index report (Wolf et al., 2022), China’s environmental performance is ranked 120th in 180 countries; its air quality has become the second worst, which makes pollution abatement a top priority of the society. The Chinese government has executed a variety of policies and regulations for environmental conservation. However, environmental protection is tied to economic short-run growth cuts (Chen et al., 2018). For example, China used to mainly rely on mandatory measures to curb environmental pollution, which discouraged the enthusiasm of economic entities for production (Tu and Shen, 2014). Thus, it has long been a critical issue for China on how economic growth can be kept in balance with environmental protection. A tradable permit scheme based on the price principle gets the government’s good graces owing to being less costly. However, even if the tradable program is less costly, it might still impose production costs, especially labor costs, on regulated firms due to the reallocation of inputs and outputs (Curtis, 2018). China’s economic growth rate has slowed down, given that there are many workers who migrate from rural to urban areas, there is a large amount of low-skilled employment in manufacturing, and keeping a stable employment is an important concern for policymakers (Liu et al., 2017).

Particularly, to reduce SO2 emissions, China has initiated the SO2 emissions trading scheme (SETS) in 2002. As a market-based instrument, the SETS is mainly aimed at industrial enterprises. Does it take effect in emissions reduction? In the meanwhile, does this policy affect labor markets of industrial firms? How does it influence these? We used the matched firm-level data from the Annual Survey of Industrial Firms (ASIF) and the Environmental Survey and Reporting (ESR) to estimate the impact of the SETS on emissions, employment, and wages of industrial enterprises in China. The result indicates that the SETS reduces employment and wages, while decreasing emissions due to decreasing coal inputs, negative output effects, and insufficient technology. The key contribution of this study is that we took wages into consideration to explore the full effects of the SETS on industrial enterprises’ labor markets in China and clarified the impact mechanism of the policy, which broadens the existing literature and is crucial for improving the policy system and promoting China’s sustainable development.

Generally speaking, environmental regulations are divided into administrative measures and market-oriented policy instruments. Mandatory environmental governance measures are argued as being not conducive to reducing emissions reduction costs, while market-oriented emissions trading schemes are more effective than mandatory tools due to lower pollution abatement costs (Montgomery, 1972). Some research have examined the effects of administrative policies on environmental quality and pollution emissions (Fan et al., 2019; Chen et al., 2022), health and mortality (Greenstone and Hanna, 2014; Ye and Tao, 2023), employment and productivity (He et al., 2020; Liu et al., 2021), and abatement costs and the related economic outcomes (Walker, 2013; Cai et al., 2016). Some studies have also explored the effects of market-oriented tools, and most of the works emphasize on the influences of environmental tax/subsidies (Franco and Marin, 2017; Shouraki et al., 2018) or the impacts of tradable permit schemes, such as the carbon emissions trading scheme (Wang et al., 2016; Lin and Jia, 2019; Peng et al., 2023), NOx emissions trading scheme (Farrell et al., 1999; Linn, 2008; Deschênes, 2017), and SO2 emissions trading scheme (Färe et al., 2013; 2014). These studies have examined environmental efficiency and abatement costs (Zhang and Zhang, 2019; Zhu et al., 2020) and innovation and technology (Borghesi et al., 2015; Ren et al., 2022). No matter the mandatory measures or the tradable environmental schemes, most evidence indicate to environmental improvement that has been brought about by technical progress or has come at the expense of economic costs, especially costs that are related to the labor market.

In terms of technical progress, according to Van der Linde and Porter (1995), appropriate regulations on the environment can activate technological innovation in the long run. The supporters state that technological innovation can partially or fully offset the costs of regulation and achieve a win–win scenario between the environment and economy (Calel and Dechezleprêtre, 2016). But opponents argue that environmental regulations may increase production costs and hinder firms’ technology upgrades (Gray, 1987; Levinsohn and Petrin, 2003). Other researchers consider that the impact is uncertain (Testa et al., 2011). In terms of economic costs, the inefficiency or economic losses of the farming and transport sector have been examined (Abbas et al., 2022; Abbas et al., 2023). Particularly, the variations from the labor market such as enterprises’ employment and workers’ income caused by environmental regulations have been the most concerning issues. Implementation of the environmental policy may increase production and abatement costs, limit the production scale, and decrease the labor demand of enterprises (Abbas et al., 2022). Meanwhile, an increase in costs will be passed on to product prices, resulting in lower market demand, lower corporate profits, and lower wages. However, firms can use tradable permits of emissions as a competitive element to raise production scales and profits of enterprises and increase labor demand and wages. The economic performance is called the output effect (Berman and Bui, 2001; Morgenstern et al., 2002). Considering the effect of substitution, if pollution management activities of firms occur at the production process, it will lead firms to shrink production, transfer costs to product price, and cut down workforce and wages of enterprises. If firms implement the end-of-pipe treatment, the operation and maintenance of pollution abatement equipment may require the enhancement of labor, but abatement costs from the end-of-pipe treatment will also pass on to the product price and result in decrease of wages (Sheriff et al., 2019). Some works have argued that environmental regulations could reduce jobs or wages (Walker, 2011; Gray et al., 2014), while other scholars have an opposite view (Martin et al., 2015; Yamazaki, 2017). For example, Anger and Oberndorfer (2008) found that the EU ETS did not have a significant impact on the employment of regulated firms. Curtis (2018) argued that the NOx trading scheme decreased employment and earnings in the manufacturing sector, while Ren et al. (2020) considered that China’s SETS significantly increases the labor demand of regulated firms based on listed enterprise data. This implies that the overall impact of environmental management on firms’ wages and on employment still remains unclear and thus requires clarification of this question.

This work adds to relevant research outcomes in two aspects. Firstly, we provide comprehensive evidence on the impacts of the SETS on emissions, labor demand, and wages of industrial firms in a developing economy. Although a few studies have concentrated on the SETS, they have either explored Chinese regional outcomes (Hou et al., 2020), only examined a certain aspect (e.g., production or innovation) in China (Tang et al., 2020), or focused on developed countries (Carlson et al., 2000; Benkovic and Kruger, 2001). Actually, Ren et al. (2020) have examined the impact of China’s SETS on employment of mining and manufacturing industries based on listed enterprises data, but the sample size of these data is not comprehensive. Moreover, estimating an employment effect alone could not capture the full effects of the labor markets. To bridge the abovementioned gaps, we gathered and matched an abundance of firm-level data by combining the ASIF with the ESR; we took wages into consideration and employed a framework of time-varying difference-in-differences (DID) identification to estimate the impact of the SETS on emissions, employment, and wages. We found that the SETS is effective if it could motivate the regulated firms to improve production and pollution discharge technology. Secondly, new empirical proof drawn from the leading developing nation is offered in the research for a debate on the environmental regulation and variation of the labor market. This study is a pioneering one to look into the SETS’ impacts on wages in the largest developing economy.

The SO2 emissions trading scheme is of two stages. The first stage is the exploration phase (2001–2006). In 2001, Taiyuan promulgated the first local policy document on the SETS in China. Furthermore, SETS pilots were formally launched in 2002. Two business entity, three municipalities, and four provinces (China Huaneng Group, Liuzhou, Shanghai, Tianjin, Jiangsu, Shandong, Henan, and Shanxi) were selected as SETS pilot entities or regions. This scheme had expanded to 727 cities and firms by 2002. Four provinces and three municipalities in the SETS have traded 25,000 tons of SO2 emissions by 2004, with a transaction volume exceeding 20 million yuan. In 2007, SETS began entering the second stage, namely, the intensification phase. The MEP (Ministry of Environmental Protection) extended pilots, another seven provinces that included Shanxi, Chongqing, Inner Mongolia, Zhejiang, Hebei, Hunan, and Hubei have been approved as regions of the SETS. The pilot regions comprises a diversity of geographical regions at different economic development levels, which, according to the statistics by the China Statistical Yearbook published in 2008, accounts for 56.1% of industrial SO2 emissions in 2007. This scheme mainly involves the steel, cement, glass, chemical, mining, and other industries. For the initial allocation of emissions trading, the MEP caps the total emissions, and each province is allocated certain quotas based on its real emissions in a base year. The participant firms have to purchase initial emissions permits from the local MEP, and the allowances must not exceed the quantities meeting the environmental assessment standard. The benchmark price for SO2 emissions trading is set by the local government, and the transaction price is decided by market competition subsequently. The firms are required to apply their emissions allowances to the production process and could not exceed the allowed permits; otherwise, it becomes punishable by the MEP by means of fines, prohibition of emissions, or cancellation of business licenses.

The pilots in the SETS are selected with little interference of the local governments by the central government, thus this policy is largely a quasi-natural experiment which allows us to estimate the effects of the SETS on firms’ emissions and economic performances using the DD strategy. Specifically, the regression equation is

In formula (1),

Data used for empirical research are gathered and matched from two corporate data sets: one is the Environmental Survey and Reporting and the other is the Annual Survey of Industrial Firms. We also used official statistical publications, which consist of the city-level China City Statistical Yearbook and the China Statistical Yearbook. We finally constructed a data set incorporating each firm’s environmental conditions and financial situation, city, and province, covering the time period from 1998 to 2007. In order to get the real output value and wage levels, we also used the producer and consumer price index data from the China City Statistical Yearbook and from the China Statistical Yearbook to deflate nominal outputs and wages. Furthermore, we discard the observed data that evidently go against accounting rules, for instance, the case of current depreciation exceeding the cumulative depreciation and the case of fixed assets (or net fixed assets) exceeding the total assets. In Table 1, we present, in detail, the definitions of the variables and summaries of the results. In Table 1, the amount of industrial SO2 emissions for each firm is approximately 80,000 kg on average; the annual number of employees is 380.7 persons on average, and the annual total payable wages are 4,391 thousand CNY on average. The minimum operating profit of every enterprise is negative. Table 1 demonstrates that every variable exhibits great variations.

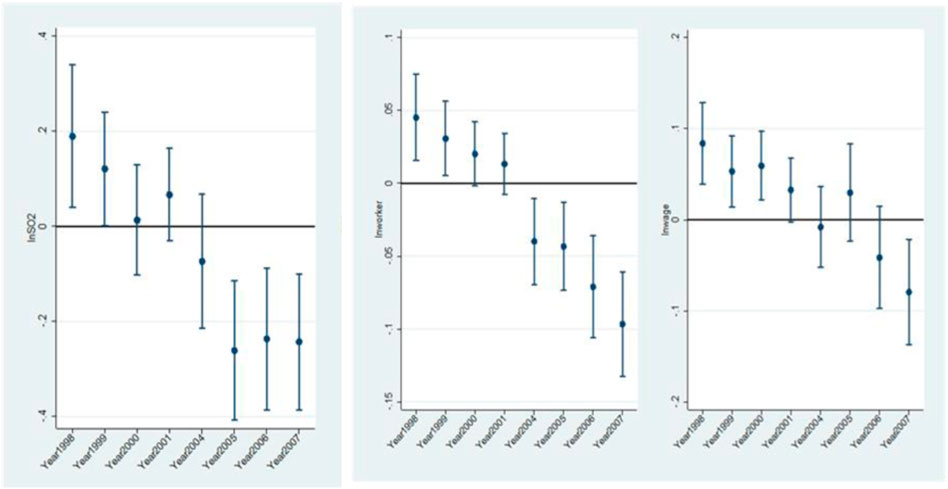

The estimates of this research rely on the identification assumption that the firms arranged for the SETS and the non-SETS have common trends in SO2 emissions, employment, and wages before implementing the policy. To verify the validity of the identifying strategy, the method of event study by Jacobson et al. (1993) is adopted to check on the identification assumption. Figure 1 presents the coefficients for the time trend of SO2 emissions, employment, and wages between the SETS and non-SETS firms with a 95% confidence interval. The result shows that all the estimates in SO2 emissions were positive before the policy was enacted, but the coefficients dropped to negative and were statistically significant after the adoption of the treatment, indicating that SETS and non-SETS firms have common trends in SO2 emissions before policy intervention. In addition, the differences in the number of workers were significantly positive prior to the treatment, but after the treatment in 2002, these differences declined to become negative, and this situation persisted with an increasing magnitude. The estimates for wages were positive before implementing the SETS and despite some fluctuations, the coefficients became negative since 2004, suggesting certain lagging impacts that the change in policies exerted on the wages of enterprises. The results indicate that SETS and non-SETS firms have common trends in SO2 emissions, employment, and wages, which provide an identifying basis.

FIGURE 1. Parallel trend test for firm-level SO2 emissions, employment, and wages. Note: The figure illustrates the time trends of industrial SO2 emissions between the SETS and that of non-SETS firms. The omitted time category is 2002. In particular, the year 2003 is omitted owing to the lack of data. The estimation includes fixed effects of firms, region–year, and industry–year. Standard errors are clustered at the city–year level.

Table 2 presents the baseline results. The estimates for SO2 emissions are in given in Column (1), which includes the control variable and fixed effects of firms and years. SO2 emissions dropped more evidently in SETS firms than in non-SETS firms after the policy was put into effect. Column (2) incorporates the control variable and fixed effects of firms, further adding the region–year and industry–year fixed effects to keep common year-specific shocks across regions and industries in check. The result shows that the SETS proves to have a remarkable negative influence on SO2 emissions of designated firms. Our estimate in Table 2 indicates a 10% decrease of SO2 emissions in designated firms when compared to non-SETS firms.

Columns (3)–(4) in Table 2 report the results of the SETS effects on firm employment. The SETS firms undergo a labor demand decline in comparison with the non-SETS firms. Column (5) presents a simple DD estimation for workers’ wages with fixed effects in terms of firms and years. We find an evidently negative interaction. The estimation of Column (6) also shows a significantly negative interaction with increasing magnitude when including the control variable, fixed effects of firms, region–year, and industry–year, suggesting that the SETS has a significant negative effect on workers’ wages of firms. Workers and wages of regulated firms had declined, respectively, by 2.3% and 3% due to the SETS policy.

The central government proposed an SO2 emissions reduction program in 1998, which was designed to build regional control zones that suffered the most SO2 emissions and acid rains, i.e., the SO2 Two Control Zones (TCZ). This policy was intended to lessen SO2 emissions, hence a possible concern is that the results of our estimation may be influenced by the TCZ policy. To address this problem, we added the variable

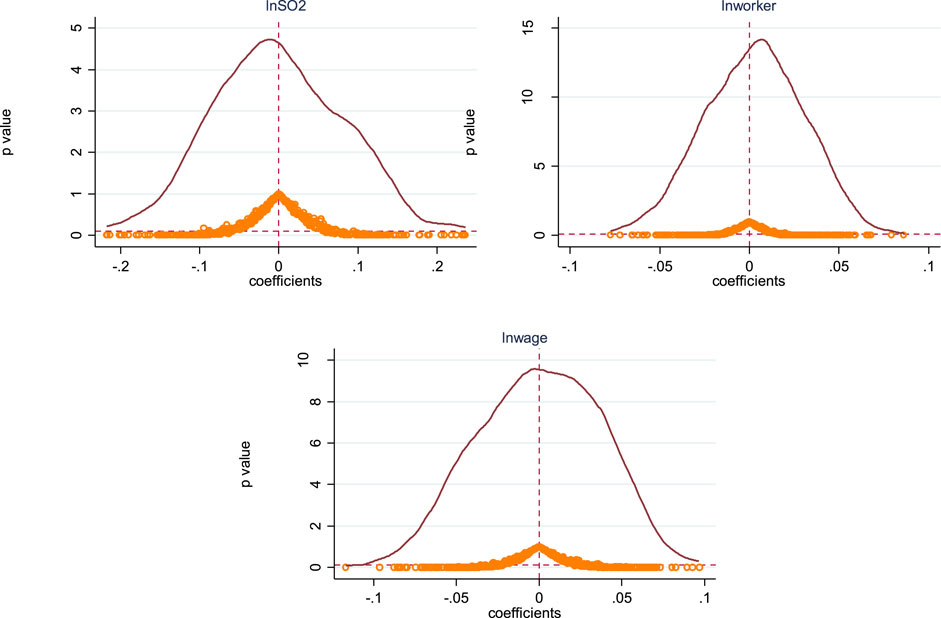

With the intention to avoid the potential interference of omitted variables in the estimation results, 14 provinces are randomly selected from a total of 30 sampled provinces, and we assign the SETS status

FIGURE 2. Placebo test. Note: The orange curve plots the kernel density distribution of the estimates, while the orange dots are associated with the p-values. The horizontal red dashed line indicates that the p-value is equal to 0.1.

An interesting question is that whether the effect of the SETS on SO2 emissions, labor, and wages of firms varies by ownership, size, and technology, which gives us an insight into the way that firms of different sorts shoulder the burden of environmental regulations. As shown by the results in terms of firm ownership in Table 4, it is the private firms that primarily contribute to emissions reduction and bear the loss of employment and wages, while state-owned enterprises (SOEs) are not significantly impacted by the SETS in terms of their SO2 emissions, workers, and wages, indicating that SOEs are controlled or invested in by the central or local government. Compared with private firms, they can get more preferential policies and financial subsidies, therefore SOEs face less stringent enforcement of the SETS.

In addition, we explore the heterogeneity by technology types. According to the National Bureau of Statistics, we classify the industry into high- and low-technology industries. High-tech industries consist of computer manufacturing, pharmaceutical manufacturing, aviation and aerospace, electronics and telecommunication, information chemicals, and medical equipment. Other industries are low-tech industries. As shown by the results in Table 5, the SETS significantly reduces SO2 emissions, employment, and wages of low-technology industry firms but has no significant impact on those of high-technology industry enterprises. The reason for this result may be because low-technology firms are typically labor intensive and energy intensive, their production technology and operating performance are relatively lagged, and they are more sensitive to the policy shock.

Fossil fuels are the main contributors of ambient pollution in the process of manufacturing. In general, the more the fossil fuels such as coal are consumed, the greater the emissions such as SO2 emissions. Meanwhile, the “end-of-pipe” treatment skills like desulfurization capacity may also affect the emissions of flue gas, and the desulfurization capacity can be seen as the pollution treatment technology. Emissions abatement is derived from energy reduction or technological advancement. To this end, we use the total industrial coal consumption and fuel coal consumption as the proxy of fossil energy. In addition, the removal rate of SO2 at the firm level is estimated with the proportion of the total quantity of removed SO2 over the sum of removed SO2 and emitted SO2. We collect desulfurization capacity data of firm-level desulfurization facilities and use the data and firm-level SO2 removal rate as the proxy of pollution treatment technology. We explore the effects of the SETS on fossil energy and SO2 treatment technique to clarify the channel of SO2 emissions abatement. As implied by the estimates in Table 6, a significantly negative coefficient in coal and fuel consumption is seen, but there are no significant impacts on SO2 desulfurization capacity and technology. These results suggest that a reduction in SO2 emissions is derived from a decrease of fossil energy input rather than an improvement in desulfurization technology.

The output effect generally means that the environmental regulation stimulates a firm to raise production scales, output values, and profits by improving technological innovation or firm competitiveness, resulting in an increase of the firm’s workers and wages; otherwise, it means the opposite. The substitute effect implies that pollution control activities in the production process or “end-of-pipe” treatment shrink the firm’s production scale and outputs, or the operation and maintenance of pollution abatement facilities may require more labor, leading to a decrease or an increase of workers and wages. Following this theory, we select the total industrial output value, the operating profit, and the industrial added value to be proxies of the output effects. The installation of flue gas treatment facilities and desulfurization units are used as proxies of the substitute effects. Furthermore, the total factor productivity (TFP) and R&D expenditures of industrial enterprises are employed as proxies of technology and innovation. Economic performances of firms are influenced by the output effects or substitute effects and are derived from technology. As indicated by the results shown in Table 7, the coefficients are significantly negative in aspects of industrial outputs and profits, but the results are not significant in the substitute effect of pollution treatment. Specifically, the SETS significantly reduced the total industrial output value, industrial added value, and operating profits of the regulated enterprises in the pilots, but the decreasing extent of the total industrial output and industrial added value is smaller (0.054 and 0.027, respectively), while the decline extent of the operating profits is greater (0.133). This indicates that the relative contribution of the operating profits decline driving a lower labor performance that is larger than the output reduction. Although the policy has a significant positive effect on R&D expenditures of regulated firms, its impact on the TFP is not significant. This indicates that the program promotes regulated firms to jack up expenditures of research and development, but the R&D-based technology transformation of firms is insufficient, which is why the policy exerts a significant negative influence on the outputs of regulated enterprises. Therefore, the decline of the SETS on the employment and wages of enterprises in pilots mainly derives from the negative output effect and inadequate technological progress.

This study presents an economic cost analysis of the SETS, namely, the trade-offs between SO2 emissions and labor market performances. The result shows that the SETS reduced the logarithm of SO2 emissions by 0.1. Given that the control mean levels of SO2 emissions are 17.436 tons, the estimation result indicates that the policy led to a decrease in SO2 emissions by 17.436 × 0.1 = 1.7436. For employment, the policy led to an average decline in employees by 2.3 percentage points. The average number of workers in the sample period is 380.728 persons. Therefore, the result means a loss in employment (380.728 × 0.023 = 8.757), which suggests that one ton of reduction in industrial SO2 emissions would result in five persons' unemployment (8.757/1.7436 = 5.022). For wages, the policy resulted in an average decrease in wages by 3 percentage points. The average wage levels during our sample period are 4,391.53 × 103 Chinese Yuan (CNY). We deflate all firm-level wage values using the provincial consumer price index of each year and take the year 1998 as the baseline. Therefore, a 3% reduction in wages means a loss of 131.746 thousand CNY (4,391.53 × 103 × 0.03 = 131.746 × 103). In other words, one ton of reduction in industrial SO2 emissions would be at the cost of nearly 76 thousand CNY wages (131.746 × 103/1.7436 = 75.561 × 103).

This work examines how the SO2 emissions trading scheme influences SO2 emissions, employment, and wages of industrial enterprises in China. Through research, it is noted that the emissions trading program evidently reduces SO2 emissions, employment, and wages of firms with environmental regulations. After a series of robustness checks, the results were found to be consistent. The heterogeneity analyses show that emissions reduction, the loss of employment, and wages from the SETS are mainly derived from private firms, large firms, and low-technology firms. Furthermore, the mechanism analyses indicate that firm-level SO2 emissions reduction is driven by fossil energy input decrease rather than by desulfurization technology. The negative effects of firm-level employment and wages are driven by the negative output effect and insufficient innovations rather than by the environmental substitute effect.

This study has several policy implications. Firstly, the industrial enterprises should accelerate technological innovations, especially clean production technology and pollution treatment technology. This can help firms improve production and productivity and reduce input and pollution. Secondly, the government should unceasingly consummate the market mechanism of the SO2 emissions trading program, bring full play into the competitiveness of enterprises, stimulate firm technology innovations, and expand market share to raise employment and income of workers. Finally, supporting policies can be put forward by policymakers so as to avoid potential negative effects of the SETS on employment and wages of firms. For example, appropriate financial support or subsidies should be given to the firms with good environmental performance, or reemployment training should be targeted at the laid-off workers.

This study also has some limitations. Our sample period is a little short because of the lack of data. Moreover, due to the lack of data on the specific types of workers, we only estimated the overall employment effect of the SETS on workers. Future research could concentrate on the effects of the policy on staff groups such as male staff and female staff and skilled staff and unskilled staff. In addition, the study can also be expanded to other environmental permit trading programs such as the energy use permit trading scheme.

The data analyzed in this study are subject to the following licenses/restrictions: need to apply for use. Requests to access these data sets should be directed to the Annual Survey of Industrial Firms and the Environmental Survey and Reporting.

WZ: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Methodology, Writing–original draft, Writing–review and editing. PZ: Conceptualization, Methodology, Resources, Supervision, Writing–review and editing. XN: Conceptualization, Supervision, Writing–review and editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Henan Province Philosophy and Social Science Planning Project (2022CJJ137).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, editors, and reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbas, A., Mushtaq, Z., Ikram, A., Yousaf, K., and Zhao, C. Y. (2023). Assessing the factors of economic and environmental inefficiency of sunflower production in Pakistan: an epsilon-based measure model, Frontiers in Environmental Science 11 (9), 1–10. doi:10.3389/fenvs.2023.1186328

Abbas, A., Waseem, M., Ahmad, R., Ahmed khan, K., Zhao, C. Y., and Zhu, J. T. (2022). Sensitivity analysis of greenhouse gas emissions at farm level: case study of grain and cash crops. Environmental Science and Pollution Research 29, 82559–82573. doi:10.1007/s11356-022-21560-9

Abbas, A., Zhao, C. Y., Waseem, M., Ahmed khan, K., and Ahmad, R. (2022). Analysis of energy input–output of farms and assessment of greenhouse gas emissions: a case study of cotton growers. Frontiers in Environmental Science9 (3), 1–11. doi:10.3389/fenvs.2021.826838

Anger, N., and Oberndorfer, U. (2008). Firm performance and employment in the EU emissions trading scheme: an empirical assessment for Germany. Energy Policy 36 (1), 12–22. doi:10.1016/j.enpol.2007.09.007

Benkovic, S. R., and Kruger, J. U. S. (2001). Sulfur dioxide emissions trading program: results and further applications. Water, Air, and Soil Pollution 130, 241–246. doi:10.1023/a:1013815319308

Berman, E., and Bui, L. T. M. (2001). Environmental regulation and labor demand: evidence from the south coast air basin. Journal of Public Economics 79, 265–295. doi:10.1016/s0047-2727(99)00101-2

Borghesi, S., Cainelli, G., and Mazzanti, M. (2015). Linking emission trading to environmental innovation: evidence from the Italian manufacturing industry. Research Policy 44 (3), 669–683. doi:10.1016/j.respol.2014.10.014

Cai, X. Q., Lu, Y., Wu, M. Q., and Yu, L. H. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. Journal of Development Economics, 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Calel, R., and Dechezleprêtre, A., 2016, Environmental policy and directed technological change: evidence from the European carbon market. The Review of Economics and Statistics, 98:, doi:10.1162/rest_a_00470

Carlson, C., Burtraw, D., Cropper, M., and Palmer, K. L. (2000). Sulfur dioxide control by electric utilities: what are the gains from trade. Journal of Political Economy 108 (6), 1292–1326. doi:10.1086/317681

Chen, J. D., Huang, S. S., Shen, Z. Y., Song, M. L., and Zhu, Z. H. (2022). Impact of sulfur dioxide emissions trading pilot scheme on pollution emissions intensity: a study based on the synthetic control method. Energy Policy 161, 1–11. doi:10.1016/j.enpol.2021.112730

Chen, Y. J., Li, P., and Lu, Y. (2018). Career concerns and multitasking local bureaucrats: evidence of a target-based performance evaluation system in China. Journal of Development Economics 133, 84–101. doi:10.1016/j.jdeveco.2018.02.001

Curtis, E. M. (2018). Who loses under cap-and-trade programs? The labor market effects of the NOxbudget trading program. The Review of Economics and Statistics 100 (1), 151–166. doi:10.1162/rest_a_00680

Deschênes, O., Greenstone, M., and Shapiro, J. S. (2017). Defensive investments and the demand for air quality: evidence from the NOx budget program. American Economic Review 107 (10), 2958–2989. doi:10.1257/aer.20131002

Fan, H. C., Zivin, J. S. G., Kou, Z. L., Liu, X. Y., and Wang, H. H. (2019). Going green in China: firms’ responses to stricter environmental regulations. NBER, Working paper. https://www.nber.org/system/files/working_papers/w26540/w26540.pdf,

Färe, R., Grpsskopf, S., and Pasurka, C. A. (2013). Tradable permits and unrealized gains from trade. Energy Economics 40, 416–424. doi:10.1016/j.eneco.2013.07.015

Färe, R., Grpsskopf, S., and Pasurka, C. A. (2014). Potential gains from trading bad outputs: the case of U.S. electric power plants. Resource and Energy Economics 36, 99–112. doi:10.1016/j.reseneeco.2013.11.004

Farrell, A., Carter, R., and Raufer, R. (1999). The NOx budget: market-based control of tropospheric ozone in the northeastern United States. Resource and Energy Economics 21, 103–124. doi:10.1016/s0928-7655(98)00035-9

Franco, C., and Marin, G. (2017). The effect of within-sector, upstream and downstream environmental taxes on innovation and productivity. Environmental and Resource Economics 66, 261–291. doi:10.1007/s10640-015-9948-3

Gray, W. B. (1987). The cost of regulation: OSHA, EPA and the productivity slowdown. American Economic Review 77 (5), 998–1006. doi:10.1016/0038-0121(88)90025-0

Gray, W. B., Shadbegian, R. J., Wang, C. B., and Meral, M. (2014). Do EPA regulations affect labor demand? Evidence from the pulp and paper industry. Journal of Environmental Economics and Management 68, 188–202. doi:10.1016/j.jeem.2014.06.002

Greenstone, M., and Hanna, R. (2014). Environmental regulations, air and water pollution, and infant mortality in India. American Economic Review 104 (10), 3038–3072. doi:10.1257/aer.104.10.3038

He, G. J., Wang, S. D., and Zhang, B. (2020). Watering down environmental regulation in China. The Quarterly Journal of Economics 135, 2135–2185. doi:10.1093/qje/qjaa024

Hou, B. Q., Wang, B., Du, M. Z., and Zhang, N. (2020). Does the SO2emissions trading scheme encourage green total factor productivity? An empirical assessment on China’s cities. Environmental Science and Pollution Research 27, 6375–6388. doi:10.1007/s11356-019-07273-6

Jacobson, L. S., LaLonde, R. J., and Sullivan, D. G. (1993). Earnings losses of displaced workers. American Economic Review 83 (4), 685–709. Available at: http://www.jstor.org/stable/2117574.

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The Review of Economic Studies 70, 317–341. doi:10.1111/1467-937x.00246

Lin, B. Q., and Jia, Z. J. (2019). Impacts of carbon price level in carbon emission trading market. Applied Energy 239, 157–170. doi:10.1016/j.apenergy.2019.01.194

Linn, J. (2008). Technological modifications in the nitrogen oxides tradable permit program. The Energy Journal 29 (3), 1–24. doi:10.5547/issn0195-6574-ej-vol29-no3-8

Liu, M. D., Shadbegian, R., and Zhang, B. (2017). Does environmental regulation affect labor demand in China? Evidence from the textile printing and dyeing industry. Journal of Environmental Economics and Management 86, 277–294. doi:10.1016/j.jeem.2017.05.008

Liu, M. D., Tan, R. P., and Zhang, B. (2021). The costs of “blue sky”: environmental regulation, technology upgrading, and labor demand in China. Journal of Development Economics 150, 102610–102616. doi:10.1016/j.jdeveco.2020.102610

Martin, R., Muuls, M., and Wagner, U. J. (2015). The impact of the European Union emissions trading scheme on regulated firms: what is the evidence after Ten years. Review of Environmental Economics and Policy 10, 129–148. doi:10.1093/reep/rev016

Montgomery, W. D. (1972). Markets in licenses and efficient pollution control programs. Journal of Economic Theory 5, 395–418. doi:10.1016/0022-0531(72)90049-x

Morgenstern, R. D., Pizer, W. A., and Shih, J.-S. (2002). Jobs versus the environment: an industry-level perspective. Journal of Environmental Economics and Management 43 (3), 412–436. doi:10.1006/jeem.2001.1191

Olley, G. S., and Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica 64, 1263–1297. doi:10.2307/2171831

Peng, W., Xin, B. G., and Xie, L. (2023). Optimal strategies for production plan and carbon emission reduction in a hydrogen supply chain under cap-and-trade policy. Renewable energy, 215, 118960. doi:10.1016/j.renene.2023.118960

Porter, M. E., and Linde, C. V. D. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives 9 (4), 97–118. doi:10.1257/jep.9.4.97

Ren, S. G., Liu, D. H., Li, B., Wang, Y. J., and Chen, X. H. (2020). Does emissions trading affect labor demand? Evidence from the mining and manufacturing industries in China. Journal of Environmental Management 254, 1–11. doi:10.1016/j.jenvman.2019.109789

Ren, S. G., Yang, X. Y., Hu, Y. C., and Chevallier, J. (2022). Emission trading, induced innovation and firm performance. Energy Economics 112, 1–12. doi:10.1016/j.eneco.2022.106157

Sheriff, G., Ferris, A. E., and Shadbegian, R. J. (2019). How did air quality standards affect employment at US power plants? The importance of timing, geography, and stringency. Journal of the Association of Environmental and Resource Economists 6, 111–149. doi:10.1086/700929

Shouraki, M. A., Khalilian, S., and Mortazavi, S. A. (2018). Effects of declining energy subsidies on value added in agricultural Sector. Journal of Agriculture, Science and Technology 15 (3), 423–433. Available at: http://jast.modares.ac.ir/article-23-5635-en.html.

Tang, H. L., Liu, J. M., Mao, J., and Wu, J. G. (2020). The effects of emission trading system on corporate innovation and productivity-empirical evidence from China’s SO2 emission trading system. Environmental Science and Pollution Research 27, 21604–21620. doi:10.1007/s11356-020-08566-x

Testa, F., Iraldo, F., and Frey, M. (2011). The effect of environmental regulation on firms’ competitive performance: the case of the building and construction sector in someEU regions. Journal of Environmental Management 92 (1), 2136–2144. doi:10.1016/j.jenvman.2011.03.039

Tu, Z. G., and Shen, R. J. (2014). Can China’s industrial SO2emissions trading pilot scheme reduce pollution abatement costs? Sustainability 6, 7621–7645. doi:10.3390/su6117621

Walker, W. R. (2013). The transitional costs of sectoral reallocation: evidence from the clean air act and the workforce. The Quarterly Journal of Economics 128, 1787–1835. doi:10.1093/qje/qjt022

Wang, K., Wei, Y.-M., and Huang, Z. M. (2016). Potential gains from carbon emissions trading in China: a DEA based estimation on abatement cost savings. Omega 63, 48–59. doi:10.1016/j.omega.2015.09.011

Wolf, M. J., Emerson, J. W., Esty, D. C., de Sherbinin, A., and Wendling, Z. A., (2022). Environmental performance index. New Haven, CT: Yale Center for Environmental Law and Policy.

Yamazaki, A. (2017). Jobs and climate policy: evidence from British Columbia’s revenue-neutral, carbon tax. Journal of Environmental Economics and Management 83, 197–216. doi:10.1016/j.jeem.2017.03.003

Ye, Y. Z., and Tao, Q. S. (2023). The dynamic relationship among economic development, air pollution, and health production in China: the DNSBM efficiency model. Frontiers in Environmental Science 7, 1–22. doi:10.3389/fenvs.2023.1205712

Zhang, W. J., Zhang, N., and Yu, Y. N. (2019). Carbon mitigation effects and potential cost savings from carbon emissions trading in China's regional industry. Technological Forecasting and Social Change 141, 1–11. doi:10.1016/j.techfore.2018.12.014

Keywords: SO2 emissions trading scheme, pollution abatement, labor demand, wage, industry

Citation: Zhang W, Zhang P and Niu X (2024) The impact of SO2 emissions trading scheme on pollution abatement and labor market for industrial enterprises in China. Front. Environ. Sci. 11:1302809. doi: 10.3389/fenvs.2023.1302809

Received: 27 September 2023; Accepted: 04 December 2023;

Published: 03 January 2024.

Edited by:

Ashfaq Ahmad Shah, Hohai University, ChinaReviewed by:

Adnan Abbas, Nanjing University of Information Science and Technology, ChinaCopyright © 2024 Zhang, Zhang and Niu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Panpan Zhang, cGFucGFuZGF6aGFuZ0BoYXV0LmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.