- State Grid Jiangsu Electric Power Co., Ltd., Economic Research Institute, Nanjing, China

Introduction: The financial sustainability of the electric power industries is of significant practical significance for achieving carbon neutrality and peak carbon emissions.

Methods: We innovatively use web crawler technology to obtain keywords related to fintech in the search index and constructs a regional fintech indicator system. Based on this indicator system, we explore the impact of fintech on the financial sustainability of the electric power industry by panel regression model. The result shows that fintech significantly improved the financial sustainability of electric power companies. Further evidence indicates that fintech can promote financial sustainable development by enhancing corporate risk-taking ability, increasing operating income, and alleviating financing constraints. Heterogeneity analysis indirectly proves that compared to state-owned electric power enterprises, private electric power enterprises face a more severe financing environment. But private enterprises can obtain more credit funds through new financing channels opened by financial technology. So, the role of fintech in alleviating the phenomenon of ownership discrimination in the financial system cannot be ignored. In addition, we also find that fintech is more significant in helping small and medium-sized electric-power enterprises in financial sustainability, while it is less helpful for large enterprises.

Discussion: In the context of the fusion development of technology and financial markets, the research conclusions of this article provide important references for governments, enterprises, and traditional financial institutions to make corresponding reforms.

1 Introduction

The current global economic situation is severe, with increasing risks and challenges, various industries face some unknown encounter (Liu et al., 2021). Against this backdrop, financial sustainability of enterprises has become the key to stable growth. Sustainable financial growth of enterprises is conducive to achieving sales growth and earnings growth, thereby promoting sustainable development of the enterprises (Bui et al., 2020). It is worth noting that the electric power industry, as the most important basic energy industry in a country’s economic entity, its operating status directly affects the carbon emission intensity of the power production and supply chain. As the largest carbon emitter, China’s slowing economic growth and improving economic quality have also brought about changes in its economic structure. Therefore, using Chinese enterprises as research samples to study the financial sustainable growth of electric power industry has important reference significance for understanding carbon emissions and carbon peaking.

Financial sustainable growth of enterprises means the increase in assets. While the capital structure remains unchanged, the liabilities and equity of enterprises increase proportionally (Huerga and Rodríguez-Monroy, 2019). In recent years, with the progress of big data analysis, artificial intelligence and other high-tech, not only the traditional financial industries such as banks and securities institutions have ushered in technological changes, but also a number of new financial ecological industries have emerged, and fintech has developed rapidly (Abad-Segura et al., 2020). The fintech provides funding for corporate debt and is an important guarantee for achieving financial sustainability. Existing literature has shown that fintech can compensate for the shortcomings of traditional financial systems such as high service costs and low service efficiency, and improve the financing environment of enterprises (Feng et al., 2022). In addition, the emerging financial ecosystem brought about by fintech has included individual consumers who have been excluded from traditional finance in the scope of financial services, alleviating consumer liquidity constraint, increasing consumer consumption tendencies, and optimizing the business environment faced by enterprises. These studies provide a theoretical basis for fintech to better serve the sustainable financial growth of enterprises. However, there is still a lack of relatively complete empirical evidence on the issue of fintech driven sustainable growth in corporate finance (Li and Jiang, 2021).

Fintech involves many new digital technologies (Puschmann, 2017). For instance, through digital payments, blockchain technology, and supply chain finance, fintech can improve financial efficiency (Wu et al., 2023), reduce costs, and provide greater transparency for enterprises. Research in this area underscores the potential of fintech in promoting corporate financial sustainability. Fintech plays a pivotal role in enterprise risk management, which is crucial for sustainability. Research indicates that fintech tools such as big data analytics and artificial intelligence aid in better identifying, quantifying, and managing environmental, social, and governance (ESG) risks (Du et al., 2022), thereby improving corporate sustainability performance (Arner et al., 2020). Green fintech has become a significant driver of sustainable investments (Macchiavello and Siri, 2022; Merello et al., 2022). Literature covers how fintech facilitates the integration of environmental, social, and governance (ESG) criteria into investment decisions. It also examines the role of fintech platforms in supporting green bonds, impact investing, and the allocation of capital to sustainable projects. Fintech is seen as a means to enhance financial inclusion, which is directly related to sustainable economic development. Research explores how fintech innovations (Lagna and Ravishankar, 2022), including digital lending and mobile banking, can extend financial services to underserved populations, thereby contributing to inclusive growth and corporate social responsibility (Ediagbonya and Tioluwani, 2023). Fintech adoption often leads to digital transformation in corporate finance, resulting in increased efficiency and reduced operational costs (Alt et al., 2018). This stream of research emphasizes how fintech can optimize financial processes, reduce paper-based transactions, and streamline corporate finance operations, all of which are integral to financial sustainability (Dhiaf et al., 2022). In conclusion, the literature on the relationship between fintech and corporate financial sustainability demonstrates that fintech innovations have the potential to bring about positive changes in various aspects of corporate finance. From risk management and sustainable investing to regulatory considerations and financial inclusion, fintech is increasingly recognized as a key enabler of corporate financial sustainability. Further research in this area continues to be vital in understanding the evolving role of fintech in the corporate sustainability landscape.

Reviewing current research, many articles have focused on the measurement and development characteristics of fintech (Pollari, 2016; Suryono et al., 2020). But overall, most articles have certain limitations in measuring the fintech indicator. Some scholars use digital inclusive finance to calculate, but this practice confuses the concepts of fintech and digital inclusive finance. The fintech focus on the latest technological means, while the digital inclusive finance utilizes digital technology and financial means. In addition, the data of digital inclusive finance stems from finite databases and has a small coverage, which cannot comprehensively measure the development level of fintech. Although some scholars have begun to use search engine indices to measure regional fintech levels (Sheng and Fan, 2020), these studies mostly explore the impact of fintech on enterprise innovation (Wang et al., 2023). There is still a lack of empirical evidence on the relationship between the level of fintech and the financial sustainability of electric power industry. Given that the innovation in the electric power industry will have positive effects on the economy and environment, it is worth exploring how the development of fintech can affect the financial sustainability of the electric power industry.

To compensate for the shortcomings of many studies in measuring the level of fintech, this article uses web crawler technology to obtain fintech related search indices to construct a fintech indicator system. On this basis, we used data from A-share listed companies of electric power industry from 2010 to 2020 to examine the impact of fintech on corporate financial sustainability. The reason for choosing this time range for research is that there are the most enterprises with necessary variable data during that period. In order to provide sufficient depth for the research, we also explored the driving channels for the impact of fintech on financial sustainability. Besides, this article also conducts heterogeneity analysis, which has important reference significance for different types of power enterprises to develop their fintech level.

The contributions of this research are as follows. Firstly, regarding the impact of fintech on corporate financial sustainability, this article focuses its research perspective on the power industry, which is not available in most literature. The research results can provide momentous guide for the financial sustainability development of power enterprises and even the basic energy industry. Secondly, existing literature often examines the impact of internal conditions such as enterprise innovation, corporate governance, or financing environment on financial sustainability. As an important external condition for enterprise development, there are not many articles on the relationship between fintech and financial sustainability. Our results enrich the perspective of existing research. From the perspective of enterprise risk, operating income, and financing constraints, this paper reveals their role in the impact of fintech on sustainable financial growth of enterprises, and further clarifies the mechanism of fintech progress on corporate financial sustainability.

The remainder of this paper is arranged as follows. Section 2 is data specifications, theoretical methods and models. Section 3 introduces the analysis of empirical results. Section 4 discusses the impact of empirical results on governments, financial institutions, and enterprises. Section 5 is the conclusion.

2 Literature review and research hypotheses

Fintech establishes effective risk sharing mechanism and provides safeguard for enterprise development (Zhang and Wang, 2021). With the support of high-tech technologies such as cloud computing, fintech can quickly collect and intelligently classify massive amounts of information in the market. And through powerful data processing capabilities, this unstructured information can be structured and transformed, making it easy for information demanders to use (Tang et al., 2020). With the help of precise and reliable information resources, on the one hand, it reduces the probability of the enterprise facing unknown risks, and on the other hand, it improves shareholders’ understanding of the daily operation status of the enterprise. From this perspective, fintech can improve the risk-taking ability of enterprises. Driven by interests, enterprises with higher risk-taking capacity will increase their investment in high-yield projects. For example, enterprises with higher risk-taking ability will introduce new technologies and make innovative investments, so as to improve their performance (Luu and Ngo, 2019) and financial sustainable growth.

Through the above analysis, we propose hypothesis 1: the fintech can improve the financial sustainability of enterprises by enhancing their risk-taking ability.

Existing research have shown that fintech can increase operating income of enterprises. On the one hand, because of the transmission of financial information, enterprises can accurately grasp customer needs through the information shared by financial institutions, thereby adjusting marketing strategies and increasing operating revenue (Luo et al., 2022). On the other hand, the development of finthch has changed payment methods, such as the emergence of mobile payments. This greatly saves the payment cost of consumers, improves the efficiency of payment (Berger, 2003), and thus stimulates consumption (Li et al., 2020). The ultimate benefit is that the increase in consumer demand promotes corporate income. It is obvious that an increase in business revenue will directly increase the profit margin of enterprise. According to the definition of Eq 1, the financial sustainability level of enterprises will increase.

Therefore, this paper proposes hypothesis 2: fintech can improve financial sustainability growth of enterprises by increasing operating income.

From the financing perspective, fintech has lowered the investment threshold for scattered investors. This will increase the total amount of credit funds for enterprises (Bellardini et al., 2022), thus providing effective financial support for enterprises (Muganyi et al., 2022). On the one hand, fintech can effectively reduce the financing costs of enterprises. The new and high technology brought about by the development of fintech can make the transaction behavior and credit information of enterprises more transparent. Therefore, such technologies can effectively evaluate corporate reputation and alleviate information asymmetry between banks and enterprises (Duarte et al., 2012; Cheng et al., 2014). This will reduce various information costs for both sides of the credit transaction (Heiskanen, 2017), thereby improving the financing environment. On the other hand, fintech can create more new financing modes. With the support of big data, blockchain and other technologies, a series of online financing ways have emerged (Buchak et al., 2018; Jagtiani and Lemieux, 2018). More financing channels will bring more credit funds to enterprises on the edge of the financial system, especially small and medium-sized enterprises. The direct advantage of improving the financing environment is the increase of the equity multiplier of enterprises, thus reducing the financial risk of enterprises.

In view of this, we propose hypothesis 3: the fintech can improve the financial sustainability of enterprises by improving financing constraints.

3 Data and models

3.1 Econometric model

Referring to Nanda and Rhodes-Kropf (2013), we construct the following econometric model:

In Eq 1, we added a city attribute to each business sample, based on the location of the business. SGRit represents the financial sustainable growth of company i in the t-th year. fintechkt is the financial technology development level of city k where enterprise i is located in the t-th year. controls represents a vector of a set of control variables, including fixed asset ratio (far), government subsidy (subsidy), enterprise size (size), corporate leverage (leverage), regional economic level (lnrgdp), and scientific research input and education input (input).

In order to explore the reasons why fintech affects financial sustainable growth of enterprise, this paper constructs the following mediating effect model:

In Eqs 3, 4, mediator represents a mediator variable, corporate risk-taking ability (risk), or operating income (income), or financing constraints (constraints). The meanings of other parameters in Eqs 2–4 are the same as those in Eq 1. Based on the concept of causal progressive regression, if

3.2 Variable selection and design

3.2.1 Dependent variable

The usual models for measuring sustainable financial growth of enterprises are divided into two categories: accounting and cash flow. Compared to the calculation method of cash flow, using accounting standards is more accurate. This is because the factors that affect accounting profits are more stable. Referring to Liu and Xie. (2021), this article uses the Van Horne model to calculate the sustainable financial growth of enterprises. This model relaxed the assumption that new shares cannot be issued, which is more in line with the actual state of operation of the enterprises. The calculation formula is as follows:

In Eq 5, i represents the year and t represents the enterprise. SGR is the sustainable financial growth of enterprise. profit is sales net profit, retention is the retention rate of income, and PPR is the proportion of property right. turnover is designated as the ratio of total assets turnover and inrate is the net profit margin on sales.

3.2.2 Independent variable

Refer to Li et al. (2020), this article selects 48 keywords related to fintech: EB level storage, NFC payment, Cloud computing, Internet finance, Artificial intelligence, Billion-level concurrency, Cyber-physical system, Memory computing, Distributed computing, Blockchain, Business intelligent, Image understanding, Graph Processing, Secure multi-party computation, Big data, Differential privacy technology, Open Bank, Heterogeneous data, Credit investigation, Investment decision support system, Digital currency, Data visualization, Web data mining, Text mining, Intelligent customer service, Intelligent investment advisor, Intelligent data analysis, Smart finance contract, Machine learning, Stream computing, Deep learning, The Internet of things, Biometrics, Mobile internet, Mobile payment, Third-party payment, Brain-inspired computing, Green computing, Online UnionPay, Equity crowdfunding financing, Natural language processing, Virtual reality, Fusion Architecture, Cognitive computing, Semantic search, Speech recognition, Authentication, Quantitative finance. Using web crawler technology, we count the number of news pages with cities and the above keywords by year in Baidu News Advanced Search. Next, add up the total number of search results for 48 keywords in each city and year. Due to the distribution of this indicator is significantly right-skewed, this paper performs a logarithmic transformation on this indicator to obtain the final fintech index.

3.2.3 Control variables

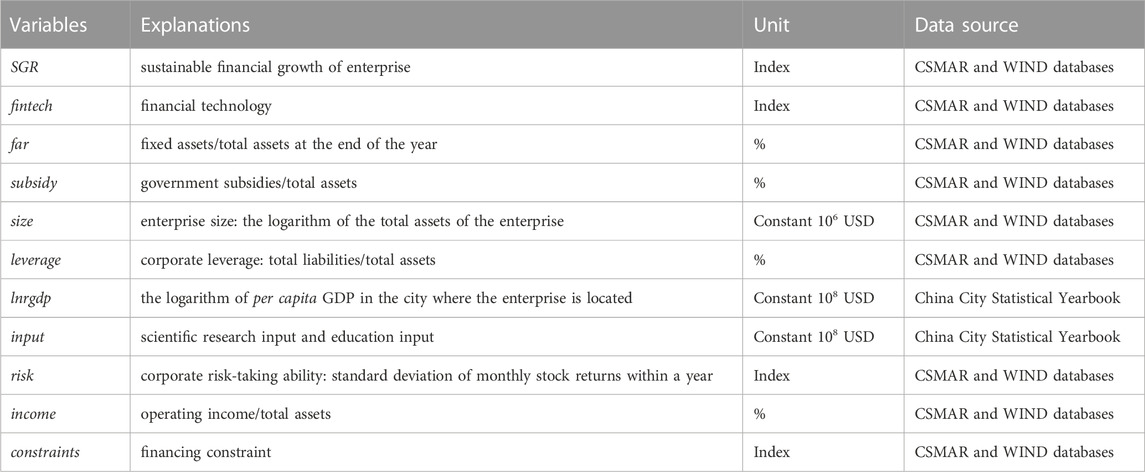

To alleviate estimation bias caused by missing explanatory variables, referring to (Wang et al., 2023), a series of control variables at the enterprise and regional levels are also included in the construction of the econometric models: in the enterprise level, fixed asset ratio (far), government subsidy (subsidy), enterprise size (size), corporate leverage (leverage); in the regional level: regional economic level (lnrgdp), scientific research input and education input (input). There are two reasons for selecting these control variables. The first is to avoid endogeneity issues with the independent variable, that is, some variables are related to both the dependent variable and the variable of interest. If not controlled, endogeneity issues may arise with the variable of interest. The second is to minimize the estimation bias of the concerned variables as much as possible. In addition, this article also selected three types of mediating variables for the study of impact mechanisms, they are corporate risk-taking ability (risk), operating income (income), and financing constraints1 (constraints), respectively. The theoretical analysis of the impact mechanism of these three mediating variables will be elaborated in Section 3. The specifications for all variables selected in this article are shown in Table 1.

To make the estimation results more reliable, we first exclude companies with abnormal financial conditions and delisting risks, then remove samples with missing data in the main variables, and finally perform the winsorize on continuous variable data with upper and lower limits of 1%.

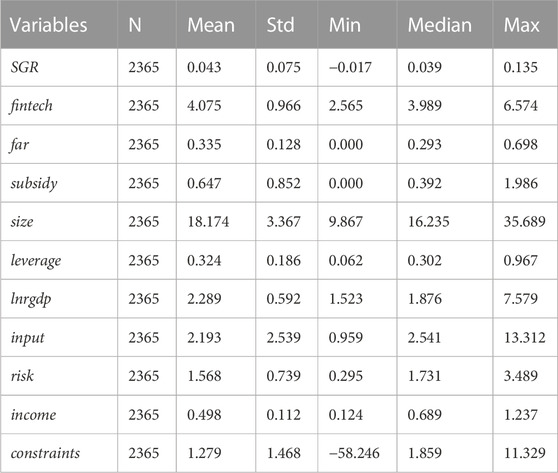

3.3 Descriptive statistics

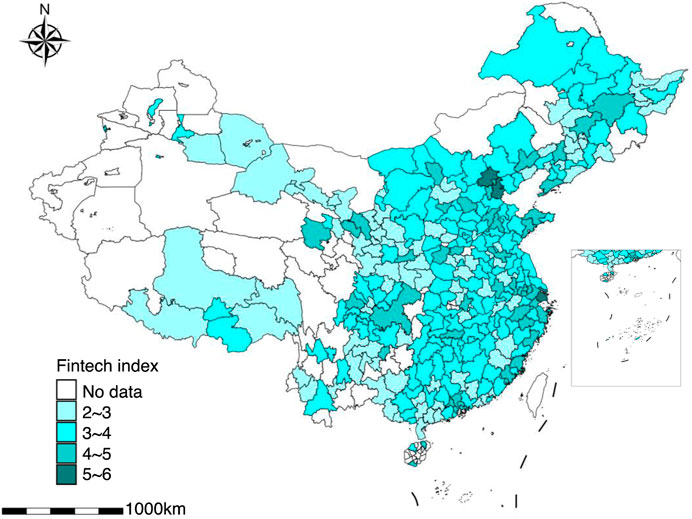

Table 2 reports the basic statistical characteristics of the main variables. The minimum value for SGR is −0.017, and the maximum value is 0.135. This indicates that there are relatively apparent differences in the sustainable financial growth of enterprises in our sample. It is noteworthy that the difference between the mean and the median for each variable is not very large, the range for subsidy is 1.594, and the range for lnrgdp is 5.703. This indicates that there is no significant skewness in the data of all variables. In addition, we also visualized the average level of fintech in each city during the sample period, the results are shown in Figure 1. It can be seen that there is a significant geographical distribution difference in the level of financial technology, and the closer it is to coastal areas, the higher its value, especially in Beijing and Shanghai.

4 Results and analysis

4.1 Baseline regressions analysis

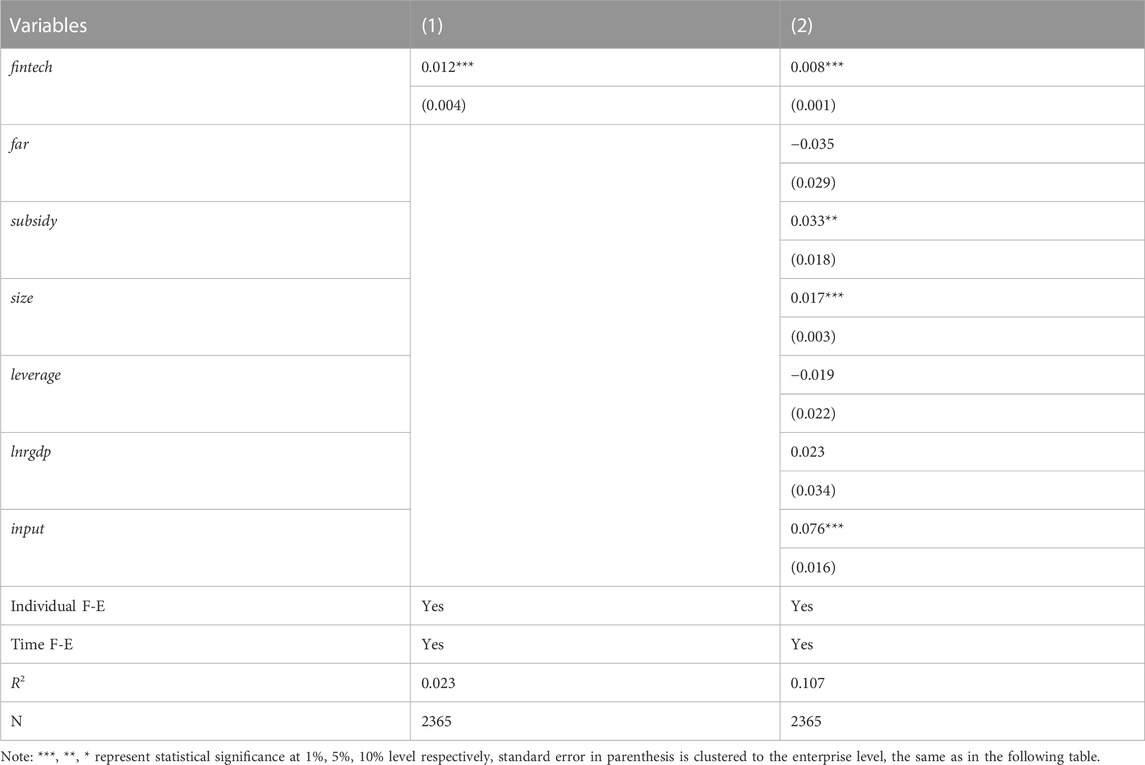

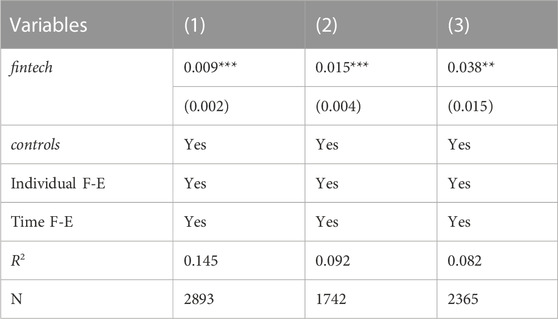

Table 3 reports on the impact of fintech on the financial sustainable growth of electric power enterprises. The first column shows the regression results that only include the explanatory variable fintech. Compared to the first column, the result in the second column has an apparent increase in R-squared after adding control variables. The coefficient of fintech is significantly positive in both types of regressions, this indicates the positive effect of the fintech development on the financial sustainability of electric power enterprises.

The development of enterprises cannot do without the support of financial institutions. Under the traditional financial model, enterprises find it difficult and expensive to obtain more external funds for production due to difficulties in financing, which has a constraining effect on their development. With the rapid rise of digital technology, it has rapidly integrated with various industries, effectively promoting the development of digital finance. The financing problems of enterprises have also been effectively alleviated, making it easier for enterprises to obtain more financing funds than before.

There is also a certain relationship between control variables and financial sustainability. The coefficient of subsidy is positive and reaches a significance level of 5%, indicating that government subsidies are beneficial for sustainable financial growth of enterprises. The coefficients of size and input are positive and reach a significance level of 1%. This indicates that the financial sustainability level of large enterprises is relatively better, and the financial sustainability of enterprises is stronger in cities with higher levels of science and education.

4.2 Analysis of impact mechanism

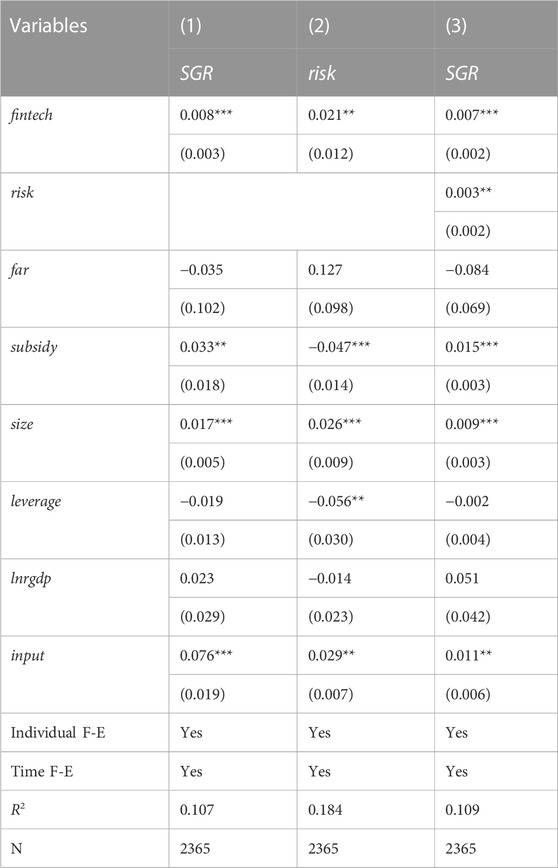

Table 4 is the regression results using the corporate risk-taking ability (risk) as a mediator variable. The regression results of columns (1), (2), and (3) correspond to the models in Eqs 3–5, respectively. The coefficient of fintech in column (2) is positive at a significance level of 5%, indicating that fintech can improve the risk-taking ability of electric power enterprises. The coefficient of fintech in column (3) is positive at a significance level of 1%, we can think that the risk-taking ability has played a part of the mediating effect between fintech and corporate financial sustainability. In other words, the improvement of fintech level of electric power enterprises can promote their sustainable financial growth by enhancing their risk resistance ability.

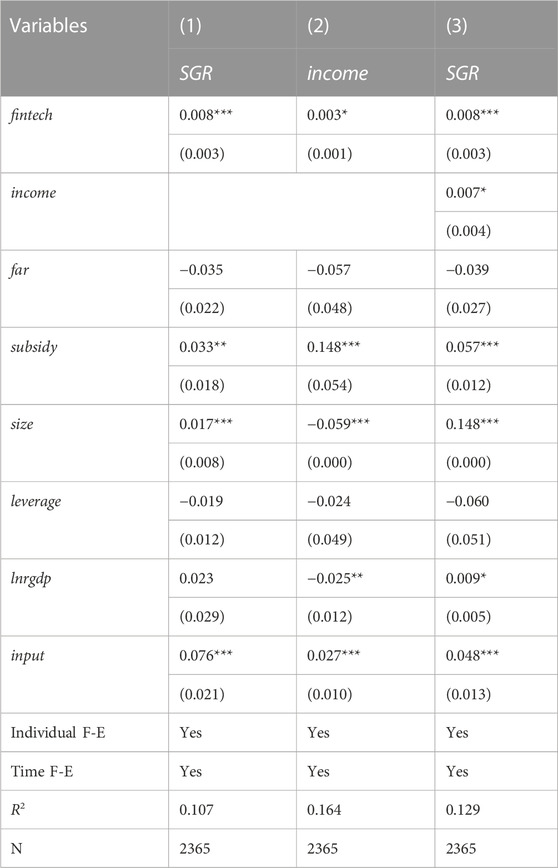

Table 5 reports the regression results using the operating income (income) as a mediator variable. For the results in column (2), the coefficient of fintech is positive at a significance level of 10%, indicating that fintech can stimulate the increase of operating income for enterprises. The results in column (3) indicate that after adding the mediator variable income, the coefficient of fintech remains positive at a significance level of 1%. This shows that the operating income of enterprises has played a part of the mediating effect in the impact of fintech on corporate financial sustainability. The increase in operating income will result in more cash flow for the enterprises (Fairfield et al., 2003), and enterprises have more funds to upgrade products, technologies, and systems of organization. This will improve the operational efficiency of the enterprise, thereby promoting financial sustainable growth.

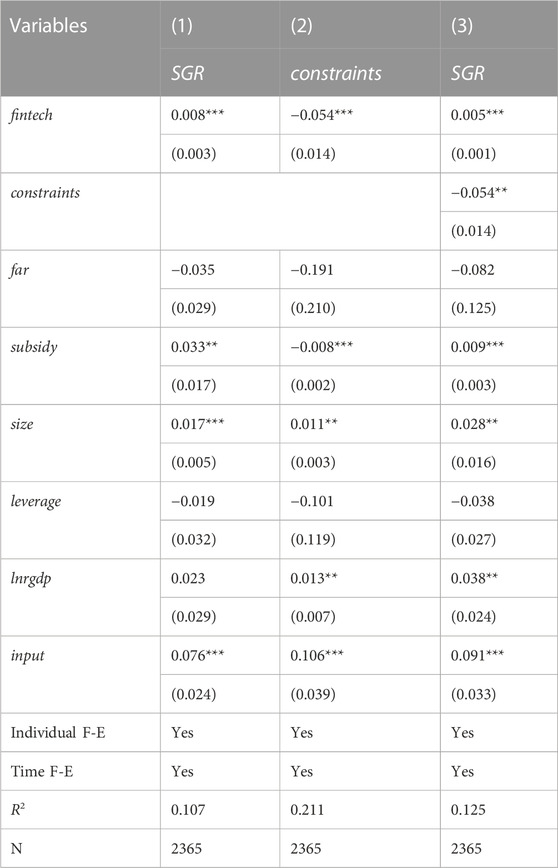

Table 6 shows the regression results using the financing constraints (constraints) as a mediator variable. Similar to previous analysis, the coefficient of fintech in column (2) is negative at a significance level of 1%, indicating that fintech can relieve financing constraints of electric power enterprises. For the results in column (3), the coefficient of fintech is significantly positive and the coefficient of the mediating variable remains significantly negative. This proves that for electric power enterprises, the financing constraints has played a part of the mediating effect between fintech and corporate financial sustainability. One possible explanation is that with the improvement of the financing environment, enterprises have more funds to participate in projects with high returns but long cycles, thereby increasing their profits and promoting financial sustainable growth.

4.3 Heterogeneity analysis

As mentioned earlier, the financing environment faced by small and medium-sized enterprises is often more severe. According to the results in Table 6, the financing environment has a mediating effect. This means that there are often differences in financial conditions for enterprises of different sizes. So, is there a difference in the impact of fintech on financial sustainable growth for enterprises of different sizes? Based on the median of enterprise size (size), we divide the research samples into two groups for regression and comparison. The results are shown in columns (1) and (2) of Table 7. The coefficient of fintech in column (1) is positive at a significance level of 1%, but the p-value of the coefficient in column (2) is 0.103. This indicates that for smaller power companies, the development of fintech can better improve their financial sustainability. This is mainly because compared to large enterprises, financing for small and medium-sized enterprises is more difficult (Watson R and Wilson, 2002; Abdulsaleh and Worthington, 2013). But fintech has expanded financing channels, improved the financing environment for small and medium-sized enterprises, and enabled their financial situation to significantly take a turn for the better.

The data of electric power enterprises selected in this paper come from two industries, the power generation industry and the electrical equipment manufacturing industry. So, is there a significant difference in the impact of fintech on financial sustainability between these two industries? The samples belonging to the two industries are respectively used for regression estimation. Column (3) in Table 7 shows the regression results belonging to the power generation industry, while column (4) shows the regression results of the electrical equipment manufacturing industry. It can be seen that the coefficient of fintech is significantly positive in both columns (3) and (4), indicating that the difference between the two industries is not very conspicuous. This may be because both industries belong to technology intensive industries, which have long technology and equipment development cycles and high demand for capital investment. Fintech provides a favorable financing environment and stronger risk-taking ability for these types of enterprises, which significantly promotes their financial sustainable growth.

In terms of financing environment there is a widespread phenomenon of "ownership discrimination” in the financial market. Compared to private enterprises, state-owned enterprises are often more likely to receive financial support (Poncet et al., 2010; Guariglia et al., 2011). For example, Cull et al. (2009) found that even though some state-owned enterprises have low profitability, they are still more likely to obtain loans from banks. As the technology-intensive and capital-intensive industries, the situation of ownership discrimination in electric power industry is often more severe. Therefore, the research samples are divided into two groups for comparison: state-owned enterprises and private enterprises. Column (5) in Table 7 is the regression results belonging to the state-owned enterprises, while column (6) is the regression results of private enterprises. Although the coefficients of both are significant, the effect of fintech on improving the financial sustainability of private enterprises is much greater than that of state-owned enterprises. With the support of network technology, the development of financial technology has expanded financing channels. With the support of network technology, the development of financial technology has expanded financing channels, which to some extent alleviates the phenomenon of ownership discrimination.

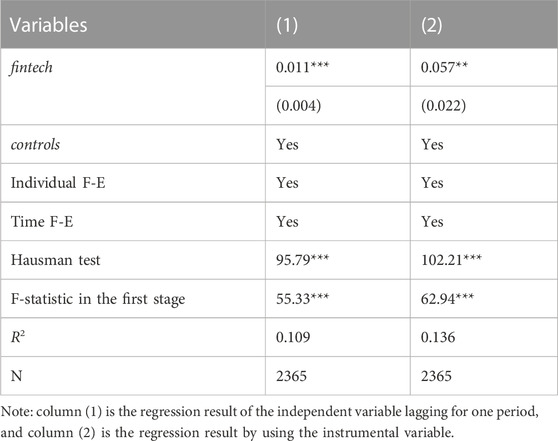

4.4 Endogeneity and robustness

The fintech level calculated in this article is at the macro level, so it may lead to endogeneity issues due to variables omission or measurement errors. This way uses two methods to weaken endogeneity to verify the reliability of the conclusion. The first method is that the independent variable is lagged by one period to reevaluate the model, and the other method is the instrumental variable method. According to Chong et al. (2013), the average value of the fintech development level of all neighboring cities in a city in the same year is used as an instrumental variable. This instrumental variable meets the two conditions of correlation and exogeneity. On the one hand, because of the similar economic levels of neighboring cities, the level of fintech is interrelated. On the other hand, due to the regional segmentation of credit financing, fintech of surrounding areas is difficult to affect the financial sustainability of enterprises in local city. Table 8 reports the regression results of two methods. The Hausman test and F-statistic in the first stage are significant, it indicates that the instrumental variable meets the conditions for exogenous and effectiveness. In the regression results of both methods, the coefficients of fintech are significantly positive, indicating the reliability of the results in this paper.

To verify the robustness of the estimation results, this article uses the following three methods to re-estimate the model. The first method is to adjust the time range of the sample, we perform regression estimate again with a 1-year lag on the sample. The second method is to exclude samples belonging to financial metropolises, including Beijing, Shanghai, and Shenzhen. The third method is to reevaluate by replacing fintech data from city level to provincial level. The robustness estimation results are shown in Table 9, columns (1)–(3) in the table correspond to the three robustness estimation methods mentioned above, respectively. Regardless of the method, the estimated results are consistent with Table 3. This proves the robustness of the main conclusions in this paper.

5 Implications of the research results

5.1 The perspective of government

As the most important basic energy industry, the sustainable development of electric power industry is related to the stability of a country’s economy and society. Based on our mediation effect results, specifically, the government should build diversified financial services industry to achieve precise abutment between finance and enterprises, especially small and medium-sized electric power enterprises. This is beneficial for the electric power industry to obtain financial services at a lower cost and in a more convenient way, and to better exert the advantages of fintech in enhancing economic growth efficiency. In addition, the results in Table 7 show that the impact of fintech on financial sustainability tends to be different for different types of electric power enterprises. While encouraging the development of fintech, it is necessary for the government to identify and protect vulnerable enterprises, and comprehensively promote the positive role of fintech in the electric power industry.

5.2 The perspective of enterprises

The electric power industry should adapt to the trend of the times and strengthen the integration with regional fintech development. The results of Table 3 demonstrate that fintech can promote the financial sustainable growth of electric power companies. Enterprises should make good use of the advantages of fintech development, alleviate financing difficulties, improve their own risk resistance ability, and ensure corporate financial sustainability. Heterogeneity analysis indicates that compared to large and state-owned enterprises, small and medium-sized enterprises and private enterprises are more able to enjoy the financial benefits brought by the development of fintech. This is mainly because small and medium-sized enterprises and private enterprises have always been in a disadvantaged position in the traditional financial system, making it more difficult for them to obtain loans from banks. But the development of fintech can change their financial difficulties. With the support of artificial intelligence, big data, cloud computing and other technologies, a series of new financial products and services have been produced. Therefore, for small and medium-sized enterprises and private enterprises, they should seek more new financing channels through fintech to better achieve their own financial sustainable growth.

5.3 The perspective of financial institutions

Facing the opportunities brought by the development of fintech, traditional financial institutions need to strengthen their integration with emerging technologies. The results of columns (1) and (2) in Table 7 indirectly illustrate the more severe financing environment faced by small and medium-sized enterprises. Traditional financial institutions can ease the financing difficulties of small and medium-sized electric power enterprises through the technology brought by fintech. For example, by building open banks, connecting financial services with commercial cooperation, providing diversified and high-quality financing channels for small and medium-sized enterprises. Analysis of impact mechanism in this paper indicates that fintech can promote the financial sustainable growth of electric power enterprises by reducing financing constraints and enhancing risk-taking ability. Therefore, in the process of technological transformation, financial institutions can focus on the reform at the credit and insurance aspects, lower the threshold for financial services, and innovate more credit and insurance products.

6 Conclusion and outlook

This paper explores the impact mechanism of fintech on the financial sustainable growth of electric power enterprises. After extracting 48 fintech related keywords, we construct a regional fintech indicator system using web crawler technology. On this basis, we used data from A-share listed companies of electric power industry from 2010 to 2020 to build the econometric model that includes both enterprise and regional levels. The results indicate that fintech has significantly improved the financial sustainability of electric power enterprises. Further exploration finds that fintech can promote financial sustainable development by enhancing corporate risk-taking ability, increasing operating income, and alleviating financing constraints.

Heterogeneity analysis indicates that ownership discrimination still exists in electric power enterprises. Private enterprises can obtain more credit funds through new financing channels opened by financial technology. So compared to state-owned enterprises, fintech has a more significant effect on improving the financial sustainability of private enterprises. In addition, fintech is more significant in helping small and medium-sized electric-power enterprises in financial sustainability, while it is less helpful for large enterprises. The results of robustness and endogeneity tests show that the research results of this article are reliable.

Because of the difficulty in obtaining data, this study only takes China as an example to explore the impact of fintech on the financial sustainability of the electric power industry. In the future, we can obtain data from more countries to seek more universally applicable conclusions. In addition, we only analysis three potential paths for fintech to improve financial sustainability. Therefore, more impact mechanisms can be found through data from more countries.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LQ: Conceptualization, Methodology, Project administration, Resources, Writing–review and editing. ML: Conceptualization, Data curation, Methodology, Software, Writing–original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

Authors LQ and ML were employed by State Grid Jiangsu Electric Power Co., Ltd.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Referring to Kaplan and Zingales. (1997), this article calculates the financing constraint index. The larger the index, the greater the degree of financing constraints faced by the enterprise.

References

Abad-Segura, E., González-Zamar, M. D., López-Meneses, E., and Vázquez-Cano, E. (2020). Financial technology: review of trends, approaches and management. Mathematics 8, 951. doi:10.3390/math8060951

Abdulsaleh, A. M., and Worthington, A. C. (2013). Small and medium-sized enterprises financing: a review of literature. Int. J. Asian. Bus. Inf. 8, 36. doi:10.5539/ijbm.v8n14p36

Alt, R., Beck, R., and Smits, M. T. (2018). FinTech and the transformation of the financial industry. Electron. Mark. 28, 235–243. doi:10.1007/s12525-018-0310-9

Arner, D. W., Buckley, R. P., Zetzsche, D. A., and Veidt, R. (2020). Sustainability, FinTech and financial inclusion. Eur. Bus. Organ. Law Rev. 21, 7–35. doi:10.1007/s40804-020-00183-y

Bellardini, L., Del Gaudio, B. L., Previtali, D., and Verdoliva, V. (2022). How do banks invest in fintechs? Evidence from advanced economies. J. Int. Financ. Mark. I. 77, 101498. doi:10.1016/j.intfin.2021.101498

Berger, A. N. (2003). The economic effects of technological progress: evidence from the banking industry. J. Money. Credit. Bank. 35, 141–142. doi:10.17016/feds.2002.50

Buchak, G., Matvos, G., Piskorski, T., and Seru, A. (2018). Fintech, regulatory arbitrage, and the rise of shadow banks. J. Financ. Econ. 130, 453–483. doi:10.1016/j.jfineco.2018.03.011

Bui, T. D., Ali, M. H., Tsai, F. M., Iranmanesh, M., Tseng, M. L., and Lim, M. K. (2020). Challenges and trends in sustainable corporate finance: a bibliometric systematic review. J. Risk Financ. Manag. 13, 264. doi:10.3390/jrfm13110264

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate social responsibility and access to finance. Strateg. Manage. J. 35, 1–23. doi:10.1002/smj.2131

Chong, T., Lu, L., and Ongena, S. (2013). Does banking competition alleviate or worsen credit constraints faced by small-and medium-sized enterprises? Evidence from China. J. Bank. Financ. 37, 3412–3424. doi:10.1016/j.jbankfin.2013.05.006

Cull, R., Xu, L. C., and Zhu, T. (2009). Formal finance and trade credit during China's transition. J. Financ. Intermed. 18, 173–192. doi:10.1016/j.jfi.2008.08.004

Dhiaf, M. M., Khakan, N., Atayah, O. F., Marashdeh, H., and El Khoury, R. (2022). The role of FinTech for manufacturing efficiency and financial performance: in the era of industry 4.0. J. Decis. Syst. 2022, 1–22. doi:10.1080/12460125.2022.2094527

Du, P., Huang, S., Hong, Y., and Wu, W. (2022). Can FinTech improve corporate environmental, social, and governance performance? a study based on the dual path of internal financing constraints and external fiscal incentives. Front. Environ. Sci. 10, 1061454. doi:10.3389/fenvs.2022.1061454

Duarte, J., Siegel, S., and Young, L. (2012). Trust and credit: the role of appearance in peer-to-peer lending. Rev. Financ. Stud. 25, 2455–2484. doi:10.1093/rfs/hhs071

Ediagbonya, V., and Tioluwani, C. (2023). The role of fintech in driving financial inclusion in developing and emerging markets: issues, challenges and prospects. Technol. Sustain. 2 (1), 100–119. doi:10.1108/techs-10-2021-0017

Fairfield, P. M., Whisenant, S., and Yohn, T. L. (2003). The differential persistence of accruals and cash flows for future operating income versus future profitability. Rev. Acc. Stud. 8, 221–243. doi:10.1023/a:1024413412176

Feng, S., Zhang, R., and Li, G. (2022). Environmental decentralization, digital finance and green technology innovation. Struct. Change Econ. D. 61, 70–83. doi:10.1016/j.strueco.2022.02.008

Guariglia, A., Liu, X., and Song, L. (2011). Internal finance and growth: microeconometric evidence on Chinese firms. J. Dev. Econ. 96, 79–94. doi:10.1016/j.jdeveco.2010.07.003

Heiskanen, A. (2017). The technology of trust: how the Internet of Things and blockchain could usher in a new era of construction productivity. Constr. Res. Innovation 8, 66–70. doi:10.1080/20450249.2017.1337349

Huerga, A., and Rodríguez-Monroy, C. (2019). Mandatory convertible notes as a sustainable corporate finance instrument. Sustainability 11, 897. doi:10.3390/su11030897

Jagtiani, J., and Lemieux, C. (2018). Do fintech lenders penetrate areas that are underserved by traditional banks? J. Econ. Bus. 100, 43–54. doi:10.1016/j.jeconbus.2018.03.001

Kaplan, S. N., and Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi:10.1162/003355397555163

Lagna, A., and Ravishankar, M. N. (2022). Making the world a better place with fintech research. Inf. Syst. J. 32 (1), 61–102. doi:10.1111/isj.12333

Li, C. T., Yan, X. W., Song, M., and Yang, W. (2020a). Fintech and corporate innovation—evidence from Chinese NEEQ-listed companies. China Ind. Econ. 382, 81–98. doi:10.19581/j.cnki.ciejournal.2020.01.006

Li, J., and Jiang, S. C. (2021). Bank financial technology and commercial sustainability of inclusive finance—micro evidence of financial enhancement effect. China Econ. Q. 21, 889–908.

Li, J., Wu, Y., and Xiao, J. J. (2020b). The impact of digital finance on household consumption: evidence from China. Econ. Model. 86, 317–326. doi:10.1016/j.econmod.2019.09.027

Liu, C., Cai, W., Zhai, M., Zhu, G., Zhang, C., and Jiang, Z. (2021). Decoupling of wastewater eco-environmental damage and China's economic development. Sci. Total Environ. 789, 147980. doi:10.1016/j.scitotenv.2021.147980

Liu, K. M., and Xie, X. B. (2021). Enterprise financialization, financing constraints, and sustainable growth. South China Finance 543, 38–50.

Luo, S., Sun, Y., Yang, F., and Zhou, G. Y. (2022). Does fintech innovation promote enterprise transformation? Evidence from China. Technol. Soc. 68, 101821. doi:10.1016/j.techsoc.2021.101821

Luu, N., and Ngo, L. V. (2019). Entrepreneurial orientation and social ties in transitional economies. Long. Range Plann 52, 103–116. doi:10.1016/j.lrp.2018.04.001

Macchiavello, E., and Siri, M. (2022). Sustainable finance and fintech: can technology contribute to achieving environmental goals? A preliminary assessment of ‘green fintech’and ‘sustainable digital finance. Eur. Co. Financial Law Rev. 19 (1), 128–174. doi:10.1515/ecfr-2022-0005

Merello, P., Barberá, A., and De la Poza, E. (2022). Is the sustainability profile of FinTech companies a key driver of their value? Technol. Forecast. Soc. Change 174, 121290. doi:10.1016/j.techfore.2021.121290

Muganyi, T., Yan, L., Yin, Y., Sun, H., Gong, X., and Taghizadeh-Hesary, F. (2022). Fintech, regtech, and financial development: evidence from China. Finan. Innov. 8, 29–20. doi:10.1186/s40854-021-00313-6

Nanda, R., and Rhodes-Kropf, M. (2013). Investment cycles and startup innovation. J. Financ. Econ. 110, 403–418. doi:10.1016/j.jfineco.2013.07.001

Poncet, S., Steingress, W., and Vandenbussche, H. (2010). Financial constraints in China: firm-level evidence. China Econ. Rev. 21, 411–422. doi:10.1016/j.chieco.2010.03.001

Sheng, T. X., and Fan, C. L. (2020). Fintech, optimal banking market structure, and credit supply for SMEs. J. Financ. R. 480, 114–132.

Suryono, R. R., Budi, I., and Purwandari, B. (2020). Challenges and trends of financial technology (Fintech): a systematic literature review. Information 11, 590. doi:10.3390/info11120590

Tang, S., Wu, X. C., and Zhu, J. (2020). Digital finance and enterprise technology innovation: structural feature, mechanism identification and effect difference under financial supervision. Manag. World 36, 52–66.

Wang, X. H., Song, M., Meng, X. Z., and Li, N. (2023). Fintech and structural features of manufacturing innovation—discussion on the effect differences of pilot policy of combining technology and finance. J. Southwest Univ. Soc. Sci. Ed. 49, 119–133.

Watson, R., and Wilson, N. (2002). Small and medium size enterprise financing: a note on some of the empirical implications of a pecking order. J. Bus. Finan. Acc. 29, 557–578. doi:10.1111/1468-5957.00443

Wu, Y. H., Bai, L., and Chen, X. (2023). How does the development of fintech affect financial efficiency? Evidence from China. Econ. Research-Ekonomska Istraživanja 36 (2), 2106278. doi:10.1080/1331677x.2022.2106278

Keywords: electric power industry, fintech, financial sustainability, financing environment, China

Citation: Qin L and Lu M (2023) How fintech affects financial sustainability in the electric power industry?—evidence from Chinese companies. Front. Environ. Sci. 11:1297030. doi: 10.3389/fenvs.2023.1297030

Received: 19 September 2023; Accepted: 09 November 2023;

Published: 21 November 2023.

Edited by:

Wei Zhang, China University of Geosciences Wuhan, ChinaReviewed by:

Shikuan Zhao, Chongqing University, ChinaGuoxiang Li, Nanjing Normal University, China

Ming Zhang, China University of Mining and Technology, China

Ruijin Du, Jiangsu University, China

Copyright © 2023 Qin and Lu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Li Qin, MTM4MDE1ODI3ODZAMTM5LmNvbQ==

Li Qin

Li Qin Meihua Lu

Meihua Lu