- 1School of Economics and Management, Tibet University, Lhasa, Tibet, China

- 2SJTU-UNIDO Joint Institute of Inclusive and Sustainable Industrial Development, Shanghai Jiao Tong University, Shanghai, China

Introduction: Carbon market is an important market instrument to deal with environmental problems and an important practice of the green development concept. Among the many economic sectors in China, the energy sector is the largest emitter of carbon dioxide, therefore, the transformation of the energy sector is the focus of China’s green development.

Methods: This study used data from 211 prefecture-level cities in China from 2015 to 2020 to construct carbon market, green development, energy transition (shift to clean and low-carbon energy), and financial development indices to determine how to achieve green development beginning with a carbon emissions market and investigate how carbon markets affect environmentally friendly development from a green economics perspective. Unlike previous studies, this study uses a moderated dual mediation model for analysis to examine the indirect impact of carbon markets on green development through energy efficiency and new energy use channels of energy transition. Afterward, examine how financial development influences carbon markets and green development and the mediating effect of such development in eastern, central, and western China are performed, respectively.

Results: The empirical results of this study reveal the following: first, carbon markets directly influence green development in a favorable way. Second, energy transition creates a bridge between carbon markets as well as green development; and third, financial development plays a moderating role among carbon markets, energy transition, and green development.

Discussion: Based on the empirical findings, this study provides recommendations for promoting green development, such as enhancing information disclosure and guiding green finance development.

1 Introduction

Climate change has elevated to one of humanity’s most pressing issues in recent years, and great efforts are being made by governments to reduce global greenhouse gas emissions. These efforts can be grouped into two categories: 1) market instruments, which are represented by carbon emission rights, pollutant discharge right, and energy use rights; 2) non-market instruments, which are represented by carbon taxes and regulation. As the world’s second-largest carbon market, China has developed policies that will lead to the success or failure of humanity’s response to the climate problem (Rui et al., 2017). In recent years, the Chinese government is currently focused on the protection and management of ecological resources and the environment (Wang et al., 2023a). On 22 September 2020, China stated that it would attain carbon neutrality by 2060 and peak carbon emissions by 2030, thereby proclaiming carbon reduction and green development as two of the most important issues in China (The Chinese Foreign Ministry, 2020). In 2022, China proposed building a unified national market, thus highlighting the role of market instruments, such as carbon emission rights trading markets (The Central Committee of the Communist Party of China, 2022).

The market-based approach to environmental issues can be traced back to the U.S.‘s Clean Air Act in 1970 and its 1990 amendments, which introduced a tool called “tradable permits” or the “cap-and-trade system,” which paved the way for the allocation and trading of carbon emission rights. Subsequently, annual industrial sulfur dioxide emissions in the U.S. dropped from 31 million tons in 1970 to around 2.7 million tons in 2016 (Nordhaus, 2021). In 2005, the Kyoto Protocol was enacted, which led to the establishment of the first international carbon market, namely, the EU Emissions Trading System, which applied market-based instruments for environmental issues to reduce carbon emissions (Duan et al., 2017). In 2011, China’s National Development and Reform Commission issued a notice on a pilot carbon emissions trading system, which covered over 1.2 billion tons of carbon dioxide, ushering in an era of market-based regulation of China’s carbon emissions and making China the world’s second largest emissions trading system (Martin et al., 2014). China’s national carbon emissions trading market, which was established in 2021, is the second national-level or above carbon emissions market in the world.

The promotion of green and sustainable development is an important global issue (Wang et al., 2023b). Chinese President Xi Jinping proposed a new development strategy in 2015 to encourage innovative, coordinated, green, open, and shared development in response to the high energy consumption and high pollution caused by industrialization. Thus, green development became a strategic concept at the national level, and a green development path was laid. Therefore, determining how to achieve green development has become an important issue. Green development is oriented toward green welfare and green wealth, which refer to the welfare and wealth shared by the present and future generations and involves the welfare of the entire society and the generation of wealth centered on natural and social systems. This study tries to clarify the methods for achieving green development. It also examines the carbon emission market’s influence on green development from the viewpoint of green economics.

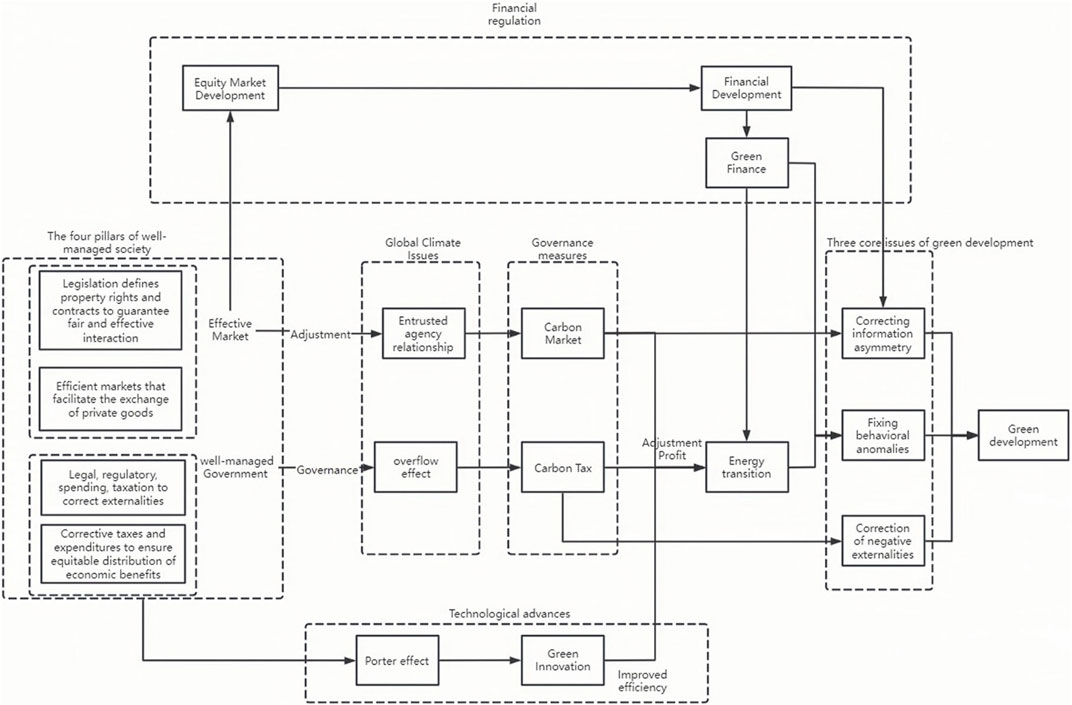

This study constructs a theoretical framework based on Nordhaus’s concept of green economics to explore the relationship between carbon emission markets and green development. Nordhaus (2021) has called the ideal form of society that considers green development a society of well-managed, which he believes has four pillars: laws defining property rights and contracts to guarantee fair and effective interaction; efficient markets to facilitate the exchange of private goods; laws, regulations, expenditures, and taxes to correct externalities; corrective taxes and expenditures to promote the fair distribution of economic benefits. Herein, the first two characteristics are summarized as an effective market and the last two characteristics are summarized as an effective government.

This study demonstrates that the main problem to be solved in the effective market part of the climate issue is the problem of the principal-agent relationship between enterprises and residents, where residents can be seen as the principals of environmental protection and enterprises can be seen as the agents of environmental protection. In a normal principal-agent relationship, the principal has a close relationship with the agent and can supervise the agent’s situation. However, with environmental protection, the relationship between principal and agent is weak to the extent that they do not recognize each other’s existence. In this case, the company as an agent may fail to take environmental protection actions in the interests of the residents and other principals and may even go to the extent of polluting the environment. This problem can be resolved by introducing carbon trading rights and building a carbon market. Carbon markets rectify the profit mechanism of the enterprises to ensure that they compensate monetarily for generating excess CO2 emissions, which in turn leads to an energy transition and, ultimately, green development. It also rectifies the information asymmetry between enterprises and residents, industry and commerce, and enterprises and the government, and strengthens the link between principals and agents.

Over the course of climate change, an effective government must address the environmental protection problem and the spillover effects of environmental pollution. The spillover effects of environmental protection and pollution are extremely serious. The benefits of environmental protection and the damage of environmental pollution have minimal impact on the entities themselves because the vast majority of the benefits or damage are borne by others and a natural feedback mechanism is lacking. Thus, the market alone is incapable of solving the problem of environmental pollution. One solution is to impose a carbon tax to increase corporate costs, impact corporate profits, and promote businesses to shift to clean and low-carbon energy, thereby promoting green development. Therefore, the imposition of a carbon tax is conducive to internalizing externalities and promoting green development.

The paths of influence of both an effective government and an effective market involve an energy transition, which is influenced by technological advances and financial development. The emphasis on environmental protection in a well-managed society may have a Porter effect, which in turn may promote green innovation and reduce the cost of energy-efficient technologies and new energy production, thereby contributing to the energy transition. Similarly, the energy transition may also be regulated by green finance and thus could provide an objective measure of the discounted market rates of return and then correct for high discount rates and the tendency for investment to consume too much energy (Nordhaus, 2021).

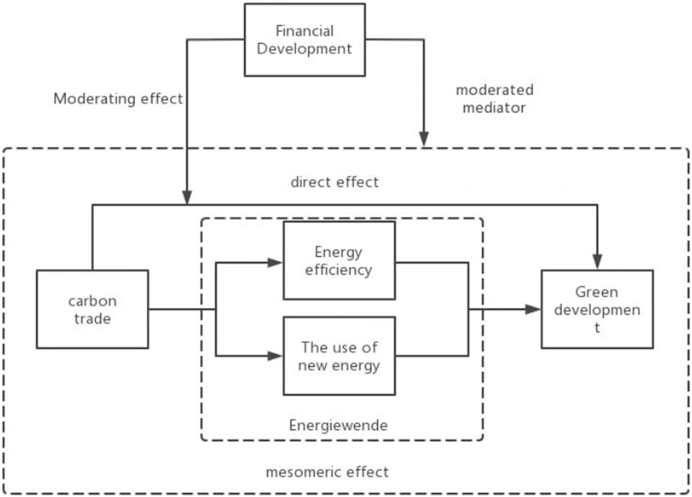

The impact of financial development, another component of efficient markets, should not be underestimated because financial development may also facilitate the disclosure of market information and thus correct information asymmetries. Furthermore, financial development may also force the system to improve, which would correct the behavioral anomalies caused by the system. For example, fixing the problem that the cost of air conditioning in state-owned enterprises is not linked to employees leads to employees treating energy as a free commodity and wasting it. The method flow is shown in Figure 1.

This paper focuses on how the market affects green development and explores the relationship among carbon trading, energy transition, green development, and financial development. The model was constructed as shown in Figure 2:

FIGURE 2. Schematic depicting the relationship among carbon trading, energy transition, green development, and financial development.

Numerous studies have shown that carbon emissions trading markets have positive effects. In terms of carbon trading market and energy transition, Cai et al. (2015) analyzed low-carbon technology efficiency in carbon emissions trading and energy transition and demonstrated the impact of carbon emissions on energy transition. Li, Huang and Wu (2022) used the Super-Super-Epsilon-Based Measure model and demonstrated that carbon emissions affect total factor productivity in the green by influencing the structure of depletion of resources and total energy consumption. Nong et al. (2020) confirmed that Vietnam’s carbon emissions trading market is also conducive to a shift to clean and low-carbon energy. In order to show that carbon emissions have a favorable effect on the green transformation of the manufacturing industry, Zhou, Ma, and Lin (2022) utilized the worldwide Malmquist Luenberger productivity index based on the SBM-DEA approach from the perspective of the manufacturing industry. Wang and He (2022) developed the green equilibrium index, took into account the efficiency and justice dimensions, and used the DID model to show how the carbon trading market promoted green development. Panel data from 30 provinces from 2005 to 2017 were used by Wu, Tambunlertchai and Pornchaiwiseskul (2021) to confirm the function of carbon trading markets in green development. According to the “China’s Green Development in the New Era” white paper, an initial allocation and trading system for water rights, energy use rights, emission rights, and carbon emission rights must be set up under the presumption of a scientific and reasonable management of total volume. To further utilize the market’s essential function in the distribution of ecological and environmental resources, it was further stated that the development of a national carbon emission trading market and the green power trading pilot should be carried out (China’s Green Development in the New Era, 2023). Although several studies have been performed in this regard, the analyses have been limited to the provincial or national level. According to the principle of green federalism, issues such as domestic waste disposal and greening of built-up areas are optimally analyzed from the local and municipal levels.

Based on the existing literature, the following hypotheses are proposed herein:

H1:. The development of a carbon market can lead to a shift toward green and low-carbon energy.

H2:. The development of a carbon market can influence the level of green development.Few studies have concentrated on how energy transition impacts green development or investigated the green attributes of green growth. Cai et al. (2015) stated that sources of clean power, such as nuclear, wind, and solar, capture and store decouple energy from carbon, thereby keeping the world at a high level of energy consumption, which is conducive to economic growth.Based on the existing literature and theoretical framework of this investigation, the following hypotheses are proposed:

H3:. The shift to green and low carbon in energy markets will affect the level of green development.

H4:. The development of a carbon market will impact green development by promoting a shift to green and low-carbon energy.The moderating effects of financial development on the energy transition and green development have been the subject of pertinent studies, but none of them specifically addressed the moderating role of financial development in mediating the energy transition. Wang and Taghizadeh-Hesary (2023) confirmed that the growth of green finance has facilitated the use of wind and water energy and, consequently, the energy transition by using data from 15 Organization for Economic Cooperation and Development members. Moreover, Sun and Sun (2023) confirmed the strong correlation between the financial and carbon markets.Based on these findings, the following hypotheses are proposed:

H5:. Financial development has a moderating role on the impact of carbon markets on green development.

H6:. Financial development has a moderating effect on the impact of carbon markets on green development via the effect of carbon trading on energy transition.

H7:. Financial development has a moderating effect on the impact of carbon markets on green development via the effect of the energy transition on green development.

2 Model construction and data

2.1 Model construction

To verify the impact of carbon trading on green development, a basic regression model was constructed as follows:

where

This study created a moderating effect model as follows to confirm the effects of carbon pricing on green development under the financial development constraint:

where

where

To further explore the mediating role of energy transition in carbon trading on green development under financial development constraints, this study constructed the following moderated mediation model:

2.2 Variable measures and descriptions

2.2.1 Core explanatory variables

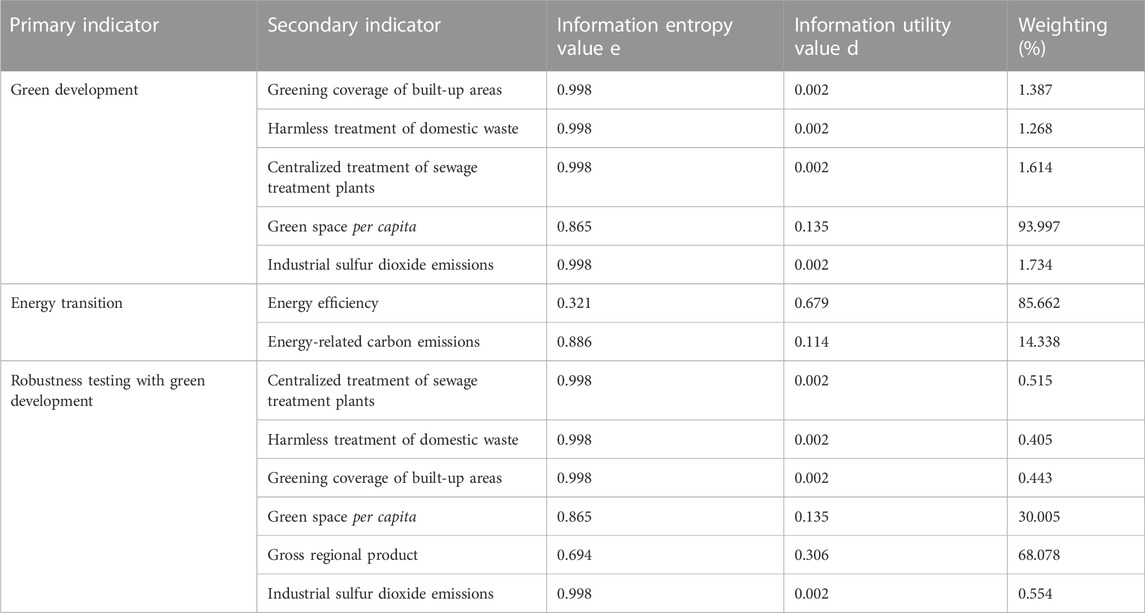

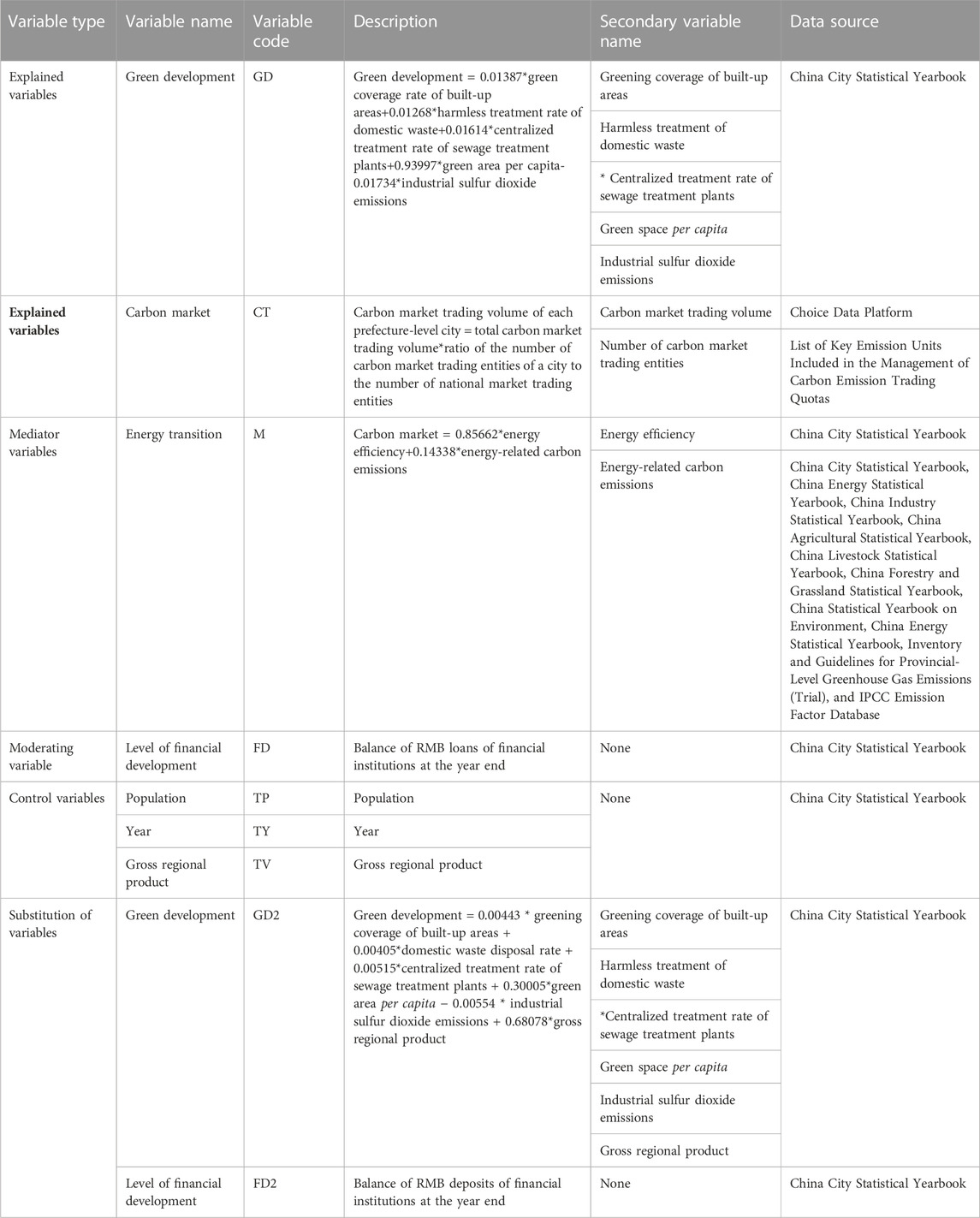

2.2.1.1 Explanatory variables: green development

Green development, a new economic model based on the idea of sustainable development, is the main explanatory variable. Its core is economic growth that is socially and environmentally responsible and attempts to use resources wisely while minimizing negative effects on the environment. (YCELP, 2012). Here, the greening rate of built-up areas, harmless treatment rate of household waste, centralized treatment rate of wastewater treatment facilities, green area per capita, and industrial sulfur dioxide emissions were used to measure the green development level of cities in China based on a study by Weng et al. (2018) and taking data availability into consideration. To address the issue of unit inconsistency among the data, the equivalent data for 211 Chinese cities were taken from the China City Statistical Yearbook and standardized. The entropy weighting method was used to process the data, with weights obtained as shown in the table. Industrial sulfur dioxide emissions is a negative indicator, while the remaining indicators are positive indicators. Green development indicators were generated based on the results of the entropy weighting method. The calculation process is as follows:

1. For an evaluated object G = (G1, G2⋯Gm) and evaluation index Q = (Q1, Q2⋯Qn), the value of the evaluated object Gi to the index Qj is noted as Xij (i = 1,2,⋯,m; j = 1,2,⋯,n), which forms the original data matrix X = (Xij)m×n, where Xij is the value of the ith evaluation object under the jth indicator.

2. For positive indicator order would be

3. Calculate the characteristic weight of the ith evaluation object under the jth indicator

4. Calculate the entropy weight of each indicator

5. Determine the comprehensive evaluation value of each evaluation object

The results of the entropy method used here are shown in Table 1.

2.2.1.2 Explanatory variables: carbon market

The explanatory variable is the carbon market. Based on a study by Weng and Xu (2018), the carbon market trading volume to measure carbon market development was used. In view of the lack of available data on the current carbon market trading volume of each prefecture-level city, this investigation assumed that the ratio of the number of trading entities of a prefecture-level city in a certain carbon market to the total number of national trading entities in that carbon market would be equal to the ratio of the trading volume of a prefecture-level city in a certain carbon market to the national trading volume in that carbon market. The ratio of trading entities of a prefecture-level city in a carbon market to the total number of entities in each carbon emission trading market was multiplied by the total trading volume of each carbon emission market to get the prefecture-level city carbon market trading volume. The formula is as follows:

where

2.2.1.3 Mediating variable: energy transition

The mediating variable is energy transition. According to a study by Teng et al. (2023), the main path to achieving an energy transition is to increase the energy intensity and develop new energy sources. Energy intensity is the ratio of energy consumption to GDP. Here, considering data availability and avoiding interference from residential energy use, the energy intensity formula was improved and the following energy efficiency index was constructed to measure it:

where

As for the measurement of the development of new energy, according to a study by Erkut (2022), the carbon emissions of new energy such as wind, solar and nuclear power are lower than those of traditional energy such as coal, oil and natural gas. Clean energy acts as an essential player in environmental protection (Li et al., 2023). Given the difficulty of obtaining data on new energy development by city, an energy carbon emission index to measure the development of new energy was constructed in this study. According to a study by Khondaker et al. (2016), the energy sector is the largest emitter of CO2 among the numerous economic sectors in China, and it accounts for >80% of the total emissions. Therefore, regional carbon emissions were used to represent regional energy sector carbon emissions. The energy-related carbon emissions indicator was calculated by dividing regional carbon emissions by regional energy use to obtain the regional carbon emissions per unit of energy.

The carbon emissions of each provincial-level city were calculated from the sum of emissions from transportation and construction, emissions from industrial processes, emissions from agriculture, forestry and land use change, emissions from waste disposal activities, emissions from purchased electricity, and emissions from heating and cooling. Emissions factors were adopted from the Inventory and Guidelines for Provincial-Level Greenhouse Gas Emissions (Trial) and the IPCC Emission Factor Database. The emissions of each sector are from the China Energy Statistical Yearbook, the China Industry Statistical Yearbook, the China City Statistical Yearbook, the China Environment Statistical Yearbook, and the administrative Statistical yearbooks at all levels. Finally, energy efficiency weight was assigned using the entropy weight method.

2.2.1.4 Moderating variable: financial development

According to a study by Lin and Chen (2019), carbon markets have dynamic linkages and spillover effects with financial markets, such as the stock and coal markets. Ren et al. (2022) also proved a strong correlation between energy markets and financial markets. According to a study by Mbutor O. Mbutor (2010), changes in bank loans lead to equity price fluctuations. Therefore, the effect of financial market development constraints were studied and based on the availability of data, we used year-end RMB balances of various loans of financial institutions to represent the level of financial development. The sample data of financial development were obtained from the China City Statistical Yearbook.

2.2.2 Control variables

Here, the urban gross regional product, population size, and time were used as control variables.(Sun and Sun, 2023) stated that carbon prices are strongly influenced by macroeconomics; therefore, to ensure the empirical results are not influenced by macroeconomics, the gross regional product of cities was used as a control variable.

As the Fujian carbon emissions exchange traded between 2015 and 2020, carbon trading volumes may be affected by time; therefore, time was used as a control variable.

Wu, Tambunlertchai and Pornchaiwiseskul (2021) used population as a control variable, as labor force size affects carbon emissions trading. Wang and He (2022) also used population as a control variable. Following previous studies, uses population was used as a control variable.

2.2.3 Substitution of variables

2.2.3.1 Substitution of explanatory variables

According to the study by Wang and He (2022), green economic development is the driving force of green development, whereas the ecological and environmental conditions are prerequisites for green development. Therefore, for variable substitution, GDP was included in the measurement of green development and the coefficient of green development, which defines economic development, was calculated using the entropy weighting method as the explanatory variable for the robustness test.

2.2.3.2 Substitution of moderating variables

The development of commercial banking and financial institutions depends on the issuance of loans and the acquisition of deposits. Deposits and loans are two sides of the development of banking and financial institutions. Therefore, the level of financial development using year-end RMB balances of various deposits in financial institutions were measured for the robustness test.

2.2.3.3 Substitution of control variables

Since the total output value has been considered in the explanatory variable green development in the robustness test, total output value was removed from the control variables.

2.3 Data sources

In this study, the data of 211 cities in China between 2015 and 2020 were selected, and in view of the missing data of some cities, the samples with missing data were removed, leaving 349 sample data. The data in this paper come from the China City Statistical Yearbook, the List of Key emission Units for Provincial and National Carbon Emission Trading Quota Management, the Choice Data Platform and the China Energy Statistical Yearbook. The details are shown in Table 2.

3 Results and discussion

3.1 Descriptive statistics and correlation analysis

Table 3 presents the results of descriptive statistics and correlations between variables for all the variables in this study. In terms of the core explanatory variables, the amount of carbon trading is significantly and positively correlated with green development (r = 0.257, p < 0.01), which is consistent with hypothesis H2. Carbon trading volume is weakly correlated with energy transition (r = −0.087, p = 0.111), whereas carbon trading volume is significantly negatively correlated with energy-related carbon emissions (r = −0.194, p < 0.01), and the logarithm of energy efficiency is also significantly negatively correlated with carbon trading volume (r = −0.275, p < 0.01). The energy transition consists of both energy efficiency and new energy use; therefore, subsequent studies have used the logarithm of energy efficiency and energy-related carbon emissions instead of the logarithm of energy transition. Therefore, this study replaced the mediation model with a dual mediation model. Since energy-related carbon emission is a negative indicator, the conclusions obtained are consistent with H1 in terms of new energy use. Nevertheless, energy efficiency is a positive indicator; therefore, the resulting combination is inconsistent with H1 in terms of energy efficiency. Energy-related carbon emissions have a clear positive correlation with green development (r = 0.577, p < 0.01), which is consistent with H3. Energy efficiency has a clear positive correlation with green development (r = 0.374, p < 0.01), which is consistent with H3. Regarding the control variables, population has a significant negative relationship with green development and energy-related carbon emissions (p < 0.01); carbon emissions trading and energy-related carbon emissions have a significant positive correlation with time (p < 0.01); and gross regional product has a significant negative correlation with carbon emissions trading and energy-related carbon emissions (p < 0.01).

3.2 Regression analysis

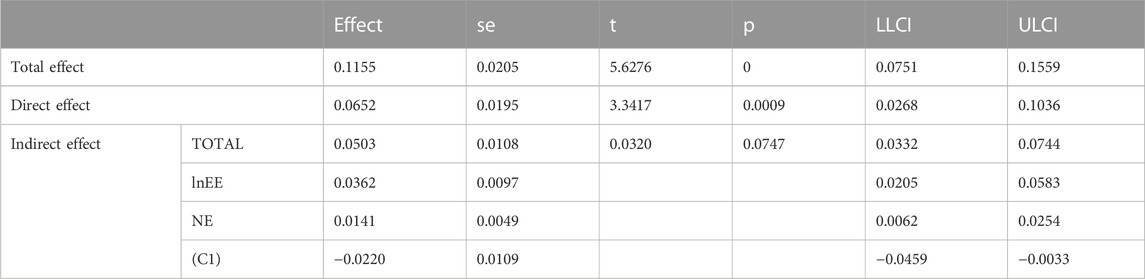

3.2.1 Mediating effect test

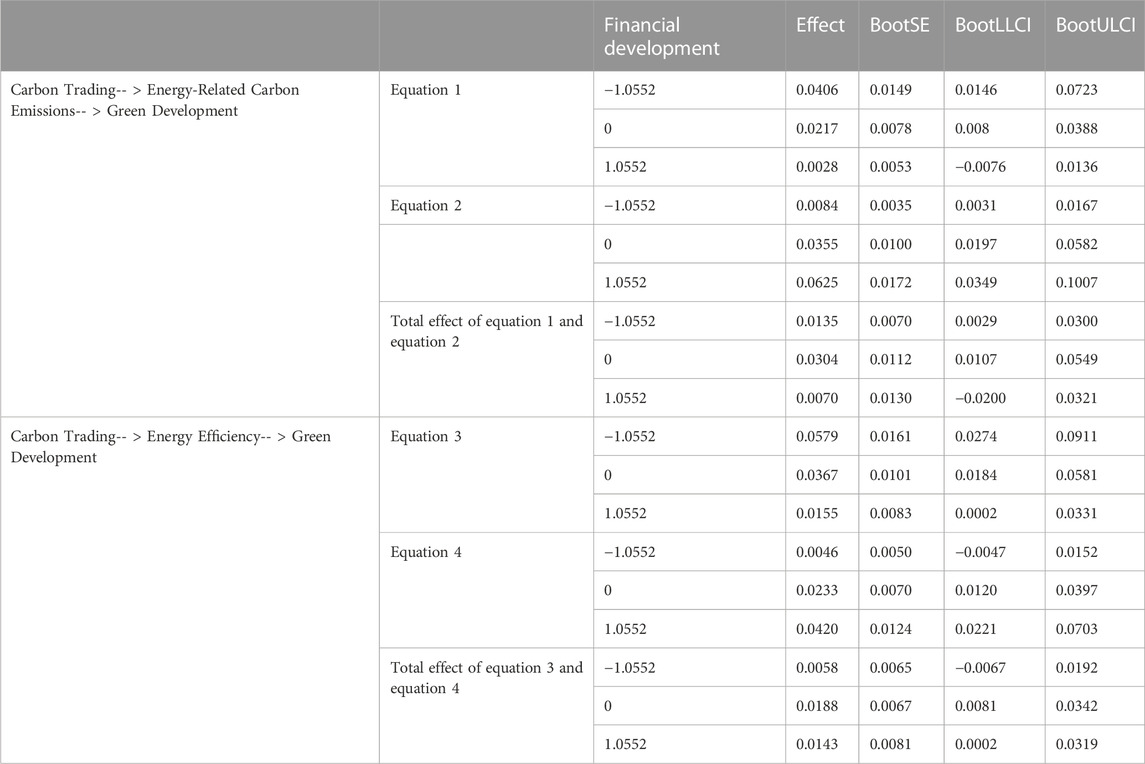

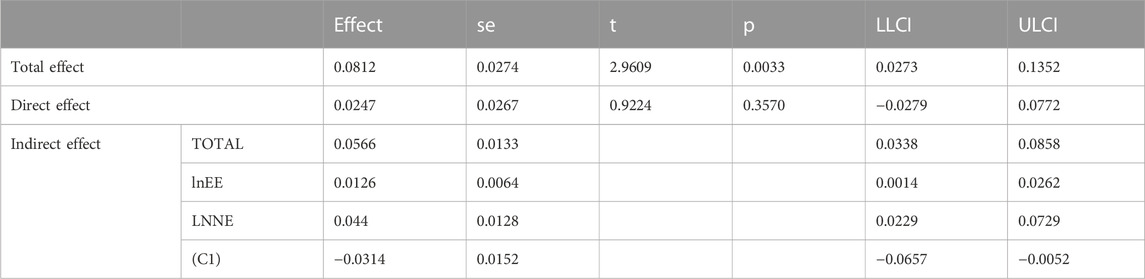

As shown in Table 4, the 95% confidence intervals of direct and indirect benefits do not pass through 0 and the p-values are all less than 0.05, indicating that both are significant. Moreover, the mediating effect of carbon trading on green development through energy-related carbon emissions is incomplete mediation. The direct benefit of carbon markets on green development is positive, with a value of 0.0652, which indicates that for every 1% increase in carbon trading volume, green development is directly enhanced by 0.0652%. The indirect benefit of carbon markets has a positive mediating effect on energy-related carbon emissions, with a value of 0.0503. The value of energy efficiency as a mediating variable is 0.0362, whereas that of energy-related carbon emissions is 0.0141. Thus, the development of carbon markets can promote green development by reducing energy-related carbon emissions and improving energy efficiency. The total benefit is 0.1155, indicating that the development of carbon markets will significantly improve green development in general and every 1% increase in carbon trading volume will lead to 0.1155% improvement in green development. Accordingly, hypotheses H1, H2, and H3 are verified.

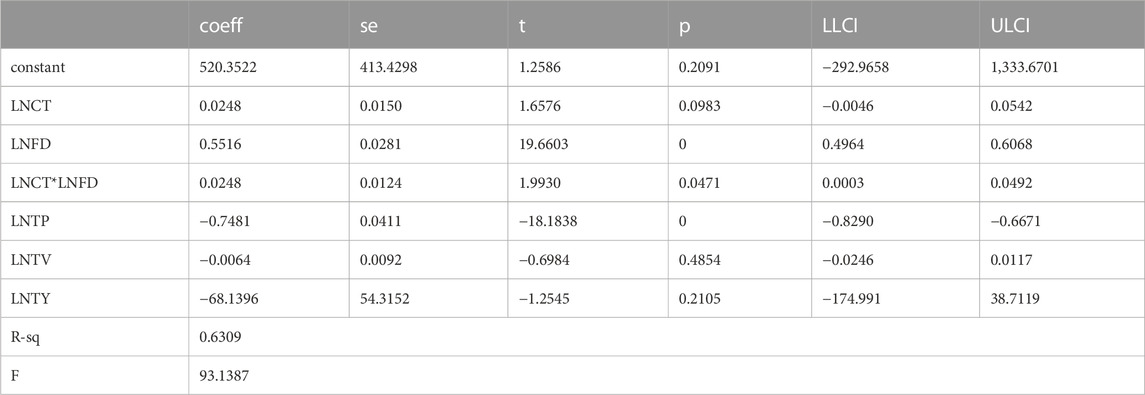

3.2.2 Direct effect test with moderation

Hierarchical analysis was used to test the mediating effect model with moderation (Wen and Ye, 2014). In the hierarchical analysis method, the first step is to determine whether the moderating variable (financial development) has a moderating effect on the direct effect.

As shown in Table 5, the confidence interval predicted by the moderated direct effect interaction term (LNCT*LNFD) does not contain 0, and the p-value is less than 0.05, so the moderated direct effect is significant. The coefficient of the impact of carbon market on green development is positive, and the coefficient of the interaction term between carbon market and financial development on green development is positive, so financial development plays a role in enhancing the direct effect.

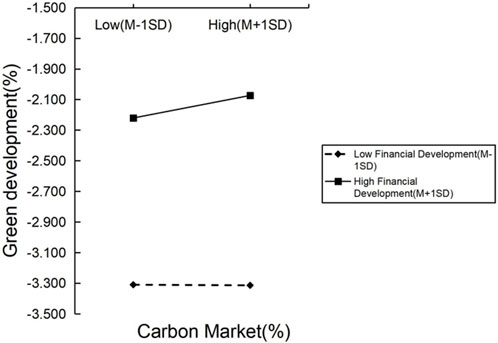

To further explore the moderating role between carbon markets and financial development, we divided carbon markets into high and low groups based on the previous and next standard deviation, performed simple slope tests, and plotted a simple effect analysis.

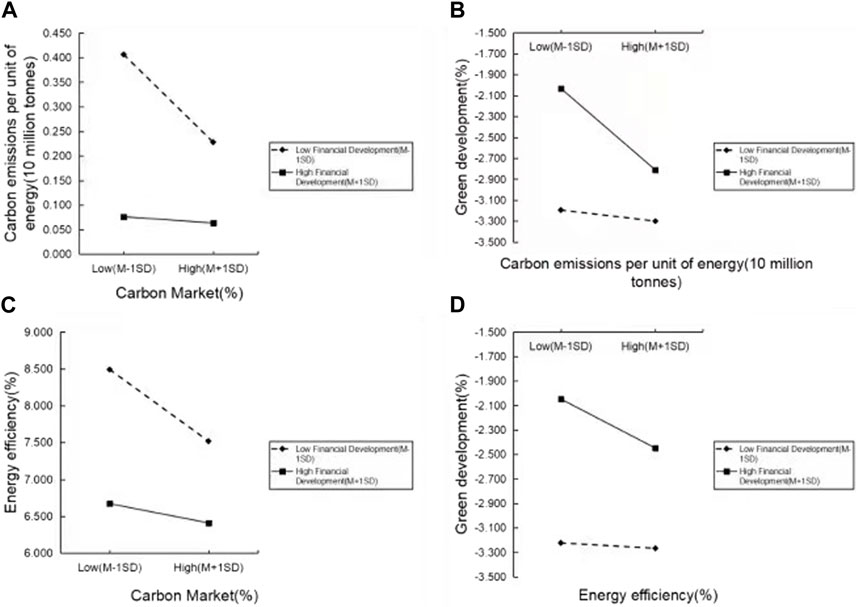

The results in Figure 3 indicate that the carbon markets have a significant positive impact on green development when financial development is high (p = 0.0023, β = 0.0509), whereas carbon markets do not have a significant impact on energy-related carbon emissions when financial development is low (p = 0.9523, β = −0.0013).

3.2.3 Test for moderated mediation effect

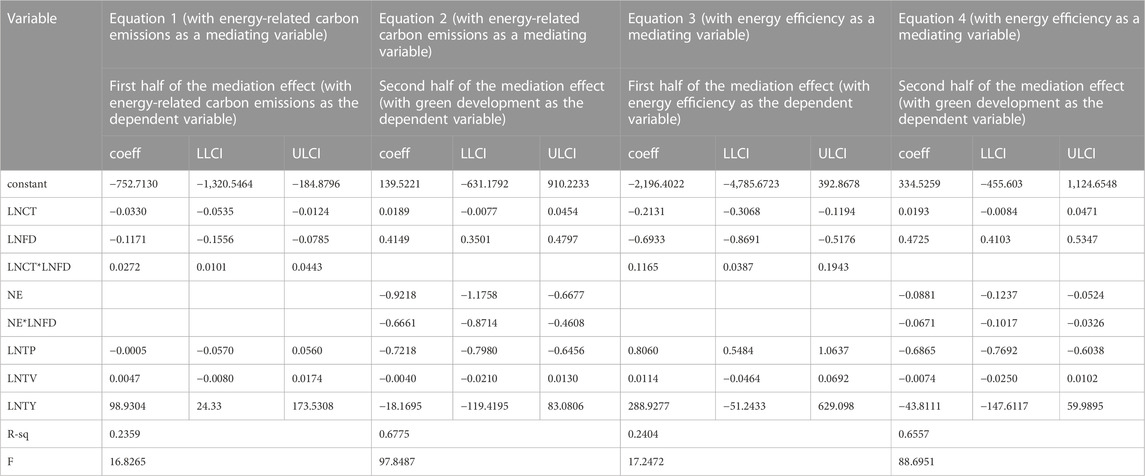

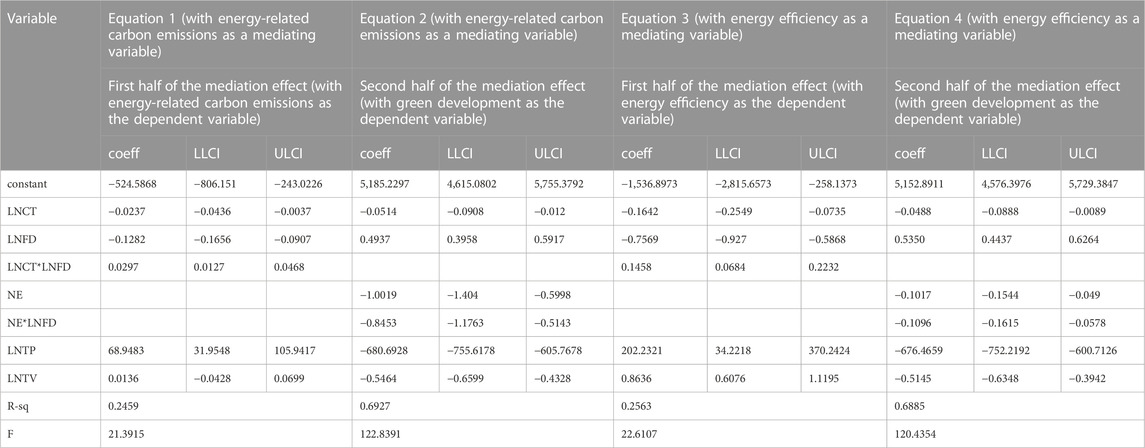

To verify the moderated mediation mechanism, the first half of the mediation effect (carbon market-energy transition) and the second half (energy transition-green development) were tested separately. As the mediating variable of energy transition is weakly correlated with carbon markets, new energy use and energy efficiency were used as mediating variables for testing. The results are shown in Table 6.

As shown in Table 6, if energy carbon emissions are used as the mediating variable, in Eq. (1), the carbon market negatively affects energy carbon emissions, and the interaction term between carbon market and financial development has a positive impact on energy carbon emissions, weakening the mediating effect. In Eq. (2), energy carbon emissions negatively affect green development, and the interaction term between energy carbon emissions and financial development has a negative impact on green development, which strengthens the mediating effect. H6 and H7 hold, so H5 holds. The moderating effect of financial development on the mediating effect is shown in Table 7. The total moderating effect of financial development on the mediating role of energy-related carbon emissions is obtained before and after financial development occurs, which showed that the mediating effect of energy-related carbon emissions increased and then decreased as the level of financial development increases and the level of decrease is not significant.

As shown in Table 6, carbon markets negatively affect the mediating variable energy efficiency. In Eq. (3), the interaction term between carbon markets and financial development has a positive effect on energy efficiency, which weakens the mediating effect; moreover, the confidence interval of the prediction of the interaction term does not contain 0, which means that H6 holds true. In Eq. (4), energy efficiency negatively affects green development and the interaction term of energy efficiency and financial development has a negative effect on green development, which strengthens the mediating effect; moreover, the confidence interval of the interaction term prediction does not contain 0, which means that H7 holds true. Since H6 and H7 hold true, H5 also holds true. The moderating effect of financial development on the mediating effect of energy efficiency is shown in Table 7. The total moderating effect of financial development on the mediating role of energy efficiency is determined before and after financial development occurs, which shows that the mediating effect initially increases and then decreases with financial development and the level of increase is not significant.

In order to further explore the moderating effect of carbon market, energy carbon emission, energy consumption and financial development, we divided carbon markets, energy-related carbon emissions, and energy consumption into high and low groups based on the previous and next standard deviation, performed simple slope tests, and plotted a simple effect analysis.

The results in Figure 4 show that when financial development is high, the carbon market has a negative impact on energy carbon emissions, but it is not significant (p = 0.7110, β = −0.0043). When the level of financial development is low, the carbon market has a significantly negative impact on energy carbon emissions (p = 0.0001, β = −0.0617). When financial development is high, energy carbon emissions have a significantly negative impact on green development (p = 0.0000, β = −1.6247). When financial development is low, energy carbon emissions have a significantly negative impact on green development (p = 0.0030, β = −0.2189). When financial development is high, the carbon market has a negative impact on energy efficiency, but not significant (p = 0.0889, β = −0.0902). When financial development is low, the carbon market has a significantly negative impact energy efficiency (p = 0.0000, β = −0.3360). When financial development is high, energy efficiency has a significantly negative impact on green development (p = 0.0000, β = −0.1589); When the level of financial development is low, its moderating effect is not significant, but energy efficiency also has a small negative impact on green development (p = 0.3904, β = −0.0172).

FIGURE 4. The moderating role of financial development in carbon markets and energy-related carbon emissions (A), green development and energy-related carbon emissions (B), carbon markets and energy efficiency (C), and energy efficiency and green development (D).

3.3 Robustness tests

In this study, after replacing the independent variables, mediating variables, and moderating variables owing to the varying data volumes, descriptive statistics, correlation analyses, and regression analyses were performed again. The conclusions obtained from H1, H2, H3, H4, H6, and H7 were verified to be robust; however, the conclusion obtained from H5 was not robust.

Owing to the weak bivariate significance of green development and carbon trading volume, a partial correlation test was conducted using time and population as control variables, and the results indicated significance (p = 0.003).

Table 8 show that the confidence interval for the predictions of the direct effect in the mediating effect test contains 0; therefore, it is not significant and the direct effect results are not robust. None of the confidence intervals for the mediating effect predictions contain 0; therefore, the indirect benefit results are robust.

Tables 9 and Table 10 show that the moderated mediating effect is robust for both the first and second half of the mediating effect. However, in terms of the overall mediating effect, the moderating effect of financial development is nonsignificant in both the previous and next standard deviation; therefore, the moderation effect of financial development on the overall mediating variable is not robust.

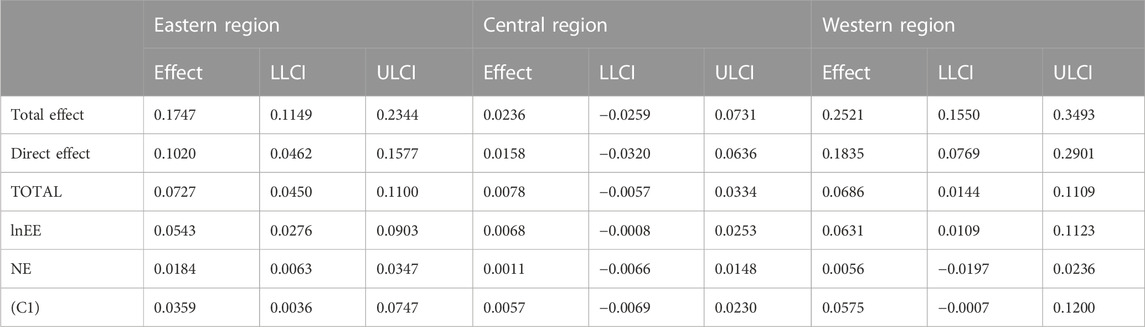

3.4 Heterogeneity analysis

Because of the large regional differences among the central, eastern, and western China, this study used a dual mediation effect model to regress the samples for each region separately to explore the effect of geographical heterogeneity on the impact of carbon markets on green development.

As show in Table 11, carbon trading in the central region has the weakest impact and a nonsignificant effect on green finance. In the eastern region, carbon trading has a moderate effect, and in the western region, it has the strongest impact on green development. The direct effect of carbon trading on green development in the western region contributes significantly to the total effect, with a value close to double the direct benefit in the eastern region. However, the indirect benefits of carbon markets for green development are greater in the eastern region than in the western region because the mediating channel, energy carbon emissions, is in effect in the eastern region compared to the western region, although the impact of the energy efficiency channel is weaker in the eastern region.

In terms of the mediation mechanism, carbon trading in the western region can affect green development through energy efficiency but not through energy-related carbon emissions. Both energy efficiency and energy-related carbon emissions in the eastern region can act as mediating variables to influence green development.

4 Conclusion and recommendations

4.1 Green development benefits directly from carbon markets

This study verified the green development benefits directly from carbon markets; however, this role is not robust. This influence is mainly associated with the development of a carbon market, which gradually breaks down the information asymmetry between different enterprises, enterprises and the government, and enterprises and citizens. Under such conditions, citizens, government, and other enterprises can act as principals to better monitor the efforts of enterprises to fulfill their carbon emission control obligations and thus promote green development. The positive impact of this correction of information asymmetry is the largest in western China, because the development of financial industry and other industries in western China is not perfect, and the degree of information asymmetry among enterprises, citizens and government is high. Therefore, carbon markets can effectively promote a reduction in information asymmetry. Additionally, due to western China’s lack of green development, a small amount of development appears substantial. However, in the central region, this corrective effect is not notable, which is likely because the greening rate is higher in the central region and the reduction of information asymmetry is smaller for green development. In addition, just one of the eight markets for trading carbon emissions is situated in the central region; therefore, the role of carbon trading market in reducing information asymmetry is limited. Seven of the eight carbon emissions trading markets are located in the eastern region, which has a greater rate of greening. The high reduction in information asymmetry by the carbon markets has had a substantial impact in this region.

Financial development can sometimes play a moderating role in the direct impact of carbon markets on green development; however, this moderating role is not robust. Financial development can contribute to green development through the information asymmetry channel by disclosing environmental, social, and governance information, reducing information asymmetry, and promoting green development. It can also promote the maximization of corporate interests and the transformation of “gray companies” into “green companies”. Therefore, the function of financial progress in controlling the carbon market and green development may change according to the specific situation, and in such cases, the government should promote the development of green finance.

4.2 Significant effect of energy transition in mediating between carbon markets and green development

This study divided energy transition into two aspects: energy efficiency and new energy applications. Both have a positive mediating effect on green development. With a robust carbon market, the cost of energy use by enterprises increases, thereby promoting more efficient energy use by the enterprises, which in turn promotes a higher level of green development. Similarly, with a robust carbon market, companies that want to reduce their energy costs can opt for clean energy and reduce their carbon emissions per unit of energy. This promotes the use of new energy sources, which in turn drives the level of green development.

In eastern China, the mediating effect of energy efficiency and new energy sources was found to be significant. The development of carbon markets can promote both improvements in energy use efficiency and reductions in carbon emissions per unit of energy, which in turn can promote the improvement of green development. In western China, only the energy efficiency channel had an effect, which is likely because of the region’s low market efficiency and the subsequent weak correction effect of carbon market development on the profit mechanism of corporate energy-related carbon emissions. The market mechanism provides a stronger intrinsic incentive for companies to improve their energy use efficiency and does not have a strong ability to make them use new energy sources to reduce their carbon emissions. This results in an effective mediation channel for energy efficiency and an ineffective mediation channel for energy-related carbon emissions in the western region.

4.3 Financial development plays a moderating role among carbon markets, energy transition, and green development

Financial development has a significant moderating effect on the mediating role of carbon markets in green development. This role is based on regulating the impact of carbon markets on the energy transition and that of the energy transition on green development.

In terms of the negative impact of carbon markets on energy-related carbon emissions, financial development weakens their role. As the level of financial development increases, it becomes easier for companies to access capital and purchase excess carbon credits. When companies have access to more capital from financial institutions and can choose between purchasing carbon credits and reducing carbon emissions per unit of energy, they will likely choose to purchase carbon credits rather than reduce carbon emissions per unit of energy because purchasing carbon credits provides greater certainty and short-term results. Therefore, financial development will instead weaken the impact of carbon markets on reducing energy emissions.

In terms of the negative impact of carbon markets on energy efficiency, financial development weakens their role. Interestingly, carbon markets drive down the efficiency of energy use, which is most likely caused by the influence of specific periods and events. Starting at the beginning of 2016, China increased the intensity of environmental protection inspections, and 2017 was considered the strictest environmental protection year in China’s history. However, inspections used administrative means more than market mean values, which are less flexible. Therefore, a number of companies with energy needs could not expand to other energy sources and could only improve the efficiency of their energy use. With the gradual establishment and improvement of carbon markets, these enterprises will be able to purchase carbon emission rights from carbon markets to expand the source of energy; therefore, their incentive to improve energy efficiency will be reduced, which leads to a situation in which the improvement of carbon markets reduces energy efficiency. With the development in finance and availability of capital, companies have more capacity to research technologies that enhance the efficiency of energy use; therefore, financial development leads to the weakening of this negative effect.

With regard to the role of the energy transition for green development, financial development amplifies the impact of this channel on green development, whether it is the energy carbon emissions channel or the energy efficiency channel. This amplification effect may be because financial development is a catalyst for economic development, and both positive and negative outcomes are amplified by financial development. This phenomenon may be since the targeted liquidity injection tools in China today are not yet perfect, making it difficult to control the negative effects that may result from financial development. With the gradual improvement of the system of financial instruments, this conclusion may also change.

4.4 Recommendations

In carbon markets, the disclosure of information related to carbon emissions trading entities should be strengthened to reduce information asymmetry, which will promote the positive effect of carbon markets on green development. In addition, as financial development inhibits the positive effect of carbon markets, the focus of such development should be on the use of funds in financial institutions and special guidance measures to promote the development of green finance. At present, with special guidance measures to promote the development of green finance, major commercial banks and financial institutions in China have established a green credit system (Ren et al., 2023). Furthermore, the construction of an effective market should be investigated to allow carbon markets to more efficiently regulate corporate profits, thereby promoting the energy transition by enterprises. After that, local governments and enterprises should focus on upgrading carbon emission reduction related technologies, and with the help of finance, open up the conduction path of “carbon emission - energy transition - green development”, so as to correct the behavioral abnormalities of enterprises through the energy transition channel and promote green development.

On the other hand, increasing green development requires an effective market as well as an effective government, which should utilize various administrative tools such as carbon taxes, reduce the use of one-size-fits-all administrative instruments for reducing carbon emissions, and work with carbon markets to regulate the issues affecting green development. The government should focus on the application of the principle of green federalism to correct negative externalities by grading the management of various types of carbon emission behaviors, clarifying the principal-agent relationship, and determining the level of the main body of carbon emission management. For example, carbon emissions from the automobile industry can be handled by municipal governments, while carbon emissions from the aviation industry need to be handled by national governments.

With the use of market and non-market instruments, green development pathways will be further practiced and global climate problems are likely to be further mitigated.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

SK: Conceptualization, Formal Analysis, Funding acquisition, Supervision, Validation, Writing–original draft, Writing–review and editing. HL: Data curation, Methodology, Software, Writing–original draft, Writing–review and editing. ST: Supervision, Writing–review and editing, Conceptualization, Validation.

Funding

The authors declare financial support was received for the research, authorship, and/or publication of this article. This work was funded by Science and Technology Department of Tibet (Number: 00060853) and Tibet University (Number: 00061114/007/001).

Acknowledgments

The authors would like to thank Z. Yu, T. Wang, T. Liu and M. Bai for their invaluable comments on an earlier draft of this paper.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1257449/full#supplementary-material

References

Cai, W., and Ye, P. (2022). Does carbon emission trading improve low-carbon technical efficiency? Evidence from China. Sustain. Prod. Consum. 29, 46–56. doi:10.1016/j.spc.2021.09.024

Cai, Y., Newth, D., Finnigan, j., and Gunasekera, D. (2015). A hybrid energy-economy model for global integrated assessment of climate change, carbon mitigation and energy transformation. Appl. Energy 148, 381–395. doi:10.1016/j.apenergy.2015.03.106

Duan, M., Tian, Z., Zhao, Y., and Li, M. (2017). Interactions and coordination between carbon emissions trading and other direct carbon mitigation policies in China. Energy Res. Soc. Sci. 33, 59–69. doi:10.1016/j.erss.2017.09.008

Erkut, B. (2022). Renewable energy and carbon emissions: New empirical evidence from the union for the mediterranean. Sustainability 14 (11), 6921. doi:10.3390/su14116921

Khondaker, A. N., Hasan, M. A., Rahman, S. M., Malik, K., Shafiullah, Md., and Muhyedeen, M. A. (2016). Greenhouse gas emissions from energy sector in the United Arab Emirates – an overview. Renew. Sustain. Energy Rev. 59, 1317–1325. doi:10.1016/j.rser.2016.01.027

Li, J., Huang, D., and Wu, X. (2022). The impact of China’s carbon emission TradingPolicy on green total factor productivity– influence analysis based on super-EBMand multiple mediators. Pol. J. Environ. Stud. 31 (6), 5107–5123. doi:10.15244/pjoes/151538

Li, Y., Yan, C., and Ren, X. (2023). Do uncertainties affect clean energy markets? Comparisons from a multi-frequency and multi-quantile framework. Energy Econ. 121, 106679. doi:10.1016/j.eneco.2023.106679

Lin, B., and Chen, Y. (2019). Dynamic linkages and spillover effects between cet market, coal market and stock market of new energy companies: A case of Beijing cet market in China. Energy 172, 1198–1210. doi:10.1016/j.energy.2019.02.029

Martin, R., Muûls, M., and Wagner, U. J. (2014). The Impact of the EU ETS on Regulated Firms: What is the evidence after nine years? SSRN Electron. J. doi:10.2139/ssrn.2344376

Mbutor, M. O. (2010). Exchange rate volatility, stock price fluctuations and the lending behaviour of banks in Nigeria. J. Econ. Int. finance 2 (11), 251–260. doi:10.5897/JEIF.9000047

Nong, D., Nguyen, T. H., Wang, C., and Khuc, Q. V. (2020). The environmental and economic impact of the emissions trading scheme (ETS) in Vietnam. Energy Policy 140, 111362. doi:10.1016/j.enpol.2020.111362

Ren, X., Qin, J., Jin, C., and Yan, C. (2022). Global oil price uncertainty and excessive corporate debt in China. Energy Econ. 115, 106378. doi:10.1016/j.eneco.2022.106378

Ren, X., Zeng, G., and Zhao, Y. (2023). Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pacific-Basin Finance J. 79, 102019. doi:10.1016/j.pacfin.2023.102019

Rui, X., Zhenguo, W., and Binbi, Z. (2017). Research on the driving factors and critical path of China's carbon emission growth. Chin. J. Manag. Sci. 10, 119–129. doi:10.16381/j.cnki.issn1003-207x.2017.10.013

State Council Information Office of the People's Republic of China, (2023). China's green development in the New Era white paper (extract). Environ. Prot. 51 (03), 49–57. doi:10.14026/j.cnki.0253-9705.2023.03.016

Sun, W., and Sun, C. (2023). Analysis on the influencing factors of the carbon trading market price in China based on factor augmented vector autoregressive model.

TCFM (The Chinese Foreign Ministry) (2020). Statement by Xi jinping president of the people's Republic of China at the general debate of the 75th session of the united nations general assembly. Available at: https://www.fmprc.gov.cn/mfa_eng/zxxx_662805/t1817098.shtml.

Teng, X., Zhuang, W., Liu, F., Chang, T., and Chiu, Y. (2023). China's path of carbon neutralization to develop green energy and improve energy efficiency. Renew. Energy 206, 397–408. doi:10.1016/j.renene.2023.01.104

The Central Committee of the Communist Party of China (2022). Opinions of the CPC central committee and the state council on strengthening the building of a large unified national market. Gazette State Counc. People's Repub. China 12, 24–30. doi:10.28655/n.cnki.nrmrb.2022.004032

Wang, Z., Fu, H., and Ren, X. (2023a). Political connections and corporate carbon emission: New evidence from Chinese industrial firms. Technol. Forecast. Soc. Change 188, 122326. doi:10.1016/j.techfore.2023.122326

Wang, Y., and He, L. (2022). Can China’s carbon emissions trading scheme promote balanced green development? A consideration of efficiency and fairness. J. Clean. Prod. 367, 132916. doi:10.1016/j.jclepro.2022.132916

Wang, Y., and Taghizadeh-Hesary, F. (2023). Green bonds markets and renewable energy development: Policy integration for achieving carbon neutrality. Energy Econ. 123, 106725. doi:10.1016/j.eneco.2023.106725

Wang, Z., Fu, H., and Ren, X. (2023b). The impact of political connections on firm pollution: New evidence based on heterogeneous environmental regulation. Petroleum Sci. 20 (1), 636–647. doi:10.1016/j.petsci.2022.10.019

Wen, Z., and Ye, B. (2014). Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 22 (05), 731–745. doi:10.3724/sp.j.1042.2014.00731

Weng, Q., and Xu, H. (2018). A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 91, 613–619. doi:10.1016/j.rser.2018.04.026

Wu, Q., Tambunlertchai, K., and Pornchaiwiseskul, P. (2021). Examining the impact and influencing channels of carbon emission trading pilot markets in China. Sustainability 13 (10), 5664. doi:10.3390/su13105664

Keywords: carbon market, energy transition, green development, moderated dual mediation model, energy efficiency, energy-related carbon emissions

Citation: Kong S, Li H and Tan S (2023) Carbon markets, energy transition, and green development: a moderated dual-mediation model. Front. Environ. Sci. 11:1257449. doi: 10.3389/fenvs.2023.1257449

Received: 12 July 2023; Accepted: 01 August 2023;

Published: 14 August 2023.

Edited by:

Xiaohang Ren, Central South University, ChinaReviewed by:

Liu Jiang, Lanzhou University of Finance and Economics, ChinaWanbo Lu, Southwestern University of Finance and Economics, China

Copyright © 2023 Kong, Li and Tan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hanzun Li, MTQzMzUwNzg5OUBxcS5jb20=

Shaohua Kong

Shaohua Kong Hanzun Li

Hanzun Li Shuwen Tan

Shuwen Tan