95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 25 August 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1244119

This article is part of the Research Topic Sustainable Finance for the Blue Economy View all 5 articles

Introduction: Although a large number of publications are devoted to analyzing the relationship between financial development and economic growth, we focused on the answer to the question that sustainable development is accompanied by financial development in particular European Union countries. To our best knowledge, it is a new and original research approach that addresses important research gaps.

Methodology: A synthetic indicator based on 13 variables was built to assess the level of sustainable development, taking into account the financial aspect. Fuzzy logic was used to assess the relationship between the level of sustainable development and financial development. It is an original and novel approach.

Results: The research results showed significant differences between the north and south and Europe’s east and west. The highest levels of the synthetic measure for all analyzed periods were recorded for Sweden, Finland, and Denmark, and the lowest for Lithuania (2013), Cyprus (2014–2015), and Bulgaria (2016–2021). Over the nine years covered by the analysis, the level of sustainable development, considering the financial aspect, improved in two countries: Germany and Portugal, but deteriorated in six: Bulgaria, Croatia, Italy, Latvia, Romania, and Slovenia. In all analyzed years, the higher the level of the synthetic measure (sustainable development), the higher the value of the financial development index (FDI index).

Discussion: When developing sustainable development policies, policymakers should consider their links with financial development and the policy of developing and regulating financial markets. Financial markets are essential for sustainability, and finance is a crucial driver of sustainable development.

In the literature on the subject, attention is drawn to the relationship between financial development and economic growth (Guru and Yadav, 2019) it is also indicated that finance is one of the main drivers of sustainability (Nykvist and Maltais, 2022). Guru and Yadav (2019) point out that economic development requires financing, and here the role of financial institutions is crucial. At the same time, the Authors emphasize that the financial effect manifests itself not only through the development of financial markets and their growth but also affects poverty reduction. As a result of their research, Guru and Yadav (2019) showed that the indicators of the development of the banking sector and the stock market interact with indicators on the side of economic growth, which indicates the interdependence of these phenomena. Also, research carried out by R. Levine (2004) confirmed that countries with better-functioning banks and financial markets tend to grow faster. R. Levine (1997) highlights the ambiguous research results on financial development and economic growth. However, the Author points to a positive relationship between financial development and economic growth, confirmed in his research and also points out that better functioning financial systems allow enterprises to overcome barriers to external financing and ensure market expansion (Levine, 1997).

Acemoğlu, Johnson, and Robinson (2005) assumed the positive impact of financial intermediaries on economic growth. The Authors note the relationship between activities undertaken by financial intermediaries consisting in encouraging market participants to accumulate savings, multiplying them through appropriate asset management and using the obtained surpluses for development financing. A vital research trend is the analysis of the impact of innovation on financial development and the search for relationships between financial development, economic growth, and innovations (Cheng and Hou, 2022). The role of innovations (technological and financial) as an essential factor in the development of growth and development was pointed out by Schumpeter (1961), and Todaro and Smith (2012). In particular, Schumpeter drew attention to the role of credit and its importance for developing enterprises (Schumpeter, 1961; Kuzilwa, 2005).

An increasingly important research trend is the analysis of the relationships between financial development, economic growth, and sustainability. It is a research gap in which the field of research remains wide (Yang et al., 2022). Financial institutions such as banks, mutual funds, and ESG rating agencies could contribute to sustainability by encouraging new business models and sustainable value (Beattie and Smith, 2013; Bocken et al., 2013; Bocken, 2014; Bocken, 2015). Research results indicate that ESG rating agencies identify the short-term effects from the internal organizational perspective, mainly in the environmental dimension. In contrast, social aspects are emphasized from the external organizational perspective (Muñoz-Torres et al., 2018).

Some research assumes a strong financial system impacts sustainability and the emissions mitigating effects through innovations (Yang et al., 2022). Tao et al. (2023) investigated the effects of financial development on carbon emission intensity in OECD countries. Based on research, they claimed that financial development negatively affects carbon emission intensity. The second finding is that the interaction effect between financial development and information and communication technology (ICT) on carbon emission intensity is relatively weak. The second conclusion is particularly interesting due to the thesis that “some tools in digital finance are known to emit significant amounts of CO2” (Galanti and Ozsoy, 2021). The progressing processes of digitization and computerization of the financial sector can be indicated, resulting in increased energy consumption, often from non-renewable sources impacting carbon footprint. Ke et al. (2022) found that “the interaction between ICTs and financial development increases CO2 emissions”. The financialization effect is essential in analyzing financial development and economic growth (Dembinski and Viganò, 2009). The research points to a ‘threshold effect’ in the relationship between the extension of financial resources and growth; thus, the expansion of the financial system is beneficial to growth only up to a point. Financial development means access to innovations (Nazir et al., 2021) and ensuring financing for sustainable development (Rani et al., 2022). Still, on the other hand, it is responsible for creating growth and related negative externalities.

Considering the role of the financial markets in the economy, the question arises of how financial development affects sustainable development. While research on the relationship between economic growth and financial development is well documented, many questions arise in financial development versus sustainable development, creating a gap and justification for research in this area. The paper’s main contribution is searching the relationship between financial development and sustainable development with fuzzy logic. It is one of the first studies dealing with this issue. Many stakeholders may benefit from this study, mainly other policymakers, decision-makers, the business sector, academia, local governments, NGOs, investors, financial institutions, etc. The roadmap of the paper presents Figure 1.

The article addresses an original research problem by attempting to identify the relationship between sustainable development and financial development in selected European Union countries in the conditions of the green economy. The article aimed to assess the relationship between the level of sustainable development and financial development from the point of view of the “green economy.” The following research questions were posed in the article.

• Is sustainable development accompanied by financial development in particular European Union countries?

• Which countries record the highest levels of sustainable and financial development, and what is the rationale for this?

• What is the link between the FDI index values in individual years and the variables adopted for the study?

This paper is organized as follows: The introduction is Section 1; in Section 2, the literature review. Section 3 presents the methodological approach, data collection procedure, and description of the methods. Section 4 discusses the research results, and Section 5 includes the conclusion.

A breakthrough in the dissemination and development of the sustainable development concept was the Bruntland Commission report published in 1987. It contained one of the most frequently cited definitions of sustainable development, i.e., “development that meets the needs of the present without compromising the ability of future generations to meet their own needs (United Nations, 1987). This concept, focused around inter- and intragenerational equity, is based on three pillars, i.e., environment, economy, and society (Waas et al., 2011; Boyer et al., 2016).

Initially, there were two approaches in the literature. Some scientists perceived the pillars of sustainable development as three separate perspectives (Brown et al., 1987; Goodland, 1995; Caradonna, 2014), while others represented a systemic approach (Barbier, 1987; Cocklin, 1989; Campbell, 1996; Milne, 1996; Giddings et al., 2002). Currently, the areas of environment, economy, and society are perceived as a set of interrelated concepts that should be the basis for human decisions and actions aimed at achieving sustainable development (Yang et al., 2021). Olawumi and Chan (2018) make a step further, claiming that these pillars must be harmonized to achieve sustainable development goals. One of the main goals of sustainable development is the transition to a low- and ultimately zero-emission economy, which is part of the “green economy” concept (Weber and Cabras, 2017; Pan et al., 2019; Ali et al., 2021).

In the literature on the subject, the terms ‘sustainable development’ and ‘sustainability’ are used interchangeably, although according to Axelsson et al. (2011) these are two separate concepts. The essence of sustainability focuses on determining how to use natural resources without depleting them, while maintaining ecological integrity, biodiversity and ecological sustainability (Parrotta et al., 2006). The concept of sustainable development concerns the process of achieving common economic, ecological and socio-cultural goals involving many stakeholders at different levels of decision-making (Strange and Bayley, 2008). This process includes searching for solutions that ensure economic growth and enable all social groups to actively participate in these processes, while giving them the opportunity to benefit from economic growth.

In the process of implementation of the sustainable development concept in 2015, 17 sustainable development goals were adopted, which are the basis of the 2030 Agenda. These goals are a kind of continuation of the Millennium Development Goals (MDGSs). They refer to several key issues that have not been achieved under the MDGSs and include a broader and more transformative program that better reflects the current challenges in implementing the concept of sustainable development (Fukuda-Parr, 2016). Sustainable development goals are interrelated and complementary, which means that the implementation of one goal may contribute to the achievement of another goal (Tosun and Leininger, 2017; Fasoli, 2018), but tensions may also arise, which entails the need to make difficult choices, e.g., deforestation, which positively affects the implementation of SDG 2, may at the same time weaken the implementation of SDG 13, i.e., climate action. Taylor (2016) therefore proposes that individual countries review the goals to be able to distinguish those that can become a catalyst and those that can have multidirectional effects on the implementation of the concept of sustainable development.

Despite the undoubted importance of the SDGs in the implementation of the sustainable development concept, they are not legally binding (Zhao et al., 2020). Therefore, the use of standards developed by the International Organization for Standardization (ISO) as tools to facilitate the achievement of sustainable development goals becomes extremely useful and important. An example is the ISO 37100 series standards developed by the technical committee ISO/TC 268, aimed at helping cities define and achieve their sustainability objectives (ISO, 2020). In the macroeconomic perspective, Bwalya (2019) showed the usefulness of the 37,100 series standards in building smart cities on the example of Johannesburg. Batty et al (2012) notice that smart cities will seek to reduce gas emissions and carbon footprint, reduce the environmental impact of humans and industry, and seek green energy solutions (i.e., increase share of renewable energy). Zhao et al. (2020) identified standards contributing to achieving SDG 2 - Zero Hunger. These include: ISO 22000 - Food safety management systems, ISO 12875 - Traceability of finfish products, ISO 12878 - Environmental monitoring of the impacts from marine finfish farms on soft bottom, ISO 14000 Environmental management, ISO 26000 - Guidance on social responsibility, and ISO 20400 - Sustainable procurement. ISO standards are also applicable on a micro scale. Sayan (2018) showed the importance of ISO 14000 for the sustainable development of enterprises, and Rezak et al. (2022) revealed that ISO 56000 (innovation management standards) also contributes to it.

The area of sustainable development has been the subject of intensive research for several years. The literature on the subject has quite well documented the positive relationship between sustainable development and innovation (Cañeque and Hart, 2017; Guerrero-Villegas et al., 2018; Soewarno et al., 2019; Manigandan et al., 2023), including eco-innovation (Xavier et al., 2017; Ji et al., 2021; Wu et al., 2021). Many researchers demonstrated positive impact of R&D (research and development) expenditure (Fernández et al., 2018; Hojnik et al., 2022; Li et al., 2023), and environmental tax (Kwilinski et al., 2019; Xie and Jamaani, 2022; Liu et al., 2023) on sustainable development. The relationship between sustainable development and the competitiveness index (Wondowossen et al., 2014; Kiseľáková et al., 2018) and the SDG index (Schmidt-Traub et al., 2017; Horan, 2020) were also studied. One of the SDGs is the reduction of inequalities, hence the analysis of the negative relationship between the Gini index and sustainable development (Scherer et al., 2018; Caous and Huarng, 2020).

A positive relationship between sustainable development and financial development was revealed by Koirala and Pradhan (2020) based on the analysis of panel data from 1990 to 2014 for 12 Asian countries. In turn, Zahoor et al. (2022), recognized financial development as a determinant of China’s sustainable development. Additionally, Vo and Zaman (2020) showed that financial development contributes to the reduction of carbon dioxide emissions in various countries. It allows the use of more efficient and greener technologies (Shahzad et al., 2014; Pata, 2018) and the increase in the use of renewable energy sources (Samour et al., 2022).

Hypothesis 1. (H1): Sustainable development is accompanied by financial development

According to The Financial Development Report, financial development should be understood as “the factors, policies, and institutions that lead to effective financial intermediation and markets, as well as deep and broad access to capital and financial services” (World Economic Forum, 2011). Choong and Chan (2011) perceive it in a similar way, describing it as “improvement in quantity, quality and efficiency of financial intermediary services” and Levine (1999), who describes it as “the ability of the financial system to research firms and identify profitable ventures, exert corporate control, manage risk, mobilize savings, and ease transactions.” All the quoted definitions emphasize the role of financial intermediaries and capital markets (Valickova et al., 2015). Financial development makes it possible for the financial sector to better and more efficiently support the growth of the real economy. It also acts as a catalyst for high-quality development, helping to reduce inequality and financial exclusion among citizens. Consequently, it is consistent with the SDGs and the idea of sustainable development. According to the financial development theory, a stable financial system can efficiently mobilize saving funds and direct them toward profitable investments (Gao et al., 20,022).

Hypothesis 2. (H2): The strength of the relationship between financial development and sustainable development varies from country to country

Hypothesis 3. (H3): The higher the level of the sustainable development indicator, the higher the level of the financial development indicator

The Sustainable Development Goals Report 2022 and Sustainable Development Report 2022 show that, as in previous editions, Finland, Denmark, Sweden and Norway are the countries with the highest SDG index. All the countries in the top ten are European countries, eight of which are members of the European Union. Low-income countries tend to score lower on the SDG Index. In part, this is due to the specificity of the Sustainable Development Goals focused on reducing inequalities, extreme poverty and ensuring access to basic services and infrastructure for all, including access to financial services. At this point, it should also be emphasized that the implementation of the sustainable development goals, especially in the environmental area, requires high financial outlays. Research also shows that higher-income countries have higher levels of financial development (Ezeibekwe, 2020; Green Finance Platform, 2021).Numerous scientific studies confirm the positive impact of financial development on economic growth (De Gregorio and Guidotti, 1995; Khan and Senhadji, 2003; Valickova et al., 2015; Guru and Yadav, 2019), including green financial development (Nawaz et al., 2021). Research on the relationship between financial development and economic growth in 110 European regions in 1997–2018 was carried out by Rossi and Scalise (2022). The capillarity of bank branches and the agglomeration of the entire financial industry were used to assess the level of financial development. The research results showed that economic growth in regional terms is determined to the greatest extent by the presence of agglomerations of a complex financial sector, and not only by the presence of bank branches. In turn, Caporale et al. (2015) analyzed the impact of financial development on economic growth in 10 countries that joined the European Union in 2004–2007. The outcomes demonstrated that the lack of financial depth limits the impact of financial development on economic growth. The more efficient banking industry, on the other hand, have faster growth.Asteriou and Spanos (2019), using a panel data set of 26 European Union countries in the years 1990–2016, examined the relationship between financial development and economic growth in the conditions of the financial crisis. The study shows that while before the crisis financial development was conducive to economic growth, during and after the crisis it hampered economic activity.Okuyan (2022) examined the relationship between financial development and economic growth in developing countries and came to the conclusion that there is no relationship between financial development and economic growth for all these countries.In the literature on the subject, there are also publications showing that financial development is always unfavorable for economic growth, but this negative effect is greater in high-income countries (Cheng et al., 2021). However, to the best of the authors’ knowledge, there is no study that examines the relationship between sustainable development and financial development in relation to individual countries.

In the study, synthetic measures of development based on fuzzy logic were used to assess the relationship between the level of sustainable development and financial development from the point of view of the “green economy".

In order to build a model of a fuzzy process or phenomenon, the first step is to define a set of fuzzy variables. The membership of each element of such a set is described by the membership function (Zadeh, 1965; Klir and Yuan, 1995, p.11):

As in classical sets, the value of the membership function equal to 1 means complete membership in the set, and the value 0 means no membership. In fuzzy sets, we also deal with partial membership when the value of the membership function is greater than 0 and less than 1.

To describe the mutual relations between fuzzy variables (so-called fuzzy logic), linguistic variables are used, described by five parameters (Klir and Yuan, 1995; Ross, 2010, pp.142–145):

Where:

In the classical econometric model, the links and interactions between the explanatory variables and the dependent variable are the result of the strength and direction of the correlation between them. It is independent and results from the values of the variables that are the basis for building the model. In the fuzzy model, it is the researcher who, using a base of rules, defines the structure of the phenomenon (process) by determining the mutual relations between the values of fuzzy variables and the state of the phenomenon (process). Such a base consists of single rules (Shepherd and Shi, 1998; Chen and Pham, 2001, p. 58; Ross, 2010, pp. 145–146):

where the elements X and Y are related by the levels of the membership function (

Due to the fact that the fuzzy model outputs a fuzzy value, there is a need to convert it to a numerical value. This process is called defuzzification (Rotshtein and Shtovba, 2002; Van Broekhaven and De Beats, 2006).

To assess the level of sustainable development, taking into account financial development, 13 variables from 2013–2021 were used, among which we can distinguish six indices. These variables are as follows.

• X1—Eco-Innovation Index

• X2—Share of environmental taxes in total revenues from taxes and social contributions

• X3—Environmental tax revenues - Percentage of total revenues from taxes and social contributions (including imputed social contributions)

• X4—Environmental tax revenues - Percentage of gross domestic product (GDP)

• X5—Gross domestic expenditure on R&D by sector - Business enterprise sector

• X6—Gross domestic expenditure on R&D by sector - Government sector

• X7—Gross domestic expenditure on R&D by sector - Higher education sector

• X8—Sustainable Development Index (SDI)

• X9—SDG Index

• X10—Green Growth Index

• X11—International Tax Competitiveness Index

• X12—Gini coefficient of equalized disposable income before social transfers (pensions excluded from social transfers)

• X13—Human Development Index

Data on individual variables came from, e.g., the database of Eurostat, the World Bank, UN agencies and other institutions. In their set, only variable X12 has a destimulant character, i.e., it has a negative impact on the studied phenomenon.

The algorithm for determining the value of a synthetic measure proceeds in five stages.

Stage 1: Substantive division of the set of variables.Due to the similar informative nature of the variables, they were divided into three subgroups.

• group 1—includes variables defining the level of development of the analyzed economies in terms of sustainable development and environmental protection goals. It consists of variables: X1, X8, X9 and X10;

• group 2—includes variables characterizing the fiscal systems of the analyzed countries, their effectiveness and possibilities of financing the energy transformation. It includes the following variables: X2, X3, X4 and X11;

• group 3—includes variables measuring social potential and development opportunities of new technologies. Within it, the following variables were distinguished: X5, X6, X7, X12 and X13.

Table 1 presents the classification by variables and years of analysis.Stage 2: Bringing the set of variables to comparabilityDue to the different nature of the variables constituting the research set, in order to make them comparable, it was first necessary to unify their variability intervals. For this purpose, the zero unitarization method was used, the mathematical notation of which is presented below (Kukuła and Bogocz, 2014; Zadrąg and Kniaziewicz, 2017).

• for stimulants:

• for destimulants:

Stage 3: Calculation of aggregate measures in groups of variablesTo classify EU countries according to the three groups of variables identified in stage 1, synthetic aggregate measures were used, calculated according to the formula:

where.

Stage 4: Building a model based on fuzzy logicIn order to examine the relationship between the level of sustainable development and financial development in the context of the possibility of financing the transformation towards a “green economy”, based on synthetic measures for groups of variables calculated in stage 3, a model based on fuzzy logic was constructed. Information on the two basic elements necessary for the construction of such a model was presented below: linguistic variables (Table 2) and the rule base.To describe the fuzzy variables, triangular and trapezoidal membership functions were used, describing the probability of classifying elements to individual fuzzy sets.

• fuzzy rule base:

IF (fv_1 is low OR fv_1 is mid OR fv_1 is high) AND fv_2 is low AND fv_3 is low THEN U is low.IF fv_1 is low AND (fv_2 is low OR fv_2 is mid OR fv_2 is high) AND fv_3 is low THEN U is low.IF fv_1 is low AND fv_2 is low AND (fv_3 is low OR fv_3 is mid OR fv_3 is high) THEN U is low.IF (fv_1 is low OR fv_1 is mid OR fv_1 is high) AND fv_2 is mid AND fv_3 is mid THEN U is mid.IF fv_1 is mid AND (fv_2 is low OR fv_2 is mid OR fv_2 is high) AND fv_3 is mid THEN U is mid.IF fv_1 is mid AND fv_2 is mid AND (fv_3 is low OR fv_3 is mid OR fv_3 is high) THEN U is mid.IF fv_1 is low AND fv_2 is mid AND fv_3 is high THEN U is mid.IF fv_1 is mid AND fv_2 is low AND fv_3 is high THEN U is mid.IF fv_1 is mid AND fv_2 is high AND fv_3 is low THEN U is mid.IF fv_1 is low AND fv_2 is high AND fv_3 is mid THEN U is mid.IF fv_1 is high AND fv_2 is mid AND fv_3 is low THEN U is mid.IF fv_1 is high AND fv_2 is low AND fv_3 is mid THEN U is mid.IF (fv_1 is low OR fv_1 is mid OR fv_1 is high) AND fv_2 is high AND fv_3 is high THEN U is high.IF fv_1 is high AND (fv_2 is low OR fv_2 is mid OR fv_2 is high) AND fv_3 is high THEN U is high.IF fv_1 is high AND fv_2 is high AND (fv_3 is low OR fv_3 is mid OR fv_3 is high) THEN U is high.Stage 5: Calculation of the value of the synthetic measure.The value of the synthetic measure showing the level of sustainable development of EU countries, taking into account the fiscal aspect

Table 3 presents, for each of the EU countries and the years 2013–2021, the values of the synthetic measure determining the level of their sustainable development, taking into account the financial development.

The average value of the synthetic measure for all analyzed years oscillated around 0.500, of which the highest (0.522) was recorded for 2015, and the lowest (0.500) in the last 2 years of the analysis. Diversity remained high, coefficients of variation ranged from 37.06% (2015) to 40.09% (2016). It is worth noting that the range between maximum and minimum value of synthetic measures, equal to 0.611, remained constant for almost the entire analysis period.

The highest levels of the synthetic measure for all analyzed periods were recorded for three countries: Sweden, Finland and Denmark. In their case, the level of the measure was in the range from 0.780 to 0.806. The lowest values were recorded for Lithuania (2013), Cyprus (2014–2015) and Bulgaria (2016–2021), they ranged from 0.194 to 0.205.

Figure 2 shows the average values of the synthetic measure for 27 EU countries, obtained over the 9 years of the analysis.

On the basis of Figure 2, we can distinguish three groups of countries. The first group included nine countries with the highest average level of the synthetic measure. It includes: Sweden (0.805), Finland (0.799), Denmark (0.793), Austria (0.769), Germany (0.753), Slovenia (0.743), the Netherlands (0.729), France (0.667) and the Czech Republic (0.654). Thus, the countries of the so-called of the “Old Union”, i.e., those whose accession took place before 2004.

The second group consisted of countries with an average synthetic measure: Italy (0.581), Latvia (0.581) and Croatia (0.578). The third group consisted of the remaining 15 countries: Romania (0.480), Estonia (0.472), Slovakia (0.430), Greece (0.428), Luxembourg (0.412), Spain (0.402), Belgium (0.361), Poland (0.358), Hungary (0.352), Portugal (0.336), Ireland (0.328), Malta (0.282), Lithuania (0.268), Bulgaria (0.232) and Cyprus (0.222). It follows that as many as nine of them gained accession after 2004.

Based on the values of synthetic measures presented in Table 1, in each of the sub-periods of the analysis, countries were classified into one of four typological groups:

where.

The grouping results are presented in Table 4.

When analyzing the classification of individual countries, it should be emphasized that only 13 out of 27 of them changed the typological group during the 9 years of the analysis. This may indicate a great difficulty in quickly changing the level of sustainable development, taking into account the fiscal aspect. Figure 3 and Figure 4 show the spatial distribution of synthetic measures for the countries under study in 2013 and 2021.

The analysis of the data presented in Figure 3 and Figure 4 shows that both in 2013 and 2021 there were significant differences between the countries of northern and western Europe and the countries from the south and east of the continent. Over the 9 years covered by the analysis, the level of fiscal sustainability improved in two countries: Germany and Portugal, but deteriorated in six: Bulgaria, Croatia, Italy, Latvia, Romania and Slovenia

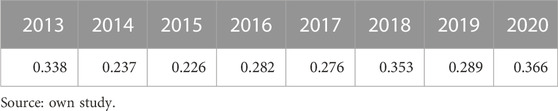

Table 5 presents the values of Pearson’s linear correlation coefficients between synthetic measures and the values of the Financial Development Index (FDI). In all analyzed periods, the assessment of correlation coefficients was positive, which indicates that the higher the level of the synthetic measure, the higher the value of the FDI index. However, the values of the coefficients indicate a low level of correlation between the two variables in 2014–2017 and in 2019, and a moderate level in 2013, 2018 and 2020.

TABLE 5. Pearson’s linear correlation coefficients between the values of the synthetic measure and the FDI index by years.

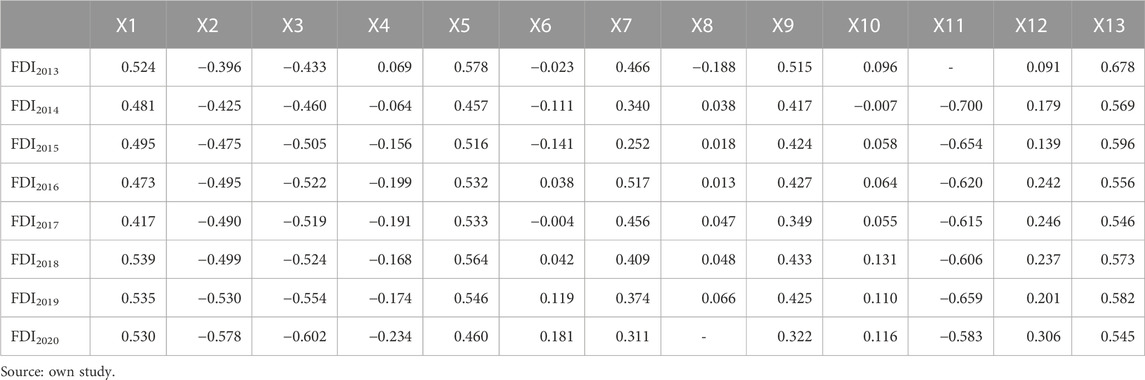

From the point of view of the purpose of the study, it is important to examine the relationship between the FDI index values in individual years and the variables adopted for the study (Table 6). It should be noted that most of the variables are moderately positively correlated with FDI. A moderate negative correlation was found with only three variables: X2 (Share of environmental taxes in total revenues from taxes and social contributions), X3 (Environmental tax revenues - Percentage of total revenues from taxes and social contributions) and X11 (Gini coefficient of equalized disposable income before social transfers). In the case of variable X4 (Environmental tax revenues - Percentage of gross domestic product) i) there is a negative correlation, but of weak strength. In turn, the X6 variable (Gross domestic expenditure on R&D by sector - Government sector) is weakly and negatively correlated with the FDI variable only in the years 2013–2015, the relationship between FDI and X8 is similar - a weak negative correlation applies only to 2013.

TABLE 6. Pearson’s linear correlation coefficients between the values of the variables and the FDI index.

The relationship between financial development and economic growth has been the subject of many studies, but we focused on finding the answer to the question of whether sustainable development is accompanied by financial development in individual countries of the European Union. Our results confirm the existence of a relationship between sustainable development and financial development, but the strength of this relationship varies for the individual countries. The relationship between financial development, economic growth, and sustainability was the subject of research by Yang et al. (2022). They came to the results that a strong financial system can support economic growth and have a positive impact on sustainable development in the long term. A developed and effective financial system can effectively mobilize saving funds and allocate them to productive investments compliant with the SDGs. It is also conducive to technical progress and innovation of the economy, which positively affects economic growth. A positive correlation between financial development and sustainable economic growth was demonstrated by Gao et al. (2022). Based on panel data from 283 Chinese cities in 2003–2016, they proved that financial development improves sustainable economic growth. Similar conclusions were reached by Ahmed et al. (2022), who, based on data from South Asian countries in 2000–2018, showed that financial development is a driving factor in promoting green economic growth.

The positive relationship between financial development and Environmental, Social and Governance (ESG) performance was confirmed by Ng et al. (2020). Based on data from Asian countries in 2013–2017, they showed that financial development (both in relation to financial markets and financial institutions) is positively correlated with ESG successes. Our results are generally also in line with those of Tekin Turhan et al. (2023), who demonstrated long-term positive influence of financial development and educational attainment on economic sustainability. The impact of indirect channels of financial development on reduction of carbon emissions was confirmed by Khan and Ozturk (2021).

To assess the relationship between financial development and sustainable development, a synthetic indicator based on 13 variables was built to assess the level of sustainable development, taking into account the financial aspect. The analysis of the value of this indicator showed that there are large differences between north and south and between east and west of Europe. The highest levels of the synthetic measure in all analyzed periods were recorded for Sweden, Finland and Denmark, and the lowest for Lithuania (2013), Cyprus (2014–2015) and Bulgaria (2016–2021). Similar research, but with regard to developing countries, was conducted by Houda and Lamia (2016). Based on panel data in 20 countries from 1995 to 2011, they showed that the financial system has a positive impact on the environment (and therefore also on sustainable development). However, they also showed a negative impact on industrial investment and economic growth. Similar studies for low middle income countries were conducted by Hunjra et al. (2022). The research results confirmed the positive relationship between sustainable economic development and financial development.

The relationship between finance and economic growth has long been the subject of scientific discussion and research. Research in this area is well-argued. Relationships between sustainable and financial development are a relatively new area of consideration. An efficient financial system is a prerequisite for the proper functioning of the economy, as it is responsible for both capital allocation and risk management. It is assumed that the financial market effectively fulfills both of these roles. For a long time, the financial market logic assumes only profit maximization, mainly return on investment. In this approach, sustainable development is guided by a different approach because profit maximization is not the goal, and ESG issues are a top priority. In recent years, however, the phenomenon of greening the financial sector and increasing its social responsibility has been observed. Recommendations for the financial sector, defined in the form of principles of social and environmental risk management (E&S risk) in financial institutions, played a vital role in implementing sustainable development postulates in finance and banking. Authors such as Lydenberg (2009) or Tonello (2006) draw attention to the risk determined by short-termism for financial markets, pointing to the risk of instability and excessive volatility in macro terms and short-term perception and business thinking in micro terms. In this context, it is worth mentioning investments in companies operating in the liquid fuels industry that are profitable for investors in the short term but unfavorable for the environment in the long term due to the increase in greenhouse gas emissions into the atmosphere and environmental consequences related to fuel consumption. Despite the accusations against financial markets (especially after the 2008 crisis) that they are guided only by the profit criterion, are not transparent and are reluctant to include stakeholders in decision-making processes and ignore social and environmental issues in their business models, changes in the attitude and behavior of financial institutions are observable conducive to sustainable development. The article attempts to examine whether sustainable development and financial development go hand in hand or are mutually exclusive. It is an original research approach that fills the gap in research on sustainable development and financial development.

The article attempts to examine the relationship between sustainable development and financial development. This approach is original in the research context, focusing mainly on analyzing the relationship between financial development and economic growth. The study used 13 variables. The study data came from the Eurostat database, the World Bank, UN agencies, and other institutions. The methodology is based on the fuzzy approach. The taxonomic measure distinguishes three groups of countries differentiated in terms of sustainable development and financial development. The analysis carried out shows that both in 2013 and 2021, significant differences were noticeable between the countries of northern and western Europe and the countries of the south and east of the continent. Over the 9 years covered by the analysis, the level of fiscal sustainability improved in two countries: Germany and Portugal, but deteriorated in six: Bulgaria, Croatia, Italy, Latvia, Romania, and Slovenia. Only 13 out of 27 changed the typological group during the 9 years of analysis. Considering the fiscal aspect, it may indicate a great difficulty in quickly changing the level of sustainable development. In all analyzed years, the higher the level of the synthetic measure (sustainable development), the higher the value of the financial development index (FDI index). Thus, the study confirmed that a high level of financial development also characterizes countries with a high level of sustainable development. Therefore, the role of financial markets in supporting sustainable development remains essential. The specific research result is that the higher degree of sustainable development, the higher level of financial development, especially in northern and Western Europe countries.

The research results can be a valuable guideline for political decision-makers in the process of designing the state’s sustainable development strategy, especially in the field of policy of developing and regulating the financial market. The importance of the financial market as drivers for sustainable development has been confirmed by the results of studies by Stoian and Iorgulescu (2019), AlKaabi and Nobanee (2020) and Tan (2022). In addition, the selection of variables used to build synthetic indicator to assess the level of sustainable development, taking into account the financial aspect, may provide the government with hints on the tools that can be used in the process of supporting and stimulating sustainable development.

The main research limitation is related to the comparability of data and methodological approach. Future research will be carried out based on more financial variables for the countries from the first and third groups. Future work will include the development of a model supporting decision-makers from the financial and non-financial sectors in making decisions on the directions of financing sustainable development. This will enable better management of financial resources from the point of view of implementing, for example, sustainable development goals.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Conceptualization: MZ; methodology: IB, MO; software: IB, MO; validation: IB, MO, and MZ; formal analysis: MZ, AS, IB, MO; investigation: MZ, AS, IB, MO; resources: AS; data curation: IB, MO; writing—original draft preparation: MZ, AS, IB, MO; writing—review and editing: MZ, AS, IB, MO, PN, KR; visualization: MZ, AS, IB, MO; supervision: MZ; project administration: MZ; funding acquisition: KR, PN. All authors contributed to the article and approved the submitted version.

Research results are a part of research project financed by the National Science Centre Poland (NCN) OPUS16 2018/31/B/HS4/00570

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The handling editor DT is currently organizing a Research Topic with the author MZ.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1244119/full#supplementary-material

Acemoğlu, D., Johnson, S., and Robinson, A. J. (2005). “Institutions as a fundamental cause of long-run growth,” in Handbook of economic growth. Editors P. Aghi-on, and S. N. Durlauf (Amsterdam: Elsevier Science Publishers), 385–472. 1A.

Ahmed, F., Kousar, S., Pervaiz, A., and Shabbir, A. (2022). Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanb. Rev. 22 (1), 189–196. doi:10.1016/j.bir.2021.03.005

Ali, E. B., Anufriev, V. P., and Amfo, B. (2021). Green economy implementation in Ghana as a road map for a sustainable development drive: a review. Sci. Afr. 12, e00756. doi:10.1016/j.sciaf.2021.e00756

AlKaabi, A., and Nobanee, H. (2020). Sustainable capital market: a mini-review. SSRN. doi:10.2139/ssrn.3540111

Asteriou, D., and Spanos, K. (2019). The relationship between financial development and economic growth during the recent crisis: evidence from the EU. Finance Res. Lett. 28, 238–245. doi:10.1016/j.frl.2018.05.011

Axelsson, R., Angelstam, P., Elbakidze, M., Stryamets, N., and Johansson, K.-E. (2011). Sustainable development and sustainability: landscape approach as a practical interpretation of principles and implementation concepts. J. Landsc. Ecol. 4, 5–30. doi:10.2478/v10285-012-0040-1

Barbier, E. B. (1987). The concept of sustainable economic development. Environ. Conserv. 14 (2), 101–110. doi:10.1017/s0376892900011449

Batty, M., Axhausen, K. W., Giannotti, F., Pozdnoukhov, A., Bazzani, A., Wachowicz, M. O., et al. (2012). “Smart cities of the future”. Eur. Phys. J. Special Top. 214 (1), 481–518. doi:10.1140/epjst/e2012-01703-3

Beattie, V., and Smith, S. J. (2013). Value creation and business models: refocusing the intellectual capital debate. Br. Account. Rev. 45 (4), 243–254. doi:10.1016/j.bar.2013.06.001

Bocken, N. M. P. (2015). “Conceptual framework for shared value creation based on value mapping,” in Global Cleaner Production, Sitges, 1-4 November 2015 (Barcelona). Citation. 1.

Bocken, N., Short, S., Rana, P., and Evans, S. (2013). A value mapping tool for sustainable business modelling. Corp. Gov. 13 (5), 482–497. doi:10.1108/cg-06-2013-0078

Boyer, R., Peterson, N., Arora, P., and Caldwell, K. (2016). Five approaches to social sustainability and an integrated way forward. Sustainability 8, 878–918. doi:10.3390/su8090878

Brown, B. J., Hanson, M. E., Liverman, D. M., and Merideth, R. W. (1987). Global sustainability: toward definition. Environ. Manage. 11, 713–719. doi:10.1007/bf01867238

Bwalya, K. J. (2019). “The smart city of Johannesburg, South Africa,” in Smart city emergence (Elsevier), 407–419.

Campbell, S. (1996). Green cities, growing cities, just cities? Urban planning and the contradictions of sustainable development. J. Am. Plann. Assoc. 62 (3), 296–312. doi:10.1080/01944369608975696

Cañeque, F. C., and Hart, S. L. (2017). Base of the pyramid 3.0: sustainable development through innovation and entrepreneurship. Routledge.

Caous, E. L., and Huarng, F. (2020). Economic complexity and the mediating effects of income inequality: reaching sustainable development in developing countries. Sustainability 12 (5), 1–26. doi:10.3390/su12052089

Caporale, G. M., Rault, C., Sova, A. D., and Sova, R. (2015). Financial development and economic growth: evidence from 10 new European Union members. Int. J. Finance Econ. 20 (1), 48–60. doi:10.1002/ijfe.1498

Chen, G., and Pham, T. T. (2001). Introduction to fuzzy sets, fuzzy logic and fuzzy control systems. London: CRC Press.

Cheng, C. Y., Chien, M. S., and Lee, C. C. (2021). ICT diffusion, financial development, and economic growth: an international cross-country analysis. Econ. Model. 94, 662–671. doi:10.1016/j.econmod.2020.02.008

Cheng, S. Y., and Hou, H. (2022). Innovation, financial development, and growth: evidences from industrial and emerging countries. Econ. Change Restruct. 55, 1629–1653. doi:10.1007/s10644-021-09361-5

Choong, C. K., and Chan, S. G. (2011). Financial development and economic growth: a review. Afr. J. Bus. Manag. 5 (6), 2017–2027. doi:10.5897/AJBM10.772

Cocklin, C. R. (1989). Methodological problems in evaluating sustainability. Environ. Conserv. 16 (4), 343–351. doi:10.1017/s0376892900009772

De Gregorio, J., and Guidotti, P. E. (1995). Financial development and economic growth. World Dev. 23 (3), 433–448. doi:10.1016/0305-750x(94)00132-i

Dembinski, P., and Viganò, F. (2009). “Financialization: Limits and ways out,” in Finance for a better World. Editors H. C. de Bettignies, and F. Lépineux (London: Palgrave Macmillan). doi:10.1057/9780230235755_12

Ezeibekwe, O. F. (2020). Financial development in developing countries. Glob. Econ. J. 20 (03), 2050016. doi:10.1142/s2194565920500165

Fasoli, E. (2018). State responsibility and the reparation of non-economic losses related to climate change under the Paris Agreement. Riv. Dirit. internazionale 101, 90–130.

Fernández, Y. F., López, M. F., and Blanco, B. O. (2018). Innovation for sustainability: the impact of R&D spending on CO2 emissions. J. Clean. Prod. 172, 3459–3467. doi:10.1016/j.jclepro.2017.11.001

Fukuda-Parr, S. (2016). From the Millennium development goals to the sustainable development goals: shifts in purpose, concept, and politics of global goal setting for development. Gend. Dev. 24 (1), 43–52. doi:10.1080/13552074.2016.1145895

Galanti, S., and Ozsoy, C. Y. (2021). “Digital finance, development, and climate change,” in International Conference on "Statistics for Sustainable Finance", co-organised with the Banque de France and the Deutsche Bundesbank, Paris, France, 14-15 September 2021. hybrid format.

Gao, C., Yao, D., Fang, J., and He, Z. (2022). Analysis of the relationships between financial development and sustainable economic growth: evidence from Chinese cities. Sustainability 14 (15), 9348. doi:10.3390/su14159348

Giddings, B., Hopwood, B., and O'brien, G. (2002). Environment, economy and society: fitting them together into sustainable development. Sustain. Dev. 10 (4), 187–196. doi:10.1002/sd.199

Goodland, R. (1995). The concept of environmental sustainability. Annu. Rev. Ecol. Syst. 26 (1), 1–24. doi:10.1146/annurev.es.26.110195.000245

Green Finance Platform (2021). Global financial development report. Available at: https://www.greenfinanceplatform.org/research/global-finance-and-development-report-2021.

Guerrero Villegas, J., Sierra García, L., and Palacios Florencio, B. (2018). The role of sustainable development and innovation on firm performance. Corp. Soc. Responsib. Environ. Manag. 25 (6), 1350–1362. doi:10.1002/csr.1644

Guru, B. K., and Yadav, I. S. (2019). Financial development and economic growth: panel evidence from BRICS. J. Econ. Finance Adm. Sci. 24 (47), 113–126. doi:10.1108/jefas-12-2017-0125

Hojnik, J., Prokop, V., and Stejskal, J. (2022). R&D as bridge to sustainable development? Case of Czech republic and Slovenia. Corp. Soc. Responsib. Environ. Manag. 29 (1), 146–160. doi:10.1002/csr.2190

Horan, D. (2020). National baselines for integrated implementation of an environmental sustainable development goal assessed in a new integrated SDG index. Sustainability 12 (17), 6955. doi:10.3390/su12176955

Houda, B., and Lamia, M. J. (2016). Interaction between financial development and sustainable development, evidence from developing countries: a panel data study. Int. J. Econ. Finance 8 (2), 243. doi:10.5539/ijef.v8n2p243

Hunjra, A. I., Azam, M., Bruna, M. G., and Taskin, D. (2022). Role of financial development for sustainable economic development in low middle income countries. Finance Res. Lett. 47, 102793. doi:10.1016/j.frl.2022.102793

ISO (2020). ISO and sustainable cities. Available at: https://www.iso.org/files/live/sites/isoorg/files/store/en/PUB100423.pdf.

Ji, X., Umar, M., Ali, S., Ali, W., Tang, K., and Khan, Z. (2021). Does fiscal decentralization and eco innovation promote sustainable environment? A case study of selected fiscally decentralized countries. Sustain. Dev. 29 (1), 79–88. doi:10.1002/sd.2132

Ke, J., Jahanger, A., Yang, B., Usman, M., and Ren, F. (2022). Digitalization, financial development, trade, and carbon emissions; implication of pollution haven hypothesis during globalization mode. Front. Environ. Sci. 10, 873880. doi:10.3389/fenvs.2022.873880

Khan, M., and Ozturk, I. (2021). Examining the direct and indirect effects of financial development on CO2 emissions for 88 developing countries. J. Environ. Manag. 293, 112812. doi:10.1016/j.jenvman.2021.112812

Khan, M. S., and Senhadji, A. S. (2003). Financial development and economic growth: a review and new evidence. J. Afr. Econ. 12 (Suppl. l_2), ii89–ii110. doi:10.1093/jae/12.suppl_2.ii89

Kiseľáková, D., Šofranková, B., Čabinová, V., and Onuferová, E. (2018). Competitiveness and sustainable growth analysis of the EU countries with the use of Global Indexes' methodology. Entrepreneursh. Sustain. Issues 5 (3), 581–599. doi:10.9770/jesi.2018.5.3(13)

Klir, G. J., and Yuan, B. (1995). Fuzzy sets and fuzzy Theory and applications. Upper Saddle River: Prentice Hall PTR.

Koirala, B. S., and Pradhan, G. (2020). Determinants of sustainable development: evidence from 12 Asian countries. Sustain. Dev. 28 (1), 39–45. doi:10.1002/sd.1963

Kukuła, K., and Bogocz, D. (2014). Zero unitarization method and its application in ranking research in agriculture. Econ. Reg. Stud. 3 (7), 5–13. Available at: http://bbc.mbp.org.pl/Content/9023/Segregator1.pdf.

Kuzilwa, J. A. (2005). The role of credit for small business success: a study of the national entrepreneurship development fund in Tanzania. J. Entrepreneursh. 14 (2), 131–161. doi:10.1177/097135570501400204

Kwilinski, A., Ruzhytskyi, I., Patlachuk, V., Patlachuk, O., and Kaminska, B. (2019). Environmental taxes as a condition of business responsibility in the conditions of sustainable development. J. Leg. Ethical and Regul. Isses 22, 1.

Levine, R. (2004). Finance and growth: theory and evidence. Cambridge: National Bureau Of Economic Research, 1–5. Working Paper 10766.

Levine, R. (1997). Financial development and economic growth: views and agenda. J. Econ. literature 35 (2), 688–726.

Levine, R. (1999). Law, finance, and economic growth. J. financial Intermediation 8 (1-2), 8–35. doi:10.1006/jfin.1998.0255

Li, M., Zhang, K., Alamri, A. M., Ageli, M. M., and Khan, N. (2023). Resource curse hypothesis and sustainable development: evaluating the role of renewable energy and R&D. Resour. Policy 81, 103283. doi:10.1016/j.resourpol.2022.103283

Liu, H., Zafar, M. W., Sinha, A., and Khan, I. (2023). The path to sustainable environment: do environmental taxes and governance matter? Sustainable Development.

Lydenberg, S. (2009). “Building the case for long-term investing in stock markets: breaking free from the short-term measurement dilemma,” in Finance for a better World. Editors H. C. de Bettignies, and F. Lépineux (London: Palgrave Macmillan). doi:10.1057/9780230235755_9

Manigandan, P., Alam, M. S., Alagirisamy, K., Pachiyappan, D., Murshed, M., and Mahmood, H. (2023). Realizing the Sustainable Development Goals through technological innovation: juxtaposing the economic and environmental effects of financial development and energy use. Environ. Sci. Pollut. Res. 30 (3), 8239–8256. doi:10.1007/s11356-022-22692-8

Milne, M. J. (1996). On sustainability; the environment and management accounting. Manag. Acc. Res. 7 (1), 135–161. doi:10.1006/mare.1996.0007

Muñoz-Torres, M. J., Fernández-Izquierdo, M. Á., Rivera-Lirio, J. M., Ferrero-Ferrero, I., Escrig-Olmedo, E., Gisbert-Navarro, J. V., et al. (2018). An assessment tool to integrate sustainability principles into the global supply chain. Sustainability 10 (2), 535. doi:10.3390/su10020535

Nawaz, M. A., Hussain, M. S., and Hussain, A. (2021). The effects of green financial development on economic growth in Pakistan. iRASD J. Econ. 3 (3), 281–292. doi:10.52131/joe.2021.0302.0044

Nazir, M. R., Tan, Y., and Nazir, M. I. (2021). Financial innovation and economic growth: Empirical evidence from China, India and Pakistan. Int. J. Fin. Econ. 2, 6036–6059. doi:10.1002/ijfe.2107

Ng, T. H., Lye, C. T., Chan, K. H., Lim, Y. Z., and Lim, Y. S. (2020). Sustainability in Asia: the roles of financial development in environmental, social and governance (ESG) performance. Soc. Indic. Res. 150, 17–44. doi:10.1007/s11205-020-02288-w

Nykvist, B., and Maltais, A. (2022). Too risky–The role of finance as a driver of sustainability transitions. Environ. Innovation Soc. Transitions 42, 219–231. doi:10.1016/j.eist.2022.01.001

Okuyan, H. A. (2022). The nexus of financial development and economic growth across developing economies. South East Eur. J. Econ. Bus. 17 (1), 125–140. doi:10.2478/jeb-2022-0009

Olawumi, T. O., and Chan, D. W. (2018). A scientometric review of global research on sustainability and sustainable development. J. Clean. Prod. 183, 231–250. doi:10.1016/j.jclepro.2018.02.162

Pan, W., Pan, W., Hu, C., Tu, H., Zhao, C., Yu, D., et al. (2019). Assessing the green economy in China: an improved framework. J. Clean. Prod. 209, 680–691. doi:10.1016/j.jclepro.2018.10.267

Parrotta, J., Agnoletti, M., and Johan, E. (2006). Cultural heritage and sustainable forest management: the role of traditional knowledge. Ministerial Conference on the Protection of Forests in Europe. Liaison Unit Warsaw.

Pata, U. K. (2018). Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J. Clean. Prod. 187, 770–779. doi:10.1016/j.jclepro.2018.03.236

Rani, T., Amjad, M. A., Asghar, N., and Rehman, H. U. (2022). Revisiting the environmental impact of financial development on economic growth and carbon emissions: evidence from South Asian economies. Clean. Techn Environ. Policy 24, 2957–2965. doi:10.1007/s10098-022-02360-8

Rezak, R., Djenouhat, A., and Kherbachi, H. (2022). The impact of ISO 56000 standard on managerial practices towards sustainable development-A prospective study on an Algerian international port company. Valahian J. Econ. Stud. 13 (2), 101–112. doi:10.2478/vjes-2022-0020

Rossi, P., and Scalise, D. (2022). Financial development and growth in European regions. J. Reg. Sci. 62 (2), 389–411. doi:10.1111/jors.12572

Rotshtein, A. P., and Shtovba, S. D. (2002). Influence of defuzzification methods on the rate of tuning a fuzzy model. Cybern. Syst. Anal. 38 (5), 782–789. doi:10.1023/A:1021851228684

Samour, A., Baskaya, M. M., and Tursoy, T. (2022). The impact of financial development and FDI on renewable energy in the UAE: a path towards sustainable development. Sustainability 14 (3), 1208. doi:10.3390/su14031208

Sayan, İ. (2018). “Development standards and stages of application of ISO 14000 environmental management system in enterprises,” in Handbook of research on supply chain management for sustainable development (IGI Global), 115–132.

Scherer, L., Behrens, P., de Koning, A., Heijungs, R., Sprecher, B., and Tukker, A. (2018). Trade-offs between social and environmental sustainable development goals. Environ. Sci. policy 90, 65–72. doi:10.1016/j.envsci.2018.10.002

Schmidt-Traub, G., Kroll, C., Teksoz, K., Durand-Delacre, D., and Sachs, J. D. (2017). National baselines for the sustainable development goals assessed in the SDG index and dashboards. Nat. Geosci. 10 (8), 547–555. doi:10.1038/ngeo2985

Schumpeter, J. A. (1961). The theory of economic development: an inquiry into profits, capital, credit, interest, and the business cycle. Oxford University Press.

Shahzad, S. J. H., Rehman, M. U., Hurr, M., and Zakaria, M. (2014). Do economic and financial development increase carbon emission in Pakistan: empirical analysis through ARDL cointegration and VECM causality.

Shepherd, D., and Shi, F. K. C. (1998). Economic modelling with fuzzy logic. IFAC Proc. V. 16 (31), 435–440. doi:10.1016/S1474-6670(17)40518-0

Soewarno, N., Tjahjadi, B., and Fithrianti, F. (2019). Green innovation strategy and green innovation: the roles of green organizational identity and environmental organizational legitimacy. Manag. Decis. 57 (11), 3061–3078. doi:10.1108/md-05-2018-0563

Stoian, A., and Iorgulescu, F. (2019). Sustainable capital market. Financing sustainable development: key challenges and prospects, 193–226.

Strange, T., and Bayley, A. (2008). Sustainable development linking economy, society, environment. OECD: OECD Insights.

Tan, C. (2022). Private investments, public goods: regulating markets for sustainable development. Eur. Bus. Organ. Law Rev. 23 (1), 241–271. doi:10.1007/s40804-021-00236-w

Tao, M., Sheng, M. S., and Wen, L. (2023). How does financial development influence carbon emission intensity in the OECD countries: some insights from the information and communication technology perspective. J. Environ. Manag. 335, 117553. ISSN 0301-4797. doi:10.1016/j.jenvman.2023.117553

Tekin Turhan, G., Tokal, P., and Sart, G. (2023). The role of financial sector development and educational attainment in the achievement of economic sustainability: evidence from BRICS economies. Sustainability 15 (6), 5527. doi:10.3390/su15065527

Tonello, M. (2006). Revisiting stock market short-termism. The Conference Board Research. The Conference Board Research Report No. R-1386-06-RR. doi:10.2139/ssrn.938466

Tosun, J., and Leininger, J. (2017). Governing the interlinkages between the sustainable development goals: Approaches to attain policy integration. Glob. Chall. 1 (9), 1700036. doi:10.1002/gch2.201700036

United Nations (1987). Report of the world commission on environment and development: our common future. Oslo, Norway: United Nations General Assembly, Development and International Co-operation: Environment, 43.

Valickova, P., Havranek, T., and Horvath, R. (2015). Financial development and economic growth: a meta analysis. J. Econ. Surv. 29 (3), 506–526. doi:10.1111/joes.12068

Van Broekhaven, E., and De Beats, B. (2006). Fast and accurate center of gravity defuzzification of fuzzy system outputs defined on trapezoidal fuzzy partitions. Fuzzy Sets Syst. 157 (7), 904–918. doi:10.1016/j.fss.2005.11.005

Vo, X. V., and Zaman, K. (2020). Relationship between energy demand, financial development, and carbon emissions in a panel of 101 countries:“go the extra mile” for sustainable development. Environ. Sci. Pollut. Res. 27, 23356–23363. doi:10.1007/s11356-020-08933-8

Waas, T., Hugé, J., Verbruggen, A., and Wright, T. (2011). Sustainable development: a bird's eye view. Sustainability 3 (10), 1637–1661. doi:10.3390/su3101637

Weber, G., and Cabras, I. (2017). The transition of Germany's energy production, green economy, low-carbon economy, socio-environmental conflicts, and equitable society. J. Clean. Prod. 167, 1222–1231. doi:10.1016/j.jclepro.2017.07.223

Wondowossen, T. A., Nakagoshi, N., Yukio, Y., Jongman, R. H., and Dawit, A. Z. (2014). Competitiveness as an indicator of sustainable development of tourism: applying destination competitiveness indicators to Ethiopia. J. Sustain. Dev. Stud. 6 (1), 71–95.

World Economic Forum (2011). The financial development report 2011. Available at: https://dupuch.com/tbi-media/WEF_FinancialDevelopmentReport_2011.pdf.

Wu, C. H., Tsai, S. B., Liu, W., Shao, X. F., Sun, R., and Wacławek, M. (2021). Eco-technology and eco-innovation for green sustainable growth. Ecol. Chem. Eng. S 28 (1), 7–10. doi:10.2478/eces-2021-0001

Xavier, A. F., Naveiro, R. M., Aoussat, A., and Reyes, T. (2017). Systematic literature review of eco-innovation models: opportunities and recommendations for future research. J. Clean. Prod. 149, 1278–1302. doi:10.1016/j.jclepro.2017.02.145

Xie, P., and Jamaani, F. (2022). Does green innovation, energy productivity and environmental taxes limit carbon emissions in developed economies: implications for sustainable development. Struct. Change Econ. Dyn. 63, 66–78. doi:10.1016/j.strueco.2022.09.002

Yang, B., Jahanger, A., Usman, M., and Khan, M. A. (2021). The dynamic linkage between globalization, financial development, energy utilization, and environmental sustainability in GCC countries. Environ. Sci. Pollut. Res. 28, 16568–16588. doi:10.1007/s11356-020-11576-4

Yang, J., Sun, Y., Sun, H., Lau, C. K. M., Apergis, N., and Zhang, K. (2022). Role of financial development, green technology innovation, and macroeconomic dynamics toward carbon emissions in China: analysis based on bootstrap ARDL approach. Front. Environ. Sci. 10, 886851. doi:10.3389/fenvs.2022.886851

Zadrąg, R., and Kniaziewicz, T. (2017). Utilization of the zero unitarization method for the building of a ranking for diagnostic marine engine parameters. Combust. Engines 171 (4), 44–50. doi:10.19206/CE-2017-408

Zahoor, Z., Khan, I., and Hou, F. (2022). Clean energy investment and financial development as determinants of environment and sustainable economic growth: Evidence from China. Environ. Sci. Pollut. Res. 1-11, 16006–16016. doi:10.1007/s11356-021-16832-9

Zhao, X., Castka, P., and Searcy, C. (2020). Iso standards: a platform for achieving sustainable development goal 2. Sustainability 12 (22), 9332. doi:10.3390/su12229332

Keywords: green economy, sustainability, development, financial development, sustainable development, fuzzy logic

Citation: Zioło M, Bąk I, Spoz A, Oesterreich M, Niedzielski P and Raczkowski K (2023) Relationship between sustainable development and financial development from the perspective of the European green economy. Fuzzy approach. Front. Environ. Sci. 11:1244119. doi: 10.3389/fenvs.2023.1244119

Received: 21 June 2023; Accepted: 31 July 2023;

Published: 25 August 2023.

Edited by:

Diana Mihaela Tirca, Constantin Brâncusi University, RomaniaReviewed by:

Ángel Acevedo-Duque, Autonomous University of Chile, ChileCopyright © 2023 Zioło, Bąk, Spoz, Oesterreich, Niedzielski and Raczkowski. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Anna Spoz, YXNwb3pAa3VsLmx1Ymxpbi5wbA==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.