95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 28 July 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1211174

The Yangtze River Delta region is one of the most active regions in China’s economic development and financial innovation, and its green finance is at the leading level in the country. To promote the integrated development of green finance in China’s Yangtze River Delta and boost high-quality economic development, this paper uses the data of three provinces and one city in the Yangtze River Delta from 2010 to 2021, constructs the green finance development index and the high-quality economic development index by entropy weight method, and constructs the VAR model to analyze the interaction between the two. The coupling coordination model is used to analyze the coupling coordination degree between green finance and high-quality economic development, and the correlation between green finance and high-quality economic development is deeply analyzed by using the gray correlation method. Finally, the gray prediction model is used to predict the coupling coordination between green finance and high-quality economic development. The research shows that green finance and high-quality economic development have short-term mutual promotion effects, and the coupling and coordination are good, but there are regional differences. The overall degree of correlation between the two is medium to upper, and the interaction force is strong. From the forecast results, the coupling coordination and coupling priority of the Yangtze River Delta region show positive development, and Anhui Province has more room for improvement. Based on the above research, this paper proposes to establish a green finance integrated development mechanism to promote regional green finance synergistic development, promote green finance infrastructure interconnection to better realize resource allocation and information sharing, attract more professionals to participate in green finance innovation, and build a favorable external development environment for green finance.

With the continuous development of the social economy, environmental problems in many countries are becoming more and more serious, which poses a threat to the sustainable development of mankind (Wu et al., 2021). To promote sustainable economic development, green development will be the future trend (Tian et al., 2022). Green finance is seen as a “lubricant” and “booster” for green development (Wang and Wang, 2020; Sun Z. Y., 2022a), is attracting wide attention from all over the world (Schafer, 2018; Liu et al., 2019). As an environmental economic policy, green finance is different from traditional financial services in that it lays more emphasis on ecological and environmental benefits to promote sustainable economic development while developing the economy (Wang K. H. et al., 2022a). From the perspective of environmental psychology, green finance can effectively adjust the industrial structure by increasing financial support for the green environmental protection industry and financing constraints on industries with high energy consumption and high pollution, to promote the transformation and upgrading of enterprises with high pollution and high energy consumption, promote high-quality economic development, and achieve coordinated development of economy and environment (Zhou et al., 2020; Hu et al., 2021). High-quality economic development pursues sustainable economic development. As an environmental economic policy, green finance is known as the “undertone” of high-quality economic development (Wen et al., 2022). While supporting economic development, it pays more attention to environmental protection, guides more funds to green industries, and improves the quality of economic development (Jiang and Hu, 2021; Li et al., 2022). Thus, green finance pursues sustainable economic development and supports high-quality economic development in essence (Yu and Fan, 2022).

All countries in the world have made unremitting efforts to promote sustainable and high-quality economic development (Cai and Wang, 2022). In terms of green finance development, developed countries are more concerned about its impact on climate, while developing countries are more focused on its role in energy conservation and emission reduction (Lin and Xiao, 2023). As a big developing country, China has made unremitting efforts and made some progress in the development of green finance in to promote the coordinated development of economic and environmental benefits. With the continuous introduction and implementation of green finance policies, by the end of 2021, the balance of domestic and foreign green loans in China has reached 15.9 trillion yuan, and the stock scale of China’s green credit has ranked second in the world in the same year. At the end of 2022, China’s green loan balance in domestic and foreign currencies was even higher at 2,203 billion yuan, an increase of 38.47% year-on-year. This shows that China has great potential in developing green finance. As one of the most active regions in economic development and financial innovation in China (Wang S. et al., 2022b), the Yangtze River Delta region is at the leading level in the country in green financial development (Research Group of Hangzhou Central Sub-branch of the People’s Bank of China and W. F. Lu, 2022). Its annual contribution to GDP accounts for about one-quarter of the national total, playing a very important role in China’s modernization (Hu, 2022). In November 2018, China listed the integration of the Yangtze River Delta as a national strategy, and at the same time made higher requirements for the integrated development of green finance in the region. In 2019, China issued the Outline for the Integrated Development of the Yangtze River Delta Region, guiding government departments and financial institutions in the Yangtze River Delta region to actively explore and improve supporting green finance policies. However, at present, the Yangtze River Delta region in China is still in its infancy in terms of integrated development of green finance, and there are still problems such as unbalanced regional development (Zhang and Shen, 2023).

With the increasingly severe environmental problems, the relationship between green finance and economic development has received more and more attention from scholars. In the existing literature, some relatively early studies concluded that green finance is detrimental to macroeconomic development (Wang et al., 2016; Su and Lian, 2018). With the gradual enrichment of empirical samples, most studies have concluded that the development of green finance can adjust the industrial structure by guiding the flow of capital and promoting green technological innovation (Hu et al., 2023), and promoting the transformation and upgrading of industrial structure (Li and Zhou, 2023), which can pull the high-quality economic development (Wen et al., 2022; Zhang and Yu, 2023). Although existing studies have shown that green finance has an impact on economic development, it is important to note that most of the current studies on the relationship between green finance and economic development are one-way studies, and few in-depth studies have been conducted from the perspective of the interactions between the two systems of green finance and high-quality economic development. Most of the existing studies focus on the national scale, and there is a lack of research on the regional scale. Therefore, the purpose of this study is to analyze in depth the mutual dynamic relationship between green finance and high-quality economic development in the Yangtze River Delta region, and to understand the level of coupled and coordinated development between the two systems and their degree of association, to put forward constructive suggestions for promoting the development of green finance in the Yangtze River Delta region.

This study contributes to the existing knowledge system in the following aspects. First, this paper empirically analyzes the interaction dynamics between the two systems in the Yangtze River Delta region using a VAR model, unlike the vast majority of the previous literature, which only studies the single interaction relationship between the two systems. Second, this paper uses a coupled coordination model to analyze the coupling and coordination between green finance and high-quality economic development in three provinces and one city in the Yangtze River Delta region and analyzes the influencing factors in conjunction with the actual situation, which complements the existing research and helps to promote the synergistic development of green finance and high-quality economy in the Yangtze River Delta region. Third, this paper establishes a gray correlation model to clarify the degree of interconnection between the two systems and their subsystems and analyzes their intrinsic causes in depth. Finally, this paper uses a gray prediction model to forecast the coupled coordination status of the three provinces and one city in the Yangtze River Delta and conducts a comparative analysis of its evolution trend. To the authors’ knowledge, the existing literature is mainly based on the analysis of existing data, and few studies have made future predictions on the level of coordination between green finance and high-quality economic development in the region. The above analysis provides an empirical basis for the formulation of future development policies of green finance in the Yangtze River Delta region so that it can further promote high-quality economic development, which can help promote the integrated development of green finance and high-quality economic development in the Yangtze River Delta region. It also provides a useful reference for the positive interaction between green finance and economic development in other regions.

With the growing severity of environmental problems, green finance has received more and more attention from scholars. In the existing literature, numerous scholars have conducted relevant studies on green finance (Sachs et al., 2019; Li and Zhou, 2023; Zhang and Yu, 2023). At the early stage of research, scholars mainly focused on the theoretical aspects of green finance connotation, green financial system construction, and green finance policies (White, 1996; Jeucken and Bouma, 1999; An, 2008). For the connotation of green finance, studies have defined green finance as a policy, financial instrument or behavior, etc. Green finance is the incentive policy and institutional arrangement implemented to promote the development of green industries as well as the improvement of the ecological environment (Zhou, 2019). Green finance is a financial instrument that focuses on environmental benefits and promotes sustainable economic development (Yu, 2016; Sachs et al., 2019). Green finance is the behavior of financial institutions to incorporate environmental factors into investment decisions (Wang, 2021). Meanwhile, green finance is a financial investment activity that is beneficial to sustainable development (Gu and Cai, 2015; Yu and Fan, 2022).

As research at the theoretical level has matured, many scholars have conducted quantitative research on green finance from macro and micro perspectives (Sun M. Y., 2022b). At the macro level, the objects of study are mainly economic development and the ecological environment. Many studies have concluded that green finance is beneficial to sustainable development and ecological environmental protection (Li, 2020; Liu and He, 2021). Also, it can promote industrial transformation and upgrading (Li and Shi, 2022). At the micro level, numerous scholars have conducted relevant studies on green financial instruments. Most scholars believe that the implementation of green financial instruments such as green credit and green bonds can improve the return on green energy projects (Tolliver et al., 2020; Taghizadeh-Hesary et al., 2021), bank profitability, etc. (Zhu et al., 2021). Some studies have also argued that the development of green financial instruments is detrimental to the development of financial institutions and increases their bankruptcy rates in the short term (Shao and Yan, 2020).

Financial development is a major cause of economic growth (Baloch and Danish, 2022), but its impact on the environment has not yet reached a uniform conclusion. Several studies have concluded that financial development is beneficial to environmental protection and sustainable development (Baloch and DanishMeng, 2019; Baloch et al., 2020; Usman and Balsalobre-Lorente, 2022). Financial development can contribute to sustainable development by reducing carbon emissions through increased energy efficiency (Alvarez-Herranz et al., 2017). Green finance contributes to environmental protection and sustainable development through innovative financial instruments and improved related policies (Sachs et al., 2019). Also, it has been shown that economic growth can reduce CO2 emissions and contribute to sustainable development (Park et al., 2018). However, some studies have also concluded that financial development has increased carbon emissions and ecological footprint, among others, and has caused some pollution to the environment, thus reducing environmental quality (Xu et al., 2018; Baloch et al., 2019).

Economic growth and financial support have been the focus of scholarly research (Wang et al., 2021a). Green finance, as an environmental economic policy, can effectively link the economy and the environment, focusing on environmental benefits while developing the economy (Wang K. H. et al., 2022a). For the research on the relationship between green finance and high-quality economic development, more scholars believe that green financial development can promote high-quality economic development (Liu and Ma, 2022; Hua and Shi, 2023; Li, 2023). Green finance can promote enterprise innovation (Wang et al., 2021b) and industrial transformation and upgrading (Li and Shi, 2022; Zhang et al., 2022) to promote economic growth (Markandya et al., 2015). Through an empirical analysis of provincial panel data in China, Wen et al. (2022) found that green finance has the important function of supporting high-quality economic development through green innovation. However, a small number of scholars believe that the development of green finance hinders the development of the macro-economy (Ning and She, 2014). Su and Lian (2018) believe that excessive punishment of green credit is not conducive to the transformation and upgrading of polluting enterprises.

In summary, many scholars have conducted certain research on green finance and high-quality economic development. The existing researches demonstrate that green finance has a certain influence on high-quality economic development. However, the existing studies show more research on the one-way interaction relationship and less research on the two-way interaction relationship, and there is even less literature to predict the future coordinated development level of regional green finance and high-quality economic development. To supplement the existing literature, this paper makes an in-depth study of the Yangtze River Delta region. This paper analyzes the dynamic interaction between the two systems of green finance and high-quality economic development in this region, the level of coordinated development, the degree of correlation, and the prediction of the future coordinated development of the two systems. This study provides an empirical basis for the future development of green finance policies in the Yangtze River Delta region.

In terms of the construction of green finance indicators, it can be seen from the Guidance on Building a Green Finance System released in 2016 that green finance mainly includes green credit, green insurance, green investment, green bonds, etc. (Liu and He, 2021). At the same time, referring to the research content of Tian et al. (2022) and Yu and Fan (2022), and considering the availability of data, this paper finally constructs the first-level index of green finance system from the four dimensions of green credit, green insurance, green investment, and green bond. Compared with the previous selection of green credit as the measurement index of green finance development, this paper constructs the green finance index system from various aspects, which is more scientific and rational. Meanwhile, referring to the studies of He et al. (2019) and Zeng et al. (2014), the second-level index of green finance constructed in this paper is shown in Table 1. Among them, the interest expense of high-energy consuming industries is replaced by the interest expense generated by six high-energy consuming industries (Guo, 2022). The index data of green insurance is measured by the relevant data of agricultural insurance (Ren et al., 2020). When constructing high-quality economic development indicators, this paper combines the research content of Li et al. (2019) and Huo (2021). Finally, this paper selects economic growth, social development, ecological civilization, and scientific and technological progress as first-level indicators, and selects 12 second-level indicators to build the index system of high-quality economic development. Specific second-level indicators are shown in Table 1.

Since the indicators constructed in this paper contain 14 positive indicators and 4 negative indicators, the data must be preprocessed. In this paper, the polarization method is first used to standardize the index data (Tian et al., 2022), to eliminate the dimensional influence among various indicators. At the same time, to ensure the objectivity and referenceability of index weight calculation results, the entropy weight method is used in this paper to solve the weight (Sun M. Y., 2022b; Cai and Wang, 2022). The specific results are shown in Table 2.

The research scope selected in this paper is the data from three provinces and one city in the Yangtze River Delta from 2010 to 2021. Among them, some data on green finance indicators and high-quality economic development indicators are missing, and the mean value method is used to fill in the data. The rest of the index data are mainly from the China Industrial Statistics Yearbook, China Insurance Yearbook, China Environmental Statistics Yearbook, Wind database, statistics bureau, and statistical yearbook of various provinces and cities, etc.

For the calculation of index weights, the entropy weight method is adopted in this paper to ensure the objectivity of the calculation results. The specific calculation formula is as follows:

In the formula, Xij refers to the value of index i in the j year, Yij refers to the standardization of the value of the i index in the j year, Pij refers to the proportion of the i index in the j evaluation object, ej refers to the entropy of the j index, gj refers to the coefficient of variation of the j index, wj refers to the proportion of the j index. See Table 2 for weight reconfiguration.

After summing the weights obtained respectively and calculating their comprehensive scores, the final index of green finance and high-quality economic development in the Yangtze River Delta and its three provinces and one city from 2010 to 2021 is shown in Table 3, which is visualized in Figure 1. It is obvious from Figure 1 that the overall development index of green finance and high-quality economic development in the Yangtze River Delta region and its three provinces and one city shows a gradual upward trend.

The VAR model, namely, the vector autoregressive model, can be used to evaluate the dynamic relationship between endogenous variables (Huang, 2019). To understand the dynamic relationship between green finance and high-quality economic development, this paper first establishes a VAR model to conduct an in-depth analysis of the development indices of the two systems. The specific expression is shown as follows:

In the formula, yt refers to the endogenous variable vector, t refers to the number of samples, matrix

To understand the coordinated development level between green finance and high-quality economic development in the three provinces and one city of the Yangtze River Delta in recent years, this paper uses the relevant data of the three provinces and one city of the Yangtze River Delta region from 2010 to 2021 to build a coupled coordination model and conduct an in-depth analysis of it.

(1) Coupling degree: It can be used to reflect the specific degree of dependence and interaction between the two systems. The specific calculation formula is as follows:

In the formula, u1 is the green finance development index, u2 is the high-quality economic development index, and c is the coupling degree.

In addition, based on previous studies, this paper refers to the research method of Sun M. Y., 2022b and divides the coupling state into four stages, as shown in Table 4.

(2) Coupling coordination degree: To avoid the result of a high coupling degree caused by the low development level of the two systems, this paper continues to analyze the coupling coordination degree, which can reflect the overall coordination degree between the two systems more comprehensive. The specific calculation formula is as follows:

(3) Coupled priority: It can well reflect the priority relationship between the development of the two systems and judge whether the two systems are in lagged development, synchronous development, or advanced development. Thus, the specific priority relationship between green finance and high-quality economic development can be understood. The specific calculation formula is as follows:

Referring to the research method of Gao et al. (2020), this paper considers that when p < 0.9, the green finance coupling development lags between the two systems. When 0.9 < p < 1.2, green finance coupled development synchronous type. When p > 1.2, it is an advanced type of coupled development of green finance (Gao et al., 2020).

Grey correlation analysis can quantify the degree of correlation between various system factors, and the larger the calculated value, the higher the degree of correlation between the two. The specific calculation formula is as follows:

In the formula,

The grey prediction model can predict the future development of things with a small amount of incomplete information. In this paper, the grey prediction model is used to predict the coupling coordination degree of three provinces and one city in the Yangtze River Delta region in the future, to analyze its evolution trend. The specific calculation formula is as follows:

In the formula, D is the coupling coordination degree of each province or city.

To improve the accuracy of the model, the grey differential equation established in this paper is:

In the formula,

The corresponding whitening equation is (

According to the least square method, this study uses Matlab software to work out

This paper first conducts an ADF unit root test on the development indexes of the two systems in the Yangtze River Delta, and the results are shown in Table 6. The p values of D (X) and D (Y) are both less than 0.05, indicating that these two sequences are stationary, and therefore they are both first-order monostationary sequences.

In this paper, six information criteria are used to judge the lag order of this model. The running results are shown in Table 7, indicating that the optimal lag order of this VAR model is 1.

The Granger causality test is of great significance for predicting macro variables (Li et al., 2022), and the test results are shown in Table 8. In the test of variable X and variable Y, the corresponding concomitant probability p-values are both less than 0.05, indicating that X and Y are granger causes of each other. Therefore, it is suitable to establish the VAR model.

The stationarity test was conducted on the VAR(1) model, and the test results were shown in Figure 2. The results show that the characteristic roots of the characteristic equation of the model are all in the unit circle. This indicates that the established VAR(1) model is stable and can support the subsequent research.

From the first-order lagged impulse response function diagram (Figure 3), it can be seen that the trend of economic development changes after a unit shock to green finance is more significant, showing a trend of first rising and then gradually declining and then leveling off. As can be seen from Figure 3, economic development reaches the maximum value of 0.579 in the second period and then declines rapidly. In the fifth phase, it decreases to 0.102. And in the eighth phase, it reaches the minimum value of −0.003. After that, it levels off and converges to 0. This shows that green finance can promote economic development. However, its contribution to economic development is only more significant in the short term, and its role is small and almost non-existent small in the long term. This finding is in general agreement with Li et al. (2022) and Huo (2021). The reason is that green finance can provide strong support for the green industry. Coupled with relevant fiscal preferential policies implemented by the government, more and more people start to pay attention to the development of green industry, which is conducive to the adjustment of industrial structure. At the same time, financial institutions implement green credit policies and increase the introduction of relevant professionals, so that the level of green finance business can be improved, which in turn can better provide services for the green economy and promote its development. However, excessive financial stimulation may reduce the operational efficiency of social funds, resulting in financing difficulties in the real economy, which is not conducive to economic development.

When high-quality economic development is impacted by one unit, green finance shows a trend of first rising, then declining, then leveling off. In the second phase, green finance reaches the maximum value of 0.379. In the fourth phase, it reaches the minimum value of −0.02. Then it fluctuates up and down for six periods and gradually converges to 0. This indicates that economic development can promote green finance, but only in the short term. With the continuous development of the economy, environmental problems become more and more serious, which makes people and the government pay more and more attention to the development of the green environmental protection industry, and then promote the development of green finance. But over-stimulating economy development can have negative consequences for the financial sector.

After impulse response analysis, this paper performs variance decomposition on the VAR(1) model to analyze the specific contribution rate changes between the two systems of green finance and high-quality economic development. The specific data results are shown in Table 9.

Figure 4 shows that the contribution degree of high-quality economic development to green finance is 0% in the first period. After that, the contribution degree of high-quality economic development to green finance increases somewhat, but the growth rate is relatively small. After the seventh period, the contribution degree stabilizes at about 4.81%. Thus, the development and change of green finance mainly come from its contribution. As can be seen from the variance decomposition result of the economic high-quality development index (Figure 5), in the first period, its contribution to itself has been as high as 75.04%, and the contribution of green finance to it is only 24.96%. However, in the second period, the contribution of green finance to high-quality economic development is as high as 51.68%, which is comparable to the contribution of high-quality economic development to itself. After that, the contribution of green finance to it fluctuates slightly, but stabilizes after the fifth period, with its value stabilizing at around 56.42%. Thus, the development of green finance does help promote high-quality economic development to a certain extent, and its contribution to high-quality development is stable at about 56.42% in the later period. However, the contribution of high-quality economic development to green finance is only about 4.81% in the long run. It shows that high-quality economic development has a low probability of long-term impact on green finance development. This finding is not entirely consistent with the findings of Wang K. H. et al., 2022a.

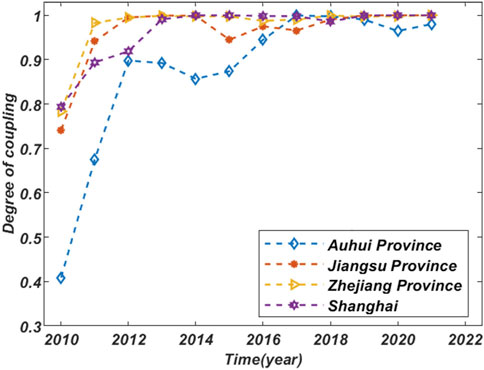

In terms of the coupling degree between green finance and high-quality economic development, Figure 6 shows that the coupling degree evolution trend of three provinces and one city in the Yangtze River Delta region fluctuates slightly in the early stage and then gradually approaches 1.

FIGURE 6. Evolution trend of the coupling degree between green finance and high-quality economic development.

As can be seen from Table 10, the coupling degree of three provinces and one city in the Yangtze River Delta is mostly at a high coupling stage. From 2010 to 2021, the coupling degree values of 2010 and 2011 in Anhui Province were lower than 0.8, among which, 2010 was in the antagonistic stage, 2011 was in the run-in stage, and the remaining years were in the highly coupled stage. Only in 2010, the coupling degree of Shanghai was lower than 0.8, which was in the run-in stage, and the other years were in the highly coupled stage. The same is true of Jiangsu Province and Zhejiang Province, which were in the highly coupled stage in all years except 2010. Jiangsu, Zhejiang, and Shanghai entered into the highly coupled state 1 year earlier than Anhui. Since 2012, the coupling degree values of Jiangsu, Zhejiang, and Shanghai were all greater than 0.9. It can be seen that in recent years, the interaction between green finance and high-quality economic development in various provinces and cities in the Yangtze River Delta region is very significant, and the degree of matching between the two is very high. This finding is roughly the same as that of Zhou and Lu (2017). This indicates that in recent years, the Yangtze River Delta region has paid more and more attention to green finance and high-quality economic development, and has continuously improved and gradually implemented relevant policies to enhance the development level of green finance. The interaction between green finance and high-quality economic development in the Yangtze River Delta region is getting stronger and stronger, and gradually developing in a benign and orderly way. However, the coupling degree of Anhui Province is relatively lower than that of other provinces and cities. The study of Hu (2022) also drew similar conclusion. This phenomenon is more obvious during 2010–2015. The reasons for this may be related to the policy support, geographical location, economic level, and talent resources of each province and city. Jiangsu, Zhejiang, and Shanghai, which have superior geographical locations and many famous schools in China, are ahead of Anhui Province in terms of economic development level and talent resources.

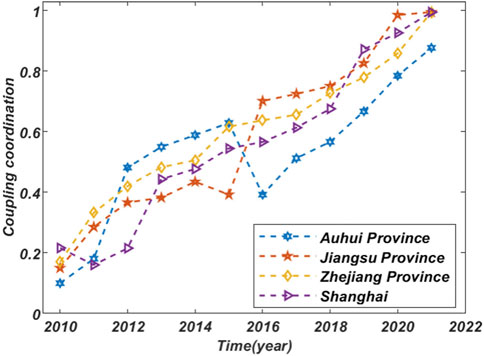

In terms of coupling coordination degree, it can be seen from Figure 7 that the three provinces and one city in the Yangtze River Delta region show an obvious trend of gradual rise from 2010 to 2021. Since 2016, the coupling coordination degree of Jiangsu Province, Zhejiang Province, and Shanghai City is significantly ahead of Anhui Province.

FIGURE 7. Evolution trend of the coupling coordination degree between green finance and high-quality economic development.

From Table 11, it can be seen that during the period 2010–2021, Jiangsu Province, Zhejiang Province, and Shanghai have been upgraded from severe or moderate disorder to high-quality coordination. Anhui Province has been upgraded from severe disorder to good coordination. In recent years, the coupling and coordination between green finance and high-quality economic development in the three provinces and one city have been developing well, and most of them are mutually reinforcing at a high level. In addition, Anhui Province is slightly second to the other three regions in the overall coupling coordination status, which is consistent with the findings of Liang and Ren (2022). This shows that the development of green finance in the Yangtze River Delta region has the phenomenon of unbalanced development (Research Group of Hangzhou Central Sub-branch of the People’s Bank of China and W. F. Lu, 2022). For these reasons, there are certain gaps between Anhui Province and other provinces and cities in the Yangtze River Delta region in terms of the green financial market, institutional innovation, and talent resources. In terms of the green finance market, Jiangsu and Zhejiang are in a relatively leading position. In terms of institutional innovation, Zhejiang Province, as the only approved green finance reform pilot in the Yangtze River Delta region, has formed a relatively advanced green finance theory and system compared with other regions in the Yangtze River Delta region. In terms of talent resources, there are more famous universities in Shanghai, Jiangsu, and Zhejiang than in Anhui. Many green finance professionals are more inclined to work in Shanghai, Jiangsu, and other regions with relatively advanced economic development levels. As the green finance integration in the Yangtze River Delta is only in the preliminary stage of exploration, it is relatively short of cross-regional and cross-departmental coordination mechanisms and exchange platforms, which makes it difficult to share many excellent resources. For example, the experience and achievements of green finance already formed in Zhejiang cannot be effectively developed and promoted in other provinces and cities in the Yangtze River Delta region. The differences in resource allocation, institutional innovation, and economic development levels in different regions result in the unbalanced development of green finance in the Yangtze River Delta region.

TABLE 11. Degree of coupling coordination between green finance and high-quality economic development.

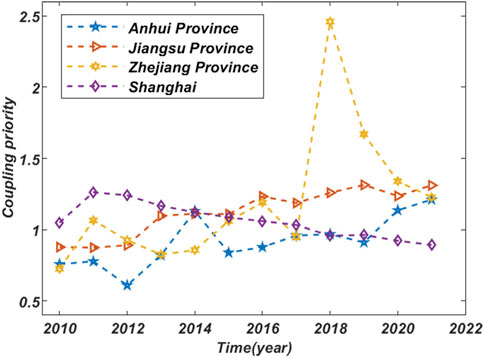

In terms of the coupling priority of green finance and high-quality economic development, it can be seen from Figure 8 that the three provinces and one city in the Yangtze River Delta all present an unstable state with obvious changes.

FIGURE 8. Evolution trend of the coupled priority of green finance and high-quality economic development.

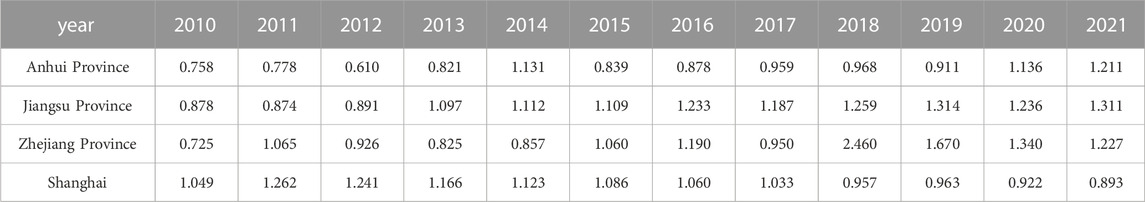

As can be seen from Table 12, the coupling development types of green finance and high-quality economic development in Anhui Province and Zhejiang Province have successively experienced the lagged type, synchronous type, lagged type, synchronous type, and advanced type. Jiangsu Province has successively experienced the lagged type, synchronous type, leading type, synchronous type, advanced type, synchronous type, and advanced type. Shanghai has successively experienced the synchronous type, leading type, synchronous type, and lagged type. Since 2018, Jiangsu and Zhejiang provinces have been in the advanced type of green finance development. This shows that compared with Anhui and Shanghai, Jiangsu and Zhejiang pay more attention to the development of green finance in recent years. Their green finance systems are more sound and relevant supporting facilities are more perfect, which are enough to promote the high-quality development of the local economy. From 2010 to 2021, Anhui Province was mostly in the lagging type of green finance development. This shows that Anhui Province in the development of green finance business has a large room for improvement. The reason is that green finance in Anhui Province is still in the early stage of development and has not formed an industrial scale. There are still problems such as an unsound green finance system, insufficient policy support, and a lack of innovation in products. Shanghai is mostly in the coupled development synchronous type, which indicates that Shanghai’s green finance development and local economic development go hand in hand, and both develop in synergy.

TABLE 12. The value of Coupling priority between green finance and high-quality economic development.

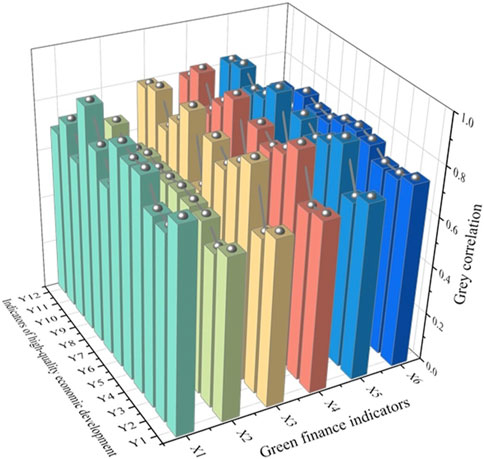

To deeply analyze the degree of correlation between green finance and high-quality economic development in the Yangtze River Delta region and analyze it’s influencing factors. This paper uses the grey correlation method to conduct in-depth research on the two systems and subsystems of green finance and high-quality economic development. The results are shown in Table 13 and visualized in Figure 9.

FIGURE 9. Correlation degree between indicators of green finance and indicators of high-quality economic development.

As can be seen from Figure 9, on the whole, the correlation between the subsystems of green finance and the subsystems of high-quality development in the Yangtze River Delta region is medium to high, and the interaction between the two is strong. Among them, green credit and green investment have a higher correlation with high-quality economic development systems. Social development and ecological civilization have a high correlation with the green finance system.

Specifically, as can be seen from Table 13, in the green credit subsystem, the average correlation degree between the interest expenditure ratio of energy-consuming industries (X1) and high-quality economic development is 0.788. This shows that the development of energy-intensive industries can affect the high-quality development of the economy to a large extent. This finding is consistent with the research conclusion of Wen et al. (2022) and Li and Lin (2023). The development of energy-intensive industries will bring more pollution to the environment. They should be promoted to transform and upgrade to reduce the pollution of the environment. Commercial banks and other financial institutions should establish and improve the control system for polluting industries. Government departments should issue relevant policies to support the technological transformation of industries with high pollution and high energy consumption and promote their transformation and upgrading. The mean correlation degree between the green investment subsystem and high-quality economic development is 0.787. Among them, the mean correlation degree between the proportion of completed industrial pollution control investment in GDP (X4) and high-quality economic development is 0.786, and the mean correlation degree between the proportion of fiscal expenditure on energy conservation and environmental protection (X6) and high-quality economic development is 0.789. This shows that the government’s attention to the green environmental protection industry and financial support can promote high-quality economic development to a large extent. Local government departments should increase support for green and environmental protection industries so that more funds flow to the energy-saving and environmental protection industries. At the same time, government departments should introduce and improve relevant supporting policies to better promote the high-quality development of the local economy. In addition, the mean correlation degree between the social development subsystem and the green finance system is 0.797. The mean correlation degree between the ecological civilization subsystem and the green finance system is 0.756. Green finance conforms to the concept of “Lucian waters and lush mountains are invaluable assets”. After certain development, green finance has alleviated environmental pollution to a large extent, which is of great significance to the construction of ecological civilization. At the same time, the development of green finance is conducive to the construction of a green and sustainable economic environment, which in turn acts to build society, improve people’s quality of life, and thus promote social development. The correlation degree between scientific and technological progress and green finance is 0.744, indicating that the development of scientific and technological innovation can well promote the development of green finance. This finding is consistent with the findings of Xu and Tian (2022) and Zhang and Shen (2023). At the same time, this finding well explains that technological innovation can help green finance promote industrial upgrading (Li and Shi, 2022). To improve the development level of green finance and promote high-quality economic development, the Yangtze River Delta region should take advantage of its talent resources to attract more professionals to the field of green finance.

After understanding the interaction relationship, coupling coordination status, and correlation degree between green finance and high-quality economic development in three provinces and one city in the Yangtze River Delta region, this paper predicts the coupling coordination degree and coupling priority of green finance and high-quality economic development in three provinces and one city in the Yangtze River Delta region in the next 4 years. In this paper, the gray prediction model is adopted for prediction, and the prediction results of coupling coordination degree are visualized, as shown in Figure 10.

As can be seen from Figure 10, the coupling coordination degree of three provinces and one city will increase and then stabilize in the next few years. Compared with Anhui province, Jiangsu, Zhejiang, and Shanghai take the lead in achieving a fully coupled coordination state. The trend of change in Anhui Province is the most significant, indicating that there is still more room for improvement in the development of green finance in Anhui Province. After 2024, all three provinces and one city will be in a fully coupled coordination state. With the continuous improvement of China’s emphasis on the development of green finance and the continuous introduction and implementation of relevant green finance policies in the Yangtze River Delta region, although Anhui Province is relatively backward compared with Zhejiang, Jiangsu, and Shanghai, its future development trend is very good, which is consistent with Xu and Tian (2022). Green finance and high-quality economic development in the three provinces and one city in the Yangtze River Delta will be well-coordinated in the future. Local governments should improve relevant supporting policies and encourage financial institutions to develop green finance businesses. At the same time, the government should increase financial support, so that more funds to invest in the green industry. Financial institutions should establish and improve the green financial system and innovate green financial products to improve the development level of green finance. The Yangtze River Delta region should establish a unified green financial service platform to facilitate resource sharing and improve the efficiency of regional financial resource allocation.

Compared with the study of He et al. (2015), this study further predicts the coupling coordination degree and coupling priority degree of the three provinces and one city respectively. In the prediction results of coupling priority (Figure 11), the changing trend of coupling priority in the three provinces and one city in the Yangtze River Delta is slightly different in the next few years. Anhui Province and Jiangsu Province show a steady upward trend and belong to the advanced type of green finance coupling development in the next few years. The coupling priority of Zhejiang Province in the next few years will first rise and then decline. In 2022, it belongs to the synchronous type of coupled development, and the other 3 years belong to the advanced type of coupled development. In addition, although the coupling priority of Shanghai will show an upward trend in the next few years, its value is lower than that of other regions. In the predicted 4 years, the first 2 years of Shanghai will be in the synchronous coupling development type, while the second 2 years will be in the advanced coupling development type of green finance. In contrast, the coupling priority of Zhejiang Province will increase significantly in the next few years. This shows that with the strong support of relevant policies, green finance in the three provinces and one city in the Yangtze River Delta region will develop for the better in the future, and can better promote the high-quality development of the local economy. Among them, Zhejiang Province and Jiangsu Province are likely to be better than Shanghai and Anhui Province in the next few years in terms of green finance driving high-quality regional economic development.

With the increasing seriousness of environmental problems, green development will be the future trend. Green finance, as a kind of environmental economic policy, is an important force to promote green development. Green finance pursues sustainable development, which essentially supports high-quality economic development. Clarifying the mutual dynamic relationship, coordinated development status, and correlation degree between green finance and high-quality economic development can provide an empirical basis for the formulation of policies related to the future development of green finance, and has strong significance for the development of regional green finance. However, existing studies are relatively lacking in exploring the mutual dynamic relationship between green finance and high-quality economic development. At the same time, the scope of existing studies is mostly focused on the whole country, and there are fewer studies on regional green finance. Therefore, the entropy weight method is used in this paper to construct the index of green finance and high-quality economic development in the Yangtze River Delta region, and the VAR model and coupled coordination model are established to empirically analyze the mutual relationship and coordinated development level between the two systems. The degree of correlation between the two systems and their influencing factors are analyzed in depth through the gray correlation method. Finally, the gray prediction model is used to predict the coupling coordination development of the two systems, and the results are analyzed in depth. The main conclusions are as follows:

From the interaction between green finance and high-quality economic development, there is a mutual promotion between green finance and high-quality economic development in the Yangtze River Delta region. However, this mutual promotion is relatively obvious in the short term, but not in the long term. This finding is consistent with Li et al. (2022). It shows that in the short term, green finance and high-quality economic development can contribute to each other. However, in the long term, financial development has a small impact on economic development, while economic growth has a minimal contribution to financial development. In the mutual promotion relationship between the two, the promotion effect of green finance on economic quality development is more obvious than the promotion effect of economic quality development on green finance. It shows that the development of green finance can well promote high-quality economic development. However, the promotion effect of economic development on green finance is relatively weak.

From the coupling and coordination status of green finance and high-quality economic development, the coupling degree of the three provinces and one city in the Yangtze River Delta region is mostly in the high coupling stage. The overall coordination level is good and shows a rising trend, mostly at a high level of mutual promotion. This finding is roughly the same as that of Zhou and Lu (2017). This indicates that with the continuous implementation of relevant policies in the Yangtze River Delta region, the interaction between overall green finance and high-quality economic development in the region becomes stronger and stronger, and gradually develops in a benign and orderly way. At the same time, the research results show that the coupling coordination status of Anhui Province is slightly lower than that of the other three regions, indicating that the development of green finance in the Yangtze River Delta region is unbalanced, which is consistent with (Research Group of Hangzhou Central Sub-branch of the People’s Bank of China and W. F. Lu, 2022).

From the perspective of the correlation between green finance and high-quality economic development, overall the degree of correlation between green finance subsystem and high-quality economic development in the Yangtze River Delta region is medium to high, and the interaction between the two is strong. This research result is the same as that of Huo (2021). It shows that the development of green finance can promote high-quality economic development to a large extent. Meanwhile, high-quality economic development also contributes to the improvement of the development level of green finance. The interest expenditure ratio of energy-consuming industries and the green investment subsystem are highly correlated with the high-quality economic development system. It indicates that the transformation and upgrading of high-energy-consuming industries and the support of government departments for green industries can influence high-quality economic development to a greater extent. This finding is in line with the studies of Wen et al. (2022) and Li and Lin (2023). In addition, research shows that social development, ecological civilization and scientific, and technological progress are highly related to the green finance system. It indicates that the improvement of scientific and technological innovation ability can well promote the development of green finance. This finding is consistent with the research of Xu and Tian (2022) and Zhang and Shen (2023).

From the forecast results of the three provinces and one city in the Yangtze River Delta region for the next 4 years, the coupling coordination and coupling priority of the three provinces and one city in the Yangtze River Delta region are on the whole in positive development in the next few years. Anhui Province has higher room for improvement in this regard compared with other regions in the Yangtze River Delta. With the continuous adjustment of industrial structure and the gradual optimization of resource allocation, Anhui Province, which is currently lagging in the development of green finance, can also improve its development level well. This conclusion is consistent with Xu and Tian (2022). At the same time, the results show that Zhejiang Province and Jiangsu Province are likely to be better than Shanghai and Anhui Province in terms of green finance driving high-quality regional economic development in the next few years.

This study strongly suggests that the two systems of green finance and high-quality economic development in the Yangtze River Delta region are mutually reinforcing in the short term, and the promotion of green finance to high-quality economic development is stronger, implying that the development of green finance can well promote high-quality economic development. Although the level of coordination between green finance and high-quality economic development in the Yangtze River Delta shows a good trend, there is still an uneven development phenomenon. The upgrading and transformation of energy-intensive industries, the government’s strong support for green industries, and the improvement of scientific and technological innovation capability can make green finance better promote the high-quality development of the regional economy. The above findings provide an empirical basis for the development of green finance in the Yangtze River Delta to better promote the high-quality development of the local economy and also provide a useful reference for the positive interaction between green finance and economic development in other regions. Based on the above findings, the policy implications of this study are as follows: First, the Yangtze River Delta region should establish a mechanism for the integrated development of green finance, including the establishment of a unified green finance standard system to evaluate the development level of green finance more scientifically, and the overall formulation of regional green finance development planning to build a favorable related policy system, to promote the overall coordinated development of green finance in the region and alleviate regional development imbalances. Secondly, the connectivity of green finance infrastructure in the Yangtze River Delta should be promoted to better realize resource allocation and information sharing. For example, building a unified green financial service platform to realize the integration and docking of resources to improve the allocation efficiency of regional financial resources. Then, the Yangtze River Delta should give play to regional talent advantages. It is suggested to attract more professionals to devote themselves to the field of green finance and actively innovate green financial products to improve the innovation ability of green financial technology. Finally, local government departments should constantly improve and implement relevant fiscal support policies according to local conditions, encourage financial institutions to actively carry out green finance business, and build a favorable external environment for green finance development. At the same time, the government and financial institutions should increase financial support for green and environmental protection industries and guide high-polluting and energy-consuming industries to carry out technological transformation and upgrading, to better promote high-quality economic development.

Although this study has put forward relatively sufficient conclusion and some constructive suggestions, it still reflects some limitations. First of all, there is no unified conclusion on the indicators to measure green finance and high-quality economic development. According to previous literature studies, some indicators of green finance are explained by alternative indicators when constructing the index system (Guo, 2022). Although it has certain rationality, it still lacks certain authority. Therefore, it is still necessary to explore a more scientific and reasonable index system in future research. In addition, due to the limitations of the methodology and the lack of completeness of relevant data at the city level in the Yangtze River Delta, we failed to provide the status of high-quality green finance and economic development in each city in the Yangtze River Delta and targeted recommendations. In future studies, we will look for new methods and paths to obtain more refined data and conduct more targeted studies from the city level.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

This research was supported by the Humanities and Social Sciences Research Major Project of Education Department of Anhui Province (SK2019A1161).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Alvarez-Herranz, A., Balsalobre-Lorente, D., Shahbaz, M., and Cantos, J. M. (2017). Energy innovation and renewable energy consumption in the correction of air pollution levels. Energy Policy 105, 386–397. doi:10.1016/j.enpol.2017.03.009

An, W. (2008). A preliminary study on the mechanisms and practices of green finance. Econ. Surv. 5, 156–158. doi:10.15931/j.cnki.1006-1096.2008.05.039

Baloch, M. A., and Danish, (2022). CO2 emissions in BRICS countries: What role can environmental regulation and financial development play? Clim. Change 172 (1-2), 9. doi:10.1007/s10584-022-03362-7

Baloch, M. A., Danish, , and Meng, F. C. (2019). Modeling the non-linear relationship between financial development and energy consumption: Statistical experience from OECD countries. Environ. Sci. Pollut. Res. 26 (9), 8838–8846. doi:10.1007/s11356-019-04317-9

Baloch, M. A., Ozturk, I., Bekun, F. V., and Khan, D. (2020). Modeling the dynamic linkage between financial development, energy innovation, and environmental quality: Does globalization matter? Bus. Strategy Environ. 30 (1), 176–184. doi:10.1002/bse.2615

Baloch, M. A., Zhang, J. J., Iqbal, K., and Iqbal, Z. (2019). The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 26 (6), 6199–6208. doi:10.1007/s11356-018-3992-9

Cai, Q., and Wang, X. X. (2022). The impact of green finance on high-quality economic development from a spatial perspective. Jianghan Forum 6, 21–28.

Gao, J., Yu, J. P., Wu, T., and Liu, W. (2020). Research on coupling and coordinated development of the agricultural eco-economic system in our country. Chin. J. Agric. Resour. Regional Plan. 41 (1), 1–7.

Gu, P. Y., and Cai, Y. C. (2015). Development of green finance in developed countries and its enlightenment to our country. Environ. Prot. 43 (2), 44–47. doi:10.14026/j.cnki.0253-9705.2015.02.006

Guo, X. Y. (2022). Influence mechanism and empirical test of green finance in promoting low-carbon economic transformation. South. Finance 1, 52–67.

He, L. Y., Liu, R. Y., Zhong, Z. Q., Wang, D. Q., and Xia, Y. F. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 143, 974–984. doi:10.1016/j.renene.2019.05.059

He, Y. Q., Wang, Y. Y., Zhou, Y. F., and Zhou, Z. W. (2015). An empirical study on the coupling coordination of financial agglomeration, regional industrial structure, and ecological efficiency: A case study of three economic circles. Explor. Econ. Problems 5, 131–137.

Hu, G. Q., Wang, X. Q., and Wang, Y. (2021). Can the green credit policy stimulate green innovation in heavily polluting enterprises? Evidence from a quasi-natural experiment in China. Energy Econ. 98, 105134. doi:10.1016/j.eneco.2021.105134

Hu, S. Q. (2022). Development status and policy recommendations of green finance in the context of high-quality development: A case study of the Yangtze River Delta region. Hebei Finance 4, 33–36. doi:10.14049/j.cnki.hbjr.2022.04.011

Hu, W. T., Sun, J. N., and Chen, L. (2023). Green finance, industrial structure ecologization, and regional green development. Contemp. Econ. Manag. 45 (5), 88–96. doi:10.13253/j.cnki.ddjjgl.2023.05.011

Hua, Y. T., and Shi, B. F. (2023). Research on the impact of green finance on high-quality economic development. Front. Sci. Technol. Eng. Manag., 1–10. http://kns.cnki.net/kcms/detail/34.1013.N.20230515.1100.002.html.

Huang, X. H. (2019). An empirical study on the impact of energy consumption on potential economic growth rate: A case study of henan province. Adm. Assets Finance 9, 47–48.

Huo, Y. F. (2021). Green finance boosts high-quality economic development: A case study of Anhui province. Shijiazhuang, China: Hebei Normal University.

Jeucken, M., and Bouma, J. (1999). The changing environment of banks. Greener Manag. Int. 27, 20–35. doi:10.9774/gleaf.3062.1999.au.00005

Jiang, A. Y., and Hu, N. N. (2021). Different types of commercial banks' social responsibility, reputation spillover, and market effect: Based on the analysis of commercial banks' implementation of equator principle in China. J. Shandong Univ. Finance Econ. 33 (3), 80–88.

Li, C. G. (2023). The impact of green finance on high-quality economic development. J. Zhongnan Univ. Econ. Law (2), 65–77. doi:10.19639/j.cnki.issn1003-5230.2023.0014

Li, J. C., Shi, L. M., Xu, A. T., Du, D., Lin, Y., and Shao, M. (2019). Dispersive single-atom metals anchored on functionalized nanocarbons for electrochemical reactions. Stat. Res. 36 (1), 4–14. doi:10.1007/s41061-018-0229-9

Li, L. H., and Shi, B. W. (2022). Green finance, technological innovation, and regional industrial upgrading. Explor. Financial Theory 5, 62–71. doi:10.16620/j.cnki.jrjy.2022.05.006

Li, T. R., and Lin, H. (2023). Regional green finance, space spillover, and high-quality economic development. Explor. Econ. Problems 4, 157–174.

Li, X. H. (2020). On the path of green finance to promote the development of environmental protection industry. Agric. Econ. 11, 117–119.

Li, Y., Zhao, T. T., and Shu, T. Y. (2022). Spatiotemporal differentiation and the response of coupling coordination between green finance and high-quality economic development. Ecol. Econ., 1–12. http://kns.cnki.net/kcms/detail/53.1193.F.20220922.1505.002.html.

Li, Y., and Zhou, H. M. (2023). Study on the spatial effect and heterogeneity of green financial development on the transformation and upgrading of industrial structure: Explanation based on spatial Durbin model. J. Southwest. Univ. Nat. Sci. Ed. 45 (3), 164–174. doi:10.13718/j.cnki.xdzk.2023.03.014

Liang, H. T., and Ren, B. P. (2022). The coupling coordination and spatio-temporal evolution of finance and environment in the Yangtze River Delta urban Agglomeration. Statistics Decis. 38 (6), 159–163. doi:10.13546/j.cnki.tjyjc.2022.06.032

Lin, M. X., and Xiao, Y. B. (2023). Study on the measurement and mechanism of green Finance to promote high-quality economic development. Mod. Econ. Sci., 1–18. doi:10.20069/j.cnki.DJKX.202303008

Liu, F., and Ma, C. L. (2022). A study on the coupling and coordination of green finance affecting the high-quality development of regional economy. Jiangxi Soc. Sci. 42 (6), 42–52.

Liu, H. K., and He, C. (2021). Mechanism and test of green Finance promoting high-quality urban economic development: Empirical evidence from 272 prefecture-level cities in China. Invest. Res. 40 (7), 37–52.

Liu, R. Y., Wang, D. Q., Zhang, L., and Zhang, L. H. (2019). Can green financial development promote regional ecological efficiency? A case study of China. Nat. Hazards 95, 325–341. doi:10.1007/s11069-018-3502-x

Markandya, A., Antimiani, A., Costantini, V., Martini, C., Palma, A., and Tommasino, M. C. (2015). Analyzing trade-offs in international climatepolicyoptions: The case of the green climate fund. World Dev. 74 (10), 93–107. doi:10.1016/j.worlddev.2015.04.013

Ning, W., and She, J. H. (2014). An empirical study on the dynamic relationship between green finance and macroeconomic growth. Seek 8, 62–66. doi:10.16059/j.cnki.cn43-1008/c.2014.08.050

Park, Y., Meng, F. C., and Baloch, M. A. (2018). The effect of ICT, financial development, growth, and trade openness on CO2emissions: An empirical analysis. Environ. Sci. Pollut. Res. 25 (30), 30708–30719. doi:10.1007/s11356-018-3108-6

Ren, X. D., Shao, Q. L., and Zhong, R. Y. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 277, 122844. doi:10.1016/j.jclepro.2020.122844

Research Group of Hangzhou Central Sub-branch of the People's Bank of China and W. F. Lu (2022). Development status, problems and suggestions of green finance integration in the Yangtze River Delta. Zhejiang Finance (2), 3–14.

Sachs, J. D., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). Importance of green finance for achieving sustainable development goals and energy security. Handb. Green Finance, 3–12. doi:10.1007/978-981-13-0227-5_13

Schafer, H. (2018). Germany: The ‘greenhorn’ in the green finance revolution. Environ. Sci. Policy Sustain. Dev. 60 (1), 18–27. doi:10.1080/00139157.2018.1397472

Shao, C. L., and Yan, Y. S. (2020). Is green finance a "double-edged sword" for commercial banks' risk-taking: A quasi-natural experimental study in China's banking industry. J. Guizhou Univ. Finance Econ. 1, 68–77.

Su, D. W., and Lian, L. L. (2018). Does green credit affect the investment and financing behavior of heavy polluters? Financial Res. 12, 123–137.

Sun, M. Y. (2022b). Research on Coupling relationship between green finance and high-quality economic development in our country. Manag. Adm., 1–14. doi:10.16517/j.cnki.cn12-1034/f.20221226.001

Sun, Z. Y. (2022a). Role mechanism and innovation path of green finance to boost high-quality economic development. J. Shenyang Official 24 (5), 39–41.

Taghizadeh-Hesary, F., Yoshino, N., and Phoumin, H. (2021). Analyzing the characteristics of green bond markets to facilitate green finance in the post-COVID-19 world. Sustainability 13 (10), 5719. doi:10.3390/su13105719

Tian, J. L., Huang, W. Y., Peng, J. C., and Fu, S. K. (2022). Transmission mechanism and spatial effect of green finance enabling carbon neutrality. West Forum 32 (5), 44–62.

Tolliver, C., Keeley, A., and Managi, S. (2020). Policy targets behind green bonds for renewable energy: Do climate commitments matter? Technol. Forecast. Soc. Change 157, 120051. doi:10.1016/j.techfore.2020.120051

Usman, M., and Balsalobre-Lorente, D. (2022). Environmental concern in the era of industrialization: Can financial development, renewable energy, and natural resources alleviate some load? Energy Policy 162, 112780. doi:10.1016/j.enpol.2022.112780

Wang, C., Liu, J., and Hu, Y. X. (2021a). Coupling coordination and orientation choice of Green Economy and green finance development in Anhui Province. J. Anqing Normal Univ. Soc. Sci. Ed. 40 (4), 70–76. doi:10.13757/j.cnki.cn34-1329/c.2021.04.012

Wang, K. H., Zhao, Y. X., Jiang, C. F., and Li, Z. Z. (2022a). Does green finance inspire sustainable development? Evidence from a global perspective. Econ. Analysis Policy 75, 412–426. doi:10.1016/j.eap.2022.06.002

Wang, L. P., Xu, J. H., and Li, C. (2021b). Mechanism of action and stage evolution of green financial policies for corporate innovation. Soft Sci. 35 (12), 81–87. doi:10.13956/j.ss.1001-8409.2021.12.13

Wang, R. (2021). Evaluation of the governance effect of green finance and green policy choice in China: Based on the micro data of 334 public companies. Macroecon. Res. 6, 133–145. doi:10.16304/j.cnki.11-3952/f.2021.06.012

Wang, S., Liu, W. F., and Liu, Y. X. (2022b). Measurement and driving mechanism of regional economic integration in the Yangtze River Delta: From the perspective of high-quality development. Stat. Res. 39 (12), 104–122.

Wang, Y., Pan, D. Y., and Zhang, X. (2016). Study on the contribution of green finance to China's economic development. Comp. Econ. Soc. Syst. 6, 33–42.

Wang, Z. C., and Wang, Y. F. (2020). Green finance boosts high-quality economic development: Main paths and countermeasures and suggestions. J. Agro-Forestry Econ. Manag. 19 (3), 389–396. doi:10.16195/j.cnki.cn36-1328/f.2020.03.42

Wen, S. Y., Liu, H., and Wang, H. (2022). Green finance, green innovation, and high-quality economic development. Financial Res. 8, 1–17.

White, M. A. (1996). Environmental finance: Value and risk in an age of ecology. Bus. Strategy Environ. 5 (3), 198–206. doi:10.1002/(sici)1099-0836(199609)5:3<198::aid-bse66>3.0.co;2-4

Wu, W. L., and Chen, W. X. (2022). Study on synergistic effect and differential convergence of inclusive green development in the Yangtze River Economic Belt. Rev. Econ. Res. 6, 103–118. doi:10.16110/j.cnki.issn2095-3151.2022.06.009

Wu, Z. H., Wang, J., Yin, B. J., Hou, J. R., Feng, X. W., and Peng, W. H. (2021). The exploration and practice of creating the green development of coal enterprises. E3S Web Conf. 275, 02021. doi:10.1051/e3sconf/202127502021

Xu, Z. F., Baloch, M. A., Danish, , Meng, F. C., Zhang, J. J., and Mahmood, Z. (2018). Nexus between financial development and CO2 emissions in Saudi arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 25 (28), 28378–28390. doi:10.1007/s11356-018-2876-3

Xie, X. S., and Yan, S. P. (2021). Study on coupling and coordination between green finance and high-quality economic development in Fujian Province. J. Fujian Bus. Univ. 2, 36–44. doi:10.19473/j.cnki.1008-4940.2021.02.006

Xu, X. Y., and Tian, X. X. (2022). Spatial and temporal evolution and trend prediction of green development level in the Yangtze River Delta urban agglomeration. Resour. Environ. Yangtze Basin 31 (12), 2568–2581.

Yu, B., and Fan, C. L. (2022). Green finance, technological innovation, and high-quality economic development. Nanjing Soc. Sci. 9, 31–43. doi:10.15937/j.cnki.issn1001-8263.2022.09.004

Yu, L. (2016). Research on green finance development and innovation. Econ. Probl. 1, 78–81. doi:10.16011/j.cnki.jjwt.2016.01.014

Zeng, X. W., Liu, Y. Q., Man, M. J., and Shen, Q. L. (2014). Measurement and analysis of the development degree of green finance in China. J. China Exec. Leadersh. Acad. Yan'an 7 (11), 112–121.

Zhang, Q., and Shen, J. Q. (2023). Spatio-temporal evolution and driving mechanism of the coordinated level of high-quality development in the Yangtze River Delta. East China Econ. Manag. 37 (1), 24–32. doi:10.19629/j.cnki.34-1014/f.220616004

Zhang, Q., and Yu, Y. (2023). A study on the role of green finance on high-quality urban development: Evidence from data of 277 prefecture-level cities. Financial Dev. Res. 3, 52–58. doi:10.19647/j.cnki.37-1462/f.2023.03.008

Zhang, T., Li, Z. H., and Cui, J. (2022). Green finance, environmental regulation, and industrial structure optimization. J. Shanxi Univ. Finance Econ. 44 (6), 84–98. doi:10.13781/j.cnki.1007-9556.2022.06.007

Zhou, F. M. (2019). Thoughts and suggestions on accelerating the reform and development of green finance in Shandong Province. Financial Dev. Res. 1, 3–9. doi:10.19647/j.cnki.37-1462/f.2019.01.001

Zhou, H. M., and Lu, J. (2017). Measurement of the coupling degree between financial development and economic growth: A case study of the Yangtze River Delta urban agglomeration. Urban Probl. 3, 59–66+86. doi:10.13239/j.bjsshkxy.cswt.170308

Zhou, X. G., Tang, X. M., and Zhang, R. (2020). Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environ. Sci. Pollut. Res. 27 (16), 19915–19932. doi:10.1007/s11356-020-08383-2

Keywords: green finance, high-quality economic development, VAR model, coupled coordination model, grey correlation model, Yangtze River Delta

Citation: Zhang S, Liang B-B, Xu S-Z and Hou J-L (2023) Empirical analysis of green finance and high-quality economic development in the Yangtze River Delta based on VAR and coupling coordination model. Front. Environ. Sci. 11:1211174. doi: 10.3389/fenvs.2023.1211174

Received: 25 April 2023; Accepted: 07 June 2023;

Published: 28 July 2023.

Edited by:

Taqwa Hariguna, Amikom University Purwokerto, IndonesiaReviewed by:

Muhammad Awais Baloch, Baoji University of Arts and Sciences, ChinaCopyright © 2023 Zhang, Liang, Xu and Hou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jin-Long Hou, aG91amlubG9uZzIwMDBAMTI2LmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.