- 1UM6P, School of Architecture Planning and Design SAP+D, Mohammed VI Polytechnic University, Ben Guerir, Morocco

- 2Graduate School of Economics and Management, Ural Federal University, Ekaterinburg, Russia

- 3Department of Local Governance and City Management, SD Dombo University of Business and Integrated Development Studies, Wa City, Ghana

- 4International Planning Studies, TU-Dortmund, Dortmund, Germany

- 5Department of Urban Regional Planning, Ardhi University, Dar es Ssalam, Tanzania

- 6Ecole Polytechnique Fédérale de Lausanne, Lausanne, Switzerland

Studies on urban environmental quality are evolving emphasizing the need for policy response concerning the enactment of environmental regulations to attain sustainable development goals (SDGs), mainly target 13. Over the years, the concerns to improve urban environmental quality especially managing noise, air quality, water, sanitation, and waste have increased. Consequently, limited studies exist on the determinant of urban environmental quality. This paper attempts to build on existing studies of environmental quality, by analyzing the determinants of environmental quality in urban Morocco in the context of important factors, such as energy consumption, urbanization, manufacturing, and financial development. The study draws on time series data covering the period from 1971 to 2019 and uses Autoregressive Distributed Lag (ARDL) approach to analyze the impacts of per capita income, energy consumption, urbanization, manufacturing value-added, capital investment, and financial development on CO2. The findings of this research reveal both short-run and long-run associations between these variables in Morocco. Manufacturing activities and financial development significantly deteriorate Moroccan environmental quality in the long-run. The findings suggest that efforts towards improving environmental quality in urban Morocco require the development and implementation of urban policies that advocate for the adoption and advancement of sustainable energy sources.

1 Introduction

Globalization and industrialization together with the rising global urban population have awakened the interests and concerns about environmental quality control including air pollution, water and sanitation, open spaces and waste management especially among policy-makers, scholars, and development agencies (Schwela et al., 2012; Panagopoulos et al., 2016; Imamoglu, 2018; Hunjra et al., 2020). Controlling these issues is necessary to promote goal 13 of SDGS, which demands significant actions to curb climate change. In rapidly urbanizing countries, air pollution, poor sanitation, and waste disposal challenge cities’ efforts toward the attainment of green growth (Kahn & Walsh, 2015; OMS, 2020). Studies show that rising air pollution and solid and liquid waste place residents at risk of respiratory health disorders (Schwela et al., 2012). Studies linking urbanization (URB) and environmental quality demonstrate how the growth of cities fosters the rise in the usage of existing natural resources and the usage of uncleaned energy-related technologies leading to higher levels of emissions (Silva & Mendes, 2012; Kahn & Walsh, 2015). Others show how low enforcement of regulations and policies contributes to poor environmental quality in the urban environment (Imamoglu, 2018). Related studies of cities’ environmental quality highlight how the rise in human population prompts the rise in air pollution through the use of uncleaned energy technologies (Schwela et al., 2012). Some works also demonstrate the ripple effects of industrial activities on urban environmental quality, by revealing that informal economic activities tend to foster air and water pollution in the urban environment (Schwela et al., 2012; Imamoglu, 2018). In addition, poor environmental quality affects the prosperity of cities, because urban environmental quality influences the standard of living for inhabitants, particularly their health and well-being (Van Kamp et al., 2003; Silva & Mendes, 2012; Panagopoulos et al., 2016; Hunjra et al., 2020).

Regrettably, cities in the global South are more or less at risk of poor environmental quality, including poor sanitation and solid and liquid wastes as a result of low enforcement of environmental policies and regulations, unguided urbanization, and excessive concentration of human and industrial activities in the urban areas (Silva & Mendes, 2012; Ganda, 2021). Some studies demonstrate the roles of urban policies and regulations towards environmental quality control, by revealing that countries (e.g., Hong Kong, Tokyo, and Singapore) that uphold environmental quality control policies and regulations witness significant improvement in urban environmental quality, especially air quality (Schwela et al., 2012). These studies more or less advocate for adequate knowledge of the factors that influence the quality of the urban environment towards the design of appropriate policies and regulations (Panagopoulos et al., 2016; Mackie & Haščič, 2018). Nonetheless, related studies on urban environmental quality have been engrossed in the design of appropriate tools and indexes for effective tracking and analysis of the various components of environmental quality, such as water quality, air quality, sanitation, and waste amongst others (Silva & Mendes, 2012; Stossel, Kissinger, & Meir, 2015).

The correlation between sustainable financing of banks and its impact on financial risk management has been evidenced by certain scholars (Liu & Huang, 2022). Also, empirical works revealed how financial development (FD) impacts energy consumption (ENC) in developing countries (Sadorsky, 2010). Some works also highlight the role of economic, financial, and institutional development on environmental degradation, and reveal how economic development contributes to reducing environmental degradation, especially when regulated (Tamazian & Rao, 2010). This study seeks to contribute to the literature on urban environmental quality through an analysis of the interlinked roles of ENC, URB, manufacturing value added (MVA), and FD in the Moroccan urban context. This work is necessitated by rapid urbanization, the proliferation of manufacturing activities and financial institutions, especially in major cities of the global South as well as the observed environmental risk associated with the financial investment (Liu & Huang, 2022). Cities serve as the common grounds, where industrial activities and rising population along with financial support of institutions increase ENC (Imamoglu, 2018; Liu & Huang, 2022). In light of this, some scholars argue that the financial sector has the potential to significantly contribute to the mobilization and utilization of savings, enhancement of business transactions, and effective monitoring of resource allocation toward economic development (Adekunle et al., 2013; Nasreen et al., 2017). Therefore, an adequate understanding of the roles of ENC, URB, manufacturing firms, and FD may serve as input for further reflections and tailoring policy interventions toward improving urban ecological quality.

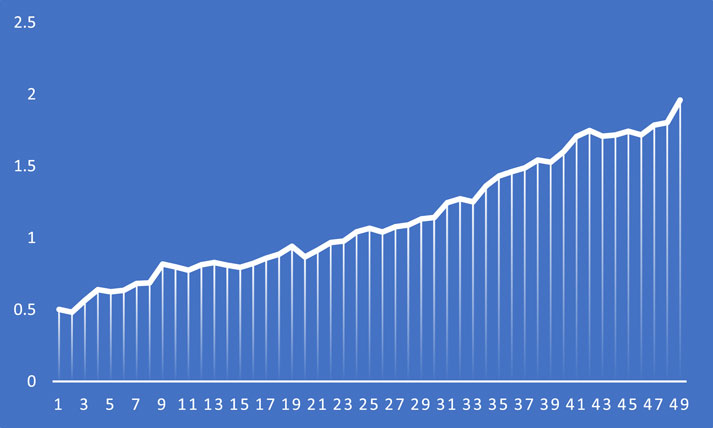

Morocco is facing a situation of increasing environmental deterioration due to a rise in emissions as shown in Figure 1. Some studies affirm that Morocco’s financial sector facilitates business transactions for economic development often by promoting investment activities in the urban environment. These comprise the allocation of resources to productive channels, facilitating trade exchanges, managing risks, and as well encouraging companies to adopt environmentally sustainable practices, such as eco-friendly manufacturing methods in their daily operations. Dasgupta et al. (2001) demonstrate the correlation between the cleanliness of urban environments and the financial stability of countries. By revealing that nations with more advanced financial markets tend to have cleaner cities. Nations possessing stable financial markets have a tendency to lure greater numbers of foreign direct investment (FDI) with the aim of fostering growth which poses positive impacts on urban environmental quality. Studies suggest that there is a noticeable connection between the advancement of the financial sector and the standard of environmental quality. Also, enhancement in financial operations may spur economic growth (GDP) with a likely ripple effect on the level of environmental protection and preservation, as observed by the environmental Kuznets curve (EKC) (Schwela et al., 2012; Ganda, 2021). Again, FD may impact the urban environment positively, especially in urban environments where private sector actors invest more in improved technologies, that are less detrimental to the environment. The increase in investment results in a corresponding rise in energy usage in industries, resulting in an increase or decrease in carbon dioxide emissions (CO2). This is equally dependent on the type of energy sources being used (Mesagan et al., 2018).

Some scholars suggest that credit allocation may serve as a viable policy strategy for maintaining environmental quality. In this context, the denial of credit facilities to high-carbon emitting firms by financial institutions or restricting credit facilities to low-carbon emitting firms may reduce the externalities that firms exert on the urban environment (Sovacool, 2011; Gallagher & Qi, 2021). In light of this, other studies conclude that strong financial performance is crucial in driving firms’ activities toward the promotion or protection of the environment (Charfeddine and Khediri, 2016; Mahalik et al., 2017; Maji et al., 2017; Shahbaz et al., 2017; Salahuddin et al., 2018). Within the framework of theoretical explanations, the EKC suggests that during the initial growth phase of an economy, growth may be accomplished through a rise in emissions levels. Adding that, green growth may be attained via regulation of the emissions as the economy becomes financially stable (Andreoni and Levinson, 2001; Dasgupta et al., 2001). This is regardless of the state of economic development. The EKC also suggest that the link between GDP and environmental pollution follows an inverted U-shape (Dasgupta et al., 2001). Indeed, the standard of financial services within a nation may stimulate economic development (Levine, 1996). Therefore, a thorough understanding of the functions of FD, ENC, URB, and MVA are critical in the drive towards green growth. Thus, promoting environmental quality through the impacts of ENC, URB, MVA and improving the financial system is at the center of this scientific investigation. Sadorsky (2011) reveals that FD impacts energy demand. Thus, policies towards preserving energy and reducing CO2 emissions are necessary in the context of FD. Therefore, to manage CO2 emissions effectively, it is important to have a deeper understanding of energy demand patterns. Karanfil (2009) suggests enhancing the energy demand function by incorporating crucial financial indicators in addition to just income variables. This suggests the need to understand the interplay of ENC, URB, MVA, and FD towards urban environmental quality.

This paper aims to analyze the determinants of urban environmental quality by assessing the nexus of ENC, URB, MVA, FD, and CO2 taking the context of urban Morocco. The study is topical for Morocco due to the necessity to consider the roles of manufacturing activities and the financial sector in reducing CO2 emissions and supporting environmental quality efforts.

The article is structured as follows: Section 2 draws a review of the literature to gain insight into the factors that impact urban environmental quality. Section 3 outlines the material and methods; section 4 illustrates the analysis of the empirical findings and corresponding discussions; and finally, section 5 offers policy recommendations and concluding remarks intended to enhance urban environmental quality.

2 Review of literature

In the second part, we examine existing literature to gain preliminary insight into the interlinked role of manufacturing activities, ENC, URB, and FD. We discuss cross and country-specific studies in the context of urban environmental quality. Studies such as Moghadam and Dehbashi (2018) analyze the extent to which FD influences the quality of Iran’s environment. These studies show that FD tends to worsen environmental degradation. Similarly, Boutabba (2014) examines the interplay between FD and the roles of income and ENC in India. It confirmed the EKC hypothesis in the contest of the Indian economy. Further, it revealed a unidirectional causal relationship between income, ENC, FD, and CO2. Considering the context of Qatar and using the ARDL bounds testing approach, Charfeddine et al. (2018) observe that a relationship exists between environmental degradation and GDP in Qatar’s economy. Their study showed the EKC hypothesis. They further recommend the promotion of policies towards fostering energy conservation and mitigating the harmful impacts of GDP on the environment. Related studies, such as Jalil and Feridun (2011), also show that a relationship exists between FD and the environment, by revealing that FD tends to foster a decrease in environmental pollution. Jalil and Feridun conduct their studies in China and discover the presence of the EKC.

Furthermore, some scholars such as Shahbaz et al. (2013), note that FD and trade liberalization in turn lower CO2 emissions, while GDP turns to contribute to the rise in CO2 emissions. Through analysis of the Malaysian economy, Alam et al. (2015) uncover the correlation between CO2 emissions and the provision of domestic credit to the private sector. Additionally, they show that an increase in access to monetary provisions tends to enhance carbon emissions. Others demonstrate how energy demand shapes the financial sector, by revealing that rising demand for energy tends to significantly heighten financial sector credit and affects monetary supply in the form of credit. Further studies such as Maji et al. (2017) demonstrate how FD boots CO2 emissions. Through sectoral analysis, they show that the intensity of CO2 emissions was associated with the development of transportation, oil and gas sectors. They further show that CO2 emissions witness a reduction with the advancement of manufacturing and construction sectors in Malaysia. Furthermore, related studies such as Hunjra et al. (2020) conducted in Southern Asia also reveal how FD translates into a rise in CO2 emissions. They further reveal that FD in Asian countries manifests more capitalization than technological improvement for green production.

Charfeddine and Khediri (2016) analyze the association between FD and CO2 emissions drawing on cointegration alongside structural breaks. Their studies reveal an inverted U-shaped relationship between FD and CO2 emissions. Additionally, they demonstrate that factors such as electricity usage, trade openness (TO), and URB levels also play an important role and tend to promote improvement in environmental quality in the United Arab Emirates. Related studies also reveal short and long runs co-existing relationships between low environmental quality, weak financial sector, and ENC. For example, studies concerning the Nigerian economy reveal existing positive linear relationships between income and CO2 emissions as well as a correlation between FDI, TO, and CO2 emissions, but found no relation on the presence of the EKC in the context (Alege and Ogundipe, 2015). Related studies devoted to the analysis of the Turkish economy reveal long-term co-existing relationship between CO2 emission, real income, FD, ENC, and trade (Ozturk and Acaravci, 2013). They also indicate that FD does not affect the environment in Turkey. Drawing the context of India, Shahbaz et al. (2014) demonstrate an absence of a causal relationship between FD and ENC. They show that FD and ENC tend to negatively affect the growth of income.

Furthermore, studies devoted to the analysis of income inequality in Asian economies also indicate the existence of a negative correlation between FD and CO2 emissions (Khan et al., 2018). They further show that a high rate of income inequality tends to limit the rate of carbon emissions. It is observed that an increase in ENC often leads to a corresponding rise in carbon emissions in Asian economies. Moreover, related studies that examine causality in both the short and long-run between FD, ENC, and GDP in six countries’ reveal the presence of a persistent connection between FD, GDP, and ENC over the long-term (Kahouli, 2017). Kahouli’s studies also reveal short-run causality. Abid (2017) sought to examine the EKC hypothesis focusing on the (in)direct impacts broadly in developed and developing economies. Abid shows a monotonically increasing association between CO2 and GDP in both the global North and South. Other studies focusing on the interplay of ENC, URB, and CO2 emissions in the Middle East and North African (MENA) economies also confirm the existing long-run bidirectional positive association between the aforementioned variables (Al-Mulali et al., 2013).

Al-Mulali et al. (2016) conducted an empirical investigation into the correlation between FD and CO2 emissions in European countries. They found that FD has a negative impact on the environment as it leads to an increase in CO2. Similarly, Abbasi and Riaz (2016) re-analyzed the relationship between FD and CO2 emissions by incorporating FDI into the equation for CO2 emissions.

Studies estimating the case of countries in the Gulf Cooperation Council (GCC) confirm a long-run causal nexus between the increase of CO2 emissions, FD, and economic development (Bekhet et al., 2017). They further note that FD unidirectionally contributes to CO2 emissions in the UAE, Oman, and Kuwait. Others show that FD and rising usage of energy are invariably linked to environmental pollution. These studies thus, recommended energy policies towards reducing emissions, especially in economies experiencing rising consumption of energy (Al-Mulali and Sab, 2012). Also, in the Asian economies, studies depict that an increase in financial stability tends to affect carbon emissions negatively. They note that a rise in ENC and gross domestic product instigate a rise in CO2 emissions (Nasreen et al., 2017). Others observed a bidirectional interconnection between income and CO2 emissions, FD, and trade liberalization. They also reveal the existence of a unidirectional relationship manifesting between income, CO2 emissions, and FD, particularly in the MENA economies (Omri et al., 2015), Further studies analyzing the interlink between FDI, URB, FD, and MVA in Western Africa region reveal that a rise in environmental degradation is often occasioned by multiple factors including GDP and renewable ENC (Saidi and Mbarek, 2017; Radoine et al., 2022). Following the above survey of the literature, it is evident that there is very limited recognition of the relationship between manufacturing activities and FD as essential determinants of environmental quality. The present study seeks to build on existing studies on urban environmental quality by deepening our understanding of the basis of urban environmental quality drawing on the interplay between ENC, URB, MVA, and FD.

3 Materials and methods

3.1 Data and variables

In this paper, the Stochastic Impacts by Regression on Population, Affluence, and Technology (STIRPAT) model is employed to examine the influence of various factors on the environmental quality in urban areas in Morocco. The model known as the SIRPAT, which was initially introduced by Dietz and Rosa (1994) and later expanded upon by York et al. (2005), has been extensively used in previous studies to investigate the relationship between socioeconomic changes and environmental degradation. Typically, this model considers population as an independent variable and uses income per capita as the independent variable, and CO2 emissions per capita as the dependent variable. In its general form, the SIRPAT model can be expressed as follows:

Environmental indicator (I) is represented by CO2 emissions, economic growth represents affluence (A), urbanization represents population (P), and energy consumption represents technology (Table 1). The symbol “a” is used to denote the constant, whereas the elasticities of population, affluence, and technology are indicated by “b,” “c,” and “d,” respectively.

Urbanization was employed as a metric to assess the impact of population, as the concentration of people in urban areas has a significant bearing on emissions levels. Morocco is already witnessing rising urbanization. Due to the model’s flexibility in representing various variables, we add variables such as MVA, FDI, and FD to understand their relationships with urban environmental degradation in Morocco. The chosen variables for the research study are transformed into their natural logarithmic form as presented below.

3.2 Methodology

3.2.1 Unit root tests

To start, we conducted a unit root analysis in our first step to examine the unit root characteristics of our variables. It's essential to conduct a unit root analysis before applying cointegration and causality techniques. Cointegration tests can only be applied if our variables are integrated at the first difference. Additionally, some cointegration methods can be affected by fractional integration, so it's crucial to determine whether our variables have the same level of integration or are fractionally integrated. We employed two tests, namely the Phillips-Perron (PP) unit root test and the Augmented Dickey-Fuller (ADF) test, to assess the order of integration. These tests check the null hypothesis of non-stationary against the alternative hypothesis of stationary. However, according to Dai et al. (2023), the ADF and PP unit root tests have low power and may generate unreliable outcomes in the existence of structural breaks in the data. To address this, we used the Perron unit root test, which is effective for detecting one unknown structural break in the data.

3.2.2 The ARDL bound test

The ARDL bound testing approach was chosen for its various benefits. This method is highly adaptable, accommodating variables that are integrated at 1 (0) and/or 1 (1), making it suitable for small sample sizes (Ahmed et al., 2022a). Selecting an appropriate lag length is crucial when implementing the ARDL approach to avoid potential endogeneity issues. Moreover, this technique simultaneously provides both long-run and short-run outcomes, with the error correction term (ECT) revealing valuable insights into the convergence to the long-run equilibrium path (Ahmed et al., 2022b). Given the advantages mentioned above, we opted for the ARDL approach in our research and developed the subsequent ARDL model for our variables.

The abbreviated notations used in the model are as follows: the short-run coefficients are represented by βa to βg, while β1 to β7 represents the long-run coefficients. The symbol ∆ denotes the first difference operator, and μ t stands for the error term. To determine the cointegration, we employed the ARDL bound test, where the F-statistics produced by the test is compared with critical values. Once we confirmed the presence of a cointegration relationship between variables, we estimated Equation 2 to compute the long-run and short-run dynamics. Furthermore, we conducted several diagnostic tests to ensure the stability of our model.

4 Results and discussion

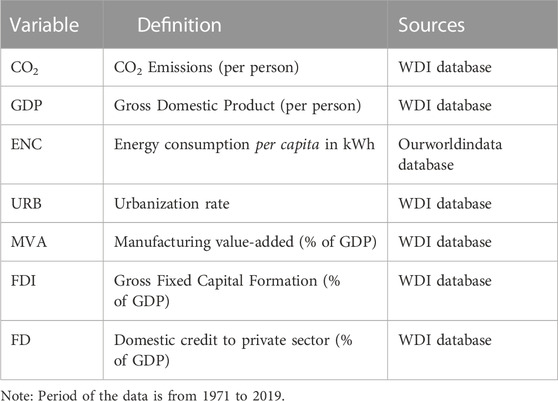

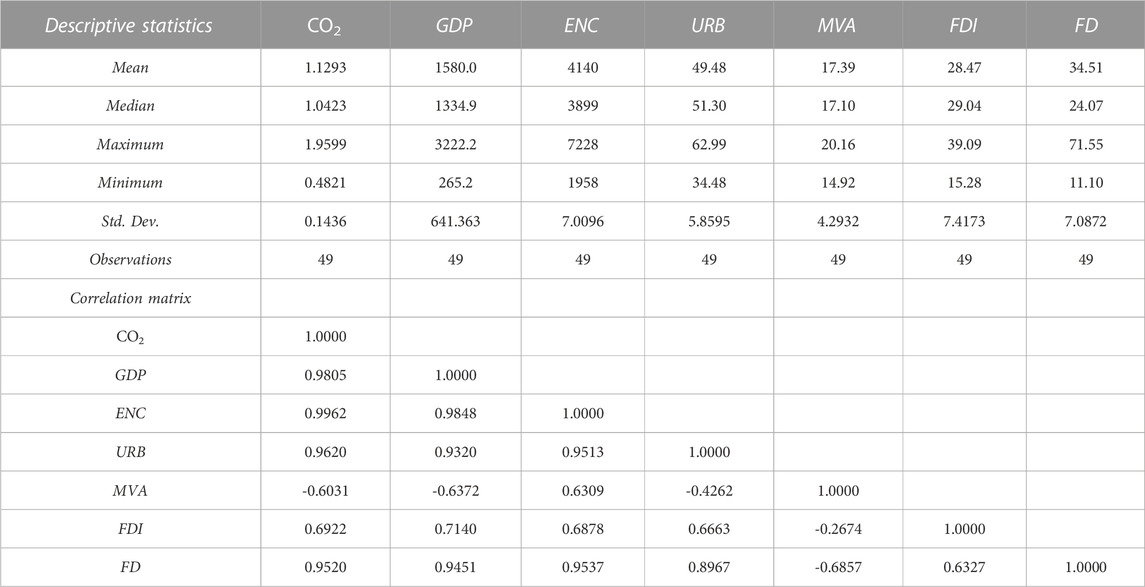

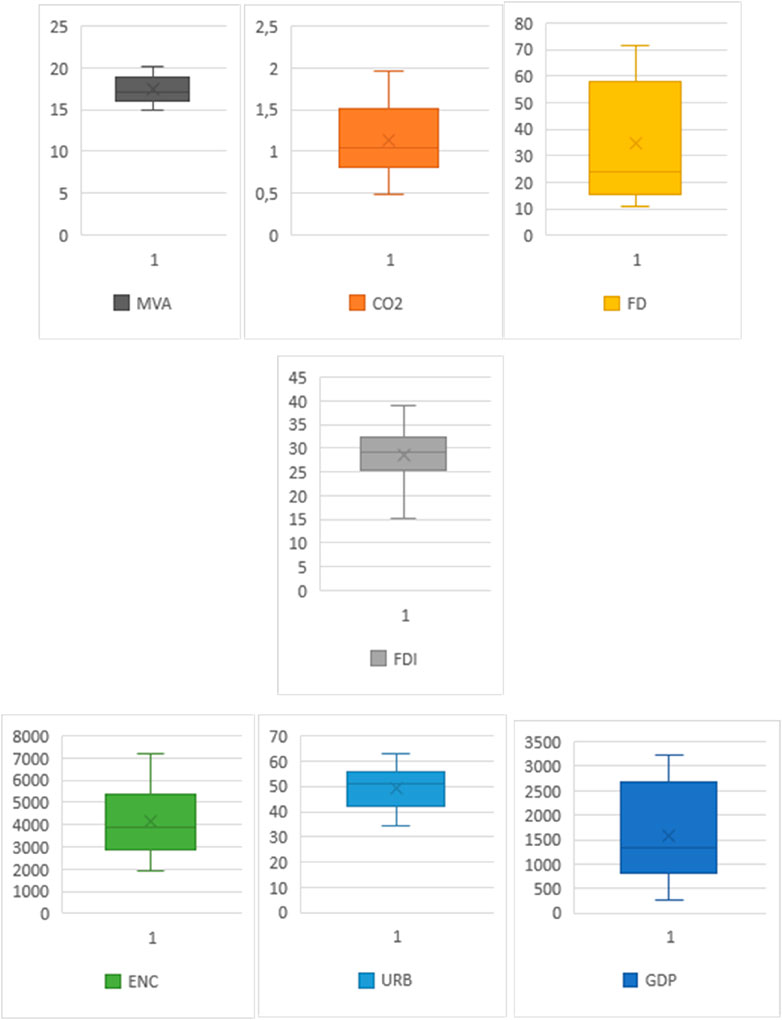

Before analyzing the selected series, it is crucial to examine the descriptive statistics of the studied variables. Table 2 summarizes the Moroccan data set within a span of 49 years (1971–2019) of the selected variables. The outputs of a pair-wise correlation matrix to explain the correlation between the selected variables are reported in Table 2. The findings reveal that CO2 emissions are strongly correlated with GDP, ENC, and URB. CO2 emissions are also negatively correlated with MVA and moderately correlated with FDI.

The descriptive statistics as shown in Figure 2 in the box plots, the dot represents the mean, the horizontal line within the box represents the median, and the upper and lower limits of data represent minimum and maximum values.

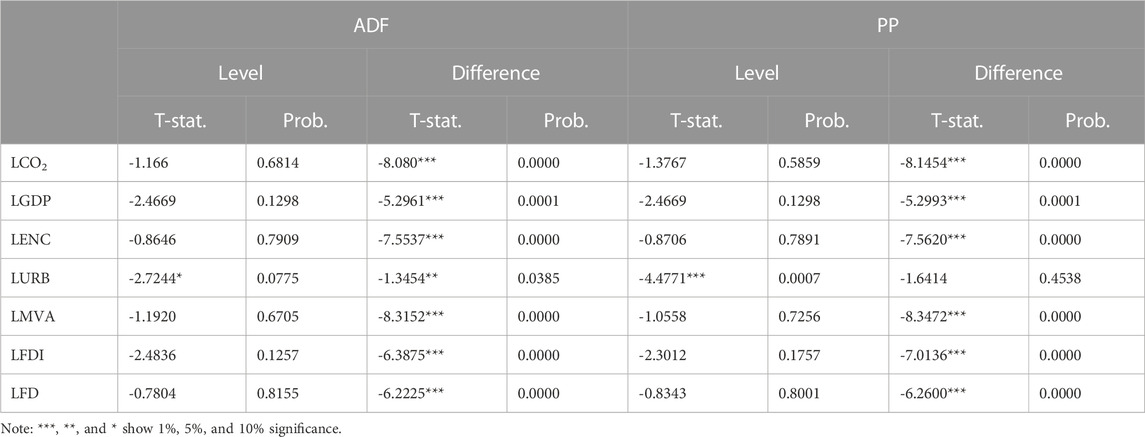

Table 3 represents the findings of the conventional unit root tests. PP and ADF tests show that most of the chosen variables possess a unit root at 1 (0), except for URB, which is stationary at 1 (1).

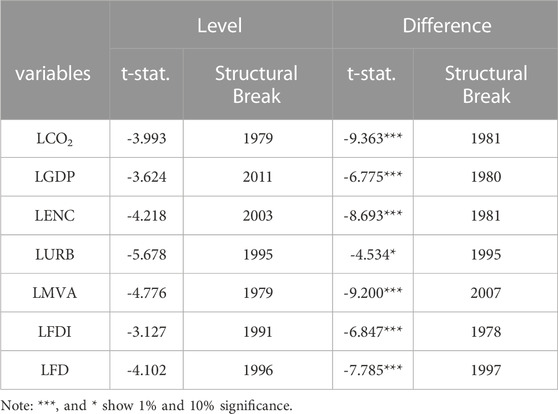

Ahmed and Wang (2019) and Ahmed et al. (2019b) represent the drawback of these unit root tests which do not furnish information regarding structural breaks. As a result, this study employs the Perron structural break test in order to identify any unspecified structural breaks. Structural breaks discovered in the case of CO2 emissions, GDP, ENC, URB, MVA, FDI, and FD are in the years 1981, 1986, 1981, 1995, 2007, 1978, and 1997, respectively. The test outcomes are represented in Table 4.

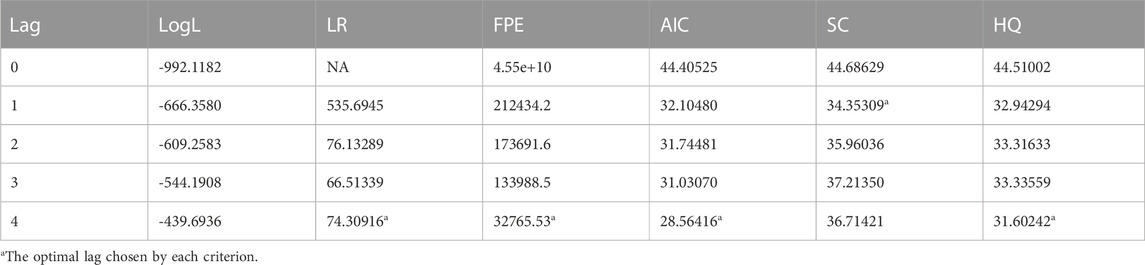

Schwarz information criterion (AIC) is used for the optimal lags’ selection (see Table 5).

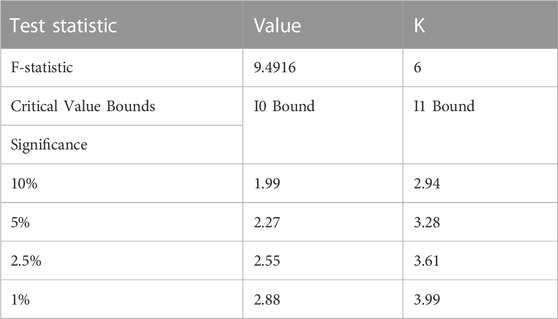

Table 6 represents the bound test output, which shows the F-statistics and the relevant lower and upper bound values. The results presented show that F-statistics value is higher than the upper values, which indicates the existence of cointegration among the variables chosen in the model.

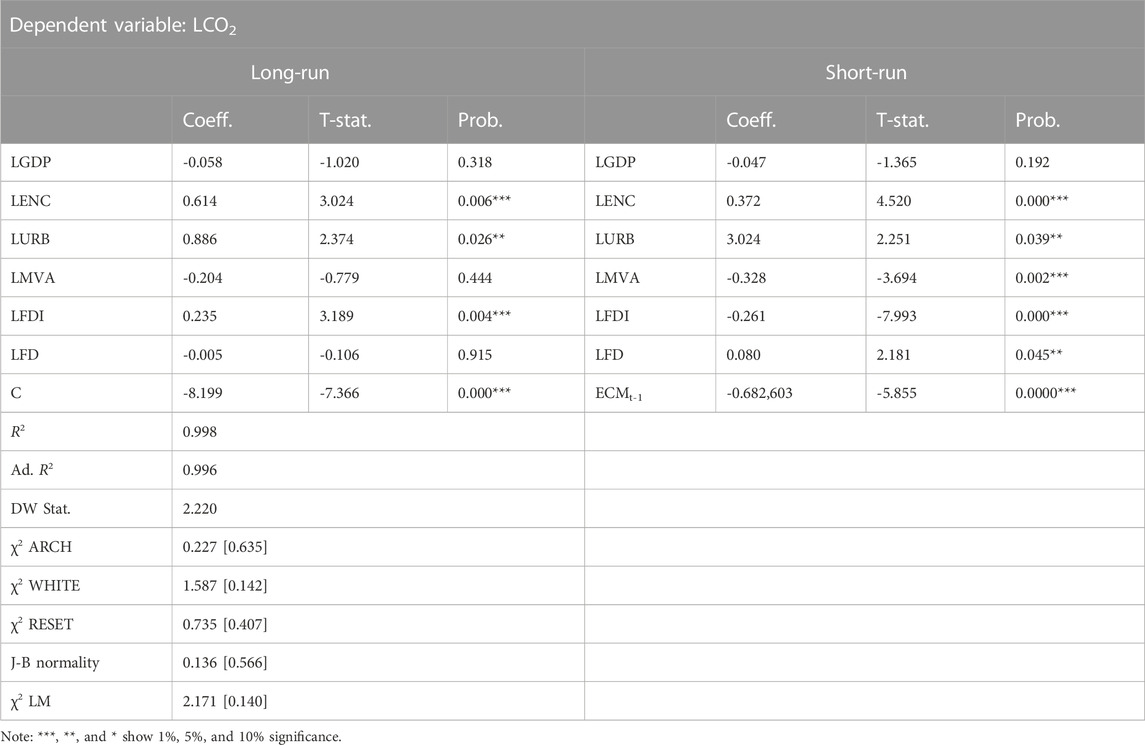

In Table 7, we show the short-term and long-term ARDL estimations. In the short-run, ENC, URB, and FD are positively connected to the CO2 emissions in Morocco. The results indicated that an increase in ENC, URB, and FD by 1% will enhance CO2 emissions by 0.373%, 3.024%, and 0.080%, respectively. In the long-term, a rise in ENC, URB, and FDI by 1% will increase the CO2 emissions by 0.614%, 0.886%, and 0.235%, respectively. Furthermore, an increase in GDP, MVA, and FD by 1% reduces CO2 emissions by 0.047%, 0.328%, and 0.261% in the short run. This suggests that an increase in GDP in Morocco may result in an enhancement in the quality of the environment in Morocco. However, the increase of 1% in GDP, MVA, and FD will decrease CO2 emissions by 0.058%, 0.204%, and 0.005% in the long run, respectively. Similar outputs exist in previous studies like Alege and Ogundipe (2015) in Nigeria, Ozturk and Acaravci (2013) in the Turkish economy and Kirikkaleli and Sofuoğlu (2023) in Ireland.

The findings we obtained also align with Tamazian et al.'s (2009) study. Notably, they demonstrated that advanced capital markets can lower financing expenses and direct financial capital toward procuring new equipment and funding novel ventures. These actions, in turn, improve environmental quality.

The negative consequences of ENC on environmental degradation in Morocco are justified by the country’s energy dependence on fossil energy imports. As a result, Morocco has increased its investments in renewable energy over the last decade to reach an aim of 52% by 2030. The findings align with those of previous studies conducted by Ulucak et al, 2020 focused on the case of OECD countries and those of Destek and Sinha (2020).

Diagnostic tests represent the reliability of this analysis. Statistical test results including DW and χ2 LM show that there is no evidence of serial correlation in this model. Additionally, the χ2 ARCH and χ2 WHITE tests indicate that the model is not affected by autoregressive conditional heteroskedasticity and white heteroskedasticity. The model is found to be well-suited based on the results of the Ramsey test (χ2 RESET), and the J-B normality test demonstrates that the residuals are normally distributed.

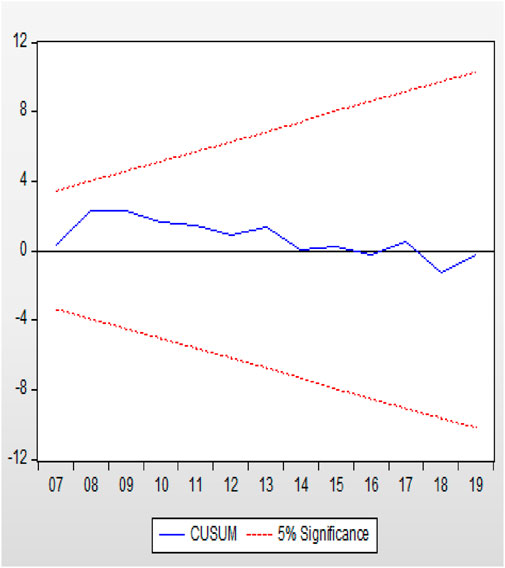

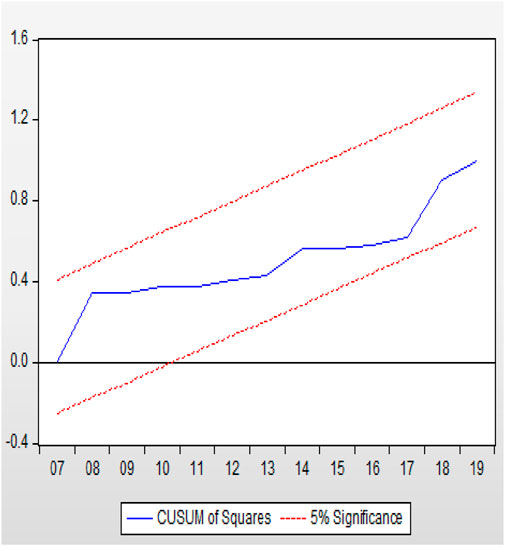

Figures 3, 4 show the results of the cumulative sum of recursive residuals (COSUM) and the COSUM of squares (COSUMs) tests. Both diagrams are situated inside the critical bounds at a 5% significance level, which indicates the stability of the ARDL parameters in our research study.

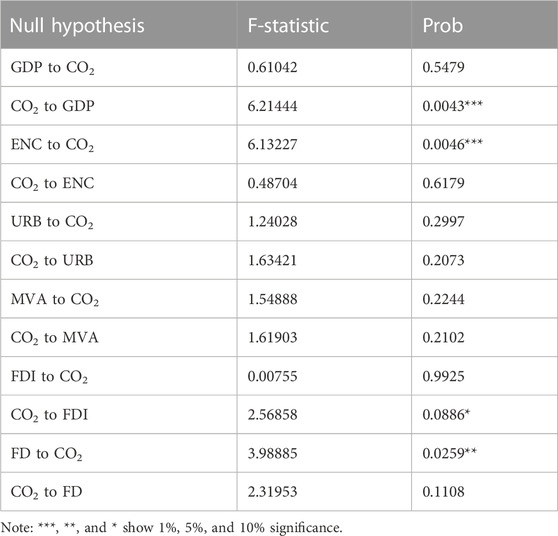

Table 8 represents the Granger causality test, it illustrates the casual linkages between CO2 emissions, GDP, ENC, URB, MVA, FDI, and FD. The results do not show any bivariate causality between CO2 emissions and other selected variables. The study also reveals a univariate causality from CO2 emissions to GDP. However, no causality was reported from the GDP to CO2 emissions. Moreover, a univariate causality is found from ENC to CO2, FD to CO2, and CO2 to FDI.

The Granger causality findings also validate the baseline ARDL model estimations; as the ENC produces CO2 emissions due to economic and manufacturing activities. FD influences CO2 emissions suggesting that FD may aggravate environmental problems, especially where a lending facility is provided for heavy industrial activities. Moreover, financial institutions tend to provide loans to companies and heavy manufacturing firms. There is a possibility that the environment may be negatively impacted due to inefficient production practices, which could result in adverse environmental effects.

5 Conclusion and policies

5.1 Conclusion

This article studied the nexus between CO2 emissions, GDP, ENC, URB, MVA, FDI, and FD in the case of Morocco. This work explores this connection in response to limited studies that analyze the factors shaping urban environmental quality in Morocco. The study showed that ENC and URB contribute significantly to an increase in CO2 emissions in Morocco in the short and long run. Although, GDP and MVA reduce the environmental degradation in Morocco both in the long and short run. The empirical outcomes also suggest that a univariate causality from CO2 emissions to GDP exists, though no causality was found from the GDP to CO2 emissions. Moreover, a univariate causality was found from ENC to CO2, FD to CO2, and CO2 to FDI.

5.2 Policy implication

Our research study suggests different policy suggestions aimed at enhancing environmental sustainability and promoting progress on SDG 13 in Morocco. In order to promote sustainable urban growth and ENC, it is crucial to implement an urban development plan that accommodates the URB and establish an ENC policy with a focus on long-term sustainability. Additionally, transforming Morocco’s industries into a green economy is vital for reducing the environmental impacts caused by economic expansion. This will help reduce the harm to the environment and ensure that resources are preserved for future generations. The focus of product fabrication should be on environmental and energy efficiency, in addition to enhancing the protection of employees, local areas, and the products themselves. The aim should be to attain sustainable industrialization through creative methods tailored to the needs of manufacturing companies. In light of this, the study also recommends that the Moroccan government enact and implement rules and regulations towards environmental conservation and health. Given that an increase in GDP may foster improvement in environmental quality, it is imperative that policies provide direction for industrialization and FD along with strict enforcement of regulations toward clean industrialization efforts. Also, considering the link between ENC, URB, and the rise in CO2 emissions in Morocco, it is imperative that policymakers and urban planners place emphasis on clean energy sources usage, including but not limited to solar energy, wind energy, and bioenergy. This is significant because energy is a prerequisite requirement for the functioning of other sectors, such as manufacturing, the financial sector, as well as domestic level. Finally, to achieve sustainable urbanization, effective policies relating to energy, economics, and the environment are necessary to steer urban development while balancing GDP and reducing CO2 emissions to the urban environment. Moroccan policymakers and urban planners should aim at reducing the rate of spatial urbanization via the practice of strict adherence to land uses and encouraging green growth by ameliorating the influence of urbanization environmental quality.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SB, writing original draft, data curation, conceptualization, formal analysis. HR, editing and review. SA, reviewing, editing, writing original draft, helping in revision. FD, writing, editing and review. JC, review and editing.

Funding

This research article received financial assistance from the research Project “Sustainable, Resilient and Smart African Cities,” a collaboration between Mohammed VI Polytechnic University-Morocco and École Polytechnique Fédérale de Lausanne-Switzerland (AS22).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, F., and Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 90, 102–114.

Abid, M. (2017). Does economic, financial and institutional developments matter for environmental quality? A comparative analysis of eu and mea countries. J. Environ. Manag. 188, 183–194.

Adekunle, O., Salami, G., and Oluseyi, A. (2013). Impact of financial sector development on the Nigerian economic growth. Am. J. Bus. Manag. 2 (4), 347–356.

Ahmed, Z., Can, M., Sinha, A., Ahmad, M., Alvarado, R., and Rjoub, H. (2022a). Investigating the role of economic complexity in sustainable development and environmental sustainability. Int. J. Sustain. Dev. World Ecol. 29, 771–783. doi:10.1080/13504509.2022.2097330

Ahmed, Z., Le, H. P., and Shahzad, S. J. H. (2022b). Toward environmental sustainability: How do urbanization, economic growth, and industrialization affect biocapacity in Brazil? Environ. Dev. Sustain. 24, 11676–11696. doi:10.1007/s10668-021-01915-x

Ahmed, Z., and Wang, Z. (2019). Investigating the impact of human capital on the ecological footprint in India: An empirical analysis. Environ. Sci. Pollut. Res. 26, 26782–26796. doi:10.1007/s11356-019-05911-7

Ahmed, Z., Wang, Z., Mahmood, F., Hafeez, M., and Ali, N. (2019b). Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ. Sci. Pollut. Res. 26, 18565–18582. doi:10.1007/s11356-019-05224-9

Al-Mulali, U., Fereidouni, H. G., Lee, J. Y., and Sab, C. N. B. C. (2013). Exploring the relationship between urbanization, energy consumption, and CO2 emission in MENA countries. Renew. Sustain. Energy Rev. 23, 107–112. doi:10.1016/j.rser.2013.02.041

Al-Mulali, U., Ozturk, I., and Lean, H. H. (2016). The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat. Hazards 79, 621–644. doi:10.1007/s11069-015-1865-9

Al-Mulali, U., and Sab, C. N. B. C. (2012). The impact of energy consumption and CO2 emission on the economic and financial development in 19 selected countries. Renew. Sustain. Energy Rev. 16 (7), 4365–4369. doi:10.1016/j.rser.2012.05.017

Alam, A., Azam, M., Abdullah, A. B., Malik, I. A., Khan, A., Hamzah, T. A. A. T., et al. (2015). Environmental quality indicators and financial development in Malaysia: Unity in diversity. Environ. Sci. Pollut. Res. 22 (11), 8392–8404. doi:10.1007/s11356-014-3982-5

Alege, P. O., and Ogundipe, A. A. (2015). Environmental quality and economic growth in Nigeria: A fractional cointegration analysis. Int. J. Dev. Sustain., 2(2)(2):1– 17.

Andreoni, J., and Levinson, A. (2001). The simple analytics of the environmental Kuznets curve. J. Public Econ. 80 (2), 269–286. doi:10.1016/s0047-2727(00)00110-9

Bekhet, H. A., Matar, A., and Yasmin, T. (2017). CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 70, 117–132. doi:10.1016/j.rser.2016.11.089

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 40, 33–41. doi:10.1016/j.econmod.2014.03.005

Charfeddine, L., Al-Malk, A. Y., and Korbi, K. A. (2018). Is it possible to improve environmental quality without reducing economic growth: Evidence from the Qatar economy. Renew. Sustain. Energy Rev. 82, 25–39. doi:10.1016/j.rser.2017.09.001

Charfeddine, L., and Khediri, K. B. (2016). Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew. Sustain. Energy Rev. 55, 1322–1335. doi:10.1016/j.rser.2015.07.059

Dai, J., Ahmed, Z., Pata, U. K., and Ahmad, M. (2023). Achieving SDG-13 in the era of conflicts: The roles of economic growth and government stability. Eval. Rev. 22, 193841X231160626. doi:10.1177/0193841X231160626

Dasgupta, S., Laplante, B., and Mamingi, N. (2001). Pollution and capital markets in developing. J. Environ. Econ. Manag. 42, 310–335. doi:10.1006/jeem.2000.1161

Destek, M. A., and Sinha, A. (2020). Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic co-operation and development countries. J. Clean. Prod. 242, 118537. doi:10.1016/j.jclepro.2019.118537

Dietz, T., and Rosa, E. A. (1994). Rethinking the environmental impacts of population, affluence, and technology. Hum. Ecol. Rev. 1 (2), 277–300.

Gallagher, K. S., and Qi, Q. (2021). Chinese overseas investment policy: Implications for climate change. Glob. Policy 12 (3), 260–272. doi:10.1111/1758-5899.12952

Ganda, F. (2021). The influence of growth determinants on environmental quality in Sub-Saharan Africa states. Environ. Dev. Sustain. 23 (5), 7117–7139. doi:10.1007/s10668-020-00907-7

Hunjra, A. I., Tayachi, T., Chani, M. I., Verhoeven, P., and Mehmood, A. (2020). The moderating effect of institutional quality on the financial development and environmental quality nexus. Sustainability 12 (9), 3805. doi:10.3390/su12093805

Imamoglu, H. (2018). Is the informal economic activity a determinant of environmental quality? Environ. Sci. Pollut. Res. 25 (29), 29078–29088. doi:10.1007/s11356-018-2925-y

Jalil, A., and Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 33 (2), 284–291. doi:10.1016/j.eneco.2010.10.003

Kahn, M. E., and Walsh, R. (2015). “Cities and the environment,” in Handbook of regional and urban economics. 1st ed., Vol. 5. doi:10.1016/B978-0-444-59517-1.00007-6

Kahouli, B. (2017). The short and long run causality relationship among economic growth, energy consumption and financial development: Evidence from South Mediterranean Countries (SMCs). Energy Econ. 68, 19–30. doi:10.1016/j.eneco.2017.09.013

Karanfil, F. (2009). How many times again will we examine the energy-income nexus using a limited range of traditional econometric tools? Energy Policy 37 (4), 1191–1194. doi:10.1016/j.enpol.2008.11.029

Khan, A., Saleem, N., and Fatima, S. (2018). Financial development, income inequality, and CO2 emissions in Asian countries using STIRPAT model. Environ. Sci. Pollut. Res. 25 (7), 6308–6319. doi:10.1007/s11356-017-0719-2

Kirikkaleli, D., and Sofuoğlu, E. (2023). Does financial stability matter for environmental degradation? Geol. J. doi:10.1002/gj.4707

Levine, R. (1996). Foreign banks, financial development, and economic growth. Int. Financ. Mark. Harmon. versus Compet. 7, 224–254.

Liu, H., and Huang, W. (2022). Sustainable financing and financial risk management of financial institutions—case study on Chinese banks. Sustain. Switz. 14 (15), 9786. doi:10.3390/su14159786

Mackie, A., and Haščič, I. (2018). The distributional aspects of environmental policies: Opportunities for individuals and households. Green Growth and Sustainable Development Forum Issue Paper.

Mahalik, M. K., Babu, M. S., Loganathan, N., and Shahbaz, M. (2017). Does financial development intensify energy consumption in Saudi Arabia? Renew. Sustain. Energy Rev. 75, 1022–1034. doi:10.1016/j.rser.2016.11.081

Maji, I., Habibullah, M., and Saari, M. (2017). Financial development and sectoral CO2 emissions in Malaysia. Environ. Sci. Pollut. Res. 24 (8), 7160–7176. doi:10.1007/s11356-016-8326-1

Mesagan, E., Isola, W., and Ajide, K. (2018). The capital investment channel of environmental improvement: Evidence from BRICS. Environ. Dev. Sustain. 24, 1561–1582. doi:10.1007/s10668-018-0110-6

Moghadam, H. E., and Dehbashi, V. (2018). The impact of financial development and trade on environmental quality in Iran. Empir. Econ. 54 (4), 1777–1799. doi:10.1007/s00181-017-1266-x

Nasreen, S., Anwar, S., and Ozturk, I. (2017). Financial stability, energy consumption and environmental quality: Evidence from South Asian economies. Renew. Sustain. Energy Rev. 67, 1105–1122. doi:10.1016/j.rser.2016.09.021

Oms, (2020). WHO global strategy on health, environment and climate change and wellbeing sustainably through healthy. Available at: https://apps.who.int/iris/bitstream/handle/10665/331959/9789240000377-eng.pdf%0Ahttps://apps.who.int/iris/bitstream/handle/10665/331959/9789240000377-eng.pdf?ua=1.

Ozturk, I., and Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 36, 262–267. doi:10.1016/j.eneco.2012.08.025

Panagopoulos, T., González Duque, J. A., and Bostenaru Dan, M. (2016). Urban planning with respect to environmental quality and human well-being. Environ. Pollut. 208, 137–144. doi:10.1016/j.envpol.2015.07.038

Radoine, H., Bajja, S., Chenal, J., and Ahmed, Z. (2022). Impact of urbanization and economic growth on environmental quality in Western Africa: Do manufacturing activities and renewable energy matter? Front. Environ. Sci. 10, 1012007. doi:10.3389/fenvs.2022.1012007

Sadorsky, P. (2011). Financial development and energy consumption in Central and Eastern European frontier economies. Energy Policy 39 (2), 999–1006. doi:10.1016/j.enpol.2010.11.034

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy 38 (5), 2528–2535. doi:10.1016/j.enpol.2009.12.048

Saidi, K., and Mbarek, M. B. (2017). The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ. Sci. Pollut. Res. 24 (14), 12748–12757. doi:10.1007/s11356-016-6303-3

Salahuddin, M., Alam, K., Ozturk, I., and Sohag, K. (2018). The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Syst. 81, 2002–2010. doi:10.1016/j.rser.2017.06.009

Schwela, D., Haq, G., Huizenga, C., Han, W. J., Fabian, H., and Ajero, M. (2012). “Urban air pollution in asian cities: Status, challenges and management,” in Urban air pollution in asian cities: Status (Challenges and Management). doi:10.4324/9781849773676

Shahbaz, M., Hoang, T. H. V., Mahalik, M. K., and Roubaud, D. (2017). Energy consumption, financial development and economic growth in India: New evidence from a nonlinear and asymmetric analysis. Energy Econ. 63, 199–212. doi:10.1016/j.eneco.2017.01.023

Shahbaz, M., Hye, Q. M. A., Tiwari, A. K., and Leitao, N. C. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew. Sustain. Energy Rev. 25, 109–121. doi:10.1016/j.rser.2013.04.009

Shahbaz, M., Sbia, R., Hamdi, H., and Ozturk, I. (2014). Economic growth, electricity consumption, urbanization and environmental degradation relationship in United Arab Emirates. Ecological 45, 622–631. doi:10.1016/j.ecolind.2014.05.022

Silva, L. T., and Mendes, J. F. G. (2012). City Noise-Air: An environmental quality index for cities. Sustain. Cities Soc. 4 (1), 1–11. doi:10.1016/j.scs.2012.03.001

Sovacool, B. K. (2011). The policy challenges of tradable credits: A critical review of eight markets. Energy Policy 39 (2), 575–585. doi:10.1016/j.enpol.2010.10.029

Stossel, Z., Kissinger, M., and Meir, A. (2015). Assessing the state of environmental quality in cities - a multi-component urban performance (EMCUP) index. Environ. Pollut. 206, 679–687. doi:10.1016/j.envpol.2015.07.036

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 37, 246–253. doi:10.1016/j.enpol.2008.08.025

Tamazian, A., and Rao, B. B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 32 (1), 137–145. doi:10.1016/j.eneco.2009.04.004

Ulucak, R., Danish, S., and Ozcan, B. (2020). Relationship between energy consumption and environmental sustainability in OECD countries: The role of natural resources rents, Res. Policy 69, 101803. doi:10.1016/j.resourpol.2020.101803

Van Kamp, I., Leidelmeijer, K., Marsman, G., and De Hollander, A. (2003). Urban environmental quality and human well-being. Landsc. Urban Plan. 65 (1–2), 5–18. doi:10.1016/S0169-2046(02)00232-3

Keywords: environmental quality, sustainable development goal 13, urbanization, manufacturing value-added, economic growth

Citation: Bajja S, Radoine H, Abbas S, Dakyaga F and Chenal J (2023) Determinants of urban environmental quality in Morocco: The roles of energy consumption, urbanization, manufacturing, and financial development in achieving SDG 13. Front. Environ. Sci. 11:1174439. doi: 10.3389/fenvs.2023.1174439

Received: 26 February 2023; Accepted: 07 April 2023;

Published: 20 April 2023.

Edited by:

Nazim Hussain, University of Groningen, NetherlandsReviewed by:

Dr. Muhammad Saeed Meo, Xiamen University, Malaysia, MalaysiaDervis Kirikkaleli, European University of Lefka, Türkiye

Copyright © 2023 Bajja, Radoine, Abbas, Dakyaga and Chenal. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Salwa Bajja, c2Fsd2EuYmFqamFAdW02cC5tYQ==

Salwa Bajja

Salwa Bajja Hassan Radoine1

Hassan Radoine1 Shujaat Abbas

Shujaat Abbas Francis Dakyaga

Francis Dakyaga Jerome Chenal

Jerome Chenal