- 1School of Business, Anhui University of Technology, Maanshan, China

- 2School of Business, Zhejiang University City College, Hangzhou, China

- 3School of Economics and Management, Nanjing University of Technology, Nanjing, China

This study takes the panel data of China’s A-share listed companies from 2016 to 2020 as the sample to empirically analyze the impact of environmental uncertainty on the degree of corporate financialization, and the moderating role of executive incentive in affecting the relationship between environmental uncertainty and the degree of corporate financialization. It is found that the rise of environmental uncertainty aggravates the degree of enterprise financialization. Executive equity incentives alleviate the degree of corporate financialization and significantly hedge the effect of environmental uncertainty on the degree of corporate financialization. In contrast, executive compensation incentives exacerbate the degree of corporate financialization and do not observably hedge the effect of environmental uncertainty on the degree of corporate financialization. Subgroup regressions indicate that the moderating effect of equity incentives on the relationship between environmental uncertainty and corporate financialization mainly occurs in non-state-owned firms. The findings of this study provide a theoretical base for firms to develop reasonable and practical incentive mechanisms to cope with environmental uncertainty.

1 Introduction

The COVID-19 pandemic and the Russia-Ukrain military conflict have currently led to increased risks, and the economy is facing rising complexity, severity, and uncertainty. According to the report “World Economic Situation and Prospects 2023”released by the United Nations, Economic Development in January 25 states that the world economic outlook is bleak and uncertain due to the convergence of multiple crises. 2023 global economic growth is expected to be 1.9%, making it one of the lowest growth years in decades. The global economic outlook has deteriorated significantly, and overall economic risks have risen significantly (Gu et al., 2018). While the level of economic globalization is increasing (Liu et al., 2023), the economy is also facing far greater than normal levels of environmental uncertainty. Environmental uncertainty refers to a state in which enterprise managers cannot accurately predict future changes in technology and market when they do not fully understand external environmental information (Cevahir et al., 2012). Firstly, environmental uncertainty increases the degree of information asymmetry (Ghosh and Olsen, 2009). Secondly, environmental uncertainty increases financial market risk and corporate risk aversion motivation (Bonaime et al., 2018). Rising uncertainty makes managers more risk-averse, causing a decline in physical corporate investment, accompanied by a rise in financial investment (Jin et al., 2022). Entrepreneurs’ expectations of risk can significantly influence the structure of corporate investment and contribute to the trend of “de-realization” of the economy (Gulen and Ion, 2016). The degree of corporate financialization is an important form of “de-realization”. Opinions on the impact of corporate financialization on economy varied. The positive opinion is that a certain degree of financialization is beneficial for enterprise development. However, after the financial crisis, many scholars pointed out that the continuous flow of bank credit funds into the financial investment field has produced a significant crowding-out effect, which leads to slow growth of real economy and hurts the long-term development of the economy (Cecchetti and Kharroubi, 2018; Xu and Xuan, 2021). The eclectic view is that appropriate investment in financial assets helps improve business conditions and enhance business performance of the enterprises. However, if financial assets are invested excessively, the internal R&D investment is crowded out, which is not beneficial for the long-term development of the enterprises (Bloom et al., 2007).

In the 14th Five-Year Plan and the Long-Range Objectives Through the Year 2035, China proposed to build an institutional mechanism for finance to effectively support the real economy, strengthen real investment and promote the balanced development of finance, real estate, and the real economy. Due to that serious corporate financialization exists in China, balancing the development of real and financial investments is the goal of high-quality economic development. As the key figures of enterprise operation, executives play a leading role in decisions on allocation of real and financial investments. However, the principal-agent problem due to the separation of powers in most companies makes executives tend to avoid money-heavy and large time span real investments, which is contrary to the goal of high-quality economic development. Under the circumstance of uncertain economic environment, executive incentives, as the primary means to mitigate the conflict of interest between principals and agents, are expected to play an important role in regulating the development strategy of the enterprises.

In this context, this paper focuses on the impact of environmental uncertainty on the degree of corporate financialization and the hedging role that executive incentives play in it. Compared with previous studies, the marginal contribution of this paper is in: 1) Widening the research perspective of reflecting macroeconomics at the micro level. Since companies need to constantly adjust their business activities and asset allocation to adapt to the external environment, abnormal fluctuations in the operating income of enterprises are used to reflect changes in uncertainty of the external environment. 2) By putting executive incentives, environmental uncertainty and the degree of corporate financialization in the same framework, we analyze the moderating role of executive incentives between environmental uncertainty and corporate financialization. The study aims to more comprehensively understand the implementation effect of executive incentives in China’s listed companies, to expand and improve the theory of executive incentives, and to provide a reference for companies to formulate reasonable and practical incentives to cope with environmental uncertainty.

2 Literature review and hypothesis

2.1 Environmental uncertainty and corporate financialization

The deepening financialization is mainly manifested in the rising proportion of financial assets allocated to total assets of non-financial entities (Davis and Kim, 2015), which is also a rational choice of enterprises seeking to maximize their interests. From the perspective of corporate income, the return on capital investment in the real economy has been declining due to factors such as overcapacity, short of effective demand, and increasing labor costs. Companies are forced to look for “new ways out” and focus on real estate and finance industries, trying to obtain high returns by increasing investment in financial field. Financial assets have a “reservoir effect” and an “investment substitution effect”. The reservoir effect refers to that the increase of speculative short-term financial assets characterized by strong liquidity and fast liquidation rate can help enterprises overcome difficulties when facing financing constraints (Hall and Bagchi, 2002; Peng et al., 2022). Short-term financial assets do not crowd out real investment while intensifying the degree of financialization of enterprises. The investment substitution effect refers to that enterprises weigh the investment return between real and financial investments and choose investment allocation with a high rate of return to maximize corporate profitability, thus crowding out real industry investment (Li et al., 2020).

In recent years, China’s economy has been in an essential stage of transformation and upgrading. Uncertainties have increased, and more and more studies have researched the impact of uncertainty on firm behavior Bloom et al. (2007) studied the impact of environmental uncertainty on corporate investment, Ghosh and Olsen (2009) studied the impact of environmental uncertainty on surplus management. Kang et al. (2014) argued that the uncertainty of economic policies is expected to raise the total amount of corporate financial assets and affect the financial asset allocation structure. Kim and Kung (2017) proposed that in an uncertain environment, with uncertain investment prospects and irreversible sunk costs in real investments, corporate management’s prudential motives for delaying physical investments result in passive holdings of financial assets, thus exacerbating corporate financialization. The mutual imitation among firms also causes financialization to have a cohort effect, and the higher the environmental uncertainty, the stronger the cohort effect of financialization of enterprise. Based on the above analysis, the hypothesis is proposed.

H1: Rising environmental uncertainty will aggravate the degree of corporate financialization.

2.2 The moderating role of executive equity incentives between environmental uncertainty and corporate financialization

At present, the principal-agent problems due to the state of separation of powers have been notable in most companies. Implementing executive incentives in companies can alleviate the principal-agent problem to a certain extent and make both managers and owners focus on the long-term development of the company (Bova et al., 2014; Cheng et al., 2022). The implementation of executive equity incentives links managers’ wealth growth to the company’s share price. The share price of a company is determined by the enterprise value, and the enterprise value depends on the long-term investment in the company. Some previous studies have proved that increasing investment in R&D can promote innovation and improve the firm’s competitiveness to increase the firm’s value (Gupta et al., 2017). Therefore, the greater the weight of managers’ equity in the firm, the more inclined they are to increase the long-term investment in the firm.

Under the circumstance of high environmental uncertainty, the reasonable allocation of the enterprise’s assets is the core issue for the management team, which determines the success or failure of the enterprise, as well as the earnings and honor of the manager. When the environment is highly uncertain, companies tend to hide “bad news”, raising the risk for stock price crash (Jin and Myers, 2006). Corporate financialization can lead to increased short-sightedness of managers (Wang and Mao, 2021), but equity incentives as a long-term incentive can reduce the short-sightedness of managers, who will pay more attention to the fluctuation of stock prices in the long-term capital market. This reduces the “crowding out” of R&D and fixed asset investment by financial asset and make allocation of resources more rational. This is ultimately manifested by that executive equity incentives negatively moderate the relationship between environmental uncertainty and corporate financialization. The following hypotheses are proposed based on above analysis.

H2a: Executive equity incentives will alleviate the degree of corporate financialization.

H2b: Executive equity incentives can hedge against the impact of environmental uncertainty on corporate financialization.

2.3 The moderating role of executive compensation incentives between environmental uncertainty and corporate financialization

Compensation incentives are monetary rewards in forms of salaries, bonuses, and benefits given to managers (O’Connor and Rafferty, 2010). Since compensation incentives are generally linked to the firm’s current performance (Core et al., 1999), and the return on investment in the financial sector is generally higher than that in the real economy in short term, managers tend to allocate more capital to the financial industry to achieve high returns in the short period. Some scholars have argued that implementing executive compensation incentives amplifies managers’ self-confidence (Wen and Tang, 2012). On one hand, this can improve the management’s work effort; on the other hand, it will amplify their short-sighted behavior to gain for more money and power, and prompt them to satisfy the psychological bias of overconfidence by getting more private gains through increasing financial investments. Therefore, implementing executive compensation incentives will increase corporate financial asset allocation (An et al., 2018).

Environmental uncertainty lasts for a long term in business development. Chan and Ma (2017) argue that different executive incentives may have different effects on the execution of corporate strategies. Compensation incentives, as a short-term incentive, can link managers’ interests to corporate value in a relatively short period of time. On the one hand, the “bird in hand” theory suggests that uncertainty increases with time. Investors tend to choose more liquid short-term financial investments and abandon long-term investments with long cycles and high risks. This is manifested in the relationship between executive compensation incentives negatively moderating environmental uncertainty and corporate financialization. On the other hand, since executive compensation incentives tend to be positively correlated with a firm’s current operating profits, they may induce managers to prefer investments with higher levels of returns in the short term (Lin and Tomaskovic-Devey, 2013), but compensation incentives do not necessarily have a long-term impact on firm management. Therefore, compared to long-term equity incentives, short-term compensation incentives do not negatively moderate the relationship between environmental uncertainty and corporate financialization. In summary, three hypotheses are proposed.

H3a: Executive compensation incentives will aggravate the degree of corporate financialization

H3b: Executive compensation incentives can hedge against the impact of environmental uncertainty on corporate financialization.

H3c: Executive compensation incentives do not hedge against the impact of environmental uncertainty on corporate financialization.

3 Research design

3.1 Date and sample

This paper selects the data of Chinese listed companies in Shanghai and Shenzhen A-shares from 2016 to 2020 as the sample. The data are obtained from the China Stock Market and Accounting Research (CSMAR) database. The screening process of the original data is as follows: 1) Excluding financial listed companies and listed companies in ST status. 2) Excluding the companies with missing values in the data of operating income or executive incentives in the sample. 3) The continuous variables are reduced by 1% tailing at both ends, and 9,781 valid observations are finally obtained.

3.2 Definition of the variables

3.2.1 Dependent variable

Environmental Uncertainty. Environmental uncertainty refers to fluctuations in the external business environment of enterprises, competition in the product market, as well as supply and demand in the factor and labor markets, which can lead to fluctuations in external environmental uncertainty of enterprises. According to the method of Tosi et al. (1973). Step 1: Enterprises with no missing values in their operating income for five consecutive years were selected. Step 2: The standard deviation of each company’s abnormal operating income in the past 5 years was estimated using the OLS classification method, and the mean value of each company’s normal operating income was calculated (Ghosh and Olsen, 2009; Shen et al., 2012). Step 3: The standard deviation of abnormal operating income was divided by the mean value of normal operating income to obtain the unadjusted environmental uncertainty indicator without industry adjustment. Step 4: Since there is variability among industries, to reduce the deviation caused by industry differences, this paper draws on the study by Ghosh and Olsen (2009) to calculate the median of unadjusted environmental uncertainty by industry and year (Tomaskovic-Devey et al., 2015). Finally, the environmental uncertainty indicator is obtained by dividing the unadjusted environmental uncertainty by the median of unadjusted environmental uncertainty of each industry.

3.2.2 Independent variables

The degree of corporate financialization. Corporate financialization is a micro indicator measuring the process of an economy “de-realization”. In this paper, the ratio of financial assets to total assets is used to as the corporate financialization indicator (Zhou et al., 2021), where financial assets include trading financial assets, derivative financial assets, available-for-sale financial assets, held-to-maturity investments, net investment properties, and long-term equity investments. The larger ratio represents the higher degree of enterprise financialization, and the faster process of diverting from real economy.

3.2.3 Moderating variables

Executive incentives. Two indicators were selected, which are executive equity incentive and executive compensation incentive. The executive equity incentive index is measured by the logarithm of the number of executive shareholdings; The executive compensation incentive is measured by the logarithm of the top three executives’ salaries (Jin et al., 2022).

3.2.4 Control variables

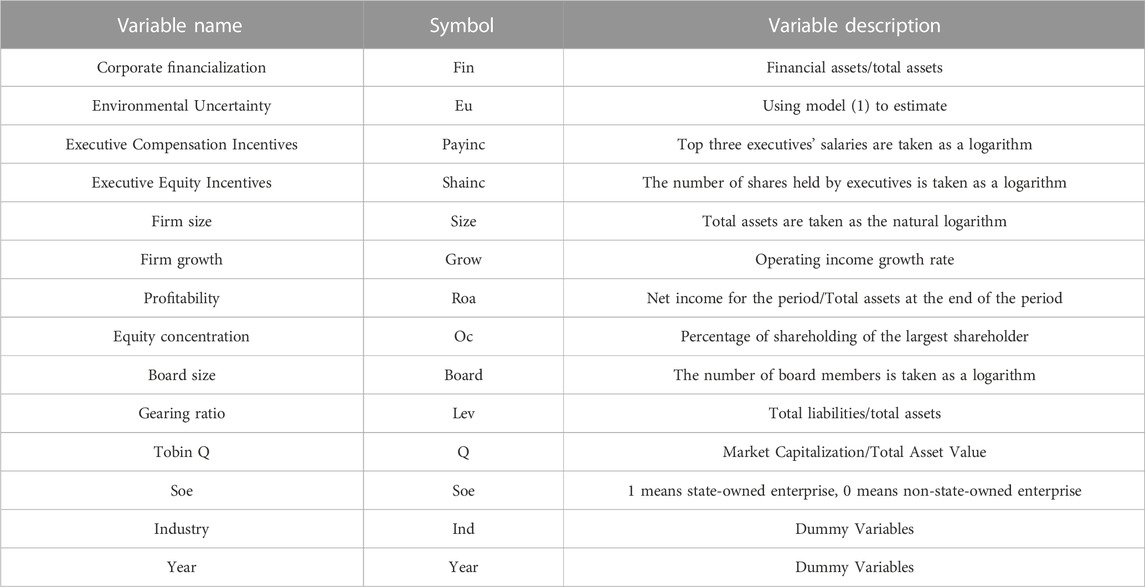

Control variables. The following firm characteristics variables were selected as control variables: firm size, profitability, firm growth, equity concentration, the board size, gearing ratio, and Tobin’s Q. Table 1 presents the variables.

3.3 The model design

An OLS model is applied to empirically investigate the relationship between environmental uncertainty and the degree of corporate financialization.

The explained variable Fini,t denotes the degree of financialization of firm i in year t. The explanatory variable Eui,t denotes the environmental uncertainty value of firm i in year t ∑Control denotes the set of control variables, Ind denotes the fixed industry effect, Year denotes the fixed year effect, and εi,t is the residual value.

Models (3) and (4) are used to test the moderating role played by executive equity incentives in the relationship between environmental uncertainty and corporate financialization.

Models (5) and (6) are used to test the moderating role played by executive compensation incentives in the relationship between environmental uncertainty and corporate financialization.

For models (4) and (6), if the coefficient of β2 is positive, it indicates that executive incentives further promote the degree of corporate financialization caused by environmental uncertainty. If the coefficient of β2 is negative, it indicates that executive incentives inhibit the corporate financialization caused by environmental uncertainty.

4 Empirical results

4.1 Descriptive statistics

Table 2 shows the descriptive statistics of the sample data for five consecutive years from 2016 to 2020. The minimum value of the degree of enterprise financialization (Fin) is 0, indicating that the enterprise has no investment in financial assets. The maximum value is 53.6122, indicating that the enterprise’s allocation of financial assets is 53.6122%. The standard deviation is 10.4591, which suggests that the enterprises differ in financial asset allocation. The standard deviation of environmental uncertainty (Eu) is 1.4278, which indicates a significant difference between the fluctuations of abnormal sales revenue among the firms. For executive equity incentive (Shainc), the minimum value is 0, indicating that the firm does not implement executive equity incentive. The maximum value is 20.2068 and the standard deviation is 3.1121, suggesting significant differences between equity incentive programs among firms. The minimum value of executive compensation incentive (Payinc) is 11.3206, the maximum value is 18.2917, and the standard deviation is 0.680. This indicates that the compensation incentive program also differs between different enterprises. For the control variables, there are significant differences in firm size (Size), firm growth (Grow), equity concentration (Oc), and Tobin Q) among different firms.

4.2 Analysis of regression results

4.2.1 The impact of environmental uncertainty on corporate financialization

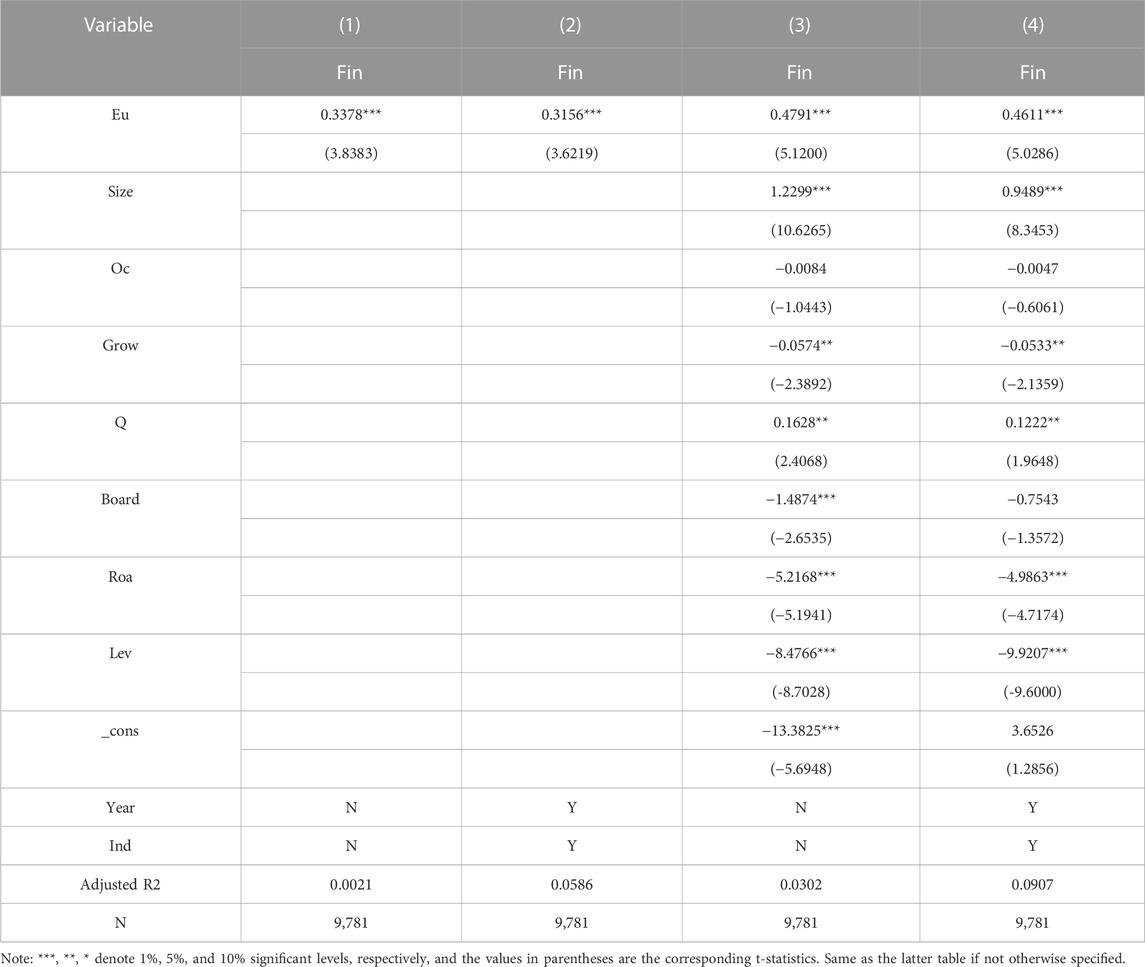

To ensure the reliability of the prediction results, this paper uses regressions with stepwise addition of control variables and industry and year dummy variables. The results are presented in Table 3. Column (1) shows that under the conditions of not including control variables and fixing industry and year effects, the coefficient of the with environmental uncertainty regression is 0.3378, which is significantly positive at the 1% level (t = 3.8383). Column (2) shows that after fixing the dual effect of industry and year, the coefficient of environmental uncertainty is 0.3156, still significantly positive at the 1% level (t = 3.6219). This demonstrates that a rise in environmental uncertainty will substantially intensify the degree of corporate financialization. The regression with the addition of control variables in Column (3), it shows that the coefficient of environmental uncertainty is 0.4791, still significant at the 1% level (t = 5.1200). Finally, this paper draws on the methodology of Edziah et al. (2022), using a fixed effects model. Column (4) further fixes the dual effect of time and industry, at which point the coefficient of environmental uncertainty is 0.4611, still significantly positive at the 1% level (t = 5.0286). The above empirical results indicate a causal relationship between environmental uncertainty and corporate financialization. It indicates that a rise in environmental uncertainty will intensify the degree of corporate financialization. Hypothesis H1 is established, and the conclusion is reliable.

In addition, the estimation results of the control variables are generally consistent with expectations. Firm size is significantly and positively correlated with the degree of corporate financialization at the 1% level. Equity concentration is negatively correlated with corporate financialization, indicating that the higher the equity concentration, the lower the degree of corporate financialization. There is a significant negative correlation between firm growth and profitability and corporate financialization, indicating that the higher the firm’s revenue growth rate, the more the firm focuses on increasing the profitability of its primary business, and therefore the lower the proportion of financial assets allocated. The significant positive correlation between Tobin’s Q and corporate financialization indicates that an increase in Tobin’s Q will reduce the financing constraints of enterprises and obtain more financing to invest in financial assets. The significant negative correlation between the firm’s gearing ratio and corporate financialization indicates that the firm’s highly indebted asset structure will inhibit the firm’s financial asset allocation.

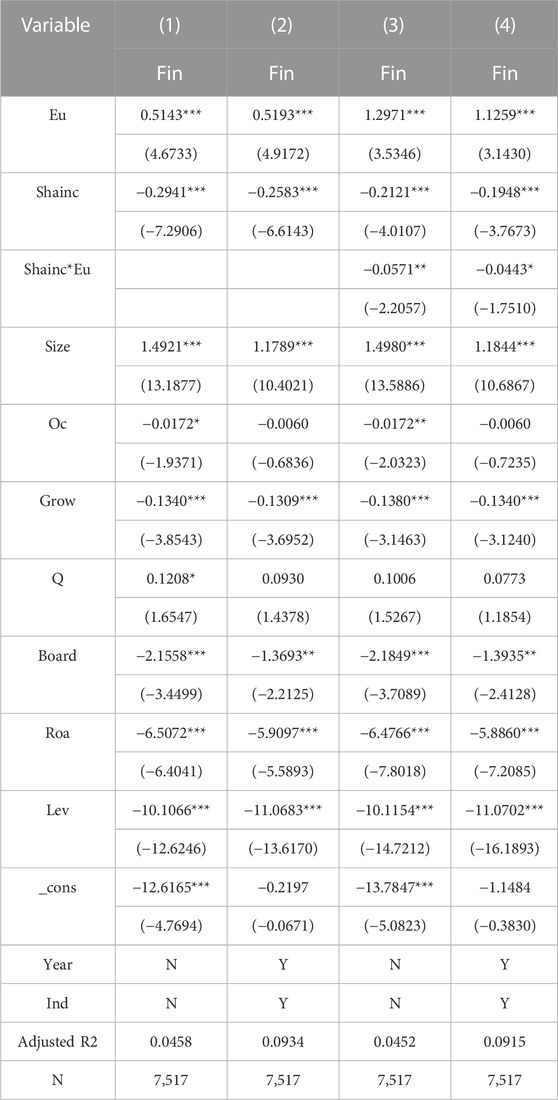

4.2.2 The relationship between environmental uncertainty, executive equity incentives, and the degree of corporate financialization

The relationship between environmental uncertainty, executive equity incentives, and the degree of corporate financialization is shown in Table 4. Column (1) shows that the regression coefficient of environmental uncertainty is 0.5143 with a significance level of 1% (t = 4.6733), which validates H1. The coefficient of the moderating variable executive equity incentives is −0.2941, which is significantly negative at the 1% level (t = −7.2906), empirically validating H2a that the implementation of executive equity incentives can mitigate the degree of corporate financialization. When he industry and year dual effects are further fixed, Column (2) shows that the coefficient of environmental uncertainty is 0.5193, and the coefficient of executive equity incentive is −0.2583, further validating H1 and H2a. Column (3) shows that the coefficient of environmental uncertainty is 1.2971, and the coefficient of executive equity incentive is −0.2121, both significant at the 1% level. The coefficient of interaction between environmental uncertainty and executive equity incentive is −0.0571, which is significant at the level of 5% (t = −2.2057), verifying H2b. When the dual effects of industry and year are fixed on the basis of Column (3), Column (4) shows that the coefficient of environmental uncertainty is 1.1259, and the coefficient of executive equity incentive is −0.1948, both significant at the 1% level. The coefficient of interaction between environmental uncertainty and executive equity incentive is −0.0443, which is significant at the level of 10% (t = 1.7510). This suggests that executive equity incentives can dramatically hedge the relationship between environmental uncertainty and corporate financialization, further validating H2b.

TABLE 4. The moderating effect of executive equity incentives between environmental uncertainty and corporate financialization.

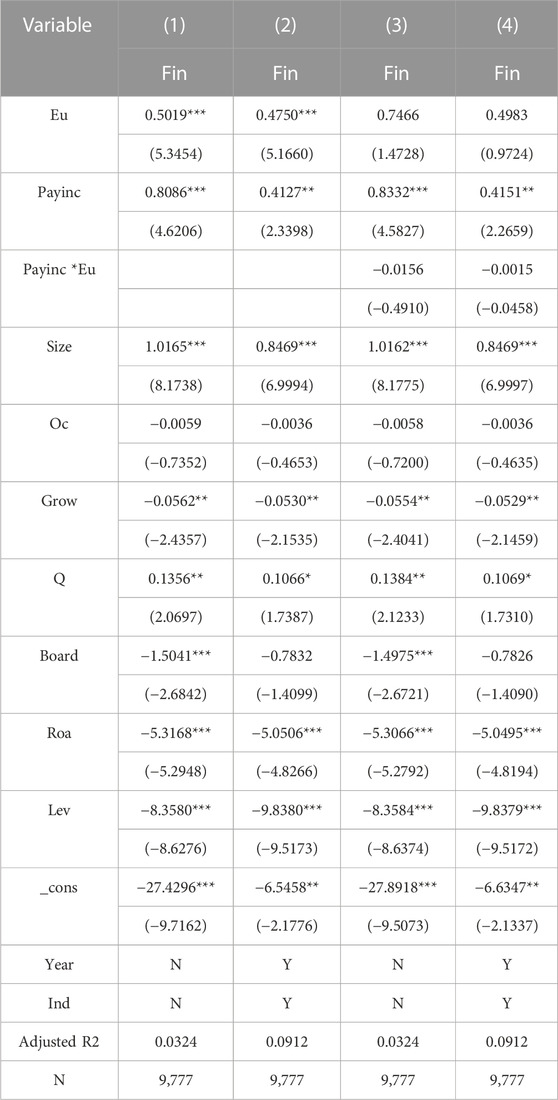

4.2.3 The relationship between environmental uncertainty, executive compensation incentives, and corporate financialization

The relationship between environmental uncertainty, executive compensation incentives, and corporate financialization is shown in Table 5. Column (1) shows that the coefficient of the core explanatory variable, environmental uncertainty is 0.5019, which is significantly positive at the 1% level (t = 5.3454), validating H1. At the same time, the coefficient of executive compensation incentives is 0.8086, which is significant at the 1% level (t = 4.6206), validating H3a. These suggest that the implementation of executive compensation incentives will intensify the degree of corporate financialization. After the dual effects of industry and year are fixed on the basis of Column (1), Column (2) shows that the coefficients of both environmental uncertainty and executive compensation incentives are significantly positive, indicating that rising environmental uncertainty and the implementation of executive compensation incentives will intensify the degree of corporate financialization. Column (3) shows that the coefficient of the interaction term between environmental uncertainty and executive compensation incentives is −0.0156, which is not significant, rejecting hypothesis H3b and accepting hypothesis H3c. It indicates that executive compensation incentives as short-term incentives do not significantly hedge the relationship between environmental uncertainty and corporate financialization. After the year and industry dual effect are fixed in Column (4), and the interaction term coefficient is −0.0015, which is still insignificant and further validates H3c.

TABLE 5. The moderating effect of executive compensation incentives between environmental uncertainty and corporate financialization.

4.3 Robustness tests

4.3.1 Propensity score-matching method (PSM)

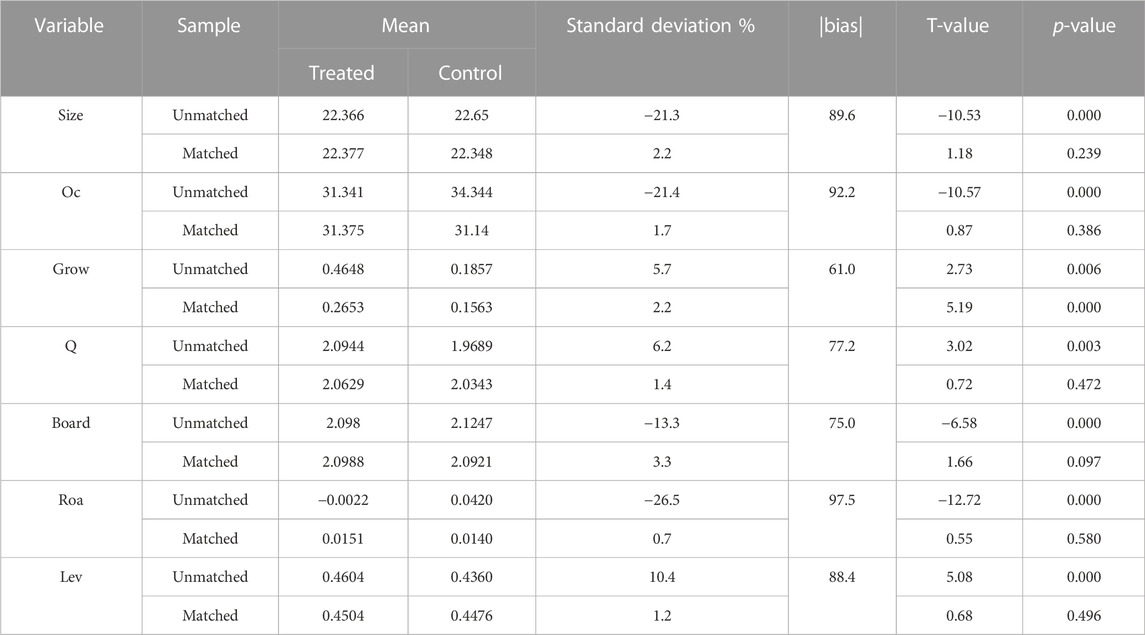

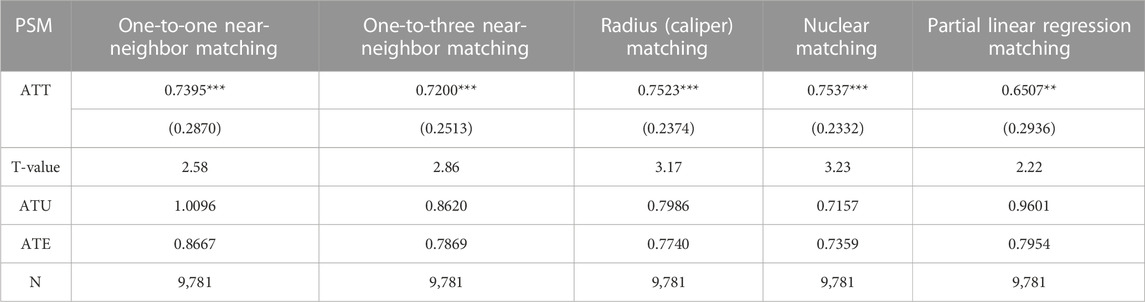

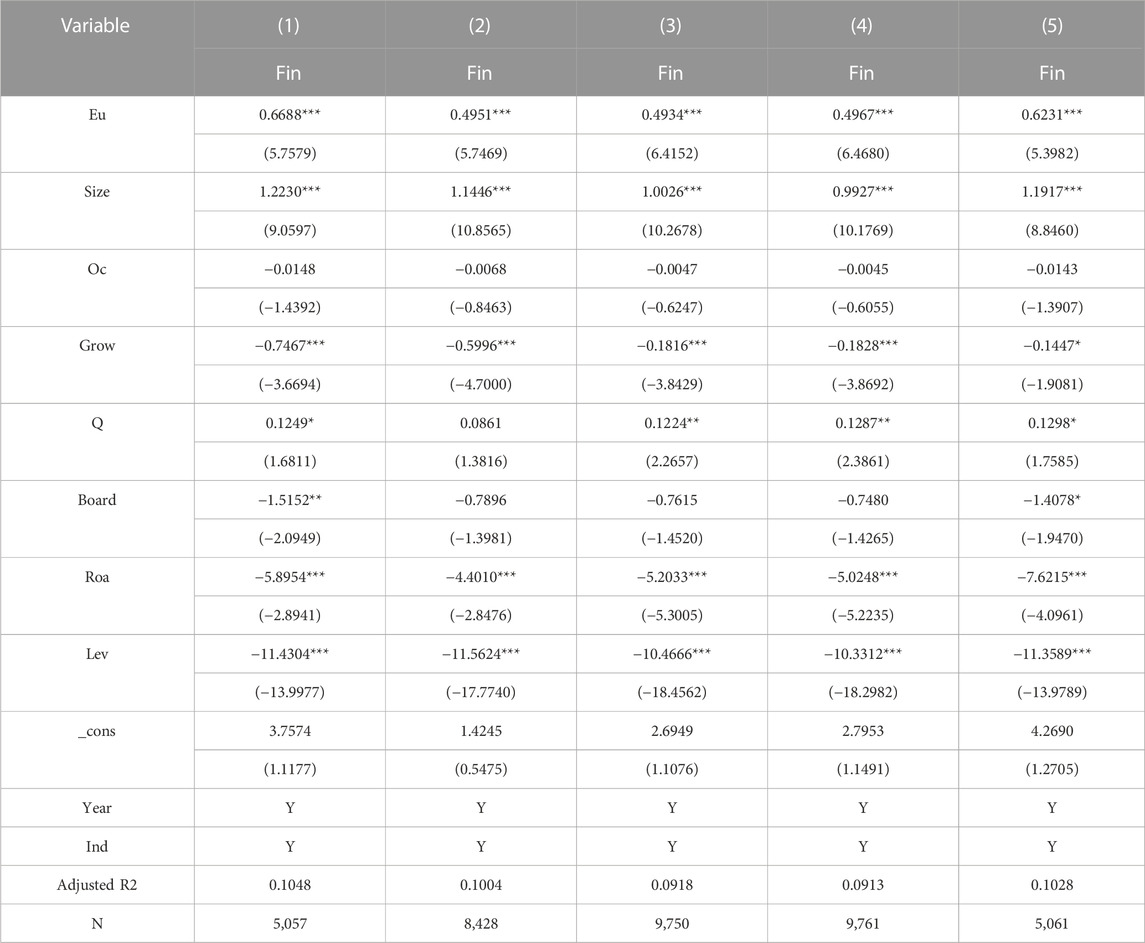

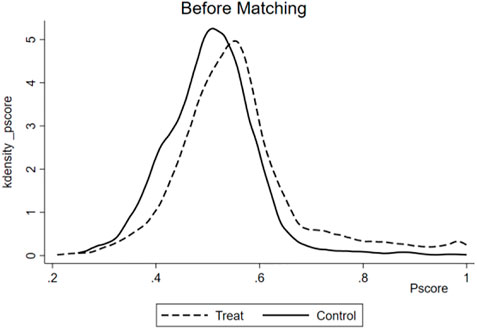

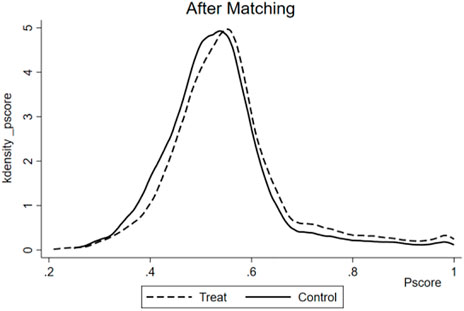

To test the validity of the model results, the propensity matching score method is used to address the problem of sample selection bias (Dehejia and Wahba, 2002). A counterfactual set of comparison data is constructed to assess how firms with high environmental uncertainty allocate their assets in the presence of low environmental uncertainty. First, all listed companies are classified as “high environmental uncertainty” and “low environmental uncertainty” based on whether each company’s environmental uncertainty value is greater than the average value of environmental uncertainty in the overall sample data. Second, all the control variables are matched as covariates in a one-to-three nearest neighbor matching, and the matching results are shown in Table 6. The absolute values of the standardized errors of all covariates are below 10%, and the standardized deviations of all variables are substantially reduced compared to the results before matching, at the same time, the p-values of most variables increase after matching, indicating that the selection of variables meets the prerequisite requirements of PSM. Table 7 shows the ATT, ATU, ATE and T values obtained by conducting five matching methods: one-to-one nearest neighbor matching, one-to-three nearest neighbor matching, radius (caliper) matching, kernel matching, and local linear regression matching. From the results in Table 7, the significance level of most ATT values after matching remains at 1%, and all five matching methods pass the significance level test, indicating the robustness of the findings that rising environmental uncertainty will exacerbate the degree of corporate financialization. From the sample size in Table 8, it can be found that the kernel matching method caused the most negligible value of data loss; therefore, the data can be fully matched. The kernel density plots before and after kernel matching are shown in Figures 1, 2, and the density distribution of the experimental and control groups after matching is a closer relative to that before matching. To further verify the validity of the findings, remove the loss values from the matching process, and the regression was rerun after fixing the double effect of time and year. The results are shown in Table 8. Column (1) shows the results of one-to-one nearest neighbor matching. At this time, the sample size is 5,057, and the coefficient of environmental uncertainty is 0.6688, which is significant at the 1% level (t = 5.7579). Column (2) shows a pair of three nearest neighbors matching with a data volume of 8,428 after excluding the loss values. The environmental uncertainty coefficient is significantly positive at the 1% level (t = 5.7469). Column (3) shows radius (caliper) matching with a data volume of 9,750, and the coefficient of environmental uncertainty is still significantly positive at the 1% level (t = 6.4152). Column 4) shows the kernel matching with a sample size of 9,761 and a coefficient of environmental uncertainty of 0.4967, still significant at the 1% level (t = 6.4680). Column (5) shows a local linear regression match with a data size of 5,061 and the coefficient of environmental uncertainty was significant at the 1% level (t = 5.3982). The results before and after matching remain consistent with expectations, suggesting robust findings.

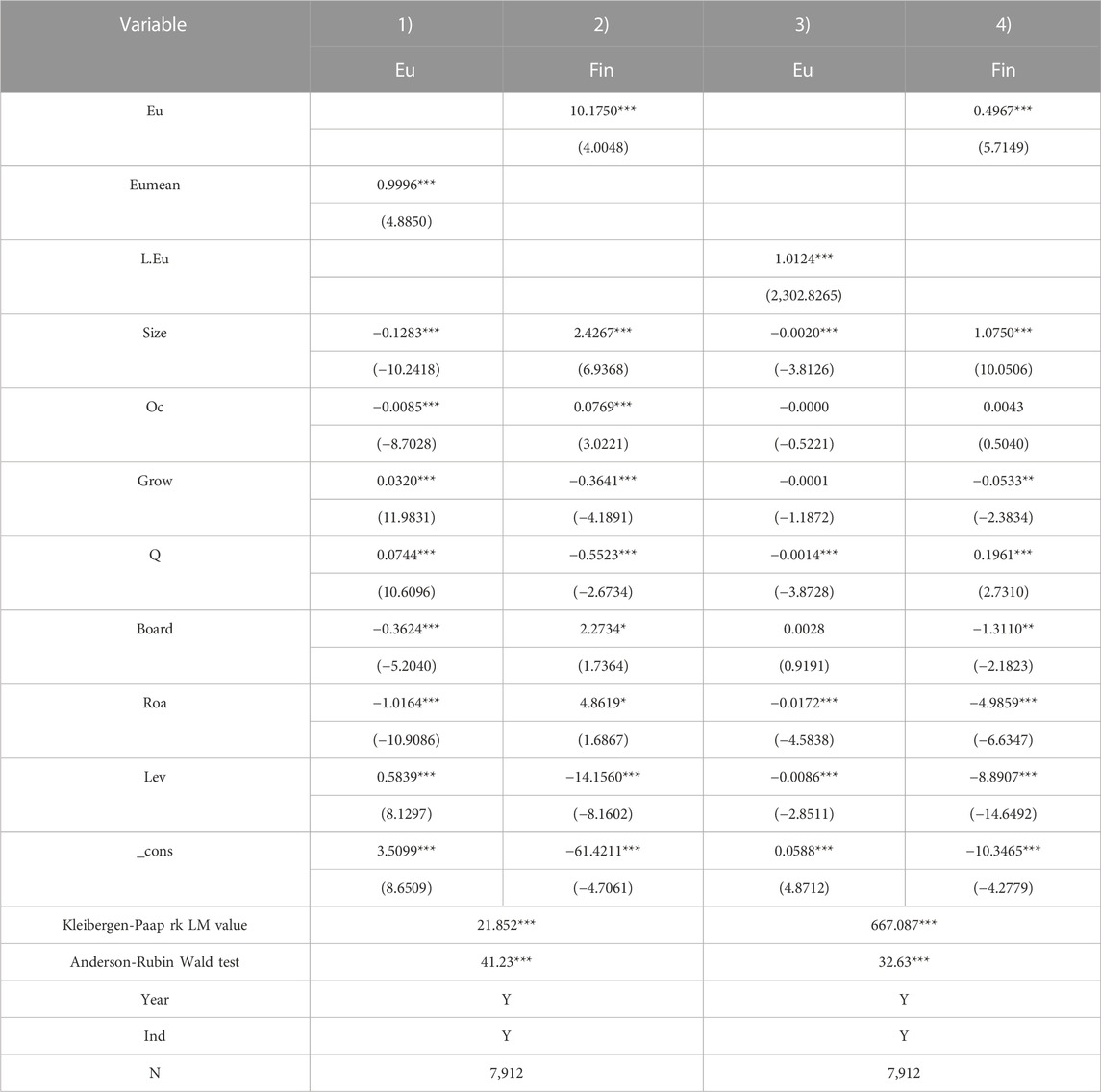

4.3.2 Instrumental variables method

Considering the possible endogeneity problem, this paper refers to Fisman and Svensson’s (2007) approach to constructing instrumental variables by selecting the average of environmental uncertainty indicators (Eumean) of other firms in the same year and in the same industry and the environmental uncertainty with one period lag (L.Eu) as instrumental variables to measure the environmental uncertainty indicators of this firm. In the same year, the average environmental uncertainty of other firms in the same industry and the lag of the one-period environmental uncertainty value is correlated with this firm’s environmental uncertainty, but does not directly affect this firm’s financial asset allocation. In addition, environmental uncertainty in the current period will have an important impact on uncertainty in the next period, but the level of environmental uncertainty in previous years will hardly have a direct impact on firms’ investment decisions in the current period. From the 2SLS estimation results in Table 9. In the first stage, the regression coefficients of Eumean and L. Eu are significantly positive, indicating that the instrumental variable is correlated. In the second stage, the Kleibergen-Paap rk LM statistics are 21.852 and 667.087, respectively, this instrumental variable passes the weak instrumental variable test. The Anderson-Rubin Wald test values are 41.23 and 32.63, all rejected the weak instrumental variable hypothesis that the sum of endogenous regression coefficients is equal to 0 at the 1% level, and pass the robust weak identification test. The regression results of the second stage indicate that the coefficients of environmental uncertainty are all significantly positive at the 1% level and the regression results are robust.

4.3.3 Substitution of variables

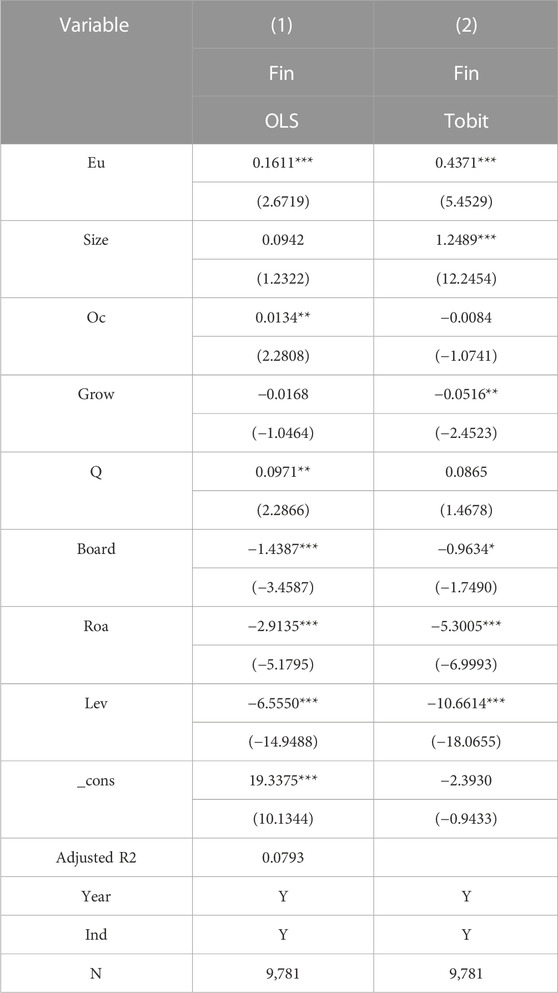

To ensure the accuracy and scientific nature of the results, this paper changes the measure of corporate financialization. Since some of the literatures consider that the fair value of long-term equity investments can be reliably measured and meets the theoretical definition of financial assets, then long-term equity investments are considered as financial assets held by enterprises. Still, there is also a majority of literatures that believe long-term equity investments are biased towards operating investments and do not belong to financial assets. This paper tests financial assets, excluding long-term equity investments, as a proxy variable. The results are shown in Column (1) of Table 10, where the coefficient of environmental uncertainty is 0.1611, which is significantly positive at the 1% level (t = 2.6719) and remains consistent with expectations.

4.3.4 Change of measurement method

Since the explanatory variable the degree of corporate financialization is a continuous variable, some firms do not invest in financial assets and therefore their financialization level is zero, the data in this paper are suitable for the truncated tail regression model. Therefore, the OLS method is changed to Tobit left imputation method for regression. The results are shown in Column (2) of Table 10, and the regression coefficient of environmental uncertainty is 0.4371, which is significantly positive at the 1% level (t = 5.4529), proving that the results are robust.

5 Further research

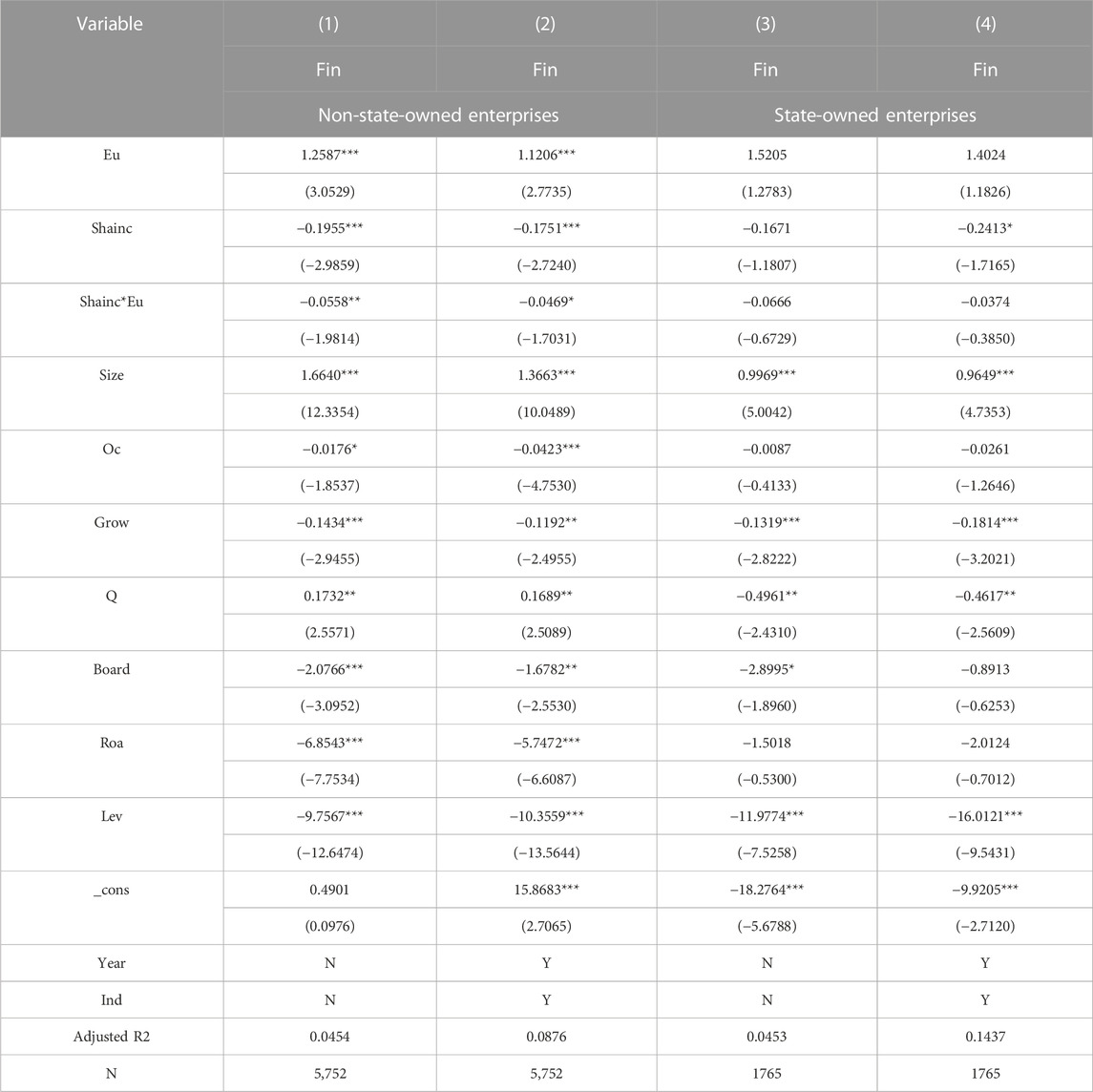

5.1 Moderating effect of executive equity incentives based on the heterogeneity of property rights

The above analyzed the negative moderating effect of executive equity incentives on environmental uncertainty and corporate financialization. Then, how would executive equity incentives with different equity properties moderate the relationship between environmental uncertainty and the degree of enterprise financialization? In this paper, enterprises are divided into state-owned enterprises and non-state-owned enterprises. The relationship between executive equity incentives moderating environmental uncertainty and corporate financialization is shown in Table 11. Column (1) shows that in non-state-owned firms, the interaction term between executive equity incentives and environmental uncertainty is significantly negative at the 5% level (t = −1.9814). After fixing the industry and year effects in column (1), Column (2) shows the coefficient of the interaction term between executive equity incentives and environmental uncertainty is 0.0469, which is significantly negative at the 10% level (t = −1.7031). Column (3) suggests that the coefficient of the interaction term between executive equity incentives and environmental uncertainty is insignificant in state-owned enterprises. After the industry and year effects are fixed on the basis of Column (3), Column (4) shows that the coefficient of the interaction term between executive equity incentives and environmental uncertainty is still insignificant. The above results indicate that executive equity incentive significantly and negatively moderates the relationship between environmental uncertainty and corporate financialization in non-state-owned firms, but not in state-owned firms. Possible reasons are: On the one hand, for the equity incentive, the equity incentive ratio of state-owned enterprises will be subject to many restrictions, and the average shareholding ratio of executives in state-owned enterprises is much lower than that of non-state-owned enterprises, and the personal benefits of managers through increasing the allocation of financial assets are limited; On the other hand, the critical function of state-owned enterprises is to undertake social responsibility, to respond to the macroeconomic policies promulgated by the government, to make up for the market shortage, and to drive sustained and stable economic growth. Therefore, the managers of state-owned enterprises have more administrative role and focus more on promotion opportunities, which makes the role of equity incentives in state-owned enterprises insignificant (Gong. 2021). Some scholars argue that executive compensation in non-state-owned firms is always linked to business performance, while implementing executive compensation incentives to alleviate the principal-agent problem is ineffective, and non-state-owned firms are more inclined to choose equity incentives to mitigate the principal-agent problem. Therefore, in non-state-owned firms, equity incentives can significantly and negatively regulate the relationship between environmental uncertainty and firm financialization.

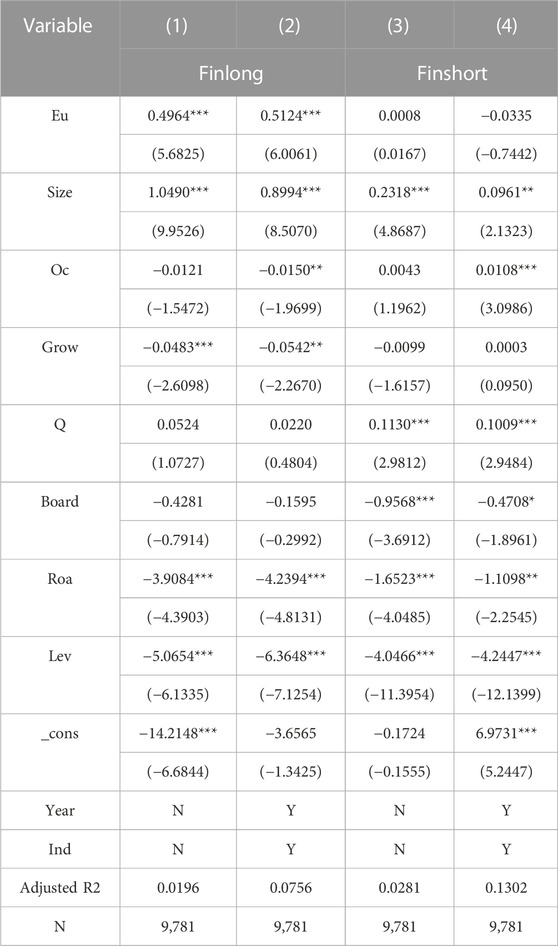

5.2 Heterogeneity in the impact of environmental uncertainty on financial asset allocation

We classify trading financial assets and available-for-sale financial assets as speculative short-term financial assets. The evaluation metric of short-term financialization of enterprises is the ratio of short-term financial assets to total assets. Derivative financial assets, held-to-maturity investments, net investment properties, and long-term equity investments are classified as value-preserving long-term financial assets. The ratio of long-term financial assets to total assets measures long-term financialization. The regression results between environmental uncertainty and financialization of different types of enterprises are shown in Table 12. Column (1) shows that the coefficient of environmental uncertainty and long-term financialization is 0.4964, which is positive at 1% level of significance (t = 5.6825). Column (2) fixes the dual effect of industry and year. At this point, the regression coefficient between environmental uncertainty and long-term financialization is 0.5124, which is still positive at 1% level of significance (t = 6.0061). Column (3) shows that the coefficient of environmental uncertainty is insignificant, and Column (4) displays that the environmental uncertainty coefficient is still not significant after fixing the dual effect of industry and year. This suggests that as environmental uncertainty rises, the allocation of financial assets within firms will shift from speculative short-term financial investments to value-preserving long-term financial assets, manifested by a decrease in firms’ short-term financialization and an increase in long-term financialization. Therefore, the financialization of enterprises intensified by rising environmental uncertainty is mainly reflected in the growth of the share of long-term financial assets in total assets.

5.3 Impact of corporate financialization on firm performance

The effect of corporate financialization on firm performance is shown in Table 13, using earnings per share (Eps) and firm profitability (Roa) to represent the level of firm performance, respectively. Column (1) shows that the regression coefficient between corporate financialization and firm profitability is −0.0011 with a significance level of 1% (t = −7.9180), indicating that the higher the degree of corporate financialization, the more serious the negative impact on the firm’s performance. Column (2) keeps the coefficient value and significance level of corporate financialization constant after fixing the dual effect of industry and year. To enhance the accuracy of the results, Column (3) uses earnings per share to measure the firm performance level. At this point, the regression coefficient between corporate financialization and earnings per share is −0.0035, which is significantly negative at the 1% level (t = −4.8415). After fixing the dual effect of industry and year, Column (4) shows that the regression coefficient between the degree of corporate financialization and earnings per share is - 0.0033 with a significance level of 1% (t = −4.4272). All of these results indicate that corporate financialization harms firm performance. Therefore, in a highly uncertain external environment, adopting appropriate equity incentives by firms can mitigate the degree of corporate financialization and improve the firm’s operating performance.

6 Conclusion and insights

Under environmental uncertainty, enterprises should pay great attention to and take appropriate measures to inhibit enterprise financialization continuous development. Based on the research sample of Chinese A-share listed companies from 2016 to 2020, this paper investigates the impact of environmental uncertainty on corporate financialization and the moderating effect of two types of executive incentives using empirical analysis. The key findings are: 1) Rising environmental uncertainty will intensify the degree of corporate financialization; 2) The implementation of executive equity incentives will restrain the degree of corporate financialization, while the implementation of executive compensation incentives will intensify the degree of corporate financialization; 3) Executive equity incentives hedge the financialization of firms caused by environmental uncertainty, while compensation incentives do not significantly hedge the relationship between environmental uncertainty and corporate financialization; 4) The implementation of executive equity incentives in non-state-owned firms can significantly alleviate the degree of financialization based on heterogeneity analysis. In contrast, implementing executive equity incentives in state-owned enterprises does not significantly alleviate the degree of financialization; 5) The rising uncertainty in the external environment makes enterprises invest less in short-term financial assets and more in long-term financial assets, and the increase in financialization has a significant negative impact on firm performance.

In summary, the following suggestions are made. First of all, in the context of environmental uncertainty, Enterprises should improve their own governance mechanisms and implement reasonable and effective executive incentive measures based on their own characteristics to curb the deepening process of enterprise financialization; As two typical ways to motivate executives, compensation incentive and equity incentive may have opposite effects. Therefore, in the design of executive incentive contracts, the differences between compensation incentives and equity incentives should be clarified and treated differently to avoid the shortcomings. In terms of compensation incentives, we should focus on the risk of financialization of enterprises brought about by compensation incentives to avoid further “de-realization” of enterprises, and in terms of equity incentives, we should give full play to the role of long-term equity incentives to curb the financialization of enterprises. Companies should adopt multi-dimensional performance evaluation indicators to identify the competence of executives, avoid executives from taking opportunistic actions that are detrimental to corporate interests due to performance pressure from external risks, make risk sharing between management and owners, and strengthen the concept of executives’ commitment to long-term corporate development. Second, the financial regulators should strengthen the active supervision and control of asset allocation, guide the financial business to serve the real economy, and reduce the large-scale inflow of bank credit funds into the financial sector. At the same time, When formulating and adjusting policies, the government should enhance transparency and procedures, provide stable expectations for enterprises, thus minimizing uncertainty and creating a “stable, fair, transparent and predictable business environment”, and also formulate relevant policies to support the real economy, for example, implementing a policy of lowering tax rates can reduce the operating costs of enterprises, improve operating profitability and ease the further financialization of enterprises. Finally, enterprises should focus on developing their primary business and make appropriate financial investments to ensure that their main business is not affected by the shortage of funds.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

Methodology, DC; writing—review and editing, YZ and NZ; supervision, MX. All authors have read and agreed to the published version of the manuscript.

Funding

This article is supported by the Research Projects on National Social Science Foundation of China under Grant number 21AJY003.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

An, L., Shen, Y., and Yu, R. H. (2018). Research on the relationship between executive incentive and firm’s financial asset allocation ----a perspective of comparing compensation incentive and equity incentive. J. shanxi finance Econ. Univ. 21, 109–117. (Chinese). doi:10.13781/j.cnki.1007-9556.2018.12.003

Bloom, N., Bond, S., and Reenen, J. V. (2007). Uncertainty and investment dynamics. Rev. Econ. Stud. 74, 391–415. doi:10.1111/j.1467-937x.2007.00426.x

Bonaime, A., Gulen, H., and lon, M. (2018). Does policy uncertainty affect mergers and acquisitions. J. Financial Econ. 129 (3), 531–558. doi:10.1016/j.jfineco.2018.05.007

Bova, F., Dou, Y. W., and Hope, O. K. (2014). Employee ownership and firm disclosure. Contemp. Account. Res. 32, 639–673. doi:10.1111/1911-3846.12084

Cecchetti, S, G., and Kharroubi, E. (2018). Why does credit growth crowd out real economic growth? Work. Pap. 2, 01–28. doi:10.1111/manc.12295

Cevahir, U., Rachna, K., and Halil, S. K. (2012). The impact of environmental uncertainty dimensions on organizational innovativeness: An empirical study on SMES. Int. J. Innovation Manag. 16 (2), 1–23. doi:10.1142/S1363919611003647

Chan, R. Y. K., and Ma, K. (2017). Impact of executive compensation on the execution of it-based environmental strategies under competition. Eur. J. Inf. Syst. 26 (5), 489–508. doi:10.1057/s41303-017-0052-3

Cheng, X., Kong, D., and Kong, G. (2022). Foreign institutional investors and executive compensation incentives: Evidence from China. J. Multinatl. financial Manag. 66, 100758. doi:10.1016/j.mulfin.2022.100758

Core, J. E., Holthausen, R. W., and Larcker, D. F. (1999). Corporate governance, chief executive officer compensation, and firm performance. J. financial Econ. 51, 371–406. doi:10.1016/s0304-405x(98)00058-0

Davis, G. F., and Kim, S. (2015). Financialization of the economy. Annu. Rev. Sociol. 41, 203–221. doi:10.1146/annurev-soc-073014-112402

Dehejia, R. H., and Wahba, S. (2002). Propensity score-matching methods for nonexperimental causal studies. Rev. Econ. statistics 84, 151–161. doi:10.1162/003465302317331982

Edziah, B. K., Sun, H., Adom, P. K., Wang, F., and Agyemang, A. O. (2022). The role of exogenous technological factors and renewable energy in carbon dioxide emission reduction in Sub-Saharan Africa. Renew. Energy 196, 1418–1428. doi:10.1016/j.renene.2022.06.130

Fisman, R., and Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. J. Dev. Econ. 83, 63–75. doi:10.1016/j.jdeveco.2005.09.009

Ghosh, D., and Olsen, L. (2009). Environmental uncertainty and managers’ use of discretionary accruals. Account. Organ. Soc. 34, 188–205. doi:10.1016/j.aos.2008.07.001

Gong, N. (2021). Financialization of enterprises, equity incentive and corporate performance. Econ. Manag. J. 1, 156–174. (Chinese). doi:10.19616/j.cnki.bmj.2021.01.010

Gu, W. T., Zheng, X. Y., Pan, L. Y., and Li, H. K. (2018). Economic policy uncertainty, bank credit, external demand, and corporate investment. Romanian J. Econ. Forecast. 21, 57–72.

Gulen, H., and lon, M. (2016). Polisscy uncertainty and corporate investment. Rev. financial Stud. 29, 523–564. doi:10.1093/rfs/hhv050

Gupta, K., Banerjee, R., and Onur, I. (2017). The effects of R&D and competition on firm value: International evidence. Int. Rev. Econ. finance 51, 391–404. doi:10.1016/j.iref.2017.07.003

Hall, L. A., and Bagchi, S. S. (2002). A Study of R&D, innovation, and business performance in the canadian biotechnology industry. Technovation 22, 231–244. doi:10.1016/s0166-4972(01)00016-5

Jin, L., and Myers, S. C. (2006). R2 around the world: New theory and new tests. J. financial Econ. 79 (2), 257–292. doi:10.1016/j.jfineco.2004.11.003

Jin, X. M., Mai, Y., and Cheung, A. W. K. (2022). Corporate financialization and fixed investment rate: Evidence from China. Finance Res. Lett. 48, 102898. doi:10.1016/j.frl.2022.102898

Kang, W. S., Lee, K., and Ratti, R. A. (2014). Economic policy uncertainty and firm-level investment. J. Macroecon. 39, 42–53. doi:10.1016/j.jmacro.2013.10.006

Kim, H., and Kung, H. (2017). The asset redeployability channel: How uncertainty affects corporate investment. Rev. financial Stud. 30 (1), 245–280. doi:10.1093/rfs/hhv076

Li, Z., Wang, Y., Tan, Y., and Huang, Z. (2020). Does corporate financialization affect corporate external responsibility? An empirical study of China. Sustainability 12 (9), 3696. doi:10.3390/su12093696

Lin, K. H., and Tomaskovic-Devey, D. (2013). Financialization and US income inequality:1970-2008. Am. J. Sociol. 118 (5), 1284–1329. doi:10.1086/669499

Liu, F., Sim, J., Sun, H., Edziah, B. K., Adom, P. K., and Song, S. (2023). Assessing the role of economic globalization on energy efficiency:Evidence from a global perspective. China Econ. Rev. 77, 101897. doi:10.1016/j.chieco.2022.101897

O'Connor, M. L., and Rafferty, M. (2010). Incentive effects of executive compensation and the valuation of firm assets. J. Corp. finance 16, 431–442. doi:10.1016/j.jcorpfin.2010.04.001

Peng, C., Fu, W. T., Zhang, X. Y., and Jiang, H. (2022). The impact of subscribing to director’s and officers’ liability insurance on corporate financialization: Evidence from China. Front. Psychol. 13, 986135. doi:10.3389/fpsyg.2022.986135

Shen, H. H., Yu, P., and Wu, L. S. (2012). State ownership, environment uncertainty and investment efficiency. J. Econ. Stud. 7, 113–126. (Chinese).

Tomaskovic-Devey, D., Lin, K. H., and Meyers, N. (2015). Did financialization reduce economic growth? Socio-economic Rev. 13 (3), 525–548. doi:10.1093/ser/mwv009

Tosi, H., Aldag, R., and Storey, R. (1973). On the measurement of the environment: An assessment of the lawrence and lorsch environmental uncertainty subscale. Adm. Sci. Q. 18, 27–36. doi:10.2307/2391925

Wang, J. H., and Mao, N. (2021). Does financialization of non-financial corporations promote or prohibit corporate risk-taking? Emerg. Mark. finance trade 58, 1913–1924. doi:10.1080/1540496x.2021.1944853

Wen, F., and Tang, S. X. (2012). Executive compensation and managerial overconfidence: Study from the angle of compensation-based behavioral view. Financial Res. 38, 48–58. doi:10.1016/B978-075068289-3.50012-5

Xu, X. M., and Xuan, C. (2021). A study on the motivation of financialization in emerging markets: The case of Chinese non-financial corporations. Int. Rev. Econ. finance 72, 606–623. doi:10.1016/j.iref.2020.12.026

Keywords: environmental uncertainty, enterprise financialization, executive equity incentive, executive compensation incentive, moderating effect

Citation: Chen D, Zhu Y, Zhou N and Xing M (2023) Impacts of environmental uncertainty on degree of enterprise financialization and the moderating role of executive incentives. Front. Environ. Sci. 11:1170596. doi: 10.3389/fenvs.2023.1170596

Received: 21 February 2023; Accepted: 12 April 2023;

Published: 05 May 2023.

Edited by:

Huaping Sun, Jiangsu University, ChinaReviewed by:

Hao Liu, Business School of Wenzhou University, ChinaYunsu Du, Nanjing University of Finance and Economics, China

Copyright © 2023 Chen, Zhu, Zhou and Xing. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yating Zhu, zyt@ahut.edu.cn

Dong Chen1

Dong Chen1 Yating Zhu

Yating Zhu