- 1School of Business Administration, Chaohu University, Hefei, China

- 2Center for International Education, Philippine Christian University, Manila, Philippines

Introduction: Studying the influence and mechanism between environmental regulation, environmental protection investment, and enterprise green technology innovation is crucial to realize ecological civilization construction and sustainable economic growth.

Methods: Based on the green patent data and the corresponding enterprise data of A-share heavily polluting industry enterprises from 2010 to 2020, a comprehensive index of environmental regulation is constructed, and the system GMM estimation method, threshold effect test, and intermediary effect model are used. The impact and mechanism of environmental regulation on enterprise green technology innovation are studied, and the heterogeneity of property rights is analyzed.

Results: The following conclusions are drawn: 1) Environmental regulation presents a “U”-shaped relationship of first suppressing and then promoting enterprise green technology innovation, and there is only a single threshold effect, and the “inflection point” is 2.756. 2) There is an intermediary effect of environmental investment in the impact of environmental regulation on enterprise green technology creation; that is, environmental regulation affects enterprise green technology innovation by affecting the environmental protection investment behavior of enterprises. 3) State-owned enterprises are more sensitive to environmental regulation, and environmental regulation has a greater impact on enterprise green technology innovation.

Discussion: These conclusions play an important role in the formulation of environmental policies by governments and in the green development of enterprises.

1 Introduction

Since the reform and opening up, China’s economy has continued to develop rapidly, accompanied by extensive economic growth characterized by high input and high consumption, which has also brought about problems such as resource scarcity and environmental pollution. In particular, enterprises in highly polluting industries have become the main source of environmental pollution. At this stage, China’s economy has shifted from a high-speed development stage to a high-quality stage, and environmental problems have become a bottleneck limiting the sustainable development of China’s economy (Li et al., 2018). If we can effectively control the problem of corporate pollution, we will definitely be able to realize the ecological civilization concept of “gold and silver mountains are green water and green mountains” put forward by General Secretary Xi Jinping, and the government is trying to reduce carbon emissions and achieve carbon neutrality, promoting the coordinated development of economic development and ecological environmental protection. Sustainable energy use and technological innovation are considered important means to promote carbon neutrality (Muzzammil Hussain and Wang, 2022; Zhou et al., 2022). Enterprises are an important carrier of technological innovation. They are also the main body of environmental pollution management. Since the ecological environment has the characteristics of public goods, enterprises lack the motivation to actively manage the environment and need the “visible hand” of the government to compensate for the market failure caused by the single market, so the environmental regulation led by the government is of great significance to environmental governance. Government environmental regulation stimulates the green transformation of enterprises by internalizing the social costs of pollution and is considered an effective way to mitigate the conflict between environmental protection and sustainable economic growth (Zhang, 2022).

The most fundamental and effective way to control environmental pollution is green innovation (Magat, 1978). Technological innovation can effectively curb carbon emissions and contribute to carbon neutrality (Hasanov et al., 2021), and technological progress has a catalytic effect on economic growth (Ximei et al., 2022; Danish et al., 2023). For enterprises, compliance with environmental regulations will lead to an increase in operating costs of enterprises; enterprises can balance the cost of compliance with the efficiency improvement effect brought by environmental improvement and finally formulate enterprises’ environmental policies, whether passive pollution emission reduction or active green technology innovation. Green technology innovation can also improve the efficiency of enterprises and promote the upgrading and transformation of enterprises while combating environmental pollution. Green technology innovation requires a large amount of capital investment. As a special investment activity, environmental protection investment can provide financial support for enterprises’ green innovation. Environmental investments are also effective in reducing carbon emissions and promoting carbon neutrality (Hasanov et al., 2021). However, enterprises’ investment decisions are affected by the intensity of environmental regulations. Therefore, we investigate the following question: how do the formulation of environmental regulatory policies and their intensity affect the green technology innovation of enterprises, and what are the characteristics and mechanisms of their impact?

The relationship between environmental regulation and green innovation is the focus of the current research. The incentive effect of environmental regulations on enterprises’ green technology innovation is still controversial. Traditional institutional economics believes that the increase in the intensity of environmental regulation crowds out enterprises’ production resources, increases production costs, and hinders technological innovation (Gollop and Roberts, 1983), while the “Porter hypothesis" (Porter, 1991) holds the opposite view, and moderate environmental regulation helps improve enterprises’ innovation behavior. In order to avoid environmental regulation and drive enterprises to carry out technological innovation, thereby generating compensatory benefits for enterprises, technological innovation has also long contributed to enhancing the competitive advantage of enterprises. This has given rise to a controversy in the academic community about environmental regulation and enterprise green technology innovation. Many scholars have carried out many useful studies on the heterogeneity of environmental regulation and the mechanism of environmental regulation on green innovation (Guo and Yuan, 2020; Xu et al., 2023). However, further research can still be conducted: (1) Most of the research focuses on environmental regulation and green innovation at the provincial and municipal levels, and the research at the micro level of enterprises is not rich enough. (2) Some studies on the relationship between environmental regulation and green innovation still need to be deepened; for example, some scholars have proposed a “U”-shaped relationship, but there is a lack of more in-depth testing of the inflection point. (3) Environmental protection investment is an active means for enterprises to deal with environmental pollution, but some scholars pointed out that enterprises make environmental protection investments to respond to the government’s environmental regulation and opportunism. What role does environmental protection investment play in the green innovation of environmental regulation enterprises? Literature studies are less involved regarding this issue.

Based on the aforestated problems, this paper selects enterprises in highly polluting industries, which are key industries monitored by government environmental regulation, to study the relationship between environmental regulation, environmental protection investment, and enterprise green technology innovation and deeply explore the mechanism of environmental regulation on enterprise green innovation. The research in this paper can contribute in the following aspects: (1) At the micro level, we propose that there is a “U”-shaped relationship between environmental regulation and enterprise green innovation, and we specifically propose the inflection point, which enriches the relevant research on environmental regulation and green innovation at the theoretical level. (2) We propose to study the mediating role of environmental investment in environmental regulation on enterprise green innovation and verify the role of environmental regulation on enterprise green technological innovation mechanism. (3) It is proposed that there are differences in the impact curves of environmental regulation on enterprise green technological innovation under different property rights characteristics. These conclusions have important guiding significance for the formulation of the intensity of government environmental regulation and the investment decision of enterprises’ green transformation and upgrading. It has practical implications for promoting the coordinated development of economic growth and environmental protection.

The rest of this article is organized as follows. Section 2 provides a literature review of environmental regulation, environmental investment, and green technology innovation; Section 3 presents the theoretical analysis and research hypotheses; Section 4 presents the materials and methods; Section 5 presents the empirical results and discussion; Section 6 presents the heterogeneity analysis; and Section 7 presents the conclusions, policy recommendations, and future research directions.

2 Literature review

Looking back at the relevant literature at home and abroad, there is no unified conclusion on the relationship between environmental regulation and green innovation. The following views are the main conclusions: (1) the promoting effect; that is, environmental regulation can stimulate enterprises to “innovation compensation” effect, thereby promoting enterprise green technology innovation (Li et al., 2021; Li et al., 2023). (2) The inhibiting effect; that is, environmental regulation has a “crowding-out” effect on enterprise innovation and research and development because it increases the cost of enterprise pollution control, thereby inhibiting enterprise green technology innovation (Leeuwen and Mohnen, 2017). (3). A large number of scholars have proposed the “U”-shaped relationship between environmental regulation and green innovation through theory and empirical evidence, and the implementation of environmental regulation will crowd out innovative research and development due to the increase in expenditure costs, and with the increase of the intensity of environmental regulation, its impact on enterprise green technology innovation is transformed from an inhibition effect to an innovation effect (Ouyang and Du, 2020; Lyu et al., 2022; Xu et al., 2023). (4). Uncertainty; environmental regulation may not necessarily promote green technology innovation, green technology innovation is affected by a combination of factors, and the relationship between the two is not simply linear or nonlinear (Rexhäuser and Rammer, 2014).

Regarding the heterogeneity of the Porter hypothesis, some scholars believe that the establishment of the Porter hypothesis requires certain premises, and the effect of environmental regulatory innovation faces many constraints (Yuan et al., 2017). From the perspective of regional differences, the regions with better development in the east support the “Porter hypothesis,” while the western region with relatively poor economic development does not (Wang and Wang, 2011). There are also differences in the impact of different types of environmental regulations on green technology innovation (Chen et al., 2022; Liping Wang and Chuang, 2022; Liu et al., 2022). Moreover, different forms of enterprise ownership and enterprises in different industries also have different green innovation performances under the same environmental regulation (Liping Wang and Chuang, 2022). In terms of research methods, scholars conducted panel data regression from the provincial (Shao et al., 2022), prefecture, and municipal levels (Xiaoxi Cao, 2022) and the industry (Lian et al., 2022) and constructed a dynamic panel regression model with the lag term of the explanatory variable to control the endogeneity effect.

Regarding environmental regulations and environmental investments: Based on Porter’s hypothesis (Xie et al., 2017), pollution paradise hypothesis (Arouri et al., 2012), and factor endowment hypothesis (Wu et al., 2019), many scholars explain the impact of environmental regulation on environmental protection investment from three aspects: promotion, inhibition, and “double” marginal effect. Although the relationship between environmental regulation and environmental protection investment is different, it shows that the decision of enterprises on environmental protection investment is influenced by environmental regulation. Regarding environmental protection investment and green innovation, based on the perspective of resource base, capital support is the key factor of green innovation (Wang et al., 2022), environmental protection investment provides the basic platform and conditions for green innovation, and the amount of environmental protection investment invested by enterprises has become an important driving force for enterprise green technology innovation. It is a common belief that environmental protection investment will promote green technology innovation (Heinkel et al., 2001; Li et al., 2022), so more research focuses on innovation output and innovation efficiency and proposes time (Ma and Hou, 2018), government (Sun, 2016), loan interest rate (Huang et al., 2019), and other factors in the impact of environmental protection investment on the output and efficiency of green technology innovation.

3 Theoretical analysis and research hypotheses

3.1 Environmental regulation and corporate green innovation

The strengthening of environmental regulations will prompt enterprises to improve their processes and increase productivity, which will have a positive impact on the improvement of enterprises’ green technological innovation capacity, and the improvement of technological innovation can compensate enterprises’ compliance costs and also bring new market opportunities, thus improving the competitiveness of enterprises, which is the innovation compensation effect brought by environmental regulations (Porter, 1991; Horbach, 2008). Thus, the strengthening of environmental regulations stimulates enterprises to innovate green technology.

However, environmental regulations impose additional costs on enterprises and have a negative impact on them: first, environmental regulations require enterprises to reduce pollutant emissions and engage in clean production, which raises entry barriers for enterprises, hinders the initial development of SMEs with insufficient capital, and reduces market dynamism; second, environmental regulations inevitably lead to additional expenses for enterprises to control pollution, which also inevitably crowd out funds for technological research and development, etc. Thus, environmental regulations have a crowding-out effect on green technology innovation (Leeuwen and Mohnen, 2017). This hinders green innovation.

In summary, environmental regulations and enterprises’ green technology innovation are affected by a combination of the innovation compensation effect and crowding-out effect. This paper reasonably speculates that the relationship between environmental regulation and corporate green innovation is not simply linear but that there should be an “inflection point” between the two, and when environmental regulation exceeds this point, the innovation compensation effect of environmental regulation on corporate green innovation is greater than the crowding-out effect, which shows that enterprise green innovation has a positive impact. Otherwise, it shows a negative impact. Based on this, this paper proposes hypothesis 1.

H1. Environmental regulation and enterprise green technology innovation have a “U”-shaped relationship.

3.2 The role of enterprise environmental protection investment in environmental regulation in the innovation of enterprise green technology

The strengthening of environmental regulations will affect the investment decisions of enterprises in environmental protection (Turken et al., 2020). First, in the face of the strengthening of local environmental regulations, it will restrict the investment of enterprises that have not carried out environmental management (Li et al., 2023), and second, environmental regulations will affect the financing environment of enterprises. With the strengthening of environmental regulations, enterprises will actively invest in environmental protection to obtain investment opportunities and reduce financing costs. Especially for heavily polluting industries and countries or regions with high environmental protection requirements, environmental regulations will promote environmental investment (Luo et al., 2021; Wang et al., 2022).

According to the literature, environmental investment can significantly promote green technology innovation. Environmental investment can provide the capital needed for enterprise green technology innovation and provide the infrastructure for talent to gather, so there is an input–output relationship between environmental protection investment and enterprise green innovation, and enterprise environmental protection investment is conducive to enterprise green technology innovation and further enhance enterprise value (Lee et al., 2015).

From the perspective of compliance costs, when enterprises face stricter environmental regulations, enterprises will weigh the benefits of environmental protection investment with the costs of environmental regulations (fines, environmental protection taxes, etc.), adjust the investment structure of enterprises, and increase strong environmental protection investment, thereby affecting the green technology innovation of enterprises.

According to the chain rule, environmental regulation will affect enterprises’ environmental protection investment, and environmental protection investment will affect enterprises’ green technology innovation, so this paper proposes hypothesis 2.

H2. Environmental protection investment plays an intermediary role in environmental regulation and green technology innovation of enterprises; that is, environmental regulation affects environmental protection investment and then affects green technology innovation of enterprises.

3.3 Heterogeneity of different enterprise ownership forms

In general, state-owned enterprises have more social responsibility, are more sensitive to government environmental regulations, will take more proactive measures in the face of environmental regulations, have more financial resources than passive measures, such as paying pollution discharge fees, and are more likely to make environmental protection investments, proactively innovating green technologies. Non-state-owned enterprises will be more cautious about environmental protection investment, preferring to invest in short-term income projects, while green innovation for enterprises is relatively conservative, and only when the benefits of green innovation are higher than the cost of environmental regulation, non-state-owned enterprises will take the initiative to carry out green innovation. Based on the aforestated analysis, this paper proposes hypothesis 3.

H3. Environmental regulations help to improve green technology innovation in SOEs but not in non-SOEs.

4 Materials and methods

4.1 Sample selection and data sources

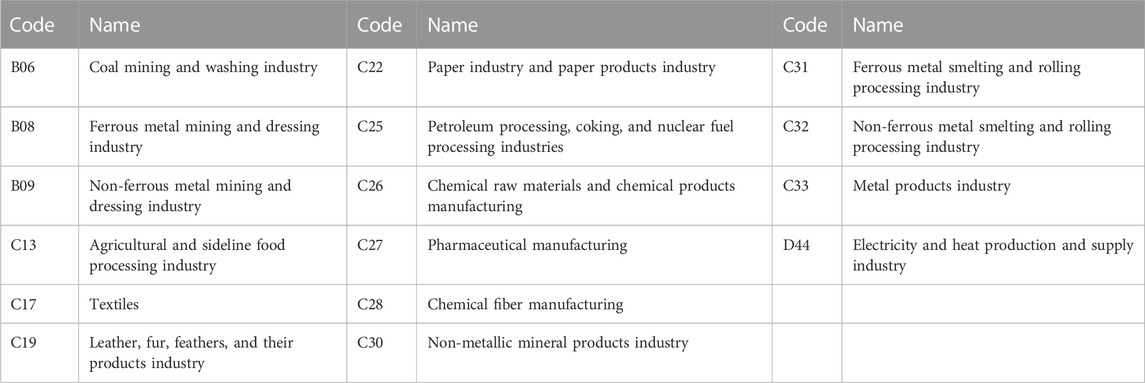

Considering the availability of data, the data of listed companies in China’s heavily polluting industries from 2010 to 2020 were selected as the research sample. According to the 2010 Guidelines for Environmental Information Disclosure of Listed Companies and the 2012 Revised Guidelines for the Classification of Listed Companies by Industry, the heavily polluting industries are defined as B mining, C manufacturing, D electricity, heat, gas, and water production and supply in three major categories of 16 sub-categories, as shown in Table 1. The samples were screened as follows: (1) ST, *ST companies during the exclusion period; (2) exclusion of samples with missing key data. In the end, 625 samples and 9,334 observations were screened. Among them, the environmental regulation is measured, the data of enterprise green technology innovation and enterprise environmental protection investment are manually screened, and the main sources of other enterprise data are the Guotai’an database, the Wind database, and the website of the National Bureau of Statistics.

4.2 Variable setting

(1) Explained variable: enterprise green technology innovation (GTI).

Considering the delay in patent approval, the number of green patent applications is used instead to represent green technology innovation. Regarding the number of green patent applications obtained, first, the patent IPC classification number was searched from the State Intellectual Property Office (SIPO), and the patent applications of all enterprises in heavily polluting industries were manually obtained; second, the green patent IPC classification number was obtained from the “International Patent Green Classification List” launched by the World Intellectual Property Organization (WIPO) in 2010; finally, the types of patent applications of enterprises in heavily polluting industries obtained from the State Intellectual Property Office were matched with the green patent IPC classification number to obtain the number of green patents applied by enterprises in heavily polluting industries each year, according to Qi et al. (2018). In this paper, alternative energy production, waste management, and energy conservation patents are selected as the specific projects of green patents, and each enterprise is added according to the three aforementioned patent applications as a measure of enterprise green technology innovation. The number of green utility patent applications is used as an alternative index of enterprise green technology innovation for robustness testing.

(2) Explanatory variable: environmental regulation (Er)

Environmental regulation is based on the practice of Ye et al. (2018) to calculate the comprehensive index of environmental regulation intensity through the industrial wastewater discharge, SO2 emission, and industrial soot emission of enterprises. The larger the comprehensive index of environmental regulation, that is, the more polluting the emissions, the lower the intensity of environmental regulation, and vice versa. The specific measurement method of the specific environmental regulation comprehensive index is as follows.

① We standardize the industrial wastewater discharge, SO2 emission, and industrial smoke emission of the enterprise, and the standardized formula is as follows:

where

② Calculating the weight of each pollutant:

where

③ Through the standardization and weight of pollutant emissions, the comprehensive index of environmental regulation of the enterprise is finally calculated.

(3) Intermediary variable: environmental investment (EI)

Environmental protection investment refers to investment in pollution control, emission reduction, resource conservation, etc. In the narrow sense, environmental protection investment refers to environmental protection capital expenditure, and in the broad sense, it includes not only environmental protection capital expenditure but also environmental protection cost expenditure. Here, we define corporate environmental protection investment as corporate environmental protection capital expenditure. The acquisition of capital environmental protection investment data adopts the practice of Zhang et al. (2019) and retrieves the environmental protection-related production line renovation, clean production equipment purchase, and other items from the “construction in progress” details in the company’s financial statements as the amount of capital environmental protection investment. In order to eliminate the effect of enterprise size, the deflation of total assets at the end of the period is adopted.

(4) Control variables

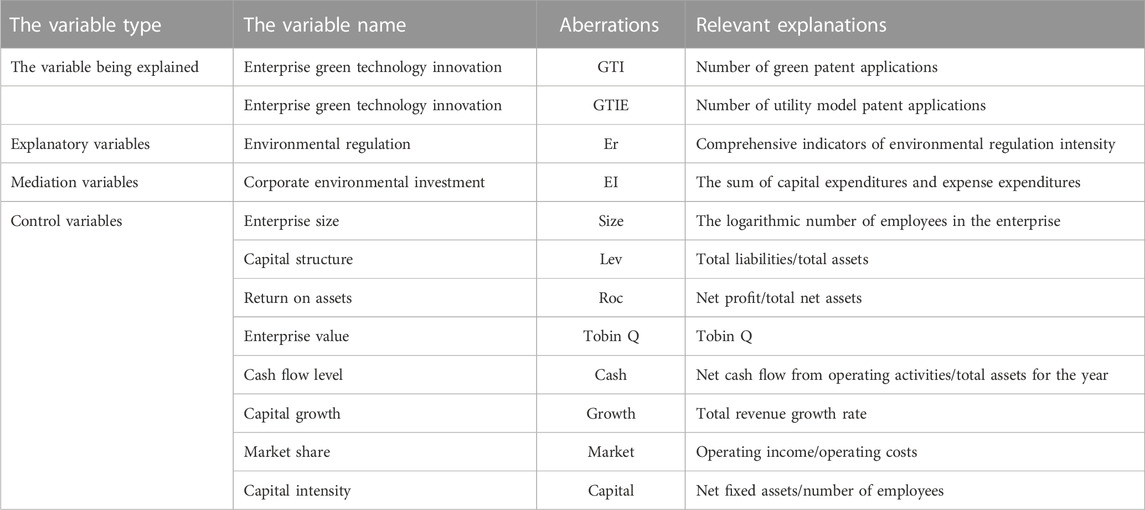

Enterprise green technology innovation will also be influenced by other factors that need to be controlled variables. According to the results of research studies by Qi et al. (2018) and You and Li (2022), combined with the actual situation, we choose the enterprise size, capital structure, return on assets, enterprise value, cash flow level, enterprise growth, market share, and capital intensity as control variables, as shown in Table 2.

4.3 Model settings

(1) Benchmark model of environmental regulation for enterprise green technology innovation

We have analyzed the impact of environmental regulation on green technology innovation theoretically, but the relationship needs to be verified econometrically based on enterprise-related data. A multiple linear regression model usually uses a set of predictor variables to measure the response to a particular variable. While the relationship between environmental regulation and enterprises’ green technology innovation is not a simple linear relationship, so we refer to the study by Ouyang and Du (2020) and add the square of environmental regulation to the linear regression model to construct a benchmark effect model for regression to test the effect of environmental regulation on enterprises’ green technology innovation, which is as follows:

Among them, i represents enterprise, t represents time, GTI represents enterprise green technology innovation, Er represents environmental regulation,

(2) Dynamic panel GMM model of environmental regulation and enterprise green technology innovation

The GMM estimation method can effectively solve the endogeneity problem by constructing equations parameters based on moment conditions without assuming the distribution of variables or knowing the distribution information of random disturbance terms (Roodman, 2009). Considering the possible endogeneity of environmental regulation and green technology innovation, in order to eliminate the influence of endogeneity and ensure the stability of the conclusion, this paper introduces the instrumental variables, selects the lag of one period of green technology innovation lag as the instrumental variable, and uses the more efficient systematic GMM estimation method to establish the dynamic panel GMM model of environmental regulation and enterprise green technology innovation for regression. The details are as follows:

where

(3) The threshold effect model of environmental regulation on enterprise green technology innovation

There is a threshold for the incentive effect of environmental regulations on enterprises’ green innovation. Theoretical analysis also suggests that there may be a “U”-shaped relationship between the two, and we need to further explore the specific inflection point values. In order to explore the “inflection point” of the “U”-shaped relationship between environmental regulation and green technology innovation, we analyze the impact of environmental regulation on green technology innovation at different intervals. According to the findings of Hansen (1999), we choose environmental regulation as the threshold variable and construct a threshold effect model:

where I ( ) represents the indicator function. When the expression in parentheses is positive, the value is 1; otherwise, the value is 0;

(4) The mediation effect model of enterprise environmental protection investment

We aimed to investigate the mediating role of environmental protection investment of enterprises in environmental regulation on enterprises’ green technology innovation. To establish the mediation effect model, the traditional mediation effect generally adopts the stepwise regression method of Wen et al. (2004), and later, Jiang (2022) proposed to verify whether the regression coefficient estimate of the explanatory variable by adding the mediation variable to the explanatory variable is significant. The causal chain between the explanatory variable and the interpreted variable should not be too long, and the influence of the mediating variable on the interpreted variable should be obvious. In this paper, the suggestions of Jiang Boat are used to test whether the relationship between the environmental protection investment of enterprises in the mediation variable and the environmental regulation of the explanatory variable is significant. In addition, the relationship between the green technology innovation of the explanatory variable enterprises and the environmental protection investment of the mediation variable enterprises has been elaborated in the literature review, and there is a significant positive relationship between the two. The specific model is as follows:

where

5 Results and discussion

5.1 Descriptive statistics

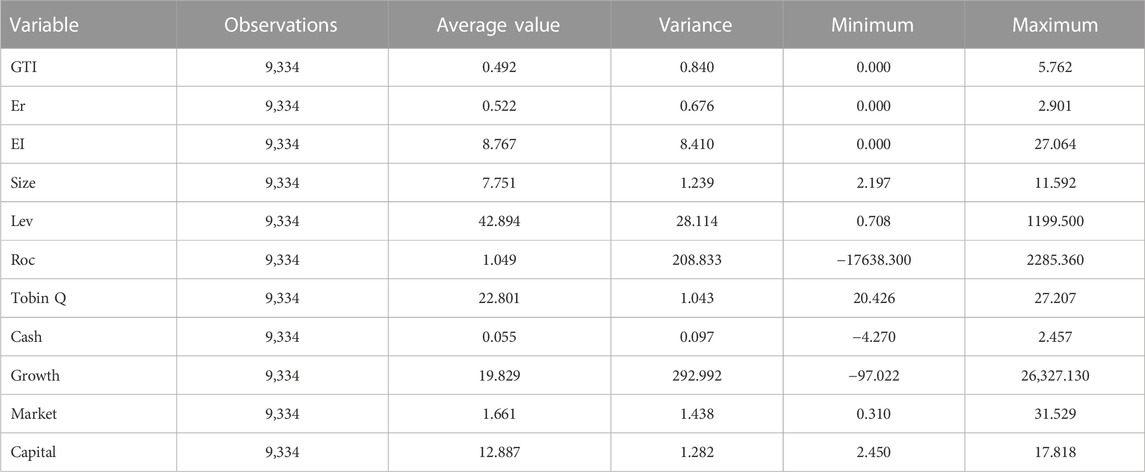

The descriptive statistics of each variable are shown in Table 3. All data were dimensionless, and the results of descriptive statistics showed that different high polluting enterprises have different attitudes towards green technology innovation. A considerable number of enterprises have no idea of green technology innovation, and there are some enterprises that are more proactive in green innovation. The attitude to green innovation also affects the amount of environmental investment of enterprises, so the variables of environmental protection investment also vary widely.

5.2 Regression model results and discussion

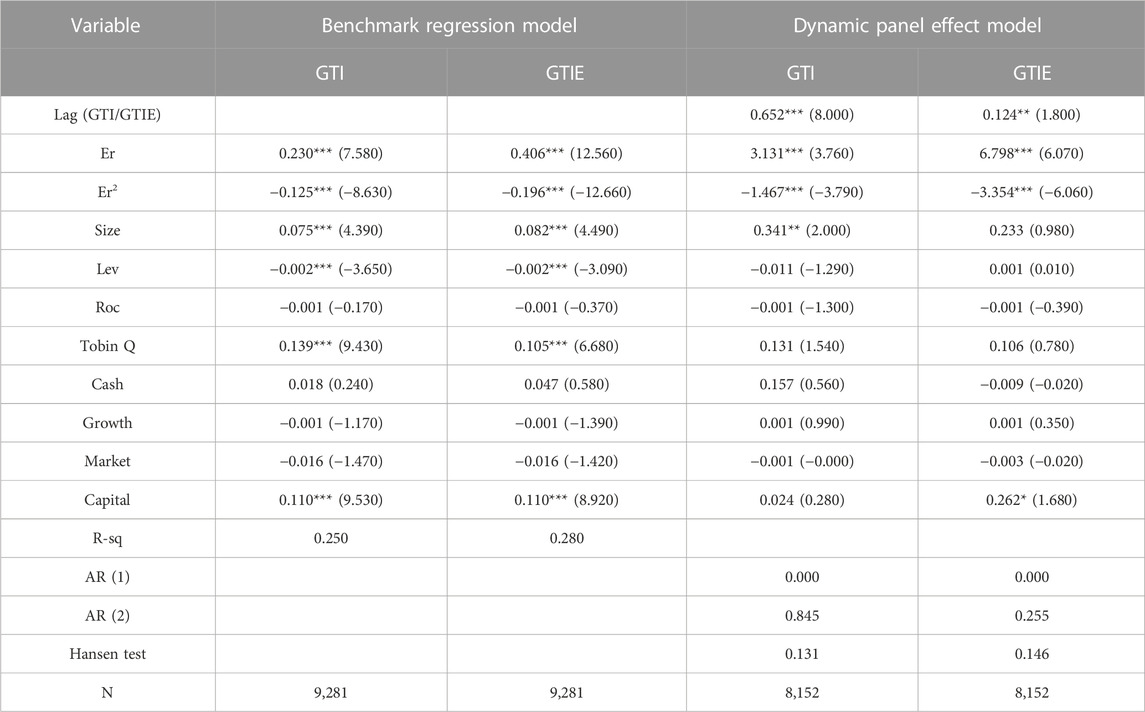

The benchmark regression results according to model 1 are shown in Table 4. According to the results of the Hausman test, this paper selects the fixed-effects model to test the multiple regression of environmental regulation on enterprise green technology innovation. From the results, it can be seen that the coefficient of the environmental regulation composite index on enterprise green technology innovation is significantly positive, and since the larger the environmental regulation composite index, the weaker the environmental regulation, the positive coefficient indicates that the environmental regulation is negatively significant on enterprise green technology innovation, and the negative coefficient of the quadratic term of environmental regulation on enterprise green technology innovation indicates positive significance. This indicates that environmental regulation has a “U”-shaped relationship that first inhibits and then promotes green technology innovation, and the result remains unchanged after substituting the variable being explained, which verifies the correctness of hypothesis 1. This result shows that in the face of tightening environmental regulations, enterprises cope with environmental regulations in the initial stage and continuously increase investment in pollution control costs and have a crowding-out effect on green R&D costs, leading to a reduction in enterprise green technology innovation; as the cost of pollution control increases, by comparing the long-term benefits of green innovation with the current costs of passive pollution control expenditures, companies will invest more in green innovation and improve green production technologies to produce green products, thus reducing the cost of pollution control, which is the “innovation compensation effect.” The strength of environmental regulation affects enterprises’ decisions on green innovation. In the long run, the government will continue to tighten environmental regulations, and enterprises will continue to improve their green innovation capability to meet the standards and make green technology innovation their core competitiveness. Therefore, the change in environmental regulations will lead to a nonlinear relationship of first inhibiting and then promoting the green technology innovation of enterprises.

TABLE 4. Results of the regression model of environmental regulation on enterprise green technology innovation.

From the regression results of the control variables in Table 4, the effect of capital structure on enterprise green technology innovation is significantly negative. It means that the lower the asset-liability ratio, the more sufficient funds enterprises have for green technology research and development. Enterprise size, enterprise value, and capital intensity have a positive effect on enterprise green technology innovation. The explanation for this is that the larger the scale of the enterprise, the more inclined to conduct green technology research and development for long-term development when faced with environmental regulations; enterprises with higher enterprise value pay more attention to investment in future technologies and pay more attention to green technology research and development; the more capital-intensive the enterprise, the stronger the financial capacity and the more funds are used for green technology research and development.

5.3 Dynamic panel model results and discussion

To solve the endogeneity problem, the dynamic panel model is used for further verification, and we use the systematic GMM estimation method. The specific results are reported as shown in Table 4. AR (1) passed the 0.01 test, and AR (2) did not pass, indicating that the residuals only had first-order sequence correlation and did not have second-order sequence correlation problems. The Hensen test was passed, indicating that there was no over-identification problem, which indicates the robustness of the results of the GMM estimation. From the results point of view, the impact of green technology innovation of enterprises lagging behind in the first period on the green technology innovation of the current period is significantly positive, indicating that the current technological innovation mode of enterprises has received the impact of technology transformation, research and development difficulties, or market advantages of new products, and will not change much in the short term. In the dynamic regression results, the quadratic terms of the environmental regulation composite index and the environmental regulation composite index are relatively significant, and the direction is consistent with the benchmark regression. It indicates that the results of the effect of environmental regulation on enterprises’ green technology innovation are robust.

5.4 Threshold effect test results and discussion

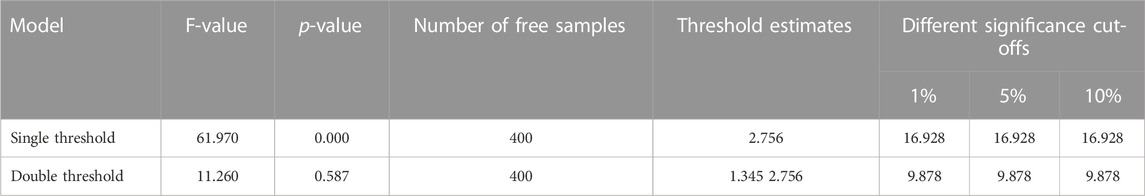

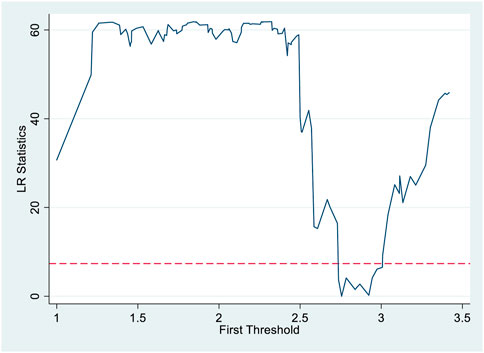

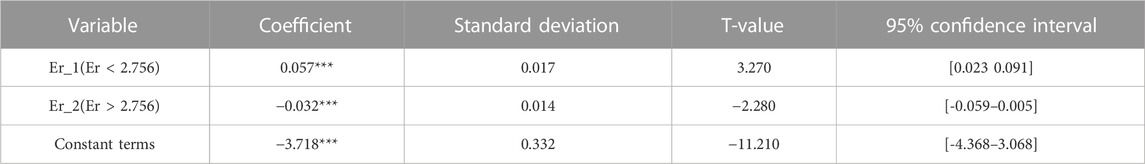

According to the aforestated analysis, the impact of environmental regulation on enterprise green technology innovation shows a nonlinear relationship of first decline and then rise, but whether there are multiple inflection points of decline and rise, where are the specific inflection points, and what are the impacts of environmental regulation on enterprise green technology innovation in different intervals need to be further analyzed by the threshold effect model. Referring to the research by Yang Dan et al. [38], this paper analyzes the inflection point of environmental regulation on enterprise green innovation and examines the difference in the impact of environmental regulation on enterprise green innovation in different intervals. In this paper, the bootstrap self-help method was selected to sample 400 times to estimate the threshold and related statistics. The specific results are as follows: as can be seen from Table 5, the single threshold value is 2.756, and the F-statistic is significant at the 1% level, while the double threshold F-statistic is not significant. Therefore, it shows that there is a single threshold effect in environmental regulation. Figure 1 reports that a single threshold estimate passes the 95% confidence interval test; according to the regression results of the single threshold panel in Table 6, it can be seen that environmental regulation shows a “U”-shaped relationship of first decreasing and then increasing on enterprises’ green technology innovation, which further verifies hypothesis 1.

The threshold effect regression results indicate that there is no multiple downward rising inflection point of environmental regulation on enterprises’ green technological innovation, as can be seen in Table 5. The inflection point of “U” is 2.756, that is, when the environmental regulation is less than 2.756, the environmental regulation requirement is low, and enterprises passively accept environmental regulations and respond mainly by paying emission fees, fines, etc., which also crowd out green R&D expenditures without changing overall costs. In addition, the impact of environmental regulation on enterprises’ green technology innovation is inhibited in this interval; as the environmental regulation increases, the cost of pollution control and other entry barriers become higher, and enterprises need to improve green technology innovation to reduce costs and enhance competitiveness. When the environmental regulation is greater than 2.756, the impact of environmental regulation on enterprises’ green technology innovation is mainly manifested as the “innovation compensation effect,” which shows the promotion effect. The coefficient of the first interval is 0.057, and the coefficient of the second interval is 0.032, indicating that the rate of decrease in the first interval is higher than the rate of increase in the second interval. The possible reason is that at the beginning of environmental regulation, responding to pollution control, crowding-out the already small amount of green R&D costs, and as the cost of pollution control continues to rise and the cost of green R&D decreases, accelerating the reduction of green technology innovation level; with the increase of environmental regulation, enterprises have increased their investment in green R&D. The level of green technology innovation of enterprises is increasing, but due to R&D inertia, the increase of green technology innovation is slower.

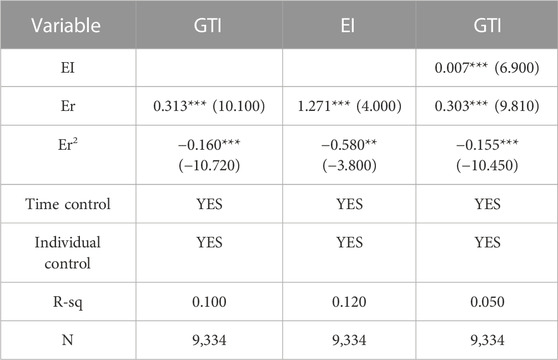

5.5 Mediation effect test results and discussion

Table 7 reports the mediating effect of environmental protection investment on enterprise green technology innovation, and it can be seen from the results that environmental regulation shows significant effects on both environmental investment and quadratic items of environmental investment, and the direction of change is consistent with the direction of the effect of environmental regulation on green technology innovation. According to the literature analysis, the positive impact of environmental protection investment on green technology innovation of enterprises is obvious. It also verifies the significant impact of environmental protection investment on green technology innovation, so we can conclude that environmental protection investment has a mediating effect on green technology innovation in environmental regulation, which verifies hypothesis 2. Changes in environmental regulations have affected the choice of environmental protection investment by enterprises. In the early stage of government environmental regulation, the cost of pollution control is lower than environmental protection investment. Therefore, enterprises are more inclined to invest more in pollution control costs and less in environmental protection. With strict environmental regulations, the government continues to guide enterprises to green innovation and subsidies for environmental investment, and enterprises aim to improve competitiveness and access to the threshold with increased investment in environmental protection. Environmental protection investment provides innovation platform, technology, capital, and other aspects of support for enterprise technological innovation so as to improve enterprise green technology innovation.

5.6 Robustness test

In order to verify the robustness of the empirical results, this paper conducts robustness tests from two aspects: (1) replacing the explanatory variables, using the number of green utility patent applications as the interpreted variables, and the test results are shown in Table 4, and the results are still stable. (2) To solve the endogenous problem and reverse causation, the instrumental variable method is adopted, and the first period of environmental regulation lag is used as a predetermined explanatory variable to construct a dynamic model, and the systematic GMM estimation method is adopted, the specific results are shown in Table 4, and the test results are consistent with the research conclusions. This shows that the conclusions of this research are robust.

6 Heterogeneity analysis

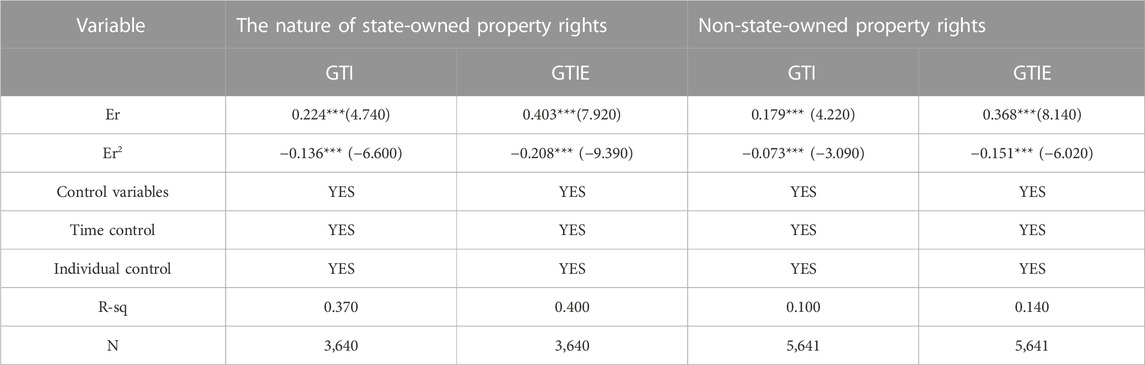

According to the type of property rights of highly polluting enterprises, private enterprises and foreign-funded enterprises are classified as non-state-owned enterprises, and state-controlled enterprises and wholly state-owned enterprises at the central, provincial, county, and municipal levels are classified as state-owned enterprises. The regression test was conducted in groups, and the specific results are shown in Table 8. Regardless of the type of property rights, the effect of environmental regulation on green technology innovation in enterprises is obvious. Thus, hypothesis 3 is rejected. State-owned property rights enterprises with high pollution have lower tolerance for environmental regulation, are more sensitive to green technology innovation, adopt a more proactive approach in the face of environmental regulation, actively strengthen environmental protection investment, and invest in green technology innovation earlier in the product production process, and the “innovation compensation effect” of positive incentives occupies the mainstream earlier. Non-state-owned property rights enterprises, on the other hand, are relatively passive in responding to environmental regulations and have a high degree of tolerance. The reason for this may be that the nature of state-owned property rights enterprise social responsibility is heavier, and it needs to be more proactive in responding to government environmental regulatory orders and, therefore, to green technology innovation.

TABLE 8. Results of the impact of environmental regulation on green technology innovation of enterprises under different property rights.

7 Conclusion, recommendations, and future directions

7.1 Conclusion

This paper takes the data of enterprises in heavily polluting industries listed on A-shares from 2010 to 2020 as a research sample, studies the impact of environmental regulation on enterprises’ green technology innovation, constructs a comprehensive index of environmental regulation, and uses enterprises’ green patent applications as a proxy for enterprises’ green technology innovation, using regression analysis and threshold effect testing. The method analyzes the impact of environmental regulation on enterprises’ green technology innovation, the mediating effect of environmental protection investment, and the heterogeneity of enterprises with different property rights and uses the systematic GMM estimation method to control endogenous problems. The specific conclusions are as follows: (1) with the improvement of environmental regulation, the “U”-shaped relationship of first suppressing and then promoting enterprise green technology innovation exists; (2) environmental regulation has a single threshold effect on enterprise green technology innovation, and the threshold inflection point is 2.756. When environmental regulation is less than 2.756, environmental regulation has a suppressing effect on enterprise green technology innovation, and when environmental regulation is greater than 2.756, environmental regulation has a promoting effect on enterprise green technology innovation; (3) environmental protection investment has an intermediary effect in environmental regulation on enterprise green technology innovation, that is, changes in environmental regulation affect the choice of environmental protection investment by enterprises, and environmental protection investment affects enterprise green technology innovation; and (4) the degree of impact of environmental regulation on enterprise green technology innovation in different property rights enterprises is different, and the nature of state-owned property rights is more sensitive to environmental regulation and has a greater impact on enterprise green technology innovation.

7.2 Recommendations

Based on the aforestated conclusions, the following suggestions are made for environmental regulation and green innovation of heavily polluting enterprises:

(1) Formulating incentive-supporting policies for green technology innovation: Strengthening environmental protection is an important means to promote sustainable and high-quality economic development and transform the mode of economic development. Among them, enterprises must change their development thinking and improve the production of green products, and the key is the research and development of green technology innovation of enterprises. The government’s flexible environmental regulatory incentives are crucial to strengthen the green technology innovation of enterprises. When the intensity of environmental regulation is low, in order to reduce passive environmental protection expenditure, such as fines by enterprises, we should start from the two aspects of financial incentives and talents, stimulate and promote the research and development of green technologies of enterprises, and pay attention to absorb and cultivate innovative talents, promote the transformation of green technology innovation, and promote the arrival of the “inflection point” as soon as possible.

(2) Improving the subsidy policy for environmental protection investment of enterprises: Environmental protection investment is an important way for enterprises to achieve green technology innovation, and in formulating environmental protection policies, we should pay attention to supporting environmental protection investment of enterprises and subsidies for environmental protection equipment. In addition, in order to prevent enterprises from fraudulently obtaining subsidies through low-quality and high-volume innovation patents, they should divide innovation activities and classify subsidies according to the difficulty and value of innovation and research and development so as to truly promote the development of green high-tech innovation. Actively expanding financing channels for enterprises’ environmental protection investment and reducing financing costs and financing risks help heavily polluting enterprises solve the dilemma of lack of cash flow for environmental protection investment and strongly support enterprises’ green technology innovation.

(3) Improving the environmental awareness of enterprises themselves: State-owned property rights type of enterprises relatively take more social responsibility, are more sensitive to environmental regulations, and pay more attention to environmental protection investment. More enterprises should be guided to sort out the correct value orientation of environmental protection, encourage enterprises to take the initiative to disclose information related to environmental protection, and enhance their own awareness of social responsibility and a good environmental image in the minds of the public. Accelerating enterprise green innovation technology research and development will boost enterprises’ transformation to green development. The green transformation of enterprises can not only promote sustainable economic development but also improve the core competitiveness of enterprises and effectively improve their business performance.

7.3 Shortcomings and future directions

Although this paper has conducted a detailed theoretical analysis and empirical research on environmental regulations and enterprises’ green technological innovation, there are still some shortcomings that can be further studied in the future: First, this paper makes a comprehensive evaluation of environmental regulations but does not break down the different types of environmental regulations. Future research should consider the impact of different types of environmental regulations on green technology innovation to provide a theoretical basis for more precise policy implementation. Second, more industries are not considered, and this paper only considers highly polluting industries that are most sensitive to environmental regulations. Different industries have different sensitivities to environmental regulations and, therefore, have different degrees of influence on green innovation, and the heterogeneity of industries needs to be considered in future research. Thus, future research should focus on the impact of environmental regulations on green technology innovation in different industries.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

BY: data collection, writing, conceptualization, and methodology. QZ: editing, reviewing, and supervision. All authors contributed to the article and approved the submitted version.

Funding

This study was supported by the Scientific Research Project of Anhui Higher Education Institution (project number: 2022AH051697); the Discipline Construction Quality Improvement Project of Chaohu University (project number: kj22kctd03) and Excellent Young Talents Fund Project of Anhui Province Universities (project number: gxyq2022077).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arouri, M. E. H., Caporale, G. M., Rault, C., Sova, R., and Sova, A. (2012). Environmental regulation and competitiveness: Evidence from Romania. Ecol. Econ. 81, 130–139. doi:10.1016/j.ecolecon.2012.07.001

Chen, Z., Chen, Z., Niu, X., Gao, X., and Chen, H. (2022). How does environmental regulation affect green innovation? A perspective from the heterogeneity in environmental regulations and pollutants. Front. Energy Res. 10. doi:10.3389/fenrg.2022.885525

Danish, , Khan, S., and Haneklaus, N. (2023). Sustainable economic development across globe: The dynamics between technology, digital trade and economic performance. Technol. Soc. 72, 102207. doi:10.1016/j.techsoc.2023.102207

Gollop, F. M., and Roberts, M. J. (1983). Environmental regulations and productivity growth: The case of fossil-fueled electric power generation. J. Political Econ. 91 (4), 654–674. doi:10.1086/261170

Guo, R., and Yuan, Y. (2020). Different types of environmental regulations and heterogeneous influence on energy efficiency in the industrial sector: Evidence from Chinese provincial data. Energy Policy 145, 111747. doi:10.1016/j.enpol.2020.111747

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. J. Econ. 93 (2), 345–368. doi:10.1016/s0304-4076(99)00025-1

Hasanov, F. J., Khan, Z., Hussain, M., and Tufail, M. (2021). Theoretical framework for the carbon emissions effects of technological progress and renewable energy consumption. Sustain. Dev. 29 (5), 810–822. doi:10.1002/sd.2175

Heinkel, R. L., Kraus, A., and Zechner, J. (2001). The effect of green investment on corporate behavior. J. Financial Quantitative Analysis 36 (4), 431–449. doi:10.2307/2676219

Horbach, J. (2008). Determinants of environmental innovation―New evidence from German panel data sources. Res. Policy 37 (1), 163–173. doi:10.1016/j.respol.2007.08.006

Huang, Z., Liao, G., and Li, Z. (2019). Loaning scale and government subsidy for promoting green innovation. Technol. Forecast. Soc. Change 144, 148–156. doi:10.1016/j.techfore.2019.04.023

Jiang, T. (2022). Mediating and moderating effects in empirical studies of causal inference. China Industrial Economics 410 (05), 100–120. doi:10.19581/j.cnki.ciejournal.2022.05.005

Lee, S.-H., Park, S., and Kim, T. (2015). Review on investment direction of green technology R&D in Korea. Renew. Sustain. Energy Rev. 50, 186–193. doi:10.1016/j.rser.2015.04.158

Leeuwen, G. v., and Mohnen, P. (2017). Revisiting the porter hypothesis: An empirical analysis of green innovation for The Netherlands. Econ. Innovation New Technol. 26 (1-2), 63–77. doi:10.1080/10438599.2016.1202521

Li, D., Huang, M., Ren, S., Chen, X., and Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. J. Bus. Ethics 150 (4), 1089–1104. doi:10.1007/s10551-016-3187-6

Li, M., Lin, Q., Lan, F., Zhan, Z., and He, Z. (2023). Trade policy uncertainty and financial investment: Evidence from Chinese energy firms. Energy Econ. 117, 106424. doi:10.1016/j.eneco.2022.106424

Li, R., Xu, G., and Ramanathan, R. (2022). The impact of environmental investments on green innovation: An integration of factors that increase or decrease uncertainty. Bus. Strategy and Environ. 31 (7), 1. doi:10.1002/bse.3090

Li, X., Hu, Z., and Zhang, Q. (2021). Environmental regulation, economic policy uncertainty, and green technology innovation. Clean Technol. Environ. Policy 23 (10), 2975–2988. doi:10.1007/s10098-021-02219-4

Li, Z., Huang, Z., and Su, Y. (2023). New media environment, environmental regulation and corporate green technology innovation:Evidence from China. Energy Econ. 119, 106545. doi:10.1016/j.eneco.2023.106545

Lian, G., Xu, A., and Zhu, Y. (2022). Substantive green innovation or symbolic green innovation? The impact of ER on enterprise green innovation based on the dual moderating effects. J. Innovation Knowl. 7 (3), 100203. doi:10.1016/j.jik.2022.100203

Liping Wang, Y. L., and Chuang, Li. (2022). Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manag. 322, 116127. doi:10.1016/j.jenvman.2022.116127

Liu, J., Liu, J., Wang, H., Ho, H., Huang, L., and Huang, L. (2022). Impact of heterogeneous environmental regulation on manufacturing sector green transformation and sustainability. Front. Environ. Sci. 10. doi:10.3389/fenvs.2022.938509

Luo, Y. S., Muhammad, , and Lu, Z. (2021). Heterogeneous impacts of environmental regulations and foreign direct investment on green innovation across different regions in China. Sci. Total Environ. 759, 143744. doi:10.1016/j.scitotenv.2020.143744

Lyu, Y., Zhang, J., Wang, L., Yang, F., and Hao, Y. (2022). Towards a win-win situation for innovation and sustainable development: The role of environmental regulation. Sustain. Dev. 30 (6), 1703–1717. doi:10.1002/sd.2336

Magat, W. A. (1978). Pollution control and technological advance: A dynamic model of the firm. J. Environ. Econ. Manag. 5 (1), 1–25. doi:10.1016/0095-0696(78)90002-5

Muzzammil Hussain, N. H., and Wang, Y. (2022). Is moderating effect of uncertain economic policies helpful for a sustainable environment in emerging economies? Environ. Sci. Pollut. Res. Int. 30 (11), 31370–31382. doi:10.1007/s11356-022-24269-x

Ouyang, X. L., and Du, K. (2020). How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energy Policy 139, 111310. doi:10.1016/j.enpol.2020.111310

Qi, S., Lin, S., and Cui, J. (2018). Can environmental equity trading market induce green innovation? -- Evidence based on data on green patents of listed companies in China. Econ. Res. 53 (12), 129–143.

Rexhäuser, S., and Rammer, C. (2014). Environmental innovations and firm profitability: Unmasking the porter hypothesis. Environ. Resour. Econ. Environ. Resour. Econ. 57 (1), 145–167. doi:10.1007/s10640-013-9671-x

Roodman, D. (2009). How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J. 9 (1), 86–136. doi:10.1177/1536867x0900900106

Shao, X., Liu, S., Ran, R., and Liu, Y. (2022). Environmental regulation, market demand, and green innovation: Spatial perspective evidence from China. Environ. Sci. Pollut. Res. 29 (42), 63859–63885. doi:10.1007/s11356-022-20313-y

Turken, N., Carrillo, J., and Verter, V. (2020). Strategic supply chain decisions under environmental regulations: When to invest in end-of-pipe and green technology. Eur. J. Operational Res. 283 (2), 601–613. doi:10.1016/j.ejor.2019.11.022

Wang, G., and Wang, D. (2011). Porter's hypothesis, environmental regulation and corporate technological innovation--a comparative analysis of the Middle East. China Soft Sci. 241 (01), 100–112.

Wang, Z., Wang, N., Hu, X., and Wang, H. (2022). Threshold effects of environmental regulation types on green investment by heavily polluting enterprises. Environ. Sci. Eur. 34 (1), 26. doi:10.1186/s12302-022-00606-2

Wen, Z., Zhang, L., and Hou, J. (2004). Mediation effect test procedure and its application. Journal of Psychology (05), 614–620.

Wu, J., Wei, Y., Chen, W., and Yuan, F. (2019). Environmental regulations and redistribution of polluting industries in transitional China: Understanding regional and industrial differences. J. Clean. Prod. 206, 142–155. doi:10.1016/j.jclepro.2018.09.042

Xiaoxi Cao, Y. Z., and Zhang, Y. (2022). Environmental regulation, foreign investment, and green innovation: A case study from China. Environ. Sci. Pollut. Res. Int. 30 (3), 7218–7235. doi:10.1007/s11356-022-22722-5

Xie, R., Yuan, Y., and Huang, J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 132 (1), 104–112. doi:10.1016/j.ecolecon.2016.10.019

Ximei, L., Latif, Z., Latif, S., and waraa, K. u. (2022). Estimating the impact of information technology on economic growth in south Asian countries: The silver lining of education. Inf. Dev. 2022. doi:10.1177/02666669221100426

Xu, L., Yang, L., Li, D., and Shao, S. (2023). Asymmetric effects of heterogeneous environmental standards on green technology innovation: Evidence from China. Energy Econ. 117, 106479. doi:10.1016/j.eneco.2022.106479

Xu, Y., Dong, Z., and Wu, Y. (2023). The spatiotemporal effects of environmental regulation on green innovation: Evidence from Chinese cities. Sci. Total Environ. 876, 162790. doi:10.1016/j.scitotenv.2023.162790

Ye, Q., Zeng, G., Dai, S., and Wang, F. (2018). Impact of different environmental regulatory instruments on technological innovation in energy conservation and emission reduction in China--based on panel data of 285 prefecture-level cities. China Population-Resources Environ. 28 (02), 115–122.

You, D., and Li, L. (2022). Environmental regulation intensity, frontier technology gap and corporate green technology innovation. Soft Sci. 39 (08), 108–114. doi:10.13956/j.ss.1001-8409.2022.08.15

Yuan, B., Ren, S., and Chen, X. (2017). Can environmental regulation promote the coordinated development of economy and environment in China's manufacturing industry?-A panel data analysis of 28 sub-sectors. J. Clean. Prod. 149, 11–24. doi:10.1016/j.jclepro.2017.02.065

Zhang, D. (2022). Environmental regulation and firm product quality improvement: How does the greenwashing response? Int. Rev. Financial Analysis 80, 102058. doi:10.1016/j.irfa.2022.102058

Zhang, Q., Yao, Z., and Kong, D. (2019). Regional environmental governance pressure, executive experience and corporate environmental protection investment: A quasi-natural experiment based on ambient air quality standards (2012). Econ. Res. J. 54 (06), 183–198.

Keywords: environmental regulation, green technology innovation of enterprises, environmental protection investment, threshold effect, mediator effect

Citation: Yang B and Zhao Q (2023) The effects of environmental regulation and environmental protection investment on green technology innovation of enterprises in heavily polluting industries—based on threshold and mediation effect models. Front. Environ. Sci. 11:1167581. doi: 10.3389/fenvs.2023.1167581

Received: 16 February 2023; Accepted: 09 May 2023;

Published: 24 May 2023.

Edited by:

Bilal, Hubei University of Economics, ChinaCopyright © 2023 Yang and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qi Zhao, 122797494@qq.com

Bing Yang

Bing Yang