- 1School of Business, Hangzhou City University, Hangzhou, Zhejiang, China

- 2School of Economics and Management, Pingdingshan University, Pingdingshan, Henan, China

A growing number of institutional investors have realized that environmental, social, and governance (ESG) performance has become financial in the long run, but the implementation of ESG approaches at the enterprise’s executive level remains insufficient. Furthermore, urgent attention needs to be paid to the full application of digital solutions for resource allocation and sustainable development. We have directed this research interest toward searching for potential approaches to sustainable digital transformation for the environment. Encouraged by the asymmetric effect between executive compensation stickiness (ECS) and ESG goals, executives are more willing to improve the ESG indices by digital transformation (DT) activities. This study employs 18,098 observations from Chinese A-share listed companies to examine the impact of ECS on ESG indicators. Our results show that ECS can significantly improve the ESG scores, whereas DT played a partial mediating role within this promotion. We further examined this relationship by the bootstrap and Sobel methods and found that all empirical results are robust and credible. Our findings provide more practical enlightenment at the management aspect for improving environmental performance through digital transformation.

1 Introduction

The world has witnessed many changes associated with industrial development and technological transformation. Since Agenda 2030’s Sustainable Development Goals (SDGs), proposed by the United Nations 2015, emphasize the role of digital technology in the enhancement of sustainability, digital transformation (DT) has become a necessary prerequisite for achieving SDCs (Camodeca and Alex, 2021). Digital transformation is not only a technological change but also highly related to the value proposition, business model, production process, and employment style in the long run (Matt et al., 2015). Here, the environmental, social, and governance (ESG) concept is a productive solution to accelerate the transition to a more sustainable future by a digital informational approach. Nowadays, ESG is receiving much attention from businesses, investors, and regulators due to the global ESG investment market’s rapid growth (Zheng et al., 2022). So, investors have started to give more importance to investigating the link behind non-financial information. ESG scores and ratings can be used to evaluate a firm’s commitment to sustainable business practices. However, the validity of ESG performance is still debatable in the current literature, with most of these studies concentrating on the effects of ESG performance in developed economies (Khan, 2022). Nevertheless, there is a lack of studies investigating the function of ESG performance and its connection to digital transformation in emerging economies. Addressing the significance of integrating sustainability strategies into digital transformation roadmaps entails thinking beyond profit and placing social and environmental considerations on the same footing with financial objectives.

Since China’s manufacturing industries and economic volume reached first and second in the world, respectively, in 2010, how to maintain the stability of China’s economy has become the major developmental strategy of China. In the new stage of high-quality economic development, efficient and equitable development has also become the main objective for all enterprises in China. In this context, the management of organizational elements for successful digital transformation and green governance has therefore become a key research topic. Owing to the characteristics of long periodicity, high uncertainty, and strong professionalism, digital technology-driven transformation is not limited to the implementation and operation of new technologies. Today’s digital transformations must be purpose-driven, offering value to all stakeholders as a prerequisite for organizational success. There are increasing interests in how ESG and DT criteria can integrate into the executive compensation contract, while executives are assumed to have the main responsibility for daily operations and management. Traditional agency theory emphasizes the role of pay-for-performance to align the interests of management and shareholders (Jensen and Murphy, 1990; Core et al., 1999), controlling executive compensation by earning management (Ali et al., 2022). Meanwhile, the literature on executive compensation is more concerned with pay-arrangement features rather than effective incentives, reflecting a “rent seeking” effect (Blanchard et al., 1994; Yermack, 1997; Bertrand and Mullainathan, 2001). Furthermore, executive compensation and corporate performance present a “downward stickiness” impact, where executive compensation does not decrease to the same extent as the firm’s performance declines (Adut et al., 2003; Garvey and Milbourn, 2006; Jackson et al., 2008; Gao et al., 2011). With the continuous improvement in the compensation contract, executive compensation stickiness (ECS) is proposed to effectively measure the marginal administrative expenses with corporate performance (Lin et al., 2013; Cordeiro et al., 2016.; Luo et al., 2016; Zhang and Gao, 2017). However, the existing literature on ECS is more focused on corporate performance with less consideration of the multi-dimensional mechanisms, including environmental and social aspects. Moreover, the importance of digital transformation on corporate governance and green indicators is also unclear. This paper aims to narrow this research gap between ECS and ESG indicators in view of digital transformation, addressing an empirical approach that contributes to harmonious and sustainable development.

The rest of this paper is organized as follows: Section 2 explains the literature review and hypothesis development; Section 3 presents the methodology, which includes sample selection and data sources, the definition of all variables, model construction, and hypothesis development; Section 4 demonstrates the empirical findings based on several regression analyses and robustness tests, including Sobel, bootstrap, replacing variable, and endogeneity approaches; Section 5 concludes the study with a summary of our findings, policy enlightenment, and limitations with regard to future prospects.

2 Hypothesis development

2.1 ECS and ESG performance

Investment on environmental and social responsibilities would waste administrative resources, increase extra expenses, and bring more negative management factors that damage shareholders’ interests (Garcia & Orsato, 2020). Moreover, performance-based payments may induce a lower level of motivation in managers for long-term investment (Cheng, 2004), so they may pursue short-term accounting performance and abandon the ESG developmental strategy in consideration of managers’ interests. However, with the continuous improvement in the compensation contract, enterprises have experienced asymmetric changes between managers’ compensation and stakeholders’ response (Jackson et al., 2008). Particularly, for institutional investors who are more focused on the long-term interests and their participation in corporate governance, this information asymmetry between executive compensation and the governance layer can also be reduced (Hong, 2022). When executives’ performance declines, those shareholders generally have a “failure tolerance” mentality, imposing more pressure on senior executives (Lai and Leng, 2021). The existence of institutional investors has inhibited executive compensation stickiness (ECS) (Yi et al., 2010), and this fact has been widely accepted in the field of environmental behavior research, whereby sustainable and environmentally conscious behavior could be further examined (Ali et al., 2023; Gansser and Reich, 2023). In general, institutional investors pay more attention on company’s life cycle and executive compensation stickiness, pushing enterprises to improve the long-term performance including all ESG dimensions. Thus, we propose the following hypothesis:

Hypothesis 1:. ECS has a positive effect on the ESG performance.

2.2 ECS and DT

Studies on digital transformation (DT) could be traced back to a dozen years, and they have attracted greater scientific interests recently. At present, digital transformation has become a “common buzzword” both in the business and academic community. Digital transformation is a comprehensive transformation process, which involves all aspects from business philosophy to corporate culture, from production to sales, and from managers to staff (Ivancic et al., 2019). Moreover, digital transformation is also a continuous process of climbing the scale of digital maturity by employing digital and other technologies along with organizational practices to create a digital culture (He and Liu, 2019). This digital maturity enables the company to provide better services, gain competitive advantages, and respond to the external environment. Meanwhile, entrepreneurial orientation further encourages managers to gain the competitive advantages of digital transformation (Sousa and Rocha, 2019; Weber et al., 2022). Ultimately, companies that succeed in employing digital transformation are generally more profitable, enjoying better returns on assets (Westerman et al., 2012), improving the operation efficiency of business structures (Ghosh et al., 2014), and reducing the tendency toward opportunism-driven earning management (Zhong et al., 2023). However, the digital scene required the necessarily matching of existing administrative architecture and management practice. Digital transformation is deemed to bring with it increasing management risks and challenges that require high levels of leadership and operating capabilities (Zeike et al., 2019). Similarly, the risk-taking characteristics of top managers favor the digital transformation process by allowing the exchange of novel ideas and initiatives on payment (Jiang et al., 2019; Porfírio et al., 2021) and reducing uncertainty in the case of ambiguous digital strategy goals (Ritala et al., 2021). In view of the traditional salary incentive mechanism, the performance-based mechanism would induce senior executives to avoid these managing risks (Manso, 2011), which is often not conducive to the process of digital transformation. Westerman et al. (2014) highlighted that firms need to build high levels of leadership and management to successfully drive the process of digital transformation. In this context, the application of ECS provides a feasible incentive design for the promotion of digital transformation of enterprises (Xu et al., 2018). Therefore, we propose the following hypothesis:

Hypothesis 2:. ECS has a positive impact on DT.

2.3 Mediating roles of DT

From the perspective of resource-based theory, resource heterogeneity is the core resource of high profit (Wernerfelt, 1984), where digital technology capability belongs to the intangible resources that are hard to be imitated or replaced (Hu, 2016). Both scarcity and sustainability of digital resources are beneficial for the enterprise to obtain more competitive advantages (Wu et al., 2021), and executives tend to integrate digital transformation activities with sustainable development goals while making data-driven decisions (He and Liu, 2019). Furthermore, digital transformation can also optimize the procurement and production links among enterprises, reducing operating costs and improving corporate governance (Qi et al., 2020). In a word, enterprises often face insufficient resources and incentives for ESG practice, but this situation may change with more core resources brought by digital transformation activities, so digital transformation can reduce the total expenses of ESG performance.

Planned behavior theory proposed by Ajzen (1991) explained the psychological and social aspects of individuals’ behavior. In view of the planned behavior theory, Vahid et al. (2023) examined the key managerial micro-foundations of the successful digital transformation process. Their results indicated that the executive management ability can positively impact the information acquisition process, and the managers’ ability for obtaining information further enhanced their capacity to exploit new business opportunities from digital transformation. With regard to signal transmission theory, digital transformation can reduce information asymmetry and transaction costs by improving the transparency of information (Xiao et al., 2021) and reducing the interaction costs between enterprises and stakeholders (Zhong et al., 2023). So this digital information is also conducive to improving corporate governance and fulfilling social responsibilities; both are closely related to ESG scores (Qiu and Yin, 2019). Overall, digital transformation can promote the long-term value of enterprises, providing more practical approaches for both ECS and ESG indices. Based on the aforementioned discussion, we propose the following hypothesis.

Hypothesis 3:. DT plays a mediating role within the impact of ECS on ESG performance.

2.4 Research framework

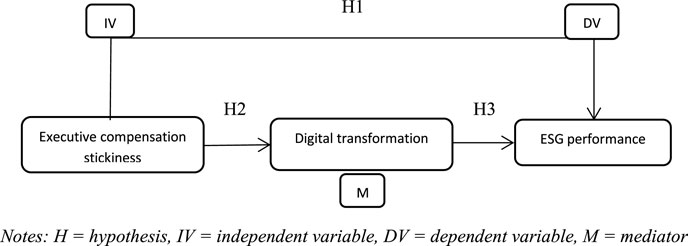

Based on the aforementioned theoretical analyses, this study constructs the research framework as shown in Figure 1.

FIGURE 1. Research framework. Notes: H, hypothesis; IV, independent variable; DV, dependent variable; M, mediator.

3 Research design

3.1 Variable definition

3.1.1 Dependent variables

In line with the studies of Staiger and Stock, (1997), Xie and Lv (2022), and Gao et al. (2021), this paper uses the Hua Zheng ESG scores as the proxy index of ESG performance. The scope of the Hua Zheng ESG index covers all A-share listed companies in China, assigning ESG ratings at the nine levels ranging from AAA to C (i.e., the ESG score is 1 if the rating is C, the ESG score is 2 if the rating is CC, and the ESG score is 9 if the rating is AAA), where a higher ESG rating indicates a better ESG performance of the enterprise in this scoring system.

3.1.2 Mediator variables

Referring to the practice of Zhao et al. (2021), Wu et al. (2021), and Tu and Yan (2022), we adopt the method of text frequency analysis to construct the digital transformation (DT) score. A higher DT score also reflects a higher degree of digital transformation of an enterprise, and the calculating steps of the DT score are as follows: (1) DT dictionary is first constructed from five dimensions of artificial intelligence, big data, cloud computing, block chain, and technology application; (2) conducting the word frequency analysis of companies based on the DT dictionary by Python software; and (3) obtaining the total DT frequency by the summation of each company and taking the natural logarithm value after adding the word frequency by 1.

3.1.3 Independent variables

Executive compensation stickiness (ECS) is the difference between executive compensation sensitivity when the company’s performance increases and decreases (Bu & Wen, 2013). According to the studies by Xu et al. (2018) and Hong (2022), we calculated the mean values of executive compensation and the company’s performance sensitivity when the company’s performance increases and decreases to acquire the total score of ECS.

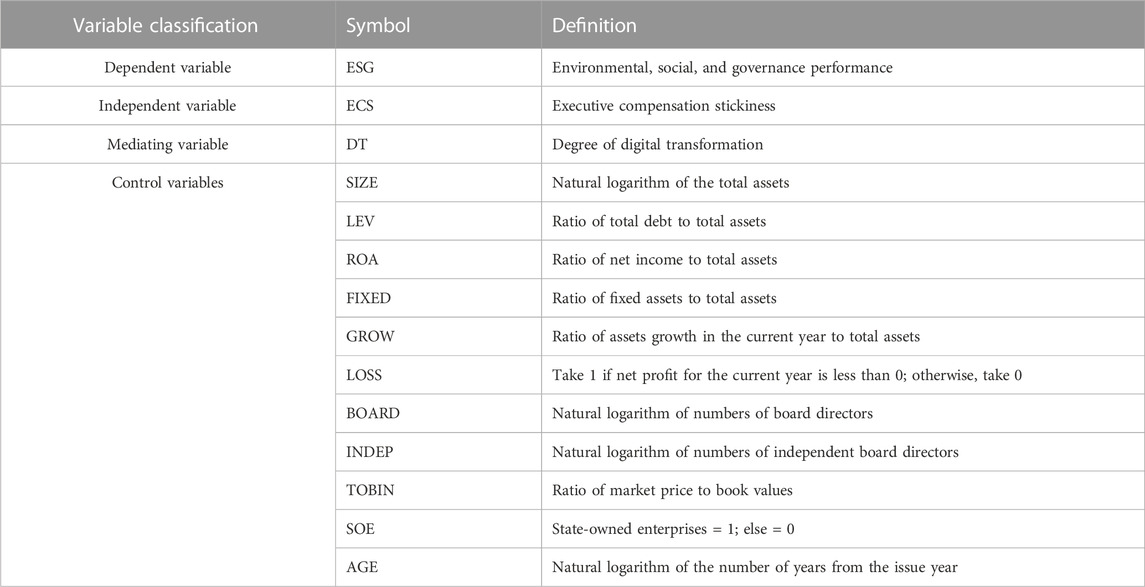

3.1.4 Control variables

Referring to previous research studies, this paper introduces the following control variables into our empirical models including total assets (SIZE), total debt (LEV), net income (ROA), fixed assets (FIXED), asset growth (GROW), net profit (LOSS), board directors (BOARD), independent board (INDEP), market value (TOBIN), enterprise nature (SOE), and firms’ age (AGE). All data of this study are collected from the RESSET database (RESSET), Wind China financial database (WIND), and China Stock Market & Accounting Research (CSMAR) database. Table 1 reports the specific definition of variables.

3.2 Model construction

The following mediating models of the “causal step approach” are adopted to verify our hypotheses H1, H2, and H3, and the model constructions are shown as

where “β” represents the estimated coefficient of variables, “

3.3 Sample selection and descriptive statistics

Our panel data on A-share listed enterprises were selected from the Shanghai and Shenzhen Stock Exchange; data collection began in 2010 because of the abnormal variation caused by the global financial crisis. In order to guarantee the validity of the empirical results, samples with the following characteristics are excluded: (1) samples with ST or ST* treated, (2) samples of the financial industry, and (3) samples with missing variables. Furthermore, we winsorize all continuous variables at the 1% and 99% quantiles to exclude the influence of outliers. Finally, 18,098 observations scanned from 2010 to 2020 were acquired for empirical regression. The descriptive statistics of all variables are shown in Table 2. Table 2 shows that the dependent variable ESG has a mean value of 6.537 and a variance of 1.117, indicating that there is some variation in the ESG performance between firms. The independent variable ECS has a mean value of 2.703 and a variance of 8.237, with a minimum value of −12.013 and a maximum value of 60.018, indicating that there are large differences in executive compensation stickiness among the sample firms. The intermediate variable DT, with a mean value of 0.094, a variance of 0.221, a minimum value of 0, and a maximum value of 1.000, indicates that the overall level of digital transformation in the sample companies is low. The means and variances of the control variables are within reasonable limits, and there are no outliers affecting the statistical results.

4 Empirical results

4.1. Correlation analyses

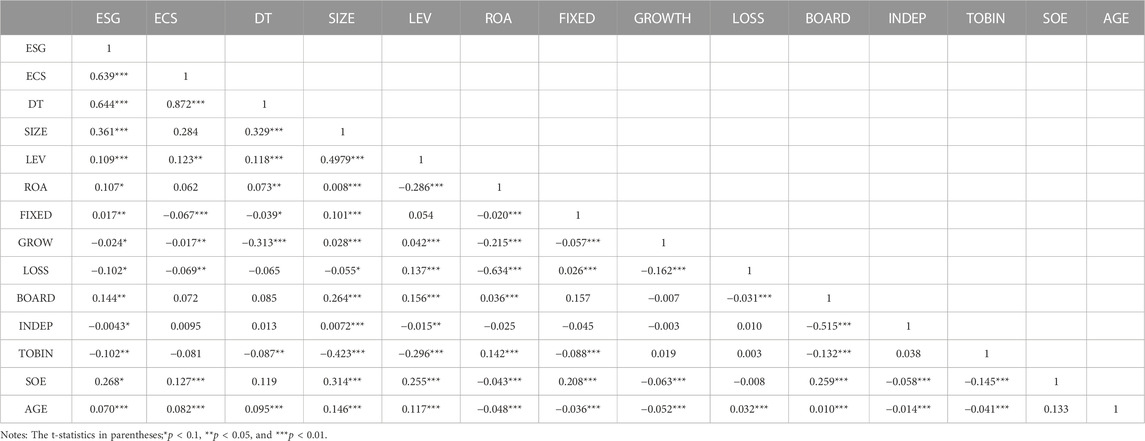

All correlation coefficients of variables are reported in Table 3, and the highest coefficient among them is 0.498, implying that there is no multicollinearity issue in our empirical regression. The results of the correlation coefficient also demonstrate a basic positive association between ECS, DT, and ESG.

4.2 Main tests

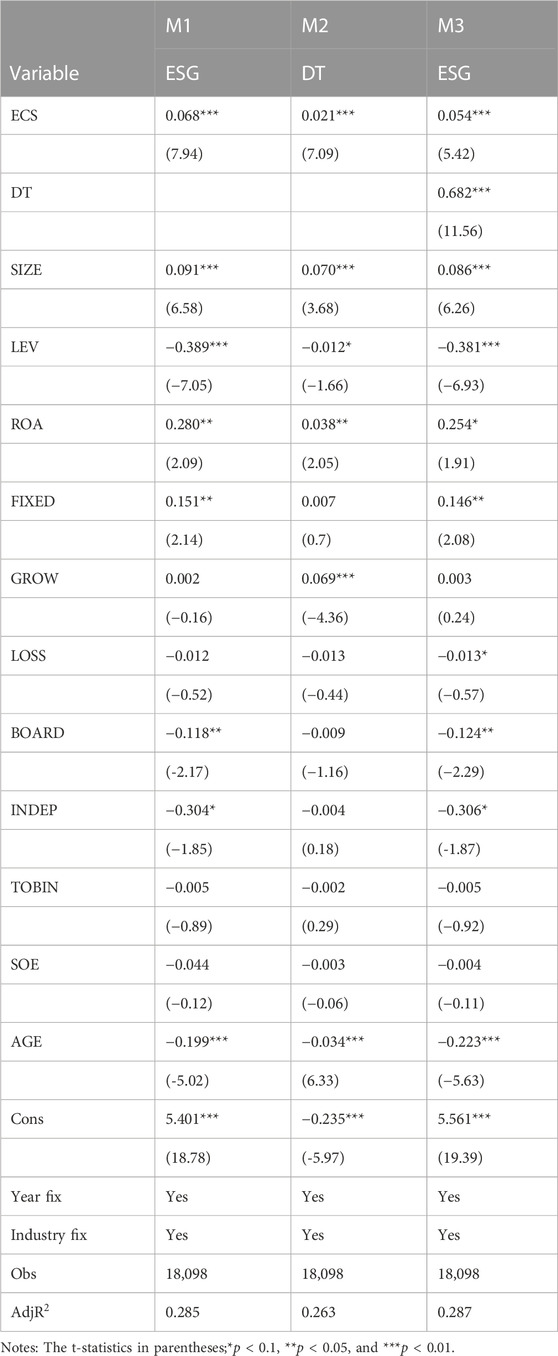

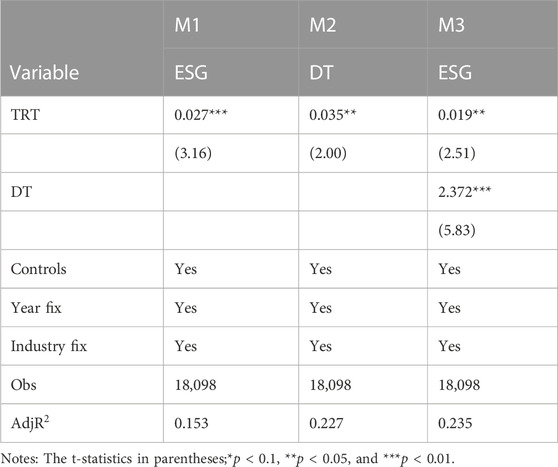

We conduct the Hausman test on models (1)–(3) before the regression analysis, and our results show that the p-value is 0.000, where the random effect model with a null hypothesis is rejected. Thus, the fixed effects (FE) model is chosen as the benchmark test with all equations. Table 2 shows that Model (1) examines the relationship between ECS and ESG. The coefficient of ECS on ESG is significant and positive, indicating that the executive compensation stickiness of enterprises can improve their ESG performance, so H1 has been supported. Similarly, the positive relationship between ECS and DT has been examined in Model (2), implying that ECS is the driving factor to optimize the ESG performance, so H2 is also verified. Model (3) introduces the impact of DT, illustrating a joint impact of ECS and DT on ESG. Both regression coefficient of ECS and DT on ESG in Model 3 are still significantly positive, but the coefficient of ECS (β = 0.054) is decreased by 0.014 in comparison with the coefficient of ECS (β = 0.068) in Model 1. The decline and the significance of ECS and DT indicate that DT plays an intermediary role between the ECS and ESG performance of enterprises, as shown in Table 4. So, H3 has been verified by mediation after controlling the influence of DT, implying that the digital transformation of enterprise plays a partial mediating effect between the ECS and ESG performance.

These findings indicate that better executive compensation systems can improve the development of enterprises (Zhang and Gao, 2017; Hong, 2022) both from the perspective of digital transformation and ESG ratings. Our results also show that digital transformation has a mediation effect within executive compensation stickiness, promoting ESG indicators (consistent with the findings of Zhao et al., 2021; Camodeca and Alex, 2021; Porfírio et al., 2021). This may be because executive compensation stickiness can strengthen the relationship between enterprises and stakeholders through digital transformation activities, improving performance in terms of environment, society, and governance, to realize the non-economic value creation from the digital transformation progress. All these findings provide more managerial implications at the executive level toward searching for approaches to sustainable digital transformation for the environment.

4.3 Robustness analyses

4.3.1 Sobel test

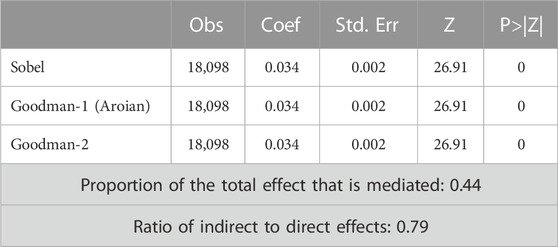

This paper conducts the Sobel test to verify the mediating effect of digital transformation. Table 5 shows that the Z value of the Sobel test is 26.91 and the p-value is less than 0.05. So the mediating effect of DT has been further verified, and displaying ECS can positively affect ESG performance through the path of digital transformation.

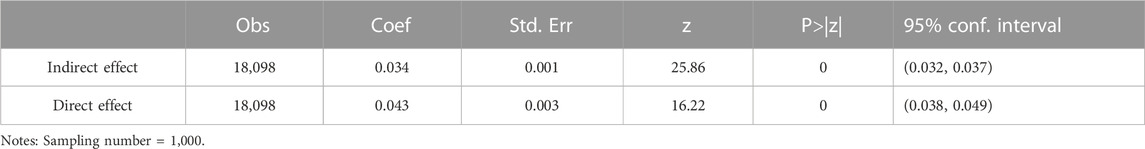

4.3.2 Bootstrap test

In order to make interval estimation, the bootstrap test has become a necessary methodology in mediation effect verification, and the Sobel test is supplemented in this paper. The 95% confidence intervals of indirect effects in Table 6 do not contain “0,” indicating the mediating effect of DT is valid. Thus, our H3 is verified again by both the Sobel and bootstrap approaches, and all results are stable and reliable.

4.3.3 Replacing variables

Referring to the methods of Xu et al. (2018) and Hong (2022), we choose the total remuneration of the top three executives (TRTs) as the substitution variable of ECS. The regression results are shown in Table 7, where TRTs can still positively promote ESG performance with a mediating effect for DT.

4.3.4 Endogeneity analyses

Considering the endogenous problems such as measurement errors and missing variables, we refer to the method of Liu (2022) and Zheng et al. (2022), employing the average number of DT in the industry and year as the instrumental variable; thus, the instrumental values of IV_DT are obtained, and the calculation formula is as follows:

Table 8 shows the regression results of the two-stage least squares (2SLS) method by instrumental variables, and the coefficient of first-stage regression of instrumental variables in column (1) is 0.605, so IV_DT passes the significance test at the 1% level. Meanwhile, the Kleibergen–Paap rk LM statistic of 50.03 corresponds to a p-value of 0, indicating that the instrumental variable is identifiable. Moreover, the Cragg–Donald Wald F-statistic of 316.32 is much greater than the Stock–Yogo critical judgment value of 16.38 at the 10% level, so there is no weak instrumental variable issue. The regression coefficients of DT on ESG in columns (2)–(3) are significantly positive at the 1% level, both with and without controlling the impact of ECS. Based on the instrumental variable test, we further estimated dynamic panel data estimation by a two-step generalized method of moment (GMM) regression, and the robustness results of columns (4)–(5) are still consistent with the main test. In general, both results of 2SLS and GMM regression are highly consistent with the baseline regression results of Model 3, further verifying and highlighting the partial mediating effect of digital transformation of listed companies.

5 Discussion

5.1 Practical implication

The previous literature has considered drivers and barriers to digital innovation in the construction industry, including technical and non-technical factors. Since enterprises incline to integrate digital technologies, such as information and communication, into the collaborative transformation of processes, models, and organizations (Wimelius et al., 2021), digital transformation progression offers substantial opportunities to accelerate this technical transition to the new era of the industrial internet of things (IIoT) (Chen et al., 2021). As the digital economy quickly expands, the emphasis has sometimes been on the need to understand the technology being adopted, but evidence suggests that digital transformation is less about technology and more about the transformation process. The indices of digitization and ESG would, therefore, be included in the assessment requirements of enterprise platforms to reduce the negative impact of incentive dislocation (Zhong et al., 2023). In this context, the management of organizational incentives for successful digital transformation and sustainability should be a key research agenda.

From the perspective of enterprises, corporate responses rely upon managers’ insistence regarding the material benefits of adjusting to and scoring high on ESG ratings and their alignment with corporate sustainability (Chen et al., 2022). Corporate sustainability is a strategic approach, aiming to create stakeholder values as critical for creating goodwill for businesses, enhancing opportunities, and managing the risks due to economic, social, and environmental developments. Therefore, investors are trying to chart the course of the future through ESG orientation, and ESG considerations should be integrated into the company’s overall digital strategy. This may involve identifying digital opportunities that align with ESG priorities, such as developing products or services that help customers reduce their carbon footprint or using digital platforms to engage with stakeholders on social issues. Considering that digital transformation is also a key aspect of an organization’s survival strategy, enterprise management and leadership has become particularly important if the change has to be successful. Moreover, executives may need to conduct their digital transformation activities with sustainability goals if their decisions are made by digital information. Enterprises would find it easier to realize resource integration and evoke the internal governance vitality by digital transformation, thus improving the information transparency and total ESG performance. Additionally, integrating quantitative data on ESG performance as a part of bonus evaluation systems can further promote the enthusiasm of senior executives, and the management committee should also support the senior executives with a long-term perspective. In general, successful digital transformation and ESG performance should therefore focus on executive compensation stickiness.

From the perspective of the government, China’s government should give priority to the impact on the environmental quality, while introducing external capital that would promote the transformation of domestic resources into green and low-carbon industries (Chen et al., 2023). Digital transformation in the industry is part of the overall digitalization process, but it accounts for the greatest impact on the environmental quality. The government should provide more environmentally friendly policies to support the green-oriented market and improve the protection of green products. Government and social organizations could establish an official ESG quality evaluation system and information-release mechanism to reward or punish enterprises in view of ESG indices. Relevant departments can also improve the administrative procedure of digital transformation, and assist enterprises to avoid potential risks within the process. In the context of better environment and digital transformation policy, new business models of green transformation would continue to emerge. Finally, it is important to consider the broader societal impact of digital transformation. This may involve assessing the impact of digital technologies on labor markets, the environment, and social inequality. Governments should take steps to mitigate any negative impacts and ensure that digital transformation is aligned with broader societal goals.

5.2 Future research

As this study’s limitation and future direction, we focused on Chinese listed firms, so future studies can extend the analysis to non-listed firms (i.e., unicorn enterprises or family businesses). Moreover, there should be a clear focus on identifying the indicators that may hamper or promote the integration of digital progression and SDGs. Future works can introduce specific key performance algorithms of digitalization as an enabler to achieve the SDGs and assess the impact of digital transformation on sustainability performance in a broader context (i.e., AI-driven alternative digitalization ratings). Additionally, there are now many providers of ESG scores and ratings, but there is ongoing debate about the reliability and comparability of these ratings. Future researchers are encouraged to explore how different providers rate companies differently and what factors contribute to these variations, investigating how investors use ESG ratings and how effective these ratings are in predicting green performance. Furthermore, digital transformation mediates the positive association of ECS and ESG, so future studies may consider other potential driving factors of ESG (i.e., CEO characteristics and investors’ reactions ) for Chinese or overseas enterprises. Finally, future researchers can alter the model to consider the present pandemic scenario and empirically investigate how COVID-19 affects the impact of ECS on ESG performance.

6 Conclusion

This paper employs 18,098 samples from Chinese A-share listed companies to examine the impact mechanism of executive compensation stickiness on environmental, social, and governance performance. Our empirical results show that executive compensation stickiness can positively impact ESG indicators, and digital transformation plays a partial mediating role within this positive relationship. Based on the “causal step approach,” we further examine the mediating effect of digital transformation by bootstrap and Sobel methods, and all empirical results are robust and credible. Our personal scientific contributions involve the dual mediating verification by Sobel and bootstrap approaches and the GMM method based on the weak instrumental variable test of 2SLS first-order regression. The results are appropriate and in agreement with the research tools used, respectively, and emphasize the innovative elements of an applied scientific nature. However, this study contributes to the current literature on developed and emerging economies about corporate government and sustainable development. Our framework provides further theoretical and empirical support for the prior research on the efficacy of digital transformation and ESG practices. The authors hope that this empirical study can guide academicians intending to further excavate this relatively uncharted area, and corporate bodies and top managers who seek some guidelines to formulate an effective payment plan.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

LC and YG contributed to the conception and design of the study. CM organized the database. LC performed the statistical analysis. CM wrote the first draft of the manuscript. LC and YG wrote sections of the manuscript. All authors contributed to manuscript revision, and read and approved the submitted version.

Funding

This work was supported by the Scientific Research Foundation of Hangzhou City University (J202310) and the Key Project of Henan Higher Education (23B630013).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adut, D., Cready, W., and Lopez, T. (2003). Restructuring charges and CEO cash compensation: A reexamination. Account. Rev. 78 (1), 169–192. doi:10.2308/accr.2003.78.1.169

Ajzen, I. (1991). The theory of planned behaviour: Reactions and reflections. Organ. Behav. Hum. Decis. Process. 50 (2), 1113–1127. doi:10.1080/08870446.2011.613995

Ali, S., Jiang, J., Hedvicakova, M., and Murtaza, G. (2022). Does doard diversity reduce the probability of financial distress? Evidence from Chinese firms. Front. Psychol. 13, 976345. doi:10.3389/fpsyg.2022.976345

Ali, S., Jiang, J., Rehman, R. u., and Khan, M. K. (2023). Tournament incentives and environmental performance: The role of green innovation. Environ. Sci. Pollut. Res. 30, 17670–17680. doi:10.1007/s11356-022-23406-w

Bertrand, M., and Mullainathan, S. (2001). Are CEOs rewarded for luck? The ones without principals are. Q. J. Econ. 116 (3), 901–932. doi:10.1162/00335530152466269

Blanchard, O., Lopezde Silanes, F., and Shleifer, A. (1994). What do firms do with cash windfalls? J. Financial Econ. 36 (3), 337–360. doi:10.1016/0304-405X(94)90009-4

Bu, D. L., and Wen, C. H. (2013). Does executive compensation stickiness increase corporate investment? J. Finance Econ. 39 (6), 63–72. doi:10.16538/j.cnki.jfe.2013.06.006

Camodeca, R., and Alex, A. (2021). Digital transformation and convergence toward the 2030 agenda’s sustainability development goals: Evidence from Italian listed firms. Sustainability 13, 11831. doi:10.3390/su132111831

Chen, L. F., Guo, F. X., and Huang, L. Y. (2023). Impact of foreign direct investment on green innovation: Evidence from China’s provincial panel data. Sustainability 15, 3318. doi:10.3390/su15043318

Chen, L. F., Wang, Y. W., and Jin, S. Y. (2022). How green credit guidelines policy affect the green innovation in China. Environ. Eng. Manag. J. 21 (3), 469–481. doi:10.30638/eemj.2022.044

Chen, L. F., Ye, Z. X., and Jin, S. Y. (2021). A security, privacy and trust methodology for IIoT. Tech. Gaz. 28 (3), 898–906. doi:10.17559/TV-20210122095638

Cheng, S. (2004). R&D expenditures and CEO compensation. Account. Rev. 79 (2), 305–328. doi:10.2308/accr.2004.79.2.305

Cordeiro, J., He, L., Conyon, M., and Shaw, T. (2016). Chinese executive compensation: The role of asymmetric performance benchmarks. Eur. J. Finance 22 (4-6), 484–505. doi:10.1080/1351847X.2013.769892

Core, J., Holthausen, R., and Larcker, D. (1999). Corporate governance, chief executive officer compensation, and firm performance. J. Financial Econ. 51 (3), 371–406. doi:10.1016/S0304-405X(98)00058-0

Gansser, O. A., and Reich, C. S. (2023). Influence of the new ecological paradigm (NEP) and environmental concerns on pro-environmental behavioral intention based on the theory of planned behavior (TPB). J. Clean. Prod. 382, 134629. doi:10.1016/j.jclepro.2022.134629

Gao, J. Y., Chu, D. X., Lian, Y. H., and Zheng, J. (2021). Can ESG performance improve the investment efficiency of enterprises? Secur. Mark. Her. 22 (11), 24–72.

Gao, W. L., Luo, H., and Cheng, P. X. (2011). Managerial power and stickiness of executive compensation. Econ. Surv. (06), 82–86. doi:10.3969/j.issn.1006-1096.2011.06.017

Garcia, A., and Orsato, R. (2020). Testing the institutional difference hypothesis: A study about environmental, social, governance, and financial performance. Bus. Strategy Environ. 29 (8), 3261–3272. doi:10.1002/bse.2570

Garvey, G., and Milbourn, T. (2006). Asymmetric benchmarking in compensation: Executives are rewarded for good luck but not penalized for bad. J. Financial Econ. 82 (1), 197–225. doi:10.1016/j.jfineco.2004.01.006

Ghosh, K., Khuntia, J., Chawla, S., and Deng, X. (2014). Media reinforcement for psychological empowerment in chronic disease management. Commun. Assoc. Inf. Syst. 34, 22. doi:10.17705/1CAIS.03422

He, F., and Liu, H. X. (2019). Evaluation of the performance improvement effect of digital transformation of real enterprises from the perspective of digital economy. Reform (04), 137–148. CNKI:SUN:REFO.0.2019-04-012.

Hong, Y. Z. (2022). Research on institutional investors and executive compensation stickiness based on fixed effect model: A case study of Chinese listed companies. Math. Problems Eng. 13, 1402891–1402913. doi:10.1155/2022/1402891

Hu, S. J. (2016). Research on the influencing factors of the willingness of enterprise big data analysis technology based on the concept of resource infrastructure. Inf. Sci. 34 (5), 148–152. doi:10.13833/j.cnki.is.2016.05.029

Ivancic, L., Vuksic, V. B., and Spremic, M. (2019). Mastering the digital transformation process: Business practices and lessons learned. Technol. Innov. Manag. Rev. 9 (2), 36–50. doi:10.22215/timreview/1217

Jackson, S., Lopez, T., and Reitenga, A. (2008). Accounting fundamentals and CEO bonus compensation. J. Account. Public Policy 27 (5), 374–393. doi:10.1016/j.jaccpubpol.2008.07.006

Jensen, M., and Murphy, K. (1990). Performance pay and top management incentives. J. Political Econ. 98 (2), 225–264. doi:10.1086/261677

Jiang, F., Wang, G., and Jiang, X. (2019). Entrepreneurial orientation and organizational knowledge creation: A configurational approach. Asia Pac. J. Manag. 36 (4), 1193–1219. doi:10.1007/s10490-018-9609-5

Khan, M. A. (2022). ESG disclosure and firm performance: A bibliometric and meta analysis. Res. Int. Bus. Finance 61, 101668. doi:10.1016/j.ribaf.2022.101668

Lai, D., and Leng, J. (2021). Stickiness of executive compensation, institutional investor holding and innovation investment efficiency. Friends Account. (08), 121–127. doi:10.3969/j.issn.1004-5937.2022.06.002

Lin, D., Kuo, H. C., and Wang, L. H. (2013). Chief executive compensation: An empirical study of fat cat CEOs. Int. J. Bus. Finance Res. 7 (2), 27–42.

Liu, Y. X. (2022). Digital economy empowers high-quality development of enterprises—empirical evidence based on total factor productivity of enterprises. Reform (9), 35–53.

Luo, Z. Y., Zhan, Q. L., and Duan, S. (2016). Internal control quality and corporate executive compensation contract. China Soft Sci. (02), 169–178. doi:10.3969/j.issn.1002-9753.2016.02.014

Manso, G. (2011). Motivating innovation. J. Finance (New York) 66 (5), 1823–1860. doi:10.1111/j.1540-6261.2011.01688.x

Matt, C., Hess, T., and Benlian, A. (2015). Digital transformation strategies. Bus. Inf. Syst. Eng. 57 (5), 339–343. doi:10.1007/s12599-015-0401-5

Porfírio, J. A., Carrilho, T., Felício, J. A., and Jardim, J. (2021). Leadership characteristics and digital transformation. J. Bus. Res. 124, 610–619. doi:10.1016/j.jbusres.2020.10.058

Qi, H. J., Cao, X. Q., and Liu, Y. X. (2020). The impact of the digital economy on corporate governance: Based on the perspective of information asymmetry and the irrational behavior of managers. Reform (04), 50–64. CNKI:SUN:REFO.0.2020-04-005.

Qiu, M. Y., and Yin, H. (2019). ESG performance and financing cost of enterprises in the context of ecological civilization construction. J. Quantitative Tech. Econ. 36 (03), 108–123. doi:10.13653/j.cnki.jqte.2019.03.007

Ritala, P., Baiyere, A., Hughes, M., and Kraus, S. (2021). Digital strategy implementation: The role of individual entrepreneurial orientation and relational capital. Technol. Forecast. Soc. Change 171, 120961. doi:10.1016/j.techfore.2021.120961

Sousa, M. J., and Rocha, A. (2019). Skills for disruptive digital business. J. Bus. Res. 94, 257–263. doi:10.1016/j.jbusres.2017.12.051

Staiger, D., and Stock, J. H. (1997). Instrumental variables regression with weak instruments. Econometrica 65 (3), 557–586. doi:10.2307/2171753

Tu, X. Y., and Yan, X. L. (2022). Digital transformation, knowledge spillover and enterprise total factor productivity-Empirical evidence from manufacturing listed companies. Industrial Econ. Res. J. 02, 43–56. doi:10.13269/j.cnki.ier.2022.02.010

Vahid, J. S., Mazzoleni, A., Hannan, A. M., Gazi, M. A., and Alberto, M. (2023). Entrepreneurs as strategic transformation managers: Exploring micro-foundations of digital transformation in small and medium internationalisers. J. Bus. Res. 154, 113287. doi:10.1016/j.jbusres.2022.08.051

Weber, E., Büttgen, M., and Bartsch, S. (2022). How to take employees on the digital transformation journey: An experimental study on complementary leadership behaviors in managing organizational change. J. Bus. Res. 143, 225–238. doi:10.1016/j.jbusres.2022.01.036

Wernerfelt, B. (1984). A resource-based view of the firm. Strategic Manag. J. 5 (2), 171–180. doi:10.1002/smj.4250050207

Westerman, G., Bonnet, D., and McAfee, A. (2014). Leading digital: Turning technology into business transformation. Brighton, Massachusetts: Harvard Business Press.

Westerman, G., Tannou, M., Bonnet, D., Ferraris, P., and McAfee, A. (2012). The digital advantage: How digital leaders outperform their peers in every industry. United States: MIT Center for Digital Business and Capgemini Consulting.

Wimelius, H., Mathiassen, L., Holmström, J., and Keil, M. A. (2021). A paradoxical perspective on technology renewal in digital transformation. Inf. Syst. J. 31, 198–225. doi:10.1111/isj.12307

Wu, F., Hu, H. Z., Lin, H. Y., and Ren, X. Y. (2021). Digital transformation of enterprises and capital market performance: Empirical evidence from stock liquidity. Manag. World 55 (07), 130–144. doi:10.19744/j.cnki.11-1235/f.2021.0097

Xiao, H. J., Yang, Z., and Liu, M. Y. (2021). The promotion effect of corporate digital social responsibility: The test of internal and external dual paths. Bus. Manag. J. 43 (11), 52–69.

Xie, H. J., and Lv, X. (2022). Responsible international investment: ESG and China OFDI. Econ. Res. J. (03), 83–99.

Xu, Y., Liu, Y. G., and Cai, G. L. (2018). Executive compensation stickiness and enterprise innovation. Account. Res. (7), 43–49. doi:10.3969/j.issn.1003-2886.2018.07.006

Yermack, D. (1997). Good timing: CEO stock option awards and company news announcements. J. Finance (New York) 52 (2), 449–476. doi:10.1111/j.1540-6261.1997.tb04809.x

Yi, Z. H., Li, Y. L., and Gao, W. (2010). Governance effect of heterogeneous institutional investors: Based on the perspective of executive compensation. Statistics Decis. (05), 122–125. doi:10.13546/j.cnki.tjyjc.2010.05.057

Zeike, S., Bradbury, K., Lindert, L., and Pfaff, H. (2019). Digital leadership skills and associations with psychological well-being. Int. J. Environ. Res. Public Health 16 (14), 2628–2712. doi:10.3390/ijerph16142628

Zhang, X. M., and Gao, Y. X. (2017). Social responsibility information disclosure and executive compensation stickiness. Soft Sci. 31 (11), 134–138. doi:10.13956/j.ss.1001-8409.2017.11.29

Zhao, C. Y., Wang, W. C., and Li, X. S. (2021). How does digital transformation affect the overall factor productivity of enterprises? Finance Trade Econ. (07), 114–129. doi:10.19795/j.cnki.cn11-1166/f.20210705.001

Zheng, J. Z., Khurram, M., and Chen, L. F. (2022). Can green innovation affect ESG ratings and financial performance-evidence from Chinese GEM listed companies. Sustainability 14 (07), 8677. doi:10.3390/su14148677

Keywords: executive compensation stickiness, ESG performance, digital transformation, bootstrap, Sobel

Citation: Chen L, Mao C and Gao Y (2023) Executive compensation stickiness and ESG performance: The role of digital transformation. Front. Environ. Sci. 11:1166080. doi: 10.3389/fenvs.2023.1166080

Received: 14 February 2023; Accepted: 03 April 2023;

Published: 18 April 2023.

Edited by:

Evgeny Kuzmin, Institute of Economics Ural Branch of the Russian Academy of Sciences, RussiaReviewed by:

Ekaterina Wegner-Kozlova, Institute of Economics of the Ural Branch of the Russian Academy of Sciences, RussiaFrancisco Diniz, University of Trás-os-Montes and Alto Douro, Portugal

Otilia Manta, Romanian Academy, Romania

Karl Weinmayer, MODUL University Vienna, Austria

Copyright © 2023 Chen, Mao and Gao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuying Gao, Z3l5Mzk5MEBwZHN1LmVkdS5jbg==

Lifeng Chen

Lifeng Chen Chuanmei Mao

Chuanmei Mao Yuying Gao2*

Yuying Gao2*