95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 28 March 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1147191

This article is part of the Research Topic Environmental Risk and Corporate Behaviour View all 30 articles

The purpose of this study is to examine the sustainability information that energy companies provide on social media and the relationship between that data and that which is shared in conventional sustainability reports. Based on stakeholder theory, we use a sample of Chinese A-share listed energy corporations in 2020 and refer to GRI G4 guidelines to conduct content analysis on their 17,451 tweets from the WeChat platform and 53 sustainability reports. The analysis results show the following: 1) both the sustainability disclosures of Chinese energy firms on WeChat platform and sustainability reports focus on investor and employee dimensions. Among them, the average proportion of investor dimension disclosure to total disclosure is 31.92% and 35.19% on social media and sustainability reports, respectively, and the average proportion of employee dimension disclosure is 27.22% and 17.92%, respectively. However, the two channels show a large difference in the environment and government dimensions. The average proportion of environment disclosure in sustainability reports is 13.44%, while on social media it is only 2.01%. Government disclosure in sustainability reports is 8.24% and as high as 20.43% on social media. (2) Chinese energy firms prefer to provide supplementary information on social media. For example, using the investor dimension as an example, the average proportion of non-GRI information on social media is 71.47%, while that of the sustainability report is only 48.56%. This study helps stakeholders to better understand sustainable information on social media.

Under the influence of global sustainability agreements, such as the Kyoto Protocol, the energy industry faces increasing pressure on sustainable development (Chodnicka-Jaworska, 2022; Deng, et al., 2022; Shen, et al., 2022; Wanday and Ajour El Zein, 2022). Especially in recent China, with the introduction of national policies including “carbon peaking and carbon neutrality” (Ju, et al., 2022), Chinese energy firms face severe sustainability challenges. In response, they actively engage in and disclose their sustainable activities (Lu, et al., 2022). According to our statistics, in 2020, 72 (approximately 47%) of the 154 Chinese A-share listed energy firms issued sustainability reports. On the other hand, increasingly popular social media is being utilized by an increasing number of firms for financial information disclosure (Blankespoor, et al., 2014; Prokofieva, 2015; Yang and Liu, 2017) and sustainability disclosure (Manetti and Bellucci, 2016; Khanal, et al., 2021). For instance, Zhou et al. (2014) discovered that, on Facebook and Twitter, respectively, 7.06% and 3.45% of the material was connected to corporate information disclosure. Amin et al. (2021) conduct research on the UK and find that corporate social responsibility (CSR) disclosures by their sample firms in tweets is on the rise, and 2.9% of firms’ tweets are related to CSR. According to our statistics, in 2020, among the 72 Chinese A-share listed energy firms that released sustainability reports, 53 (approximately 74%) registered a WeChat official account (WOA) and posted a large number of sustainability-related tweets on WeChat.

The literature has launched intense discussions on the research on the sustainability information activities of energy firms, e.g., Dilling (2016), Janik et al. (2020), Mamun (2022) and so on. However, most of these studies are limited to traditional sustainability reporting activities, such as reporting in CSR reports, and research on emerging sustainability information activities on social media is lacking. What are the topics of sustainability information on which energy firms focus on WeChat? What is the relationship between sustainability disclosure on WeChat and traditional sustainability reports?

In response to the above questions, we use 53 Chinese A-share listed energy firms that released sustainability reports and WOA in 2020 as a sample. Based on the stakeholder perspectives and referring to the GRI G4 framework1, we conduct a content analysis on the sample’s tweets and sustainability reports. We find that Chinese energy firms pay more attention to investors and employees on social media and in sustainability reports and pay less attention to communities, customers, and suppliers. However, these firms pay more attention to the governmental dimension on social media, whereas in sustainability reports, the environmental component is given more attention. In addition, Chinese energy firms tend to provide more supplementary information outside the GRI framework on social media than in sustainability reports.

The following are the significant contributions of this paper. First, our research expands the understanding of the sustainability information activities of energy firms. Studies already conducted have mostly concentrated on energy companies’ disclosure of sustainability information in conventional, cyclical sustainability reports, e.g., Dilling (2016), Janik et al. (2020) and Stuss et al. (2021), and lack an understanding of sustainability information activities in emerging social media channels. This paper provides some interesting references based on Chinese energy firms. Second, this paper compares the content that firms disclose on social media and in sustainability reports, providing a reference for the research field on firms’ social media information activities. This helps researchers better understand the commonalities and differences in firms’ information disclosures through different channels. For the core stakeholders of the firm, whether in the traditional sustainability reporting channel or the social media channel, the firm provides a large amount of disclosure for them. However, firms on social media tend to provide information for some non-professional information users and more supplementary information. Finally, this study helps stakeholders such as socially responsible investors (SRI) to better understand and use sustainable information in corporate WeChat tweets.

Sustainability disclosure is the non-financial information provided to stakeholders to obtain legitimacy and key resources from them (Herzig and Schaltegger, 2006; Milne and Gray, 2007; Adams and Whelan, 2009). As one of the most significant foundational sectors of the national economy and having a substantial effect on the environment, the energy industry is of great concern to stakeholders, including the community and governments. In response to these concerns, energy firms are increasingly devoted to sustainability disclosure activities (Jenkins and Yakovleva, 2006; Perez and Sanchez, 2009; Lu, et al., 2019; Stuss, et al., 2021). Although some evidence shows that energy firms use voluntary sustainability standards to enhance the quality of their sustainability disclosure (Alazzani and Wan-Hussin, 2013), there are still some problems in energy firms’ sustainability information activities.

First, the disclosure lacks comparability. Through a case study of the 10 largest mining firms in the world, Jenkins and Yakovleva (2006) find that there are considerable differences in firms’ report content and style. Szczepankiewicz and Mućko (2016) conduct a content evaluation of CSR reports for the Polish energy and mining industry and find that these reports are similar only in structure but are significantly different regarding specific topics. Ng et al. (2022)study the sustainability reports of Ghana’s oil industry and mining sectors and find that the comparability of the information between these firms is weak.

Second, the materiality of the disclosure is low. Guenther, et al. (2006) conduct an analysis of the sustainability disclosure of international firms in the mining, oil and gas sectors and find that, on average, each company only reported one-third of the indicators in the GRI framework. Dilling (2016) study the sustainability reports of 20 Canadian listed mining and energy firms, which revealed similar problems. The quality of their reports was low. Mamun (2022) uses a sample of Australian power firms and finds that most of the sample firms failed to disclose more than two-thirds of the GRI indicators and preferred to use declarative information rather than quantitative data.

Third, the problem of selective manipulation in disclosure is widespread. Boiral (2013) analyse 23 high-rated ESG reports in the energy and mining sectors. According to the results, almost 90% of unfavourable material events were not acknowledged, which violates the GRI guidance on the principles of balance, completeness and transparency. Dong et al. (2014) study the Chinese mining industry and show that its sustainability disclosure is more related to the needs of the central government and global consumers but ignores the requirements of mining organizations, local communities, and employees. Nwagbara and Belal (2019) find that Nigerian oil firms, despite serious criticism, still commit to engaging in active impression management by using sustainability disclosure. In the study of Janik et al. (2020), during 2020, European Union (EU) energy firms expressed great concerns over greenhouse gas issues but lacked sufficient descriptions in the disclosure of specific actions.

Since there are significant discrepancies in the amount and quality of sustainability disclosure made by energy companies, some studies have focused on the driving factors of their disclosure, including government supervision (Dong and Xu, 2016), CEO declarations (De-Miguel-Molina, et al., 2019) and regional economic development (Karaman, et al., 2021). However, worth noting is that these studies on the sustainability disclosure of energy firms have mostly concentrated on traditional periodic reports, namely, sustainability reports, and have lacked an explanation of sustainability disclosure in other new media channels (such as WeChat).

Corporate information efforts have been significantly impacted by the emergence of social media, which now includes some updated features, including removing media intermediaries, breaking the elite’s control, and higher timeliness and dynamics (Lee, et al., 2013; Lyon and Montgomery, 2013; Zheng, et al., 2018). These characteristics make social media helpful for firms to carry out self-interested information dissemination (Blankespoor, et al., 2014; Lee, et al., 2015; Jung, et al., 2017; Yang and Liu, 2017), thus guiding stakeholders’ impressions (Lee, et al., 2015; Manetti and Bellucci, 2016; Saxton, et al., 2019; She and Michelon, 2019; Russo, et al., 2022). However, they also create increases in firms’ external supervision, expand the uncertainty of public opinion (Hales, et al., 2018; Ang, et al., 2020; Lepore, et al., 2022; Turzo, et al., 2022), and even force firms to be more responsive (Lei, et al., 2018; Fan, et al., 2020; Dube and Zhu, 2021; Zhang and Yang, 2021; Shao and He, 2022). Tench and Jones (2015) argue that social media provide stakeholders with a more radical and open discussion environment, which challenges firms’ attempts to maintain their social legitimacy through traditional rules. Stohl et al. (2017) even find that some firms are inclined to inhibit employees from discussing and participating in corporate social responsibility on social media.

Research on firm sustainability disclosure on social media has mainly focused on the following topics. First, some studies have investigated the content and theme of sustainability disclosure on social media. Toppinen et al. (2015) find that the most common topics of global pulp and paper manufacturing firms on Twitter are the environment and then community. Amin et al. (2021) study the tweets from UK firms in the FTSE 350 index and suggests that 2.9% of the tweets are CSR-related. Ramananda and Atahau (2020) find that compared to annual reports, Indonesian companies post less information related to Corporate Social Responsibility on social media. ElAlfy et al. (2020) take a sample of S&P 500 firms and find that tweets related to sustainability are mostly related to their core businesses. Gómez-Carrasco et al. (2021) study the tweets of Spanish banks on Twitter and argue that supplementary CSR information on social media is more concerned by internal stakeholders, while core CSR information is more concerned by external stakeholders. Second, some studies have been concerned over the motivations for corporate sustainability disclosure on social media. Amin et al. (2021) figure that corporations with more independent directors and female directors provide more sustainability disclosure on Twitter. Baboukardos et al. (2021) figure that corporations with better CSR performance make more additional relevant disclosures on social media. Third, some studies have revealed the consequences of sustainability disclosure on social media. Yang et al. (2020) figure that CSR activities on social media benefit firms from obtaining higher brand equity. Pu et al., (2022) figure that firms use social media to restore the reputational damage caused by negative sustainability events. According to Lepore et al. (2022), social media can enhance the ability of independent directors to advance corporate social responsibility.

However, there are currently few relevant discussions on the social media disclosure of energy firms, except for Pizzi et al. (2021), who discuss the CSR strategy of oil and gas firms on social media communication with stakeholders. The literature has provided few references for the stakeholder information that is preferred by energy firms on social media and the connection of sustainability information activities between firms’ social media and conventional sustainability reports.

Certain social media services, including Facebook and Twitter, are restricted in China due to legislative measures and other aspects of the Chinese government’s policies. Thus, we select WeChat as the object social media for the following reasons. First, WeChat does not have a content limit, so it allows a larger information load. Second, WeChat has the largest user base in mainland China. For example, in 2020, WeChat had 1.09 billion daily active users and 360 million daily users who visited WOAs2.

According to the definition of the energy industry in the China Energy Statistical Yearbook (Liu, 2020), the Chinese energy industry includes the 1) coal mining and washing industry, 2) oil and natural gas extraction industry, 3) petroleum processing, coking and nuclear fuel processing industry, 4) electricity, heat production and supply industry, and 5) gas production and supply industry3. In 2020, there were 154 listed firms in China’s energy industry, of which 53 firms released sustainability reports and established WOA for at least 1 year. Supplementary Appendix SA lists the names of the listed firms in the Chinese energy industry involved in this research. Subsequently, we use Python to obtain all of the tweets published by these 53 energy listed firms on their WOA in 2020—a total of 17,451; their 53 sustainability reports came from CNINF (http://www.cninfo.com.cn/).

We refer to the GRI G4 sustainability guidelines to establish a content analysis system and use Atlas. ti 8.0 to classify the WeChat tweets and sustainability reports. According to stakeholder theory (Freeman, 1984), our content analysis system includes 7 first-level dimensions: environment, customer, employee, supplier, community, government and investor. 9 to 22 second-level subdimensions make up each first-level dimension; for example, the environment dimension includes 16 second-level subdimensions: Strategy and Analysis (EN01), Organizational Profile (EN02), Materials (EN03), Energy (EN04), Water (EN05), Biodiversity (EN06), Emissions (EN07), Effluents and Waste (EN08), Products and Services (EN09), Compliance (Environment) (EN10), Transport (EN11), Overall (EN12), Environmental Grievance Mechanisms (EN13), Product and Service Labelling (EN14), Stakeholder Engagement (EN15) and Non-GRI Others (EN16). A content taxonomy and information examples are reported in Supplementary Appendix SB.

We developed the codebook based on the index content of GRI G4. Firstly, the first researcher classified and coded the G4 index content according to stakeholders. At the same time, by reading the corporation’s social media tweets, the categories disclosed by the enterprise but not included in the GRI framework were added to the codebook. Subsequently, a second researcher worked independently to classify the G4 indicators into each stakeholder dimension and sort out the non-GRI framework’s contents. Finally, the differences between the two groups of people in coding classification were discussed, and the codebook is included in Supplementary Appendix SB.

While coding and scoring the content of tweets, our two groups of researchers independently coded and scored the tweets according to the code book. Finally, the coding and scoring of the two groups were compared and discussed to determine the final score of each sample.

In the scoring process, first, we score according to the second-level subdimension of the system. When tweets or sustainable development reports provide qualitative information about this sub-dimension, the score is 1, and the score is 2 when numerical data is provided. Then, we aggregate the scores of all of the second-level subdimensions under the first-level dimension to form first-level variables used in our main analysis. After completing the aforementioned stages, we defined 16 first-level dimension variables (see Table 1), among which 8 are social media variables and 8 are sustainability report variables.

In this section, we first compare the disclosure of the two channels based on the 7 first-level dimensions of stakeholders.

Table 2 lists 53 companies in the energy sector and their descriptive statistics for overall social media channels and the first-level dimension of sustainable information disclosure. Among them, the mean and median of the overall disclosure level wechat_all are 748.8 and 449 respectively. Rows (2) to (8) report the disclosure of the environment, customer, employee, supplier, community, government and investor variables wechat_en, wechat_cu, wechat_em, wechat_su, wechat_co, wechat_go and wechat_in respectively horizontal stats. Investors, employees, and government are the three aspects with the highest level of transparency, with mean (median) values of 239 (115), 203.8 (92), and 153 (110); The dimensions are customer dimension, community dimension, environment dimension and supplier dimension, and their mean (median) values are 80.58 (42), 55.83 (33), 15.08 (6), 1.43 (0) respectively. In addition, column (4) in Table 2 lists the proportion of the disclosure level of each dimension to the overall disclosure level. The three having the greatest percentage of disclosure level among them are the government, employee, and investor aspects, and their disclosure proportions are 31.92%, 27.22% and 20.43%4 respectively, accounting for 80% of the overall disclosure level. The above results show that the stakeholders most concerned by Chinese energy firms in their sustainability disclosure activities on social media are investors, employees and the government.

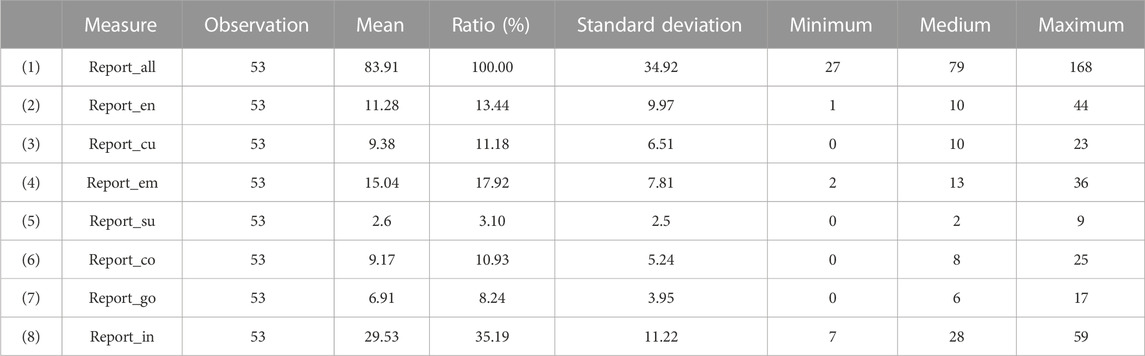

Table 3 lists the descriptive statistics of the overall sustainability reports of 53 energy industry firms and the first dimension’s sustainability information disclosure. The mean and median of the overall disclosure level report_all are 83.91 and 34.92, respectively. Rows (2) to (8) report the disclosure of environment dimension, customer dimension, employee dimension, supplier dimension, community dimension, government dimension and investor dimension variables report_en, report_cu, report_em, report_su, report_co, report_go and report_in, respectively horizontal stats. Investor, employee, and environment are the three having the greatest amount of transparency, with mean (median) values of 29.53 (28), 15.04 (13) and 11.28 (10); The dimensions are customer dimension, community dimension, government dimension and supplier dimension, and their mean (median) values are 9.38 (10), 9.17 (8), 6.91 (6), and 2.6 (2) respectively. In addition, column (4) in Table 2 lists the proportion of the disclosure level of each dimension to the overall disclosure level. The three with the most transparency are the investor, the employee, and the environment, and their disclosure proportions are 35.19%, 17.92% and 13.44%, respectively, accounting for 66% of the overall disclosure level.

TABLE 3. Overall and first-level dimension analysis of sustainability disclosure in sustainability reports.

Figure 1 reports the comparative results of the disclosures of Chinese energy corporations in WeChat and sustainability reporting channels according to the stakeholder dimension.

First of all, there are differences in the dimensions of stakeholders concerned by energy industry companies through different channels. The first three parameters of sustainability reports are investors (35.19%), employees (17.92%), and the environment (13.44%), while the first three parameters of WeChat are investors (31.92%), employees (27.22%), and the government (20.43%). The third dimension on social media is the governmental dimension (20.43%), but it ranks only sixth in sustainability reports (8.24%) with a difference of more than two times. Moreover, in the sustainable development report, the third dimension is the environmental dimension (13.44%), but it only ranks sixth (2.01%) on social media, a difference of more than six-fold. These results suggest that Chinese energy firms prefer to provide more environmental information than governmental information in sustainability reports but prefer to provide governmental information on social media, while the government receives less attention in sustainability reports.

Second, energy firms focus on the same stakeholder dimension through different channels. For example, the supplier dimension has the lowest disclosure ratio of the two channels. This might be due to the fact that energy companies are upstream in the supply chain or provide their own raw materials, meaning suppliers have less sway over them and are less concerned about sustainability disclosure. Additionally, in the two channels, the investor and employee dimensions account for a large proportion, indicating that these two stakeholder dimensions are the focus of firms.

The previous analysis suggests that the stakeholder dimensions that Chinese energy firms pay the most attention to in the two channels are investors and employees, and the accumulated proportion of the disclosure of both exceeds 50%. However, is there a reporting difference between these two stakeholder dimensions in the second-level subdimension? We discuss this issue in this section.

Table 4 shows the comparative analysis of the proportion of the second subdimensions of the two channels for the investor dimension. We report the average proportion of investors’ second-level subdimension scores to the first-level dimension scores under the two channels. For brevity, we report only the second-level subdimensions that are heavily disclosed within the two channels. Among them, except for the indicator Non-GRI Others (Investor) (IN18), other indicators are under the GRI framework. On social media, Chinese energy firms are keen to disclose information outside the GRI framework, with the proportion of IN18 is as high as 81.80%. Additionally, they are more concerned about the disclosure of Organization Introduction (IN02), accounting for an average of 12.49%, while other second-level subdimensions generally do not exceed 3%. In sustainability reporting channels, except for the indicator IN18, the second-level subdimension Organization Introduction (IN02) receives more disclosure, accounting for an average of 23.40%. Moreover, Stakeholder Engagement (Investor) (IN04), Governance (Investor) (IN06) and Economic Performance (Investor) (IN08) also receive a certain level of disclosure, with an average disclosing proportion of 11.31%, 6.98% and 5.49%.

Table 5 shows the results of the comparative analysis of the proportion of sustainability disclosure of the second-level subdimension under the employee dimension of the two channels. Similar to Table 4, we report only the second-level subdimensions that are heavily disclosed. The indicators except for Non-GRI Others (Employee) (EM22) are under the GRI framework. Chinese energy firms disclose Non-GRI Others (EM22) as high as 76.50% on social media; after EM22, the following subdimensions are Training and Education (Employee) (EM09) and Ethics and Integrity (Employee) (EM02), which account for an average of 10.01% and 9.87%, respectively. The other second-level subdimensions on social media generally do not exceed 2%. In the sustainability reporting channel, the second-level subdimension Non-GRI Others (Employee) (EM22) obtains the highest reporting proportion (55.72%), but it is lower than the proportion on social media. Then, Training and Education (Employee) (EM09) and Stakeholder Engagement (Employee) (EM03) receive more disclosure, and their average proportions are 15.43% and 11.44%, respectively. Unlike disclosure on social media, the subdimension of Ethics and Integrity (Employee) (EM02) is reported relatively lower in sustainability reports, with an average proportion of only 2.39%.

The previous analyses in Sections 4.2.1, 4.2.2 reveal that under the investor and employee dimensions, Chinese energy firms show different non-GRI disclosure proportions in different channels. In this section, we further discuss the case under the dimension of all stakeholders.

Figure 2 shows the proportions of non-GRI disclosures under all stakeholder dimensions in both channels. Among them, for social media, the non-GRI disclosure proportions of Chinese energy firms in terms of customers, suppliers, communities, investors and employees are 97.85%, 90.79%, 82.20%, 81.80% and 76.50%, respectively, while the non-GRI disclosures in the government and environment dimensions are less, accounting for 34.52% and 32.78%, respectively. For sustainability reports, the non-GRI disclosure proportions in terms of customers, communities and employees are 79.48%, 72.42% and 55.70%, respectively; in the dimensions of suppliers, investors, government and the environment, non-GRI disclosure is less, with proportions of 47.08%, 39.93%, 30.32% and 28.10%. The dimensions with the smallest difference between the two channels are environment and government, and the difference is approximately 4%. Suppliers, investors and employees have larger differences, and the largest is for the supplier dimension at approximately 43%. To more intuitively observe the proportion of non-GRI disclosure at the total level, in the last column of the graph, we sum up the non-GRI disclosure scores of all second-level subdimensions, divide by the total score, and then take the average value and mark it as “Overall.” We find that the overall proportion of non-GRI disclosures on social media channels is 71.47%, while that in sustainability reports is 48.56%, indicating that the proportion gap between the two channels exceeds 20%. Therefore, compared with sustainability reports, Chinese energy firms tend to provide more supplementary information outside the GRI framework on social media. We argue that the reason for this difference may be that, on social media, firms consider more the needs of non-professional information users, e.g., employees and community residents, which leads them to make more diversified disclosures that are beyond the framework of GRI.

This study makes a content analysis on the sustainability disclosure of Chinese energy corporations in WeChat and sustainability reporting channels. Based on stakeholder theory and referring to the GRI G4 framework, we analyse the WeChat tweets and sustainability reports published by Chinese energy firms in 2020 and find that first, both the sustainability disclosures of Chinese energy corporations on WeChat and sustainability reports focus on investor and employee dimensions but show a large difference in the environmental and government dimensions. Second, firms tend to provide more supplementary information outside the GRI framework on social media.

The practical significance of this paper is to help stakeholders interested in sustainable disclosure in corporate social media tweets, such as SRI, better understand the characteristics and implications of social media disclosure activities so that they can more effectively utilize this new incremental information.

This article also has some deficiencies. First, the WeChat platform allows firms to filter negative comments, so the displayed comments are incomplete, and we cannot analyse the communication between firms and stakeholders. Second, some sample firms do not have independent WOAs, and their social media disclosures are realized through the accounts of their parent firms. Since it is difficult to distinguish the content, we cannot include these firms in our analysis. Third, due to the limitations of length and workload, we did not specifically analyze the reasons for the difference in information disclosure between sustainable development reports and social media. At the same time, due to the limitations of space, this paper only analyzes the information disclosure in 2020 and does not compare the specific quantity and nature of the content. We will supplement these questions in subsequent research. In the future, we expect investigating these problems through questionnaire analysis, field research and case studies.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

MZ and MW contributed to the conception and design of the study, performed the statistical analysis, and wrote the first draft of the manuscript. All authors contributed to the article and approved the submitted version.

National Natural Science Foundation of China (NFSC), foundation number: 71902090 Jiangsu Provincial Social Science Foundation, foundation number: 22EYC008.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1147191/full#supplementary-material

1In 2020, the sample enterprises studied in this paper mostly used GRI G4 as a reference when compiling their sustainable development reports. For example, Jiangsu Guosen Co., LTD. disclosed that “the report was prepared according to the G4 guidelines of the Global Reporting Initiative (GRI)”.

2Data source: https://www.thepaper.cn/newsDetail_forward_10949031.

3The corresponding CSRC industry codes (2012 version) are B06, B07, C25, D44 and D45, respectively.

4The information ratio for level 1 subdimensions is calculated by dividing the average of the subdimension indicators by the average of the overall scoring indicator Wechat_all. For instance, the total score indicator Wechat_all’s 748.8 divided by the average of the environment dimension variable Wechat_en’s 15.08 yields a percentage of 15.08%.

5The website is the official website of the company group

Adams, C. A., and Whelan, G. (2009). Conceptualising future change in corporate sustainability reporting. Accounting, Auditing & Accountability Journal 22 (1), 118–143. doi:10.1108/09513570910923033

Alazzani, A., and Wan-Hussin, W. N. (2013). Global reporting initiative's environmental reporting: A study of oil and gas companies. Ecological Indicators 32, 19–24. doi:10.1016/j.ecolind.2013.02.019

Amin, M. H., Mohamed, E. K. A., and Elragal, A. (2021). CSR disclosure on twitter: Evidence from the UK. International Journal of Accounting Information Systems 40, 100500. doi:10.1016/j.accinf.2021.100500

Ang, J. S., Hsu, C., Tang, D., and Wu, C. (2020). “The role of social media in corporate governance,” in The Accounting Review 1 March 2021, 96 (2), 1–32. doi:10.2308/TAR-2018-0144

Baboukardos, D., Gaia, S., and She, C. (2021). Social performance and social media activity in times of pandemic: Evidence from covid-19-related twitter activity. Corporate Governance: The International Journal of Business in Society 21 (6), 1271–1289. doi:10.1108/cg-09-2020-0438

Blankespoor, E., Miller, G. S., and White, H. D. (2014). The role of dissemination in market liquidity: Evidence from firms’use of twitter. The Accounting Review 89 (1), 79–112. doi:10.2308/accr-50576

Boiral, O. (2013). Sustainability reports as simulacra? A counter-account of A and A+ GRI reports. Accounting, Auditing & Accountability Journal 26 (7), 1036–1071. doi:10.1108/aaaj-04-2012-00998

Chodnicka-Jaworska, P. (2022). Environmental, social, and governance impact on energy sector default risk—Long-term issuer credit ratings perspective. Frontiers in Energy Research 10, 817679. doi:10.3389/fenrg.2022.817679

De-Miguel-Molina, B., Chirivella-González, V., and García-Ortega, B. (2019). CEO letters: Social license to operate and community involvement in the mining industry. Business Ethics: A European Review 28 (1), 36–55. doi:10.1111/beer.12205

Deng, D., Li, C., Zu, Y., Liu, L. Y. J., Zhang, J., and Wen, S. (2022). A systematic literature review on performance evaluation of power system from the perspective of sustainability. Frontiers in Environmental Science 10, 925332. doi:10.3389/fenvs.2022.925332

Dilling, P. (2016). Reporting on long-term value creation—Tthe example of public canadian energy and mining companies. Sustainability 8 (9), 938. doi:10.3390/su8090938

Dong, S., and Xu, L. (2016). The impact of explicit CSR regulation: Evidence from China’s mining firms. Journal of Applied Accounting Research 17 (2), 237–258. doi:10.1108/jaar-03-2014-0030

Dong, S., Burritt, R., and Qian, W. (2014). Salient stakeholders in corporate social responsibility reporting by Chinese mining and minerals companies. Journal of Cleaner Production 84, 59–69. doi:10.1016/j.jclepro.2014.01.012

Dube, S., and Zhu, C. (2021). The disciplinary effect of social media: Evidence from firms' responses to glassdoor reviews. Journal of Accounting Research 59 (5), 1783–1825. doi:10.1111/1475-679x.12393

ElAlfy, A., Darwish, K. M., and Weber, O. (2020). Corporations and sustainable development goals communication on social media: Corporate social responsibility or just another buzzword?Sustainable Development 28 (5), 1418–1430. doi:10.1002/sd.2095

Fan, L., Yang, K., and Liu, L. (2020). New media environment, environmental information disclosure and firm valuation: Evidence from high-polluting enterprises in China. Journal of Cleaner Production 277, 123253. doi:10.1016/j.jclepro.2020.123253

Gómez-Carrasco, P., Guillamón-Saorín, E., and García Osma, B. (2021). Stakeholders versus firm communication in social media: The case of twitter and corporate social responsibility information. European Accounting Review 30 (1), 31–62. doi:10.1080/09638180.2019.1708428

Guenther, E., Hoppe, H., and Poser, C. (2006). Environmental corporate social responsibility of firms in the mining and oil and gas industries: Current status QUO of reporting following GRI guidelines. Greener Management International 53, 7–25. doi:10.9774/GLEAF.3062.2006.sp.00003

Hales, J., Moon, J. R., and Swenson, L. A. (2018). A new era of voluntary disclosure? Empirical evidence on how employee postings on social media relate to future corporate disclosures. Accounting, Organizations and Society 68-69, 88–108. doi:10.1016/j.aos.2018.04.004

Herzig, C., and Schaltegger, S. (2006). “Corporate sustainability reporting. An overview,” in Sustainability Accounting and Reporting. Editors S. Schaltegger, M. Bennett, and R. Burritt (Dordrecht: Springer) 21. doi:10.1007/978-1-4020-4974-3_13

Janik, A., Ryszko, A., and Szafraniec, M. (2020). Greenhouse gases and circular economy issues in sustainability reports from the energy sector in the European union. Energies 13 (22), 5993. doi:10.3390/en13225993

Jenkins, H., and Yakovleva, N. (2006). Corporate social responsibility in the mining industry: Exploring trends in social and environmental disclosure. Journal of Cleaner Production 14 (3), 271–284. doi:10.1016/j.jclepro.2004.10.004

Ju, B., Shi, X., and Mei, Y. (2022). The current state and prospects of China’s environmental, social, and governance policies. Frontiers in Environmental Science 10, 999145. doi:10.3389/fenvs.2022.999145

Jung, M. J., Naughton, J. P., Tahoun, A., and Wang, C. (2017). Do firms strategically disseminate? Evidence from corporate use of social media. The Accounting Review 93 (4), 225–252. doi:10.2308/accr-51906

Karaman, A. S., Orazalin, N., Uyar, A., and Shahbaz, M. (2021). CSR achievement, reporting, and assurance in the energy sector: Does economic development matter?Energy Policy 149, 112007. doi:10.1016/j.enpol.2020.112007

Khanal, A., Akhtaruzzaman, M., and Kularatne, I. (2021). The influence of social media on stakeholder engagement and the corporate social responsibility of small businesses. Corporate Social Responsibility and Environmental Management 28 (6), 1921–1929. doi:10.1002/csr.2169

Lee, K., Oh, W., and Kim, N. (2013). Social media for socially responsible firms: Analysis of fortune 500's twitter profiles and their CSR/CSIR ratings. Journal of Business Ethics 118 (4), 791–806. doi:10.1007/s10551-013-1961-2

Lee, L. F., Hutton, A. P., and Shu, S. (2015). The role of social media in the capital market: Evidence from consumer product recalls. Journal of Accounting Research 53 (2), 367–404. doi:10.1111/1475-679x.12074

Lei, L. G., Li, Y., and Luo, Y. (2018). Social media and voluntary nonfinancial disclosure: Evidence from twitter presence and corporate political disclosure. Journal of Information Systems 33 (2), 99–128. doi:10.2308/isys-52189

Lepore, L., Landriani, L., Pisano, S., D Amore, G., and Pozzoli, S. (2022). Corporate governance in the digital age: The role of social media and board independence in CSR disclosure. Evidence from Iitalian listed companies. Journal of Management and Governance. doi:10.1007/s10997-021-09617-2

Liu, W. (2020). China energy statistical yearbook 2020. Bejing: National Bureau of Statistics of China. (in Chinese).

Lu, J., Ren, L., Yao, S., Qiao, J., Strielkowski, W., and Streimikis, J. (2019). Comparative review of corporate social responsibility of energy utilities and sustainable energy development trends in the baltic states. Energies 12 (18), 3417. doi:10.3390/en12183417

Lu, P., Hamori, S., and Tian, S. (2022). Policy effect of the “blue sky plan” on air pollution, ESG investment, and financial performance of China’s steel industry. Frontiers in Environmental Science 10, 955906. doi:10.3389/fenvs.2022.955906

Lyon, T. P., and Montgomery, A. W. (2013). Tweetjacked: The impact of social media on corporate greenwash. Journal of Business Ethics 118 (4), 747–757. doi:10.1007/s10551-013-1958-x

Mamun, M. (2022). Sustainability reporting of major electricity retailers in line with GRI: Australia evidence. Journal of Accounting and Organizational Change. ahead-of-print No. ahead-of-print. doi:10.1108/jaoc-01-2022-0005

Manetti, G., and Bellucci, M. (2016). The use of social media for engaging stakeholders in sustainability reporting. Accounting, Auditing & Accountability Journal 29 (6), 985–1011. doi:10.1108/aaaj-08-2014-1797

Milne, M., and Gray, R. (2007). Future prospects for corporate sustainability reporting. London: routledge, 184–207. doi:10.4324/noe0415384889.ch10

Ng, A. W., Yorke, S. M., and Nathwani, J. (2022). Enforcing double materiality in global sustainability reporting for developing economies: Reflection on Ghana’s oil exploration and mining sectors. Sustainability 14 (16), 9988. doi:10.3390/su14169988

Nwagbara, U., and Belal, A. (2019). Persuasive language of responsible organisation? A critical discourse analysis of corporate social responsibility (CSR) reports of nigerian oil companies. Accounting. Auditing & Accountability Journal 32 (8), 2395–2420. doi:10.1108/aaaj-03-2016-2485

Perez, F., and Sanchez, L. E. (2009). Assessing the evolution of sustainability reporting in the mining sector. Environmental Management 43 (6), 949–961. doi:10.1007/s00267-008-9269-1

Pizzi, S., Moggi, S., Caputo, F., and Rosato, P. (2021). Social media as stakeholder engagement tool: CSR communication failure in the oil and gas sector. Corporate Social Responsibility and Environmental Management 28 (2), 849–859. doi:10.1002/csr.2094

Prokofieva, M. (2015). Twitter-based dissemination of corporate disclosure and the intervening effects of firms' visibility: Evidence from australian-listed companies. Journal of Information Systems 29 (2), 107–136. doi:10.2308/isys-50994

Pu, J., Shan, H., and Yuan, T. (2022). Corporate use of social media after ESG incidents. SSRN. Available at: https://ssrn.com/abstract=4096369.

Ramananda, D., and Atahau, A. D. R. (2020). Corporate social disclosure through social media: An exploratory study. Journal of Applied Accounting Research 21 (2), 265–281. doi:10.1108/jaar-12-2018-0189

Russo, S., Schimperna, F., Lombardi, R., and Ruggiero, P. (2022). Sustainability performance and social media: An explorative analysis. Meditari Accountancy Research 30 (4), 1118–1140. doi:10.1108/MEDAR-03-2021-1227

Saxton, G. D., Gomez, L., Ngoh, Z., Lin, Y., and Dietrich, S. (2019). Do CSR messages resonate? Examining public reactions to firms' CSR efforts on social media. Journal of Business Ethics 155 (2), 359–377. doi:10.1007/s10551-017-3464-z

Shao, J., and He, Z. (2022). How does social media drive corporate carbon disclosure? Evidence from China. Frontiers in Ecology and Evolution 10. doi:10.3389/fevo.2022.971077

She, C., and Michelon, G. (2019). Managing stakeholder perceptions: Organized hypocrisy in csr disclosures on facebook. Critical Perspectives on Accounting 61, 54–76. doi:10.1016/j.cpa.2018.09.004

Shen, Y., Lyu, M., and Zhu, J. (2022). Air pollution and corporate green financial constraints: Evidence from China’s listed companies. International Journal of Environmental Research and Public Health 19 (22), 15034. doi:10.3390/ijerph192215034

Stohl, C., Etter, M., Banghart, S., and Woo, D. (2017). Social media policies: implications for contemporary notions of corporate social responsibility. Journal of Business Ethics 142 (3), 413–436. doi:10.1007/s10551-015-2743-9

Stuss, M. M., Makieła, Z. J., Herdan, A., and Kuźniarska, G. (2021). The corporate social responsibility of polish energy companies. Energies 14 (13), 3815. doi:10.3390/en14133815

Szczepankiewicz, E., and Mućko, P. (2016). CSR reporting practices of polish energy and mining companies. Sustainability 8 (2), 126. doi:10.3390/su8020126

Tench, R., and Jones, B. (2015). Social media: The wild west of CSR communications. Social Responsibility Journal 11 (2), 290–305. doi:10.1108/srj-12-2012-0157

Toppinen, A., Hänninen, V., and Lähtinen, K. (2015). ISO 26000 in the assessment of CSR communication quality: CEO letters and social media in the global pulp and paper industry. Social Responsibility Journal 11 (4), 702–715. doi:10.1108/srj-09-2013-0108

Turzo, T., Marzi, G., Favino, C., and Terzani, S. (2022). Non-financial reporting research and practice: Lessons from the last decade. Journal of Cleaner Production 345, 131154. doi:10.1016/j.jclepro.2022.131154

Wanday, J., and Ajour El Zein, S. (2022). Higher expected returns for investors in the energy sector in Europe using an ESG strategy. Frontiers in Environmental Science 10. doi:10.3389/fenvs.2022.1031827

Yang, J. H., and Liu, S. (2017). Accounting narratives and impression management on social media. Accounting and Business Research 47 (6), 673–694. doi:10.1080/00014788.2017.1322936

Yang, J., Basile, K., and Letourneau, O. (2020). The impact of social media platform selection on effectively communicating about corporate social responsibility. Journal of Marketing Communications 26 (1), 65–87. doi:10.1080/13527266.2018.1500932

Zhang, Y., and Yang, F. (2021). Corporate social responsibility disclosure: Responding to investors’ criticism on social media. International Journal of Environmental Research and Public Health 18 (14), 7396. doi:10.3390/ijerph18147396

Zheng, B., Liu, H., and Davison, R. M. (2018). Exploring the relationship between corporate reputation and the public’s crisis communication on social media. Public Relations Review 44 (1), 56–64. doi:10.1016/j.pubrev.2017.12.006

Keywords: sustainable management, non-financial disclosure, ESG, CSR, new media

Citation: Zhong M and Wang M (2023) Corporate sustainability disclosure on social media and its difference from sustainability reports:Evidence from the energy sector. Front. Environ. Sci. 11:1147191. doi: 10.3389/fenvs.2023.1147191

Received: 18 January 2023; Accepted: 17 March 2023;

Published: 28 March 2023.

Edited by:

Shiyang Hu, Chongqing University, ChinaCopyright © 2023 Zhong and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Ma Zhong, em02MDQwQG5qZnUuZWR1LmNu

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.