- Faculty of Economics and Management, East China Normal University, Shanghai, China

Introduction: The Chinese government has taken the lead in proposing a carbon trading market policy to address the negative impact of excessive carbon emissions on global climate change. Since this policy’s implementation in 2011, it has had a profound impact on economic development and the structure of the national economy. In this context, we aim to study how environmental regulation and transition risks associated with climate change affect corporate capital structure.

Methods: Based on data provided by listed companies in China’s energy-intensive sector, this study uses a Difference-in-Difference (DID) model to examine the effect of the carbon trading policy on corporate capital structure.

Results: According to our results, we predict that the carbon trading policy will significantly reduce the corporate debt ratio, which remains true even when an instrumental variables approach is used to account for endogeneity and after robustness tests are conducted. This study also shows that the negative effect of the carbon trading policy on corporate capital structure is mainly a product of internal capital demand and external capital supply. In addition, the reduction effect that the carbon trading policy has on the corporate debt ratio is more significant among firms with lower government subsidies and among nonstate-owned firms.

Discussion: These findings imply that under the implementation of a carbon trading market policy, firms’ financial decision-making will change significantly in response to the policy-induced shocks of elevated corporate risk behaviour.

1 Introduction

Since the turn of the century, extreme weather events brought about by global climate change have been frequent worldwide, and the resulting ecological degradation has threatened the survival of the human race. It is against this backdrop that world leaders ratified the Paris Agreement, which attempted to establish a shared target for greenhouse gas emission reductions among the ratifying countries. The Chinese government has implemented a number of measures aimed at controlling greenhouse gas emissions, which have prominently involved carbon trading policy in recent years. At the end of 2011, China launched a carbon trading pilot program in seven provinces and cities. Since then, each pilot program has demonstrated a markedly different market profile and implemented their respective policies by actively organizing energy-based enterprises. On July 16 of 2021, the national unified carbon emission trading market was officially launched. The construction of the national carbon market adopts a “twin-city” model; i.e., Shanghai is responsible for the construction of the trading system and Wuhan in Hubei is responsible for the registration and settlement system. Thus, China’s various carbon emissions trading market pilots finally ushered in a unified national system.

The European Commission defines energy-intensive sectors as those where energy consumption is higher than the corresponding average for all sectors over the same period. The energy-intensive sector mainly relies on the production and utilisation of traditional energy sources and generally belongs to the raw material industry. Coal has been the main primary energy source for decades, but its unclean and inefficient nature has contributed to China’s many problems with pollution. Decarbonisation of the energy sector has recently received increasing attention as a key method of reducing carbon emissions, which can be achieved most directly through the increased use of renewable energy sources.

Firms have expressed concerns that they will be forced by the carbon trading policy to purchase carbon emission rights, thereby increasing their research investment in reducing emissions and thus increasing their operating costs. This will in turn stimulate firms to acquire more equity financing and drive down corporate leverage. At the same time, as lenders gradually incorporate carbon-related risks into lending decisions, the cost of corporate debt will increase and firms will subsequently reduce their recapitalisation leverage, which will also drive down corporate leverage. According to capital structure theory, firms will trade off the costs and benefits of debt due to the presence of market frictions (Modglini and Miller, 1958). Carbon trading markets can influence the corporate capital structure by altering its cash flow capacity and financing costs (for example, in the form of operating risk and transition risk). Existing research on carbon trading policy focuses on the impact of carbon constraints on the financial performance of carbon trading market players (Zhang and Liu, 2019), as well as the linkages between carbon trading markets and energy and capital markets (Ma et al., 2020). Some scholars have also studied the impact of the carbon emissions trading pilot program on the total factor productivity of firms (Pan et al., 2022). At the financial market level, there is literature examining the directional predictability of carbon trading prices to stock market prices (Razzaq et al., 2022). However, it remains unclear whether and to what degree the carbon trading policy affects corporate financial decisions and corporate capital structure at the firm level. Whether the carbon trading policy, which is associated with the implementation of China’s carbon peaking and carbon neutrality goals, will influence corporate capital structure, and to what degree, is an important question concerning the ability of financial services to adapt and their subsequent behavioural changes under the green transition. In the context of global climate change and China’s dual carbon targets, the carbon risks faced by energy-intensive firms have come to the fore and are already receiving attention from investors. Our research’s primary focus is how the carbon trading policy’s implementation has impacted these firms’ finances and liabilities as well as their transmission mechanisms. In addition, a core objective of our study is to inform regulators and to see the ways in which firms in different situation adapt to the changes. With this better understanding, more appropriate policy may be set to establish a more sustainable social economy. To this end, this study examines the impact of carbon trading policy on corporate capital structure using a Differences-in-Differences model (DID) and a research sample of Chinese A-share listed firms in the energy sector. This paper finds that the proposed carbon trading policy would significantly reduce the corporate debt ratio, which remains true even after applying an instrumental variables approach with parallel trend and placebo tests. We also find that the effect of the carbon trading policy on the reduction of the corporate debt ratio is more pronounced among privately owned firms and those with lower government subsidies. Meanwhile, the overall effect also varies depending on other related policies. The findings of this study suggest that corporate financial decision-making behaviour in the energy sector will see significant changes under the influence of the carbon trading policy as a response to the higher corporate risk shocks resulting from the energy transition.

This study contributes to the existing literature in at least three ways: First, it examines capital structure from the perspective of the carbon trading policy, providing a new perspective for observing and revealing the drivers of corporate capital structure. The existing literature on the determinants of corporate capital structure has been examined extensively at multiple levels, including firm characteristics, industry characteristics, institutional environment, and macroeconomic policies and uncertainties (Givoly and Hayn, 1992; Rajan and Zingales, 1995; Agrawal and Matsa, 2013). However, very little literature has focused on carbon trading policy in particular. This study finds that carbon trading policy is an important influencing factor on corporate capital structure, an addition which enriches and expands the literature on capital structure determinants.

Second, this paper examines how carbon trading policy affects corporate financial decisions. Existing research on carbon trading policies has focused on analysing the market efficiency of ETS pilots (Zhao et al., 2016; Montagnoli and De Vries, 2020), the relationship between carbon trading policy implementation and the mechanisms behind carbon emission reduction (Lin and Huang, 2022), as well as global economic turmoil and its impact on carbon markets (Perdan and Azapagic, 2011). Meanwhile, existing literature similar to our research focus on the dimension of risks and the impact on financial leverage. Nguyen and Phan. (2020) reported that the increased risk of financial distress due to increased carbon risk could lead to a reduction in financial leverage. Lin and Wu. (2022) concluded that carbon trading policy would increase the corporate risk-taking level of firms involved. Shu et al. (2023) found that carbon policy risk reduces the financial leverage of A-share listed firms in China through three mechanisms: financial constraints, bankruptcy risk, and government power. Our study is different in that focusing on the energy-intensive industries and the carbon trading policy, we present innovative and rigorous theoretical mechanisms: the debt funding mechanism and the demand mechanism for equity issues. We also extend the heterogeneity test in the aspect of corporate nature and government subsidy level to examine the impact of carbon trading policy, which expands the body of knowledge on the influence of carbon trading policy on corporate financial choices.

Third, the cap-and-trade system, as a government regulatory instrument, reflects the indirect effects of climate risk on business. Our study provides guidance for other articles examining climate risk. At the same time, our research has targeted recommendations for capital decisions in China’s energy-intensive and emission-intensive industries, providing the theoretical perspective necessary for a paradigm shift in support of a transition to a low-carbon economy. In the global low carbon transition, developing countries might experience environmental measures comparable to those in China. This study therefore provides a strategic direction for the developing countries to update its transformative policies.

The remaining content is organized as follows. Part 2 provides an overview of the existing literature and proposes relevant hypotheses based on this review, after which Part 3 explains the study design, data, and models. Parts 4 and 5 present the empirical results and mechanism tests, while Part 6 presents the heterogeneity analysis results. The final part provides the conclusions and implications of this research.

2 Literature review

2.1 Carbon trading market

With the signing of the Kyoto Protocol, the carbon trading market has become an essential measure in the struggle to save energy and reduce emissions at this historic moment. Following the ratification of the Paris Agreement in 2016, global efforts to reduce carbon emissions reached a new level. Carbon trading is a market-based tool for regulating the industrial carbon footprint which also has an effect on other financial markets.

Different industries utilize different calculation methods to define the measurement of carbon emissions. Ji et al. (2022) quantified the carbon intensity (CEI) metric to capture the impact of traffic flow on emissions. Li and Sun. (2021) estimated the total carbon emissions of China’s logistics industry using the IPCC’s carbon accounting method. Chen and Li. (2020) selected the intensity of research and development, value added in agriculture, agricultural labour force ratio, general level of urbanisation, rural disposable income per capita, and the area of cultivated land per capita as influencing factors to measure agricultural carbon emissions.

Carbon trading policy is an efficient environmental regulation tool. As an instrument of government regulation, a carbon emission quota allocation is one of its most basic and essential components. A carbon trading policy makes it possible for participants to exchange excess quotas to reduce emissions, turning environmental protection into typical corporate behaviour (Du et al., 2021). If a firm has a lower carbon quota and is under a higher level of regulation, the impact on the firm’s environmental behaviour will be more significant (Borghesi et al., 2015). Due to being politically feasible, reasonably priced, and having a relatively certain outcome, carbon trading regulation can effectively lead to the best allocation of relevant resources in the economy using carbon price signals (Liu et al., 2022). Carbon trading regulation can help reduce carbon sources and increase carbon sinks by restructuring industries, coordinating low-carbon policies, promoting cultural diffusion, increasing green space construction and reducing energy intensity to achieve a state of carbon neutrality (Wang et al., 2022a).

Carbon permits, one of the main components in China’s carbon trading market, are rapidly developing into a serious financial instrument. In Wang et al. (2019), the authors demonstrate that under established resource and environmental constraints, there is a degree of positive correlation between China’s carbon trading policy and signs of a low-carbon economic transition. The carbon trading pilot policy is expected to exert a significant positive influence on low-carbon innovation by firms that fall under its purview, particularly by reducing barriers to financing low-carbon innovation (Qi et al., 2021a). Qi et al. (2021b) revealed that the carbon trading pilot policy has contributed to greater levels of industrial low carbon competence through the promotion of low carbon technological progress. Empirical results showed that carbon trading mechanisms, R&D intensity, and investment in contamination control have all had a positive impact on the effectiveness of green development (Zhu et al., 2020).

As a form of government intervention, carbon trading regulation plays an essential role in upgrading industries and spurring innovation. Zhou and Wang (2022) concluded that China’s emissions trading scheme can significantly boost sustainable technical innovation in pilot cities. According to the governmental development strategy and policy, environmental regulations may prove their own worth by continuing to significantly increase these beneficial effects. Zhou et al. (2020) found that there is a clear imbalance between China’s carbon efficiency and its upgrades to industrial structures. Guo et al. (2022) concluded that the focus on research and development as well as industrial upgrades serve as a form of intermediation between CETP, IFCER and carbon emissions. Wang et al. (2022b) found in their analysis that from 2000–2017 there was an increasing trend in the coupling of carbon emissions with industrial and technological innovation at the district level. Martin et al. (2016) found that carbon trading regulation positively promoted the decision-making behaviour of enterprises at the environmental level. Enterprises under carbon trading regulation were more inclined to carry out low-carbon technological innovation.

The impact of carbon trading regulation on China’s energy-intensive industries can be reflected in the following concrete areas. Through technological advancement, carbon trading schemes can decrease the carbon intensity of China’s energy-intensive industries and boost carbon efficiency and R&D intensity (Tan and Lin, 2022). Lund. (2007) investigated the effect of the European Emissions Trading System (ETS) on the cost of the energy-intensive manufacturing sector, including both direct costs associated with mandated CO2 reduction requirements and indirect costs arising from the corresponding increase in electricity prices in the power sector. In addition, carbon trading regulation affects land supply as the availability of energy-intensive industrial land is impacted by local governmental decisions (Huang and Du, 2020). In the financial world, Sun et al. (2022) found that carbon trading regulation may cause the dominant market to reverse the cause-and-effect relationship between the carbon market and the stock market. The existing literature on the financial impact of carbon trading regulation on these firms is still relatively small.

2.2 Corporate capital structure

Modern capital structure theory began with the publication of Modigliani and Miller. (1958). In an ideal world, corporate capital structure has no impact on value. Corporate risks are all anticipated by investors and already built into financing costs. Corporate debt to equity ratio is only influenced by its preference for funding sources. Two theories discuss this relationship: the trade-off theory and the pecking order theory. First, trade-off theory suggests that a firm can finance part of its capital structure through debt and part through equity, and therefore must weigh the costs and benefits of each. Trade-off theory ultimately supports the interests of leverage in a capital structure.

Recent literature focuses on the impact of corporate financial characteristics, corporate employee characteristics, corporate governance characteristics and taxation on corporate capital structure from the perspective of the company itself (Givoly and Hayn, 1992; Rajan and Zingales, 1995; Booth et al., 2001; Ozkan, 2001; Gaud et al., 2004; Agrawal and Matsa, 2013; Larkin, 2013). Many researchers have examined the influence of finance, the legal system and culture on corporate capital structure and adjustments in the macro environment in which the firm operates (La Porta et al., 1998; Beck et al., 2004a; Beattie et al., 2006; Serfling, 2016). Other researchers have focused on inter-firm interactions, examining how the behaviour of supply chain firms and the behaviour of firms in the same industry or region affect corporate capital structure (Hoberg and Phillips, 2016; Klasa et al., 2018).

Harris and Raviv. (1991) examined theories of capital structure based on agency costs, informational asymmetry, product market interactions and enterprise control factors. Saif-Alyousfi et al. (2020) verified that profitability, tax-shielding, growth opportunities, liquidity, non-debt tax and the volatility of returns on measures of debt all have a significant impact on debt measures. Board size, equity concentration and corporate size also have a positive effect on capital structure while state ownership and corporate profitability have an opposite effect on capital structure (Feng et al., 2020). Alabdullah et al. (2018) revealed that increasing the number of non-executive positions on the board has a significant negative effect on the financial leverage ratio, while non-executive directors have a negligible impact on the capital structure. The proportion of female directors is the most influential board characteristic in terms of capital structure decisions. This characteristic is negatively correlated with leverage, cost of debt and maturity of debt (García and Herrero, 2021).

As mentioned in Jensen’s (1986) study, capital structure may have a significant impact on corporate performance. Nguyen (2020) stated higher debt utilization in a capital structure would positively improve corporate performance, but this positive impact gradually diminishes. Firm size and profitability are positively related to firm value, while capital structure is a factor negatively influencing firm value (Dang et al., 2019). For short-term debt, capital structure decisions have a positive impact on financial performance (Ngatno et al., 2021).

2.3 Carbon trading market and corporate capital structure

Previous research has posited that firms with worse environmental records, involving more carbon emissions, or that are more exposed to environmental risks, could experience higher capital costs (Sharfman and Fernando, 2008; Chava, 2014). Some academics have considered the financial and investment performance of such companies to be poor (Dowell et al., 2000; Konar and Cohen, 2001; Stefan and Paul, 2008; Matsumura et al., 2013).

Environmental policies may influence corporate financial behaviour. Total factor productivity can be considerably increased by environmental regulation and digitalisation, thereby enabling manufacturing enterprises to modernize (Wen et al., 2022). Xu et al. (2022) found that increased short-term financing for long-term investments by energy-intensive firms may result from the pressure brought on by environmental policies. There is some existing literature that analyses the green credit policy in the category of environmental policies. Green credit policy may raise the cost of debt financing for heavy emitters and polluters but lower the cost of debt for environmentally friendly firms (Xu and Li, 2020). Zhang et al. (2021) concluded that green credit policy encourages high polluting and high emission corporations to obtain funds in the short term, but over time it has a punitive impact and greatly deters investment by such firms.

Environmental policies relating to carbon regulation expose firms to associated uncertainty risks, which are also known as carbon risks. Carbon risks could affect capital structure through a firm’s operating leverage and risk of financial distress. Reduced carbon emissions can possibly reduce business risk and promote access to external capital markets, which may lead to increased debt financing and financial leverage (Sharfman and Fernando, 2008). Nguyen and Phan. (2020) suggested that carbon risk is another important element of corporate capital structure as firms facing higher carbon risks due to strict carbon controls will have lower financial leverage. Furthermore, they state that the impact of carbon risk on capital structure is mainly applied through traditional trade-off mechanisms.

In examining the impact of carbon trading on capital structure, researchers usually view the issue from two perspectives: the cost of equity and the cost of debt. In terms of the cost of debt, studies found that banks only started pricing the risk of stranded fossil fuel reserves after the Paris Agreement was adopted, resulting in higher credit costs for fossil fuel enterprises. Banks are also less concerned with the overall carbon footprint of firms as opposed to their emissions when it comes to premiums (Ehlers et al., 2021). Kleimeier and Viehs. (2016) concluded that there was an obvious positive impact on loan spreads prior to the adoption of the Paris Agreement [54]. Some country-specific studies have found that both total carbon emissions and carbon intensity increase the cost of debt (Kumar and Firoz, 2018; Maaloul, 2018).

In terms of the cost of equity, some studies have argued that the cost of equity capital for high-emitting firms has increased due to financial investors demanding compensation for the increasing regulatory and market risks brought by the economy’s low-carbon transition (Oestreich and Tsiakas, 2015; Trinks et al., 2022). Trinks et al. (2022) explained that a firm’s carbon intensity has an obvious positive impact on its cost of equity. Carbon intensity is positively correlated with the cost of equity capital, but this correlation can be reduced through extensive carbon disclosure (Bui et al., 2020).

In summary, the aforementioned seminal studies have discussed the manners and mechanisms by which environmental records and carbon risks may affect capital structure. As China’s carbon emissions trading policy is still in its initial stage, there has so far been little literature analysing the impact of this policy on the capital structure of firms; furthermore, there has been no in-depth analysis of the mechanisms of its impact and the effects of other factors on capital structure.

The capital structure of the energy sector has been affected by the recent carbon trading policy in the following ways.

First, the implementation of the carbon trading policy may cause firms in the energy sector to purchase carbon credits, thus increasing the cost of operating their assets. This increases the operating leverage of the business and increases the risk of cash flow creation and hence the business’ probability of default. The carbon trading market will also drive firms to reduce high polluting and energy-consuming operations and increase the demand for and conversion to clean technologies, which will create additional transition costs, thereby raising operation risks. All of the above will reduce the demand for debt funding and increase the demand for equity funding risk absorption, which will in turn stimulate companies to acquire more equity financing and thus drive down corporate leverage.

Second, as the government becomes more aware of the economic and social issues brought about by climate change, there will be more regulatory policies related to environmental governance and energy transition enacted, and this regulatory intensity is creating more uncertainty for firms with higher carbon risks. Through financing costs, enterprises’ carbon-related risks are incorporated into lending decisions (Jung et al., 2018). At the same time, bond investors in the financial markets are gradually focusing on carbon risk and incorporating it into the spreads of corporate bond assets. This will push up the cost of corporate debt and reduce fund supply in the bond market. Changes in the funding market will also push firms to reduce their leverage for recapitalisation. The supply effect of debt funding caused by the focus on climate risk in the debt funding market will drive down corporate leverage.

Third, carbon trading, as a form of environmental regulation, can have an impact on a company’s risk assessment, thereby affecting corporate capital structure. Corporate climate risk exposure greatly reduces corporate financial leverage, which is partly due to corporate capital requirements and debt supply effects (Li and Zhang, 2023). Transition risk is also an important component of risk assessment, which refers mainly to the impact of changes in corporate strategy or environmental regulation that will affect the firm’s debt risk and therefore its capital structure (Ilhan et al., 2020).

We propose the following hypotheses:

Hypotheses 1: Carbon trading policy will contribute to the reduction of the corporate debt ratio.

Hypotheses 2: Carbon trading policy will reduce firms’ leverage ratio by influencing its capital demand.

Hypotheses 3: Carbon trading policy will drive down corporate leverage by affecting its capital supply.

Carbon trading policies have a greater impact on energy-intensive industries. This is due to the fact that carbon trading necessitates direct costs associated with CO2 reduction requirements, as well as similarly sized indirect costs arising from electricity price increases triggered by the power sector. Carbon trading also has different impacts on sectors at different points in the supply chain. In petrochemical-related industries, upstream firms profit from carbon trading, while downstream ones have to buy additional emission permits because they fail to meet their emission targets (Lee et al., 2008).

Renewable energy credits as a monetary instrument can help promote the renewable energy market by capturing a premium for the environmental properties associated with electricity. Renewable energy credits can also reduce the cost of meeting portfolio criteria. This benefit arises from the difference in cost of renewable energy projects across different regions. The cost of the portfolio criteria can be reduced if utilities that need to meet the portfolio criteria can source from a variety of suppliers of qualified technologies based on their relative efficiency.

State-owned shares are shares held by the government and relevant authorities, and the control of listed firms in China is relatively dominated by the Chinese governance structure. State-owned enterprises, with their built-in equity financing incentives (Zou and Xiao, 2006), may display a negative association between majority shareholder ownership and firm leverage. The implementation of carbon trading policies thus has less influence over state-owned enterprises’ choice of capital structure.

As a vital means of environmental regulation, the government issues different subsidy projects to support the implementation of its policies. For government-subsidized projects, the determination of government subsidy level should be completed before the determination of the optimal debt ratio. Too low a level of government subsidy may result in the project being unbankable for financial institutions, while too high a level of subsidy may generate excess returns for project investors (Chen, 2020). This makes subsidy level an essential consideration in the study of the impact of carbon trading on capital structure.

Based on the above analysis, we propose the following hypotheses:

Hypotheses 4: Renewable energy credit policies will reduce the extent to which carbon trading policies affect a firm’s choice of capital structure.

Hypotheses 5: Carbon trading policies have differing impacts on capital structure in firms under state ownership and private ownership.

Hypotheses 6: Different levels of government subsidy have differing effects on corporate capital structure.

3 Model and data

3.1 Data source

In this paper, data was collected from the CSMAR database and the CNRDS database. In addition, information and indicators related to capital structure and carbon trading policies of A-share Chinese stock market listed energy companies were collected from the years 2005 to 2020. At the same time, by referring to narrative criteria in relevant policy documents regarding the classification of energy sectors, we delineated a range of industries closely related to energy consumption and obtained 9,028 observations at the firm-fixed level.

3.2 Construction and measurement of indicators

The aim of this paper is to investigate the impact of carbon trading policy on the corporate capital structure of firms in the energy sector, and so our focus is on how to select indicators to measure the carbon trading policy and corporate capital structure with relative accuracy.

In terms of the carbon trading policy, we construct indicators based on the Differences-in-Differences (DID) model. From our selection of DID events, we selected the Notice on the Pilot Work of Carbon Emission Trading issued by the National Development and Reform Commission in 2011 as a relevant policy event. This document describes how to use market mechanisms to promote energy-saving emission reductions to address climate change. This policy can also mitigate industries’ negative impact on the climate due to excessive energy consumption, effectively reducing the climate risk level for firms in industries with high energy consumption. Therefore, it will serve as a useful guide to explore the changes in the corporate capital structure involved in relevant energy-related industries before and after the policy’s implementation. The paper notes that Shenzhen, Shanghai, Beijing, Tianjin and Guangdong began implementing the carbon trading policy in 2013; Chongqing and Hubei began in 2014; And Fujian began in 2017. Based on this, we designate the firms involved in the relevant cities as the treatment group firms (Treat) with a value of 1 and the other firms in the sample as the control group with a value of 0. We will also assign the year after the start of the pilot in the firms’ city (Post) a value of 1, otherwise each year will have a value of 0. Finally, the cross-sectional term is obtained by multiplying Treat and Post, which incorporates both time and policy impact factors and provides a better measure of the policy’s yearly impact on each enterprise.

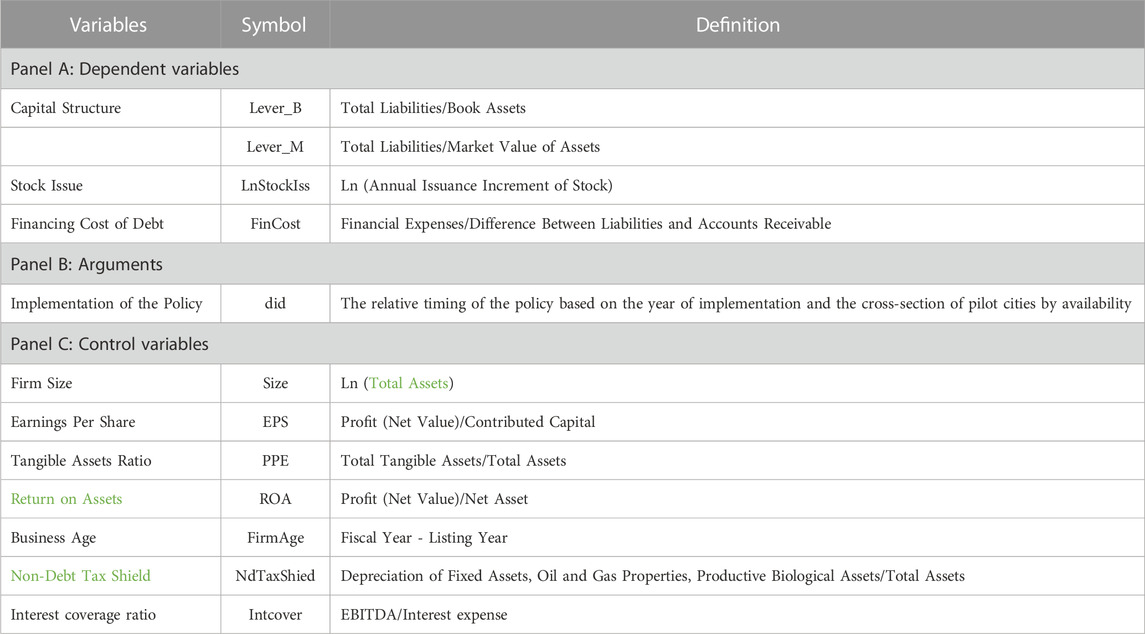

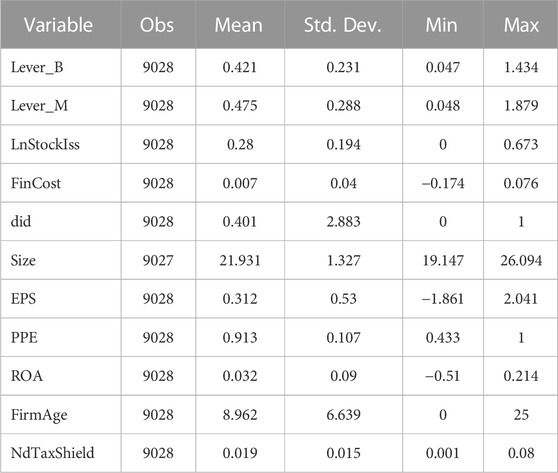

In terms of measuring the corporate capital structure, according to Booth et al. (2001), we chose the debt ratio as the primary indicator for measuring corporate capital structure. The ratio of financial expenses to the difference between total liabilities and accounts receivable is also used as a measure of capital structure in terms of debt financing costs, and the logarithm of the total number of annual equity allotments and issuances by firms is used as a measure of capital structure in terms of external financing. Tables 1, 2.

3.3 Empirical modeling

In order to empirically examine whether carbon trading policy affects corporate capital structure, we employ model (1) for testing.

where

We select the following six variables as control variables for the regressions based on the relevant literature (Rajan and Zingales, 1995; Booth et al., 2001; Booth et al., 2001; Graham and Rogers, 2002; Fan et al., 2003; Wald and Long, 2007; Bradley et al., 1984). 1) The scale of the firm. We employ the natural logarithm of a firm’s total assets to express its scale. 2) Earnings per share. The annual earnings value of the firm’s individual shares is used as a measure of earnings per share. 3) Tangible assets ratio, where the value of tangible assets over total assets is taken as the tangible assets ratio. 4) Age of firm. We use the fiscal year of the firm minus the year of its listing as an indicator of the firm’s age. 5) Non-debt tax shield. We measure the non-debt tax shield as the ratio of average annual selling and administrative expenses (including depreciation but excluding interest) to average annual sales revenue. 6) Return on Assets (ROA). We use net profit over total assets to express the return on assets of the firm.

Furthermore, in order to investigate the mediating mechanisms of the carbon trading policy on corporate capital structure, we built a two-stage mediating effect model according to Fan et al. (2021). The first stage is to test the effects of policy variables on mediating variables, see model (2). If

4 Empirical results

4.1 Regression analysis

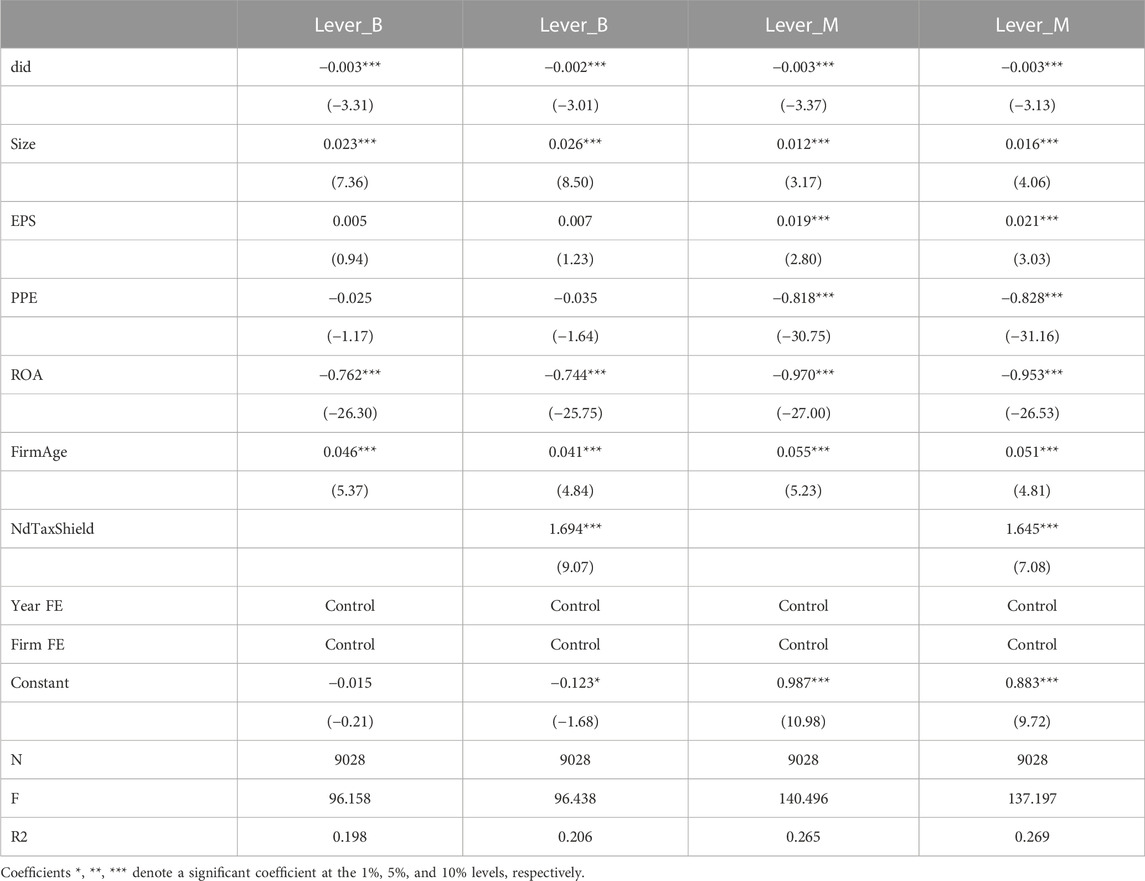

The regression results for model (1) are represented in Table 3. The results indicate that the cross term is negatively associated with the capital structure, and the coefficients of the cross term are significant at the 1% statistical level for both Lever_B and Lever_M. This demonstrates that carbon trading policy can reduce corporate financial leverage. Therefore, Hypothesis one is verified.

In terms of control variables, the coefficients of firm size under both regressions are significantly positive, meaning that larger firms have a higher asset-liability ratio, while higher ROA will lead to a lower asset-liability ratio. The coefficients of the non-debt tax shield are significantly positive, meaning that a higher non-debt tax shield will lead to a higher asset-liability ratio.

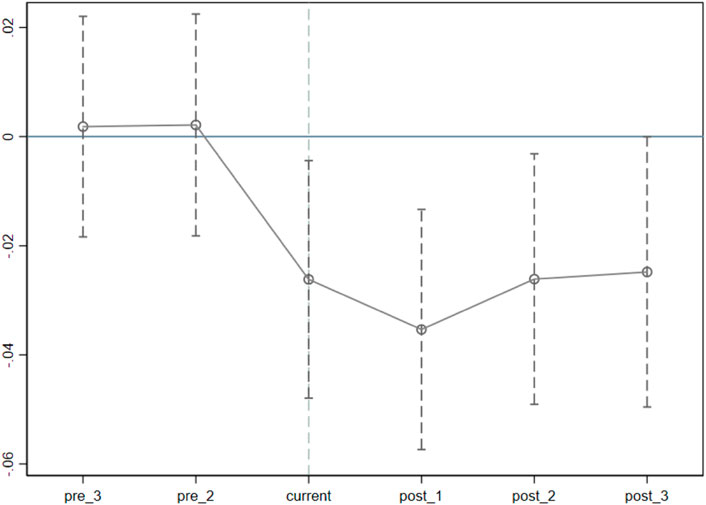

To determine if the experimental and control groups’ leverage ratios had comparable growth trajectories prior to the carbon trading policy, we conduct a parallel test. The following are the predicted yearly changes in firm leverage ratios before and after the carbon trading policy:

Here, the dummy variable

To avoid the problem of multicollinearity, we have dropped the pre_1 period. The coefficient of the fold turns negative at the current period, showing that a significant difference is observed after the implementation of the carbon trading policy. It can therefore be verified that Hypothesis one is valid, which states that the carbon trading policy significantly improved the performance of firms in the experimental group.

4.2 Placebo test

To further verify that changes in the corporate asset-liability ratio stemmed mainly from the impact of the carbon trading pilot policy, rather than other confounding factors, we conducted a placebo test on the sample. To ensure the scientific validity of the test, we chose to conduct the placebo test for both the time dimension and the city dimension, respectively.

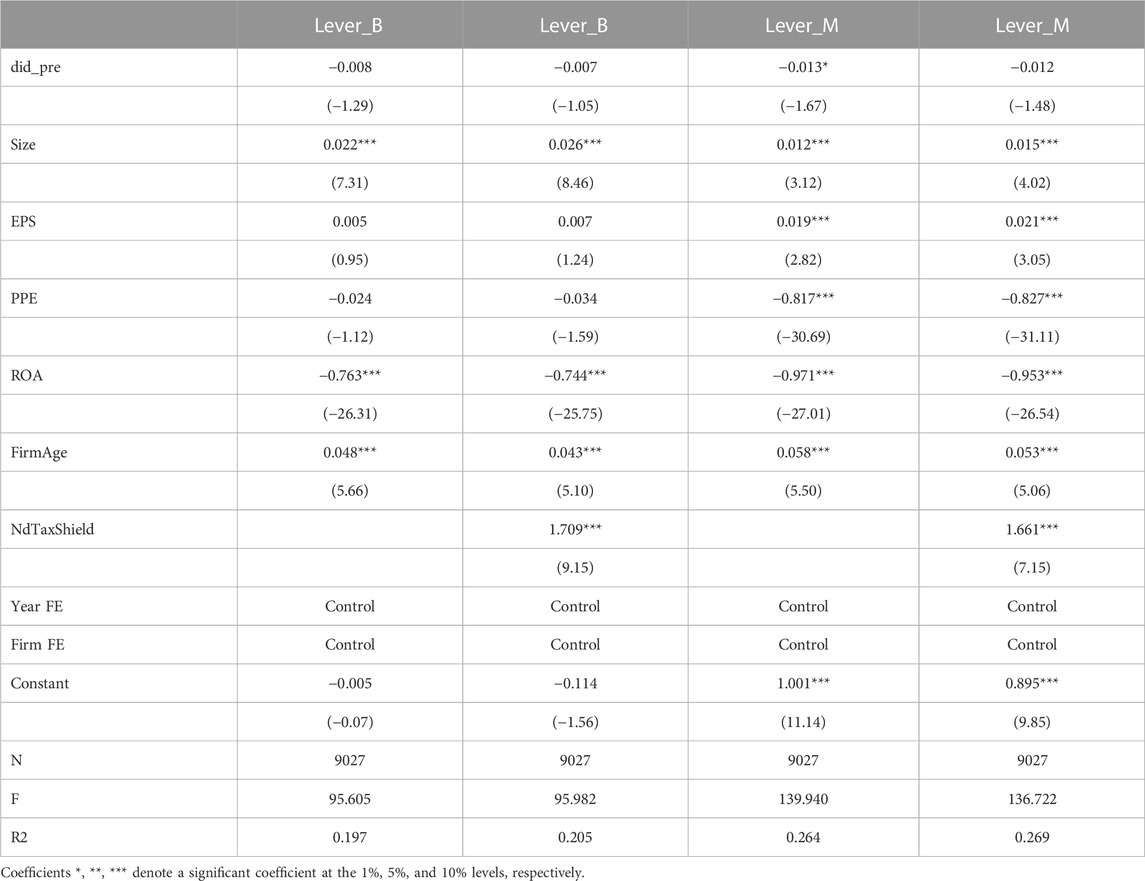

For the placebo test of the time dimension, we set the pilot time of the firms in the sample for the responding cities to 1 year before the true start time to observe whether the change has a significant effect on the regression results. Table 4 displays the regression outcomes after advancing the policy start date by 1 year. From the results in the first two columns of Table 4, the coefficient of the cross term after time adjustment (did_pre) on the dependent variable Lever_B is negative, but none of the results are significant. While the latter two columns reflect regressions where the dependent variable is Lever_M, it can be seen that the significance of did_pre before and after the inclusion of the control variable non-debt tax shield is significant, while it is insignificant at the 10% statistical level. It can be concluded that changing the start time of the carbon trading policy has a considerable effect on the regression results, indicating that the results of the basic regression were primarily influenced by the carbon trading pilot policy.

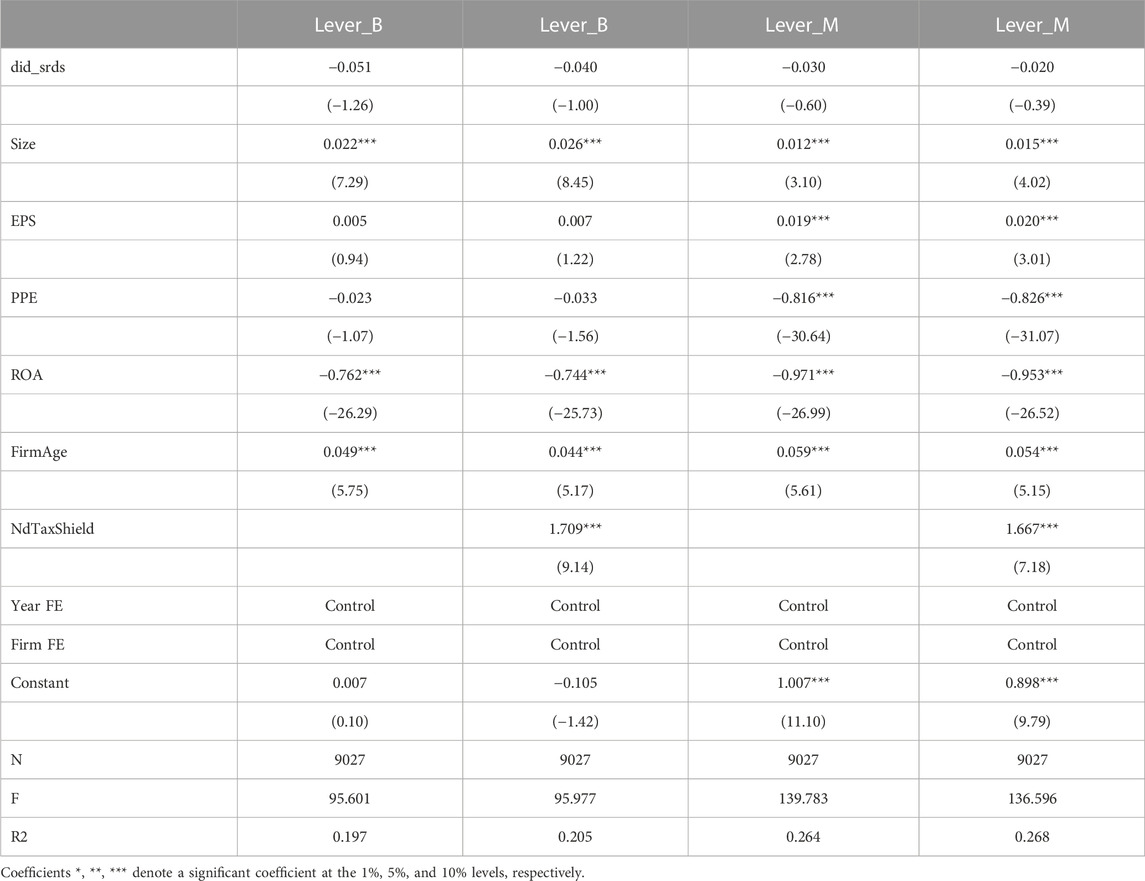

For the placebo test of the city dimension, we replace the cities in the sample that were formerly real pilot carbon trading policies with their nearby provinces of Hebei, Henan, Hunan, Guangxi, Fujian, Sichuan and Zhejiang, as a way to see if these changes have a significant effect on the regression results. The regression results for the pilot city change are shown in Table 5. The results in the first two columns of Table 5 show that the coefficient on Lever_B is negative for the cross term after city adjustment (did_srds), but none of the results are significant. The last two columns reflect the regression of the dependent variable as Lever_M, and the results are still insignificant. These results show that changing the pilot cities for the carbon trading policy also has a significant effect on the regression results, reinforcing the fact that the results of the basic regression are mainly influenced by the carbon trading pilot policy and demonstrating the high overall reliability of this placebo test.

4.3 Robustness test

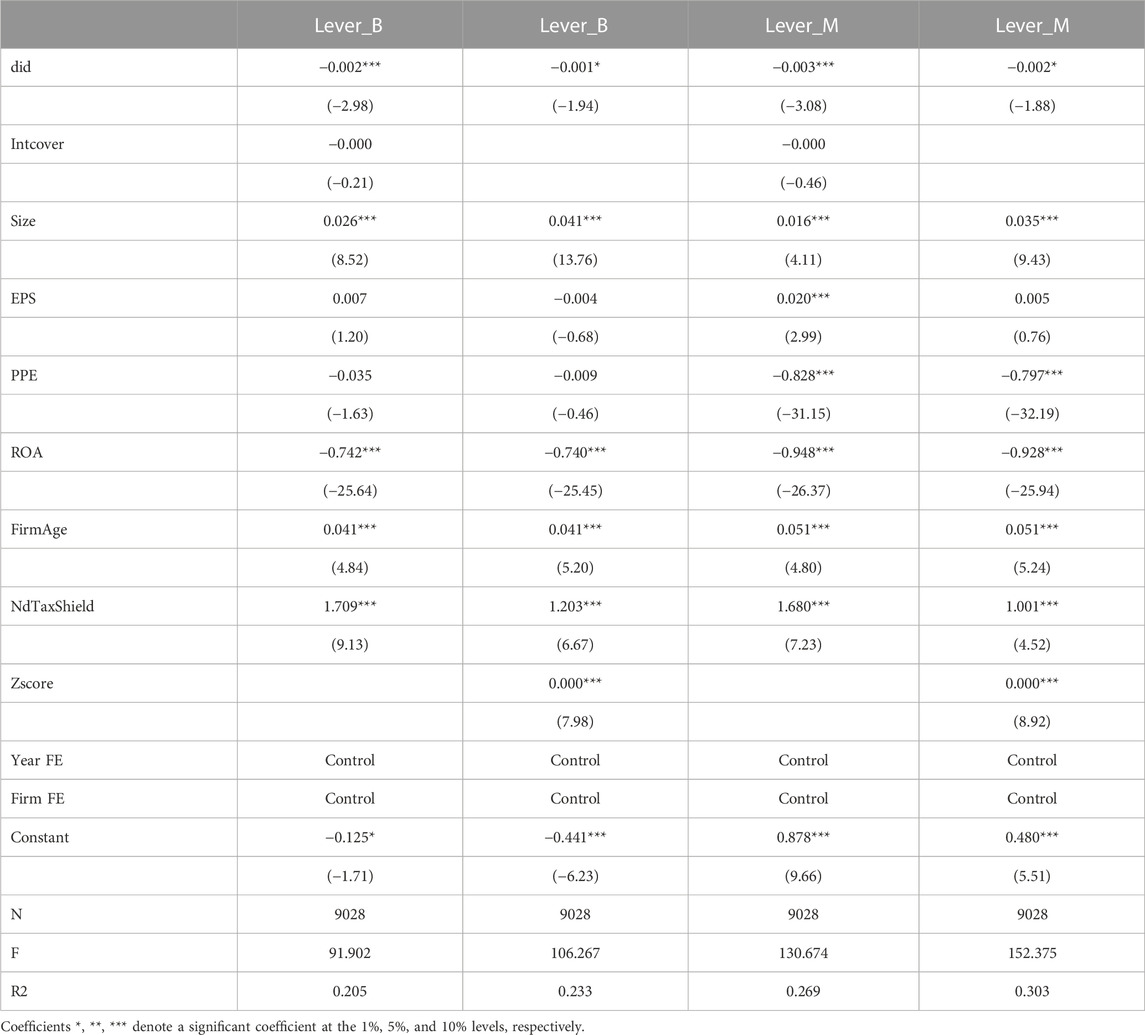

The preceding conclusions on the impact of carbon trading policy on corporate capital structure may be influenced by factors such as metric accuracy. Considering that carbon emissions are a possible source of financial risk for a firm, it is possible that the control of financial risk variables may affect the robustness of the study results. To consider this robustness issue, we employ the interest coverage ratio (Intcover) and the corporate financial distress index (Zscore) to show a firm’s financial risk, which are included in separate regression models for robustness testing. We use the ratio of EBITDA to interest expense to measure the interest coverage ratio, and the financial distress index Zscore is calculated according to the method proposed by Altman.

Table 6 shows the outcomes of the regressions with the inclusion of two separate variables reflecting the financial risk indicators of the firm. From the results in the first two columns of Table 6, the relationship between carbon trading policy implementation and Lever_B remains both negative and significant at the 1% and 10% statistical levels, respectively, after the interest coverage ratio and Zscore are placed as control variables in the regression model. We then replace the firm’s capital structure variable with Lever_M, and the results in the last two columns of Table 6 still show a negative relationship between carbon trading policy implementation and Lever_M, which is also statistically significant at the 1% and 10% levels, respectively. This suggests that the effect of carbon trading market policy is not absorbed by the firm’s typical financial risk indicators—Interest coverage ratio and Zscore. Therefore, the basic results of this study can be considered robust.

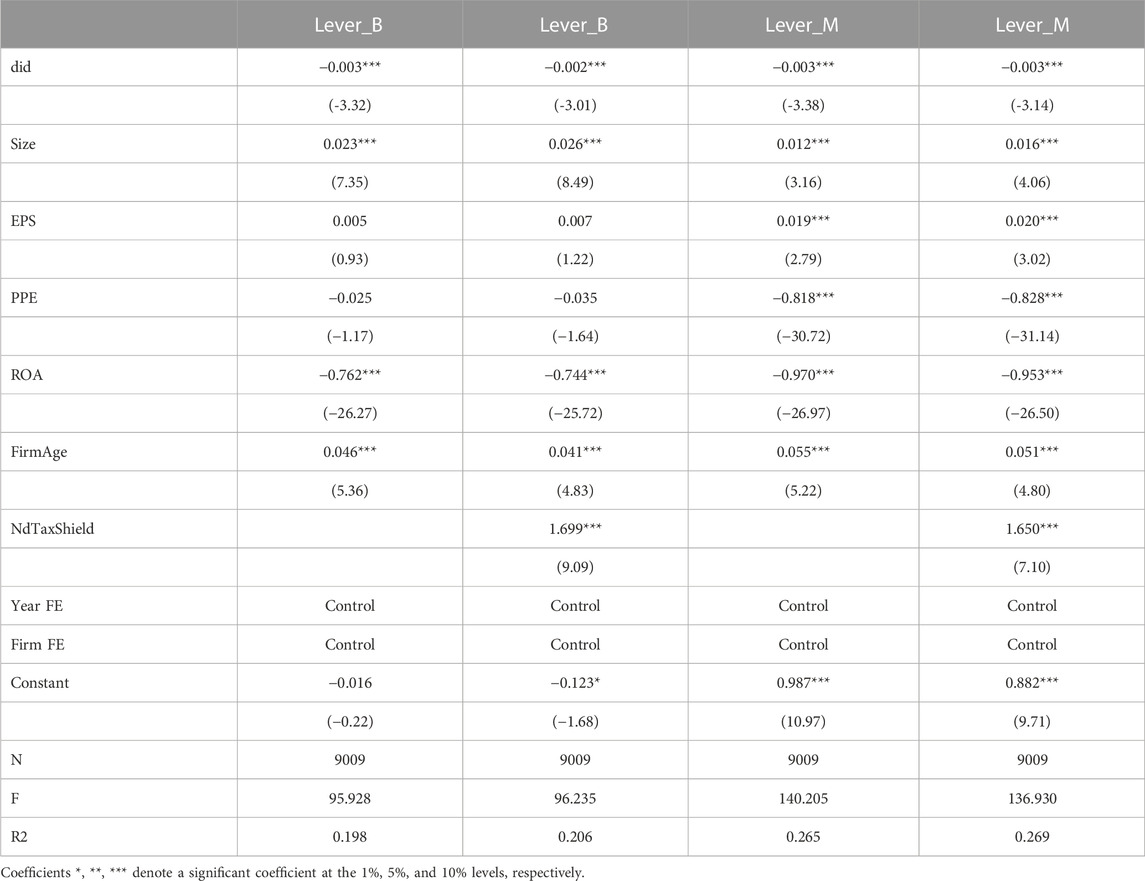

In addition, a second robustness test is conducted using a basic regression model that excludes data from a select few firms for all the years in the sample. Considering that these firms, which are not located in the pilot cities of the carbon trading policy, are simultaneously involved in other carbon trading activities, their inclusion may have an impact on the accuracy and rigour of the results.

Table 7 displays the regression results after excluding the data for the firms mentioned above. The results in the first two columns of Table 7 show that there is a negative relationship between carbon trading policy implementation and Lever_B, both of which are statistically significant at the 1% level. Next, we replace the firm’s capital structure variable with Lever_M, and the results in the last two columns of Table 7 still show a negative relationship between carbon trading policy implementation and Lever_M, both of which are also significant at the 1% statistical level. This suggests that the regression results in model (1) are not influenced by those firms participating in carbon trading but not located in the pilot areas. Therefore, the basic results of this study are robust.

5 Mechanism testing

In order to further investigate the mechanism of carbon trading policy on corporate capital structure, based on the research hypotheses presented in the theoretical analysis, mechanism testing was conducted on both the supply of funds and the demand for funds. First, we empirically investigated whether carbon trading affects the demand for the equity issuance of the firm, thus exhibiting an effect on corporate capital structure. Secondly, we empirically examine whether carbon trading affects the cost of debt funding and hence the firm’s funding supply, which would also represent an influence on corporate capital structure.

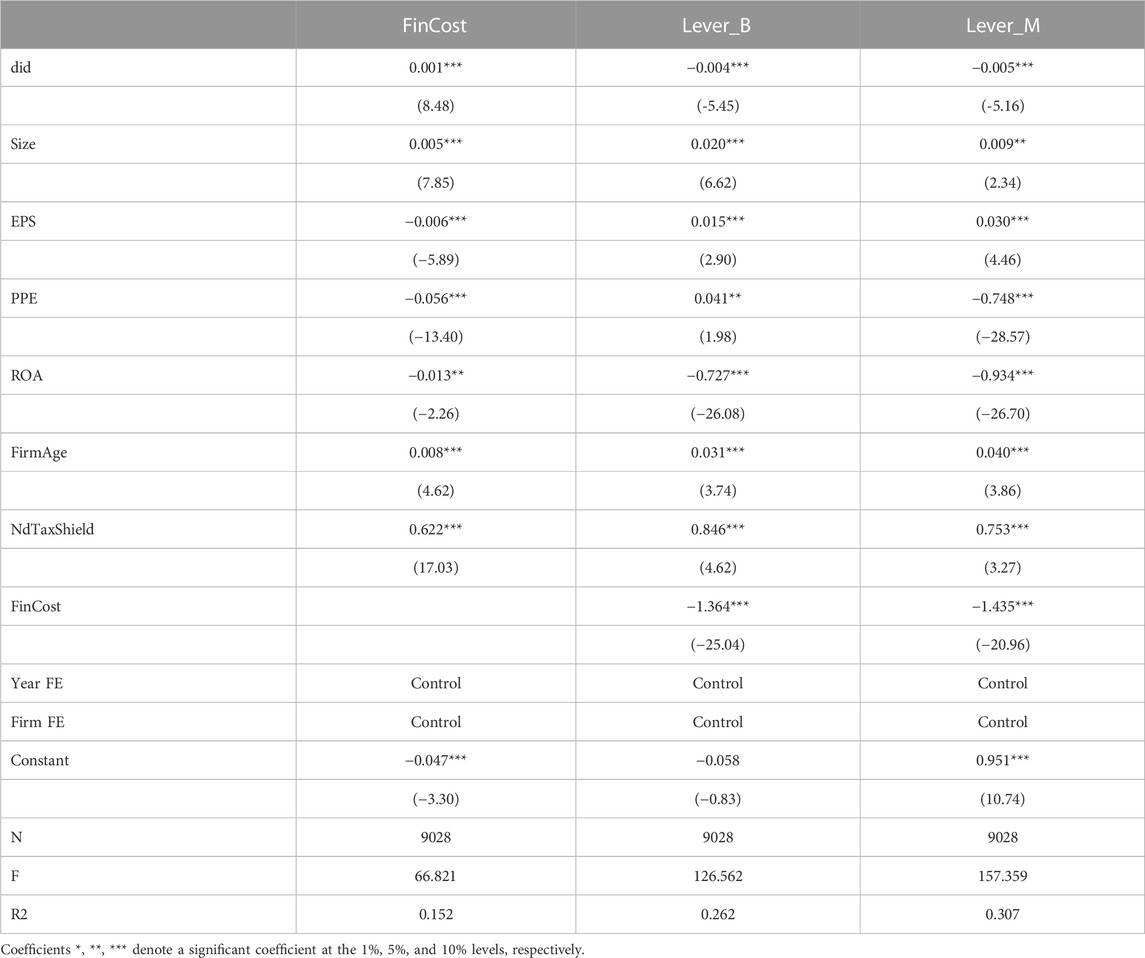

Table 8 shows the results of tests on the cost of the debt capital (debt funding) mechanism for corporate capital structure as influenced by carbon trading. The first column of the results shows a positive relationship between the cross term and FinCost, with the coefficient significant at the 1% statistical level. The second and third columns place FinCost as a mediating variable in the basic model with the dependent variables of Lever_B and Lever_M, respectively. The results show that the relationship between FinCost and both Lever_B and Lever_M are all negative as well as statistically significant at the 1% level. This indicates that an increase in the cost of corporate debt financing will significantly reduce a firm’s debt ratio.

Carbon trading can have an impact on corporate finance. In terms of carbon allowances, which reflects the direct impact of the policy on capital demand, entities need to purchase carbon credits to offset their uncovered emissions. If allowances grow less generous and the market for carbon allowances becomes more dynamic, enterprises that fail to remain on the allowance list may face significant expenditures. In addition, the implementation of the carbon trading policy forces firms in energy-intensive sectors to face higher costs for regulatory compliance, which may lead to an increase in the external financing for the firms. Certain firms may also be forced to increase investment in scientific research and readjust their business structure to meet the emission requirements of the policy, which will have an augmentative effect on capital demand as well. This mechanism shows that the implementation of the carbon trading market policy will significantly increase the debt financing cost of firms, that is, it will have a significant positive effect on the capital supply of firms. Therefore, the conclusion of Hypothesis 3 has been fully verified.

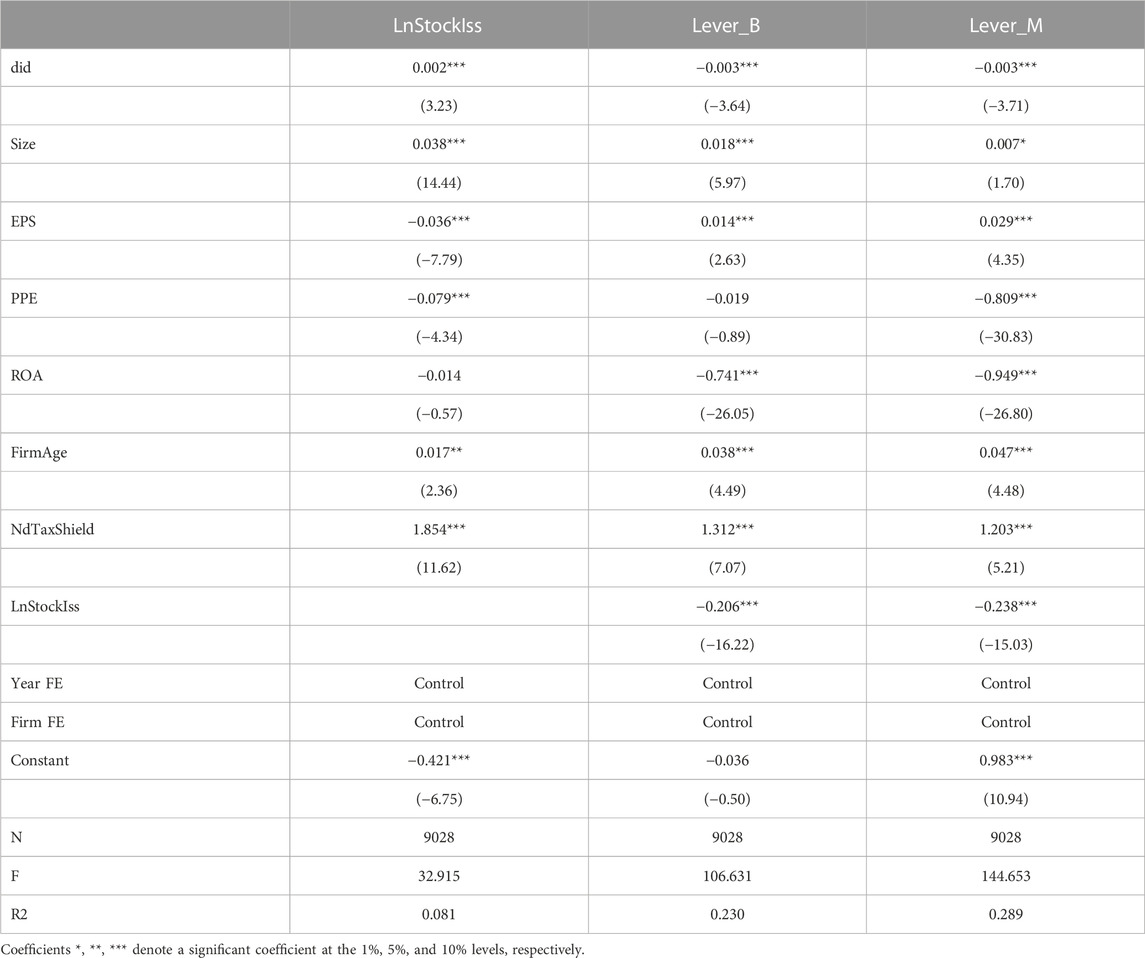

Table 9 reports the results of a test of the demand mechanism for corporate equity issuance for carbon trading which affects corporate capital structure. From column 1, the relationship between the cross term and LnStockIss is positive, with the coefficient significant at the 1% statistical level. From columns 2-3, the relationship between LnStockIss and Lever_B and Lever_M are both negative, with their coefficients significant at the 1% statistical level. This implies that a rise in equity issuance will reduce Lever_B, which is consistent with the complementary nature of equity and debt and validates the reasonableness for the selection of this indicator.

Carbon trading can have an impact on equity issuance in terms of carbon intensity and carbon risk. ET Index Research explores the link between stock returns and carbon intensity, finding that portfolios of low carbon intensity equities beat portfolios of high carbon intensity stocks by a large margin. Enterprises with low carbon intensity are also observed to earn greater profits than firms with high carbon intensity. Because carbon trading market policy encourages firms to invest in new technologies and equipment to create innovative products with lower carbon intensity, the implementation of carbon trading will encourage the issuance of additional shares and allotments of corporate shares, increasing the level of equity issuance. With investors’ willingness to invest diminishing across the board, the need for external financing for companies will continue to rise. At the same time, companies are also adjusting their capital structure by means of equity financing, thus reducing the impact that carbon trading policies have on these companies. Change in the capital structure results from a change in equity issuance, which raises the number of circulating shares and lowers the percentage of non-tradable shares. It can therefore be seen that the carbon market policy has a significant positive effect on corporate capital requirements. Thus, the findings of Hypothesis two are fully validated.

6 Heterogeneity testing

The effect of carbon trading policy on corporate capital structure could vary across differing enterprise factor endowments. Some scholars have conducted heterogeneity tests of firm nature and financing under this policy. The carbon emission reduction impact of the policy is more pronounced for non-state-owned enterprises, small-scale enterprises and pilot areas that have adopted a post-employment allowance allocation system (Shen et al., 2020). Li et al. (2009) found that state ownership is positively correlated with leverage and access to long-term debt by firms. Besides that, Xu et al. (2022b) found that government subsidies have a catalytic effect on innovation performance and are more pronounced in carbon trading pilot regions. Wang. (2016) concluded that government subsidies may, to a certain extent, help firms with financing needs and encourage the growth of firms in the new energy sector. A firm’s nature and its level of government subsidies may affect the carbon trading policy’s impact on corporate capital structure. Based on the hypotheses of heterogeneity, we tested whether or not the basic research conclusions differ across varying firm characteristics and policy influences. Heterogeneity is examined in terms of firm nature (physical risk) and financing (level of government subsidies), which serve as heterogeneity categorical variables in a sub-sample.

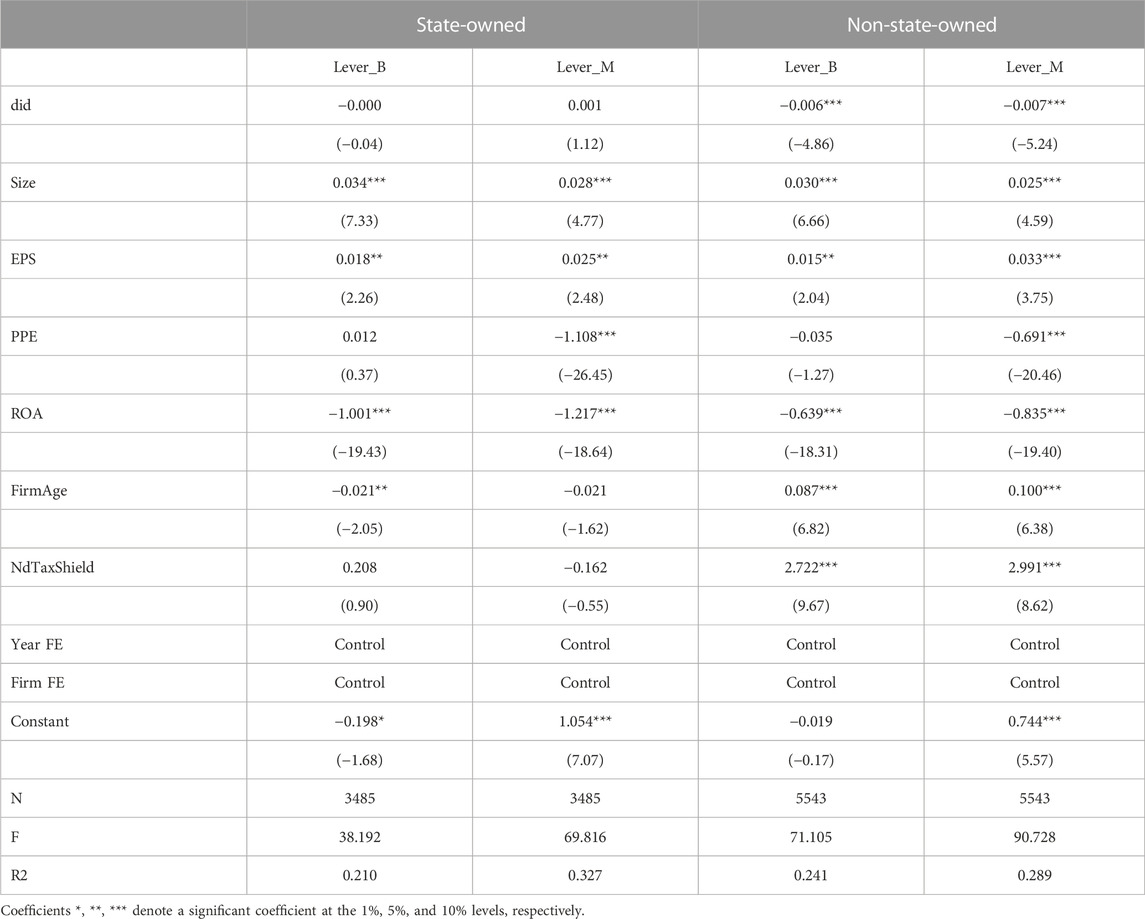

First, we empirically tested the differences between the implementation of carbon trading and corporate capital structure in different firms with physical risks. Here, the nature of the firm is chosen as the indicator for dividing the total sample of firms into two sub-samples, state-owned and non-state-owned, based on distinct property rights. State-owned enterprises (SOEs) are an important part of China’s socialist market economy development, and as in many cases they are able to receive additional financial support, policy concessions and political patronage from the state, they are more comfortable in dealing with potential physical and transition risks. This means that SOEs are under less pressure to implement carbon trading policies than non-state-owned firms. Therefore, there may be significant heterogeneity in the nature of firms in terms of the impact of carbon trading on their capital structure.

Table 10 shows the impact of carbon trading on corporate capital structure across differences in firm nature. From the results, the coefficients of the cross term on Lever_B and Lever_M are insignificant for state-owned firms, while the coefficients for non-state-owned firms are both noticeably negative and significant at the 1% statistical level. This suggests that the nature of the firm has an influence on the impact of the implementation of the carbon trading policy on corporate capital structure, and also suggests that the corporate capital structure of state-owned firms can effectively withstand the impact of the implementation of the carbon trading policy. This may be a sign of both the competitive advantage that SOEs gain in capital-intensive renewable energy investments through preferential treatment (e.g., lower cost of capital) and the use of SOEs by governments as a tool to implement low-carbon transition targets.

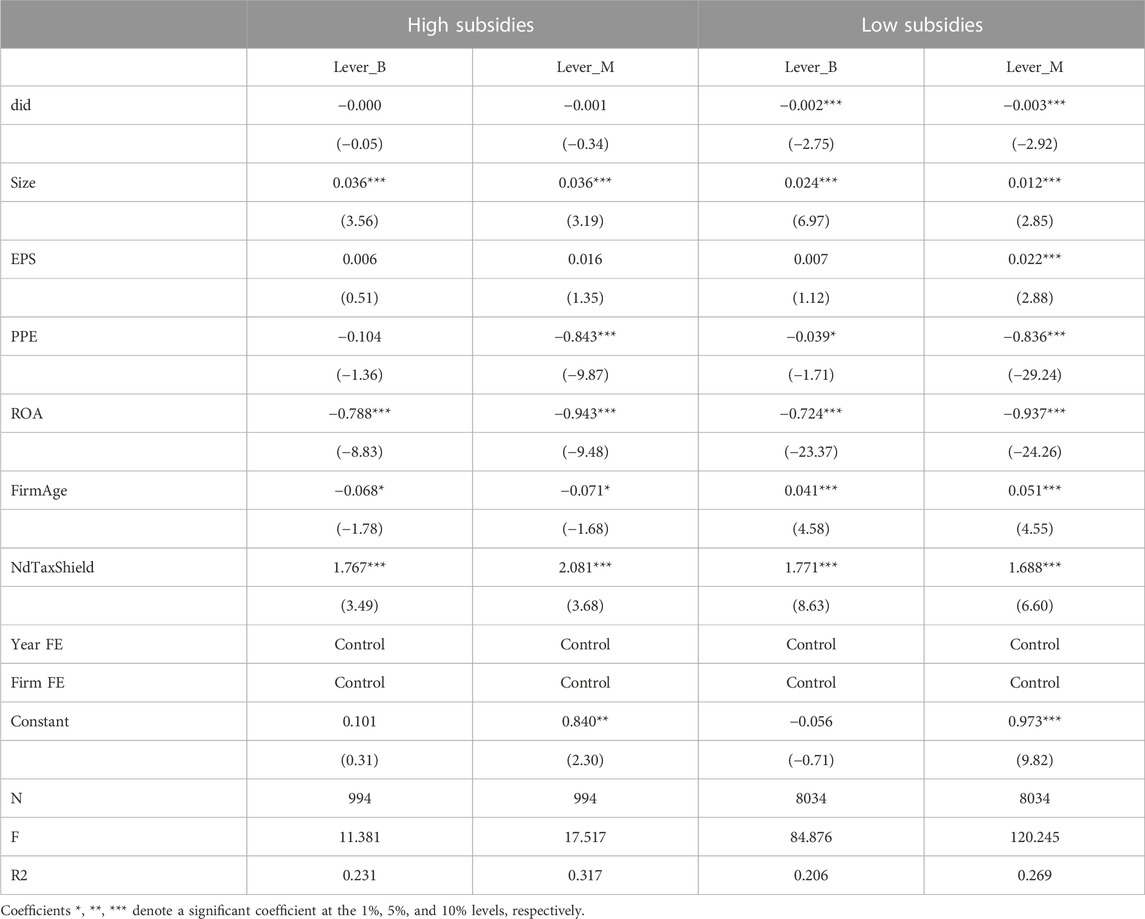

The levels of government subsidies differ across the various regions of China. For different economic development zones and industrial zones, different pilot cities have issued policy circulars for different subsidy funds. For example, the difference between the designation of a national-level green factory and a municipal-level green factory may double the total amount of government subsidy received. Therefore, differences in specific levels of government subsidy could lead to heterogeneity in the effects of the carbon trading policy. Under this background, we examine the differences between the implementation of carbon trading and capital structure among firms with different financing constraints. We have selected the total level of government subsidies as the primary indicator for dividing the total sample of firms, and use the average value of government subsidies received as a proportion of total assets as the dividing point for the sample. The total sample is divided into two sub-samples: firms with a high level of government subsidies, and firms with a low level of government subsidies.

Table 11 shows the impact of carbon trading on corporate capital structure for different levels of government subsidies. From the results, the coefficients of the cross term on Lever_B and Lever_M are not significantly negative for firms with above-average levels of government subsidies, while the coefficients are significantly negative for firms with below-average levels of subsidies, and the coefficients are statistically significant at the 1% level.

The Chinese government is now providing monetary and financial policy assistance for renewable power companies in order to increase investment and financial capabilities in the industry. Higher government subsidies will directly reduce the financial cost burden of firms and serve as a major source of corporate R&D funding. Government subsidies can reduce the negative impact of carbon trading on capital structure to a greater extent by addressing the market inefficiencies present in the process of innovation and reducing the risks and expenses associated with research and innovation.

7 Conclusions and discussions

Given that China is one of the largest carbon emitters in the world, examining the impact of the carbon trading market on corporate capital structure decision-making is an important issue to consider for making adaptive changes in micro-firm financial behaviour in the context of China’s push for a dual carbon transition. While much of the previous literature has addressed the mechanism of the effect of carbon emissions on capital structure, little has been written on the mechanism of the effect of environmental regulation on capital structure. To this end, this study complements and refines the theory of capital structure in terms of environmental regulation and physical risk, and examines the impact of corporate carbon trading market policies on firms’ capital choices using a Difference-in-Difference (DID) model with a research sample of Chinese companies listed in the energy sector. The implementation of the carbon trading market policy is found to dramatically lower the corporate debt ratio, and this finding remains true even after using the instrumental variables technique to address endogeneity and after running robustness tests. It is also found that the negative effect of the implementation of carbon trading market policy on the corporate debt ratio is mainly due to the combined effect of internal capital demand and external capital supply. Furthermore, the reduction of the corporate debt ratio by the implementation of carbon trading market policy is more significant in firms which exhibit higher transition and physical risk. The findings of this study suggest that under the carbon trading market policy, firms’ capital structure decision-making behaviour will change to cope with the higher corporate risk shocks caused by the policy. Overall, this research explores the impact of the carbon trading market as a typical policy for limiting carbon emissions worldwide on the financial decision-making of companies, while also detailing the mechanism behind carbon trading policy as a form of environmental regulation in terms of both capital demand and supply, which is relevant to the fields of climate and green finance.

Based on the above results, the findings of this study have certain significant implications. First, the implementation of a firm’s carbon trading market policy will be taken into account not only by financial institutions, but also by investors in the market as a risk factor, thus affecting the supply of external capital and resulting in the need for firms to consider the impact of carbon trading policy implementation on the cost of capital sources in their financing. Therefore, in order to encourage firms to consciously practice behaviours in line with the dual carbon goals, financial regulators need to develop friendlier green financial development policies to alleviate the shortage of external funding that may exist during the green development of firms.

Second, firms’ overall risk is elevated under the carbon trading market policy, and firms need to adjust their financial decisions appropriately to cope with the shocks brought by subsequent risks. This study shows that firms will take the initiative to increase equity issuance to change their capital structure and enhance their ability to absorb the impact brought by carbon trading policy. Therefore, regulators should also seek to vigorously develop equity capital markets, innovate equity instruments and facilitate equity issuance by firms to promote more robust operations under the carbon trading market policy.

Finally, the different financial capabilities of firms reflected by their corporate nature will lead to differences in corporate financial decision-making behaviour under carbon trading market policies. Differences in government subsidies will also affect the heterogeneous performance of firms under different ownership structures. In addition, differences in climate regulation and physical risks faced by distinct firms also plays a key role in financial decision-making. Therefore, in the process of promoting the implementation of the dual carbon targets, the government can differentiate between financial subsidies and green financial policies to encourage the comprehensive green growth of micro-enterprises in response to the differences in financial capabilities of different enterprises.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZZ: Investigation, methodology, conceptualisation, writing original draft, reviewing and editing. JL: Investigation, writing original draft, reviewing and editing. HL: Writing original draft, reviewing and editing. JP: Writing original draft, reviewing and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agrawal, A., and Matsa, D. (2013). Labor unemployment risk and corporate financing decisions. J. Financial Econ. 108, 449–470. doi:10.1016/j.jfineco.2012.11.006

Alabdullah, T. T. Y., Laadjal, A., Ries, E., and Al-Asadi, Y. A. A. (2018). Board features and capital structure in emerging markets. J. Adv. Manag. Sci. 6 (2), 80. doi:10.18178/joams.6.2.74-80

Beattie, V., Goodacre, A., and Thomson, S. J. (2006). Corporate financing decisions: UK survey evidence. J. Bus. Finance Account. 33 (9&10), 1402–1434. doi:10.1111/j.1468-5957.2006.00640.x

Beck, T., Demirgüç-Kunt, A., and Maksimovic, V. (2004a). Financial and legal institutions and firm size. Mimeo: World Bank.

Booth, L., Aivazian, V., Demirguc-Kunt, A., and Maksimovic, V. (2001). Capital structure in developing countries. J. Finance 39, 857–858. doi:10.1111/0022-1082.00320

Borghesi, S., Cainelli, G., and Mazzanti, M. (2015). Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 44 (3), 669–683. doi:10.1016/j.respol.2014.10.014

Bradley, M., Jarrell, G. A., and Kim, E. H. (1984). On the existence of an optimal capital structure: Theory and evidence. J. Finance 39 (3), 857–878.

Bui, B., Moses, O., and Houqe, M. N. (2020). Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Acc. Finance 60 (1), 47–71. doi:10.1111/acfi.12492

Chava, S. (2014). Environmental externalities and cost of capital. Manag. Sci. 60, 2223–2247. doi:10.1287/mnsc.2013.1863

Chen, B. (2020). Optimal capital structure of government-subsidized private participation in infrastructure projects. Eng. Econ. 65 (4), 321–338. doi:10.1080/0013791X.2019.1707923

Chen, Y., and Li, M. (2020). The measurement and influencing factors of agricultural carbon emissions in China’s western taiwan straits economic zone. Nat. Environ. Pollut. Technol. 19 (2), 587–601. doi:10.46488/NEPT.2020.v19i02.014

Dang, H. N., Vu, V. T. T., Ngo, X. T., and Hoang, H. T. V. (2019). Study the impact of growth, firm size, capital structure, and profitability on enterprise value: Evidence of enterprises in Vietnam. J. Corp. Account. Finance 30 (1), 144–160. doi:10.1002/jcaf.22371

Dowell, G., Hart, S., and Yeung, B. (2000). Do corporate global environmental standards create or destroy market value? Manag. Sci. 46, 1059–1074. doi:10.1287/mnsc.46.8.1059.12030

Du, G., Yu, M., Sun, C., and Han, Z. (2021). Green innovation effect of emission trading policy on pilot areas and neighboring areas: An analysis based on the spatial econometric model. Energy Policy 156, 112431. doi:10.1016/j.enpol.2021.112431

Ehlers, T., Packer, F., and de Greiff, K. (2021). The pricing of carbon risk in syndicated loans: Which risks are priced and why? J. Bank. Finance 136, 106180. doi:10.1016/j.jbankfin.2021.106180

Fan, H., Tao, S., and Hashmi, S. H. (2021). Does the construction of a water ecological civilization city improve green total factor productivity? Evidence from a quasi-natural experiment in China. Int. J. Environ. Res. Public Health 18 (22), 11829. doi:10.3390/ijerph182211829

Fan, J. P. H., Titman, S., and Twite, G. (2003). An international comparison of capital structure and debt maturity choi ces. Unpublished Working Paper 2003.

Feng, Y., Hassan, A., and Elamer, A. A. (2020). Corporate governance, ownership structure and capital structure: Evidence from Chinese real estate listed companies. Int. J. Account. Inf. Manag. 28, 759–783. doi:10.1108/IJAIM-04-2020-0042

García, C. J., and Herrero, B. (2021). Female directors, capital structure, and financial distress. J. Bus. Res. 136, 592–601. doi:10.1016/j.jbusres.2021.07.061

Gaud, P., Hoesli, M., and Bender, A. (2004). Further evidence on debt-equity choice. International Center for Financial Asset Management and Engineering.

Givoly, D., and Hayn, C. (1992). The valuation of the deferred tax liability: Evidence from the stock market.Accounting Review. Avaliable At: https://www.jstor.org/stable/247732.

Graham, J. R., and Rogers, D. A. (2002). Do firms hedge in response to tax incentives? J. Finance 57 (2), 815–839. doi:10.1111/1540-6261.00443

Guo, Q., Su, Z., and Chiao, C. (2022). Carbon emissions trading policy, carbon finance, and carbon emissions reduction: Evidence from a quasi-natural experiment in China. Econ. Change Restruct. 55 (3), 1445–1480. doi:10.1007/s10644-021-09353-5

Harris, M., and Raviv, A. (1991). The theory of capital structure. J. Finance 46 (1), 297–355. doi:10.1111/j.1540-6261.1991.tb03753.x

Hoberg, G., and Phillips, G. (2016). Text-based network industries and endogenous product differentiation. J. Political Econ. 124, 1423–1465. doi:10.1086/688176

Huang, Z., and Du, X. (2020). Toward green development? Impact of the carbon emissions trading system on local governments' land supply in energy-intensive industries in China. Sci. Total Environ. 738, 139769. doi:10.1016/j.scitotenv.2020.139769

Ilhan, E., Sautner, Z., and Vilkov, G. (2020). Carbon tail risk (june 12, 2020). Rev. Financial Stud. 34, 777–799. doi:10.1093/rfs/hhaa071

Jensen, M. (1986). Agency cost of free cash flow, corporate finance, and takeovers: Corporate finance, and takeovers. Am. Econ. Rev. 76 (2), 323–329. Avalibale At: https://www.jstor.org/stable/1818789.

Ji, Y., Dong, J., Jiang, H., Wang, G., and Fei, X. (2022). Research on carbon emission measurement of Shanghai expressway under the vision of peaking carbon emissions. Transp. Lett. 2022, 1–15. doi:10.1080/19427867.2022.2091669

Jung, J., Herbohn, K., and Clarkson, P. (2018). Carbon risk, carbon risk awareness and the cost of debt financing. J. Bus. Ethics 150 (4), 1151–1171. doi:10.1007/s10551-016-3207-6

Klasa, S., Ortiz-Molina, H., Serfling, M., and Srinivasan, S. (2018). Protection of trade secrets and capital structure decisions. J. Financial Econ. 128, 266–286. doi:10.1016/j.jfineco.2018.02.008

Kleimeier, S., and Viehs, P. M. (2016). “Carbon disclosure, emission levels, and the cost of debt,” in GSBE Research Memoranda. Maastricht university, graduate school of business and economics, 3.

Konar, S., and Cohen, M. A. (2001). Does the market value environmental performance? Rev. Econ. Stat. 83, 281–289. doi:10.1162/00346530151143815

Kumar, P., and Firoz, M. (2018). Impact of carbon emissions on cost of debt-evidence from India. Manag. Financ. 44 (12), 1401–1417. doi:10.1108/MF-03-2018-0108

La Porta, R., Lopez-de-Silanes, F., Shleifer, A., and Vishny, R. (1998). Law and finance. J. Political Econ. 106, 1113–1155. doi:10.1086/250042

Larkin, Yelena (2013). Brand perception, cash flow stability, and financial policy. J. Financial Econ. 110, 232–253. doi:10.1016/j.jfineco.2013.05.002

Lee, C. F., Lin, S. J., and Lewis, C. (2008). Analysis of the impacts of combining carbon taxation and emission trading on different industry sectors. Energy Policy 36 (2), 722–729. doi:10.1016/j.enpol.2007.10.025

Li, K., Yue, H., and Zhao, L. (2009). Ownership, institutions, and capital structure: Evidence from China. J. Comp. Econ. 37 (3), 471–490. doi:10.1016/j.jce.2009.07.001

Li, R., and Sun, T. (2021). Research on measurement of regional differences and decomposition of influencing factors of carbon emissions of China's logistics industry. Pol. J. Environ. Stud. 30 (4), 3137–3150. doi:10.15244/pjoes/130334

Li, Y., and Zhang, Z. (2023). Corporate climate risk exposure and capital structure: Evidence from Chinese listed companies. Finance Res. Lett. 51, 103488. doi:10.1016/j.frl.2022.103488

Lin, B., and Huang, C. (2022). Analysis of emission reduction effects of carbon trading: Market mechanism or government intervention? Sustain. Prod. Consum. 33, 28–37. doi:10.1016/j.spc.2022.06.016

Lin, B., and Wu, N. (2022). Will the China's carbon emissions market increase the risk-taking of its enterprises? Int. Rev. Econ. Finance 77, 413–434. doi:10.1016/j.iref.2021.10.005

Liu, M., Shan, Y., and Li, Y. (2022). Study on the effect of carbon trading regulation on green innovation and heterogeneity analysis from China. Energy Policy 171, 113290. doi:10.1016/j.enpol.2022.113290

Lund, P. (2007). Impacts of EU carbon emission trade directive on energy-intensive industries—indicative micro-economic analyses. Ecol. Econ. 63 (4), 799–806. doi:10.1016/j.ecolecon.2007.02.002

Ma, Y., Wang, L., and Zhang, T. (2020). Research on the dynamic linkage among the carbon emission trading, energy and capital markets. J. Clean. Prod. 272, 122717. doi:10.1016/j.jclepro.2020.122717

Maaloul, A. (2018). The effect of greenhouse gas emissions on cost of debt: Evidence from Canadian firms. Corp. Soc. Respon Environ. Manag. 25 (6), 1407–1415. doi:10.1002/csr.1662

Martin, R., Muûls, M., and Wagner, U. J. (2016). The impact of the European union emissions trading scheme on regulated firms: What is the evidence after ten years? Rev. Environ. Econ. policy 10, 129–148. doi:10.1093/reep/rev016

Matsumura, E. M., Prakash, R., and Vera-Muñoz, S. C. (2013). Firm-value effects of carbon emissions and carbon disclosures. Acc. Rev. 89, 695–724. doi:10.2308/accr-50629

Modigliani, F., and Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. Am. Econ. Rev. 48 (3), 261–297. Avalibale At: https://www.jstor.org/stable/1809766.

Montagnoli, A., and De Vries, F. P. (2010). Carbon trading thickness and market efficiency. Energy Econ. 32 (6), 1331–1336. doi:10.1016/j.eneco.2010.04.001

Ngatno, E., Apriatni, E. P., and Youlianto, A. (2021). Moderating effects of corporate governance mechanism on the relation between capital structure and firm performance. Cogent Bus. Manag. 8 (1), 1866822. doi:10.1080/23311975.2020.1866822

Nguyen, J. H., and Phan, H. V. (2020). Carbon risk and corporate capital structure. J. Corp. Finance 64, 101713. doi:10.1016/j.jcorpfin.2020.101713

Nguyen, V. (2020). Human capital, capital structure choice and firm profitability in developing countries: An empirical study in Vietnam. Accounting 6 (2), 127–136. doi:10.5267/j.ac.2019.11.003

Oestreich, A. M., and Tsiakas, I. (2015). Carbon emissions and stock returns: Evidence from the EU emissions trading scheme. J. Bank. Financ. 58, 294–308. doi:10.1016/j.jbankfin.2015.05.005

Ozkan, A. (2001). Determinants of capital structure and adjustment to long run target: Evidence from UK company panel data. J. Bus. Finance Account. 28 (2), 175–199. doi:10.1111/1468-5957.00370

Pan, X., Pu, C., Yuan, S., and Xu, H. (2022). Effect of Chinese pilots carbon emission trading scheme on enterprises' total factor productivity: The moderating role of government participation and carbon trading market efficiency. J. Environ. Manag. 316, 115228. doi:10.1016/j.jenvman.2022.115228

Perdan, S., and Azapagic, A. (2011). Carbon trading: Current schemes and future developments. Energy policy 39 (10), 6040–6054. doi:10.1016/j.enpol.2011.07.003

Qi, S. Z., Zhou, C. B., Li, K., and Tang, S. Y. (2021a). Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim. Policy 21 (3), 318–336. doi:10.1080/14693062.2020.1864268

Qi, S. Z., Zhou, C. B., Li, K., and Tang, S. Y. (2021b). The impact of a carbon trading pilot policy on the low-carbon international competitiveness of industry in China: An empirical analysis based on a DDD model. J. Clean. Prod. 281, 125361. doi:10.1016/j.jclepro.2020.125361

Rajan, R., and Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. J. Finance 50 (5), 1421–1460. doi:10.1111/j.1540-6261.1995.tb05184.x

Razzaq, A., Sharif, A., An, H., and Aloui, C. (2022). Testing the directional predictability between carbon trading and sectoral stocks in China: New insights using cross-quantilogram and rolling window causality approaches. Technol. Forecast. Soc. Change 182, 121846. doi:10.1016/j.techfore.2022.121846

Saif-Alyousfi, A. Y., Md-Rus, R., Taufil-Mohd, K. N., Taib, H. M., and Shahar, H. K. (2020). Determinants of capital structure: Evidence from Malaysian firms. Asia-Pacific J. Bus. Adm. 12, 283–326. doi:10.1108/APJBA-09-2019-0202

Serfling, M. (2016). Firing costs and capital structure decisions. J. Finance 71, 2239–2286. doi:10.1111/jofi.12403

Sharfman, M. P., and Fernando, C. S. (2008). Environmental risk management and the cost of capital. Strateg. Manag. J. 29, 569–592. doi:10.1002/smj.678

Shen, J., Tang, P., and Zeng, H. (2020). Does China's carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain. Dev. 59, 120–129. doi:10.1016/j.esd.2020.09.007

Shu, H., Tan, W., and Wei, P. (2023). Carbon policy risk and corporate capital structure decision. Int. Rev. Financial Analysis 86, 102523. doi:10.1016/j.irfa.2023.102523

Stefan, A., and Paul, L. (2008). Does it pay to be green? A systematic overview. Acad. Manag. Perspect. 22, 45–62. doi:10.5465/amp.2008.35590353

Sun, X., Fang, W., Gao, X., An, H., Liu, S., and Wu, T. (2022). Complex causalities between the carbon market and the stock markets for energy intensive industries in China. Int. Rev. Econ. Finance 78, 404–417. doi:10.1016/j.iref.2021.12.008

Tan, R., and Lin, B. (2022). The long term effects of carbon trading markets in China: Evidence from energy intensive industries. Sci. Total Environ. 806, 150311. doi:10.1016/j.scitotenv.2021.150311

Trinks, A., Ibikunle, G., Mulder, M., and Scholtens, B. (2022). Carbon intensity and the cost of equity capital. EJ 43, 3035864. doi:10.5547/01956574.43.2.atri

Wald, J. K., and Long, M. S. (2007). The effect of state laws on capital structure. J. Financ. Econ. 83, 297–319. doi:10.1016/j.jfineco.2005.10.008

Wang, H., Chen, Z., Wu, X., and Nie, X. (2019). Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—empirical analysis based on the PSM-DID method. Energy Policy 129, 930–938. doi:10.1016/j.enpol.2019.03.007

Wang, J., Wang, C., Yu, S., Li, M., and Cheng, Y. (2022b). Coupling coordination and spatiotemporal evolution between carbon emissions, industrial structure, and regional innovation of counties in Shandong province. Sustainability 14 (12), 7484. doi:10.3390/su14127484

Wang, L. (2016). “Government subsidies, capital structure and enterprise growth: An empirical study based on the new energy industry,” in 2016 International Conference on Logistics, Informatics and Service Sciences (LISS), Sydney, NSW, Australia, 24-27 July 2016 (IEEE). doi:10.1109/LISS.2016.7854343

Wang, X., Huang, J., and Liu, H. (2022a). Can China's carbon trading policy help achieve carbon neutrality?—a study of policy effects from the five-sphere integrated plan perspective. J. Environ. Manag. 305, 114357. doi:10.1016/j.jenvman.2021.114357

Wen, H., Wen, C., and Lee, C. C. (2022). Impact of digitalization and environmental regulation on total factor productivity. Inf. Econ. Policy 61, 101007. doi:10.1016/j.infoecopol.2022.101007

Xu, L., Guo, P., and Wen, H. (2022a). Increasing short-term lending for long-term investment under environmental pressure: Evidence from China’s energy-intensive firms. Environ. Sci. Pollut. Res. 30, 14693–14706. doi:10.1007/s11356-022-23190-7

Xu, X., Cui, X., Chen, X., and Zhou, Y. (2022b). Impact of government subsidies on the innovation performance of the photovoltaic industry: Based on the moderating effect of carbon trading prices. Energy Policy 170, 113216. doi:10.1016/j.enpol.2022.113216

Xu, X., and Li, J. (2020). Asymmetric impacts of the policy and development of green credit on the debt financing cost and maturity of different types of enterprises in China. J. Clean. Prod. 264, 121574. doi:10.1016/j.jclepro.2020.121574

Zhang, S., Wu, Z., Wang, Y., and Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 296, 113159. doi:10.1016/j.jenvman.2021.113159

Zhang, Y. J., and Liu, J. Y. (2019). Does carbon emissions trading affect the financial performance of high energy-consuming firms in China? Nat. Hazards 95 (1), 91–111. doi:10.1007/s11069-018-3434-5

Zhao, X. G., Jiang, G. W., Nie, D., and Chen, H. (2016). How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 59, 1229–1245. doi:10.1016/j.rser.2016.01.052

Zhou, D., Zhang, X., and Wang, X. (2020). Research on coupling degree and coupling path between China’s carbon emission efficiency and industrial structure upgrading. Environ. Sci. Pollut. Res. 27 (20), 25149–25162. doi:10.1007/s11356-020-08993-w

Zhou, F., and Wang, X. (2022). The carbon emissions trading scheme and green technology innovation in China: A new structural economics perspective. Econ. Analysis Policy 74, 365–381. doi:10.1016/j.eap.2022.03.007

Zhu, B., Zhang, M., Huang, L., Wang, P., Su, B., and Wei, Y. M. (2020). Exploring the effect of carbon trading mechanism on China's green development efficiency: A novel integrated approach. Energy Econ. 85, 104601. doi:10.1016/j.eneco.2019.104601

Keywords: Carbon trading policy, corporate capital structure, equity issuance, cost of debt, China

Citation: Zhang Z, Liao J, Li H and Pan J (2023) Impact of carbon trading policy on corporate capital structure: Empirical evidence from China. Front. Environ. Sci. 11:1141212. doi: 10.3389/fenvs.2023.1141212

Received: 10 January 2023; Accepted: 24 February 2023;

Published: 07 March 2023.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Huwei Wen, Nanchang University, ChinaShujahat Haider Hashmi, Bahria University, Pakistan

Copyright © 2023 Zhang, Liao, Li and Pan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhaolong Zhang, Wmhhbmd6emwxMDIwNDcwMDQ2N0AxNjMuY29t

†These authors have contributed equally to this work and share first authorship

Zhaolong Zhang

Zhaolong Zhang Jing Liao†

Jing Liao†