94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 11 April 2023

Sec. Environmental Economics and Management

Volume 11 - 2023 | https://doi.org/10.3389/fenvs.2023.1138111

This article is part of the Research TopicLow-Carbon Transformation for Sustainable DevelopmentView all 14 articles

Background: In China, the transportation sector is the main energy consumer and the main source of carbon emissions. Reducing carbon emissions in the transportation sector is an important goal for China, especially during the current period of economic development. Due to the impact of pandemic shocks, the rapid development of green finance is conducive to supporting the transportation sector in achieving a carbon peak. Thus, we examined whether the development of green finance is still effective under the impact of a pandemic and the actual effect of green finance on the reduction of carbon emissions.

Methods: In this study, we searched the internet for consumption structure data of vehicles and green finance indices of 30 Chinese provinces and cities from 2016 to 2021. A regression discontinuity model was constructed to test the effect of pandemic shock and green finance development on the reduction of transportation energy carbon emissions.

Results: The results show that the impact of the COVID-19 pandemic has helped people change their preference toward more energy-efficient vehicles and reduce carbon emissions in the transportation sector. Green finance can effectively contribute to the reduction of transportation energy carbon emissions; however, the overall mitigation effect is limited.

Conclusion: The empirical evidence is not only helpful in assessing the long-term impact of the COVID-19 pandemic but also conducive to the appropriate establishment of policy tools for supporting green finance development, which is further conducive to reducing carbon emissions in the transportation sector.

Global warming has contributed to the melting of Arctic ice and disease outbreaks in various countries. According to the report “Climate Change 2022: Mitigating Climate Change” released by the United Nations Intergovernmental Panel on Climate Change (IPCC), the average annual global greenhouse gas emissions in 2019 hit a record high of 59 billion tons. If the earth’s temperature rises 1.5°C above pre-industrial levels, humans, natural systems, and biodiversity will face additional serious risks. The transportation sector is the main energy consumption and CO2 emission sector in China; therefore, it is important to study the driving factors of low-carbon technological development and low-carbon fuel replacement to achieve carbon peak and carbon neutrality goals1.

A sound and reliable transportation system is important for a province. The transportation sector is not only important to support the economic development of the province but is also the main source of citizen welfare improvement. However, the carbon emissions associated with transportation systems cannot be underestimated, and a sound green and low-carbon transportation system is important for China to achieve its carbon emission reduction goals. The reduction of carbon emissions depends on the development of different modes of transportation, the energy efficiency of vehicles, and the substitution level of low-carbon fuels. Transport vehicles are the main driver of carbon emissions in the transportation sector, and improvement in the energy efficiency of transport vehicles and the substitution of low-carbon fuels will contribute significantly to the reduction of carbon emissions (Wang and He, 2018). As private automobile consumption continues to grow, automobile energy consumption will become one of the biggest contributors to China’s carbon emissions in the transportation sector and may even be a factor in the carbon peak. Therefore, the improvement of energy efficiency and increasing low-carbon fuel use are crucial factors for reducing transportation energy consumption and carbon emissions. For example, in the city of Xi‘an, the carbon emissions from private cars of Chinese citizens are the highest in the urban transportation system (Li et al., 2017), while the carbon dioxide emissions of electric cars can be 10–26 times lower than those of fuel cars, even though carbon dioxide emissions in the process of energy production are very high. With the introduction of electric cars, annual carbon emissions have also significantly reduced (Teixeira and Sodré, 2018). Evidently, the consumption substitution of new energy vehicles is important for implementing the reduction of carbon emissions in the transportation sector.

It will not be easy to convert the potential demand for new energy vehicles into actual consumption; higher perceived risks and costs and lower perceived benefits are the main obstacles to consumer acceptance of new energy vehicles (Huijts et al., 2012; Wang and Wang, 2013). In particular, the COVID-19 pandemic possibly contributed to the uncertainty of the new-energy vehicle industry. Consequently, the National Development and Reform Commission and 10 other departments jointly issued the Smart Vehicle Innovation and Development Strategy (FGY [2020] No. 202), confirming that new-energy vehicles have become the strategic direction of China’s automobile industry development. Simultaneously, the China Banking and Insurance Regulatory Commission (CBRC) issued a notice on further improving the financial services for epidemic prevention and control (CBRC Issue No. 15 [2020]), which requires financial institutions to improve the efficiency of online services and enhance their ability to serve the real economy. Furthermore, the relevant support policies for the development of the new-energy industry (hereafter, referred to as the new-energy industry support policy) occurred at the same time as the outbreak of COVID-19.

Has China achieved a reduction in carbon emissions in the transportation sector? Three years have passed since the outbreak of the pandemic, which provided us with an opportunity to study this issue. Logically, if the new-energy industry support policies dealing with the impact of the pandemic are effective, the pandemic will increase the dependence on new-energy vehicles for Chinese consumers and replace traditional-energy vehicles. Therefore, we can examine the impact of the pandemic on the automobile energy consumption structure to study the path of reducing China’s transport energy carbon emissions.

Green finance (GF) refers to economic activities that support environmental improvement, climate change response, resource conservation, and efficient utilization. Green finance includes financial services provided for project investments, financing, project operations, and risk management in the fields of environmental protection, energy conservation, clean energy, green transportation, and green buildings. Most importantly, green finance promotes environmental protection and governance and direct resources from industries with high pollution and energy consumption to sectors with advanced concepts and technologies. China attaches great importance to the development of green finance, which has not only decreased the cost of green industry services, expanded service boundaries, and improved service quality (Demir et al., 2022), but also changed green financial service consumer behavior, increased financial availability, and promoted the popularization effect, such as poverty reduction (Siddik and Kabiraj, 2020).

Green finance has also reduced carbon emissions (Jiang et al., 2020). Specifically, from the perspective of consumption, green financial development can encourage consumers to buy clean energy or low-energy technological products, resulting in a decrease in energy consumption. From the perspective of production, green financial development reduces the risk of financial innovation, helps producers increase investment expenditure on advanced production technologies, and promotes technological progress. Thus, backward production with high energy consumption and high emissions is eventually replaced by clean technology.

In addition, financial development can also promote capital flow to low-carbon enterprises, with high energy and resource allocation efficiencies, thereby reducing energy consumption (Ge et al., 2018; Su and Lian, 2018). With the strengthening of policy support, green finance shows great potential in promoting the win–win results of “economy” and “environment” (Wang et al., 2019). One key to green finance is promoting transportation fuel substitution and low-carbon technology innovations to reduce the cost of project technology identification, supervision, and financing. Reducing carbon emissions in the transportation sector relies on low-carbon energy substitution and cannot be achieved without a balanced flow of financial resources between regions and industries. Financial services for green industries must be innovative, oriented, and liquidated, which is the core value of green finance (Li and Hu, 2014).

However, many questions remain to be answered, such as whether the development of green finance contributes to the reduction of carbon emissions in transportation energy. This study examined whether the development of green finance is still effective under the impact of a pandemic, and the actual effect of green finance on the reduction of carbon emissions. As the development of the new-energy vehicle industry plays an important role in solving the carbon emission problem of China’s transportation sector, research on the aforementioned issues is conducive to objectively evaluating the effect of the pandemic and green finance on transportation energy carbon emissions. Our study also has important practical significance for formulating green financial support policies to help the transport sector actualize low-carbon transformation and achieve carbon emission reduction goals.

Our research has the following three main contributions. First, the carbon emission coefficient has been widely used in previous studies to calculate the carbon emission index of transportation energy, which cannot directly reflect the transformation of low-carbon consumption (Ma et al., 2019; Zeng et al., 2020). Therefore, this study used the Python crawler method to capture the transaction volume of automobile terminals from July 2017 to June 2022 and attempted to explore the impact of the pandemic on China’s transportation carbon emissions innovatively from the proportion of traditional-energy vehicles to provide empirical data support for quantifying the economic impact of the pandemic. Second, the recognition assumption for the double-difference (DID) method is difficult to establish (Dong et al., 2021). Therefore, the regression discontinuity RD model was used to identify the causal relationship between the COVID-19 pandemic, green financial, and transportation energy carbon emissions. All of China’s provinces suffered from the COVID-19 pandemic to different degrees, and the DID method renders it more difficult to identify the assumption, whereas the RD method of identity assumes that it is easier to obtain satisfaction. Third, it has been pointed out that the pandemic can help transform the energy structure and reduce carbon dioxide emissions in the construction and power sectors (Xian et al., 2019; Hepburn et al., 2020; Wang J. et al., 2020). However, quantitative analyses focusing on the transport sector are lacking. This study supplements the relevant research on the impact of major public health events on the low-carbon transformation of China’s economy at the micro level. Moreover, it is novel to study the driving effect of the epidemic impact on carbon emission reduction based on the transportation sector.

In terms of different levels and degrees of satisfaction with residents’ lives, consumption can be divided into subsistence, developmental, and enjoyment consumption (Li and Pan, 2019). The main feature of subsistence consumption is that residents’ consumption expenditure is mainly used for food, clothing, water, electricity, housing, etc., and the purchase of necessary grain, oil, food, and clothing to meet the basic needs for survival. From the mid-1980s to the mid-1990s, the “four major items” of Chinese residents’ consumption were upgraded to refrigerators, color television sets, washing machines, and recorders, indicating that Chinese residents’ consumption was upgraded from subsistence consumption to developmental consumption. In the late 1990s, the “four major items” of Chinese residents’ consumption were upgraded to durable consumer goods, such as air conditioners, computers, cars, and mobile phones, indicating that Chinese residents’ consumption has increased from development consumption to enjoyment consumption.

As an enjoyable consumer good, the consumption of traditional cars reflects the level of economic growth, while the environmental deterioration caused by fossil energy consumption is significant and even counteracts economic growth (Mele and Magazzino, 2020; Udemba et al., 2020; Magazzino and Mele, 2021). Currently, the types of transportation energy consumption represented by vehicles can be divided into traditional energy (such as gasoline) and new energy (such as electricity). In terms of reducing carbon emissions from transportation energy, new-energy vehicles are alternatives to fuel vehicles. New-energy vehicles refer to the use of unconventional vehicle fuel as the power source (or the use of conventional vehicle fuel combined with the use of new on-board power devices), integrated vehicle power control, advanced technology, the formation of advanced technical principles, new technology, and the structure of the vehicle.

Classical economic theories of consumer spending are abundant. The “Absolute Income Hypothesis” points out that consumer psychology and current disposable income are important factors in determining consumption (Keynes, 1936). The “Life Cycle Hypothesis” states that rational consumers will make decisions on consumption and saving throughout their lives based on their expected income, according to the principle of utility maximization. Therefore, consumer consumption depends not only on their current income but also on their life-cycle income (Modigliani and Brumberg, 1954). The “Permanent Income Hypothesis” observes that permanent income is an important factor that affects consumption. Consumers respond to lasting and stable income, but do not respond equally to all income changes (Friedman, 1957). The pandemic not only had a huge impact on the income of people working in multiple industries in the first quarter of 2020 but also greatly reduced the ability and willingness of the society to consume. The continued spread of the pandemic overseas, aggressive public health policies, and uncertainty regarding the pace of economic recovery have also had a significant impact on consumers’ future income expectations. Therefore, whether from an absolute income perspective, durable income perspective, or life-cycle perspective, the pandemic has had a dampening effect on current and future consumption.

According to “The Trend of Household Wealth Change in China Under the Pandemic—China Household Wealth Index Survey Report (Q1 2020),” the pandemic has hit low- and middle-income households harder. Specifically, according to the wage income index, the wage income of families with an annual income of more than 300,000 yuan has increased, whereas that of families with an annual income of less than 300,000 yuan has decreased. Compared with families with an annual income of 50,000–300,000 yuan, families with an annual income of 50,000 yuan or less have the largest reduction in wage income. The impact of the COVID-19 pandemic on China’s consumption is reflected in the fact that offline consumption for development and enjoyment suffered shock damage (Chen, 2020). In addition to daily necessities, the decline in medical care and communication equipment is relatively low. The expensive bulk-optional consumption, such as cars, home appliances, and furniture, declined significantly compared to the same period last year. Free-optional consumption, such as entertainment services, catering, tourism, and luxury goods, dropped significantly2.

In addition to reducing carbon emissions from transportation energy from the income path, the pandemic also exhibits a restraining effect on the consumer psychological path. To control the spread of the pandemic, China has formulated a series of proactive public health policies, such as sealing off high-risk areas, banning large-scale gatherings, and tracing close contacts. However, proactive pandemic prevention and control measures have had a great impact on the resumption of business and production. Due to the existence of the pandemic prevention and control policy, the spread of positive cases can cause logistical stagnation, restrict the movement of people, make it difficult for employees to return to work on time, and restrict the flow of raw materials and products, which can seriously affect the normal operation of the economy (Dong et al., 2021). To reduce the probability of contact with positive cases and the risk of being controlled and isolated, the demand for car consumption by households should be significantly higher in the long-term. This means that there is a significant uncertainty in China’s future transportation energy carbon emissions.

New-energy vehicles are more advanced, which cannot be achieved without chips or electronic control. Most new-energy vehicles have over-the-air (OTA) technology, which endows vehicles with continuous upgrades and evolution; this is the key to determining the degree of intelligence of vehicles. Moreover, compared with traditional-fuel vehicles, linear control is also more conducive to the realization of the Internet of Things, and new-energy vehicles are undoubtedly the best carriers of automobile intelligence (Wang K. et al., 2020). Furthermore, internet companies are also willing to take the initiative to join the wave of changes in the automotive industry. They are not only competitive but also teammates in the development of smart electric cars. This is conducive to accelerating the transformation and promoting the development of the intelligent electric vehicle industry. These developments reduce consumers’ perceived risks and costs of new-energy vehicles and increase their perceived benefits. Compared with other major markets, such as the United States and Germany, Chinese consumers have a higher awareness of automobile intelligence and a higher adoption rate of in-vehicle software and human–computer interaction functions3. Residents who buy energy vehicles mainly focus on energy savings, modeling, and functions. The current mature intelligent driving system, electrical platform, and updatable software meet these requirements, and the electrical architecture at the technical level will further improve the driving experience of new-energy vehicles. It has been observed that 54.1% of Chinese consumers’ plan to purchase a new-energy vehicle in 2022, which can significantly help reduce the level of carbon emissions from transportation energy4.

The reduction in an automobile consumption scale is temporary, and the transformation of the automobile energy consumption structure is the fundamental way to realize the reduction in carbon emissions in transportation energy. The formulation of a financial support policy for the new energy industry to cope with the impact of the pandemic will allow the society to have better online financial services to support its development of the new-energy industry. In particular, the existence of online consumption and supply chain finance makes consumers (or producers) more resistant to risks and weakens the external liquidity constraints formed by income shocks during epidemics (Li et al., 2022). If consumers can obtain loans in a timely and effective manner to smooth out their long-term consumption, their spending is not limited by the property they own and their current income (Zhao and Zhao, 2022). In particular, when online finance is linked with the consumption of new-energy vehicles, although it is necessary to take into account the possible large expenditures and income fluctuations in the future, online financial services make the cost of new-energy vehicle expenditures lower and reduce the perceived cost. However, online financial services weaken the uncertainty of households’ future incomes, making it difficult to form internal liquidity constraints and reducing the uncertainty of the expectations of the new-energy automobile industry by reducing the perceived risk of consumers. When making new-energy vehicle consumption decisions, households can reduce preventive savings and increase current consumption. Therefore, the link between online finance and consumption of new-energy vehicles is conducive to the purchase of energy vehicles by households, reducing the proportion of consumption of traditional-energy vehicles, thus curbing carbon emissions associated with transportation energy.

Green finance is an important support and guarantee force for the green economy and an important part of the digital economy (He and Song, 2020), and the online financing mentioned previously also belongs to this category. Theoretically, green financial services based on digital technology have brought about changes in payment methods; greatly reduced search costs, evaluation costs, and transaction costs; and have broken the spatial and temporal limitations of traditional financial services (Zeng and Reinartz, 2003; Li, 2015; Zhou and Liang, 2018), expanding the scope of traditional financial services (Campbell and Mankiw, 1991). From the consumer side, green finance reaches users online, making it easier for residents to obtain financial services (Yang et al., 2021). It can effectively supplement consumers’ credit records and make use of the interrelated characteristics of payment and financing channels to alleviate the financial constraints of households and realize intertemporal consumption (Pi et al., 2018). For example, providing financial services, such as online consumption subsidies for new-energy vehicles for households, can stimulate residents’ demand for consumption upgrades, thus releasing consumption potential. Therefore, the improvement of payment convenience and the easing of capital constraints by green finance will make a greater contribution to the enjoyment type of consumption expenditure, thus promoting the upgraded consumption of residents. Finally, the development of green finance based on digital platforms can help residents form wealth effects, diversify risks, reduce the uncertainty of households facing external shocks, and release the demand for upgraded consumption. The outbreak of the pandemic will further promote the development of digital technology and the implementation of digital financial services (Dong et al., 2021). For example, the scale of the financial platform Yu’ebao is about 1.2 trillion yuan, with individual investors accounting for 99.97% of the total, bringing 993.25 billion yuan of revenue to customers throughout the year in China. A high level of revenue lays the foundation for smooth consumption upgrading (up to 2020). Therefore, green finance can also reduce uncertainty and improve residents’ income expectations by spreading risks and wealth effects to smooth the setback of new energy vehicle consumption caused by the impact of the pandemic.

To estimate the direction and degree of the pandemic impact on carbon emissions from transportation energy and whether the carbon emission reduction effect of green finance exists, we used the research studies of Salman et al. (2022) and Shi and Li (2022). We used the time nodes of COVID-19 and breakpoint regression settings to test the inhibitory effect of the pandemic impact and green finance on carbon emissions from transportation energy. The RD model uses discontinuous characteristics of external shocks as a measurement method to identify causal relationships. These external shocks consider economic individuals as treated when an observable characteristic variable (driving variable) is equal to or greater than a certain threshold. As long as an economic individual cannot fully manipulate the driving variable, discontinuous change in the dependent variable can be regarded as being caused by the processing state (Zhang and Chen, 2014). Consistent with the basic idea of this method, a pandemic has an unpredictable external impact. After the pandemic, the relevant policies formulated by the Chinese government to support the development of the new-energy vehicle industry included the notice on further improving the financial services for epidemic prevention and control and the intelligent vehicle innovation and development strategy. These policies will enable consumers to reach the new-energy vehicle industry directly through financial online services without leaving home, reducing the perceived risks and costs of the new-energy vehicle industry and improving the perceived benefits. Therefore, since the first quarter (Q1) of 2020, the Chinese society has been affected by the pandemic.

where

where

This study used panel data from 30 provinces in China from 2016 to 2021 to assess the impact of the pandemic on carbon emissions from the transportation sector and the role of green finance in reducing emissions. Considering that the consumption of residents was seriously affected by the pandemic in January 2020, the initial operating rate was low, and the subsequent consumption response time was included, which has certain particularity. Therefore, this study chose quarter consumption data to more accurately assess the impact of the pandemic on the traffic energy of conventional incentives to reduce emissions and the timely and effective capture of the short-term finances for green transportation energy reduction of carbon emissions.

The original data of the green finance index were obtained from the quarterly data6 of provinces and cities of the Baidu Search Index (BSI) from 2016 to 2021. The original data of transportation energy carbon emission measurements were from the quarterly data7 of each province on the Autohome website. Data such as environmental regulation and urbanization level were mainly obtained from the China Fiscal Yearbook, China fixed-asset investment Statistical Yearbook, and statistical yearbooks or statistical bulletins of each province from 2016 to 2021. Among them, the individual missing data involved in the environmental regulation levels were replaced using linear interpolation and mean interpolation methods.

Explained variable: Carbon emissions from transportation energy (TRANC). In this study, the following formula was used as a proxy variable for transportation energy carbon emissions:

where new energy automobile consumption refers to the actual transaction volume of new cars as a statistical caliber. The use of new-energy vehicles will help China reduce carbon emissions from transportation energy. A lower proportion of traditional automobile consumption implies that the carbon emission level of transportation energy will be suppressed.

Explanatory variable: GF. To evaluate the green financial development level of provinces and cities, this study drew from studies by Sheng and Fan (2020) and Dong et al. (2021) to measure the level of regional financial technology from the demand side using the BSI of green finance-related keywords8 and the coefficient of the variation method to construct a GF index for each province and city during the sample period. The network search data based on the demand level can better describe the development status of GF in various provinces and cities and meet the requirements of the provincial and municipal panel data in this study. We included the GF variable into the RD model to evaluate the promoting effect of GF on the reduction of carbon emissions in transportation energy under the pandemic shock.

Other control variables included urbanization level (URB). After urbanization reaches a certain stage, it leads to increased energy consumption, aggravated environmental pollution, traffic congestion, etc. Overall, China’s urbanization has not reached the most conducive standard for carbon emission reduction (Wang, 2010; Zhang et al., 2016); therefore, this study used the ratio of urban population to rural population to represent the urbanization level (Lin and Liu, 2010). The “Porter hypothesis” states that the appropriate environmental regulation level (ENV) can stimulate enterprises’ innovation activities, improve product competitiveness, and thus reduce carbon emissions (Lanoie et al., 2008). Therefore, this study considered the proportion of local fiscal environmental protection expenditure in the regional GDP as a representative value of the environmental supervision level (Zhang and Wang, 2020). Table 1 shows descriptions of the main variables.

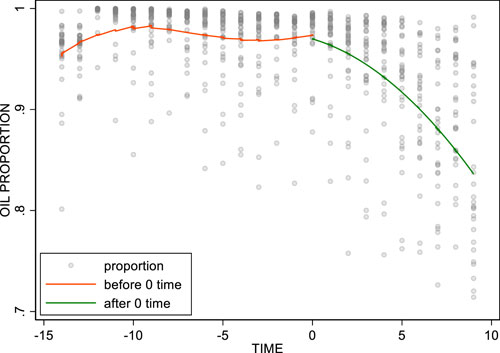

Figure 1 shows the relationship between the pandemic as a driving variable and traditional car consumption. A jump point near time 0 can be observed, which is consistent with the announcement of the COVID-19 outbreak on 20 December 2019. To smooth the short-term fluctuations in automobile consumption, the driving variable in this study was quarterly timed, the treatment state was the pandemic shock, and the treatment state was a discontinuous function of the driving variable. According to the results shown in Figure 1, at breakpoint time 0, the consumption of traditional vehicles and energy vehicles dropped significantly. We used the first quarter of 2020 as the breakpoint in the regression analysis.

FIGURE 1. Relationship between COVID-19 pandemic shock and the share of traditional automobile consumption.

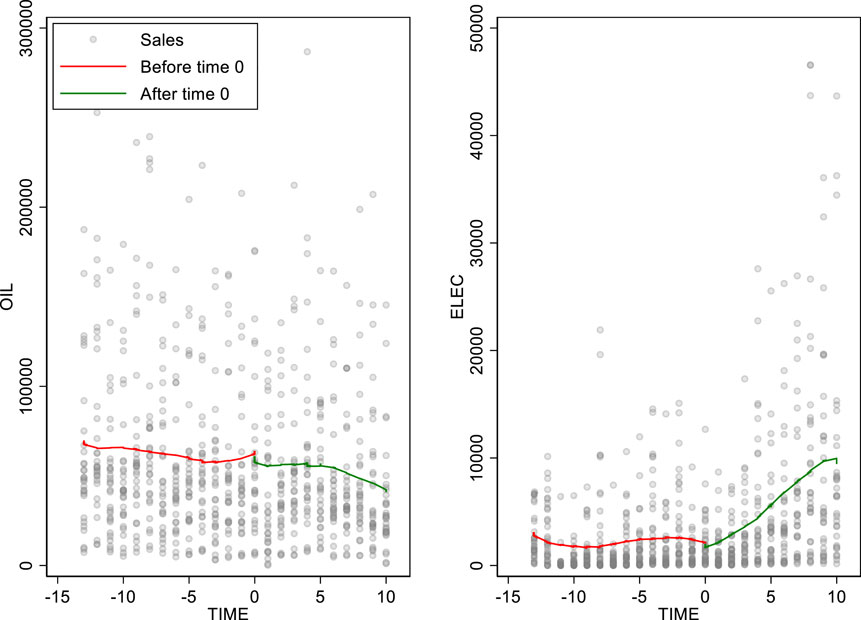

Figure 2 shows the relationship between the pandemic shock and the consumption of traditional and new energy vehicles. Again, clear jumps can be observed, with a significant drop in car consumption at the breakpoint. This indicates that the impact of the pandemic significantly reduced the level of automobile consumption, changed the structure of automobile consumption, and affected the level of transportation energy carbon emissions. As automobile consumption can be divided into traditional- and new-energy vehicles, the relationship between driving variables, the consumption of traditional vehicles, and new-energy vehicles is highly similar. However, under the impact of the pandemic, the social demand for traditional energy and new-energy vehicles has undergone structural changes. Residents prefer new-energy vehicles, and the consumption of traditional-energy vehicles has decreased more than that of new-energy vehicles; thus, the proportion of traditional-energy vehicle consumption has decreased.

FIGURE 2. Relationship between COVID-19 pandemic shock and the consumption of traditional- and new-energy vehicles.

Figure 1 shows a significant decline in the share of sales of traditional- and new-energy vehicles at the breakpoint. Figure 2 shows that the sales volume of traditional-energy vehicles and new-energy vehicles exhibits a jump point under the impact of the pandemic, and the decline of traditional-energy vehicles is greater than that of new-energy vehicles. These graphs clearly show the discontinuous variation in the outcome variable (share of energy vehicle sales) caused by dealing with the treatment state variable (COVID-19 pandemic shock), and preliminary showed that the outbreak can effectively reduce the traffic impact on energy carbon emissions. The degree of how and whether new-energy vehicle consumption is still financially dependent on the green path to the parameter estimation results remains to be observed.

We tested the second premise hypothesis of whether the control variables are continuous around the breakpoint. We used a non-parametric RD model for testing; the results are presented in Table 2. The regression coefficients of the control variables are insignificant in the RD model. This implies that before and after the first quarter of 2020, there is no significant difference in other characteristics that may affect transportation energy carbon emissions, except for the difference in the consumption proportion of new-energy vehicles caused by the development of provinces, cities, regions, and green finance.

Table 3 shows the impact of the pandemic shock on the share of conventional energy vehicles consumed. Column (1) of the table is estimated using the optimal bandwidth calculated according to the study by Imbens and Kalyanaraman (2012), and the remaining columns were estimated using other similar bandwidth settings to fully test the robustness of the results. We obtained consistent results, and the F-value test for time breakpoints far exceeded the critical value of the instrumental variable test given by Stock and Yogo (2005). The results showed that the impact of the pandemic significantly reduced the sales share of traditional-energy vehicles. According to the estimation under the optimal bandwidth setting, in the case of uncontrolled area and time effect, the pandemic impact led to a 4.80% decrease in the sales share of traditional-energy vehicles. These results are consistent with the conclusions of Aghion et al. (2019) and Hepburn et al. (2020). In addition to the sharp slowdown in economic growth, the impact of the pandemic has significantly reduced the proportion of traditional-energy vehicle consumption. This is conducive to the transformation of China’s transport energy consumption structure toward low carbon, thus reducing the carbon emissions in transport energy.

As the regression results of the rectangular kernel model are more stable, we added the green finance variable based on this model and controlled for time and province, investigated the change in the impact coefficient of the pandemic impact before and after adding the green finance variable, and then explored the role of green finance on the reduction of carbon emission in transportation energy under the pandemic impact. The results in Table 4 show that when regional and time effects are controlled and green finance variables are not added, the impact of the pandemic on the sales of traditional energy vehicles was −4.66%. After adding the green finance variable, the magnitude of the impact decreased by 0.42%, indicating that green finance had a positive effect on carbon emission reduction in transportation energy during the pandemic. This shows that under the impact of the pandemic, green finance is beneficial for Chinese residents for adopting green consumption behavior and achieving the carbon emission reduction target in the transportation sector. The aforementioned conclusions are consistent with those of Wang et al. (2019) and Jiang et al. (2020).

Some studies have indicated that global carbon emissions will be reduced by 5.7% on average in 2020, owing to the impact of COVID-19 (Le Quéré et al., 2020). From the perspective of the causes of carbon emissions reduction, in addition to the sharp slowdown of economic growth in various countries, the impact of COVID-19 on the transformation of industrial structures in various countries must not be ignored (Aghion et al., 2019; Wang Z. et al., 2020). Specifically, the impact of the pandemic can not only motivate countries’ industrial sectors to improve energy efficiency and achieve emission reduction targets (Gao et al., 2019) but also encourage governments to develop green finance, “hydrogen economy,” and “new infrastructure” investments. This helps transform the energy structure and reduce CO2 emissions in the building and power sectors (Xian et al., 2019; Hepburn et al., 2020; Wang J. et al., 2020). Furthermore, green finance not only helps achieve carbon emission reduction in the transportation sector but also has the potential to fulfill a win–win situation of “low carbon” and “economy” (Wang et al., 2019; Jiang et al., 2020). Therefore, our empirical results are consistent with existing research results.

For the following results, we used two methods: parametric model testing and a placebo test for testing robustness.

Following Lee and Lemieux, 2010, we use a parametric model for robustness testing to corroborate the results of the non-parametric test. The model is shown in Eq. 4, where STB is a dummy variable that takes the value of 1 when the sample time occurs after the first quarter of 2020 and 0 otherwise.

Table 5 shows the test results of the parametric model, and the parametric tests are consistent with the non-parametric tests for most bandwidths.

Our regression results can show a mechanical correlation or because the price of new-energy vehicles has become cheaper over time. If this is the case, then we can observe a significant “jump” in the share of new-energy vehicles sold using any year as a breakpoint. To rule out this possibility, a placebo test was conducted. Specifically, we examined whether transportation energy carbon emissions were significantly different between 2019 and 2021, using the first quarter of 2019 and 2021 as hypothetical policy shocks. The results in Table 6 show that there were no significant differences in transportation energy carbon emissions within provinces and cities in the first quarters of 2019 and 2021.

The pandemic shock has opened a new phase of carbon emission reduction in the transportation sector in China and has effectively contributed to low-carbon transformation for transportation energy consumption. Based on the latest data, we estimated the possible emission reduction effect of the pandemic shock on transportation energy carbon emissions and the promotion of green finance using a breakpoint regression method. We observed that the pandemic shock led to a 4.24% decrease in the share of traditional-energy vehicle consumption. The mitigation of China’s transportation energy carbon emissions by the pandemic shock is based on changing people’s consumption preferences for traditional-energy vehicles and promoting people to buy new-energy vehicles. Green finance contributes to the impact of the pandemic shock on transportation energy carbon emission reduction, but the magnitude of the effect is limited. Although China exceeded the emission target of a 40%–45% reduction in carbon intensity by 2020, the impact of the pandemic has put some pressure on China to successfully achieve the CO2 emission reduction target. In the long run, the impact of COVID-19 on China’s climate goals mainly depends on the balance of “environmental” and “economic” policies. At the meeting of the Standing Committee of the Political Bureau of the CPC Central Committee in 2021, proposals were created to promote the development of green and low-carbon financial product services, establish monetary policy tools for carbon emission reduction, incorporate green credit into the macro-prudential evaluation framework, and guide banks and other financial institutions to provide long-term, low-cost funds for green and low-carbon projects. The construction and formulation of “Green finance” and related policy tools will contribute to the development and transformation of low-carbon technology. These will not only help boost the economy and strengthen new-energy automobile enterprises development and low-carbon technology enterprises but also help the low-carbon development of China’s energy structure and promote the peak of China’s CO2 emissions at the earliest.

With the growing demand for household car consumption in China and the continuing process of urbanization, transportation energy carbon emissions are one of the key issues that need to be addressed for China to achieve the double-carbon target, and it is imperative to help residents’ new-energy vehicle consumption behavior. This study shows that the pandemic shock is an opportunity to open up new-energy vehicle consumption among residents; green financial support policies dealing with the pandemic and superimposed green finance together reduced the share of traditional energy vehicle consumption, and further development of green finance can reduce residents’ preference for traditional energy vehicles and mitigate the long-term threat posed by transportation energy carbon emissions. Therefore, the government must examine the time window of the pandemic impact to further promote and improve green finance consumption policies. First, it further accelerates the development of green finance to support the new-energy automobile industry; strengthen the research on the integration of green finance platforms based on 5G, the industrial Internet of Things, big data centers, artificial intelligence, and other technologies; and the low-carbon transformation and development of transportation energy. Second, it is necessary to improve the enthusiasm of residents to participate in green finance. This can be performed by establishing an incentive mechanism linking online financial consumption and the payment for energy vehicles by stages, encouraging residents’ green financial behavior, and forming a long-term incentive for new-energy vehicles purchase. Third, it gradually reduces the financing cost of green finance so that consumers have a good expectation of green finance and new-energy vehicles, which is conducive to further encourages the residents to purchase new energy vehicles. Fourth, it is necessary to strengthen the coordination and connection between green finance and the new-energy automobile industry. This can be accomplished by allowing for the resource allocation function of green finance for low-carbon technology innovation, the transformation of automobile enterprises, and implementing the survival of the fittest in transportation energy low-carbon technology. Fifth, green financial services online will improve the efficiency of low-carbon technology innovation and transform the purchase of new-energy vehicles, which is particularly important for China’s economy in the process of transformation.

This study has potential limitations that must be addressed in future research. First, in our empirical study, we considered China as a whole and did not consider the differences in carbon reduction effects among the eastern, middle, and western provinces. Second, we selected a sample of Chinese provinces for empirical testing in our study but did not conduct a comparative study with developed regions or underdeveloped countries or regions. Therefore, further research is needed when more abundant data are available. Additionally, this study only examined the economic effects of the pandemic shock from the perspective of carbon emissions from transportation energy, and further research is needed to fully assess the carbon reduction effects based on the pandemic shock and green finance. The pandemic shock may also affect the consumer’s demand and the endogenous power of consumption, supply of industries, and economic growth and stability of the country. All these directions are worthy of further research.

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Conceptualization, XZ; data curation, ZY; formal analysis, NG; funding acquisition, LL; investigation, YL; methodology, XZ; project administration, YL; resources, NG; software, LL; supervision, YL; validation, YC; visualization, YL; writing—original draft preparation, LL; writing—review and editing, LL; All authors have read and agreed to the published version of the manuscript.

This work was supported by the National Natural Science Foundation of China (grant no. 52105541), the Humanities and Social Science Fund of Ministry of Education of China (grant no. 22YJC790087), the Humanities and Social Science Fund of Ministry of Education of China (grant no. 20YJC630004), the Social Science Foundation of Jiangsu Province (grant no. 20EYC013), and the General Project of Philosophy and Social Sciences in Jiangsu universities (grant no. 2019SJA0415).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1Hereafter referred to as the “double carbon” target.

2The consumption data for the first quarter of 2020 are used as an example to observe the impact of the pandemic on consumption. Retail sales of consumer goods totaled to 7.86 trillion yuan in the first quarter of 2020, down 19 percent year-on-year, according to the National Bureau of Statistics. Clothing and textiles, gold and silver jewelry, household appliances and audio-video equipment, furniture, and automobiles were the most affected, with year-on-year declines of more than 30%. In particular, the consumption of gold and silver jewelry declined significantly, with a year-on-year decrease of 37.7%. The consumption of petroleum products, cosmetics, constructions, decoration materials, and tobacco and alcohol decreased by 10%–29%. Daily necessities and communication equipment were less affected, with a year-on-year decrease of less than 5%; only grain, oil, and food, which are daily necessities, went up 12.6% year-on-year.

3Based on Roland Berger’s survey report on “The Exploration of Disruptive Data in the Automotive Industry.”

4“Investigation on Chinese Consumers’ purchase of new energy vehicles in 2022” by iMedia Consulting.

5Considering the explanatory power of the regression results, we take the logarithm of

6For more information, please see: https://index.baidu.com/.

7For more information, please see: https://www.autohome.com.cn/.

8The keywords related to green finance mainly include conceptual-level, technical-level, payment-level, and policy-level terms. Specific terms include green finance, consumer finance, green consumption, big data, cloud computing, artificial intelligence, blockchain, biometric identification, online payment, mobile payment, third-party payment, new-energy policy, and auto finance. This article uses the “pc + mobile” search index.

Aghion, P., Hepburn, C., Teytelboym, A., and Zenghelis, D. (2019). “Path dependence, innovation and the economics of climate change,” in Handbook on green growth. Editor R. Fouquet (Cheltenham, UK: Edward Elgar Publishing), 67–83.

Campbell, J. Y., and Mankiw, N. G. (1991). The response of consumption to income: A cross-country investigation. Eur. Econ. Rev. 35, 723–756. doi:10.1016/0014-2921(91)90033-F

Chen, J. (2020). The driving force mechanism of "dual upgrading" of industry and consumption in the post the COVID-19 pandemic era. J. Shanghai Jiaot. Univ. Philos. Soc. Sci.) 28, 100–111. doi:10.13806/j.cnki.issn1008-7095.2020.05.010

Demir, A., Pesqué-Cela, V., Altunbas, Y., and Murinde, V. (2022). Fintech, financial inclusion, and income inequality: A quantile regression approach. Eur. J. Financ. 28, 86–107. doi:10.1080/1351847x.2020.1772335

Dong, X., Zhang, Y., and Xu, H. (2021). Can the development of fintech help SMEs through the crisis? A quasi-natural experiment based on COVID-19. Econ. Sci. 43, 73–87. doi:10.12088/PKU.jjkx.2021.06.05

Friedman, M. (1957). “The permanent income hypothesis,” in A theory of the consumption function. Editor M. Friedman (Princeton, NJ, USA: Princeton University Press), 20–37.

Gao, G., Chen, M., Wang, J., Yang, K., Xian, Y., Shi, X., et al. (2019). Sufficient or insufficient: Assessment of the intended nationally determined contributions (INDCs) of the world’s major greenhouse gas emitters. Front. Eng. Manag. 6, 19–37. doi:10.1007/s42524-019-0007-6

Ge, P., Huang, X., and Xu, Z. (2018). Financial development, innovation heterogeneity and promotion of green TFP: Evidence from ‘The Belt and Road. Financ. Econ. 62, 1–14.

He, Z., and Song, X. (2020). How does digital finance promote household consumption. Financ. Trade Econ. 41, 65–79. doi:10.19795/j.cnki.cn11-1166/f.2020.08.005

Hepburn, C., O’Callaghan, B., Stern, N., Stiglitz, J., and Zenghelis, D. (2020). Will COVID-19 fiscal recovery packages accelerate or retard progress on climate change? Oxf. Rev. Econ. Policy 36, S359–S381. doi:10.1093/oxrep/graa015

Huijts, N. M. A., Molin, E. J. E., and Steg, L. (2012). Psychological factors influencing sustainable energy technology acceptance: A review-based comprehensive framework. Renew. Sustain. Energy Rev. 16, 525–531. doi:10.1016/j.rser.2011.08.018

Imbens, G., and Kalyanaraman, K. (2012). Optimal bandwidth choice for the regression discontinuity estimator. Rev. Econ. Stud. 79 (3), 933–959. doi:10.1093/restud/rdr043

Jiang, H., Wang, W., Wang, L., and Wu, J. (2020). The effects of the carbon emission reduction of China’s green finance: An analysis based on green credit and green venture investment. Financ. Forum 25 (39–48), 80. doi:10.16529/j.cnki.11-4613/f.2020.11.006

Lanoie, P., Patry, M., and Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. J. Prod. Anal. 30, 121–128. doi:10.1007/s11123-008-0108-4

Le Quéré, C., Jackson, R. B., Jones, M. W., Smith, A. J. P., Abernethy, S., Andrew, R. M., et al. (2020). Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Nat. Clim. Chang. 10, 647–653. doi:10.1038/s41558-020-0797-x

Lee, D. S., and Lemieux, T. (2010). Regression discontinuity designs in economics[J]. Journal of economic literature 48(2), 281–355.

Li, J. (2015). Reflections on internet finance. J. Manag. World 31 (1–7), 16. doi:10.19744/j.cnki.11-1235/f.2015.07.002

Li, W., and Hu, M. (2014). An overview of the environmental finance policies in China: Retrofitting an integrated mechanism for environmental management. Front. Environ. Sci. Eng. 8 (3), 316–328. doi:10.1007/s11783-014-0625-5

Li, X., Liu, Y., and Jing, B. (2022). Research on the impact of support policies on the promotion of new energy vehicles in China. Manag. Rev. 34, 55–65. doi:10.14120/j.cnki.cn11-5057/f.20210616.001

Li, Y., and Pan, H. (2019). Consumption upgrading since reform and opening-up and countermeasures for further promoting consumption. Theory Pract. Financ. Econ. 40, 101–106. doi:10.16339/j.cnki.hdxbcjb.2019.03.015

Li, Z., Li, G., and Hu, Z. (2017). Xi’an household carbon emission characteristics. Resour. Sci. 39, 1394–1405. doi:10.18402/resci.2017.07.16

Lin, B., and Liu, X. (2010). China’s carbon dioxide emissions under the urbanization process: Influence factors and abatement policies. Econ. Res. J. 45, 66–78.

Ma, H., Liu, J., and Gong, Z. (2019). Carbon emission and evolution mechanism of tourism transportation in Shanxi Province. Econ. Geogr. 39, 223–231. doi:10.15957/j.cnki.jjdl.2019.04.027

Magazzino, C., and Mele, M. (2021). On the relationship between transportation infrastructure and economic development in China. Res. Transp. Econ. 88, 100947. doi:10.1016/j.retrec.2020.100947

Mele, M., and Magazzino, C. (2020). A machine learning analysis of the relationship among iron and steel industries, air pollution, and economic growth in China. J. Clean. Prod. 277, 123293. doi:10.1016/j.jclepro.2020.123293

Modigliani, F., and Brumberg, R. (1954). “Utility analysis and the consumption function: An interpretation of cross-section data,” in Post keynesian economics. Editor K. K. Kurihara (New Brunswick, NJ, USA: Rutgers University Press), 388–436.

Pi, T., Liu, Y., and Wu, H. (2018). Fintech: Connotation, logic and risk regulation. Financ. Econ. 62 (9), 16–25.

Salman, M., Long, X., Wang, G., and Zha, D. (2022). Paris climate agreement and global environmental efficiency: New evidence from fuzzy regression discontinuity design. Energy Policy 168, 113128. doi:10.1016/j.enpol.2022.113128

Sheng, T., and Fan, C. (2020). Fintech, optimal banking market structure, and credit supply for SMEs. J. Financ. Res. 63 (6), 114–132. doi:10.3969/j.issn.1006-480X.2021.04.008

Shi, D., and Li, S. (2022). Research on enterprise survival resilience under the impact of COVID-19: Evidence from Chinese listed companies. Bus. Manag. J. 44, 5–26. doi:10.19616/j.cnki.bmj.2022.01.001

Siddik, M. N. A., and Kabiraj, S. (2020). “Digital finance for financial inclusion and inclusive growth,” in Digital transformation in business and society: Theory and cases. Editors B. George,, and J. Paul (Cham, Switzerland: Springer), 155–168. doi:10.1007/978-3-030-08277-2_10

Stock, J. H., and Yogo, M. (2005). “Testing for weak instruments in linear IV regression,” in Identification and inference for econometric models: Essays in honor of thomas rothenberg. Editors D. W. K. Andrews,, and J. H. Stock (Cambridge: Cambridge University Press), 80–108.

Su, D., and Lian, L. (2018). Does green credit policy affect corporate financing and investment? Evidence from publicly listed firms in pollution-intensive industries. J. Financ. Res. 61, 123–137.

Teixeira, A. C. R., and Sodré, J. R. (2018). Impacts of replacement of engine powered vehicles by electric vehicles on energy consumption and CO2 emissions. Transp. Res. Part D. Transp. Environ. 59, 375–384. doi:10.1016/j.trd.2018.01.004

Udemba, E. N., Magazzino, C., and Bekun, F. V. (2020). Modeling the nexus between pollutant emission, energy consumption, foreign direct investment, and economic growth: New insights from China. Environ. Sci. Pollut. Res. 27 (15), 17831–17842. doi:10.1007/s11356-020-08180-x

Wang, H., and He, J. (2018). Peaking rule of CO2 emissions, energy consumption and transport volume in the transportation sector. China Popul. Resour. Environ. 28, 59–65. doi:10.12062/cpre.20171001

Wang, J., Wang, K., and Wei, Y. M. (2020). How to balance China’s sustainable development goals through industrial restructuring: A multi-regional input–output optimization of the employment–energy–water–emissions nexus. Environ. Res. Lett. 15, 034018. doi:10.1088/1748-9326/ab666a

Wang, K., Lu, M., and Wang, Q. (2020). Impact of COVID-19 on China's CO2 emissions. J. Beijing Inst. Technol. Soc. Sci. Ed.) 22, 11–16. doi:10.15918/j.jbitss1009-3370.2020.2262

Wang, X. L. (2010). Urbanization path and city scale in China: An economic analysis. Econ. Res. J. 45, 20–32.

Wang, Y., Pan, D., Peng, Y., and Liang, X. (2019). China’s incentive policies for green loans: A DSGE approach. J. Financ. Res. 62, 1–18. doi:10.2139/ssrn.3484817

Wang, Y., and Wang, Q. (2013). Factors affecting Beijing residents’ buying behavior of new energy vehicle: An integration of technology acceptance model and theory of planned behavior. Chin. J. Manag. Sci. 21, 691–698. doi:10.16381/j.cnki.issn1003-207x.2013.s2.003

Wang, Z., Li, X., and Sun, F. (2020). Development trends of new energy vehicle technology under industrial integration. Trans. Beijing Inst. Technol. 40, 1–10. doi:10.15918/j.tbit1001-0645.2019.309

Xian, Y., Wang, K., Wei, Y. M., and Huang, Z. (2019). Would China’s power industry benefit from nationwide carbon emission permit trading? An optimization model-based ex post analysis on abatement cost savings. Appl. Energy 235, 978–986. doi:10.1016/j.apenergy.2018.11.011

Yang, W., Su, L., Sun, R., and Yuan, W. (2021). Has digital finance promoted consumption upgrading? Evidence-Based on panel data. Stud. Int. Financ. 38, 13–22. doi:10.16475/j.cnki.1006-1029.2021.04.002

Zeng, M., and Reinartz, W. (2003). Beyond online search: The road to profitability. Calif. Manag. Rev. 45, 107–130. doi:10.2307/41166168

Zeng, X., Qiu, R., Lin, D., Hou, X., Zhang, L., and Hu, X. (2020). Spatio-temporal heterogeneity of transportation carbon emissions and its influencing factors in China. China Environ. Sci. 40, 4304–4313. doi:10.19674/j.cnki.issn1000-6923.2020.0477

Zhang, C., and Chen, B. (2014). Can “public pension system” substitutes “family mutual insurance”. Econ. Res. J. 49 (11), 102–115.

Zhang, J. X., and Wang, H. L. (2020). Analysis on environmental planning, agricultural technological innovation and agricultural carbon emission. J. Hubei Univ. 47, 147–156. doi:10.13793/j.cnki.42-1020/c.2020.04.018

Zhang, T. F., Yang, J., and Sheng, P. F. (2016). The impacts and channels of urbanization on carbon dioxide emissions in China. China Popul. Res. Environ. 26, 47–57. doi:10.3969/j.issn.1002-2104.2016.02.007

Zhao, S., and Zhao, X. (2022). Consumer finance for consumption upgrading under the “double cycle”: Mechanism, current situation and path. Reform Econ. Syst. 40, 28–34.

Keywords: COVID-19 pandemic shock, green finance, transportation energy carbon emissions, RD model, China

Citation: Liu L, Cheng Y, Guan N, Liu Y, Zhang X, Li Y and Yang Z (2023) Impact of COVID-19 and green finance on transportation energy carbon emissions in China: From the perspective of an automobile energy consumption structure. Front. Environ. Sci. 11:1138111. doi: 10.3389/fenvs.2023.1138111

Received: 05 January 2023; Accepted: 28 March 2023;

Published: 11 April 2023.

Edited by:

Mitali Sarkar, Chung-Ang University, Republic of KoreaReviewed by:

Cosimo Magazzino, Roma Tre University, ItalyCopyright © 2023 Liu, Cheng, Guan, Liu, Zhang, Li and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lingyun Liu, bGx5QG5qeHpjLmVkdS5jbg==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.