- 1School of Economics and Management, Anhui Agricultural University, Hefei, China

- 2Postdoctoral Research Workstation, Anhui Rural Credit Union, Hefei, China

- 3School of Social Audit, Nanjing Audit University, Nanjing, China

- 4School of Economics and Management, Hubei University of Technology, Wuhan, China

Environmental, Social, and Governance (ESG) is changing from a concept to corporate soft power. Can this improve corporate performance in capital markets? There is little literature linking environmental, Social, and Governance performance to stock liquidity. Therefore, It is of urgent theoretical and practical importance to study the impact of environmental, Social, and Governance performance on stock liquidity. Using Chinese A-share listed companies from 2015 to 2020 as a sample to empirically examine the impact of environmental, Social, and Governance performance on stock liquidity and its mechanism. We find that environmental, Social, and Governance performance has a significant positive impact on listed companie’s stock liquidity. This conclusion was validated after conducting a series of robustness tests. Mechanism analysis shows that environmental, Social, and Governance performance can promote stock liquidity by reducing agency costs, increasing the proportion of foreign ownership, and improving corporate reputation. The heterogeneity analysis shows that environmental, Social, and Governance performance in state-owned enterprises, heavily polluting enterprises, and enterprises in areas with low degrees of marketisation has a more significant positive promoting effect on stock liquidity. This study expands the research on environmental, Social, and Governance performance and has implications for promoting the development of environmental, Social, and Governance practices.

1 Introduction

New changes in social contradictions can lead to changes in a country’s developmental philosophy. Currently, the major dilemma in China is the conflict between people’s growing desire for better living conditions and their uneven and insufficient development. A report by the 20th National Congress of the Communist Party of China indicated that China’s economy will shift from a stage of high growth to a stage of high-quality development. We should deeply implement the new development concept of “innovation, coordination, green, openness, and sharing” and comply with the development trend of sustainability. The realisation of sustainable development goals at the national level requires many micro-entities to actively assume social responsibilities, reshape their business philosophy, and realise a transformation from maximising self-interest to maximising social values. Distinguished from traditional financial indicators, Environmental, Social, and Governance (ESG) is a non-financial enterprise evaluation system that focuses on the environment, society, and governance. This is an important indicator for measuring enterprises sustainable development ability and determining whether they have a sufficient sense of social responsibility. Driven by such changes in social contradictions and policies, the practice of ESG’s new development concept isn’t only a hot issue for the government, academia, and the public but also a necessary path for microeconomic entities to achieve sustainable development.

In 2004, the United Nations Environment Program formally put forward the concept of ESG for the first time, requiring enterprises to give full consideration to environmental protection, social responsibility, and corporate governance in the process of operation and development and setting a three-tier bottom line to quantify non-financial risks: environmental, social, and governance. In 2018, China Securities Regulatory Commission revised the “Code of Governance for Listed Companies,” which stipulates that listed companies shall disclose information related to environmental protection, social responsibility fulfilment, and corporate governance following laws and regulations and requirements of relevant departments. In this context, the preference for listed Chinese companies to practice the ESG concept continues to increase. According to the 2021 ESG Performance Analysis Report of A-share Listed Companies released by Syntao, a Chinese ESG performance agency, the number of ESG disclosure reports issued by A-share listed companies increased from 371 in 2009 to 1,125 in 2021. Objectively, the ESG concept will inevitably impact enterprise development and, to a certain extent, be mapped to capital market activities. As a lifeline of the capital market, stock liquidity largely reflects the price discovery function and resource allocation efficiency of the capital market and is often closely associated with market recognition (Amihud and Mendelson, 1988). Thus, a company’s business philosophy and core values are reflected, to a certain extent, by capital market liquidity, and the ESG philosophy is no exception.

However, few studies have accurately linked ESG performance and stock liquidity, and the direction and mechanism of their influence can only be inferred from other relevant literature. Good ESG performance can improve information transparency, alleviate information asymmetry, reduce agency conflicts, and thus reduce the costs of equity (El et al., 2011) and debt (Goss and Roberts, 2011). In addition, ESG can restrain manager misconduct (He et al., 2022), reduce systemic and special risks (Cerqueti et al., 2021), and play a positive role in corporate governance and risk management. More importantly, most studies find that ESG can significantly improve enterprise performance and long-term value (Friede et al., 2015; Li et al., 2020). From this perspective, ESG promotes the high-quality development of enterprises (Li et al., 2021) and generates positive feedback in the capital market, such as improving stock liquidity. Contrastingly, some scholars found that ESG is negatively correlated with corporate value (Brammer and Pavelin, 2006), and compulsory disclosure of corporate social responsibility increases costs (Chen et al., 2018) thereby leading to ineffective use of corporate resources (Alexander and Buchholz, 1978). To satisfy their original intention of self-interest, managers may take advantage of the reputational insurance effect of social responsibility activities to engage in high-risk activities (Barnea and Rubin, 2010), thus bringing uncertainty to enterprise operations. Therefore, enterprises with good ESG performance have lower corporate value (Sassen et al., 2016). Some scholars believe there is no correlation between ESG and enterprise value (Atan et al., 2018). Based on these studies, we can infer that ESG may not improve the active performance of enterprises in capital markets.

In summary, the inferences obtained from the existing literature on the relationship between ESG performance and stock liquidity haven’t yet been agreed upon and require further in-depth research. To evaluate the consequences of ESG and its role in carrying out sustainable development activities, this study focuses on exploring the impact of ESG performance on stock liquidity and its mechanism of action. It considers enterprise ESG performance as the core explanatory variable to explore whether listed companies stock liquidity responds positively to ESG performance. At the same time, this study also demonstrates the potential mechanism of action from three perspectives: agency costs, foreign stock ownership, and corporate reputation. Further, the sample enterprises are subdivided according to certain characteristic variables to analyse the heterogeneous characteristics of the impact of ESG performance on stock liquidity. This study also explores the influence, channel mechanisms, and heterogeneity of the influence between ESG and stock liquidity to provide new evidence for understanding ESG performance and capital market liquidity of Chinese listed companies.

The main contributions of this paper are in the following three areas: First, The existing literature focuses on the impact of ESG on firm value (Alareeni and Hamdan, 2020), financial risk (Shakil, 2021), innovation capacity (Tan and Zhu, 2022) and the cost of debt (Eliwa et al., 2021), few studies have focused on the role of ESG performance in enhancing capital market vitality. This paper examines the impact of corporate ESG performance from the perspective of stock liquidity, expands the boundaries of the economic consequences of ESG performance, reveals the positive effects of ESG on corporate capital market performance, and provides empirical support for promoting ESG investment, actively fulfilling ESG responsibilities and implementing the concept of sustainable development. Second, this paper extends the study on the factors influencing stock liquidity by proposing a new influencing factor, ESG performance, which combines the framework of green transformation-driven enterprises under the ESG system with the enhancement of enterprise stock activation in the capital market. Third, we examine the heterogeneity of ESG performance on stock liquidity from three perspectives: enterprise, industry, and market, and explore the intrinsic mechanism of ESG performance to promote capital market dynamics through the paths of agency costs, foreign ownership, and corporate reputation, which not only enriches the relevant literature academically, but also provides new research ideas and perspectives for subsequent related studies. Fourth, the findings of this paper provide a theoretical basis for enterprises to improve their capital market performance by enhancing ESG performance, which is an important reference value for investors’ decision making and has implications for the government to improve the construction of China’s ESG disclosure system.

2 Theoretical analysis and hypothesis development

Stock liquidity1 mainly reflects the ability to liquidate assets and the degree of stock market activity and is a central element in the efficient functioning of capital markets (Amihud and Mendelson, 1986; Du et al., 2017). Stock liquidity isn’t only related to asset prices but also has an important impact on capital structure (Lipson and Mortal, 2009), investment decisions (Benlemlih and Bitar, 2018), and R&D innovation (Fang et al., 2014), among others. Therefore, stock liquidity has become an important topic in capital market microstructure research. In the existing literature, the factors influencing stock liquidity have been explored in-depth and can be broadly summarized at the macro level and micro level. At the macro level, some scholars find that factors, such as capital market opening (Bekaert et al., 2002), monetary policy (Chordia et al., 2005), and capital market system reforms (Zhao et al., 2020) can have an impact on stock liquidity. At the micro level, studies have analyzed the impact of investor sentiment (Liu, 2015), institutional investor holdings (Dang et al., 2018), and market maker system (Grossman and Miller, 1988) on stock liquidity.

Stock liquidity is the basis of capital market functions such as price discovery, information flow, and resource allocation (Amihud and Mendelson, 1988), and reflects the quality, efficiency, and vitality of enterprises to a large extent (Benlemlih and Bitar, 2018). The ESG concept is an important tool to improve the quality and efficiency of the real economy through the high-quality development of micro-entities, reflecting the transformation of the business philosophy from shareholder value maximisation to stakeholder value maximisation. This new development concept will be reflected in the stock liquidity of the capital market. ESG performance consists of three dimensions: environmental, social, and corporate governance. First, through multidimensional non-financial information disclosure, enterprises can effectively alleviate information asymmetry, help investors understand the actual situation of enterprises from multiple perspectives, and bring into play the monitoring role of all parties (including intermediaries and stakeholders) in the capital market, thus reducing agency costs. Second, under the uncertainty of the external environment, ESG performance is a competitive advantage for enterprises and an important dimension for measuring the sustainable development performance and long-term investment value of enterprises; this is an important basis for investor’s investment decisions and helps attract the attention of institutional investors, including foreign investors, the increased investment attention will lead to higher foreign ownership. Finally, good ESG performance connotes good environmental, social, and corporate governance performance, which embodies creating diversified integrated value and safeguarding stakeholders, helping companies establish a good corporate image in the capital market, improving corporate reputation, and helping companies to achieve long-term value and sustainable development. From the above, the changes brought by ESG enhance information transparency (Ellili, 2022), foreign ownership (Yu and Zheng, 2020), corporate reputation (Maaloul et al., 2021), and other factors required for trading in the capital market, which can have a significant impact on stock liquidity. Therefore, this study explores the impact of corporate ESG performance on stock liquidity and its mechanism of action using the three main paths mentioned above.

Information asymmetry is a key factor affecting stock liquidity. The more serious the adverse selection and moral hazard problems caused by information asymmetry, the higher the agency cost and the worse the stock liquidity will be (Bhide, 1993). According to the principal-agent theory, there is serious information asymmetry between management and investors, and it is entirely possible for management to take advantage of information to make business decisions that are unfavourable to investors, thus generating higher agency costs. Good ESG performance enhances stock liquidity by improving information efficiency and reducing agency costs. First, the disclosure of non-financial information is a useful supplement to the disclosure of financial information and helps improve information transparency. ESG discloses non-financial information that can alleviate information asymmetry and reduce agency costs (Siew et al., 2016). Second, good ESG performance implies that the company has a sound corporate governance mechanism, can strictly comply with relevant laws and regulations, has lower operational risks, and has a higher sense of social responsibility, thereby reducing investment risks. Third, companies with good ESG performance receive more media attention, and their management faces stronger external monitoring pressure, which can also motivate companies to operate prudently and compliantly while reducing agency costs and curbing short-selling, inefficient investments, and on-the-job consumption.

ESG performance can attract foreign capital inflows and increase foreign ownership, thereby improving stock liquidity. As the market value of listed companies is closely related to ESG performance, foreign institutions take the ESG index as an important investment consideration factor (Cheng et al., 2015) to measure whether listed companies have sufficient ESG risk control ability and sustainable profitability (Stelner et al., 2015). According to the stakeholder theory, social responsibility in a broad sense has both economic and moral dimensions (Clarkson, 1995). A good evaluation of corporate social responsibility means that enterprises can effectively coordinate these two kinds of different responsibilities and maintain the balance between them. Social responsibility, an important aspect of ESG, can significantly affect institutional investor’s investment decisions. Mahoney and Roberts (2007) finds a significant positive correlation between CSR performance and the number of institutional investors. Furthermore, foreign ownership helps optimise the shareholding structure, diversify risks, and reduce the cost of capital (Bekaert and Harvey, 2000). Additionally, foreign investors have a higher sense of rights and participation, which helps improve the level of corporate governance and operational efficiency of enterprises. Moreover, foreign investors, as investment subjects with strong professionalism, tend to be the focus of the market, and their investment behaviour can influence the investment behaviour of other investors, helping attract more capital, forming a herding effect, generating co-investment behaviour, and promoting an increase in trading volume. In addition, some scholars have found that foreign ownership may positively affect stock liquidity through various channels such as trading (Ding et al., 2017), competition channels (Gou and Zheng, 2021), and information channels (Glosten and Milgrom, 1985).

ESG performance contributes to a company’s reputation, enhances its market position, and creates a unique competitive advantage, thereby improving its stock liquidity. First, regarding certification effects, investors lack sufficient quality information because of limited access to information. Reputation is gradually accumulated by a firm through its efforts and costs over time and constitutes a kind of guarantee and collateral for the firm (Tadelis, 1999), thus influencing the investment decisions of external investors. Good ESG performance improves a company’s reputation in the capital market. Second, from the information perspective, companies that focus on their reputation send positive signals to the market and attract external attention by increasing the quantity and quality of information disclosure, thus maintaining a high reputation and a good image and gaining investor’s trust and support, which also helps reduce information asymmetry between companies and investors and promotes trading behaviour. Third, corporate reputation is an evaluation made by stakeholders based on how well their expectations are met (Haleblian et al., 2017). A good social reputation is a fundamental resource for creating business value for firms. Enterprises with good reputations have unique competitive advantages in the market (Roberts and Dowling, 2002), which can enhance product market competitiveness (Brammer and Pavelin, 2004), ease financing constraints, lower the cost of capital, and thus reduce business risks (Dowling, 2006). A good reputation is also a positive signal in the market, which can stabilise market expectations and create a positive “exposure effect” (Zhao et al., 2020), attracting more investors to participate and increasing the vitality of the capital market. In addition, enterprises high ESG performance can ensure government support and a relaxed external environment for their development (Niessen and Ruenzi, 2010). More importantly, the ESG practices of enterprises can gain public recognition, which can reduce consumers’ price sensitivity (Flammer, 2015) and help enterprises form brand effects, enhance their potential and lasting competitive advantages, and improve stock liquidity. Based on this analysis, this study proposes the following core research hypothesis.

Hypothesis. 1Other things being equal, ESG performance will significantly increase the level of stock liquidity.

3 Data and empirical design

3.1 Data

This paper selects the data of Chinese A-share listed companies from 2015 to 2020 as the initial research sample and makes the following treatment: 1) Excluding the special treatment firms (ST and PT firms); 2) Excluding financial firms; 3) Excluding the sample with abnormal or missing ESG and other key data. To eliminate the influence of extreme values, all continuous variables are winsorized at the 1% and 99% levels. Finally, we obtain a total of 5,944 observations. The financial data of listed companies in this paper are obtained from CSMAR (China Stock Market and Accounting Research Database), and the ESG score data are obtained from Bloomberg database.

3.2 Variables definition

3.2.1 Dependent variable

Stock liquidity (Liquidity). This paper draws on Amihud and Mendelson’s (Amihud and Mendelson, 1988) research method to find the stock illiquidity indicator (ILLIQ) by Eq. 1.

Where,

3.2.2 Independent variables

Corporate ESG performance (ESG). At present, academics mainly use the construction of multi-dimensional index systems or use third-party institutions to evaluate and assign scores to measure the ESG performance of enterprises. Since self-constructed indicators are highly subjective and do not correspond to the actual basic situation in China, we followed Ge et al. (2022) cites the ESG score of listed companies provided by Bloomberg Consulting as a measure of corporate ESG performance, which can be subdivided into three types: environment (ENV), social responsibility (SOC), and corporate governance (GOV), and a higher ESG score means a better ESG performance. In the subsequent robustness tests, the corporate ESG scores provided by Hexun are used as proxy variables in this paper.

3.2.3 Control variables

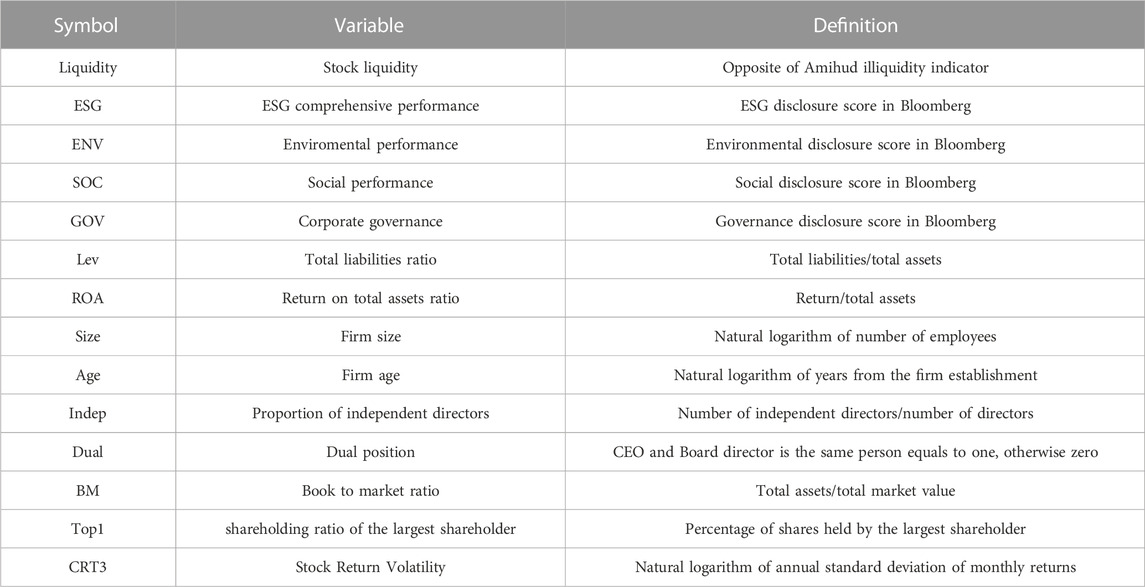

To overcome omitted variable bias, this paper selects total liabilities ratio (Lev), return on total assets ratio (ROA), firm size (Size), firm age (Age), the proportion of independent directors (Indep), duality of the chairman and CEO (Dual), book-to-market ratio (BM), shareholding ratio of the largest shareholder (Top1), and stock return volatility (CRT3) as control variables. The specific definitions of each variable can be found in Table 1.

3.3 Research method

To test the relationship between ESG performance and stock liquidity, we followed Ma et al. (2022) to construct the following baseline regression model:

In the above model, the explanatory variable in Eq. 3 is stock liquidity (Liquidity), the explanatory variable is corporate ESG performance (ESG), and Controls is the aforementioned control variable,

4 Empirical results and analysis

4.1 Descriptive statistics

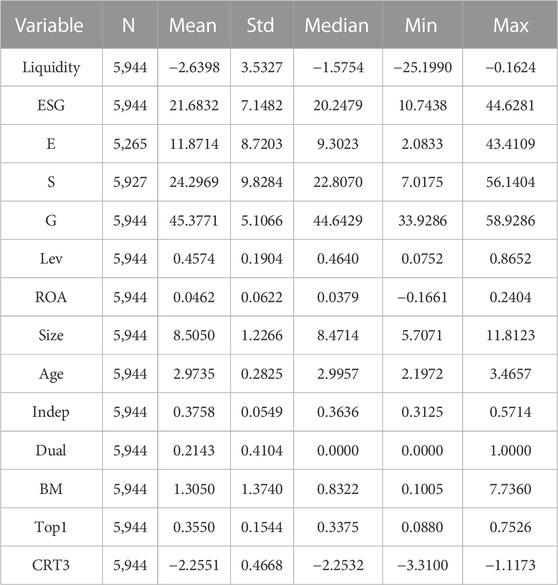

Table 2 presents the descriptive statistics of the main variables in this study. The results show that the mean value of stock liquidity (Liquidity) is −2.6398, and the minimum and maximum values are −25.1990 and −0.1624, respectively, indicating that investors pay different levels of attention to different stocks and that the differences are contrasting. The maximum ESG score (ESG) of listed companies is 44.6281, and the minimum is 10.7438, indicating a significant difference in commitment to social responsibility among different companies. Except for enterprise size (Size) and book-to-market ratio (BM), the standard deviations of all control variables are less than one, and the fluctuations are marginal, indicating that the data are relatively stable.

4.2 Baseline regression results

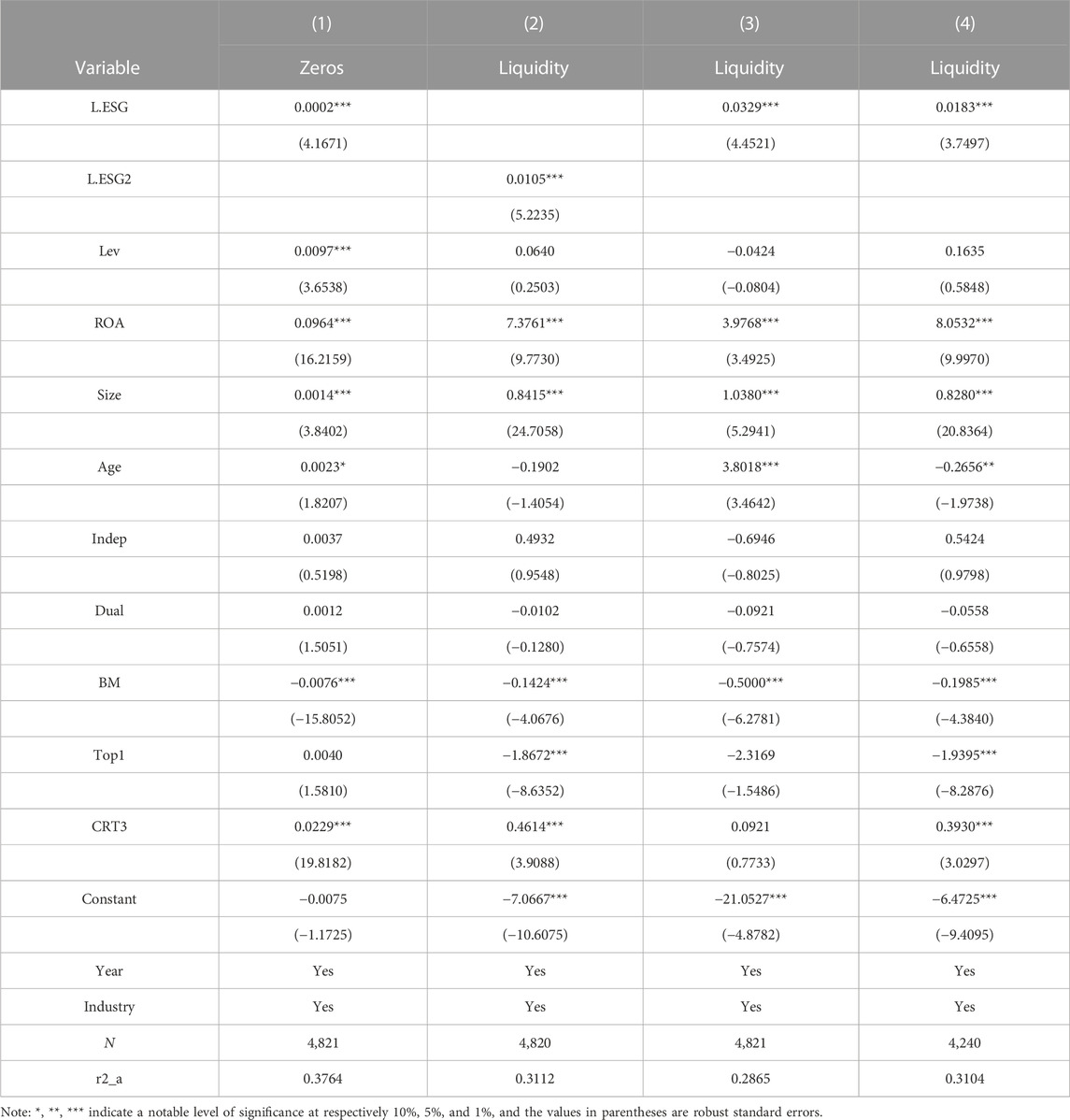

Table 3 presents the results of the baseline regression analysis of corporate ESG performance and stock liquidity. The regression results in Column (1) of Table 3 show that the estimated coefficient of the regression of the corporate ESG performance variable (ESG) is significantly positive at the 1% level. In terms of economic significance, if a listed company’s ESG performance improves by one notch, it can lead to an increase in stock liquidity (Liquidity) by 0.0183. Thus, it can be seen that the better the ESG performance of a company, the better the stock liquidity, and the hypothesis of this study is verified. The results support the findings of the literature such as Velte (2017); Li et al. (2018), and Miralles-Quirós et al. (2018) that corporate ESG helps companies to increase their value and form positive feedback in the capital market, reflecting the value creation effect of ESG practices. From the results of the control variables, the coefficient of return on total assets ratio (ROA) and stock liquidity (Liquidity) is significantly positive, indicating that firms with good profitability are more likely to be favored by investors and promote stock liquidity. Firm size (Size) is significantly and positively correlated with stock liquidity because small firms are less likely to receive market attention and have high implicit transaction costs, thus stock liquidity is correspondingly lower. The coefficient between book to market ratio (BM) and stock liquidity is significantly negative. Book to market ratio represents the risk of financial distress faced by companies, and companies with high book to market ratios are in a more fragile financial position, vulnerable to financial crises and have lower stock security, hence lower stock liquidity. The shareholding ratio of the first largest shareholde (TOP1) is significantly and negatively related to stock liquidity. A larger shareholding ratio of the first largest shareholder means higher concentration of equity, higher information asymmetry, lower information content of stock price, and higher agency costs, thus making stock liquidity lower. The higher the stock return volatility, the higher the stock liquidity, consistent with the existing literature (Lang et al., 2012).

Columns (2) to (4) in Table 3 show the regression results of the corporate environmental performance variable (ENV), corporate social performance variable (SOC), and corporate governance performance variable (GOV) on stock liquidity for corporate ESG performance. As can be seen from the regression results in Column (2) of Table 3, the estimated coefficient of the regression of ENV is significantly positive at the 1% level, indicating that the better the corporate environmental performance, the better the stock liquidity. The regression results in Column (3) of Table 3 show that the estimated coefficient of the regression of SOC is significantly positive at the 1% level, indicating that the better the corporate social responsibility performance, the better the stock liquidity. The results in column (4) of Table 3 show that the estimated coefficient of the regression of GOV is significantly positive at the 1% level, indicating that an improvement in corporate governance is beneficial to stock liquidity. In summary, a company’s ESG performance affects its performance in the capital market, and good ESG performance contributes to improving stock liquidity.

4.3 Robustness checks

The baseline regression results suggest that the better a firm’s ESG performance is, the higher its stock liquidity. To test the robustness of the regression results, we conducted the following robustness tests.

4.3.1 Alternative measurement for liquidity

To test the robustness of the baseline regression results, this study refers to Lesmond et al. (1999) and estimates the number of days with zero stock returns (zeros) using Eq. 4, which is used again as a liquidity proxy for the regression analysis, where

4.3.2 Alternative measurement for ESG performance

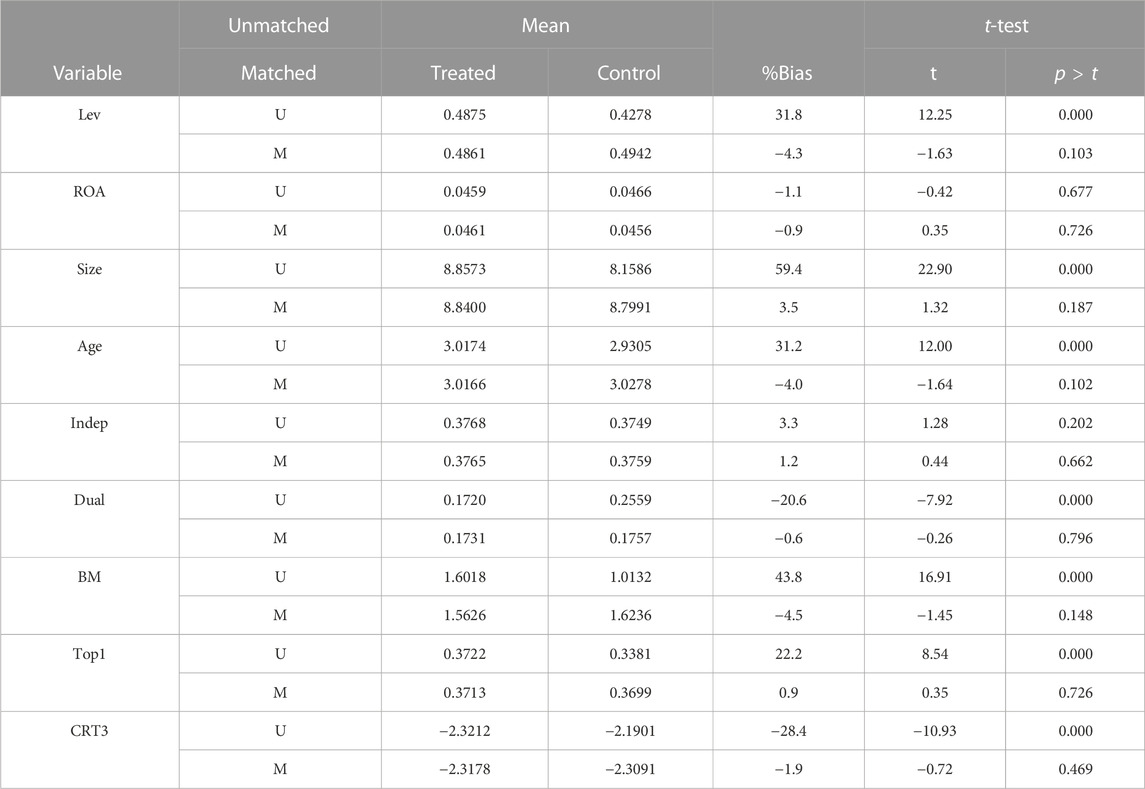

Given that corporate ESG performance is not derived from objective information such as corporate financial statements and that the fairness of index compilation by a single institution may be controversial, we use corporate ESG performance data published by Hexun (L.ESG2). The regression results are shown in Column (2) of Table 5. The results show that the regression coefficient of ESG performance and stock liquidity is 0.0105 and positively correlated at the 1% level, which indicates that the findings of this study are robust.

4.3.3 Controlling for individual fixed effects

Although the previous analysis in this study controlled for industry and annual fixed effects as unobservable firm-level factors may affect both ESG performance and stock liquidity, we controlled for individual fixed effects at the firm level and regressed again. The regression results are shown in Column (3) of Table 5. The results show that ESG performance remains significantly and positively correlated with stock liquidity, which is consistent with the previous results.

4.3.4 Sample selection bias

A company with good ESG performance may differ from other companies and have unique corporate characteristics in terms of financial level and industry characteristics. To address sample selection bias, this study was validated by propensity score matching (PSM). The test steps were as follows: first, the median ESG performance was used as the threshold to construct the experimental and control groups, and the control variables were used as covariates in the logit regression to calculate the propensity score value; then, the matched samples were paired according to the principle of nearest neighbour matching (1:4) based on the propensity score value; and finally, the matched samples were subjected to regression analysis. The balance test of the matched samples is shown in Table 4, which shows that the standardised deviations of all variables after matching are less than 5%, and the characteristic variables of the matched and control samples aren’t significantly different at the 10% level; thus, the parallel hypothesis is satisfied and the matching results are good. The matched regression results are shown in column (4) of Table 5, which shows that the regression coefficients of ESG performance and stock liquidity are positively correlated at the 1% level, indicating that ESG performance still contributes significantly to stock liquidity after controlling for the endogeneity problem arising from sample selection bias.

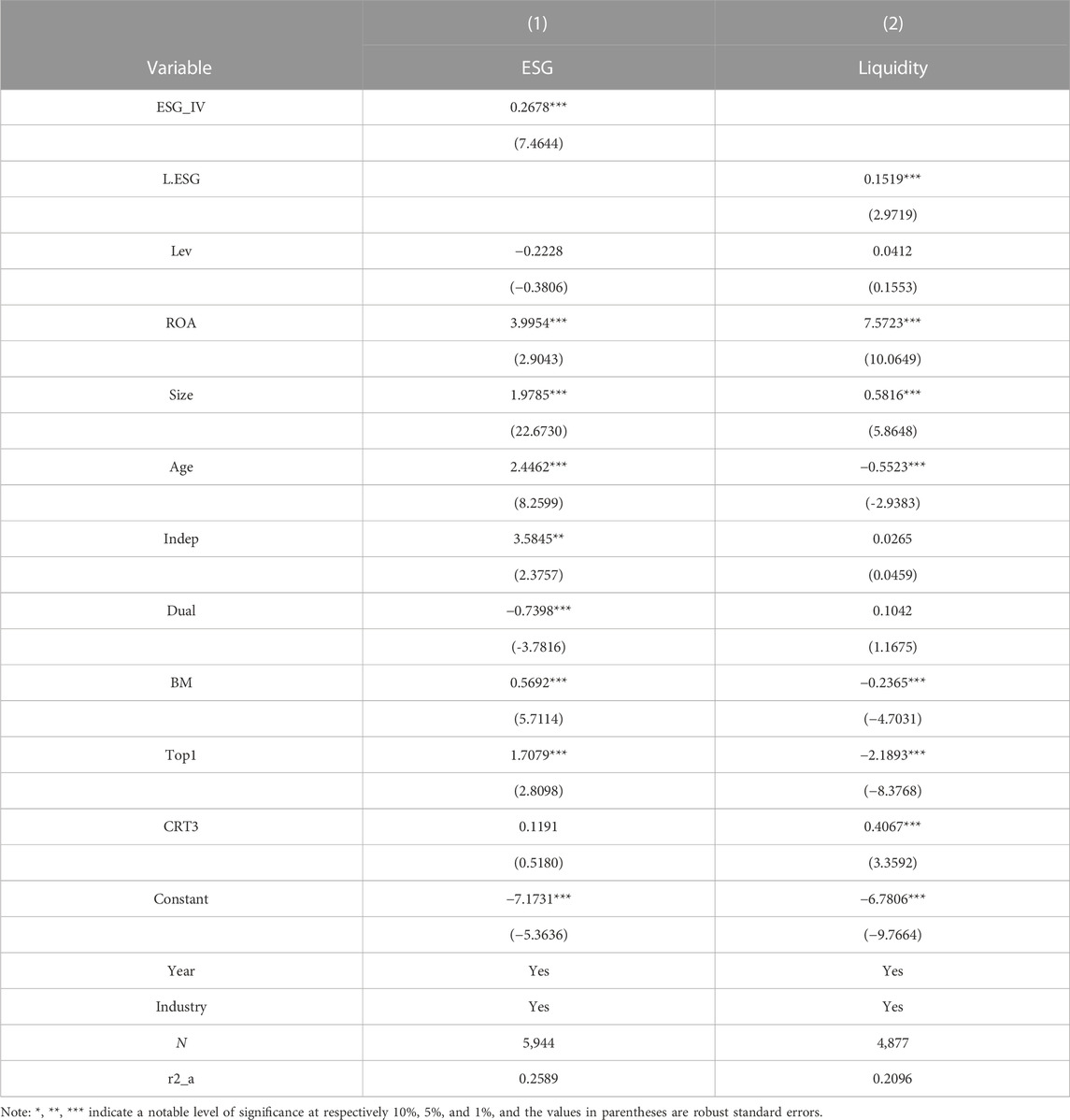

4.3.5 Instrumental variables method

A country’s institutions and culture have a significant impact on companies environmental protection, social responsibility fulfilment, and corporate governance. Traditional culture and historical values are important determinants of a company’s ESG performance. In China’s 5,000-year history, the 2,000-year-old Confucian culture is one of the most influential traditional cultures; it has had a significant impact on the formation of Chinese values and has long been used as a moral standard for individuals and organisations. The central ideas of “benevolence,” “righteousness,” “sincerity,” and “love” advocated by Confucianism are highly compatible with ESG philosophy, that is, enterprises should be responsible for the environment, society, and stakeholders. Therefore, the strength of the Confucian culture in the region where the firm is located has an impact on ESG performance and is not related to stock liquidity. The selection of the intensity of Confucian culture in the region where the firm is located as an instrumental variable meets the requirement of being correlated with endogenous variables and independent of the dependent variable. Since the academy is an important place for spreading Confucianism and since the Tang Dynasty, all state and county schools have set up Confucian temples, so to better address the endogeneity issue, we followed He et al. (2022) to use the number of Confucian temples within a 50 km radius of the firm’s location to measure the intensity of Confucian culture and use it as an instrumental variable for the firm’s ESG performance (ESG_IV) in a two-stage least squares regression, the results of which are shown in columns (1) and (2) of Table 6. Column (1) shows the regression results for the first stage, where the coefficients of the instrumental variable (ESG_IV) and ESG performance are significantly positive at the 1% level, indicating that the intensity of Confucian culture in the region is significantly and positively related to firms ESG performance. The p-value of the under-identification test (Kleibergen-Paap rk LM) statistic is 0, indicating that there is no problem with the under-identification of instrumental variables, while the value of the weak instrumental variable test (Kleibergen-Paap rk Wald F) statistic is 44.247, much larger than the 10% level threshold (16.38), indicating that there is no problem of weak instrumental variables. Column (2) shows the results of the second stage of the regression, where the coefficient of ESG performance is 0.1519, which is significantly positive at the 1% level and consistent with the baseline regression results. Therefore, the conclusion that ESG performance promotes corporate stock liquidity still holds after controlling for endogeneity using instrumental variables.

5 Further research

5.1 The impact of corporate ESG performance on stock liquidity: Based on the ownership

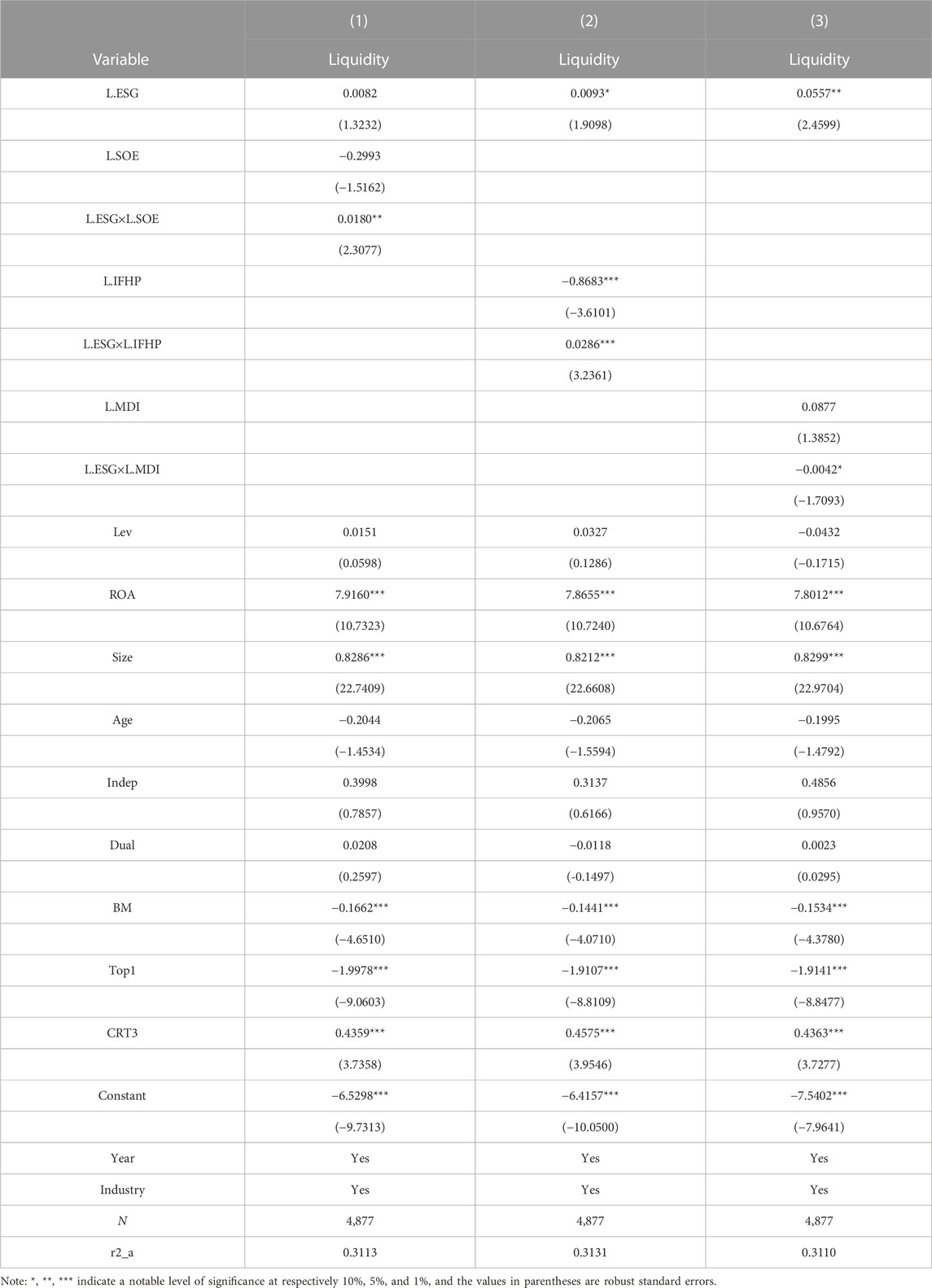

Ownership is the most typical corporate characteristic in the Chinese capital market context, and there are certain differences between state-owned and non-state-owned enterprises in terms of business objectives, social responsibility commitment, and political affiliation. On the one hand, as an important pillar of national economic development, state-owned enterprises have the dual mission of achieving economic development and fulfilling social responsibility and should take the initiative to increase ESG investment, actively assume social responsibility, and play an exemplary role in the construction of the ESG system. On the other hand, due to the advantage of access to policy resources and market financing, state-owned enterprises are better able to achieve a balance between economic and social benefits in the performance of ESG practices. This can ensure ESG sustainability and create the maximum value of ESG practices to enhance enterprise’s performance in the capital market. Therefore, this paper argues that the effect of the ESG performance of state-owned enterprises on stock liquidity will be stronger than non-state-owned enterprises. To verify whether the impact of corporate ESG performance on stock liquidity differs by ownership type, this study adds ownership (L.SOE) and the interaction term between ownership and ESG performance (L.ESG×L.SOE) to Eq. 1. According to Column {1) of Table 7, the coefficient of the interaction term between ESG performance and ownership is 0.0180 and is significant at the 5% level. Therefore, the positive contribution of corporate ESG performance to stock liquidity is more significant in state-owned enterprises.

5.2 The impact of corporate ESG performance on stock liquidity: Based on the nature of corporate pollution

Enterprises with different pollution characteristics are subject to different environmental regulatory pressures. This paper followed Liu et al. (2022) to classify the sample firms into heavily polluting and non-heavily polluting firms based on the “List of Listed Companies” Environmental Verification Industry Classification and Management developed by the Chinese Ministry of Environmental Protection in 2008. Compared with non-heavily polluting enterprises, heavily polluting enterprises are subject to more stringent environmental regulations and correspondingly higher environmental treatment costs. Due to the pressure of external regulations, heavily polluting enterprises pay more attention to ESG investment, actively take social responsibility, reduce environmental pollution, and promote the symbiosis of economic and environmental benefits. Additionally, heavily polluting enterprises policy environment, financing facilitation, market reputation, and corporate image are all relatively different from those of non-heavily polluting enterprises. To reverse their inherent image in the market and obtain good capital market evaluation and market performance, they need to pay more attention to improving ESG performance Therefore, compared with non-heavily polluting companies, heavily polluting companies have a stronger desire to increase ESG investment and seek to improve their reputation in the market by changing the perception of their heavy polluting nature, which is reflected in the increase of stock liquidity in the capital market. In this paper, we argue that the effect of the ESG performance of heavy polluters on stock liquidity is stronger than non-heavy polluters. To verify whether the impact of corporate ESG performance on stock liquidity differs by pollution type, we added pollution type (L.IFHP) and the interaction term between pollution type and ESG performance (L.ESG×L.IFHP) to Eq. 1. The results in Column (2) of Table 7 show that the regression coefficient of the interaction term between corporate ESG performance and pollution type is 0.0286 and is significantly positively correlated at the 1% level, indicating that the positive contribution of corporate ESG performance to stock liquidity is more significant among heavily polluting firms.

5.3 The impact of corporate ESG performance on stock liquidity: Based on the degree of marketization

Owing to the differences in marketisation processes in different regions of china, the role of the market in resource allocation also varies across regions. Generally, regions with a high degree of marketisation have a better legal environment, smoother information transmission, higher economic levels, and a lower degree of information asymmetry between investors and enterprises. However, in regions with a low degree of marketisation, the legal environment is poor and information asymmetry between investors and enterprises is higher. Therefore, the role of ESG in mitigating information asymmetry is more significant, and the value creation effect is correspondingly stronger in regions with low marketisation, whereas foreign investors are more likely to be influenced by companies ESG performance when making investment decisions. Summarizing the above, this paper argues that the effect of corporate ESG performance on stock liquidity is stronger in regions with low marketization. To test whether the impact of corporate ESG performance on stock liquidity differs according to the degree of marketisation, this study adds the degree of marketisation (L.MDI) and the interaction term between marketisation and ESG performance (L.ESG×L.MDI) to Eq. 1. We used the marketisation index of Wang et al. (2019) to measure the marketisation process. The results in column (3) of Table 7 show that the coefficient of the cross-product term is −0.0042 and significant at the 10% level, indicating that the contribution of corporate ESG performance to stock liquidity is more significant in regions with low marketability.

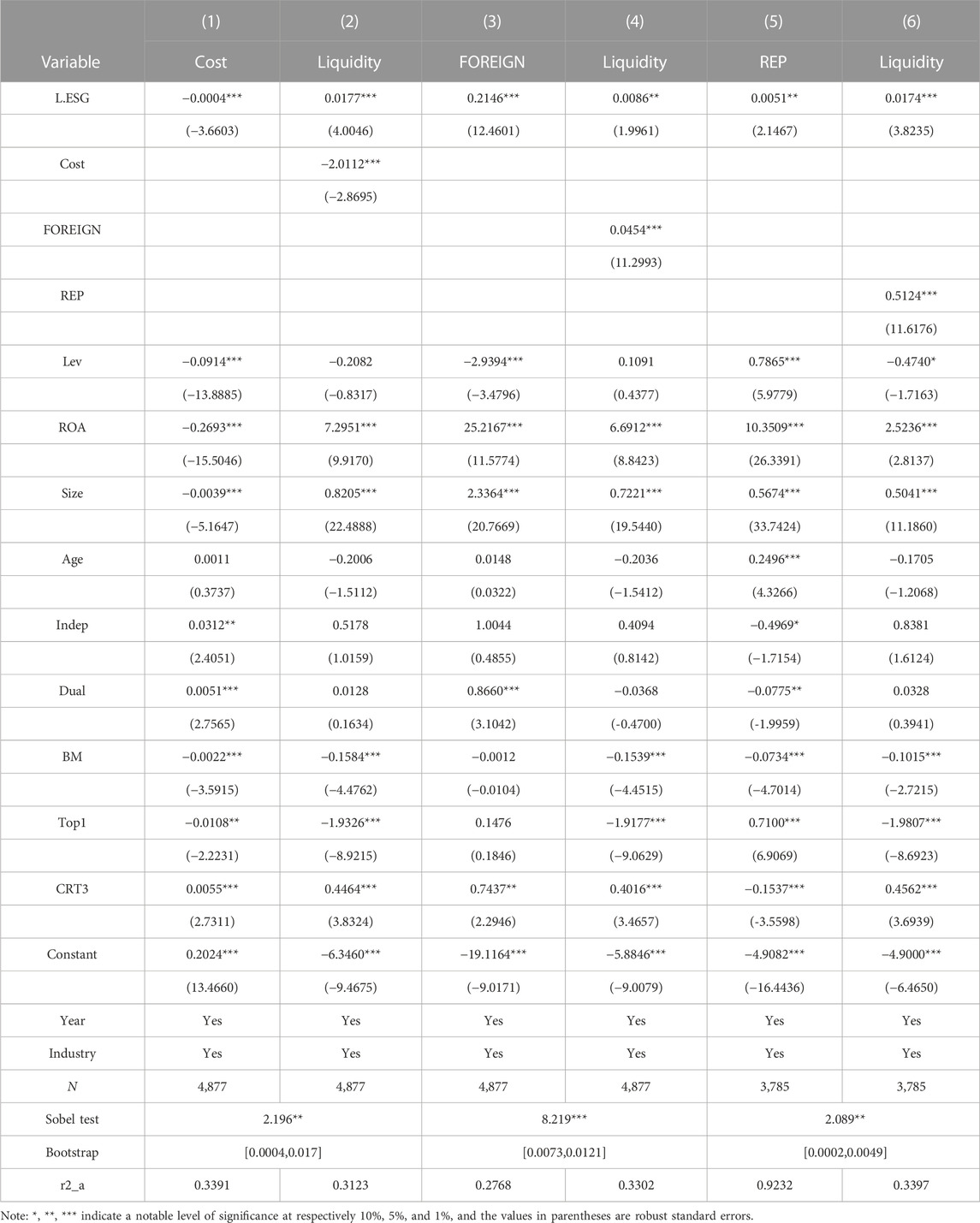

6 Mechanism test

Our analysis leads to an important conclusion that corporate ESG performance can significantly increase a firm’s stock liquidity. This section focuses on identifying the channel mechanism of the causal relationship between corporate ESG performance and stock liquidity, in conjunction with previous theoretical analyses. We selected three channel mechanisms: “agency cost,” “foreign ownership,” and “corporate reputation”. To portray the mechanistic paths through which corporate ESG performance affects stock liquidity, we constructed regression models (5) to (7) by drawing on the mediation effects testing process of Wen and Ye (2014). This test procedure is based on the stepwise regression method proposed by Baron and Kenny (1986) and combines the Sobel test and bootstrap method (drawing a self-help sample 1,000 times) to improve the reliability of the regression results.

We selected three sets of mediator variables (Mediator): the first set of variables is agency costs (Cost, the ratio of overhead to operating income) (Ang et al., 2000), which portrays the impact of corporate ESG performance at the corporate operational and governance levels; the second set of variables is foreign ownership (FOREIGN, the natural logarithm of the number of shares held by foreign shareholders among the top ten shareholders) (Chen et al., 2013), which portrays the impact of corporate ESG performance on investor behaviour; the third group of variables is corporate reputation (REP, the corporate reputation score is calculated by factor analysis, and then divided into ten groups according to the lowest to highest corporate reputation score, each group is assigned a value from 1 to 10) (Guan and Zhang, 2019), which portrays the impact of ESG performance on corporate image and market evaluation.

These three types of mediating variables were chosen for the following reasons. First, ESG practices can enhance corporate governance, alleviate the principal-agent problem, reduce the degree of information asymmetry, and enhance investor’s investment confidence, thus increasing expectations in the market and contributing to the improvement of stock liquidity. Second, ESG performance is one of the important factors for investors to make investment decisions. The higher the ESG performance, the easier it is to attract the attention of foreign investors, increase the proportion of foreign ownership, optimise the capital structure of enterprises, reduce risks, supervise the management to actively perform their duties, and create a herding effect in the capital market to improve stock liquidity. Third, the better the ESG performance, the higher the level of social responsibility of enterprises, which is conducive to the establishment of a good brand image and access to more external resources. It also helps companies expand their competitive advantage in the product market, influences investor’s decisions in the capital market, and promotes investor’s active trading, thereby enhancing stock liquidity. To assess whether the above three paths hold, we test them in a subsequent empirical analysis.

An important feature of ESG performance is that it significantly enhances information transparency and mitigates information asymmetry, thereby reducing agency costs. In Table 8, the regression coefficient of ESG performance on the agency cost variable (Cost) in Column (1) is −0.0004, significant at the 1% level, indicating that ESG performance, as a type of information disclosure, can effectively alleviate the principal-agent problem between owners and management, avoid opportunistic management behaviour, reduce agency costs, and provide conditions to promote investment. The regression coefficient between cost and stock liquidity in column (2) is −2.0112, significant at the 1% level, indicating that the reduction of agency costs contributes to the improvement of stock liquidity. This implies that corporate ESG practices can alleviate information asymmetry and reduce agency costs to some extent by disclosing corporate non-financial information and ultimately enhancing the level of stock liquidity. From another perspective, companies with better ESG performance can signal to the market that they have higher corporate governance ratings. By investing more in ESG practices, companies improve their ESG performance and promote governance, which helps reduce agency costs and enhance stock activity.

Columns (3) and (4) of Table 8 show the mechanism identification test for foreign shareholding. In Column (3), the regression coefficient between ESG performance and foreign shareholdings is 0.2146 and significant at the 1% level, implying that foreign investors prefer to invest in companies with good ESG performance. That is, the better the ESG performance, the higher the percentage of foreign shareholdings in the company. The further opening of China’s capital market will lead to an increasing number of foreign investors. Foreign investors, primarily institutional investors, increasingly regard ESG as a key driver of long-term growth. Consequently, foreign investors prioritise companies with good ESG performance in their investment decisions. Therefore, ESG performance can contribute to a large extent to the increase of foreign shareholding. Column (4) shows that the regression coefficient between foreign equity ownership and stock liquidity is significantly positive at the 1% level, indicating that foreign investors not only optimise the shareholding structure, improve governance, and enhance corporate value but also enhance the attractiveness of enterprises to other investors, forming a herding effect, generating co-investment behaviour, and promoting stock liquidity.

Finally, we test the mechanism by which ESG performance improves stock liquidity by affecting corporate reputation. Column (5) shows that corporate ESG performance and reputation are significantly positive at the 5% level, indicating that corporate ESG performance helps promote corporate reputation. In column (6), the coefficient of corporate reputation is 0.5124 and significant at the 1% level, which indicates that the higher the corporate reputation, the better the capital market performance. A good reputation is a unique resource possessed by an enterprise that makes it easier to attract talent, increase investors’ investment confidence, build higher customer loyalty, lower the threshold for enterprises to obtain various development resources from different stakeholders, and facilitate maintaining long-term excess profits and improving market positions, thus gaining competitive advantages. A company with a good reputation is bound to gain more recognition in the market, concentrated on the market’s pursuit of the company’s stock.

7 Conclusion

The ESG concept is highly compatible with China’s green development goals, and it has received widespread attention from all walks of life, with more and more domestic companies increasing their investment in ESG. Since scholars have focused on the role of corporate ESG performance in corporate innovation, investment efficiency, and financial performance, it is worthwhile exploring whether ESG performance can enhance corporate performance in the capital market and improve stock liquidity, thus realising the value creation of ESG practices. This study selects data from Chinese A-share listed companies from 2015 to 2020 as a sample to empirically test the impact of corporate ESG performance on stock liquidity and its mechanism of action. The research finds that: 1) Corporate ESG performance has a significant positive impact on stock liquidity; the better the corporate ESG performance, the better its active performance in the capital market and the higher the level of stock liquidity. The results of a series of robustness tests confirmed the findings of this study. 2) The positive effect of corporate ESG performance on stock liquidity is more significant among state-owned enterprises, heavily polluting enterprises, and enterprises in low-market regions. 3) The mechanism tests suggest that good ESG performance reduces agency costs, increases foreign ownership, and improves corporate reputation, thus activating stock trading and improving stock liquidity.

The above research findings help to gain a deeper understanding of the intrinsic mechanism of corporate ESG practices to improve capital market performance, and provide important insights for multiple parties, including governments, enterprises and investors, to promote the construction of ESG systems, increase ESG investment and promote sustainable economic development: first, the value creation effect of ESG practices helps mitigate agency costs, increase foreign ownership, and improve corporate reputation, ultimately improving the performance of firms in capital markets. Therefore, it is beneficial for companies to implement ESG concepts. Secondly, the government should improve ESG-supporting institutional measures for listed companies, especially to strengthen support for non-state enterprises, highly polluting enterprises, and enterprises with low marketization to enhance the vitality and optimize the resource allocation function of the capital market. Finally, investors should establish the ESG investment concept and fully consider corporate ESG performance when making investment decisions. While focusing on the financial performance of the company, they should also consider environmental, social, corporate governance, and other non-financial attributes of the company, which can help reduce investment risks and obtain sustainable returns.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, RC and YL; methodology, RC and YL; software, YL and RC; validation, YL and RC; formal analysis, YL and RC; investigation, YJ and JL; resources, RC, YJ, and YL; data curation, YL and JL; writing—original draft preparation, YL and RC; writing—review and editing, RC, YL, and YJ; visualization, YL and RC; supervision, YJ and JL; project administration, RC; funding acquisition, RC. All authors have read and agreed to the published version of the manuscript.

Funding

2021 Annual Topic of Guangzhou Philosophy and Social Science Planning (2021GZGJ08); Guangdong Province Philosophy and Social Sciences Planning Project (GD22XGL25).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Although the findings on the consequences of stock liquidity are not uniform (Amihud and Mendelson, 1988) (Benlemlih and Bitar, 2018), however, a large number of studies targeting the Chinese capital market have shown that stock liquidity has a positive effect on the efficiency of the capital market (Du et al., 2017) (Zhao et al., 2020). In practice, a series of major reforms by the Chinese government targeting the capital market, such as the equity division reform and the registration system reform, is conducive to promoting stock liquidity. Theoretically, there are differences in the mechanisms of stock liquidity due to the nature of property rights, institutional environment, and other aspects.

References

Alareeni, B. A., and Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. J. Corp. Gov. 20, 1409–1428. doi:10.1108/CG-06-2020-0258

Alexander, G. J., and Buchholz, R. A. (1978). Corporate social responsibility and stock market performance. J. Acad. Manage. J. 21, 479–486. doi:10.5465/255728

Amihud, Y., and Mendelson, H. (1986). Asset pricing and the bid-ask spread. J. J. Financ. Econ. 17, 223–249. doi:10.1016/0304-405X(86)90065-6

Amihud, Y., and Mendelson, H. (1988). Liquidity, volatility, and exchange automation. J. J. Acc. Audit. Fina. 3, 369–395.

Ang, J. S., Cole, R. A., and Lin, J. W. (2000). Agency costs and ownership structure. J. J. Financ. 55, 81–106. doi:10.1111/0022-1082.00201

Atan, R., Alam, M. M., Said, J., and Zamri, M. (2018). The impacts of environmental, social, and governance factors on firm performance: Panel study of Malaysian companies. J. Manag. Environ. Qual. 29, 182–194. doi:10.1108/MEQ-03-2017-0033

Barnea, A., and Rubin, A. (2010). Corporate social responsibility as a conflict between shareholders. J. J. Bus. Ethics. 97, 71–86. doi:10.1007/s10551-010-0496-z

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. J. Pers. Soc. Psychol. 51, 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bekaert, G., and Harvey, C. R. (2000). Foreign speculators and emerging equity markets. J. J. Financ. 55, 565–613. doi:10.1111/0022-1082.00220

Bekaert, G., Harvey, C. R., and Lumsdaine, R. L. (2002). Dating the integration of world equity markets. J. J. Financ. Econ. 65, 203–247. doi:10.1016/s0304-405x(02)00139-3

Benlemlih, M., and Bitar, M. (2018). Corporate social responsibility and investment efficiency. J. J. Bus. Ethics. 148, 647–671. doi:10.2139/ssrn.2566891

Bhide, A. (1993). The hidden costs of stock market liquidity. J. J. Financ. Econ. 34, 31–51. doi:10.1016/0304-405x(93)90039-e

Brammer, S., and Pavelin, S. (2004). Building a good reputation. J. Eur. Manag. J. 22, 704–713. doi:10.1016/j.emj.2004.09.033

Brammer, S., and Pavelin, S. (2006). Voluntary environmental disclosures by large UK companies. J. J. Bus. Finan. Acc. 33, 1168–1188. doi:10.1111/j.1468-5957.2006.00598.x

Cerqueti, R., Ciciretti, R., Dalò, A., and Nicolosi, M. (2021). ESG investing: A chance to reduce systemic risk. J. J. Financ. Stabil. 54, 100887. doi:10.1016/j.jfs.2021.100887

Chen, Y. C., Hung, M., and Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: Evidence from China. J. J. Acc. Econ. 65, 169–190. doi:10.1016/j.jacceco.2017.11.009

Chen, Z., Du, J., Li, D., and Ouyang, R. (2013). Does foreign institutional ownership increase return volatility? Evidence from China. J. J. Bank. Financ. 37, 660–669. doi:10.1016/j.jbankfin.2012.10.006

Cheng, M. M., Green, W. J., and Ko, J. C. W. (2015). The impact of strategic relevance and assurance of sustainability indicators on investors' decisions. J. Audit. 34, 131–162. doi:10.2308/AJPT-50738

Chordia, T., Sarkar, A., and Subrahmanyam, A. (2005). An empirical analysis of stock and bond market liquidity. J. Rev. Financ. Stu. 18, 85–129. doi:10.1093/RFS/HHI010

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. J. Acad. Manage. Rev. 20, 92–117. doi:10.2307/258888

Dang, T. L., Nguyen, T. H., Tran, N. T. A., and Vo, T. T. A. (2018). Institutional ownership and stock liquidity: International evidence. J. Asia-Pac. J. Financ. St. 47, 21–53. doi:10.1111/ajfs.12202

Ding, M., Nilsson, B., and Suardi, S. (2017). Foreign institutional investment, ownership, and liquidity: Real and informational frictions. J. Financ. Rev. 52, 101–144. doi:10.1111/fire.12126

Dowling, G. (2006). How good corporate reputations create corporate value. J. Corp. Reput. Rev. 9, 134–143. doi:10.1057/palgrave.crr.1550017

Du, J. M., Lv, H., and Wu, F. (2017). Stock liquidity, split share structure reform and enterprise innovation. J. Ind. Econ. Rev. 8, 34–44. doi:10.14007/j.cnki.cjpl.2017.06.003

El, G. S., Guedhami, O., Kwok, C. C. Y., and Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? J. J. Bank. Financ. 35, 2388–2406. doi:10.2139/ssrn.1540299

Eliwa, Y., Aboud, A., and Saleh, A. (2021). ESG practices and the cost of debt: Evidence from EU countries. J. Crit. Perspect. Accoun. 79, 102097. doi:10.1016/j.cpa.2019.102097

Ellili, N. O. D. (2022). Impact of ESG disclosure and financial reporting quality on investment efficiency. J. Corp. Gov. 22, 1094–1111. doi:10.1108/CG-06-2021-0209

Fang, V. W., Tian, X., and Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? J. J. Financ. 69, 2085–2125. doi:10.1111/jofi.12187

Flammer, C. (2015). Does product market competition foster corporate social responsibility? Evidence from trade liberalization. J. Strateg. Manage. J. 36, 1469–1485. doi:10.1002/smj.2307

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. J. Sustain. Financ. Inv. 5, 210–233. doi:10.1080/20430795.2015.1118917

Ge, G., Xiao, X., Li, Z., and Dai, Q. (2022). Does ESG performance promote high-quality development of enterprises in China? The mediating role of innovation input. J. Sustain. 14, 3843. doi:10.3390/su14073843

Glosten, L. R., and Milgrom, P. R. (1985). Bid, ask and transaction prices in a specialist market with heterogeneously informed traders. J. J. Financ. Econ. 14, 71–100. doi:10.1016/0304-405x(85)90044-3

Goss, A., and Roberts, G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. J. J. Bank. Financ. 35, 1794–1810. doi:10.1016/j.jbankfin.2010.12.002

Grossman, S. J., and Miller, M. H. (1988). Liquidity and market structure. J. J. Financ. 43, 617–633. doi:10.1111/j.1540-6261.1988.tb04594.x

Guan, K. L., and Zhang, R. (2019). Corporate reputation and earnings management: Efficient contract theory or rent-seeking theory. J. Acc. Res., 59–64.

Guo, M., and Zheng, C. (2021). Foreign ownership and corporate social responsibility: Evidence from China. J. Sustain. 13, 508. doi:10.3390/su13020508

Haleblian, J. J., Pfarrer, M. D., and Kiley, J. T. (2017). High-reputation firms and their differential acquisition behaviors. J. Strateg. Manage. J. 38, 2237–2254. doi:10.1002/smj.2645

He, F., Du, H., and Yu, B. (2022). Corporate ESG performance and manager misconduct: Evidence from China. J. Int. Rev. Financ. Anal. 82, 102201. doi:10.1016/J.IRFA.2022.102201

Lang, M., Lins, K. V., and Maffett, M. (2012). Transparency, liquidity, and valuation: International evidence on when transparency matters most. J. J. Acc. Res. 50, 729–774. doi:10.1111/j.1475-679X.2012.00442.x

Lesmond, D. A., Ogden, J. P., and Trzcinka, C. A. (1999). A new estimate of transaction costs. J. Rev. Financ. Stud. 12, 1113–1141. doi:10.1093/rfs/12.5.1113

Li, Y., Gong, M., Zhang, X. Y., and Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: The role of CEO power. J. Brit. Acc. Rev. 50, 60–75. doi:10.1016/j.bar.2017.09.007

Li, Z., Liao, G., and Albitar, K. (2020). Does corporate environmental responsibility engagement affect firm value? The mediating role of corporate innovation. J. Bus. Strateg. Environ. 29, 1045–1055. doi:10.1002/bse.2416

Li, Z., Zou, F., and Mo, B. (2021). Does mandatory CSR disclosure affect enterprise total factor productivity? J. Econ. Res-Ekon. Istraz. 35, 4902–4921. doi:10.1080/1331677X.2021.2019596

Lipson, M. L., and Mortal, S. (2009). Liquidity and capital structure. J. J. Financ. Mark. 12, 611–644. doi:10.1016/j.finmar.2009.04.002

Liu, S. (2015). Investor sentiment and stock market liquidity. J. J. Behav. Financ. 16, 51–67. doi:10.1080/15427560.2015.1000334

Liu, Y., Failler, P., and Ding, Y. (2022). Enterprise financialization and technological innovation: Mechanism and heterogeneity. J. PloS One. 17, e0275461. doi:10.1371/journal.pone.0275461

Ma, J., Gao, D., and Sun, J. (2022). Does ESG performance promote total factor productivity? Evidence from China. J. Front. Ecol. Evol. 10, 1144. doi:10.3389/fevo.2022.1063736

Maaloul, A., Zéghal, D., Ben Amar, W., and Mansour, S. (2021). The effect of environmental, social, and governance (ESG) performance and disclosure on cost of debt: The mediating effect of corporate reputation. J. Corp. Reput. Rev. 1, 1–18. doi:10.1057/s41299-021-00130-8

Mahoney, L., and Roberts, R. W. (2007). Corporate social performance, financial performance and institutional ownership in Canadian firms. J. Acc. Forum. 31, 233–253. doi:10.1016/j.accfor.2007.05.001

Miralles-Quirós, M. M., Miralles-Quirós, J. L., and Valente, Gonçalves. L. M. (2018). The value relevance of environmental, social, and governance performance: The Brazilian case. J. Sustain. 10, 574. doi:10.3390/su10030574

Niessen, A., and Ruenzi, S. (2010). Political connectedness and firm performance: Evidence from Germany. J. Ger. Econ. Rev. 11, 441–464. doi:10.1111/j.1468-0475.2009.00482.x

Roberts, P. W., and Dowling, G. R. (2002). Corporate reputation and sustained superior financial performance. J. Strateg. Manage. J. 23, 1077–1093. doi:10.1002/smj.274

Sassen, R., Hinze, A. K., and Hardeck, I. (2016). Impact of ESG factors on firm risk in Europe. J. J. Bus. Econ. 86, 867–904. doi:10.1007/s11573-016-0819-3

Shakil, M. H. (2021). Environmental, social and governance performance and financial risk: Moderating role of ESG controversies and board gender diversity. J. Resour. Policy. 72, 102144. doi:10.1016/j.resourpol.2021.102144

Siew, R. Y., Balatbat, M. C., and Carmichael, D. G. (2016). The impact of ESG disclosures and institutional ownership on market information asymmetry. J. Asia-Pac. J. Acc. E. 23, 432–448. doi:10.1080/16081625.2016.1170100

Stelner, C., Klein, C., and Zwergel, B. (2015). Corporate social responsibility and Eurozone corporate bonds: The moderating role of country sustainability. J. J. Bank. Financ. 59, 538–549. doi:10.1016/j.jbankfin.2015.04.032

Tadelis, S. (1999). What's in a name? Reputation as a tradeable asset. J. Am. Econ. Rev. 89, 548–563. doi:10.1257/aer.89.3.548

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: The mediating role of financial constraints and managers' environmental awareness. J. Technol. Soc. 68, 101906. doi:10.1016/j.techsoc.2022.101906

Velte, P. (2017). Does ESG performance have an impact on financial performance? Evidence from Germany. J. J. Glob. Res. 8, 169–178. doi:10.1108/jgr-11-2016-0029

Wang, X. L., Fan, G., and Hu, L. P. (2019). China marketization index report by Province. Beijing: Social Science Literature Press.

Wen, Z., and Ye, B. (2014). Analyses of mediating effects: The development of methods and models. J. Adv. Psychol. Sci. 22, 731. doi:10.3724/sp.j.1042.2014.00731

Yu, W., and Zheng, Y. (2020). Does CSR reporting matter to foreign institutional investors in China? J. J. Int. Acc. Audit. 40, 100322. doi:10.1016/j.intaccaudtax.2020.100322

Keywords: ESG performance, stock liquidity, capital market vitality, agency costs, foreign ownership, corporate reputation

Citation: Chen R, Liu Y, Jiang Y and Liu J (2023) Does ESG performance promote vitality of capital market? Analysis from the perspective of stock liquidity. Front. Environ. Sci. 11:1132845. doi: 10.3389/fenvs.2023.1132845

Received: 28 December 2022; Accepted: 15 March 2023;

Published: 23 March 2023.

Edited by:

Haiyue Liu, Sichuan University, ChinaReviewed by:

Roni Bhowmik, Guangdong University of Foreign Studies, ChinaDi Gao, Southwestern University of Finance and Economics, China

Zhenghui Li, Guangzhou University, China

Copyright © 2023 Chen, Liu, Jiang and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yirong Liu, OTA2MDMyOTk0QHFxLmNvbQ==

Ran Chen

Ran Chen Yirong Liu

Yirong Liu Yalin Jiang

Yalin Jiang Jiamin Liu

Jiamin Liu