- 1Renmin Business School, Renmin University of China, Beijing, China

- 2Postdoctoral Workstation, CIC Research Institute, China Investment Corporation, Beijing, China

- 3PBC School of Finance, Tsinghua University, Beijing, China

- 4State Grid Integrated Energy Planning and D&R Institute, Beijing, China

With the growing popularity of environmental, social, and governance (ESG), ESG performance is becoming increasingly important in investors’ decisions about firms. Capital market liberalization brings in more sophisticated and mature foreign investors who are more interested in corporate ESG performance. We investigate whether capital market liberalization improves corporate ESG disclosure using Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect as exogenous shocks. By compiling a comprehensive dataset of Chinese A-share listed firms from 2006 to 2019 and manually calculating the ESG disclosure score, we find that the mainland-HK Stock Connect scheme enhances corporate ESG disclosure. This effect is heterogeneous for firms with different external environments, corporate characteristics, and environmental performance. The results suggest that the competition effect dominates the role of capital market liberalization in improving ESG disclosure of mainland listed firms and firms disclose their ESG practices to cater to the need of investors. This paper enriches the empirical research on the impact of capital market liberalization on firm behavior and performance and provides a theoretical basis for strengthening regulations in ESG information disclosure.

1 Introduction

As the world develops, environmental, social, and governance (ESG) has emerged as an important indicator of sustainable development, and ESG investment (also known as “socially responsible investing”) has become an important investment strategy. In developed capital markets, stakeholders’ interests are widely concerned, and investors will consider a firm’s ESG performance in an integrated manner in their investment decisions. In contrast, for emerging capital markets like China’s A-shares market, investors tend to care more about financial performance at the expense of other aspects and pay less attention to corporate social responsibility. As China moves into a new stage of development, laws, and rules are being improved, regulation is being increased and the capital market is gradually opening up. Corporate social responsibility, corporate governance, and environmental protection have also gradually attracted the attention of investors, the government, and the public. Exploring the influencing factors of ESG disclosure has thus become an important research topic. This paper examines the impact of capital market liberalization on corporate ESG disclosure based on China’s unique capital market environment.

Capital market liberalization is an important decision by a country’s government to allow foreign investors to purchase shares in its own capital market (Henry, 2000). It is undoubtedly one of the most critical external institutional environments and may have important implications for corporate ESG disclosure by increasing the participation and monitoring of foreign investors (Bae et al., 2006; Kim et al., 2010). Foreign investors as competitors bring new investment ideas that may change the view and behavior of mainland investors, and corporate information disclosure is the main way for external stakeholders to understand the business situation of firms. As a consequence, firms may be inclined to disclose more firm-specific information so as to meet the new demands of investors and the public. It has been shown that investment perceptions from mature capital markets improve corporate disclosure (Gul et al., 2010), but existing studies on capital market liberalization and corporate behavior have focused on corporate financial information disclosure, and research on the impact of capital market liberalization on corporate non-financial disclosure is scarce. The particular reason for this might be the lack of corresponding research data and exogenous shocks. China’s unique institutional context and capital market regulatory events provide a relatively clean exogenous environment for research.

China has been implementing capital market liberalization, one of the main elements of China’s open-door policy, to promote the development of the Chinese economy and the world economy. On 10 April 2014, the CSRC officially approved the Shanghai-Hong Kong Stock Connect pilot. On 17 November 2014, the Shanghai-Hong Kong Stock Connect was officially launched with 568 stocks in the first batch. On 5 December 2016, the Shenzhen-Hong Kong Stock Connect was officially launched. The Stock Connect is a cross-boundary investment channel that connects the Shanghai, Shenzhen, and Hong Kong stock exchanges, allowing qualified mainland China investors to access eligible Hong Kong shares as well as Hong Kong and overseas investors to trade eligible A-shares subject to a certain amount of daily quota. China’s securities regulators work to expand the Stock Connect scheme to help investors in one market to trade shares in others. Prior to the Stock Connect, Qualified Foreign Institutional Investors (QFII) were the main channel for foreign investors to enter China’s A-share capital market. However, the QFII scheme imposes restrictions on investment thresholds and investment quotas. Moreover, QFII was launched in 2002, when ESG investment was not popular. Compared with the QFII scheme, the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect schemes substantially reduce the restrictions on foreign investors, and more foreign investors get to participate in the mainland market, thus having a greater impact on China’s capital market and even corporate behavior.

As for ESG disclosure, there are no official or industry principles for corporate ESG disclosure in mainland China’s capital market, despite the relatively standardized disclosure of corporate financial information. It was not until September 2018, when the China Securities Regulatory Commission (CSRC) revised the Code of Corporate Governance for Listed Companies in China, that a chapter on stakeholders, environmental protection, and social responsibility was added, stipulating that listed firms should disclose environmental information (E), fulfill social responsibilities such as poverty alleviation (S), and corporate governance-related information (G) in accordance with laws and regulations and the requirements of relevant authorities. Nevertheless, ESG elements have long been receiving attention from regulators. In January 2006, a revised version of the Companies Law was implemented, bringing the fulfillment of corporate social responsibility (CSR) to the legal level. In 2008, the Shanghai and Shenzhen exchanges issued successive notices mandating listed firms in four sectors, including SSE Governance, SSE Finance, SSE Overseas, and SZSI 100, to publish CSR reports from 2009 onwards, while encouraging other types of listed firms to voluntarily disclose CSR information. CSR-related contents include the protection of creditors, employees, suppliers, customers, and consumers, as well as environmental protection, sustainable development, product safety, and charitable activities. Li et al. (2022) reveal that the CSR mandatory disclosure can significantly improve the total factor productivity of enterprises on the whole, and this effect has the characteristics of long-term and dynamic decline. However, due to the as-yet imperfect ESG-related system and supporting measures, the content of ESG disclosure is actually determined independently by the firms themselves. This gives us the opportunity to rate the ESG performance of firms based on whether they disclose ESG-related information and how much they disclose to examine the ESG performance of different firms.

We empirically examine the impact of capital market liberalization on corporate ESG disclosure using a sample of A-share Chinese listed firms from 2006–2019 and using Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect as exogenous shocks. The basic results show that the implementation of the mainland-HK Stock Connect facilitates the disclosure of corporate ESG information, indicating that the opening of the capital market brings in foreign investors who are more concerned about ESG investment and require more information disclosure. Firms take the initiative to send more positive signals to attract resources, which is in accordance with catering theory. We also examine whether the effect of capital market liberalization on ESG disclosure varies by ESG pillars. Results show that capital market liberalization mainly promotes the disclosure of environmental and social information.

We further analyze the mechanism of the effect of capital market liberalization on corporate ESG information disclosure by conducting heterogeneous analyses. The mainland-HK Stock Connect may lead mainland listed firms to pay attention to ESG information disclosure through two channels: the monitoring effect, where foreign investors make it difficult for firms to manipulate information by monitoring corporate behavior, and the competition effect, where increased market competition and stringent requirements prompt firms to enhance information disclosure. Unlike corporate governance or non-compliance, external regulation of ESG disclosure is relatively weak, and corporate decisions are less constrained. Enhanced ESG implies increased disclosure costs, besides the possible benefits of attracting foreign investors. Firms would weigh the pros and cons to maximize their utility. The lower the information costs borne by firms, the more likely they are to enhance their disclosure. The more attention a firm receives from foreign investors, the stronger the incentive to increase information disclosure to obtain more benefits. We divide the sample firms into sub-samples according to the external environment, corporate characteristics, and environmental performance. The environment heterogeneous analyses show that capital market liberalization is more effective in promoting ESG information disclosure for firms with a more transparent information environment, firms with a more pressured institutional environment, and firms with QFII before the Stock Connect scheme. The heterogeneous analyses among firms with different characteristics and performances show that capital market liberalization is more effective in promoting ESG information disclosure for large firms, firms that do not implement CEO duality, firms in non-heavy pollution industries, and firms with better environmental performance. Our results support the basic idea of catering theory and provide empirical evidence for the competition effect of capital market liberalization.

Our paper mainly contributes to two strands in the literature. First, it extends the study of capital market liberalization on corporate behavior. Existing research demonstrates that capital market liberalization relaxes restrictions on capital flows and allows foreign investors to conduct market transactions and thus play their role in influencing corporate behavior (Zhong and Lu, 2018). For example, Zou et al. (2019) find that capital market liberalization increases the cost of violation for firms by improving the information environment or optimizing the governance structure. Zhu and Yi (2020) discover that the Shanghai-Hong Kong Stock Connect improves corporate innovation by alleviating managers’ career worries and restraining managers’ short-sighted behavior. Foreign investors can gain access to the decision-making power of the investee firms through market transactions, and then influence corporate by exercising their decision-making power (Fernandes and Ferreira, 2008; Aggarwal et al., 2011). However, the extant literature on the effect of capital market liberalization has mainly been on documenting the foreign investor monitoring role in corporate financial decisions, such as the controlling shareholders’ investment decisions (Park et al., 2016), real earnings management (Gu et al., 2022), and financial reporting quality (Kim et al., 2020). There is little research on the impact of foreign investors on corporate non-financial information disclosure. This paper examines the effect of capital market liberalization from the perspective of corporate ESG disclosure, bridging the gap in this area. Also, this paper takes advantage of China’s unique institutional background and capital market environment, uses the natural experiments of Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, and thus provides a new research environment for capital market opening-related studies.

Second, our study extends the research on ESG information disclosure. Generally speaking, firms disclose ESG-related information to optimize equity compensation, facilitate capital market transactions, reduce the cost of legal proceedings, send signals, and so on. The factors influencing corporate ESG information disclosure can be summarized into three areas: corporate characteristics, stakeholders’ needs, and the external macro environment. Firm characteristics, such as firm size (Trotman and Bradley, 1981; Cornier and Magnam, 2003), ownership structure (Roberts, 1992; Cornier and Magnam, 2003), risk characteristics (Trotman and Bradley, 1981; Lang and Lundholm, 2000; Du and Wen, 2007), industry characteristics (Walker and Howard, 2002; Gill, 2008), corporate performance (Becchetti et al., 2008), and corporate resources (Luo et al., 2015), have been proven to strongly influence the ESG disclosure. In addition to corporate characteristics, the demands of stakeholders also affect corporate ESG disclosure (Tilt, 1994; Willis, 2003; Knox et al., 2005). The greater the power of stakeholders, the greater the tendency of firms to disclose more social responsibility information (Ullmann, 1985). Furthermore, external pressure is a non-negligible factor that shapes corporate ESG behavior. External macro factors include legal requirements (Epstein and Freedman, 1994), political environment (Patten, 1992), cultural background (Hope, 2003; Van der Laan Smith et al., 2005), and institutional and market environments (Jia and Liu, 2014). Firms are required to act in compliance with laws and regulations. As the information environment becomes richer, the role of culture and governance in regulating corporate behavior becomes increasingly important. For example, Liu et al. (2022) find that China’s Air Pollution Prevention and Control Action Plan promote energy efficiency improvement. This paper investigates the impact of the mainland-HK Stock Connect on ESG disclosure and its mechanism, which enriches the research related to the motivation of corporate ESG disclosure.

From a practical perspective, this paper contributes to a better understanding of the impact of capital market liberalization. It also provides empirical evidence on how to promote the ESG investment concept as a consensus and encourage firms to actively assume social responsibility. Openness, integration, and interconnection are the inevitable trends of economic development. However, whether this trend can effectively contribute to the sustainable development of firms and how it affects business decisions is a question worth studying. This paper argues that capital market liberalization can increase the importance of ESG for enterprises, and its mechanism of action is mainly manifested as a competitive effect rather than a monitoring effect. Therefore, regulators need to pay more attention to those firms with poor performance and encourage them to take an active part in ESG. Local government should work to create a more transparent information environment. The findings of this paper could serve as a reference for policy-making authorities. It also provides valuable insights for regulators to build a predictable international regulatory environment for further high-level opening of China’s capital market to the outside world.

The remainder of our paper proceeds as follows. Section 2 develops the research hypotheses and describes the data selection and model design. Section 3 presents the baseline results and mechanism analysis, and Section 4 shows a series of robustness tests. The final section includes concluding remarks and policy implications.

2 Research scheme

2.1 Hypothesis development

The mainland-HK Stock Connect may promote ESG information disclosure through two mechanisms. First is the monitoring effect. Investors in developed capital markets have advantages in terms of experience and technology and have stronger information acquisition and utilization capabilities (Li et al., 2004). They can reflect the information they obtain in stock prices, thereby improving capital market efficiency (Zhong and Lu, 2018). They also are more capable to identify abnormal corporate behavior, which makes it more difficult for mainland listed firms to manipulate information (Ferreira and Matos, 2008; Aggarwal et al., 2011). Therefore, by improving the information environment or optimizing the governance structure, capital market liberalization promotes the listed firms to improve ESG information disclosure. The second is the competition effect (Ruan et al., 2021). The integration of the mainland capital market and the Hong Kong capital market has intensified the competition among listed firms, meanwhile, Hong Kong’s capital market as a more mature market financial system has also put forward more stringent requirements on information disclosure of listed firms (Guo et al., 2018). Firms entering the Stock Connect list face more competitive pressure and are more motivated to improve information disclosure.

Besides, incremental information from voluntary corporate non-financial disclosures can send positive signals to foreign investors and attract external capital inflows (Titman and Trueman, 1986; Beatty, 1989). Chen and Xie (2022) find that ESG disclosure has a favorable effect on corporate financial performance, and investors with ESG preferences exert a substantial moderating effect on the link between ESG disclosure and financial performance connection. Ceccarelli et al. (2022) examine the ESG disclosure of institutional investors and find that voluntary ESG disclosure by institutional investors improves capital allocation. Li et al. (2020) state that corporate environmental responsibility affects firm value. Therefore, firms have the incentive to cater to investors to voluntarily enhance ESG disclosure.

However, the direct beneficiaries of corporate ESG performance are mainly people in the same geographic area as the firm, such as creditors, employees, suppliers, customers, consumers, and the public who benefit from environmental and charitable activities. Constrained by geographical distance, foreign investors cannot directly benefit from ESG performance. Moreover, corporate engagement in ESG usually yields long-term benefits. If foreign investors seek short-term profits and focus more on financial performance instead of ESG performance, then firms would devote more resources to projects that deliver short-term financial benefits. Li and Han (2014) find that firms with good performance attract investment from QFII, but QFII participation does not enhance the value of the firms. Once a firm’s short-term performance declines, foreign investors looking for short-term profits may express their dissatisfaction by “voting with their feet” (Parrino et al., 2003; Admati and Pfleiderer, 2009). To accommodate foreign investors, firms may even lower their ESG disclosures to improve short-term financial performance. In addition, the Stock Connect scheme still imposes restrictions on the shareholding ratio of Hong Kong investors, making it less likely for these investors to participate in corporate governance by dispatching directors. They primarily play a role by influencing corporate behavior through the capital market and rely more on public disclosure than domestic investors. Although they are good at information mining, their cost of acquiring information is relatively high as the quality of disclosure of listed firms in the mainland capital market remains poor (Callen et al., 2005). Institutional differences, cultural differences, and regulatory differences among different capital markets further increase the information-gathering costs for foreign investors. To achieve better communication with foreign investors, listed companies may use private communication channels to win the trust of foreign investors, and the quality of public information disclosure will not increase or may even decrease.

Based on the above analysis, the impact of capital market liberalization on ESG information disclosure of firms is a topic that needs further exploration and empirical testing. For one thing, foreign investors may bring ESG investment philosophies and require firms to intensify ESG information disclosure. For another thing, foreign investors cannot benefit from ESG directly because of the geographical distance and may pursue short-term profits, resulting in little or even a negative impact on corporate ESG information disclosure. This paper empirically examines the impact of foreign investors on ESG disclosure using the mainland-HK Stock Connect as an exogenous shock and proposes two competing research hypotheses.

Hypothesis A: After the implementation of the mainland-HK Stock Connect, firms will increase their ESG disclosure.

Hypothesis B: After the implementation of the mainland-HK Stock Connect, ESG disclosure will not be affected or even be negatively affected.

2.2 Materials and methods

2.2.1 Data source and sample selection

The main sample in this paper includes all Chinese A-share listed firms from 2006 to 2019 since Chinese listed firms start to disclose ESG-related information in 20061. After removing firms in the financial industry, ST or *ST firms, and firms with missing values, we get 1045 listed firms, 6814 firm*year observations in total. To avoid the interference of extreme values, we perform 1% winsorize processing on all continuous variables. The ESG disclosure data come from the Chinese listed firm social responsibility research database in the China Stock Market and Accounting Research (CSMAR) database, and the remaining data are either extracted from the CSMAR database or the CNRDS database.

2.2.2 Model construction and variable description

The Stock Connect scheme, which links the mainland and Hong Kong markets, is an interconnection mechanism that allows investors to buy and sell stocks listed on the counterparty’s exchanges through securities firms or brokers. It includes two cross-boundary investment channels that were implemented at different times, the Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect. These two schemes determine the list of target stocks in batches, making the target stocks enter the experimental list at different times and are in a dynamic change of being transferred in and out. Because of that, it is not feasible to set the experimental period variable according to the classic DID model. To explore the impact of the Stock Connect, we draw on the time-varying DID method exploited by (Beck et al., 2010), and constantly adjust the list of the target stocks according to the changes such as the transfer out or new entry of the target stocks after the implementation of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect. The model is as follows.

where Disclosureit represents the ESG disclosure level of firm i in year t. It is calculated by scoring the disclosure of ESG for each firm with reference to Hope et al. (2016). The ESG-related contents include shareholder rights protection, creditor rights protection, employee rights protection, supplier rights protection, customer and consumer rights protection, environmental and sustainable development, public relations and social welfare undertakings, social responsibility system construction and improvement measures, safety production, firm’s deficiencies, and whether the firm refers to the GRI Standards-the global standards for sustainability reporting. One point is awarded for each item disclosed, and no points are awarded for non-disclosure. The total score is then used to measure the level of ESG disclosure. HSCit is the key variable of interest, which takes the value of 1 if firm i enters the list of target stocks of Shanghai-Hong Kong or Shenzhen-Hong Kong Stock Connect in year t, otherwise it takes the value of 0. Xit−1 represents a series of control variables that have been shown to potentially influence the ESG disclosure, including firm size (Size), return on total assets (ROA), financial leverage (LEV), operating revenue growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executive’s compensation (Salary), and management shareholding ratio (ManageHold) (Hope, 2003; Wang, 2016; Wang et al., 2019). ϵit is the residual item. Since the dependent variable - social responsibility disclosure score is a hierarchical variable, we use an ordered logit model for empirical testing. We also control for firm fixed effects (Firm) and year fixed effects (Year) to exclude the interference of corporate characteristics that don’t change over time and the interference of time-varying political, economic, legal, and other factors. Since the firm fixed effects, Firmi, already include the treatment group variable Treat in the classic DID model, and year fixed effects, yeart, already include the experimental period variable Post in the classic DID model, the Treat and Post are not separately controlled.

The design of the mainland-HK Stock Connect scheme to determine the list of target stocks in batches allows different firms to be affected by exogenous events at different points in time, thus providing a clean experimental environment for studying the opening-up of capital market and facilitating the overcoming of endogenous problems. Specifically, at the time level, the occurrence of various exogenous events at different times is helpful to avoid the influence of unobservable omitted variables and to exclude the confounding factors brought by other events during the same period. At the cross-sectional level, the target firm may be either the treatment group or the control group at different time points, which further controls the impact of the difference between the treatment group and the control group.

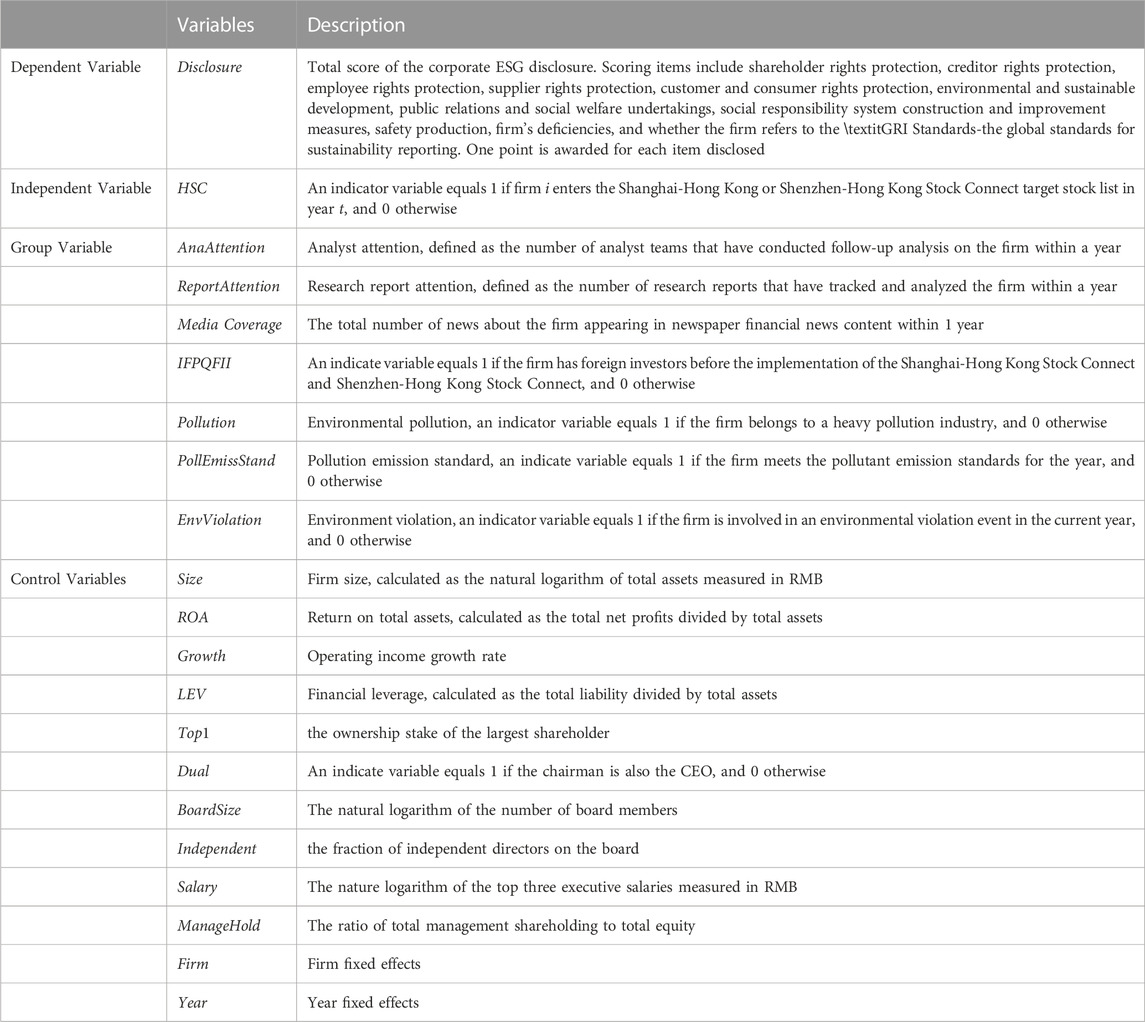

In order to further study the heterogeneity of the impact of capital market liberalization on corporate social responsibility disclosure, we go deeply by investigating the mechanism through sub-sample regressions. Table 1 describes the definitions and metrics of the majority of variables.

TABLE 1. Variable Definitions: This table presents the definition and measure of the key variables used in this paper.

3 Empirical analysis

3.1 Summary statistics

Table 2 presents the summary statistics of the main variables in this paper. All continuous variables are winsorized at 1% and 99% levels. As the table shows, the average value of ESG disclosure score (Disclosure) is 7.61, and the median is 8, indicating that firms approximately disclose 8 aspects related to ESG on average. The maximum ESG disclosure score is 11 and the minimum is 0, with a standard deviation of 1.43, which implies that the level of ESG disclosure differs substantially across firms. The average value of HSC is 0.26, indicating that 26% of the firm-year observations in our sample have achieved capital market interconnection through the Stock Connect scheme, and thus we obtain a sufficient number of treated firms in the sample to identify the effect of the capital market liberalization policy. The descriptive statistics for the remaining variables are similar to the existing literature.

TABLE 2. Summary statistics: This table presents the summary statistics of key variables in this paper. The main sample covers all Chinese A-share listed companies spanning from 2006 to 2019. Firms in the financial industry, ST or *ST firms, and firms with missing ESG disclosure data are excluded. The dependent variable, Disclosure, is a proxy variable of the level of corporate ESG disclosure. It is calculated by scoring the firm’s disclosure of ESG-related information. The independent variable, HSC, is an indicator variable that equals 1 if firm i enters the Shanghai-Hong Kong or Shenzhen-Hong Kong Stock Connect target stock list in year t, and 0 otherwise. The control variables include firm-level characteristics measured at the end of year t-1: firm size (Size), return on total assets (ROA), financial leverage (LEV), operating income growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executive’s compensation (Salary), and management shareholding ratio (ManageHold) (Hope, 2003; Wang, 2016; Wang et al., 2019). The detailed variable definitions are in Table 1. All continuous variables are winsorized at 1% and 99% levels.

3.2 Baseline results

Our primary interest is whether capital market liberalization improves corporate ESG disclosure. We focus on the Chinese stock market, as the mainland-HK Stock Connect scheme works as exogenous shocks and thus provides a clean experimental environment. Foreign investors with high information acquisition costs and strong analytical skills, often desire a more transparent information environment and more detailed information disclosure. Compared to domestic investors, they might pay more attention to corporate ESG information, in addition to financial information. Therefore, they may introduce the ESG investment philosophy into liberalizing china and prompt firms to actively increase the disclosure of environment, society, and governance information to attract more resources. In China, firms have a high degree of autonomy in whether and what to disclose about their ESG, because of the imperfect ESG disclosure system and the relatively weak awareness of domestic investors about corporate ESG performance. Capital market liberalization, one of the most essential external monitoring mechanisms, may be able to influence corporate behavior by bringing in foreign investors who are more concerned about ESG. If so, we would observe a positive relationship between capital market liberalization and ESG disclosure. If foreign investors only seek short-term profit restricted by geographic distance, firms may not be affected or even lower their ESG disclosure.

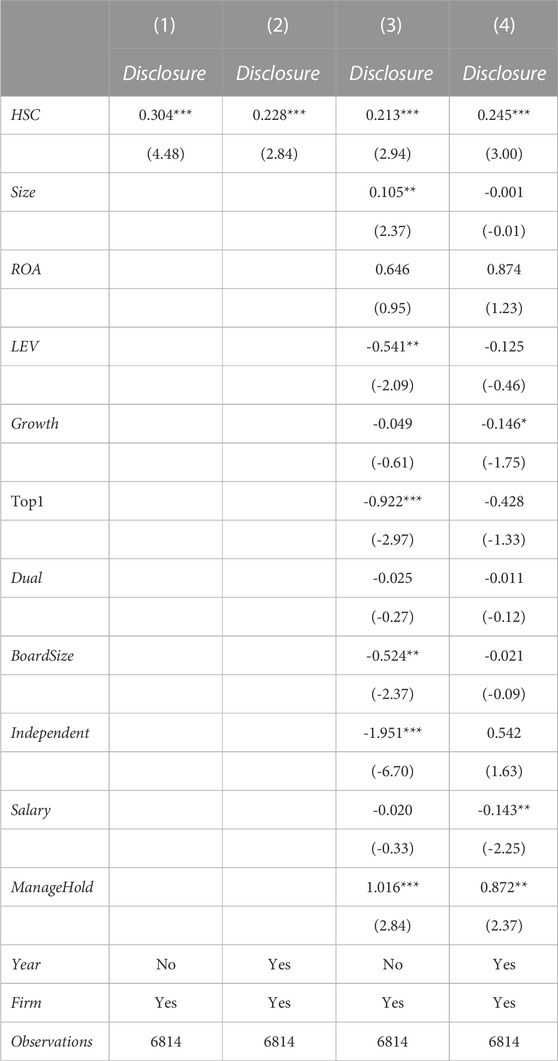

Table 3 reports the results from regression 1. Column 1 shows our baseline estimates regress. The coefficient between Disclosure and HSC is positive and statistically significant, consistent with the idea that firms that enter the list of mainland-HK Stock Connect schemes disclose more ESG-related content. For a one unit increase in HSC (i.e., going from 0 to 1), we expect a 0.30 increase in the log odds of being in a higher level of Disclosure, given all of the other variables in the model are held constant. Column 2 includes year fixed effects to rule out the potential influence of time-varying factors. The coefficient on HSC decreases by approximately 25%. Column 3 controls a series of firm characteristics variables and also shows a decreased coefficient between Disclosure and HSC. Meanwhile, most control variables have significant coefficients and are generally consistent with the existing studies. For example, the regression coefficient of firm size (Size) is significantly positive, indicating that the larger the firm size is, the higher the possibility of the firm increasing ESG information disclosure. The regression model in column 4 includes all variables and fixed effects, and the main result still holds. A one unit increase in HSC would expect a 0.25 increase in the log odds of being in a higher level of Disclosure, given that all of the other variables are held constant. Note that some control variables including Size, and LEV are no longer significant when controlling the year fixed effects at the same time. Altogether, The highly significant coefficients on HSC in all regressions reveal a positive correlation between capital market liberalization and corporate ESG disclosure. After becoming the target stocks of the Stock Connect scheme, listed firms would strengthen their ESG disclosure, which is in line with Hypothesis A. Capital market liberalization improves the investor structure, brings the investment concept of the mature capital market, and has a profound impact on the domestic capital market.

TABLE 3. Basic Results, 2006–2019: This table shows the different impact of capital market liberalization on ESG pillars. The dependent variable in column 1 is the environmental ESG score (E) which is measured by is a score for the firm-level ESG disclosure. The independent variable HSC is a dummy variable that takes the value one if the firm enters the list of Shanghai-Hong Kong Stock Connect or Shenzhen-Hong Kong Stock Connect, and zero otherwise. Other control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), operation income growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). t-statistics are reported in parentheses below each estimate. ***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

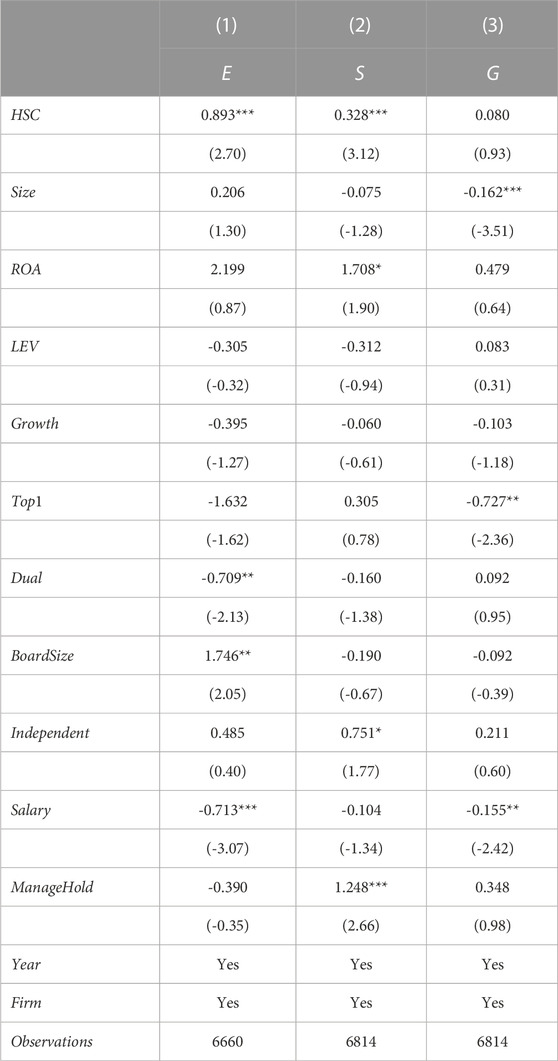

We then ask whether the effect of capital market liberalization on ESG disclosure varies by ESG pillars. We use the environmental score (E), the social score (S), and the governance score (G) as the explained variables and regress with these parts of the sample, respectively. We might observe a different pattern for an ESG individual pillar with the aggregate score, as ESG is the sum of the three pillars. The results are shown in Table 4. Environmental score(E) has the highest coefficient with HSC, with a magnitude of 0.89; while the social score(S) has a coefficient of 0.33. The governance score(G) has a positive but not significant coefficient of 0.08. It is reasonable to infer that capital market liberalization promotes corporate ESG disclosure mainly by promoting environmental information disclosure and social information disclosure.

TABLE 4. The Effect of Capital Market Liberalization among Three ESG Pillars: This table shows the impact of capital market liberalization on the three ESG pillars disclosure. The dependent variable in columns 1 to 3 is the environmental score (E), the social score (S), and the governance score (G). The independent variable HSC is a dummy variable that takes the value one if the firm enters the list of mainland-HK Stock Connect, and zero otherwise. The control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), operation income growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). t-statistics are reported in parentheses below each estimate. ***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

3.3 Mechanism analysis

Our interpretation of the promoting effect of capital market liberalization on corporate ESG disclosure is that capital market liberalization brings in sophisticated foreign investors who are more concerned about corporate performance in environmental protection, human rights, social responsibility, etc. and firms have an incentive to actively disclose information and send positive signals to foreign investors to attract resources. In this section, we provide evidence for this explanation by exploring firm heterogeneity.

Because of the information asymmetry in capital markets, parties involved in transactions need to identify true information through signaling. Signaling mechanisms can avoid the adverse selection problem (Spence, 1974). Firms as information-advantaged parties have the incentive to send positive signals to attract more high-quality resources by proactively providing more truthful and credible information to investors (information-disadvantaged parties) (Titman and Trueman, 1986; Beatty, 1989). At this point, ESG disclosure can serve as a positive signal for firms to take social responsibility and attract foreign investors.

From the perspective of the information provider, mainland listed firms voluntarily enhance ESG disclosure to obtain the attention of foreign investors and the various resources that come with it so as to maximize utility. The more attention a firm receives from foreign investors, the stronger the incentive to increase disclosure. However, there is an information cost for firms to mark their strengths. The lower the information costs a firm bears, the more likely it is to enhance disclosure. Unlike previous studies on the impact of capital market liberalization on firm behavior, ESG disclosure is not the result of mandatory or passive decision-making, but rather the result of active corporate decisions. Although capital market liberalization improves marketization and strengthens regulation of corporate behavior, there is still a lack of certain standards and an imperfect system for corporate ESG disclosure, which gives firms a lot of room for flexible choices. Firms have plenty of flexibility to choose whether to disclose ESG and which part of ESG to disclose or not to disclose based on both cost and benefit considerations.

From the perspective of the information recipient, foreign investors introduced by the mainland-HK Stock Connect may lead firms to pay attention to ESG information disclosure for two reasons. First is the monitoring effect, as foreign investors have rich market experience and skills, they can better gather non-financial information and identify abnormal corporate behavior, which makes it more difficult for mainland listed firms to manipulate information, thus promoting the listed firms to improve information disclosure. The second is the competition effect. The entry of foreign investors into the Chinese market has intensified competition among listed firms and has placed higher demands on corporate information disclosure. Firms entering the Stock Connect list face more competitive pressure and are more motivated to improve information disclosure.

This implies that the impact of capital market liberalization on corporate ESG disclosure is heterogeneous. Firms with a transparent environment and good performance are mainly affected by the competition effect, while firms with an untransparent environment and bad performance are mainly affected by the monitoring effect. We examine which mechanism is dominant, and explore the role played by foreign investors from the following three perspectives: external environment, corporate characteristics, and environmental performance.

3.3.1 Influence of external environment

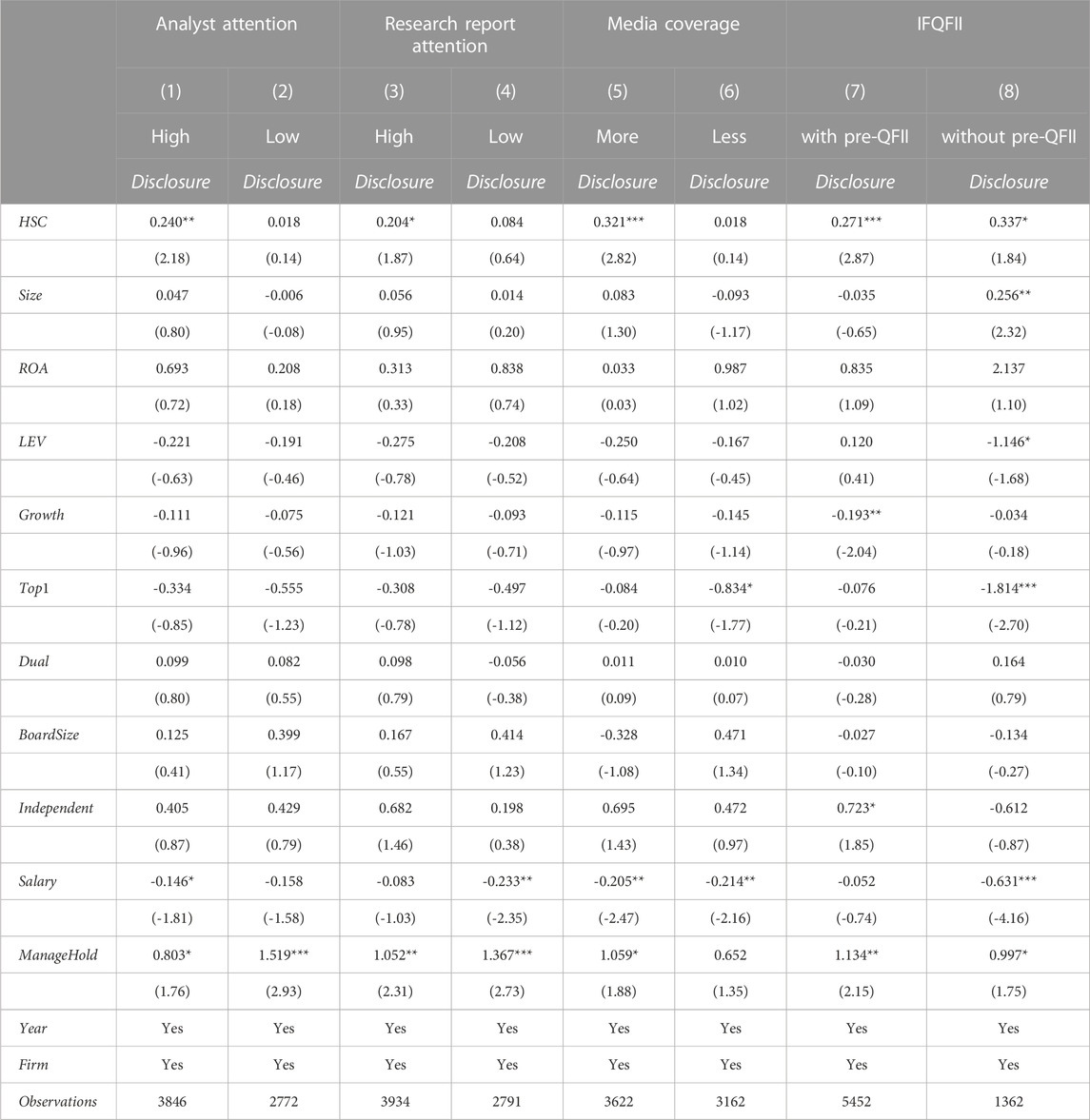

We first explore the heterogeneity of corporate ESG disclosure to capital market liberalization under different external environments. Specifically, we examine the influence of the information environment, public opinion pressure, and the presence of QFII. The subgroup regression results are shown in Table 5. In columns 1 to 4, we test whether the effect differs significantly across information environments by splitting firms into two groups based on analyst attention (research report attention). Referring to Bushman et al. (2004) and Zhong and Lu (2018), analyst attention (research report attention) is defined as the number of analysts following (research reports) within 1 year. Those firms with analyst attention (research report attention) above the sample median are classified into high information transparency samples, and those with analyst attention (research report attention) below the median are low information transparency samples. Then we rerun the basic model for each group. Column 1 (3) shows the results for the sub-sample with high analyst attention (research report attention), and Column 2(4) shows the results for the sub-sample with low analyst attention (research report attention). We find that the regression coefficients of HSC are significantly positive for the group with high analyst attention and the group with high research report attention, while no significant coefficient between HSC and ESG disclosure for the group with low analyst attention(low research report attention). These findings indicate that the promoting effect of capital market liberalization on ESG disclosure is more significant for firms with higher information transparency. The reason may be that firms in a more transparent information environment are exposed to lower information costs and are more visible to foreign investors, so they have a stronger motivation for self-improvement and are more willing to enhance their ESG performance to attract more foreign investors. Also, foreign investors have higher requirements for information disclosure, because they have a natural information disadvantage geographically. Therefore, firms with high information transparency are more favored. This result provides preliminary evidence for a competitive effect of capital market liberalization because if the monitoring effect is dominant, we should see a greater effect of capital market opening on firms with a poor information environment, but it turns out to be exactly the opposite.

TABLE 5. Capital Market Liberalization and ESG Disclosure: by External Environment: This table shows how the effect of capital market liberalization varies by the external environment. The sample firms are divided into two groups each month based on the analyst attention, the research report attention, the media coverage, and the presence of QFII (IFQFII), respectively. Analyst attention is the number of analyst teams that have conducted analysis on the firm within a year. Research report attention is the number of research reports that have tracked and analyzed the firm within a year. Media coverage is the total number of news about the firm appearing in newspaper financial news content within a year. IFPQFII is an indicator variable that equals to 1 if the firm has foreign investors before the implementation of the mainland-HK Stock Connect (with pre-QFII), and 0 otherwise (without pre-QFII). The tests are ordered logistic regressions where the dependent variable is the firm-level ESG disclosure score (Disclosure). The explanatory variables are the dummy variable that represents the mainland-HK Stock Connect (HSC) and several control variables including Size, ROA, LEV, Growth, Top1, Dual, BoardSize, Independent, Salary, and ManageHold. Refer to Table 1 for detailed variable definition.t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

In Columns 5 and 6, we examine the influence of public opinion pressure on the effect of capital market liberalization. Public opinion as an informal institutional environment and social normative mechanism can play a role in regulating corporate behavior. With the acceleration of information technology and the rise of social media, the role of media in social life is increasing. On the one hand, positive media coverage and publicity are conducive to the establishment of a good corporate image. On the other hand, the media’s monitoring and exposure of firms’ non-fulfillment of social responsibility behaviors can greatly damage the image and economic performance of enterprises. We group the sample firms based on media coverage, defined as the number of times listed firms are mentioned in the content of newspaper financial news. The more news coverage a listed firm receives, the greater the public opinion pressure. Suppose the monitoring effect plays a dominant role in the mechanism by which capital market liberalization promotes ESG disclosure, we should observe that the coefficient between capital market liberalization and ESG disclosure is more significant for firms with less media coverage. However, the results are the opposite, as firms with more media reporting significantly improve ESG disclosure after capital market liberalization, the regression coefficient of HSC in Column 5 is 0.321, which has passed the significance test with a confidence level of 1%. The possible reason for this conclusion is that firms that receive more media attention face more public pressure after being included in the Stock Connect list, while the cost of information disclosure is relatively low, so they have more incentive to release positive signals to the outside world. We do not observe an obvious effect of capital market liberalization on improving ESG disclosure for firms with less media coverage. It is reasonable to infer that capital market liberalization and media coverage may have complementary effects as external institutional environments.

In Columns 7 and 8, we examine the role of QFII in the impact of capital market liberalization on ESG disclosure. We split our firm into two groups according to whether they had foreign investors before being included in the Shanghai and Shenzhen exchanges in the Stock Connect scheme and empirically tests the effect of capital market liberalization for each group. Before the implementation of the mainland-HK Stock Connect, the QFII system, which has been in place since 2002, allowed qualified institutional investors to invest in mainland China’s securities market. Foreign investors were given permission to trade the stocks of certain cross-listed firms through the B-share and H-share markets. The official implementation of the mainland-HK Stock Connect program further expands the opening of China’s capital markets to the outside world by allowing Hong Kong investors and overseas investors to trade directly in eligible stocks listed on the Shanghai and Shenzhen stock exchanges. Some might argue that firms that previously had QFII have received sufficient oversight and that the launch of the Stock Connect scheme would have a weaker impact on their ESG disclosure than on firms without previous foreign investors. However, it is essential to note that unlike corporate non-compliance or corporate governance, there are no mandatory requirements for corporate ESG disclosure. The supervision of corporate ESG information by foreign investors is more likely a response to firms’ voluntary disclosure, rather than a response to disclosure by firms that are forced to accept supervision and have to improve corporate governance. The actual situation might be that firms take the initiative to be monitored and actively increase the disclosure of ESG information to attract foreign investors. We conjecture that the facilitating effect of the Stock Connect is more pronounced for firms that already have foreign investors before the implementation of the scheme. Indeed, the impact of capital market liberalization on ESG disclosure is heterogeneous in the group regression. Although both types of firms improve their ESG disclosure, the significance of the coefficient of HSC is stronger for firms with QFII. This is consistent with the idea that the presence of QFII affects investors’ attention, exerts pressure on firms, and decreases firms’ information disclosure costs.

The above analysis demonstrates that the external environment shapes the effectiveness of the Stock Connect scheme. Firms with a more transparent information environment, firms with a more pressured institutional environment, and firms with QFII before the mainland-Hk connect have a stronger incentive to enhance ESG disclosure. This supports the basic view of catering theory and preliminarily suggests that the mechanism of capital market opening acting on ESG disclosure is mainly manifested as a competitive effect rather than a monitoring effect.

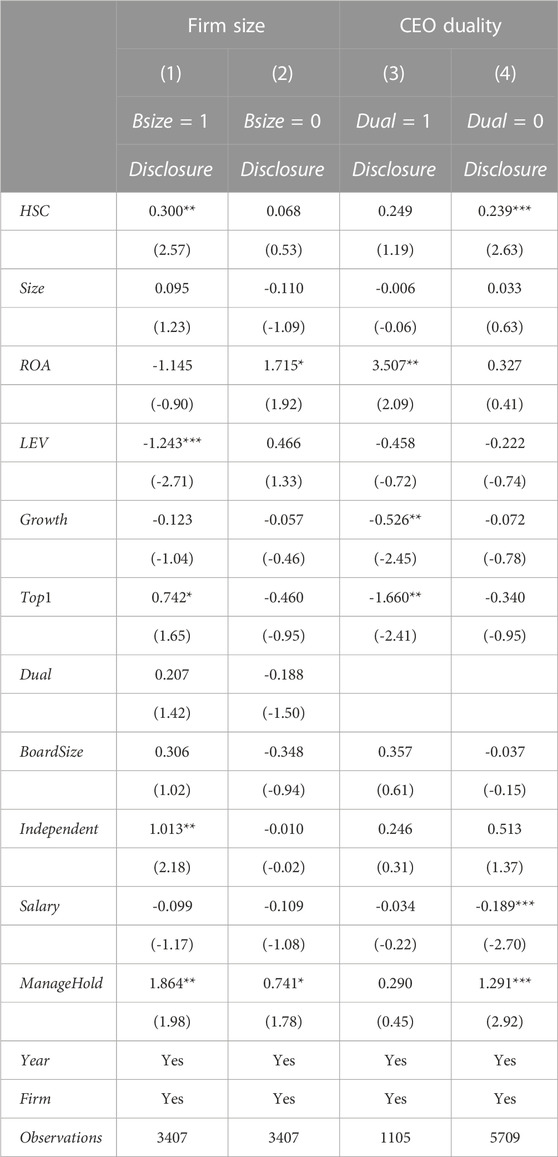

3.3.2 Influence of corporate characteristic and environmental performance

We next examine the impact of the firm’s own characteristics and performance on the relationship between capital market liberalization and ESG disclosure. We first consider the influence of corporate characteristics. We perform group tests based on firm size and CEO duality, respectively. From the perspective of regulating corporate behavior, capital market liberalization will have a better effect on firms with poor governance, and urge these firms to improve their governance as soon as possible through the power of the market. On the contrary, if the implementation of the mainland-HK Stock Connect only has a significant effect on firms with good governance, the opening of the capital market will mainly further improve firms that are already better in themselves and show more of an “icing on the cake” effect. The results in Table 6 show that the effect of capital market liberalization is positively significant for large firms and firms that do not implement CEO duality, while it has no effect for small firms and firms implementing CEO duality. The possible reasons are as follows. Compared to smaller firms, larger firms need to raise more external capital, so in order to gain investors’ favor, large firms have the incentive to disclose more information to reduce agency costs due to information asymmetry. At the same time, large firms are more able to cope with the competitive pressures brought about by the opening of capital markets. The CEO duality represents the governance capacity of a firm, where the general manager, as an agent, may not always disclose information in the interest of shareholders and therefore needs to be monitored by a separate chairman. If the two positions are combined, the general manager will tend to conceal unfavorable information from the public, which will reduce the level of voluntary disclosure of listed companies. Our results reveal that firms with good corporate governance are more motivated to send signals to cater to foreign investors by disclosing ESG information.

TABLE 6. Capital Market Liberalization and ESG Disclose: by Corporate Characteristics: This table shows how the effect of capital market liberalization varies by corporate characters. We split firms into two groups based on firm size and CEO duality, respectively. Bsize is a dummy variable that takes 1 when the logarithm of a firm’s asset value is greater than the median of the sample, and 0 otherwise. Dual takes 1 when a Chief Executive Officer (CEO), besides running the corporation at the highest level, also holds the position of the Chairman of the Board, and 0 otherwise. The dependent variable Disclosure is a score for the firm-level ESG disclosure. The independent variable HSC is a dummy variable that takes the value one if the firm enters the list of Shanghai-Hong Kong or Shenzhen-Hong Kong Stock Connect schemes, and zero otherwise. Other control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), the ratio of independent directors (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). Refer to Table 1 for detailed variable definitions. t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

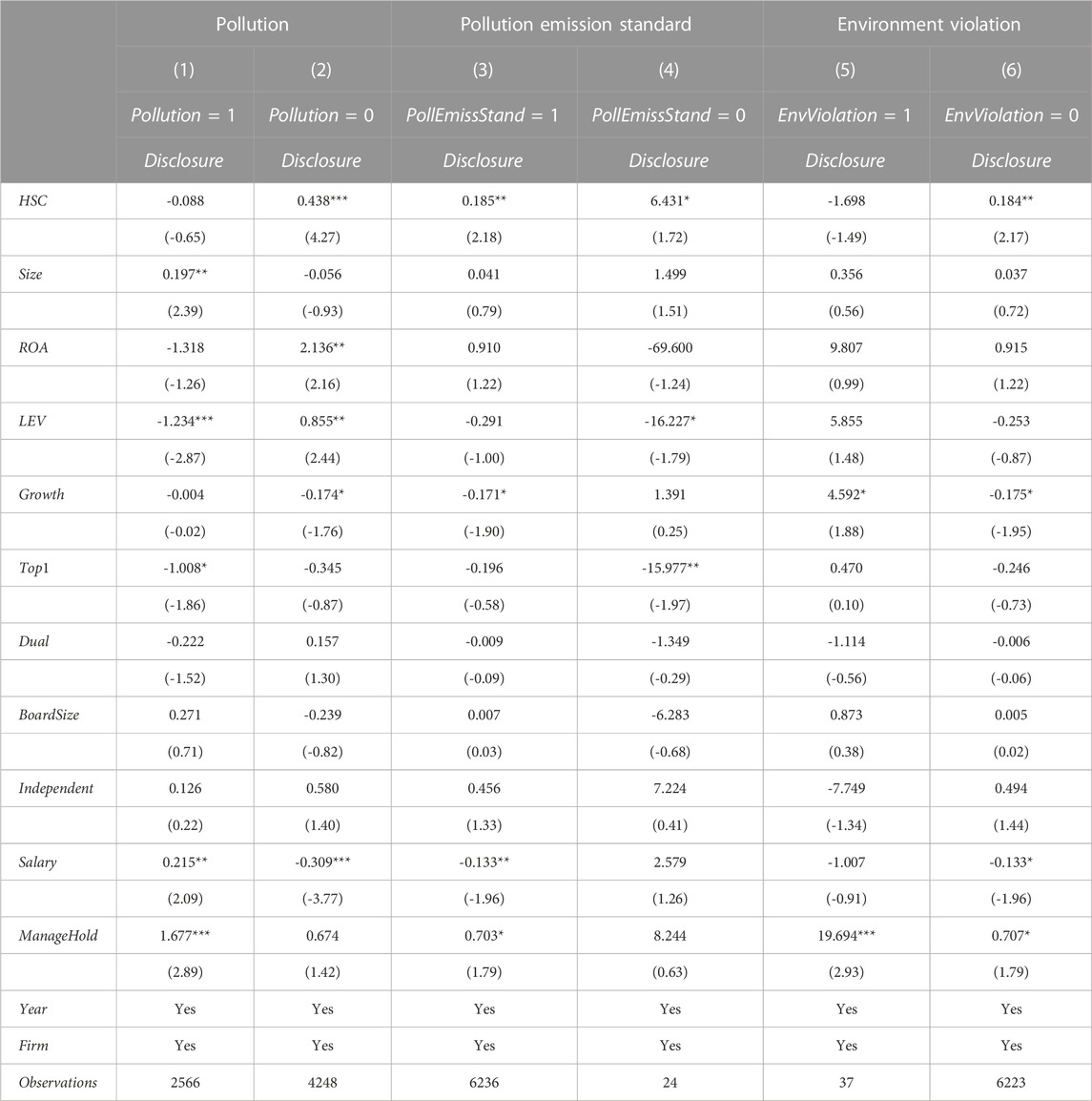

We next examine the industry characteristics. Firms in industries with different pollution levels have different levels of pollution to the environment and different pollution treatment costs. Firms in non-heavy pollution industries are more favored by foreign investors, and their enhanced ESG disclosure is more likely to attract the attention of foreign investors and gain more information benefits. Alternatively, firms in heavily polluting industries are more likely to be constrained by social norms, and their increased ESG information disclosure may instead increase exposure to pollution news and raise information costs. Because of the different views and motivations of the two types of enterprises, ESG disclosure of non-heavily polluting firms and heavily polluting firms may be disproportionately affected by capital market liberalization. Regarding Hong and Kacperczyk (2009),Li and Shen (2011) and Jin (2013), we classify firms according to the pollution characteristics of the industry to which the firm belongs; the industries are classified according to the ‘List of Listed Companies’ Environmental Protection Verification Industry Classification and Management List”. A total of 14 industries are classified as heavily polluting industries in the ‘List of Listed Companies’ Environmental Protection Verification Industry Classification and Management List” issued by the Ministry of Environmental Protection of the People’s Republic of China in 2008, including thermal power, iron and steel, cement, electrolytic aluminum, coal, metallurgy, building materials, mining, chemical, petrochemical, pharmaceutical, light industry, textile, and tannery. We manually identify the listed firms belonging to these 14 industries and assign them to the heavy pollution group. Columns 1 and 2 of Table 7 show the results of the sub-sample regressions for firms in the heavy pollution and non-heavy pollution industries, respectively. There is industry heterogeneity in the impact of capital market liberalization on corporate ESG disclosure. The regression coefficient of HSC is significantly positive for the non-heavy pollution group, while there is no effect for the heavy pollution group. The possible reasons are as follows. Compared with firms in heavy pollution industries, firms in non-heavy pollution industries are relatively less polluting, have lower information costs, and have a lower risk of negative ESG-related information disclosure. Therefore, they are more inclined to actively enhance ESG disclosure to attract more foreign investors. That is to say, capital market liberalization has a more pronounced effect on firms in non-heavy pollution industries.

TABLE 7. Capital Market Liberalization and ESG Disclosure: by Environmental Performance: This table shows how the effect of capital market liberalization varies by environmental performance. We construct three dummy variables, Pollution, PollEmissStand, and EnvViolation, and split the sample firms into two groups based on the three variables, respectively. Pollution equals 1 if the firm belongs to a heavy pollution industry, and 0 otherwise. PollEmissStand equals 1 if the firm meets the pollution emission standard, and 0 otherwise. EnvViolation equals 1 if the firm is involved in environmental violation events, and 0 otherwise. Column 1–8 shows the subgroup testing results where the dependent variable is the firm-level ESG disclosure score (Disclosure). The explanatory variables are the dummy variable that represents the mainland-HK Stock Connect (HSC) and several control variables including Size, ROA, LEV, Growth, Top1, Dual, BoardSize, Independent, Salary, and ManageHold. Refer to Table 1 for detailed variable definition.t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

We further examine the differences in the impact of capital market liberalization on ESG disclosure among firms with different environmental performances, since environmental performance is a critical item in evaluating firms’ ESG performance, and firms’ environmental behavior is governed by social norms. We divide the firms into two groups based on whether they meet the pollutant emission standards and whether they violate the regulations in the current year, respectively. The sub-group results are shown in Columns 3–6 of Table 7. We find that the effect of capital market liberalization is more significant for firms that meet the pollutant emission standards and have no environmental violations. This is further evidence that supports the catering theory and competition effect. Firms with good environmental performance are more confident in themselves and are more willing to improve ESG disclosure in the face of competitive pressure and stringent requirements brought about by the opening of the capital market.

4 Robustness test

4.1 DID test

The Shanghai-Hong Kong Stock Connect was launched in November 2014, and the Shenzhen-Hong Kong Stock Connect was launched in December 2016, which provides a more effective exogenous impact scenario for the difference-in-differences model. This paper takes 2006–2016 as the sample period and the corresponding DID test model design as follows:

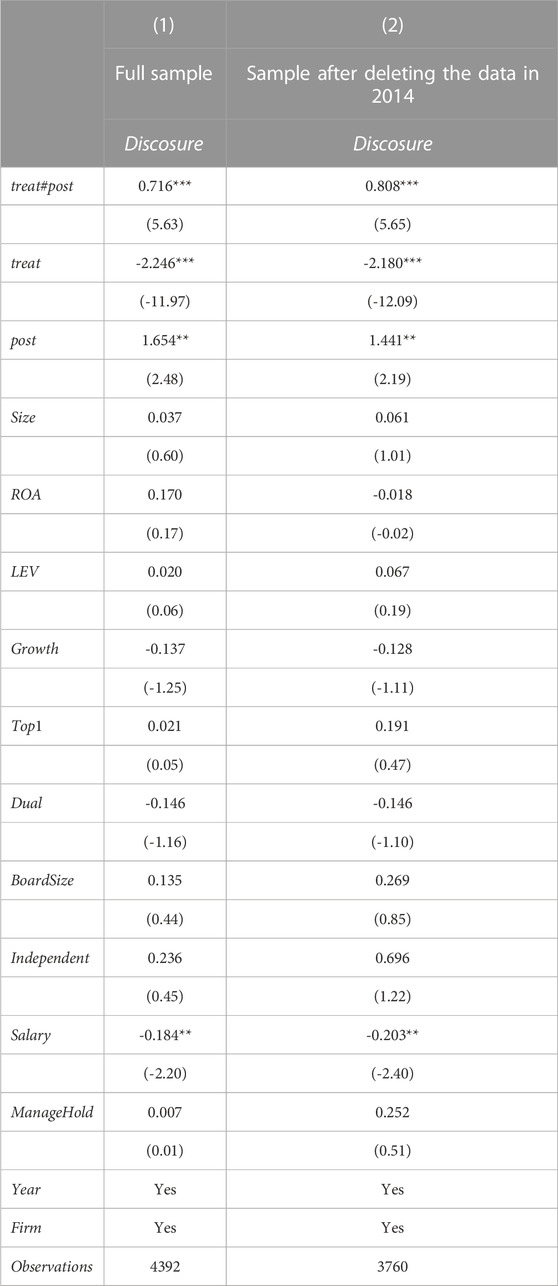

where Treat represents the sample attribute, if the firm is listed on the Shanghai Stock Exchange, the value is 1, otherwise, it is 0. Post represents the time attribute, the value of the year before 2014 is 0, and the value of 2014 and later is 1. The definitions of variable Disclosure and control variables are completely consistent with formula 1. This paper mainly focuses on the coefficient β1 of the interaction item Treat × Post. If capital market liberalization increases the ESG disclosure of listed firms, then β1 would be significantly positive. The results show that after adding the control variables and controlling the year fixed effect and firm fixed effect, the coefficient of the interaction item Treat × Post is 0.72, which is significantly positive at the 1% level (see Table 8) Considering that 2014 is the first year of the Shanghai-Hong Kong Stock Connect, the test in column 2 of Table 8 is performed after deleting the sample observations in 2014. At this point, the coefficient of the interaction term Treat × Post is 0.81, which is still significantly positive at the 1% level. The above results show that after the Shanghai-Hong Kong Stock Connect, ESG information disclosure of companies listed on the Shanghai Stock Exchange is significantly higher than that of companies listed on the Shenzhen Stock Exchange, thus providing robust evidence for the strengthening effect of the capital market on corporate ESG disclosure.

TABLE 8. DID test, 2006–2016: This table presents the DID result. The dependent variable Disclosure is the firm-level ESG disclosure score. treat#post is an interaction term by multiplying treat and post to capture the policy effect of double difference. treat is a dummy variable that takes the value 1 if the firm is listed in the Shanghai Stock market, and 0 if the firm is listed in the Shenzhen Stock market. post is a dummy variable that equals 1 if the year is after 2013, and 0 otherwise. The control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), the ratio of independent directors (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). Year fixed effects(Year) and firm fixed effects(Firm) are both included. Refer to Table 1 for detailed variable definitions. t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

4.2 Time-varying DID

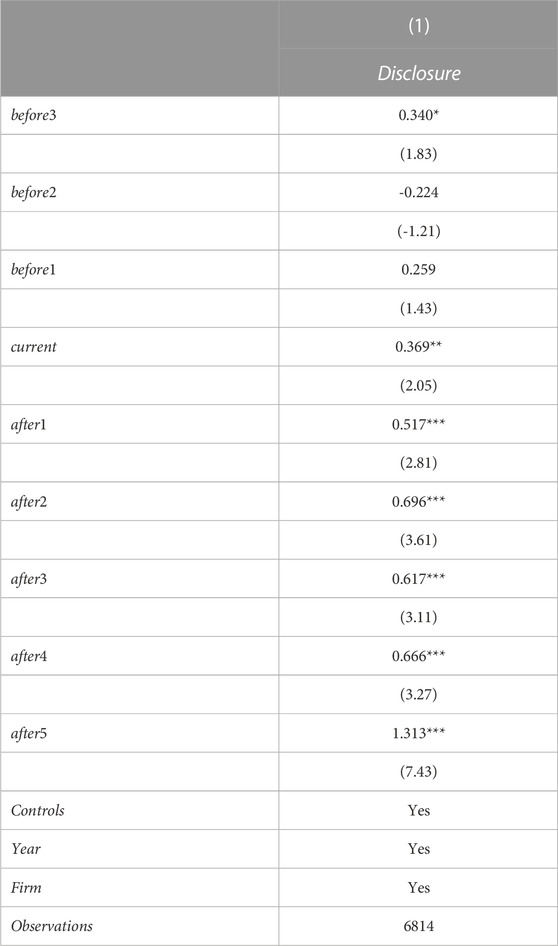

In order to eliminate the interference that firms have already shown a trend to increase ESG disclosure before being included in the mainland-HK Stock Connect target stock list, we further test the year-by-year effects of the capital market liberalization policies. Given the staggered implementation of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect, we conduct a time-varying DID test following Beck et al. (2010) to examine the dynamics of the relationship between capital market liberalization and ESG disclosure. We do this by including a series of dummy variables in the standard regression to represent the periods before and after the firms are included in the list:

where the dummy variables, the “before”s and “after”s, equal zero, except as follows: beforej equals one for firms in the jth year before entering the list of target stocks, while afterj equals one for firms in the jth year after entering the list of target stocks. current equals one for firms entering the stock list in the year of policy implementation. The vectors Firmi and Yeart are vectors of the firm and year dummy variables, respectively. At the endpoints, after5it equals one for all years that are 5 or more years after firms became target stocks. Table 9 shows that there was no upward trend in ESG disclosure before firms realized interconnection. The coefficients are mostly insignificant on the dummy variables beforej. Meanwhile, the coefficients are all positive and significant on afterj. In addition, as the policy is implemented over time, the larger the coefficient on afterj. This situation might imply that it would take some time for the policy to work after the formal implementation of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect. Firms gradually increase their ESG disclosure to attract more foreign investors after capital market liberalization.

TABLE 9. The Dynamic Impact of Capital Market Liberalization on the ESG Disclosure: This table shows the dynamic impact of capital market liberalization on the ESG disclosure. We consider a 9-year window spanning from 3 years before deregulation until 5 years after deregulation. The dependent variable Disclosure is a total score for the firm-level ESG disclosure. The beforej equals one for firms in the jth year before entering the list of target stocks, while afterj equals one for firms in the jth year after entering the list of target stocks, and 0 otherwise. current equals one for firms entering the stock list in the year of liberalization policy implementation. Controls represents all the control variables including firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), ratio of independent directors (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). Year fixed effects(Year) and firm fixed effects(Firm) are both included. Refer to Table 1 for detailed variable definitions. t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

4.3 Propensity score matching

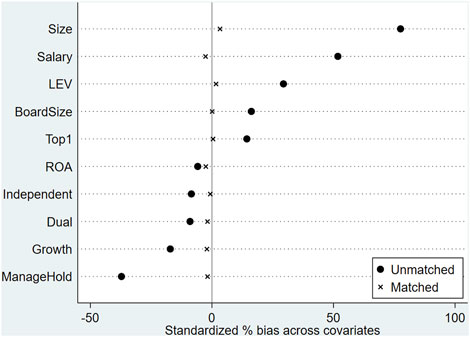

The target firms entering the scope of the mainland-HK Stock Connect pilots have distinct characteristics in terms of asset size, stock liquidity, growth rate, and profitability. To avoid the effect of sample distribution bias between the treatment group (target stocks) and the control group (non-target stocks), we perform propensity score matching (PSM) on the sample. We estimate propensity scores by adding all control variables to the ordinal logistic regression model and perform kernel matching and one-to-one nearest neighbor matching, respectively. Figure 1 plots the results of the PSM balance table. The standardized bias for each control variable is greatly reduced. The control variables are no longer significantly different for the control and treatment groups.

FIGURE 1. This figure shows the diagram of the standardized deviation of each control variable: firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold).

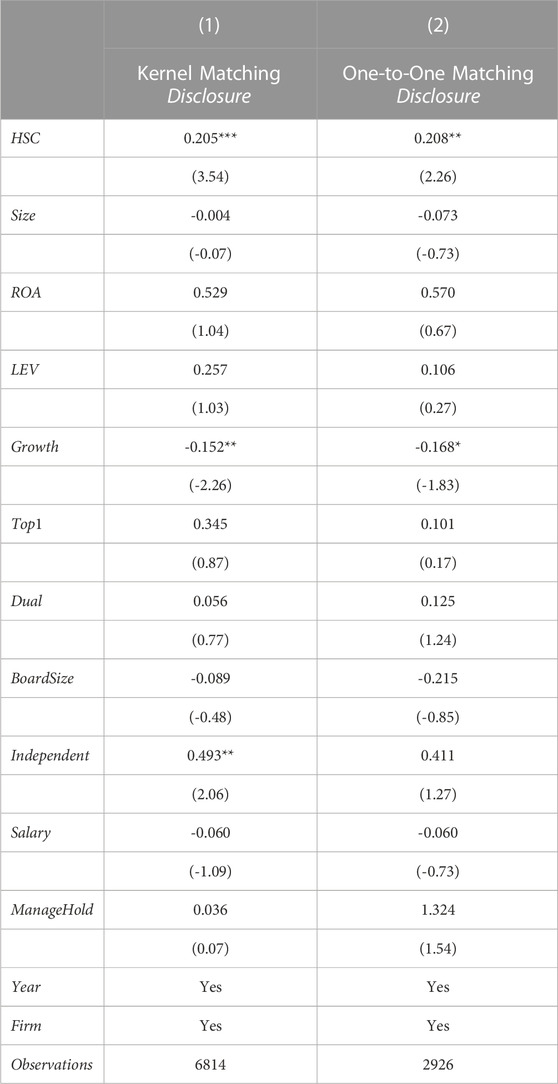

We further perform regressions on the matched samples and assign different weights to the observations based on their propensity scores. The first column of Table 10 shows the regression results using kernel matching, and the second column shows the regression results using one-to-one nearest neighbor matching. Both regression results for the PSM-matched sample show that the regression coefficients on HSC remain significantly positive. Moreover, the estimated coefficients on HSC in columns 1 and 2 increase relative to the regression coefficient on HSC in the full sample group (see column 4 in Table 3) and the coefficient on HSC in column 1 is significant at the 1% level. These findings suggest that the launch of the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect help stimulate more firms to disclose ESG-related information. The conclusion that capital market liberalization promotes ESG disclosure remains robust.

TABLE 10. The Impact of Capital Market Liberalization on the ESG Disclosure after PSM: This table presents the impact of capital market liberalization on corporate ESG disclosure after PSM. The dependent variable Disclosure represents the corporate ESG disclosure level, which is calculated by scoring the ESG-related information disclosure for each firm. The independent variable HSC is a dummy variable that takes the value one if the firm enters the list of mainland-HK Stock Connect schemes, and zero otherwise. The control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), independent director ratio (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). Year fixed effects(Year) and firm fixed effects(Firm) are both included. Refer to Table 1 for detailed variable definitions. t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

4.4 Placebo test

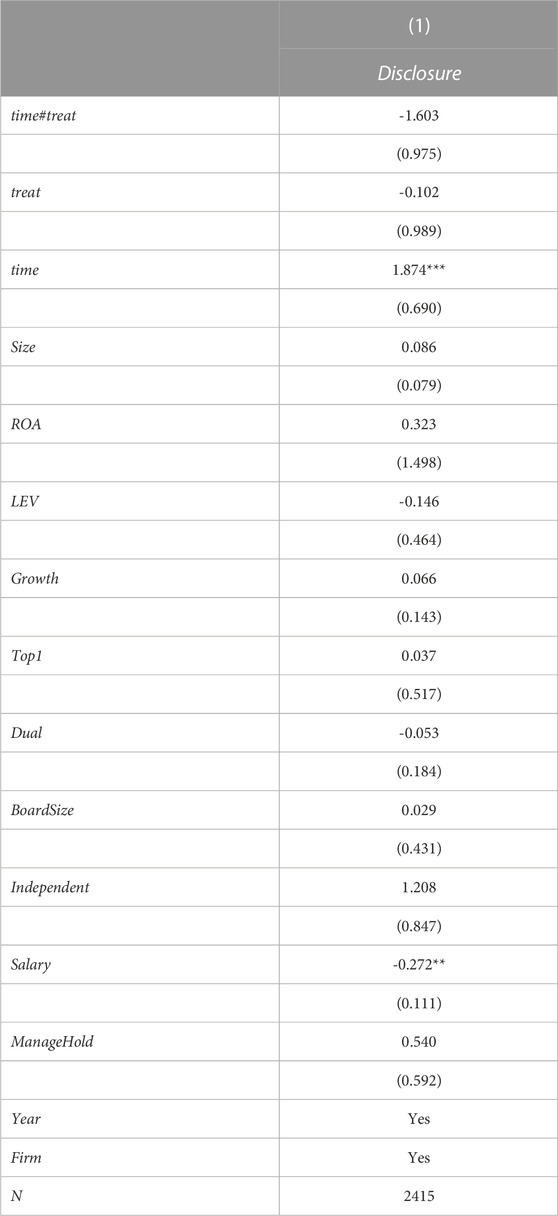

Differences between the treatment and control groups may have existed before the Stock Connect scheme actually took effect. To testify that the empirical results are indeed caused by the implementation of the mainland-HK Stock Connect scheme and not by other factors, and to eliminate the confounding of the inherent characteristics of these two groups of firms, we conduct a placebo test in this paper using DID model. The firms included in the target lists of the Stock Connect scheme remain unchanged, but the implementation of the policy is advanced by 5 years. Specifically, we assume that the policy is implemented in 2009 and use the period from 2006 to 2013 as the sample period, i.e. years before the actual implementation of the policy. We take 2009 and later years as 1 to capture the time effect (time), take the firms in the target stock list as 1 to capture the individual effect (treat), and generate interaction terms to capture the double-differential policy effect. Table 11 shows that the coefficient on the interaction term(time#treat) is negatively insignificant. Our conclusions remain robust.

TABLE 11. Placebo Test, 2006–2013: This table shows the placebo test result based on a DID model. Disclosure represents firm-level ESG disclosure. time#treat is an interaction term by multiplying time and treat to capture the policy effect of double difference, where treat is a dummy variable that takes the value 1 if the firm is in the target stock list, and 0 otherwise, and time is a dummy variable that takes the value 1 if the year is after 2009, and 0 otherwise. The sample period ranges from 2006 to 2013. The control variables include firm size (Size), return on total assets (ROA), financial leverage (LEV), growth rate (Growth), ownership concentration (Top1), integration of two positions (Dual), board size (BoardSize), the ratio of independent directors (Independent), top three executives’ compensation (Salary), and management shareholding ratio (ManageHold). Year fixed effects(Year) and firm fixed effects(Firm) are both included. Refer to Table 1 for detailed variable definitions. t-statistics are reported in parentheses.***, ** and * denote significance levels at 1%, 5% and 10%, respectively.

We also randomly assign the current year’s Stock Connect target stock list to the sample firms and then repeat the regression 1000 times using Equation (1) for each of the randomly ordered firms entering the target stock list and ESG disclosure. The Placebo test shows that the proportion of coefficients with statistically significant coefficients in the regression results is small, implying that the aforementioned constructed dummy treatment effect does not exist, thus indicating that capital market liberalization does promote corporate ESG disclosure, and there is indeed a significant causal relationship between capital market liberalization and corporate ESG disclosure2.

5 Conclusion

Taking advantage of the unique context of China, This paper studies the impact of capital market liberalization on corporate ESG disclosure, and finds that firms enhance ESG disclosure after being included in Shanghai-Hong Kong or Shenzhen-Hong Kong Stock Connect lists. The promoting effect of capital market opening on ESG disclosure is mainly reflected in the significant increase in environmental and social information disclosure. This effect is heterogeneous among firms with different external environments, corporate characteristics, and environmental performances. Specifically, The environment heterogeneous analyses show that capital market liberalization is more effective in promoting ESG information disclosure for firms with a more transparent information environment, firms with a more pressured institutional environment, and firms with QFII before the Stock Connect scheme. The heterogeneous analyses among firms with different characteristics and performances show that capital market liberalization is more effective in promoting ESG information disclosure for large firms, firms that do not implement CEO duality, firms in non-heavy pollution industries, and firms with better environmental performance. Our results support the basic idea of catering theory and provide empirical evidence for the competition effect of capital market liberalization.

The mainland-HK Stock Connect is an important step in the opening up of China’s capital market to the outside world, and its purpose is to further promote the two-way opening and healthy development of the capital market between Mainland China and Hong Kong. The findings of this paper demonstrate the effectiveness of the mechanism in promoting sustainable corporate development, however, the implementation of the mainland-HK Stock Connect has primarily boosted the leading firms. For firms with poor external environments and firms with bad performance, the boost has been limited. This is partly because the Chinese government and regulators do not yet have a sound top-level design and supporting measures on ESG. Unclear policies related to ESG information disclosure give firms too much room for free decision-making, and the lack of uniform information evaluation standards leads to large differences in corporate ESG performance. under competitive pressure, firms with better performance are more confident and active in continually strengthening ESG disclosure, while firms with poorer performance lack self-motivation and are prone to “making marginal cases”, “drilling holes” or conducting in a superficial manner. We suggest that in addition to promoting ESG information disclosure through market mechanisms, the regulator should develop a more comprehensive ESG information disclosure system according to the characteristics of different industries and play a positive guiding role. The Stock Connect can be used as an opportunity to improve the system construction of the Chinese A-share capital market. Local government and self-government organizations should also work together to create a more transparent information environment and strengthen regulation. We believe that the increased official and corporate attention to ESG disclosure can promote ESG investment as a social consensus and further promote the sustainable development of enterprises and society.

In addition, ESG investment has become an important investment strategy as capital increasingly focuses on considering the ESG performance of firms in investment selection. With the popularity of the ESG investment concept, and investors’ increasing attention to the corporate environment, social responsibility, and corporate governance, this field is of great room for expansion and great research value. In the future, with the gradual development of ESG investment and the more standardized evaluation system, further research on corporate ESG from the performance perspective becomes possible.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author contributions

MN and CC processed the data, created and edited figures and tables, and wrote the text. MN, CC, CS, and CQ contributed analysis and edited and revised the manuscript. All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2023.1131607/full#supplementary-material

Footnotes

1To avoid the impact of the 2008 financial crisis, we conduct all the empirical research using the samples spanning from 2009 to 2019. The main results hold still.

2To be brevity, the results of the 1000 placebo test and corresponding statistical distribution are not shown in the paper.

References

Admati, A. R., and Pfleiderer, P. (2009). The “wall street walk” and shareholder activism: Exit as a form of voice. Rev. Financial Stud. 22, 2645–2685. doi:10.1093/rfs/hhp037

Aggarwal, R., Erel, I., Ferreira, M., and Matos, P. (2011). Does governance travel around the world? Evidence from institutional investors. J. Financial Econ. 100, 154–181. doi:10.1016/j.jfineco.2010.10.018

Bae, K.-H., Bailey, W., and Mao, C. X. (2006). Stock market liberalization and the information environment. J. Int. Money Finance 25, 404–428. doi:10.1016/j.jimonfin.2006.01.004

Beatty, R. P. (1989). Auditor reputation and the pricing of initial public offerings. Account. Rev., 693–709.

Becchetti, L., Di Giacomo, S., and Pinnacchio, D. (2008). Corporate social responsibility and corporate performance: Evidence from a panel of us listed companies. Appl. Econ. 40, 541–567. doi:10.1080/00036840500428112

Beck, T., Levine, R., and Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65, 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Bushman, R. M., Piotroski, J. D., and Smith, A. J. (2004). What determines corporate transparency? J. Account. Res. 42, 207–252. doi:10.1111/j.1475-679x.2004.00136.x

Callen, J. L., Hope, O.-K., and Segal, D. (2005). Domestic and foreign earnings, stock return variability, and the impact of investor sophistication. J. Account. Res. 43, 377–412. doi:10.1111/j.1475-679x.2005.00175.x

Ceccarelli, M., Glossner, S., and Homanen, M. (2022). Catering through transparency: Voluntary esg disclosure by asset managers and fund flows. Available at SSRN 4110596.

Chen, Z., and Xie, G. (2022). Esg disclosure and financial performance: Moderating role of esg investors. Int. Rev. Financial Analysis 83, 102291. doi:10.1016/j.irfa.2022.102291

Cornier, D., Magnam, M., and Rahman, A. (2003). The determinants of Internet financial reporting. J. Account. Public Policy 21, 371–394. doi:10.1016/s0278-4254(02)00067-4

Du, X., and Wen, R. (2007). Corporate governance and quality of accounting information: An empirical research. J. Finance Econ. 33, 122–133.

Epstein, M. J., and Freedman, M. (1994). Social disclosure and the individual investor. Account. Auditing Account. J. 7, 94–109. doi:10.1108/09513579410069867

Fernandes, N., and Ferreira, M. A. (2008). Does international cross-listing improve the information environment. J. Financial Econ. 88, 216–244. doi:10.1016/j.jfineco.2007.06.002

Ferreira, M. A., and Matos, P. (2008). The colors of investors’ money: The role of institutional investors around the world. J. Financial Econ. 88, 499–533. doi:10.1016/j.jfineco.2007.07.003

Gill, A. (2008). Corporate governance as social responsibility: A research agenda. Berkeley J. Int. Law 26, 452.

Gu, X., An, Z., Chen, C., and Li, D. (2022). Do foreign institutional investors monitor opportunistic managerial behaviour? Evidence from real earnings management. Accounting & Finance.

Gul, F. A., Kim, J.-B., and Qiu, A. A. (2010). Ownership concentration, foreign shareholding, audit quality, and stock price synchronicity: Evidence from China. J. Financial Econ. 95, 425–442. doi:10.1016/j.jfineco.2009.11.005

Guo, Y., Shen, l., and Wang, P. (2018). Has the shanghai-Hong Kong stock sonnect reduced the risk of stock price crash—An empirical study based on the did model. J. Shanxi Univ. Fiance Econ. 40, 30–44.

Henry, P. B. (2000). Do stock market liberalizations cause investment booms? J. Financial Econ. 58, 301–334. doi:10.1016/s0304-405x(00)00073-8

Hong, H., and Kacperczyk, M. (2009). The price of sin: The effects of social norms on markets. J. Financial Econ. 93, 15–36. doi:10.1016/j.jfineco.2008.09.001

Hope, O.-K. (2003). Firm-level disclosures and the relative roles of culture and legal origin. J. Int. Financial Manag. Account. 14, 218–248. doi:10.1111/1467-646x.00097

Hope, O.-K., Hu, D., and Lu, H. (2016). The benefits of specific risk-factor disclosures. Rev. Account. Stud. 21, 1005–1045. doi:10.1007/s11142-016-9371-1

Jia, X., and Liu, Y. (2014). External environment, internal resources and corporate social responsibility. Nankai Bus. Rev. 17, 13–18+52.

Jin, Z. (2013). Social norms, financial report quality and the cost of equity capital. J. Financial Res., 194–206.

Kim, I. J., Eppler-Kim, J., Kim, W. S., and Byun, S. J. (2010). Foreign investors and corporate governance in Korea. Pacific-Basin Finance J. 18, 390–402. doi:10.1016/j.pacfin.2010.04.002

Kim, J.-B., Li, X., Luo, Y., and Wang, K. (2020). Foreign investors, external monitoring, and stock price crash risk. J. Account. Auditing Finance 35, 829–853. doi:10.1177/0148558x19843358