- 1Chinese International College, Dhurakij Pundit University Bangkok Thailand

- 2School of Economics, Lanzhou University, Lanzhou, China

With the acceleration of the digital technology construction process, digitalization has given impetus to the transformation and upgrading of China’s economy and micro businesses. China’s social and economic sectors have begun to integrate and develop in-depth with digital technology. Whether the digitalization of enterprises can drive their green innovation is an urgent question to be explored. The aim of our study is to answer this question and investigate whether digitalization has finally affected corporate green innovation. On the basis of theoretical discussion, the data of 3,547 Chinese listed companies from 2014 to 2019 were selected as samples. The fixed effect model was used to empirically test the relationship between digitization and green innovation, and then the intermediary effect model was used to analyze the influence mechanism. Research has found that digitalization is genuinely driving green innovation in business. After the robustness test, the conclusion remains the same. In order to deepen the understanding of the impact of digitalization on the green innovation of enterprises, this study additionally analyzed the impact mechanism. We find that digitization can promote corporate green innovation by easing corporate financing constraints and enhancing corporate awareness of fulfilling social responsibility. Moreover, we also find that the impact of digitalization on firm performance is more obvious in the samples with high level of internal control, state-owned enterprises and senior executives with IT background. The findings of this study enrich the related theories of digitalization and sustainability and provide empirical evidence for the positive externalities of digitalization.

1 Introduction

Based on past experience, sacrificing the environment in economic development is frequently a favorable option in the short term, especially when developing countries are seeking to quickly catch up with developed countries. After years of environmental destruction by the world’s nations, the planet’s environment is getting worse. When humans realized the catastrophic destruction caused by environmental degradation, they began to reflect and devote themselves to protecting the environment. China is one of them. China’s greening achievements have attracted worldwide attention in recent years. In recent years, China has vigorously advocated green innovation strategy, taking green innovation as the fundamental strategy to solve environmental problems (Jin et al., 2022). The high-quality development of the economy and society is the theme of the development of the era. Countries around the world increasingly attach importance to the performance of enterprises in environmental, social and governance (Hu et al., 2022). Deepening the green innovation driven strategy and promoting the greening of traditional industries will inevitably require enterprises to take green as the guidance, technology as the support and innovation as the driving force (Wang et al., 2022). The World Commission on Environment and Development stated in Our Common Future that sustainable development should be “development that meets the needs of the present without jeopardizing the ability of future generations to meet their own needs. Green innovation contributes to the creation of a favorable living environment for future generations and is an important force for sustainable development. Green technology innovation featuring high efficiency, low carbon and recycling is an important driving force in transforming economic development patterns and achieving green and sustainable development. It is also an inevitable choice for the development of human society (Ngo and O’Cass, 2009) and an important support for China to achieve “carbon peak” and “carbon neutrality” (Song et al., 2022).

In addition, today’s wave of digital development is sweeping the world, information technology and the real industry are accelerating their integration, and the current generation of digital technologies such as artificial intelligence, blockchain, cloud computing and their continuous penetration into enterprises have promoted the manufacturing industry to undergo profound changes in all aspects of the value creation process (Jin et al., 2022). Increasingly, enterprises are using emerging digital technologies for digital transformation and raising the level of digitalization in their enterprises. Enterprise digitalization refers to the process in which enterprises apply a variety of digital technologies to products, operations, management, strategic thinking, business models and other aspects in the innovation process to improve enterprise performance and competitiveness and achieve enterprise shift (Fichman et al., 2014). The gradual integration of digital technology and business model will form a digital industrial chain and industrial cluster, injecting fresh vitality into enterprises (Zuo and Chen, 2021; Zhou et al., 2022). Moreover, digitalization is becoming the leading force driving innovation and transformation (Wang et al., 2022). Digital technology has changed the combination mode of innovation elements, reduced innovation transaction and contract costs, cognitive differences, etc., so as to improve the innovation capability of enterprises (Wang et al., 2018), which together with the level of internal governance affects the future of enterprises. Digital technology also plays a crucial role in green development. The application of digital technologies such as precise collection and visualization analysis of carbon emission data by enterprises can accelerate emission reduction at the supply end, reduce carbon emissions at the consumption end, and realize energy conservation and emission reduction in urban living scenes (Shen et al., 2022), especially for state-owned enterprises. According to the data of the World Economic Forum, by 2030, all industries will benefit from information and communication technology (ICT) to reduce carbon emissions by 12.1 billion tons. Digitalization has become an essential hand to drive industrial optimization and upgrading and achieve green, high-quality development. In the process of promoting green innovation and realizing green development, digital technology is indispensable (Jin et al., 2022).

There are two main types of literature related to this research topic. One is to study the impact of digitalization on R&D efficiency, and the other is to study the positive signal effect of digitalization on reducing internal costs and freeing up external signals. According to the former group, digitalization of enterprises can enhance their capacity for technological innovation by improving the level of internal human capital, reducing R&D costs and promoting improved R&D input-output efficiency. However, it is difficult to promote the “quality improvement” of technological innovation due to the constraints of “double arbitrage” and “same-group effect” of enterprises (Smith et al., 2017; Matray, 2021). In addition, the latter group believes that the application of the Internet of Things and digital platforms in innovation can help smes reduce resource use and waste, develop cost-effective business models and gain competitive advantages (Yousaf et al.). The digitalization of enterprises reduces the cost of information analysis and process optimization, effectively improves the utilization of resources of enterprises to achieve a higher level of innovation output performance. This positive signal is an important factor to attract external investors. The relief of financing pressure will further promote enterprises to be more willing to assume social responsibility and take more promising green innovation activities (Hoenig and Henkel, 2015; Shen and Tan, 2022), especially for enterprises with information technology background. There have also been several studies on the relationship between digitalization and green technology innovation, but there is no consensus. Some studies believe that the application of digital technology by enterprises can highlight their competitive advantages in green innovation (EI-Kassar and Singh, 2019) and have a positive impact on the quality and quantity of green innovation (Xiao et al., 2022), but unfortunately they did not make a more specific analysis of the impact mechanism between the two. Another part of the research argues that advances in digital technology will drive businesses to re-purchase production equipment. However, in the transition phase of enterprise digital transformation, in order to rapidly increase production, enterprises will increase the exploitation of resources and energy consumption, which may reduce the green innovation activities of enterprises (Li et al., 2021). Both positive and negative views on the impact of digitalization on green innovation are lacking in in-depth analysis. Therefore, the research purpose of this paper is to supplement the shortcomings of existing studies on the basis of existing studies, explore the important factors to promote enterprise green innovation, and provide certain enlightenment for promoting enterprise digitalization. In this study, we carried out a theoretical analysis of the impact of digitalization on corporate green innovation and proposed research hypotheses that digitalization can promote corporate green innovation and promote corporate green innovation by easing financing constraints and improving corporate social responsibility awareness, and then conducted empirical tests on these hypotheses. In contrast to the existing studies, the contribution of this study is the following. First, this study examines the impact of digitization on green innovation, which enriches the theoretical system of related research. Second, this study provides a detailed analysis of the specific ways in which digitalization affects green innovation and expands and deepens the research system on the impact of digitalization on green innovation. Third, based on the perspective of internal corporate control, enterprise nature and executive information technology background, this study deepens the understanding of the impact of digitalization on green innovation by analyzing whether the impact of digitalization on green innovation varies across different groups.

2 Literature and theoretical reviews

2.1 Digitalization and green innovation

China leads the world in carbon emissions and its environment is in dire need of improvement. Udemba et al. (2022a) argue that China has the capacity to achieve its climate and sustainable development goals by developing policies around the energy sector and strengthening technology through strong institutions. In fact, in addition to urbanization, entrepreneurial activity (Udemba et al., 2022b), foreign direct investment (FDI), and institutional factors (Udemba et al., 2022a), the presence of digital factors also provides a powerful force for solving environmental problems. With the increase of resource and environmental pressure, the rise of labor costs and the intensification of industry competition, traditional enterprises will only gain the upper hand in the rapidly advancing digital trend by further accelerating the construction of digital infrastructure and increasing the investment in digital technology (Liu et al., 2022). Digitalization can use the new generation of information technology to promote industrial change, improve industrial operation efficiency, and build a modern economic system (Li et al., 2022a). Green innovation is an innovation activity in which enterprises use innovative technology, innovative management and alternative methods to achieve dual objectives of economic performance and environmental performance with the purpose of improving resource utilization and reducing energy consumption (Xiao et al., 2021a). According to sustainable development theory and environmental Kuznets curve theory, digital development is an essential new driving force for today’s social and economic growth, while green innovation is regarded as an influential starting point for reducing environmental pollution (Philip et al., 2022). Digital transformation needs to “feed back” green technology innovation, so as to improve the quality of overall green economic development. In fact, the promotion of digital technology facilitates enterprises to obtain customers’ consumption habits and preferences by means of the Internet of Things, huge data, etc., so as to achieve accurate identification of market demands (Bajari et al., 2019), and transform enterprises’ green innovation from experience-driven to data-driven, laying an intellectual foundation for the improvement of innovation quality. For enterprises, green innovation output capacity is a measure of the contribution of innovation achievements to the enterprise economy and technology through the implementation of green development strategies (Pan and Wang, 2022). The application of digital technology can also reduce the marginal transaction costs of enterprises, and easily form the effects of economies of scale and network economy. It can not only stimulate the green consumption of customers (Wang and Li, 2021), but also bring more invisible resources to enterprises and improve their economic benefits. In addition, according to the legitimacy theory, in the process of digital transformation, enterprises can make use of the leading advantages of digital technology to achieve the strategic goals of resource conservation and environmental protection, and create a good green image with a higher level of green innovation (Xie et al., 2016). Choosing green innovation is a smart choice for corporate management at this time. Based on resource-based and dynamic capabilities theories, the digitalization of enterprises not only brings various advantages of external resources to enterprises, but also brings a new ability to reconfigure internal and external resources. With the help of digital technology, enterprises can also efficiently allocate resource elements, obtain a lot of external information and knowledge, increase the knowledge reserve of green technology innovation, and promote green technology innovation (Zhang and Tang, 2018).

Based on the above analysis, we propose the following hypothesis

2.2 Digitalization, financing constraints and green innovation

With the dual attributes of environmental protection and innovation, green innovation is bound to face more R&D costs and higher risks, as well as lower return rates and greater uncertainty in returns. There is a serious phenomenon of information asymmetry, thus the enthusiasm of investors is low (Doran and Ryan, 2012; Liu et al., 2022). Studies have shown that when enterprises face serious financing constraints, they will actively reduce investment in green technology innovation (Yang and Xi, 2019). Information asymmetry often leaves investors, as vulnerable parties to the information, bogged down in issues of adverse selection and moral hazard. Whether or not to effectively solve the problem of information asymmetry caused by it is the key for enterprises to obtain effective support from investors on green innovation resources (Roca et al., 2017; Shen et al., 2022). Digital technology helps reduce the cost of information acquisition and communication. The government, external regulatory authorities and potential investors can timely obtain enterprise information, break the physical limit of “time and space”, invisibly expand the scale of enterprise information networks, effectively reduce pollution under reporting and concealment, and reduce information asymmetry (Li et al., 2022b). Sufficient information enables companies to continuously secure investor support for innovation activities, alleviates financing constraints faced by corporate activities or green innovation activities, and promotes corporate active participation in environmental governance. The positive “exposure effect” generated attracts investors’ attention, thus bringing additional market resources for enterprise green innovation, which is ultimately reflected in the improvement of enterprise green R&D innovation level (Biondi et al., 2002).

Based on the above analysis, we propose the following hypothesis

2.3 Digitization, corporate social responsibility and green innovation

At the end of the last century, Ramirez, (1999) put forward the concept of “value co-production”, pointing out that value is not created by a single entity, but by consumers and enterprises. Under the background of the digital era, to improve the low-carbon circular economy system and promote green development, manufacturing enterprises should attach importance to environmental protection policies, adopt green technologies to establish a green image, and bring customers, suppliers and other stakeholders into the process of creating green value (Li, 2022). Digital transformation will drive the transformation of enterprises into serve-based enterprises and encourage them to assume more social responsibilities (Zhao and Huang, 2022). The fulfillment of corporate social responsibility, including a series of organizational activities and strategic measures, is essentially a behavioral choice based on its own development strategy (Shen et al., 2022). According to the stakeholder theory, the combination of “contracts” concluded by different stakeholders constitutes an enterprise. In the process of obtaining economic resources from the “contract” subjects, enterprises need to return benefits to various stakeholders by fulfilling their social responsibilities (Huang and Kung, 2010). Corporate social responsibility has something in common with the concept of sustainable development. Corporate social responsibility includes environmental responsibility, that is, the responsibility to protect the ecological environment, which coincides with the concept of sustainable development. Active performance of social responsibility, help enterprises to obtain a wide range of social recognition and acceptance, constantly open up development space, pay attention to the protection of ecological environment, achieve external economy, promote sustainable development. The digital transformation of enterprises is based on digital technology to realize value co creation for all stakeholders, thus bringing fresh impetus for enterprises to fulfill their social responsibilities (Shang and Wu, 2022). Enterprise digitalization can also profoundly engage all aspects of CSR, strengthen the willingness and motivation of enterprises to fulfill CSR, and ultimately improve CSR performance. The performance of corporate social responsibility can promote green product and process innovation (Xiao et al., 2021b). Excellent performance of social responsibility generally means that enterprise management can coordinate the relationship between economic benefits, environmental protection and resource consumption, thus improving the level of green innovation of enterprises (Gu and Gao, 2022). The higher the level of social responsibility fulfilled, the higher the company considers the interests of its stakeholders and the more harmonious the relationship with them, the higher the company’s image and social standing. The enterprise can obtain further resources from stakeholders for green technology innovation, and the enterprise will be more successful (Yang et al., 2022). Cox and Wicks (2011) found that enterprises with higher charitable donations have higher investment in environmental protection and better environmental performance.

Based on the above analysis, we propose the following hypothesis

3 Data and methodology

3.1 Research design

Drawing on previous research, considering that the factors of company and year may affect the regression results, we build the following model (1) to test the relationship between digitalization and enterprise green innovation.

In model (1), the subscript i is industry, t is year. The dependent variable gre is enterprise green innovation, the independent variable num is enterprise digitalization level, and X represents control variables.

We used the econometric software Stata 17.0 for our empirical analysis. The Stata commands used in this study include asdoc, reghdfe, and ivreghdfe.

3.2 Variable selection

3.2.1 Dependent variable

As it takes a certain amount of time for patent application to be granted, it may have an impact on enterprises during the application process, so patent application data will be more reliable and timely than the amount granted. Referring to the research practice of Li and Zheng (2016), we adopted the number of green patent applications of listed companies (including invention patents and utility model patent applications) as the proxy variable of green innovation of enterprises, which is recorded as gre. As the green patent data has a typical “right biased” feature, we add one to it and take the natural logarithm. The greater the greener, the higher the level of green innovation in the business. In addition, we tested the robustness with the number of green patents granted by listed companies (gre2).

3.2.2 Independent variable

The previous studies mainly used the virtual variable of whether the enterprise has conducted digital transformation as the digital proxy variable (He and Hongxia, 2019), which could not measure the extent of the enterprise’s digital transformation. The extent to which an enterprise attaches importance to a specific strategic orientation can frequently be reflected by the frequency of the keywords involved in the strategy in the annual report (Wang et al., 2022). Drawing on the research of Pan and Wang, (2022), we use the word frequency of the words related to “enterprise digitalization” in the annual report to measure enterprise digitalization. When we digitize computing enterprises, we cover five categories of words, namely, artificial intelligence, blockchain, cloud computing, big data and digital technology applications, which are consistent with previous research (Wu et al., 2021).

3.2.3 Mediating variables

Following the theoretical analysis in, we choose financing constraints and CSR as intermediary variables. For the measurement of financing constraints, Kaplan andZingles, (1997) qualitatively divided the degree of enterprise financing constraints according to the financial situation of enterprises in a limited sample in 1997, and then described the quantitative relationship between the degree of financing constraints and the variables reflecting the characteristics of enterprises. Drawing on the research of Ju et al. (2013), We use the SA index, which is constructed by using the firm size (SI) and firm age (A), two variables that have little change over time and have strong externalities, as the proxy variables of financing constraints (SA). Where SA = −0.737 × SI+0.043 × SI2-0.040 × A. SI is the natural logarithm of the total assets of the enterprise, A is the listed years of the enterprise, and SA is a negative value. Take the absolute value of the SA index. If the absolute value is larger, the financing constraint is larger. The reason why we choose SA index is that SA index does not contain endogenous financing variables and is easy to calculate.

Using the research of Zhao (2022) for reference, we use the web crawler method to capture the total social responsibility scores of listed companies over the years from the social responsibility report database of Hexun listed companies as the proxy variable of corporate social responsibility. The total score for social responsibility is the sum of the sub-scores for shareholder responsibility, environmental responsibility, employee responsibility, supplier, customer and consumer interest responsibility, and social responsibility.

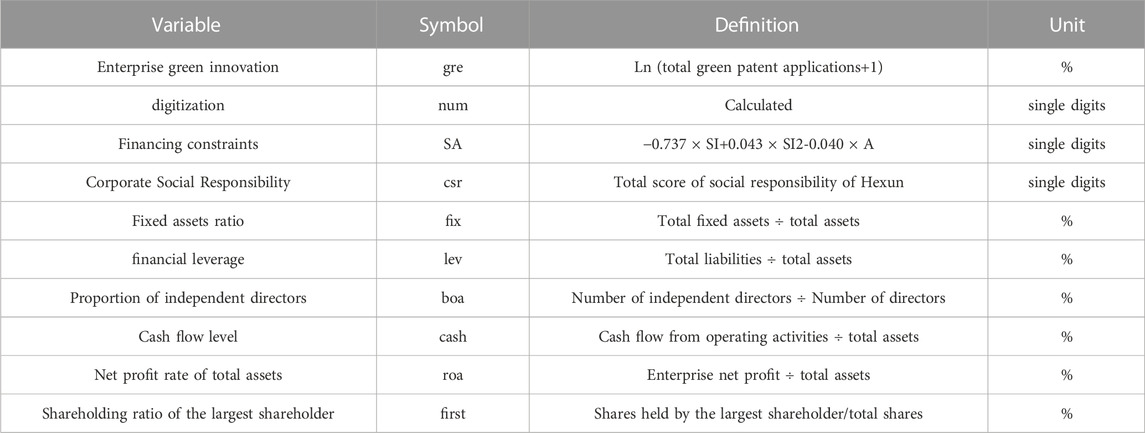

3.2.4 Control variables

Drawing on the existing literature (Jin et al., 2022; Xiao et al., 2022), the sustainable development capability of enterprises, such as green innovation, is influenced by many factors, such as basic organizational characteristics, organizational resources and R&D capability. We selected the company level factors such as fixed asset ratio (fix), financial leverage (lev), proportion of independent directors (boa), cash flow level (cash), total asset net profit rate (roa), and the first largest shareholder’s shareholding ratio (first) as the control variables of the model to exclude the impact of heterogeneous factors on enterprise performance.

The variable definition table is shown in Table 1.

3.3 Data sources

To test the theoretical hypothesis, we validate the relationship between digitalization and corporate green innovation using data from 2014 to 2020 for A-share listed companies in mainland China. Given the difficulty of obtaining complete data for non-listed companies, and the advantages of listed companies such as significant digitalization and service characteristics and transparent data information, listed companies were selected for this study. In addition, given the particularities of financial companies, we also excluded listed companies in the financial sector. The following conditions shall be followed for screening. First, ST, * ST and PT samples shall be removed (ST sample refers to listed companies with negative net profits for two consecutive accounting years, * ST sample refers to listed companies with losses of 3 years, and PT sample refers to listed companies waiting for delisting). Second, financial and insurance samples were not included. Third, missing observations of the main studied variables are eliminated. After the screening described above, After the above screening, we finally get 19,158 observations. To avoid the effect of extreme values, we shrink the tails of the continuous variables by 1 percent. Data were taken from the CSMRA and CNRDS databases (CSMRA refers to Guotai’an Database, https://cn.gtadata.com/, and CNRDS refers to China Research Data Service Platform, https://www.cnrds.com/Home/Login) and STATA 17.0 was used for data processing.

4 Empirical results

4.1 Descriptive statistics

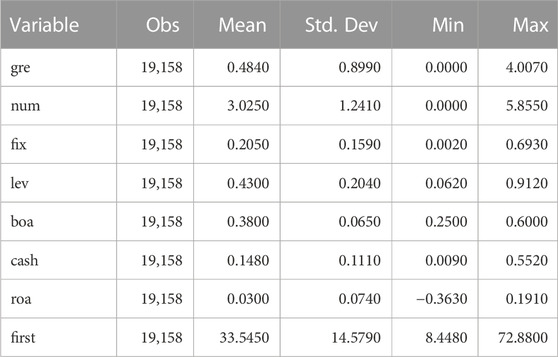

Table 2 lists the descriptive statistical results for the main variables. The average value of enterprise green innovation (gre) is 0.4840, and the standard deviation is 0.8990. The average value of digital (num) is 3.0250, the maximum value is 5.8550, and the minimum value is 0, indicating that there is still much room for Chinese enterprises to improve their digitalization. In addition, we did a multicollinearity test. We found that the VIF value of each variable was less than 2, indicating that there was no multicollinearity between variables.

4.2 Regression results

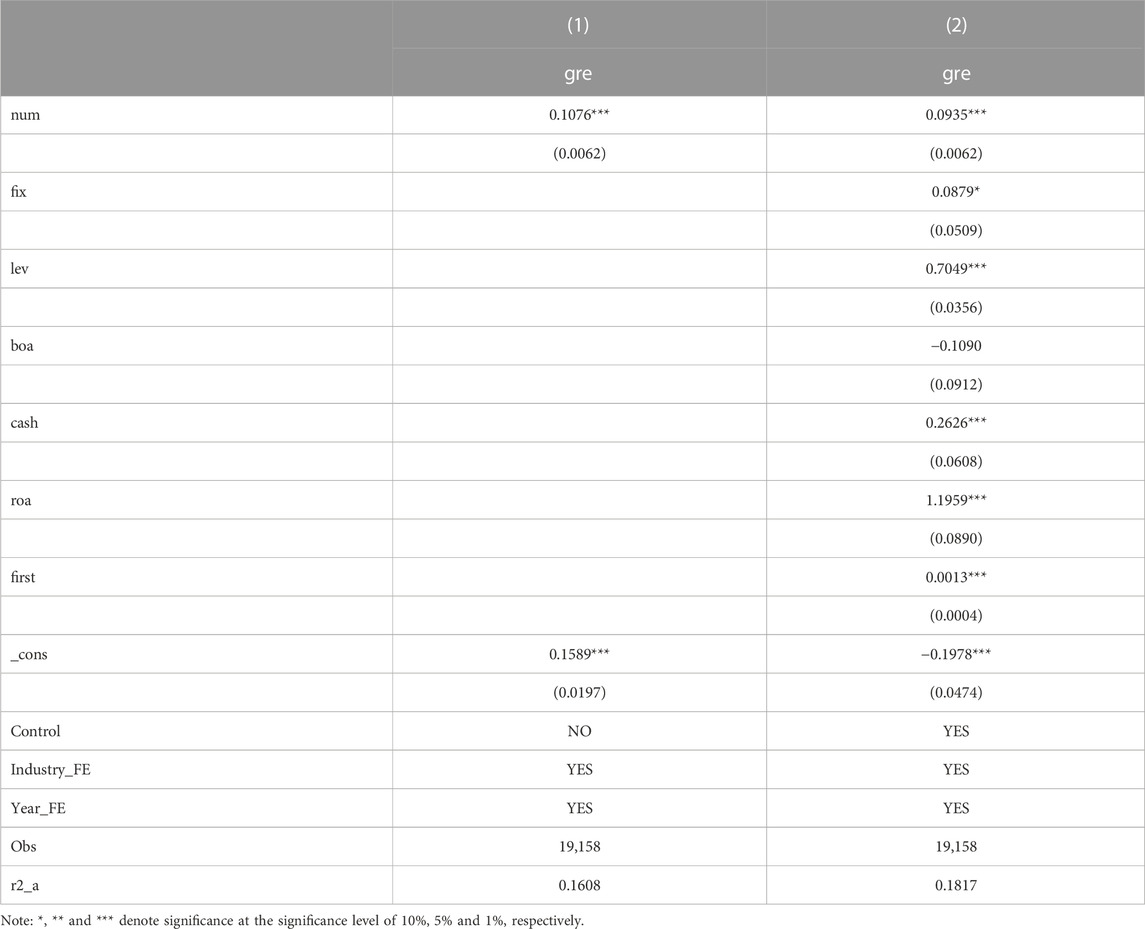

In order to reduce the interference caused by heteroscedasticity and residual autocorrelation, we have adopted clustering robust standard error for regression. Table 3 shows benchmark regression results for the impact of digitalization on corporate green innovation. Column (1) is the result without adding control variables under the condition of controlling industry fixed effect and year fixed effect. The coefficient of ϕ is 0.1076 and is significant at the 1% level. Column (2) also adds control variables, and the coefficient of num is 0.0935, which is significant at the 1% level. The results show that the coefficient of num is significantly positive in columns (1) and (2), indicating that higher digitalization can promote the level of green innovation of Chinese A-share listed companies. The research hypothesis H_1 is verified. This research conclusion is consistent with the existing research conclusions (Jin et al., 2022; Shen et al., 2022).

4.3 Robustness checks

4.3.1 Replace the dependent variable

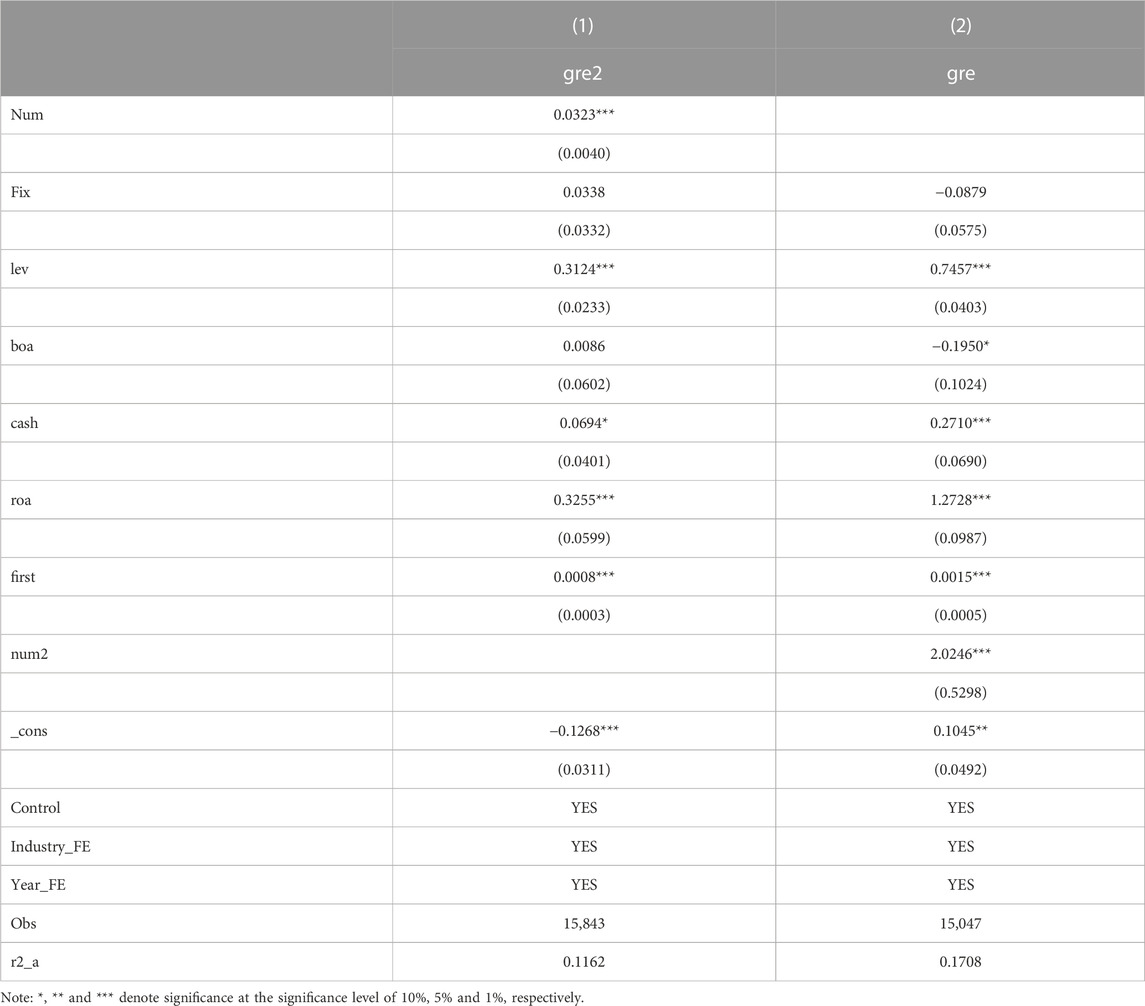

Furthermore, drawing on the research of Qi et al. (2018), we selected green patent licensing (gre2) as an indicator to measure green innovation of enterprises for robustness test. The regression results are shown in column (1) of Table 4. The coefficient of ϕ is 0.0323 and is significantly positive at the 1% level. This suggests that digitalization can effectively drive green innovation in enterprises, which is in line with previous conclusions.

4.3.2 Replace the independent variable

In order to avoid the instability of the results due to the numerical level of the measurements performed by the methods described above. Drawing on the work of He Fan et al. The regression results are shown in column (2) of Table 4. The coefficient for number two is 2.0246, which is significantly positive at the 1% level. This still suggests that digitalization can drive green innovation in companies, which is nearly the same as the baseline regression results.

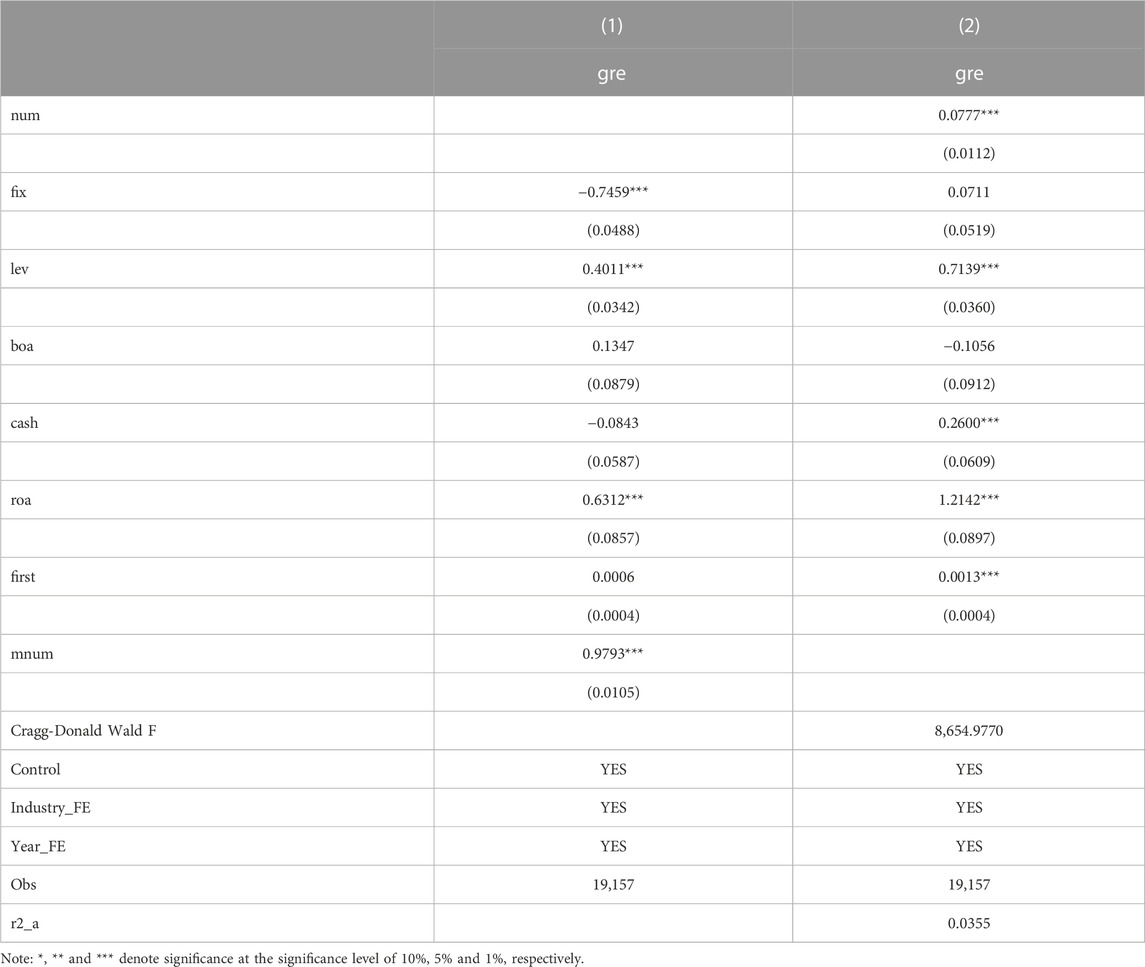

4.3.3 Regression of instrumental variable

Given the impact of digital transformation on corporate green innovation, there may be an endogenous problem of cause and effect inversion, where companies with stronger green innovation capabilities are more motivated to conduct digital transformation activities. Drawing on the research of Jin et al. (2022), we use the 2SLS method to regress the mean digital level (mnum) of peers and other enterprises in the same province as a digital tool variable. The regression results for the instrumental variables are shown in Table 5. The results of the C-D Wald F test show that the instrumental variables satisfy the correlation property and there is no problem with the weak instrumental variables, that is, the instrumental variables are reasonably reliable. The regression results of the first stage are shown in column (1). The coefficient of mnum is 0.9793, which is significantly positive at the level of 1%. The regression results of the second stage are shown in Column (2) of Table 5. The coefficient of ϕ is 0.0777 and is significantly positive at the 1% level. This result is consistent with the research conclusion of Shen et al. (2022). It also shows that digitalization has boosted the level of green innovation in companies. Our conclusions remain valid.

5 Further analysis

5.1 Influence mechanism test

Previous analyses have shown that digitalization can significantly drive green innovation in business. Next, we will further explore the internal mechanisms of enterprise digitalization to promote its green innovation. According to the theoretical analysis, we believe that digitalization can improve the level of green innovation of enterprises by easing financing constraints and enhancing corporate social responsibility awareness. Motivated by this, we develop a mediation effect model to analyze mediation effects. According to Wen and Ye, (2014) three-step method of intermediary effect model, we establish the following model:

Among them, middle represents the intermediary variable, which is represented by financing constraints (SA) and corporate social responsibility (csr). The model (2) is the same as (1).

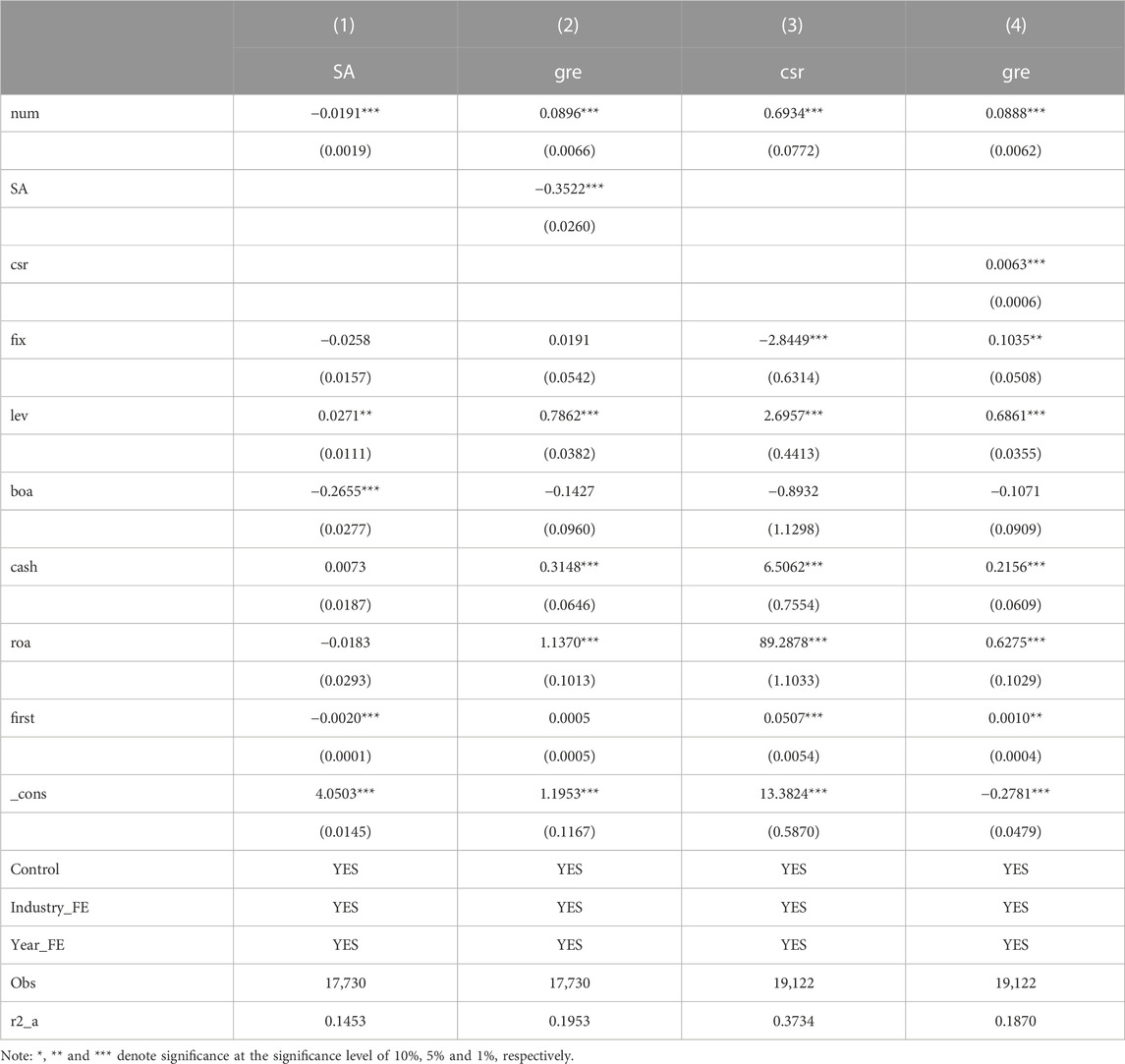

First, the SA index is used in this paper to measure the overall financing constraints faced by enterprises. If the SA index is larger, it indicates that firms are facing greater funding constraints. The results of the intermediary effect regression are shown in Table 6. In column (1), the coefficient of num is −0.0191, which is significantly negative at the level of 1%. This suggests that digitalization can ease the constraints on corporate financing. This is consistent with the research conclusion of Wang et al. (2022). In column (2), the coefficient of num is 0.0896 and the coefficient of SA is −0.3522, both of which are significant at the level of 1%. This shows that the easing of financing constraints can promote green innovation of enterprises, which is consistent with the existing research results (Ye, 2021). Analysis of intermediary effects shows that digitalization can indeed drive green innovation in businesses by easing financing constraints. Let’s say

Next, we measure corporate social responsibility (csr) with the total score of social responsibility of Hexun. The higher the score, the more CSR is achieved. In column (3), the coefficient of num is 0.6934, which is significantly positive at the 1% level. This shows that digitalization is conducive to promoting enterprises to fulfill their social responsibilities, which is consistent with Shang and Wu, (2022). In column (4), the coefficient of num is 0.0888, and the coefficient of csr is 0.0063, both of which are significantly positive at the level of 1%, indicating that the performance of corporate social responsibility can promote corporate green innovation, which is consistent with Xiao and Zeng, (2022). Analysis of intermediary effects shows that digitalization can also drive green innovation in companies by raising CSR awareness. So far, we have proved our research hypothesis

5.2 Internal control level difference analysis

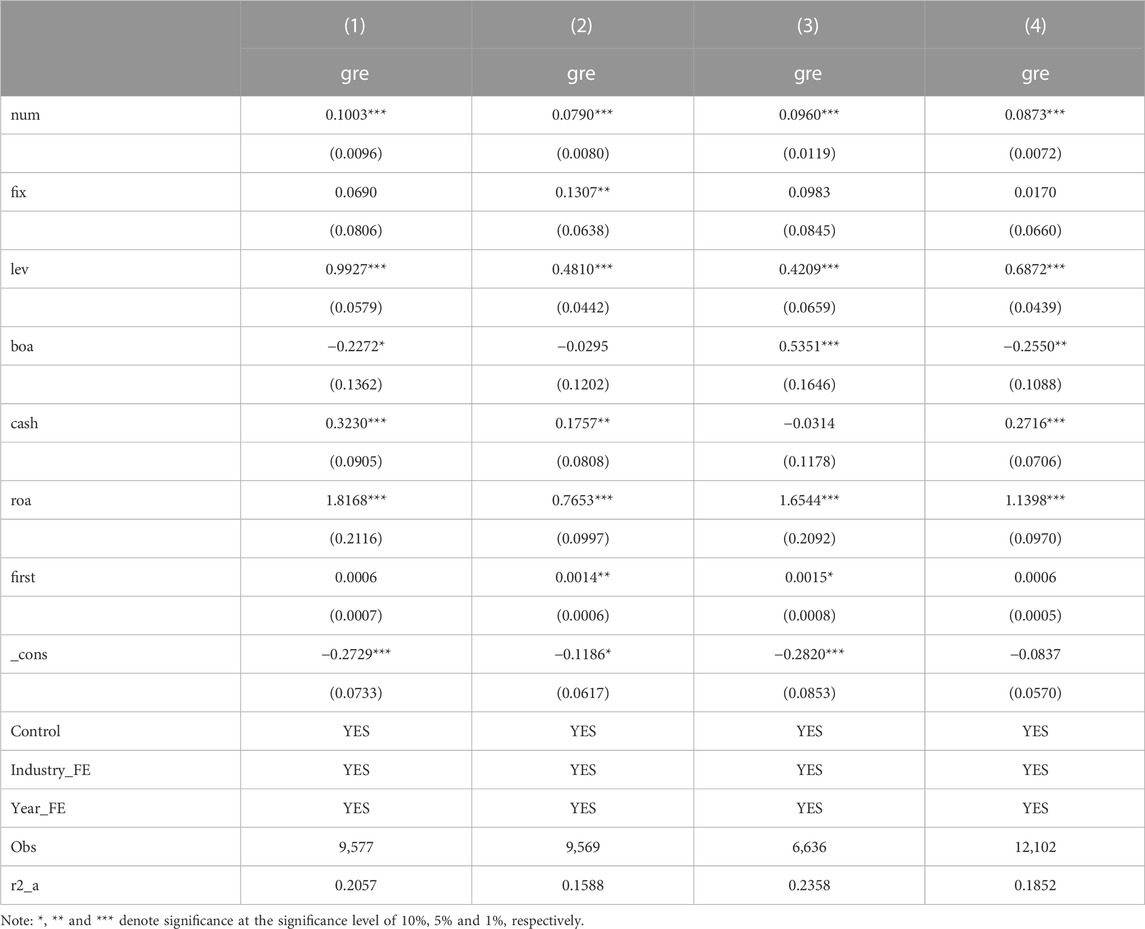

Internal control is an internal governance method or procedure involving all the senior management of the enterprise to ensure the safety of assets and the quality of accounting information, which affects the realization of enterprise operations and laws and regulations (Gao et al., 2022). A reasonable internal control system, on the one hand, can enhance an enterprise’s ability to respond to environmental uncertainties. On the other hand, it can also consolidate the owner’s supervision of the management, send a positive signal to external investors (Yan and Yang, 2022), and have an influential impact on enterprise digitalization and green innovation. Referring to the research of Zeng et al. (2022), we take the internal control index in Dibo’s internal control and risk management database as the proxy variable of the enterprise’s internal control level. The higher the index value, the higher the level of internal control in the business. In addition, we consider firms with an internal control index greater than the industry median as firms with elevated internal control levels, otherwise, we treat them as firms with low internal control levels and perform group regression. The regression results are shown in columns (1) and (2) of Table 7. It can be seen that digitalization has an impact coefficient of 0.1003 on green innovation in companies with higher levels of internal control, which is significant at the level of 1 percent. Digitalization has an impact coefficient of 0.0790 on green innovation in companies with low levels of internal control, which is significant at the 1 percent level. The quality of corporate development will be affected by the internal environment of the company. The higher the level of internal control, the better digitalization will work, ensuring the smooth development of green innovation activities and improving the impact of digitalization on corporate green innovation, which is conducive to corporate development. This is consistent with Gao et al. (2022).

5.3 Enterprise nature difference analysis

Differences in business objectives and risk control between SOEs and non-SOEs will have an impact on corporate activities and, therefore, corporate green innovation. Like most scholars, this study also analyzes the effect of differences in the nature of the business on the conclusions of the study. We regressed the samples of state-owned enterprises and non-state-owned enterprises, respectively, and the regression results are shown in columns (3) and (4) of Table 7. It can be seen that the impact of digitalization on the green innovation of SOEs has a coefficient of 0.0960, which is significantly positive at the 1 percent level. The coefficient of influence of digitalization on green innovation in non-state-owned enterprises is 0.0873, which is significantly positive at the 1 percent level. This shows that improving the level of digitalization in SOEs can effectively increase the level of green innovation in enterprises. In contrast to non-state-owned enterprises, the business objective of state-owned enterprises does not lie in their own profits, but in promoting the maximization of social and national interests. As a result, green development has been given more importance by SOEs.

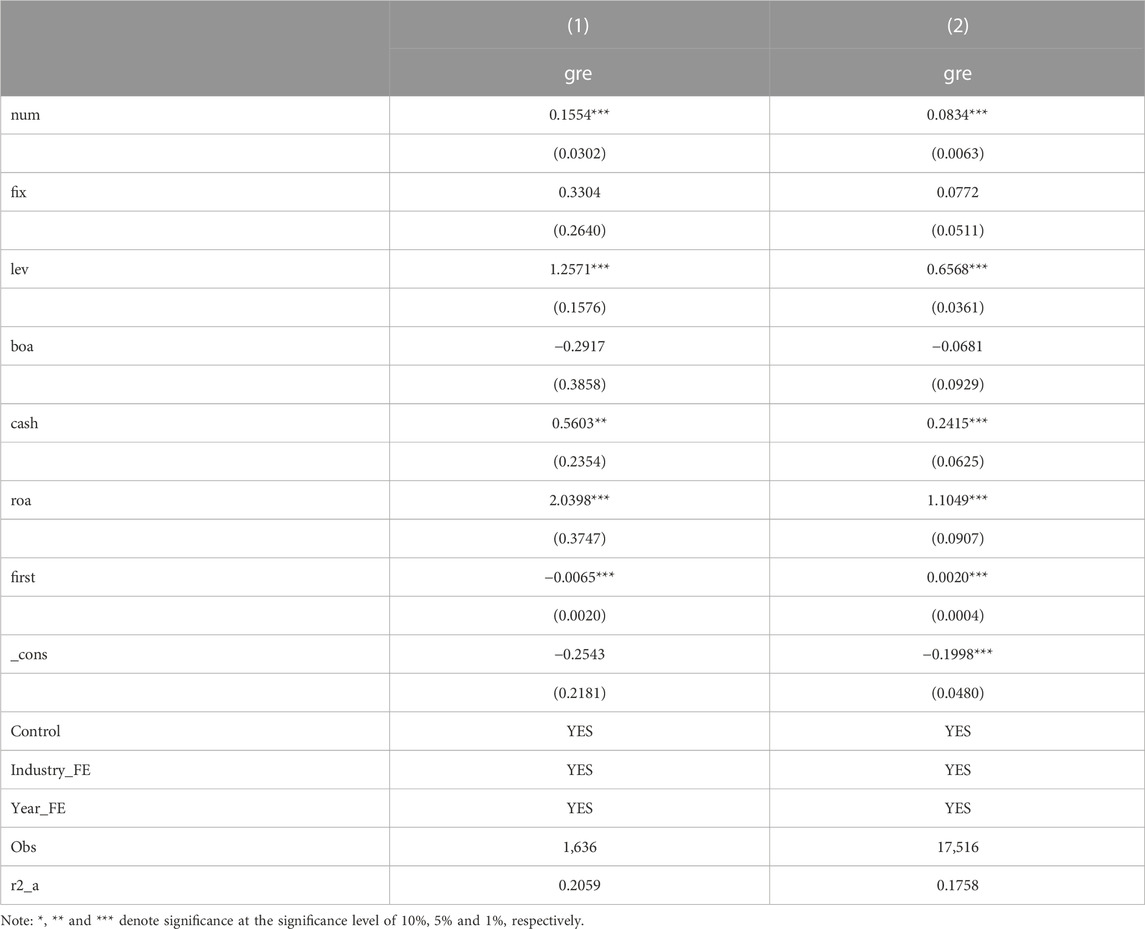

5.4 Information technology background difference

As enterprise action guides, senior executives play a decisive role in the development of corporate strategic social responsibility and green innovation activities (Xiao et al., 2021a). The heterogeneity of information technology backgrounds of senior executives means that they have different cognitive bases for digitalization, as well as different identification capabilities for digital opportunities. Using the research of Zhao and Huang, (2022) for reference, we establish a dummy variable (Dceo) for senior executives’ information technology background. Dceo has a value of one if the executive has an IT background and 0 otherwise. Further, we conducted group regression according to the information technology background of senior executives, and the regression results are shown in columns (1) and (2) of Table 8. It can be seen that digitalization has an impact coefficient of 0.1554 on corporate green innovation among companies with information technology background, which is significantly positive at the level of 1 percent. Among companies without an IT background, the impact of digitalization on corporate green innovation was 0.0834, which is significantly positive at the 1% level. This suggests that the digitalization of companies with IT backgrounds for their executives can boost the level of green innovation compared to companies without IT backgrounds for their executives. The information technology background of an executive can enhance the likelihood of applying information technology to business operations and management, as well as the quality of its application, thus enhancing the impact of digitalization on the company’s green innovation.

5.5 Evaluate and discuss together

Based on the perspective of endogenous innovation, this paper summarizes the green innovation performance of enterprises by the number of patents, and tests the effect of digitalization on green innovation. Here we will discuss more.

Social media influencers also play a role in the process of enterprise digitization. For enterprises with high degree of social network embeddedness, “data-driven” enables enterprises to better carry out green innovation activities. Especially for start-ups, social media influencers and social platforms can provide them with huge information and technology resources for green development. This study does not consider the green innovation of smes, but for smes, there is a lack of long-term vision. Small and medium-sized enterprises tend to pay special attention to short-term interests, and do not have a clear strategic planning and design for long-term interests, nor do they have implementation of organizational and management measures, which are exactly the constraints to the implementation of green innovation. In addition, countries around the world have recognized that green development is the trend of world development, and bilateral trade contracts and agreements on green economy and green policies have begun to appear on the world stage. On 18 October 2022, Australia and Singapore announced the signing of the Singapore-Australia Green Economy Agreement (GEA). By combining trade, economic and environmental goals, the agreement provides a major boost to the world’s green economy by facilitating bilateral trade in green products and extensive cooperation between emerging growth sectors to promote common rules and standards for trade and environmental sustainability, enabling both countries to jointly transition to a zero-carbon economy. The future of green innovation is bright.

6 Conclusion and policy recommendation

With the rapid development of information technology, the development of enterprises will inevitably be affected by digitalization. In this context, this study explores the impact of digitalization on the green innovation of enterprises and their internal mechanisms in a multidimensional way. Based on existing research, we have incorporated financing constraints, corporate social responsibility, internal control levels, and the information technology background of executives into the research system, expanding the accumulated literature in the related field. Based on a detailed theoretical analysis, we systematically investigate the impact of digitalization on corporate green innovation, using Chinese A-share listed companies from 2014 to 2019 as a sample. Research has found that digitalization can indeed drive green innovation in companies. This conclusion remains valid after robustness and endogenous tests. In the subsequent intermediary effect analysis, we demonstrate that digitalization can promote green innovation in businesses by easing financing constraints and enhancing corporate social responsibility awareness. In addition, we found that the impact of digitalization on corporate green innovation is more pronounced among companies with high levels of internal control, state-owned enterprises, and executives with information technology backgrounds.

In contrast to existing research, we also support the idea that digitization can drive green innovation in companies. However, we demonstrate this using relatively new data and methods. In particular, we empirically demonstrate that digitization can drive corporate green innovation by easing financing constraints and enhancing corporate social responsibility awareness. In addition, we innovatively explore the impact of the level of internal control on the outcome of the study.

Based on our conclusions, we believe that enterprises should not hesitate to implement their digital strategies and continuously improve their digital levels. Indeed, it can be found from our study that easing of financing constraints and increased awareness of CSR are also crucial. Therefore, the government should attach importance to the improvement of enterprise financing environment, and enterprises without political connection should take the initiative to establish a “pro-clear relationship between government and business” with the government to obtain government support and alleviate the predicament of resource constraints. In addition, enterprises should attach importance to the fulfillment of social responsibility, regard corporate social responsibility as a necessary strategic measure to integrate corporate economic and social attributes, and promote the integration of corporate social responsibility and sustainable development cognitive orientation into the internal strategic management and innovation management system, so as to better realize the responsibility embedding in the process of corporate technological innovation. Based on our heterogeneity analysis, we believe that while the nature of the enterprise is difficult to modify, the level of internal control of the enterprise can be changed in a short period of time. Businesses should regularly promote the improvement of their internal control levels.

However, this study is not without limitations. This paper focuses only on the Chinese case and lacks empirical analysis of other countries. The specific impact coefficient of digitalization on green innovation of listed companies calculated in this paper is 0.0935. However, there are a variety of unlisted companies in China, each with a different situation. It is difficult for unlisted companies to make specific development plans based on this figure. This study lacks a more in-depth and concrete theoretical justification.

In the future, researchers should consider additional countries and more samples, and should construct new metrics to measure non-listed companies whose data is difficult to obtain but should emerge. Researchers should construct a more specific theoretical model to discuss the impact of digital images on green innovation in business. In the future, researchers should also consider the long-term impact of digitalization on green innovation in business.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

YF: software, validation, investigation, data curation, manuscript revision financial support; QS: validation, investigation; supervision; financial support, manuscript revision XW: Conceptualization, funding acquisition and writing and horbar; original draft. MF: Methodology, writing and horbar; original draft, resources, supervision, software. Manuscript revision.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bajari, P., Chernozhukov, V., Hortagcsu, A., and Suzuki, J. (2019). The impact of big data on firm performance: An empirical investigation. AEA Pap. Proc. 109, 33–37. doi:10.1257/pandp.20191000

Biondi, V., Iraldo, F., and Meredith, S. (2002). Achieving sustainability through environmental innovation: The role of SMEs. International Journal of Technology Management24 (5/6), 612.

Cox, P., and Wicks, P. C. (2011). Institutional interest in corporate responsibility:portfolio evidence and ethical explanation. J. Bus. Ethics 103, 143–165. doi:10.1007/s10551-011-0859-0

Doran, J., and Ryan, G. (2012). Regulation and firm perception, eco-innovation and firm performance. Eur. J. Innovation Manag. 15 (4), 421–441. doi:10.1108/14601061211272367

El-Kassar, A. N., and Singh, S. K.,(2019),“Green innovation and organizational performance:the influence of big data and the moderating role of management commitment and HR practices”,Technol. Forecast. Soc. Change,144(C):483–498. doi:10.1016/j.techfore.2017.12.016

Fan, H., and Liu, H. (2019). Evaluation of performance improvement effect of digital transformation of real enterprises from the perspective of digital economy. Reform (4), 137–148.

Fichman, R., Santos, D., Brian, L., and Zheng, Z. (2014). Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 2 (38), 329–343. doi:10.25300/misq/2014/38.2.01

Gao, K., Zhao, H., and Wang, L. (2022). East China economic management (02), 119–128. doi:10.19629/j.cnki.34-1014/f.210713001

Gu, H. F., and Gao, H. H. (2022). A study on the impact of digital finance development on corporate green innovation. Statistics and Information Forum (11), 77–93.

He, F., and Hongxia, L. (2019). Assessment of the performance enhancement effect of digital change in real enterprises from the perspective of digital economy. Reform (04), 137–148.

Hoenig, D., and Henkel, J.,2015,“Quality Signals?The role of Patents,Alliances,and team experience in venture capital financing”,Res. Policy,44(5):1049–1064. doi:10.1016/j.respol.2014.11.011

Hu, J., Han, Y., and Zhong, Y. (2022). How the digital transformation of enterprises affects ESG performance - evidence from Chinese listed companies industrial economic review. doi:10.19313/j.cnki.cn10-1223/f.20221104.001

Huang, C. L., and Kung, F. H. (2010). Drivers of environmental disclosure and stakeholder expectation:Evidence from Taiwan. J. Bus. Ethics 96 (3), 435–451. doi:10.1007/s10551-010-0476-3

Jin, Y., Wen, W., and He, Y. (2022). The impact of digital transformation on green innovation of enterprises - based on empirical evidence of listed companies in China's manufacturing industry. Finance and Trade Research 33 (07), 69–83. doi:10.19337/j.cnki.34-1093/f.2022.07.006

Ju, X., Lu, D., and Yu, Y. (2013). Financing constraints, Working capital management and corporate innovation sustainability. Econ. Res. J. 48 (01), 4–16.

Kaplan, S. L., and Zingales, L. (1997). Do investment cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi:10.1162/003355397555163

Li, H. (2022). Research on the impact of digital innovation on green Innovation performance in manufacturing Industry (Master Dissertation. Harbin: Harbin University of Science and Technology.

Li, J., Chen, L., Chen, Y., and He, Y. (2022a). Digital economy, technological innovation, and green economic efficiency—empirical evidence from 277 cities in China. Manag. Decis. Econ. 43 (3), 616–629. doi:10.1002/mde.3406

Li, J., Hu, S., Qi, X., Zhou, T., and Lu, Z. (2022b). Analysis of the impact of corporate digital transformation on performance Investment and Entrepreneurship (13), 48–52.

Li, W., and Zheng, M. (2016). Substantial innovation or strategic innovation? - the impact of macro industrial policies on micro enterprise innovation. Econ. Res. 4, 60–73.

Li, X. Y., Liu, J., and Ni, P. J. (2021). The impact of the digital economy on CO2 emissions:A theoretical and empirical analysis. Sustainability 13 (13), 7267.

Liu, D., Bai, F., and Dong, K. (2022). Research on the impact mechanism of digital transformation on enterprise performance Finance and Accounting Communication (16), 120–124. doi:10.16144/j.cnki.issn1002-8072.2022.16.010

Liu, G. Z., and Liu, J. (2022). The theory and demonstration of digital finance enabling green innovation - empirical evidence from prefecture level cities Wuhan Finance (09), 50–60.

Matray, A. (2021). The local innovation spillovers of listed firms. J. Financial Econ. 141 (2), 395–412. doi:10.1016/j.jfineco.2021.04.009

Mubarak, M. F., Tiwari, S., Petraite, M., Mubarik, M., and Raja Mohd Rasi, R. Z. (2021). How industry 4.0 technologies and open innovation can improve green innovation performance? Manag. Environ. Qual. 32 (5), 1007–1022. doi:10.1108/meq-11-2020-0266

Ngo, L. V., and O'Cass, A. (2009). Creating value offerings via operant resource-basedcapabilities. Ind. Mark. Manag. 38 (1), 45–59. doi:10.1016/j.indmarman.2007.11.002

Pan, H. B., and Gao, J. F. (2022). Digital transformation and corporate innovation - Empirical evidence based on annual reports of Chinese listed companies. Journal of Central South University (Social Science Edition) (05), 107–121.

Pan, J., and Wang, F. (2022) How does digital empowerment affect the green transformation of enterprises—analysis of the dual impact of green innovation capability and organizational inertia. Journal of Nanjing University of Technology (Social Science Edition) (04), 89–100+116.

Philip, L. D., Emir, F., and Udemba, E. N. (2022). Investigating possibility of achieving sustainable development goals through renewable energy, technological innovation, and entrepreneur: A study of global best practice policies. Environ. Sci. Pollut. Res. Int. 29 (40), 60302–60313. doi:10.1007/s11356-022-20099-z

Qi, S. Z., Lin, D., and Cui, J. (2018). Can environmental equity trading market induce green innovation?—Evidence based on data on green patents of listed companies in China. Econ. Res. 12, 159–177.

Ramirez, R. (1999). Value coproduction: Intellectual origins and implications for practice and research. Strategic Manag. J. 20 (1), 49–65. doi:10.1002/(sici)1097-0266(199901)20:1<49::aid-smj20>3.0.co;2-2

Roca, J. B., Vaishnav, P., Morgan, M. G., Mendonca, J., and Fuchs, E. (2017). When risks cannot Be seen:regulating uncertainty in emerging technologies. Res. Policy 46 (7), 1215–1233. doi:10.1016/j.respol.2017.05.010

Shang, H., and Wu, T. (2022). Corporate digital transformation, social responsibility and corporate value. Technology Economics (07), 159–168.

Shen, M. H., and Tan, W. J. (2022). Digitalization and corporate green innovation performance—Identifying the dual effect based on incremental and qualitative improvement. Southern Economics (09), 118–138. doi:10.19592/j.cnki.scje.391819

Shen, M. H., Zhang, W. B., and Tan, W. J. (2022). Does digital transformation enhance corporate social responsibility fulfillment?. Western Forum, 63–80.

Smith, C., Smith, J. B., and Shaw, E.,2017,“Embracing digital networks:entrepreneurs’ social capital online”,J. Bus. Ventur.,32(1):18–34. doi:10.1016/j.jbusvent.2016.10.003

Song, D. Y., Zhu, W. B., and Ding, H. (2022). Can corporate digitalization promote green technology innovation?—An examination of listed companies in the heavy pollution industry. Financial Studies (04), 34–48. doi:10.16538/j.cnki.jfe.20211218.304

Udemba, E. N., Emir, F., and Philip, L. D. (2022a). Mitigating poor environmental quality with technology, renewable and entrepreneur policies: A symmetric and asymmetric approaches. Renew. Energy 189, 997–1006.

Udemba, E. N., Philip, L. D., and Emir, F. (2022b). Performance and sustainability of environment under entrepreneurial activities, urbanization and renewable energy policies: A dual study of Malaysian climate goal. PSN Glob. Warming Clim. Change (Topic).

Udemba, E. N., and Tosun, M. S. (2022). Moderating effect of institutional policies on energy and technology towards a better environment quality: A two dimensional approach to China's sustainable development. Technol. Forecast. Soc. Change 183, 121964. doi:10.1016/j.techfore.2022.121964

Wang, F. Z., Liu, X. L., Zhang, L., and Cheng, W. (2022). Does digitalization promote green technology innovation of resource-based enterprises Sci. Sci. Res. (02), 332–344. doi:10.16192/j.cnki.1003-2053.20210824.001

Wang, J., Guo, S., and Zhang, L. (2018). Research on the impact of the Internet on enterprise innovation performance and its mechanism - based on the interpretation of open innovation Nankai Economic Research (06), 170–190. doi:10.14116/j.nkes.2018.06.10

Wang, M., and Li, Y. (2021). The balance and stability of the green technology innovation system involving multiple entities China Management. Science (3), 59–70.

Wang, Z., and Buaisheng, (2019). Corporate social responsibility, innovation capability and internationalization strategy—The moderating role of executive compensation incentives. Manag. Rev. (03), 193–202.

Wen, Z. L., and Ye, B. (2014). Analyses of mediating effects: The development of methods and models. Adv. Psychol. Sci. 22 (05), 731–745. doi:10.3724/sp.j.1042.2014.00731

Wu, F., Hu, H., Lin, H., Ren, X., et al. (2021). Digital transformation of enterprises and capital market performance - empirical evidence from stock liquidity Management World, (7): 130–144+10. doi:10.19744/j.cnki.11-1235/f.2021.0097

Xiao, H., Yang, Z., and Ling, H. C. (2022). Does corporate social responsibility have green innovation effect? Trends Econ. (08), 117–132.

Xiao, J., and Zeng, P. (2022). Can digitization “increase the quality and quantity” of corporate green innovation?—A resource-based perspective Scientific Research 3 (10), 57–70.

Xiao, X. H., Pan, Y., and Wang, Z. (2021b). Does corporate social responsibility promote corporate green innovation Economic longitude and latitude (03), 114–123. doi:10.15931/j.cnki.1006-1096.20210324.001

Xiao, X. H., Pan, Y., and Wang, Z. (2021a). Does corporate social responsibility promote corporate green innovation? Econ. Latit. 38.03, 114–123. doi:10.15931/j.cnki.1006-1096.20210324.001

Xie, X. M., Huo, J. G., Qi, G. Y., and Zhu, K. X. G.,2016,“Green process innovation and financial performance in emerging economies:moderating effects of absorptive capacity and green subsidies”,IEEE Trans. Eng. Manag.,63(1):101–112. doi:10.1109/tem.2015.2507585

Yan, H., and Yang, H. (2022). Environmental uncertainty, internal control quality and firm performance: Evidence from the special equipment manufacturing industry. Bus. Account. (10), 25–29.

Yang, G. Z., and Xi, Y. (2019). Empirical study on financing constraints of enterprises' green technology innovation activities. Ind. Technol. Econ. 11, 70–76.

Yang, H., Shi, X., and Wang, S. (2022). The impact of heterogeneous corporate social responsibility on green technology innovation. Shandong Social Science (02), 165–175.

Ye, C. H. (2021). Financing constraints, government subsidies and green innovation of enterprises Statistics and Decision Making (21), 184–188. doi:10.13546/j.cnki.tjyjc.2021.21.038

Yousaf, Z., Radulescu, M., Sinisi, C. I., Luminita, S., and Loredana, M. P. (2021). Towards sustainable digital innovation of SMEs from the developing countries in the context of the digital economy and frugal environment. Sustainability 13 (10), 57–75.

Zeng, J. Z., Liu, G. D., and Pang, R. (2022). CEO Financial Expertise, Internal Control and Corporate Performance—Empirical Evidence Based on Chinese Listed Companies. Int. Financial Res. (05), 87–96.

Zhang, L. P., and Tang, Z. W. (2018). The impact of enterprise information technology application on Open Innovation:From the perspective of transaction cost. Sci. &Technological Prog. Policy 35 (20), 79–87.

Zhao, C. (2022). Research on the impact of digital transformation on corporate social responsibility. Contemporary Economic Science (02), 109–116.

Zhao, C. (2022). Research on the impact of digital transformation on corporate social responsibility Contemporary Economic Science (02), 109–116.

Zhao, L., and Huang, H. (2022). Research on the impact of directors' information technology background on the effectiveness of internal control in the digital age. Journal of Yunnan University of Finance and Economics (05), 80–101. doi:10.16537/j.cnki.jynufe.000787

Zhou, X., Han, L., and Xiao, X. (2022) The impact of digital economy on sustainable green innovation under the “double carbon” target—a mediating perspective based on digital transformation. Securities Market Herald (11), 2–12.

Keywords: digitization, green innovation, financing constraints, corporate social responsibility, internal control level

Citation: Fan Y, Su Q, Wang X and Fan M (2023) Digitalization and green innovation of enterprises: Empirical evidence from China. Front. Environ. Sci. 11:1120806. doi: 10.3389/fenvs.2023.1120806

Received: 10 December 2022; Accepted: 07 February 2023;

Published: 23 February 2023.

Edited by:

Evgeny Kuzmin, Ural Branch of the Russian Academy of Sciences, RussiaReviewed by:

Shujahat Haider Hashmi, Bahria University, PakistanEdmund Udemba, Gelişim Üniversitesi, Türkiye

Ирина Белик, Ural Federal University, Russia

Copyright © 2023 Fan, Su, Wang and Fan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Quan Su, c3VxdWFuc3ByaW5nQGZveG1haWwuY29t; Xiaohong Wang, d29uZ3hoQGx6dS5lZHUuY24=; Min Fan, MTE2MDUyOTg4MUBxcS5jb20=

Yaojun Fan

Yaojun Fan Quan Su1*

Quan Su1* Min Fan

Min Fan